Table of Contents

As filed with the Securities and Exchange Commission on March 24, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SeaWorld Entertainment, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 7990 | 27-1220297 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

9205 South Park Center Loop, Suite 400

Orlando, Florida 32819

(407) 226-5011

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

G. Anthony (Tony) Taylor, Esq.

Chief Legal and Corporate Affairs Officer, General Counsel and Corporate Secretary

9205 South Park Center Loop, Suite 400

Orlando, Florida 32819

(407) 226-5011

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Igor Fert, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017 (212) 455-2000 |

Marc D. Jaffe, Esq. Cathy A. Birkeland, Esq. Michael A. Pucker, Esq. Latham & Watkins LLP 885 Third Avenue New York, New York 10022-4834 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Aggregate Offering Price per Share(1) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||||

| Common Stock, par value $0.01 per share |

17,250,000 | $31.54 | $544,065,000 | $70,075.57 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes shares/offering price of shares of common stock that the underwriters have the option to purchase. See “Underwriting.” |

| (2) | These figures are estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended, based on the average of high and low prices of the common stock on March 18, 2014 as reported on the New York Stock Exchange. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor do we or the selling stockholders seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated March 24, 2014

Preliminary Prospectus

| 15,000,000 Shares |

SeaWorld Entertainment, Inc.

Common Stock

The selling stockholders identified in this prospectus are offering 15,000,000 shares of common stock of SeaWorld Entertainment, Inc. The selling stockholders will receive all of the net proceeds from this offering and we will not receive any of the proceeds from the sale of the shares of common stock being sold by the selling stockholders.

Through a special committee comprised of two of our independent, disinterested directors, we are in active discussions with the selling stockholders about a possible repurchase by the Company of 1.75 million shares of our common stock directly from such selling stockholders in a private, non-underwritten transaction. This repurchase, if it is approved by the special committee as being in the best interests of the Company and its stockholders other than the selling stockholders, would be consummated concurrently with the closing of this offering and would involve a price per share payable by the Company equal to the price per share that would be paid to the selling stockholders by the underwriters in this offering. The completion of this share repurchase would be conditioned upon, among other things, the completion of this offering, but the completion of this offering will not be conditioned upon the completion of such share repurchase.

The common stock of SeaWorld Entertainment, Inc. is listed on the New York Stock Exchange (the “NYSE”) under the symbol “SEAS.” The last reported sale price of SeaWorld Entertainment, Inc.’s common stock on the NYSE on March 21, 2014 was $33.17 per share.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 17.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price……………………………………………………… |

$ | $ | ||||||

| Underwriting discount and commissions(1)…………………………….. |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders………………….. |

$ | $ | ||||||

| (1) | See “Underwriting” for additional disclosure regarding the underwriting discount, commissions and estimated offering expenses. |

To the extent that the underwriters sell more than 15,000,000 shares of common stock, the underwriters have the option to purchase up to an additional 2,250,000 shares from the selling stockholders at the public offering price less the underwriting discount and commissions. The selling stockholders will receive all of the proceeds from the sale of any such additional shares to the underwriters.

The underwriters expect to deliver the shares against payment in New York, New York on , 2014.

| Goldman, Sachs & Co. | J.P. Morgan | |

Prospectus dated , 2014.

Table of Contents

Table of Contents

Prospectus

| Page | ||||

| ii | ||||

| ii | ||||

| iii | ||||

| 1 | ||||

| 17 | ||||

| 33 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

41 | |||

| 60 | ||||

| 81 | ||||

| 107 | ||||

| 109 | ||||

| 114 | ||||

| 115 | ||||

| 120 | ||||

| 129 | ||||

| Material United States Federal Income and Estate Tax Consequences to Non-U.S. Holders |

132 | |||

| 136 | ||||

| 141 | ||||

| 141 | ||||

| 141 | ||||

| F-1 | ||||

Unless otherwise indicated or the context otherwise requires, financial data in this prospectus reflects the consolidated business and operations of SeaWorld Entertainment, Inc. and its consolidated subsidiaries.

Neither we nor the selling stockholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. Neither we nor the selling stockholders take responsibility for, and cannot provide assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

i

Table of Contents

Market data and industry statistics and forecasts used throughout this prospectus are based on the good faith estimates of management, which in turn are based upon management’s reviews of independent industry publications, reports by market research firms and other independent and publicly available sources. Although we believe that these third-party sources are reliable, we do not guarantee the accuracy or completeness of this information and have not independently verified this information. Similarly, internal Company surveys, while believed by us to be reliable, have not been verified by any independent sources. Unless we indicate otherwise, market data and industry statistics used throughout this prospectus are for the year ended December 31, 2013.

In this prospectus (i) references to the “TEA/AECOM Report” refer to the 2012 Theme Index: The Global Attractions Attendance Report, TEA/AECOM, 2013 and (ii) references to the “IBISWorld Report” refer to the IBISWorld Industry Report 71311: Amusement Parks in the US dated June 2013. Unless otherwise noted, attendance rankings included in this prospectus are based on the TEA/AECOM Report and theme park industry statistics are based on the IBISWorld Report.

Although we are not aware of any misstatements regarding the industry data that we present in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors,” “Special Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus.

TRADEMARKS, SERVICE MARKS AND TRADENAMES

We own or have rights to use a number of registered and common law trademarks, service marks and trade names in connection with our business in the United States and in certain foreign jurisdictions, including SeaWorld Entertainment™, SeaWorld Parks & Entertainment™, SeaWorld®, Shamu®, Busch Gardens®, Aquatica™, Discovery Cove®, Sea Rescue™ and other names and marks that identify our theme parks, characters, rides, attractions and other businesses. In addition, we have certain rights to use Sesame Street® marks, characters and related indicia through certain license agreements with Sesame Workshop (f/k/a Children’s Television Workshop) (“Sesame Workshop”).

Solely for convenience, the trademarks, service marks, and trade names referred to in this prospectus are without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks, and trade names. This prospectus contains additional trademarks, service marks and trade names of others, which are the property of their respective owners. All trademarks, service marks and trade names appearing in this prospectus are, to our knowledge, the property of their respective owners.

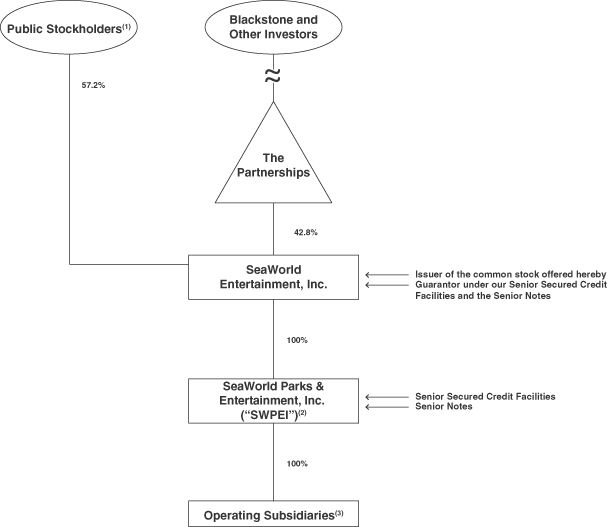

On December 1, 2009, investment funds affiliated with The Blackstone Group L.P. and certain co-investors, through SeaWorld Entertainment, Inc. and its wholly-owned subsidiary, SeaWorld Parks & Entertainment, Inc. (“SWPEI”), acquired 100% of the equity interests of Sea World LLC (f/k/a SeaWorld, Inc.) and SeaWorld Parks & Entertainment LLC (f/k/a Busch Entertainment Corporation) from certain subsidiaries of Anheuser-Busch Companies, Inc. We refer to this acquisition and related financing transactions as the “2009 Transactions.” As a result of the 2009 Transactions, Blackstone and the other co-investors own, through SW Delaware L.P. (f/k/a SW Cayman L.P.),

ii

Table of Contents

SW Delaware A L.P. (f/k/a SW Cayman A L.P.), SW Delaware B L.P. (f/k/a SW Cayman B L.P.), SW Delaware C L.P. (f/k/a SW Cayman C L.P.), SW Delaware D L.P. (f/k/a SW Cayman D L.P.), SW Delaware E L.P. (f/k/a SW Cayman E L.P.), SW Delaware F L.P. (f/k/a SW Cayman F L.P.), SW Delaware Co-Invest L.P. (f/k/a SW Cayman Co-Invest L.P.), SW Delaware (GS) L.P. (f/k/a SW Cayman (GS) L.P.) and SW Delaware (GSO) L.P. (f/k/a SW Cayman (GSO) L.P.) (collectively, the “Partnerships”), common stock of SeaWorld Entertainment, Inc. The Partnerships are the selling stockholders in this offering. For a more complete description of the Partnerships, see “Principal and Selling Stockholders” and “Certain Relationships and Related Party Transactions—Limited Partnership Agreements and Equityholders Agreement.”

As used in this prospectus, unless otherwise noted or the context otherwise requires, (i) references to the “Company,” “we,” “our” or “us” refer to SeaWorld Entertainment, Inc. and its consolidated subsidiaries, (ii) references to the “Issuer” refer to SeaWorld Entertainment, Inc. exclusive of its subsidiaries, (iii) references to “Blackstone” or the “Sponsor” refer to certain investment funds affiliated with The Blackstone Group L.P., (iv) references to the “Investor Group” refer, collectively, to Blackstone and other co-investors in the Partnerships, (v) references to the “2009 Advisory Agreement” refer to the Amended and Restated 2009 Advisory Agreement among SeaWorld Parks & Entertainment, Inc. (f/k/a SW Acquisitions Co., Inc.), Sea World Parks & Entertainment LLC, Sea World LLC and affiliates of Blackstone, (vi) references to “ABI” refer to Anheuser-Busch, Incorporated, (vii) references to “guests” refer to our theme park visitors, (viii) references to “customers” refer to any consumer of our products and services, including guests of our theme parks, and (ix) references to the “underwriters” refer to the firms listed on the cover page of this prospectus.

All references herein to a fiscal year refer to the 12 months ended December 31 of such year, and references to the first, second, third and fourth fiscal quarters refer to the three months ended March 31, June 30, September 30 and December 31, respectively.

Information presented as of December 31, 2013 and 2012 and for the fiscal years ended December 31, 2013, 2012 and 2011 is derived from our audited consolidated financial statements for those periods included elsewhere in this prospectus. Information presented as of December 31, 2011 and 2010 and for the fiscal year ended December 31, 2010 and the one month period ended December 31, 2009 is derived from our audited consolidated statements of operations and comprehensive income (loss), stockholders’ equity and cash flows for the fiscal year ended December 31, 2011 and 2010 and the one month period ended December 31, 2009 not included in this prospectus. The results for the one month period ended December 31, 2009 include the results of operations of the Company from December 1, 2009 to December 31, 2009, which is the period in which we first became an independent, stand-alone entity following the 2009 Transactions.

The historical consolidated financial statements and financial data included in this prospectus are those of SeaWorld Entertainment, Inc. and its consolidated subsidiaries. The historical consolidated financial information and financial data for the periods prior to the 2009 Transactions (the “Predecessor Financial Information”) is not presented in this prospectus because it is not comparable and therefore not meaningful to a prospective investor. The Predecessor Financial Information does not fully reflect our operations on a stand-alone basis and we believe would not materially contribute to an investor’s understanding of our historical financial performance. The Predecessor Financial Information prepared on a basis comparable with our consolidated financial statements included in this prospectus is not available and cannot be provided without unreasonable effort and expense. We believe that the omission of the Predecessor Financial Information will not have a material impact on an investor’s understanding of our financial results and condition and related trends.

iii

Table of Contents

This summary highlights certain significant aspects of our business and this offering. This is a summary of information contained elsewhere in this prospectus, is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus, including the information presented under the section entitled “Risk Factors” and the consolidated financial statements and the notes thereto, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of certain factors such as those set forth in “Risk Factors” and “Special Note Regarding Forward-Looking Statements.” When making an investment decision, you should also read the discussion under “Basis of Presentation” above for the definition of certain terms used in this prospectus and a description of certain transactions and other matters described in this prospectus.

Company Overview

We are a leading theme park and entertainment company delivering personal, interactive and educational experiences that blend imagination with nature and enable our customers to celebrate, connect with and care for the natural world we share. We own or license a portfolio of globally recognized brands including SeaWorld, Shamu and Busch Gardens. Over our more than 50 year history, we have built a diversified portfolio of 11 destination and regional theme parks that are grouped in key markets across the United States, many of which showcase our one-of-a-kind collection of approximately 86,000 marine and terrestrial animals. Our theme parks feature a diverse array of rides, shows and other attractions with broad demographic appeal which deliver memorable experiences and a strong value proposition for our guests. In addition to our theme parks, we have recently begun to leverage our brands into media, entertainment and consumer products.

During the year ended December 31, 2013, we hosted approximately 23.4 million guests in our theme parks, including approximately 3.7 million international guests. In the year ended December 31, 2013, we had total revenues of $1,460.3 million and net income of $50.5 million. Our increasing revenue and growing profit margins, combined with our disciplined approach to capital expenditures and working capital management, enable us to generate strong and recurring cash flow.

Our portfolio of branded theme parks includes the following names:

| Ÿ | SeaWorld. SeaWorld is widely recognized as the leading marine-life theme park brand in the world. Our SeaWorld theme parks, located in Orlando, San Antonio and San Diego, each rank among the most highly attended theme parks in the industry and offer up-close interactive experiences and a variety of live performances, including shows featuring Shamu in specially designed amphitheaters. We offer our guests numerous animal encounters, including the opportunity to work with trainers and feed marine animals, as well as themed thrill rides and theatrical shows that creatively incorporate our one-of-a-kind animal collection. |

| Ÿ | Busch Gardens. Our Busch Gardens theme parks are family-oriented destinations designed to immerse guests in foreign geographic settings. They are renowned for their beauty and award-winning landscaping and gardens and allow our guests to discover the natural side of fun by offering a family experience featuring a variety of attractions and rollercoasters in a richly-themed environment. Busch Gardens Tampa presents our collection of exotic animals |

1

Table of Contents

| from Africa, Asia and Australia. Busch Gardens Williamsburg, which has been named the Most Beautiful Park in the World by the National Amusement Park Historical Association for 23 consecutive years, showcases European-themed cultural and culinary experiences, including high-quality theatrical productions. |

| Ÿ | Aquatica. Our Aquatica branded water parks are premium, family-oriented destinations that are based in a South Seas-themed tropical setting. Aquatica water parks build on the aquatic theme of our SeaWorld brand and feature high-energy rides, water attractions, white-sand beaches and an innovative and entertaining presentation of marine and terrestrial animals. We position our Aquatica water parks as companion water parks to our SeaWorld theme parks in Orlando and San Diego and we have an Aquatica water park situated within our SeaWorld San Antonio theme park. |

| Ÿ | Discovery Cove. Discovery Cove is a reservations only, all-inclusive, marine-life day resort adjacent to SeaWorld Orlando. Discovery Cove offers guests personal, signature experiences, including the opportunity to swim and interact with dolphins, take an underwater walking reef tour and enjoy pristine white-sand beaches and landscaped private cabanas. Discovery Cove presently limits its attendance to approximately 1,300 guests per day and features premium culinary offerings in order to provide guests with a more relaxed, intimate and high-end luxury resort experience. |

| Ÿ | Sesame Place. Sesame Place is the only U.S. theme park based entirely on the award-winning television show Sesame Street. Located between Philadelphia and New York City, Sesame Place is a destination where parents and children can share in the spirit of imagination and experience Sesame Street together through whirling rides, water slides, colorful shows and furry friends. In addition, we have introduced Sesame Street brands in our other theme parks through Sesame Street-themed rides, shows, children’s play areas and merchandise. |

2

Table of Contents

Our theme parks are consistently recognized among the top theme parks in the world and rank among the most highly-attended in the industry. We generally locate our theme parks in geographical clusters, which improves our ability to serve guests by providing them with a varied, comprehensive vacation experience and valuable multi-park pricing packages, as well as improving our operating efficiency through shared overhead costs. The following table summarizes our theme park portfolio as of December 31, 2013:

| Location | Theme Park |

Year Opened |

Animal Habitats(2) |

Rides(3) | Shows(4) | Other(5) | ||||||

| Orlando, FL |

|

1973 | 17 | 14 | 18 | 27 | ||||||

|

2000 | 5 | 3 | 0 | 5 | |||||||

|

2008 | 5 | 13 | 0 | 4 | |||||||

| Tampa, FL |

|

1959 | 17 | 28 | 16 | 39 | ||||||

|

1980 | 0 | 12 | 0 | 7 | |||||||

| San Diego, CA |

|

1964 | 25 | 10 | 20 | 17 | ||||||

|

1996(1) | 2 | 8 | 0 | 4 | |||||||

| San Antonio, TX |

|

1988 | 12 | 23 | 33 | 50 | ||||||

|

Williamsburg, VA |

|

1975 | 7 | 38 | 14 | 43 | ||||||

|

1984 | 1 | 15 | 1 | 9 | |||||||

| Langhorne, PA |

|

1980 | 0 | 23 | 13 | 22 | ||||||

| Total(6) |

|

91 | 187 | 115 | 227 |

| (1) | On November 20, 2012, we acquired the Knott’s Soak City Chula Vista water park from a subsidiary of Cedar Fair, L.P. This water park was renovated, rebranded and relaunched as Aquatica San Diego on June 1, 2013. |

| (2) | Represents animal habitats without a ride or show element, often adjacent to a similarly themed attraction. |

| (3) | Represents mechanical dry rides, water rides and water slides (including wave pools and lazy rivers). |

| (4) | Represents annual and seasonal shows with live entertainment, animals, characters and/or 3-D or 4-D experiences. |

| (5) | Represents our 2013 portfolio for events, distinctive experiences and play areas, which collectively may include special limited time events; distinctive experiences often limited to small groups and individuals and/or requiring a supplemental fee (such as educational tours, immersive dining experiences and swimming with animals); and pure play areas, typically designed for children or seasonal special events, often without a queue (such as water splash areas or Halloween mazes). |

| (6) | The total number of animal habitats, rides, shows, play areas, events and distinctive experiences in our theme park portfolio varies seasonally. |

3

Table of Contents

Our Competitive Strengths

| Ÿ | Brands That Consumers Know and Love. We believe that our brands attract and appeal to guests from around the world and have been established as a part of popular culture. Our brand portfolio is highly stable, which we believe reduces our exposure to changing consumer tastes. We use our brands and intellectual property to increase awareness of our theme parks, drive attendance to our theme parks and create “out-of-park” experiences for our guests as a way to connect with them before they visit our theme parks and to stay connected with them after their visit. Such experiences include various media and consumer product offerings, including websites, advertisements and media programming, toys, books, apparel and technology accessories. For example, we have developed iPhone and Android smartphone applications for our SeaWorld and Busch Gardens theme parks, which have been downloaded over 1.5 million times from June 2011 through December 2013. We have also recently begun to leverage our brands into media, entertainment and consumer products. Since its debut in 2012 through December 2013, our Sea Rescue television program has attracted over 118 million viewers and has been rated as the number one show in its timeslot in a number of major U.S. markets. More recently, in October 2013, we introduced our newest television program, The Wildlife Docs, which attracted over 17 million viewers from October through December 2013. |

| Ÿ | Differentiated Theme Parks. We own and operate 11 theme parks, including five of the top 20 theme parks in North America as measured by attendance, according to the TEA/AECOM Report. Our theme parks are beautifully themed and deliver high-quality entertainment, aesthetic appeal, shopping and dining and have won numerous awards, including Amusement Today’s Golden Ticket Awards for Best Landscaping. Our theme parks feature seven of the 50 highest rated steel rollercoasters in the world, led by Apollo’s Chariot, the #5 rated steel rollercoaster in the world, and have won the top three spots in Amusement Today’s annual Golden Ticket Award for Best Marine Life Park since the award’s inception in 2006, according to Amusement Today’s 2013 Golden Ticket Awards (the “2013 Amusement Today Annual Survey”). We have over 600 attractions that appeal to guests of all ages, including 91 animal habitats, 115 shows and 187 rides. In addition, we have over 300 restaurants and specialty shops. Our theme parks appeal to the entire family and offer a broad range of experiences, ranging from emotional and educational animal encounters to thrilling rides and exciting shows. |

| Ÿ | Diversified Business Portfolio. Our portfolio of theme parks is diversified in a number of important respects. Our theme parks are located across the United States, which helps protect us from the impact of localized events. Each theme park showcases a different mix of zoological, thrill-oriented and family-friendly attractions. This varied portfolio of entertainment offerings attracts guests from a broad range of demographics and geographies. Our theme parks appeal to both regional and destination guests, which provides us with a stable attendance base while allowing us to benefit from improvements in macroeconomic conditions, including increased consumer spending and international travel. |

| Ÿ | One of the World’s Largest Zoological Collections. We believe we are attractively positioned in the industry due to our ability to display our extensive animal collection in a differentiated and interactive manner. We believe we have one of the world’s largest zoological collections with approximately 86,000 animals, including approximately 8,000 marine and terrestrial animals and approximately 78,000 fish. With 29 killer whales, we have the largest group of killer whales in human care. We have established successful and innovative breeding programs that have produced 31 killer whales, 159 dolphins and 135 sea lions, among other species, and our marine animal populations are characterized by their substantial genetic diversity. More than 80% of our marine mammals were born in human care. |

4

Table of Contents

| Ÿ | Strong Competitive Position. Our competitive position is protected by the combination of our powerful brands, extensive animal collection and expertise and attractive in-park assets located on valuable real estate. Our animal collection and zoological expertise, which have evolved over our more than five decades of caring for animals, would be very difficult to replicate. We have made extensive investments in new marketable attractions and infrastructure and we believe that our theme parks are well capitalized. The limited supply of real estate suitable for theme park development coupled with high initial capital investment, long development lead-times and zoning and other land use restrictions constrain the number of large theme parks that can be constructed. |

| Ÿ | Proven and Experienced Management Team and Employees with Specialized Animal Expertise. Our senior management team, led by Jim Atchison, our Chief Executive Officer and President, includes some of the most experienced theme park executives in the world, with an average tenure of more than 30 years in the industry. The management team is comprised of highly skilled and dedicated professionals with wide ranging experience in theme park operations, zoological operations, product development, business development and marketing. In addition, we are one of the world’s foremost zoological organizations with an average of more than 1,500 employees in 2013 dedicated to animal welfare, training, husbandry and veterinary care. |

| Ÿ | Proximity of Complementary Theme Parks. Our theme parks are grouped in key locations near large population centers across the United States, which allows us to realize revenue and operating expense efficiencies. Having theme parks located within close proximity to each other also enables us to cross market and offer bundled ticket and travel packages. In addition, closely located theme parks provide operating efficiencies including sales, marketing, procurement and administrative synergies as overhead expenses are shared among the theme parks within each region. We intend to continue to capitalize on this strength through our 2012 acquisition of Knott’s Soak City Chula Vista water park in California, which we rebranded and relaunched as Aquatica San Diego on June 1, 2013 near our SeaWorld San Diego theme park. |

| Ÿ | Attractive, Growing Profit Margins and Strong Cash Flow Generation. Our attractive and growing profit margins, combined with our disciplined approach to capital expenditures and working capital management, enable us to generate strong and recurring cash flow. Five of our 11 theme parks are open year-round, reducing our seasonal cash flow volatility. In addition, we have substantial tax assets which we expect to be available to defer a portion of our cash tax burden going forward. |

| Ÿ | Care for Our Community and the Natural World. Caring for our community and the natural world is a core part of our corporate identity and resonates with our guests. We focus on three core philanthropic areas: children, education and environment. Through the power of entertainment, we are able to inspire children and educate guests of all ages. We support numerous charities and organizations across the country. For example, we are the primary supporter and corporate member of the SeaWorld & Busch Gardens Conservation Fund, a non-profit conservation foundation, which makes grants to wildlife research and conservation projects that protect wildlife and wild places worldwide. In addition, in collaboration with the government and other members of accredited stranding networks, we operate one of the world’s most respected programs to rescue ill and injured marine animals, with the goal to rehabilitate and return them back to the wild. Our animal experts have helped more than 23,000 ill, injured, orphaned and abandoned animals for more than four decades. |

Our Strategies

We plan to grow our business by increasing our existing theme park revenues through strategies designed to drive higher attendance and increase in-park per capita spending, as well as by creating

5

Table of Contents

new sources of revenue through expansion of our theme parks, new theme park development and extending our brands into new media, entertainment and consumer products. We believe that our strategies complement each other as they lead to increased brand strength and awareness and drive revenue growth and profitability. Our strategies include the following components:

| Ÿ | Continue to Create Memorable Experiences for Our Guests. Our mission is to use the power of educational entertainment to continue to inspire our guests to celebrate, connect with and care for the natural world we share. We provide our guests with innovative and immersive theme park experiences, such as our 3-D, 360 degree TurtleTrek attraction, which opened in 2012 at SeaWorld Orlando, and our Antarctica: Empire of the Penguin attraction, which opened in 2013 also at SeaWorld Orlando, and immerses guests into a penguin habitat. We also offer guests exciting rides, animal encounters and beautifully-themed entertainment that are difficult to replicate, such as in-water experiences with beluga whales at SeaWorld Orlando and our Cheetah Hunt ride, which is a launch coaster that opened in 2011 and runs alongside a cheetah habitat at Busch Gardens Tampa. As a result of these distinctive offerings, our guest surveys routinely report very high “Overall Satisfaction” scores, with 97% of respondents in 2013 ranking their experience good or excellent. Going forward, we will continue to develop high-quality experiences for our guests, focused on integrating our impressive animal collection with creatively themed settings and products that our guests will remember long after they leave our theme parks. In November 2013, we launched www.AnimalVision.com, which allows our guests to deepen their connection with animals at our theme parks through on-habitat cameras that stream 24/7 footage of our animal habitats to customized interactive websites. |

| Ÿ | Drive Increased Attendance to Our Theme Parks. We plan to drive increased attendance to our theme parks by continually introducing new attractions, differentiated experiences and enhanced service offerings. Because of the historic correlation between capital investment and increased attendance, we plan to add to our award-winning portfolio of assets and spend capital in support of marketable events, such as SeaWorld’s 50th Anniversary Celebration. We also plan to increase awareness of our theme parks and brands through effective media and marketing campaigns, including the targeted use of online and social media platforms. For example, since their introduction in 2006, our YouTube channels have attracted approximately 29 million views, and we believe that we can continue to use traditional and new media to increase awareness of our brands and drive attendance to our theme parks. |

| Ÿ | Expand In-Park Per Capita Spending through New and Enhanced Offerings. We believe that by providing our guests additional and enhanced offerings at various price points, we can drive further spending in our theme parks. For example, we introduced an “all-day-dining deal” for a supplemental fee, which we believe has resulted in increased in-park per capita spending. In addition, we have developed iPhone and Android smartphone applications for our SeaWorld and Busch Gardens theme parks, which offer GPS navigation through the theme parks and interactive theme park maps that show the nearest dining locations, gift shops and ATMs and provide real-time updates on wait times for rides. Our guests have quickly adopted these products with over 1.5 million downloads of our smartphone applications from June 2011 through December 2013. We believe that going forward, there are significant avenues to expand guest offerings in ways that both increase guest satisfaction and provide us with incremental revenue. |

| Ÿ | Grow Revenue through Disciplined and Dynamic Pricing. We are focused on increasing our revenues through a variety of ticket options and disciplined pricing and promotional strategies. We offer an array of tailored admission options, including season passes and multi-park tickets to motivate the purchase of higher value products and increase in-park per capita spending. In addition, to increase non-peak demand we offer seasonal and special events and concerts, some of |

6

Table of Contents

| which are separately priced. We have begun deploying a dynamic pricing model, which will enable us to adjust admission prices for our theme parks based on expected demand. |

| Ÿ | Increase Profitability through Operating Leverage and Rigorous Cost Management. Adding incremental attendance and driving additional in-park per capita spending affords us with an opportunity to realize gains in profitability because of the fixed cost base and high operating leverage of our business. We also employ rigorous cost management techniques to drive additional operating efficiencies. For example, we utilize a centralized procurement and strategic sourcing team and participate in several cooperative buying organizations to leverage our purchases company-wide and have also recently consolidated our marketing spending with a single agency to streamline our marketing efforts. |

| Ÿ | Pursue Disciplined Capital Deployment, Expansion and Acquisition Opportunities. We pursue a disciplined capital deployment strategy focused on the development and improvement of rides, attractions and shows, as well as seek to leverage our strong brands and expertise to pursue selective domestic and international expansion and acquisition opportunities. As part of this strategy, we seek to replicate successful capital investments in particular attractions across multiple theme parks, as we did with our Journey to Atlantis watercoaster that premiered in SeaWorld Orlando and was later introduced in the other SeaWorld theme parks. We have been successful in grouping our theme parks and water parks near each other, which allows us to operate companion theme parks with reduced overhead costs and creates revenue opportunities through multi-park tickets and other joint marketing initiatives. For example, in November 2012, we acquired Knott’s Soak City Chula Vista water park, which we rebranded and relaunched as Aquatica San Diego on June 1, 2013, near our SeaWorld San Diego theme park. We also evaluate new domestic theme park opportunities as well as potential joint venture opportunities that would allow us to expand internationally by combining our brands and zoological and operational expertise with third-party capital. |

| Ÿ | Leverage and Expand Our Brands to Increase Awareness and Create New Opportunities. Our brands are highly regarded and are primarily based on our own intellectual property, which provides us with opportunities to leverage our intellectual property portfolio and develop new media, entertainment and consumer products. For example, on May 24, 2013, we opened Antarctica: Empire of the Penguin at our SeaWorld Orlando theme park that features a new animated penguin character, Puck, and coincides with the launch of new in-park merchandise, mobile gaming and consumer products designed around the Puck character. In addition, we are able to expand into new media platforms by partnering with others to create new, powerful entertainment opportunities. In 2012, we launched Sea Rescue, a Saturday morning television show airing on the ABC Network featuring our work to rescue injured animals in coordination with various government agencies and other rescue organizations. Since its debut through December 2013, Sea Rescue has attracted over 118 million viewers and has been rated as the number one show in its timeslot in a number of major U.S. markets. More recently, in October 2013, we introduced our newest television program, The Wildlife Docs, which attracted over 17 million viewers from October through December 2013. |

| Ÿ | Continue our Support of Species Conservation, Sustainability and Animal Welfare. Our zoological know-how and coast-to-coast presence provide us with significant opportunities to contribute to global species conservation, sustainability and animal welfare initiatives. For example, our employees regularly assist in animal rescue efforts, and the non-profit SeaWorld & Busch Gardens Conservation Fund, of which we are the primary supporter and corporate member, makes grants to wildlife research and species conservation projects worldwide. Our species conservation efforts and philanthropic activities generate positive |

7

Table of Contents

| awareness and goodwill for our business. These efforts are a core part of our corporate culture and identity and resonate with our customers. |

Our Industry

We believe that the theme park industry is an attractive sector characterized by a proven business model that generates significant cash flow and has clear avenues for growth. Theme parks offer a strong consumer value proposition, particularly when compared to other forms of out-of-home entertainment such as concerts, sporting events, cruises and movies. As a result, theme parks attract a broad range of guests and generally exhibit strong margins across regions, operators, park types and macroeconomic conditions.

According to the IBISWorld Report, the U.S. theme park industry, which hosts approximately 315 million visitors per year, is comprised of a large number of venues ranging from a small group of high attendance, heavily-themed destination theme parks to a large group of lower attendance local theme parks and family entertainment centers. According to the TEA/AECOM Report, the United States is the largest theme park market in the world with five of the ten largest theme park operators and 12 of the 25 most-visited theme parks in the world. In 2013, the U.S. theme park industry was expected to generate approximately $14.7 billion in revenues, according to the IBISWorld Report.

Risks Related to Our Business and this Offering

Investing in our common stock involves substantial risks, and our ability to successfully operate our business is subject to numerous risks, including those that are generally associated with operating in the theme park industry and the broader entertainment industry. Some of the more significant challenges and risks include the following:

| Ÿ | we could be adversely affected by a decline in discretionary consumer spending or consumer confidence. Difficult economic conditions and the unavailability of discretionary income may adversely impact attendance figures and guest spending patterns at our theme parks, which could adversely affect our revenue and profitability; |

| Ÿ | various factors beyond our control, including natural disasters, bad weather or forecasts of bad weather, an outbreak of infectious disease affecting our animals and a rise in oil prices and travel costs, could adversely affect attendance and guest spending patterns at our theme parks; |

| Ÿ | our inability to protect our valuable intellectual property rights, including as a result of intellectual property infringement claims by others resulting in the loss of our intellectual property rights, could adversely affect our business; |

| Ÿ | incidents or adverse publicity involving the risk of accidents, illnesses, environmental incidents and other incidents concerning our theme parks or the theme park industry generally could harm our brands and reputation, as well as negatively impact our revenue and profitability; |

| Ÿ | adverse litigation judgments or settlements could reduce our profitability or limit our ability to operate our business; |

| Ÿ | changes in or violations of federal and state regulations governing the treatment of animals, or the loss of licenses and permits required to exhibit animals, could materially adversely affect our business; |

| Ÿ | featuring animals at our theme parks involves some degree of risk to our employees and guests which could materially adversely affect us; |

| Ÿ | the loss of key personnel, including members of our senior management team who have extensive experience in the industry, may adversely affect our business; |

8

Table of Contents

| Ÿ | the restrictions in our debt agreements may limit our flexibility in operating our business; |

| Ÿ | our substantial leverage could, among other things, adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry, and prevent us from meeting our obligations under our indebtedness; and |

| Ÿ | other factors set forth under “Risk Factors” in this prospectus. |

Before you participate in this offering, you should carefully consider all of the information in this prospectus, including matters set forth under the heading “Risk Factors.”

Recent Developments

2013 Secondary Offering and Share Repurchase

On December 17, 2013, selling stockholders affiliated with Blackstone completed a registered secondary offering of 18,000,000 shares of our common stock at a price of $30.00 per share. The selling stockholders received all of the net proceeds from the sale of these shares and the Company paid all expenses related to this secondary offering, other than the underwriting discount and commissions. Concurrently with the secondary offering, the Company repurchased 1,500,000 shares of our common stock directly from the selling stockholders in a private, non-underwritten transaction at a price per share equal to the price per share paid to the selling stockholders by the underwriters in the secondary offering. This repurchase was approved by a special committee comprised of two of our independent, disinterested directors as being in the best interests of the Company and our stockholders other than the selling stockholders. All repurchased shares were recorded as treasury stock at a cost of $44.2 million.

Initial Public Offering

On April 24, 2013, we completed an initial public offering of our common stock at a price to the public of $27.00 per share. In the initial public offering, the Company issued and sold 10,000,000 shares of common stock and the selling stockholders offered and sold 19,900,000 shares of common stock, including 3,900,000 shares of common stock pursuant to the exercise in full of the underwriters’ option to purchase additional shares. Our initial public offering raised net proceeds to the Company, after deducting underwriting discounts and commissions, expenses and transaction costs, of $245.4 million, a portion of which was used to redeem $140.0 million aggregate principal amount of our 11% Senior Notes due 2016 (the “Senior Notes”), to make a one-time payment of $46.3 million to an affiliate of Blackstone in connection with the termination of the 2009 Advisory Agreement and to repay $37.0 million of our Term B Loan (as defined below) under our senior secured credit agreement (the “Senior Secured Credit Facilities”). The Company did not receive any of the proceeds from the sale of the shares sold by the selling stockholders in our initial public offering.

Amendments to Our Senior Secured Credit Facilities

On May 14, 2013 and August 9, 2013, we entered into Amendment No. 5 and Amendment No. 6, respectively (collectively, the “Amendments”), to our Senior Secured Credit Facilities. Pursuant to the Amendments, among other things, we refinanced our Term A Loan (as defined below) and Term B Loan into new Term B-2 Loans (as defined below), extended the final maturity date of our term loan facilities, reduced future principal and interest payments, provided for additional future borrowings and made certain other amendments.

9

Table of Contents

Antarctica: Empire of the Penguin

On May 24, 2013, we opened Antarctica: Empire of the Penguin, a realm within our SeaWorld Orlando theme park themed to the snowy continent that includes a new attraction with innovative ride technology. Antarctica immerses guests into a penguin habitat and features the new animated penguin character, Puck. The attraction coincides with the launch of new in-park merchandise, mobile gaming and consumer products designed around the Puck character.

Aquatica San Diego

In November 2012, we acquired the Knott’s Soak City Chula Vista water park in California from a subsidiary of Cedar Fair L.P. This water park was rebranded and relaunched as Aquatica San Diego on June 1, 2013 after undergoing extensive renovations. Aquatica San Diego is located near our SeaWorld San Diego theme park and is the latest theme park to be added to our portfolio.

Share Repurchase

A special committee of our Board of Directors comprised of two of our independent, disinterested directors is actively reviewing the repurchase of 1.75 million of shares of our common stock from the selling stockholders. This repurchase, if it is approved by the special committee as being in the best interests of the Company and its stockholders other than the selling stockholders, would be consummated concurrently with the closing of this offering and would involve a price per share payable by the Company equal to the price per share that would be paid to the selling stockholders by the underwriters or purchasers in this offering. The completion of the share repurchase would be conditioned upon, among other things, the completion of this offering, but the closing of this offering will not be conditioned upon the consummation of the share repurchase, and there can be no assurance that the share repurchase will be consummated.

In connection with the repurchase, we would expect to enter into an agreement with the selling stockholders to repurchase, concurrently with the closing of this offering, 1.75 million shares of our common stock directly from such selling stockholders in a private, non-underwritten transaction at a price per share equal to the price paid by the underwriters in this offering. We refer to this repurchase as the “share repurchase.” We intend to fund the share repurchase with cash on hand. As a result, the funding of the share repurchase will, if completed, decrease the amount of cash on our balance sheet. The consummation of the share repurchase will be contingent on the satisfaction of customary closing conditions.

The description and the other information in this prospectus regarding the share repurchase is included in this prospectus solely for informational purposes. Nothing in this prospectus should be construed as an offer to sell, or the solicitation of an offer to buy, any of our common stock subject to the share repurchase.

Corporate History and Information

SeaWorld Entertainment, Inc. was incorporated in Delaware on October 2, 2009 in connection with the 2009 Transactions and changed its name from “SW Holdco, Inc.” to SeaWorld Entertainment, Inc. on December 13, 2012. We completed our initial public offering in April 2013 and our common stock is listed on the New York Stock Exchange under the symbol “SEAS.”

Our principal executive offices are located at 9205 South Park Center Loop, Suite 400, Orlando, Florida 32819, and our telephone number is (407) 226-5011. We maintain a website at www.seaworldentertainment.com, as well as a number of other theme park specific and marketing

10

Table of Contents

websites. The information contained on our websites or that can be accessed through our websites neither constitutes part of this prospectus nor is incorporated by reference herein.

Our Sponsor

Blackstone is one of the world’s leading investment and advisory firms. Blackstone’s alternative asset management businesses include the management of corporate private equity funds, real estate funds, hedge fund solutions, credit-oriented funds and closed-end mutual funds. Blackstone also provides various financial advisory services, including financial and strategic advisory, restructuring and reorganization advisory and fund placement services. Through its different investment businesses, as of December 31, 2013, Blackstone had assets under management of approximately $265.8 billion.

Affiliates of Blackstone no longer control a majority of the voting power of our outstanding common stock. However, Blackstone will continue to be able to significantly influence us and their interests may not in all cases be aligned with our or your interests. For a discussion of certain risks, potential conflicts and other matters associated with Blackstone’s ownership of our common stock, see “Risk Factors—Risks Related to Our Business and Our Industry—Affiliates of Blackstone will continue to be able to significantly influence our decisions and their interests may conflict with ours or yours in the future,” “Description of Capital Stock” and “Certain Relationships and Related Party Transactions.”

11

Table of Contents

THE OFFERING

| Common stock offered by the selling stockholders |

15,000,000 shares of common stock. |

| Common stock to be outstanding after this offering and the share repurchase |

90,014,580 shares of common stock (assuming a repurchase by the Company of 1.75 million shares of common stock from the selling stockholders). |

| Option to purchase additional shares of common stock from the selling stockholders |

2,250,000 shares of common stock |

| Use of proceeds |

The selling stockholders will receive all of the net proceeds from the sale of the shares of our common stock in this offering, including upon the sale of shares if the underwriters exercise their option to purchase additional shares, from the selling stockholders in this offering. We will not receive any of the proceeds from the sale of the shares of common stock by the selling stockholders. |

| Share repurchase |

If the share repurchase is approved by the special committee, we would expect to enter into an agreement with the selling stockholders to repurchase, concurrently with the closing of this offering, 1.75 million shares of our common stock directly from such selling stockholders in a private, non-underwritten transaction at a price per share equal to the price paid by the underwriters in this offering. The completion of the share repurchase would be conditioned upon, among other things, the completion of this offering, but the completion of this offering will not be conditioned upon the completion of the share repurchase. |

| Risk factors |

See “Risk Factors” beginning on page 17 and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Dividend policy |

In June 2013, our Board of Directors adopted a policy to pay, subject to legally available funds, a regular quarterly cash dividend. Pursuant to this policy, the Company paid quarterly cash dividends of $0.20 per share on July 1, 2013, October 1, 2013 and January 3, 2014. On March 4, 2014, the Company declared a cash dividend of $0.20 per share payable on April 1, 2014. |

12

Table of Contents

| We intend to continue to pay cash dividends on our common stock, subject to our compliance with applicable law, and depending on, among other things, our results of operations, financial condition, level of indebtedness, capital requirements, contractual restrictions, restrictions in our debt agreements and in any preferred stock, business prospects and other factors that our Board of Directors may deem relevant. However, the payment of any future dividends will be at the discretion of our Board of Directors and our Board of Directors may, at any time, modify or revoke our dividend policy on our common stock. See “Dividend Policy” and “Description of Indebtedness” for a description of the restrictions on our ability to pay dividends. |

| NYSE ticker symbol |

“SEAS.” |

The number of shares of our common stock to be outstanding immediately after the consummation of this offering and the share repurchase is based on 91,764,580 shares of common stock outstanding as of March 17, 2014, and does not give effect to 14,528,669 shares of common stock reserved for future issuance under our 2013 omnibus incentive plan (the “2013 Omnibus Incentive Plan”) as of March 17, 2014.

Unless we indicate otherwise or the context otherwise requires, all information in this prospectus:

| Ÿ | assumes an offering of 15,000,000 shares by the selling stockholders and no exercise of the underwriters’ option to purchase additional shares; and |

| Ÿ | reflects an eight-for-one stock split of our common stock and an increase in our authorized capital stock to 1,000,000,000 shares of common stock, par value $0.01 per share, effected on April 8, 2013. |

13

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following tables set forth our summary historical consolidated financial and operating data for the periods and as of the dates indicated.

We derived the summary consolidated financial data for the years ended December 31, 2013, 2012 and 2011 and as of December 31, 2013 and 2012 from our audited consolidated financial statements included elsewhere in this prospectus. See “Basis of Presentation.”

Our historical operating results are not necessarily indicative of future operating results.

The summary historical consolidated financial data set forth below should be read in conjunction with “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the notes thereto included elsewhere in this prospectus.

14

Table of Contents

| Year Ended December 31, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| (Amounts in thousands, except per share and per capita amounts) |

||||||||||||

| Statement of comprehensive income data: |

||||||||||||

| Net revenues |

||||||||||||

| Admissions |

$ | 921,016 | $ | 884,407 | $ | 824,937 | ||||||

| Food, merchandise and other |

539,234 | 539,345 | 505,837 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total revenues |

1,460,250 | 1,423,752 | 1,330,774 | |||||||||

| Costs and expenses |

||||||||||||

| Cost of food, merchandise and other revenues |

114,192 | 118,559 | 112,498 | |||||||||

| Operating expenses (exclusive of depreciation and amortization shown separately below) |

739,989 | 726,509 | 687,999 | |||||||||

| Selling, general and administrative |

187,298 | 184,920 | 172,368 | |||||||||

| Termination of advisory agreement |

50,072 | — | — | |||||||||

| Secondary offering costs |

1,407 | — | — | |||||||||

| Depreciation and amortization |

166,086 | 166,975 | 213,592 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total costs and expenses |

1,259,044 | 1,196,963 | 1,186,457 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating income |

201,206 | 226,789 | 144,317 | |||||||||

| Other income (expense), net |

241 | 1,563 | (1,679 | ) | ||||||||

| Interest expense |

93,536 | 111,426 | 110,097 | |||||||||

| Loss on early extinguishment of debt and write-off of discounts and deferred financing costs |

32,429 |

|

— |

|

— | |||||||

|

|

|

|

|

|

|

|||||||

| Income before income taxes |

75,482 | 116,926 | 32,541 | |||||||||

| Provision for income taxes |

25,004 | 39,482 | 13,428 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net income |

$ | 50,478 | $ | 77,444 | $ | 19,113 | ||||||

|

|

|

|

|

|

|

|||||||

| Net income attributable to common stockholders |

$ | 50,478 | $ | 77,444 | $ | 19,113 | ||||||

|

|

|

|

|

|

|

|||||||

| Per share data(1): |

||||||||||||

| Basic net income per share |

$ | 0.58 | $ | 0.94 | $ | 0.23 | ||||||

|

|

|

|

|

|

|

|||||||

| Diluted net income per share |

$ | 0.57 | $ | 0.93 | $ | 0.23 | ||||||

|

|

|

|

|

|

|

|||||||

| Cash dividends declared per share |

$ | 0.60 | $ | 6.07 | $ | 1.34 | ||||||

|

|

|

|

|

|

|

|||||||

| Weighted-average number of shares used in per share amounts: |

||||||||||||

| Basic |

87,537 | 82,480 | 81,392 | |||||||||

|

|

|

|

|

|

|

|||||||

| Diluted |

88,152 | 83,552 | 82,024 | |||||||||

|

|

|

|

|

|

|

|||||||

| Other financial and operating data: |

||||||||||||

| Adjusted EBITDA(2) |

$ | 439,128 | $ | 415,206 | $ | 382,059 | ||||||

| Capital expenditures |

$ | 166,258 | $ | 191,745 | $ | 225,316 | ||||||

| Attendance |

23,391 | 24,391 | 23,631 | |||||||||

| Total revenue per capita(3) |

$ | 62.43 | $ | 58.37 | $ | 56.31 | ||||||

| As of December 31, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| Consolidated balance sheet data (at end of period): |

||||||||||||

| Cash and cash equivalents |

$ | 116,841 | $ | 45,675 | $ | 66,663 | ||||||

| Total assets |

$ | 2,582,273 | $ | 2,521,052 | $ | 2,547,095 | ||||||

| Total long-term debt |

$ | 1,641,233 | $ | 1,823,974 | $ | 1,417,887 | ||||||

| Total equity |

$ | 654,132 | $ | 449,848 | $ | 872,467 | ||||||

| (1) | All share and per share amounts reflect an eight-for-one stock split of our common stock effected on April 8, 2013. |

| (2) | Under the indenture governing the Senior Notes and under our Senior Secured Credit Facilities, our ability to engage in activities such as incurring additional indebtedness, making investments, refinancing certain indebtedness, paying dividends and entering into certain merger transactions is governed, in part, by our ability to satisfy tests based on Adjusted EBITDA. |

The Senior Notes and our Senior Secured Credit Facilities generally define “Adjusted EBITDA” as net income (loss) before interest expense, income tax expense (benefit), depreciation and amortization, as further adjusted to exclude certain unusual, non-cash, and other items permitted in calculating covenant compliance under the indenture governing the Senior Notes and our Senior Secured Credit Facilities.

| (3) | Calculated as total revenue divided by total attendance. |

15

Table of Contents

We believe that the presentation of Adjusted EBITDA is appropriate to provide additional information to investors about the calculation of, and compliance with, certain financial covenants in the indenture governing the Senior Notes and in our Senior Secured Credit Facilities. Adjusted EBITDA is a material component of these covenants. In addition, investors, lenders, financial analysts and rating agencies have historically used EBITDA-related measures in our industry, along with other measures to evaluate a company’s ability to meet its debt service requirement, to estimate the value of a company and to make informed investment decisions. We also use Adjusted EBITDA in connection with certain components of our executive compensation program as described under “Management—Compensation Discussion and Analysis.”

Adjusted EBITDA is not a recognized term under generally accepted accounting principles in the United States (“GAAP”), and should not be considered in isolation or as a substitute for a measure of our liquidity or performance prepared in accordance with GAAP and is not indicative of income from operations as determined under GAAP. Adjusted EBITDA and other non-GAAP financial measures have limitations which should be considered before using these measures to evaluate our liquidity or financial performance. Adjusted EBITDA, as presented by us, may not be comparable to similarly titled measures of other companies due to varying methods of calculation.

We believe that the most directly comparable GAAP measure to Adjusted EBITDA is net income (loss). The following table sets forth a reconciliation of net income to Adjusted EBITDA:

| For the Year Ended December 31, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| (Amounts in thousands) | ||||||||||||

| Net income |

$ | 50,478 | $ | 77,444 | $ | 19,113 | ||||||

| Provision for income taxes |

25,004 | 39,482 | 13,428 | |||||||||

| Loss on early extinguishment of debt and write-off of discounts and deferred financing costs(a) |

32,429 | — | — | |||||||||

| Interest expense |

93,536 | 111,426 | 110,097 | |||||||||

| Depreciation and amortization |

166,086 | 166,975 | 213,592 | |||||||||

| Secondary offering costs(b) |

1,407 | — | — | |||||||||

| Termination of advisory agreement(c) |

50,072 | — | — | |||||||||

| Advisory fees(d) |

2,799 | 6,201 | 6,012 | |||||||||

| Equity-based compensation expense(e) |

6,026 | 1,681 | 823 | |||||||||

| Debt refinancing costs(f) |

892 | 1,000 | 441 | |||||||||

| Other adjusting items(g) |

843 | 630 | — | |||||||||

| Other non-cash expenses(h) |

9,556 | 10,367 | 12,468 | |||||||||

| Carve-out costs(i) |

— | — | 6,085 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 439,128 | $ | 415,206 | $ | 382,059 | ||||||

|

|

|

|

|

|

|

|||||||

| (a) | Reflects a $15.4 million premium paid for the early redemption of $140.0 million of our Senior Notes using net proceeds from our initial public offering in April 2013, along with a write-off of approximately $5.5 million in related discounts and deferred financing costs and a write-off of approximately $11.5 million of certain capitalized debt issuance costs in connection with Amendment No. 5 to our Senior Secured Credit Facilities. |

| (b) | Reflects fees and expenses incurred in connection with the secondary offering of our common stock in December 2013. The selling stockholders received all of the net proceeds from the offering and we paid all expenses related to the offering, other than underwriting discounts and commissions. No shares were sold by us in the secondary offering. |

| (c) | Reflects a one-time fee of $46.3 million paid to an affiliate of Blackstone in connection with the termination of the 2009 Advisory Agreement, and a related write-off of prepaid advisory fees of $3.8 million. In connection with our initial public offering, the 2009 Advisory Agreement was terminated on April 24, 2013 in accordance with its terms. |

| (d) | Reflects historical fees paid to an affiliate of Blackstone under the 2009 Advisory Agreement. |

| (e) | Reflects non-cash compensation expenses associated with the grants of equity compensation. |

| (f) | Reflects costs which were expensed related to the amendments to our Senior Secured Credit Facilities. |

| (g) | Reflects costs related to our acquisition of the Knott’s Soak City Chula Vista water park and pre-opening costs related to Aquatica San Diego. |

| (h) | Reflects non-cash expenses related to miscellaneous asset write-offs and non-cash gains/losses on foreign currencies which were expensed. |

| (i) | Reflects certain carve-out costs and savings related to our separation from ABI and the establishment of certain operations at the Company on a stand-alone basis. These amounts primarily consist of the cost of third-party professional services, relocation expenses, severance costs and cost savings related to the termination of certain employees. |

16

Table of Contents

An investment in our common stock involves a high degree of risk. You should carefully consider each of the following risks as well as the other information included in this prospectus, including “Selected Historical Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes, before investing in our common stock. Any of the following risks could materially and adversely affect our business, financial condition or results of operations. In such a case, the trading price of the common stock could decline and you may lose all or part of your investment in the Company.

Risks Related to Our Business and Our Industry

We could be adversely affected by a decline in discretionary consumer spending or consumer confidence.

Our success depends to a significant extent on discretionary consumer spending, which is heavily influenced by general economic conditions and the availability of discretionary income. The recent severe economic downturn, coupled with high volatility and uncertainty as to the future global economic landscape, has had and continues to have an adverse effect on consumers’ discretionary income and consumer confidence.

Difficult economic conditions and recessionary periods may adversely impact attendance figures, the frequency with which guests choose to visit our theme parks and guest spending patterns at our theme parks. The actual or perceived weakness in the economy could also lead to decreased spending by our guests. For example, in 2009 and 2010, we experienced a decline in attendance as a result of the global economic crisis, which in turn adversely affected our revenue and profitability. Both attendance and total per capita spending at our theme parks are key drivers of our revenue and profitability, and reductions in either can materially adversely affect our business, financial condition and results of operations.

Various factors beyond our control could adversely affect attendance and guest spending patterns at our theme parks.

Various factors beyond our control could adversely affect attendance and guest spending patterns at our theme parks. These factors could also affect our suppliers, vendors, insurance carriers and other contractual counterparties. Such factors include:

| Ÿ | war, terrorist activities or threats and heightened travel security measures instituted in response to these events; |

| Ÿ | outbreaks of pandemic or contagious diseases or consumers’ concerns relating to potential exposure to contagious diseases; |

| Ÿ | natural disasters, such as hurricanes, fires, earthquakes, tsunamis, tornados, floods and volcanic eruptions and man-made disasters such as the oil spill in the Gulf of Mexico, which may deter travelers from scheduling vacations or cause them to cancel travel or vacation plans; |

| Ÿ | bad weather and even forecasts of bad weather, including abnormally hot, cold and/or wet weather, particularly during weekends, holidays or other peak periods; |

| Ÿ | changes in the desirability of particular locations or travel patterns of our guests; |

| Ÿ | low consumer confidence; |

| Ÿ | oil prices and travel costs and the financial condition of the airline, automotive and other transportation-related industries, any travel-related disruptions or incidents and their impact on travel; and |

17

Table of Contents

| Ÿ | actions or statements by U.S. and foreign governmental officials related to travel and corporate travel-related activities (including changes to the U.S. visa rules) and the resulting public perception of such travel and activities. |

Any one or more of these factors could adversely affect attendance and total per capita spending at our theme parks, which could materially adversely affect our business, financial condition and results of operations.

Our intellectual property rights are valuable, and any inability to protect them could adversely affect our business.

Our intellectual property, including our trademarks, service marks, domain names, copyrights, patent and other proprietary rights, constitutes a significant part of the value of the Company. To protect our intellectual property rights, we rely upon a combination of trademark, copyright, patent, trade secret and unfair competition laws of the United States and other countries, as well as contract provisions and third-party policies and procedures governing internet/domain name registrations. However, there can be no assurance that these measures will be successful in any given case, particularly in those countries where the laws do not protect our proprietary rights as fully as in the United States. We may be unable to prevent the misappropriation, infringement or violation of our intellectual property rights, breaching any contractual obligations to us, or independently developing intellectual property that is similar to ours, any of which could reduce or eliminate any competitive advantage we have developed, adversely affect our revenues or otherwise harm our business.

We have obtained and applied for numerous U.S. and foreign trademark and service mark registrations and will continue to evaluate the registration of additional trademarks and service marks or other intellectual property, as appropriate. We cannot guarantee that any of our pending applications will be approved by the applicable governmental authorities. Moreover, even if the applications are approved, third parties may seek to oppose or otherwise challenge these registrations. A failure to obtain registrations for our intellectual property in the United States and other countries could limit our ability to protect our intellectual property rights and impede our marketing efforts in those jurisdictions.

We are actively engaged in enforcement and other activities to protect our intellectual property rights. If it became necessary for us to resort to litigation to protect these rights, any proceedings could be burdensome, costly and divert the attention of our personnel, and we may not prevail. In addition, any repeal or weakening of laws or enforcement in the United States or internationally intended to protect intellectual property rights could make it more difficult for us to adequately protect our intellectual property rights, negatively impacting their value and increasing the cost of enforcing our rights.

We may be subject to claims for infringing the intellectual property rights of others, which could be costly and result in the loss of significant intellectual property rights.

We cannot be certain that we do not and will not infringe the intellectual property rights of others. We have been in the past, and may be in the future, subject to litigation and other claims in the ordinary course of our business based on allegations of infringement or other violations of the intellectual property rights of others. Regardless of their merits, intellectual property claims can divert the efforts of our personnel and are often time-consuming and expensive to litigate or settle. In addition, to the extent claims against us are successful, we may have to pay substantial money damages or discontinue, modify, or rename certain products or services that are found to be in violation of another party’s rights. We may have to seek a license (if available on acceptable terms, or at all) to continue offering products and services, which may significantly increase our operating expenses.

18

Table of Contents

Incidents or adverse publicity concerning our theme parks or the theme park industry generally could harm our brands or reputation as well as negatively impact our revenues and profitability.