EX-99.1

Exhibit 99.1

SeaWorld Entertainment, Inc. Reports Record Full Year 2013 Results

Orlando, Fla. (March 13, 2014)—SeaWorld Entertainment, Inc. (NYSE: SEAS), a leading theme park and entertainment company, today reported

financial results for the fourth quarter and full year of 2013.

Release Highlights

| |

• |

|

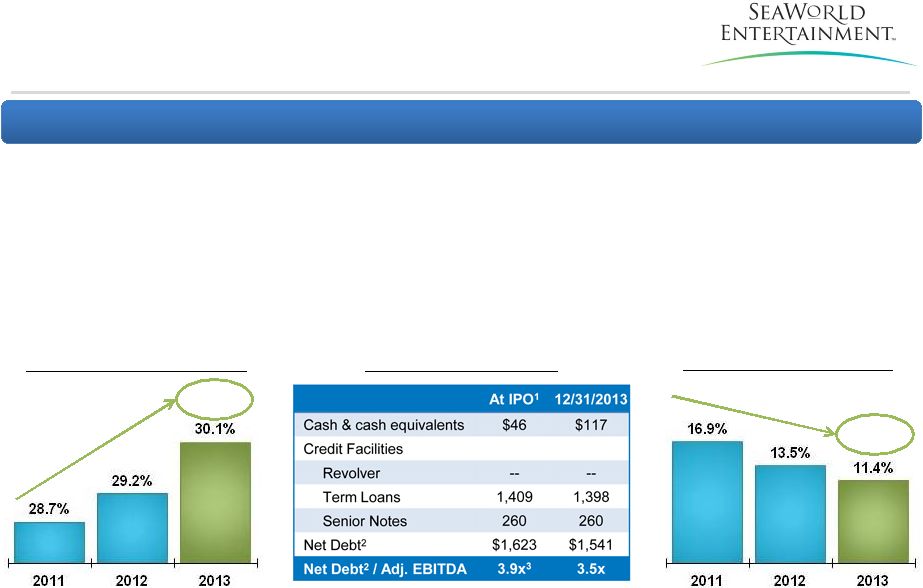

Record revenue of $1,460.3 million in 2013, an increase of $36.5 million, or 3%, compared to 2012. |

| |

• |

|

Record Adjusted EBITDA[1] of $439.1 million in 2013, an increase of $23.9 million, or 6%, compared to 2012. |

| |

• |

|

Adjusted Free Cash Flow[1] of $169.8 million in 2013, an increase of $58.1 million, or 52%, compared to 2012. |

| |

• |

|

Completed a secondary offering by selling stockholders of 18 million shares of common stock in the fourth quarter of 2013 and concurrently repurchased 1.5 million shares of common stock directly from such

selling stockholders. |

| |

• |

|

Declared a cash dividend of $0.20 per share on March 4, 2014, payable on April 1, 2014. |

| |

• |

|

Announced fiscal 2014 revenue guidance in the range of $1,490 million to $1,520 million and Adjusted EBITDA in the range of $450 million to $465 million. |

“Driven by record fourth quarter total attendance at our SeaWorld-branded parks in Orlando, San Diego, and San Antonio, I am pleased to report our third

consecutive year of record revenue and Adjusted EBITDA,” Jim Atchison, President and Chief Executive Officer of SeaWorld Entertainment, Inc. said. “We ended the year with Adjusted EBITDA of $439.1 million, at the high end of our previously

provided guidance range. We are pleased to deliver on the financial and operating commitments we made in our first year as a public company. Delivering these results in a challenging operating environment is a testament to the strength of our

brands, company, management team and, most importantly, our team members.”

Year to Date Results

For the full year 2013, the Company generated revenue of $1,460.3 million, an increase of $36.5 million, or 3%, over 2012. Adjusted EBITDA was $439.1 million,

an increase of $23.9 million, or 6%, over 2012. The Company reported full year net income for 2013 of $50.5 million, or $0.57 per diluted share. Adjusted Net Income[1] was $101.4 million, or $1.15

per diluted share. In the prior year, the Company generated net income of $77.4 million, or $0.93 per diluted share. Adjusted Free Cash Flow was $169.8 million for the full year 2013, an increase of $58.1 million, or 52%, compared to 2012.

| [1] |

This earnings release includes several metrics, including Adjusted EBITDA, Adjusted Net Income (Loss), Adjusted Net Income (Loss) per Diluted Share, Free Cash Flow and Adjusted Free Cash Flow that are not calculated in

accordance with Generally Accepted Accounting Principles in the U.S. (“GAAP”). See “Statement Regarding Non-GAAP Financial Measures” section at the end of this earnings release for the definitions of Adjusted EBITDA, Adjusted Net

Income (Loss), Adjusted Net Income (Loss) per Diluted Share, Free Cash Flow and Adjusted Free Cash Flow and their reconciliation to their respective most comparable financial measures calculated in accordance with GAAP. |

1

The increase in revenue was driven by a total revenue per capita increase of 7.0% from $58.37 in 2012 to $62.43

in 2013, partially offset by a decrease in attendance. Admission per capita, defined as admissions revenue divided by total attendance, increased by 8.6% from $36.26 in 2012 to $39.37 in 2013 primarily as a result of higher ticket pricing and yield

management strategies implemented at the beginning of 2013. In-park per capita spending, calculated as food, merchandise and other revenue divided by total attendance, increased by 4.3% from $22.11 in 2012 to $23.05 in 2013 due primarily to targeted

price increases and increased in-park offerings.

Attendance in 2013 declined by 4.1% from 24.4 million guests in 2012 to 23.4 million guests in

2013. The decline was primarily attributable to the expected result of planned pricing and yield management strategies that increased revenue but reduced low yielding and free attendance. Also contributing to the decline in full year attendance

was unexpected adverse weather conditions in the Company’s second quarter and July as well as the impact of an early Easter in 2013.

Fourth

Quarter 2013

During the fourth quarter of 2013, the Company generated total revenue of $272.0 million, an increase of $8.8 million, or 3%, over the

same period in 2012. Adjusted EBITDA was $46.6 million, a decrease of $2.8 million, or 6%, over the fourth quarter of 2012. The Company reported a net loss for the fourth quarter of 2013 of $13.5 million, or a loss of $0.15 per diluted share.

Adjusted Net Loss[1] for the quarter was $11.6 million, or a loss of $0.13 per diluted share. In the fourth quarter of 2012, the Company incurred a net loss of $8.8 million, or a loss of $0.11 per

diluted share. Due to the seasonal nature of the business, the Company typically generates its highest revenues during the second and third quarters of each year and historically incurs a net loss in the first and fourth quarters.

The increase in revenue was driven by a 4.8% increase in total revenue per capita from $58.11 in the fourth quarter of 2012 to $60.91 in the fourth quarter of

2013, partially offset by a decrease in attendance. Admissions per capita increased by 4.3% over the prior year quarter, from $37.22 to $38.84 primarily as a result of higher ticket pricing and yield management strategies. In-park per capita

spending increased by 5.7% from $20.89 to $22.07 in the fourth quarter of 2013, due primarily to targeted price increases and increased in-park offerings.

Despite record fourth quarter attendance at the Company’s SeaWorld-branded parks, consolidated fourth quarter attendance declined by 1.4% to

4.5 million guests in 2013. The attendance decline was the expected result of planned pricing and yield management strategies implemented at the beginning of 2013. Attendance trends improved sequentially through the year with a 1.4% decline in

the fourth quarter compared to a 3.6% decline in the third quarter and a 5.7% decline in the first half of the year.

Other

On December 17, 2013, selling stockholders affiliated with The Blackstone Group L.P. completed an underwritten secondary offering of 18 million

shares of the Company’s common stock at a price of $30.00 per share. The selling stockholders received all of the net proceeds from the secondary offering and no shares were sold by the Company. The Company incurred approximately $1.4 million

in expenses related to this secondary offering. Concurrently with the closing of the secondary offering, the Company repurchased 1.5 million shares of its common stock directly from the selling stockholders in a private, non-underwritten

transaction. These shares are held as treasury stock at cost as of December 31, 2013.

2

On March 4, 2014, the Company’s Board of Directors declared a cash dividend of $0.20 per share, which

is payable on April 1, 2014, to all common stockholders of record at the close of business on March 20, 2014.

Guidance

The following guidance is based on current management expectations. All financial guidance amounts are estimates subject to change, including as a result of

matters discussed under the “Forward-Looking Statements” caption below and the Company undertakes no obligation to update its guidance. For the full year of 2014, the Company expects revenue to be in the range of $1,490 million to $1,520

million and Adjusted EBITDA to be in the range of $450 million to $465 million.

Conference Call

The Company will hold a conference call today, Thursday, March 13 at 5:00 P.M. Eastern Time to discuss its fourth quarter and full year 2013 financial

results. The conference call will be broadcast live on the Internet and the release, conference call and supplemental materials can be accessed via the Company’s website at seaworldentertainment.com by clicking on the “Investor

Relations” link located on the upper right corner of that page. For those unable to participate in the live call, a replay of the webcast will be available after 8:00 P.M. Eastern Time March 13, 2014 via the “Investor Relations”

section of seaworldentertainment.com. A replay of the call can also be accessed telephonically from 8:00 P.M. Eastern Time on March 13, 2014 through 11:59 P.M. Eastern Time on March 20, 2014 by dialing 1-877-870-5176 from anywhere

in the U.S. or 1-858-384-5517 from international locations, conference code 9590768.

Statement Regarding Non-GAAP Financial Measures

This earnings release and accompanying financial statement tables include several supplemental non-GAAP financial measures, including Adjusted EBITDA, Adjusted

Net Income (Loss), Adjusted Net Income (Loss) per Diluted Share, Free Cash Flow and Adjusted Free Cash Flow. Adjusted EBITDA, Adjusted Net Income (Loss), Adjusted Net Income (Loss) per Diluted Share, Free Cash Flow, and Adjusted Free Cash Flow are

not recognized terms under GAAP, should not be considered in isolation or as a substitute for a measure of liquidity or performance prepared in accordance with GAAP and are not indicative of net income or loss or net cash provided by operating

activities as determined under GAAP. Adjusted EBITDA, Adjusted Net Income (Loss), Adjusted Net Income (Loss) per Diluted Share, Free Cash Flow, Adjusted Free Cash Flow and other non-GAAP financial measures have limitations that should be considered

before using these measures to evaluate the Company’s liquidity or financial performance. Adjusted EBITDA, Adjusted Net Income (Loss), Adjusted Net Income (Loss) per Diluted Share, Free Cash Flow or Adjusted Free Cash Flow, as presented, may

not be comparable to similarly titled measures of other companies due to varying methods of calculation.

3

Adjusted EBITDA is defined as net income (loss) before income tax expense, interest expense, depreciation and

amortization, as further adjusted to exclude certain non-cash, and other items permitted in calculating covenant compliance under the indenture governing the Company’s existing senior notes and the credit agreement governing the Company’s

senior secured credit facilities. Adjusted EBITDA is a material component of these covenants. Management presents Adjusted EBITDA because it believes that it provides additional information to investors about the calculation of and compliance with

these financial covenants. Management also uses Adjusted EBITDA in connection with certain components of its executive compensation program. In addition, investors, lenders, financial analysts and rating agencies have historically used

EBITDA-related measures in the Company’s industry, along with other measures to evaluate a company’s ability to meet its debt service requirement, to estimate the value of a company and to make informed investment decisions.

Adjusted Net Income (Loss) is defined as net income (loss) before the after-tax impact of the advisory termination fee, secondary offering costs and the loss

on early extinguishment of debt and write-off of discounts and deferred financing costs. Adjusted Net Income (Loss) per Diluted Share is calculated by dividing Adjusted Net Income (Loss) for the period by the diluted shares outstanding. Management

presents Adjusted Net Income (Loss) and Adjusted Net Income (Loss) per Diluted Share to eliminate the impact of items, net of tax, that management does not consider indicative of ongoing operating performance due to their inherent unusual nature or

because they result from an event of a similar nature.

Free Cash Flow is defined as net cash provided by operating activities reduced by capital

expenditures. Adjusted Free Cash Flow is defined as Free Cash Flow further adjusted by the one-time cash payment of the 2009 Advisory Agreement termination fee. Management presents Free Cash Flow and Adjusted Free Cash Flow because it believes it

provides supplemental information to assist investors in analyzing the Company’s ability to generate liquidity from its operating activities. Free Cash Flow and Adjusted Free Cash Flow have limitations due to the fact that they do not represent

the residual cash flow available for discretionary expenditures as they do not take into consideration certain other non-discretionary cash requirements, such as mandatory principal payments on the Company’s long-term debt.

The financial statement tables that accompany this press release include a reconciliation of non-GAAP financial measures to the applicable most comparable

U.S. GAAP financial measures.

About SeaWorld Entertainment, Inc.

SeaWorld Entertainment, Inc. (NYSE: SEAS) is a leading theme park and entertainment company delivering personal, interactive and educational experiences that

blend imagination with nature and enable its customers to celebrate, connect with and care for the natural world we share. The Company owns or licenses a portfolio of globally recognized brands including SeaWorld, Shamu and Busch Gardens. Over its

more than 50-year history, the Company has built a diversified portfolio of 11 destination and regional theme parks that are grouped in key markets across the United States, many of which showcase its one-of-a-kind collection of approximately 86,000

marine and terrestrial animals. The Company’s theme parks feature a diverse array of rides, shows and other attractions with broad demographic appeal which deliver memorable experiences and a strong value proposition for its guests. In addition

to its theme parks, the Company has recently begun to leverage its brands into media, entertainment and consumer products.

4

Copies of this and other news releases as well as additional information about SeaWorld Entertainment, Inc. can

be obtained online at www.seaworldentertainment.com. Shareholders and prospective investors can also register to automatically receive the Company’s press releases, SEC filings and other notices by e-mail by registering at that website.

Forward-Looking Statements

In addition to

historical information, this press release contains statements relating to future results (including certain projections and business trends) that are “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. The Company generally uses the words “may”, “will”,

“could”, “expect”, “anticipate”, “believe”, “estimate”, “plan”, “intend”, and similar expressions in this press release and any attachment to identify forward-looking statements.

All statements, other than statements of historical facts included in this press release, including statements concerning plans, objectives, goals, beliefs, business strategies, future events, business conditions, results of operations, financial

position and business outlook, earnings guidance, business trends and other information are forward-looking statements. The forward-looking statements are not historical facts, and are based upon current expectations, estimates and projections, and

various assumptions, many of which, by their nature, are inherently uncertain and beyond management’s control. All expectations, beliefs and projections are expressed in good faith and the Company believes there is a reasonable basis for them.

However, there can be no assurance that management’s expectations, beliefs and projections will result or be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements.

These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from the

forward-looking statements contained in this press release, including among others: various factors beyond management’s control adversely affecting discretionary spending and attendance at the Company’s theme parks; inability to protect

intellectual property or the infringement on intellectual property rights of others; incidents or adverse publicity concerning the Company’s theme parks; outbreak of infectious disease affecting the Company’s animals; change in federal and

state regulations governing the treatment of animals; and other risks, uncertainties and factors set forth in the section entitled “Risk Factors” in the Company’s final prospectus dated as of December 11, 2013 with the Securities

and Exchange Commission (“SEC”).

Although the Company believes that these statements are based upon reasonable assumptions, it cannot guarantee

future results and readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s opinions only as

5

of the date of this press release. There can be no assurance that (i) the Company has correctly measured or identified all of the factors affecting its business or the extent of these

factors’ likely impact, (ii) the available information with respect to these factors on which such analysis is based is complete or accurate, (iii) such analysis is correct or (iv) the Company’s strategy, which is based in

part on this analysis, will be successful. Except as required by law, the Company undertakes no obligation to update or revise forward-looking statements to reflect new information or events or circumstances that occur after the date of this press

release or to reflect the occurrence of unanticipated events or otherwise. Readers are advised to review the Company’s filings with the SEC (which are available from the SEC’s EDGAR database at www.sec.gov and via the Company’s

website at www.seaworldentertainment.com).

Contacts:

Investor Relations Inquiries:

SeaWorld Entertainment,

Inc.

855.797.8625

investors@seaworld.com

Media Inquiries:

Fred Jacobs

Vice President of Communications

Fred.Jacobs@SeaWorld.com

SOURCE SeaWorld Entertainment, Inc.

6

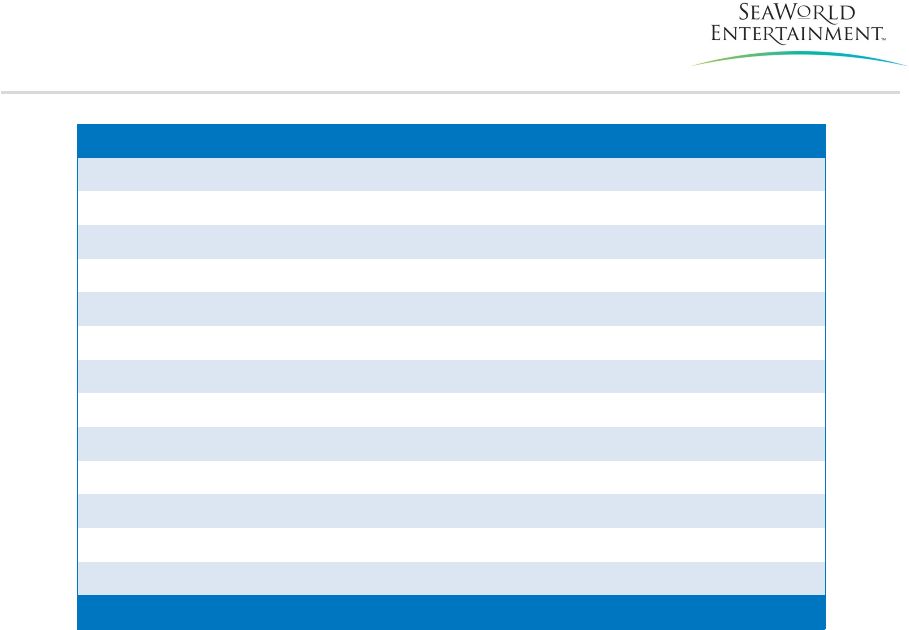

SEAWORLD ENTERTAINMENT, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended

December 31, |

|

|

Change |

|

|

For the Year Ended

December 31, |

|

|

Change |

|

| |

|

2013 |

|

|

2012 |

|

|

$ |

|

|

% |

|

|

2013 |

|

|

2012 |

|

|

$ |

|

|

% |

|

| Net revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Admissions |

|

$ |

173,406 |

|

|

$ |

168,565 |

|

|

$ |

4,841 |

|

|

|

3% |

|

|

$ |

921,016 |

|

|

$ |

884,407 |

|

|

$ |

36,609 |

|

|

|

4% |

|

| Food, merchandise and other |

|

|

98,553 |

|

|

|

94,608 |

|

|

|

3,945 |

|

|

|

4% |

|

|

|

539,234 |

|

|

|

539,345 |

|

|

|

(111 |

) |

|

|

(0%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

271,959 |

|

|

|

263,173 |

|

|

|

8,786 |

|

|

|

3% |

|

|

|

1,460,250 |

|

|

|

1,423,752 |

|

|

|

36,498 |

|

|

|

3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of food, merchandise and other revenues |

|

|

20,968 |

|

|

|

19,450 |

|

|

|

1,518 |

|

|

|

8% |

|

|

|

114,192 |

|

|

|

118,559 |

|

|

|

(4,367 |

) |

|

|

(4%) |

|

| Operating expenses |

|

|

169,430 |

|

|

|

166,364 |

|

|

|

3,066 |

|

|

|

2% |

|

|

|

739,989 |

|

|

|

726,509 |

|

|

|

13,480 |

|

|

|

2% |

|

| Selling, general and administrative |

|

|

37,717 |

|

|

|

34,349 |

|

|

|

3,368 |

|

|

|

10% |

|

|

|

187,298 |

|

|

|

184,920 |

|

|

|

2,378 |

|

|

|

1% |

|

| Termination of advisory agreement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

50,072 |

|

|

|

— |

|

|

|

50,072 |

|

|

|

ND |

|

| Secondary offering costs |

|

|

1,407 |

|

|

|

— |

|

|

|

1,407 |

|

|

|

ND |

|

|

|

1,407 |

|

|

|

— |

|

|

|

1,407 |

|

|

|

ND |

|

| Depreciation and amortization |

|

|

41,932 |

|

|

|

44,890 |

|

|

|

(2,958 |

) |

|

|

(7%) |

|

|

|

166,086 |

|

|

|

166,975 |

|

|

|

(889 |

) |

|

|

(1%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total costs and expenses |

|

|

271,454 |

|

|

|

265,053 |

|

|

|

6,401 |

|

|

|

2% |

|

|

|

1,259,044 |

|

|

|

1,196,963 |

|

|

|

62,081 |

|

|

|

5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

|

|

505 |

|

|

|

(1,880 |

) |

|

|

2,385 |

|

|

|

127% |

|

|

|

201,206 |

|

|

|

226,789 |

|

|

|

(25,583 |

) |

|

|

(11%) |

|

| Other income (loss), net |

|

|

48 |

|

|

|

(547 |

) |

|

|

595 |

|

|

|

109% |

|

|

|

241 |

|

|

|

1,563 |

|

|

|

(1,322 |

) |

|

|

(85%) |

|

| Interest expense |

|

|

20,986 |

|

|

|

25,163 |

|

|

|

(4,177 |

) |

|

|

(17%) |

|

|

|

93,536 |

|

|

|

111,426 |

|

|

|

(17,890 |

) |

|

|

(16%) |

|

| Loss on early extinguishment of debt and write-off of discounts and deferred financing costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

32,429 |

|

|

|

— |

|

|

|

32,429 |

|

|

|

ND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income before income taxes |

|

|

(20,433 |

) |

|

|

(27,590 |

) |

|

|

7,157 |

|

|

|

26% |

|

|

|

75,482 |

|

|

|

116,926 |

|

|

|

(41,444 |

) |

|

|

(35%) |

|

| (Benefit from) provision for income taxes |

|

|

(6,926 |

) |

|

|

(18,791 |

) |

|

|

11,865 |

|

|

|

63% |

|

|

|

25,004 |

|

|

|

39,482 |

|

|

|

(14,478 |

) |

|

|

(37%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(13,507 |

) |

|

$ |

(8,799 |

) |

|

$ |

(4,708 |

) |

|

|

(54%) |

|

|

$ |

50,478 |

|

|

$ |

77,444 |

|

|

$ |

(26,966 |

) |

|

|

(35%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income per share, basic |

|

$ |

(0.15 |

) |

|

$ |

(0.11 |

) |

|

|

|

|

|

|

|

|

|

$ |

0.58 |

|

|

$ |

0.94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income per share, diluted |

|

$ |

(0.15 |

) |

|

$ |

(0.11 |

) |

|

|

|

|

|

|

|

|

|

$ |

0.57 |

|

|

$ |

0.93 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average commons shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

89,523 |

|

|

|

82,576 |

|

|

|

|

|

|

|

|

|

|

|

87,537 |

|

|

|

82,480 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

89,523 |

|

|

|

82,576 |

|

|

|

|

|

|

|

|

|

|

|

88,152 |

|

|

|

83,552 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7

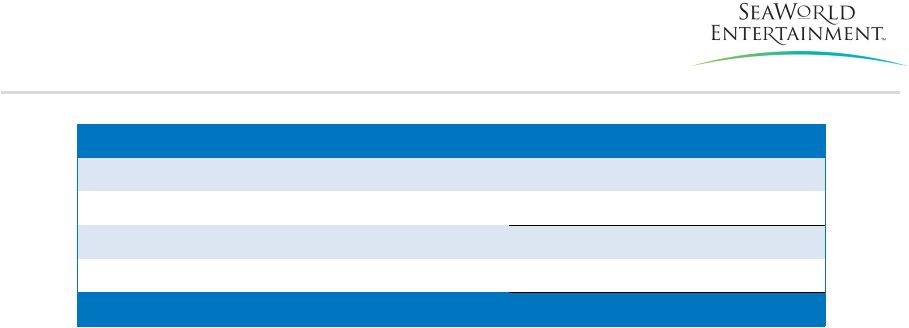

SEAWORLD ENTERTAINMENT, INC. AND SUBSIDIARIES

UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended

December 31, |

|

|

Change |

|

|

For the Year Ended

December 31, |

|

|

Change |

|

| |

|

2013 |

|

|

2012 |

|

|

$ |

|

|

% |

|

|

2013 |

|

|

2012 |

|

|

$ |

|

|

% |

|

| Net (loss) income |

|

$ |

(13,507 |

) |

|

$ |

(8,799 |

) |

|

$ |

(4,708 |

) |

|

|

(54%) |

|

|

$ |

50,478 |

|

|

$ |

77,444 |

|

|

$ |

(26,966 |

) |

|

|

(35%) |

|

| (Benefit from) provision for income taxes |

|

|

(6,926 |

) |

|

|

(18,791 |

) |

|

|

11,865 |

|

|

|

63% |

|

|

|

25,004 |

|

|

|

39,482 |

|

|

|

(14,478 |

) |

|

|

(37%) |

|

| Loss on early extinguishment of debt and write-off of discounts and deferred financing costs (a) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

32,429 |

|

|

|

— |

|

|

|

32,429 |

|

|

|

ND |

|

| Interest expense |

|

|

20,986 |

|

|

|

25,163 |

|

|

|

(4,177 |

) |

|

|

(17%) |

|

|

|

93,536 |

|

|

|

111,426 |

|

|

|

(17,890 |

) |

|

|

(16%) |

|

| Depreciation and amortization |

|

|

41,932 |

|

|

|

44,890 |

|

|

|

(2,958 |

) |

|

|

(7%) |

|

|

|

166,086 |

|

|

|

166,975 |

|

|

|

(889 |

) |

|

|

(1%) |

|

| Secondary offering costs (b) |

|

|

1,407 |

|

|

|

— |

|

|

|

1,407 |

|

|

|

ND |

|

|

|

1,407 |

|

|

|

— |

|

|

|

1,407 |

|

|

|

ND |

|

| Termination of advisory agreement (c) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

50,072 |

|

|

|

— |

|

|

|

50,072 |

|

|

|

ND |

|

| Advisory fees (d) |

|

|

— |

|

|

|

1,126 |

|

|

|

(1,126 |

) |

|

|

(100%) |

|

|

|

2,799 |

|

|

|

6,201 |

|

|

|

(3,402 |

) |

|

|

(55%) |

|

| Equity-based compensation expense (e) |

|

|

1,322 |

|

|

|

320 |

|

|

|

1,002 |

|

|

|

313% |

|

|

|

6,026 |

|

|

|

1,681 |

|

|

|

4,345 |

|

|

|

258% |

|

| Debt refinancing costs (f) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

892 |

|

|

|

1,000 |

|

|

|

(108 |

) |

|

|

(11%) |

|

| Other adjusting items (g) |

|

|

— |

|

|

|

463 |

|

|

|

(463 |

) |

|

|

(100%) |

|

|

|

843 |

|

|

|

630 |

|

|

|

213 |

|

|

|

34% |

|

| Other non-cash expenses (h) |

|

|

1,427 |

|

|

|

5,085 |

|

|

|

(3,658 |

) |

|

|

(72%) |

|

|

|

9,556 |

|

|

|

10,367 |

|

|

|

(811 |

) |

|

|

(8%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

46,641 |

|

|

$ |

49,457 |

|

|

$ |

(2,816 |

) |

|

|

(6%) |

|

|

$ |

439,128 |

|

|

$ |

415,206 |

|

|

$ |

23,922 |

|

|

|

6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(13,507 |

) |

|

$ |

(8,799 |

) |

|

$ |

(4,708 |

) |

|

|

(54%) |

|

|

$ |

50,478 |

|

|

$ |

77,444 |

|

|

$ |

(26,966 |

) |

|

|

(35%) |

|

| Termination of advisory agreement (c) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

50,072 |

|

|

|

— |

|

|

|

50,072 |

|

|

|

ND |

|

| Secondary offering costs (b) |

|

|

1,407 |

|

|

|

— |

|

|

|

1,407 |

|

|

|

ND |

|

|

|

1,407 |

|

|

|

— |

|

|

|

1,407 |

|

|

|

ND |

|

| Loss on early extinguishment of debt and write-off of discounts and deferred financing costs (a) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

32,429 |

|

|

|

— |

|

|

|

32,429 |

|

|

|

ND |

|

| Income taxes of certain non-GAAP adjustments |

|

|

492 |

|

|

|

— |

|

|

|

492 |

|

|

|

ND |

|

|

|

(32,968 |

) |

|

|

— |

|

|

|

(32,968 |

) |

|

|

ND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Net (Loss) Income |

|

$ |

(11,608 |

) |

|

$ |

(8,799 |

) |

|

$ |

(2,809 |

) |

|

|

(32%) |

|

|

$ |

101,418 |

|

|

$ |

77,444 |

|

|

$ |

23,974 |

|

|

|

31% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income per share, diluted |

|

$ |

(0.15 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.04 |

) |

|

|

(36%) |

|

|

|

0.57 |

|

|

$ |

0.93 |

|

|

$ |

(0.36 |

) |

|

|

(39%) |

|

| Termination of advisory agreement (c) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.57 |

|

|

|

— |

|

|

|

0.57 |

|

|

|

ND |

|

| Secondary offering costs (b) |

|

|

0.02 |

|

|

|

— |

|

|

|

0.02 |

|

|

|

ND |

|

|

|

0.02 |

|

|

|

— |

|

|

|

0.02 |

|

|

|

ND |

|

| Loss on early extinguishment of debt and write-off of discounts and deferred financing costs (a) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.36 |

|

|

|

— |

|

|

|

0.36 |

|

|

|

ND |

|

| Income taxes of certain non-GAAP adjustments |

|

|

0.00 |

|

|

|

— |

|

|

|

0.00 |

|

|

|

ND |

|

|

|

(0.37 |

) |

|

|

— |

|

|

|

(0.37 |

) |

|

|

ND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Net (Loss) Income per share, diluted |

|

$ |

(0.13 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.02 |

) |

|

|

(18%) |

|

|

$ |

1.15 |

|

|

$ |

0.93 |

|

|

$ |

0.22 |

|

|

|

24% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding, diluted |

|

|

89,523 |

|

|

|

82,576 |

|

|

|

|

|

|

|

|

|

|

|

88,152 |

|

|

|

83,552 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

$ |

13,477 |

|

|

$ |

865 |

|

|

$ |

12,612 |

|

|

|

1458% |

|

|

$ |

289,794 |

|

|

$ |

303,513 |

|

|

$ |

(13,719 |

) |

|

|

(5%) |

|

| Advisory termination fee cash payment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

46,300 |

|

|

|

— |

|

|

|

46,300 |

|

|

|

ND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted cash flow from operations |

|

$ |

13,477 |

|

|

$ |

865 |

|

|

$ |

12,612 |

|

|

|

1458% |

|

|

$ |

336,094 |

|

|

$ |

303,513 |

|

|

$ |

32,581 |

|

|

|

11% |

|

| Capital expenditures |

|

|

40,406 |

|

|

|

36,769 |

|

|

|

3,637 |

|

|

|

10% |

|

|

|

166,258 |

|

|

|

191,745 |

|

|

|

(25,487 |

) |

|

|

(13%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Free Cash Flow |

|

$ |

(26,929 |

) |

|

$ |

(35,904 |

) |

|

$ |

8,975 |

|

|

|

25% |

|

|

$ |

169,836 |

|

|

$ |

111,768 |

|

|

$ |

58,068 |

|

|

|

52% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8

SEAWORLD ENTERTAINMENT, INC. AND SUBSIDIARIES

UNAUDITED BALANCE SHEET DATA

(In thousands)

|

|

|

|

|

|

|

|

|

| |

|

As of December 31, |

|

| |

|

2013 |

|

|

2012 |

|

| Cash and cash equivalents |

|

$ |

116,841 |

|

|

$ |

45,675 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

2,582,273 |

|

|

$ |

2,521,052 |

|

|

|

|

|

|

|

|

|

|

| Long-term debt, including current maturities: |

|

|

|

|

|

|

|

|

| Term A Loan |

|

$ |

— |

|

|

$ |

152,000 |

|

| Term B Loan |

|

|

— |

|

|

|

1,293,774 |

|

| Term B-2 Loans |

|

|

1,397,975 |

|

|

|

— |

|

| Senior Notes |

|

|

260,000 |

|

|

|

400,000 |

|

|

|

|

|

|

|

|

|

|

| Total long-term debt, including current maturities |

|

$ |

1,657,975 |

|

|

$ |

1,845,774 |

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

$ |

654,132 |

|

|

$ |

449,848 |

|

|

|

|

|

|

|

|

|

|

SEAWORLD ENTERTAINMENT, INC. AND SUBSIDIARIES

UNAUDITED OTHER DATA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended

As of December 31, |

|

|

Change |

|

|

For the Year Ended

As of December 31, |

|

|

Change |

|

| |

|

2013 |

|

|

2012 |

|

|

$ |

|

|

% |

|

|

2013 |

|

|

2012 |

|

|

$ |

|

|

% |

|

| Attendance (in thousands) |

|

|

4,465 |

|

|

|

4,529 |

|

|

|

(64 |

) |

|

|

(1.4 |

%) |

|

|

23,391 |

|

|

|

24,391 |

|

|

|

(1,000 |

) |

|

|

(4.1 |

%) |

| Total revenue per capita (i) |

|

$ |

60.91 |

|

|

$ |

58.11 |

|

|

$ |

2.80 |

|

|

|

4.8 |

% |

|

$ |

62.43 |

|

|

$ |

58.37 |

|

|

$ |

4.06 |

|

|

|

7.0 |

% |

ND-Not determinable

(a) Reflects a $15.4 million premium paid for the early redemption of $140.0 million of the Company’s Senior Notes using net proceeds from

the Company’s initial public offering in April 2013, along with a write-off of approximately $5.5 million in related discounts and deferred financing costs and a write-off of approximately $11.5 million of certain capitalized debt issuance

costs in connection with Amendment No. 5 to the Company’s Senior Secured Credit Facilities.

(b) Reflects fees and expenses

incurred by the Company in connection with the secondary offering of common stock in December 2013. The selling stockholders received all of the net proceeds from the offering and the Company paid all expenses related to the offering, other than

underwriting discounts and commissions. No shares were sold by the Company in the secondary offering.

(c) Reflects a one-time fee of $46.3

million paid by the Company to an affiliate of Blackstone in connection with the termination of the 2009 Advisory Agreement, and a related write-off of prepaid advisory fees of $3.8 million.

(d) Reflects historical fees paid to an affiliate of Blackstone under the 2009 Advisory Agreement.

(e) Reflects non-cash compensation expense associated with the grants of equity compensation.

(f) Reflects costs which were expensed related to the amendments to the Senior Secured Credit Facilities.

(g) Reflects costs related to the Company’s acquisition of the Knott’s Soak City Chula Vista water park and pre-opening costs related

to Aquatica San Diego.

(h) Reflects non-cash expenses related to miscellaneous asset write-offs and non-cash gains/losses on foreign

currencies, which were expensed.

(i) Calculated as total revenues divided by attendance.

9