UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

ALLAKOS INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

April 23, 2024

825 Industrial Road, Suite 500

San Carlos, California 94070

To Stockholders of Allakos Inc.:

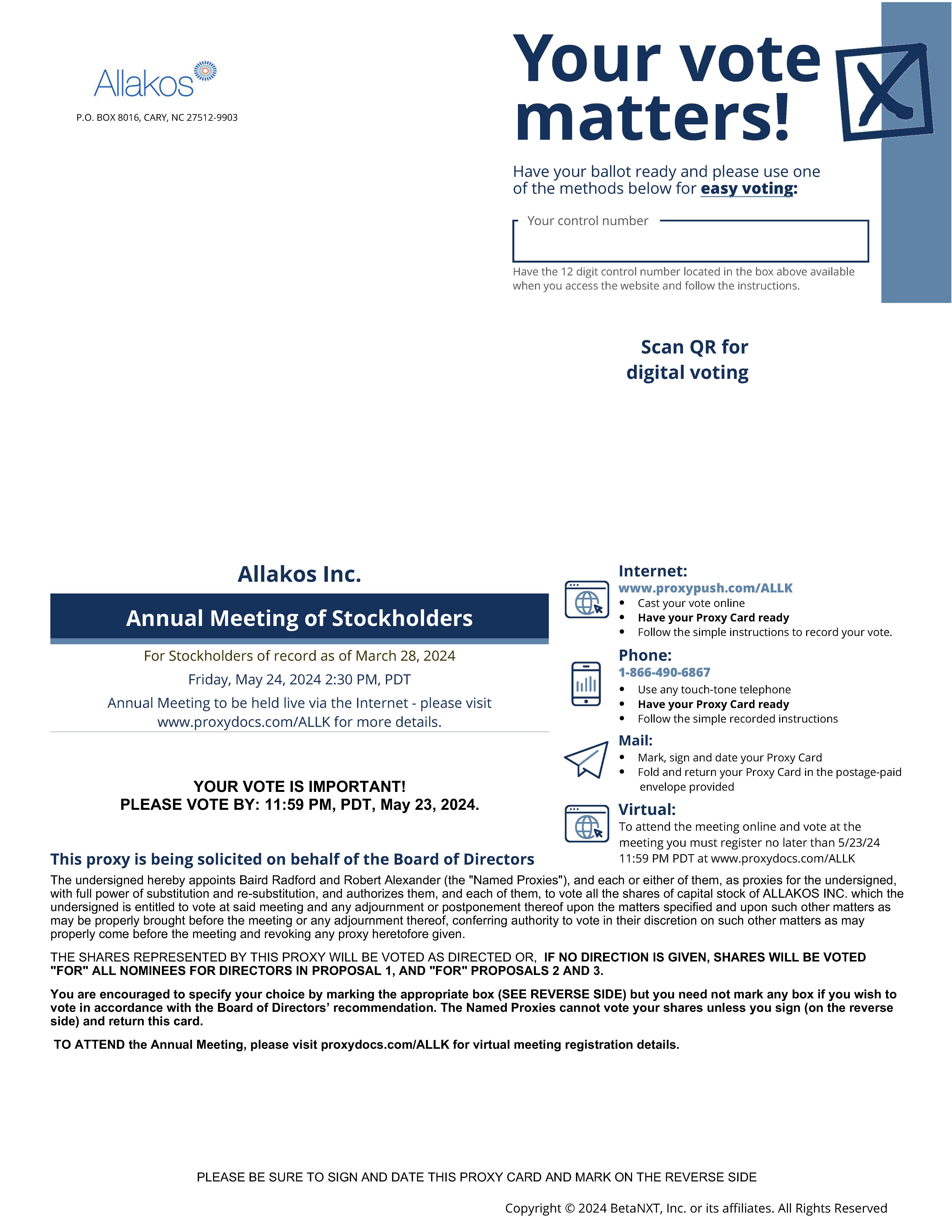

Our 2024 Annual Meeting of Stockholders (“2024 Annual Meeting”) will be held on Friday, May 24, 2024, at 2:30 p.m., PDT. The 2024 Annual Meeting will be conducted exclusively online via a live webcast. You will be able to attend the meeting, submit your questions during the meeting and vote your shares electronically at the meeting by registering at www.proxydocs.com/ALLK. Because the meeting is completely virtual and being conducted via the Internet, stockholders will not be able to attend the meeting in person. In order to attend the meeting, you must register at www.proxydocs.com/ALLK. The attached notice and proxy statement describe the formal business to be transacted at the meeting.

In accordance with the rules of the Securities and Exchange Commission, we are advising our stockholders of the availability on the Internet of our proxy materials related to our forthcoming annual meeting. These rules allow companies to provide access to proxy materials in one of two ways. Because we have elected to utilize the “full set delivery” option, we are delivering paper copies of all proxy materials to each stockholder, as well as providing access to those proxy materials on a publicly accessible website. Beginning on April 23, 2024, you may read, print and download our 2023 Annual Report to Stockholders on Form 10-K and our Proxy Statement at www.proxydocs.com/ALLK.

You may vote your shares by regular mail, online or by telephone. The 2024 Annual Meeting is being held so that stockholders may consider the election of Class III directors, the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, and a non-binding advisory vote on the compensation of our named executive officers.

Our Board of Directors determined that the matters to be considered at the 2024 Annual Meeting are in the best interests of us and our stockholders. For the reasons set forth in the Proxy Statement, our Board of Directors unanimously recommends a vote “FOR” the election of each Class III director, a vote “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, and a vote “FOR” the approval, on a non-binding advisory basis, of the compensation of our named executive officers.

On behalf of the Board of Directors and the officers and employees of Allakos Inc., I would like to take this opportunity to thank our stockholders for their continued support.

Sincerely, |

Robert Alexander, Ph.D. |

Chief Executive Officer and Director |

Table of Contents

|

Page |

1 |

|

3 |

|

8 |

|

PROPOSAL NO. 2 – RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

12 |

PROPOSAL NO. 3 – ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION |

14 |

15 |

|

16 |

|

24 |

|

25 |

|

35 |

|

52 |

|

53 |

|

56 |

|

57 |

|

58 |

|

58 |

Allakos Inc.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Notice is hereby given that our 2024 Annual Meeting of Stockholders (“2024 Annual Meeting”) will be held virtually via live webcast on the Internet on Friday, May 24, 2024, at 2:30 p.m., PDT for the following purposes:

These proposals are more fully described in the Proxy Statement following this Notice.

Our Board of Directors recommends that you vote (i) FOR the election of the respective nominees for Class III directors named in this proxy statement to serve as directors of the Company, (ii) FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 and (iii) FOR the approval, on a non-binding advisory basis, of the compensation of our named executive officers as described in this proxy statement. You will be able to attend the meeting, submit your questions during the meeting, and vote your shares electronically at the meeting by registering at www.proxydocs.com/ALLK.

Along with the attached Proxy Statement, we are sending you copies of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Our Board of Directors has fixed the close of business on March 28, 2024, as the record date for the determination of the stockholders entitled to notice of, and to vote at, the 2024 Annual Meeting. Accordingly, only stockholders of record at the close of business on that date will be entitled to vote at the 2024 Annual Meeting.

Stockholders are cordially invited to attend the 2024 Annual Meeting. Regardless of whether you plan to attend, please mark, date, sign and return the enclosed proxy to ensure that your shares are represented. If you are a stockholder of record and are voting by proxy, your vote must be received by 11:59 p.m., PDT on May 23, 2024, to be counted. You may also attend the 2024 Annual Meeting virtually and vote your shares then. Please note that if you hold your shares through a brokerage account or through a bank or another nominee, they may have an earlier deadline. Please refer to the voting instructions you received from such broker, bank or other record holder.

By order of the Board of Directors, |

Robert Alexander, Ph.D. |

Chief Executive Officer and Director |

April 23, 2024

YOUR VOTE IS IMPORTANT

Please vote via the Internet or telephone.

Internet: www.proxypush.com/ALLK

Phone: 1-866-490-6867

1

To vote by mail, please mark, sign and date the enclosed proxy card and

return it promptly in the self-addressed, stamped envelope provided.

2

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be Held on May 24, 2024

The Securities and Exchange Commission (the “SEC”) has adopted rules regarding how companies must provide proxy materials to their stockholders. These rules are often referred to as “notice and access,” under which a company may select either of the following options for making proxy materials available to its stockholders:

A company may use a single method for all of its stockholders or use full set delivery for some while adopting the notice only option for others.

Full Set Delivery Option

Under the full set delivery option, a company delivers all proxy materials to its stockholders by mail as it would have done prior to the change in the rules. In addition to delivery of proxy materials to stockholders, the company must post all proxy materials on a publicly accessible website and provide information to stockholders about how to access the website.

In connection with our 2024 Annual Meeting, we have elected to use the full set delivery option. Accordingly, you will receive all proxy materials by mail. These proxy materials include the Notice of 2024 Annual Meeting of Stockholders, proxy statement, proxy card and our Annual Report on Form 10-K.

Notice Only Option

Under the notice only option, which we have elected NOT to use for the 2024 Annual Meeting, a company must post all proxy materials on a publicly accessible website. Instead of delivering proxy materials to its stockholders, the company instead delivers a “Notice of Internet Availability of Proxy Material.” The notice must include, among other things:

If a stockholder requests paper copies of the proxy materials, these materials must be sent to the stockholder within three business days and by first class mail.

We May Use the Notice Only Option in the Future

Although we have elected to use the full set delivery option in connection with the 2024 Annual Meeting, we may choose to use the notice only option in the future. By reducing the amount of materials that a company needs to print and mail, the notice only option provides an opportunity for cost savings as well as conservation of paper products. Many companies that have used the notice only option have also experienced a lower participation rate resulting in fewer stockholders voting at the meeting. We plan to evaluate the future possible cost savings as well as the possible impact on stockholder participation as we consider future use of the notice only option.

Householding

We and some banks, brokers and other nominee record holders participate in the practice of “householding” proxy statements and annual reports. This means that we and such banks, brokers and other nominee record holders are permitted to mail only one copy of our documents, including the 2023 Annual Report and this proxy statement to any household in which two or more different stockholders reside and are members of the same household or in which one stockholder has multiple accounts. We will promptly deliver a separate copy of either document to you upon written or oral request to Allakos Inc., 825 Industrial Road, Suite 500, San Carlos, California 94070, Attention: Corporate Secretary, 1-650-597-5002. If you want to receive separate copies of the proxy statement or annual report

3

to stockholders in the future, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker or other nominee record holder, or you may contact us at the above address and phone number.

When is the 2024 Annual Meeting?

Our 2024 Annual Meeting will be held on Friday, May 24, 2024, at 2:30 p.m. PDT.

What do I need to do to attend the 2024 Annual Meeting?

This year’s annual meeting will be a virtual meeting via live webcast on the Internet. In order to vote or submit a question during the 2024 Annual Meeting, you will need to register for the meeting at www.proxydocs.com/ALLK with the control number included on your Notice or proxy card and follow the instructions in the email you will receive after registering. Any stockholder wishing to attend the 2024 Annual Meeting must visit www.proxydocs.com/ALLK to register before May 23, 2024 at 11:59 p.m. PDT. Beneficial stockholders who do not have a control number may gain access to the meeting by logging into their broker, bank or other nominee’s website and selecting the shareholder communications mailbox to link through to the meeting. Instructions should also be provided on the voting instruction card provided by your broker, bank or other nominee.

What is the purpose of the 2024 Annual Meeting?

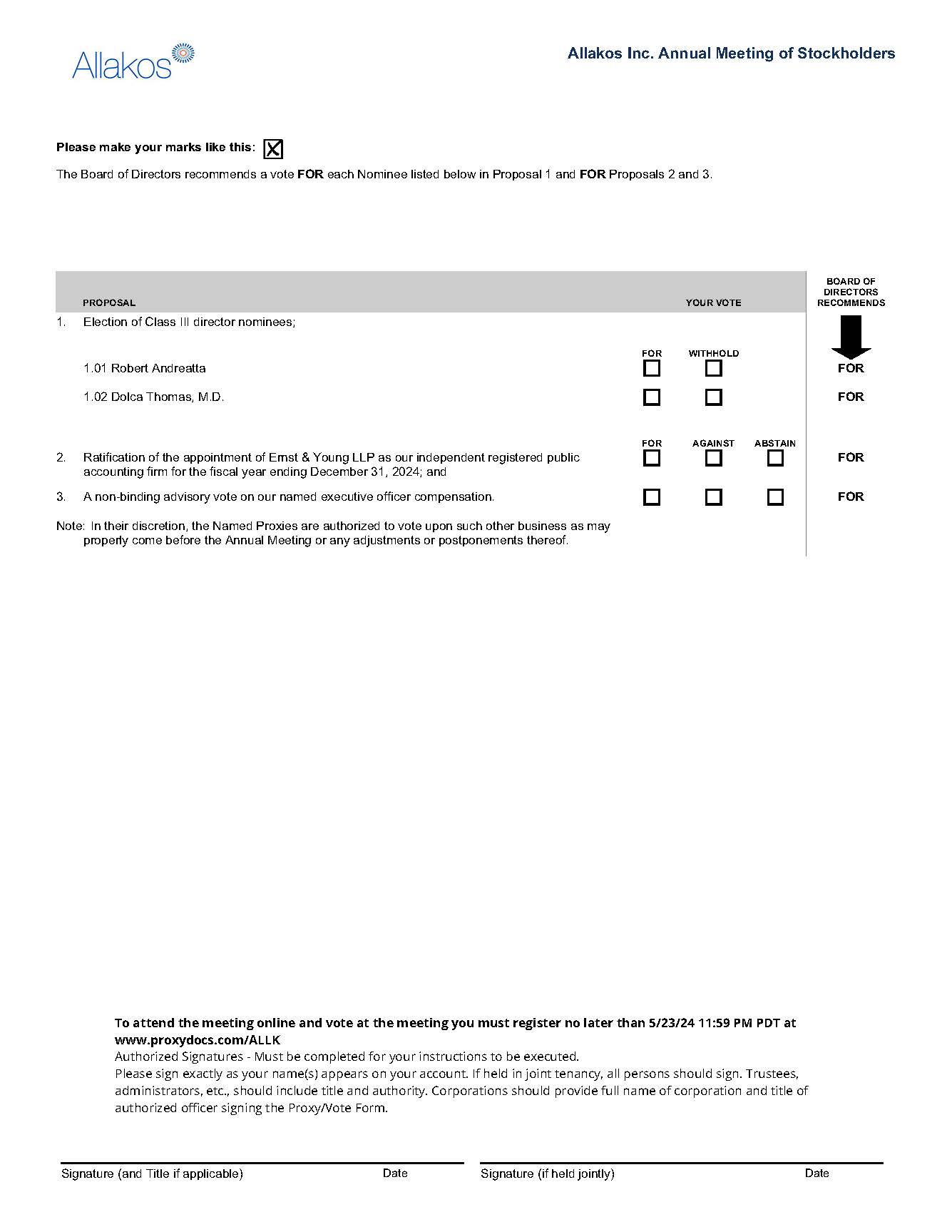

At our 2024 Annual Meeting, stockholders will act upon the matters outlined in the notice of meeting on the cover page of this proxy statement, consisting of:

What are the Board’s recommendations?

Our Board recommends that you vote:

Who is entitled to vote at the 2024 Annual Meeting?

Only holders of our common stock as of the close of business on March 28, 2024, the record date, are entitled to receive notice of and to vote at the 2024 Annual Meeting. In deciding all matters at the 2024 Annual Meeting, each stockholder will be entitled to one vote for each share of our common stock owned as of the record date. We do not have cumulative voting rights for the election of directors. As of the record date, there were 88,544,474 shares of our common stock outstanding and entitled to vote. We do not have any outstanding shares of preferred stock.

Stockholders of Record. If your shares of common stock are registered directly in your name with our transfer agent, Equiniti Trust Company, LLC, then you are considered the stockholder of record with respect to those shares, and the proxy materials were sent directly to you by us. As a stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote on your own behalf at the 2024 Annual Meeting. Throughout this proxy statement, we refer to these holders as “stockholders of record.”

Street Name Stockholders. If your shares are held in a brokerage account or by a broker, bank or other nominee, then you are considered the beneficial owner of shares held in street name, and the proxy materials were forwarded to you by your broker, bank or other nominee, which is considered the stockholder of record with respect to those

4

shares. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares held in your account by following the instructions that your broker, bank or other nominee sent to you. Throughout this proxy statement, we refer to these holders as “street name stockholders.”

Is there a list of registered stockholders entitled to vote at the 2024 Annual Meeting?

A list of stockholders entitled to vote at the meeting will be available for examination by any stockholder for any purpose germane to the 2024 Annual Meeting for a period of 10 days ending on the day before the date of the 2024 Annual Meeting during our ordinary business hours at our principal executive offices at 825 Industrial Road, Suite 500, San Carlos, California 94070.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of common stock representing a majority of the combined voting power of the outstanding shares of stock on the record date will constitute a quorum, permitting the meeting to conduct its business. Abstentions, choosing to withhold authority to vote and broker non-votes are counted as present and entitled to vote for purposes of determining a quorum. If less than a quorum is represented at the 2024 Annual Meeting, a majority of the shares so represented, or the chairperson of the meeting, may adjourn the 2024 Annual Meeting from time to time without further notice other than announcement at the meeting.

What vote is required to approve each item?

Except as otherwise provided by law, our amended and restated certificate of incorporation, our amended and restated bylaws or the rules of any applicable stock exchange on which our securities are listed, the affirmative vote

5

of a majority of the shares of common stock present or represented by proxy and entitled to vote thereon is required for the approval of any other matter that may be submitted to a vote of our stockholders.

What if I do not specify how my shares are to be voted or fail to provide timely directions to my broker, bank or other nominee?

Stockholders of Record. If you are a stockholder of record and you submit a proxy, but you do not provide voting instructions, your shares will be voted:

Street Name Stockholders. Brokers, banks and other nominees holding shares of common stock in street name for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker, bank or other nominee will have discretion to vote your shares on our sole routine matter: the proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024. Your broker, bank or other nominee will not have discretion to vote on our other proposals, which are considered non-routine matters, absent direction from you. In the event that your broker, bank or other nominee votes your shares on our routine matter, but is not able to vote your shares on the non-routine matters, then those shares will be treated as broker non-votes with respect to the non-routine proposals. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your shares are counted on each of the proposals.

What are the effects of abstentions and broker non-votes?

An abstention represents a stockholder’s affirmative choice to decline to vote on a proposal. If a stockholder indicates on its proxy card that it wishes to abstain from voting its shares, or if a broker, bank or other nominee holding its customers’ shares of record causes abstentions to be recorded for shares, these shares will be considered present and entitled to vote at the 2024 Annual Meeting. As a result, abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against a proposal in cases where approval of the proposal requires the affirmative vote of a majority of the voting power of the shares present in person or represented by proxy at the 2024 Annual Meeting and entitled to vote thereon (e.g., Proposal No. 2 and Proposal No. 3). However, because the outcome of Proposal No. 1 (Election of Directors) will be determined by a plurality vote, abstentions will have no impact on the outcome of such proposal as long as a quorum exists.

A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker, bank or other nominee does not have discretionary voting power with respect to such proposal and has not received voting instructions from the beneficial owner of the shares. Broker non-votes will be counted for purposes of calculating whether a quorum is present at the 2024 Annual Meeting but will not be counted for purposes of determining the number of votes cast. Therefore, a broker non-vote will make a quorum more readily attainable but will not otherwise affect the outcome of the vote on Proposals No. 1 and 3. Because Proposal No. 2 is a routine proposal, your broker, bank or other nominee will have discretion to vote your shares on this routine matter. See “What if I do not specify how my shares are to be voted or fail to provide timely directions to my broker, bank or other nominee?” above. Therefore, we do not expect any broker non-votes on Proposal No. 2, however, if a broker non-vote is received for Proposal No. 2, it will make a quorum more readily attainable but will not otherwise affect the outcome of the vote.

Who will count the votes?

A representative of Mediant Communications, Inc. will tabulate the votes and act as inspector of election.

6

How do I vote?

Stockholders of Record. You may vote by following the instructions set forth on your proxy card or, if you are a street name holder (that is, if you hold your shares through a bank, broker or other holder of record), you must vote in accordance with the voting instruction form provided by your bank, broker or other holder of record. You may access the Notice, proxy materials and our annual report to stockholders at www.proxydocs.com/ALLK.

Street Name Stockholders. If you are a street name holder, the availability of telephone or internet voting will depend upon your bank’s, broker’s, or other holder of record’s voting process. If you are not voting in person at the 2024 Annual Meeting, your vote must be received by 11:59 p.m., PDT on May 23, 2024 to be counted.

Can I change my vote after I return my proxy card?

Stockholders of Record. Yes. The giving of a proxy does not eliminate the right to vote in person should any stockholder giving the proxy so desire. Stockholders have an unconditional right to revoke their proxy at any time prior to the exercise of that proxy, by voting in person at the 2024 Annual Meeting, or by filing a written revocation or duly executed proxy bearing a later date with our Secretary at our headquarters.

Street Name Stockholders. If you are a street name stockholder, then your broker, bank or other nominee can provide you with instructions on how to change or revoke your proxy.

Who pays for costs relating to the proxy materials and annual meeting of stockholders?

Our Board is soliciting the enclosed proxy. The costs of preparing, assembling and mailing this proxy statement, the Notice of Annual Meeting of Stockholders and the enclosed Annual Report and proxy card, along with the cost of posting the proxy materials on a website, are to be borne by us. In addition to the use of mail, our directors, officers and employees may solicit proxies personally and by telephone, facsimile and other electronic means. They will receive no compensation in addition to their regular salaries. We may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy material to their principals and to request authority for the execution of proxies. We may reimburse these persons for their expenses in so doing.

7

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

One of our sitting Class III Directors, Robert Andreatta, and Dolca Thomas, M.D., currently a Class I Director, will stand for election as Class III Directors at the 2024 Annual Meeting. Daniel Janney and E. Rand Sutherland, M.D., current Class III directors, were not nominated by our Board for re-election. The decision not to nominate Mr. Janney and Dr. Sutherland for re-election was not due to a disagreement with our management or Board, and we extend our gratitude and appreciation to Mr. Janney and Dr. Sutherland for their contributions to Allakos.

Our Board currently consists of nine members, with staggered three-year terms, pursuant to our amended and restated certificate of incorporation and amended and restated bylaws. As Daniel Janney and E. Rand Sutherland, M.D., Class III Directors, were not nominated for re-election to the Board, their current terms end effective upon the election of directors at the 2024 Annual Meeting. The Board has resolved that upon the expiration of Mr. Janney’s and Dr. Sutherland’s terms, the authorized number of directors shall be reduced to seven, consisting of two (2) Class I directorships, three (3) Class II directorships, and two (2) Class III directorships. Proxies cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement.

The terms of office of directors in Class I, which consists of Robert Alexander, Ph.D., Steven P. James, and, prior to her transition to a Class III directorship in upon the election of directors at the 2024 Annual Meeting, Dolca Thomas, M.D., and Class II, which consists of Paul Walker, Amy L. Ladd, M.D., and Neil Graham, M.D., expire at our Annual Meetings of Stockholders to be held in 2025 and 2026, respectively. At the recommendation of our corporate governance and nominating committee of the Board (“Corporate Governance and Nominating Committee”), our Board proposes that each of Robert Andreatta and Dolca Thomas, M.D. be elected as a Class III director for a three-year term expiring at our 2027 Annual Meeting of Stockholders, or until such director’s successor is duly elected and qualified, or until their earlier death, resignation, disqualification or removal. Dolca Thomas, M.D. has agreed to serve as a Class III Director if elected at the 2024 Annual Meeting in order to maintain the sizes of the three classes of our Board as nearly equal as practicable. If any nominee for any reason is unable to serve or will not serve, the proxies may be voted for such substitute nominee as the proxy holder may determine.

Our directors and their ages as of March 31, 2024 and current positions with the Company are provided in the table below and in the additional biographical descriptions set forth in the text below the table.

Name |

|

Age |

|

Position |

|

Class and Term |

Daniel Janney (2)(3) |

|

58 |

|

Chair of Board and Director |

|

Class III, expires 2024 |

Robert E. Andreatta (1) |

|

62 |

|

Director and Director Nominee |

|

Class III, expires 2024 |

E. Rand Sutherland, M.D. (4) |

|

54 |

|

Director |

|

Class III, expires 2024 |

Dolca Thomas, M.D. (4)(5) |

|

53 |

|

Director and Director Nominee |

|

Class I, expires 2025 |

Robert Alexander, Ph.D. |

|

54 |

|

Chief Executive Officer and Director |

|

Class I, expires 2025 |

Steven P. James (1)(3) |

|

66 |

|

Director |

|

Class I, expires 2025 |

Paul Walker (1)(2) |

|

49 |

|

Director |

|

Class II, term expires 2026 |

Amy L. Ladd, M.D. (2)(3) |

|

66 |

|

Director |

|

Class II, term expires 2026 |

Neil Graham, M.D. (4) |

|

65 |

|

Director |

|

Class II, term expires 2026 |

8

Class III Director Nominees

Robert E. Andreatta has served as a member of our Board since June 2018. Mr. Andreatta has served as Vice President, Controllership at Alphabet, Inc. since March 2016. Previously, at Genentech, he served as Director of Collaboration Finance from June 2003 to September 2004, Director of Corporate Accounting and Reporting from September 2004 to May 2005, Assistant Controller and Senior Director, Corporate Finance from May 2005 to June 2006, Controller from June 2006 to November 2008, Chief Accounting Officer from April 2007 to November 2008 and Vice President, Controller and Chief Accounting Officer from November 2008 to March 2016. Prior to joining Genentech, he held various officer positions at HopeLink Corporation, a healthcare information technology company, from 2000 to 2003 and was a member of the board of directors of HopeLink from 2002 to 2003. Mr. Andreatta worked for KPMG from 1983 to 2000, including service as an audit partner from 1995 to 2000. He earned a Bachelor of Science degree in accounting from Santa Clara University.

We believe Mr. Andreatta is qualified to serve on our Board because of his extensive financial and accounting expertise, his industry experience and his experience as a public company executive.

Dolca Thomas, M.D. has served as a member of our Board since July 2023. She has served as a venture partner at Samsara Biocapital since March 2023 and has been an independent director on the board of Ventus Therapeutics since September 2021. She is also a scientific advisor for AnaptysBio. Previously, she was a director at Chinook Therapeutics, Inc., until it was acquired by Novartis in August 2023, and held multiple roles in biotech companies including Executive Vice President, Head of Research and Development and Chief Medical Officer at Equillium from January 2021 until February 2022, and the Chief Medical Officer of Principia Biopharma from October 2018 until September 2020, when it was acquired by Sanofi. Prior to biotech, Dr. Thomas held multiple roles in pharma including Vice President and Global Head of Translational Medicine for Immunology, Inflammation, and Infectious Disease at Roche where her team was instrumental for the approval of Xofluza; Vice President of Clinical Development and Clinical Immunophenotyping at Pfizer and Vice President and Chief Development Officer of the Biosimilars Research and Development Unit at Pfizer that resulted in the registrational approval of 4 biosimilar assets across oncology and immunology. Dr. Thomas began her industry career at Bristol-Myers Squibb as Director of Global Clinical Development in Immunology, where she was involved in the registrational approval of the immunomodulatory drug, belatacept and the life cycle management of abatacept.

Dr. Thomas began her career as a tenured track faculty member at Weill Cornell Medicine’s Department of Nephrology and Transplantation Medicine. She was the medical director of the Islet Cell Transplantation Program where she performed 5 islet cell transplants in 3 patients and was a principal investigator in several clinical trials. Dr. Thomas earned a Bachelor of Arts in sociology and an M.D. from Cornell University. Dr. Thomas was recommended by a third-party executive search firm focused on the biotechnology industry.

We believe Dr. Thomas is qualified to serve on our board of directors because her academic, clinical research, and extensive operational experience in the biotechnology industry.

Continuing Directors

Robert Alexander, Ph.D. has served as a member of our Board since May 2017 and as our Chief Executive Officer since April 2017. Dr. Alexander previously served as a member of our board of directors from December 2012 until June 2013. From December 2013 to April 2017, Dr. Alexander served as Chief Executive Officer of ZS Pharma (acquired by AstraZeneca in December 2015), where he also served as a member of the board of directors, including as Chairman from March 2013 to March 2014. From November 2005 to March 2013, Dr. Alexander served as a Director at Alta Partners, a venture capital firm in life sciences. In addition, he acted as Executive Chairman and interim Chief Executive Officer of SARcode Biosciences (acquired by Shire plc in April 2013), a biopharmaceutical company. During his time at Alta, he led investments in SARcode Biosciences, Lumena Pharmaceuticals, ZS Pharma and Allakos. Previously, Dr. Alexander was a Principal in MPM Capital’s BioEquities fund where he sourced opportunities and led due diligence efforts for both public and private investments. Dr. Alexander also previously worked in the Business Development group at Genentech (now a member of the Roche Group), a biotechnology company, where he was responsible for sourcing and screening product opportunities based on scientific merit and strategic fit, leading diligence teams and negotiating terms and definitive agreements. Dr. Alexander joined Genentech after completing his post-doctoral fellowship at Stanford University in the Pathology

9

department. He earned a Ph.D. with a focus in immunology from the University of North Carolina and a Bachelor of Arts in zoology from Miami University of Ohio.

We believe Dr. Alexander is qualified to serve on our Board because of the perspective and experience he provides as our CEO, as well as his broad experience within the pharmaceutical industry, particularly in the area of immunology.

Steven P. James has served as a member of our Board since April 2016. From July 2014 to present, Mr. James has been an independent director at several biotechnology companies and served as acting or interim Chief Executive Officer at Antiva Biosciences (previously Hera Therapeutics) and Pionyr Immunotherapeutics (previously Precision Immune). Mr. James served as President and Chief Executive Officer of Labrys Biologics, from December 2012 until its acquisition by Teva Pharmaceuticals in July 2014. He was President and Chief Executive Officer of KAI Pharmaceuticals, from October 2004 until its acquisition by Amgen in July 2012. He was Senior Vice President, Commercial Operations, at Exelixis, from 2003 until 2004. Previously he held senior business roles at Sunesis Pharmaceuticals and Isis Pharmaceuticals. He began his career in new product planning at Eli Lilly and Company. Mr. James is currently a director of Juvena Therapeutics, Ventus Therapeutics and Lyterian Therapeutics. He was also a member of the board of directors of Ocera Therapeutics, Cascadian Therapeutics, Chrono Therapeutics, Soteria Biotherapeutics, Antiva Biosciences, and Pionyr Immunotherapeutics, where he was President and Chief Executive Officer from January 2016 until Pionyr Immunotherapeutics was acquired in August 2023 by Ikena Oncology. Mr. James earned a Bachelor of Arts degree in biology from Brown University and a Masters in Management degree from the Kellogg Graduate School of Management at Northwestern University.

We believe Mr. James is qualified to serve on our board of directors because of his experience as an executive of pharmaceutical companies, as well as his experience serving on the board of directors for several biotechnology companies.

Paul Walker has served as a member of our Board since November 2017. Mr. Walker has been a partner of New Enterprise Associates, an investment firm focused on venture capital and growth equity investments, since April 2008, where Mr. Walker focuses on later-stage biotechnology and life sciences investments. From January 2001 to March 2008, Mr. Walker worked at MPM Capital, a life sciences venture capital firm, where he specialized in public, private-investment-in-public-equity and mezzanine-stage life sciences investing as a general partner with the MPM BioEquities Fund. From July 1996 to December 2000, Mr. Walker served as a portfolio manager at Franklin Resources, a global investment management organization known as Franklin Templeton Investments. Mr. Walker previously served as a member of the board of directors of TRACON Pharmaceuticals and Trillium Therapeutics and manages a number of NEA’s other late-stage and public investments. Mr. Walker earned a Bachelor of Science in biochemistry and cell biology from the University of California at San Diego and holds the designation of Chartered Financial Analyst.

We believe Mr. Walker is qualified to serve on our board of directors because of his experience in the life sciences and venture capital industries, his educational background and his experience as a public company director.

Amy L. Ladd, M.D. has served as a member of our Board since July 2022 and has spent three decades practicing orthopaedic surgery at Stanford University. She currently serves as the Elsbach-Richards Professor of Surgery, Professor of Orthopaedic Surgery as well as Professor of Medicine (Immunology & Rheumatology), by courtesy, at the Stanford Universal Medical Center. Dr. Ladd is also a member of the board of directors for Intuitive Surgical, Inc. and serves on their compensation committee. She is currently president-elect of the Association of Bone and Joint Surgeons. She is a co-founder of several orthopaedic device companies and serves on non-profit boards including the Perry Initiative and the American Foundation for Surgery of the Hand. Previously, she served as the chair of the American Academy of Orthopaedic Surgeons (AAOS) Board of Specialties Society and is a past member of the AAOS board of directors.

Dr. Ladd earned her M.D. from SUNY Upstate Medical University, completed her Orthopaedic Residency at the University of Rochester and completed the Harvard Combined Hand Surgery Fellowship. Prior to joining the Stanford University faculty, Dr. Ladd was a fellow at L’Institut de la Main in Paris, France. She earned her Bachelor of Arts in History from Dartmouth College.

10

We believe Dr. Ladd is qualified to serve on our board of directors because of her extensive experience as a medical practitioner, clinician scientist, and corporate director.

Neil Graham, M.D. has served as a member of our board of directors since August 2023. Dr. Graham has 30 years of experience in global drug development and commercialization. Currently, Dr. Graham is a member of the Board of Directors of Aslan Pharmaceuticals Limited, serving since February 2021, as well as a member of the Board of Directors of Pharmaxis Limited, serving since May 2020, and Zura Bio Limited, serving since March 2023. From February 2021 to January 2022, Dr. Graham served as Chief Medical Officer of Tiziana Life Sciences LTD, a biotechnology company. Prior to Tiziana, Dr. Graham served as VP of Strategic Program Direction, Immunology and Inflammation at Regeneron Pharmaceuticals, Inc., from 2010 to 2020 and SVP, Program and Portfolio Management, at Vertex Pharmaceuticals from 2007 to 2010. Dr. Graham also held roles as CMO at Trimeris Inc. and XTL Biopharmaceuticals and Director of HIV Medical Affairs at Glaxo Wellcome. Dr. Graham began his career as Associate Professor of Epidemiology and Medicine, Johns Hopkins Bloomberg School of Public Health. Dr. Graham earned his M.D., M.P.H. and M.B.B.S. from the University of Adelaide.

We believe Dr. Graham is qualified to serve on our board of directors because of his academic, clinical research, and extensive operational experience in the biotechnology industry. Dr. Graham was recommended by a third-party executive search firm focused on the biotechnology industry.

Vote Required

The election of Class III directors requires a plurality vote of the shares of our common stock present or represented by proxy at the 2024 Annual Meeting and entitled to vote thereon to be approved. Because the outcome of this proposal will be determined by a plurality vote, any shares not voted FOR a particular nominee, whether as a result of choosing to WITHHOLD authority to vote or a broker non-vote, will have no effect on the outcome of the election.

RECOMMENDATION OF THE BOARD OF DIRECTORS

THE BOARD OF DIRECTORS UNANIMOUSLY

RECOMMENDS A VOTE FOR THE ELECTION OF EACH NOMINEE UNDER PROPOSAL NO. 1

11

PROPOSAL NO. 2 – RATIFICATION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee of the Board (“Audit Committee”) has appointed Ernst & Young LLP, as our independent registered public accounting firm to perform the audit of our financial statements for the fiscal year ending December 31, 2024. Ernst & Young LLP has served as the Company’s auditor since 2016.

Stockholder ratification of the appointment of Ernst & Young LLP is not required by our amended and restated bylaws or other applicable legal requirements. However, our Board is submitting the appointment of Ernst & Young LLP to our stockholders for ratification as a matter of good corporate governance. In the event that this appointment is not ratified by the affirmative vote of a majority of the shares present in person or by proxy at the 2024 Annual Meeting and entitled to vote thereon, such appointment will be reconsidered by our Audit Committee. Even if the appointment is ratified, our Audit Committee, in its sole discretion, may appoint another independent registered public accounting firm at any time during our fiscal year ending December 31, 2024 if our Audit Committee believes that such a change would be in the best interests of the Company and its stockholders. If the appointment is not ratified by our stockholders, the Audit Committee may reconsider whether it should appoint another independent registered public accounting firm.

We expect that representatives of Ernst & Young LLP will attend the 2024 Annual Meeting and will have the opportunity to make a statement if they so desire and to respond to appropriate questions.

Fees Paid to the Independent Registered Public Accounting Firm

The following table presents fees for professional audit services and other services rendered to us by Ernst & Young LLP for our fiscal years ended December 31, 2023 and 2022.

|

|

2023 |

|

|

2022 |

|

||

Audit Fees (1) |

|

$ |

1,255,513 |

|

|

$ |

1,544,498 |

|

Audit-Related Fees (2) |

|

|

— |

|

|

|

— |

|

Tax Fees (3) |

|

|

— |

|

|

|

— |

|

All Other Fees (4) |

|

|

— |

|

|

|

3,600 |

|

Total Fees |

|

$ |

1,255,513 |

|

|

$ |

1,548,098 |

|

Auditor Independence

The Audit Committee has concluded that the provision of the non-audit services listed above was compatible with maintaining the independence of Ernst & Young LLP.

12

Audit Committee Policy on Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our Audit Committee has established a policy governing our use of the services of our independent registered public accounting firm. Under the policy, our Audit Committee is required to pre-approve all audit and permissible non-audit services performed by our independent registered public accounting firm in order to ensure that the provision of such services does not impair such accounting firm’s independence. All services provided by Ernst & Young LLP for our fiscal years ended December 31, 2023 and 2022 were pre-approved by our Audit Committee.

Vote Required

The affirmative vote of a majority of the shares of common stock present or represented by proxy and entitled to vote thereon is required for the ratification of the appointment of Ernst & Young LLP. Abstentions will have the same effect as a vote AGAINST this proposal. Because this is a routine proposal, your broker, bank or other nominee will have discretion to vote your shares on this routine matter. See “What if I do not specify how my shares are to be voted or fail to provide timely directions to my broker, bank or other nominee?” above. Therefore, we do not expect any broker non-votes on this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

THE BOARD OF DIRECTORS UNANIMOUSLY

RECOMMENDS A VOTE FOR THE RATIFICATION OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT PUBLIC ACCOUNTING FIRM UNDER PROPOSAL NO. 2

13

PROPOSAL NO. 3 – ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, and Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), our stockholders are entitled to vote to approve, on a non-binding advisory basis, the compensation of our named executive officers (“NEOs”) as disclosed in this proxy statement.

As described in detail under the heading “Executive Compensation Discussion,” our executive compensation programs are designed to retain and incentivize the high-quality executives whose efforts are key to our long-term success. Under these programs, our named executive officers are rewarded on the basis of individual and corporate performance measured against established corporate and strategic goals. Please read the remainder of this proxy statement for additional details about our executive compensation programs, including the section entitled “Executive Officer and Director Compensation” for information about the fiscal year 2023 compensation of our NEOs.

The compensation committee of our Board (the “Compensation Committee”) continually reviews the compensation programs for our NEOs to ensure they achieve the desired goals of aligning our executive compensation structure with our stockholders’ interests and current market practices.

We are asking our stockholders to indicate their support for our NEO compensation as described in this proxy statement. This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on our NEOs’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our NEOs and the philosophy, policies and practices described in this proxy statement.

The Board has adopted a policy providing for triennial advisory votes on the compensation of our named executive officers. Accordingly, we expect that the next “say-on-pay” vote will occur at our 2027 annual meeting of stockholders.

Vote Required

The affirmative vote of a majority of the shares of common stock present or represented by proxy and entitled to vote thereon is required to approve, on a non-binding advisory basis, the compensation awarded to NEOs. Abstentions will have the same effect as a vote AGAINST this proposal. Broker non-votes are not included in the tabulation of voting results on this proposal, and will not affect the outcome of voting on this proposal.

Because your vote is advisory, it will not be binding upon the Board. However, the Board and the Compensation Committee value the opinions expressed by our stockholders and will review the voting results in connection with their ongoing evaluation of our executive compensation program.

RECOMMENDATION OF THE BOARD OF DIRECTORS

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE APPROVAL, ON A NON-BINDING ADVISORY BASIS, OF THE COMPENSATION OF NAMED EXECUTIVE OFFICERS UNDER PROPOSAL NO. 3

14

TRANSACTION OF OTHER BUSINESS

Our Board does not know of any other matters to be raised at the 2024 Annual Meeting. If any other matters not mentioned in this proxy statement are properly brought before the meeting, the proxies will use their discretionary voting authority under the proxy to vote the proxy in accordance with the recommendation of our Board. If the meeting is adjourned or postponed, then proxies can vote your shares at the adjournment or postponement as well.

15

CORPORATE GOVERNANCE

Director Independence

Our common stock is listed on the Nasdaq Global Select Market (“Nasdaq”). Under the rules of Nasdaq, independent directors must comprise a majority of a listed company’s board of directors. In addition, the rules of Nasdaq require that, subject to specified exceptions, each member of a listed company’s audit, compensation and corporate governance and nominating committees be independent. Audit committee members and compensation committee members must also satisfy the independence criteria set forth in Rule 10A-3 and Rule 10C-1, respectively, under the Exchange Act. Under the rules of Nasdaq, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

To be considered to be independent for purposes of Rule 10A-3 and under the rules of Nasdaq, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors or any other board committee: (1) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or (2) be an affiliated person of the listed company or any of its subsidiaries.

To be considered independent for purposes of Rule 10C-1 and under the rules of Nasdaq, the board of directors must affirmatively determine that each member of the compensation committee is independent, including a consideration of all factors specifically relevant to determining whether the director has a relationship to the company which is material to that director’s ability to be independent from management in connection with the duties of a compensation committee member, including, but not limited to: (i) the source of compensation of such director, including any consulting, advisory or other compensatory fee paid by the company to such director and (ii) whether such director is affiliated with the company, a subsidiary of the company or an affiliate of a subsidiary of the company.

Our Board undertook a review of its composition, the composition of its committees and the independence of our directors and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. Based upon information requested from and provided by each director concerning her or his background, employment and affiliations, including family relationships, our Board has determined that each of Robert E. Andreatta, Neil Graham, M.D., Daniel Janney, Steven P. James, Amy L. Ladd, M.D., E. Rand Sutherland, M.D., Dolca Thomas, M.D. and Paul Walker, representing eight of our nine directors, do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the rules of Nasdaq.

In making these determinations, our Board considered the current and prior relationships that each nonemployee director has with our company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each nonemployee director, and the transactions involving them described in the section titled “Certain Relationships and Related Party Transactions.” There are no family relationships among any of our directors or executive officers.

Board Leadership Structure

Our Board is currently chaired by Mr. Janney. As a general policy, our Board believes that separation of the positions of nonemployee Chair of our Board and Chief Executive Officer reinforces the independence of our Board from management, creates an environment that encourages objective oversight of management’s performance and enhances the effectiveness of our Board as a whole. As such, Robert Alexander, Ph.D. serves as our Chief Executive Officer while Mr. Janney serves as the nonemployee Chair of our Board but is not an officer. We currently expect and intend the positions of nonemployee Chair of our Board and Chief Executive Officer to continue to be held by two individuals in the future. We believe that this leadership structure is appropriate given the attention, time, effort, and energy that the Chief Executive Officer is required to dedicate to his position in the current business environment, and the high level of commitment required to serve as Chair of our Board. We have not yet selected a new Chair of the Board to succeed Mr. Janney.

16

Role of Board of Directors in Risk Oversight

Our Board has an active role, as a whole and also at the committee level, in overseeing the management of our risks. Our Board is responsible for general oversight of risks and regular review of information regarding our risks, including credit risks, liquidity risks, cybersecurity risks and operational risks. The Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements. The Audit Committee is responsible for overseeing the management of risks relating to accounting matters and financial reporting. The Corporate Governance and Nominating Committee is responsible for overseeing the management of risks associated with the independence of our Board and potential conflicts of interest. The Research and Clinical Development Committee is responsible for assisting the Board in overseeing, evaluating and making decisions related to our research and development programs. Although each committee is responsible for evaluating certain risks and overseeing the management of such risks, our entire Board is regularly informed through discussions from committee members about such risks. Our Board believes its administration of its risk oversight function has not negatively affected the Board’s leadership structure.

Board Diversity Matrix

We are proud to have a well-balanced and diverse group of employees and believe that our current workforce structure demonstrates our commitment to diversity in all aspects of our business. We note that more than half of our employees as of December 31, 2023, identified as non-Caucasian and more than half as female. We also know that diversity is vital at every level, including the Board.

We added female board members in July 2022 and July 2023, both with extensive medical backgrounds and experience. In August 2021, a separate female board member voluntarily resigned from her Allakos board seat as a condition of her employment to accept a chief executive officer position at another company. Improving our position on board diversity is a priority and we support the election and appointment of diverse candidates to the Board when appropriate opportunities arise. The Corporate Governance and Nominating Committee values the diversity of thought and backgrounds of our Board members as well as their ability to work collaboratively with other Board members and the management team. The Corporate Governance and Nominating Committee instructs the search firms it engages to include qualified candidates with diverse backgrounds, including diversity by race, ethnicity, gender and sexual orientation. We remain committed to seeking diversity on our Board.

The table below provides certain highlights of the composition of our Board members and nominees as of March 31, 2024. Each of the categories listed in the table below has the meaning as it is used in Nasdaq Rule 5605(f).

Total Number of Directors: Nine |

|

|

|

|

|

|

|

|

|

|

||

|

|

Female |

|

|

Male |

|

|

Non-Binary |

|

Did Not Disclose Gender |

||

Gender Identity |

|

|

|

|

|

|

|

|

|

|

||

Directors |

|

|

2 |

|

|

|

7 |

|

|

— |

|

— |

Demographic Background |

|

|

|

|

|

|

|

|

|

|

||

African American or Black |

|

|

— |

|

|

|

— |

|

|

— |

|

— |

Alaskan Native or Native American |

|

|

|

|

|

|

|

|

|

|

||

Asian |

|

|

|

|

|

|

|

|

|

|

||

Hispanic or Latinx |

|

|

1 |

|

|

|

1 |

|

|

— |

|

— |

White |

|

|

1 |

|

|

|

6 |

|

|

— |

|

— |

Two or More Races or Ethnicities |

|

|

— |

|

|

|

— |

|

|

— |

|

— |

LGBTQ+ |

|

|

— |

|

|

|

— |

|

|

— |

|

— |

Did Not Disclose Demographic Background |

|

|

— |

|

|

|

— |

|

|

— |

|

— |

Board and Committee Meetings

During 2023, our Board held thirteen meetings (including regularly scheduled and special meetings), and each director attended at least 75% of the aggregate of (i) the total number of meetings of our Board held during the period for which she or he served as a director and (ii) the total number of meetings held by all committees of our Board on which she or he served during the periods that she or he served.

17

It is the policy of our Board to regularly have separate meeting times for independent directors without management. Although we do not have a formal policy regarding attendance by members of our Board at annual meetings of stockholders, we encourage, but do not require, our directors to attend. All of our then-serving directors attended our 2023 annual meeting of stockholders.

Board Committees

Our Board has established an Audit Committee, a Compensation Committee, a Corporate Governance and Nominating Committee, and a Research and Clinical Development Committee. We believe that the composition of these committees meets the criteria for independence under, and the functioning of these committees comply with the requirements of, the Sarbanes-Oxley Act of 2002, the Nasdaq rules and SEC rules and regulations. We comply with Nasdaq requirements with respect to committee composition of independent directors. Additionally, in 2023 our Board established a Research and Clinical Development Committee to assist the Board in overseeing various scientific matters related to our drug discovery and preclinical and clinical development programs. Each committee has the composition and responsibilities described below. Our Board may from time to time establish other committees.

Audit Committee

The members of our Audit Committee are Messrs. Andreatta, James and Walker. Mr. Andreatta is the chair of our Audit Committee and is our Audit Committee financial expert, as that term is defined under the SEC rules implementing Section 407 of the Sarbanes-Oxley Act of 2002, and possesses financial sophistication, as defined under the rules of Nasdaq. Our Audit Committee oversees our corporate accounting and financial reporting process and assists our Board in monitoring our financial systems. Our Audit Committee also:

Our Audit Committee operates under a written charter which satisfies the applicable rules of the SEC and the listing standards of Nasdaq. A copy of the charter of our Audit Committee is available on our website at http://investor.allakos.com/investor-relations in the “Corporate Governance” section of our Investors webpage. During 2023, our Audit Committee held four meetings. The Board has determined that each of Messrs. Andreatta, James and Walker qualify as independent directors under the Nasdaq corporate governance standards and independence requirements of Rule 10A-3 of the Exchange Act.

Compensation Committee

The members of our Compensation Committee are Dr. Ladd and Messrs. Janney and Walker. Mr. Janney is the chair of our Compensation Committee. As Mr. Janney’s term as director will expire effective upon the commencement of

18

the 2024 Annual Meeting, he will no longer serve on the Compensation Committee following the 2024 Annual Meeting. The new chair of our Compensation Committee following Mr. Janney’s departure has not yet been selected. Our Compensation Committee oversees our compensation policies, plans and benefits programs. The Compensation Committee also:

Our Compensation Committee operates under a written charter which satisfies the applicable rules of the SEC and the listing standards of Nasdaq. A copy of the charter of our Compensation Committee is available on our website at http://investor.allakos.com/investor-relations in the “Corporate Governance” section of our Investors webpage. During 2023, our Compensation Committee held three meetings. The Board has determined that each of Dr. Ladd and Messrs. Janney and Walker meet the independence qualifications applicable to members of a Compensation Committee under the Nasdaq corporate governance standards.

Our Compensation Committee has engaged Compensia, Inc. (“Compensia”), as its independent compensation consultant. The Compensation Committee has assessed the independence of Compensia, considering all relevant factors, including those set forth in Rule 10C-1(b)(4)(i) through (vi) under the Exchange Act. Based on this review, the Compensation Committee concluded that there are no conflicts of interest raised and that Compensia is independent. Compensia provides analysis and recommendations to the Compensation Committee regarding:

Compensia reports to the Compensation Committee and not to management, although Compensia meets with management for purposes of gathering information for its analyses and recommendations.

Corporate Governance and Nominating Committee

The members of our Corporate Governance and Nominating Committee are Dr. Ladd and Messrs. James and Janney. Mr. James is the chair of our Corporate Governance and Nominating Committee. As Mr. Janney’s term as director will expire effective upon the commencement of the 2024 Annual Meeting, he will no longer serve on the Corporate Governance and Nominating Committee following the 2024 Annual Meeting. Our Corporate Governance and Nominating Committee oversees and assists our Board in reviewing and recommending nominees for election as directors. Specifically, the Corporate Governance and Nominating Committee:

19

Our Corporate Governance and Nominating Committee operates under a written charter which satisfies the applicable rules of the SEC and the listing standards of Nasdaq. A copy of the charter of our Corporate Governance and Nominating Committee is available on our website at http://investor.allakos.com/investor-relations in the “Corporate Governance” section of our Investors webpage. During 2023, our Corporate Governance and Nominating Committee held no meetings and only acted by unanimous written consent. The Board has determined that each of Dr. Ladd and Messrs. James and Janney qualify as independent directors under the Nasdaq corporate governance standards.

Research and Clinical Development Committee

The members of our Research and Clinical Development Committee are Drs. Graham, Sutherland and Thomas. As Dr. Sutherland’s term as a director will expire effective upon the commencement of the 2024 Annual Meeting, he will no longer serve on the Research and Clinical Development Committee following the 2024 Annual Meeting. Our Research and Clinical Development Committee does not yet have a chair.

Specific responsibilities of our Research and Clinical Development Committee include:

Our Research and Clinical Development Committee operates under a written charter and, during 2023 the committee held one meeting. The committee’s charter requires that each member have sufficient scientific, development and/or medical expertise to review and evaluate appropriately the Company’s research and clinical development programs or meet other requirements as may be established by the Board from time to time. The Board has determined that each of Dr. Graham, Dr. Sutherland and Dr. Thomas met the qualifications applicable to members under the Committee’s charter.

Considerations in Evaluating Director Nominees

It is the policy of the Corporate Governance and Nominating Committee of our Board to consider recommendations for candidates to our Board from stockholders holding no less than one percent (1%) of the outstanding shares of the Company’s common stock continuously for at least 12 months prior to the date of the submission of the recommendation or nomination.

The Corporate Governance and Nominating Committee will consider candidates recommended by stockholders in the same manner as candidates recommended to the Corporate Governance and Nominating Committee from other sources. The Corporate Governance and Nominating Committee will use the following procedures to identify and evaluate any individual recommended or offered for nomination to our Board:

20

The Corporate Governance and Nominating Committee may propose to our Board a candidate recommended or offered for nomination by a stockholder as a nominee for election to our Board. In the future, the Corporate Governance and Nominating Committee may pay fees to third parties to assist in identifying or evaluating director candidates.

Stockholder Recommendations for Nominations to the Board

A stockholder that wants to recommend a candidate for consideration by the Corporate Governance and Nominating Committee for election to the Board should direct the recommendation in writing by letter to the Company, attention of the Secretary, at 825 Industrial Road, Suite 500, San Carlos, California 94070. The recommendation must include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a signed letter from the candidate confirming willingness to serve, information regarding any relationships between the candidate and the Company and evidence of the recommending stockholder’s ownership of Company stock. Such recommendations must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for Board membership, including issues of character, integrity, judgment, diversity of experience, independence, area of expertise, corporate experience, length of service, potential conflicts of interest, other commitments and the like and personal references.

A stockholder that instead desires to nominate a person directly for election to the Board at an annual meeting of the stockholders must meet the deadlines and other requirements set forth in Section 2.4 of our amended and restated bylaws and the rules and regulations of the SEC. Section 2.4 of our amended and restated bylaws require that a stockholder who seeks to nominate a candidate for director must provide a written notice to our Secretary not later than 5:00 p.m., Pacific time, on the 45th day nor earlier than 8:00 a.m., Pacific time, on the 75th day before the one-year anniversary of the date on which we first mailed its proxy materials or a notice of availability of proxy materials (whichever is earlier) for the preceding year’s annual meeting; provided, however, that in the event that no annual meeting was held in the previous year or if the date of the annual meeting is changed by more than 25 days from the one-year anniversary of the date of the previous year’s annual meeting, then notice by the stockholder to be timely must be so received by our Secretary not earlier than 5:00 p.m., Pacific time, on the 120th day prior to such annual meeting and not later than 5:00 p.m., Pacific time, on the later of (i) the 90th day prior to such annual meeting or (ii) the 10th day following the day on which Public Announcement (as defined below) of the date of such annual meeting is first made. That notice must state the information required by Section 2.4 of our amended and

21

restated bylaws, and otherwise must comply with applicable federal and state law. Our Secretary will provide a copy of the amended and restated bylaws upon request in writing from a stockholder. “Public Announcement” shall mean disclosure in a press release reported by the Dow Jones News Service, Associated Press or a comparable national news service or in a document publicly filed by us with the SEC pursuant to Section 13, 14 or 15(d) of the Exchange Act, or by such other means as is reasonably designed to inform the public or our stockholders in general of such information, including, without limitation, posting on our investor relations website.

Stockholders also have the right to propose director candidates for consideration by the Corporate Governance and Nominating Committee or our Board and also directly nominate director candidates, without any action or recommendation on the part of the Corporate Governance and Nominating Committee or our Board, by following the procedures set forth in the section of this proxy statement titled “Stockholder Proposals.”

Deadline for Stockholder Nominations to the Board of Directors under the Universal Proxy Rules

To comply with universal proxy rules, stockholders who intend to solicit proxies in support of director nominees (other than our nominees) in connection with our 2025 Annual Meeting must provide the information required by Rule 14a-19 of the Exchange Act no later than March 12, 2025.

Compensation Committee Interlocks and Inside Participation

None of the members of our Compensation Committee is or has been an officer or employee of our company. None of our executive officers currently serves, or in the past fiscal year has served, as a member of the Board or Compensation Committee (or other Board committee performing equivalent functions or, in the absence of any such committee, the entire Board) of any entity that has one or more executive officers serving on our Board or Compensation Committee.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The code of business conduct and ethics is available on our website at http://investor.allakos.com/investor-relations in the “Corporate Governance” section of our Investors webpage. We intend to disclose any future amendments to such code, or any waivers of its requirements, applicable to any principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions or our directors on our website identified above.

Communications with the Board

Our Board believes that management speaks for Allakos Inc. Individual board members may, from time to time, communicate with various constituencies that are involved with the Company, but it is expected that board members would do this with knowledge of management and, in most instances, only at the request of management.

In cases where stockholders and other interested parties wish to communicate directly with our non-management directors, messages can be sent to our Secretary, at 825 Industrial Road, Suite 500, San Carlos, California 94070. Our Secretary monitors these communications and will provide a summary of all received messages to the Board at each regularly scheduled meeting of the Board. Our Board generally meets on a quarterly basis. Where the nature of a communication warrants, our Secretary may determine, in his or her judgment, to obtain the more immediate attention of the appropriate committee of the board or non-management director, of independent advisors or of Company management, as our Secretary considers appropriate.

Our Secretary may decide in the exercise of his or her judgment whether a response to any stockholder or interested party communication is necessary.

This procedure for stockholder and other interested party communications with the non-management directors is administered by the Company’s Corporate Governance and Nominating Committee. This procedure does not apply

22

to (a) communications to non-management directors from officers or directors of the Company who are stockholders, (b) stockholder proposals submitted pursuant to Rule 14a-8 or Rule 14a-19 under the Exchange Act or (c) communications to the Audit Committee pursuant to the Complaint Procedures for Accounting and Auditing Matters.

Stock Ownership and Policy on Trading, Pledging and Hedging of Company Stock

Certain transactions in our securities (such as purchases and sales of publicly traded put and call options, and short sales) create a heightened compliance risk or could create the appearance of misalignment between management and stockholders. In addition, securities held in a margin account or pledged as collateral may be sold without consent if the owner fails to meet a margin call or defaults on the loan, thus creating the risk that a sale may occur at a time when an officer or director is aware of material, non-public information or otherwise is not permitted to trade in company securities. Our insider trading policy expressly prohibits, without prior approval from our general counsel or chief financial officer, in consultation with our Board or an independent committee thereof, short sales and derivative transactions of our stock by our officers, directors, employees and agents and their respective affiliates, purchases or sales of puts, calls or other derivative securities of the Company, or hedging transactions. In addition, our insider trading policy expressly prohibits our executive officers, directors, employees and agents and their respective affiliates from borrowing against Company securities held in a margin account, or, pledging our securities as collateral for a loan, in each case without prior approval from our general counsel or chief financial officer, in consultation with our Board or an independent committee thereof.

Removal of Directors; Vacancies

Our amended and restated certificate of incorporation and amended and restated bylaws provide that the number of directors will be fixed from time to time exclusively pursuant to a resolution adopted by the Board. Newly created director positions resulting from an increase in size of the Board and vacancies may be filled by our Board, subject to certain exceptions. Any or all of the directors may be removed from office by the stockholders only for cause.

23

EXECUTIVE OFFICERS

Our Board chooses our executive officers, who then serve at the discretion of our Board. There is no family relationship between any of the directors or executive officers and any of our other directors or executive officers. The following table sets forth certain information about our executive officers as of March 31, 2024.

Name |

|

Age |

|

Position |

Robert Alexander, Ph.D. |

|

54 |

|

Chief Executive Officer and Director |

Baird Radford |

|

54 |

|

Chief Financial Officer |

Adam Tomasi, Ph.D. |

|

54 |

|

President |

Chin Lee, M.D. |

|

54 |

|

Chief Medical Officer |

For the biography of Dr. Alexander, see “Proposal No. 1 – Election of Directors.”

Baird Radford has served as our Chief Financial Officer since April 2021.Mr. Radford has over 25 years of finance and leadership experience at companies in multiple industries and various stages of growth. Prior to joining us, Mr. Radford served as Senior Vice President of Finance at Aimmune Therapeutics from January 2020 to February 2021, where he led the company's financial planning, controllership, tax and treasury functions. Prior to working at Aimmune Therapeutics, he served as the Chief Financial Officer at HeartFlow from July 2014 to January 2020, and held senior finance positions at Intuitive Surgical, eBay and PricewaterhouseCoopers. Mr. Radford received his Bachelor of Business Administration from Ohio University.

Adam Tomasi, Ph.D. has served as our President since December 2019. From April 2017 through December 2022, Mr. Tomasi also served as our Chief Operating Officer. From April 2017 to August 2019 and again from December 2020 to April 2021, Mr. Tomasi also served as our Chief Financial Officer. Dr. Tomasi also served as our Secretary from April 2017 until August 2019. He was previously a member of the board of directors of Attune Pharmaceuticals, a private biotechnology company. From August 2013 to January 2015, Dr. Tomasi served as Senior Vice President, Corporate Development of ZS Pharma, and from February 2015 to March 2017, he served as Chief Scientific Officer and Head of Corporate Development of ZS Pharma. Previously, Dr. Tomasi was a Principal at Alta Partners, where he was involved in the funding and development of notable medical technology and life science companies including Chemgenex, Excaliard, Lumena Pharmaceuticals, Achaogen, Immune Design, Allakos and ZS Pharma. Prior to joining Alta Partners, Dr. Tomasi was in the Harvard-MIT Biomedical Enterprise Program where he completed internships as an equity analyst at Lehman Brothers and at MPM Capital. Dr. Tomasi also previously worked as a medicinal chemist with Gilead Sciences and Cytokinetics, where he helped create the cardiovascular drug CK-1827452, which was licensed to Amgen. Dr. Tomasi holds a Bachelor of Science in Chemistry from the University of California, Berkeley, an M.B.A. from the Massachusetts Institute of Technology Sloan School of Management and a Ph.D. in Chemistry from the University of California, Irvine.

Chin Lee, M.D. has served as our Chief Medical Officer since February 2024. Dr. Lee previously served as our Executive Vice President of Clinical Development since joining the Company in July 2023 until his promotion to Chief Medical Officer in February 2024. Prior to Allakos, Dr. Lee served as the Chief Medical Officer at Connect Biopharma, a clinical-stage company focused on development of innovative therapies for chronic inflammatory diseases based on T cell-driven research, from March 2022 to August 2023. Dr. Lee also previously served as Vice President, Head of Clinical Science, and Chief Medical Officer at Theravance Biopharma, Inc. from April 2021 to March 2022, Lead Group Medical Director within the Genentech Research & Early Development (gRED) group from January 2018 to April 2021, as well held roles of increasing responsibility within the Immunology Therapeutic Area at Eli Lilly & Co., and the Immunoscience Group at Abbott (now AbbVie). During his time in industry, Dr. Lee has successfully led the submission of global regulatory filings and participated in product commercialization across multiple autoimmune and immunology disease indications. Prior to entering the biopharmaceutical industry, Dr. Lee was on the academic faculty at the Northwestern University Feinberg School of Medicine in the Division of Rheumatology. Dr. Lee received his Bachelor of Science in Biology and an M.D. from the University of North Carolina at Chapel Hill, and an M.P.H. from Northwestern University.

24

EXECUTIVE COMPENSATION DISCUSSION

Overview

This Executive Compensation Discussion explains our executive compensation program for our NEOs listed below and describes the Compensation Committee’s process for making compensation decisions, including its rationale for specific decisions related to compensation paid to our NEOs in the fiscal year ended December 31, 2023.

Name |

|

Position |

Robert Alexander, Ph.D. |

|

Chief Executive Officer and Director |

Baird Radford |

|

Chief Financial Officer |

Adam Tomasi, Ph.D. |

|

President |

Although Allakos qualifies as an “smaller reporting company” as defined by the SEC, which allows us to take advantage of scaled-back disclosure requirements, we are including more extensive narrative in this Executive Compensation Discussion about our executive compensation program in an effort to be more transparent. We are also committed to keeping an open dialogue with our stockholders to help ensure that we have a regular pulse on investor perspectives and continue to adjust our compensation program design to align with our business strategy, leadership talent objectives and investor expectations. Over the last few years, ongoing communications with our stockholders have helped validate the philosophy, objectives, and design of our overall compensation program and provided us with important perspectives on how to improve and better explain our program in the future.

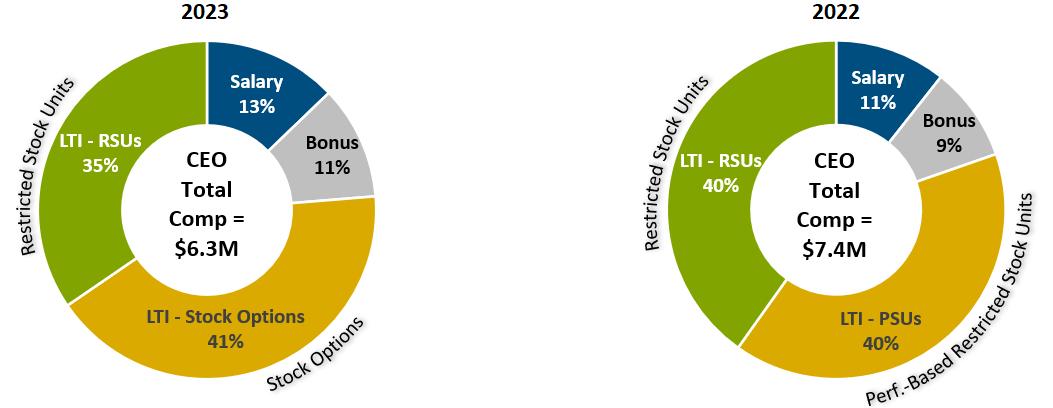

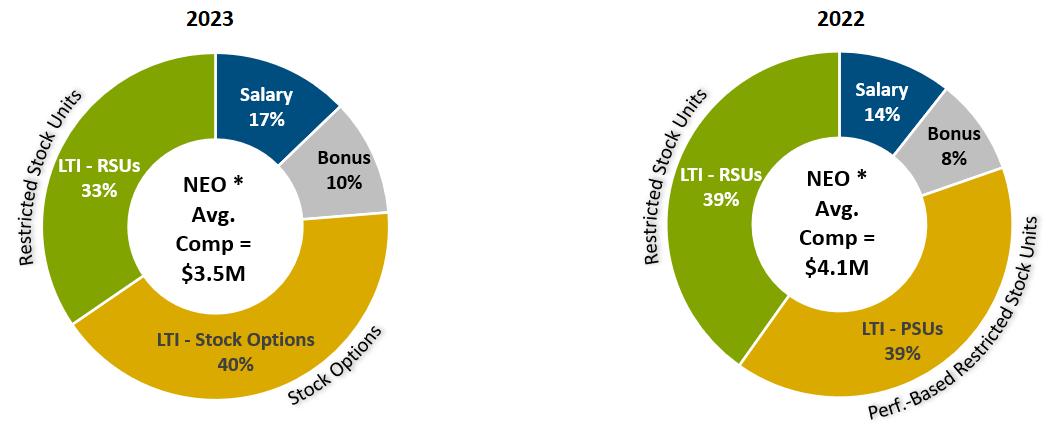

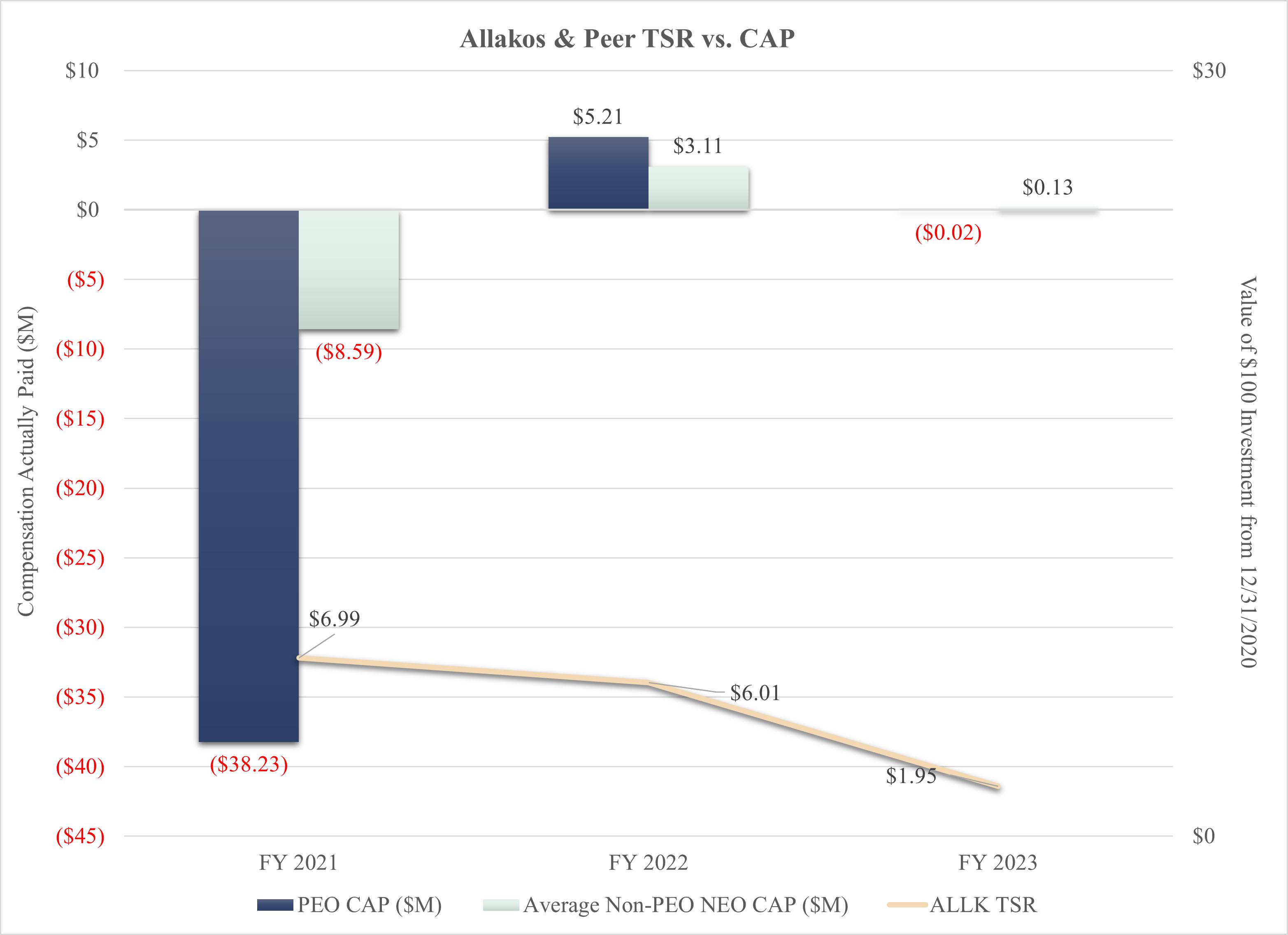

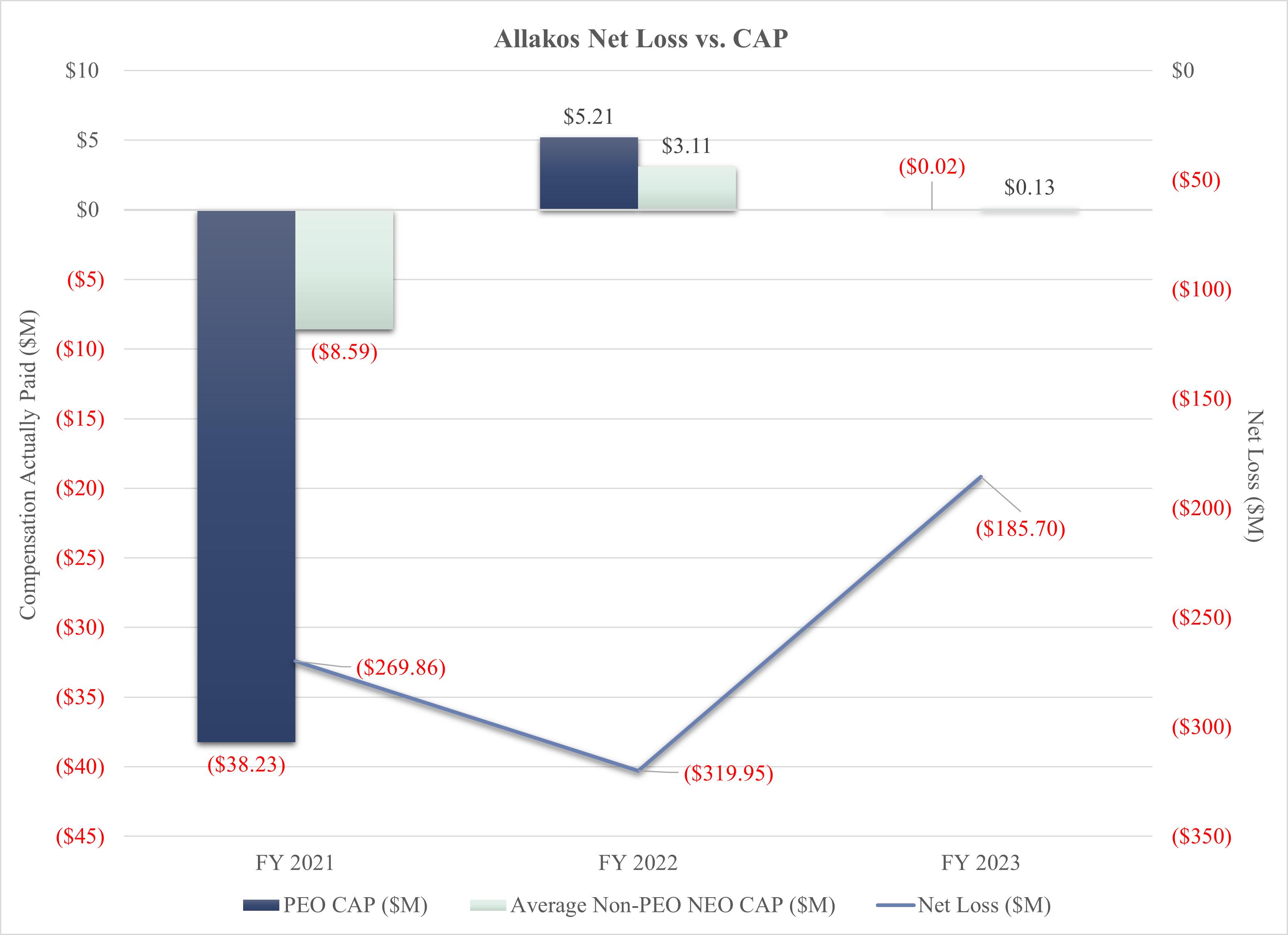

EXECUTIVE SUMMARY

About Our Business and How We Approach Performance-Based Compensation