Raymond James Texas Bank Tour November 5, 2015 David Brooks, Chairman and CEO Michelle Hickox, EVP and CFO Leslie Beseda, SVP and Director Financial Reporting Exhibit 99.1

Safe Harbor Statement 2 From time to time, our comments and releases may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”). Forward-looking statements can be identified by words such as “believes,” “anticipates,” “expects,” “forecast,” “guidance,” “intends,” “targeted,” “continue,” “remain,” “should,” “may,” “plans,” “estimates,” “will,” “will continue,” “will remain,” variations on such words or phrases, or similar references to future occurrences or events in future periods; however, such words are not the exclusive means of identifying such statements. Examples of forward-looking statements include, but are not limited to: (i) projections of revenues, expenses, income or loss, earnings or loss per share, and other financial items; (ii) statements of plans, objectives, and expectations of Independent Bank Group or its management or Board of Directors; (iii) statements of future economic performance; and (iv) statements of assumptions underlying such statements. Our estimates of earnings and earnings per share accretion, book value earn-back and tangible book value dilution are forward-looking statements. Forward-looking statements are based on Independent Bank Group’s current expectations and assumptions regarding its business, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Independent Bank Group’s actual results may differ materially from those contemplated by the forward-looking statements, which are neither statements of historical fact nor guarantees or assurances of future performance. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to: (1) local, regional, national, and international economic conditions and the impact they may have on us and our customers and our assessment of that impact; (2) volatility and disruption in national and international financial markets; (3) government intervention in the U.S. financial system, whether through changes in the discount rate or money supply or otherwise; (4) changes in the level of non-performing assets and charge-offs; (5) changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; (6) adverse conditions in the securities markets that lead to impairment in the value of securities in our investment portfolio; (7) inflation, deflation, changes in market interest rates, developments in the securities market, and monetary fluctuations; (8) the timely development and acceptance of new products and services and perceived overall value of these products and services by customers; (9) changes in consumer spending, borrowings, and savings habits; (10) technological changes; (11) the ability to increase market share and control expenses; (12) changes in the competitive environment among banks, bank holding companies, and other financial service providers; (13) the effect of changes in laws and regulations (including laws and regulations concerning taxes, banking, securities, and insurance) with which we and our subsidiaries must comply; (14) the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board, and other accounting standard setters; (15) the costs and effects of legal and regulatory developments including the resolution of legal proceedings; and (16) our success at managing the risks involved in the foregoing items and (17) the other factors that are described in the Company’s Form 10-K for the year ended December 31, 2014 and the Form 10-Qs for the quarters ended March 31, 2015, June 30, 2015 and September 30, 2015, under the heading “Risk Factors.” Any forward-looking statement made by the Company in this release speaks only as of the date on which it is made. Factors or events that could cause the Company’s actual results to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Company Snapshot 3 Overview Branch Map as of September 30, 2015 Financial Highlights as of September 30, 2015 • Headquartered in McKinney, Texas • 100+ years of operating history • 42 banking offices • Dallas-Fort Worth metropolitan area • Greater Austin area • Houston metropolitan area • Acquired Bank of Houston and its six locations April 15, 2014 • Acquired Houston City Bancshares and its four locations on October 1, 2014 • Closed the acquisition of Grand Bank and its two locations on November 1, 2015 (1) Non-GAAP financial measure. See Appendix for reconciliation. Balance Sheet ($ in millions) Total Assets $4,478 Total Loans 3,535 Total Deposits 3,534 Equity 568 sset Quality NPAs / Assets 0.34% NPL / Loans 0.33 Allowance / Loans 0.71 NCO Ratio (annualized) 0.07 Profitability Core Net Interest Margin 4.07% Core Efficiency Ratio (1) 59.25

Third Quarter 2015 Highlights 4 • Return to historically strong organic loan growth with loans increasing 18.1% on an annualized basis for the quarter and 13.7% year to date. • Core earnings were $8.9 million, or $0.52 per diluted share, for the quarter ended September 30, 2015 compared to $9.5 million, or $0.58 per diluted share, for the quarter ended September 30, 2014 and to $10.5 million, or $0.61 per diluted share, for the quarter ended June 30, 2015. • Prudent additional provision for loan loss further mitigating potential risk related to continued lower energy pricing. • Asset quality remains strong, as reflected by a nonperforming assets to total assets ratio of 0.34% and a nonperforming loans to total loans ratio of 0.33% at September 30, 2015. Net charge offs were 0.07% annualized for the quarter. • Prompt regulatory approval and integration progress on the Grand Bank transaction enabling a November 1, 2015 closing.

Proven Successful Acquirer 5 • Nine transactions since 2010 Bank / Market Date of Acquisition Total Assets Town Center Bank Dallas/North Texas July 31, 2010 $37.5 million Farmersville Bancshares, Inc. Dallas/North Texas September 30, 2010 $99.4 million I Bank Holding Company, Inc. Austin/Central Texas March 30, 2012 $173 million The Community Group, Inc. Dallas/North Texas October 1, 2012 $111 million Collin Bank Dallas/North Texas November 29, 2013 $168 million Live Oak Financial Corp. Dallas/North Texas January 1, 2014 $131 million BOH Holdings, Inc. Houston/Southeast Texas April 15, 2014 $1.2 billion Houston City Bancshares, Inc. Houston/Southeast Texas October 1, 2014 $351 million Grand Bank Dallas/North Texas November 1, 2015 $592 million

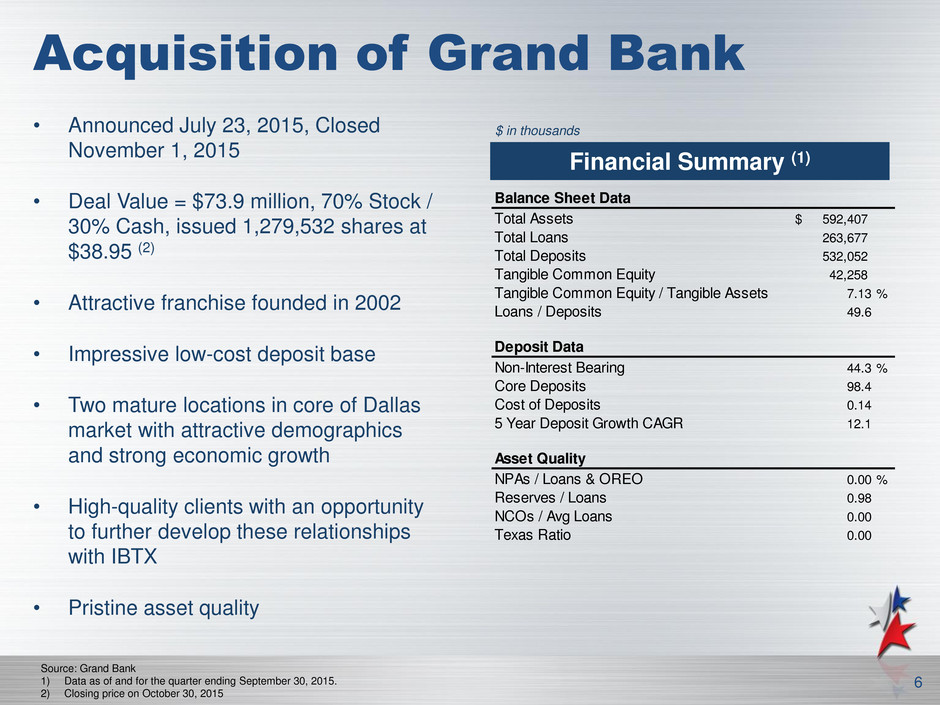

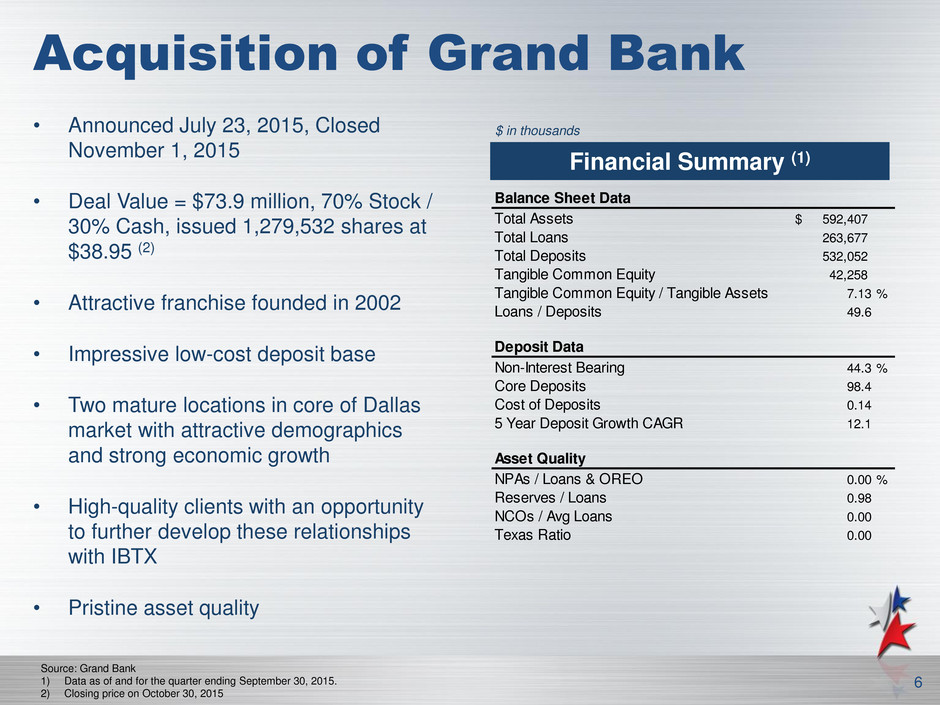

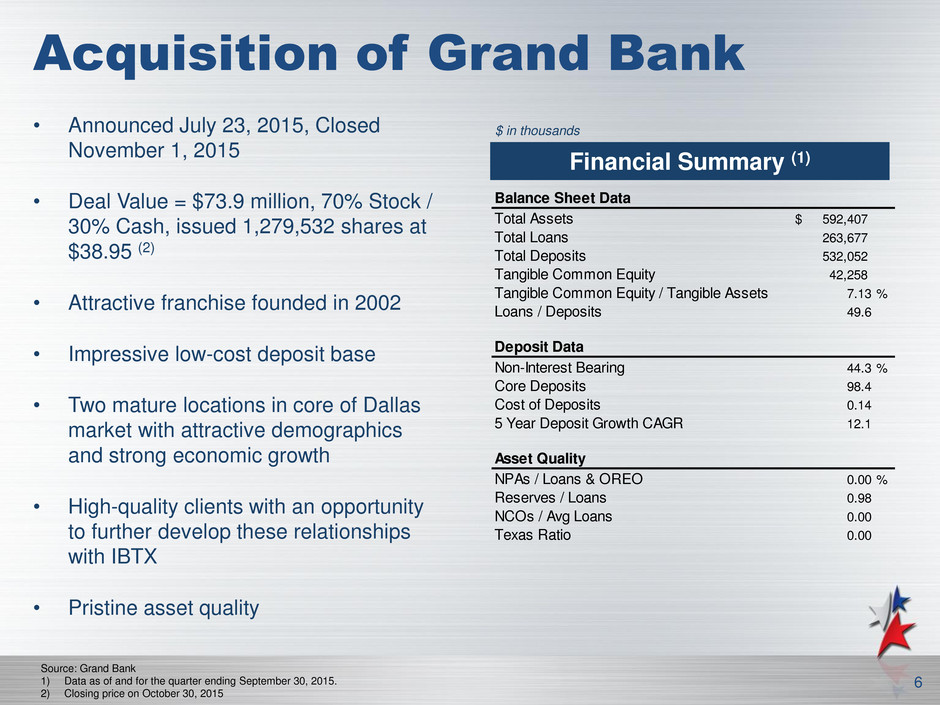

Acquisition of Grand Bank 6 • Announced July 23, 2015, Closed November 1, 2015 • Deal Value = $73.9 million, 70% Stock / 30% Cash, issued 1,279,532 shares at $38.95 (2) • Attractive franchise founded in 2002 • Impressive low-cost deposit base • Two mature locations in core of Dallas market with attractive demographics and strong economic growth • High-quality clients with an opportunity to further develop these relationships with IBTX • Pristine asset quality Source: Grand Bank 1) Data as of and for the quarter ending September 30, 2015. 2) Closing price on October 30, 2015 Financial Summary (1) $ in thousands Balance Sheet Data Total Assets 592,407$ Total Loans 263,677 Total Deposits 532,052 Tangible Common Equity 42,258 Tangible Common Equity / Tangible Assets 7.13 % Loans / Deposits 49.6 Deposit Data Non-Interest Bearing 44.3 % Core Deposits 98.4 Cost of Deposits 0.14 5 Year Deposit Growth CAGR 12.1 Asset Quality NPAs / Loans & OREO 0.00 % Reserves / Loans 0.98 NCOs / Avg Loans 0.00 Texas Ratio 0.00

Financial Impact 7 Estimated EPS Accretion ~6% accretive in 2016(1) Estimated Tangible Book Value Earnback Period ~2.4 years Estimated Cost Savings ~30% Internal Rate of Return ~20% Pro Forma Capital Ratios at September 30, 2015: TCE/TA 6.5% Tier 1 Capital Ratio 9.0% Total Risk-based Capital Ratio 11.43% CET1 Ratio 7.95% 1) Excludes one-time transaction costs.

$3,747 $4,478 Q3 2014 Q3 2015 Impact of Acquisitions (In Year Acquired) Organic Growth IBTX Continued Demonstrated Growth 8 Total Assets Prior Years Total Assets Q3 2015 v. Q3 2014 Note: Dollars in millions. $1,740 $2,164 $4,133 2012 2013 2014

EPS Growth 9 EPS Core EPS (1) $1.78 $1.86 $0.54 $0.48 $0.00 $0.50 $1.00 $1.50 $2.00 2013 2014 Q3 2014 Q3 2015 $1.56 $2.19 $0.58 $0.52 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 2013 2014 Q3 2014 Q3 2015 (1) See Appendix for non-GAAP Reconciliation.

Solid Net Interest Income Growth 10 Net Interest Income and NIM $58.6 $74.9 $124.1 $32.4 $38.1 4.40% 4.30% 4.19% 4.04% 4.08% $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 2012 2013 2014 2014 Q3 2015 Q3 4.00% 4.10% 4.20% 4.30% 4.40% 4.50% Net Interest Income NIM Note: Dollars in millions.

Select Metrics 11 Core Pre-Tax Pre-Provision Earnings Income (1) Note: Dollars in thousands. (1) See Appendix for non-GAAP Reconciliation. Core Efficiency Ratio (1) 67.3% 64.6% 57.9% 58.3% 2012 2013 2014 2015 YTD $21,828 $29,466 $56,604 2012 2013 2014 $15,266 $17,123 Q3 2014 Q3 2015

Portfolio by Region 12 Loans at 9/30/15 Deposits at 9/30/15 Central 26% North 45% Houston 29% Central 16% North 54% Houston 30%

Deposit Mix & Pricing 13 Deposit Composition at 9/30/15 Deposit Growth versus Average Rate (1) 2015 YTD Rate on Interest-Bearing Deposits: 0.46% (1) Annual average rate for total deposits. Note: Dollars in millions. Financial data as of and for quarter ended September 30, 2015. $1,030 $1,391 $1,710 $3,250 $3,534 1.00% 0.69% 0.47% 0.37% 0.35% $200 $700 $1,200 $1,700 $2,200 $2,700 $3,200 $3,700 2011 2012 2013 2014 2015 YTD 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% Deposits Avg. Rate Noninterest- bearing 25% Interest-bearing Checking 29% Interest-bearing Public Funds (including CD's) 15% Sav ings Accoiunts 4% MMAs 4% Other 5% IRAs 1% CDs <$100k 3% CDs >$100k 14%

Diversified Loan Portfolio 14 Loan Composition at 9/30/15 CRE Loan Composition at 9/30/15 2015 YTD Yield on Loans: 4.94% Net of Acquired Loan Accretion: 4.91% 40.2% of CRE Loans are Owner-Occupied C&I 18% CRE 50% C&D 9% 1-4 Family 16% 1-4 Family Const. 4% Agriculture 1% Consumer 1% Other 1% Multi-family 8% Office 25% Hotel / Motel 3% Retail 25 Industrial / WH 7% Healthcare 9% Church 4% Day Care/ School 3% Misc. 16%

Energy Overview 15 • Outstanding production loans 5.9% of total IBTX loans • Strong energy credit policy with dynamic price decks – All credits are secured – Agreements provide discretion to reduce borrowing bases and to initiate monthly commitment reductions – Significant hedges through 2015 and into 2016 – In-house engineering reviews all credits and reports to Credit Policy – Portfolio is predominantly Texas based – 27 borrowers with IBTX the sole lender on 20 and the agent on four • IBTX energy team has deep industry knowledge and experience • Oil field related service exposure – Less than 1% of total loans – Multiple borrowers/all secured – Focused on existing oil and gas production – No criticized or classified service loans

Historically Strong Credit Culture 16 NPLs / Loans Note: Financial data as of and for years ended December 31, and the quarter ended June 30, 2015 for peer data and September 30, 2015 for IBTX. Source: U.S. and Texas Commercial Bank numbers from SNL Financial. NCOs / Average Loans 4.11% 3.36% 2.67% 2.25% 1.87% 2.91% 2.38% 1.83% 1.50% 1.42% 1.14% 0.81% 0.53% 0.32% 0.33% 2011 2012 2013 2014 2015 YTD U.S. Commercial Banks TX Commercial Banks IBTX 1.64% 1.13% 0.70% 0.49% 0.42% 0.74% 0.39% 0.19% 0.10% 0.10% 0.11% 0.06% 0.09% 0.03% 0.03% 2011 2012 2013 2014 2015 YTD U.S. Commercial Banks TX Commercial Banks IBTX

Capital Ratios 17 (1) See Appendix for GAAP Reconciliation. As of September 30, 2015 apital Ratios Tier 1 Leverage Ratio 8.67% Common Equity Tier 1 Risk-Based Capital Ratio 8.26 Tier 1 Risk-Based Capital Ratio (1) 9.37 Total Risk-Based Capital Ratio 11.86 Tangible Common Equity to Tangible Assets Ratio 7.15

Summary 18 A Leading Texas Community Bank Franchise Focused in Major Metropolitan Markets (Dallas, Austin, Houston) Significant Inside Ownership Aligned with Shareholders Demonstrated Organic Growth Completed Nine Acquisitions Since 2010 Increased Profitability and Improving Efficiency Strong Credit Culture and Excellent Credit Quality

APPENDIX 19

Experienced Management Team 20 Name / Title Background David R. Brooks Chairman of the Board, CEO, Director • 36 years in the financial services industry; 28 years at Independent Bank • Active in community banking since the early 1980s - led the investor group that acquired the Company in 1988 • Previously served as the Chief Financial Officer at Baylor University from 2000 to 2004 • Serves on the Board of Managers of Noel-Levitz, LLC, and on the Board of Trustees of Houston Baptist University Torry Berntsen President, COO, Director • 35 years in the financial services industry; 6 years at Independent Bank • Served as Vice Chairman of Corporate Development from 2009 to 2013 • Vice Chairman of Virtu Management, LLC • 25 years in various senior management roles at The Bank of New York Mellon Daniel W. Brooks Vice Chairman, Chief Risk Officer, Director • 32 years in the financial services industry; 26 years at Independent Bank • Previously served as President and a Director of the Company from 2002 to 2009 • Active in community banking since the late 1980s • Chairman of the Board for Medical Center of McKinney and on the Boards of Directors of McKinney Christian Academy and the McKinney Education Foundation James D. Stein Vice Chairman, CEO – Houston, Director • 31 years in the financial services industry; 10 years at Bank of Houston/Independent Bank • Founding President and CEO of Bank of Houston • Served as President of Columbus State Bank and on the Board of the Texas Bankers Association • Active in various Houston based non-profit organizations Brian E. Hobart Vice Chairman, Chief Lending Officer • 22 years in the financial services industry; 11 years at Independent Bank • Since 2009 he has functioned as Chief Lending Officer and has served as President and Director of the Company • One of the founders of IBG Central Texas - served as its President from 2004 until 2009 Michelle S. Hickox EVP, Chief Financial Officer • 25 years in the financial services industry; 3 years at the Company • Previously a Financial Services Audit Partner at McGladrey LLP • Licensed certified public accountant, member of the AICPA, the Texas Society of Certified Public Accountants and the Dallas CPA Society

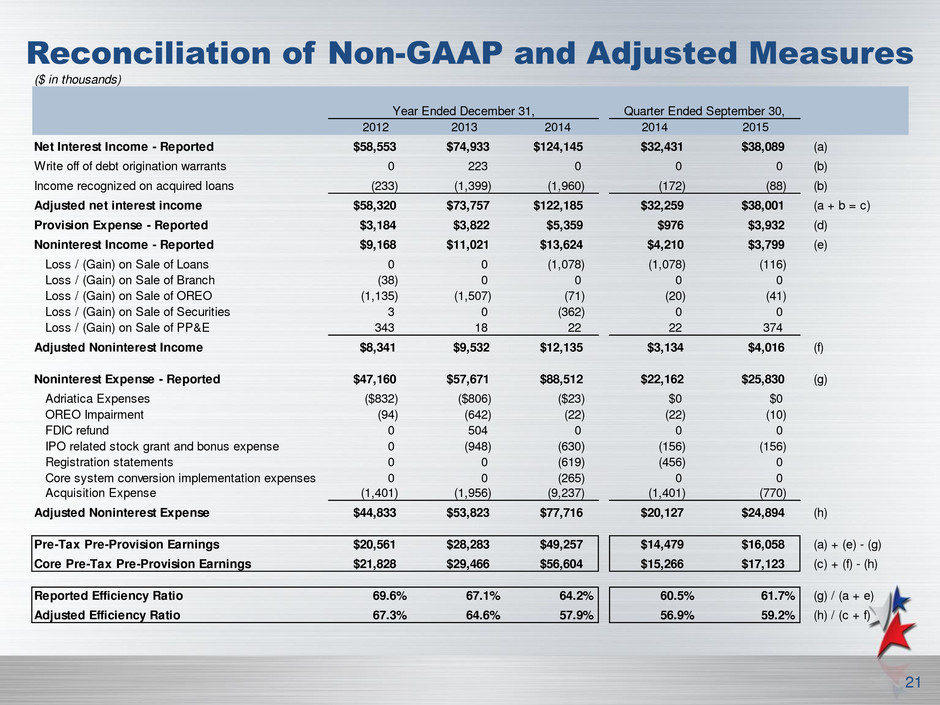

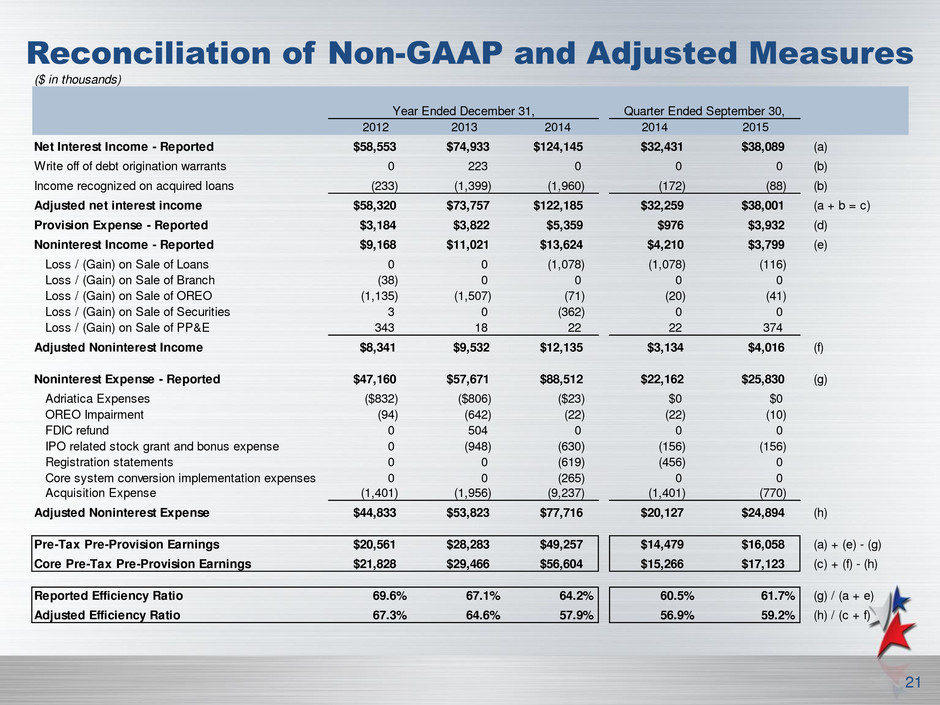

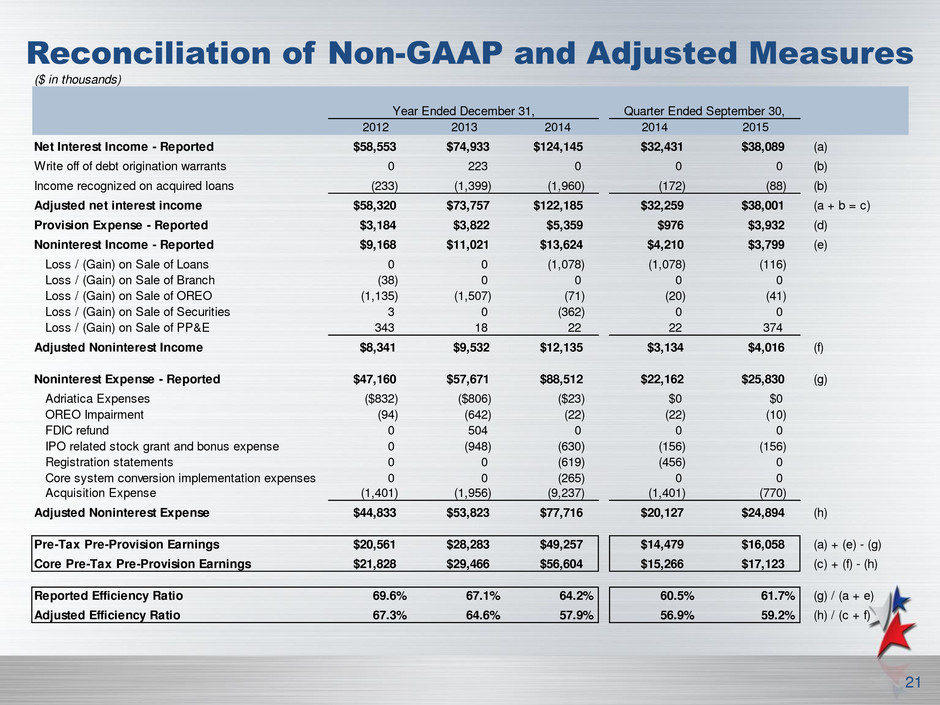

Reconciliation of Non-GAAP and Adjusted Measures 21 ($ in thousands) 2012 2013 2014 2014 2015 Net Interest Income - Reported $58,553 $74,933 $124,145 $32,431 $38,089 (a) Write off of debt origination warrants 0 223 0 0 0 (b) Income recognized on acquired loans (233) (1,399) (1,960) (172) (88) (b) Adjusted net interest income $58,320 $73,757 $122,185 $32,259 $38,001 (a + b = c) Provision Expense - Reported $3,184 $3,822 $5,359 $976 $3,932 (d) Noninterest Income - Reported $9,168 $11,021 $13,624 $4,210 $3,799 (e) Loss / (Gain) on Sale of Loans 0 0 (1,078) (1,078) (116) Loss / (Gain) on Sale of Branch (38) 0 0 0 0 Loss / (Gain) on Sale of OREO (1,135) (1,507) (71) (20) (41) Loss / (Gain) on Sale of Securities 3 0 (362) 0 0 Loss / (Gain) on Sale of PP&E 343 18 22 22 374#REF! Adjusted Noninterest Income $8,341 $9,532 $12,135 $3,134 $4,016 (f) Noninterest Expense - Reported $47,160 $57,671 $88,512 $22,162 $25,830 (g) Adriatica Expenses ($832) ($806) ($23) $0 $0 OREO Impairment (94) (642) (22) (22) (10) FDIC refund 0 504 0 0 0 IPO related stock grant and bonus expense 0 (948) (630) (156) (156) Registration statements 0 0 (619) (456) 0 Core system conversion implementation expenses 0 0 (265) 0 0 Acquisition Expense (1,401) (1,956) (9,237) (1,401) (770) Adjusted Noninterest Expense $44,833 $53,823 $77,716 $20,127 $24,894 (h) Pre-Tax Pre-Provision Earnings $20,561 $28,283 $49,257 $14,479 $16,058 (a) + (e) - (g) Core Pre-Tax Pre-Provision Earnings $21,828 $29,466 $56,604 $15,266 $17,123 (c) + (f) - (h) Reported Efficiency Ratio 69.6% 67.1% 64.2% 60.5% 61.7% (g) / (a + e) Adjusted Efficiency Ratio 67.3% 64.6% 57.9% 56.9% 59.2% (h) / (c + f) Year Ended December 31, Quarter Ended September 30,

22 Reconciliation of Non-GAAP and Adjusted Measures ($ in thousands, except per share data) As of 9/30/2015 Total Common Stockholders' Equity $544,319 Goodwill (229,818) Core Deposit Intangibles, net (11,353) Tangible Common Equity $303,148 Common Shares Outstanding 17,111,394 Book Value per Share $31.81 Tangible Book Value per Share $17.72 ($ in thousands) As of 9/30/2015 Total Common Stockhold rs' Equity - GAAP $544,319 Unrealized Gain on AFS Securities (2,863) Goodwill (229,8 8) C re Deposit Intangibles, net (2 952 Tier 1 Common Equity $308,686 Qulifying Restricted Core Capital Elements (junior subordinated Debenture 7,600 Preferred Stock 23,938 ier 1 Equity $350,224s) Total Risk-Weighted Assets $3,738,305 Total Common Stockholders' Equity to Risk-Weighted Assets Ratio 14.56% Tier 1 Equity to Risk-Weighted Assets Ratio 9.37% Tier 1 Common Equity to Risk-Weighted Assets Ratio 8.26%

Contact Information 23 Corporate Headquarters Analysts/Investors: Independent Bank Group, Inc. Torry Berntsen 1600 Redbud Blvd President and Chief Operating Officer Suite 400 (972) 562-9004 McKinney, TX 75069 tberntsen@ibtx.com 972-562-9004 Telephone Michelle Hickox 972-562-7734 Fax Executive Vice President and Chief Financial Officer www.ibtx.com (972) 562-9004 mhickox@ibtx.com Media: Robb Temple Executive Vice President and Chief Administrative Officer (972) 562-9004 rtemple@ibtx.com