Document

Granite Real Estate Investment Trust

Annual Information Form

March 8, 2023

TABLE OF CONTENTS

| | | | | | | | | | | |

| GENERAL MATTERS | | Purchases of REIT Units | |

| Date of Information | | Trustees | |

| Note Regarding Financial Information | | REIT Unit Redemption Right | |

| Non-IFRS Measures and Ratios | | Meetings of REIT Unitholders | |

FORWARD-LOOKING STATEMENTS | | Limitations on Non-Resident Ownership of REIT Units | |

| GLOSSARY OF TERMS | | Amendments to the Declaration of Trust | |

| CORPORATE STRUCTURE | | Term of Granite REIT | |

| Granite REIT | | Acquisition Offers | |

| Granite GP | | Information and Reports | |

| Granite LP | | Conflict of Interest Provisions | |

| Organizational Structure and Subsidiaries | | GRANITE GP CAPITAL STRUCTURE | |

| GENERAL DEVELOPMENT OF THE BUSINESS | | CREDIT FACILITY AND INDEBTEDNESS | |

| BUSINESS OVERVIEW | | Credit Facility | |

| Income-Producing Properties | | Construction Loan | |

| Property Types | | Term Loans | |

| Profile of Granite's Real Estate Portfolio | | Other Unsecured Indebtedness | |

| Schedule of Lease Expiries | | Credit Ratings | |

| Lease Maturity Summary | | DISTRIBUTION AND DIVIDEND POLICY | |

| Principal Markets in which Granite Operates | | Distribution Policy of Granite REIT and Granite GP | |

| Development, Expansion and Improvement Projects | | Distributions of Granite REIT | |

| Foreign Exchange | | MARKET FOR SECURITIES | |

| Leasing Arrangements | | Trading Price and Volume | |

| Government Regulation | | TRUSTEES, DIRECTORS AND MANAGEMENT OF GRANITE | |

| Employees | | Cease Trade Orders, Bankruptcies, Penalties or Sanctions | |

| Magna, Granite's Largest Tenant | | Potential Conflicts of Interest | |

| ENVIRONMENTAL, SOCIAL, GOVERNANCE AND RESILIENCE | | AUDIT COMMITTEE | |

| INVESTMENT GUIDELINES AND OPERATING POLICIES OF GRANITE | | Composition of the Audit Committee | |

| REIT Investment Guidelines | | Pre-Approval of Policies and Procedures | |

| Operating Policies | | Audit Committee's Charter | |

| Amendments to Investment Guidelines and Operating Policies | | Audit Fees | |

| RISK FACTORS | | INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | |

| Risks Relating to Granite's Business | | AUDITORS, REGISTRAR AND TRANSFER AGENT | |

| Risks Relating to Taxation | | LEGAL PROCEEDINGS | |

| Risks Relating to the Stapled Units | | MATERIAL CONTRACTS | |

| Risks Relating to the Debentures | | Agreements in Connection with the 2011 Arrangement | |

| DESCRIPTION OF STAPLED UNITS | | Other Material Contracts | |

| Support Agreement | | ADDITIONAL INFORMATION | |

| DECLARATION OF TRUST AND DESCRIPTION OF REIT UNITS | | APPENDIX A GRANITE REAL ESTATE INVESTMENT TRUST AUDIT COMMITTEE CHARTER | A-1 |

| Allotment and Issue of REIT Units | | APPENDIX B GRANITE REIT INC. AUDIT COMMITTEE CHARTER | B-1 |

| Transferability and Stapling of REIT Units | | | |

GENERAL MATTERS

This Annual Information Form contains information about both Granite Real Estate Investment Trust and Granite REIT Inc. The trust units of Granite REIT ("REIT Units") and the common shares of Granite GP ("GP Shares") trade as stapled units (‘‘Stapled Units’’), each consisting of one REIT Unit and one GP Share. The Stapled Units are listed on the TSX under the symbol ‘‘GRT.UN’’ and on the NYSE under the symbol ‘‘GRP.U’’.

Date of Information

Information in this AIF is dated as of December 31, 2022, unless otherwise indicated.

Note Regarding Financial Information

Financial information of Granite REIT and Granite GP is presented on a combined basis as permitted under exemptions granted by applicable Canadian securities regulatory authorities. Accordingly, throughout this Annual Information Form, unless otherwise specified or the context otherwise indicates, ‘‘Granite’’ refers to the combined Granite REIT and Granite GP and their subsidiaries.

Except as otherwise noted, financial data included in this Annual Information Form has been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. This Annual Information Form should be read in conjunction with the combined financial statements and appended notes, and management’s discussion and analysis, each of which appear in Granite’s annual report for 2022 and are available on SEDAR at www.sedar.com. Granite refers to Canadian dollars as ‘‘dollars’’ or ‘‘$’’, United States dollars as “US$” or ‘‘USD’’ and Euros as ‘‘EUR’ or "€". Granite publishes its financial statements in Canadian dollars.

Non-IFRS Measures and Non-IFRS Ratios

In addition to using financial measures determined in accordance with IFRS, Granite also uses certain non-IFRS measures and non-IFRS ratios in managing its business to measure financial and operating performance as well as for capital allocation decisions and valuation purposes. Granite believes that providing these measures on a supplemental basis to the IFRS results is helpful to investors in assessing the overall performance of Granite’s business. These non-IFRS measures and non-IFRS ratios include the total debt and net debt and the net leverage ratio.

Total debt is a non-IFRS performance measure calculated as the sum of all current and non-current debt, the net mark to market fair value of cross-currency interest rate swaps and lease obligations as per the combined financial statements. Net debt subtracts cash and cash equivalents from total debt. Granite believes that it is useful to include the cross-currency interest rate swaps and lease obligations for the purposes of monitoring Granite's debt levels.

The net leverage ratio is a non-IFRS ratio that Granite believes is useful in evaluating Granite's degree of financial leverage, borrowing capacity and the relative strength of its balance sheet. Readers are cautioned that total debt, net debt and net leverage ratio do not have a standardized meaning prescribed under IFRS and, therefore, should not be construed as an alternative to net income, cash provided by operating activities or any other measure calculated in accordance with IFRS. Additionally, because these terms do not have a standardized meaning prescribed by IFRS, they may not be comparable to similarly titled measures presented by other reporting issuers. The net leverage ratio is calculated as the carrying value of total debt less cash and cash equivalents, divided by the fair value of investment properties (excluding assets held for sale).

Granite REIT 2022 Annual Information Form 3

Total debt, net debt and net leverage ratio are calculated from the audited combined financial statements as at and for the year ended December 31, 2022 as follows:

| | | | | | | | | | | | |

As at December 31, 2022 | | (in millions) | | | | |

| Unsecured debt, net | | $ | 2,983.6 | | | | |

Derivatives, net (1) | | (138.4) | | | | |

| Lease obligations | | 33.7 | | | | |

| Secured debt | | 51.4 | | | | |

Total debt | | $ | 2,930.3 | | | | |

| Less: cash and cash equivalents | | 135.1 | | | | |

Net debt | [A] | $ | 2,795.2 | | | | |

| Investment properties | [B] | $ | 8,839.6 | | | | |

Net leverage ratio | [A]/[B] | 32 | % | | | | |

(1) Balance is net of the derivative assets and derivative liabilities. | | | | |

| | | | | | |

4 Granite REIT 2022 Annual Information Form

FORWARD-LOOKING STATEMENTS

This Annual Information Form and the documents incorporated by reference herein contain statements that, to the extent they are not recitations of historical fact, constitute ‘‘forward- looking statements’’ or ‘‘forward looking information’’ within the meaning of applicable securities legislation, including the United States Securities Act of 1933, as amended, the United States Securities Exchange Act of 1934, as amended, and applicable Canadian securities legislation. Forward-looking statements and forward-looking information may include, among others, statements regarding Granite’s future plans, goals, strategies, intentions, beliefs, estimates, costs, objectives, capital structure, cost of capital, tenant base, tax consequences, economic performance or expectations, or the assumptions underlying any of the foregoing. Words such as ‘‘outlook’’, ‘‘may’’, ‘‘would’’, ‘‘could’’, ‘‘should’’, ‘‘will’’, ‘‘likely’’, ‘‘expect’’, ‘‘anticipate’’, ‘‘believe’’, ‘‘intend’’, ‘‘plan’’, ‘‘forecast’’, ‘‘objective’’, ‘‘strategy’’, ‘‘project’’, ‘‘estimate’’, ‘‘seek’’ and similar expressions are used to identify forward-looking statements and forward-looking information. Forward-looking statements and forward-looking information should not be read as guarantees of future events, performance or results and will not necessarily be accurate indications of whether or the times at or by which such future performance will be achieved. Undue reliance should not be placed on such statements. There can also be no assurance that Granite's expectations regarding various matters, including the following, will be realized in a timely manner with the expected impact or at all, Granite's ability to deliver cash flow stability and growth and create long-term value for REIT Unitholders and GP Shareholders; Granite’s ability to implement its ESG+R program and related targets and goals; the expansion, and diversification of Granite’s real estate portfolio, including acquisitions of properties in new markets; the reduction in Granite’s exposure to Magna and the special purpose properties; Granite’s ability to strategically redeploy the proceeds from recently sold properties and financing initiatives; Granite’s ability to find and integrate satisfactory acquisition, joint venture and development opportunities and to strategically deploy the proceeds from recently sold properties and financing initiatives; Granite's sale from time to time of Stapled Units under its ATM Program; Granite’s ability to accelerate growth and execute its short and long-term business strategies; Granite’s ability to renew land leases upon their expiration; Granite’s ability to optimize its balance sheet; Granite’s ability to increase its leverage ratio; and the expected amount of any distributions and distribution increase, including any expected increases can be achieved in a timely manner, with the expected impact or at all. Forward-looking statements and forward- looking information are based on information available at the time and/or management’s good faith assumptions and analyses made in light of Granite’s perception of historical trends, current conditions and expected future developments, as well as other factors management believes are appropriate in the circumstances. Forward-looking statements and forward-looking information are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond Granite’s control, that could cause actual events or results to differ materially from such forward-looking statements and forward-looking information. Important factors that could cause such differences include, but are not limited to: the risk of changes to tax or other laws and treaties that may adversely affect Granite REIT’s mutual fund trust status under the Tax Act or the effective tax rate in other jurisdictions in which Granite operates; the risks related to Russia's 2022 invasion of Ukraine that may adversely impact Granite's operations and financial performance; economic, market and competitive conditions and other risks that may adversely affect Granite’s ability to expand and diversify its real estate portfolio, dispose of any non-core assets on satisfactory terms and pay the expected amount of any distributions; and, the risks set forth in this Annual Information Form in the ‘‘Risk Factors’’ section, which investors are strongly advised to review. The ‘‘Risk Factors’’ section also contains information about the material factors or assumptions underlying such forward-looking statements and forward-looking information. Forward-looking statements and forward-looking information speak only as of the date the statements were made and unless otherwise required by applicable securities laws,

Granite REIT 2022 Annual Information Form 5

Granite expressly disclaims any intention and undertakes no obligation to update or revise any forward-looking statements or forward-looking information contained in this Annual Information Form to reflect subsequent information, events or circumstances or otherwise.

6 Granite REIT 2022 Annual Information Form

GLOSSARY OF TERMS

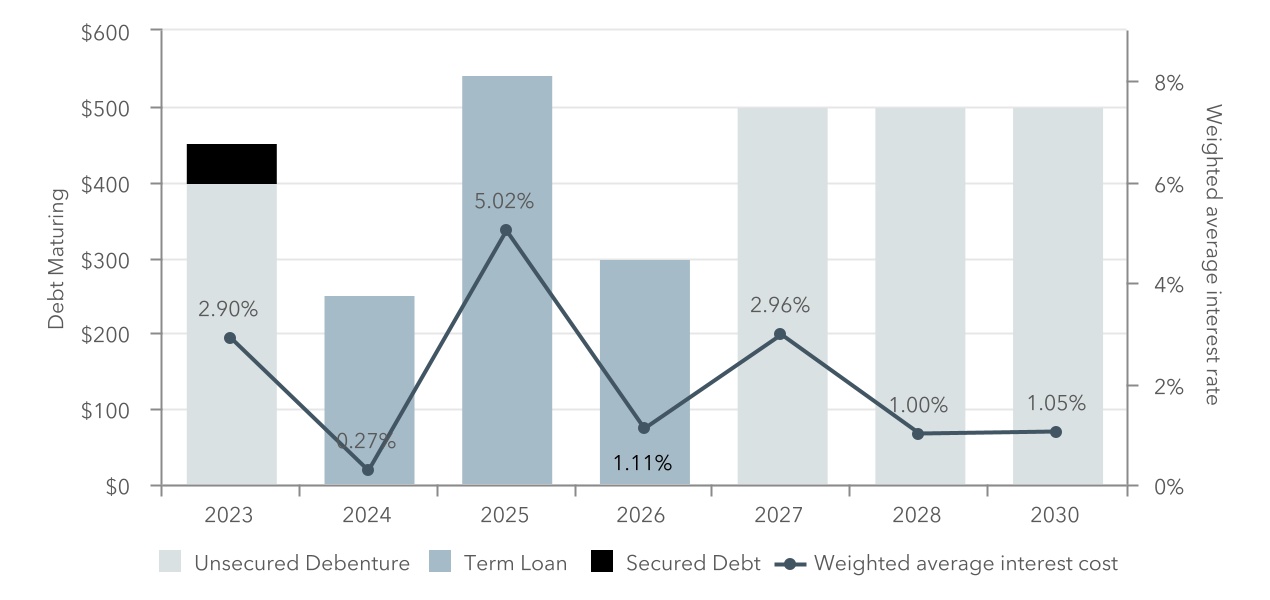

“0.522% Swap” means the cross-currency interest rate swap entered into by Granite LP to exchange the US$185 million principal and related variable rate interest payments from the 2024 Term Loan to EUR 168.2 million principal and Euro-denominated interest payments at a 0.522% interest rate.

“0.536% Swap” means the cross-currency interest rate swap entered into by Granite LP to exchange the $350 million portion of principal related 2.194% interest payments from the 2028 Debentures to EUR 242.1 million principal and Euro-denominated interest payments at a 0.536% interest rate.

“1.045% Swap” means the cross-currency interest rate swap entered into by Granite LP to exchange the $500 million principal and related 2.378% interest payments from the 2030 Debentures to EUR 319.4 million principal and Euro-denominated interest payments at a 1.045% interest rate.

“1.355% Swap” means the cross-currency interest rate swap entered into by Granite LP to exchange the $300 million principal and related variable rate interest payments from the 2026 Term Loan to EUR 205.5 million principal and Euro-denominated interest payments at a 1.355% interest rate.

“2.096% Swap” means the cross-currency interest rate swap entered into by Granite LP to exchange the $500 million principal and related 2.194% interest payments from the 2028 Debentures to US$397.0 million principal and U.S.-denominated interest payments at a 2.096% interest rate. As at February 3, 2022, the 2.096% Swap was reduced to $150 million principal outstanding, exchanging US$119.1 million principal and USD denominated interest payments at a 2.096% interest rate.

“2.43% Swap” means the cross-currency interest rate swap entered into by Granite LP to exchange the $400 million principal and related 3.873% interest payments from the 2023 Debentures to EUR 281.1 million principal and Euro-denominated interest payments at a 2.43% interest rate.

“2.964% Swap” means the cross-currency interest rate swap entered into by Granite LP to exchange the $500 million principal and related 3.062% interest payments from the 2027 Debentures to US $370.3 million principal and USD-denominated interest payments at a 2.964% interest rate.

“5.016% Swap” means the float to fixed interest rate swap entered into by Granite LP to exchange the floating SOFR portion of the interest payments from the 2025 Term Loan to fixed interest payments resulting in an all-in fixed interest rate of 5.016%.

“2011 Arrangement” means the completion of a court-approved plan of arrangement of Granite Co. under the Business Corporations Act (Ontario), which eliminated Granite Co.’s dual class share capital structure through which Mr. Frank Stronach and his family had previously controlled Granite Co.

“2013 Arrangement” means the completion of Granite Co.’s conversion from a corporate structure to a stapled unit real estate investment trust structure pursuant to a plan of arrangement under the Business Corporations Act (Québec) on January 3, 2013.

Granite REIT 2022 Annual Information Form 7

“2016 Indenture” means, together, the trust indenture and supplemental indenture providing for, among other things, the creation and issue of the 2023 Debentures.

“2020 First Indenture” means, together, the trust indenture and supplemental indenture providing for, among other things, the creation and issue of the 2027 Debentures.

“2020 Second Indenture” means, together, the trust indenture and supplemental indenture providing for, among other things, the creation and issue of the 2030 Debentures.

“2021 Indenture” means, together, the trust indenture and supplemental indenture providing for, among other things, the creation and issue of the 2028 Debentures.

“2023 Debentures” means the $400 million aggregate principal amount of 3.873% Series 3 senior debentures due November 30, 2023 issued by Granite LP.

“2024 Term Loan” means the senior unsecured non-revolving term facility in the amount of US$185 million entered into by Granite LP on December 19, 2018, as extended on October 21, 2019.

“2025 Term Loan” means the senior unsecured non-revolving term facility in the amount of US$400 million entered into by Granite LP on September 15, 2022.

“2026 Term Loan” means the senior unsecured non-revolving term facility in the amount of $300 million entered into by Granite LP on December 12, 2018, as extended on November 27, 2019.

“2027 Debentures” means the $500 million aggregate principal amount of 3.062% Series 4 senior debentures due June 4, 2027 issued by Granite LP.

“2028 Debentures” means the $500 million aggregate principal amount of 2.194% Series 6 senior debentures due August 30, 2028 issued by Granite LP.

“2030 Debentures” means the $500 million aggregate principal amount of 2.378% Series 5 senior debentures due December 18, 2030 issued by Granite LP.

"Advanced Notice Provisions" has the meaning set out under the heading "Declaration of Trust and Description of REIT Units — Meetings of the REIT Unitholders — Advanced Notice Provisions".

"Agreement with Initiating Shareholders" means the agreement regarding the Arrangement Agreement dated January 31, 2011 amongst Granite Co., the Stronach Shareholder, The Stronach Trust and the Initiating Shareholders .

“AIF” or “Annual Information Form” means this annual information form.

“annualized revenue” means contractual base rent for the month subsequent to the quarterly reporting period multiplied by 12 months. Annualized revenue excludes revenue from properties classified as assets held for sale.

“Arrangement Agreement” means the arrangement agreement dated January 31, 2011 between MI Developments Inc., the Stronach Shareholder and The Stronach Trust (including the schedules thereto).

8 Granite REIT 2022 Annual Information Form

"ATM Program" means the at-the-market equity program established by Granite on November 3, 2021 pursuant to which Granite may issue up to $250 million of Stapled Units from treasury.

“Audit Committee” means the audit committee of Granite REIT or the audit committee of Granite GP, as the context requires.

“BCBCA” means the Business Corporations Act (British Columbia).

"BREEAM" means Building Research Establishment's Environmental Assessment Method.

“CDOR” means Canadian Dollar Offered Rate.

"CDP" means the Carbon Disclosure Project.

"Complainant" has the meaning set out under the heading "Declaration of Trust and Description of REIT Units — REIT Unitholder Remedies — Oppression Remedy".

"CORRA" means the Canadian Overnight Repo Rate Average.

“Credit Facility” means Granite’s unsecured revolving credit facility in the amount of $1 billion with a five-year term commencing on March 31, 2021.

“DBRS” means DBRS Limited.

“Debentures” means, collectively, the 2023 Debentures, the 2027 Debentures, the 2028 Debentures, the 2030 Debentures and any other debentures subsequently issued under the 2016 Indenture, the 2020 First Indenture, the 2020 Second Indenture and the 2021 Indenture.

“Declaration of Trust” means Granite REIT’s amended and restated declaration of trust dated June 9, 2022.

"DGNB" means the German Sustainable Building Council.

“Directors” means the Board of Directors of Granite GP.

“Disclosable Interest” has the meaning set out under the heading “Declaration of Trust and Description of REIT Units — Conflict of Interest Provisions”.

“Equity Distribution Agreement” means the equity distribution agreement dated November 3, 2021 among Granite REIT, Granite GP, BMO Nesbitt Burns Inc., Scotia Capital Inc. and TD Securities Inc. in connection with Granite’s ATM program.

"ESG" means Environmental, Social and Governance.

“ESG+R” means Environmental, Social, Governance and Resilience.

“Event of Uncoupling” has the meaning set out under the heading “Risk Factors — Risks Related to Stapled Units — Uncoupling of Stapled Units — Significant Matters”.

“Exempt Plans” has the meaning set out under the heading “Risk Factors — Risks Relating to the Stapled Units — Redemptions of Stapled Units”.

"EURIBOR" means the Euro Interbank Offered Rate.

Granite REIT 2022 Annual Information Form 9

“FDAP” has the meaning set out under the heading “Risk Factors — Risk Relating to Taxation — United States — Potential Uncertainty as to the Availability of Treaty Benefits to Distributions from Granite America”.

“FIRPTA” means the United States Foreign Investment in Real Property Tax Act of 1980.

“Forbearance Agreement” means the forbearance agreement entered into by Granite Co. prior to the implementation of the 2011 Arrangement.

“GLA” means gross leasable area.

“GP Redemption Right” has the meaning set out under the heading “Declaration of Trust and Description of REIT Units — REIT Unit Redemption Rights”.

“GP Share” has the meaning set out under the heading "General Matters".

"GP Shareholder" means a holder of a GP Share or GP Shares.

“Granite America” means Granite REIT America Inc.

“Granite Co.” means, for periods prior to January 3, 2013, Granite’s predecessor Granite Real Estate Inc.

“Granite GP” means Granite REIT Inc.

“Granite LP” means Granite REIT Holdings Limited Partnership.

“Granite REIT” or the “Trust” means Granite Real Estate Investment Trust.

“Green Bond Framework” means the Green Bond Framework which complies with the Green Bond Principles developed by the ICMA as of June 2018 and as described in Granite’s Green Bond Framework dated April 2020, which is available on Granite’s website.

"Green Globes" means the online assessment protocol, rating system, and guidance for green building design, operation and management.

“GRESB” means Global Real Estate Sustainability Benchmark.

“GRI” means Global Reporting Initiative.

"ICMA" means the International Capital Markets Association.

“IFRS” means the International Financial Reporting Standards as issued by the International Accounting Standards Board.

"IREM" means Institute of Real Estate Management.

"LEED" means Leadership in Energy and Environmental Design.

“leverage” or “leverage ratio”, unless otherwise indicated, refers to the carrying value of total debt divided by the total fair value of investment properties and “net leverage ratio” subtracts cash and cash equivalents from total debt.

10 Granite REIT 2022 Annual Information Form

“LIBOR” means London Interbank Offered Rate.

“Magna”, unless otherwise indicated, refers to Magna International Inc., its operating divisions and subsidiaries and its other controlled entities.

“Moody’s” means Moody’s Investor Service.

“NCIB” means normal course issuer bid.

"Nominating Unitholder" has the meaning set out under the heading "Declaration of Trust and Description of REIT Units — Meetings of the REIT Unitholders — Nomination of Trustees".

“Non-Residents” are to persons who are not residents of Canada for the purposes of the Tax Act.

“Non-Resident Beneficiaries” means Non-Residents or partnerships that are not Canadian partnerships within the meaning of the Tax Act.

"Notice Date" has the meaning set out under the heading "Declaration of Trust and Description of REIT Units — Meetings of the REIT Unitholders — Advance Notice Provisions".

“NYSE” means the New York Stock Exchange.

“PFIC” means a passive foreign investment company for U.S. federal income tax purposes.

"Proposal" has the meaning set out under the heading "Declaration of Trust and Description of REIT Units — Meetings of the REIT Unitholders — REIT Unitholder Proposals".

"Qualified Unitholder" has the meaning set out under the heading "Declaration of Trust and Description of REIT Units — Meetings of the REIT Unitholders — REIT Unitholder Proposals".

“qualifying income exception” has the meaning set out under the heading “Risk Factors — Risk Relating to Taxation — United States — Granite REIT’s Status as a Partnership”.

“REIT Exception” has the meaning set out under the heading “Risk Factors — Risk Relating to Taxation — Canada — Real Estate Investment Trust Status”.

"REIT Unit" has the meaning set out under the heading "General Matters".

“REIT Unitholder” means a holder of a REIT Unit or REIT Units.

“Resident Canadian” means a resident in Canada for purposes of the Tax Act.

"SASB" means Sustainability Accounting Standards Board.

“SEC” means the United States Securities and Exchange Commission.

“SF” means square feet.

“SIFT” has the meaning set out under the heading “Investment Guidelines and Operating Policies of Granite — REIT Investment Guidelines”.

"SOFR” means Secured Overnight Financing Rate.

Granite REIT 2022 Annual Information Form 11

“Stapled Units” has the meaning set out under the heading “General Matters”.

“Stronach Shareholder” means 445327 Ontario Limited.

“Support Agreement” means the support agreement dated as of January 3, 2013 entered into by Granite REIT and Granite GP, as amended and restated on December 20, 2017.

“Sustainability Plan” means Granite’s Sustainability Plan, which is available on Granite’s website.

“Tax Act” means the Income Tax Act (Canada).

"TCFD" means Task Force on Climate-related Financial Disclosures.

“Transfer Agreement” means the transfer agreement between Granite Co., the Stronach Shareholder and The Stronach Trust, entered into immediately prior to the implementation of the 2011 Arrangement.

“Trustees” means the board of trustees of Granite REIT.

"TSX" means the Toronto Stock Exchange.

“Unit Redemption Assets” has the meaning set out under the heading “Declaration of Trust and Description of REIT Units — REIT Unit Redemption Right”.

“Unit Redemption Date” has the meaning set out under the heading “Declaration of Trust and Description of REIT Units — REIT Unit Redemption Right”.

“Unit Redemption Price” has the meaning set out under the heading “Declaration of Trust and Description of REIT Units — REIT Unit Redemption Right”.

"WALT" means weighted average lease term.

12 Granite REIT 2022 Annual Information Form

CORPORATE STRUCTURE

Granite REIT

Granite REIT is an unincorporated, open-ended, limited purpose trust established under and governed by the laws of the Province of Ontario pursuant to the Declaration of Trust. Although it is intended that Granite REIT qualify as a ‘‘mutual fund trust’’ pursuant to the Tax Act, Granite REIT is not a mutual fund under applicable securities laws. The principal office and centre of administration of Granite REIT is located at 77 King Street West, Suite 4010, P.O. Box 159, Toronto-Dominion Centre, Toronto, Ontario, M5K 1H1.

Granite GP

Granite GP was incorporated on September 28, 2012 pursuant to the BCBCA. On January 4, 2013, the articles of Granite GP were altered to remove a class of non-voting shares that had been used for certain steps of the 2013 Arrangement. The head office of Granite GP is located at 77 King Street West, Suite 4010, P.O. Box 159, Toronto-Dominion Centre, Toronto, Ontario, M5K 1H1 and the registered office of Granite GP is Suite 2600, Three Bentall Centre, 595 Burrard Street P.O. Box 49314, Vancouver, British Columbia, V7X 1L3.

Granite LP

Granite’s business is carried on directly and indirectly by Granite LP, all of the partnership units of which are owned by Granite REIT and Granite GP.

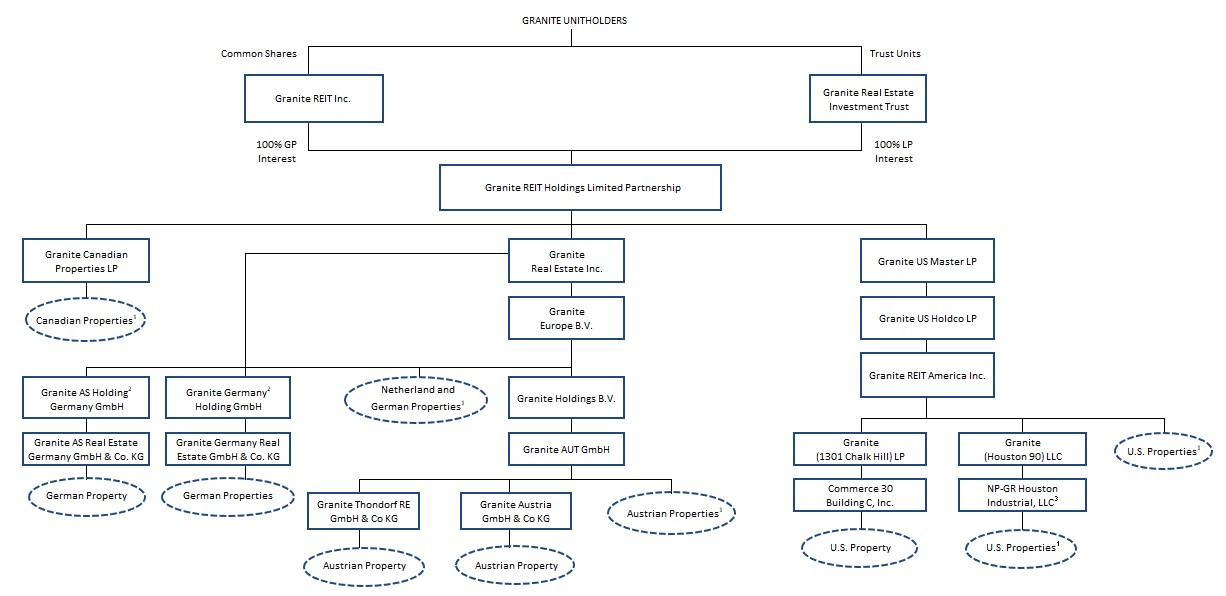

Organizational Structure and Subsidiaries

The following is a simplified illustration of Granite’s organizational structure as at December 31, 2022:

| | | | | | | | | | | |

| Organizational Structure and Subsidiaries |

(1) Ownership of the properties is held directly or indirectly through wholly owned special purpose entities.

(2) Granite Europe B.V. and Granite Real Estate Inc. own 99.74%. The remaining 0.26% is owned by a third party shareholder.

(3) Granite (Houston 90) LLC owns 95.27%. The remaining 4.73% is owned by a third party shareholder.

Granite REIT 2022 Annual Information Form 13

Granite LP’s material subsidiaries as at December 31, 2022 and their respective jurisdictions of incorporation or formation are listed below. Parent/subsidiary relationships are identified by indentation. The percentages of the votes attaching to all voting securities beneficially owned by Granite LP or over which Granite exercises control or direction, directly or indirectly, are also indicated. Granite LP’s percentage voting interest is equivalent to Granite’s economic interest in each subsidiary listed below. The voting securities of each subsidiary are held in the form of common shares or, in the case of limited partnerships and their foreign equivalents, share quotas or partnership interests.

| | | | | | | | | | | |

| List of Material Subsidiaries |

aterial Subsidiaries | | | | | | | | |

| Ownership of

Voting Securities | Jurisdiction of Incorporation or Formation |

| Granite Canadian Properties LP | 100 | % | Ontario |

| Granite US Master LP | 100% | Delaware |

| Granite US Holdco LP | 100% | Delaware |

| Granite REIT America Inc. | 100% | Delaware |

| Granite (1301 Chalk Hill) LP | 100% | Delaware |

| Commerce 30 Building C, Inc. | 100% | Delaware |

| Granite (Houston 90) LP | 100% | Delaware |

| NP-GR Houston Industrial, LLC | 95.27% | Delaware |

| Granite Real Estate Inc. | 100% | Quebec |

| Granite Europe B.V. | 100% | Netherlands |

| Granite Holdings B.V. | 100% | Netherlands |

| Granite AUT GmbH | 100% | Austria |

| Granite Thondorf RE GmbH & Co KG | 100% | Austria |

| Granite Austria GmbH & Co KG | 100% | Austria |

| Granite Germany Holding GmbH | 99.74% | Germany |

| Granite Germany Real Estate GmbH & Co KG | 99.74% | Germany |

| Granite AS Holding Germany GmbH | 99.74% | Germany |

| Granite AS Real Estate Germany GmbH & Co. KG | 99.79% | Germany |

GENERAL DEVELOPMENT OF THE BUSINESS

The following is a summary of the general development of Granite over the past three years:

2020

Acquisitions

During the year ended December 31, 2020, Granite acquired 24 income-producing modern industrial properties in Canada, the United States and Netherlands, a property under development in Netherlands (subsequently completed) and a parcel of development land in the United States. Property acquisitions consisted of the following:

14 Granite REIT 2022 Annual Information Form

| | | | | | | | | | | | | | | | | | | | |

| Acquisitions | | | | | |

| (in millions, except as noted) | | | | | |

| Property Address | Location | Sq ft(1) | Weighted Average Lease Term, in years by sq ft(1) | Date Acquired | Property Purchase Price(2) | Stabilized Yield(1) |

| | | | |

| Property under development: | | | | | | |

Aquamarijnweg 2 (3) | Bleiswijk, Netherlands | 0.2 | 10.0 | March 13, 2020 | $35.6 | 4.2 | % |

| Income-producing properties: | | | | | | |

| Oude Graaf 15 | Weert, Netherlands | 0.2 | 10.0 | May 1, 2020 | 31.9 | | 4.9 | % |

De Kroonstraat 1 (4) | Tilburg, Netherlands | 0.5 | 10.0 | July 1, 2020 | 71.7 | | 4.3 | % |

| Francis Baconstraat 4 | Ede, Netherlands | 0.1 | 15.1 | July 1, 2020 | 21.4 | | 5.8 | % |

5600-5630 Timberlea (5) | Mississauga, ON | 0.1 | 5.6 | September 28, 2020 | 19.5 | | 4.1 | % |

| 8995 Airport Road | Brampton, ON | 0.1 | 4.9 | September 1, 2020 | 22.2 | | 5.1 | % |

| 555 Beck Crescent | Ajax, ON | 0.1 | 10.0 | September 30, 2020 | 15.4 | | 4.6 | % |

8500 Tatum Road (6) | Palmetto, GA | 1.0 | 14.0 | November 12, 2020 | 105.2 | | 4.4 | % |

| Industrieweg 15 | Voorschoten, Netherlands | 0.4 | 5.8 | November 20, 2020 | 24.6 | | 5.9 | % |

| Zuidelijke Havenweg 2 | Hengelo, Netherlands | 0.3 | 15.0 | December 4, 2020 | 46.2 | | 4.2 | % |

Beurtvaartweg 2-4,

Sprengenweg 1-2 | Nijmegen, Netherlands | 0.3 | 10.0 | December 18, 2020 | 39.1 | | 6.0 | % |

| 12 Tradeport Road | Hanover Township, PA | 1.4 | 20.2 | December 22, 2020 | 174.7 | | 5.1 | % |

| 250 Tradeport Road | Nanticoke, PA | 0.6 | 5.9 | December 22, 2020 | 79.8 | | 5.1 | % |

| Midwest portfolio (five properties): | | | | | |

| 6201 Green Pointe Drive South | Groveport, OH | 0.5 | 1.4 | | | |

| 8779 Le Saint Drive | Hamilton, OH | 0.3 | 2.5 | | | |

| 8754 Trade Port Drive | West Chester, OH | 0.5 | 5.4 | | | |

| 445 Airtech Parkway | Indianapolis, IN | 0.6 | 3.5 | June 18, 2020 | 177.6 | | 5.4 | % |

| 5415 Centerpoint Parkway | Obetz, OH | 0.5 | 9.5 | July 8, 2020 | 45.1 | | 5.4 | % |

| Memphis portfolio (three properties): | | | | | |

| 4460 East Holmes Road | Memphis, TN | 0.4 | 7.1 | | | |

| 4995 Citation Drive | Memphis, TN | 0.4 | 2.8 | | | |

| 8650 Commerce Drive | Southaven, MS | 0.7 | 7.3 | June 18, 2020 | 111.6 | 5.8 | % |

| Development land: | | | | | | |

| 5005 Parker Henderson Road | Fort Worth, TX | N/A | N/A | June 8, 2020 | 8.9 | N/A |

| | | | | | |

| | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | 9.2 | | | | $1,030.5 | 5.1 | % |

(1)As at the date of acquisition except as noted in notes 3 and 4 below. |

(2)Purchase price does not include transaction costs associated with property acquisitions. | | |

(3)Acquired as a property under development in March 2020; however, the development was completed and the tenant occupied the property as at September 1, 2020. The SF, weighted average lease term and yield is based on the asset as-complete. |

(4) The purchase price excludes construction costs and holdbacks of $12.4 million (€8.1million) related to a 0.1 million SF expansion that was underway at the date of acquisition and completed and occupied by the tenant during the fourth quarter of 2020. The square footage and yield for this property represents the as-complete value. |

(5) Represents a complex of four properties located at 5600, 5610, 5620 and 5630 Timberlea Boulevard, Mississauga, Ontario. |

(6) Granite acquired the leasehold interest in this property which resulted in the recognition of a right-of-use asset, including transaction costs of $105,373. Granite will acquire freehold title to the property on December 1, 2029. |

Granite REIT 2022 Annual Information Form 15

Dispositions

During the year ended December 31, 2020, Granite disposed of three properties for total proceeds of $31.3 million. The three properties were tenanted by Magna, thereby reducing Granite’s overall exposure to Magna to 27% of total GLA and 36% of total annualized revenue as at December 31, 2020.

| | | | | | | | | | | | | | | | | | |

| Dispositions | | | | | |

| (in millions, except as noted) | | | | | | |

| Property Address | Location | Sq ft | Date Disposed | Sale Price(1) | | Annualized Revenue |

| Disposed during the year ended December 31, 2020: | | | | |

| | | | | | |

| 201 Patillo Road | Tecumseh, ON | 0.3 | September 14, 2020 | $17.0 | | $1.3 |

| 2032 First Street Louth | St. Catharines, ON | 0.1 | September 14, 2020 | 6.5 | | | 0.5 |

| 11 Santiago Russinyol Street | Barcelona, Spain | 0.1 | October 23, 2020 | 7.8 | | | 0.6 |

| | | | | | |

| | 0.5 | | | $31.3 | | $2.4 |

(1)Sale price does not include transaction costs associated with disposition. |

Other

On May 19, 2020, Granite announced the renewal of its NCIB and its intention to purchase for cancellation purposes up to an aggregate of 5,344,576 of its issued and outstanding Stapled Units, from time to time, if the Stapled Units are trading at a price that Granite believes is materially below intrinsic value. The NCIB was for a 12 month period beginning on May 21, 2020 and concluded on May 20, 2021.

On May 28, 2020, Granite announced its Green Bond Framework and Sustainalytics’ second party opinion confirming alignment with the ICMA's Green Bond Principles.

On June 2, 2020, Granite completed a bought deal equity offering of 4,255,000 Stapled Units at a price of $68.00 per Stapled Unit for total gross proceeds of $289,340,000.

On June 4, 2020, Granite issued the 2027 Debentures as green bonds under Granite’s Green Bond Framework. Granite also entered into a cross-currency interest rate swap to exchange the Canadian dollar denominated principal and interest payments of the 2027 Debentures for USD-denominated payments, resulting in an effective fixed interest rate of 2.964% for the seven-year term.

On June 4, 2020, at the annual general meetings of Granite GP and Granite REIT, 95.45% votes were received for Granite’s non-binding advisory resolution on its approach to executive compensation.

On June 19, 2020, Granite published an ESG overview providing an update on Granite’s sustainability initiatives including a summary of Granite’s progress to date against the principles outlined in its Sustainability Plan.

On November 4, 2020, Granite announced that it had increased its targeted annualized distribution to $3.00 from $2.90 per Stapled Unit, to be effective upon the distribution payable in January 2021.

On November 24, 2020, Granite completed a bought deal equity offering of 3,841,000 Stapled Units at a price of $75.00 per Stapled Unit for total gross proceeds of $288,075,000.

16 Granite REIT 2022 Annual Information Form

On December 18, 2020, Granite issued the 2030 Debentures. Granite also entered into a cross currency interest rate swap to exchange the Canadian dollar denominated principal and interest payments of the 2030 Debentures for Euro-denominated payments, resulting in an effective fixed interest rate of 1.045% for the ten-year term.

2021

Acquisitions

During the year ended December 31, 2021, Granite acquired 16 income-producing modern industrial properties in Canada, the United States and Netherlands, four properties under development in the United States, and a parcel of development land in Canada. Property acquisitions consisted of the following:

| | | | | | | | | | | | | | | | | | | | | |

| Acquisitions | | | | | | |

| (in millions, except as noted) | | | | | | |

| Property Address | Location | Sq ft(1) | Weighted Average Lease Term, in years by sq ft(1) | Date Acquired | Property Purchase Price(2) | | Stabilized Yield(1) |

| | | | | |

| Income-producing properties: | | | | | | |

3090 Highway 42 (3) | Locust Grove, GA | 1.0 | 7.6 (4) | March 12, 2021 | $85.1 | | 5.0 | % |

| 3801 Rock Creek Blvd. | Joliet, IL | 0.3 | 5.9 | June 25, 2021 | 30.2 | | 4.6 | % |

| 3900 Rock Creek Blvd. | Joliet, IL | 0.3 | 4.1 | June 25, 2021 | 34.7 | | 5.2 | % |

| 1695-1701 Crossroads Dr. | Joliet, IL | 0.5 | 2.9 | June 25, 2021 | 50.7 | | 4.6 | % |

| US Portfolio (4 properties): | | | | | | | |

| 1243 Gregory Dr. | Antioch, IL | | | | | | |

| 60 Logistics Blvd. | Richwood, KY | | | | | | |

| 8740 South Crossroads Dr. | Olive Branch, MS | | | | | | |

| 12577 State Line Rd. | Olive Branch, MS | 2.4 | 3.2 | September 3, 2021 | 243.7 | | 4.7 | % |

| 1600 Rock Creek Blvd. | Joliet, IL | 0.1 | 4.4 | September 7, 2021 | 20.7 | | 4.9 | % |

| Sophialaan 5 | Utrecht, NL | 0.2 | 1.2 | September 17, 2021 | 42.1 | | 2.3 | % |

| 100 Ronson Dr. | Toronto, ON | 0.1 | 1.0 | December 13, 2021 | 18.4 | | 2.8 | % |

| 110 Ronson Dr. | Toronto, ON | 0.1 | 1.0 | December 13, 2021 | 16.2 | | 2.8 | % |

| 115 Sinclair Blvd. | Brantford, ON | 0.4 | 15.0 | December 17, 2021 | 66.0 | | 5.1 | % |

| Hazeldonk 6520-6524 | Breda, NL | 0.6 | 5.7 | December 17, 2021 | 87.9 | | 3.6 | % |

| Hazeldonk 6526-6530 | Breda, NL | 0.3 | 5.7 | December 17, 2021 | 54.7 | | 3.7 | % |

| 5400 E 500 S | Whitestown, IN | 0.6 | 10.9 | December 22, 2021 | 87.5 | | 3.9 | % |

| | | | | | | |

| Properties under development: | | | | | | |

| 2120 Logistics Way | Murfreesboro, TN | N/A | N/A | June 30, 2021 | 17.3 | | 5.3 | % |

Highway 109 (3 properties) | Lebanon, TN | N/A | N/A | September 8, 2021 | 6.5 | | 5.3 | % |

| | | | | | | |

| | | | | | | |

| Development land: | | | | | | | |

| 375/395 Hardy Rd. | Brantford, ON | N/A | N/A | August 16, 2021 | 62.2 | | N/A |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | 6.9 | | | $923.9 | | 5.1% |

(1)As at the date of acquisition except as noted in notes 3 and 4 below. |

(2)Purchase price does not include transaction costs associated with property acquisitions. | | | |

(3) To provide for a real estate tax abatement, Granite acquired a leasehold interest in this property which resulted in the recognition of a right-of-use asset, including transaction costs of $85.5 million. Granite will acquire freehold title to the property on December 1, 2028. |

(4) Weighted average lease term applicable to the occupied space. |

Granite REIT 2022 Annual Information Form 17

Dispositions

During the year ended December 31, 2021, Granite disposed of three properties for total proceeds of $36.8 million.

| | | | | | | | | | | | | | | | | |

| Dispositions | | | | |

| (in millions, except as noted) | | | | | |

| Property Address | Location | Sq ft | Date Disposed | Sale Price(1) | Annualized Revenue (2) |

| Disposed during the year ended December 31, 2021: | | | |

| | | | | |

| Hedera Rd., Ravensbank Business Park | Redditch, United Kingdom | 0.1 | January 28, 2021 | $10.6 | $0.8 |

| Puchberger Straße 267 | Weikersdorf, Austria | 0.2 | June 30, 2021 | 13.2 | 0.7 |

| Götzendorfer Straße 3-5 | Ebergassing, Austria | 0.4 | November 30, 2021 | 13.0 | 1.2 |

| | | | | |

| | 0.7 | | | $36.8 | $2.7 |

(1)Sale price does not include transaction costs associated with disposition. |

(2) As at the date of disposition. The property in Weikersdorf, Austria was 53% occupied on the disposition date. |

Other

Effective January 1, 2021, Granite appointed Michael A. Ramparas to Executive Vice President, Global Real Estate and Head of Investments.

On January 4, 2021, Granite LP redeemed in full the outstanding $250.0 million aggregate principal amount of the 3.788% Series 2 senior debentures due July 5, 2021 issued by Granite LP for a total redemption price of $254.0 million. In conjunction with the redemption, Granite LP terminated the corresponding cross-currency interest rate swap on January 4, 2021 and the related net mark to market liability of $17.7 million was settled.

On January 28, 2021, Granite disposed of one property located in Redditch, United Kingdom for gross proceeds of $10.6 million (£6.0 million).

On March 4, 2021, Granite announced the release of its first Green Bond Use of Proceeds Report for the period ending December 31, 2021 with respect to the allocation of net proceeds of Granite’s 3.062% $500.0 million Series 4 Senior Debentures due 2027.

On March 22, 2021, DBRS Morningstar updated Granite LP’s issuer rating and senior unsecured debentures rating to BBB (high) from BBB, both with stable trends.

On March 31, 2021, Granite announced that it had amended its existing unsecured revolving credit facility agreement to extend the maturity date for a new five-year term to March 31, 2026 and had increased the credit facility limit from $500.0 million to $1.0 billion.

On May 19, 2021, Granite announced the renewal of its NCIB and its intention to purchase for cancellation purposes up to an aggregate of 6,154,057 of its issued and outstanding Stapled Units, from time to time, if Granite’s Stapled Units are trading at a price that Granite believes is materially below intrinsic value. The NCIB was for a 12-month period beginning on May 21, 2021 and concluded on May 20, 2022.

On June 9, 2021, Granite completed a bought deal equity offering of 3,979,000 Stapled Units at a price of $79.50 per Stapled Unit for total gross proceeds of $316,330,500.

18 Granite REIT 2022 Annual Information Form

On June 10, 2021, at the annual general meetings of Granite GP and Granite REIT, 97.80% votes were received for Granite’s non-binding advisory resolution on its approach to executive compensation.

On August 4, 2021, Granite announced that the Board had appointed Ms. Emily Pang to serve as a Trustee of Granite REIT and a Director of Granite GP.

On August 4, 2021, Granite released its 2020 ESG+R report, which highlights Granite’s ESG+R program implementation and updates from the 2020 calendar year.

On August 30, 2021, Granite issued the 2028 Debentures. Granite also entered into the 2.096% Swap, a cross-currency interest rate swap to exchange the Canadian dollar denominated principal and interest payments of the 2028 Debentures for USD-denominated payments, resulting in an effective fixed interest rate of 2.096% for the seven-year term. The 2028 Debentures are Granite’s second green bond issuance pursuant to its Green Bond Framework.

On October 4, 2021, Granite filed and obtained a receipt for new base shelf prospectuses for both equity and debt securities (the “Shelf Prospectuses”). The Shelf Prospectuses are valid for a 25-month period, during which time Granite may offer and issue, from time to time, stapled units, stapled convertible debentures, stapled subscription receipts, stapled warrants, units or any combination thereof, having an aggregate offering price of up to $1.5 billion or debt securities having an aggregate offering price of up to $1.75 billion.

On November 3, 2021, Granite announced that it had increased its targeted annualized distribution to $3.10 from $3.00 per Stapled Unit, to be effective upon the December 2021 distribution, payable in January 2022.

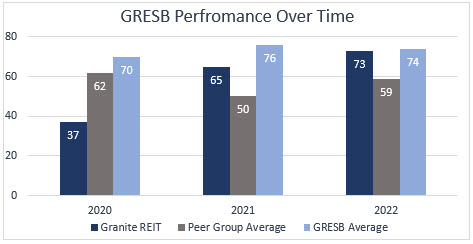

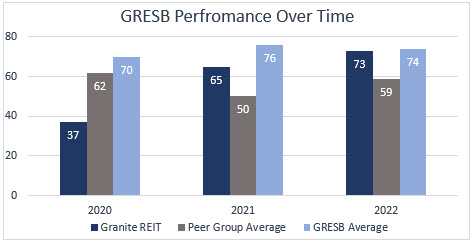

On November 3, 2021, Granite announced that it completed its first annual GRESB Real Estate Assessment in 2020 and completed its second submission in June 2021. GRESB’s 2021 results were published on October 1, 2021 and Granite’s score significantly improved by 76% to 65 points, as a result of which Granite placed third and became the sole Canadian entity in the North American Industrial Listed sector comprised of seven reporting entities. In addition, Granite ranked 1st out of 10 in the North America Industrial GRESB public disclosure group which evaluates the level of ESG disclosure by listed property companies and REITs.

On November 3, 2021, Granite announced that it had established its ATM Program and entered into the Equity Distribution Agreement pursuant to which Granite may issue up to $250 million of Stapled Units from treasury to the public from time to time, at Granite’s discretion, at the prevailing market price when issued on the TSX or any other existing trading market for the Stapled Units in Canada. The ATM Program will be effective until November 1, 2023, unless previously terminated.

Granite REIT 2022 Annual Information Form 19

2022

Acquisitions

During the year-ended December 31, 2022, Granite acquired eight income-producing industrial properties in Germany, the United States, Canada and Netherlands, one property under development in the United States and one parcel of development land in Canada. Property acquisitions consisted of the following:

| | | | | | | | | | | | | | | | | | | | |

| Acquisitions | | Weighted Average Lease Term, in years by sq ft(1)(3) | | | |

| (in millions, except as noted) | | | Property Purchase Price(2) | |

| Property Address | Location | Sq ft(1) | Date Acquired | Stabilized Yield(1) |

| | | |

| | | | | | |

| Income-producing properties: | | | | | |

| Georg-Beatzel Straße 15 | Wiesbaden, GER | 0.2 | | 8.3 | | February 3, 2022 | $ | 62.0 | | 3.4 | % |

| Raiffeisenstraße 28-32 | Korbach, GER | 0.5 | | 8.2 | | February 3, 2022 | 60.3 | | 3.7 | % |

| In der Langen Else 4 | Erfurt, GER | 0.1 | | 1.9 | | February 3, 2022 | 17.6 | | 4.1 | % |

| 10566 Gateway Pt. | Clayton, USA | 0.9 | | 9.8 | | April 14, 2022 | 121.3 | | 4.2 | % |

| 2128 Gateway Pt. | Clayton, USA | 0.4 | | 10.3 | | April 14, 2022 | 57.9 | | 4.4 | % |

| 102 Parkshore Dr. | Brampton, CAN | 0.1 | | 7.0 | | May 24, 2022 | 20.9 | | 4.5 | % |

| 195 Steinway Blvd. | Etobicoke, CAN | 0.1 | | 15.0 | | May 26, 2022 | 17.7 | | 5.0 | % |

| Swaardvenstraat 75 | Tilburg, NED | 0.5 | | 10.0 | | July 1, 2022 | 102.1 | | 3.2 | % |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Property under development: | | | | | |

| 905 Belle Ln. | Bolingbrook, USA | 0.2 | | N/A | May 5, 2022 | 14.5 | | 3.9 | % |

| | | | | | |

| | | | | | |

| | | | | | |

| Development land: | | | | | | |

| 161 Markel Dr. | Brant County, CAN | N/A | N/A | August 19, 2022 | 6.4 | N/A |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | 3.0 | | | | $ | 480.7 | | 3.8 | % |

(1) As at the date of acquisition except as noted in note 3 below.

(2) Purchase price does not include transaction costs associated with property acquisitions.

(3) Weighted average lease term applicable to the occupied space.

20 Granite REIT 2022 Annual Information Form

Dispositions

During the year ended December 31, 2022, Granite disposed of two income-producing properties and a parcel of land located in Poland and the Czech Republic for total proceeds of $66.0 million.

| | | | | | | | | | | | | | | | | |

| Dispositions | | | | |

| (in millions, except as noted) | | | | |

| Property Address | Location | Sq ft | Date Disposed | Sale Price(1) | Annualized Revenue (2) |

Disposed during the year ended December 31, 2022: | | | |

| 10 Topolowa | Mirków, Poland | 0.3 | | February 18, 2022 | $34.5 | | $ | 1.6 | |

378 10 Hospodářský Park, České Velenice (3) | Třeboň, Czech Republic | 0.3 | | June 9, 2022 | 31.5 | | 2.6 | |

| | | | | |

| | 0.6 | | | $66.0 | | $ | 4.2 | |

(1) Sale price does not include transaction costs associated with disposition. |

(2) As at the date of disposition. |

(3) In conjunction with the disposal of the income producing property, the associated carrying value of the non-controlling interest of $1.4 million was derecognized on June 9, 2022. |

Other

Effective January 1, 2022, Granite appointed Lawrence Clarfield to Executive Vice President, General Counsel and Corporate Secretary.

On February 3, 2022, Granite terminated $350.0 million of a total $500.0 million principal of the 2.096% Swap which exchanged Canadian dollar denominated principal and interest payments of Granite’s 2028 Debentures for US dollar denominated payments at a fixed interest rate of 2.096%.

Simultaneously, Granite entered into the 0.536% Swap, a new $350.0 million cross-currency interest rate swap maturing August 30, 2028 to exchange the Canadian dollar denominated principal and interest payments of the 2028 Debentures for Euro denominated payments at a fixed interest rate of 0.536%. The restructuring of a portion of Granite’s hedge relating to the 2028 Debentures will result in annual interest expense savings of approximately $5.5 million or approximately $0.083 on a per unit basis. Upon termination, Granite paid $6.6 million to settle the mark-to-market liability relating to the $350.0 million principal portion of the 2.096% Swap.

From April 1, 2022 to April 29, 2022, Granite issued 120,300 Stapled Units under its ATM Program, at an average Stapled Unit price of $98.84 for gross proceeds of $11.9 million, and incurred issuance costs of $0.3 million, for net proceeds of $11.6 million.

On May 19, 2022, Granite announced the renewal of its NCIB and its intention to purchase for cancellation purposes up to an aggregate of 6,566,292 of its issued and outstanding Stapled Units, from time to time, if the Stapled Units are trading at a price that Granite believes is materially below intrinsic value. The NCIB is for a 12-month period beginning on May 24, 2022 and will conclude on the earlier of the date on which purchases under the bid have been completed and May 23, 2023. For the year ended December 31, 2022, Granite repurchased 2,165,600 Stapled Units through the NCIB.

On June 9, 2022, at the annual general meetings of Granite GP and Granite REIT, 96.54% votes in favour were received for Granite’s non-binding advisory resolution on its approach to executive compensation, 99.95% votes in favour were received for Granite's ordinary resolution approving certain amendments to the Declaration of Trust, 99.82% votes in favour were

Granite REIT 2022 Annual Information Form 21

received for Granite's special resolution approving certain amendments to the Declaration of Trust, 98.77% votes in favour were received for Granite's ordinary resolution approving the Non-Employee Directors' Deferred Share Unit Plan of Granite GP, and 29.01% votes in favour were received for Granite's special resolution approving certain amendments to the articles of Granite GP.

On August 10, 2022, Granite announced that it released its 2021 ESG+R Report, which follows the GRI framework with TCFD and SASB disclosures.

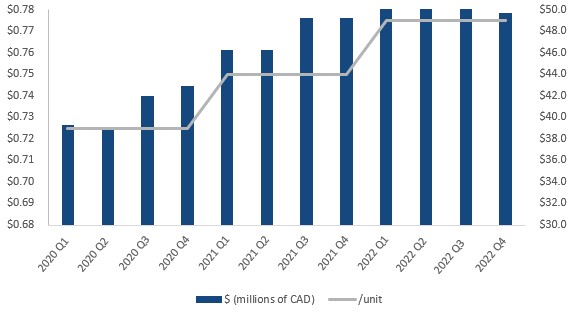

On November 9, 2022, Granite announced that it had increased its targeted annualized distribution to $3.20 from $3.10 per Stapled Unit, to be effective upon the December 2022 distribution, payable in January 2023.

2023 to date

Other

On February 1, 2023, Granite announced that the leases at its properties in Graz, Austria comprising approximately 5.0 million SF, had been contractually extended for ten years to January 31, 2034.

On March 3, 2023, Granite amended its existing unsecured credit facility agreement to extend the maturity date for a new five-year term to March 31, 2028.

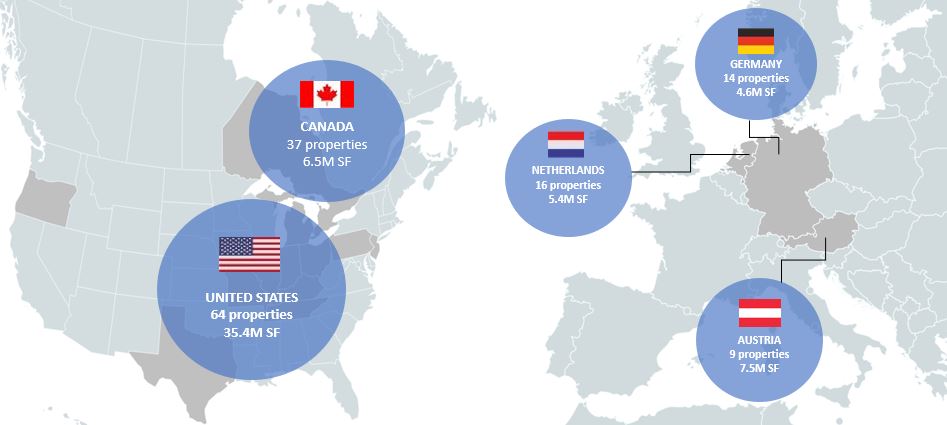

BUSINESS OVERVIEW

Granite is a Canadian-based real estate investment trust engaged in the acquisition, development, ownership and management of logistics, warehouse and industrial properties in North America and Europe. As at March 8, 2023, excluding assets held for sale, Granite owns 140 investment properties in five countries having approximately 59.4 million SF of gross leasable area.

22 Granite REIT 2022 Annual Information Form

Granite provides REIT Unitholders and GP Shareholders with stable cash flow growth generated by revenue it derives from the ownership of and investment in income-producing real estate properties. It strives to maximize long term unit value through the execution of its long-term strategy of building an institutional quality and globally diversified industrial real estate business. Underpinning this strategy, Granite seeks to grow and diversify its asset base through acquisitions, development, re-development and dispositions; to drive organic growth through leasing execution and asset management; maintain a conservative balance sheet; and to reduce its exposure to its largest tenant, Magna, and the special purpose properties.

Granite has positioned itself financially to execute on its strategic plan including to capitalize on acquisition and development opportunities within its targeted geographic footprint as well as benefit from a net leverage ratio of 32% and as of March 8, 2023, liquidity of approximately $1.1 billion. Granite believes this favourable liquidity position and continued conservative leverage will facilitate Granite’s near-term objectives to drive net asset value growth through development and opportunistic acquisitions and execute on its long-term strategy of building an institutional quality and globally diversified industrial real estate business.

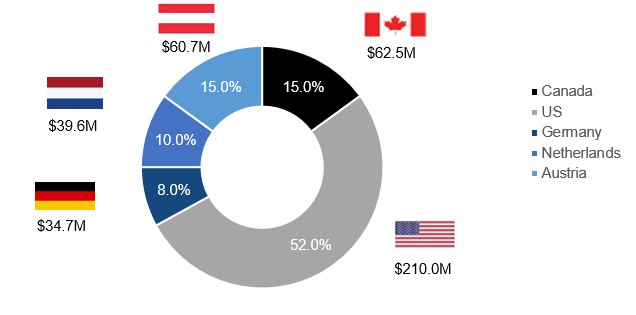

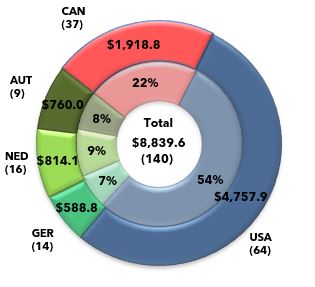

Investment Properties

Granite’s investment properties consist of income-producing properties, properties under development and land held for development as set out in the audited combined financial statements as at December 31, 2022. Granite’s investment properties by geographic location, property count and square footage as at March 8, 2023 are summarized below:

| | |

Investment Properties Summary |

Five countries/140 properties/59.4 million SF |

Investment Proper

Investment ProperGERMANY

14 properties

(1) Excludes assets held for sale as at December 31, 2022.

Income-Producing Properties

Granite REIT 2022 Annual Information Form 23

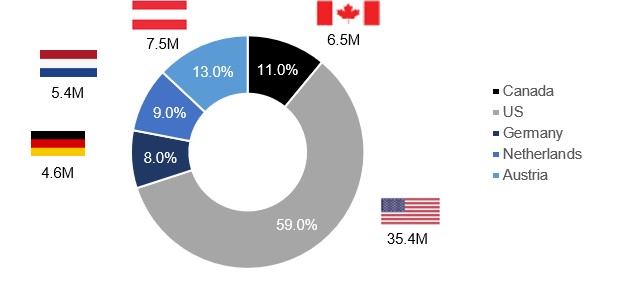

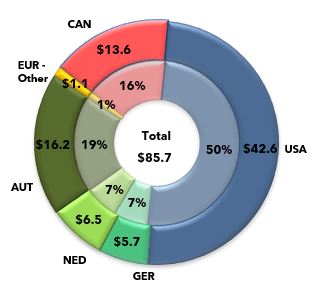

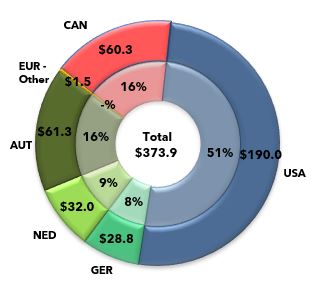

Geographic Breakdown

As at December 31, 2022, Granite’s income-producing properties were located in five countries: Canada, the United States, Netherlands, Austria and Germany. Lease payments are primarily denominated in three currencies: the Canadian dollar, the United States dollar and the Euro. Unless the context requires otherwise, references to income-producing properties do not include the properties currently classified by Granite as assets held for sale (two properties), properties under development (eight properties), and land held for development (four properties) as set out in the audited combined financial statements as at December 31, 2022. The following charts show the geographic breakdown of Granite’s income-producing properties by number and approximate square footage as at December 31, 2022.

The following charts show the geographic breakdown of Granite’s income-producing properties by number and approximate square footage as at December 31, 2022:

Number of Income-Producing Properties(1)

(1) The chart does not include properties under development (eight properties), land held for development (four properties) or assets held for sale (two income-producing properties) in the combined financial statements as at December 31, 2022.

24 Granite REIT 2022 Annual Information Form

Square Feet(1)

(1) The chart does not include properties under development (eight properties), land held for development (four properties) or assets held for sale (two income-producing properties) in the combined financial statements as at December 31, 2022.

The following table shows the geographic breakdown of Granite’s income-producing properties by fair value as at December 31, 2022:

| | | | | | | | | | | |

Real Estate Assets(1) |

| Location | Income-Producing

Property Portfolio

Fair Value (in millions) | Income-Producing

Property Portfolio

Fair Value |

| North America | | |

| Canada | $ | 1,833.3 | | 21.6 | % |

| United States | 4,489.9 | | 52.9 | % |

| Europe | | |

| Austria | 760.0 | | 9.0 | % |

| Germany | 588.8 | | 6.9 | % |

| Netherlands | 814.1 | | 9.6 | % |

| Total | $ | 8,486.1 | | 100.0 | % |

(1) Excludes assets held for sale.

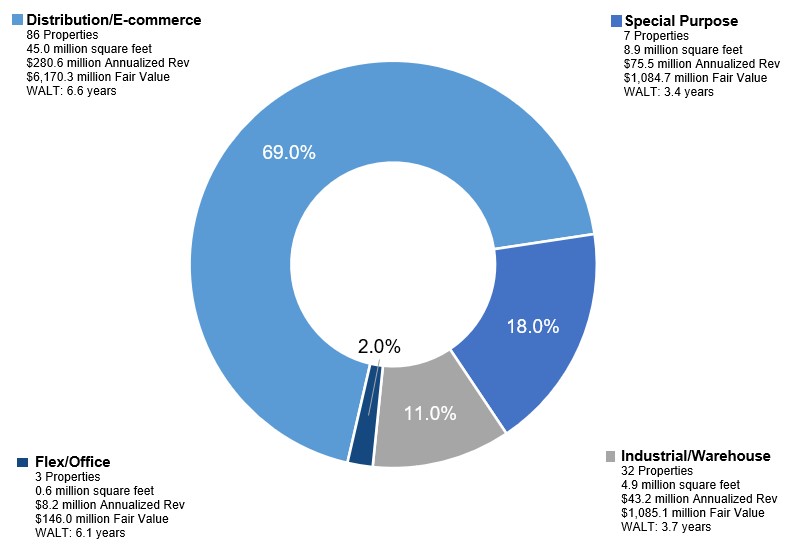

Property Types

Substantially all of Granite’s income-producing properties are for industrial use and can be categorized as (i) distribution/e-commerce, (ii) industrial/warehouse, (iii) flex/office, or (iv) special purpose properties designed and built with specialized features and leased primarily to Magna.

The chart below illustrates the proportion of Granite’s annualized revenue from income-producing properties that are distribution/e-commerce, industrial/warehouse, flex/office or special purpose properties as at December 31, 2022.

Granite REIT 2022 Annual Information Form 25

| | | | | | | | | | | | | | | | | |

Annualized Revenue(1) by Property Type |

(1) The chart does not include properties under development (eight properties), land held for development (four properties) or assets held for sale (two income-producing properties) in the combined financial statements as at December 31, 2022.

Tenant Overview

In addition to Magna, at December 31, 2022, Granite had 125 other tenants from various industries that in aggregate comprised 74% of Granite's annualized revenue. Each of these tenants accounted for less than 5% of Granite's annualized revenue as at December 31, 2022.

Granite’s top 10 tenants by annualized revenue at December 31, 2022 are summarized in the table below:

| | | | | | | | | | | | | | |

| Top 10 Tenants Summary |

|

| Tenant | Annualized Revenue % | GLA % | WALT (years) | Credit Rating(1)(2) |

| Magna | 26 | % | 20 | % | 3.7 | | A- |

| Amazon | 4 | % | 4 | % | 16.2 | | AA |

| Mars Petcare US | 3 | % | 4 | % | 7.6 | | NR |

| True Value Company | 2 | % | 2 | % | 18.2 | | NR |

| ADESA | 2 | % | — | % | 6.6 | | CCC+ |

| Ceva Logistics US Inc. | 2 | % | 2 | % | 2.0 | | BB+ |

| Restoration Hardware | 2 | % | 2 | % | 5.3 | | Ba3 |

| Light Mobility Solutions GmbH | 2 | % | 1 | % | 0.9 | | NR |

| Samsung Electronics America | 2 | % | 1 | % | 3.8 | | AA- |

| Spreetail FTP | 2 | % | 2 | % | 3.8 | | NR |

| Top 10 Tenants | 47 | % | 38 | % | 5.9 | | |

(1) Credit rating is quoted on the Standard & Poor’s rating scale or equivalent where publicly available. NR refers to Not Rated.

(2) The credit rating indicated may, in some instances, apply to an affiliated company of Granite’s tenant which may not be the guarantor of the lease.

26 Granite REIT 2022 Annual Information Form

As at December 31, 2022, Magna, a diversified global automotive supplier, was the tenant at 27 of Granite’s income-producing properties and lease payments under those leases represented approximately 26% of Granite’s annualized revenue. See ‘‘— Magna, Granite’s Largest Tenant’’.

Granite believes that its existing portfolio of Magna-tenanted properties provides a level of stability for its business. Six of Granite’s seven special purpose properties are occupied exclusively by Magna in Canada and Austria. Magna has invested significant capital in these active production facilities making it expensive to relocate. The special purpose attributes of these properties may make it more difficult to lease to future tenants should Magna vacate (see ‘‘Risk Factors’’), but with a weighted average remaining lease term of 3.7 years as at December 31, 2022 (extended to 8.9 years following the lease extensions at Granite's properties in Graz, Austria on February 1, 2023), they also present the opportunity for a stable and, relative to distribution/ e-commerce, industrial/warehouse or flex/office properties, enhanced rental income stream. See ‘‘— Magna, Granite’s Largest Tenant’’. On balance, the risk profile of the special purpose properties is substantially similar to that of Granite’s distribution/e-commerce, industrial/ warehouse and flex/office properties.

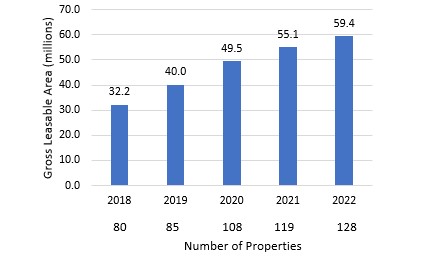

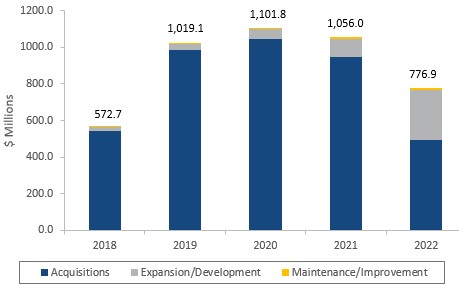

Profile of Granite’s Real Estate Portfolio

Granite’s Income-Producing Real Estate Portfolio

The following chart shows the total leasable area (net of dispositions) and number of properties within Granite’s income-producing property portfolio in each of the last five years:

| | |

| Total Leasable Area and Number of Properties |

The chart below shows Granite’s historical capital expenditures for its real estate portfolio, including (i) acquisitions; (ii) expansion/development, and (iii) maintenance/improvements in each of the last five years:

Granite REIT 2022 Annual Information Form 27

Schedule of Lease Expiries

The weighted average remaining term to expiry based on leased area for income-producing properties was as follows as at December 31 in each of the last five years:

December 31, 2022 — 5.9 years;

December 31, 2021 — 5.8 years;

December 31, 2020 — 6.3 years;

December 31, 2019 — 6.5 years; and

December 31, 2018 — 6.0 years.

28 Granite REIT 2022 Annual Information Form

Lease Expiration

As at December 31, 2022, Granite’s portfolio had a weighted average lease term by square footage of 5.9 years (December 31, 2021 - 5.8 years) with lease expiries by GLA (in thousands of SF) and any lease renewals committed adjusted accordingly, lease count and annualized revenue (calculated as the contractual base rent for the month subsequent to the quarterly reporting period multiplied by 12 months, in millions) as set out in the table below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Vacancies | | 2023 | | 2024 | | 2025 | | 2026 | | 2027 | | 2028 | | 2029 and Beyond |

| Country | Total GLA | Total Lease Count | Total Annualized Revenue $ | Sq Ft | | Sq Ft | Annualized Revenue $ | | Sq Ft | Annualized Revenue $ | | Sq Ft | Annualized Revenue $ | | Sq Ft | Annualized Revenue $ | | Sq Ft | Annualized Revenue $ | | Sq Ft | Annualized Revenue $ | | Sq Ft | Annualized Revenue $ |

| Canada | 6,544 | | 33 | | 62.5 | | 72 | | | 380 | | 2.5 | | | 569 | | 5.5 | | | 1,450 | | 11.3 | | | 573 | | 5.9 | | | 529 | | 6.4 | | | 79 | 1.2 | | | 2,892 | | 29.7 | |

| Canada-committed | — | | — | | — | | — | | | (289) | | (1.8) | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | 289 | 1.8 | | | — | | — | |

| Canada - net | 6,544 | | 33 | | 62.5 | | 72 | | | 91 | | 0.7 | | | 569 | | 5.5 | | | 1,450 | | 11.3 | | | 573 | | 5.9 | | | 529 | | 6.4 | | | 368 | 3.0 | | | 2,892 | | 29.7 | |

| United States | 35,400 | | 77 | | 210.1 | | 90 | | | 6,442 | | 33.0 | | | 3,475 | | 20.2 | | | 1,895 | | 11.1 | | | 3,611 | | 25.2 | | | 1,708 | | 8.1 | | | 3,911 | 19.4 | | | 14,268 | | 93.1 | |

United States-committed (1) | — | | — | | — | | — | | | (4,613) | | (22.9) | | | — | | — | | | 945 | | 4.2 | | | 76 | | 0.5 | | | 86 | | 0.6 | | | 2,232 | 11.1 | | | 1,274 | | 6.5 | |

| United States - net | 35,400 | | 77 | | 210.1 | | 90 | | | 1,829 | | 10.1 | | | 3,475 | | 20.2 | | | 2,840 | | 15.3 | | | 3,687 | | 25.7 | | | 1,794 | | 8.7 | | | 6,143 | 30.5 | | | 15,542 | | 99.6 | |

| Austria | 7,472 | | 9 | | 60.7 | | — | | | 125 | | 1.3 | | | 5,349 | | 37.1 | | | — | | — | | | 389 | | 3.0 | | | 802 | | 10.3 | | | 807 | 9.0 | | | — | | — | |

| Austria-committed | — | | — | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | — | | | — | | — | |

| Austria-net | 7,472 | | 9 | | 60.7 | | — | | | 125 | | 1.3 | | | 5,349 | | 37.1 | | | — | | — | | | 389 | | 3.0 | | | 802 | | 10.3 | | | 807 | 9.0 | | | — | | — | |

| Germany | 4,640 | | 15 | | 34.7 | | — | | | 2,308 | | 16.7 | | | 308 | | 2.3 | | | 195 | | 1.7 | | | 303 | | 1.8 | | | 290 | | 2.1 | | | 339 | 2.5 | | | 897 | | 7.6 | |

Germany-committed (1) | — | | — | | — | | — | | | (1,390) | | (9.3) | | | — | | — | | | — | | — | | | 717 | | 4.3 | | | — | | — | | | 335 | 2.5 | | | 338 | | 2.5 | |

| Germany-net | 4,640 | | 15 | | 34.7 | | — | | | 918 | | 7.4 | | | 308 | | 2.3 | | | 195 | | 1.7 | | | 1,020 | | 6.1 | | | 290 | | 2.1 | | | 674 | 5.0 | | | 1,235 | | 10.1 | |

| Netherlands | 5,367 | | 32 | | 39.6 | | 48 | | | 411 | | 3.9 | | | 52 | | 0.7 | | | 629 | | 5.1 | | | 354 | | 1.7 | | | 1,125 | | 7.6 | | | — | — | | | 2,748 | | 20.6 | |

| Netherlands - committed | — | | — | | — | | — | | | (314) | | (2.8) | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | 314 | 2.8 | | | — | | — | |

| Netherlands - net | 5,367 | | 32 | | 39.6 | | 48 | | | 97 | | 1.1 | | | 52 | | 0.7 | | | 629 | | 5.1 | | | 354 | | 1.7 | | | 1,125 | | 7.6 | | | 314 | 2.8 | | | 2,748 | | 20.6 | |

| Total | 59,423 | | 166 | | 407.6 | | 210 | | | 9,666 | | 57.4 | | | 9,753 | | 65.8 | | | 4,169 | | 29.2 | | | 5,230 | | 37.6 | | | 4,454 | | 34.5 | | | 5,136 | | 32.1 | | | 20,805 | | 151.0 | |

Total-committed (1) | — | | — | | — | | — | | | (6,606) | | (36.8) | | | — | | — | | | 945 | | 4.2 | | | 793 | | 4.8 | | | 86 | | 0.6 | | | 3,170 | | 18.2 | | | 1,612 | | 9.0 | |

As at December 31, 2022 | 59,423 | | 166 | | 407.6 | | 210 | | | 3,060 | | 20.6 | | | 9,753 | | 65.8 | | | 5,114 | | 33.4 | | | 6,023 | | 42.4 | | | 4,540 | | 35.1 | | | 8,306 | | 50.3 | | | 22,417 | | 160.0 | |

% of portfolio as at December 31, 2022: | | | | | | | | | | | | | | | | | | | | | |

| * by sq ft (in %) | 100.0 | | | | 0.4 | | | 5.1 | | | | 16.4 | | | | 8.6 | | | | 10.1 | | | | 7.6 | | | | 14.0 | | | | 37.8 | | |

| * by Annualized Revenue (in %) | | | 100.0 | | | | | 5.1 | | | | 16.1 | | | | 8.2 | | | | 10.4 | | | | 8.6 | | | | 12.3 | | | | 39.3 | |

(1) Committed vacancies represent leases signed during the current period but not occupied until after period end.

Granite REIT 2022 Annual Information Form 29

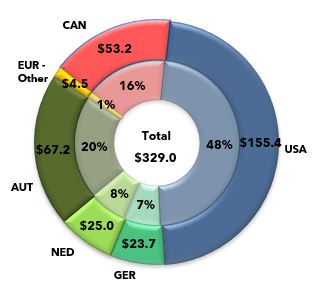

Principal Markets in which Granite Operates

Geographic Diversification

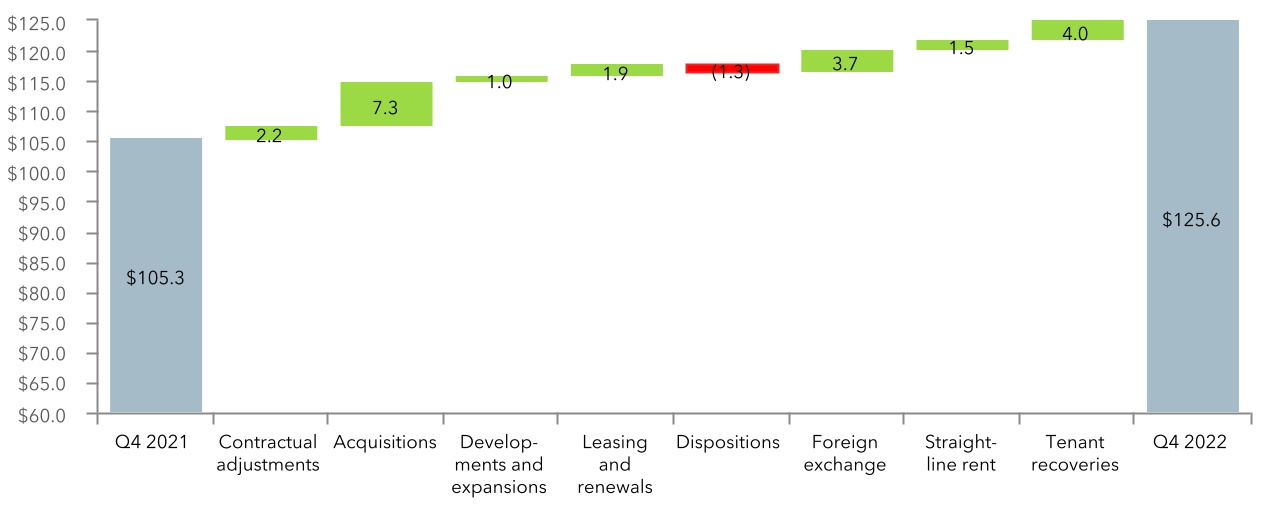

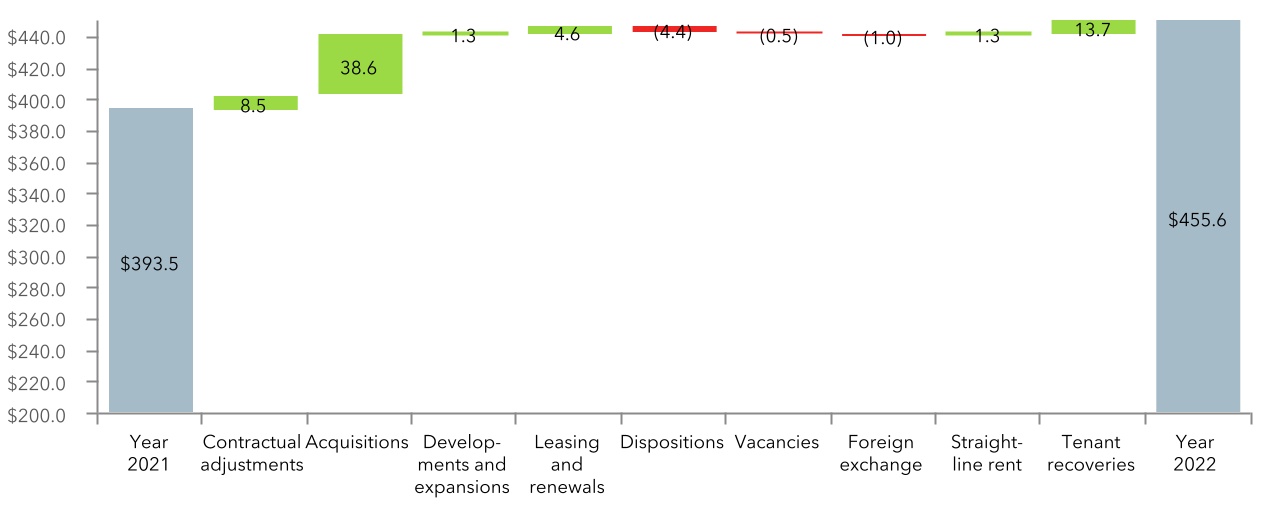

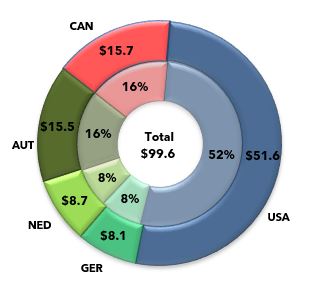

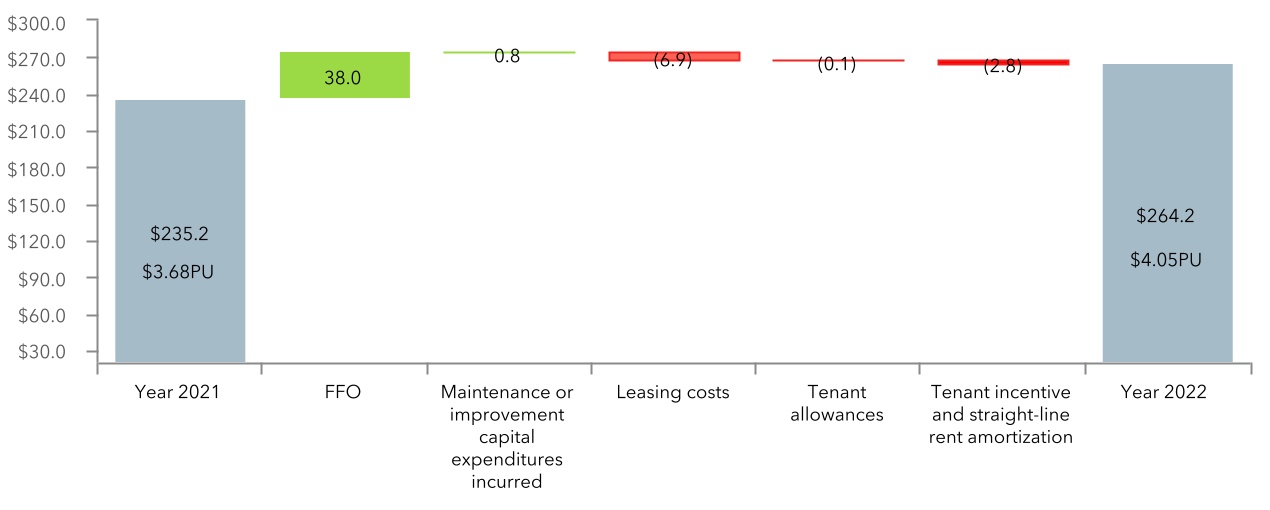

The following chart shows a breakdown of Granite’s $407.5 million of annualized revenue by country from income-producing properties as at December 31, 2022:

| | | | | | | | | | | | | | | | | |

Income-Producing Property Portfolio Breakdown of Annualized Revenue by Country at December 31, 2022 (in millions of dollars) |

The chart below shows the breakdown of Granite’s income-producing property portfolio by country, property type, fair value and number of properties as at December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income-Producing Property Portfolio Breakdown by Country, Property Type, Fair Value & Number of Properties as at December 31, 2022 (in millions of dollars)(1) |

| | | | | | | | | | | |

| Modern Distribution | | Industrial/Warehouse | | Flex/Office | | Special purpose properties | | Total |

| Country | Fair Value | # | | Fair Value | # | | Fair Value | # | | Fair Value | # | | Fair Value | # |

| Canada | $ | 529.2 | | 8 | | $ | 845.3 | | 22 | | $ | 83.6 | | 2 | | $ | 375.2 | | 2 | | $ | 1,833.3 | | 34 |

| United States | 4,410.6 | | 53 | | 16.8 | | 1 | | 62.5 | | 1 | | — | | — | | 4,489.9 | | 55 |

| Austria | — | | — | | 95.3 | | 5 | | — | | — | | 664.7 | | 4 | | 760.0 | | 9 |

| Germany | 452.4 | | 10 | | 91.5 | | 3 | | — | | — | | 44.9 | | 1 | | 588.8 | | 14 |

| Netherlands | 778.0 | | 15 | | 36.1 | | 1 | | — | | — | | — | | — | | 814.1 | | 16 |

| Total | $ | 6,170.2 | | 86 | | $ | 1,085.0 | | 32 | | $ | 146.1 | | 3 | | $ | 1,084.8 | | 7 | | $ | 8,486.1 | | 128 |

(1) Excludes assets held for sale.

30 Granite REIT 2022 Annual Information Form

The table below is a listing of Granite’s income-producing property portfolio by country as at December 31, 2022:

| | | | | | | | | | | |

List of Income-Producing Properties by Region(1) |

| Property Address | Location | Property Type | Sq ft |

| 365 Market Dr. | Milton, ON, CAN | Distribution/E-Commerce | 195,944 | |

| 600 Tesma Way | Concord, ON, CAN | Distribution/E-Commerce | 144,862 | |

| 2020 Logistics Dr. | Mississauga, ON, CAN | Distribution/E-Commerce | 773,318 | |

| 2095 Logistics Dr. | Mississauga, ON, CAN | Distribution/E-Commerce | 232,552 | |

| 8995 Airport Rd | Brampton, ON, CAN | Distribution/E-Commerce | 125,650 | |

| 115 Sinclair Blvd. | Brantford, ON, CAN | Distribution/E-Commerce | 397,080 | |

| 195 Steinway Blvd. | Etobicoke, ON, CAN | Distribution/E-Commerce | 68,612 | |

| 102 Parkshore Dr. | Brampton, ON, CAN | Distribution/E-Commerce | 54,350 | |

| 2550 Steeles Avenue E. | Brampton, ON, CAN | Flex/Office | 253,410 | |

| 1000 Tesma Way | Concord, ON, CAN | Flex/Office | 48,951 | |

| 225 Claireville Dr. | Etobicoke, ON, CAN | Industrial/Warehouse | 214,180 | |

| 190 Claireville Dr. | Etobicoke, ON, CAN | Industrial/Warehouse | — | |

| 210 Citation Dr. | Concord, ON, CAN | Industrial/Warehouse | 245,962 | |

| 201 Confederation Pkwy | Concord, ON, CAN | Industrial/Warehouse | 214,667 | |

| 401 Caldari Rd. | Concord, ON, CAN | Industrial/Warehouse | 200,834 | |

| 140 Staffern Dr. | Concord, ON, CAN | Industrial/Warehouse | 173,445 | |

| 251 Aviva Park Dr. | Concord, ON, CAN | Industrial/Warehouse | 275,552 | |

| 67 Green Lane | Markham, ON, CAN | Industrial/Warehouse | 90,879 | |

| 90 Snidercroft Rd | Concord, ON, CAN | Industrial/Warehouse | 115,805 | |

| 20 Pullman Crt. | Scarborough, ON, CAN | Industrial/Warehouse | 41,163 | |

| 2000 Langstaff Rd. | Concord, ON, CAN | Industrial/Warehouse | 115,030 | |

| 141 Staffern Dr. | Concord, ON, CAN | Industrial/Warehouse | 143,363 | |

| 430 Cochrane Dr. | Concord, ON, CAN | Industrial/Warehouse | 98,893 | |

| 800 Tesma Way | Concord, ON, CAN | Industrial/Warehouse | 190,686 | |

| 1755 Argentia Rd. | Mississauga, ON, CAN | Industrial/Warehouse | 253,000 | |

| 555 Beck Cres. | Ajax, ON, CAN | Industrial/Warehouse | 99,600 | |

| 5600 Timberlea Blvd. | Mississauga, ON, CAN | Industrial/Warehouse | 22,786 | |

| 5610 Timberlea Blvd. | Mississauga, ON, CAN | Industrial/Warehouse | 43,323 | |

| 5620 Timberlea Blvd. | Mississauga, ON, CAN | Industrial/Warehouse | 23,525 | |

| 5630 Timberlea Blvd. | Mississauga, ON, CAN | Industrial/Warehouse | 29,722 | |

| 100 Ronson Dr. | Etobicoke, ON, CAN | Industrial/Warehouse | 71,654 | |

| 110 Ronson Dr. | Etobicoke, ON, CAN | Industrial/Warehouse | 69,500 | |

| 331 Market Dr. | Milton, ON, CAN | Special Purpose Property | 928,617 | |

| 400 Chisholm Dr. | Milton, ON, CAN | Special Purpose Property | 586,402 | |

| Total Canada | | | 6,543,317 | |

| | | |

| Elin-Süd-Straße 14 | Weiz, AT | Industrial/Warehouse | 88,178 | |

| Neudorf 164 | Neudorf bei Ilz, AT | Industrial/Warehouse | 300,560 | |

| Frank-Stronach-Straße 3 | Albersdorf, AT | Industrial/Warehouse | 125,421 | |

| Elin-Süd-Straße 16 | Weiz, AT | Industrial/Warehouse | 152,395 | |

| Elin-Süd-Straße 18 | Weiz, AT | Industrial/Warehouse | 239,906 | |

| Frank-Stronach-Straße 1 | Albersdorf, AT | Special Purpose Property | 806,675 | |

| Industriestraße 35 | Lannach, AT | Special Purpose Property | 802,029 | |

| Liebenauer Hauptstraße 317 | Graz, AT | Special Purpose Property | 3,850,075 | |

Granite REIT 2022 Annual Information Form 31

| | | | | | | | | | | |

List of Income-Producing Properties by Region(1) |

| Property Address | Location | Property Type | Sq ft |

| Walter-P.-Chrysler-Platz 1 | Graz, AT | Special Purpose Property | 1,106,594 | |

| Total Austria | | | 7,471,833 | |

| | | |

| Im Ghai 36 | Altbach, GER | Distribution/E-Commerce | 292,654 | |

| Belgrader Straße 2-4 | Straubing, GER | Distribution/E-Commerce | 218,701 | |

| Heisenbergstraße 2 | Peine, GER | Distribution/E-Commerce | 303,391 | |

| Opmünder Weg 80 | Soest, GER | Distribution/E-Commerce | 308,310 | |

| Max-Herz-Straße 5 | Neumarkt in der Oberpfalz, GER | Distribution/E-Commerce | 194,827 | |

| Max-Eyth-straße 2 | Empfingen, GER | Distribution/E-Commerce | 116,218 | |

| Joseph-Meyer-Straße 3 | Erfurt, GER | Distribution/E-Commerce | 717,133 | |

| Georg-Beatzel Strasse 15 | Wiesbaden, GER | Distribution/E-Commerce | 209,390 | |

| Raiffeisenstrasse 28-32 | Korbach, GER | Distribution/E-Commerce | 505,042 | |

| In der Langen Else 4 | Erfurt, GER | Distribution/E-Commerce | 121,481 | |

| Unterm Hünenstein 4 | Heilbad Heiligenstadt, GER | Industrial/Warehouse | 289,904 | |

| Peiner Straße 151-155 | Saltzgitter, GER | Industrial/Warehouse | 338,180 | |

| Stettiner Straße 7 | Straubing, GER | Industrial/Warehouse | 228,281 | |

| Jakob-Wolf-Straße 12 | Obertshausen, GER | Special Purpose Property | 796,431 | |

| Total Germany | | | 4,639,943 | |

| | | |

| Blankenweg 22 | Bergen op Zoom, NL | Distribution/E-Commerce | 629,538 | |

| Hertog Karelweg 22 | Haaften, NL | Distribution/E-Commerce | 499,876 | |

| Nieuwesluisweg 250 | Botlek Rotterdam, NL | Distribution/E-Commerce | 313,789 | |

| Heirweg 3 | Born, NL | Distribution/E-Commerce | 259,378 | |

| Aquamarijnweg 1 | Bleiswijk, NL | Distribution/E-Commerce | 238,598 | |

| Oude Graaf 15 | Weert, NL | Distribution/E-Commerce | 241,489 | |

| De Kroonstraat 1 | Tilburg, NL | Distribution/E-Commerce | 494,780 | |

| Francis Baconstraat 4 | Ede, NL | Distribution/E-Commerce | 125,098 | |

| Industrieweg 15 | Voorschoten, NL | Distribution/E-Commerce | 355,140 | |

| Zuidelijke Havenweg 2 | Hengelo, NL | Distribution/E-Commerce | 307,923 | |

| Beurtvaartweg 2-4 | Nijmegen, NL | Distribution/E-Commerce | 148,219 | |

| Sprengenweg 1-2 | Nijmegen, NL | Distribution/E-Commerce | 195,903 | |

| Swaardvenstraat 75 | Tilburg, NL | Distribution/E-Commerce | 496,399 | |

| Hazeldonk 6520-6524 | Breda, NL | Distribution/E-Commerce | 577,774 | |

| Hazeldonk 6526-6530 | Breda, NL | Distribution/E-Commerce | 287,644 | |

| Sophialaan 5 | Utrecht, NL | Industrial/Warehouse | 196,474 | |

| Total Netherlands | | | 5,368,022 | |

| | | |

| 2100 Center Square Rd. | Logan Township, NJ, USA | Distribution/E-Commerce | 365,760 | |

| 101 Clyde Alexander Ln. | Pooler, GA, USA | Distribution/E-Commerce | 347,280 | |

| 41 Martha Dr. | Bethel, PA, USA | Distribution/E-Commerce | 750,000 | |

| 972 Conestoga Pkwy. | Shepherdsville, KY, USA | Distribution/E-Commerce | 631,336 | |

| 18201 NE Portal Way | Portland, OR, USA | Distribution/E-Commerce | 264,984 | |

| 8741 Jacquemin Dr. | West Chester, OH, USA | Distribution/E-Commerce | 601,065 | |

| 501 Airtech Pkwy. | Plainfield, IN, USA | Distribution/E-Commerce | 500,000 | |

| 1451 Allpoints Court | Plainfield, IN, USA | Distribution/E-Commerce | 533,520 | |

| 1201 Allpoints Court | Plainfield, IN, USA | Distribution/E-Commerce | 510,965 | |

| 535 Gateway Blvd. | Monroe, OH, USA | Distribution/E-Commerce | 651,515 | |

| 601/673 Gateway Blvd. | Monroe, OH, USA | Distribution/E-Commerce | 649,312 | |