QuickLinks -- Click here to rapidly navigate through this document

Granite Real Estate Investment Trust

Annual Information Form

March 5, 2013

| |

Page | |

|---|---|---|

GENERAL MATTERS |

1 | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

1 | |

GRANITE |

2 | |

Granite REIT |

2 | |

Granite GP |

2 | |

Organizational Structure and Subsidiaries |

3 | |

GENERAL DEVELOPMENT OF THE BUSINESS |

4 | |

Three-Year History |

4 | |

Significant Acquisitions |

6 | |

BUSINESS OVERVIEW |

7 | |

Geographic Breakdown |

7 | |

Property Types |

7 | |

Tenant Base |

8 | |

Improvement and Expansion Projects |

8 | |

Profile of Our Real Estate Portfolio |

9 | |

Principal Markets in Which We Operate |

11 | |

Leasing Arrangements |

12 | |

Our Business Strengths |

13 | |

Government Regulation |

13 | |

Employees |

14 | |

Business and Operations of Magna, Our Principal Tenant |

14 | |

INVESTMENT GUIDELINES AND OPERATING POLICIES OF GRANITE REIT |

15 | |

Investment Guidelines |

15 | |

Operating Policies |

16 | |

Amendments to Investment Guidelines and Operating Policies |

16 | |

RISK FACTORS |

17 | |

Risks Relating to Granite's Business |

17 | |

Risks Relating to the Stapled Unit Real Estate Investment Trust Structure |

23 | |

Risks Relating to Taxation |

26 | |

DESCRIPTION OF STAPLED UNITS |

29 | |

Support Agreement |

29 | |

DECLARATION OF TRUST AND DESCRIPTION OF REIT UNITS |

30 | |

REIT Units |

30 | |

Allotment and Issue of REIT Units |

31 | |

Transferability and Stapling of REIT Units |

31 | |

Purchases of REIT Units |

32 | |

Trustees |

32 | |

REIT Unit Redemption Right |

35 | |

Meetings of REIT Unitholders |

36 | |

Limitations on Non-Resident Ownership of REIT Units |

37 | |

Amendments to the Declaration of Trust |

37 | |

Term of Granite REIT |

39 | |

Acquisition Offers |

39 | |

Information and Reports |

39 | |

Conflict of Interest Provisions |

40 | |

GRANITE GP CAPITAL STRUCTURE |

40 | |

CREDIT FACILITY AND INDEBTEDNESS |

41 | |

Credit Facility |

41 | |

Other Unsecured Indebtedness |

41 | |

Other Secured Indebtedness |

41 | |

Credit Ratings |

42 | |

DISTRIBUTION AND DIVIDEND POLICY |

42 | |

Distribution Policy of Granite REIT and Granite GP |

42 | |

Dividends of Granite Co. |

43 | |

MARKET FOR SECURITIES |

43 | |

TRUSTEES AND MANAGEMENT OF GRANITE REIT |

44 | |

AUDIT COMMITTEE |

51 | |

Composition of the Audit Committee |

51 | |

Pre-Approval Policies and Procedures |

51 | |

Audit Committee's Charter |

51 | |

Audit Fees |

51 | |

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTION |

52 | |

AUDITORS, REGISTRAR AND TRANSFER AGENT |

52 | |

LEGAL PROCEEDINGS |

52 | |

MATERIAL CONTRACTS |

53 | |

Agreements in Connection with the 2011 Arrangement |

53 | |

Other Material Contracts |

54 | |

ADDITIONAL INFORMATION |

54 | |

APPENDIX A — GRANITE REIT AUDIT COMMITTEE CHARTER |

A-1 | |

APPENDIX B — GRANITE GP AUDIT COMMITTEE CHARTER |

B-1 |

i

On January 3, 2013, Granite Real Estate Inc. ("Granite Co."), previously MI Developments Inc., Granite Real Estate Investment Trust ("Granite REIT") and Granite REIT Inc. ("Granite GP") completed a conversion (the "2013 Arrangement") of Granite Co. from a corporate structure to a "stapled unit" real estate investment trust structure pursuant to a plan of arrangement under the Business Corporations Act (Québec). Under the 2013 Arrangement, the holders of common shares of Granite Co. exchanged their common shares, in a series of steps, for stapled units ("Stapled Units"), each consisting of one trust unit of Granite REIT (each a "REIT Unit") and one common share of Granite GP (each a "GP Share"), on a one-for-one basis. The Stapled Units are listed on the Toronto Stock Exchange (the "TSX") under the symbol "GRT.UN" and on the New York Stock Exchange (the "NYSE") under the symbol "GRP.U." After completion of the 2013 Arrangement, Granite REIT and Granite GP, through Granite REIT Holdings Limited Partnership ("Granite LP") and its subsidiaries, own, directly and indirectly, all the shares of the (reorganized) Granite Co. and all of the subsidiaries, business and assets previously held by Granite Co.

Upon completion of the 2013 Arrangement, Granite REIT and Granite GP became successor reporting issuers to Granite Co. under the securities laws of each of the provinces and territories in Canada and in the United States. Granite REIT and Granite GP have obtained exemptions from applicable Canadian securities regulatory authorities for relief from the requirement for each of Granite REIT and Granite GP to file on a stand-alone basis, annual and interim financial statements along with the accompanying annual or interim management's discussion and analysis ("MD&A") and certifications by officers of each of Granite REIT and Granite GP, and instead have permission to file combined financial statements and MD&A for Granite REIT and Granite GP. Granite GP has also obtained relief from disclosure obligations of Granite GP relating to the filing of annual information forms and material change reports, the sending of management information circulars, and the disclosure of certain executive compensation and corporate governance matters, and has permission to rely on such disclosures by Granite REIT, so long as, among other things, certain disclosure about Granite GP is included. Granite Co. remains a reporting issuer under applicable Canadian securities legislation but has obtained an exemption from the applicable Canadian securities regulatory authorities from continuous disclosure obligations. Granite LP and Granite Europe Limited Partnership ("Fin LP"), a subsidiary of Granite LP, became reporting issuers under applicable Canadian securities legislation, and have also obtained an exemption from the applicable Canadian securities regulatory authorities from continuous disclosure obligations. Accordingly, throughout this annual information form ("Annual Information Form" or "AIF"), unless otherwise specified or the context otherwise indicates, "we", "us", "our" and "Granite" refer to the combined Granite REIT and Granite GP and their subsidiaries and investees and, for periods prior to implementation of the 2013 Arrangement on January 3, 2013, their predecessor Granite Co. and its predecessors and subsidiaries.

When we use the term "Magna", unless indicated otherwise, we are referring to Magna International Inc., its operating divisions and subsidiaries and other controlled entities. References herein to leases with Magna include leases with operating subsidiaries of Magna International Inc., and when we refer to the tenant at certain of our properties being Magna, we are referring to Magna International Inc. or one of its operating subsidiaries.

In this Annual Information Form, we refer to Canadian dollars as "dollars", "$" or "Cdn.$", United States dollars as "U.S.$" or "U.S. dollars" and euros as "EUR". As of January 1, 2012 we publish our financial statements in Canadian dollars.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Information Form and the documents incorporated by reference herein contain statements that, to the extent they are not recitations of historical fact, constitute "forward-looking statements" within the meaning of applicable securities legislation, including the United States Securities Act of 1933, as amended and the United States Securities Exchange Act of 1934, as amended. Forward-looking statements may include, among others, statements regarding Granite's future plans, goals, strategies, intentions, beliefs, estimates, costs, objectives, capital structure, cost of capital, tenant base, tax consequences, economic performance or expectations, or the assumptions underlying any of the foregoing. In particular, this Annual Information Form contains forward-looking statements regarding the proposed fortification and growth of our relationship with

1

Magna, the expansion and diversification of Granite's lease portfolio, expected increases in leverage and certain accounting policies expected to be adopted under International Financial Reporting Standards ("IFRS"). Words such as "may", "would", "could", "will", "likely", "expect", "anticipate", "believe", "intend", "plan", "forecast", "project", "estimate", "seek" and similar expressions are used to identify forward-looking statements. Forward-looking statements should not be read as guarantees of future events, performance or results and will not necessarily be accurate indications of whether or the times at or by which such future performance will be achieved. Undue reliance should not be placed on such statements. There can also be no assurance that the fortification and growth of our relationship with Magna, the expansion and diversification of our lease portfolio, the expected increases in leverage and the application of certain IFRS accounting policies to transactions and circumstances can be achieved in a timely manner, with the expected impact or at all. Forward-looking statements are based on information available at the time and/or management's good faith assumptions and analyses made in light of our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances, and are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond Granite's control, that could cause actual events or results to differ materially from such forward-looking statements. Important factors that could cause such differences include, but are not limited to: the risk of changes to tax or other laws that may adversely affect Granite REIT's mutual fund trust status under the Income Tax Act (Canada) (the "Tax Act"); economic, market and competitive conditions and other risks that may adversely affect Granite's ability to fortify and grow its relationship with Magna, expand and diversify its lease portfolio and increase its leverage; and the risks set forth in this Annual Information Form in the "Risk Factors" section, which investors are strongly advised to review. The "Risk Factors" section also contains information about the material factors or assumptions underlying such forward-looking statements. Forward-looking statements speak only as of the date the statements were made and unless otherwise required by applicable securities laws, Granite expressly disclaims any intention and undertakes no obligation to update or revise any forward-looking statements contained in this Annual Information Form to reflect subsequent information, events or circumstances or otherwise.

Granite is engaged principally in the ownership and management of predominantly industrial properties in North America and Europe. As of December 31, 2012, Granite owned and managed approximately 28 million square feet in 104 rental income properties.

Granite provides holders of REIT Units ("REIT Unitholders") with stable cash flow generated by revenue it derives from the ownership of and investment in income-producing real estate properties. It strives to maximize long term unit value through ongoing active management of its portfolio, the acquisition of additional income-producing properties and the development and construction of projects and properties which enhance the quality, diversification and value of its real estate portfolio.

Granite's business is carried on directly and indirectly by Granite LP, all of the partnership units of which are owned by Granite REIT and Granite GP.

Granite REIT

Granite REIT is an unincorporated, open-ended, limited purpose trust established under and governed by the laws of the Province of Ontario pursuant to an amended and restated declaration of trust (the "Declaration of Trust") dated January 3, 2013. Although it is intended that Granite REIT qualify as a "mutual fund trust" pursuant to the Tax Act, Granite REIT is not a mutual fund under applicable securities laws. The head office of Granite REIT is located at 77 King Street West, Suite 4010, P.O. Box 159, Toronto-Dominion Centre, Toronto, Ontario, M5K 1H1.

Granite GP

Granite GP was incorporated on September 28, 2012 under the Business Corporations Act (British Columbia) (the "BCBCA"). On January 4, 2013, the Articles of Granite GP were altered to remove a class of non-voting shares that had been used for certain steps of the 2013 Arrangement. The head and principal office

2

of Granite GP is located at 77 King Street West, Suite 4010, P.O. Box 159, Toronto-Dominion Centre, Toronto, Ontario, M5K 1H1 and the registered office of Granite GP is Suite 2600, Three Bentall Centre, 595 Burrard Street P.O. Box 49314, Vancouver, British Columbia V7X 1L3.

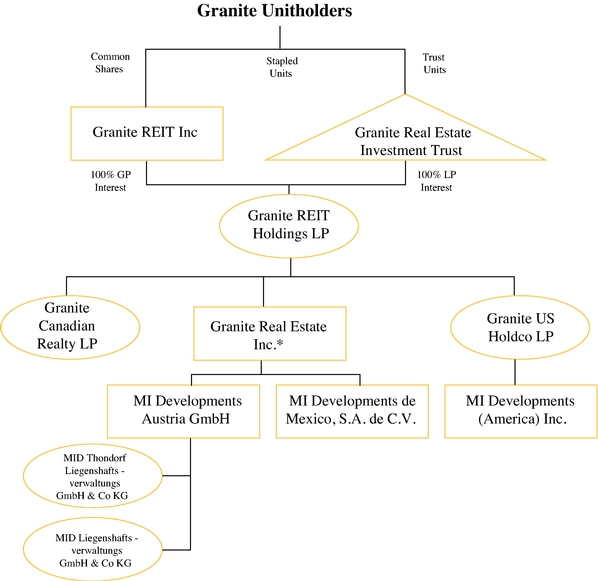

Organizational Structure and Subsidiaries

The following chart summarizes the structure of Granite REIT, Granite GP and material subsidiaries as of the date of this Annual Information Form.

- *

- Former public company pre-2013 Arrangement.

The following is a list of material subsidiaries of Granite LP and their respective jurisdictions of incorporation or formation, as of the date of this Annual Information Form. Parent/subsidiary relationships are identified by indentation. The percentages of the votes attaching to all voting securities beneficially owned by us or over which control or direction is exercised by us, directly or indirectly, are also indicated. Subsidiaries not shown below or above individually each represent less than 10% of our total 2012 consolidated revenues and total consolidated assets as at December 31, 2012 and, in the aggregate, represent less than 20% of our total 2012 consolidated revenues and total consolidated assets as at December 31, 2012, determined on a pro forma basis as if Granite had completed the 2013 Arrangement on January 1, 2012. Our percentage voting interest is equivalent to our economic interest in each subsidiary listed below. The voting securities of each subsidiary are

3

held in the form of common shares or, in the case of limited partnerships and their foreign equivalents, share quotas or partnership interests.

| |

Ownership of Voting Securities |

Jurisdiction of Incorporation or Formation |

|||

|---|---|---|---|---|---|

Granite Canadian Realty LP |

100% | Ontario | |||

Granite US Holdco LP |

100% | Delaware | |||

MI Developments (America) Inc. |

100% | Delaware | |||

Granite Real Estate Inc. |

100% | Québec | |||

MI Developments de Mexico, S.A. de C.V. |

100% | Mexico | |||

MI Developments Austria GmbH |

100% | Austria | |||

MID Thondorf Liegenshaftsverwaltungs GmbH & Co KG |

100% | Austria | |||

MID Liegenshaftsverwaltungs GmbH & Co KG |

100% | Austria | |||

GENERAL DEVELOPMENT OF THE BUSINESS

Three-Year History

2010 |

For the year ended December 31, 2010, we completed an expansion project in Mexico at a Magna-tenanted property, representing an aggregate of 122,000 square feet of leaseable area. |

|||

2011 |

On June 30, 2011, Granite Co., the predecessor of Granite REIT and Granite GP, completed a court-approved plan of arrangement (the "2011 Arrangement") under the Business Corporations Act (Ontario) which eliminated Granite Co.'s dual class share capital structure through which Mr. Frank Stronach and his family (the "Stronach Shareholder") had previously controlled Granite Co. Immediately following the completion of the 2011 Arrangement, an entirely new board of directors, elected as post-closing directors at Granite Co.'s annual general and special meeting of shareholders on March 29, 2011, commenced their term of office. |

|||

|

Definitive agreements with respect to the 2011 Arrangement were entered into by Granite Co. on January 31, 2011. The 2011 Arrangement eliminated Granite Co.'s dual class share capital structure through: |

|||

|

i) |

the purchase for cancellation of 363,414 Class B Shares of Granite Co. ("Class B

Shares") held by the Stronach Shareholder upon the transfer to the Stronach Shareholder of Granite Co.'s former racing and gaming operations including U.S.$20 million of working capital at January 1, 2011,

substantially all of Granite Co.'s lands held for development and associated assets and liabilities (Granite Co. was granted an option to purchase at fair value certain of these development lands if needed to expand Granite Co.'s

income-producing properties), a property located in the United States, an income-producing property located in Canada, and cash in the amount of U.S.$8.5 million. In addition, the Stronach Shareholder received a 50% interest in the note

receivable and cash proceeds from the sale of Lone Star LP, a 50% interest in any future payments under a holdback agreement relating to the prior sale by Magna Entertainment Corp. of The Meadows racetrack and a second right of refusal (behind

Magna's first right of refusal) in respect of certain properties owned by Granite Co. and leased to Magna in Oberwaltersdorf, Austria and Aurora, Canada; and |

||

4

|

ii) |

the purchase for cancellation by Granite Co. of each of the other 183,999 Class B Shares in consideration for 1.2 Class A subordinate voting shares of Granite Co. (the "Class A Subordinate Voting Shares") per Class B Share, which following cancellation of the Class B Shares and together with the then outstanding Class A Subordinate Voting Shares were renamed common shares. |

||

|

Pursuant to the 2011 Arrangement, Granite Co. and a wholly-owned subsidiary thereof entered into a forbearance agreement (the "Forbearance Agreement"). Under the terms of the Forbearance Agreement, Granite is restricted from: (a) entering into the horseracing or gaming business; (b) making any debt or equity investment in, or otherwise giving financial assistance to, any entity primarily engaged in the horseracing or gaming business; or (c) entering into any transactions with, or providing any services or personnel to, any entity primarily engaged in the horseracing or gaming business. |

|||

|

On October 25, 2011, Granite Co. announced that it had completed its strategic review process and that the board of directors had unanimously approved a strategic plan that encompasses the following five major elements and objectives: |

|||

|

1. |

Convert Granite Co. from a Canadian corporation to a real estate investment trust. |

||

|

2. |

Increase Granite Co.'s quarterly dividend to U.S.$0.50 per share to reflect a targeted annualized dividend of U.S.$2.00 per share. |

||

|

3. |

Fortify Granite Co.'s relationship with Magna by selectively investing in Granite Co. properties and opportunistically growing with Magna in new strategic locations. |

||

|

4. |

Diversify by significantly increasing the lease revenue derived from new industrial tenants and reducing the proportion of capital invested in Magna properties to less than 50% within approximately three years. |

||

|

5. |

Increase leverage to 40% to 50% of total capital. |

||

|

This strategic plan remains current and, as described below, certain elements have been completed with the remaining objectives in progress. |

|||

|

On October 25, 2011, Granite Co. increased its quarterly dividend to U.S.$0.50 per share. |

|||

|

For the year ended December 31, 2011, we completed 13 minor or expansion projects at Magna-tenanted properties (three in the U.S., one in Mexico, five in Austria, three in Germany and one in the Czech Republic) and partially completed one additional project at a non-Magna-tenanted property in Canada, representing an aggregate of approximately 722,000 square feet of leaseable area. In certain cases, these projects were coupled with lease extensions. |

|||

2012 |

On June 13, 2012, Granite Co. changed its name from MI Developments Inc. to Granite Real Estate Inc. On September 25, 2012, Granite Co. continued from Ontario to Québec, as previously approved by its shareholders. |

|||

|

The 2013 Arrangement was approved on November 15, 2012 by Granite Co.'s shareholders and on November 20, 2012, by the Superior Court of Québec. |

|||

|

For the year ended December 31, 2012, we renewed or extended 16 leases, representing an aggregate of approximately

2.4 million square feet. We completed expansions at three of our properties, representing a total aggregate of approximately 264,000 additional square feet of leaseable area. |

|||

5

2013 – Year to Date |

On January 3, 2013, Granite Co., completed its conversion from a corporate structure to a stapled unit real estate investment trust structure pursuant to the 2013 Arrangement. All of the common shares of Granite Co. were exchanged, on a one-for-one basis, for Stapled Units, each consisting of one REIT Unit and one GP Share. On January 4, 2013, the Stapled Units began trading on the TSX under the symbol "GRT.UN" and on the NYSE under the symbol "GRP.U." |

|||

|

Upon completion of the 2013 Arrangement, the board of trustees (the "Board of Trustees" or the "Trustees") of Granite REIT and the board of directors (the "Board of Directors" or the "Directors") of Granite GP were composed of the seven individuals who comprised the board of directors of Granite Co. and the senior management of Granite REIT and Granite GP were composed of the members of Granite Co.'s senior management team. |

|||

|

On February 1, 2013, Granite established a new unsecured revolving credit facility in the amount of $175 million (which may be increased with the consent of lenders participating in such increase provided that no increase beyond $250 million is permitted without the consent of all of the lenders). See "Credit Facility and Indebtedness — Credit Facility". |

|||

|

On February 13, 2013, Granite completed the acquisition of a 90% interest in two income-producing multi purpose industrial

properties, one located in Logan, New Jersey and the other in Savannah, Georgia. The buildings total 713,040 square feet and were acquired for a total purchase price (100% interest) of U.S.$39.8 million, excluding acquisition

costs. Granite's investment was completed through a joint venture with the vendor, Dermody Properties, a U.S.-based national industrial real estate development group. |

|||

Significant Acquisitions

During the most recently completed financial year, we did not undertake any significant acquisition for which a business acquisition report was required to be filed pursuant to Canadian securities law.

6

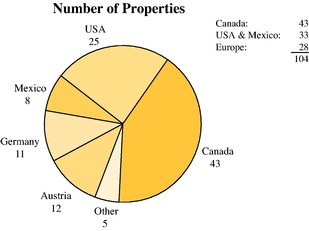

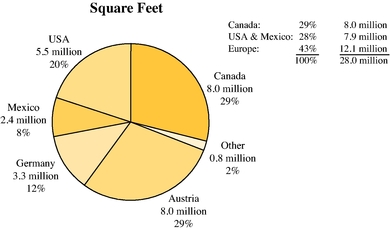

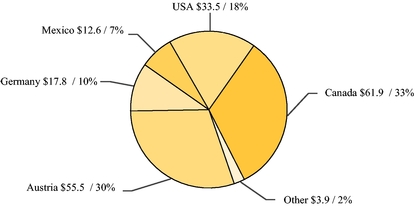

Geographic Breakdown

At December 31, 2012, our real estate portfolio consisted of 104 income-producing industrial and commercial properties located in nine countries: Canada, the United States, Mexico, Austria, Germany, the Czech Republic, the United Kingdom, Spain and Poland. This portfolio of income-producing properties represents approximately 28 million square feet of leaseable area with a gross book value of approximately $1.7 billion at December 31, 2012. The lease payments are primarily denominated in three currencies: the euro, the Canadian dollar and the U.S. dollar.

The following charts show the geographic breakdown of our properties by number and approximate square footage.

Geographic Breakdown

|

|

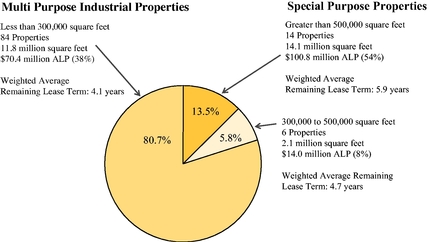

Property Types

Approximately 81% of our income-producing properties are industrial properties of less than 300,000 square feet, which we consider tenantable by a wide variety of potential users. As of December 31, 2012, these properties accounted for approximately 38% of our annualized lease payments. The remaining approximately 19% of our income-producing properties are large, special-purpose facilities. As of December 31, 2012, these larger, special purpose facilities accounted for approximately 62% of our annualized lease payments.

When we use the term "annualized lease payments" or "ALP" in this Annual Information Form, we mean, for any fiscal year, the total annual rent payable to Granite if the lease payments as at the last day of such fiscal year were in place for the entire fiscal year, with rents denominated in foreign currencies being converted to Canadian dollars based on exchange rates in effect as at the last day of the reporting period. These amounts do not conform to revenue recognition policies under generally accepted accounting principles.

7

The chart below illustrates the division of our properties between multi purpose industrial properties and special-purpose properties.

Multi Purpose vs. Special Purpose Facilities

by Number of Properties

Tenant Base

Magna, a diversified global automotive supplier, is the tenant of 89 of our 104 income-producing properties. As at December 31, 2012, lease payments under leases with Magna represented approximately 97% of our annualized lease payments. See "— Business and Operations of Magna, Our Principal Tenant".

We have a growing list of other tenants, that, as of the date of this Annual Information Form includes, among others: Bohler Uddeholm, Cardinal Health, Dole, HH Gregg, Peer 1 Networks, Sears, Siemens Canada and United Parcel Service.

One of our objectives is to increase the percentage of revenue from non-Magna tenants through new acquisitions, selected dispositions, partnerships/joint ventures and possibly asset exchanges. The planned diversification is international in nature, targeting favourable tax jurisdictions and focusing on acquiring industrial buildings in three target categories: (i) core stabilized, (ii) value add, and (iii) development. We expect the majority of our investment targets to be "core stabilized" industrial buildings with multi purpose designs, new age characteristics, primary or secondary market locations and single or multi-tenant leases. We also expect to target some "value add" industrial buildings in strong locations that can be acquired at a discount to replacement cost but may need capital for lease up and potential yield enhancement. Finally, in an environment of low capitalization rates on best-in-class product, we will consider undertaking some limited development of buildings in core markets that can become future core stabilized properties. We plan to be price-disciplined in our approach and intend to continue to explore and leverage strategic partnerships with counterparties that can provide local market intelligence and growth opportunities.

We believe that our existing portfolio of Magna-tenanted properties provides a level of stability for our business. We intend to continue to fortify our relationship with Magna, including selective investment in our Magna-tenanted properties. Our 21 largest properties (those greater than 300,000 square feet) are occupied exclusively by Magna in locations around the world. The special purpose attributes of these properties cause them to have a higher risk profile but they also present the opportunity for an enhanced and stable rental income stream. See "— Business and Operations of Magna, Our Principal Tenant". Granite is engaged in growth opportunities with Magna that include the improvement and expansion of certain facilities currently owned by Granite.

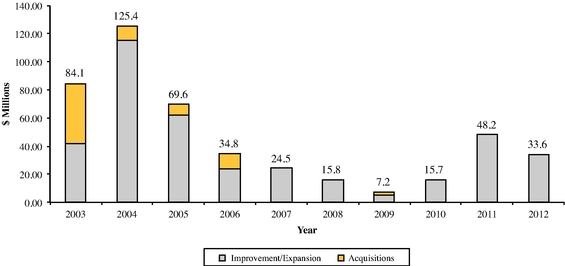

Improvement and Expansion Projects

For the year ended December 31, 2012, we completed eight improvement or expansion projects at Magna-tenanted facilities (four in Canada, two in the U.S., one in Austria and one in Germany), representing a total

8

cost of approximately $27.8 million and approximately 264,000 square feet of additional leaseable area. In the majority of cases, the projects were coupled with lease extensions.

As at December 31, 2012, we had six active expansion or improvement projects in Canada, the United States and the Czech Republic, with aggregate anticipated costs of approximately $11.8 million. We expect to complete each of these projects before the end of 2013.

For most construction projects, we use our experience and local expertise to construction-manage specific elements of a project to maximize returns and minimize construction costs. On the remainder of our projects, we outsource the design and construction of our projects to a qualified general contractor. Depending on the nature and location of the project, we either manage our construction with regular on-site supervisory employees, or remotely through cost, scope of work and other management control systems. We do not have long-term contractual commitments with our contractors, subcontractors, consultants or suppliers of materials, who are generally selected on a competitive bid basis.

Profile of Our Real Estate Portfolio

Our income-producing properties consist of industrial facilities, corporate offices, product development and engineering centres and test facilities. The following table sets out a summary profile of the aggregate gross book value of our real estate assets in millions of dollars as at December 31, 2012.

Real Estate Assets

Location

|

Income-Producing Property Portfolio Gross Book Value |

|||

|---|---|---|---|---|

North America |

||||

Canada |

$ | 574.8 | ||

U.S. |

$ | 305.8 | ||

Mexico |

$ | 97.4 | ||

Europe |

||||

Austria |

$ | 452.7 | ||

Germany |

$ | 182.9 | ||

Other |

$ | 45.7 | ||

Total in $ |

$ | 1,659.3 | ||

At December 31, 2012, our annualized lease payments were $185.2 million, representing a return of 11.2% on the gross carrying value of our income-producing property portfolio.

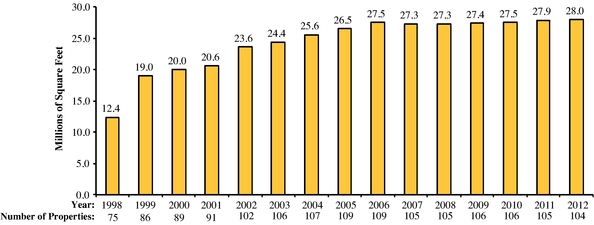

Historical Growth of Our Real Estate Portfolio

Our income-producing property portfolio has grown from 75 properties totalling approximately 12.4 million square feet in 1998 to 104 properties totalling approximately 28 million square feet of leaseable area as at December 31, 2012.

For the year ended December 31, 2012, we invested $31.4 million in income-producing properties occupied by Magna.

9

The following chart shows the historical growth in total leaseable area (net of dispositions) and number of properties within our income-producing property portfolio.

Income-Producing Property Portfolio

Total Leasable Area and Number of Properties

The following chart shows our historical capital expenditures, including acquisitions, expansions and improvements to our income-producing properties.

Annual Capital Expenditures

Schedule of Lease Expiries

As of December 31, 2012, the weighted average remaining term to expiry based on leased area for our income-producing property portfolio was approximately 4.8 years (December 31, 2011 — 5.4 years; December 31, 2010 — 6.1 years; December 31, 2009 — 6.7 years; December 31, 2008 — 7.7 years; December 31, 2007 — 8.4 years).

10

Principal Markets in Which We Operate

Geographic Diversification

At December 31, 2012, approximately 67% of our annual lease payments were denominated in the euro and the U.S. dollar and, accordingly, foreign exchange can have a significant impact on our results. The following chart shows a breakdown of our $185.2 million of annualized lease payments by country at December 31, 2012.

Income-Producing Property Portfolio

Breakdown of Annualized Lease Payments at December 31, 2012 by Country

(in millions of Cdn. Dollars)

Income-Producing Properties Located in Canada

Our 43 Canadian income-producing properties are located in Ontario. 37 properties representing approximately 78% of the Canadian income-producing properties based on annualized lease payments at December 31, 2012 are located in the Greater Toronto Area. The remaining six properties in the Canadian portfolio are located in Southwestern Ontario. All the leases for properties in Canada are denominated in Canadian dollars.

Income-Producing Properties in the United States

Our income-producing property portfolio includes 25 properties in the United States. Approximately 32% of the annualized lease payments at December 31, 2012 from our income-producing properties in the United States is derived from properties located in Michigan, 21% is derived from a property in Kentucky, 23% is derived from a property in South Carolina and 7% is derived from properties located in Iowa. The remainder of our annualized lease payments from the United States are derived from properties located in Tennessee, Illinois, Indiana, Missouri and Maryland. All the leases for properties in the United States are denominated in U.S. dollars.

Income-Producing Properties in Mexico

Our income-producing property portfolio includes 8 properties in Mexico. Our Mexican income-producing properties are located in the states of Puebla, Coahuila and Nuevo Leon. All the leases for properties in Mexico are denominated in U.S. dollars.

Income-Producing Properties in Austria

Our income-producing property portfolio includes 12 properties in Austria. Approximately 94% of the Austrian income-producing properties based on annualized lease payments at December 31, 2012 are located in the Province of Styria. Magna's Eurostar and Thondorf plants (our two largest income-producing properties globally account for approximately 16% of our total annualized lease payments) are located in the city of Graz, which is located approximately 170 kilometres south of Vienna. All the lease payments for properties in Austria are denominated in euros.

11

Income-Producing Properties in Germany

Our income-producing property portfolio includes 11 properties in Germany. Our German income-producing properties are located in smaller communities in the south of Germany in close proximity to Frankfurt, in the Stuttgart region, and in northern Germany. The properties are primarily located in the states of Baden-Württemberg, Hessen, Bavaria, Thüringen/Thuringia, Saarland and Niedersachsen/Lower Saxony. All the leases for properties located in Germany are denominated in euros.

Income-Producing Properties in Other European Locations

Our income-producing property portfolio also includes two properties in the United Kingdom. United Kingdom leases are denominated in British pounds.

We also have one income-producing property in each of Spain, the Czech Republic and Poland. With the exception of Poland, which has lease payments denominated in zlotys, lease payments in respect of these properties are denominated in euros.

Leasing Arrangements

Leases

Our leases generally provide that the tenant is responsible for all costs of occupancy, including operating costs, property taxes, the costs of maintaining insurance in respect of the property and maintenance costs. The tenant is not responsible for income taxes or capital taxes charged to us.

We are responsible for structural repairs and replacements relating to the structural non-process related elements of our properties. For certain components of a property, such as the roof membrane, paved areas and non-process related HVAC systems, some of our leases provide that we pay for the costs of replacement as necessary and, in most cases, recover such costs, plus interest, from the tenant over the expected useful life of the item replaced, as additional rent during the course of the lease.

Contractual Step-Ups in Rental Rates

A majority of our existing leases provide for periodic rent escalations based either on fixed-rate step increases or on the basis of a consumer price index adjustment (generally limited to 10% over five years).

Renewal Options Tied to Market Rental Rates

A majority of our existing leases include built-in renewal options, generally tied to either market rental rates or to the existing rent plus inflation. In cases where the renewal is linked to market rates, the determination of market rent is, failing agreement, generally subject to arbitration.

Obligation to Restore Premises

Our leases generally provide that the tenant is obligated to restore the premises to a condition consistent with the condition on the commencement date of the lease, subject to reasonable wear and tear. The majority of our leases provide that, if requested by the landlord, the tenant is obligated to remove any alterations to the premises carried out over the term of the lease.

Environmental Obligations

Our leases also generally provide that the tenants must maintain the properties in accordance with applicable laws, including environmental laws, and that the tenant must remove all hazardous and toxic substances from the premises when and as required by applicable laws, regulations and ordinances and in any event prior to the termination of its occupation of the premises. The leases generally also contain indemnities in our favour with respect to environmental matters. Those indemnities expire after a specified number of years following the termination of the lease. The leases generally provide that we may conduct environmental assessments and audits from time to time at our sole expense. See "— Government Regulation".

12

On occasion, our tenants' operations and our properties may become the subject of complaints from adjacent landowners, or inquiries or investigations by environmental regulators (see "Risk Factors"). Almost all of the costs relating to such complaints, inquiries or investigations to date have been incurred by our tenants pursuant to the terms of our leases with them. In the past, Granite has engaged consultants and incurred minimal costs with respect to environmental matters arising from adjacent or nearby properties in order to protect the condition and marketability of our properties.

Restrictions on Sales and Tenant Rights of Refusal

Most of our significant leases include a right of refusal in favour of the tenant with respect to the sale of the property in question. This right typically provides the tenant with a right to match any third party offer within a prescribed period of time, failing which we are free to accept the offer and complete the sale to the third party. Some of our leases with Magna provide that so long as the tenant is controlled, directly or indirectly, by Magna International Inc., we may not sell the property to a competitor of the tenant without the tenant's consent.

Tenant Assignment Rights

The leases contain a restriction on assignment by the tenant without our consent, other than to affiliates or associates of the tenant. Generally, the existing leases do not restrict a change of control of the tenant.

Statutory Rights

Due to certain local statutory requirements, our leases in Austria may be terminated by the tenant at any time upon 12 months' notice, unless the tenant has specifically waived the right to do so. In all but one of our Austrian leases, the tenant has provided us with such a waiver for various periods of time. All of our tenants in Austria have provided us with a guarantee from a non-Austrian affiliate with respect to their payment obligations under the lease. However, in the event the tenants terminate the leases in accordance with their termination rights, the guarantors are not obligated to pay rent beyond such termination date.

Our Business Strengths

We believe that we have a number of key strengths, including:

- •

- a large, geographically diversified portfolio of properties that provides a stable income and opportunities for expansion

growth;

- •

- a strong balance sheet with comparatively low leverage, which provides us with the financial flexibility to pursue

attractive growth opportunities;

- •

- a strong track record of on-time and on-budget development and construction in all of our

geographic markets;

- •

- an experienced senior real estate management team and a construction group with extensive industrial building and

infrastructure expertise that is familiar with the requirements of our tenants; and

- •

- an entrepreneurial culture that drives our employees and management to grow our business.

Government Regulation

We are subject to a wide range of laws and regulations imposed by governmental authorities, including particular zoning, building and similar regulations that affect our real estate holdings.

As an owner and developer of real property, we are also subject to environmental laws and regulations relating to air emissions, soil and ground water quality, noise emissions, wastewater discharge, waste management and storage of hazardous substances. Our leases permit us to conduct environmental assessments and audits from time to time at our own expense. Such assessments and audits are in addition to the monitoring our tenants may undertake to meet their contractual environmental obligations for the properties they lease.

Substantially all of our leases also require the tenant to assume the costs of environmental compliance, including remediation or clean-up of any contamination that they have caused or contributed to on the leased

13

premises. Despite our tenants' obligation to indemnify us, we are also responsible under applicable law for ensuring that a particular property is in compliance with environmental laws. See "Risk Factors".

Employees

At December 31, 2012, we employed 64 people, the majority of whom are based at our headquarters in Toronto, and the balance of whom are located in the United States, Austria, Barbados, Iceland and Luxembourg. We are not party to any collective bargaining agreements with any of our employees.

Business and Operations of Magna, Our Principal Tenant

Magna is the tenant of 89 of our 104 income-producing properties. Magna is a diversified global automotive supplier. Magna designs, develops and manufactures technologically advanced automotive systems, assemblies, modules and components, and engineers and assembles complete vehicles, primarily for sale to original equipment manufacturers of cars and light trucks. Magna's product capabilities span a number of major automotive areas, including interior systems, seating systems, closure systems, body and chassis systems, vision systems, electronic systems, exterior systems, powertrain systems, roof systems, hybrid electric vehicles/systems and complete vehicle engineering and assembly. According to Magna's public disclosure, as at September 30, 2012, Magna had 305 manufacturing operations and 88 product development, engineering and sales centres, in 27 countries.

Magna is a public company, with its common shares listed for trading on the TSX and NYSE. For information on the conditions affecting the automotive industry and Magna's results of operations, we encourage you to consult Magna's public disclosure, including its Management's Discussion and Analysis of Results of Operations and Financial Position for the three months and year ended December 31, 2012, its Annual Information Form for 2011 and, when released by Magna, its Annual Information Form for 2012. None of those documents or their contents, however, shall be deemed to be incorporated by reference into this Annual Information Form unless specifically otherwise noted in this Annual Information Form.

Our Relationship with Magna

Granite's relationship with Magna is an arm's length landlord and tenant relationship governed by the terms of Granite's leases with Magna. Our lease arrangements with Magna generally provide for the following:

- •

- obligation of Magna to pay for costs of occupancy, including operating costs, property taxes and maintenance and

repair costs;

- •

- rent escalations based on either fixed-rate steps or inflation;

- •

- renewal options tied to market rental rates or inflation;

- •

- environmental indemnities from the tenant; and

- •

- right of first refusal in favour of Magna on sale of property.

Renewal terms, rates and conditions are typically set out in our leases with Magna and form the basis for tenancies that continue beyond the expiries of the initial lease terms.

Magna is Granite's largest and most significant tenant. Granite strives to seek opportunities to enhance our relationship with Magna and to make investments in properties that are beneficial to both Granite as landlord and to Magna as tenant.

Magna has a decentralized management style which generally leads to lease renewals and negotiations on a "lease by lease" basis, although when possible Granite works with Magna to deal with multiple lease renewals by operating group.

According to its public disclosure, Magna's success is primarily dependent upon the levels of North American and European car and light truck production by Magna's customers and the relative amount of content Magna has in the various programs. The ongoing challenge of the automotive industry, and other factors, have resulted in Magna seeking to take advantage of lower operating cost countries and consolidating,

14

moving, closing and/or selling operating facilities to align its capacity utilization and manufacturing footprint with vehicle production and consumer demand. Magna has disclosed that it has significant ongoing activities in its "Rest of World" segment, including a number of new facilities under construction or launching in Asia and South America, as well as the integration of recent acquisitions in South America. Granite management expects Magna to continuously seek to optimize its global manufacturing footprint and consequently, Magna may not renew leases for facilities currently under lease at their expiries.

INVESTMENT GUIDELINES AND OPERATING POLICIES OF GRANITE REIT

Investment Guidelines

The Declaration of Trust provides certain guidelines on investments which may be made directly or indirectly by Granite REIT. The assets of Granite REIT may be invested only in accordance with such guidelines including, among others, those summarized below:

- (a)

- activities

will focus primarily on acquiring, holding, developing, maintaining, improving, leasing, managing, repositioning, disposing or otherwise dealing

with revenue producing real property;

- (b)

- Granite

REIT shall not make or hold any investment, take any action or omit to take any action that would result in:

- (i)

- Granite

REIT not qualifying as a "mutual fund trust" or "unit trust", both within the meaning of the Tax Act;

- (ii)

- REIT

Units not qualifying as qualified investments for investment by trusts governed by registered retirement savings plans, registered retirement income

funds, registered education savings plans, deferred profit sharing plans, registered disability savings plans or tax-free savings accounts;

- (iii)

- Granite

REIT not qualifying as a "real estate investment trust", as defined in subsection 122.1(1) of the Tax Act if, as a consequence of

Granite REIT not so qualifying, Granite REIT would be subject to tax on "taxable SIFT trust distributions" pursuant to section 122 of the Tax Act; or

- (iv)

- Granite

REIT being liable to pay a tax imposed under Part XII.2 of the Tax Act;

- (c)

- best

efforts will be used to ensure that Granite REIT will not be a "publicly traded partnership" taxable as a corporation under Section 7704 of the

Internal Revenue Code of 1986;

- (d)

- factors

to be considered in making investments shall include the political environment and governmental and economic stability in the relevant

jurisdiction(s), the long-term growth prospects of the assets and the economy in the relevant jurisdiction(s), the currency in the relevant jurisdiction(s) and the income-producing

stability of the assets;

- (e)

- Granite

REIT may make its investments and conduct its activities, directly or indirectly, through an investment in one or more persons on such terms as the

Trustees may from time to time determine, including without limitation by way of joint ventures, partnerships and limited liability companies;

- (f)

- Granite

REIT may only invest in operating businesses indirectly through one or more trusts, partnerships, corporations or other legal entities; and

- (g)

- Granite REIT shall not invest in raw land for development, except for (i) existing properties with additional development, (ii) the purpose of renovating or expanding existing properties, or (iii) the development of new properties, provided that the aggregate cost of the investments of Granite REIT in raw land, after giving effect to the proposed investment, will not exceed 15% of Gross Book Value (as defined in the Declaration of Trust).

15

Operating Policies

The Declaration of Trust provides that the operations and activities of Granite REIT shall be conducted in accordance with the policies summarized below:

- (a)

- Granite

REIT shall not trade in currency or interest rate futures contracts other than for hedging purposes that comply with National

Instrument 81-102 — Mutual Funds, as amended from time to time, or any successor instrument

or rule;

- (b)

- (i)

any written instrument under which Granite REIT grants a mortgage, and (ii) to the extent practicable, written instruments which create a

material obligation, shall contain a provision or be subject to an acknowledgement to the effect that the obligation being created is not personally binding upon, and that resort shall not be had to,

nor shall recourse or satisfaction be sought from, the private property of any of the Trustees, REIT Unitholders, annuitants or beneficiaries under a plan of which a REIT Unitholder acts as a trustee

or a carrier, or officers, employees or agents of Granite REIT, but that only property of Granite REIT or a specific portion shall be bound; Granite REIT, however, is not required, but shall use all

reasonable efforts, to comply with this requirement in respect of obligations assumed by Granite REIT upon the acquisition of real property;

- (c)

- Granite

REIT shall not incur or assume any Indebtedness (as defined in the Declaration of Trust) if, after giving effect to the incurring or

assumption of the Indebtedness, the total Indebtedness of Granite REIT would be more than 65% of Gross Book Value (as defined in the Declaration of Trust);

- (d)

- Granite

REIT shall not guarantee any liabilities of any person unless such guarantee: (i) is given in connection with an otherwise permitted

investment; (ii) has been approved by the Trustees; and (iii) (A) would not disqualify Granite REIT as a "mutual fund trust" within the meaning of the Tax Act, and

(B) would not result in Granite REIT losing any other status under the Tax Act that is otherwise beneficial to Granite REIT and REIT Unitholders;

- (e)

- except

for real property held by a person partially owned by Granite REIT, title to each real property shall be held by and registered in the name of

Granite REIT, the Trustees or in the name of a corporation or other entity wholly-owned, directly or indirectly, by Granite REIT or jointly, directly or indirectly, by Granite REIT with joint

venturers or in such other manner which, in the opinion of management, is commercially reasonable;

- (f)

- Granite

REIT shall conduct such diligence as is commercially reasonable in the circumstances on each real property that it intends to acquire and obtain a

report with respect to the physical condition thereof from an independent and experienced consultant;

- (g)

- Granite

REIT shall either (i) have conducted an environmental site assessment or (ii) be entitled to rely on an environmental site assessment

dated no earlier than six months prior to receipt by Granite REIT, in respect of each real property that it intends to acquire, and if the environmental site assessment report recommends that further

environmental site assessments be conducted Granite REIT shall have conducted such further environmental site assessments, in each case, by an independent and experienced environmental

consultant; and

- (h)

- Granite REIT shall obtain and maintain, or cause to be obtained and maintained, at all times, insurance coverage in respect of its potential liabilities and the accidental loss of value of its assets from risks, in amounts, with such insurers, and on such terms as the Trustees consider appropriate, taking into account all relevant factors including the practices of owners of comparable properties.

Amendments to Investment Guidelines and Operating Policies

Pursuant to the Declaration of Trust, all of Granite REIT's investment guidelines and the operating policies of Granite REIT set out in paragraphs (a), (c), (d), (f) and (g) under the heading "— Operating Policies" may be amended only with the approval of two-thirds of the votes cast at a meeting of REIT Unitholders. The remaining operating policies set out under the heading "— Operating Policies" may be amended with the approval of a majority of the votes cast at a meeting of REIT Unitholders.

16

Notwithstanding the foregoing paragraph, if at any time a government or regulatory authority having jurisdiction over Granite REIT or any property of Granite REIT shall enact any law, regulation or requirement which is in conflict with any investment guideline or operating policy of Granite REIT then in force, such guideline or policy in conflict shall, if the Trustees on the advice of legal counsel to Granite REIT so resolve, be deemed to have been amended to the extent necessary to resolve any such conflict and, notwithstanding anything to the contrary in the Declaration of Trust, any such resolution of the Trustees shall not require the prior approval of REIT Unitholders.

Investing in securities of Granite involves a high degree of risk. In addition to the other information contained in this Annual Information Form, you should carefully consider the following risk factors before investing in securities of Granite. The occurrence of the following risk factors could have a material adverse effect on our business, financial condition, operating results and prospects. In addition, other risks and uncertainties that are not known to us or that we currently believe are not material, may also have a material adverse effect on our business, financial condition, operating results and prospects.

Risks Relating to Granite's Business

Substantially all of our revenue comes from payments that we receive under leases with Magna, so factors affecting Magna's businesses will also affect us.

Although one element of our strategic plan is to diversify by increasing the lease revenue that we derive from new tenants, as of December 31, 2012, 89 of our 104 income-producing properties were leased to operating subsidiaries of Magna. For the year ended December 31, 2012, payments under leases with Magna represented approximately 97% of our annualized lease payments.

We encourage you to consult Magna's public disclosure for information on factors affecting the business of Magna, including the factors described in the section entitled "Industry Trends and Risks" in Magna's Management's Discussion and Analysis of Results of Operations and Financial Position for the three months and year ended December 31, 2012, which section, excluding any forward-looking information contained therein expressly referring to Magna's beliefs, is incorporated by reference into this AIF.

The level of business we have received from Magna has declined and beyond our existing lease agreements, we have no agreement with Magna that it will continue to do business with us in the same manner as it has in the past or at all.

We may experience reductions in the amount of expansion-related business that Granite receives from Magna as Magna pursues its disclosed significant ongoing activities in its "Rest of the World" segment. Although we have acted as the developer, real estate advisor, property manager and owner of a significant number of the industrial facilities for Magna since our inception, we have no assurance that we will continue to be able to do so.

Although we intend to diversify by significantly increasing the lease revenue that we derive from new tenants, virtually all the historical growth of our rental portfolio has been dependent on our relationship with Magna as tenant of our income-producing properties and as the customer for our development projects.

We may be unable to renew leases on favourable terms or find new tenants for vacant properties.

Our tenants have in the past determined, and may in the future determine, not to lease certain properties from us and not to renew certain leases on terms as favourable to us as our existing arrangements with them, or at all. We may be unable to lease a vacant property in our portfolio on economically favourable terms, particularly properties that are considered to be special purpose in nature and were designed and built with unique features or are located in secondary or rural markets.

17

In addition, we may not be able to renew an expiring lease or to find a new tenant for the property for which the lease has expired, in each case on terms at least as favourable as the expired lease or at all. Renewal options are generally based on changes in the consumer price index or prevailing market rates. Market rates may be lower at the time of the renewal options, and accordingly, leases may be renewed at lower levels of rent than are currently in place. Our tenants may fail to renew their leases if they need to relocate their operations as a result of changes in location of their customers' operations or if they choose to discontinue operations as a result of the loss of business.

Many factors will affect our ability to lease vacant properties, and we may incur significant costs in making property modifications, improvements or repairs required by a new tenant. In addition, we may incur substantial costs in protecting our investments in leased properties, particularly if we experience delays and limitations in enforcing our rights against defaulting tenants. Furthermore, if one of our tenants rejects or terminates a lease under the protection of bankruptcy, insolvency or similar laws, our cash flow could be materially adversely affected. The failure to maintain a significant number of our income-producing properties under lease would have a material adverse effect on our financial condition and operating results.

Our operating and net income and the value of our property portfolio depend on the credit and financial stability of our tenants.

We would be adversely affected if a significant number of tenants were to become unable to meet their obligations to us, or if we were unable to lease a significant amount of available space on economically favourable terms.

Additionally, the tenants for the majority of the properties in our rental portfolio are non-public subsidiaries of Magna International Inc., which does not guarantee the obligations of its subsidiaries under their leases with us. As a result, we may not have the contractual right to proceed directly against Magna International Inc. in the event that one of these subsidiaries defaulted on its lease with us. We could be materially adversely affected if any Magna subsidiaries became unable to meet their respective financial obligations under their leases, and if Magna International Inc. was unwilling or unable to provide funds to such subsidiaries for the purpose of enabling them to meet such obligations.

The terms of our leases limit our ability to increase rents in response to market conditions, so we may receive rents at levels below current fair market values.

Leases representing 39% of our total leaseable area as at December 31, 2012 expire in 2017. Our leases generally provide for periodic rent escalations based on specified percentage increases or a consumer price index adjustment, subject in some cases to a cap. As a result, the long-term nature of these leases limits our ability to increase rents contemporaneously with increases in market rates and may therefore limit our revenue growth and the market value of our income-producing property portfolio.

Our international operations expose us to additional risks that may materially adversely affect our business.

During 2012, 34% of our revenue was generated in Canada, 30% of our revenue was generated in Austria, 17% of our revenue was generated in the United States, 10% of our revenue was generated in Germany, 7% of our revenue was generated in Mexico and our remaining revenue was generated in four other countries. Operating in different regions and countries exposes us to political, economic and other risks as well as multiple foreign regulatory requirements that are subject to change, including:

- •

- economic downturns in countries or geographic regions where we have significant operations, particularly if the sovereign

debt crisis that is currently affecting the European Union continues or intensifies over an extended period;

- •

- economic tensions between governments and changes in international trade and investment policies;

- •

- regulations restricting our ability to do business in certain countries;

- •

- local regulatory compliance requirements;

18

- •

- consequences from changes in tax laws including restrictions on the repatriation of funds; and

- •

- political and economic instability, natural calamities, war, and terrorism.

The effects of these risks may, individually or in the aggregate, materially adversely affect our business.

Foreign currency fluctuations could reduce our revenues and increase our costs, and any future hedging transactions may limit our gains or result in losses for us.

A majority of our current property portfolio is located outside of Canada and generates lease payments that are not denominated in Canadian dollars (see the chart titled "Real Estate Assets" in "Business Overview — Profile of Our Real Estate Portfolio", above). Since we currently report our financial results in Canadian dollars and do not currently hedge all of our non-Cdn.$ rental revenues, we are subject to foreign currency fluctuations that could, from time to time, have an adverse impact on our financial position or operating results.

From time to time, we may attempt to minimize or hedge our exposure to the impact that changes in foreign currency rates or interest rates may have on our revenue and liabilities through the use of derivative financial instruments. The use of derivative financial instruments, including forwards, futures, swaps and options, in our risk management strategy carries certain risks, including the risk that losses on a hedge position will reduce our profits and the cash available for development projects or dividends. A hedge may not be effective in eliminating all the risks inherent in any particular position. Our profitability may be adversely affected during any period as a result of the use of derivatives.

We are subject to risks affecting the automotive parts industry.

Since Magna operates in the automotive parts industry, our business is, and for the foreseeable future will be, subject to conditions affecting the automotive industry generally. Although we intend to lease additional properties to tenants other than Magna, it is likely that our dependence on the automotive industry will continue to be significant.

The global automotive industry is cyclical. A worsening of economic and political conditions, including through rising interest rates or inflation, high unemployment, increasing energy prices, declining real estate values, increased volatility in global capital markets, international conflicts and/or other factors, may result in lower consumer confidence, which has a significant impact on consumer demand for vehicles. Vehicle production is affected by consumer demand, particularly following the restructuring actions taken by some automobile manufacturers in recent years. The continuation of economic uncertainty or a deterioration of the global economy for an extended period of time could have a material adverse effect on the profitability and financial condition of participants in the automotive parts industry. While a number of regions appear to have recovered from the 2008-2009 global recession, uncertainty remains about the strength of the recovery in some regions such as North America, while other regions such as Europe are currently experiencing an economic downturn and face economic uncertainty. The continuation of economic uncertainty or deterioration of the global economy for an extended period of time could have a material adverse effect on our profitability and financial condition. A decrease in the long-term profitability or viability of the automotive industry and the automotive parts sector in particular would have a material adverse impact on the financial condition of our tenants and could therefore adversely impact the value of our properties and our operating results.

Environmental compliance costs and liabilities with respect to our real estate may adversely affect us.

Our tenants operate certain manufacturing facilities that use environmentally sensitive processes and hazardous materials. Under various federal, state, provincial and local environmental laws, ordinances and regulations, a current or previous owner or operator of real property may be liable for the costs of removal or remediation of hazardous or toxic substances on, under or in an affected property. Such laws often impose liability whether or not the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances. In addition, the presence of hazardous or toxic substances, or the failure to remediate properly, may materially impair the value of our real property assets or adversely affect our ability to borrow by using such real property as collateral. Certain environmental laws and common law principles could be used to impose

19

liability for releases of hazardous materials, including asbestos-containing materials, into the environment, and third parties may seek recovery from owners or operators of real properties for personal injury associated with exposure to released asbestos-containing materials or other hazardous materials. As an owner of properties, we are subject to these potential liabilities.

Capital and operating expenditures necessary to comply with environmental laws and regulations, to defend against claims of liability or to remediate contaminated property may have a material adverse effect on our results of operations and financial condition. To date, environmental laws and regulations have not had a material adverse effect on our operations or financial condition. However, changes in these laws and regulations are ongoing and we may become subject to more stringent environmental standards as a result of changes to environmental laws and regulations, compliance with which may have a material adverse effect on our results of operations and financial condition. We cannot predict future costs that we may be required to incur to meet environmental obligations.

Moreover, environmental laws may impose restrictions on the manner in which a property may be used or transferred or in which businesses may be operated, limiting development or expansion of our property portfolio or requiring significant expenditures.

We are subject to competition for the acquisition of new properties and we may not compete successfully, which would limit our ability to invest in and develop new properties.

We compete for suitable real estate investments with many other parties, including real estate investment trusts, pension funds, insurance companies, private investors and other investors (both Canadian and foreign), which are currently seeking, or which may seek in the future, real estate investments similar to those desired by us. Some of our competitors may have greater financial and operational resources, or lower required return thresholds, than we do, or operate without our investment guidelines and operating policies. Accordingly, we may not be able to compete successfully for these investments. Increased competition for real estate investments resulting, for example, from increases in the availability of investment funds or reductions in financing costs would tend to increase purchase prices and reduce the yields from the investments.

Real estate investments are subject to numerous risks that could adversely affect our operating results, many of which are beyond our control.

Because we own, lease and develop real property in multiple jurisdictions, we are subject to the risks generally incident to investments in real property, which risk may vary by jurisdiction. The investment returns available from investments in real estate depend in large part on the amount of income earned and capital appreciation generated by the properties, as well as the expenses incurred. We may experience delays and incur substantial costs in enforcing our rights as lessor under defaulted leases, including costs associated with being unable to rent unleased properties to new tenants on a timely basis or with making improvements or repairs required by a new tenant.

In addition, a variety of other factors outside of our control affect income from properties and real estate values, including environmental laws and other governmental regulations, real estate, zoning, tax and eminent domain laws, interest rate levels and the availability of financing. For example, new or existing environmental, real estate, zoning or tax laws can make it more expensive or time consuming to develop real property or expand, modify or renovate existing structures. When interest rates increase, the cost of acquiring, developing, expanding or renovating real property increases and real property values may decrease as the number of potential buyers decreases. In addition, real estate investments are often difficult to sell quickly. Similarly, if financing becomes less available, it becomes more difficult both to acquire and to sell real property. Moreover, governments can, under eminent domain laws, take real property. Sometimes this taking is for less compensation than the owner believes the property is worth.

20

Real estate development is subject to timing, budgeting and other risks that could adversely affect our operating results.

Subject to compliance with the Declaration of Trust, we intend to develop properties as suitable opportunities arise, taking into consideration the general economic climate. Real estate development has a number of risks, including risks associated with:

- •

- the potential insolvency of a third party developer (where we are not the developer);

- •

- a third party developer's failure to use advanced funds in payment of construction costs;

- •

- construction delays or cost overruns that may increase project costs;

- •

- failure to receive zoning, occupancy and other required governmental permits and authorizations;

- •

- development costs incurred for projects that are not pursued to completion;

- •

- natural disasters, such as earthquakes, hurricanes, floods or fires that could adversely impact a project;

- •

- increases in interest rates during the period of the development;

- •

- inability to raise capital; and

- •

- governmental restrictions on the nature or size of a project.

Our development projects may not be completed on time or within budget, and there may be no market for the new use after we have completed development, either of which could adversely affect our operating results.

Real property investments are relatively illiquid and are subject to volatile valuations.

Real estate investments are relatively illiquid. This will tend to limit our ability to adjust or adapt our portfolio promptly in response to changing economic or investment conditions. If for whatever reason liquidation of assets is required, there is a significant risk that we would realize sale proceeds of less than the current book value of our real estate investments.

Additionally, many of our significant leases provide our tenants with rights of first refusal, which may adversely affect the marketability and market value of our income-producing property portfolio. These rights of first refusal may deter third parties from incurring the time and expense that would be necessary for them to bid on our properties in the event that we desire to sell those properties. Accordingly, these rights of first refusal may adversely affect our ability to sell our properties or the prices that we receive for them upon any sale. See "Business Overview — Leasing Arrangements — Restrictions on Sales and Tenant Rights of Refusal".

We may be unable to successfully implement our strategic plan, or may fail to realize benefits which are currently targeted to result from the implementation of that plan.

The objectives of the strategic plan are subject to known and unknown risks, uncertainties and other unpredictable factors which, in addition to those discussed in this document, include: adverse changes to foreign or domestic tax or other laws; changes in economic, market and competitive conditions and other risks that may adversely affect our ability to fortify and grow our relationship with Magna, expand and diversify our lease portfolio and increase our leverage.

We may be unable to obtain necessary future financing.

Our access to third-party financing will be subject to a number of factors, including general market conditions; our credit rating; the market's perception of our stability and growth potential; our current and future cash flow and earnings; our ability to renew certain long term leases and compliance with the Declaration of Trust. There is no assurance that capital will be available when needed or on favourable terms. Our failure to access required capital on acceptable terms could adversely affect our investments, cash flows, operating results or financial condition. Additionally, as a result of global economic volatility, we may have restricted access to

21

capital and increased borrowing costs. As future acquisitions and capital expenditures will be financed out of cash generated from operations, borrowings and possible future debt or equity security issuances, our ability to do so is dependent on, among other factors, the overall state of capital markets and investor appetite for investments in the real estate sector and automotive industry and in our securities in particular.

To the extent that external sources of capital become limited or unavailable or available on onerous terms, our ability to make acquisitions and capital investments and maintain existing assets may be impaired, and our assets, liabilities, business, financial condition and results of operations may be materially and adversely affected as a result.

We may face unexpected risks relating to acquisitions.

In implementing our strategic plan, we expect to acquire new properties and may also acquire going-concern businesses. It is our operating policy to conduct such diligence as is commercially reasonable in the circumstances on each real property or business that we intend to acquire and obtain a report with respect to the physical condition of real properties from an independent and experienced consultant. Integrating acquired properties and businesses involves a number of risks that could materially and adversely affect our business, including:

- •

- failure of the acquired properties or businesses to achieve expected investment results;

- •

- risks relating to the integration of the acquired properties or businesses and the retention and integration of key

personnel relating to the acquired properties or businesses;

- •

- the risk that acquisitions may require substantial financial resources that otherwise could be used in the development of

other aspects of our business; and

- •

- the risk that major tenants or clients of the acquired properties or businesses may not be retained following the acquisition of such properties or businesses.

Furthermore, the properties and businesses acquired may have undisclosed liabilities for which we may not be entitled to any recourse against the vendor, and any contractual, legal, insurance or other remedies may be insufficient. The discovery of any material liabilities subsequent to the closing of the acquisition for any property or business could have a material adverse effect on our cash flows, financial condition and results of operations.

We may incur significant capital expenditures and other fixed costs.

Certain significant expenditures, including property taxes, maintenance costs, mortgage payments, insurance costs and related charges, must be made throughout the period of ownership of real property, regardless of whether the property is producing sufficient income to pay such expenses. In order to retain desirable rentable space and to generate adequate revenue over the long term, we must maintain or, in some cases, improve each property's condition to meet market demand.