UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

|

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

or

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number:

(Exact name of registrant as specified in its charter)

|

|

|

|

|

(State or other jurisdiction of incorporation or organizations) |

|

(I.R.S. Employer Identification Number) |

3000 31st Street

(Address of principal executive offices, including zip code)

(Registrant's telephone, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

|

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (Exchange Act) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

☒ |

|

☐ |

Accelerated filer |

|

|

|

|

|

|

☐ |

Non-accelerated filer |

|

Smaller reporting company |

|

|

|

||

|

|

Emerging growth company |

||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

|

Class |

|

Number of Shares Outstanding |

|

Class A common stock, $0.00001 par value |

|

|

|

Class B common stock, $0.00001 par value |

|

|

|

Class C common stock, $0.00001 par value |

|

|

TABLE OF CONTENTS

|

|

|

|

|

Page |

|

|

|

|

|

|

|

|

3 |

|||

|

|

5 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

|

|

6 |

|

|

|

|

|

6 |

|

|

|

|

|

7 |

|

|

|

|

|

8 |

|

|

|

|

|

9 |

|

|

|

|

|

10 |

|

|

|

|

|

11 |

|

|

Item 2. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

28 |

|

Item 3. |

|

|

41 |

|

|

Item 4. |

|

|

43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

|

|

44 |

|

|

Item 1A. |

|

|

44 |

|

|

Item 2. |

|

|

81 |

|

|

Item 3. |

|

|

81 |

|

|

Item 4. |

|

|

81 |

|

|

Item 5. |

|

|

81 |

|

|

Item 6. |

|

|

82 |

|

|

|

|

|

83 |

|

Snap Inc., “Snapchat,” and our other registered and common-law trade names, trademarks, and service marks appearing in this Quarterly Report on Form 10-Q are the property of Snap Inc. or our subsidiaries.

2

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this report, including statements regarding guidance, our future results of operations or financial condition, our stock repurchase program, future stock dividends, business strategy and plans, user growth and engagement, product initiatives, and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “going to,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or the negative of these words or other similar terms or expressions. We caution you that the foregoing may not include all of the forward-looking statements made in this report.

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Quarterly Report on Form 10-Q primarily on our current expectations and projections about future events and trends, including our financial outlook, geo-political conflicts, and the COVID-19 pandemic, that we believe may continue to affect our business, financial condition, results of operations, and prospects. These forward-looking statements are subject to risks, uncertainties, and other factors described in “Risk Factors” and elsewhere in this Quarterly Report on Form 10-Q, including among other things:

|

|

• |

our financial performance, including our revenues, cost of revenues, operating expenses, and our ability to attain and sustain profitability; |

|

|

• |

our ability to generate and sustain positive cash flow; |

|

|

• |

our ability to attract and retain users and partners; |

|

|

• |

our ability to attract and retain advertisers; |

|

|

• |

our ability to compete effectively with existing competitors and new market entrants; |

|

|

• |

our ability to effectively manage our growth and future expenses; |

|

|

• |

our ability to comply with modified or new laws, regulations, and executive actions applying to our business; |

|

|

• |

our ability to maintain, protect, and enhance our intellectual property; |

|

|

• |

our ability to successfully expand in our existing market segments and penetrate new market segments; |

|

|

• |

our ability to attract and retain qualified team members and key personnel; |

|

|

• |

our ability to repay outstanding debt; |

|

|

• |

future acquisitions of or investments in complementary companies, products, services, or technologies; and |

|

|

• |

the potential adverse impact of climate change, natural disasters, health epidemics, including the COVID-19 pandemic, macroeconomic conditions, and war or other armed conflict, including Russia’s invasion of Ukraine, on our business, operations, and the markets and communities in which we and our partners, advertisers, and users operate. |

Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Quarterly Report on Form 10-Q. The results, events, and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this Quarterly Report on Form 10-Q. And while we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

The forward-looking statements made in this Quarterly Report on Form 10-Q relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this report to reflect events or circumstances after the date of this report or to reflect new information or the occurrence of unanticipated events, including future developments related to geo-political conflicts, the COVID-19 pandemic, and macroeconomic conditions, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, dispositions, joint ventures, restructurings, legal settlements, or investments.

Investors and others should note that we may announce material business and financial information to our investors using our websites (including investor.snap.com), filings with the U.S. Securities and Exchange Commission, or SEC, webcasts, press releases, and conference calls. We use these mediums, including Snapchat and our website, to communicate with our members and the public about our company, our products, and other issues. It is possible that the information that

3

we make available may be deemed to be material information. We therefore encourage investors and others interested in our company to review the information that we make available on our websites.

4

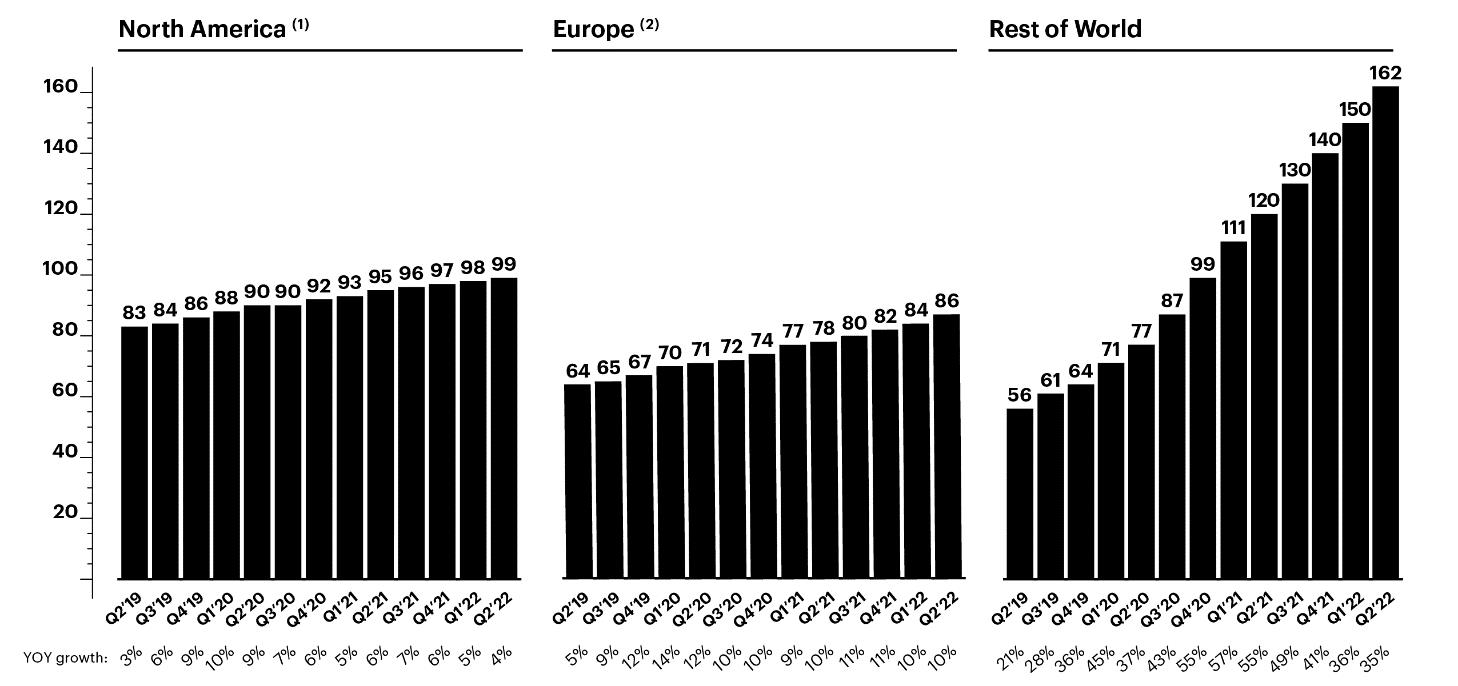

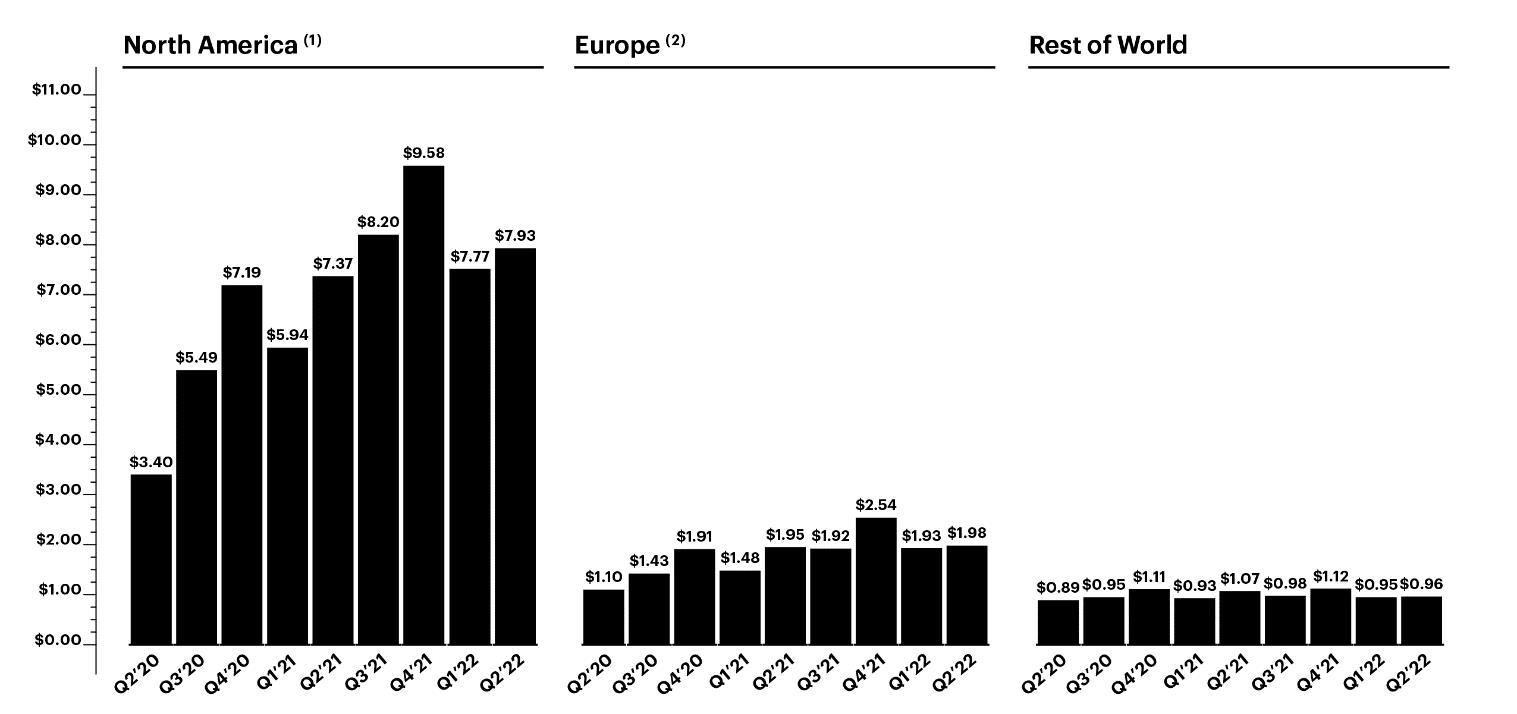

NOTE REGARDING USER METRICS AND OTHER DATA

We define a Daily Active User, or DAU, as a registered Snapchat user who opens the Snapchat application at least once during a defined 24-hour period. We calculate average DAUs for a particular quarter by adding the number of DAUs on each day of that quarter and dividing that sum by the number of days in that quarter. DAUs are broken out by geography because markets have different characteristics. We define average revenue per user, or ARPU, as quarterly revenue divided by the average DAUs. For purposes of calculating ARPU, revenue by user geography is apportioned to each region based on our determination of the geographic location in which advertising impressions are delivered, as this approximates revenue based on user activity. This allocation differs from our components of revenue disclosure in the notes to our consolidated financial statements, where revenue is based on the billing address of the advertising customer. For information concerning these metrics as measured by us, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Unless otherwise stated, statistical information regarding our users and their activities is determined by calculating the daily average of the selected activity for the most recently completed quarter included in this report.

While these metrics are determined based on what we believe to be reasonable estimates of our user base for the applicable period of measurement, there are inherent challenges in measuring how our products are used across large populations globally. For example, there may be individuals who have unauthorized or multiple Snapchat accounts, even though we forbid that in our Terms of Service and implement measures to detect and suppress that behavior. We have not determined the number of such multiple accounts.

Changes in our products, infrastructure, mobile operating systems, or metric tracking system, or the introduction of new products, may impact our ability to accurately determine active users or other metrics and we may not determine such inaccuracies promptly. We also believe that we don’t capture all data regarding each of our active users. Technical issues may result in data not being recorded from every user’s application. For example, because some Snapchat features can be used without internet connectivity, we may not count a DAU because we don’t receive timely notice that a user has opened the Snapchat application. This undercounting may increase as we grow in Rest of World markets where users may have poor connectivity. We do not adjust our reported metrics to reflect this underreporting. We believe that we have adequate controls to collect user metrics, however, there is no uniform industry standard. We continually seek to identify these technical issues and improve both our accuracy and precision, including ensuring that our investors and others can understand the factors impacting our business, but these and new issues may continue in the future, including if there continues to be no uniform industry standard.

Some of our demographic data may be incomplete or inaccurate. For example, because users self-report their dates of birth, our age-demographic data may differ from our users’ actual ages. And because users who signed up for Snapchat before June 2013 were not asked to supply their date of birth, we may exclude those users from our age demographics or estimate their ages based on a sample of the self-reported ages that we do have. If our active users provide us with incorrect or incomplete information regarding their age or other attributes, then our estimates may prove inaccurate and fail to meet investor expectations.

In the past we have relied on third-party analytics providers to calculate our metrics, but today we rely primarily on our analytics platform that we developed and operate. We count a DAU only when a user opens the application and only once per user per day. We believe this methodology more accurately measures our user engagement. We have multiple pipelines of user data that we use to determine whether a user has opened the application during a particular day, and becoming a DAU. This provides redundancy in the event one pipeline of data were to become unavailable for technical reasons, and also gives us redundant data to help measure how users interact with our application.

If we fail to maintain an effective analytics platform, our metrics calculations may be inaccurate. We regularly review, have adjusted in the past, and are likely in the future to adjust our processes for calculating our internal metrics to improve their accuracy. As a result of such adjustments, our DAUs or other metrics may not be comparable to those in prior periods. Our measures of DAUs may differ from estimates published by third parties or from similarly titled metrics of our competitors due to differences in methodology or data used.

5

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Snap Inc.

Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of debt issuance costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Losses (gains) on debt and equity securities, net |

|

|

|

|

|

( |

) |

|

|

|

|

|

|

( |

) |

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in operating assets and liabilities, net of effect of acquisitions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net of allowance |

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

( |

) |

|

Prepaid expenses and other current assets |

|

( |

) |

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Operating lease right-of-use assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other assets |

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Accounts payable |

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

Accrued expenses and other current liabilities |

|

( |

) |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

Operating lease liabilities |

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Other liabilities |

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities |

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Purchases of strategic investments |

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Sales of strategic investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for acquisitions, net of cash acquired |

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Purchases of marketable securities |

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Sales of marketable securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maturities of marketable securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Net cash provided by (used in) investing activities |

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of convertible notes, net of issuance costs |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of capped calls |

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Proceeds from the exercise of stock options |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments of debt issuance costs |

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

Net cash provided by (used in) financing activities |

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in cash, cash equivalents, and restricted cash |

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents, and restricted cash, beginning of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents, and restricted cash, end of period |

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Supplemental disclosures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for income taxes, net |

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Cash paid for interest |

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

See Notes to Consolidated Financial Statements.

6

Snap Inc.

Consolidated Statements of Operations

(in thousands, except per share amounts)

(unaudited)

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

|

Revenue |

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Interest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Other income (expense), net |

|

( |

) |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

Loss before income taxes |

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Income tax benefit (expense) |

|

( |

) |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

Net loss |

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Net loss per share attributable to Class A, Class B, and Class C common stockholders (Note 3): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Diluted |

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Weighted average shares used in computation of net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Consolidated Financial Statements.

7

Snap Inc.

Consolidated Statements of Comprehensive Income (Loss)

(in thousands)

(unaudited)

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

|

Net loss |

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Other comprehensive income (loss), net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on marketable securities, net of tax |

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Foreign currency translation |

|

( |

) |

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Total other comprehensive income (loss), net of tax |

|

( |

) |

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Total comprehensive loss |

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

See Notes to Consolidated Financial Statements.

8

Snap Inc.

Consolidated Balance Sheets

(in thousands, except par value)

|

|

June 30, 2022 |

|

|

December 31, 2021 |

|

|||

|

|

(unaudited) |

|

|

|

|

|

||

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

|

|

|

$ |

|

|

|

|

Marketable securities |

|

|

|

|

|

|

|

|

|

Accounts receivable, net of allowance |

|

|

|

|

|

|

|

|

|

Prepaid expenses and other current assets |

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

|

|

|

|

|

|

|

Operating lease right-of-use assets |

|

|

|

|

|

|

|

|

|

Intangible assets, net |

|

|

|

|

|

|

|

|

|

Goodwill |

|

|

|

|

|

|

|

|

|

Other assets |

|

|

|

|

|

|

|

|

|

Total assets |

$ |

|

|

|

$ |

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

$ |

|

|

|

$ |

|

|

|

|

Operating lease liabilities |

|

|

|

|

|

|

|

|

|

Accrued expenses and other current liabilities |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

|

|

|

|

|

|

|

Convertible senior notes, net |

|

|

|

|

|

|

|

|

|

Operating lease liabilities, noncurrent |

|

|

|

|

|

|

|

|

|

Other liabilities |

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 8) |

|

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

|

|

|

Class A non-voting common stock, $ authorized, at December 31, 2021. |

|

|

|

|

|

|

|

|

|

Class B voting common stock, $ authorized, |

|

— |

|

|

|

— |

|

|

|

Class C voting common stock, $ authorized, |

|

|

|

|

|

|

|

|

|

Additional paid-in capital |

|

|

|

|

|

|

|

|

|

Accumulated other comprehensive income (loss) |

|

( |

) |

|

|

|

|

|

|

Accumulated deficit |

|

( |

) |

|

|

( |

) |

|

|

Total stockholders’ equity |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

$ |

|

|

|

$ |

|

|

|

See Notes to Consolidated Financial Statements.

9

Snap Inc.

Consolidated Statements of Stockholders’ Equity

(in thousands)

(unaudited)

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||||||||||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||||||||||||||||||

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

||||||||

|

Class A non-voting common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, beginning of period |

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

Shares issued in connection with exercise of stock options under stock-based compensation plans |

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

Issuance of Class A non-voting common stock in connection with acquisitions |

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

Issuance of Class A non-voting common stock for vesting of restricted stock units and restricted stock awards, net |

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Issuance of Class A non-voting common stock for the induced conversion related to convertible senior notes |

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

Conversion of Class B voting common stock to Class A non-voting common stock |

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

Balance, end of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class B voting common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, beginning of period |

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

Shares issued in connection with exercise of stock options under stock-based compensation plans |

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

Conversion of Class C voting common stock to Class B voting common stock |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Conversion of Class B voting common stock to Class A non-voting common stock |

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

Balance, end of period |

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

Class C voting common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, beginning of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of Class C voting common stock for settlement of restricted stock units, net |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Conversion of Class C voting common stock to Class B voting common stock |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Balance, end of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional paid-in capital |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, beginning of period |

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Stock-based compensation expense |

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Shares issued in connection with exercise of stock options under stock-based compensation plans |

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Cumulative-effect adjustment from accounting changes |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

Issuance of Class A non-voting common stock in connection with acquisitions |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Issuance of Class A non-voting common stock for the induced conversion related to convertible senior notes |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Purchase of capped calls |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

Balance, end of period |

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Accumulated deficit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, beginning of period |

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

Cumulative-effect adjustment from accounting changes |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Net loss |

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

Balance, end of period |

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

Accumulated other comprehensive income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, beginning of period |

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Other comprehensive income (loss), net of tax |

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

Balance, end of period |

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

|

|

|

Total stockholders’ equity |

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

See Notes to Consolidated Financial Statements.

10

Snap Inc.

Notes to Consolidated Financial Statements

1. Description of Business and Summary of Significant Accounting Policies

Snap Inc. is a camera company.

Snap Inc. (“we,” “our,” or “us”) was formed as Future Freshman, LLC, a California limited liability company, in 2010. We changed our name to Toyopa Group, LLC in 2011, incorporated as Snapchat, Inc., a Delaware corporation, in 2012, and changed our name to Snap Inc. in 2016. Snap Inc. is headquartered in Santa Monica, California. Our flagship product, Snapchat, is a camera application that was created to help people communicate through short videos and images called “Snaps.”

Basis of Presentation

The accompanying unaudited consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information. Our consolidated financial statements include the accounts of Snap Inc. and our wholly owned subsidiaries. All intercompany transactions and balances have been eliminated in consolidation. Our fiscal year ends on December 31. These unaudited interim consolidated financial statements should be read in conjunction with the consolidated financial statements and related notes included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, as filed with the Securities and Exchange Commission (“SEC”) in February 2022 (the “Annual Report”).

In our opinion, the unaudited interim consolidated financial statements include all adjustments of a normal recurring nature necessary for the fair presentation of our financial position, results of operations, and cash flows. Certain reclassifications have been made in the prior periods to conform to the current year's presentation. None of these reclassifications had a material impact on our consolidated financial statements. The results of operations for the three and six months ended June 30, 2022 are not necessarily indicative of the results to be expected for the year ending December 31, 2022.

There have been no changes to our significant accounting policies described in our Annual Report that have had a material impact on our consolidated financial statements and related notes.

Use of Estimates

The preparation of our consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts in the consolidated financial statements. Management’s estimates are based on historical information available as of the date of the consolidated financial statements and various other assumptions that we believe are reasonable under the circumstances. Actual results could differ from those estimates.

Key estimates relate primarily to determining the fair value of assets and liabilities assumed in business combinations, evaluation of contingencies, uncertain tax positions, forfeiture rate, the fair value of stock-based awards, and the fair value of strategic investments. On an ongoing basis, management evaluates our estimates compared to historical experience and trends, which form the basis for making judgments about the carrying value of assets and liabilities.

Recent Accounting Pronouncements

In June 2022, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2022-03, Fair Value Measurement (Topic 820): Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions, which clarifies the guidance when measuring the fair value of an equity security subject to contractual restrictions that prohibit the sale of an equity security and introduces new disclosure requirements for equity securities subject to contractual sale restrictions that are measured at fair value in accordance with Topic 820. The guidance is effective for annual periods beginning after December 15, 2023, with early adoption permitted. Effective

In November 2021, the FASB issued ASU 2021-10, Government Assistance (Topic 832): Disclosure by Business Entities about Government Assistance, which improves the transparency of government assistance received by requiring the disclosure of: (1) the types of government assistance received; (2) the accounting for such assistance; and (3) the effect of the

11

assistance on an entity's financial statements. The guidance is effective for annual periods beginning after December 15, 2021, with early adoption permitted. Effective

In October 2021, the FASB issued ASU 2021-08, Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers. Under ASU 2021-08, an acquirer must recognize and measure contract assets and contract liabilities acquired in a business combination in accordance with ASU 2014-09, Revenue from Contracts with Customers (Topic 606). The guidance is effective for interim and annual periods beginning after December 15, 2022, with early adoption permitted. Effective

In August 2020, the FASB issued ASU 2020-06, Debt—Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity. Under ASU 2020-06, the embedded conversion features are no longer separated from the host contract for convertible instruments with conversion features that are not required to be accounted for as derivatives under Topic 815, or that do not result in substantial premiums accounted for as paid-in capital. Consequently, a convertible debt instrument will be accounted for as a single liability measured at its amortized cost, as long as no other features require bifurcation and recognition as derivatives. The new guidance also requires the if-converted method to be applied for all convertible instruments. ASU 2020-06 is effective for fiscal years beginning after December 15, 2021, with early adoption permitted. Adoption of the standard requires using either a modified retrospective or a full retrospective approach. Effective

2. Revenue

We determine revenue recognition by first identifying the contract or contracts with a customer, identifying the performance obligations in the contract, determining the transaction price, allocating the transaction price to the performance obligations in the contract, and recognizing revenue when, or as, we satisfy a performance obligation.

Revenue is recognized when control of the promised goods or services is transferred to our customers, in an amount that reflects the consideration we expect to receive in exchange for those goods or services. We determine collectability by performing ongoing credit evaluations and monitoring customer accounts receivable balances. Sales tax, including value added tax, is excluded from reported revenue.

We generate substantially all of our revenues by offering various advertising products on Snapchat, which include Snap Ads and AR Ads, referred to as advertising revenue. AR Ads include Sponsored Filters and Sponsored Lenses. Sponsored Filters allow users to interact with an advertiser’s brand by enabling stylized brand artwork to be overlaid on a Snap. Sponsored Lenses allow users to interact with an advertiser’s brand by enabling branded augmented reality experiences.

The substantial majority of advertising revenue is generated from the display of advertisements on Snapchat through contractual agreements that are either on a fixed fee basis over a period of time or based on the number of advertising impressions delivered. Revenue related to agreements based on the number of impressions delivered is recognized when the advertisement is displayed. Revenue related to fixed fee arrangements is recognized ratably over the service period, typically less than 30 days in duration, and such arrangements do not contain minimum impression guarantees.

In arrangements where another party is involved in providing specified services to a customer, we evaluate whether we are the principal or agent. In this evaluation, we consider if we obtain control of the specified goods or services before they are transferred to the customer, as well as other indicators such as the party primarily responsible for fulfillment, inventory risk, and discretion in establishing price. For advertising revenue arrangements where we are not the principal, we recognize revenue on a net basis. For the periods presented, revenue for arrangements where we are the agent was not material.

We also generate revenue from sales of hardware products. For the periods presented, revenue from the sales of hardware products was not material.

12

The following table represents our revenue disaggregated by geography based on the billing address of the advertising customer:

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

|

|

(in thousands) |

|

|||||||||||||

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America (1) (2) |

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Europe (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rest of world |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

(1) |

North America includes Mexico, the Caribbean, and Central America. |

|

(2) |

United States revenue was $ |

|

(3) |

Europe includes Russia and Turkey. Effective March 2022, we halted advertising sales to Russian and Belarusian entities. |

3. Net Loss per Share

We compute net loss per share using the two-class method required for multiple classes of common stock. We have three classes of authorized common stock for which voting rights differ by class.

Basic net loss per share is computed by dividing net loss attributable to each class of stockholders by the weighted-average number of shares of stock outstanding during the period, adjusted for restricted stock awards (“RSAs”) for which the risk of forfeiture has not yet lapsed.

For the calculation of diluted net loss per share, net loss per share attributable to common stockholders for basic net loss per share is adjusted by the effect of dilutive securities, including awards under our equity compensation plans. Diluted net loss per share attributable to common stockholders is computed by dividing the resulting net loss attributable to common stockholders by the weighted-average number of fully diluted common shares outstanding. We use the if-converted method for calculating any potential dilutive effect of the convertible senior notes due in 2025, 2026, 2027, and 2028 (collectively, the “Convertible Notes”) on diluted net loss per share. The Convertible Notes would have a dilutive impact on net income per share when the average market price of Class A common stock for a given period exceeds the respective conversion price of the Convertible Notes. For the periods presented, our potentially dilutive shares relating to stock options, restricted stock units (“RSUs”), RSAs, and Convertible Notes were not included in the computation of diluted net loss per share as the effect of including these shares in the calculation would have been anti-dilutive.

13

The numerators and denominators of the basic and diluted net loss per share computations for our common stock are calculated as follows for the three and six months ended June 30, 2022 and 2021:

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||||||||||||||||||||||||||||||||||

|

|

|

(in thousands, except per share data) |

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

Class A Common |

|

|

Class B Common |

|

|

Class C Common |

|

|

Class A Common |

|

|

Class B Common |

|

|

Class C Common |

|

|

Class A Common |

|

|

Class B Common |

|

|

Class C Common |

|

|

Class A Common |

|

|

Class B Common |

|

|

Class C Common |

|

||||||||||||

|

Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Net loss attributable to common stockholders |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares - Basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares - Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share attributable to common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

Diluted |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

The following potentially dilutive shares were excluded from the calculation of diluted net loss per share because their effect would have been anti-dilutive for the periods presented:

|

|

|

Three and Six Months Ended June 30, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

|

|

(in thousands) |

|

|||||

|

Stock options |

|

|

|

|

|

|

|

|

|

Unvested RSUs and RSAs |

|

|

|

|

|

|

|

|

|

Convertible Notes (if-converted) |

|

|

|

|

|

|

|

|

4. Stockholders’ Equity

We maintain

Restricted Stock Units and Restricted Stock Awards

The following table summarizes the RSU and RSA activity during the six months ended June 30, 2022:

|

|

|

Class A Outstanding |

|

|

Weighted- Average Grant Date Fair Value |

|

||

|

|

|

(in thousands, except per share data) |

|

|||||

|

Unvested at December 31, 2021 |

|

|

|

|

|

$ |

|

|

|

Granted |

|

|

|

|

|

$ |

|

|

|

Vested |

|

|

( |

) |

|

$ |

|

|

|

Forfeited |

|

|

( |

) |

|

$ |

|

|

|

Unvested at June 30, 2022 |

|

|

|

|

|

$ |

|

|

14

All RSUs and RSAs vest on the satisfaction of a service-based condition. Total unrecognized compensation cost related to outstanding RSUs and RSAs was $

Stock Options

The following table summarizes the stock option award activity under the Stock Plans during the six months ended June 30, 2022:

|

|

|

Class A Number of Shares |

|

|

Class B Number of Shares |

|

|

Weighted- Average Exercise Price |

|

|

Weighted- Average Remaining Contractual Term (in years) |

|

|

Aggregate Intrinsic Value(1) |

|

|||||

|

|

|

(in thousands, except per share data) |

|

|||||||||||||||||

|

Outstanding at December 31, 2021 |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

Granted |

|

|

— |

|

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

$ |

— |

|

|

Exercised |

|

|

( |

) |

|

|

( |

) |

|

$ |

|

|

|

|

— |

|

|

$ |

— |

|

|

Forfeited |

|

|

( |

) |

|

|

— |

|

|

$ |

|

|

|

|

— |

|

|

$ |

— |

|

|

Outstanding at June 30, 2022 |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

(1) |

The aggregate intrinsic value is calculated as the difference between the exercise price of the underlying stock option awards and the closing market price of our Class A common stock as of December 31, 2021 and June 30, 2022, respectively. |

Total unrecognized compensation cost related to unvested stock options was $

Stock-Based Compensation Expense by Function

Total stock-based compensation expense by function was as follows:

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

|

|

(in thousands) |

|

|||||||||||||

|

Cost of revenue |

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Research and development |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

15

5. Business Acquisitions

2022 Acquisitions

In the six months ended June 30, 2022, we completed acquisitions to enhance our existing platform, technology, and workforce. The aggregate purchase consideration was $

2021 Acquisitions

Wave Optics

In May 2021, we acquired Wave Optics Limited (“Wave Optics”), a display technology company that supplies light engines and diffractive waveguides for augmented reality displays. The total consideration was $

The allocation of the total purchase consideration for this acquisition was as follows:

|

|

Total |

|

|

|

|

(in thousands) |

|

|

|

Trademarks |

$ |

|

|

|

Technology |

|

|

|

|

Customer relationships |

|

|

|

|

Goodwill |

|

|

|

|

Net deferred tax liability |

|

( |

) |

|

Other assets acquired and liabilities assumed, net |

|

|

|

|

Total |

$ |

|

|

The goodwill amount represents synergies expected to be realized from the business combination and assembled workforce. The associated goodwill and intangible assets are not deductible for tax purposes.

Fit Analytics

In March 2021, we acquired Fit Analytics GmbH (“Fit Analytics”), a sizing technology company that powers solutions for retailers and brands, to grow our e-commerce and shopping offerings. The purchase consideration for Fit Analytics was $

The allocation of the total purchase consideration for this acquisition was as follows:

|

|

Total |

|

|

|

|

(in thousands) |

|

|

|

Trademarks |

$ |

|

|

|

Technology |

|

|

|

|

Customer relationships |

|

|

|

|

Goodwill |

|

|

|

|

Net deferred tax liability |

|

( |

) |

|

Other assets acquired and liabilities assumed, net |

|

|

|

|

Total |

$ |

|

|

16

The goodwill amount represents synergies expected to be realized from this business combination and assembled workforce. The associated goodwill and intangible assets are not deductible for tax purposes.

Other 2021 Acquisitions

For the year ended December 31, 2021, we completed other acquisitions to enhance our existing platform, technology, and workforce. The aggregate purchase consideration was $

|

|

Total |

|

|

|

|

(in thousands) |

|

|

|

Technology |

$ |

|

|

|

Customer relationships |

|

|

|

|

Goodwill |

|

|

|

|

Net deferred tax liability |

|

( |

) |

|

Other assets acquired and liabilities assumed, net |

|

|

|

|

Total |

$ |

|

|

The goodwill amount represents synergies related to our existing platform expected to be realized from the business acquisitions and assembled workforces. Of the acquired goodwill and intangible assets, $

6. Goodwill and Intangible Assets

The changes in the carrying amount of goodwill for the six months ended June 30, 2022 were as follows:

|

|

Goodwill |

|

|

|

|

(in thousands) |

|

|

|

Balance as of December 31, 2021 |

$ |

|

|

|

Goodwill acquired |

|

|

|

|

Foreign currency translation |

|

( |

) |

|

Balance as of June 30, 2022 |

$ |

|

|

Intangible assets consisted of the following:

|

|

As of June 30, 2022 |

|

|||||||||||||

|

|

Weighted- Average Remaining Useful Life - Years |

|

|

Gross Carrying Amount |

|

|

Accumulated Amortization |

|

|

Net |

|

||||

|

|

(in thousands, except years) |

|

|||||||||||||

|

Domain names |

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Trademarks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Technology |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer relationships |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Patents |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

17

|

|

As of December 31, 2021 |

|

|||||||||||||

|

|

Weighted- Average Remaining Useful Life - Years |

|

|

Gross Carrying Amount |

|

|

Accumulated Amortization |

|

|

Net |

|

||||

|

|

(in thousands except years) |

|

|||||||||||||

|

Domain names |

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Trademarks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Technology |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer relationships |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Patents |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

Amortization of intangible assets was $

As of June 30, 2022, the estimated intangible asset amortization expense for the next five years and thereafter is as follows:

|

|

Estimated Amortization |

|