UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-55610

GREENBACKER RENEWABLE ENERGY COMPANY LLC

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 80-0872648 |

| (State or Other Jurisdiction of | (I.R.S. Employer |

| Incorporation or Organization) | Identification No.) |

11 East 44th Street, Suite 1200

New York, NY 10017

Tel (646) 237-7884

(Address, including zip code and telephone number, including area code, of registrants Principal Executive Office)

Charles Wheeler

c/o

Greenbacker Capital Management LLC

30 Danforth Street, Suite 206

Portland, ME 04101

Tel (646) 237-7884

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one):

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) Smaller reporting company ☐ | |

| Emerging growth company ☒ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of March 1, 2019, the registrant had 40,502,073 shares of common interests, $0.001 par value, outstanding.

TABLE OF CONTENTS

i

GLOSSARY OF KEY TERMS

In this annual report on Form 10-K, except as otherwise indicated, the terms:

| • | The term “LLC” refers to Greenbacker Renewable Energy Company LLC; |

| • | “we,” “us,” “our” and the “company” refers, collectively, to Greenbacker Renewable Energy Company LLC, Greenbacker Renewable Energy Corporation, and GREC Entity Holdco LLC; |

| • | The “advisor” and “GCM” refer to Greenbacker Capital Management LLC, our advisor; |

| • | The term “Special Unitholder” refers to GREC Advisors, LLC, a Delaware limited liability company, which is a subsidiary of our advisor; |

| • | The term “special unit” refers to the special unit of limited liability company interest in the LLC entitling the Special Unitholder to an incentive allocation and distribution; |

| • | The term “SC Distributors” and “dealer manager” refer to SC Distributors, LLC, a Delaware limited liability company, the LLC’s dealer manager; |

| • | “GREC” refers to Greenbacker Renewable Energy Corporation, a Maryland corporation; |

| • | “GREC Holdco” refers to GREC Entity Holdco LLC, a wholly owned subsidiary of GREC; |

| • | “Greenbacker Administration” and “Administrator” refers to Greenbacker Administration, LLC, our Administrator; |

| • | “Greenbacker Group LLC” refers to a sponsor of the company and the parent of GCM; |

| • | “DRP” — Distribution Reinvestment Plan; |

| • | “ITC”— Investment Tax Credit; |

| • | “PTC”— Production Tax Credit; |

| • | “MWh”— Megawatt Hours; |

| • | “kW”— Kilowatts; |

| • | “kWh”— Kilowatt hours; |

| • | “REC”— Renewable Energy Credit; |

| • | “SREC”— Solar Renewable Energy Credit; |

| • | “MW”— Megawatts- (DC) for all Solar assets and (AC) for Wind assets |

| • | “PPA” — Power Purchase Agreement; |

| • | “RPS”— Renewable Portfolio Standard; |

| • | “EEC”— Energy Efficiency Certificate; and |

| • | “PV”— Photovoltaic. |

ii

FORMATION OF OUR COMPANY

The LLC, a Delaware limited liability company, formed in December 2012, is an externally managed energy company that acquires and manages income-generating renewable energy and energy efficiency projects, and other energy-related businesses, as well as finances the construction and/or operation of these and sustainable development projects and businesses. The LLC conducts substantially all of its operations through its wholly-owned subsidiary, GREC. GREC is a Maryland corporation formed in November 2011 and the LLC currently holds all of the outstanding shares of capital stock of GREC. GREC Holdco, a wholly-owned subsidiary of GREC, was formed in Delaware, in June 2016. We are externally managed and advised by the advisor, a renewable energy, energy efficiency and sustainability related project acquisition, consulting and development company that is registered as an investment adviser under the Investment Advisers Act of 1940, as amended (“Advisers Act”). The LLC’s fiscal year end is December 31.

Pursuant to an initial Registration Statement on Form S-1 (File No. 333-178786-01), the company offered up to $1,500,000,000 in shares of limited liability company interests, or the shares, including up to $250,000,000 pursuant to a DRP, through the dealer manager. The offering pursuant to that initial Registration Statement terminated on February 7, 2017. Pursuant to a Registration Statement on Form S-1 (File No. 333-211571), the company is offering on a continuous basis up to $1,000,000,000 in shares of limited liability company interests, or the shares, including up to $200,000,000 of shares pursuant to the DRP, on a “best efforts” basis through the dealer manager, meaning it is not required to sell any specific number or dollar amount of shares. The dealer manager coordinates the distribution of our shares, manages our relationships with participating broker-dealers and provides assistance in connection with compliance matters relating to the marketing of our offering. The dealer manager provides only the foregoing distribution-related services to us, and does so pursuant to the dealer manager agreement. The dealer manager exercises no control or influence over our investment, asset management or accounting functions or any other aspect of our management or operations. For the avoidance of doubt, the dealer manager owns no equity interests in our advisor. The company is publicly offering three classes of shares: Class A, C and I shares in any combination with a dollar value up to the maximum offering amount. In addition, the company is privately offering Class P-A and P-I shares. The share classes have different selling commissions, dealer manager fees and there is an ongoing distribution fee with respect to Class C shares. The company has adopted a DRP pursuant to which a shareholder owning publicly offered share classes may elect to have the full amount of cash distributions reinvested in additional shares. The company reserves the right to reallocate the offered shares within each offering between each and any share class and between its public offering and the DRP. While the Company plans to terminate its public offering of securities on or before April 30, 2019, shares are only offered for sale in states where securities registrations are current. While the Company only plans to accept subscriptions for its’ public shares until on or about April 30, 2019, the DRP and the share repurchase plan will continue to be available to investors after such date.

Each quarter, our advisor, utilizing the services of an independent valuation firm when necessary, reviews and approves the net asset value for each class of shares, subject to the oversight of the company’s board of directors. The company expects such determination will ordinarily be made within 30 days after each such completed fiscal quarter. To the extent that the net asset value per share on the most recent valuation date increases above or decreases below the net proceeds per share, the company will adjust the offering prices of all classes of shares currently available for sale. The adjustments to the per share offering prices, which will become effective five business days after such determination is published, will ensure that after the effective date of the new offering prices, the offering prices per share, after deduction of selling commissions, dealer manager fees and organization and offering expenses, are not above or below net asset value per share as of the most recent valuation date. The purchase price per share to be paid by each investor will be equal to the price that is in effect on the date such investor submits his or her completed subscription agreement. The company’s shares are offered in the primary offering at a price based on the most recent valuation, plus related selling commissions, dealer manager fees and organization and offering expenses. Five days after the publication of each quarter end valuation, shares will be offered pursuant to the DRP at a price equal to the current offering price per each class of shares, less the sales selling commissions and dealer manager fees associated with that class of shares in the primary offering.

OVERVIEW OF OUR BUSINESS

Our business objective is to generate attractive risk-adjusted returns for our members, consisting of both current income and long-term capital appreciation, by acquiring, and financing the construction and/or operation of income-generating renewable energy, energy efficiency and sustainable development projects, primarily within but also outside of North America. We expect the size of our investments to generally range between approximately $5 million and $100 million. We will seek to maximize our risk-adjusted returns by: (1) capitalizing on market opportunities; (2) focusing on hard assets that produce dependable cash flows; (3) efficiently utilizing government incentives where available; (4) employing creative deal structuring to optimize capital and ownership structures; (5) partnering with experienced financial, legal, engineering and other professional firms; (6) employing sound due diligence and risk mitigation processes; and (7) monitoring and managing our portfolio of assets on an ongoing basis.

2

Our goal is to assemble a diversified portfolio of renewable energy, energy efficiency and other sustainability related projects and businesses. Renewable energy projects generally earn revenue through the sale of generated electricity as well as frequently through the sale of related project attributes such as RECs and EECs. We initially have focused on solar, wind and energy efficiency projects. We believe solar energy projects generally offer more predictable power generation characteristics, due to the relative predictability of sunlight over the course of time compared to other renewable energy technologies and therefore we expect them to provide more stable income streams. However, technological advances in wind turbines and other energy generation technologies, as well as government incentives, also make wind energy and other types of projects attractive. Solar energy projects provide maximum energy production during daylight hours in the summer months when days are longer and nights shorter. Solar energy projects tend to have minimal environmental impact enabling such projects to be developed close to areas of dense population where electricity demand is highest. Solar technology is scalable and well-established and is relatively simple to integrate new acquisitions and projects into our portfolio. Over time, we have broadened our strategy, and expect to continue to broaden our strategy, to include other types of renewable energy projects and energy efficiency projects and businesses, which may include wind farms, hydropower assets, geothermal plants, biomass and biofuel assets, combined heat and power technology assets, fuel cell assets and other energy efficiency assets, among others, and to the extent we deem the opportunity attractive, other energy and sustainability related assets and businesses. Recently, we have begun to investigate investments in biomass as well as hydroelectric plants.

Our preferred investment strategy is to acquire controlling equity stakes in our target assets or to be named the managing member of a limited liability company in order to oversee and supervise their operations. We define controlling equity stakes as companies in which we own 25% or more of the voting securities of such company, have greater than 50% representation on such company’s board of directors, or as the managing member of a limited liability company. However, we will also provide financing to projects owned by others, including through the provision of secured loans which may or may not include some form of equity participation. We may also provide projects with senior unsecured debt, subordinated secured debt, subordinated unsecured debt, mezzanine debt, convertible debt, convertible preferred equity, and preferred equity, and make minority equity investments. We may also participate in projects by acquiring contractual payment rights or rights to receive a proportional interest in the operating cash flow or net income of a project. We may also make equity investments in or loans to parties financing the supply of renewable energy and energy efficiency to residential and commercial customers or the adoption of strategies that encourage energy conservation to reduce the consumption of energy by those customers. Our strategy will be tailored to balance long-term cash flow certainty, which we can achieve through long-term agreements for our products, with shorter term arrangements that allow us to potentially generate higher risk-adjusted returns.

Our renewable energy projects generate revenue primarily by selling (1) generated electric energy and/or capacity to local utilities and high quality, utility, municipal, corporate and individual residential counterparties, and (2) in some cases, RECs, EECs, and other attributes associated with renewable generation or related incentives. We seek to acquire or finance projects that contain transmission infrastructures and access to power grids or networks that will enable the generated power to be sold. We generally expect our projects will have PPAs with one or more counterparties, including local utilities or other high credit quality counterparties, who agree to purchase the electricity generated from the project. We refer to these PPAs as “must-take contracts”, and we refer to these other counterparties as “off-takers.” These must-take contracts guarantee that all electricity generated by each project will be purchased. Although we intend to work primarily with high credit quality counterparties, if an off-taker cannot fulfill its contractual obligation to purchase the power, we generally can sell the power to the local utility or other suitable counterparty, which would potentially ensure revenue is generated for all solar electricity generation. We may also generate revenue from the receipt of interest, fees, capital gains and distributions from investments in our target assets.

Our PPAs, when structured with utilities and other large commercial users of electricity, are generally long-term in nature, tied to 100% of the output of the specific generating asset, and priced at a rate established pursuant to a formula set by the agreement. The formula is often dependent upon the type of subsidies, if any, offered by the local and state governments for project development. Although we focus on projects with long-term contracts that ensure price certainty, we also look for projects with shorter term arrangements that will allow us to participate in market rate changes which could lead to higher current income.

3

Certain projects are structured as “behind the meter” systems in residential, commercial and/or or municipal installations. Under the agreements, all electricity generated is purchased by the off-taker at an agreed-upon rate that could be set at a slight discount to the equivalent retail electric tariff rate for the off-taker. These agreements also typically provide for annual rate increases over the term of the agreement although that is not a necessary requirement. The behind the meter agreement is generally long-term in nature and further typically provides that, should the off-taker fail to fulfill its contractual obligations, any electricity that is not purchased by the off-taker may be sold to the local utility, usually at an equivalent wholesale spot electric rate.

4

We have structured some of our investments in residential solar assets with a similar commercial arrangement to that of the PPAs with utilities and other large commercial users of electricity for our energy projects, as described above. We also acquired residential solar assets which have a private purchase agreement with the residential homeowner as counterparty as well as leasing the solar assets to a residential owner on a long-term basis where the residential owner directly receives the benefit of the electricity generated. In our residential solar asset portfolio, we have a combination of long-term homeowner PPAs and leases.

We currently finance energy efficiency projects, which seek to enable residential customers, businesses and governmental organizations to consume less energy while at the same time providing the same or greater level of amenity. Financing for energy efficiency projects is generally used to pay for energy efficiency retrofits of buildings, homes, businesses, and replacement of other inefficient energy consuming assets with more modern technologies. These projects are structured to provide predictable long-term cash flows by receiving a portion of the energy savings and the potential sale of associated RECs and EECs generated by such installations. In each of our renewable energy and energy efficiency investments, we intend, where appropriate, to maximize the benefits of renewable portfolio standards or RPS as well as other U.S. federal, state and local government support and incentives for the renewable energy industry.

The table below sets forth the company’s investments in alternative energy generation portfolios as of December 31, 2018.

| Acquisition Date | Classification | Location(s) | Form of Investment*** | Cost**/Principal Amount* | Assets | Generation Capacity in (MW)* | ||||||||||||

| East to West Solar Portfolio | First quarter 2015, Second quarter 2015, Fourth quarter 2015, Second quarter 2018 | Commercial Solar | Colorado, Connecticut, Florida, Hawaii, Indiana and North Carolina | 100% equity ownership | $ | 37,079,887 | Commercial ground and roof mounted photovoltaic systems | 26.20 | ||||||||||

| Foresight Solar Portfolio | Fourth quarter 2017 | Commercial Solar | California, Colorado | Managing member, majority equity owner | $ | 13,650,000 | Commercial ground and roof mounted photovoltaic systems | 10.00 | ||||||||||

| Golden Horizons Solar Portfolio | Fourth quarter 2017 | Commercial Solar | California | 100% equity ownership | $ | 9,400,000 | Commercial ground and roof mounted photovoltaic systems | 7.79 | ||||||||||

| Green Maple Portfolio | Fourth quarter 2014, Fourth quarter 2015 | Commercial Solar | Vermont | 100% equity ownership | $ | 17,582,823 | Commercial ground and roof mounted photovoltaic systems | 7.39 | ||||||||||

| Magnolia Sun Portfolio | Third quarter 2015, First quarter 2016 | Commercial Solar | California, Massachusetts and Tennessee | 100% equity ownership | $ | 10,775,000 | Commercial ground and roof mounted photovoltaic systems | 5.30 | ||||||||||

| Midway III Solar Portfolio | Fourth quarter 2017 | Commercial Solar | California | Managing member, majority equity owner | $ | 11,552,904 | Commercial ground and roof mounted photovoltaic systems | 26.00 | ||||||||||

| Raleigh Portfolio | Third quarter 2017 | Commercial Solar | North Carolina | Managing member, majority equity owner | $ | 20,822,198 | Commercial ground and roof mounted photovoltaic systems | 27.83 | ||||||||||

| Six States Solar Portfolio | Fourth quarter 2015, Third quarter 2017 | Commercial Solar | Arizona, California, Colorado, Connecticut, Indiana and North Carolina | 100% equity ownership | $ | 12,470,306 | Ground and roof mounted solar systems | 12.97 | ||||||||||

| Sun Farm Portfolio | Fourth quarter 2018 | Commercial Solar | North Carolina | Managing member, majority equity owner | $ | 10,514,960 | Commercial ground and roof mounted photovoltaic systems | 13.94 | ||||||||||

| Sunny Mountain Portfolio | Third quarter 2014 | Commercial Solar | Colorado | 100% equity ownership | $ | 884,578 | Commercial and residential ground and roof mounted solar photovoltaic systems | 0.80 | ||||||||||

| Canadian Northern Lights Portfolio | Fourth quarter 2014, Fourth quarter 2015 | Residential Solar | Ontario, Canada | 100% equity ownership | $ | 1,603,136 | Residential rooftop mounted solar photovoltaic systems | 0.60 | ||||||||||

| Enfinity Colorado DHA Portfolio | First quarter 2017 | Residential Solar | Colorado | 100% equity ownership | $ | 1,400,000 | Residential rooftop mounted solar photovoltaic systems | 2.51 | ||||||||||

| Greenbacker Residential Solar Portfolio | Third quarter 2016, First quarter 2017, Second quarter 2017 | Residential Solar | Arizona, California, Connecticut, Hawaii, Maryland, Massachusetts, New Jersey and New York | 100% equity ownership or managing member, majority equity owner | $ | 28,100,000 | Residential rooftop mounted solar photovoltaic systems | 18.56 | ||||||||||

| Greenbacker Residential Solar Portfolio II | Second quarter 2017 | Residential Solar | Arizona, California, Connecticut, Maryland, Massachusetts, Nevada, New Jersey and New York | Managing member, majority equity owner | $ | 6,400,000 | Residential rooftop mounted solar photovoltaic systems | 10.22 | ||||||||||

| Greenbacker Wind Portfolio - California | Fourth quarter 2017 | Wind | California | 100% equity ownership | $ | 9,500,000 | Operating wind power facilities | 6.00 | ||||||||||

| Greenbacker Wind Portfolio - Idaho | Second quarter 2017 | Wind | Idaho | 100% equity ownership | $ | 7,320,000 | Operating wind power facilities | 10.50 | ||||||||||

| Greenbacker Wind Portfolio - Montana | Fourth quarter 2015, Fourth quarter 2016 | Wind | Montana | Managing member, equity owner | $ | 21,709,487 | Operating wind power facilities | 35.00 | ||||||||||

| Greenbacker Wind Portfolio - Vermont | Fourth quarter 2017 | Wind | Vermont | 100% equity ownership | $ | 24,917,193 | Operating wind power facilities | 10.00 | ||||||||||

| Colorado CSG Solar Portfolio | First quarter 2018 | Pre-Operational Assets | Colorado | Managing member, equity owner | $ | 27,333,205 | Ground and roof mounted solar systems | 25.20 | ||||||||||

| Phoenix Solar Portfolio | Fourth quarter 2018 | Pre-Operational Assets | Maryland | 100% equity ownership | $ | 9,964,515 | Commercial ground and roof mounted photovoltaic systems | 10.89 | ||||||||||

| SE Solar Portfolio | Fourth quarter 2018 | Pre-Operational Assets | North Carolina | 100% equity ownership | $ | 7,178,207 | Commercial ground and roof mounted photovoltaic systems | 21.70 | ||||||||||

| Turquoise Solar Portfolio | Fourth quarter 2018 | Pre-Operational Assets | Nevada | 100% equity ownership | $ | 5,877,188 | Commercial ground and roof mounted photovoltaic systems | 60.00 | ||||||||||

| Other Portfolios | Third quarter 2018 Fourth quarter 2018 | Other Investments**** | California, Colorado, & North Carolina | 100% equity ownership | $ | 1,279,273 | Commercial ground and roof mounted photovoltaic systems & Biomass facility | N/A | ||||||||||

| GREC Energy Efficiency Portfolio | Third quarter 2015 | Energy Efficiency | Puerto Rico | Capital lease | $ | 447,885 | Energy efficiency LED lighting | N/A | ||||||||||

| Renew AEC One, LLC | Fourth quarter 2015 | Energy Efficiency | Pennsylvania | Secured loan | $ | 551,640 | Energy efficiency LED lighting | N/A | ||||||||||

* Approximate

** Does not include assumed project level debt

*** 100% Equity ownership, majority equity owner (≥50%), equity owner (<50%), Managing Member of the Limited Liability Company, secured loan or a capital lease

**** Includes pre-acquisition and due diligence expenses

5

The investments described above have allowed us to execute on our strategy of constructing a portfolio of projects offering predictable power generation characteristics and generally stable income streams which includes seasonal solar generation income (generally stronger in the summer months), wind generation income (generally stronger in the winter months), and energy efficiency lights investments.

The LLC conducts a significant portion of its operations through GREC, of which the LLC is the sole shareholder, holding both shares of common stock and the special preferred stock. We intend to continue to operate our business in a manner permitting us to maintain our exemption from registration under the Investment Company Act of 1940, as amended (the "Investment Company Act"). We are not a blank check company within the meaning of Rule 419 of the Securities Act of 1933, as amended (the "Securities Act") and have no specific intent to engage in a merger or acquisition in the next 12 months.

Pursuant to a Registration Statement on Form S-1 (File No. 333-211571), we are offering on a continuous basis up to $1,000,000,000 in shares of our limited liability company interests, consisting of up to $800,000,000 of shares in the primary offering and up to $200,000,000 of shares pursuant to the DRP. The primary offering is expected to terminate on or before April 30, 2019. SC Distributors, LLC is the dealer manager for the current offering. The company’s initial offering pursuant to a Registration Statement on Form S-1 (File No. 333-178786-01) terminated on February 7, 2017.

After the finalization of the December 31, 2018 net asset value, the current offering price of the Class A shares is $9.626 per share, the current offering price of the Class C shares is $9.007 per share, the current offering price of the Class I shares is $8.842 per share, the current offering price of the Class P-A shares is $9.501 per share, and the current offering price of the Class P-I shares is $8.761 per share.

As of December 31, 2018 and December 31, 2017, through initial purchases of shares and participation in the DRP program, our advisor owned 23,601 shares. The affiliate of our advisor redeemed all of its shares during the year ended December 31, 2017 and no longer owns shares.

As of December 31, 2018, we had received subscriptions for and issued 38,319,164 of our shares (including shares issued under the DRP) for gross proceeds of $360,420,438 (before dealer-manager fees of $4,075,482 and selling commissions of $13,596,582 for net proceeds of $342,748,374). As of December 31, 2017, we had received subscriptions for and issued 24,008,372 of our shares (including shares issued under the DRP) for gross proceeds of $230,720,821 (before dealer-manager fees of $3,242,439 and selling commissions of $11,160,498 for net proceeds of $216,317,884).

OUR ADVISOR

GCM, a private firm that is registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the "Advisers Act"), serves as our advisor. Under the direction of our board of directors, GCM manages our day-to-day operations and provides advisory and management services to us.

Led by its Chief Executive Officer, David Sher, who has over 10 years of experience in the energy infrastructure and project finance sector and in excess of 25 years of experience in the financial services sector, its President and Chief Investment Officer, Charles Wheeler (Mr. Wheeler also serves as our President and board of directors’ member, as well as President, CEO and as a director of GREC), who has greater than 30 years of experience in the energy infrastructure and project finance sector as well as the financial services sector, its Chief Financial Officer, Richard Butt, who has 10 years of experience in the energy infrastructure and project finance sector and over 35 years of experience in the financial services sector, and Managing Director Spencer Mash, who has 8 years of experience in energy infrastructure and over 10 years in the financial services sector, and Director Mehul Mehta, who brings over 10 years of experience in energy finance, GCM’s management team has in excess of 50 years of experience in the energy, infrastructure, and project finance sectors and over 90 years of experience in the financial services sector. Over this time, they have developed significant commercial relationships across multiple industries that we believe will benefit us as we implement our business plan. GCM maintains comprehensive renewable energy, project finance, and capital markets databases and has developed proprietary analytical tools and due diligence processes that will enable GCM to identify prospective projects and to structure transactions quickly and effectively on our behalf. Neither GCM, Greenbacker Group LLC nor our senior management team have previously sponsored any other programs, either public or non-public, or any other programs with similar investment objectives as us.

6

We will continue to capitalize on the significant investing experience of our advisor’s management team, including the 30+ years of investment banking and renewable energy expertise of Charles Wheeler, our Chief Executive Officer and President, and the Chief Investment Officer and President of GCM. Mr. Wheeler has held various senior positions with Macquarie Group, including Head of Financial Products for North America and Head of Renewables for North America. While serving as Head of Renewables for North America, Mr. Wheeler’s experience included evaluating wind project developers, solar asset acquisitions, assisting in the development of wind and solar greenfield projects, and assisting in the preparation of investment analyses for a biomass facility. Before moving to the United States to serve as Head of Financial Products for Macquarie Group in North America, Mr. Wheeler was a Director of the Financial Products Group in Australia with responsibility for the development, distribution and ongoing management of a wide variety of retail financial products, including Real Estate Investment Trusts, infrastructure bonds, international investment trusts and diversified domestic investment trusts. Mr. Wheeler brings his extensive background in renewable energy and project and structured finance to help us effectively execute our strategy.

7

GCM’s Chief Executive Officer, David Sher has extensive experience in the financial services and capital markets industries as well as significant successful entrepreneurial experience. Mr. Sher was previously a senior adviser at Prospect Capital Corporation, a mezzanine debt and private equity firm that manages a publicly traded, closed-end, dividend-focused business development company. Prior to joining Prospect, Mr. Sher was a serial entrepreneur, founding a number of ventures in the financial services and brokerage industry. Mr. Sher was a founder and Managing Director of ESP Technologies, a leading provider of financial software and services to institutional asset managers and hedge funds. Prior to ESP, Mr. Sher was a founder and CEO of an online brokerage company, ElephantX dot com Inc. He was also co-founder of Lafayette Capital Management LLC, a statistical arbitrage hedge fund, and spent six years at The Bear Stearns and Company, Inc. where he developed trading ideas and strategies for institutional and brokerage correspondent clearing customers.

Together with Charles Wheeler and David Sher, Richard Butt is an integral part of GCM’s management team with extensive experience in the investment management industry. Over the course of his 35+ year career, Mr. Butt has held a variety of senior management positions for global investment and financial institutions. Most recently, from July 2012 to August 2013, he served as President and Chief Executive Officer of P3 Global Management LLC, a firm focused on investing in municipal infrastructure assets. From August 2006 to January 2011, he served as President of Macquarie Capital Investment Management LLC., with offices in New York and Sydney, Australia, responsible for administration, operations, finance, compliance, treasury, marketing, business operations and FX/cash management for portfolios domiciled in North America, Australia, Asia, Europe and the Caribbean. In addition, Mr. Butt served as Chief Financial and Accounting Officer for Macquarie Global Infrastructure Fund, a New York Stock Exchange listed closed end fund (NYSE: MGU). Prior to joining Macquarie, Mr. Butt served as President of Refco Alternative Investments LLC and Refco Fund Holdings LLC, the commodity pool businesses associated with Refco, Inc., from January 2003 to August 2006. In this capacity, Mr. Butt was responsible for the initial development and ongoing operations of numerous public and private commodity pools. During the period from 1990 through 2003, he served in various operational and financial capacities with multiple mutual/hedge fund third party administration firms. Earlier in his career, he served as Vice President at Fidelity Investments, where he was responsible for fund accounting and financial reporting for all equity and global mutual funds. Mr. Butt is a Certified Public Accountant (Inactive) previously working at major accounting firms such as PricewaterhouseCoopers LLP, from July 1978 to July 1984, where he was an Audit Manager, and KPMG from December 1994 to October 1996, where he was a Director in their financial services consulting practice. Mr. Butt holds a Bachelor’s degree in Management Science from Duke University.

Spencer Mash, who is responsible for analyzing all potential asset acquisitions, has extensive experience in structuring, modeling, performing diligence for, and executing transactions such as mergers and acquisitions, investments in private debt securities and bankruptcy restructurings. Prior to joining GCM, from 2010 to 2011, Mr. Mash was employed by TM Capital Corp., a boutique investment bank where he focused on sell side mergers and acquisitions assignments and bankruptcy restructurings. From 2008 to 2009, Mr. Mash was an investment analyst at Gandhara Capital LTD, a long/short hedge fund investing in global large cap public equity. From 2005 to 2008, Mr. Mash was employed by Deerfield Capital Management in its Leveraged Finance Group. Mr. Mash’s duties included performing in-depth due diligence and financial analyses, negotiating loan documentation and monitoring for over 20 investments in private middle market first lien, second lien, mezzanine and one-stop senior secured debt investments. From 2003 to 2005, Mr. Mash was an analyst at Bank of America Merrill Lynch, where he analyzed, structured and marketed financial sponsor- and mergers and acquisitions-related leveraged loan and high yield securities.

Mehul Mehta, who is responsible for investment origination, has extensive experience in structuring, modeling, performing diligence for energy finance. He has served as a Vice President of GCM since June 2016 bringing with him 10 years of experience within energy finance, working in a wide variety of roles and functions over that period. From 2015 to 2016 Mehul worked at BlackRock Infrastructure Investment Group as an Associate within the Global Renewable Power team, helping structure and execute investments into the North American renewable power space. Prior to this role, he worked at UBS within the equity research department helping cover alternative energy and semiconductor capital equipment companies, working on a team consistently ranked as a top research team by Institutional Investor. From 2012 to 2014 he worked at Recurrent Energy, a leading solar developer, where he worked in Business Planning and Analysis, helping the company COO oversee development, construction, and operations of solar assets and in the Originations group helping to analyze deals for bidding and executing Power Purchase Agreements. Mehul began his career as a power and natural gas options trader, first at Bank of America Merrill Lynch from 2006 to 2009 and later from 2009 to 2010 at Hess Energy Trading Company (now Hartree, a part of Oaktree Investments). Mehul received his BA in Mathematics and Economics from New York University and his MBA from Yale University.

8

INVESTMENT COMMITTEE OF OUR ADVISOR

Our advisor utilizes an internal investment committee to oversee the implementation of our investment strategy and to govern multiple aspects of our portfolio. The investment committee, among other things:

| ● | determines the composition of our portfolio, the nature and timing of the changes to our portfolio and the manner of implementing such changes; |

| ● | identifies, evaluates and negotiates the structure of the investments we make (including performing due diligence on our prospective projects); |

| ● | closes and monitors the investments we make; and |

| ● | assists in the preparation of requests to members. |

The investment committee is comprised of Charles Wheeler, who also serves as President of the company, and President and Chief Investment Officer of our advisor and a member of our board of directors, David Sher, who serves as Chief Executive Officer of our advisor and is a member of our board of directors, and Robert Brennan, who serves as Co-Chairmen of Greenbacker Group, LLC. All investments are required to be unanimously approved by the GCM investment committee prior to consideration and approval by the company.

OVERVIEW OF SIGNIFICANT GOVERNMENT INCENTIVES

The renewable energy and energy efficiency sector attracts significant U.S. federal, state and local government support and incentives to address technical barriers to the deployment of renewable energy and energy efficiency technologies and to promote the use of renewable energy and energy saving strategies. These U.S. federal, state and local government incentives have historically functioned to increase (1) the revenue generated by, and (2) the equity returns available from, renewable energy projects. Energy efficiency projects are also eligible to receive government incentives at the U.S. federal, state and local levels that can be applied to offset project development costs. Governments in other jurisdictions also provide several types of incentives.

Corporate entities are eligible to receive benefits through tax credits, such as PTCs, ITCs, tax deductions, accelerated depreciation and U.S. federal grants and loan guarantees (from the U.S. Department of Energy, for instance), as described below.

The following is a description of certain U.S. federal and state government incentives, which we may utilize in executing our business strategy.

U.S. Federal Incentives

The impacts of the Tax Cuts and Jobs Act of 2017 (the "TCJA") that are effective for tax years beginning January 1, 2018 include updates concerning depreciation that have been assessed by our advisor’s management team and are highlighted in the sections below.

Corporate Depreciation: Modified Accelerated Cost Recovery System ("MACRS"). Under MACRS, owners of renewable energy and some energy efficiency projects can recover capital invested through accelerated depreciation, which reduces the payment of corporate tax. Bonus depreciation under Section 168(k) of the Internal Revenue Code of 1986, as amended (the "Internal Revenue Code") is extended and modified. Businesses can now immediately deduct 100% of the cost of eligible property in the year it is placed in service, through 2022. Also, the TCJA eliminated the rule that made bonus depreciation available only for new property. The changes in the TCJA provide more flexibility than the current bonus depreciation rules in that they permit a taxpayer to depreciate an asset that is not new; however, the asset must be acquired from a third party in an arm’s-length sale.

Production Tax Credits. PTCs are provided to owners of certain renewable energy projects that produce electricity for sale to unrelated persons. This credit is applicable for a 10-year period from the time a project is placed into service and benefits owners with tax liabilities against which to claim the tax credit. As part of the federal tax extenders legislation passed in December 2015, the 2.3 cent-per kilowatt hour PTC for wind has been extended through 2016 and 2.4 cent-per kilowatt hour for 2017 and 2018. Projects that begin construction in 2017 will see a 20% reduction in the incentive. The PTC will then drop 20% each year through 2019 then 100% reduction beginning in 2020 and thereafter. This provision was unaltered by the TCJA.

9

Investment Tax Credits. ITCs provide that eligible systems, such as solar systems and fuel cell systems, receive a credit of 30% of the eligible cost-basis with no maximum limit. This credit is currently structured as a tax credit, whereby the owners of a qualifying renewable energy or energy efficient project can receive the tax credit once the project is placed into service. Also, under the federal tax extenders legislation passed in December 2015, the 30% ITC for solar energy will be extended for another three years. It will then ramp down incrementally through 2021, and remain at 10% permanently beginning in 2022. This provision was unaltered by the TCJA.

State Incentives

Renewable Portfolio Standards. RPSs, while varying based on jurisdiction, specify that a portion of the power utilized by local utilities must be derived from renewable energy sources. Currently, according to the U.S. Energy Information Administration’s (“EIA”) Annual Energy Outlook 2019, more than 30 state and territorial governments have enacted RPS programs, set mandates, or set goals that require utilities to include or obtain a minimum percentage of their energy from specific renewable energy sources. Under the RPS programs, utilities can (1) build or own renewable energy generation facilities, (2) purchase energy or RECs generated from renewable energy generation facilities, or (3) pay a penalty for any shortfalls in meeting the RPS.

Renewable Energy Certificates. RECs (or EECs) are used in conjunction with compliance with an RPS program or as tradable certificates that represents a certain number of kilowatt hours of energy that have been generated by a renewable source or that have been saved by an energy efficiency project, which provide further support to renewable energy initiatives. RECs are produced in conjunction with the generation of renewable energy and can used for state RPS compliance, traded or sold to load-serving entities or to third parties, brokers and other market makers for investment purposes. Many states have specific compliance carve-outs for different types of renewable generation.

Feed-In Tariffs. Certain U.S. states and provinces of Canada have implemented feed-in tariffs ("FITs") that entitle the renewable energy producer to enter into long-term contracts pursuant to which payment is based on the cost of generation for the diverse types of renewable energy projects. In addition to differences in FITs based on the type of project, FITs vary based on projects in various locations, such as rooftops or ground-mounted for solar PV projects, different sizes, and different geographic regions. FITs are available to anyone including homeowners, business owners, farmers, as well as private investors. The tariffs are typically designed to ratchet downward over time to both track and encourage technological change.

Tax Reform

The TCJA was enacted on December 22, 2017. ASC 740, Accounting for Income Taxes, required companies to recognize the effect of tax law changes in the period of enactment even though the effective date for most provisions was for tax years beginning after December 31, 2017, or in the case of certain other provisions, January 1, 2018. We have completed our assessment during 2017.

The major provisions under the Act and impact are discussed below:

Corporate Tax Rate

The law reduced the corporate tax rate to 21% effective December 22, 2017. A company must remeasure its deferred tax assets and liabilities to reflect the effects of enacted changes in tax laws or rates at the date of enactment, i.e., the date the President signed the law, even though the changes may not be effective until future periods. The effect of the remeasurement was reflected in the period ending December 31, 2017 and was allocated directly to income tax expense (benefit) included in Net Investment Income.

10

Repatriation of existing earnings and profits

Under the Act, a company’s foreign earnings and profits (E&P) accumulated in controlled foreign corporations (CFCs) under legacy tax laws are deemed repatriated for the last taxable year of a CFC that begins before January 1, 2018. E&P are determined as the higher of the balance at November 2 or December 31, 2017. The tax on those deemed repatriated earnings is no longer indefinitely deferred but may be paid over eight years with no interest charged:

| — | 8% in each of Years 1 to 5; |

| — | 15% in Year 6; |

| — | 20% in Year 7; and |

| — | 25% in Year 8. |

The Company has one Canadian CFC. This CFC has negative E&P at the end of 12/31/2018. As such, no mandatory repatriation is required.

Cost Recovery

Under the Act, a company can expense 100% of investments in depreciable property other than real property or certain utility property and certain businesses with floor plan indebtedness. The new rules apply to original or used property. The new rules apply to investments after September 27, 2017 and before January 1, 2023 and will phase-out beginning January 1, 2023 through December 31, 2026.

The Company expects to opt out of the 100% deduction on its eligible assets acquired in 2018 and 2019.

Interest Expense Limitation

Under the Act, effective January 1, 2018, a company can only deduct interest expense up to the amount of business interest income plus 30% of "adjusted taxable income". For taxable years beginning after December 31, 2017 and before January 1, 2022, the definition of adjusted taxable income is computed without regard to the deduction for depreciation, amortization, or depletion. Beginning in 2022, depreciation, amortization, and depletion must be considered when calculating adjusted taxable income. The disallowed interest expense can be carried forward indefinitely. Certain businesses with average gross receipts of $25 million or less are exempt from the rule.

Since the Company reports depreciation as cost of goods sold for tax purposes, we cannot addback the depreciation expense in calculating the adjusted taxable income. Based on our analysis of the adjusted taxable income calculation we do not expect to be subject to the interest expense limitation.

Net Operating Losses (NOL)

Under the Act, for NOLs generated after December 31, 2017, it can only offset up to 80% of taxable income. The unused NOL can be carried forward indefinitely. The NOL generated before January 1, 2018 remains subject to the old rules (i.e., 100% utilization and 20-year expiration). When scheduling out NOL utilization for the valuation reserve analysis, the Company applied the currently in force NOL limitation rules.

The Company expects to generate adequate future net income within the twenty-year carryforward period to utilize all pre-2017 Federal NOLs and to utilize all post 2018 Federal NOLs with an indefinite carryforward period, as well as using all current State NOL carryforwards except for Montana.

ENVIRONMENTAL REGULATION

Various U.S. federal, state and local permits are required to construct renewable energy and energy efficiency projects. The projects in which we invest must conform to all applicable environmental regulations and codes, including those relating to the discharge of materials into the air, water and ground, which will vary from place to place and time to time, as well as based on the type of renewable energy asset involved in the project.

We seek to purchase, finance or otherwise invest in projects that are at least "shovel ready," meaning that all, or substantially all, planning, engineering and permitting, including all major permits and approvals from local and state regulatory agencies, are in place and construction can begin immediately or upon receipt of certain final permits that must be obtained immediately prior to construction. However, the projects in which we invest may incur significant costs in the ordinary course of business related to operations, maintenance and continued compliance with these laws, regulations and permit requirements.

11

Failure to comply with these laws, regulations and permit requirements may result in administrative, civil and criminal penalties, imposition of investigatory, cleanup and site restoration costs and liens, denial or revocation of permits or other authorizations and issuance of injunctions to limit or cease operations. In addition, claims for damages to persons or property have been brought and may in the future result from environmental and other impacts of the activities of our projects.

COMPETITION

Although we believe there is currently a capital shortage in the renewable energy sector, we will still compete for projects with other energy corporations including investment funds (including private equity funds and mezzanine funds), traditional financial services companies such as commercial banks and other sources of funding, as well as utilities and other producers of electricity. Moreover, alternative investment vehicles also make investments in renewable energy projects. Our competitors may be substantially larger and have considerably greater financial, technical and marketing resources than we do.

STAFFING

We do not have any employees. Our day-to-day investment operations are managed by GCM. In addition, pursuant to an administration agreement with Greenbacker Administration, it provides us with administrative services including accounting, compliance and asset management services for all our investments. As of the date hereof, Greenbacker Administration has delegated certain of its administrative functions to U.S. Bancorp Fund Services, LLC. Greenbacker Administration may enter into similar arrangements with other third-party administrators as necessary in the future. While Greenbacker Administration performs the majority of asset management, accounting and oversight services for the company’s investments, it is anticipated that Greenbacker Administration will continue to delegate certain administrative functions to third parties for the LLC and GREC to recognize certain operational efficiencies for the benefit of the company.

ADVISORY AGREEMENT

Advisory Services

GCM, a private firm that is registered as an investment adviser under the Advisers Act, serves as our advisor. Under the direction of our board of directors, GCM manages our day-to-day operations and provides advisory and management services to us. Under the terms of our advisory agreement, GCM will, among other things:

| ● | determine the composition of our portfolio, the nature and timing of the changes to our portfolio and the manner of implementing such changes; |

| ● | identify, evaluate and negotiate the structure of the investments we make (including performing due diligence on our prospective projects); |

| ● | close and monitor the investments we make; and |

| ● | assist in the preparation of requests to members. |

Our advisor and its officers and employees currently spend substantially all their time and resources on us. Pursuant to our advisory agreement, officers and personnel of the advisor who provide services to us must comply with our code of business conduct and ethics, including the conflicts of interest policy included in the code of business conduct and ethics. However, GCM’s services under the advisory agreement are not exclusive, and it, and its members and affiliates, are free to furnish similar services to other entities so long as its services to us are not impaired.

The advisory agreement was initially approved by our board of directors and became effective on April 25, 2014. Unless earlier terminated, the advisory agreement will remain in effect for successive one-year periods if approved annually by a majority of our independent directors. The advisory agreement was most recently re-approved in February 2019, for a one-year period commencing April 24, 2019.

We may terminate the advisory agreement, without penalty, upon 60 days’ written notice. The decision to terminate the agreement may be made by a majority of our independent directors. In addition, GCM may terminate the advisory agreement with us upon 120 days’ written notice. If the advisory agreement is terminated or not renewed, we will pay our advisor accrued and unpaid fees and expense reimbursements, including any payment of subordinated fees, earned prior to termination or non-renewal of the advisory agreement. Furthermore, if the advisory agreement is terminated or not renewed, GCM will have no further obligation to incur offering expenses on behalf of the company and we will not have any further obligation to reimburse GCM for operating or offering expenses not reimbursed as of the date of the termination.

12

Pursuant to the advisory agreement, which has been approved by our board of directors, GCM is authorized to retain one or more sub-advisors with expertise in our target assets to assist GCM in fulfilling its responsibilities under the advisory agreement. However, GCM will be required to monitor any sub-advisor to ensure that material information discussed by management of any sub-advisor is communicated to our board of directors, as appropriate. If GCM retains any sub-advisor to assist it in fulfilling its responsibilities under the advisory agreement in the future, our advisor will pay such sub-advisor a portion of the fees that it receives from us. We will not pay any additional fees to a sub-advisor. While our advisor will oversee the performance of any sub-advisor, our advisor will remain primarily liable to us to perform all of its duties under the advisory agreement, including those delegated to any sub-advisor. No sub-advisors have been retained by GCM since inception of the advisory agreement.

Management Fee and Incentive Allocation and Distribution

Pursuant to an advisory agreement, we pay GCM a base management fee for advisory and management services. The base management fee is calculated at a monthly rate of 0.167% (2.00% annually) of our gross assets (including amounts borrowed). For services rendered under the advisory agreement, the base management fee is payable monthly in arrears. The base management fee is calculated based on the average of the values of our gross assets for each day of the prior month. Base management fees for any partial period are appropriately pro-rated.

GCM may elect to defer or waive all or a portion of the fees that would otherwise be paid to it in its sole discretion. Any portion of a deferred fee not taken as to any period will be deferred without interest and may be taken in any other period prior to the occurrence of a liquidity event as GCM may determine in its sole discretion.

In addition, the Special Unitholder, an entity affiliated with our advisor, holds the special unit in our company entitling it to an incentive allocation and distribution. Pursuant to the company’s amended and restated limited liability company agreement ("LLC Agreement"), the incentive allocation and distribution, or incentive distribution, is comprised of three parts as follows: The first part, the income incentive distribution, is calculated and payable quarterly in arrears based on our pre-incentive distribution net investment income for the immediately preceding fiscal quarter. For this purpose, pre-incentive distribution net investment income means (1) interest income, (2) dividend income from equity investments (but excluding that portion of distributions that are treated as a return of capital) and (3) any other income (including any other fees, such as commitment, origination, structuring, diligence and consulting fees or other fees that we receive, but excluding any fees for providing managerial assistance) accrued during the fiscal quarter, minus our operating expenses for the fiscal quarter (including the base management fee, expenses payable under the administration agreement with our Administrator, and any interest expense and distributions paid on any issued and outstanding indebtedness and preferred units of limited liability company interest, but excluding the incentive distribution). Pre-incentive distribution net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with pay in kind interest and zero-coupon securities), accrued income that we have not yet received in cash. If interest income is accrued but never paid, our board of directors would decide to write off the accrual in the fiscal quarter when the accrual is determined to be uncollectible in accordance with U.S. generally accepted accounting principles ("GAAP"). The write off would cause a decrease in interest income for the fiscal quarter equal to the amount of the prior accrual. GCM is not under any obligation to reimburse us for any part of the incentive distribution it received that was based on accrued income that we never receive as a result of a default by an entity on the obligation that resulted in the accrual of such income. Pre-incentive distribution net investment income does not include any realized capital gains, realized capital losses, unrealized capital appreciation or depreciation or any accrued income taxes and other taxes including, but not limited to, franchise, property, and sales taxes. Pre-incentive distribution net investment income, expressed as a rate of return on the value of our average adjusted capital at the end of the fiscal quarter will be compared to a "hurdle rate" of 1.75% per fiscal quarter (7.00% annualized). Our net investment income used to calculate this part of the incentive distribution is also included in the amount of our gross assets used to calculate the 2.00% annualized base management fee.

Adjusted capital shall mean: cumulative gross proceeds generated from sales of our shares and preferred units of limited liability company interests (including our distribution reinvestment plan) reduced for distributions to members of proceeds from non-liquidation dispositions of our assets and amounts paid for share repurchases pursuant to our share repurchase program. Average adjusted capital shall mean: the average value of the adjusted capital for the two most recently completed fiscal quarters.

13

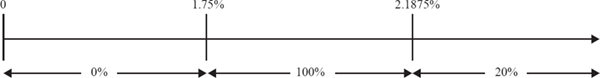

The Special Unitholder shall receive an incentive distribution with respect to our pre-incentive distribution net investment income in each fiscal quarter as follows:

| ● | no incentive distribution in any fiscal quarter in which our pre-incentive distribution net investment income does not exceed the “hurdle rate” of 1.75%; |

| ● | 100% of our pre-incentive distribution net investment income with respect to that portion of such pre-incentive distribution net investment income, if any, that exceeds the hurdle but is less than 2.1875% in any fiscal quarter (8.75% annualized with a 7% annualized hurdle rate). We refer to this portion of our pre-incentive distribution net investment income (which exceeds the hurdle but is less than 2.1875%) as the “catch-up.” The “catch-up” is meant to provide the Special Unitholder with 20% of our pre-incentive distribution net investment income as if a hurdle did not apply if this net investment income exceeds 2.1875% in any fiscal quarter; and |

| ● | 20% of the amount of our pre-incentive distribution net investment income, if any, that exceeds 2.1875% in any fiscal quarter (8.75% annualized with a 7% annualized hurdle rate) is distributed to the Special Unitholder (once the hurdle is reached and the catch-up is achieved, 20% of all pre-incentive distribution investment income thereafter is allocated to the Special Unitholder). |

The following is a graphical representation of the calculation of the income-related portion of the incentive distribution:

Quarterly Incentive Distribution Based on Net Investment Income

Pre-incentive distribution net investment income

(expressed as a percentage of the value of average adjusted capital)

Percentage of pre-incentive distribution net investment income allocated to the Special Unitholder

These calculations are appropriately prorated for any period of less than three months and adjusted for any share issuances or repurchases during the relevant quarter. You should be aware that a rise in the general level of interest rates can be expected to lead to higher interest rates applicable to our debt investments. Accordingly, an increase in interest rates would make it easier for us to meet or exceed the incentive distribution hurdle rate and may result in an increase of the amount of incentive distributions payable to the Special Unitholder with respect to pre-incentive distribution net investment income.

The second part of the incentive distribution, the capital gains incentive distribution, will be determined and payable in arrears as of the end of each fiscal quarter (or upon termination of the advisory agreement, as of the termination date) and will equal 20.0% of our realized capital gains, if any, on a cumulative basis from inception through the end of each fiscal quarter, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid capital gains incentive distributions. For purposes of calculating the foregoing: (1) the calculation of the incentive distribution shall include any capital gains that result from cash distributions that are treated as a return of capital, (2) any such return of capital will be treated as a decrease in our cost basis of an investment, and (3) all quarterly valuations will be determined by us in accordance with our valuation procedures. In determining the capital gains incentive distribution to which the Special Unitholder may be entitled, we will calculate the aggregate realized capital gains, aggregate realized capital losses and aggregate unrealized capital depreciation, as applicable, with respect to each of our assets. For this purpose, aggregate realized capital gains, if any, will equal the sum of the differences between the net sales price of each investment, when sold or otherwise disposed, and the aggregate cost basis of such investment reduced by cash distributions that are treated as returns of capital. Aggregate realized capital losses will equal the sum of the amounts by which the net sales price of each investment, when sold or otherwise disposed, is less than the aggregate cost basis of such investment reduced by cash distributions that are treated as returns of capital. Aggregate unrealized capital depreciation will equal the sum of the difference, if negative, between the valuation of each investment as of the applicable date and the aggregate cost basis of such investment reduced by cash distributions that are treated as returns of capital. At the end of the applicable period, the amount of capital gains that serves as the basis for our calculation of the capital gains incentive distribution will equal the aggregate realized capital gains, excluding any accrued income taxes and other taxes including, but not limited to, franchise, property, and sales taxes associated with the sale or disposal of the asset, less aggregate realized capital losses and less aggregate unrealized capital depreciation with respect to our assets. If this number is positive at the end of such period, then the capital gains incentive distribution for such period will be equal to 20% of such amount, less the aggregate amount of any capital gains incentive distributions paid in all prior periods.

14

Because of the structure of the incentive distribution, it is possible that the Special Unitholder may be entitled to receive an incentive distribution in a fiscal quarter where we incur a loss. For example, if we receive pre-incentive distribution net investment income in excess of the hurdle rate for a fiscal quarter, we will make the applicable income incentive distribution even if we have incurred a loss in that fiscal quarter due to realized or unrealized losses on our investments.

The third part of the incentive distribution, which we refer to as the liquidation incentive distribution, will equal 20.0% of the net proceeds from a liquidation of our company in excess of adjusted capital, as calculated immediately prior to liquidation. In the event of any liquidity event that involves a listing of our shares, or a transaction in which our members receive shares of a company that is listed, on a national securities exchange, if that liquidity event produces a listing premium (which we define as the amount, if any, by which our listing value following such liquidity event exceeds the adjusted capital, as calculated immediately prior to such listing), the liquidation incentive distribution, which will equal 20% of any listing premium, will be determined and payable in arrears 30 days after the commencement of trading following such liquidity event. To calculate this distribution, our “listing value” will be the product of: (i) the number of listed shares and (ii) average closing price per share over the 30 trading-day period following such liquidity event. To calculate the listing premium, any cash consideration received by members in connection with any such liquidity event will be included in (as an addition to) our listing value. If the members receive non-listed securities as full or partial consideration with respect to any listing, no value will be attributed to such non-listed securities.

The liquidation incentive distribution is payable in cash or shares, or in any combination thereof.

Upon the occurrence of (1) non-renewal of the advisory agreement upon the expiration of its then current term; (2) termination of the advisory agreement for any reason under circumstances where an affiliate of Greenbacker Group LLC does not serve as the advisor under any replacement advisory agreement; or (3) resignation of GCM under the advisory agreement, which we refer to as a “trigger event”, we will have the right, but not the obligation, to repurchase the special unit or the special preferred stock, as applicable, at the fair market value of the special unit or the special preferred stock on the date of termination, as determined by an independent appraiser. In such event, the purchase price will be paid in cash or shares of limited liability company interests, at the option of the Special Unitholder. We must purchase any such interests within 120 days after giving the Special Unitholder written notice of our desire to repurchase the special unit or the special preferred stock. If the advisory agreement is terminated or not renewed, we will pay our advisor accrued and unpaid fees and expense reimbursements, including any payment of subordinated fees, earned prior to termination or non-renewal of the advisory agreement.

Examples of Quarterly Incentive Distribution Calculation

Example 1: Income Related Portion of Incentive Distribution:

Alternative 1

Assumptions

Investment income (including interest, distributions, fees, etc.) = 1.25% Hurdle rate(1) = 1.75%

Management fee(2) = 0.500%

Other operating expenses (i.e. legal, accounting, custodian, transfer agent, etc.) = 0.20%

Pre-incentive distribution net investment income

(investment income – (management fee + other operating expenses)) = 0.55%

Pre-incentive net investment income does not exceed hurdle rate, therefore there is no incentive distribution.

15

Alternative 2

Assumptions

Investment income (including interest, distributions, fees, etc.) = 2.70% Hurdle rate(1) = 1.75%

Management fee(2) = 0.50%

Other operating expenses (i.e. legal, accounting, custodian, transfer agent, etc.) = 0.20%

Pre-incentive distribution net investment income

(investment income – (management fee + other operating expenses)) = 2.00%

Pre-incentive net investment income exceeds hurdle rate, therefore there is an income incentive distribution payable by us to GCM.

| Incentive distribution | = 100% × pre-incentive distribution net investment income, subject to the “catch-up”(3) | |

| = 100% × (2.00 % – 1.75%) | ||

| = 0.25% |

Alternative 3

Assumptions

Investment income (including interest, distributions, fees, etc.) = 3.00% Hurdle rate(1) = 1.75%

Management fee(2) = 0.50%

Other operating expenses (i.e. legal, accounting, custodian, transfer agent, etc.) = 0.20%

Pre-incentive distribution net investment income

(investment income – (management fee + other operating expenses)) = 2.30%

Pre-incentive net investment income exceeds hurdle rate, therefore there is an income incentive distribution made to the Special Unitholder.

Incentive distribution = 20% × pre-incentive distribution net investment income, subject to “catch-up”(3)

Incentive distribution = 100% × “catch-up” + (20% × (pre-incentive distribution net investment income – 2.1875%)) Catch-up = 2.1875% – 1.75%

| = 0.4375% |

Incentive distribution = (100% × 0.4375%) + (20% × (2.3% – 2.1875%))

| = 0.4375% + (20% × 0.1125%) | |

| = 0.4375% + 0.0225% | |

| = 0.46% |

| (1) | Represents 7.00% annualized hurdle rate. |

| (2) | Represents 2.00% annualized management fee. |

| (3) | The “catch-up” provision is intended to provide the Special Unitholder with an incentive distribution of 20% on all our pre-incentive distribution net investment income as if a hurdle rate did not apply when our net investment income exceeds 2.1875% in any fiscal quarter. |

Example 2: Capital Gains Portion of Incentive Distribution:

Alternative 1

Assumptions

| ● | Year 1: $20 million investment made in company A (“Investment A”), and $30 million investment made in company B (“Investment B”) |

| ● | Year 2: Investment A sold for $50 million and fair market value (“FMV”) of Investment B determined to be $32 million |

| ● | Year 3: FMV of Investment B determined to be $25 million |

| ● | Year 4: Investment B sold for $31 million |

16

The capital gains portion of the incentive distribution would be:

| ● | Year 1: None |

| ● | Year 2: Capital gains incentive distribution of $6 million ($30 million realized capital gains on sale of Investment A multiplied by 20%) |

| ● | Year 3: None |

| ● | Year 4: Capital gains incentive distribution of $200,000 |

$6.2 million ($31 million cumulative realized capital gains multiplied by 20%) less $6 million (capital gains fee taken in Year 2)

Alternative 2

Assumptions

| ● | Year 1: $20 million investment made in company A (“Investment A”), $30 million investment made in company B (“Investment B”) and $25 million investment made in company C (“Investment C”) |

| ● | Year 2: Investment A sold for $50 million, FMV of Investment B determined to be $25 million and FMV of Investment C determined to be $25 million |

| ● | Year 3: FMV of Investment B determined to be $27 million and Investment C sold for $30 million |

| ● | Year 4: FMV of Investment B determined to be $35 million |

| ● | Year 5: Investment B sold for $20 million |

The capital gains incentive distribution, if any, would be:

| ● | Year 1: None |

| ● | Year 2: $5 million capital gains incentive distribution |

| ● | 20% multiplied by $25 million ($30 million realized capital gains on Investment A less $5 million unrealized capital depreciation on Investment B) |

| ● | Year 3: $1.4 million capital gains incentive distribution(1) |

$6.4 million (20% multiplied by $32 million ($35 million cumulative realized capital gains less $3 million unrealized capital depreciation)) less $5 million capital gains fee received in Year 2

| ● | Year 4: None |

| ● | Year 5: None |

$5 million (20% multiplied by $25 million (cumulative realized capital gains of $35 million less realized capital losses of $10 million)) less $6.4 million cumulative capital gains fee paid in Year 2 and Year 3

| (1) | As illustrated in Year 3 of Alternative 1 above, if we were to be wound up on a date other than December 31st of any year, we may have paid aggregate capital gains incentive distributions that are more than the amount of such fees that would be payable if we had been wound up on December 31 of such year. |

17

Example 3: Liquidation Incentive Distribution:

Alternative 1

Assumptions

| ● | Year 1: Gross offering proceeds total $85 million. $20 million investment made in company A (“Investment A”), $30 million investment made in company B (“Investment B”) and $25 million investment made in company C (“Investment C”). |

| ● | Year 2: Investment A sold for $25 million and all proceeds, net of any capital gains incentive distributions payable, are returned to members. FMV of Investment B determined to be $30 million and FMV of Investment C determined to be $27 million. |

| ● | Year 3: FMV of Investment B determined to be $31 million. FMV of Investment C Determined to be $20 million. |

| ● | Year 4: FMV of Investment B determined to be $35 million. FMV of Investment C determined to be $25 million. |

| ● | Year 5: Investments B and C sold in an orderly liquidation for total proceeds of $55 million. All proceeds, net of any capital gains incentive distributions payable, are returned to members. |

The capital gains incentive distribution, if any, would be:

| ● | Year 1: None |

| ● | Year 2: Incentive distribution on capital gains during operations of $1 million ($5 million realized capital gains on sale of Investment A multiplied by 20.0%). Adjusted capital now equals $61 million ($85 million gross proceeds less $24 million returned to members from the sale of portfolio investments). |

| ● | Year 3: None |

| ● | Year 4: None |

| ● | Year 5: No liquidation incentive distribution due—Liquidation proceeds of $55 million are less than adjusted capital immediately prior to liquidation ($61 million). |

Alternative 2

Assumptions

| ● | Year 1: Gross offering proceeds total $85 million. $20 million investment made in company A (“Investment A”), $30 million investment made in company B (“Investment B”) and $25 million investment made in company C (“Investment C”). |

| ● | Year 2: Investment A sold for $25 million and all proceeds, net of any capital gains incentive distributions payable, are returned to members. FMV of Investment B determined to be $30 million and FMV of Investment C determined to be $27 million. |

| ● | Year 3: FMV of Investment B determined to be $31 million. FMV of Investment C determined to be $20 million. |

| ● | Year 4: FMV of Investment B determined to be $35 million. FMV of Investment C determined to be $25 million. |

| ● | Year 5: Investments B and C sold in an orderly liquidation for total proceeds of $80 million. All proceeds, net of any capital gains incentive distributions payable, are returned to members. |

The capital gains incentive distribution, if any, would be:

| ● | Year 1: None |

18

| ● | Year 2: Incentive distribution on capital gains during operations of $1 million ($5 million realized capital gains on sale of Investment A multiplied by 20.0%). Adjusted capital now equals $61 million ($85 million gross proceeds less $24 million returned to members from the sale of portfolio investments). |

| ● | Year 3: None |

| ● | Year 4: None |

| ● | Year 5: $3.8 million liquidation incentive distribution—20.0% multiplied by liquidation proceeds ($80 million) in excess of adjusted capital immediately prior to liquidation ($61 million), or $19 million. |

Alternative 3 (If the liquidity event is a listing)

Assumptions

| ● | Year 1: Gross offering proceeds total $85 million. $20 million investment made in company A (“Investment A”), $30 million investment made in company B (“Investment B”) and $25 million investment made in company C (“Investment C”). |

| ● | Year 2: Investment A sold for $25 million and all proceeds, net of any capital gains incentive distributions payable, are returned to members. |

Incentive distribution on capital gains paid to GCM of $1 million ($5 million realized capital gains on sale of Investment A multiplied by 20.0%). Adjusted capital now equals $61 million ($85 million gross proceeds less $24 million returned to members from the sale of portfolio investments).

| ● | Year 3: No change in adjusted capital. |

| ● | Year 4: No change in adjusted capital. |

| ● | Year 5: All shares of the company are listed on a national securities exchange. The listing value is $85 million. |

The liquidation incentive distribution in this example would be: