UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

| For

the fiscal year ended | |

| or | |

| Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

For the transition period from to

Commission

File Number

(Exact Name of Registrant as Specified in Its Charter)

| (State or other jurisdiction of | (I.R.S. Employer | |

| Incorporation or organization) | Identification No.) |

(Address of Principal Executive Offices, including zip code)

(Registrant’s telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES ☐ ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

YES ☐ ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller

reporting company | |

| Emerging

growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.

YES

☐

The

aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, computed by reference to

the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of June 30, 2022 was

approximately $

At March 20, 2023, there were shares of the registrant’s common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

BIOSTAGE, INC.

TABLE OF CONTENTS

ANNUAL REPORT ON FORM 10-K

For the Year Ended December 31, 2022

INDEX

| i |

Forward-Looking Statements

This Annual Report on Form 10-K contains statements that are not statements of historical fact and are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 (the Exchange Act), each as amended. The forward-looking statements are principally, but not exclusively, contained in “Item 1: Business” and “Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements include, but are not limited to, statements about management’s confidence or expectations and our plans, objectives, expectations and intentions that are not historical facts and the potential impact of COVID-19 on our business and operations. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “seek,” “expect,” “plans,” “aim,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “intends,” “think,” “continue,” “potential,” “is likely,” “permit,” “objectives,” “optimistic,” “new,” “goal,” “target,” “strategy” and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We discuss many of these risks in detail under the heading “Item 1A. Risk Factors” beginning on page 24 of this Annual Report on Form 10-K. You should carefully review all of these factors, as well as other risks described in our public filings, and you should be aware that there may be other factors, including factors of which we are not currently aware, that could cause these differences. Also, these forward-looking statements represent our estimates and assumptions only as of the date of this Annual Report. We may not update these forward-looking statements, even though our situation may change in the future, unless we have obligations under the federal securities laws to update and disclose material developments related to previously disclosed information. Biostage, Inc. is referred to herein as “we,” “our,” “us,” and “the Company.”

| ii |

PART I

Item 1. Business.

OVERVIEW

We are a clinical-stage biotechnology company developing regenerative-medicine treatments for disorders of the gastro-intestinal system and the airway resulting from cancer, trauma or birth defects. Our technology is based on our proprietary cell-therapy platform that uses a patient’s own stem cells to regenerate and restore function to damaged organs. We believe that our technology represents a next-generation solution for restoring organ function because it allows the patient to regenerate their own organ, thus eliminating the need for human donor or animal transplants, the sacrifice of another of the patient’s own organs or permanent artificial implants.

In August 2017, we conducted the world’s first successful regeneration of the esophagus after the cancer in the patient’s esophagus had been surgically removed. This surgery was performed by Dr. Dennis Wigle, Chair of Thoracic Surgery at the Mayo Clinic. The results were published in the Journal of Thoracic Oncology Clinical and Research Reports in August 2021. The procedure demonstrated that our technology was able to successfully regenerate esophageal tissue, including the mucosal lining, to restore the integrity, continuity and functionality of the esophageal tube.

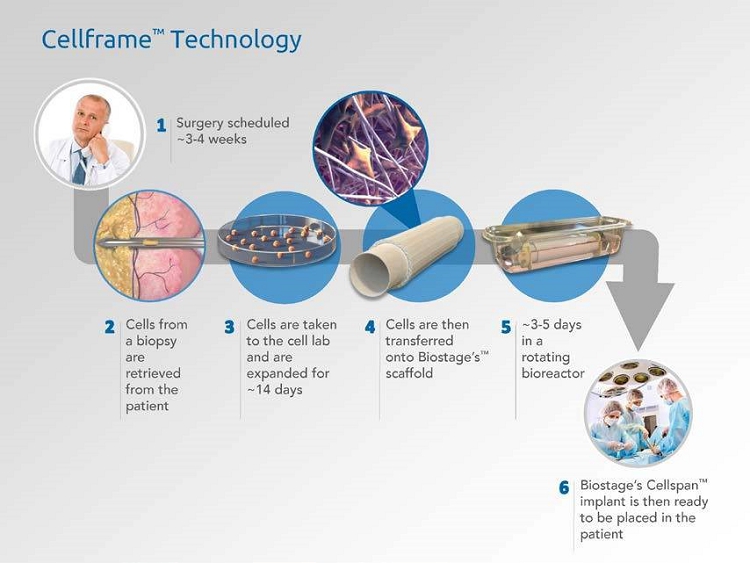

Our technology uses mesenchymal stem cells that are retrieved via biopsy from the patient’s abdominal adipose, or fat, tissue prior to surgery. These stem cells are isolated, expanded and then implanted on a hollow, tubular scaffold made from extremely thin fibers of polyurethane. The scaffold is then incubated in a customized bioreactor where the stem cells expand further and begin to adhere to the fibers of the scaffold. The finished graft is then surgically implanted to replace the resected portion of the damaged organ. Several weeks after surgery, once a conduit has been established, the implanted scaffold is removed. No permanent artificial implant remains in the body.

We are initially targeting regeneration of the organs of the gastro-intestinal tract and the airway, where organ transplants are not medically possible today. Human-donor organ transplants or animal xenotransplants are currently not performed for these organs due to high rates of rejection. Additionally, we believe that our technology and intellectual property will allow us to develop organ-regeneration treatments for other organs.

Based on our successful first-in-human procedure and our preclinical procedures in over 50 pigs, the U.S. Food and Drug Administration, or FDA has approved our Investigational New Drug (IND) application to begin a combined phase 1/2 clinical trial for esophageal regeneration. This open-label trial will assess both safety and efficacy in up to ten patients requiring up to a 6cm esophageal replacement for any reason, including cancer, at up to five U.S. hospitals. We have contracted with IQVIA, a leading global provider of advanced analytics, technology solutions and clinical research services to the life sciences industry, as the contract research organization (CRO) to manage our first clinical trial. We intend to initiate this trial in the second quarter of 2023.

Our product candidates are currently in development and have not yet received regulatory approval for sale anywhere in the world.

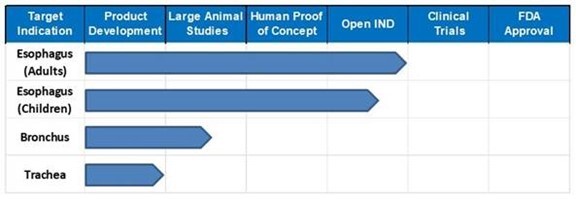

Our Pipeline

We believe our organ-regeneration technology has the potential for broad applications in the field of medicine, for the repair or replacement of diseased or damaged organs. We are initially targeting conditions of the esophagus, including cancer, traumatic injury and birth defects. Additional product candidates in our development pipeline include ones to treat cancer, injury and birth defects of the bronchus. Based on discussions with surgeons familiar with regenerative medicine techniques, we believe that our technology may also be applicable to treating cancer, injury and birth defects in the colon and intestine.

| 1 |

Our Strategy

Our strategy is to develop and advance our pipeline of products, beginning with our lead product for the treatment of esophageal cancer, through clinical development and commercialization. The key elements of our strategy include:

| ● | Initiate the phase 1/2 clinical trial for our lead product candidate, the BiostageTM Esophageal Implant, for the treatment of severe esophageal disease. Based upon our successful initial case of esophageal regeneration and our animal models, the FDA has approved our Investigational New Drug (IND) application to commence a clinical trial in up to ten patients. We plan to initiate this trial in early 2023. | |

| ● | Advance our other pipeline products through clinical development. Based on the establishment of a favorable safety and efficacy profile that we expect to demonstrate in our phase 1/2 clinical trial for regeneration of the esophagus, we intend to initiate a clinical trial for the treatment of esophageal atresia, a rare birth defect. As we build our safety and efficacy data, we plan to initiate clinical trials in other areas including cancer, injury and birth defects in the bronchus. | |

| ● | Develop our technology for use in other life-threatening conditions that have a relatively shorter time to market. We believe our technology has broad applications to treat organ failure. We intend to develop products focused on life-threatening conditions where current treatments are ineffective, expensive or both. Many organ failures are orphan diseases, and we have orphan drug designations from the FDA on our product candidates for severe disease in both the esophagus and the trachea. We believe that developing products for such conditions will require smaller clinical trials and an overall less expensive development pathway than developing treatments for less severe conditions. | |

| ● | Pursue development pathways in international markets. In addition to the U.S., we intend to pursue regulatory approval for our products in several key international markets, including China, Europe and the UK. Many of the conditions we are targeting have significantly higher patient populations in foreign countries than in the U.S., thereby making them attractive commercial markets. We intend to engage foreign health regulatory bodies to develop clinical and regulatory strategies to gain international approvals. | |

| ● | Collaborate with leading medical and research institutions to develop our products and build awareness. We intend to continue to collaborate with thought-leading medical institutions as we continue clinical development of our products and ultimately reach commercialization. We currently have a co-development initiative with the Mayo Clinic and with the Connecticut Children’s Medical Center. We intend to build additional partnerships and collaborations with leading institutions that we believe will help to drive awareness of our products and increase the likelihood of market adoption. |

The Problem

According to the American Cancer Society, every year approximately 17,000 Americans are diagnosed with esophageal cancer and approximately 15,000 of these diagnosed patients die from it. A year after being diagnosed with esophageal cancer, 50% of the patients have died. After five years, 80% of these patients have died. According to the World Health Organization’s International Agency for Research on Cancer, every year, there are more than 600,000 patients diagnosed with esophageal cancer worldwide.

The current treatment for patients with esophageal cancer is removal of the diseased part of the esophagus in a surgical procedure called an esophagectomy. The gap left by the removal of part of the esophagus is then repaired using one of two, difficult and expensive surgeries, both of which have frequent and significant complications. The first type of surgery is gastric pull-up. In this surgery, the patient’s stomach is reshaped into a tube and pulled up from the abdomen into the chest to connect to the top of the esophagus. With gastric pull-up, the patient no longer has a stomach with which to digest food. In the second type of surgery, termed colonic interposition, a piece of the patient’s bowel is cut out and used to bridge the gap where the diseased esophagus was removed. With colonic interposition, the patient often has insufficient intestine to digest food properly. Both surgical procedures have high rates of complications such as damage to the lungs and infections caused by leakage of stomach acids into the chest. Even with these surgical treatments, esophageal cancer is one of the deadliest forms of cancer.

| 2 |

In addition to cancer, there are other injuries to the esophagus such as fistulas (holes), injuries caused by the accidental ingestion of acids and alkalis, and birth defects. These are all difficult to treat surgically and often have significant long-term complications.

Hence, there is an enormous need for, and a huge market for, a better treatment for cancer, injuries and birth defects of the esophagus.

Our Solution – Biostage Organ-Regeneration Technology

Our organ-regeneration technology uses a patient’s own stem cells seeded on a temporary scaffold to regrow and restore their damaged organ. We believe our technology has numerous advantages over other attempts to restore organ function because our implant is not a transplant of a human-donor organ, it is not a transplant of an animal organ, it is not a piece of one of the patient’s other organs, and it is not an artificial implant that remains permanently in the body. Our implants will allow the patient to regenerate their own organ inside their own body.

Our esophageal implant consists of a hollow, tubular scaffold consisting of a thin polyurethane fiber mesh that is formed in the shape of the damaged section of the organ. This scaffold is seeded with the patient’s own mesenchymal stem cells which are obtained a few weeks before surgery through a biopsy of adipose (fat) tissue from the patient’s abdomen. The stem cells are isolated and expanded and then seeded onto the tubular scaffold. The scaffold is then be placed into a customized bioreactor for incubation and further cell expansion. During several days of incubation in our bioreactor, the stem cells attach to and grow into the outer 25% of the scaffold. The stem cell-seeded scaffold is then surgically implanted into the patient to bridge the gap created where diseased or damaged part of the esophagus was removed.

The stem cells then stimulate the body’s natural wound-healing process including stimulating new blood vessel formation, scar-tissue formation and the remodeling of that scar tissue into esophageal tissue. The scaffold guides the growth of new cells to regenerate the esophagus. After approximately one month, a complete biological tube, or conduit, has formed and after approximately three months, the tube has developed into a layered structure that contains the critical blood supply, muscles, and mucous-secreting glands to create a functioning esophagus. At this point, the implanted scaffold is removed, as it is not a permanent implant.

Our Technology Platform: How the Biostage Esophageal Implant Works

The bioreactor and scaffold are made in our clean-room facilities in Holliston, Massachusetts and the cell seeding is performed at the FDA-approved, clinical-grade human cell culture facility at the University of Texas Medical Branch.

| 3 |

Our manufacturing process for the bioreactors and scaffolds has been approved by the FDA for the clinical trial. Based on expected FDA inspections additional development may be necessary for product approval.

For our scaffolds, our primary materials are medical-grade plastic resins and solvents used to liquefy the resins in our manufacturing process. These materials are readily available from a variety of suppliers and do not currently represent a large proportion of our total costs. For our autoseeders and bioreactors, we perform final assembly and testing of components that we buy from third parties like machine shops, parts distributors, molding facilities and printed circuit board manufacturers. These manufacturing operations are performed primarily at our Holliston, Massachusetts headquarters.

Advantages of the Biostage Esophageal Implant

Compared with the current standard of care procedures for esophageal cancer patients, either gastric pull-up or colonic interposition, our esophageal implant offers the following major advantages:

| ● | Patients can avoid the frequently life-threatening complications of either gastric pull up or colonic interpositioning surgery; | |

| ● | Autologous stem cells eliminate the risk of immune system rejection; | |

| ● | The procedure does not require the sacrifice of the patient’s stomach or colon, so those organs remain intact and function accordingly; | |

| ● | It leaves no permanent implant or artificial structure in the body. Permanent implants can lead to long-term complications, including infection, which can lead to further surgical procedures including removal; | |

| ● | Eliminates the need for sutures where the two ends of the esophagus are joined together. The sutures are a frequent cause of fluid leaks and infections post-surgery; and | |

| ● | Patients can remain on a reasonable diet after a procedure with our esophageal implant. |

We believe that these significant medical advantages will lead to strong demand from patients and doctors for our esophageal implant. Additionally, we believe that it will receive a favorable reimbursement profile from payors and insurance companies because of the high cost and complications associated with alternative procedures.

First-In-Human Use of the Biostage Esophageal Implant and Scientific Proof of Esophageal Regeneration

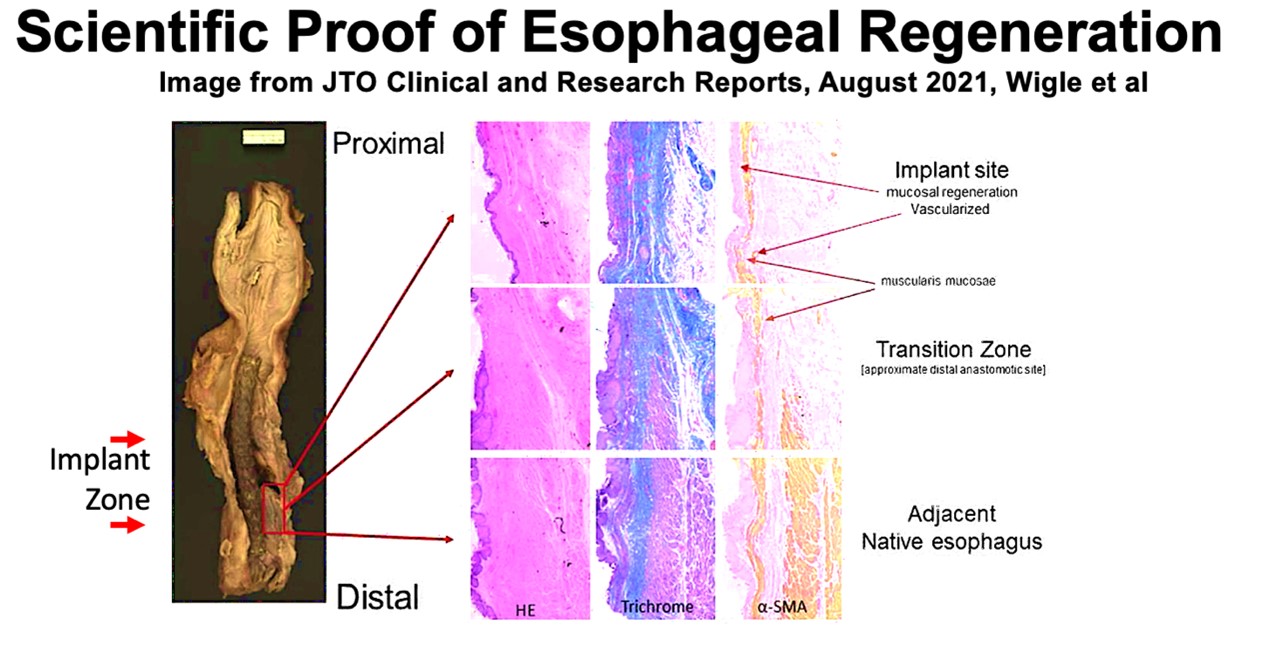

On August 7, 2017, we announced the use of our esophageal implant in a patient at the Mayo Clinic via an FDA-approved single-use expanded access, or compassionate use, application. The patient was a 75-year-old male with a life-threatening cancerous mass in his chest that spanned his heart, a lung, and his esophagus. The surgery was performed by Dr. Dennis Wigle, Chair of Thoracic Surgery, to remove the tumor, repair the heart, part of one lung, and a section of the esophagus. Our esophageal implant was interpositioned into the gap in the esophagus created by the removal of the tumor. The patient’s surgeon informed us at that time that the surgery was successful, and the patient was discharged from the hospital 42 days after implantation. The scaffold and stent were removed on day 104 after implantation.

In February 2018, the surgeon informed us that the patient had died after living approximately eight months after surgery. The surgeon stated that the cause of death was a stroke, and that the stroke was unrelated to the esophageal implant. The surgeon also informed us that a preliminary autopsy had shown that the esophageal implant resulted in a regenerated esophageal tube in the patient, except for a very small (approximately 5mm) hole outside the implant zone on the lateral wall that was right up against a synthetic graft inserted as part of the patient’s heart repair on the vena cava in that same surgery. The synthetic graft on the pericardium was not related to our esophageal implant product candidate and may have acted as an irritant to esophageal tissue where it contacted the esophageal implant. The surgeon also informed us that the esophageal regeneration in this patient was consistent with the regeneration previously observed in our pig studies.

The results were published in the Journal of Thoracic Oncology Clinical and Research Reports in August 2021. The photographs below, taken from the paper, show the explanted esophagus from this procedure. The image on the left is the actual esophagus. As displayed below, the implant zone is visually almost identical to native esophagus which is the area both above and below the implant zone. The thickness, color and texture of the regenerated esophagus is nearly indistinguishable from the native esophagus.

| 4 |

The dark-brown tube in the center of the esophagus is the stent that was added to avoid narrowing of the esophagus. The stent for this patient was changed twice, once prior to our esophageal implant scaffold removal and once after the scaffold and the second stent were removed. The final stent was removed at five and a half months post-surgery. We anticipate that patients treated with our esophageal implant are likely to undergo at least one stent exchange during their recovery with the discontinuation of stents by six to nine months post-surgery. Stents are deployed and retrieved endoscopically, that is, via the mouth, and accordingly, there is no surgical incision in the chest.

The images on the righthand side are photographs taken under a microscope to show, from left to right, cells (stained pink), layered structure (stained blue and purple) and muscles (stained yellow). The images show a high level of consistency between the regenerated esophagus and the native esophagus, both to the naked eye and under the microscope. In the right most panels, the yellowish coloration along the left side of the images shows a continuous line of muscles running up the regenerated esophagus. These muscles are the muscularis mucosae which contract to eject mucous into the esophagus. This mucosal lining is essential to the long-term survival of the patient because it both lubricates the esophagus to allow food to be swallowed and provides a barrier to infection. This mucosal lining was seen at three months in both the human patient and in our pig models.

In this patient we saw the development of a tube of the patient’s own tissue within one month, and the development of the mucosal lining within three months. In pig models we have similarly seen the development of a tube within one month and the development of the mucosal lining within three months. In our clinical trial, the primary endpoint is the development of the tube of the patient’s tissue within three months and one of the secondary endpoints is the development of the mucosal lining within twelve months.

Preclinical Models - Pig Studies

The pre-clinical animal studies using our esophageal implant investigated several key aspects of the product pertaining to the implant procedure, cell survival, the architecture of the regenerated tissue at multiple survival time points, the post-implantation clinical management procedures including Computed Tomography, or CT imaging to assess the growth of new tissue, esophageal stent management, endoscopy procedures, barium swallow tests and nutritional management.

Following implantation, CT imaging revealed early tissue deposition and the formation of a contiguous tissue conduit. Endoscopic evaluation at multiple time points revealed complete epithelialization of the lumenal surface by day 90. Histologic evaluation at several necropsy time points, post-implantation, demonstrated that the tissue continues to remodel over the course of a one-year survival time period, resulting in the development of esophageal structural features, including the mucosal epithelium, muscularis mucosae, lamina propria, as well as smooth muscle proliferation/migration initiating the formation of a laminated adventitia. One-year survival demonstrated restoration of oral nutrition, normal animal growth and the overall safety of this treatment regimen.

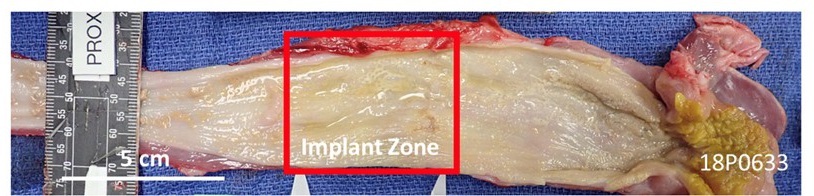

The image below is taken from a paper we published in Nature Partner Journals Regenerative Medicine in January 2022, in conjunction with our development partner, Connecticut Children’s Medical Center.

This image shows an esophagus explanted from a pig 90 days after our esophageal implant was implanted. The implant zone is visually almost identical to the native tissue to the left and right of it. We can note the regeneration of the interior surface of the esophagus and the regeneration of the surrounding tissue that is visible in red at the top of the red box. The red color of the surrounding tissue indicates the presence of a healthy blood supply. We note further the glossy, reflective coating on the inside of the esophagus. This is evidence of the mucosal lining which is essential to the long-term survival of the patient. This mucosal lining was seen at three months in the pigs and was also observed in the human patient. The investigators concluded that at one year it was difficult to distinguish neo-tissue versus the native tissue.

| 5 |

Upcoming Phase 1/2 Clinical Trial

Based on both the successful in-human procedure at the Mayo Clinic and our extensive large-animal research, the FDA has approved our Investigational New Drug application to commence our clinical trial. The trial will be a ten-patient combined phase 1/2 trial, in up to five hospitals in the U.S. that measures both the safety and efficacy of our product candidate in the patient population. Enrollment criteria includes any patient that requires removal of a part of the esophagus that is less than six centimeters long for any medical reason. We expect enrolled patients to include esophageal cancer patients, but we may enroll patients with other esophageal conditions that require regeneration. We expect to initiate the trial in the second quarter of 2023.

The primary endpoint of the upcoming trial is the establishment of a continuous biological neoconduit, or tube, by three months post-surgery. We saw this tube at one month in the human patient and in the pigs. One of the secondary endpoints will be the development of a mucosal lining in the esophagus by twelve months post-surgery. We saw this mucosal lining by three months in the human patient and the pigs. Because we reached the primary endpoint and one of the secondary endpoints in both the human patient and the pigs, we believe that we have a high likelihood of success in this clinical trial.

Based on the FDA’s approval of our clinical trial for any condition that requires removal of part of the esophagus, we believe that we are able to pursue the treatment of multiple diseases, injuries or birth defects with a single clinical trial. As a result, we believe that this clinical trial will advance the Biostage Esophageal Implant for numerous indications including to treat esophageal cancer, Barrett esophagus, fistulas, traumatic injury to the esophagus and birth defects in the esophagus. Compared to developing treatments for a single underlying medical condition, we believe that addressing multiple medical conditions in a single clinical trial has the potential to significantly reduce our costs to expand the market for our products.

| 6 |

Preclinical Development

In January 2022, together with Connecticut Children’s Medical Center, we published in Nature Partner Journals Regenerative Medicine the results of implanting pediatric-sized esophageal implants in 15 piglets. Numerous survival times were histologically analyzed to understand the tissue development and timing of the regeneration. Overall, the graft implantation procedure was deemed safe and feasible. The piglets showed regeneration of a conduit, or tube, by one month and the regeneration of a normal mucosal lining by three months. Additionally, histological evaluation demonstrated that the tissue continued to develop throughout the course of the one-year survival period. Importantly, the piglets also showed normal growth and weight gain which are considered critical in treating human babies.

This research also developed novel post-surgical techniques that closely mimic the hospital care that human babies undergo. These techniques included non-invasive CT imaging of the regenerated tissue and feeding the piglets via G tubes which are normally used to feed human babies after surgeries in the gastro-intestinal tract.

Clinical Pathway

We believe that this study laid both the scientific and clinical groundwork for treating babies with birth defects in the esophagus with the Biostage Esophageal Implant. The FDA approval for the clinical trial allows us to treat children once we have established safety in adult patients in the phase 1/2 clinical trial. Once we have established the safety of the implant in adults, we expect to recruit children into the clinical trial.

Orphan Drug Designation – Seven Years of Exclusivity

In November 2016, we were granted Orphan Drug Designation for our esophageal implant by the FDA to restore the structure and function of the esophagus subsequent to esophageal damage due to cancer, injury or congenital abnormalities. We also were granted Orphan Drug Designation for trachea on September 4, 2014.

The Orphan Drug Act provides incentives to manufacturers to develop and market drugs and biologics for rare diseases and conditions affecting fewer than 200,000 persons in the U.S. at the time of application for orphan drug designation, or more than 200,000 individuals in the U.S. and for which there is no reasonable expectation that the cost of developing and making a drug or biological product available in the U.S. for this type of disease or condition will be recovered from sales of the product. Orphan product designation must be requested before submitting a new drug application, or NDA, or Biologics License Application or BLA. After the FDA grants orphan product designation, the identity of the therapeutic agent and its potential orphan use are disclosed publicly by the FDA. Orphan product designation does not convey any advantage in or shorten the duration of the regulatory review and approval process. The first developer to receive FDA marketing approval for an orphan biologic is entitled to a seven-year exclusive marketing period in the U.S. for that product as well as a waiver of the BLA user fee. The exclusivity prevents FDA approval of another application for the same product for the same indication for a period of seven years, except in limited circumstances where there is a change in formulation in the original product and the second product has been proven to be clinically superior to the first. In addition, Orphan Drug Designation provides a seven-year marketing exclusivity period against competition in the U.S. from the date of a product’s approval for marketing. This exclusivity would be in addition to any exclusivity we may obtain from our patents. Additionally, orphan designation provides certain incentives, including tax credits and a waiver of the BLA fee. We also plan to apply for Orphan Drug Designation for our esophageal implant in Europe. Orphan Drug Designation in Europe would provide market exclusivity in Europe for a period of ten years from the date of the product’s approval for marketing.

| 7 |

Our Strategy

Our strategy is to develop and advance our pipeline of products, beginning with our lead product for the treatment of esophageal cancer, through clinical development and commercialization. The key elements of our strategy include:

| ● | Initiate the phase 1/2 clinical trial for our lead esophageal implant product candidate for the treatment of severe esophageal disease. Based upon our successful initial case of esophageal regeneration and our animal models, the FDA has approved our IND application to commence a clinical trial in up to ten patients. We plan to initiate this trial in the second quarter of 2023. | |

| ● | Advance our other pipeline products through clinical development. Based on the establishment of a favorable safety and efficacy profile that we expect to demonstrate in our phase 1/2 clinical trial for regeneration of the esophagus, we intend to initiate a clinical trial for the treatment of esophageal atresia, a rare birth defect. As we build our safety and efficacy data, we plan to initiate clinical trials in other areas including cancer, injury and birth defects in the bronchus. | |

| ● | Develop our technology for use in other life-threatening conditions that have a relatively shorter time to market. We intend to develop products focused on life-threatening conditions where current treatments are ineffective, expensive or both. Many organ failures are orphan diseases, and we have orphan drug designations from the FDA on our product candidates for severe disease in both the esophagus and the trachea. We believe that developing products for such conditions will require smaller clinical trials and an overall less expensive development pathway than developing treatments for less severe conditions. | |

| ● | Pursue development pathways in international markets. In addition to the U.S., we intend to pursue regulatory approval for our products in several key international markets, including China, Europe and the UK. Many of the conditions we are targeting, have significantly higher patient populations in foreign countries than in the U.S., thereby making them attractive commercial markets. We intend to engage foreign health regulatory bodies to develop clinical and regulatory strategies to gain international approvals. | |

| ● | Collaborate with leading medical and research institutions to develop our products and build awareness. We intend to continue to collaborate with thought-leading medical institutions as we continue clinical development of our products and ultimately reach commercialization. We currently have a co-development initiative with the Mayo Clinic and with the Connecticut Children’s Medical Center. We intend to build additional partnerships and collaborations with leading institutions that we believe will help to drive awareness of our products and increase the likelihood of market adoption. |

Our Technology

Biocompatible Scaffold Component

Our proprietary biocompatible scaffold component of our esophageal implant is constructed primarily of extremely thin polyurethane fibers. This material was chosen based on extensive testing of various materials. The scaffold is made using a manufacturing process known as electrospinning. The combination of the electrospinning process, which provides control over the desired microstructure of the scaffold fabric, with the polyurethane results in a scaffold that we believe has favorable biocompatibility characteristics.

The Patient’s Cells

The cells we seed onto the scaffold are obtained from the patient’s adipose tissue, or abdominal fat. This fat tissue is obtained from a standard biopsy during the weeks leading up to the implant surgery. Mesenchymal stromal cells are extracted and isolated from the adipose tissue biopsy. The isolated cells are then expanded, or grown, for a short period prior to surgery in order to derive a sufficient cell population to be seeded on the scaffold. The cells are then seeded on the scaffold in our proprietary bioreactor and incubated there before the implant surgery.

| 8 |

Our technology is protected by twelve issued U.S. patents (including patents on the bioreactor, the structure of the scaffold and the retrievable nature of the scaffold), two Orphan-Drug Designations from the FDA, both of which confer seven years of exclusivity in addition to protection offered by the patents, and our first-mover advantage which allows us to improve the standard of care. Potential competitors would now have to improve upon our new standard of care rather than just improve on the existing standard of care in order to get their product candidates approved by the FDA. In addition, our patent claims cover patches as well as tubular structures. We intend to develop patches for the repair of tubular organs as well as solid organs.

See the “Intellectual Property, Licenses and Related Agreements” section below for more details.

Additional Targeted Diseases

Targeted Diseases

According to the World Health Organization, or WHO, International Agency for Research on Cancer’s Global Cancer Observatory database, worldwide there were over 600,000 cases of esophageal cancer in 2020. There are over one million cases of colon cancer. In addition, there are approximately 22,000 cases of bronchus cancer that, based on conversations with surgeons, we believe could be treated with our technology. The following are the approximate case counts by certain geographic region pertaining to the cancers noted below:

| Case Count by Geography | ||||||||||||||||||||||||

| Cancer Type | USA | China | Japan | Europe | ROW | Worldwide | ||||||||||||||||||

| Esophageal | 18,309 | 324,422 | 26,262 | 52,993 | 182,114 | 604,100 | ||||||||||||||||||

| Colon | 101,809 | 306,078 | 96,781 | 325,335 | 318,512 | 1,148,515 | ||||||||||||||||||

| Treatable Bronchus | 2,279 | 8,156 | 507 | 4,775 | 6,351 | 22,068 | ||||||||||||||||||

| Total | 122,397 | 638,656 | 123,550 | 383,103 | 506,977 | 1,774,683 | ||||||||||||||||||

Sources: Global Cancer Statistics 2020: GLOBOCAN Estimates of Incidence and Mortality Worldwide for 36 Cancers in 185 Countries Hyuna Sung, PhD; Jacques Ferlay, MSc, ME; Rebecca L. Siegel, MPH; Mathieu Laversanne, MSc; Isabelle Soerjomataram, MD, MSc, PhD; Ahmedin Jemal, DMV, PhD; Freddie Bray, BSc, MSc, PhD.

The above table excludes case counts for Tracheal Cancer. We estimate there are approximately 1,000 cases per year of trachea cancer in the U.S. and Europe that are severe enough to be treated with our technology. Please see “Life-threatening conditions of the Trachea” below. These numbers of patients do not include those with fistulas, ulcers, injuries or birth defects, all of which we believe may be treatable with our technology.

Because our product candidates are likely to save or extend lives, improve the quality of life, and save money by reducing the complications associated with current surgical repair techniques, we expect to charge more than $250,000 per product in the U.S. market.

Treating even one tenth of only those patients who are diagnosed with esophageal cancer each year could generate billions of dollars in annual revenue. We believe that the market potential for our products is significantly higher.

Esophageal Disease

Esophageal cancer is one of the deadliest types of cancer. According to the American Cancer Society, there are approximately 17,000 new diagnoses of esophageal cancer in the U.S. each year, and there are more than 15,000 deaths. Typically, a year after diagnosis with esophageal cancer, 50% of the patients are dead and after 5 years, 80% are dead.

There are approximately 600,000 new diagnoses of esophageal cancer globally each year, according to the World Health Organization’s International Agency for Research on Cancer.

Hence, there is a vast need for a better treatment for esophageal cancer.

| 9 |

Approximately 5,000 esophagectomy surgeries occur in the U.S. annually to treat esophageal cancer, and approximately 10,000 esophagectomies occur in Europe annually. We believe that approximately one half of the world’s esophageal cancer cases occur in China, which would represent the largest potential patient population for our adult esophageal product candidate. We believe that our esophageal implant, if approved, has the potential to provide a major advance over the current esophagectomy procedures for addressing esophageal disease, which have high complication and morbidity rates.

We believe that our esophageal implant has the potential to provide physicians a new, simpler procedure to restore organ function while significantly reducing complication and morbidity rates compared with the current standard of care, and without creating significant quality of life issues for patients.

Pediatric Esophageal Atresia

Each year, it is estimated that approximately 1,000 children in the U.S. are born with a congenital birth defect known as esophageal atresia. Esophageal atresia is a condition where an infant is born with an esophagus that does not extend completely from the mouth to the stomach. When a long segment of the esophagus is lacking, the current standard of care is a series of surgical procedures where sutures are applied to both ends of the esophagus in an attempt to stretch them and pull them together so they can be surgically connected at a later date.

This surgical process can take several weeks, and the procedure often involves serious complications and high rates of failure. The infant usually must remain in the neonatal intensive-care unit for this time which can cost thousands of dollars per day. This process also requires at least two separate surgical interventions. Other surgical options include the use of the child’s stomach or intestine that would be pulled up into the chest to allow a connection to the mouth. These methods are similar to the use of gastric pull ups and interpositioning used in adult patients and carry similar side effect and safety profiles. We are working in collaboration with the Connecticut Children’s Medical Center, to advance an esophageal implant solution to address esophageal atresia that we believe will be more effective, safer, and less expensive than the current procedures.

Colon Cancer

Based on input from our Scientific Advisory Board, which includes certain well-known surgeons in the field of regenerative medicine, we are planning to research regenerating other parts of the gastro-intestinal tract such as the stomach, intestine and colon. All these organs require replacement when they are damaged by cancer, injury, and birth defects. There are over one million patients diagnosed with colon cancer every year.

Bronchial (Central Lung) Cancer

Lung cancer is the most common form of cancer and the most common cause of death from cancer worldwide. There are more than 700,000 new lung cancer diagnoses annually in the U.S. and Europe. In approximately 25% of all lung cancer cases, the cancerous tumor resides only in a bronchus and not in the lobes of the lungs and is known as central lung cancer. Approximately 33,000 central lung cancer cases diagnosed in the U.S. and Europe are Stage I and II and are considered eligible for surgical resection, often with adjuvanted chemotherapy and radiation.

Approximately 5,000 of these patients are treated via pneumonectomy, a surgical procedure involving the resection of the cancer tumor, the whole bronchus below the tumor and the entire lung to which it is connected. It is a highly complex surgery and due to the removal of a lung, results in a 50% reduction in the patient’s respiratory capacity. The procedure has reported rates of post-surgical, or in-hospital, mortality of 8% to 15%. Complication rates associated with pneumonectomy are reported as high as 50%, and include post-operative pneumonia, supraventricular arrhythmias, and anastomotic leakage, placing patients at significant mortality risk post-discharge.

We intend to develop a Biostage bronchial implant to treat bronchial cancer, bronchial fistulas (holes), and birth defects in the bronchus. Based on discussions with surgeons in the field, we estimate that approximately 7,000 of these conditions in the U.S. and Europe would be potentially treatable with our technology.

| 10 |

Life-threatening conditions of the Trachea

There are approximately 8,000 patients per year in the U.S. and Europe who suffer from a condition of the trachea that put the patient at high risk of death. These conditions can be due to tracheal trauma, tracheal stenosis or trachea cancer. There are approximately 40,000 tracheal trauma patients diagnosed each year in the U.S. Of those, approximately 1,000 are severe enough to need surgical resection procedures. Tracheal stenosis is a rare complication from tracheostomies but may have a devastating impact on respiratory function for patients. Approximately 2,000 patients are diagnosed with stenosis from tracheostomy in the U.S. each year. Trachea cancer is a very rare but extremely deadly cancer. Trachea cancer patients in the U.S. have a median survival of 10 months from diagnosis and a 5-year survival of only 27%. There were approximately 200 cases of primary trachea cancer diagnosed in the U.S. in 2013. Based on these facts, we estimate that there are approximately 8,000 patients in the U.S. and Europe with conditions of the trachea that put them at high risk of death, but for whom there is currently no clinically effective tracheal implant or replacement method currently available.

We believe that a Biostage tracheal implant may provide physicians a treatment to re-establish the structural integrity and function of a damaged or diseased trachea to address life-threatening conditions due to tracheal trauma, stenosis, cancer, or birth defects.

We have not performed regeneration of a trachea using a Biostage tracheal implant. However, based on the regeneration observed in the bronchus, we believe that regeneration of the trachea may be possible.

Our History

We were incorporated under the laws of the State of Delaware on May 3, 2012 as a wholly-owned subsidiary of Harvard Bioscience, Inc., or Harvard Bioscience, to provide a means for separating its regenerative medicine business from its other businesses. Harvard Bioscience decided to separate its regenerative medicine business into our company, a separate corporate entity, or the Separation, and it spun off its interest in our business to its stockholders in November 2013. Since the Separation we have been a separately-traded public company and Harvard Bioscience has not controlled our operations. Following the Separation, we continued to innovate our bioreactors based on our physiology expertise, we developed our materials science capabilities and we investigated and developed a synthetic tracheal scaffold. By that time, we had built and staffed cell biology laboratories at our Holliston facility, to give ourselves the ability to perform and control our scientific investigation and developments internally. At that point, we began the second phase of our company’s development.

In mid-2014, we increased the pace of our scientifically-based internal analysis and development of our first-generation tracheal implant product candidate, the HART-Trachea. From large-animal studies conducted thereafter we found that the product candidate elicited an unfavorable inflammatory response after implantation, which required additional development and testing. These requirements extended our expectations regarding our regulatory milestones, and we announced the additional testing and extended milestone expectations in January 2015. During 2015 we isolated and tested all major variables of the organ scaffold and the cell source and protocols, examining the effects of alternatives against the then-existing product approach. Through extensive in vitro preclinical studies, and small-animal and large-animal studies, we made dramatic improvements, and discovered that the mechanism of action of our current approach was very different from our hypothesis regarding that of the first-generation product candidate. Our technology uses a different scaffold material and microstructure, a different source and concentration of the patient’s cells and several other changes from our earlier trachea initiative. These changes resulted in a scaffold that was temporary and could be removed via the mouth in an endoscopic procedure that did not require major surgery in the chest. The temporary nature of the scaffold reduces the risk of long-term complications that can arise from permanent implants such as those from hernia meshes and breast implants.

| 11 |

Clinical Trials

The FDA has approved our first clinical trial.

Based on both the successful human experience at the Mayo Clinic, and our extensive large-animal research (we have performed surgeries on over 50 pigs including for both adult and pediatric diseases), the FDA has approved our clinical trial. The trial will be a 10-patient combined phase 1 and phase 2 trial that measures both the safety and efficacy of our product candidate in the patient population. This clinical trial is for any patient that requires removal of a part of the esophagus that is less than 6cm long for any reason. The primary endpoint in the trial is the establishment of a continuous biological neoconduit, or tube, by three months. In the human patient, this tube was seen in one month. In the pig research, we have seen the formation of a conduit by one month and sometimes by 14 days. One of the secondary endpoints will be the development of a mucosal lining in the esophagus by 12 months or earlier. In the one human patient treated so far, this mucosal lining was seen at three months. In the pig research, we have seen this mucosal lining in three months.

The FDA approval for our clinical trial allows us to treat babies born without a complete esophagus once we have established safety in adults.

Our esophageal implant will not be tested for safety on healthy volunteers (the usual goal of a phase 1 trial) or for dose-response and maximum-tolerated dose (the usual goals of a phase 2 trial). Measuring safety and efficacy in the patient population is normally the goal of a phase 3 clinical trial. Hence, our approved trial is more similar to a small phase 3 trial than a typical first clinical trial. We expect to add patients to this trial, including in Europe and China until we have sufficient data to gain approval.

Unlike the normal drug discovery process, which assesses a drug for its ability to treat a single disease, we can pursue multiple diseases with a single clinical trial. This is because any medical condition that requires the removal of part of the esophagus can be repaired with the our esophageal implant. It does not matter that the need to surgically remove part of the esophagus is caused by esophageal cancer, Barrett esophagus (damage to the lower esophagus caused by the reflux of stomach acids into the esophagus), a fistula (a hole in the esophagus), a birth defect, or a wound or injury to the esophagus. Our esophageal implant can be used to treat any of these conditions. Because of this, we believe that the available market in treating the esophagus to be far larger than that for treating esophageal cancer alone. In addition, we can access that large patient population without having to conduct a new clinical trial for each underlying medical condition. Compared to the development of new drugs, this greatly reduces our costs to expand the market size for our products.

We intend to request Fast Track status, Breakthrough Therapy designation, Regenerative Medicine Advanced Therapy, or RMAT, designation, Accelerated Approval, Priority Review and a Priority Review Voucher from the FDA. There are many benefits of such designations, including reduced costs and faster times to market. Please refer the Regulatory Strategy section for more details.

Our first clinical trial will be in the U.S. for patients with cancer, injury, or birth defects in the esophagus. However, there are far more patients with these conditions in Europe and Asia than there are in the U.S. For this reason, we intend to expand our clinical trial to include patients in Europe and Asia and to seek regulatory approval in those countries as well.

In addition to having large patient populations, for product candidates like ours, both the European Union, or E.U., and some countries in Asia allow for “conditional approval”. Conditional approval is country specific but, in general, it would allow us to market our products, and obtain revenue from the sales of the respective product, after successful phase 2 results. Conditional approval is granted subject to the regulatory authority being able to rescind the approval if something goes wrong as more patients get treated. Hence, it is possible that we could see revenue in either Asia or the E.U. before we see revenue in the U.S.

| 12 |

Research and Development

Our primary research and development activities are focused in three areas: materials science, cell biology and engineering. In materials science, we focus on designing and testing biocompatible organ scaffolds, testing the structural integrity and the cellularization capacities of the scaffolds. In cell biology, we focus on developing and testing isolation and expansion protocols, cell characterization and fate studies, investigating the effects of various cell types and concentrations, evaluating the biocompatibility of scaffolds, experimenting with different cell seeding methodologies, and developing protocols for implantation experiments. Our engineering group supports the materials science and cell biology groups across an array of their activities, i.e. designing, engineering and making our proprietary bioreactors and autoseeders. All three of our R&D groups combine to plan and execute our in vitro studies. A fundamental part of our R&D effort in developing our technology has been dedicated to the discovery and development of small and large-animal model studies. The large-animal model employs the use of Yucatan mini-pigs.

In addition to our in-house engineering and scientific development team, we collaborate with leaders in the field of regenerative medicine who are performing the fundamental research and surgeries in this field to develop and test new product candidates that will advance and improve the procedures being performed. We will work with our collaborators to further enhance our product candidates to make them more efficient and easier to use by surgeons. In the U.S., our principal collaborations have been with Mayo Clinic and Connecticut Children’s Medical Center. Collaboration typically involves us developing new technologies specifically to address issues these researchers and clinicians encounter, and then working together to translate our technology from pre-clinical studies to clinical trials. In certain instances, we have entered into agreements that govern the ownership of the technologies developed in connection with these collaborations.

We incurred approximately $1.7 million and $1.6 million of research and development expenses in 2022 and 2021, respectively. As we have not yet applied for or received regulatory approval to market any clinical products, no amount of these research and development costs have been passed on to our customers.

On March 28, 2018, we were awarded a Fast-Track Small Business Innovation Research, or SBIR, grant by the Eunice Kennedy National Institute of Child Health and Human Development, or NICHD, to support testing of pediatric version of our esophageal implant. The award for Phase I provided for the reimbursement of approximately $0.2 million of qualified research and development costs which was received and recognized as grant income during 2018.

On October 26, 2018, we were awarded the Phase II Fast-Track SBIR grant from the Eunice Kennedy NICHD grant aggregating $1.1 million to support development, testing, and translation to the clinic through September 2019 and represented years one and two of the Phase II portion of the award. On August 3, 2020, we were awarded a third year of the Phase II grant totaling $0.5 million for support of development, testing, and translation to the clinic covering qualified expenses incurred from October 1, 2019 through September 30, 2020. In September of 2020, we filed and were granted a one year, no-cost extension for the Phase II grant period extending through September 30, 2021.

For the years ended December 31, 2022 and 2021, we recognized $0 and $0.2 million of grant income, respectively, from Phase II of the SBIR grant. The aggregate SBIR grant to date provided us with a total award of $1.8 million, of which approximately $1.5 million had been recognized through December 31, 2021.

The Phase II portion of the award expired effective September 30, 2021.

The research conducted under this grant led to the publication on the regeneration of the esophagus in piglets that was published in January 2022 in collaboration with Connecticut Children’s Medical Center.

Manufacturing and Resources

The bioreactor and scaffold are made in our clean-room facilities in Holliston, Massachusetts and the cell seeding is currently performed at the FDA-approved clinical-grade human cell culture facility at the University of Texas Medical Branch.

| 13 |

Our manufacturing process for the bioreactors and scaffolds has been approved by the FDA for the clinical trial. Additional development is likely to be necessary for product approval.

For our scaffolds, our primary materials are medical-grade plastic resins and solvents used to liquefy the resins in our manufacturing process. These materials are readily available from a variety of suppliers and do not currently represent a large proportion of our total costs. For our autoseeders and bioreactors, we perform final assembly and testing of components that we buy from third parties like machine shops, parts distributors, molding facilities and printed circuit board manufacturers. These manufacturing operations are performed primarily at our Holliston, Massachusetts headquarters.

Sales and Marketing

We expect that most surgeries using our esophageal implant will be performed at a relatively small number of major hospitals in the U.S., Asia and in Europe. In addition, our technology platform is initially aimed at treating the esophagus, the bronchi, and the trachea, all of which are treated by thoracic surgeons. As a result, we expect to employ only a small sales force as compared to companies selling treatments for larger patient populations.

We expect to price the product commensurate with the medical value created for the patient and the costs avoided with the use of our product. Because our products are likely to save or extend lives, improve the quality of life, and save money by reducing the complications associated with current surgical repair techniques, we expect to charge approximately $250,000 per product in the U.S.

We further expect to be paid by the hospital that buys the product from us. Finally, we expect that the hospital would seek reimbursement from government payers, private health insurers and other third-party payers for the entire transplant procedure, including the use of our products.

Intellectual Property, Licenses, and Related Agreements

We have twelve issued U.S. patents that cover the bioreactor, the scaffold, and the surgical procedure. The patent claims cover the use of synthetic scaffolds for any use in the gastro-intestinal tract and the airways. These patents include the claim of having a removable scaffold. The patent claims cover patches as well as tubes. We intend to research the patch-based approach to treat damage to solid organs. We also have two issued patents in China and there are numerous other filings pending. We expect these patents to provide protection into the mid to late 2030’s.

Sublicense Agreement with Harvard Bioscience

We own the right to use the brand name “Harvard Apparatus Regenerative Technology” in the medical sciences field under a license agreement with Harvard University via a sublicense from Harvard Bioscience. Harvard Bioscience’s right to use the name arises from a license agreement, effective December 19th, 2002, between it and the President and Fellows of Harvard University. Harvard Bioscience began at Harvard University in 1903 as Harvard Apparatus and has a license to the name Harvard Apparatus in research and industrial fields. Our right to use the names in the medical field arises from the sublicense signed when Biostage, Inc. (then known as Harvard Apparatus Regenerative Technology) was separated from Harvard Bioscience in 2013 (as more fully described below). Harvard Bioscience delegated its right to use the name in the medical field to us and Harvard Bioscience has no right to use the Harvard mark in the medical field. We intend to use this brand name on our products in the future. We do not have the right to use the Harvard or Harvard Apparatus marks alone but only as Harvard Apparatus Regenerative Technology. We believe we are the only licensee of the Harvard name in the medical products’ field. This license is perpetual, worldwide and royalty-free. There are restrictions on our use of the name such as not using it in the color crimson and not using it in a serifed font. We currently have no affiliation with Harvard University.

Separation Agreements with Harvard Bioscience

On November 1, 2013, to effect the Separation, Harvard Bioscience distributed all of the shares of our common stock to the Harvard Bioscience stockholders, or the Distribution. Prior to the Distribution, Harvard Bioscience contributed the assets of its regenerative medicine business, and approximately $15 million in cash, to our company to fund our operations following the Distribution.

| 14 |

In connection with the Separation and immediately prior to the Distribution, we entered into a Separation and Distribution Agreement, Intellectual Property Matters Agreement, Product Distribution Agreement, Tax Sharing Agreement, Transition Services Agreement, and Sublicense Agreement with Harvard Bioscience to effect the Separation and Distribution and provide a framework for our relationship with Harvard Bioscience after the Separation. These agreements govern the current relationships among us and Harvard Bioscience and provided for the allocation among us and Harvard Bioscience of Harvard Bioscience’s assets, liabilities, and obligations (including employee benefits and tax-related assets and liabilities) attributable to periods prior to the Separation.

Government Regulation

Our product candidates and our operations are subject to extensive regulation by the U.S. FDA and other federal and state authorities, as well as comparable authorities in foreign jurisdictions, which are discussed below. The FDA is divided into various “Centers” by product type such as the Center for Drug Evaluation and Research, or CDER, the Center for Biologics Evaluation and Research, or CBER, and the Center for Devices and Radiological Health, or CDRH. Different Centers review drug, biologic, or device applications. Our product candidates are subject to regulation as combination products, biologics and medical devices, in the United States under the Federal Food, Drug, and Cosmetic Act, or FDCA, and the Public Health Services Act, or PHS Act, and their implementing regulations as implemented and enforced by the FDA.

CBER regulates medical devices related to licensed blood and cellular products by applying appropriate medical device laws and regulations. Specifically, CBER regulates the medical devices involved in the collection, processing, testing, manufacture and administration of licensed blood, blood components and cellular products. The medical devices regulated by CBER are intimately associated with the blood collection and processing procedures as well as the cellular therapies regulated by CBER. CBER has developed specific expertise in blood, blood products and cellular therapies and the integral association of certain medical devices with those biological products supports the regulation of those devices by CBER. CBER also regulates biologics, which includes cells and tissues, serum, vaccines, blood and blood products, and analogous substances.

After receiving FDA approval or clearance, an approved or cleared product must comply with post-market safety reporting requirements applicable to the product based on the application type under which it received marketing authorization. In the case of current good manufacturing practices, or cGMP, the applicant may take one of two approaches: (1) complying with cGMP for each constituent part, or (2) a streamlined approach specific to combination products, subject to certain limitations.

Regulatory Strategy

Domestic Regulation of our Product Candidates - FDA Approval Process

The FDA extensively regulates, among other things, the research, development, testing, manufacture, quality control, approval, labeling, packaging, storage, record-keeping, promotion, advertising, distribution, marketing and import and export of medical products. The FDA governs the following activities that we may perform or that may be performed on our behalf, to ensure that the medical products we may in the future manufacture, promote and distribute domestically or export internationally are safe and effective for their intended uses:

| ● | product design, preclinical and clinical development and manufacture; | |

| ● | product premarket clearance and approval; | |

| ● | product safety, testing, labeling and storage; | |

| ● | recordkeeping procedures; | |

| ● | product marketing, sales and distribution; and | |

| ● | post-marketing surveillance, complaint handling and adverse event reporting, including reporting of deaths, serious injuries, malfunctions or other deviations; and | |

| ● | recall of products, including repairs or remediation. |

The labeling, advertising, promotion, marketing and distribution of biologics and medical devices also must be in compliance with the FDA and U.S. Federal Trade Commission, or FTC, requirements which include, among others, standards and regulations for off-label promotion, industry sponsored scientific and educational activities, promotional activities involving the internet, and direct-to-consumer advertising. The FDA and FTC have very broad enforcement authority, and failure to abide by these regulations can result in penalties, including the issuance of a warning letter directing us to correct deviations from regulatory standards and enforcement actions that can include seizures, injunctions and criminal prosecution. Recently, promotional activities for FDA-regulated products of other companies have been the subject of enforcement action brought under healthcare reimbursement laws and consumer protection statutes. In addition, under the federal Lanham Act and similar state laws, competitors and others can initiate litigation relating to advertising claims. In addition, we are required to meet regulatory requirements in countries outside the U.S., which can change rapidly with relatively short notice.

| 15 |

The FDA has broad post-market and regulatory enforcement powers. Manufacturers of biologics and medical devices are subject to unannounced inspections by the FDA to determine compliance with applicable regulations, and these inspections may include the manufacturing facilities of some of our subcontractors. Failure by manufacturers or their suppliers to comply with applicable regulatory requirements can result in enforcement action by the FDA or other regulatory authorities. Potential FDA enforcement actions include:

| ● | untitled letters, warning letters, fines, injunctions, consent decrees and civil penalties; | |

| ● | unanticipated expenditures to address or defend such actions | |

| ● | customer notifications for repair, replacement, refunds; | |

| ● | recall, detention or seizure of our products; | |

| ● | operating restrictions or partial suspension or total shutdown of production; | |

| ● | refusing or delaying our requests for 510(k) clearance or premarket approval of new products or modified products; | |

| ● | operating restrictions; | |

| ● | withdrawing 510(k) clearances on PMA approvals that have already been granted; | |

| ● | refusal to grant export approval for our products; or | |

| ● | criminal prosecution. |

In addition, other government authorities influence the success of our business, including the availability of adequate reimbursement from third party payors, including government programs such as Medicare and Medicaid. Medicare and Medicaid reimbursement policies can also influence corresponding policies of private insurers and managed care providers, which can further affect our business.

Combination Products

A combination product is the combination of two or more regulated components, i.e., drug/device, biologic/device, drug/biologic, or drug/device/biologic, that are combined or mixed and produced as a single entity; packaged together in a single package or as a unit; or a drug, device, or biological product packaged separately that according to its investigational plan or proposed labeling, is intended for use only with an approved individually specified drug, device, or biological product where both are required to achieve the intended use, indication, or effect.

To determine which FDA center or centers will review a combination product candidate submission, companies may submit a request for assignment to the FDA. Those requests may be handled formally or informally. In some cases, jurisdiction may be determined informally based on the FDA’s experience with similar products. However, informal jurisdictional determinations are not binding on the FDA. Companies also may submit a formal “Request for Designation” to the FDA Office of Combination Products. The Office of Combination Products will review the request and make its jurisdictional determination within 60 days of receiving a Request for Designation.

The FDA will determine which center or centers within the FDA will review the product candidate and under what legal authority the product candidate will be reviewed. Depending on how the FDA views the product candidates that are developed, the FDA may have aspects of the product candidate reviewed by CBER, CDRH, or CDER, though one center will be designated as the center with primary jurisdiction, based on the product candidate’s primary mode of action. The FDA determines the primary mode of action based on the single mode of action that provides the most important therapeutic action of the combination product candidate. This would be the mode of action expected to make the greatest contribution to the overall intended therapeutic effects of the combination product candidate. The review of such combination product candidates is often complex and time consuming, as the FDA may select the combination product candidate to be reviewed and regulated by one, or multiple FDA centers identified above, which could affect the path to regulatory clearance or approval. Furthermore, the FDA may also require submission of separate applications to multiple centers.

Once commercialized, manufacturers of combination products must generally comply with the applicable regulations governing each constituent part. For example, in January 2013, the FDA finalized 21 CFR Part 4, “Current Good Manufacturing Practice Requirements for Combination Products”, which was effective July 22, 2013. Associated guidance was also issued in January 2017. Both the rule and guidance reiterate that combination product manufacturers are responsible for compliance with both biologic and device cGMPs when engaging in manufacturing both constituent parts. The guidance allows the use of an abbreviated approach as well. Manufacturers of combination products also must comply with post marketing safety reporting, or PMSR, requirements in accordance with 21 CFR Part 4.

| 16 |

We have been informed by the FDA that our esophageal implant is a combination biologic/device product. Biological products must satisfy the requirements of the PHS Act and the FDCA and their implementing regulations. The lead reviewing FDA Center will be the Center for Biologics Evaluation and Research or CBER. The CBER may choose to consult or collaborate with the FDA’s Center for Devices and Radiological Health, or CDRH, with respect to the characteristics of the synthetic scaffold component of our product based on the CBER’s determination of need for such assistance. Because the CBER is the lead, in order for our esophageal implant to be legally marketed in the U.S., the product must have a BLA approved by the FDA.

We discuss both the CBER and the CDRH regulatory paradigms below, as potential future products may implicate elements of each, largely at the CBER’s discretion to involve the CDRH in the review and approval process.

The BLA Approval Process

The basic steps for obtaining FDA approval of a BLA to market a biopharmaceutical, or biologic product in the U.S. include:

| ● | completion of preclinical laboratory tests, animal studies and formulation studies under the FDA’s GLP regulations; | |

| ● | submission to the FDA of an IND application, for human clinical testing, which must become effective before human clinical trials may begin and which must include Institutional Review Board, or IRB, approval at each clinical site before the trials may be initiated; | |

| ● | performance of adequate and well-controlled clinical trials in accordance with Good Clinical Practices, or GLP, to establish the safety, purity, and potency of the product for each indication; | |

| ● | submission to the FDA of a BLA, which contains detailed information about the chemistry, manufacturing and controls for the product, reports of the outcomes of the clinical trials, and proposed labeling and packaging for the product; | |

| ● | the FDA’s acceptance of the BLA for filing; | |

| ● | satisfactory review of the contents of the BLA by the FDA, including the satisfactory resolution of any questions raised during the review or by the advisory committee, if applicable; | |

| ● | satisfactory completion of an FDA inspection of the manufacturing facility or facilities at which the product is produced to assess compliance with cGMP regulations, to assure that the facilities, methods and controls are adequate to ensure the product’s identity, strength, quality and purity; and | |

| ● | FDA approval of the BLA. |

In order to obtain approval to market a biological product in the United States, a marketing application must be submitted to the FDA that provides sufficient data establishing the safety, purity and potency of the proposed biological product for its intended indication. The application includes all relevant data available from pertinent preclinical and clinical trials, including negative or ambiguous results as well as positive findings, together with detailed information relating to the product’s chemistry, manufacturing, controls and proposed labeling, among other things. Data can come from company-sponsored clinical trials intended to test the safety and effectiveness of a use of a product, or from a number of alternative sources, including studies initiated by investigators. To support marketing approval, the data submitted must be sufficient in quality and quantity to establish the safety, purity and potency of the biological product to the satisfaction of the FDA.

The results of product development, preclinical studies and clinical trials, along with descriptions of the manufacturing process, analytical tests conducted on the chemistry of the drug, proposed labeling, and other relevant information are submitted to the FDA as part of a BLA requesting approval to market the product. The submission of a BLA is subject to the payment of user fees; a waiver of such fees may be obtained under certain limited circumstances. The FDA initially reviews all BLAs submitted to ensure that they are sufficiently complete for substantive review before it accepts them for filing. The FDA generally completes this preliminary review within 60 calendar days. The FDA may request additional information rather than accept a BLA for filing. In this event, the BLA must be resubmitted with the additional information. The resubmitted application also is subject to review before the FDA accepts it for filing. Once the submission is accepted for filing, the FDA begins an in-depth substantive review. FDA may refer the BLA to an advisory committee for review, evaluation and recommendation as to whether the application should be approved and under what conditions. The FDA is not bound by the recommendation of an advisory committee, but it generally follows such recommendations. The approval process is lengthy and often difficult, and the FDA may refuse to approve a BLA if the applicable regulatory criteria are not satisfied or may require additional clinical or other data and information. Even if such data and information are submitted, the FDA may ultimately decide that the BLA does not satisfy the criteria for approval. Data obtained from clinical trials are not always conclusive and the FDA may interpret data differently than we interpret the same data. FDA reviews a BLA to determine, among other things whether the product is safe, pure and potent and the facility in which it is manufactured, processed, packed or held meets standards designed to assure the product’s continued safety, purity and potency. Before approving a BLA, the FDA will inspect the facility or facilities where the product is manufactured. The FDA may issue a complete response letter, which may require additional clinical or other data or impose other conditions that must be met in order to secure final approval of the BLA, or an approval letter following satisfactory completion of all aspects of the review process.