The Space to Grow 2017 ANNUAL REPORT (317) 532-7900 | 11201 USA Parkway Fishers, IN 46037 | www.firstinternetbancorp.com

LIKE THE INTERNET, WE STARTED OUT SMALL BEFORE WE GREW. AND GREW. AND THEN WE GREW SOME MORE. IT TOOK FIFTEEN YEARS IN OPERATION TO REACH OUR FIRST BILLION IN ASSETS. TWO SHORT YEARS LATER, WE HAD REACHED THE SECOND BILLION. NOW WE’RE WELL ON OUR WAY TO OUR THIRD BILLION. As our CEO David Becker likes to say, we’re an 18-year overnight success story. And it’s our entrepreneurial spirit that keeps us adapting to customer needs and challenging ourselves to keep innovating, keep growing. We really listen to what our customers tell us they need and we’ve featured a few stories here—from personal banking to business and commercial real estate lending—that aptly illustrate our partnership. Unlike traditional banks hemmed in by banker’s hours and expensive overhead, our branchless model means we can give our customers the space to do exactly what’s most valuable to them—to grow. The Space to Grow 1999 WE OPENED OUR VIRTUAL DOORS IN YEAR OVERNIGHT SUCCESS STORY! WE'RE AN

2017 ANNUAL REPORT | 1 *As of December 31, 2017 **$1.5 million of balances in US territories/Armed Forces included in headquarters/Midwest balance NATIONWIDE DEPOSIT BASE—WITHOUT BRANCHES $339.5M 16.3% $171.9M 8.2% $395.3M 19.0% $350.9M 16.8% $2.1B Total Deposits* Nationwide consumer, small business and commercial deposit base Innovative technology and convenience supported by exceptional service 2017 YEAR OVER YEAR ASSET GROWTH 49% MOBILE APP RATINGS NET INCOME ($ in thousands) $20,000 $15,000 $10,000 $5,000 $0 201520142013 20172016 $15,226 $4,593 $4,324 $8,929 $12,074 $827.4M 39.7% ** Google Play 4.6/5 Apple App Store 4.6/5

2 | FIRST INTERNET BANCORP FINDING THE SPACE TO GROW IN AN INDUSTRY WITH NO SHORTAGE OF PARTICIPANTS TOOK VISION. Establishing the right formula for expansion—when the options available to us were many—required focus. And reaching our potential and then raising the bar still higher…well, that calls for deliberate execution—day after day. In 2017, we made good on our promise to continue to diversify our asset generation channels to support growth and increase profitability. Early in the year, we established First Internet Public Finance Corp. to serve the borrowing needs of governmental entities and not-for-profit organizations. Our public finance team exceeded our expectations, originating nearly $450 million in new loans during the year. In the third quarter, we announced a national strategic partnership with Lendeavor, Inc., a San Francisco- based technology-enabled lender to healthcare practices. The early results of our partnership with Lendeavor are encouraging, with healthcare finance balances surpassing $30 million at year end. In total, we were able to expand loan balances across our balance sheet by 67% in 2017. Capitalizing on opportunities and focusing on prudent practices, we have increased our loan relationships by more than 480% over five years, as loan balances eclipsed $2 billion at the end of 2017. To put this in context for you, our growth rate was 4.5 times greater than our peers’ in the same time period. We completed a common stock offering in the third quarter, receiving net proceeds of more than $51 million. Our amplified capital base gives us the ability to continue producing solid balance sheet and earnings improvements. We take very seriously our responsibility to deploy our capital in an accretive manner that builds shareholder value. Excluding the effect of the revaluation of our net deferred tax assets resulting from federal tax reform passed in December 2017, we produced higher earnings per share on a year-over-year basis—despite the increase in common shares outstanding. Moreover, we have enhanced tangible book value per share consistently over the last several years as a direct result of organic balance sheet growth. In addition to our strong financial results, we maintained our position of thought leadership in the industry. As a pioneer in the branchless delivery of consumer and commercial banking services, we are often asked to share our knowledge and experiences. Our leaders were visible as presenters at events across the country and as experts in their field in industry publications and broadcasts. Several employees were also celebrated for their contributions to our industry, and our community as well. Our team works tirelessly on behalf of our customers, our shareholders and our communities, and it’s gratifying when they receive recognition for their efforts. The ability to attract and retain top-level talent is crucial in the service industry. For this reason, we were elated when a leading industry publication recognized us—for the fifth consecutive year—as one of the best banks in the nation to work for. We also received attention at the local and state levels for being an employer of choice. Talent and teamwork across the organization enabled us to deliver record annual net income to you in 2017. Our results are the culmination of vision, focus and intentional execution, and they are the fulfillment of the promises we have made to our shareholders. On behalf of the Board of Directors and the leadership team, I thank you for your continued support. Sincerely, David B. Becker Chairman, President and Chief Executive Officer Dear Fellow Shareholder, 67% Loan balance expansion across our balance sheet in 2017

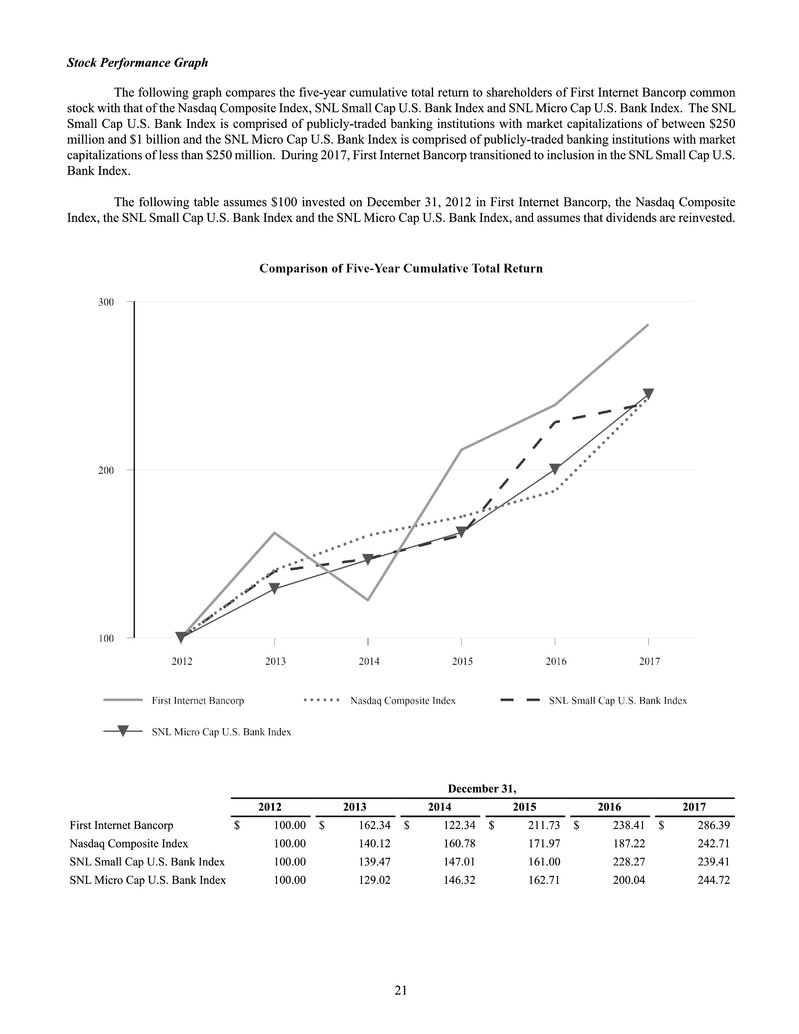

2017 ANNUAL REPORT | 3 BALANCE SHEET GROWTH TOTAL ASSETS TOTAL LOANS 2013 $802 $501 2014 $732 $971 2015 $954 $1,270 2016 $1,251 $1,854 2017 $2,768 $2,091 ($ in millions) REVENUE GROWTH NONINTEREST INCOME NET INTEREST INCOME TOTAL ANNUAL REVENUE 2013 $9,517 $17,448 $26,965 2014 $7,174 $29,461 $22,287 2015 $10,141 $40,894 $30,753 2016 $53,766 $14,077 $39,689 2017 $10,541 $53,982 $64,523 ($ in thousands) COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN FIRST INTERNET BANCORP SNL SMALL CAP US BANK INDEX SNL MICRO CAP US BANK INDEX NASDAQ COMPOSITE INDEX 300% 200% 100% 201520142013 20172016 286% 0%

4 | FIRST INTERNET BANCORP CONSUMER AND SMALL BUSINESS BANKING Without a costly branch network to weigh us down, we can offer great rates and low fees with all the online and mobile banking tools our customers need to help them make smart financial choices. Our offerings include checking and savings accounts, CDs, IRAs, health savings accounts and credit cards. RESIDENTIAL MORTGAGE AND HOME EQUITY LENDING With an award-winning national online platform for origination in all 50 states, we originate conventional, FHA, VA, and jumbo 1-4 family mortgage loans and sell the majority of our originated loans to the secondary market. We also originate home equity loans and lines of credit; we retain and service these loans. CONSUMER LENDING By lending directly to consumers as well as indirectly through an established dealer network, we attract creditworthy customers across the country. We specialize in RV and horse trailer loans. COMMERCIAL REAL ESTATE LENDING We customize financing solutions for experienced developers and owners of investment property located throughout Indiana and nearby Midwestern locations featuring a variety of real estate oriented loan products. Offerings include construction and development debt capital for office, retail, industrial and multi- family properties. We also finance residential construction and development with active, reputable homebuilders and developers operating in the Central Indiana market. SINGLE TENANT LEASE FINANCING Acquisition financing is offered nationwide for savvy real estate owners introduced to us through our committed, growing network of mortgage bankers, brokers and national correspondents. Properties financed are generally well-located within their respective markets and subject to long-term, net lease arrangements with well-known, financially qualified tenants. COMMERCIAL BANKING We offer customized solutions on business lines of credit, term loans, credit cards and owner- occupied real estate to middle- market companies in Indiana and Arizona. Our comprehensive lineup of online treasury management services allows our clients to run their businesses more efficiently and optimize their cash positions with robust reporting and access capabilities. PUBLIC FINANCE We offer a variety of lending and depository solutions for government and not-for-profit customers. Options are available for funding capital projects or refinancing existing debt for hospitals, economic development districts, public infrastructure projects and police and fire departments. The Space for Solutions CAN A HIGH-TECH BANK STILL DELIVER PERSONALIZED SERVICE? From the founding of First Internet Bank in 1999, we’ve been passionate about delivering convenience and unparalleled support to our customers. WITH OUR RELATIONSHIP BANKERS ON HAND TO ANSWER CUSTOMER QUESTIONS QUICKLY, EFFICIENTLY AND ACCURATELY, THAT'S EXACTLY HOW MANY WE NEED. 0 EXACT NUMBER OF REMOTE FIRST INTERNET BANK BRANCHES

2017 ANNUAL REPORT | 5 With an approach to innovation and flexibility we’ve not seen elsewhere in the industry, First Internet Bank enables us to give practice owners well-deserved access to a truly unparalleled combination of branchless banking products and streamlined practice financing.” DANIEL TITCOMB, CO-FOUNDER AND CEO LENDEAVOR “ HEALTHCARE LENDING Through a partnership with Lendeavor, a San Francisco-based technology-enabled lender, we offer business loans for dental, veterinary and other healthcare practices. Funding is available for buying or growing a practice, refinancing practice debt or buying equipment. Lendeavor’s powerful technology takes complicated financial transactions and makes them easier and faster. Greater efficiency means faster funding and better rates for practice owners. Along with Lendeavor, we share a commitment to solving banking and financing challenges through extraordinary customer experience and innovative technology.

6 | FIRST INTERNET BANCORP STORY 1 DAVID JURKIEWICZ ATTORNEY AND RETAIL BANKING CUSTOMER When you work as closely as I have with banking institutions, you develop an ability to quickly judge the culture and character of a bank.” “

2017 ANNUAL REPORT | 7 It’s not just about a great rate—it’s really about the relationship.” “ ED AGARWAL, CEO BIERMAN ABA AUTISM CENTER As an attorney who primarily represents financial institutions, you could say David Jurkiewicz knows a thing or two about banking. “When you work as closely as I have with banking institutions, you develop an ability to quickly judge the culture and character of a bank,” said Jurkiewicz. And that ability serves him well in his legal practice and when it comes to personal banking. A little more than ten years ago, First Internet Bank acquired the institution where Jurkiewicz conducted his personal banking. Having been accustomed to interacting with a more traditional bank with multiple branches, he was, at first, a bit reluctant to keep his accounts in place. “Let’s just say my father wouldn’t bank with someone named First Internet Bank, but I’m a bit more forward thinking,” remarked Jurkiewicz. So he decided to give it a go…and he’s never looked back. From checking and savings accounts to home loans, First Internet Bank has helped make Jurkiewicz’s banking needs more convenient and hassle-free. “I don’t always follow some of the protocols required by traditional banks, but that has never been a problem here,” laughed Jurkiewicz. “It’s okay if I forget a deposit slip, and the funds still show up in my account as expected. Some other banks don’t have employees who care enough to make sure that happens.” At First Internet Bank, we appreciate people like David who are willing to take a chance when something different comes along—like thinking of banking in a whole new way. Jurkiewicz captured it perfectly when he remarked, “It feels kinda cool to bank with First Internet Bank.” The Space to Be a Pioneer

8 | FIRST INTERNET BANCORP It’s not just about a great rate—it’s the relationship. When you can find that in a trusted advisor, it transcends everything else.” “ ED AGARWAL, CEO BIERMAN ABA AUTISM CENTER Parents of children with autism usually notice no signs during early developmental stages of their child’s life. But as hints of behavioral symptoms emerge, families often face a traumatic and life-changing experience. “When parents first learn of a child’s autism diagnosis, common feelings are devastation, guilt and fear,” said Courtney Bierman, President and Founder at Bierman ABA Autism Center. “We help provide our families relief.” Compassionate care for children with autism, along with their families, requires an intensive and tailored approach to each patient’s unique set of circumstances, and Bierman ABA Autism Center uses an early intervention model to develop treatments when children are most receptive to them. Bierman’s clinical team customizes plans and programming, leading kids to more resilient, successful lives. A key element of Bierman’s therapeutic approach is the clinic itself. Colorful, engaging and comfortable spaces help create many atmospheres in one setting, encouraging learning and development. When Bierman planned to expand the clinic to support this type of environment and meet ever-growing capacity needs in 2013, the team turned to First Internet Bank to secure financing for the project. This marked the beginning of what has become a truly collaborative alliance. First Internet Bank’s customized, relationship-driven approach, not unlike that of Bierman’s, assured Bierman CEO Ed Agarwal he’d found the right partner. “First Internet Bank took the time to fully understand our needs by asking the right questions and gaining insight into our plans for growth. And, they did it with the speed we needed to execute our plans,” said Agarwal. First Internet Bank has since provided Bierman financing for additional locations to support its national expansion. But financial services only scratch the surface of the partnership. When Bierman makes important decisions, from selecting an accounting firm or an insurance agent to hiring a key employee, they seek input from their First Internet Bank team. “It’s not just about a great rate— it’s the relationship,” Agarwal confirmed. “When you can find that in a trusted advisor, it transcends everything else.” The Space to Trust

2017 ANNUAL REPORT | 9

10 | FIRST INTERNET BANCORP STORY 3 At Platinum Properties we are straightforward. We say what we mean and we work with integrity, and First Internet Bank reflects those same values.” “ STEVE EDWARDS, LAND DEVELOPER PLATINUM PROPERTIES MANAGEMENT COMPANY, LLC

2017 ANNUAL REPORT | 11 ED AGARWAL, CEO BIERMAN ABA AUTISM CENTER Bikes cruising safely through quiet streets, children’s voices echoing from a pool, neighbors gathered on manicured lawns. For many, these sights and sounds epitomize the American Dream. For real estate land developer Steve Edwards, they mark the culmination of years of research, approvals, negotiations, surveying, digging and lots of hard work. Edwards’s company, Platinum Properties Management Company LLC, has found success in making part of the American Dream— homeownership—a reality for many in Central Indiana by developing neighborhoods and subdivisions for large home builders. But as with anyone tied to the housing market during the recession of the late 2000s, he’s also been forced to persevere through a challenging era. “I still have scars,” Edwards noted, “but my business is stronger now because of them.” In 2009, after the housing market crashed and banks were far less willing to provide real estate financing, Edwards was introduced to First Internet Bank. “At the time, most other banks simply ran away from real estate financing without truly taking the time to conduct the proper due diligence to determine the creditworthiness of a deal. First Internet Bank did their research and ultimately believed in our company,” reflected Edwards. By securing a new line of credit, Platinum Properties weathered the storm. As the economy began to recover and real estate transactions gained momentum, Edwards and Mike Lewis, SVP of Commercial Real Estate Banking at First Internet Bank, both acknowledged a paradigm shift was needed in post-recession financing. “We talked regularly to reach common ground on how to proceed in a cautious fashion. For the sake of both companies, we landed on a more ‘phased’ approach—once part of a project was complete, the loan would be repaid,” said Edwards. Edwards continues to work closely and collaboratively with First Internet Bank to see each phase of his development projects through. “At Platinum Properties, we are straightforward. We say what we mean and we work with integrity, and First Internet Bank reflects those same values. They also have a true understanding of real estate economics, risk factors and housing market trends that I’ve never experienced with other banks,” Edwards remarked. “They’re a breath of fresh air.” The Space to Dream

12 | FIRST INTERNET BANCORP As we’ve continued to grow and gain acceptance over time, we’ve had other banks approach us, but there’s no reason to consider any others.” “ JUSTIN GOHEEN, FOUNDER AND CEO TRADECYCLE CAPITAL, LLC For the Founder and CEO of a company that specializes in technology-enabled, supply-chain finance, you’d assume the description “entrepreneur” would easily roll off the tongue. But Justin Goheen is hesitant to think of himself in those terms. “I never felt that label applied to me, it just seems more suitable for others,” noted Goheen. Forgive us, Justin, if we respectfully disagree. Tradecycle Capital LLC, Goheen’s brainchild, was created to fill an unmet need for middle-market companies hoping to extend their payables, while at the same time offering quicker payments to their supply chain partners. “What we provide is a win-win situation by optimizing working capital for our clients— the buyer—and improving the cash flow of our clients’ suppliers— the seller,” Goheen explained. Goheen’s extensive experience in international structured trade finance provides the expertise to successfully integrate risk mitigation tools into their funding structures, while custom-built technology helps facilitate client transactions and transparency. Originally, partnered with a highly-experienced investor, Tradecycle utilized private funds to finance its activities, but in order to meet the burgeoning demand for their solutions, a bank partner became a necessity to accommodate future growth. Goheen feared most traditional banks would be uncomfortable lending to a start-up concern with little operational history, much less one with such an unconventional offering. Enter First Internet Bank. Goheen knew First Internet Bank by reputation only, but was introduced to CEO David Becker shortly after launching Tradecycle. Goheen quickly recognized the entrepreneurial spirit that Becker and First Internet Bank exemplified, and realized he may have finally found a banking partner that “gets it.” “David immediately understood our innovative model and wanted to help support our growth. As we've continued to grow and gain acceptance over time, we’ve had other banks approach us. But there’s no reason to consider any others,” said Goheen. “First Internet Bank saw our potential when others didn’t, and they afford us all the service and flexibility we need.” The Space to Innovate

2017 ANNUAL REPORT | 13

14 | FIRST INTERNET BANCORP AWARDS AND ACCOLADES First Internet Bank has earned a number of workplace awards over the years. We’ve been recognized for our service to the community and acknowledged as a great place to work! BEST BANKS TO WORK FOR First Internet Bank was recognized as one of the top ten Best Banks to Work For in 2017 in a nationwide ranking by American Banker and Best Companies Group. We’ve earned the distinction of being one of the best every year since the program began in 2013. TOP WORKPLACES IN INDIANAPOLIS First Internet Bank ranked #2 of all Indianapolis workplaces in 2017, the 4th consecutive year the Bank has earned the honor from The Indianapolis Star. We also moved from the small companies category to the midsize group in 2017. BEST PLACES TO WORK IN INDIANA First Internet Bank was honored as one of 21 organizations named as a Best Place to Work in Indiana in the medium-sized category for 2017, the 3rd time we’ve been honored with this recognition. The Space for Community WE ARE AS PASSIONATE ABOUT OUR COMMUNITY AS WE ARE ABOUT OUR CUSTOMERS, AND WE USE BOTH OUR TIME AND OUR TALENTS TO MAKE A LASTING IMPACT. FIRST INTERNET BANK SUPPORTS VOLUNTEER TIME OFF FOR EMPLOYEES so that our employees can share time and talent with causes they're passionate about. First Internet Bank is full of talented, imaginative, hardworking folks who enjoy being a part of something meaningful. Our employees come from a wide range of backgrounds and reflect a blend of proficiencies that help create an effective, dynamic working environment throughout our lines of business.

2017 ANNUAL REPORT | 15 Employees traded their laptops for paintbrushes and power tools as part of a volunteer event with Habitat for Humanity. The First Internet Bank team worked together to provide the finishing touches on homes for several deserving families in Indianapolis.

16 | FIRST INTERNET BANCORP INSIDE BACK COVERTotal Deposits* The Space for Success IN ASSETS AT CLOSE OF 2017 Like most start-ups, our early days were challenging. But we built our success—and transformed the banking industry—by staying true to our roots as innovators and trailblazers. Today, we bring the same passion and creativity to every interaction you have with First Internet Bank—we want to empower you to bank on your own ideas.” “ DAVID B. BECKER, PRESIDENT AND CHIEF EXECUTIVE OFFICER $2.8B FIVE-YEAR TOTAL ASSET GROWTH FIVE-YEAR TOTAL LOAN GROWTH FIVE-YEAR TOTAL DEPOSIT GROWTH 335% 86% 85% 293% FIRST INTERNET BANCORP SNL SMALL CAP US BANKS 106% 484%

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 31, 2017. or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period From ________ to ________. Commission File Number 001-35750 First Internet Bancorp (Exact Name of Registrant as Specified in its Charter) Indiana 20-3489991 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 11201 USA Parkway Fishers, Indiana 46037 (Address of principal executive offices) (Zip Code) (317) 532-7900 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of class Name of exchange on which registered Common stock, without par value The Nasdaq Stock Market LLC 6.0% Fixed to Floating Subordinated Notes due 2026 The Nasdaq Stock Market LLC Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. Yes No Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. Large Accelerated Filer Accelerated Filer Non-accelerated Filer (Do not check if a smaller reporting company) Smaller Reporting Company Emerging Growth Company If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No The aggregate market value of common stock held by non-affiliates of the registrant as of June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $170.6 million, based on the closing sale price for the registrant’s common stock on that date. For purposes of determining this number, all officers and directors of the registrant are considered to be affiliates of the registrant. This number is provided only for the purpose of this report and does not represent an admission by either the registrant or any such person as to the status of such person. As of March 5, 2018, the registrant had 8,422,371 shares of common stock issued and outstanding. Documents Incorporated By Reference Portions of our Proxy Statement for our 2018 Annual Meeting of Shareholders are incorporated by reference in Part III.

i Cautionary Note Regarding Forward-Looking Statements This annual report on Form 10-K contains “forward-looking statements” within the meaning of the federal securities laws. These statements are not historical facts, but rather statements based on the current expectations of First Internet Bancorp and its consolidated subsidiaries (the “Company,” “we,” “our,” “us”) regarding its business strategies, intended results and future performance. Forward-looking statements are generally preceded by terms such as “can,” “expects,” “believes,” “anticipates,” “intends,” “may,” “plan,” “should” and similar expressions. Such statements are subject to certain risks and uncertainties including: general economic conditions, whether national or regional, and conditions in the lending markets in which we participate that may have an adverse effect on the demand for our loans and other products, our credit quality and related levels of nonperforming assets and loan losses, and the value and salability of the real estate that we own or that is the collateral for our loans; failures or breaches of or interruptions in the communication and information systems on which we rely to conduct our business that could reduce our revenues, increase our costs or lead to disruptions in our business; our plans to grow our commercial real estate, commercial and industrial, public finance and healthcare finance loan portfolios which may carry greater risks of non-payment or other unfavorable consequences; our dependence on capital distributions from First Internet Bank of Indiana (the “Bank”); results of examinations of us by our regulators, including the possibility that our regulators may, among other things, require us to increase our allowance for loan losses or to write-down assets; changing bank regulatory conditions, policies or programs, whether arising as new legislation or regulatory initiatives, that could lead to restrictions on activities of banks generally, or the Bank in particular; more restrictive regulatory capital requirements; increased costs, including deposit insurance premiums; regulation or prohibition of certain income producing activities or changes in the secondary market for loans and other products; changes in market rates and prices that may adversely impact the value of securities, loans, deposits and other financial instruments and the interest rate sensitivity of our balance sheet; our liquidity requirements being adversely affected by changes in our assets and liabilities; the effect of legislative or regulatory developments, including changes in laws concerning taxes, banking, securities, insurance and other aspects of the financial services industry; competitive factors among financial services organizations, including product and pricing pressures and our ability to attract, develop and retain qualified banking professionals; executing of future acquisition, reorganization or disposition transactions, including the related time and costs of implementing such transactions, integrating operations as party of those actions and possible failures to achieve expected gains, revenue growth and/or expense savings and other anticipated benefits from such actions; changes in U.S. tax laws; the growth and profitability of noninterest or fee income being less than expected; the loss of any key members of senior management; the effect of changes in accounting policies and practices, as may be adopted by the Financial Accounting Standards Board (the “FASB”), the Securities and Exchange Commission (the “SEC”), the Public Company Accounting Oversight Board (the “PCAOB”) and other regulatory agencies; and the effect of fiscal and governmental policies of the United States federal government. Additional factors that may affect our results include those discussed in this report under the heading “Risk Factors” and in other reports filed with the SEC. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The factors listed above could affect our financial performance and could cause our actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. Except as required by law, we do not undertake, and specifically disclaim any obligation, to publicly release the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

ii First Internet Bancorp Table of Contents PART I PAGE Item 1. Business Item 1A. Risk Factors Item 1B. Unresolved Staff Comments Item 2. Properties Item 3. Legal Proceedings Item 4. Mine Safety Disclosures PART II Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Item 6. Selected Financial Data Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations Item 7A. Quantitative and Qualitative Disclosures About Market Risk Item 8. Financial Statements and Supplementary Data Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Item 9A. Controls and Procedures Item 9B. Other Information PART III Item 10. Directors, Executive Officers and Corporate Governance Item 11. Executive Compensation Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Item 13. Certain Relationships and Related Transactions, and Director Independence Item 14. Principal Accounting Fees and Services PART IV Item 15. Exhibits, Financial Statement Schedules Item 16. Form 10-K Summary SIGNATURES 1 10 19 19 19 19 20 23 25 43 44 44 44 44 45 46 46 46 46 47 49 50

1 PART I Item 1. Business General First Internet Bancorp is a bank holding company that conducts its primary business activities through its wholly-owned subsidiary, First Internet Bank of Indiana, an Indiana chartered bank. First Internet Bank of Indiana was the first state-chartered, Federal Deposit Insurance Corporation (“FDIC”) insured Internet bank and commenced banking operations in 1999. First Internet Bancorp was incorporated under the laws of the State of Indiana on September 15, 2005. On March 21, 2006, we consummated a plan of exchange by which we acquired all of the outstanding shares of the Bank. When we refer to “First Internet Bancorp,” the “Company,” “we,” “us” and “our” in the remainder of this annual report on Form 10-K, we mean First Internet Bancorp and its consolidated subsidiaries, unless the context indicates otherwise. References to “First Internet Bank” or the “Bank” refer to First Internet Bank of Indiana, an Indiana chartered bank and wholly-owned subsidiary of the Company. We offer a wide range of commercial, small business, consumer and municipal banking products and services. We conduct our consumer and small business deposit operations primarily through online channels on a nationwide basis and have no traditional branch offices. Our residential mortgage products are offered nationwide primarily through an online direct-to-consumer platform and are supplemented with Central Indiana-based mortgage and construction lending. Our consumer lending products are primarily originated on a nationwide basis over the Internet as well as through relationships with dealerships and financing partners. Our commercial banking products and services are delivered through a relationship banking model and include commercial real estate (“CRE”) banking, commercial and industrial (“C&I”) banking, public finance and healthcare finance. Through our CRE team, we offer single tenant lease financing on a nationwide basis in addition to traditional investor commercial real estate and construction loans primarily within Central Indiana and adjacent markets. To meet the needs of commercial borrowers and depositors located primarily in Central Indiana, Phoenix, Arizona and adjacent markets, our C&I banking team provides credit solutions such as lines of credit, term loans, owner-occupied commercial real estate loans and corporate credit cards as well as treasury management services. Our public finance team, established in early 2017, provides a range of public and municipal lending and leasing products to government entities on a nationwide basis. Healthcare finance lending solutions are originated through a strategic partnership we entered into during 2017 with Lendeavor, Inc., a San Francisco-based technology-enabled lender to healthcare practices. As of December 31, 2017, we had total assets of $2.8 billion, total liabilities of $2.5 billion, and shareholders’ equity of $224.1 million. We employed 206 full-time equivalent employees at December 31, 2017. Our principal executive offices are located at 11201 USA Parkway, Fishers, Indiana 46037 and our telephone number is (317) 532-7900. Subsidiaries The Bank has two wholly-owned subsidiaries, First Internet Public Finance Corp., which was organized in early 2017 and provides a range of public and municipal finance lending and leasing products to governmental entities throughout the United States and acquires securities issued by state and local governments and other municipalities, and JKH Realty Services, LLC, which manages other real estate owned properties as needed. Performance Balance Sheet Growth. Total assets have increased 245.0% from $802.3 million at December 31, 2013 to $2.8 billion at December 31, 2017. This increase was driven primarily by strong organic growth. During the same time period, loans increased from $501.2 million to $2.1 billion and deposits increased from $673.1 million to $2.1 billion, increases of 317.3% and 209.8%, respectively. Our sustained growth profile is the result of our flexible and highly scalable Internet banking platform that allows us to target a broad reach of customers across all 50 states. Additionally, key strategic commercial banking hires have enabled us to further expand our product offerings on both a local and national basis. At December 31, 2017, commercial loans comprised 73.2% of loans compared to 42.3% at December 31, 2013.

2 Earnings Growth. Net income has increased 231.5% from $4.6 million for the twelve months ended December 31, 2013 to $15.2 million for the twelve months ended December 31, 2017. Diluted earnings per share have increased 41.1% from $1.51 for the twelve months ended December 31, 2013 to $2.13 for the twelve months ended December 31, 2017. Asset Quality. We have maintained a high quality loan portfolio due to our emphasis on a strong credit culture, conservative underwriting standards, disciplined risk management processes, and a diverse national and local customer base. At December 31, 2017, our nonperforming assets to total assets was 0.21%, our nonperforming loans to total loans was 0.04% and our allowance for loan losses to total loans was 0.72%. Strategic Focus We operate on a national basis through our scalable Internet banking platform to gather deposits and offer residential mortgage and consumer lending products rather than relying on a conventional brick and mortar branch system. We primarily conduct commercial banking, including CRE and C&I, and related activities on a local basis, except for single tenant lease financing, public finance and healthcare finance which are offered nationwide. Our overriding strategic focus is enhancing franchise and shareholder value while maintaining strong risk management policies and procedures. We believe the continued creation of franchise and shareholder value will be driven by profitable growth in commercial and consumer banking, effective underwriting, strong asset quality and efficient technology-driven operations. National Focus on Deposit and Consumer Banking Growth. Our first product offerings were basic deposit accounts, certificates of deposit, electronic bill pay and credit cards. Within 90 days of opening, we had accounts with consumers in all 50 states. Over the years, we added consumer loans, lines of credit, home equity loans and single-family mortgages. Our footprint for deposit gathering and these consumer lending activities is the entire nation. With the use of our Internet-based technology platform, we do not face geographic boundaries that traditional banks must overcome for customer acquisition. Armed with smart phones, tablets and computers, our customers can access our online banking system, bill pay, and remote deposit capture 24 hours a day, seven days a week, on a real-time basis. In addition, we have dedicated banking specialists who can service customer needs via telephone, email or online chat. We intend to continue to expand our deposit base by leveraging technology and through targeted marketing efforts. Commercial Banking Growth. We have diversified our operations by adding commercial banking, public finance and healthcare finance to complement our consumer platform. We offer traditional CRE loans, single tenant lease financing, C&I loans, healthcare finance loans, corporate credit cards, treasury management services and public and municipal finance loans and leases. Our commercial lending teams consist of seasoned commercial bankers, many of whom have had extensive careers with larger money center, super-regional or regional banks. These lenders leverage deep market knowledge and experience to serve commercial borrowers with a relationship-based approach. We intend to continue expanding our commercial banking platform by hiring additional seasoned loan officers and relationship managers with specialized market or product expertise. Experience. Our management team and our Board of Directors are integral to our success. Our management team and Board of Directors are led by David B. Becker, the founder of First Internet Bank of Indiana. Mr. Becker is a seasoned business executive and entrepreneur with over three decades of management experience in the financial services and financial technology space, and has served as Chief Executive Officer since 2005. Mr. Becker has been the recipient of numerous business awards, including Ernst & Young Entrepreneur of the Year in 2001, and was inducted into the Central Indiana Business Hall of Fame in 2008. The senior management team consists of individuals with backgrounds in both regional and community banking and financial technology services. The senior management team is overseen by a dedicated Board of Directors with a wide range of experience from careers in financial services, legal and regulatory services, and industrial services. Increased Efficiency Through Technology. We have built a scalable banking platform based upon technology as opposed to a traditional branch network. We intend to continue leveraging this infrastructure as well as investing in and utilizing new technologies to compete more effectively as we grow in the future. Through our online account access services, augmented by our team of dedicated banking specialists, we can satisfy the needs of our retail and commercial customers in an efficient manner. Our data processing systems run on a “real-time” basis, unlike many banks that run a “batch system,” so customers benefit from an up-to-the-minute picture of their financial position, particularly our commercial customers who complete numerous transactions in a single day. We believe that our business model and digital banking processes are capable of supporting continued growth and producing a greater level of operational efficiency, which should drive increasing profitability. Expand Asset Generation and Revenue Channels. Our geographic and credit product diversity have produced sustained balance sheet and earnings growth. We expect to continue exploring additional asset and revenue generation capabilities that complement our commercial and consumer banking platforms. These efforts may include adding personnel or teams with product, industry or geographic expertise or through strategic acquisitions.

3 Lending Activities We earn interest income on loans as well as fee income from the origination of loans. Lending activities include loans to individuals, which primarily consist of residential real estate loans, home equity loans and lines of credit, and consumer loans, and loans to commercial clients, which include C&I loans, CRE loans, municipal loans and leases, lines of credit, letters of credit, single tenant lease financing and loans to healthcare providers. Residential real estate loans are either retained in our loan portfolio or sold to secondary investors, with gains or losses from the sales being recognized within noninterest income. Refer to Note 4 of the financial statements for further discussion of each loan portfolio segment as of December 31, 2017. Deposit Activities and Other Sources of Funds We obtain deposits through the ACH network (direct deposit as well as customer-directed transfers of funds from outside financial institutions), remote and mobile deposit capture, mailed checks, wire transfers and a deposit-taking ATM network. Additionally, we had approximately $76.7 million in brokered time deposits at December 31, 2017. The Bank does not own or operate any ATMs. Through network participation, the Bank’s customers are able to use nearly any ATM worldwide to withdraw cash. The Bank currently rebates up to $10.00 per customer per month for surcharges our customers incur when using an ATM owned by another institution. Management believes this program is more cost effective for the Bank, and more convenient for our customers, than it would be to build and maintain a proprietary nationwide ATM network. By providing robust online capabilities, quality customer service and competitive pricing for the products and services offered, we have been able to develop relationships with our customers and build brand loyalty. As a result, we are not dependent upon costly account acquisition campaigns to attract new customers on a continual basis. Competition The markets in which we compete to make loans and attract deposits are highly competitive. For retail banking activities, we compete with other banks that use the Internet as a primary service channel, including Ally Bank, EverBank (a division of TIAA, FSB), Synchrony Bank, Goldman Sachs Bank USA and Bank of Internet USA. However, we also compete with other banks, savings banks, credit unions, investment banks, insurance companies, securities brokerages and other financial institutions, as nearly all have some form of Internet delivery for their services. For residential mortgage lending, competitors that use the Internet as a primary service channel include Quicken Loans and loanDepot. We also compete with money center and superregional banks in residential mortgage lending, including Bank of America, Chase and Wells Fargo. For our traditional commercial lending activities, we compete with larger financial institutions operating in the Midwest and Central Indiana regions, including KeyBank, PNC Bank, Chase, BMO Harris Bank, Huntington National Bank and First Financial Bank. In the Southwest, competitors include Wells Fargo, Chase, Bank of America, U.S. Bank, Mid First Bank and Arizona Business Bank. For our single tenant lease financing activities, we compete nationally with regional banks, local banks and credit unions, as well as life insurance companies and commercial mortgage-backed securities lenders. Examples of these competitors include Wells Fargo, First Savings Bank, CapStar Bank, EverBank and StanCorp. For our public finance activities, we compete nationally with superregional and regional banks, such as Huntington National Bank, KeyBank, Capital One, Sterling National Bank and Texas Capital Bank. These competitors may have significantly greater financial resources and higher lending limits than we do, and may also offer specialized products and services that we do not. For our healthcare finance activities, we compete nationally with superregional and regional banks, such as TD Bank, PNC Bank, Wintrust Financial Corporation and Columbia Bank. In the United States, banking has experienced widespread consolidation over the last decade leading to the emergence of several large nationwide banking institutions. These competitors have significantly greater financial resources and offer many branch locations as well as a variety of services we do not. We have attempted to offset some of the advantages of the larger competitors by leveraging technology to deliver product solutions and better compete in targeted segments. We have positioned ourselves as an alternative to these institutions for consumers who do not wish to subsidize the cost of large branch networks through high fees and unfavorable interest rates. We anticipate that consolidation will continue in the financial services industry and perhaps accelerate as a result of intensified competition for the same customer segments and significantly increased regulatory burdens and rules that are expected to increase expenses and put pressure on earnings.

4 Regulation and Supervision The Company and the Bank are extensively regulated under federal and state law. The Company is a registered bank holding company under the Bank Holding Company Act of 1956 (the “BHCA”) and, as such, is subject to regulation, supervision and examination by the Board of Governors of the Federal Reserve System (the “Federal Reserve”). The Company is required to file reports with the Federal Reserve on a quarterly basis. The Bank is an Indiana-chartered bank formed pursuant to the Indiana Financial Institutions Act (the “IFIA”). As such, the Bank is regularly examined by and subject to regulations promulgated by the Indiana Department of Financial Institutions (the “DFI”) and the FDIC as its primary federal bank regulator. The Bank is not a member of the Federal Reserve System. The regulatory environment affecting the Company has been and continues to be altered by the enactment of new statutes and the adoption of new regulations as well as by revisions to, and evolving interpretations of, existing regulations. State and federal banking agencies have significant discretion in the conduct of their supervisory and enforcement activities and their examination policies. Any change in such practices and policies could have a material impact on the Company’s results of operations and financial condition. The following discussion is intended to be a summary of the material statutes, regulations and regulatory directives that are currently applicable to us. It does not purport to be comprehensive or complete and it is expressly subject to and modified by reference to the text of the applicable statutes, regulations and directives. The Dodd-Frank Act The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) comprehensively reformed the regulation of financial institutions and the products and services they offer. Certain provisions of the Dodd-Frank Act noted in this section are also discussed in other sections. Among other things, the Dodd-Frank Act provided for capital standards that eliminate or restrict the treatment of trust preferred securities as Tier 1 capital based on the asset size of an institution. The Company has never issued any trust preferred securities. The Dodd-Frank Act permanently raised deposit insurance levels to $250,000, retroactive to the beginning of 2008. Pursuant to modifications under the Dodd-Frank Act, deposit insurance assessments are now being calculated based on an insured depository institution’s assets rather than its insured deposits, and the minimum reserve ratio of the FDIC’s Deposit Insurance Fund (the “DIF”) was raised to 1.35%. The payment of interest on business demand deposit accounts is permitted by the Dodd- Frank Act. The Dodd-Frank Act authorized the Federal Reserve to regulate interchange fees for debit card transactions and established new minimum mortgage underwriting standards for residential mortgages. Further, the Dodd-Frank Act barred certain banking organizations from engaging in proprietary trading and from sponsoring and investing in hedge funds and private equity funds, except as permitted under certain limited circumstances. The Dodd-Frank Act empowered the newly established Financial Stability Oversight Council to designate certain activities as posing a risk to the U.S. financial system and to recommend new or heightened standards and safeguards for financial organizations engaging in such activities. The Dodd-Frank Act also established the Consumer Financial Protection Bureau (the “CFPB”) as an independent agency within the Board of Governors of the Federal Reserve System. The CFPB has the exclusive authority to administer, enforce, and otherwise implement federal consumer financial laws, which includes the power to make rules, issue orders, and issue guidance governing the provision of consumer financial products and services. The CFPB has exclusive federal consumer law supervisory authority and primary enforcement authority over insured depository institutions with assets totaling over $10 billion. Authority for institutions with $10 billion or less rests with the prudential regulator, and in the case of the Bank lies with the FDIC. Further, the Dodd-Frank Act established the Office of Financial Research, which has the power to require reports from other financial services companies. In 2015, the CFPB’s final rules on integrated mortgage disclosures under the Truth in Lending Act and the Real Estate Settlement Procedures Act became effective. The new disclosures are intended to improve disclosures to consumers and also contain tolerance limitations that may cause lenders to refund fees charged to consumers when certain costs vary between the initial and final disclosure.

5 Holding Company Regulation We are subject to supervision and examination as a bank holding company by the Federal Reserve under the BHCA. In addition, the Federal Reserve has the authority to issue orders to bank holding companies to cease and desist from unsafe or unsound banking practices and from violations of conditions imposed by, or violations of agreements with, the Federal Reserve. The Federal Reserve is also empowered, among other things, to assess civil money penalties against companies or individuals who violate Federal Reserve orders or regulations, to order termination of nonbanking activities of bank holding companies and to order termination of ownership and control of a nonbanking subsidiary by a bank holding company. Federal Reserve approval is also required in connection with bank holding companies’ acquisitions of more than 5% of the voting shares of any class of a depository institution or its holding company and, among other things, in connection with the bank holding company’s engaging in new activities. Under the BHCA, our activities are limited to businesses so closely related to banking, managing or controlling banks as to be a proper incident thereto. The BHCA also requires a bank holding company to obtain approval from the Federal Reserve before (1) acquiring or holding more than a 5% voting interest in any bank or bank holding company, (2) acquiring all or substantially all of the assets of another bank or bank holding company or (3) merging or consolidating with another bank holding company. We have not filed an election with the Federal Reserve to be treated as a “financial holding company,” a type of holding company that can engage in certain insurance and securities-related activities that are not permitted for a bank holding company. Source of Strength. Under the Dodd-Frank Act, we are required to serve as a source of financial and managerial strength for the Bank in the event of the financial distress of the Bank. This provision codifies the longstanding policy of the Federal Reserve. Although the Dodd-Frank Act requires the federal banking agencies to issue regulations to implement the source of strength provisions, no regulations have been promulgated at this time. In addition, any capital loans by a bank holding company to any of its depository subsidiaries are subordinate to the payment of deposits and to certain other indebtedness. In the event of a bank holding company’s bankruptcy, any commitment by the bank holding company to a federal bank regulatory agency to maintain the capital of a depository subsidiary will be assumed by the bankruptcy trustee and entitled to a priority of payment. Regulatory Capital. The Federal Reserve sets risk-based capital ratio and leverage ratio guidelines for bank holding companies. Under the guidelines and related policies, bank holding companies must maintain capital sufficient to meet both a risk-based asset ratio test and a leverage ratio test on a consolidated basis. The guidelines provide a systematic analytical framework that makes regulatory capital requirements sensitive to differences in risk profiles among banking organizations, takes off-balance sheet exposures expressly into account in evaluating capital adequacy and minimizes disincentives to holding assets considered by regulatory agencies to be liquid and low-risk. The risk-based ratio is determined by allocating assets and specified off-balance sheet commitments into risk-weighted categories, with higher weighting assigned to categories perceived as representing greater risk. The risk-based ratio represents total capital divided by total risk-weighted assets. The leverage ratio is Tier 1 capital divided by total average assets adjusted as specified in the guidelines. The Bank, supervised by the FDIC and DFI, is subject to substantially similar capital requirements. Our applicable capital ratios as of December 31, 2017 and 2016 are summarized in Note 13 to the financial statements. In 2013, the Federal Reserve published final rules (the “Basel III Capital Rules”) establishing a new comprehensive capital framework for U.S. bank holding companies. The FDIC adopted substantially identical standards for institutions, like the Bank, subject to its jurisdiction in an interim final rule. The Basel III Capital Rules implement requirements consistent with agreements reached by the Basel Committee on Banking Supervision as well as certain provisions of the Dodd-Frank Act. These rules substantially revised the risk-based capital requirements applicable to depository institutions and their holding companies, including the Company and the Bank. The Basel III Capital Rules were effective for all banks as of the beginning of 2015, subject to certain phase-in periods for some requirements. Among other things, the Basel III Capital Rules (i) introduced a new capital measure called “Common Equity Tier 1” (“CET1”), (ii) specified that Tier 1 Capital consists of CET1 and “Additional Tier 1 Capital” instruments meeting specified requirements, (iii) applied most deductions/adjustments to regulatory capital measures to CET1 and not to the other components of capital, thus potentially requiring higher levels of CET1 in order to meet minimum ratios, and (iv) expanded the scope of the deductions/adjustments from capital in comparison to current regulations. Under Basel III Capital Rules, the minimum capital ratios are: 4.5% CET1 to risk-weighted assets, 6.0% Tier 1 capital to risk-weighted assets, 8.0% Total Capital (Tier 1 Capital plus Tier 2 Capital) to risk-weighted assets and 4.0% Leverage Ratio. In addition, a capital conservation buffer of 2.5% above each level applicable to the CET1, Tier 1, and Total Capital ratios will be required for banking institutions like the Company and the Bank to avoid restrictions on their ability to make capital distributions, including dividends, and pay certain discretionary bonus payments to executive officers. The capital conservation buffer is being

6 phased in with annual increases through 2019. The following are the Basel III regulatory capital levels, inclusive of the capital conservation buffer, that the Company and the Bank must satisfy to avoid limitations on capital distributions, including dividends, and discretionary bonus payments during the applicable phase-in period from January 1, 2015, until January 1, 2019: Basel III Regulatory Capital Levels January 1, 2015 January 1, 2016 January 1, 2017 January 1, 2018 January 1, 2019 Common equity tier 1 capital to risk-weighted assets 4.50% 5.125% 5.75% 6.375% 7.00% Tier 1 capital to risk-weighted assets 6.00% 6.625% 7.25% 7.875% 8.50% Total capital to risk-weighted assets 8.00% 8.625% 9.25% 9.875% 10.50% The Basel III Capital Rules revise the prompt corrective action framework by (i) introducing a CET1 ratio requirement at each capital level, with a required CET1 ratio to remain well-capitalized at 6.5%, (ii) increasing the minimum Tier 1 Capital ratio requirement for each category, with the minimum Tier 1 Capital ratio for well-capitalized status being increased to 8% and (iii) transitioning to a Leverage Ratio of 4% in order to qualify as adequately capitalized and a Leverage Ratio of 5% to be well- capitalized. The Company believes that, as of December 31, 2017, the Company and the Bank would meet all capital adequacy requirements under the Basel III Capital Rules on a fully phased-in basis if such requirements were then effective. Regulation of Banks Business Activities. The Bank derives its lending and investment powers from the IFIA, the Federal Deposit Insurance Act (the “FDIA”) and related regulations. Loans-to-One Borrower Limitations. Generally, the Bank’s total loans or extensions of credit to a single borrower, including the borrower’s related entities, outstanding at one time, and not fully secured, cannot exceed 15% of the Bank’s unimpaired capital and surplus. If the loans or extensions of credit are fully secured by readily marketable collateral, the Bank may lend up to an additional 10% of its unimpaired capital and surplus. Community Reinvestment Act. Under the Community Reinvestment Act (the “CRA”), as implemented by FDIC regulations, the Bank has a continuing and affirmative obligation, consistent with safe and sound banking practices, to help meet the credit needs of its entire community, including low and moderate income neighborhoods. The CRA does not establish specific lending requirements or programs for financial institutions nor does it limit an institution’s discretion to develop the types of products and services that it believes are best suited to its particular community, consistent with the CRA. The CRA requires the FDIC, in connection with its examinations of the Bank, to assess the Bank’s record of meeting the credit needs of its entire community and to take that record into account in evaluating certain applications for regulatory approvals that we may file with the FDIC. Due to its Internet-driven model and nationwide consumer banking platform, the Bank has opted to operate under a CRA Strategic Plan, which was submitted to and approved by the FDIC and sets forth certain guidelines the Bank must meet. The current Strategic Plan expired December 31, 2017 and the Bank has submitted a new plan for approval that will be in effect through December 31, 2020. The Bank received a “Satisfactory” CRA rating in its most recent CRA examination. Failure of an institution to receive at least a “Satisfactory” rating could inhibit such institution or its holding company from engaging in certain activities or pursuing acquisitions of other financial institutions. Transactions with Affiliates. The authority of the Bank, like other FDIC-insured banks, to engage in transactions with its “affiliates” is limited by Sections 23A and 23B of the Federal Reserve Act and the Federal Reserve’s Regulation W. An “affiliate” for this purpose is defined generally as any company that owns or controls the Bank or is under common ownership or control with the Bank, but excludes a company controlled by a bank. In general, transactions between the Bank and its affiliates must be on terms that are consistent with safe and sound banking practices and at least as favorable to the Bank as comparable transactions between the Bank and non-affiliates. In addition, covered transactions with affiliates are restricted individually to 10% and in the aggregate to 20% of the Bank’s capital. Collateral ranging from 100% to 130% of the loan amount depending on the quality of the collateral must be provided for an affiliate to secure a loan or other extension of credit from the Bank. The Company is an “affiliate” of the Bank for purposes of Regulation W and Sections 23A and 23B of the Federal Reserve Act. We believe the Bank is in compliance with these provisions.

7 Loans to Insiders. The Bank’s authority to extend credit to its directors, executive officers and principal shareholders, as well as to entities controlled by such persons (“Related Interests”), is governed by Sections 22(g) and 22(h) of the Federal Reserve Act and Regulation O of the Federal Reserve. Among other things, these provisions require that extensions of credit to insiders: (1) be made on terms that are substantially the same as, and follow credit underwriting procedures that are not less stringent than, those prevailing for comparable transactions with unaffiliated persons and that do not involve more than the normal risk of repayment or present other unfavorable features; and (2) not exceed certain limitations on the amount of credit extended to such persons, individually and in the aggregate, which limits are based, in part, on the amount of the Bank’s capital. In addition, extensions of credit in excess of certain limits must be approved in advance by the Bank’s Board of Directors. Further, provisions of the Dodd-Frank Act require that any sale or purchase of an asset by the Bank with an insider must be on market terms and if the transaction represents more than 10% of the Bank’s capital stock and surplus it must be approved in advance by a majority of the disinterested directors of the Bank. We believe the Bank is in compliance with these provisions. Enforcement. The DFI and the FDIC share primary regulatory enforcement responsibility over the Bank and its institution- affiliated parties (“IAPs”), including directors, officers and employees. This enforcement authority includes, among other things, the ability to appoint a conservator or receiver for the Bank, to assess civil money penalties, to issue cease and desist orders, to seek judicial enforcement of administrative orders and to remove directors and officers from office and bar them from further participation in banking. In general, these enforcement actions may be initiated in response to violations of laws, regulations and administrative orders, as well as in response to unsafe or unsound banking practices or conditions. Standards for Safety and Soundness. Pursuant to the FDIA, the federal banking agencies have adopted a set of guidelines prescribing safety and soundness standards. These guidelines establish general standards relating to internal controls and information systems, internal audit systems, loan documentation, credit underwriting, interest rate risk exposure, asset growth, asset quality, earnings standards, compensation, fees and benefits. In general, the guidelines require appropriate systems and practices to identify and manage the risks and exposures specified in the guidelines. We believe we are in compliance with the safety and soundness guidelines. Dividends. The ability of the Bank to pay dividends is limited by state and federal laws and regulations that require the Bank to obtain the prior approval of the DFI before paying a dividend that, together with other dividends it has paid during a calendar year, would exceed the sum of its net income for the year to date combined with its retained net income for the previous two years. The amount of dividends the Bank could pay may also be affected or limited by other factors, such as the requirements to maintain adequate capital. Capital Distributions. The FDIC may disapprove of a notice or application to make a capital distribution if: • the Bank would be undercapitalized following the distribution; • the proposed capital distribution raises safety and soundness concerns; or • the capital distribution would violate a prohibition contained in any statute, regulation or agreement applicable to the Bank. Insurance of Deposit Accounts. The Bank is a member of the DIF, which is administered by the FDIC. All deposit accounts at the Bank are insured by the FDIC up to a maximum of $250,000 per depositor. The FDIA, as amended by the Federal Deposit Insurance Reform Act and the Dodd-Frank Act, requires the FDIC to set a ratio of deposit insurance reserves to estimated insured deposit. In March 2016, the FDIC issued a final rule to increase the statutory minimum designated reserve ratio (the “DRR”) to 1.35% by September 30, 2020, the deadline imposed by the Dodd- Frank Act. The FDIC’s rules reduced assessment rates on all FDIC-insured financial institutions but imposed a surcharge on banks with assets of $10 billion or more until the DRR reaches 1.35% and provide assessment credits to banks with assets of less than $10 billion for the portion of their assessments that contribute to the increase of the DRR to 1.35%. The rules also changed the methodology used to determine risk-based assessment rates for established banks with less than $10 billion in assets to better ensure that banks taking on greater risks pay more for deposit insurance than banks that take on less risk. FDIC insurance expense, including assessments relating to Financing Corporation (FICO) bonds, totaled $1.4 million for 2017. Under the FDIA, the FDIC may terminate deposit insurance upon a finding that the institution has engaged in unsafe and unsound practices, is in an unsafe or unsound condition to continue operations or has violated any applicable law, regulation, rule, order or condition imposed by the FDIC.

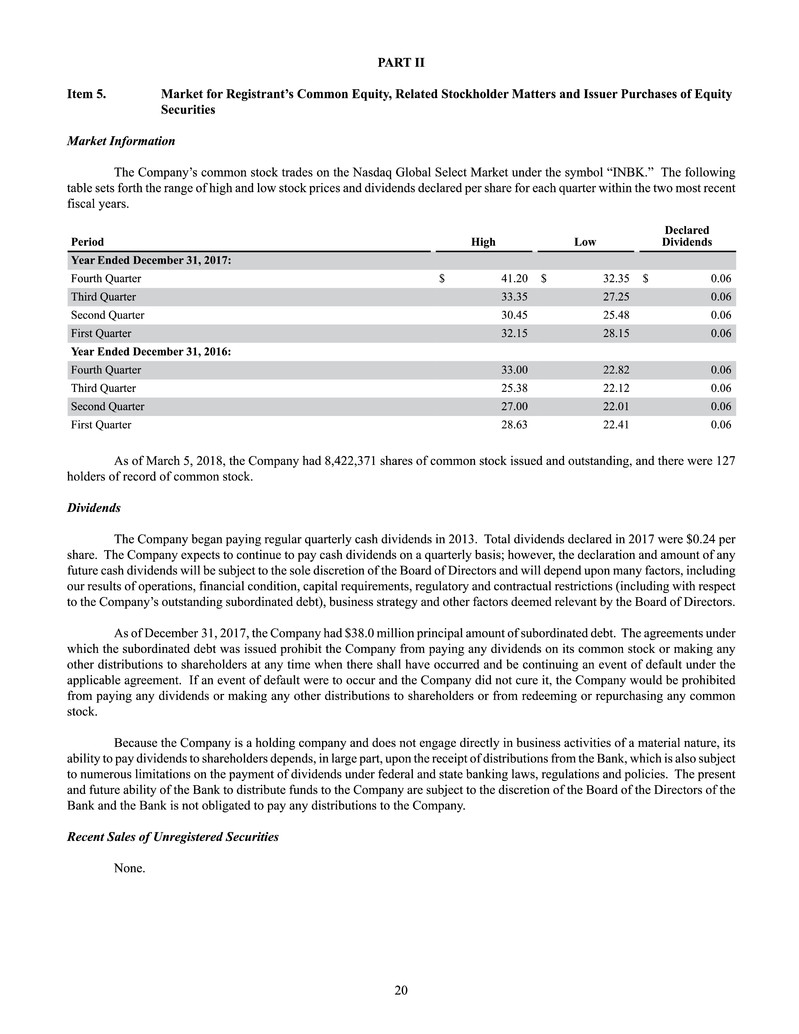

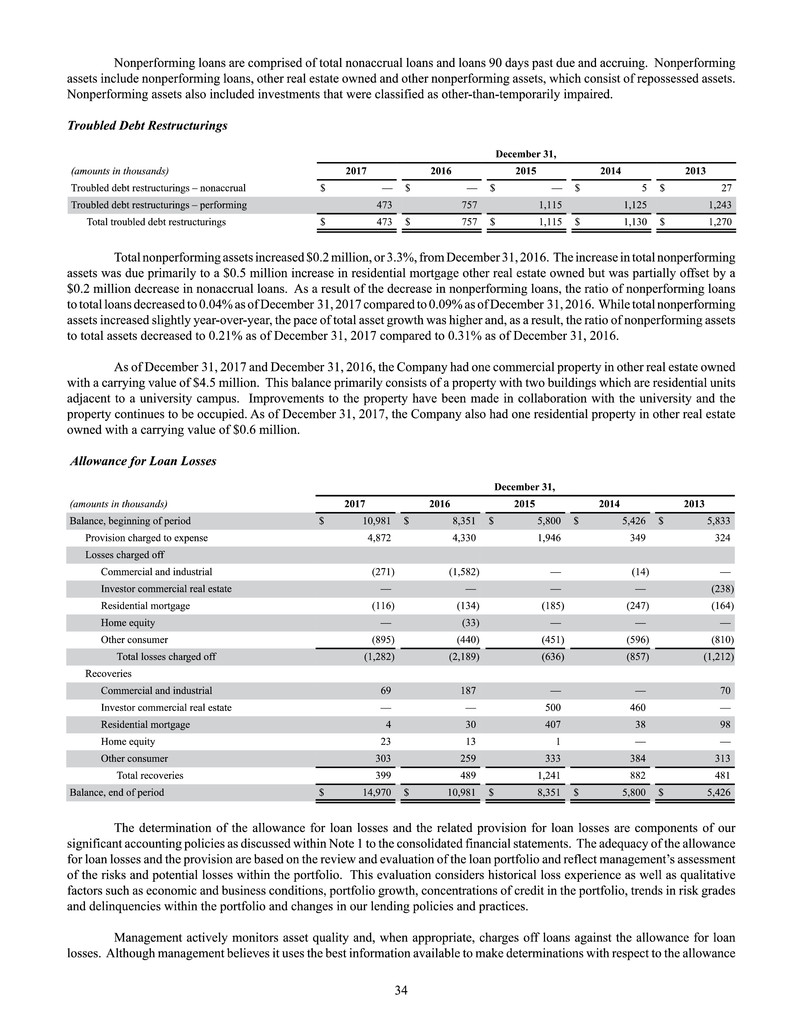

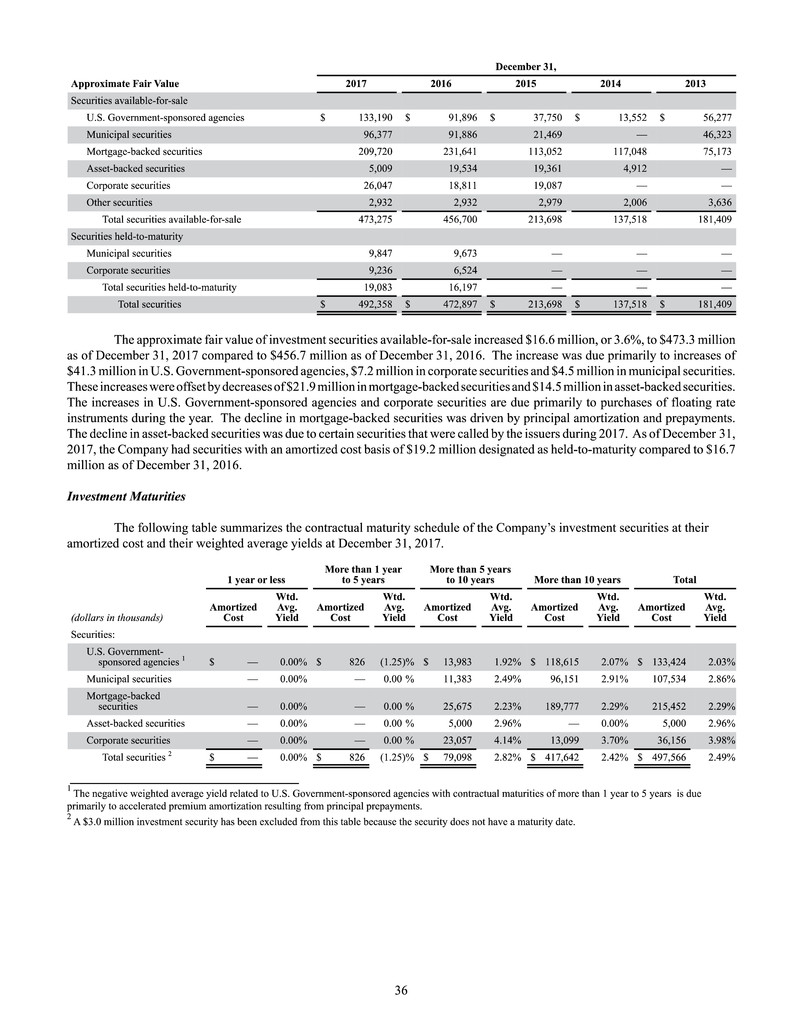

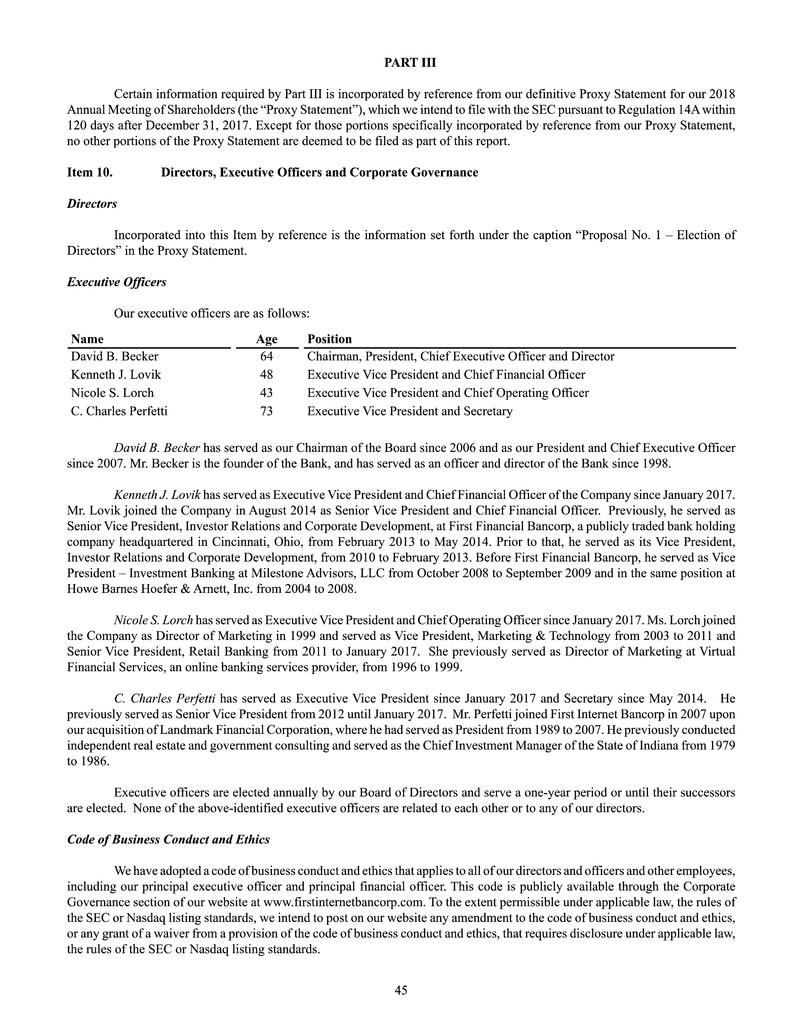

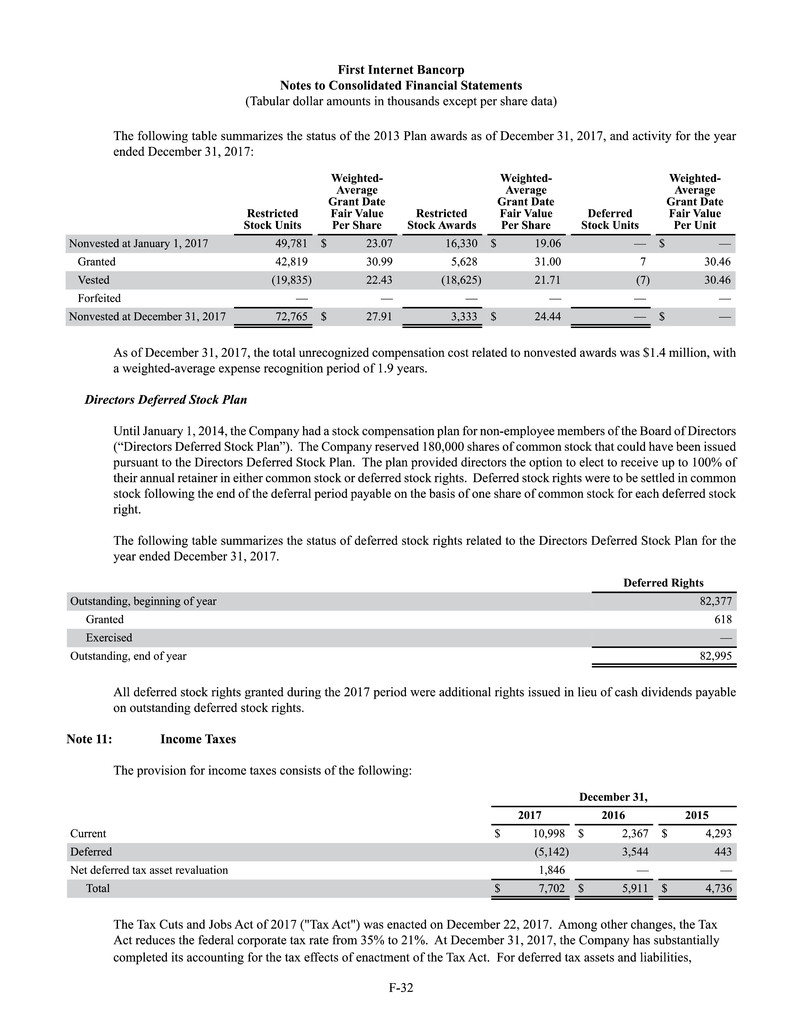

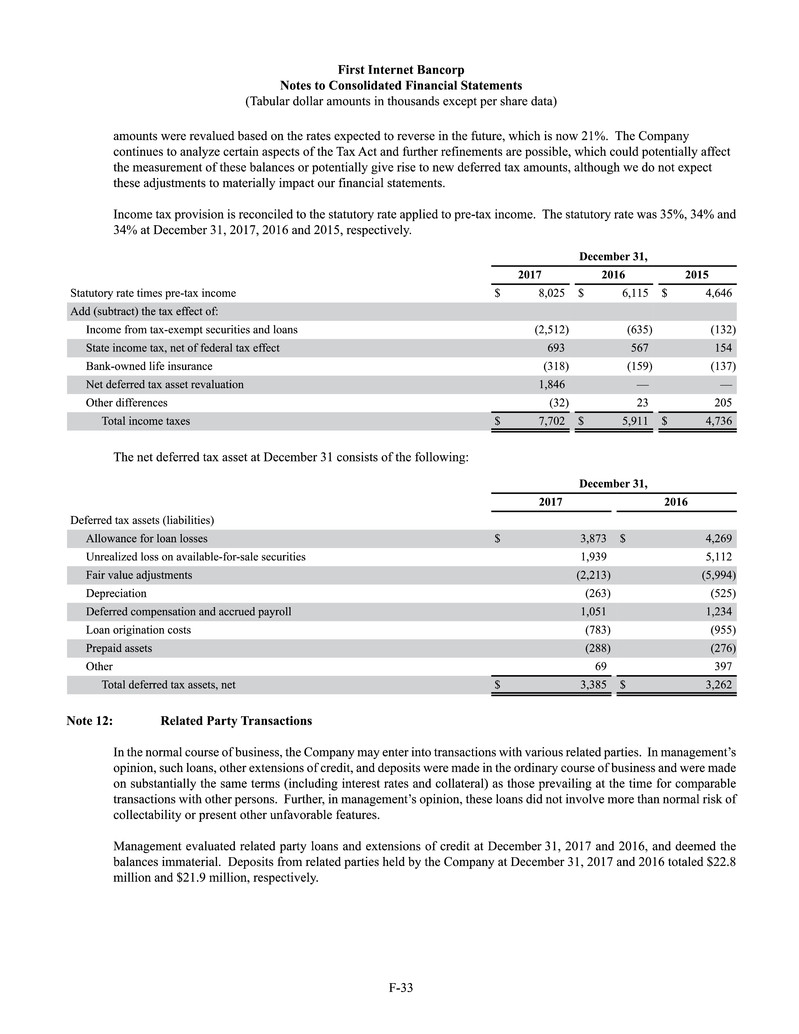

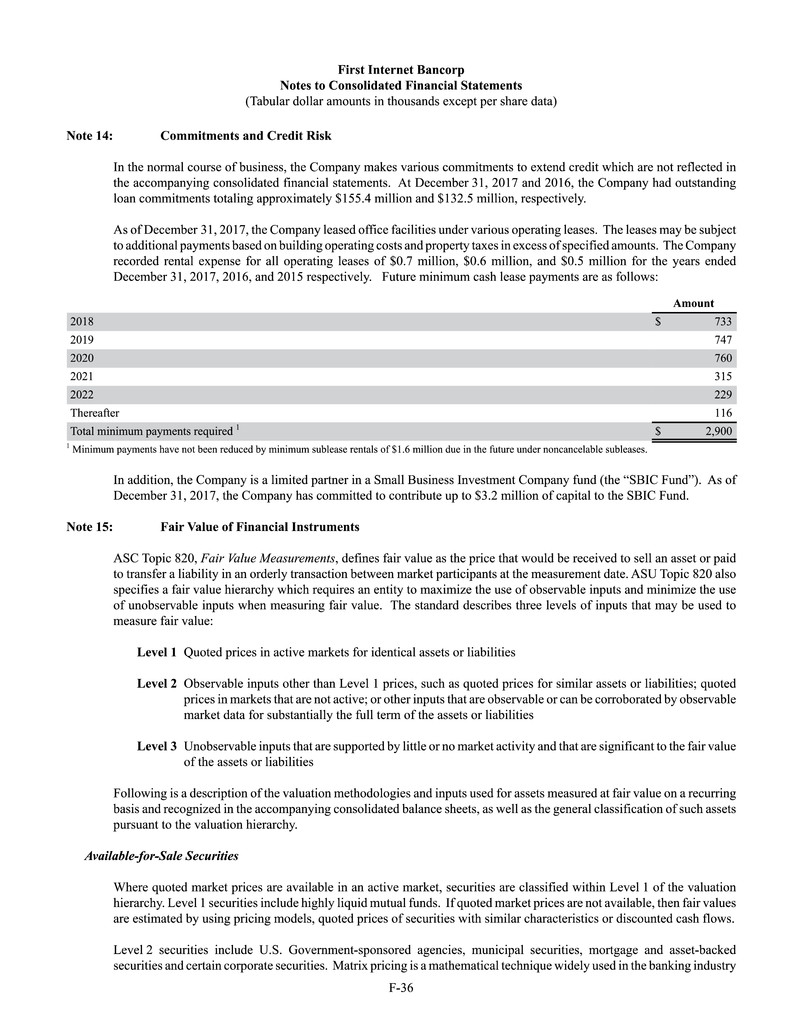

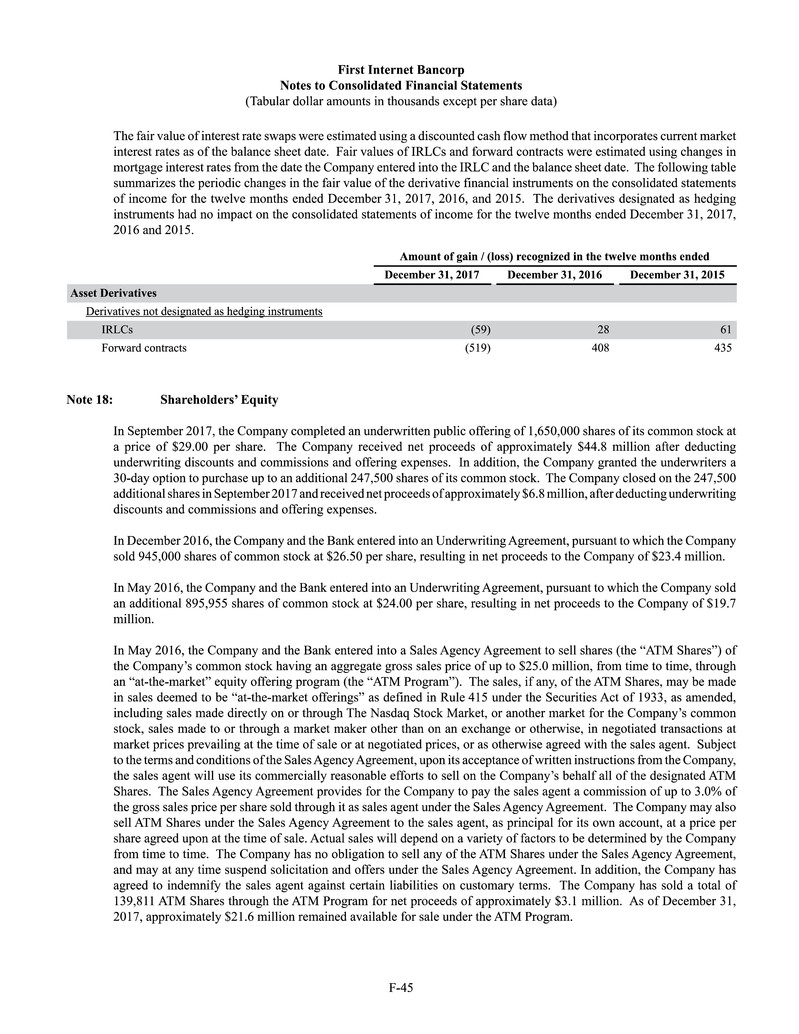

8 Liquidity. The Bank is required to maintain a sufficient amount of liquid assets to ensure its safe and sound operation. To fund its operations, the Bank historically has relied upon deposits, Federal Home Loan Bank of Indianapolis (“FHLB”) borrowings, Fed Funds lines with correspondent banks and brokered deposits. The Bank believes it has sufficient liquidity to meet its funding obligations. Federal Home Loan Bank System. The Bank is a member of the FHLB, which is one of the regional Federal Home Loan Banks comprising the Federal Home Loan Bank System. Each Federal Home Loan Bank serves as a central credit facility primarily for its member institutions. The Bank, as a member of the FHLB, is required to acquire and hold shares of FHLB capital stock. While the required percentage of stock ownership is subject to change by the FHLB, the Bank is in compliance with this requirement with an investment in FHLB stock at December 31, 2017 of $19.6 million. Any advances from the FHLB must be secured by specified types of collateral, and long term advances may be used for the purpose of providing funds to make residential mortgage or commercial loans and to purchase investments. Long term advances may also be used to help alleviate interest rate risk for asset and liability management purposes. The Bank receives dividends on its FHLB stock. Federal Reserve System. Although the Bank is not a member of the Federal Reserve System, it is subject to provisions of the Federal Reserve Act and the Federal Reserve’s regulations under which depository institutions may be required to maintain reserves against their deposit accounts and certain other liabilities. In 2008, the Federal Reserve Banks began paying interest on reserve balances. Currently, reserves must be maintained against transaction accounts (primarily NOW and regular checking accounts). As of December 31, 2017, the Federal Reserve’s regulations required reserves equal to 3% on transaction account balances over $15.5 million and up to $115.1 million, plus 10% on the excess over $115.1 million. These requirements are subject to adjustment annually by the Federal Reserve. The Bank is in compliance with the foregoing reserve requirements. The balances maintained to meet the reserve requirements imposed by the Federal Reserve may be used to satisfy liquidity requirements imposed by the FDIC. Anti-Money Laundering and the Bank Secrecy Act. Under the Bank Secrecy Act (the “BSA”), a financial institution is required to have systems in place to detect and report transactions of a certain size and nature. Financial institutions are generally required to report to the U.S. Treasury any cash transactions involving more than $10,000. In addition, financial institutions are required to file suspicious activity reports for transactions that involve more than $5,000 and which the financial institution knows, suspects or has reason to suspect involves illegal funds, is designed to evade the requirements of the BSA or has no lawful purpose. The Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (the “USA PATRIOT Act”), which amended the BSA, is designed to deny terrorists and others the ability to obtain anonymous access to the U.S. financial system. The USA PATRIOT Act has significant implications for financial institutions and businesses of other types involved in the transfer of money. The USA PATRIOT Act, in conjunction with the implementation of various federal regulatory agency regulations, has caused financial institutions, such as the Bank, to adopt and implement additional policies or amend existing policies and procedures with respect to, among other things, anti-money laundering compliance, suspicious activity, currency transaction reporting, customer identity verification and customer risk analysis. The United States has imposed economic sanctions that affect transactions with designated foreign countries, nationals and others. These sanctions, which are administered by the Treasury Office of Foreign Assets Control (“OFAC”), take many different forms. Generally, however, they contain one or more of the following elements: (1) restrictions on trade with or investment in a sanctioned country, including prohibitions against direct or indirect imports from and exports to a sanctioned country and prohibitions on “U.S. persons” engaging in financial transactions relating to making investments in, or providing investment- related advice or assistance to, a sanctioned country; and (2) blocking of assets in which the government or specially designated nationals of the sanctioned country have an interest by prohibiting transfers of property subject to U.S. jurisdiction (including property in the possession or control of U.S. persons). Blocked assets (for example, property and bank deposits) cannot be paid out, withdrawn, set off or transferred in any manner without a license from OFAC. Consumer Protection Laws. The Bank is subject to a number of federal and state laws designed to protect consumers and prohibit unfair or deceptive business practices. These laws include the Equal Credit Opportunity Act, Fair Housing Act, Home Ownership Protection Act, Fair Credit Reporting Act, as amended by the Fair and Accurate Credit Transactions Act of 2003 (the “FACT Act”), the Gramm-Leach-Bliley Act (the “GLBA”), the Truth in Lending Act, the CRA, the Home Mortgage Disclosure Act, the Real Estate Settlement Procedures Act, the National Flood Insurance Act and various state law counterparts. These laws and regulations mandate certain disclosure requirements and regulate the manner in which financial institutions must interact with customers when taking deposits, making loans, collecting loans and providing other services. Further, the Dodd-Frank Act established the CFPB, which has the responsibility for making and amending rules and regulations under the federal consumer protection laws relating to financial products and services. The CFPB also has a broad mandate to prohibit unfair or deceptive acts and practices and is specifically empowered to require certain disclosures to consumers and draft model disclosure forms.