Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 27, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 333-185732

US Foods, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 36-3642294 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

9399 W. Higgins Road, Suite 500

Rosemont, IL 60018

(847) 720-8000

(Address, including Zip Code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The registrant is a privately held corporation and its equity shares are not publicly traded. At March 20, 2015, 1,000 shares of the registrant’s common stock were outstanding, all of which were owned by USF Holding Corp.

Table of Contents

US Foods, Inc.

Annual Report on Form 10-K

| Page No. | ||||||

| Item 1. |

1 | |||||

| Item 1A. |

6 | |||||

| Item 1B. |

14 | |||||

| Item 2. |

15 | |||||

| Item 3. |

16 | |||||

| Item 4. |

17 | |||||

| Item 5. |

18 | |||||

| Item 6. |

18 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

21 | ||||

| Item 7A. |

38 | |||||

| Item 8. |

39 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

89 | ||||

| Item 9A. |

89 | |||||

| Item 9B. |

90 | |||||

| Item 10. |

91 | |||||

| Item 11. |

96 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

132 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

134 | ||||

| Item 14. |

135 | |||||

| Item 15. |

136 | |||||

| 137 | ||||||

| 138 | ||||||

Table of Contents

| Item 1. | Business |

US Foods, Inc. and its consolidated subsidiaries is referred to here as “we,” “our,” “us,” “the Company,” or “US Foods.” We are a 100% owned subsidiary of USF Holding Corp. (“USF Holding”).

Our Company

We are a leading foodservice distributor in the United States, with about $23 billion in net sales for fiscal 2014. The Company provides an important link between over 5,000 suppliers and our 200,000 foodservice customers nationwide. We offer an innovative array of fresh, frozen and dry food, and non-food products, with approximately 350,000 stock-keeping units (“SKUs”). US Foods provides value-added services that meet specific customer needs. We believe the Company has one of the most extensive private label product portfolios in foodservice distribution. For the latest fiscal year, this represented about 30,000 SKUs, and over $7 billion in net sales. Many customers benefit from our support, such as product selection, menu preparation and costing strategies.

A sales force of approximately 4,000 associates market our products to a diverse customer base. Our principal customers include independently owned single and multi-location restaurants, regional concepts, national chains, hospitals, nursing homes, hotels and motels, country clubs, fitness centers, government and military organizations, colleges and universities, and retail locations. We have standardized our operations across the country that allows us to manage the business as a single operating segment with 61 divisions nationwide. We support our business with one of the largest private refrigerated fleets in the U.S., with roughly 6,000 trucks traveling an average of approximately 200 million miles each year. For business segment information, see Note 24 to the Audited Consolidated Financial Statements included in this Annual Report on Form 10-K.

Our vision, “To create a great American food company focused solely on foodservice.” This statement serves as a guide for our corporate strategy, summarized in four words: food, food people, and easy.

Food: To be a great American food company, our strategy focuses on offering customers great brands and innovative products, supported by an industry-leading category management capability. We strive to be the first to market with meaningful advances in product taste, quality, affordability or ease of use. We are building a cost-competitive, differentiated and efficient product assortment in every market, which corresponds to the needs of each individual customer category.

Food People: Our business model emphasizes local relationships with customers. To support this, our selling and marketing approach enables salespeople to easily share our wide assortment, and help customers select the products that fit their needs. They also are able to present value-added services that allow customers to better operate their businesses.

Easy: We offer customers a variety of tools and services so they can succeed in a competitive and challenging market. For example, our mobile and Internet-enabled ordering tools allow customers to place orders, track shipments, and quickly and efficiently see product details.

We have also focused on making the Company more efficient. That resulted in significant improvements in centralizing our operations and organizing them along functional lines. This includes customer-facing areas (such as category management and merchandising functions) as well as support functions (such as finance).

Our investments in the business reflect these strategic priorities. In 2015, we plan to enhance our category management and merchandising initiatives, and to optimize supply chain management. We continue to look for opportunities to provide our customers with new and innovative products and services.

Corporate History

US Foods’ roots date back over 150 years to a number of heritage companies, including Monarch Foods, founded in 1853, and White Swan, founded in 1872. During the 20th Century, through acquisitions and organic growth, three organizations emerged that would eventually become US Foods. These companies were US Foodservice, PYA/Monarch, and Alliant Foodservice. In 2000, Koninklijke Ahold N.V. (“Ahold”) entered the U.S. foodservice distribution industry, embarking on a period of rapid growth through acquisition. Ahold purchased US Foods and PYA/Monarch in April and December of 2000, respectively. In November 2001, Ahold acquired Alliant Foodservice. With this acquisition, US Foods established itself as the second largest broadline foodservice distribution company in the U.S. In 2007, USF Holding—formed and controlled by investment funds associated with or managed by Clayton, Dubilier & Rice, Inc. (“CD&R”), and Kohlberg Kravis Roberts & Co. (“KKR”) (collectively, the “Sponsors”)—acquired all the outstanding common shares of US Foods.

1

Table of Contents

Sysco/US Foods Merger

USF Holding is our parent company, which owns substantially all of our outstanding shares of common stock. On December 8, 2013, USF Holding entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Sysco Corporation, a Delaware corporation (“Sysco”); Scorpion Corporation I, Inc., a Delaware corporation and a wholly owned subsidiary of Sysco; and Scorpion Company II, LLC, a Delaware limited liability company and a wholly owned subsidiary of Sysco. Under the Merger Agreement, Sysco will acquire USF Holding (the “Acquisition”) based on the terms and subject to the conditions in the Merger Agreement. The Acquisition is subject to customary conditions, including the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”). The Merger Agreement could have been terminated by USF Holding or Sysco if the closing did not occur by March 8, 2015; provided that if all of the conditions to closing, other than termination of the waiting period of the HSR Act, have been satisfied, either party may extend the termination date in 60 day intervals to September 8, 2015 (such termination date is referred to as the “Merger Termination Date”). If the Merger Agreement is terminated because the required antitrust approvals cannot be obtained, in certain circumstances Sysco will be required to pay USF Holding, our parent, a termination fee of $300 million. On March 6, 2015, Sysco notified USF Holding of its decision to extend the termination date of the Merger Agreement for 60 days, from the then current termination date of March 8, 2015, to May 7, 2015.

On February 2, 2015, USF Holding, US Foods and certain of our subsidiaries and Sysco entered into an asset purchase agreement (the “Asset Purchase Agreement”) with Performance Food Group, Inc. (“PFG”), through which PFG agreed to purchase, subject to the terms and conditions of the Asset Purchase Agreement, eleven US Foods distribution centers located in the Cleveland, Ohio; Corona, California; Denver, Colorado; Kansas City, Kansas; Las Vegas, Nevada; Minneapolis, Minnesota; Phoenix, Arizona (including the Phoenix Stock Yards business); Salt Lake City, Utah; San Diego, California (including the San Diego Stock Yards business); San Francisco, California and Seattle, Washington markets, and related assets and liabilities, in connection with (and subject to) the closing of the Acquisition. The Asset Purchase Agreement contains certain termination rights, including the right for PFG to terminate if the transaction has not closed by the earlier of September 9, 2015 and the Merger Termination Date (subject to PFG’s right to extend under certain circumstances), and automatically terminates in the event the Merger Agreement terminates. The Asset Purchase Agreement provides that, upon termination under certain circumstances, PFG will be entitled to receive an aggregate termination fee of $25 million if termination occurs after May 2, 2015 and on or prior to July 6, 2015 and $50 million after July 6, 2015, with each of Sysco and US Foods responsible for one half of such aggregate termination fee.

On February 19, 2015, the U.S. Federal Trade Commission (“FTC”) voted by a margin of 3-2 to seek to block the Merger by filing a federal district court action in the District of Columbia for a preliminary injunction to prevent the parties from closing the Acquisition until after a full trial is conducted by a FTC Administrative Law Judge in a separate administrative action that was filed concurrently by the FTC. In addition, the District of Columbia and state attorney generals from 10 states have joined the FTC’s complaint for a preliminary injunction. Sysco issued a press release, announcing that it will contest the FTC’s attempt to block the proposed Acquisition. The preliminary injunctive hearing in federal court is scheduled to commence on May 5, 2015 and conclude no later than May 13, 2015. The FTC administrative trial is scheduled to commence on July 21, 2015.

In connection with the Merger Agreement, on December 10, 2013, we solicited the consents (the “Consent Solicitation”) of holders of our 8.5% unsecured Senior Notes (“Senior Notes”) due June 30, 2019 to amend the indenture with respect to the Senior Notes to modify certain definitions contained in the indenture for the Senior Notes, so that the Acquisition would not constitute a “Change of Control” under the indenture, and US Foods will not be required to make a “Change of Control Offer” to holders of the Senior Notes in connection with the Acquisition. On December 19, 2013, we received the required consents in connection with the consent solicitation and entered into a supplemental indenture with respect to these amendments.

Pursuant to the terms of the supplemental indenture, if either 1) the Merger Agreement is terminated in accordance with its terms or 2) the Acquisition is not consummated by a date as specified in the Merger Agreement, the indenture will revert to its prior form as if the amendments proposed in the consent solicitation had never become operative.

Although we have been advised by Sysco that, if any of our Senior Notes remain outstanding following the consummation of the Acquisition, Sysco intends to fully and unconditionally guarantee the obligations of US Foods under the indenture for the Senior Notes—Sysco is under no contractual or legal obligation to do so.

See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” for more information about the Acquisition and its impact on our business, and “Item 1A. Risk Factors” for risks associated with the Acquisition.

Industry Overview

The annual United States foodservice distribution industry that we can serve is estimated at about $240 billion. It is very fragmented, with about 15,000 foodservice distributors nationwide. These range from businesses selling a single product category (such as produce) to large broadline distributors with many divisions and thousands of products across many categories.

2

Table of Contents

This means customers have many choices. They often purchase concurrently from several foodservice distributors, including national distributors, regional distributors, local distributors and specialty distributors. In addition, they frequently buy from wholesale outlets (such as Restaurant Depot), and retailers (including Wal-Mart, Sam’s Club and Costco). With the rise of eCommerce, and low barriers to entry, Amazon.com and other Internet-oriented businesses also have entered the market. It is expected that wholesale outlets, large retailers and Internet-based suppliers will continue to expand their presence in the food distribution industry and seek to take market share from traditional foodservice distributors.

Based upon data provided by the USDA Economic Research Service, for over 25 years and prior to 2008, the U.S. foodservice industry was characterized by stable, predictable growth in total food purchases by dollar value. In 2008, however, the market was hit by the economic recession and the dislocation in the financial markets. That led to significant declines for large and small operators. Since 2010, the industry has shown signs of stabilization. This reflects improvements in the macroeconomic environment, consumer confidence, and stronger discretionary spending. However, growth remains well below historical averages.

The combination of high fragmentation, competition from all types and sizes of distributors, adjacent completion such as cash and carry and club stores, new market entrants, and low demand growth make this market very competitive.

Customers and Products

Our sales force of approximately 4,000 associates serves a diverse group of customers. These include independently owned single and multi-location restaurants, regional concepts, national chains, hospitals, nursing homes, hotels and motels, country clubs, fitness centers, government and military organizations, colleges and universities, and retail locations. In fiscal 2014, no individual customer represented more than 4% of total customer sales. Sales to our top 50 customers and group purchasing organizations (“GPOs”) represented approximately 43% of our net sales in fiscal year 2014.

Our customers rely on us for support in many areas, including product expertise and selection, menu preparation, recipe ideas and pricing strategies. They also benefit from nationally branded and private label products, value-added offerings, and customer service. Our customers typically purchase products from multiple foodservice distributors.

We have relationships with GPOs that act as agents for their members, negotiating pricing, delivery, and other terms. Some of our customers who are members of GPOs purchase their products directly from us pursuant to the terms negotiated by their GPOs. In fiscal 2014, about 23% of our total customer purchases came from customers pursuant to terms negotiated by GPOs. GPOs primarily focus on healthcare, hospitality, education, government/military and restaurant chains.

This table presents the sales mix for our principal product categories for the years ended December 27, 2014, December 28, 2013 and December 29, 2012:

| 2014 | 2013 | 2012 | ||||||||||

| Meats and seafood |

36 | % | 34 | % | 34 | % | ||||||

| Dry grocery products |

18 | % | 19 | % | 19 | % | ||||||

| Refrigerated and frozen grocery products |

15 | % | 16 | % | 16 | % | ||||||

| Equipment, disposables and supplies |

9 | % | 10 | % | 10 | % | ||||||

| Dairy |

11 | % | 10 | % | 10 | % | ||||||

| Beverage products |

6 | % | 6 | % | 6 | % | ||||||

| Produce |

5 | % | 5 | % | 5 | % | ||||||

|

|

|

|

|

|

|

|||||||

| 100 | % | 100 | % | 100 | % | |||||||

|

|

|

|

|

|

|

|||||||

Merchandising

Our Merchandising Group manages procurement and our portfolio of products, including private label and national brands. It is responsible for setting and executing product and category strategies and working with each division to ensure our category vision is implemented. It concentrates on optimizing product assortment, economies of scale and leveraging our purchasing scale. We implemented a strategic vendor management process to ensure our supplier partners provide the most effective combination of quality, service and price over the long term. This allows us to use a national marketing calendar to more effectively reach our diverse customer base.

The Merchandising Group’s test kitchen facilitates product research and development. A team of chefs and product developers works closely with our category managers and supplier partners to develop products that only are available from us, and serve to differentiate our offerings. This product innovation and marketing program is a centerpiece of our strategy of becoming a leading food company. The Merchandising Group also uses extensive food safety and quality assurance resources to ensure consistency, integrity, and high standards of excellence in the products we distribute.

3

Table of Contents

Logistics

Our Logistics Group focuses on increasing company-managed inbound freight, freight reduction and freight optimization initiatives. This group includes national operations and logistics support teams in Rosemont, IL, and a field-based logistics team. The national logistics team handles the building, tracking and execution of inbound transportation loads using our centralized transactional processing. The logistics support team works with operations and divisions to identify opportunities, reduce costs, and manage broader strategic initiatives associated with managing inbound freight. The logistics support team also manages carrier and vendor relationships, such as the inbound freight component of a vendor relationship, versus the product cost component—which is managed by our Merchandising Group. The Logistic Group’s goal is to improve overall service levels and reduce inbound freight expenses, as well as investigate and implement network-wide opportunities.

Suppliers

We purchase from over 5,000 individual suppliers, none of which accounted for more than 10% of our aggregate purchases in fiscal year 2014. Our supplier base consists generally of large corporations, selling national brand name and private label products. Additionally, regional suppliers support targeted geographic initiatives and private label programs requiring regional distribution. We generally negotiate supplier agreements on a centralized basis.

Product Brands and Other Intellectual Property

To meet the needs of our customers, we offer a broad assortment of categories and brands. In many categories, we offer products under our own brands and trademarks.

Our brands are positioned in a variety of ways, primarily to support the requirements of our customers. Some are value brands, which offer a wide variety of lower cost products for customers who demand consistent quality and superior value. Others are positioned to match or exceed the quality of comparable manufacturer brand products. We increasingly focus on bringing unique, innovative products with exclusive, differentiated brands to our customers. We have registered the trademarks US Foods, Food Fanatics, and Chef’Store—in connection with our overall US Foods brand strategy and with our new retail outlets. We have also registered or applied to register the following trademarks in the United States in connection with our brand portfolio: Chef’s Line, Rykoff Sexton, Stock Yards and Metro Deli in our Best tier; Monarch, Monogram, Molly’s Kitchen and Glenview Farms, among others, in our Better tier; and Valu+Plus and Harvest Value in our Good Tier. Other than the US Foods trademark, and the trademarks for our brand portfolio, we do not believe that trademarks, patents, copyrights or trade secrets are material to our business.

Competition

The foodservice distribution industry is highly competitive and fragmented. We believe that about 15,000 foodservice distributors participate in the food away from home marketplace. Competition consists of national distributors and many regional and local distributors. These companies align themselves with other local and regional players through purchasing cooperatives and marketing groups. This allows them to expand their geographic markets, private label offerings, overall purchasing power, and ability to meet customers’ distribution requirements.

A number of other adjacent competitors also serve the commercial foodservice market. These include cash and carry operations, commercial wholesale outlets (such as Restaurant Depot), club stores (such as Sam’s Club and Costco), and grocery stores. Recently, we have begun to experience competition from online direct food wholesalers, including e-commerce companies such as Amazon.com.

Our customers are accustomed to purchasing from multiple suppliers. Product needs, service requirements and price are just a few of the factors they evaluate when deciding where to purchase. Customers can choose from many broadline foodservice distributors, specialty distributors that focus on specific categories such as produce, meat or seafood, club stores, grocery stores and a myriad of new online retailers. Since switching costs are very low, customers can make supplier and channel changes very quickly. There are few barriers to market entry. Existing foodservice competitors can extend their shipping distances, and add truck routes and warehouses relatively quickly to serve new markets or customers.

4

Table of Contents

US Foods differentiates itself from its competition through management and sales expertise (better service), purchasing scale (better price) and logistics expertise (better delivery). We serve a diverse customer base, and our sales force of approximately 4,000 associates is well equipped to meet evolving customer demands. We have increased our category management capabilities, while remaining focused on innovation and differentiation in our exclusive brand portfolio. We leveraged our investment in information technology to make the customer experience easy. We face many challenges, such as the foodservice market’s sensitivity to national and regional conditions, and the foodservice distribution industry’s low margins.

Working Capital

Our operations and strategic objectives require continuing capital investment, and our resources include cash provided by operations, as well as access to capital from bank borrowings, various types of debt and other financing arrangements. See the discussion in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding our liquidity and capital resources.

Regulation

As a marketer and distributor of food products in the United States, US Foods is subject to regulation by numerous federal, state and local regulatory agencies. At the federal level, we are subject to the Federal Food, Drug and Cosmetic Act, the Bioterrorism Act and regulations promulgated by the U.S. Food and Drug Administration (the “FDA”). The FDA regulates manufacturing and holding requirements for foods, specifies the standards of identity for certain foods, and prescribes the format and content of certain information required to appear on food product labels. For certain product lines, we are also subject to the Federal Meat Inspection Act, the Poultry Products Inspection Act, the Perishable Agricultural Commodities Act, the Country of Origin Labeling Act, and regulations promulgated under the U.S. Department of Agriculture (the “USDA”). The USDA imposes standards for product quality and sanitation, including the inspection and labeling of meat and poultry products and the grading and commercial acceptance of produce shipments from our vendors.

We and our products are also subject to state and local regulation through such measures as the licensing of our facilities, enforcement by state and local health agencies of state and local standards for our products and facilities, and regulation of our trade practices in connection with the sale of our products.

Our premises are generally inspected at least annually by federal and/or state authorities. These facilities are also subject to inspections and regulations issued pursuant to the Occupational Safety and Health Act by the U.S. Department of Labor, which require us to comply with certain manufacturing, health and safety standards to protect our employees from accidents, and to establish hazard communication programs to transmit information about the hazards of certain chemicals present in some of the products we distribute.

We are also subject to regulation by numerous federal, state and local regulatory agencies. In particular, among other things, we service the federal government—including the Department of Defense and Department of Veterans Affairs facilities—as well as certain state and local entities. This subjects us to government contractor regulation at those respective levels. Our operations are subject to zoning, environmental and building regulations, as well as laws that prohibit discrimination in employment on the basis of disability—including the Americans with Disabilities Act—and other laws relating to accessibility and the removal of barriers. Our workers’ compensation self-insurance is subject to regulation by the jurisdictions in which we operate.

Environmental, Health and Safety Matters

Our operations are subject to a broad range of federal, state and local laws and regulations, including those governing environmental issues (e.g., discharges to air, soil and water, the handling and disposal of solid and hazardous wastes, and the investigation and remediation of contamination resulting from releases of petroleum products and other regulated substances), employee health and safety and fleet safety. Compliance with environmental, health and safety laws and/or regulations is not currently requiring us to incur material expenditures. However, the discovery of currently unknown conditions, new laws or regulations or changes in the enforcement of existing requirements, could require us to incur additional costs or result in unexpected liabilities that could be significant.

Seasonality

Our business does not fluctuate significantly from quarter to quarter and, as a result, is not considered seasonal.

5

Table of Contents

Research and Development

As noted above, the Merchandising Group’s test kitchen facilitates product research and development, with a focus on exclusive product development and product performance attributes. The cost of these activities is not considered material to our operations.

Employees

We employ a large and diverse workforce, of which approximately 65% are non-exempt employees. As of December 27, 2014, we had approximately 25,000 employees. Our non-exempt employee base is primarily comprised of warehouse and driver labor, consisting of approximately 16,000 non-exempt employees. Approximately 4,700 of our employees were members of local unions associated with the International Brotherhood of Teamsters and other labor organizations. In fiscal year 2014, 11 agreements covering approximately 1,500 employees were renegotiated. In fiscal year 2015, 15 agreements covering approximately 1,200 employees will be subject to renegotiation. We believe we have good relations with both union and non-union employees and we are well-regarded in the communities in which we operate.

Available Information

You may read and copy any documents that we file at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549 at prescribed rates. You may call the SEC at 1-800-SEC-0330 to obtain further information about the public reference room. In addition, the SEC maintains an Internet website (www.sec.gov) that contains reports, proxy and information statements and other information about issuers that file electronically with the SEC, including US Foods, Inc. The SEC’s website address is included in this Annual Report on Form 10-K as an inactive textual reference only. We also maintain a website, www.usfood.com, which does not contain investor information at this time due to the proposed Acquisition, but does provide additional information about our locations, products and services, brands, and leadership and provides additional contact information for US Foods.

We have agreed under the terms of the indenture governing our Senior Notes that from the time we first became subject to the reporting requirements of Section 13(a) or Section 15(d) of the Exchange Act, and for so long as any of our Senior Notes remain outstanding, we will file with the SEC (unless such filing is not permitted under the Exchange Act or by the SEC), the annual reports, information, documents and other reports that we are required to file with the SEC pursuant to such Section 13(a) or Section 15(d), or would be so required to file if we were subject to the filing requirements of Section 13(a) or Section 15(d).

You may also obtain a copy of this Annual Report on Form 10-K and other information that we file with the SEC at no cost by calling us or writing to us at the following address: US Foods, Inc., 9399 W. Higgins Road, Suite 600, Rosemont, IL 60018, (847) 720-8000.

| Item 1A. | Risk Factors |

We are subject to many risks and uncertainties including, without limitation, our results of operations and cash flows. Some of these risks and uncertainties may cause our financial performance, business or operations to vary, or they may materially or adversely affect our financial performance. These are discussed below. The risks and uncertainties described in this Annual Report on Form 10-K are not the only ones we face. Others—which are not currently known to us, or that we believe are immaterial—also may adversely affect our financial performance, business or operations.

Risks Relating to the Proposed Acquisition by Sysco

There can be no assurance that Sysco will assume the Senior Notes. There also can be no assurance as to the credit worthiness of the obligors under the indenture for the Senior Notes after the Acquisition.

There can be no assurance as to the credit worthiness of the obligors under the indenture for the Senior Notes after the Acquisition has been completed. At that time, US Foods and the subsidiary guarantors of the Senior Notes will all become indirect subsidiaries of Sysco. Sysco has advised us that if any of our Senior Notes remain outstanding following the Acquisition, it intends to fully and unconditionally guarantee those obligations. However, Sysco is under no contractual or legal obligation to do this under the indenture, the Merger Agreement or otherwise or to redeem or refinance the Senior Notes. If Sysco assumes the Senior Notes, there is no assurance it will have the same credit worthiness that it does now, or that it will continue to maintain that credit worthiness after it integrates US Foods and its subsidiaries. If Sysco does not assume the Senior Notes—and we and the subsidiary guarantors continue to be obligors under the indenture—there can be no assurances on the credit worthiness or operational plans of US Foods or the subsidiary guarantors after they have been acquired by Sysco. Further, pursuant to the consent of the holders of the Senior Notes, the Acquisition will not be deemed to be a change of control under the indenture, and Sysco will not need to make a change of control offer.

6

Table of Contents

The proposed Acquisition is subject to receiving consents and approvals from government entities with the power to impose conditions that could have an adverse effect on us, or could delay or prevent the Acquisition.

Completion of the Acquisition is conditioned upon, among other things, the expiration or termination of applicable waiting periods under the HSR Act. In addition, we must receive other regulatory approvals, each as described in the Merger Agreement. On February 19, 2015, the FTC voted by a margin of 3-2 to seek to block the Merger by filing a federal district court action in the District of Columbia for a preliminary injunction to prevent the parties from closing the Acquisition until after a full trial is conducted by a FTC Administrative Law Judge in a separate administrative action that was filed concurrently by the FTC. In addition, the District of Columbia and the following state attorneys general have joined the FTC’s complaint for a preliminary injunction: California, Illinois, Iowa, Maryland, Minnesota, Nebraska, Ohio, Pennsylvania, Tennessee, and Virginia. Sysco issued a press release, announcing that it will contest the FTC’s attempt to block the proposed Acquisition. These legal proceedings may cause extensive delays in the consummation of the Acquisition or may prevent the Acquisition from occurring at all. In connection with the negotiations with the FTC, Sysco, USF Holding, US Foods, and certain of our subsidiaries have entered into the Asset Purchase Agreement with PFG which provides for the sale to PFG of US Foods facilities in 11 markets upon consummation of the Acquisition. These facilities represent approximately $4.6 billion in annual sales. There is no assurance that US Foods and Sysco will obtain the governmental approvals necessary for the Acquisition and if the Acquisition is allowed to proceed, additional restrictions or conditions could be imposed. Any further delay in completing the Acquisition could diminish its anticipated benefits, or result in additional transaction costs, loss of revenue, or other negative effects associated with uncertainty about the situation.

Sysco’s failure to acquire us could adversely affect our business.

There is no assurance the Acquisition or any other transaction will occur. Consummation of the Acquisition is subject to various conditions, including the consents or approvals of government authorities noted above. We will have incurred significant costs—including the diversion of management resources—for which we will receive little or no benefit if the Acquisition does not close. The Merger Agreement is subject to termination by either party if the Acquisition is not completed on or before May 7, 2015. The Merger Agreement also is subject to further extension by either party to allow for clearance under the HSR Act, but not past September 8, 2015. In addition, the Merger Agreement contains certain other termination rights for both USF Holding and Sysco. A failed transaction may result in negative publicity. Any of these events—individually or in combination—could have an adverse effect on our results of operations and financial condition.

Our pending Acquisition could adversely affect our business, financial results and operations, including our relationships with customers, vendors and employees.

The proposed Acquisition could cause material disruptions in and create uncertainty surrounding our business. This could affect our relationships with customers, vendors and employees, which could have an adverse effect on our business, financial results and operations. In particular, we could lose important personnel if some employees decide to leave in light of the proposed Acquisition. We could potentially lose customers or suppliers, or our customers or suppliers could modify their relationships with us in an adverse manner. In addition, we have devoted—and will continue to devote—significant management resources to complete the Acquisition. This may cause our business and operating results to suffer.

The Merger Agreement also places restrictions on how we conduct our business before the Acquisition is completed. These restrictions could result in our inability to respond effectively, and in a timely manner, to competitive pressures, industry developments and future opportunities. This could harm our business, financial results and operations. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” for more information about the proposed Acquisition and its impact on our business, including restrictive covenants relating to our operations.

Risks Related to Our Business

Ours is a low-margin business, and our profitability is directly affected by cost inflation, commodity volatility and other factors.

Foodservice distribution is characterized by relatively high inventory turnover with relatively low profit margins. We make a significant portion of our sales at prices that are based on the cost of products we sell, plus a percentage margin. As a result, our profit levels may be negatively affected during periods of product cost deflation, even though our gross profit percentage may

7

Table of Contents

remain relatively constant. Prolonged periods of product cost inflation also may reduce our profit margins and earnings, if product cost increases cannot be passed on to customers because they resist paying higher prices. In addition, periods of rapid inflation may have a negative effect on our business. There may be a lag between the time of the price increase and the time at which we are able to pass it along, as well as the impact it may have on discretionary spending by consumers.

Competition in our industry is intense, and we may not be able to compete successfully.

Foodservice distribution is highly competitive. This includes a large number of local and regional distributors. These companies often align themselves with other smaller distributors through purchasing cooperatives and marketing groups. The goal is to enhance their geographic reach, private label offerings, overall purchasing power, cost efficiencies, and ability to meet customer distribution requirements. These suppliers also rely on local presence as a source of competitive advantage, and they may have lower costs and other competitive advantages due to geographic proximity. Additionally, adjacent competition—such as cash and carry operations, commercial wholesale outlets, club stores and grocery stores—continue to serve the commercial foodservice market. We also experience competition from online direct food wholesalers, such as Amazon.com. We generally do not have exclusive service agreements with our customers, and they may switch to others that offer lower prices, differentiated products or customer service that is perceived to be superior. We believe most purchasing decisions in the foodservice distribution industry are based on the quality and price of the product, plus a distributor’s ability to completely and accurately fill orders and provide timely deliveries.

Increased competition has caused the foodservice distribution industry to change, as distributors seek to lower costs, further increasing pressure on the industry’s profit margins. Heightened competition among our suppliers, significant pricing initiatives or discount programs established by competitors, new entrants, and trends toward vertical integration could create additional competitive pressures that reduce margins and adversely affect our business, financial condition and results of operations.

We rely on third-party suppliers, and our business may be affected by interruption of supplies or increases in product costs.

We get substantially all of our foodservice and related products from third-party suppliers. We typically do not have long-term contracts with suppliers. Although our purchasing volume can provide leverage when dealing with suppliers, they may not provide the foodservice products and supplies we need in the quantities and at the prices requested. We do not control the actual production of the products we sell. This means we are also subject to delays caused by interruption in production and increases in product costs based on conditions outside our control. These conditions include work slowdowns, work interruptions, strikes or other job actions by employees of suppliers; severe weather; crop conditions; product recalls; transportation interruptions; unavailability of fuel or increases in fuel costs; competitive demands; and natural disasters or other catastrophic events (including, but not limited to, the outbreak of food-borne illnesses in the U.S.). Our inability to obtain adequate supplies of foodservice and related products because of any of these or other factors could mean that we could not fulfill our obligations to our customers and, as a result, our customers may turn to other distributors.

Significant increases in fuel costs could hurt our business.

The high cost of fuel can negatively affect consumer confidence and discretionary spending. As a result, this reduces the frequency and amount spent by consumers for food prepared away from home. In addition, the high cost of fuel can also increase the price we pay for products, as well and the costs we incur to deliver products to our customers. These factors in turn negatively affect our sales, margins, operating expenses and operating results. Additionally, from time to time, we enter into forward purchase commitments for some of our fuel requirements—at prices equal to the then-current market price. If fuel prices decrease significantly, these forward purchases may prove ineffective and result in us paying higher than market costs for part of our fuel. As of December 27, 2014, we had diesel fuel forward purchase commitments totaling $177 million through December 2016, which locked in approximately 53% of our projected diesel fuel purchase needs for the contracted period. A 10% change in diesel prices would cause our uncommitted diesel fuel costs through December 2016 to change by less than $20 million. See “Item 7A. Quantitative and Qualitative Disclosures about Market Risk” for further discussion of market risks relating to diesel fuel.

An economic downturn, or other factors affecting consumer confidence, could reduce the amount of food prepared and consumed away from home, which could harm our business.

The foodservice market is sensitive to national and regional economic conditions. The general U.S. economic slowdown in the recent years, the uncertainty in the financial markets, and slow job growth affected consumer confidence and discretionary spending. Inflation, a renewed decline in economic activity, and other factors affecting consumer confidence—and the frequency and amount spent by consumers for food prepared away from home—may reduce our sales and operating results in the future. Additionally, prolonged periods of product cost inflation may have a negative impact on our profit margins and

8

Table of Contents

earnings, if the product cost increases cannot be passed on to customers who resist paying higher prices or negatively affect consumer spending. Our operating results are also sensitive to, and may be adversely affected by, other factors. These include difficulties collecting accounts receivable, competitive price pressures, severe weather conditions, and unexpected increases in fuel or other transportation-related costs that are beyond our control. There can be no assurance that one or more of these factors will not reduce future operating results.

We face risks related to labor relations and the availability of qualified labor.

On December 27, 2014, we had approximately 25,000 employees. About 4,700 were members of local unions associated with the International Brotherhood of Teamsters and other labor organizations. In fiscal year 2014, 11 agreements covering approximately 1,500 employees were renegotiated. In fiscal 2015, 15 agreements covering approximately 1,200 employees will be subject to renegotiation. Failure to effectively renegotiate any of these contracts could result in work stoppages. We may be subject to increased efforts to subject us to a multi-location labor dispute, as an individual labor agreements expire. This would place us at greater risk of being materially adversely affected by labor disputes. We also believe we have satisfactory relationships with our employees, including the unions that represent some of our employees. However, a work stoppage due to our failure to renegotiate union contracts could have a significant negative effect on us. So could any shortage of qualified labor. We do extensive contingency planning in advance of all negotiations. Our goal is to ensure that we are able to operate a facility that may be affected by a work stoppage. Recruiting and retention efforts, and actions to increase productivity may not be successful, and we could encounter a shortage of qualified drivers in the future. This kind of shortage would decrease our ability to effectively serve customers. It would also likely lead to higher wages for employees and a corresponding reduction in our profitability.

A change in our relationships with Group Purchasing Organizations could negatively affect our relationships with customers, which could reduce our profitability.

No single customer represented more than 4% of our total customer sales in fiscal 2014. However, some of our customers purchase their products under arrangements with Group Purchasing Organizations (“GPOs”). GPOs act as agents on behalf of their members by negotiating pricing, delivery, and other terms with us. Our customers who are members of GPOs purchase products directly from us on the terms negotiated by their GPO. GPOs use the combined purchasing power of their members to lower the prices paid by their members, and we have experienced some pricing pressure from customers who associate with GPOs. Approximately 23% of our net sales in fiscal 2014 were made by customers under terms negotiated by GPOs. To the extent our customers are able to independently negotiate competitive pricing or become members of GPOs, we may be forced to lower our prices so they will remain customers, which would negatively affect operating margins. In addition, if we are unable to maintain our relationships with GPOs—or if GPOs are able to negotiate more favorable terms for their members with our competitors—we could lose some or all of that business. This could adversely affect our future operating profits.

If we fail to increase or maintain our sales to independent restaurant customers, our profitability may suffer.

Our most profitable customers are independent restaurants. We typically provide a higher level of services to these customers and are able to earn a higher operating margin on sales. Our ability to continue to gain market share of independent customers is critical to achieving increased operating profits. Changes in the buying practices of independent customers or decreases in our sales to this type of customer could have a material negative impact on our profitability.

Changes in industry pricing practices could negatively affect our profitability.

Promotional allowances have traditionally generated a significant percentage of foodservice distribution gross margins. These payments from suppliers are based upon the efficiencies that the distributor provides by volume purchasing, and marketing and merchandising expertise. Promotional allowances are a standard industry practice and represent a significant source of profitability for our competitors and us. Any change in industry practices that reduced or eliminated purchasing allowances—without corresponding increases in sales margin—could be disruptive to us and the industry as a whole, and could have a material negative effect on our profitability.

If our competitors implement a lower cost structure, they may be able to offer reduced prices to customers. We may be unable to adjust our cost structure to compete profitably.

Over the last several decades, the food retail industry has undergone a significant change. Companies such as Wal-Mart and Costco have developed a lower cost structure, so they can provide their customers with an everyday low-cost product offering. In addition, commercial wholesale outlets, such as Restaurant Depot, offer an additional low-cost option in the markets they serve. As a large-scale foodservice distributor, we have similar strategies to remain competitive in the marketplace by reducing

9

Table of Contents

our cost structure. However, to the extent more of our competitors adopt an everyday low price strategy, we would potentially be pressured to lower prices to our customers. That would require us to achieve additional cost savings to offset these reductions. We may be unable to change our cost structure and pricing practices rapidly enough to successfully compete in that environment.

Our business may be subject to significant environmental, health and safety costs.

Our operations face a broad range of federal, state and local laws and regulations. These include environmental issues, such as discharges to air, soil and water; the handling and disposal of hazardous substances; the investigation and remediation of contamination resulting from releasing petroleum products and other hazardous substances; employee health and safety; and fleet safety. In the course of our operations, we use and dispose of limited volumes of hazardous substances, and we store fuel in on-site aboveground and underground storage tanks. At several current and former facilities, we are investigating and remediating known or suspected contamination from releases of fuel and other hazardous substances. We cannot be sure that compliance with existing or future environmental, health and safety laws—such as those related to remediation obligations—will not adversely affect future operating results.

We are subject to extensive governmental regulation, the enforcement of which could adversely affect our business, financial condition and results of operations.

Our operations are subject to a number of complex and stringent food safety, transportation, labor, employment and other laws and regulations. These laws and regulations generally require us to maintain and comply with a wide variety of certificates, permits, licenses and other approvals. (See “Business—Regulation.”) Regulatory authorities have broad powers with respect to our operations. They may revoke, suspend, condition or limit our licenses or ability to conduct business. Our failure to maintain required certificates, permits or licenses—or to comply with applicable laws, ordinances or regulations—could result in substantial fines or possible revocation of our authority to conduct our operations. We cannot be sure that existing laws or regulations will not be revised, or that new laws or regulations—which could have an adverse impact on our operations—will not be adopted or become applicable to us. We also cannot be sure that we will be able to recover any or all increased costs of compliance from our customers, or that our business and financial condition will not be materially and adversely affected by future changes in applicable laws and regulations.

We rely heavily on technology, and any disruption in existing or delay in implementing new technology could adversely affect our business.

Our ability to control costs and maximize profits, as well as to serve customers most effectively, depends on the reliability of our information technology systems and related data entry processes in our transaction intensive business. We rely on software and other technology systems to manage significant aspects of our business. These include to make purchases, process orders, manage our warehouses, load trucks in the most efficient manner, and to optimize the use of storage space. Any disruption to these information systems could negatively affect our customer service, decrease the volume of our business, and result in increased costs. We have invested and continue to invest in technology security initiatives, business continuity, and disaster recovery plans. However, these measures cannot fully insulate us from technology disruption that could impair operations and profits. Information technology systems evolve rapidly. To compete effectively, we are required to integrate new technologies in a timely and cost-effective manner. If competitors implement new technologies before we do, allowing them to provide lower priced or enhanced services of superior quality compared to those we provide, our operations and profits could be affected.

A cybersecurity incident and other technology disruptions could negatively affect our business and our relationships with customers.

We rely upon information technology networks and systems to process, transmit and store electronic information, and to manage or support virtually all of our business processes and activities. We also use mobile devices, social networking and other online activities to connect with our employees, suppliers, business partners and our customers. These uses give rise to cybersecurity risks, including security breach, espionage, system disruption, theft and inadvertent release of information. Our business involves the storage and transmission of numerous classes of sensitive and/or confidential information and intellectual property, including customers’ and suppliers’ personal information, private information about employees, and financial and strategic information about the Company and its business partners. Further, the Company is also expanding and improving its information technologies, resulting in a larger technological presence and corresponding increased exposure to cybersecurity risk. Additionally, while we have implemented measures to prevent security breaches and cyber incidents, our preventative measures and incident response efforts may not be entirely effective. The theft, destruction, loss, misappropriation, or release of sensitive and/or confidential information or intellectual property—or interference with our information technology systems or the technology systems of third parties on which we rely—could result in business disruption, negative publicity, brand damage, violation of privacy laws, loss of customers, potential liability and competitive disadvantage.

10

Table of Contents

We may be subject to or affected by liability claims related to products we distribute.

We—as any seller of food—may be exposed to liability claims in the event that the products we sell cause injury or illness. We believe we have sufficient primary or excess umbrella liability insurance to cover product liability claims. However, our current insurance may not continue to be available at a reasonable cost or, if available, may not be adequate to cover all of our liabilities. We generally seek contractual indemnification and insurance coverage from parties supplying products to us. But this indemnification or insurance coverage is limited, as a practical matter, to the creditworthiness of the indemnifying party and the insured limits of any insurance provided by suppliers. If we do not have adequate insurance or contractual indemnification available, the liability related to defective products could adversely affect our results of operations.

Any negative media exposure or other event that harms our reputation could hurt our business.

Maintaining a good reputation is critical to our business, particularly in selling our private label products. Any event that damages our reputation, justified or not, could quickly affect our revenues and profits. This includes adverse publicity about the quality, safety or integrity of our products. Reports—whether or not they are true—of food-borne illnesses (such as e. coli, avian flu, bovine spongiform encephalopathy, hepatitis A, trichinosis or salmonella) and injuries caused by food tampering could severely injure our reputation. If patrons of our national chain and local restaurant customers become ill from food-borne illnesses, the customers could be forced to temporarily close restaurant locations and our sales would correspondingly decrease. In addition, instances of food-borne illnesses or food tampering or other health concerns—even those unrelated to our products—can result in negative publicity about the food service distribution industry and dramatically reduce our sales.

We have been the subject of governmental investigations.

We have received a subpoena from the State of Florida’s Department of Financial Services regarding a contract we have with the Florida Department of Corrections, as well as a request for information from the Office of the Attorney General of the State of California seeking information regarding transactions with our California customers from 2001 to present. In each respective instance, we are cooperating with the investigation. We are further aware of two qui tam actions filed in Florida courts against us. However, because each suit is sealed, we do not have any further information about the nature of the claims alleged or remedies sought. At this stage, we cannot determine the likelihood of success of any of the above claims or the potential liability if they are successful and therefore there can be no assurance that adverse determination with respect to either matter would not have a material adverse effect on our financial condition.

Our retirement benefits could give rise to significant expenses and liabilities in the future.

We sponsor defined benefit pension and other postretirement plans. Pension and postretirement obligations give rise to significant expenses that are dependent on assumptions discussed in Note 17 to the Audited Consolidated Financial Statements included in this Annual Report on Form 10-K.

Pension and postretirement expense for fiscal 2014 was $21 million. The amount by which the present value of projected benefit obligations of our pension and other postretirement plans exceeded the market value of plan assets of our plans, as of December 27, 2014, was $228 million. We review our pension and postretirement plan assumptions regularly. We participate in various “multi-employer” pension plans administered by labor unions representing some of our employees. We make periodic contributions to these plans to allow them to meet their pension benefit obligations to their participants. In the event that we withdraw from participating in one of these plans, then-applicable law could require us to make withdrawal liability payments to the plan, and we would have to reflect that on our balance sheet. Our withdrawal liability for any multi-employer plan would depend on the extent of the plan’s funding of vested benefits. In connection with the closing of a distribution facility in 2011, we incurred a withdrawal liability of approximately $40 million, to be paid in installments, including interest, through 2031. In 2012, we incurred an $18 million settlement charge resulting from lump-sum payments to former employees participating in several Company-sponsored pension plans. In the ordinary course of our renegotiation of collective bargaining agreements with labor unions that maintain these plans, we could decide to discontinue participation in a plan. In that event, we could face a withdrawal liability. We could also be treated as withdrawing from participation in one of these plans, if the number of our employees participating in these plans is reduced to a certain degree over certain periods of time. Such reductions in the number of employees participating in these plans could occur as a result of changes in our business operations, such as facility closures or consolidations. Some multi-employer plans, including ones in which we participate, are reported to have significant underfunded liabilities. Such underfunding could increase the size of our potential withdrawal liability. For a detailed description of our retirement plans, see Note 17 to the Audited Consolidated Financial Statements included in this Annual Report on Form 10-K.

11

Table of Contents

Failure to maintain effective systems over internal control over financial reporting and disclosure controls and procedures could cause a loss of confidence in our financial reporting and adversely affect the value and liquidity of our indebtedness.

There is no guarantee that our disclosure controls and procedures or internal control over financial reporting will be effective in future years. Any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations. If we are unable to conclude that we have effective internal control over financial reporting, investors could lose confidence in the reliability of our financial statements, which could result in a decrease in value and liquidity of our indebtedness, including the Senior Notes, and make it more difficult for us to raise capital in the future. Failure to comply with the Sarbanes-Oxley Act of 2002 or applicable rules and regulations of the SEC could potentially subject us to sanctions or investigations by the SEC, or other regulatory authorities.

We must effectively integrate the businesses we acquire.

Historically, a portion of our growth has come through acquisitions. If we are unable to integrate acquired businesses successfully—or realize anticipated economic, operational and other benefits and synergies in a timely manner—our profitability may decrease. Integrating acquired businesses may be more difficult in a region or market in which we have limited expertise. A significant expansion of our business and operations, in terms of geography or magnitude, could strain our administrative and/or operational resources. Significant acquisitions may also require incurring additional debt. This could increase our interest expense, and make it difficult for us to get favorable financing for other acquisitions or capital investments in the future.

We may be unable to achieve some or all of the benefits that we expect from our cost savings initiatives.

We may not be able to realize some or all of our expected cost savings in the future. A variety of factors could cause us not to realize some of the expected cost savings. These include, among others, delays in the anticipated timing of activities related to our cost savings initiatives, lack of sustainability in cost savings over time, and unexpected costs associated with operating our business. All of these factors could negatively affect our profitability and competitiveness.

Risks Related to Our Substantial Indebtedness

We have substantial debt, which could adversely affect our financial health, and our ability to obtain financing in the future, react to changes in our business, and make payments on our debt.

As of December 27, 2014 we have had an aggregate principal amount of $4,733 million of outstanding debt, excluding $15 million of unamortized premium. Our substantial debt could have important consequences to holders of the Senior Notes, including the following:

| • | Our ability to obtain additional financing for working capital, capital expenditures, acquisitions, debt service requirements, acquisitions or general corporate purposes, and our ability to satisfy our obligations with respect to our indebtedness, including the Senior Notes, may be impaired in the future |

| • | A substantial portion of our cash flow from operations must be dedicated to the payment of principal and interest on our indebtedness, thereby reducing the funds available to us for other purposes (for example, approximately $280 million was dedicated to the payment of interest for the fiscal year ended December 27, 2014) |

| • | We are exposed to the risk of increased interest rates because a substantial portion of our borrowings are at variable rates of interest |

| • | It may be more difficult for us to satisfy our obligations to our lenders, resulting in possible defaults on and acceleration of such indebtedness |

| • | We may be more vulnerable to general adverse economic and industry conditions |

| • | We may be at a competitive disadvantage compared to our competitors with less debt or comparable debt at more favorable interest rates and they, as a result, may be better positioned to withstand economic downturns |

| • | Our ability to refinance indebtedness may be limited or the associated costs may increase |

12

Table of Contents

| • | Our flexibility to adjust to changing market conditions and ability to withstand competitive pressures could be limited, or we may be prevented from carrying out capital spending that is necessary or important to our growth strategy and efforts to improve operating margins or our business |

Despite our indebtedness levels, we and our subsidiaries may be able to incur substantially more debt, including secured debt. This could further exacerbate the risks associated with our substantial indebtedness.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future. The terms of our debt agreements do not fully prohibit us or our subsidiaries from doing so. As of December 27, 2014, we had commitments for additional borrowings under our asset-based senior secured revolving loan ABL Facility and our 2012 ABS Facility of $929 million (of which approximately $829 million was available based on our borrowing base), all of which were secured. All of those borrowings and any other secured indebtedness permitted under the agreements governing such credit facilities and indentures are effectively senior to the unsecured Senior Notes to the extent of the value of the assets securing such indebtedness. If new debt is added to our current debt levels, the related risks that we now face would increase and we may not be able to meet all our debt obligations, including the repayment of the Senior Notes. In addition, the Indenture does not prevent us from incurring obligations that do not constitute indebtedness.

The agreements and instruments governing our debt contain restrictions and limitations that could significantly impact our ability to operate our business.

Our credit facilities and the indentures contain covenants that, among other things, restrict our ability to do the following:

| • | Dispose of assets |

| • | Incur additional indebtedness (including guarantees of additional indebtedness) |

| • | Pay dividends and make certain payments |

| • | Make voluntary prepayments on the Senior Notes or make amendments to the terms thereof |

| • | Create liens on assets |

| • | Make investments (including joint ventures) |

| • | Engage in mergers, consolidations or sales of all or substantially all of our assets |

| • | Engage in certain transactions with affiliates |

| • | Change the business conducted by us |

| • | Amend specific debt agreements |

In addition, if borrowing availability under the ABL Facility—plus the amount of cash and cash equivalents held by us—falls below a specified threshold of $100 million, the borrowers are required to comply with a minimum fixed charge coverage ratio of 1 to 1. In addition, if our borrowing availability under the ABL Facility falls below $110 million, additional reporting responsibilities are triggered under the ABL Facility and the 2012 ABS Facility.

Our ability to comply with these provisions in future periods will depend on our ongoing financial and operating performance, which in turn will be subject to economic conditions and to financial, market and competitive factors, many of which are beyond our control. Our ability to comply with these provisions in future periods will also depend substantially on the pricing of our products, our success at implementing cost reduction initiatives and our ability to successfully implement our overall business strategy.

The restrictions under the terms of our credit facilities may prevent us from taking actions that we believe would be in the best interest of our business, and may make it difficult for us to successfully execute our business strategy or effectively compete with companies that are not similarly restricted. We may also incur future debt obligations that might subject us to additional restrictive covenants that could affect our financial and operational flexibility. We cannot assure you that we will be granted waivers or amendments to these agreements if for any reason we are unable to comply with these agreements or that we will be able to refinance our debt on terms acceptable to us, or at all.

Our ability to comply with the covenants and restrictions contained in our credit facilities may be affected by economic, financial and industry conditions beyond our control. The breach of any of these covenants or restrictions could result in a default under our credit facilities that would permit the applicable lenders or note holders, as the case may be, to declare all amounts outstanding thereunder to be due and payable, together with accrued and unpaid interest. If we are unable to repay

13

Table of Contents

debt, lenders having secured obligations, the lenders could proceed against the collateral securing the debt. In any such case, we may be unable to borrow under and may not be able to repay the amounts due under our credit facilities. This could have serious consequences to our financial condition and results of operations and could cause us to become bankrupt or insolvent.

Our ability to generate the significant amount of cash needed to pay interest and principal on our debt facilities and our ability to refinance all or a portion of our indebtedness or obtain additional financing depends on many factors beyond our control.

Our ability to make scheduled payments on, or to refinance our obligations under our debt will depend on our financial and operating performance. This, in turn, will be subject to prevailing economic and competitive conditions and to the financial and business factors, many of which may be beyond our control, as described under “Risk Factors—Risks Relating to Our Business” above.

If our cash flow and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets, seek to obtain additional equity capital or restructure our debt. In the future, our cash flow and capital resources may not be sufficient for payments of interest on and principal of our debt, and such alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations.

The 2012 ABS Facility will mature in 2016. The ABL Facility will mature in 2016. The Amended 2011 Term Facility will mature in 2019. The CMBS Fixed Rate Loan will mature in 2017. The Senior Notes will mature in 2019. We cannot assure you that we will be able to refinance any of our indebtedness or obtain additional financing, particularly because of our anticipated high levels of debt and the debt incurrence restrictions imposed by the agreements governing our debt, as well as prevailing market conditions. In the absence of such operating results and resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. Our credit facilities and indentures restrict our ability to dispose of assets and use the proceeds from any such dispositions. As a result, we cannot assure you we will be able to consummate those sales, or if we do, what the timing of the sales will be, or whether the proceeds that we realize will be adequate to meet the debt service obligations when due.

An increase in interest rates would increase the cost of servicing our debt and could reduce our profitability.

A significant portion of our outstanding debt bears interest at variable rates. As a result, an increase in interest rates—whether because of an increase in market interest rates or a decrease in our creditworthiness—would increase the cost of servicing our debt and could materially reduce our profitability and cash flows. The impact of such an increase would be more significant for us than it would be for some other companies because of our substantial debt.

| Item 1B. | Unresolved Staff Comments |

None.

14

Table of Contents

| Item 2. | Properties |

As of February 18, 2015, we maintained 76 primary operating facilities used in our divisions, of which approximately 78% were owned and 22% were leased. In addition to the operating facilities, our real estate includes general corporate facilities in Rosemont, IL, and Tempe, AZ. The Rosemont, IL and Tempe, AZ facilities are leased. The portfolio also includes a number of local sales offices, truck “drop-sites” and vacant land. Additionally, there is a minimal amount of surplus owned or leased property. Leases with respect to our leased facilities expire at various dates from 2015 to 2026, exclusive of renewal options.

The table below sets out the number of distribution facilities occupied by us in each state and the aggregate square footage of such facilities. The table reflects single divisions that may contain multiple locations or buildings. The table does not include retail sales locations, such as cash and carry or US Foods Culinary Equipment & Supply outlet locations, closed locations, vacant properties, or ancillary use owned and leased properties—such as temporary storage, remote sales offices or parking lots. In addition the table shows the square footage of our Rosemont, IL Headquarters and Tempe, AZ Shared Services Center:

| Number of | ||||||||||||

| Location |

Facilities | Square Feet | ||||||||||

| Alabama |

1 | 371,744 | ||||||||||

| Arizona |

3 | 329,431 | ||||||||||

| Arkansas |

1 | 135,009 | ||||||||||

| California |

5 | 1,261,588 | ||||||||||

| Colorado |

1 | 314,883 | ||||||||||

| Connecticut |

1 | 239,899 | ||||||||||

| Florida |

5 | 1,406,084 | ||||||||||

| Georgia |

2 | 703,852 | ||||||||||

| Illinois |

3 | 558,743 | ||||||||||

| Indiana |

1 | 233,784 | ||||||||||

| Iowa |

1 | 114,250 | ||||||||||

| Kansas |

1 | 350,859 | ||||||||||

| Maryland |

1 | 356,000 | ||||||||||

| Massachusetts |

1 | 188,000 | ||||||||||

| Michigan |

1 | 276,003 | ||||||||||

| Minnesota |

3 | 414,963 | ||||||||||

| Missouri |

3 | 602,947 | ||||||||||

| Nebraska |

1 | 112,070 | ||||||||||

| Nevada |

4 | 941,001 | ||||||||||

| New Jersey |

3 | 1,073,375 | ||||||||||

| New Mexico |

1 | 133,486 | ||||||||||

| New York |

3 | 388,683 | ||||||||||

| North Carolina |

3 | 954,736 | ||||||||||

| North Dakota |

2 | 221,314 | ||||||||||

| Ohio |

2 | 404,815 | ||||||||||

| Oklahoma |

1 | 308,307 | ||||||||||

| Pennsylvania |

6 | 1,179,319 | ||||||||||

| South Carolina |

2 | 1,148,887 | ||||||||||

| Tennessee |

3 | 700,920 | ||||||||||

| Texas |

4 | 927,453 | ||||||||||

| Utah |

1 | 267,180 | ||||||||||

| Virginia |

2 | 629,318 | ||||||||||

| Washington |

2 | 228,500 | ||||||||||

| West Virginia |

1 | 137,337 | ||||||||||

| Wisconsin |

1 | 172,826 | ||||||||||

|

|

|

|

|

|||||||||

| Total |

76 | 17,787,566 | ||||||||||

|

|

|

|

|

|||||||||

| Owned | 13,910,122 | 78 | % | |||||||||

|

|

|

|

|

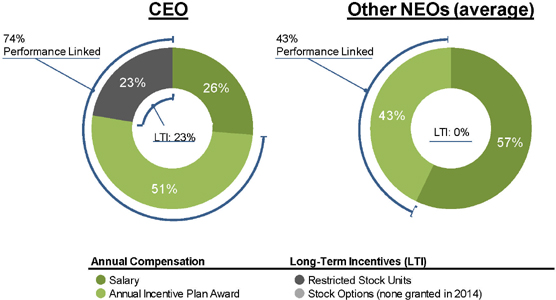

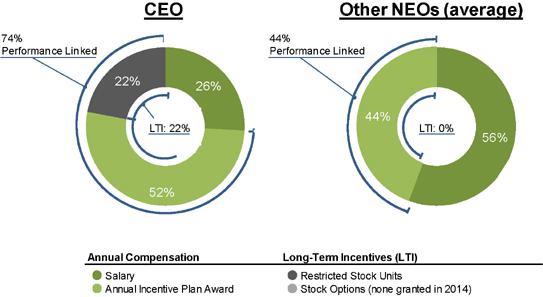

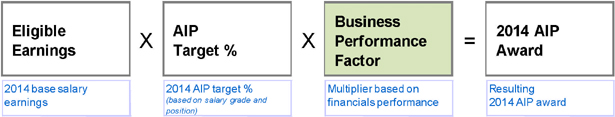

|||||||||