UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2022

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number: 001-35877

HANNON ARMSTRONG SUSTAINABLE

INFRASTRUCTURE CAPITAL, INC.

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

(410 ) 571-9860

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal controls over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2022, the aggregate market value of the registrant’s common stock (includes unvested restricted stock) held by non-affiliates of the registrant was $3.3 billion based on the closing sales price of the registrant’s common stock on June 30, 2022 as reported on the New York Stock Exchange.

On February 16, 2023, the registrant had a total of 91,010,597 shares of common stock, $0.01 par value, outstanding (which includes 155,453 shares of unvested restricted common stock).

DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTS

| Page | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

- 2 -

FORWARD-LOOKING STATEMENTS

We make forward-looking statements in this Annual Report on Form 10-K (“Form 10-K”) within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are subject to risks and uncertainties. For these statements, we claim the protections of the safe harbor for forward-looking statements contained in such Sections. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives. When we use the words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may” or similar expressions, we intend to identify forward-looking statements. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements.

Forward-looking statements are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Accordingly, any such statements are qualified in their entirety by reference to, and are accompanied by, important factors included in Part I, Item 1A. Risk Factors (in addition to any assumptions and other factors referred to specifically in connection with such forward-looking statements) that could have a significant impact on our operations and financial results, and could cause our actual results to differ materially from those contained or implied in forward-looking statements made by or on our behalf in this Form 10-K, in presentations, on our websites, in response to questions or otherwise.

Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances, including, but not limited to, unanticipated events, after the date on which such statement is made, unless otherwise required by law. New factors emerge from time to time and it is not possible for management to predict all of such factors, nor can it assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained or implied in any forward-looking statement.

- 3 -

RISK FACTOR SUMMARY

An investment in our securities involves a high degree of risk. You should carefully consider the risks summarized in Item 1A, “Risk Factors” included in this report. These risks include, but are not limited to, the following:

Risks Related to Our Business and Our Industry

•Our business depends in part on U.S. federal, state and local government policies and a decline in the level of government support could harm our business.

•If the cost of energy generated by traditional sources of energy declines or continues to remain low, demand for the projects in which we invest may decline.

•We operate in a competitive market, which may impact the terms of the investments we make.

•A change in the fiscal health, level of appropriations or budgets of U.S. federal, state and local governments could reduce demand for the projects in which we invest and the capital we provide.

Risks Related to Our Assets and Projects in Which We Invest

•The lack of liquidity of our assets may adversely affect our business, including our ability to value our assets.

•We rely on our project sponsors for financial reporting related to our project companies, and our financial statements may be materially affected if the financial reporting related to our project companies proves to be incorrect.

•Our investments are subject to delinquency, foreclosure and loss, any or all of which could result in losses to us.

•Our mezzanine or subordinated loans are riskier, less protected against loss than, and generally less liquid than, other forms of debt with more senior preference.

•Our equity investments, many of which are illiquid with no readily available market, involve a substantial degree of risk.

•We generally do not control the projects in which we invest, which may result in the project owner making certain business decisions or taking risks with which we disagree.

•Portions of the electricity our assets generate is sold on the open market at spot-market prices. A prolonged environment of low prices for natural gas, or other conventional fuel sources may have a material adverse effect on our long-term business prospects, financial condition and results of operations.

•Some of the projects in which we invest may require substantial operating or capital expenditures in the future.

•We invest in projects which rely on third parties to manufacture quality products or provide reliable services in a timely manner and the failure of these third parties could cause project performance to be adversely affected.

•Our insurance and contractual protections may not always cover lost revenue, increased expenses or liquidated damages payments.

•Energy efficiency, renewable energy and other sustainable infrastructure projects are subject to performance risks, including risks due to extreme weather events, that could impact the repayment of and the return on our assets.

Risks Related to Our Company

•We may change our operational policies (including our investment guidelines and strategies) with the approval of our board of directors (“Board”) but without stockholder consent at any time, which may adversely affect the market value of our common stock and our ability to make distributions to our stockholders.

•An increase in our borrowing costs relative to the interest we receive on our assets may adversely affect our profitability and our cash available for distribution to our stockholders. Our borrowings may have a shorter duration than our assets.

•While we have an established Board-approved leverage limit, our Board may change our financial leverage guidelines without stockholder consent.

•Major public health issues and related disruptions in the U.S. and global economy and financial markets could adversely impact or disrupt our financial condition and results of operations.

- 4 -

Risks Related to Our Common Stock

•We cannot assure you of our ability to make distributions in the future. Although we currently do not intend to do so, if our portfolio of assets does not generate sufficient income and cash flow, we could be required to sell assets, borrow funds or make a portion of our distributions in the form of a taxable stock distribution or distribution of debt securities in order to maintain our qualification as a REIT.

Risks Related to Our Organization and Structure

•Our qualification as a REIT depends on interpretations of highly technical and complex legal provisions, and our failure to qualify or remain qualified as a REIT would subject us to taxes that would negatively impact the results of our operations and reduce the amount of cash available for distribution to our stockholders.

Risks Related to Our Taxation as a REIT

•Complying with REIT requirements may force us to liquidate assets or forego otherwise attractive investments.

- 5 -

PART I

In this Form 10-K, unless specifically stated otherwise or the context otherwise indicates, references to “we,” “our,” “us,” “HASI,” and “our company” refer to Hannon Armstrong Sustainable Infrastructure Capital, Inc., a Maryland corporation and any of our subsidiaries. Hannon Armstrong Sustainable Infrastructure, L.P., a Delaware limited partnership, is a subsidiary of which we are the sole general partner and to which we refer in this Form 10-K as our “Operating Partnership.” Our business is focused on reducing the impact of greenhouse gases that have been scientifically linked to climate change. We refer to these gases, which are often for consistency expressed as carbon dioxide equivalents, as carbon emissions.

Item 1. Business

GENERAL

We invest in climate solutions developed or sponsored by leading companies in the energy efficiency, renewable energy and other sustainable infrastructure markets. We believe that we were one of the first U.S. public companies solely dedicated to climate solutions. Our goal is to generate attractive returns from a diversified portfolio of project company investments with long-term, predictable cash flows from proven technologies that reduce carbon emissions or increase resilience to climate change. Our vision is that every investment improves our climate future. In executing this vision, we focus on a wide variety of climate solutions including:

•Building Energy Efficiency | •LED Building Lighting | ||||

•Energy Efficient Heating, Cooling and Ventilation | •Building Controls and Sensors | ||||

•Combined Heat and Power Systems | •Electric Distribution Systems | ||||

•LED Street Lighting | •Distributed Commercial and Industrial Solar | ||||

•Community Solar | •Residential Solar | ||||

•Utility Scale Solar | •Utility Scale Wind | ||||

•Water and Stream Distribution Systems | •Clean Fleet Transportation | ||||

•Nature Based Solutions and Environmental Credits | •Storm Water Management | ||||

•Renewable Natural Gas | •Other Climate Related Technologies | ||||

We are internally managed, and our management team has extensive relevant industry knowledge and experience. We have long-standing relationships with the leading energy service companies (“ESCOs”), manufacturers, project developers, utilities, owners and operators that provide recurring, programmatic investment and fee-generating opportunities. Additionally, we have relationships with leading commercial and investment banks and institutional investors from which we are referred additional investment and fee-generating opportunities.

We completed approximately $1.8 billion of transactions during 2022, compared to approximately $1.7 billion during 2021. As of December 31, 2022, we held approximately $4.3 billion of transactions on our balance sheet, which we refer to as our “Portfolio.” For those transactions that we choose not to hold on our balance sheet, we transfer all or a portion of the economics of the transaction, typically using securitization trusts, to institutional investors in exchange for cash and, in certain cases, residual interests in the trusts and ongoing fees. As of December 31, 2022, we managed approximately $5.5 billion in these trusts or vehicles that are not consolidated on our balance sheet. When we combine these assets with our Portfolio, as of December 31, 2022, we manage approximately $9.8 billion of assets, which we refer to as our “Managed Assets.”

Our investments take many forms, including equity, joint ventures, land ownership, loans, and other financing transactions. We also generate ongoing fees via off-balance sheet securitization transactions, advisory services, and asset management. We use borrowings as part of our strategy to fund our investments in climate solutions and have available to us a broad range of financing sources including short-term commercial paper issuances, revolving credit facilities, non-recourse or recourse debt, equity, and off-balance sheet securitization structures. We calculate the estimated carbon emission savings using CarbonCount®, a proprietary tool which measures the efficiency with which our investments reduce carbon emissions, and generally provide the associated CarbonCount metrics for our debt issuances. In addition, certain of our debt issuances meet the environmental eligibility criteria for green bonds as defined by the International Capital Markets Association’s Green Bond Principles, which we believe makes our debt more attractive for many investors compared to such offerings that do not qualify under these principles. A further description of our financing activities can be found herein.

We have a large and active pipeline of potential new opportunities that are in various stages of our underwriting process. We believe the Inflation Reduction Act signed into law on August 16, 2022, that incentivizes the construction of and

- 6 -

investment in climate solutions will result in additional investment opportunities in the markets in which we invest over the next several years, which may result in increases in our pipeline in the future. We refer to potential opportunities as being part of our pipeline if we have determined that the project fits within our climate solutions investment strategy and exhibits the appropriate risk and reward characteristics through an initial credit analysis, including a quantitative and qualitative assessment of the opportunity, as well as research on the relevant market and sponsor. Our pipeline of transactions that could potentially close in the next 12 months consists of opportunities in which we will be the lead originator as well as opportunities in which we may participate with other institutional investors. As of December 31, 2022, our pipeline consisted of more than $4.5 billion in new equity, debt and real estate opportunities. There can, however, be no assurance with regard to any specific terms of such pipeline transactions or that any or all of the transactions in our pipeline will be completed.

We are committed to leadership in transparent disclosure on environmental, social, and governance (“ESG”) matters. Beginning in 2013, we became one of the first capital providers to evaluate the carbon efficiency of our Portfolio by utilizing CarbonCount. In 2017, we believe we were the first U.S-based public company to commit to the Climate Disclosure Standards Board led initiative on implementing the recommendations of the Financial Stability Board’s Task Force for Climate-related Financial Disclosures (“TCFD”) and provide the recommended disclosures in our Form 10-K. In 2020, we joined the Partnership for Carbon Accounting Financials (“PCAF”), a global financial industry-led partnership to implement a consistent and transparent disclosure framework to report carbon emissions and avoided emissions resulting from financed assets. We began to report in accordance with PCAF in 2022. For further information on our ESG disclosures, see the discussion in the sections titled “Investment Strategy” and “Environmental and Social Responsibility and Corporate Governance” herein. We are committed to providing transparent disclosures on our human capital management, which can be found herein in the section titled “Human Capital Strategy.” In 2021, we founded the Hannon Armstrong Foundation, which provides monetary and non-monetary support to programs that align with our philanthropic priorities of ensuring equal access to climate solutions, empowering and creating opportunity for marginalized individuals and communities, and creating a local impact.

We elected to be taxed as a REIT for U.S. federal income tax purposes commencing with our taxable year ended December 31, 2013, and operate our business in a manner that permits us to maintain our exemption from registration as an investment company under the 1940 Act.

INVESTMENT STRATEGY

With scientific consensus that global-warming trends are linked to human activities and result in various extreme weather events, we believe our firm is well-positioned to generate attractive risk-adjusted returns by investing in, and managing a portfolio of, assets that address climate-changing greenhouse gas emissions. Further, with increasing weather-related disasters, we see similar investment opportunities in infrastructure assets that mitigate the impact of, and increase the resiliency to, these weather events and other adverse impacts of climate change.

Our vision is that every investment improves our climate future and thus the carbon impact of an investment is at the core of our business model. We believe that climate positive investments will produce attractive risk adjusted returns and we require investments to be neutral to negative on incremental carbon emissions or have some other tangible environmental benefit such as reducing water consumption or increasing resilience to climate change influenced weather events.

Our climate-positive investment thesis is based on the following theories:

•more efficient technologies are more productive and thus should lead to higher economic returns;

•lower portfolio risk is inherent in a portfolio of smaller investments, generated by trends of increasing decentralization and digitalization of energy assets;

•investing in assets aligned with scientific consensus and broadly held societal values will reduce potential regulatory and social costs through more internalization of externalities; and

•assets that reduce carbon emissions represent an embedded option that may increase in value if regulatory authorities were to set a price on carbon emissions.

We believe combining this investment thesis with our multi-decade experience in investing in our markets through multiple interest rate and business cycles, intermittent governmental support for reducing carbon emissions and several cycles of business expansions in renewable and other sustainable infrastructure markets, allows us to earn attractive risk-adjusted returns on the assets in which we invest. We also believe there is a very large potential market opportunity as the legacy technologies for generating and using energy and the systems that produce carbon emissions are retired and replaced by low-to-no carbon emission systems. Mitigation and resiliency investments continue to grow to address severe weather events and other climate change impacts.

Our investments in climate solutions are focused on three markets:

- 7 -

•Behind-the-Meter (“BTM”): distributed building or facility projects, which reduce energy usage or cost through the use of solar generation and energy storage or energy efficiency improvements including heating, ventilation and air conditioning systems (“HVAC”), lighting, energy controls, roofs, windows, building shells, and/or combined heat and power systems;

•Grid-Connected (“GC”): renewable energy projects that deploy cleaner energy sources, such as solar, solar-plus-storage, and wind, to generate power production where the off-taker or counterparty may be part of the wholesale electric power markets; and

•Sustainable Infrastructure (“SI”): upgraded transmission and distribution systems, water and storm water infrastructure, transportation fleet enhancements, renewable natural gas plants, and other projects that improve water or energy efficiency, increase resiliency, positively impact the environment or more efficiently use natural resources.

Of our pipeline, 42% is related to BTM assets and 45% is related to GC assets, with the remainder related to SI. We prefer investments in which the assets use proven technology and have a long-term, creditworthy off-taker or counterparties. For BTM assets, the off-taker or counterparty may be the building owner or occupant, and our investment may be secured by the installed improvements or other real estate rights. For GC assets, the off-takers or counterparties may be utility or electric users who have entered into contractual commitments, such as power purchase agreements (“PPAs”), to purchase power produced by a renewable energy project at a specified price with potential price escalators for a portion of the project’s estimated life.

We make our investments utilizing a variety of structures, including:

•equity investments in either preferred or common structures in unconsolidated entities which own renewable energy or energy efficiency projects;

•commercial and government receivables or securities, such as loans for renewable energy and energy efficiency projects; and

•real estate, such as land or other assets leased for use by GC projects typically under long term leases.

Our equity investments in climate solutions projects are operated by various renewable energy companies or by joint ventures in which we participate. These transactions allow us to participate in the cash flows associated with these projects, typically on a priority basis. Our energy efficiency debt investments are usually assigned the payment stream from the project savings and other contractual rights, often using our pre-existing master purchase agreements with the ESCOs. Our debt investments in various renewable energy or other sustainable infrastructure projects or portfolios of projects are generally secured by the installed improvements, or other real estate rights. We also own, directly or through equity investments, land that is leased under long-term agreements to renewable energy projects where our investment returns are typically senior to most project costs, debt, and equity.

We often make investments where we hold a preferred or mezzanine position in a project company where we are subordinated to project debt and/or preferred forms of equity. Investing greater than 10% of our assets in any individual project company requires the approval of a majority of our independent directors. We may adjust the mix and duration of our assets over time in order to allow us to manage various aspects of our Portfolio, including expected risk-adjusted returns, macroeconomic conditions, liquidity, availability of adequate financing for our assets, and the maintenance of our REIT qualification and our exemption from registration as an investment company under the 1940 Act.

As of December 31, 2022, our Portfolio consisted of over 340 investments, with approximately 56% of our Portfolio invested in BTM assets and approximately 40% invested in GC assets, which include our land holdings. The mix of our Portfolio is expected to vary over time, as we seek to manage the diversity of our Portfolio by, among other factors, project type, project operator, type of investment, type of technology, transaction size, geography, obligor, and maturity.

As part of our investment process, we calculate the ratio of the estimated first year of metric tons of carbon emissions avoided by our investments divided by the capital invested to quantify the carbon impact of our investments. In this calculation, which we refer to as CarbonCount, we use emissions factor data, expressed on a CO2 equivalent basis, from the U.S. Government or the International Energy Administration to an estimate of a project’s energy production or savings to compute an estimate of metric tons of carbon emissions avoided. We estimate that our investments originated in 2022 will reduce annual carbon emissions by over 600 thousand metric tons, equating to a CarbonCount of 0.35. In addition to carbon, we also consider other environmental attributes, such as water use reduction, stormwater remediation benefits and stream restoration benefits.

We believe that our long history of climate solutions investing, the experience, expertise and relationships of our management team, the anticipated credit strength of the obligors or investees involved in our investments and the size and growth potential of our market, position us well to capitalize on our strategy.

- 8 -

Refer to Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations, for additional discussion on the performance of our Portfolio.

FINANCING STRATEGY

We believe we have available a broad range of financing sources as part of our strategy to fund our investments in climate solutions. We may finance our investments through the use of non-recourse debt, recourse debt or equity and may also finance such transactions through the use of off-balance sheet securitizations or syndication structures. When issuing debt, we generally provide the estimated carbon emission savings using CarbonCount. In addition, certain of our debt issuances meet the environmental eligibility criteria for green bonds as defined by the International Capital Markets Association’s Green Bond Principles, which we believe makes our debt more attractive for certain investors compared to such offerings that do not qualify under these principles.

We plan to raise additional equity capital and continue to use fixed and floating rate borrowings, which may be in the form of short-term commercial paper issuances, revolving credit facilities, term loans, repurchase agreements, and public and private debt issuances, including convertible debt and off-balance sheet securitization structures, as a means of financing our business. We may also consider the use of special purpose entities or funds in which outside investors participate to allow us to expand the investments that we make or to manage our Portfolio diversification.

The decision on how we finance our business is largely driven by market conditions including the overall interest rate environment, prevailing credit spreads and the terms of available financing. During periods of market disruption, certain sources of financing may be less accessible than others which may impact our financing decisions. Over time, as market conditions change, we may use other forms of financial leverage in addition to these financing arrangements. Although we are not restricted by any regulatory requirements as to the type or amount of financial leverage we may use, our Board has established a target limit of our leverage ratio, defined as the ratio of debt to equity, of at or below 2.5 to 1, and a target range for our percentage of fixed rate debt to total debt of between 75% and 100%, allowing for percentages as low as 70% on a short term basis if we intend to repay or swap floating rate borrowings in the near term. See additional discussion in “Item 7. Management’s Discussion and Analysis of Financial Conditions and Results of Operations—Liquidity and Capital Resources” regarding our ongoing evaluation of our leverage limits and fixed-rate debt targets.

In our off-balance sheet financings, we transfer all or a portion of an investment to a securitization trust in exchange for cash and/or residual interests in the trust, and in some cases, ongoing fees. The availability of securitization counterparties has remained high throughout various market cycles due to investor demand for high credit quality, long-term climate-positive investments. We may arrange such securitizations of loans or other assets prior to originating the transaction and thus avoid exposure to credit spread, interest rate and funding risks. We also typically manage and service these assets in exchange for fees. We may also use other funds or structures where institutional investors purchase all or a portion of the economics of the transaction and where we may receive upfront or ongoing fees for managing the assets. We periodically provide other services, including arranging financings that are held on the balance sheets of other investors and advising various companies with respect to structuring investments.

Refer to Item 7. Management’s Discussion and Analysis of Financial Conditions and Results of Operations—Liquidity and Capital Resources, for additional discussion on our financings and our ratios and Item 8. Financial Statements and Supplementary Data, Notes 5, 7 and 8 to our financial statements for further information on the types and amounts of our financing activities.

HUMAN CAPITAL STRATEGY

An emphasis on a durable social fabric, including diverse, engaged, and fairly compensated staff, is an important factor in our financial success. Our culture is focused on hiring and retaining highly talented employees with diverse backgrounds and empowering them to create value for our stockholders, and our success is dependent on employee understanding of and investment in their role in that value creation. Our employees are responsible for upholding our vision, purpose, and values.

It is important to us that our employees are engaged in our mission of sustainability because we believe engagement improves their performance, as well as our employee recruitment and retention. Our chief executive officer periodically leads employee meetings intended to reinforce the importance of sustainability and regularly meets with small groups of employees to receive their feedback on our business. We also meet no less than quarterly as a Company to provide information to employees on our mission, strategic planning and financial results. We continuously evaluate our employees’ level of engagement through in-person or remote meetings that include asking open-ended questions and through formal surveys or similar tools administered on a periodic basis.

We adhere to a blended learning approach with the understanding that our people learn from experiences (on the job and in life), from other people (mentors or supportive managers), and from formal learning and training programs. We acknowledge that learning is highly individualized and needs to be offered in a way that is most conducive to a specific learner’s needs. We run a periodic education series that includes internal and external speakers presenting topics of interest that are relevant to our

- 9 -

employees. We provide multiple learning solutions that cover a wide range of areas such as diversity, equity, and inclusion training, leadership skills, financial knowledge, technology training, and presentation skills. We also support the pursuit of advanced certifications and degrees in areas including business, science and engineering, and liberal and fine arts and employ formal and informal coaching arrangements.

We care about our employees’ employment experience and recognize them as individuals who are motivated in different ways. Managers hold performance conversations with their employees on a periodic basis to ensure they receive the performance feedback they deserve, and to allow managers to obtain insight into how to support the development of their staff, and to ensure that performance expectations are clear and aligned with the overarching objectives of the Company. We also provide continuous dialogue in between these formal touchpoints.

We believe we provide attractive benefits that promote the health of our employees and their families and design compelling job opportunities, aligned with our mission, in an energizing work environment. We also encourage our employees to continue to develop in their careers, including by obtaining advanced degrees or professional certifications. We compensate our employees according to our fair remuneration policies and believe in paying for performance. Therefore, employees typically receive a portion of their compensation in the form of annual bonuses as well as equity grants which are both tied in part to the Company’s financial performance. We encourage our employees to contribute their time to support various community and charitable activities and contribute to local community organizations with a primary focus on organizations addressing issues around environmental and social justice. In addition to competitive base salaries, cash bonuses, and equity participation for most employees, we are committed to continuously evaluating and ensuring the competitiveness of our benefits offerings so that we meet the various needs of our employees and their families. Despite a healthcare environment that is facing rising costs, we continue to pay substantially all of the cost of our employees’ healthcare insurance. Further, in addition to what we believe to be market total rewards benefits, we provide additional benefits, such as on-site seasonal vaccination clinics, back-up childcare solutions, and a tuition reimbursement program.

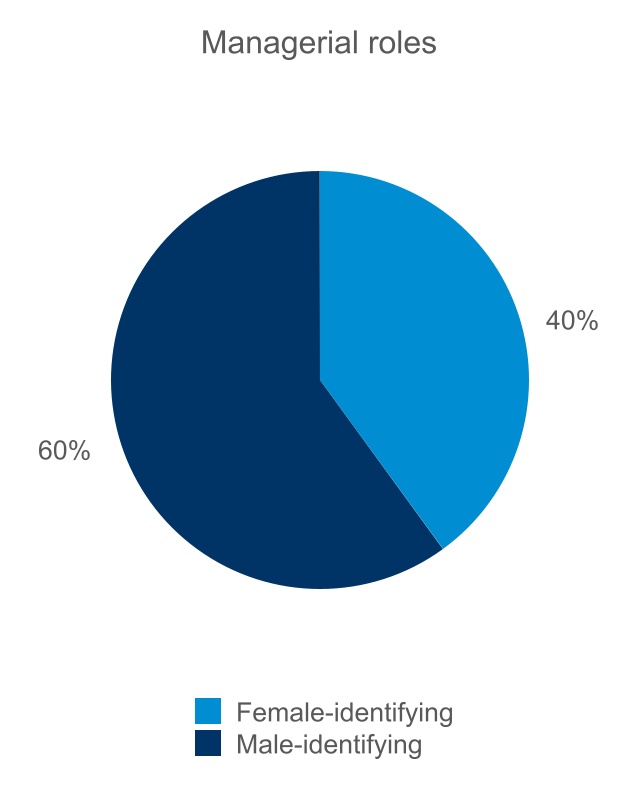

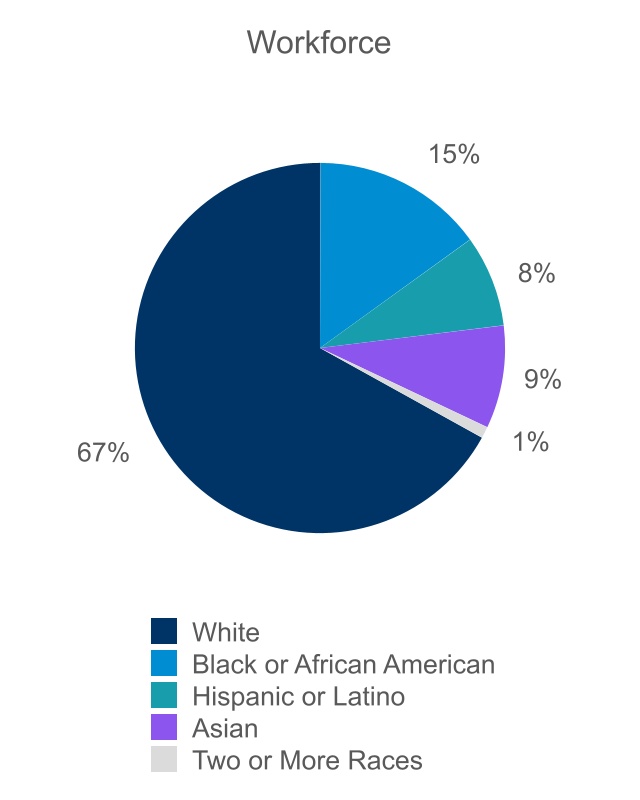

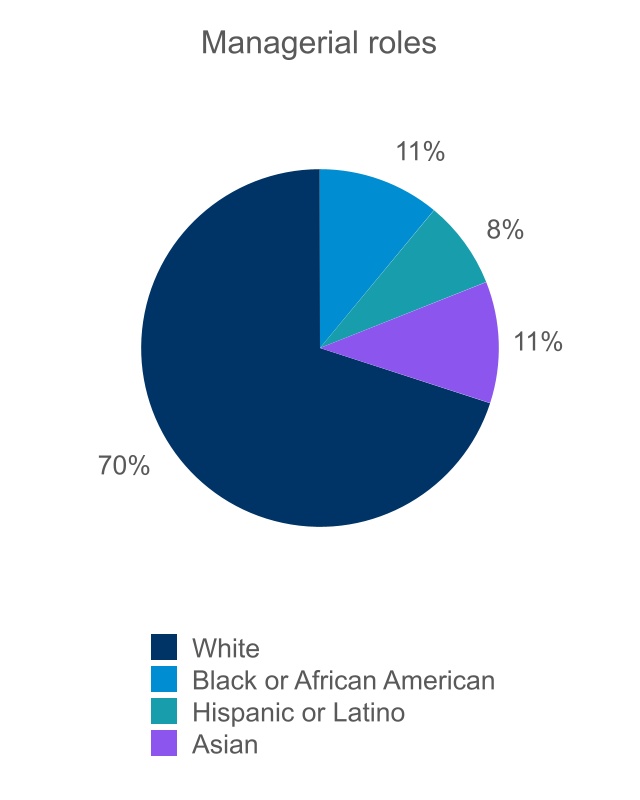

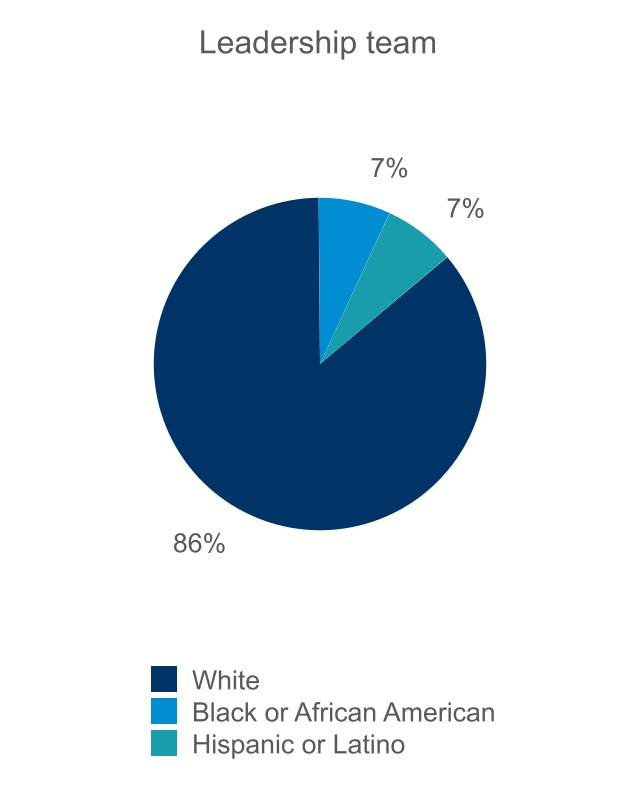

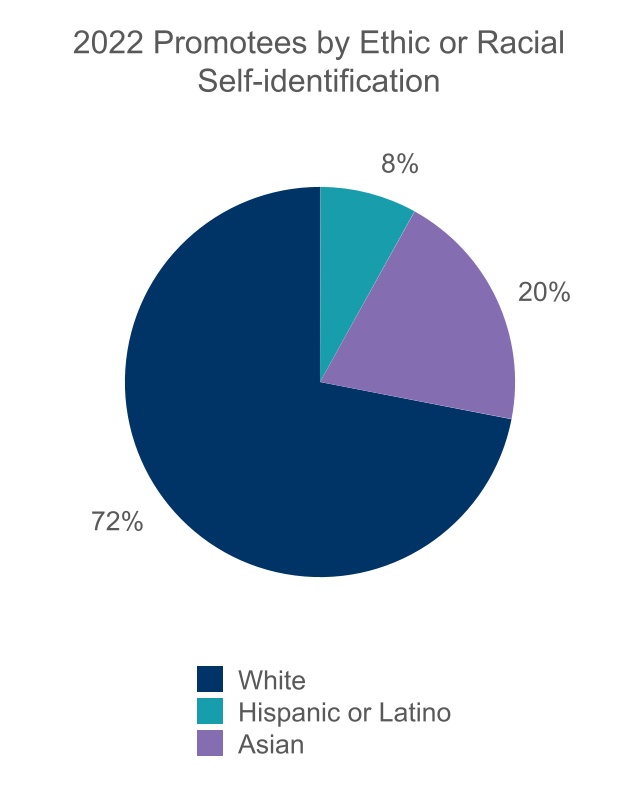

We take a values-driven, broad view of diversity, equity, and inclusion. We believe that fostering an internal climate that is supportive and allows people of all backgrounds to flourish lends itself to the highest levels of company performance and facilitates the attraction and retention of best-in-class talent. We also believe it is inherently the right way to conduct business. We support an innovative, creative culture where people can bring their best and most authentic selves to work. Employees who hold divergent opinions are encouraged to voice their views. We track and report internally on key talent metrics including workforce demographics, critical role pipeline data, diversity data, and engagement and inclusion indices.

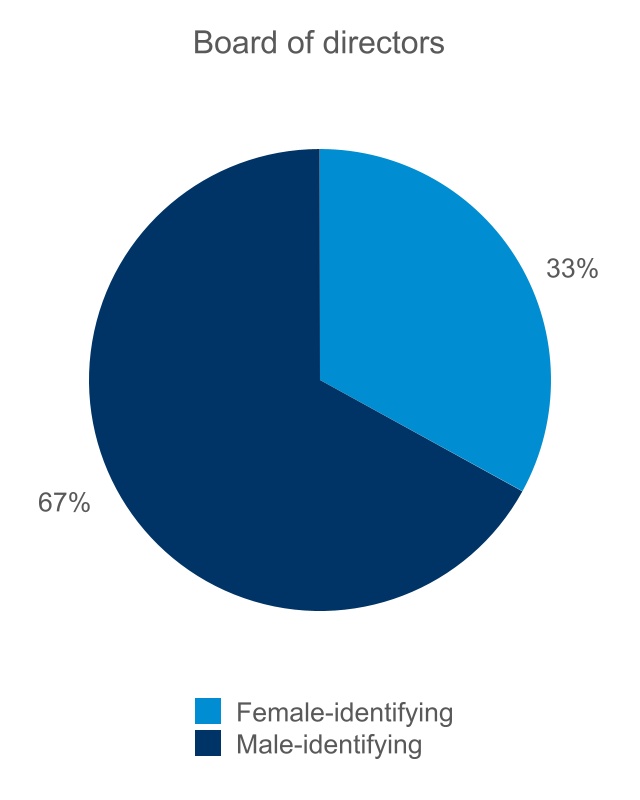

Decisions regarding staffing, selection, and promotions are made on the basis of individual qualifications related to the requirements of the position. We are committed to identifying and developing the next generation of leaders. We endeavor to select qualified individuals from a diverse pool of candidates derived from broad outreach efforts when we are recruiting. We are committed to the sourcing and/or promotion of highly-qualified women, people of color and other under-represented groups for management and Board positions. To better support our female and underrepresented employees in their onboarding, training, development and progression within the Company, we have established a mentorship program where certain members of our Board mentor female employees who are developing managers.

Our policy is “equal pay for equal work” in compliance with applicable state law. Compensation for our employees is based upon experience, seniority, educational attainment, and individual contribution and company performance against goals.

As of December 31, 2022, we employed 114 people. We intend to hire additional business professionals as needed to assist in the implementation of our business strategy. Refer to “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Results of Operations – Human Capital Metrics” for discussion of metrics related to our Human Capital Strategy.

ENVIRONMENTAL AND SOCIAL RESPONSIBILITY AND CORPORATE GOVERNANCE

We own and invest in a diversified portfolio of climate solutions projects focused on reducing or mitigating the impacts of climate change. Under the direction of our chief executive officer and the Board, we are focused on achieving a high level of environmental and social responsibility and strong corporate governance. The Nominating, Governance and Corporate Responsibility Committee of our Board is responsible for our ESG oversight, including related policies and communications. Additionally, we have a committee of employees from across our organization that is focused on implementing ESG strategies and policies and reports directly to our chief executive officer. Annually we publish a report that illustrates our progress on these matters.

Environmental Responsibility. Our business and business strategy are focused on addressing climate change, in part through the reduction of carbon emissions that have been scientifically linked to climate change. As described under “Investment Strategy”, we quantify the carbon impact of each of our investments. In addition, we operate our business in a manner intended to reduce our own environmental impact, including by purchasing carbon-free renewable energy for our office, encouraging recycling and composting, and offering clean transportation employee incentives for electric and hybrid vehicles. We have also adopted policies focused on minimizing the environmental impact of our operations.

- 10 -

Through our membership in the Net Zero Asset Managers Initiative, we are pleased to participate in the Glasgow Financial Alliance for Net Zero, which brings the financial sector together to accelerate a shared commitment to decarbonizing the global economy. In 2021, we established targets for our transition to net-zero carbon emissions by 2050 using the foundational framework developed by the Science Based Targets Initiative.

We are a signatory to the United Nations Global Compact, an initiative focused on responsible business practices related to human rights, labor, the environment and anti-corruption. We participate in a number of initiatives and coalitions that share our commitment to climate action, corporate sustainability, climate-risk disclosure and reporting, and the expansion of clean energy including the United Nations-supported Principles for Responsible Investment, the United Nations Global Compact campaign entitled Business Ambition for 1.5°, Climate Action 100+, and the reporting framework established by an international consortium of business and environmental NGOs referred to as the Climate Disclosure Standards Board.

Social Responsibility. We recognize that the effects of pollution, environmental degradation, increased climate-fueled extreme weather events, and the economic transition away from fossil fuels fall most heavily on marginalized communities in our society, especially communities of color. We know that the effects of climate change are already disproportionately impacting disadvantaged communities, and these adverse outcomes will be exacerbated if we do not eliminate harmful greenhouse gas emissions. Equally so, we acknowledge the legacy of discriminatory policies in creating and perpetuating this imbalance.

We believe in every person’s inherent worth and dignity and that we should all have access to clean water, clean air, healthy food, resilient and reliable shelter and energy, and good paying jobs. We believe these disparities must be addressed while society works to accelerate the transition to a net-zero economy, both here in the United States and across the globe, a concept we refer to as “climate justice”.

We are determined to incorporate climate justice ideals and actions across our entire business, including in our process for underwriting investments, our engagement with business partners, our human capital strategy, philanthropy, and policy advocacy efforts. In 2021, we established the Hannon Armstrong Foundation, that provides cash and in-kind support to programs which provide climate solutions investments and career opportunities for those from historically underrepresented communities, as well as organizations across our local region that seek to strengthen the social fabric and promote economic and climate resiliency.

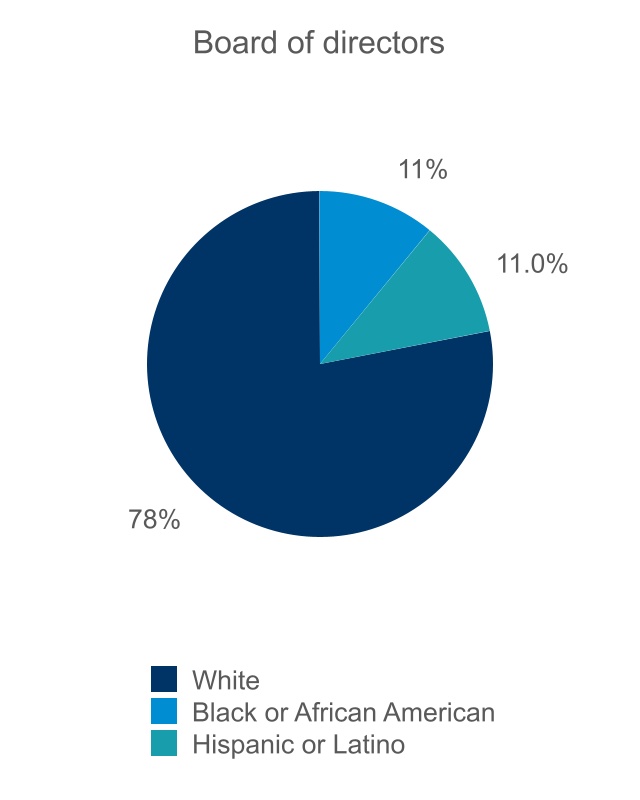

Corporate Governance. We are focused on achieving best-in-class corporate governance practices to help ensure that our team will operate in a manner consistent with our organizational mission and deliver attractive risk-adjusted returns. Our corporate governance philosophy is based on maintaining a close alignment of our interests with those of our stakeholders. Notable features of our corporate governance structure include the following:

•our Corporate Governance Guidelines provide for a majority vote policy for the election of directors pursuant to which any nominee who receives a greater number of votes “withheld” from his or her election than votes “for” such election shall promptly tender his or her resignation to our Board for their consideration to accept or reject such resignation;

•our Board is not staggered, with each of our directors subject to re-election annually;

•our Board has determined that eight of our nine directors are independent for purposes of the New York Stock Exchange (“NYSE”) corporate governance listing standards and Rule 10A-3 under the Exchange Act;

•we have a lead independent director of the Board that convenes and chairs executive sessions of the independent directors to discuss certain matters without management or the chairman present;

•effective March 1, 2023, we have separated the executive chairman and chief executive officer roles as discussed in Item 9B of this Form 10-K;

•three of our directors qualify as an “audit committee financial expert” as defined by the Securities and Exchange Commission (the “SEC”);

•three of our directors (including our lead independent director) are women and one of our directors is a person of color constituting 33% and 11% respectively, of our Board in furtherance of our board diversity policy;

•a target retirement age of 75 has been established for our directors;

•we have an active stockholder outreach program, including providing stockholders the right to vote on an advisory basis on the fairness of the remuneration of executives;

•our Board members and named executive officers are required to maintain certain levels of stock ownership in our company ranging between three and six times their base salary or retainer, depending on position;

- 11 -

•we have a Clawback Policy that provides for the possible recoupment of performance or incentive-based compensation in the event of an accounting restatement due to material noncompliance by us with any financial reporting requirements under the securities laws (other than due to a change in applicable accounting methods, rules or interpretations);

•we have opted out of the control share acquisition statute in the Maryland General Corporations Law (the “MGCL”);

•stockholders have the ability to amend the Company’s bylaws by the affirmative vote of the holders of a majority of the outstanding shares of common stock of the Company pursuant to a binding proposal submitted by a stockholder;

•we have exempted from the business combinations statute in the MGCL transactions that are approved by our Board (including a majority of our directors who are not affiliates or associates of the acquiring person); and

•we do not have a stockholder rights plan (i.e., no poison pill).

In order to foster the highest standards of ethics and conduct in all business relationships, we have adopted a Code of Business Conduct and Ethics policy (the “Code of Conduct”). This policy covers a wide range of business practices and procedures and applies to our officers, directors, employees, agents, representatives, and consultants. In addition, we have implemented whistleblowing procedures designed to facilitate the report of accounting and auditing matters as well as Code of Conduct matters (the “Whistleblower Policy”) that sets forth procedures by which any Covered Persons (as defined in the Whistleblower Policy) may report, on a confidential basis, concerns regarding, among other things, any questionable or unethical accounting, internal accounting controls or auditing matters with our Audit Committee as well as any potential Code of Conduct or ethics violations with our Nominating, Governance and Corporate Responsibility Committee or our Chief Legal Officer.

We have adopted a Statement of Corporate Policy Regarding Equity Transactions that governs the process to be followed in the purchase or sale of our securities by any of our directors, officers, employees and consultants and prohibits any such persons from buying or selling our securities on the basis of material nonpublic information, and also prohibits our directors and officers from hedging equity securities of the Company, holding such securities in a margin account or pledging such securities as collateral for a loan. We review all of these policies on a periodic basis with our employees.

Our business is managed by our leadership team, subject to the supervision and oversight of our Board. Our directors stay informed about our business by attending meetings of our Board and its committees and through supplemental reports and communications.

OUR FOCUS ON TRANSPARENT ESG REPORTING

We believe in transparent reporting relating to ESG matters because we believe such reporting improves the understanding of our financial results. As discussed in the “Investment Strategy” section above, we quantify the environmental impact of every transaction we execute through the application of CarbonCount. Our 2022 CarbonCount and avoided emissions for investments originated in 2022 can be found in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Results of Operations — Environmental Metrics”.

We continue to implement the TCFD recommendations, and the recommended disclosures are located in this filing as follows;

•Governance - “Environmental and Social Responsibility and Corporate Governance”,

•Strategy - “Investment Strategy”

•Risk Management - “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Factors Impacting our Operating Results — Impact of climate of climate change on our future operations (Scenario Analysis)” and “Item 7A. Quantitative and Qualitative Disclosures About Market Risk — Risk Management”, and

•Metrics and Targets - “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Results of Operations - Environmental Metrics”.

In addition to the above environmental reporting initiatives, in 2022, we reported our corporate emissions under PCAF, a global financial industry-led partnership to implement a consistent and transparent disclosure framework to report carbon emissions and avoided emissions resulting from financed assets. We also disclose metrics related to our Human Capital Strategy. Refer to “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Results of Operations — Human Capital Metrics”. When issuing debt, we generally provide the estimated carbon emission savings using CarbonCount, and in some instances are able to achieve better borrowing rates by achieving certain CarbonCount scores. Certain of our debt issuances have been evaluated to determine that they meet the environmental eligibility criteria for green bonds as defined by the International Capital Markets Association’s Green Bond Principles.

- 12 -

COMPETITION

We compete against a number of parties, including banks, private equity, hedge or infrastructure investment funds, insurance companies, mutual funds, institutional investors, investment banking firms, specialty finance companies, utilities, independent power producers, project developers, pension funds, governmental bodies, private credit platforms, green banks, and public entities established to own infrastructure assets and other entities.

We compete primarily on the basis of service, price, structure and flexibility as well as the breadth and depth of our expertise. We may at times compete and at other times partner or work as a participant with alternative financing sources. The continued low yields in alternative investment opportunities and increasing investor acceptance of the climate solutions market has increased the level of competition we experience. We may also encounter competition in the form of potential customers or our origination partners electing to use their own capital rather than engaging us as an outside capital provider. In addition, we may also face competition based on technological developments that reduce demand for electricity, increase power supplies through existing infrastructure or that otherwise compete with climate solutions projects in which we have invested. We believe that a significant part of our competitive advantage is our management team’s experience and industry expertise.

For additional information concerning these competitive risks, see “Item 1A. Risk Factors—We operate in a competitive market, which may impact the terms of the investments we make.”

INFORMATION ABOUT OUR EXECUTIVE OFFICERS AND OTHER LEADERSHIP TEAM PERSONNEL

Our executive officers and other leadership team personnel and their biographies are provided below. On February 16, 2023, we announced that Jeffrey W. Eckel will become executive chair of our Board, Jeffrey A. Lipson will become president and chief executive officer, and Marc T. Pangburn will become executive vice president and chief financial officer, each effective as of March 1, 2023.

Jeffrey W. Eckel, 64, has served as our president, chief executive officer, and chairman of our Board since 2013 and was with the predecessor of our company as president and chief executive officer since 2000 and prior to that from 1985 to 1989 as a senior vice president. Mr. Eckel is on the board of trustees of The Nature Conservancy of Maryland and DC. Mr. Eckel was appointed by the governor of Maryland to the board of the Maryland Clean Energy Center in 2011 where Mr. Eckel served until 2016 while also serving as its chairman from 2012 to 2014. Mr. Eckel has over 35 years of experience in financing, owning and operating infrastructure and energy assets. Mr. Eckel received a Bachelor of Arts degree from Miami University in 1980 and a Master of Public Administration degree from Syracuse University, Maxwell School of Citizenship and Public Affairs, in 1981. He holds Series 24, 63 and 79 securities licenses.

Jeffrey A. Lipson, 55, has served as an executive vice president and our chief operating officer since 2021 and as our chief financial officer since 2019. Previously, Mr. Lipson was president and chief executive officer and director of Congressional Bancshares and its subsidiary Congressional Bank (now Forbright Bank). Mr. Lipson has also been a senior vice president and the treasurer of CapitalSource Inc. and its subsidiary CapitalSource Bank and a senior vice president, Corporate Treasury, at Bank of America and its predecessor FleetBoston Financial. Mr. Lipson received a Bachelor of Science degree in Economics from Pennsylvania State University in 1989 and a Masters in Business Administration in Finance from New York University’s Leonard N. Stern School of Business in 1993. Mr. Lipson serves on the board of directors of the Jewish Council for the Aging of Greater Washington.

Susan D. Nickey, 62, has served as an executive vice president and our chief client officer since January 2021 and is responsible for leading business development and managing client relationships. Ms. Nickey previously served as a managing director from 2014 to 2021. Ms. Nickey currently serves as chair-elect on the board of directors of the American Clean Power Association and is a member of the President’s Council at Ceres, a non-profit sustainability advocacy organization. Previously, she founded and served as CEO of Threshold Power. Ms. Nickey received a Bachelor in Business Administration from the University of Notre Dame in 1983 and a Master’s of Science in Foreign Service from Georgetown University in 1986.

Steven L. Chuslo, 65, has served as an executive vice president and our general counsel and secretary since 2013 and the chief legal officer since January 2021. Previously, Mr. Chuslo has served with the predecessor of our company as general counsel and secretary since 2008. Mr. Chuslo is responsible for governance support to the Board and management and oversees the company’s legal resources in the investment and portfolio management activities. Mr. Chuslo has more than 30 years of experience in the fields of securities, commercial and project finance, energy project development, and U.S. federal regulation. Mr. Chuslo received a Bachelor of Arts degree in History from the University of Massachusetts/Amherst and a Juris Doctorate from the Georgetown University Law Center.

Nathaniel J. Rose, CFA, 45, has served as executive vice president since 2015 and a co-chief investment officer beginning in 2021. Previously, Mr. Rose served as our chief operating officer from 2015 to 2017, our chief investment officer from 2013 to 2015 and 2017 to 2020 and has been with the Company and its predecessor since 2000. Mr. Rose has been involved with a vast majority of our transactions since 2000. Mr. Rose earned a joint Bachelor of Science and Bachelor of Arts degree from the University of Richmond in 2000, a Master of Business Administration degree from the Darden School of

- 13 -

Business Administration at the University of Virginia in 2009, is a CFA charter holder and has passed the CPA examination. He holds a Series 63 and 79 securities licenses.

Daniel K. McMahon, CFA, 51, has served us as an executive vice president since 2015 and is the co-head of our portfolio management group and the head of our syndication group. He has been with the Company and its predecessor since 2000 in a variety of roles, including as a senior vice president from 2007 to 2015. He has played a role in analyzing, negotiating, structuring, and managing several billion dollars of transactions. Mr. McMahon received his Bachelor of Arts degree from the University of California, San Diego in 1993, and is a CFA charter holder. He holds Series 24, 63 and 79 securities licenses.

Marc T. Pangburn, 37, has served as an executive vice president and a co-chief investment officer since January 2021. Mr. Pangburn joined the Company in 2013 and previously served as a managing director until 2021, and is jointly responsible for the Company’s investing activities. Previously, Mr. Pangburn worked at MP2 Capital, a solar development and financing company, where he was responsible for structuring the firm’s transactions, and worked in the private capital group at New York Life Investments, focusing on utilities, energy and infrastructure debt and equity investments. Mr. Pangburn received his Bachelor of Arts degree in economics from Drew University.

Richard R. Santoroski, 58, has served as executive vice president and co-head of portfolio management since October 2021, previously serving as chief analytics officer since January 2021 after joining the company in 2020 as a managing director. Mr. Santoroski is responsible for integrating analytics across portfolio, investment, and risk-related decisions. Previously, Mr. Santorski served as co-founder and managing partner of Wye Holdings from 2017 to 2020. From 2012 to 2016, he served as co-founder and managing director of American Capital Energy and Infrastructure (ACEI), an emerging markets investor in power generation projects across Africa, Asia, Latin America, and the Middle East. Prior to ACEI, Mr. Santoroski served as executive vice president, chief risk officer, and head of corporate mergers, acquisitions & development of The AES Corporation. Prior to joining AES, he worked for several years at New York State Electric and Gas as an engineer and energy trader. Mr. Santoroski holds a Bachelor of Science degree in electrical engineering from Pennsylvania State University as well as a Master of Science degree in electrical engineering and a Master of Business Administration degree from Syracuse University.

Katherine McGregor Dent, 50, has served as our senior vice president and chief human resources officer since April 2020, focusing on culture, strategy, and organizational development. Previously, Ms. Dent served as vice president, deputy general counsel, and assistant secretary from 2003 to 2020, where she played a key role in structuring, developing, negotiating, and closing billions of dollars of transactions for the Company. Ms. Dent received a Bachelor of Arts in English from Niagara University in 1993 and a Juris Doctor from the University at Buffalo School of Law in 1996. Ms. Dent serves on the board of trustees for St. Anne’s School of Annapolis, for which she served as Chair from 2020 to 2022.

Amanuel Haile-Mariam, 43, has served as a managing director since joining the Company in 2021 and is responsible for the company’s structured investments in Grid-Connected renewable energy markets. Prior to joining the Company, Mr. Haile-Mariam worked at GE Energy Financial Services for 15 years leading the execution, asset management, capital raise and divestment of energy infrastructure projects. Prior to joining GE Energy Financial Services, he worked at GE Corporate Audit Staff, conducting financial audits, leading simplification and operational excellence projects. Mr. Haile-Mariam received his Bachelor of Science degree in accounting and Master of Business Administration in finance from the University of Connecticut.

Charles W. Melko, CPA, 42, has served as a senior vice president and our chief accounting officer since 2017 and as our treasurer since January 2021. He joined the Company in 2016 as a senior vice president and controller and has since been responsible for leading the company’s accounting and financial reporting function. In his treasurer role, he is involved in the company’s cash management and related capital markets activities. Previously, he served in a number of roles at PricewaterhouseCoopers LLP since 2005, including as a Senior Manager in the National Professional Services Group where he focused on complex financial instruments accounting issues for energy clients. Mr. Melko received a Bachelor of Science degree in Accountancy in 2002, a Master of Business Administration degree in 2005 and a Master of Science degree in Accountancy from Wheeling Jesuit University in 2005. He holds a CPA license in West Virginia and Maryland and is also a Certified Treasury Professional (CTP).

Annmarie Reynolds, 53, has served as a managing director since joining the Company in 2022 and is responsible for building and growing the company’s investment in markets beyond current asset classes. Prior to joining the Company, Ms. Reynolds worked at The AES Corporation for 22 years serving in several senior roles including chief customer officer, chief commercial officer – US and Eurasia, chief risk officer and managing director climate solutions. Prior to joining The AES Corporation, she worked several years at New York State Electric and Gas as an energy trader and engineer. Ms. Reynolds received her Bachelor of Science degree in Mechanical Engineering from Rutgers University, the State University of New Jersey.

Daniela Shapiro, 48, joined the Company as managing director in 2022 and is responsible for growing the company’s investments in Behind-the-Meter opportunities and expanding solutions for broader onsite and as-a-service offerings. Daniela has over 20 years of energy industry experience. Prior to joining the Company, Ms. Shapiro was the CFO for Guzman Energy

- 14 -

and held various other executive positions, including at SoCore/ ENGIE. Prior to this, Ms. Shapiro worked in the banking industry for 10 years, where she was responsible for deploying capital in energy and infrastructure assets, including tax equity investments in renewable energy projects. Ms. Shapiro received her Bachelor of Science degree in Electrical Engineering from UNIFEI in Brazil, and her MBA from Northwestern University’s Kellogg School of Management.

AVAILABLE INFORMATION

We maintain a website at www.hannonarmstrong.com. Information on our website is not incorporated by reference in this Form 10-K. We will make available, free of charge, on our website (a) our Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K (including any amendments thereto), proxy statements and other information (collectively, “Company Documents”) filed with, or furnished to, the SEC, as soon as reasonably practicable after such documents are so filed or furnished, (b) Corporate Governance Guidelines, (c) Director Independence Standards, (d) Code of Business Conduct and Ethics policy and (e) written charters of the Audit Committee, Compensation Committee, Nominating, Governance and Corporate Responsibility Committee and Finance and Risk Committee of our Board. Company Documents filed with, or furnished to, the SEC are also available for review by the public at the SEC’s website at www.sec.gov. We provide copies of our Corporate Governance Guidelines and Code of Business Conduct and Ethics policy, free of charge, to stockholders who request such documents. Requests should be directed to Investor Relations, One Park Place, Suite 200, Annapolis, Maryland 21401, (410) 571-9860.

Item 1A. Risk Factors

Our business and operations are subject to a number of risks and uncertainties, the occurrence of which could adversely affect our business, financial condition, consolidated results of operations and ability to make distributions to stockholders and could cause the value of our capital stock to decline. We may refer to the energy efficiency, renewable energy and the other sustainable infrastructure projects or market collectively as climate solutions projects or the industry. Please also refer to the sections entitled “Forward-Looking Statements” and “Risk Factor Summary”.

Risks Related to Our Business and Our Industry

Our business depends in part on U.S. federal, state and local government policies, and a decline in the level of government support could harm our business.

The projects in which we invest typically depend in part on various U.S. federal, state or local governmental policies and incentives that support or enhance project economic feasibility. Such policies may include governmental initiatives, laws and regulations designed to reduce energy usage and impact the use of renewable energy or the investment in and the use of climate solutions, including the Infrastructure Investment and Jobs Act and the Inflation Reduction Act.

U.S. federal policies and incentives include, for example, tax credits (including credits that have been recently reduced and scheduled to be eliminated or phased out in the future), tax deductions, bonus depreciation, federal grants and loan guarantees and energy market regulations. State and local governments policies and incentives include, for example, renewable portfolio standards (“RPS”), commercial property assessed clean energy (“C-PACE”) programs, feed-in tariffs, other tariffs, tax incentives and other cash and non-cash payments.

Governmental agencies, commercial entities and developers of climate solutions projects frequently depend on these policies and incentives to help defray the costs associated with, and to finance, various projects. Government regulations also impact the terms of third-party financing provided to support these projects, including through energy savings performance contracts. If any of these government policies, incentives or regulations are adversely amended, delayed, eliminated, reduced, retroactively changed or not extended beyond their current expiration dates, or there is a negative impact from the recent federal law changes or proposals, the operating results of the projects we finance and the demand for, and the returns available from, the investments we make may decline, which could harm our business.

U.S. federal, state and local government entities are major participants in, and regulators of, the energy industry, and their actions could be adverse to our project companies or our company.

The projects we invest in are subject to substantial regulation by U.S. federal, state and local governmental agencies. For example, many projects require government permits, licenses, concessions, leases or contracts. Government entities, due to the wide-ranging scope of their authority, have significant leverage in setting their contractual and regulatory relationships with third parties. In addition, government permits, licenses, concessions, leases and contracts are generally very complex, which may result in periods of non-compliance, or disputes over interpretation or enforceability. If the projects in which we invest fail to obtain or comply with applicable regulations, permits, or contractual obligations, they could be prevented from being constructed or subjected to monetary penalties or loss of operational rights, which could negatively impact project operating results and the returns on our assets. In addition, government counterparties also may have the discretion to change or increase regulation of project operations, or implement laws or regulations affecting project operations, separate from any contractual

- 15 -

rights they may have. These actions could adversely impact the efficient and profitable operation of the projects in which we invest.

Contracts with government counterparties that support the projects in which we invest may be more favorable to the government counterparties compared to commercial contracts with private parties. For example, a lease, concession or general service contract may enable the government to modify or terminate the contract without requiring the payment of adequate compensation. Typically, our contracts with government counterparties contain termination provisions including prepayment amounts. In most cases, the prepayment amounts provide us with amounts sufficient to repay the financing we have provided but may be less than amounts that would be payable under “make whole” provisions customarily found in commercial lending arrangements.

Government entities may also suspend or debar contractors from doing business with the government or pursue various criminal or civil remedies under various government contract regulations. They may also issue new government contracts or fail to extend existing government contracts. Our ability to originate new assets could be adversely affected if one or more of the ESCOs or other origination sources with whom we have relationships are suspended or debarred or fail to win new, or renew existing, contracts.

If the cost of energy generated by traditional sources of energy continues to stay or further declines from present levels, demand for the projects in which we invest may decline.

Many traditional sources of energy such as coal, petroleum-based fuels and natural gas can be influenced by the price of underlying or substitute commodities. Such prices, which have decreased and may continue to decrease, may reduce the demand for energy efficiency projects or other projects, including renewable energy facilities, that do not rely on fossil fuel energy sources. For example, low natural gas prices may reduce the demand for projects like renewable energy that can substitute for natural gas. Low natural gas prices also typically adversely affect both the price available to renewable energy projects under future power sale agreements and the price of the electricity the projects sell on either a forward or a spot-market basis. Further, as has occurred in the past, technological progress in electricity generation, storage or in the production of traditional fuels or the discovery of large new deposits of traditional fuels could reduce the cost of energy generated from those sources and consequently reduce the demand for the types of projects in which we invest, which could harm our new business origination prospects as well as the value of our existing Portfolio. In addition, volatility in commodity prices, including energy prices, may cause building owners and other parties to be reluctant to commit to projects for which repayment is based upon a fixed monetary value for energy savings that would not decline if the price of energy declines. Any resulting decline in demand for our investments or the price that industry participants receive for the sale of fossil fuel could adversely impact our operating results.

If the market for various types of climate solutions projects or the investment techniques related to such projects do not develop as we anticipate, new business generation in this target area may be adversely impacted.

The market for various types of climate solutions projects is emerging and rapidly evolving, leaving their future success uncertain. If some or all market segments or investing techniques prove unsuitable for widespread commercial deployment or if demand for such projects or techniques fail to grow sufficiently, the demand for our capital may decline or develop more slowly than we anticipate. Many factors will influence the widespread adoption and demand for such projects and investing techniques, including general and local economic conditions, commodity prices of fossil fuel energy sources, the cost and availability of energy storage, the cost-effectiveness of various projects and techniques, performance and reliability of such technologies compared to conventional power sources and technologies, and the extent of government subsidies and regulatory developments. Any changes in the markets, products, technologies, financing techniques, or the regulatory environment could adversely impact the demand or financial performance for such projects and our investments.

Some projects in which we invest rely on net metering and related policies to improve project economics which if reduced could impact repayment of our investments or the return on our assets.

There has been a nationwide increase in distributed generation which has prompted discussions among policy makers and regulators regarding ways to both better integrate distributed energy resources into the electric grid and how to compensate distributed generators. Many states have a regulatory policy known as net energy metering, or net metering. Net metering typically allows some project customers to interconnect their on-site solar or other renewable energy systems to the utility grid and offset their utility electricity purchases by receiving a bill credit at the utility’s retail rate for the amount of energy in excess of their electric usage that is generated by their renewable energy system and is exported to the grid. At the end of the billing period, the customer simply pays for the net energy used or receives a credit at the retail rate if more energy is produced than consumed. Net metering policies are under review or have been limited or amended in a number of states. The ability and willingness of customers to pay for renewable energy systems that benefit from net metering rules may be reduced if net metering rules are eliminated or their benefits reduced, which may also impact our returns on such systems.

- 16 -

Existing electric utility industry regulations, and changes to regulations, may present technical, regulatory and economic barriers to the purchase and use of renewable energy and energy efficiency systems that may significantly reduce demand for systems and projects in which we invest or may adversely affect the profitability of such projects.

Federal, state and local government regulations and policies concerning the electric utility industry, and internal policies and regulations promulgated by electric utilities, heavily influence the market for electricity products and services. These regulations and policies often relate to electricity pricing and the interconnection of customer-owned electricity generation. In the United States, governments and utilities continuously modify these regulations and policies. These regulations and policies could deter customers from purchasing energy efficiency and renewable energy systems. For example, Federal Energy Regulatory Commission (“FERC”) recently conducted its own review of grid resiliency and the functioning of electricity markets and has made, and could continue to make, changes to policies and regulations related to the function of the electricity markets and grid resiliency which may negatively impact the use of renewable energy or encourage the use of fossil fuel energy over renewable energy. This could result in a significant reduction in the potential demand for such systems. Utilities commonly charge fees to larger, industrial customers for disconnecting from the electric grid or for having the capacity to use power from the electric grid for back-up purposes. In addition, there is an increasing trend towards initiating or increasing fixed fees for users to have electricity service from a utility. These fees could increase our customers’ cost to use energy efficiency and renewable energy systems not supplied by the utility and make them less desirable, thereby harming our business, prospects, financial condition and results of operations. In addition, any changes to government or internal utility regulations and policies that favor electric utilities could reduce competitiveness and cause a significant reduction in demand for systems in which we invest.

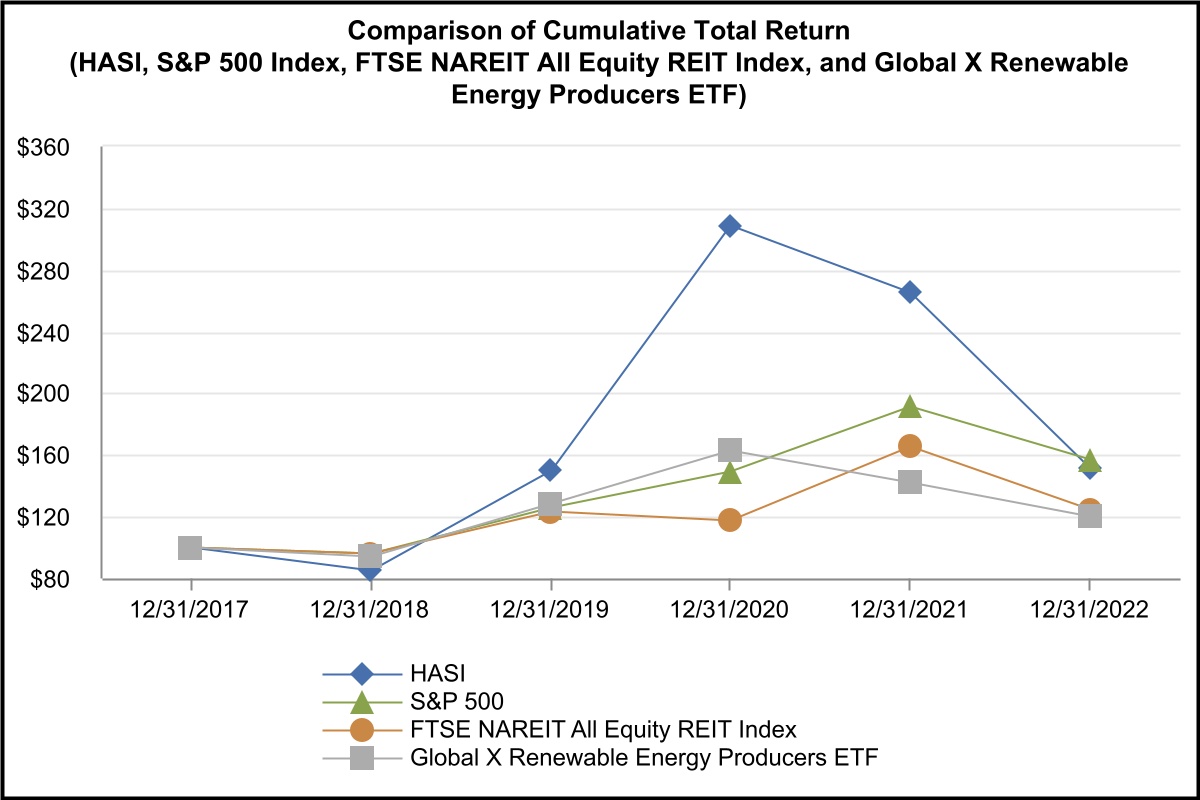

Further, certain climate solutions projects in which we invest may be “qualifying facilities” that are exempt from rate regulation as public utilities by FERC under the Federal Power Act, (the “FPA”). FERC regulations under the FPA confer upon these qualifying facilities key rights to interconnection with local utilities and can entitle such facilities to enter into PPAs with local utilities, from which the qualifying facilities benefit. Changes to these U.S. federal laws and regulations could increase the regulatory burdens and costs and could reduce the revenue of the project. In addition, modifications to the pricing policies of utilities could require climate solutions projects to achieve lower prices in order to compete with the price of electricity from the electric grid and may reduce the economic attractiveness of certain energy efficiency measures. To the extent that the projects in which we invest are subject to rate regulation, the project owners will be required to obtain FERC acceptance of their rate schedules for wholesale sales of energy, capacity and ancillary services. Any adverse changes in the rates project owners are permitted to charge could negatively impact the repayment of our investments, or the return on our assets.