Total | |||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| First Trust Global Tactical Commodity Strategy Fund | |||||||||||||||||||||||||||||||||||

| Summary Information | |||||||||||||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||||||||||||

The First Trust Global Tactical Commodity Strategy Fund (the "Fund") seeks to provide total return by providing investors with commodity exposure while seeking a relatively stable risk profile. | |||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | |||||||||||||||||||||||||||||||||||

The following table describes the fees and expenses you may pay if you buy and hold shares of the Fund. Investors purchasing and selling shares may be subject to costs (including customary brokerage commissions) charged by their broker, which are not reflected in the table below. | |||||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||

| Example | |||||||||||||||||||||||||||||||||||

The example below is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. This example does not take into account customary brokerage commissions that you pay when purchasing or selling shares of the Fund in the secondary market. The example assumes that you invest $10,000 in the Fund for the time periods indicated. The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain at current levels. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities, or through the Subsidiary, as defined below, when it buys and sells Commodities Instruments, as defined below (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 0% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||||||||||||

The Fund is an actively managed exchange-traded fund ("ETF") that seeks to achieve attractive risk adjusted returns by investing in commodity futures contracts and exchange-traded commodity linked instruments (collectively, "Commodities Instruments") through a wholly-owned subsidiary of the Fund organized under the laws of the Cayman Islands (the "Subsidiary"). The Fund will not invest directly in Commodities Instruments. The Fund expects to gain exposure to these investments exclusively by investing in the Subsidiary. The Subsidiary is advised by First Trust Advisors L.P., the Fund's investment advisor. The Fund's investment in the Subsidiary is intended to provide the Fund with exposure to commodity markets within the limits of current federal income tax laws applicable to investment companies such as the Fund, which limit the ability of investment companies to invest directly in Commodities Instruments. The Subsidiary has the same investment objective as the Fund, but unlike the Fund, it may invest without limitation in Commodities Instruments. Except as otherwise noted, for purposes of this prospectus, references to the Fund's investments include the Fund's indirect investments through the Subsidiary. The Fund will invest up to 25% of its total assets in the Subsidiary. The Subsidiary seeks to make investments generally in Commodities Instruments while managing volatility. Investment weightings of the underlying Commodities Instruments held by the Subsidiary are rebalanced in an attempt to stabilize risk levels. The dynamic weighting process is designed to result in a disciplined, systematic investment process, which is keyed off of the Fund's investment advisor's volatility forecasting process. The Subsidiary's holdings in Commodities Instruments will consist, in part, of futures contracts, which are contractual agreements to buy or sell a particular commodity or financial instrument at a pre-determined price in the future. The Subsidiary may also invest in commodity-linked instruments, which include: (1) ETFs that provide exposure to commodities; and (2) pooled investment vehicles that invest primarily in commodities and commodity-related instruments. The Subsidiary may have both long and short positions in Commodities Instruments. However, for a given Commodity Instrument the Subsidiary will provide a net long exposure. Net long exposure means to hold or be exposed to a security or instrument with the expectation that its value will increase over time. As U.S. and London exchanges list additional contracts, as currently listed contracts on those exchanges gain sufficient liquidity or as other exchanges list sufficiently liquid contracts, the Fund's investment advisor will include those contracts in the list of possible investments of the Subsidiary. The list of Commodities Instruments and commodities markets considered for investment can and will change over time. The remainder of the Fund's assets will primarily be invested in: (1) short-term investment grade fixed income securities, including U.S. government and agency securities and sovereign debt obligations of non-U.S. countries and repurchase agreements; (2) money market instruments; (3) ETFs and other investment companies registered under the Investment Company Act of 1940, as amended (the "1940 Act"); and (4) cash and other cash equivalents. The Fund uses such instruments as investments and to collateralize the Subsidiary's Commodities Instruments exposure on a day-to-day basis. The Fund may also invest directly in ETFs and other investment companies, including closed-end funds, that provide exposure to Commodities Instruments, equity securities and fixed income securities to the extent permitted under the 1940 Act. The Fund may enter into repurchase agreements with counterparties that are deemed to present acceptable credit risks. A repurchase agreement is a transaction in which the Fund purchases securities or other obligations from a bank or securities dealer and simultaneously commits to resell them to a counterparty at an agreed-upon date or upon demand and at a price reflecting a market rate of interest unrelated to the coupon rate or maturity of the purchased obligations. | |||||||||||||||||||||||||||||||||||

| Principal Risks | |||||||||||||||||||||||||||||||||||

You could lose money by investing in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. There can be no assurance that the Fund's investment objective will be achieved. The order of the below risk factors does not indicate the significance of any particular risk factor. The risks of the Fund will result from both the Fund's direct investments and its indirect investments made through the Subsidiary. Accordingly, the risks that result from the Subsidiary's activities will be described herein as the Fund's risks. AUTHORIZED PARTICIPANT CONCENTRATION RISK. Only an authorized participant may engage in creation or redemption transactions directly with the Fund. A limited number of institutions act as authorized participants for the Fund. To the extent that these institutions exit the business or are unable to proceed with creation and/or redemption orders and no other authorized participant steps forward to create or redeem, the Fund's shares may trade at a premium or discount to the Fund's net asset value and possibly face delisting. CALL RISK. Some debt securities may be redeemed, or "called," at the option of the issuer before their stated maturity date. In general, an issuer will call its debt securities if they can be refinanced by issuing new debt securities which bear a lower interest rate. The Fund is subject to the possibility that during periods of falling interest rates an issuer will call its high yielding debt securities. The Fund would then be forced to invest the proceeds at lower interest rates, likely resulting in a decline in the Fund's income. CASH TRANSACTIONS RISK. The Fund will effect some or all of its creations and redemptions for cash rather than in-kind. As a result, an investment in the Fund may be less tax-efficient than an investment in an ETF that effects all of its creations and redemptions in-kind. Because the Fund may effect redemptions for cash, it may be required to sell portfolio securities in order to obtain the cash needed to distribute redemption proceeds. A sale of shares may result in capital gains or losses and may also result in higher brokerage costs. CLEARING BROKER RISK. The failure or bankruptcy of the Fund's and the Subsidiary's clearing broker could result in a substantial loss of Fund assets. Under current Commodity Futures Trading Commission ("CFTC") regulations, a clearing broker maintains customers' assets in a bulk segregated account. If a clearing broker fails to do so, or is unable to satisfy a substantial deficit in a customer account, its other customers may be subject to risk of loss of their funds in the event of that clearing broker's bankruptcy. In that event, the clearing broker's customers, such as the Fund and the Subsidiary, are entitled to recover, even in respect of property specifically traceable to them, only a proportional share of all property available for distribution to all of that clearing broker's customers. COMMODITIES RISK. Commodity prices can have significant volatility, and exposure to commodities can cause the value of the Fund's shares to decline or fluctuate in a rapid and unpredictable manner. The values of physical commodities may be affected by changes in overall market movements, real or perceived inflationary trends, commodity index volatility, changes in interest rates or currency exchange rates, population growth and changing demographics, international economic, political and regulatory developments, and factors affecting a particular region, industry or commodity, such as drought, floods, or other weather conditions, livestock disease, changes in storage costs, trade embargoes, competition from substitute products, transportation bottlenecks or shortages, fluctuations in supply and demand, and tariffs. The commodity markets are subject to temporary distortions or other disruptions due to, among other factors, lack of liquidity, the participation of speculators, and government regulation and other actions. COMMODITY-LINKED DERIVATIVES RISK. Investments linked to the prices of commodities may be considered speculative. Significant investment exposure to commodities may subject the Fund to greater volatility than investments in traditional securities. Therefore, the value of such instruments may be volatile and fluctuate widely based on a variety of macroeconomic factors or commodity-specific factors. At times, price fluctuations may be quick and significant and may not correlate to price movements in other asset classes. A liquid secondary market may not exist for certain commodity-linked derivatives, which may make it difficult for the Fund to sell them at a desirable price or at the price at which it is carrying them. COMMODITY REGULATORY RISK. The Fund's investment decisions may need to be modified, and commodity contract positions held by the Fund may have to be liquidated at disadvantageous times or prices, to avoid exceeding any applicable position limits established by the CFTC, potentially subjecting the Fund to substantial losses. The regulation of commodity transactions in the United States is subject to ongoing modification by government, self-regulatory and judicial action. The effect of any future regulatory change with respect to any aspect of the Fund is impossible to predict, but could be substantial and adverse to the Fund. COUNTERPARTY RISK. Fund or Subsidiary transactions involving a counterparty are subject to the risk that the counterparty will not fulfill its obligation to the Fund or Subsidiary. Counterparty risk may arise because of the counterparty's financial condition (i.e., financial difficulties, bankruptcy, or insolvency), market activities and developments, or other reasons, whether foreseen or not. A counterparty's inability to fulfill its obligation may result in significant financial loss to the Fund. The Fund or the Subsidiary may be unable to recover its investment from the counterparty or may obtain a limited recovery, and/or recovery may be delayed. CREDIT RISK. An issuer or other obligated party of a debt security may be unable or unwilling to make dividend, interest and/or principal payments when due. In addition, the value of a debt security may decline because of concerns about the issuer's ability or unwillingness to make such payments. CYBER SECURITY RISK. The Fund is susceptible to operational risks through breaches in cyber security. A breach in cyber security refers to both intentional and unintentional events that may cause the Fund to lose proprietary information, suffer data corruption or lose operational capacity. Such events could cause the Fund to incur regulatory penalties, reputational damage, additional compliance costs associated with corrective measures and/or financial loss. Cyber security breaches may involve unauthorized access to the Fund's digital information systems through "hacking" or malicious software coding but may also result from outside attacks such as denial-of-service attacks through efforts to make network services unavailable to intended users. In addition, cyber security breaches of the issuers of securities in which the Fund invests or the Fund's third-party service providers, such as its administrator, transfer agent, custodian, or sub-advisor, as applicable, can also subject the Fund to many of the same risks associated with direct cyber security breaches. Although the Fund has established risk management systems designed to reduce the risks associated with cyber security, there is no guarantee that such efforts will succeed, especially because the Fund does not directly control the cyber security systems of issuers or third-party service providers. DEBT SECURITIES RISK. Investments in debt securities subject the holder to the credit risk of the issuer. Credit risk refers to the possibility that the issuer or other obligor of a security will not be able or willing to make payments of interest and principal when due. Generally, the value of debt securities will change inversely with changes in interest rates. To the extent that interest rates rise, certain underlying obligations may be paid off substantially slower than originally anticipated and the value of those securities may fall sharply. During periods of falling interest rates, the income received by the Fund may decline. If the principal on a debt security is prepaid before expected, the prepayments of principal may have to be reinvested in obligations paying interest at lower rates. Debt securities generally do not trade on a securities exchange making them generally less liquid and more difficult to value than common stock. DERIVATIVES RISK. The use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks include: (i) the risk that the counterparty to a derivative transaction may not fulfill its contractual obligations; (ii) risk of mispricing or improper valuation; and (iii) the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset. Derivative prices are highly volatile and may fluctuate substantially during a short period of time. Such prices are influenced by numerous factors that affect the markets, including, but not limited to: changing supply and demand relationships; government programs and policies; national and international political and economic events, changes in interest rates, inflation and deflation and changes in supply and demand relationships. Trading derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities. Derivative contracts ordinarily have leverage inherent in their terms. The low margin deposits normally required in trading derivatives, including futures contracts, permit a high degree of leverage. Accordingly, a relatively small price movement may result in an immediate and substantial loss. The use of leverage may also cause the Fund to liquidate portfolio positions when it would not be advantageous to do so in order to satisfy its obligations or to meet collateral segregation requirements. The use of leveraged derivatives can magnify potential for gain or loss and, therefore, amplify the effects of market volatility on share price. EXTENSION RISK. Extension risk is the risk that, when interest rates rise, certain obligations will be paid off by the issuer (or other obligated party) more slowly than anticipated, causing the value of these debt securities to fall. Rising interest rates tend to extend the duration of debt securities, making their market value more sensitive to changes in interest rates. The value of longer-term debt securities generally changes more in response to changes in interest rates than shorter-term debt securities. As a result, in a period of rising interest rates, securities may exhibit additional volatility and may lose value. FOREIGN COMMODITY MARKETS RISK. The Fund, through the Subsidiary, engages in trading on commodity markets outside the United States. Trading on such markets is not regulated by any United States government agency and may involve certain risks not applicable to trading on United States exchanges. The Fund may not have the same access to certain trades as do various other participants in foreign markets. Furthermore, as the Fund determines its net assets in United States dollars, with respect to trading in foreign markets the Fund is subject to the risk of fluctuations in the exchange rate between the local currency and dollars as well as the possibility of exchange controls. Certain futures contracts traded on foreign exchanges are treated differently for federal income tax purposes than are domestic contracts. FREQUENT TRADING RISK. The Fund regularly purchases and subsequently sells (i.e., "rolls") individual commodity futures contracts throughout the year so as to maintain a fully invested position. As the commodity contracts near their expiration dates, the Fund rolls them over into new contracts. This frequent trading of contracts may increase the amount of commissions or mark-ups to broker-dealers that the Fund pays when it buys and sells contracts, which may detract from the Fund's performance. FUTURES CONTRACTS RISK. Futures contracts are typically exchange-traded contracts that call for the future delivery of an asset by one party to another at a certain price and date, or cash settlement of the terms of the contract. The risk of a position in a futures contract may be very large compared to the relatively low level of margin the Fund is required to deposit. In many cases, a relatively small price movement in a futures contract may result in immediate and substantial loss or gain to the investor relative to the size of a required margin deposit. In the event no secondary market exists for a particular contract, it might not be possible to effect closing transactions, and the Fund will be unable to terminate the derivative. If the Fund uses futures contracts for hedging purposes, there is a risk of imperfect correlation between movements in the prices of the derivatives and movements in the securities or index underlying the derivatives or movements in the prices of the Fund's investments that are the subject of such hedge. The prices of futures contracts may not correlate perfectly with movements in the securities or index underlying them. GAP RISK. The Fund is subject to the risk that a commodity price will change from one level to another between periods of trading. Usually such movements occur when there are adverse news announcements, which can cause a commodity price to drop substantially from the previous day's closing price. INCOME RISK. The Fund's income may decline when interest rates fall or if there are defaults in its portfolio. This decline can occur because the Fund may subsequently invest in lower-yielding securities as debt securities in its portfolio mature, are near maturity or are called, or the Fund otherwise needs to purchase additional debt securities. INDEX CONSTITUENT RISK. The Fund may be a constituent of one or more indices. As a result, the Fund may be included in one or more index-tracking exchange-traded funds or mutual funds. Being a component security of such a vehicle could greatly affect the trading activity involving the Fund's shares, the size of the Fund and the market volatility of the Fund. Inclusion in an index could increase demand for the Fund and removal from an index could result in outsized selling activity in a relatively short period of time. As a result, the Fund's net asset value could be negatively impacted and the Fund's market price may be below the Fund's net asset value during certain periods. In addition, index rebalances may potentially result in increased trading activity in the Fund's shares. INFLATION RISK. Inflation risk is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the present value of the Fund's assets and distributions may decline. INTEREST RATE RISK. Interest rate risk is the risk that the value of the debt securities in the Fund's portfolio will decline because of rising market interest rates. Interest rate risk is generally lower for shorter term debt securities and higher for longer-term debt securities. The Fund may be subject to a greater risk of rising interest rates than would normally be the case due to the current period of historically low rates and the effect of potential government fiscal policy initiatives and resulting market reaction to those initiatives. Duration is a reasonably accurate measure of a debt security's price sensitivity to changes in interest rates and a common measure of interest rate risk. Duration measures a debt security's expected life on a present value basis, taking into account the debt security's yield, interest payments and final maturity. In general, duration represents the expected percentage change in the value of a security for an immediate 1% change in interest rates. For example, the price of a debt security with a three-year duration would be expected to drop by approximately 3% in response to a 1% increase in interest rates. Therefore, prices of debt securities with shorter durations tend to be less sensitive to interest rate changes than debt securities with longer durations. As the value of a debt security changes over time, so will its duration. LEVERAGE RISK. Leverage may result in losses that exceed the amount originally invested and may accelerate the rates of losses. Leverage tends to magnify, sometimes significantly, the effect of any increase or decrease in the Fund's exposure to an asset or class of assets and may cause the value of the Fund's shares to be volatile and sensitive to market swings. LIQUIDITY RISK. The Fund and the Subsidiary may hold certain investments that may be subject to restrictions on resale, trade over-the-counter or in limited volume, or lack an active trading market. Accordingly, the Fund may not be able to sell or close out of such investments at favorable times or prices (or at all), or at the prices approximating those at which the Fund currently values them. Illiquid securities may trade at a discount from comparable, more liquid investments and may be subject to wide fluctuations in market value. MANAGEMENT RISK. The Fund is subject to management risk because it is an actively managed portfolio. In managing the Fund's investment portfolio, the portfolio managers will apply investment techniques and risk analyses that may not produce the desired result. There can be no guarantee that the Fund will meet its investment objective. MARKET MAKER RISK. The Fund faces numerous market trading risks, including the potential lack of an active market for Fund shares due to a limited number of market markers. Decisions by market makers or authorized participants to reduce their role or step away from these activities in times of market stress could inhibit the effectiveness of the arbitrage process in maintaining the relationship between the underlying values of the Fund's portfolio securities and the Fund's market price. The Fund may rely on a small number of third-party market makers to provide a market for the purchase and sale of shares. Any trading halt or other problem relating to the trading activity of these market makers could result in a dramatic change in the spread between the Fund's net asset value and the price at which the Fund's shares are trading on the Exchange, which could result in a decrease in value of the Fund's shares. This reduced effectiveness could result in Fund shares trading at a discount to net asset value and also in greater than normal intraday bid-ask spreads for Fund shares. MARKET RISK. Market risk is the risk that a particular security, or shares of the Fund in general, may fall in value. Securities are subject to market fluctuations caused by such factors as economic, political, regulatory or market developments, changes in interest rates and perceived trends in securities prices. Shares of the Fund could decline in value or underperform other investments. In addition, local, regional or global events such as war, acts of terrorism, spread of infectious diseases or other public health issues, recessions, or other events could have a significant negative impact on the Fund and its investments. Such events may affect certain geographic regions, countries, sectors and industries more significantly than others. Such events could adversely affect the prices and liquidity of the Fund's portfolio securities or other instruments and could result in disruptions in the trading markets. Any of such circumstances could have a materially negative impact on the value of the Fund's shares and result in increased market volatility. During any such events, the Fund's shares may trade at increased premiums or discounts to their net asset value. PREMIUM/DISCOUNT RISK. The market price of the Fund's shares will generally fluctuate in accordance with changes in the Fund's net asset value as well as the relative supply of and demand for shares on the Exchange. The Fund's investment advisor cannot predict whether shares will trade below, at or above their net asset value because the shares trade on the Exchange at market prices and not at net asset value. Price differences may be due, in large part, to the fact that supply and demand forces at work in the secondary trading market for shares will be closely related, but not identical, to the same forces influencing the prices of the holdings of the Fund trading individually or in the aggregate at any point in time. However, given that shares can only be purchased and redeemed in Creation Units, and only to and from broker-dealers and large institutional investors that have entered into participation agreements (unlike shares of closed-end funds, which frequently trade at appreciable discounts from, and sometimes at premiums to, their net asset value), the Fund's investment advisor believes that large discounts or premiums to the net asset value of shares should not be sustained. During stressed market conditions, the market for the Fund's shares may become less liquid in response to deteriorating liquidity in the market for the Fund's underlying portfolio holdings, which could in turn lead to differences between the market price of the Fund's shares and their net asset value. PREPAYMENT RISK. Prepayment risk is the risk that the issuer of a debt security will repay principal prior to the scheduled maturity date. Debt securities allowing prepayment may offer less potential for gains during a period of declining interest rates, as the Fund may be required to reinvest the proceeds of any prepayment at lower interest rates. These factors may cause the value of an investment in the Fund to change. SIGNIFICANT EXPOSURE RISK. To the extent that the Fund invests a large percentage of its assets in a single asset class or the securities of issuers within the same country, state, region, industry or sector, an adverse economic, business or political development may affect the value of the Fund's investments more than if the Fund were more broadly diversified. A significant exposure makes the Fund more susceptible to any single occurrence and may subject the Fund to greater market risk than a fund that is more broadly diversified. SHORT SALES RISK. In connection with a short sale of a security or other instrument, the Fund is subject to the risk that instead of declining, the price of the security or other instrument sold short will rise. If the price of the security or other instrument sold short increases between the date of the short sale and the date on which the Fund replaces the security or other instrument borrowed to make the short sale, the Fund will experience a loss, which is theoretically unlimited since there is a theoretically unlimited potential for the market price of a security or other instrument sold short to increase. In addition, as a series of an investment company registered under the 1940 Act, the Fund must segregate liquid assets, or engage in other measures to "cover" open positions with respect to short sales. The Fund may nonetheless incur significant losses on short sales even if they are covered. SUBSIDIARY INVESTMENT RISK. Changes in the laws of the United States and/or the Cayman Islands, under which the Fund and the Subsidiary are organized, respectively, could result in the inability of the Fund to operate as intended and could negatively affect the Fund and its shareholders. The Subsidiary is not registered under the 1940 Act and is not subject to all the investor protections of the 1940 Act. Thus, the Fund, as an investor in the Subsidiary, will not have all the protections offered to investors in registered investment companies. TAX RISK. The Fund intends to treat any income it may derive from Commodities Instruments received by the Subsidiary as "qualifying income" under the provisions of the Internal Revenue Code of 1986, as amended, applicable to "regulated investment companies" ("RICs"). The Internal Revenue Service had issued numerous private letter rulings ("PLRs") provided to third parties not associated with the Fund or its affiliates (which only those parties may rely on as precedent) concluding that similar arrangements resulted in qualifying income. Many of such PLRs have now been revoked by the Internal Revenue Service. In March of 2019, the Internal Revenue Service published Regulations that concluded that income from a corporation similar to the Subsidiary would be qualifying income, if the income is related to the Fund's business of investing in stocks or securities. Although the Regulations do not require distributions from the Subsidiary, the Fund intends to cause the Subsidiary to make distributions that would allow the Fund to make timely distributions to its shareholders. The Fund generally will be required to include in its own taxable income the income of the Subsidiary for a tax year, regardless of whether the Fund receives a distribution of the Subsidiary's income in that tax year, and this income would nevertheless be subject to the distribution requirement for qualification as a regulated investment company and would be taken into account for purposes of the 4% excise tax. If the Fund did not qualify as a RIC for any taxable year and certain relief provisions were not available, the Fund's taxable income would be subject to tax at the Fund level and to a further tax at the shareholder level when such income is distributed. In such event, in order to re-qualify for taxation as a RIC, the Fund might be required to recognize unrealized gains, pay substantial taxes and interest and make certain distributions. This would cause investors to incur higher tax liabilities than they otherwise would have incurred and would have a negative impact on Fund returns. In such event, the Fund's Board of Trustees may determine to reorganize or close the Fund or materially change the Fund's investment objective and strategies. In the event that the Fund fails to qualify as a RIC, the Fund will promptly notify shareholders of the implications of that failure. The Fund may invest a portion of its assets in equity repurchase agreements. Recent changes in the law have the potential of changing the character and source of such instruments potentially subjecting them to unexpected U.S. taxation. Depending upon the terms of the contracts, the Fund may be required to indemnify the counterparty for such increased tax. TRADING ISSUES RISK. Although the shares of the Fund are listed for trading on the Exchange, there can be no assurance that an active trading market for such shares will develop or be maintained. Further, secondary markets may be subject to irregular trading activity and wide bid-ask spreads (which may be especially pronounced for smaller funds). Trading in shares on the Exchange may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in shares inadvisable. In addition, trading in shares on the Exchange is subject to trading halts caused by extraordinary market volatility pursuant to the Exchange's "circuit breaker" rules. Market makers are under no obligation to make a market in the Fund's shares, and authorized participants are not obligated to submit purchase or redemption orders for Creation Units. In the event market makers cease making a market in the Fund's shares or authorized participants stop submitting purchase or redemption orders for Creation Units, Fund shares may trade at a larger premium or discount to their net asset value. There can be no assurance that the requirements of the Exchange necessary to maintain the listing of the Fund will continue to be met or will remain unchanged. The Fund may have difficulty maintaining its listing on the Exchange in the event the Fund's assets are small or the Fund does not have enough shareholders. U.S. GOVERNMENT SECURITIES RISK. U.S. government securities are subject to interest rate risk but generally do not involve the credit risks associated with investments in other types of debt securities. As a result, the yields available from U.S. government securities are generally lower than the yields available from other debt securities. U.S. government securities are guaranteed only as to the timely payment of interest and the payment of principal when held to maturity. While securities issued or guaranteed by U.S. federal government agencies (such as Ginnie Mae) are backed by the full faith and credit of the U.S. Department of the Treasury, securities issued by government sponsored entities (such as Fannie Mae and Freddie Mac) are solely the obligation of the issuer and generally do not carry any guarantee from the U.S. government. VALUATION RISK. The Fund or Subsidiary may hold securities or other assets that may be valued on the basis of factors other than market quotations. This may occur because the asset or security does not trade on a centralized exchange, or in times of market turmoil or reduced liquidity. There are multiple methods that can be used to value a portfolio holding when market quotations are not readily available. The value established for any portfolio holding at a point in time might differ from what would be produced using a different methodology or if it had been priced using market quotations. Portfolio holdings that are valued using techniques other than market quotations, including "fair valued" assets or securities, may be subject to greater fluctuation in their valuations from one day to the next than if market quotations were used. In addition, there is no assurance that the Fund or Subsidiary could sell or close out a portfolio position for the value established for it at any time, and it is possible that the Fund or Subsidiary would incur a loss because a portfolio position is sold or closed out at a discount to the valuation established by the Fund or Subsidiary at that time. The Fund's ability to value investments may be impacted by technological issues or errors by pricing services or other third-party service providers. VOLATILITY RISK. Volatility is the characteristic of a security, an index or a market to fluctuate significantly in price within a short time period. The Fund may invest in securities or financial instruments that exhibit more volatility than the market as a whole. Such exposures could cause the Fund's net asset value to experience significant increases or declines in value over short periods of time. WHIPSAW MARKETS RISK. The Fund may be subject to the forces of "whipsaw" markets (as opposed to choppy or stable markets), in which significant price movements develop but then repeatedly reverse. "Whipsaw" describes a situation where a security's price is moving in one direction but then quickly pivots to move in the opposite direction. There are two types of whipsaw patterns. The first involves an upward movement in a price, which is then followed by a drastic downward move causing the price to fall relative to its original position. The second type occurs when a share price drops in value for a short time and then suddenly surges upward to a positive gain relative to the original position. Such market conditions could cause substantial losses to the Fund. | |||||||||||||||||||||||||||||||||||

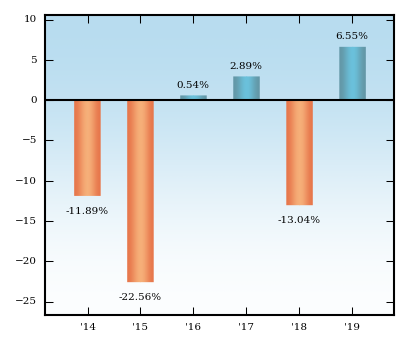

| Annual Total Return | |||||||||||||||||||||||||||||||||||

The bar chart and table below illustrate the annual calendar year returns of the Fund based on net asset value as well as the average annual Fund returns. The bar chart and table provide an indication of the risks of investing in the Fund by showing changes in the Fund's performance from year-to-year and by showing how the Fund's average annual total returns based on net asset value compared to those of a benchmark index, a market index and a broad-based securities market index. See "Total Return Information" for additional performance information regarding the Fund. The Fund's performance information is accessible on the Fund's website at www.ftportfolios.com. | |||||||||||||||||||||||||||||||||||

| First Trust Global Tactical Commodity Strategy Fund (FTGC) Calendar Year Total Returns as of 12/31 | |||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||

During the periods shown in the chart above:

| |||||||||||||||||||||||||||||||||||

| Average Annual Total Returns for the Periods Ended December 31, 2019 | |||||||||||||||||||||||||||||||||||

The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Returns before taxes do not reflect the effects of any income or capital gains taxes. All after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of any state or local tax. Returns after taxes on distributions reflect the taxed return on the payment of dividends and capital gains. Returns after taxes on distributions and sale of shares assume you sold your shares at period end, and, therefore, are also adjusted for any capital gains or losses incurred. Returns for the market indices do not include expenses, which are deducted from Fund returns, or taxes. Your own actual after-tax returns will depend on your specific tax situation and may differ from what is shown here. After-tax returns are not relevant to investors who hold Fund shares in tax-deferred accounts such as individual retirement accounts (IRAs) or employee-sponsored retirement plans. | |||||||||||||||||||||||||||||||||||

|