UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest event Reported): February 14, 2014

The Staffing Group Ltd.

(Exact name of registrant as specified in its charter)

| Nevada | 333-185083 | 99-0377457 |

| (State or other jurisdiction of | (Commission File Number) | (IRS Employer Identification No.) |

| incorporation or organization) | ||

|

400 Poydras Street, Suite 1165 New Orleans, LA 70130 |

||

| (Address of principal executive offices) | ||

| (504) 525-7955 | ||

| (Registrant’s telephone number, including area code) | ||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “seeks,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Such statements may include, but are not limited to, information related to: anticipated operating results; licensing arrangements; relationships with our customers; consumer demand; financial resources and condition; changes in revenues; changes in profitability; changes in accounting treatment; cost of sales; selling, general and administrative expenses; interest expense; the ability to produce the liquidity or enter into agreements to acquire the capital necessary to continue our operations and take advantage of opportunities; legal proceedings and claims.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Unless the context otherwise requires, all references in this Report to “we,’’ ‘‘us,’’ ‘‘our’’ and “the Company” refer collectively to The Staffing Group Ltd., a Nevada corporation, and its subsidiaries, including EmployUS Ltd., a private Nevada corporation.

| Item 1.01 | Entry into a Material Definitive Agreement |

As previously disclosed in our Current Report on Form 8-K filed on January 27, 2014, on January 22, 2014, we entered into a Share Exchange Agreement (the “Exchange Agreement”) with EmployUS Ltd., a Nevada corporation (“EmployUS”), all of the stockholders of EmployUS (the “EmployUS Shareholders”), and our controlling stockholders. The following items were conditions to the closing of the Exchange Agreement:

| - | The Company will have received an audit report of EmployUS with respect to its two most recently completed fiscal years from an independent accounting firm that is registered with the Public Company Accounting Oversight Board; |

| - | The Company and EmployUS shall obtain shareholder approval; and |

| - | The Company will complete a capital raise of at least $1,500,000. |

The Company has received an audit report with respect to EmployUS’s two most recently completed fiscal years ended December 31, 2012 and 2011, respectively. Additionally, both we and EmployUS have obtained shareholder approval for the Exchange Agreement. With respect to the capital raise of $1,500,000, both parties have agreed to amend that requirement to reduce the total amount of the capital raise to $1,000,000 and allow the raise to occur post-closing.

Accordingly, with all of the closing conditions having been met or amended, effective as of February 14, 2014, the Exchange Agreement is closed. A copy of the final, fully executed copy of the Exchange Agreement is attached hereto as Exhibit 2.1.

For additional information with respect to the Exchange Agreement and the business of the acquired entity, please see the disclosures set forth in Item 2.01 to this Current Report, which disclosures are incorporated into this item by reference.

| 2 |

| Item 2.01 | Completion of Acquisition or Disposition of Assets |

On January 22, 2014, we entered into the Exchange Agreement with EmployUS which agreement closed on February 14, 2014. Pursuant to the terms and conditions of the final, fully executed Exchange Agreement, and upon the consummation of the closing:

| ● | Each share of EmployUS’s common stock issued and outstanding immediately prior to the closing of the Exchange Agreement was converted into the right to receive an aggregate of 13,153,800 shares of our common stock. | |

| ● |

Three of our shareholders agreed to cancel the following shares: (i) Joseph Albunio agreed to cancel 8,386,413 shares of his common stock. After the cancellation he owns 500,000 shares of our common stock. (ii) Brian McLoone agreed to cancel 2,836,413 shares of his common stock. After the cancellation he owns 6,050,000 shares of our common stock. (iii) Luidmila Yuziuk agreed to cancel 1,930,972 shares of her common stock. After the cancellation, she does not own any shares of our common stock. | |

After the closing of the Exchange Agreement, our capitalization of the Company is as follows:

| Shareholder | # of Shares Owned | Percentage Ownership |

| Broadsmoore Group | 7,103,800 | 20.24% |

| BD Callais | 6,050,000 | 17.24% |

| Brian McLoone | 6,050,000 | 17.24% |

| Joseph Albunio | 500,000 | 1.42% |

| Iroquois Master Fund | 1,883,309 | 5.37% |

| Float Shares | 13,512,902 | 38.49% |

| Total Outstanding | 35,100,011 |

The purposes of the transactions described in this Current Report were to complete a reverse merger with the result being that EmployUS became a wholly-owned subsidiary of The Staffing Group Ltd. The Staffing Group, Ltd’s business operations will now focus on the business of EmployUS.

The foregoing description of the Exchange Agreement, Closing and related transactions does not purport to be complete and is qualified in its entirety by reference to the complete text of (i) the Exchange Agreement, which is filed as Exhibit 2.1 to this Current Report on Form 8-K; and (ii) the other documents and disclosures associated with this transaction, each of which is incorporated herein by reference.

Following the Exchange Agreement, as of the date of this current report on Form 8-K, there are 35,100,011 shares of our common stock issued and outstanding, which include 13,153,800 shares held by the former stockholders of EmployUS and 6,050,000 by Brian McLoone, EmployUS’s Chairman and a stockholder of The Safety Group , LTD. but not a stockholder of EmployUS prior to the merger . As a result, our pre-merger stockholders, exclusive of Brian McLoone, hold approximately 45.28% of our issued and outstanding shares of common stock and the former stockholders of EmployUS including Brian McLoone hold approximately 54.72%.

The shares of common stock issued to the former stockholders of EmployUS in connection with the Exchange Agreement were not registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemption from registration provided by Section 4(2) of the Securities Act and Regulation D promulgated thereunder, which exempts transactions by an issuer not involving any public offering. These securities may not be offered or sold absent registration or an applicable exemption from the registration requirements. We have not committed to registering these shares for resale. Certificates representing these shares contain a legend stating the restrictions applicable to such shares.

Changes to the Business. We intend to carry on EmployUS’s business as our sole line of business. We have relocated our executive offices to 400 Poydras Street, Suite 1165, New Orleans, LA 7013 and our telephone number is (504) 525-7955.

Accounting Treatment. The Exchange Agreement is being accounted for as a reverse merger and recapitalization and EmployUS is deemed to be the acquirer in the reverse merger for accounting purposes. Consequently, the assets and liabilities and the historical operations of the Company that will be reflected in the financial statements prior to the closing will be those of EmployUS, and the consolidated financial statements of the Company after completion of the reverse merger will include the assets and liabilities of EmployUS, historical operations of EmployUS and operations of EmployUS from the Closing Date of the Exchange Agreement.

| 3 |

Tax Treatment. The reverse merger is intended to constitute a tax-deferred exchange of property governed by Section 351 of the United States Internal Revenue Code of 1986, as amended (the “Code”), or such other tax free reorganization or restructuring provisions as may be available under the Code. Any gain required to be recognized will be subject to regular individual or corporate federal income taxes, as the case may be.

DESCRIPTION OF BUSINESS

EmployUS is a full service turnkey staffing company formed in September of 2010. Initially established to respond to the relief and recovery of the major oil spill in the Gulf of Mexico, EmployUS has since expanded to work on most major construction, chemical, and maritime projects in the Southeast United States. Brent Callais, the company’s founder, used his relationships as a prominent former politician to quickly expand operations throughout the state of Louisiana. From its single initial project three years ago, EmployUS has aggressively grown to 10 offices in 3 states with more than 150 customers. In 2012, we sent over 3,000 part-time employees to our 150 customers.

The company is led by a management team consisting of industry professionals that capitalizes on their team’s extensive business experience, track record of profitable growth and nationwide network of client relationships. EmployUS recruits, hires, employs and manages skilled workers, eliminating the need for the client do so. By eliminating this necessary administrative requirement of identifying and employing skilled workers, the client has the ability to focus on the important task of managing and growing their own business without needing to worry about the company’s labor needs.

The services provided include:

| · | Payroll related taxes | |

| · | Workers’ compensation coverage | |

| · | General liability insurance | |

| · | Professional risk management team | |

| · | 24/7 availability of office staff | |

| · | Safety equipment & training programs | |

| · | Drug & alcohol screenings | |

| · | Background checks/MVR reports | |

| · | Temporary to permanent workers. |

To expand the company’s business, the leadership team employs a professional sales team with a lead generation system that targets new customers and utilizes sources such as permits issued for construction projects. The company plans on an aggressive expansion of their existing business and sales model throughout the United States and internationally. In addition, the Company has forged relationships with industry leaders within the safety, training, oil & gas, and risk mitigation sectors. The prospective synergy between these various, interrelated industries and their leaders, we believe, will create growth and increased margins due to the existing pipeline of business and management overlap.

Corporate History

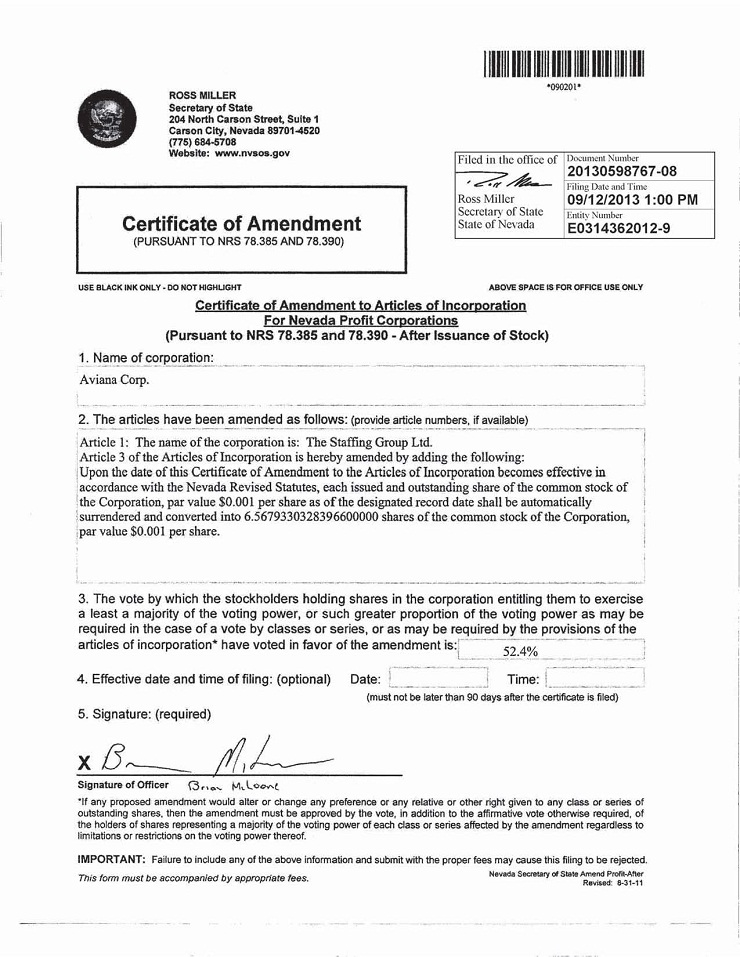

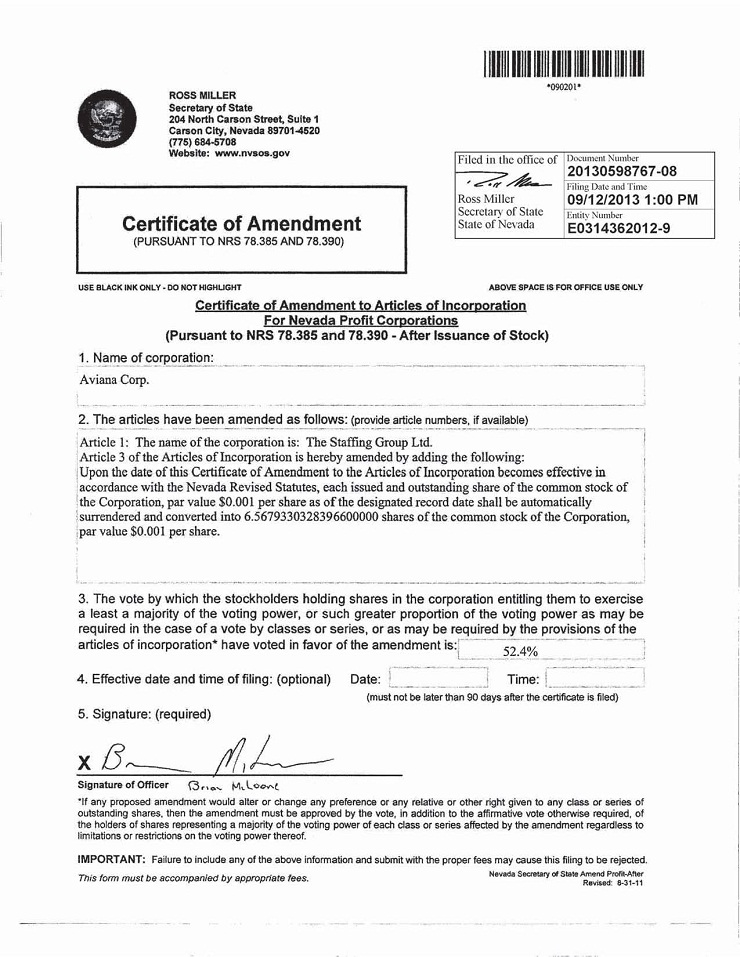

We were originally incorporated under the laws of the State of Nevada on June 11, 2012 under the name Aviana, Corp. Our registration statement was declared effective on January 23, 2013. Our original business was a Poland based corporation that operates a consulting business in EMF (electromagnetic fields), Microwave, Electrical and Ionizing detection, shielding and protection in Poland. We were unsuccessful in operating our business and on August 27, 2013 we entered into a binding letter of intent with EmployUS. It was in connection with that letter of intent that our prior officer and director, Liudmila Yuziuk, resigned and we appointed Mr. Brian McLoone as our sole officer and director. In addition, we changed our name to The Staffing Group, Ltd to better represent our new business operations.

| 4 |

Our Industry

EmployUS LTD primary focus is the blue collar staffing industry. The primary placements that EmployUS LTD makes are to companies in the construction industry, light industrial, refuse industry, stevedoring and ship repair.

Products and Services

We are a service provider that is in the business of providing temporary staffing solutions in the way of general laborers to construction, light industrial, refuse, ship repair and stevedoring companies. EmployUS recruits, hires, trains and manages skilled workers so the client doesn’t have to. By eliminating the administrative requirements of finding and employing skilled workers, EmployUS gives our clients the ability to focus on the important task of managing and growing their business and not worry about staffing their projects. Services included when utilizing EmployUS for temporary labor are payroll related taxes, workers’ compensation insurance, general liability Insurance, personal protective equipment, safety training programs, drug and alcohol screening, background checks. EmployUS is currently working in 3 states in the Southeast United States. EmployUS has one location in Jackson Mississippi, three locations in Florida (Tampa, Sarasota, Titusville), and six locations in Louisiana (New Orleans, Baton Rouge, Houma, Lafayette, Slidell, Bridge City).

EmployUS relies on a workforce from the local communities that we and our clients operate in. We do not provide a tangible product that relies on the availability of raw materials. We rely on the services being provided by each employee. EmployUS provides temporary help to customers within a 40 mile radius of each location. We recruit locally so that we do not logistical problems dispatching the workforce.

Seasonality of the Business

EmployUS operates throughout the entire year. Our work is not seasonal, however, historical data shows that the 3rd quarter is the strongest quarter of the year and December through January tend to be the slowest time due to the holidays.

Concentration or Dependence on Key Vendors, Suppliers or Clients

EmployUS is not dependent on any single supplier and our product is based on the manpower that we provide. Currently, EmployUS has over 150 active clients spread out through 10 locations. Our single largest customer is Progressive Waste. They are currently using our services in five (5) of our locations. They account for approximately 24% of our gross revenue for the 9 months ended September 30, 2013.

Marketing

EmployUS LTd. relies on a trained sales force to market its services in the territories that it has locations. The marketing plan consists of field sales calls by both account executives as well as branch managers. EmployUS LTD also relies on telemarketing and direct mail as a means to market our services. Lastly we utilize local state and national industry associations to market our company. Through the efforts of our staff, a solid relationship has been established with our current customers. Many of our clients start by using us at one location and then refer us to other locations in the same or sometimes different markets. Our primary source of generating sales leads is through field sales calls. This provides us the opportunity to visit prospective clients in their work environment, which we believe will increase our chances of doing business with them. Staffing is a highly competitive industry and building relationships is the primary way to grow your market share.

Subsidiaries

Following the Closing of the Exchange Agreement, EmployUS became our wholly-owned subsidiary. We are the legal acquirer in this transaction. Neither we nor EmployUS have any other subsidiaries.

| 5 |

Competition

The staffing industry is highly competitive and fragmented throughout the Southeast United States. There are multiple staffing companies that fill a wide variety of positions and service a wide variety of industries. Our competition would be those that focus on blue collar staffing. The largest competitor is Labor Ready with over 600 locations nationwide and they are in all of our markets. Pacesetters is another company that has over 70 locations in the Southeast and they are in all of our Florida markets. Trillium Staffing and Savard Staffing are two smaller companies that we compete with and they are in every one of our markets in Louisiana. In addition to these companies previously mentioned each office has at a minimum ten other local staffing companies that they directly compete with.

Regulatory Matters/Compliance

We are not aware of any need for any government approval of our principal services. We do not anticipate any governmental regulations on our business. However, we do provide workers compensation insurance for all our employees and we must ensure we are adhering to all OSHA requirements. We are responsible for all federal, state and local taxes for our employees. When working in a port all employees must have a T.W.I.C. identification card which ensures they are authorized to work in heightened security atmosphere. Employees that work on federally funded projects have their wages determined and validated by the federal government based on The Davis Bacon Act. Like all large employers EmployUS will also have to adhere to the Affordable Care Act

Intellectual Property

We do not have any intellectual property or proprietary rights to any of our services.

Research and Development

We are a provider of staffing services for blue-collar jobs. We do not spend any resources on research and development. We incur approximately $100,000 per year on developing and training our staffers to better understand our clients and to ensure that we are meeting the needs of our clients.

Employees

As of February 14, 2014, we have twenty-three (23) full-time employees. None of these employees are represented by collective bargaining agreements and the Company considers it relations with its employees to be good.

Additionally, we do employ a number of part-time employees that are staffed with our clients. These employees are hired on a part-time and as-needed basis. At any one time, we would have approximately 3,000 part-time employees staffed with our clients.

Properties

The Company’s corporate headquarters is located in New Orleans, Louisiana. The Company currently leases space located at 400 Poydras Street, Suite 1165, New Orleans, LA 70130. The lease is for a term of thirty seven months beginning on September 1, 2013. Our lease payments are $1,978.67 until September 30, 2014 and each year thereafter the monthly base rent increases to $2,040.50 per month for the next year and then $2,102.33 per month for the final year of the lease.

We have nine (9) other offices. A brief summary of locations, term of lease and monthly rent is as follows:

| Lease Location | Term of Lease | Base Monthly Rent |

| Titusville, Florida | 1/14/2014 - 12/31/2014 | $525 |

| Jackson, Mississippi | 5/1/2012 - 11/1/2014 | $800 |

| Sarasota, Floria | Month to Month | $160.50 |

| Bridge City, Louisiana | 9/2/2013 - 8/31/2015 | $1,000 |

| Houma, Louisiana |

4/1/2013 - 10/1/2013 (with automatic 6 month extension) |

$700 |

| Slidell, Louisiana | 6/25/2013 - 6/30/2014 | $700 |

| Prairieville, Louisiana | 12/1/2013 - 2/28/2014 | $800 |

| Jefferson Parish, Louisiana | 1/1/2014 - 12/31/2015 | $1,350 |

| Tampa, Florida | 8/1/2013 - 7/31/2014 | $1,005.80 |

| 6 |

Each of these offices are used as a place to recruit local staff to service our clients. We also have sales staff at each location to meet with prospective clients.

Corporation Information

Our principal executive offices are located at 400 Poydras Street, Suite 1165, New Orleans, Louisiana 70130. Our telephone number is (504) 525-7955. Our website is www.employusllc.com.

LEGAL PROCEEDINGS

From time to time, the Company is involved in litigation matters relating to claims arising from the ordinary course of business. While the results of such claims and legal actions cannot be predicted with certainty, the Company’s management does not believe that there are claims or actions, pending or threatened against the Company, the ultimate disposition of which would have a material adverse effect on our business, results of operations, financial condition or cash flows.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of the results of operations and financial condition of EmployUS for the fiscal years ended December 31, 2012 and 2011, and the nine month periods ended September 30, 2013 and 2012, should be read in conjunction with the Selected Consolidated Financial Data, EmployUS’s financial statements, and the notes to those financial statements that are included elsewhere in this Current Report. Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under the Risk Factors, Cautionary Notice Regarding Forward-Looking Statements and Business sections in this Current Report. We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements.

Overview

We were originally incorporated under the laws of the State of Nevada on June 11, 2012 under the name Aviana, Corp. Our registration statement was declared effective on January 23, 2013. Our original business was a Poland based corporation that operates a consulting business in EMF (electromagnetic fields), Microwave, Electrical and Ionizing detection, shielding and protection in Poland. We were unsuccessful in operating our business and on August 27, 2013 we entered into a binding letter of intent with EmployUS. It was in connection with that letter of intent that our prior officer and director, Liudmila Yuziuk, resigned and we appointed Mr. Brian McLoone as our sole officer and director. In addition, we changed our name to The Staffing Group, Ltd to better represent our new business operations.

EmployUS is a full service turnkey staffing company formed in September of 2010. Initially established to respond to the relief and recovery of the major oil spill in the Gulf of Mexico, EmployUS has since expanded to work on most major construction, chemical, and maritime projects in the Southeast United States. Brent Callais, the company’s founder, used his relationships as a prominent former politician to quickly expand operations throughout the state of Louisiana. From its single initial project three years ago, EmployUS has grown to 10 offices in 3 states with more than 150 customers and we have provided staffing needs of over 3,000 people to our 150 customers.

| 7 |

The company is led by a management team consisting of industry professionals that capitalizes on their team’s extensive business experience, track record of profitable growth and nationwide network of client relationships. EmployUS recruits, hires, employs and manages skilled workers, eliminating the need for the client do so. By eliminating this necessary administrative requirement of identifying and employing skilled workers, the client has the ability to focus on the important task of managing and growing their own business without needing to worry about the company’s labor needs.

The services provided include:

| · | Payroll related taxes | |

| · | Workers’ compensation coverage | |

| · | General liability insurance | |

| · | Professional risk management team | |

| · | 24/7 availability of office staff | |

| · | Safety equipment & training programs | |

| · | Drug & alcohol screenings | |

| · | Background checks/MVR reports | |

| · | Temporary to permanent workers. |

Nine months ended September 30, 2013 compared to nine months ended September 30, 2012

Results of Operation

The following table presents a summary of operating information for the nine months ended September 30, 2013 and 2012:

| 2013 | 2012 | |||||||

| Net Revenues | ||||||||

| Contract staffing services | $ | 10,276,195 | $ | 9,442,461 | ||||

| Cost of Services | (8,212,125 | ) | (7,343,553 | ) | ||||

| Gross Profit | 2,064,070 | 2,098,908 | ||||||

| Selling, General and Administrative | ||||||||

| Selling, general and administrative | 652,722 | 838,313 | ||||||

| Payroll and related expenses | 838,286 | 911,438 | ||||||

| Total Selling, General and Administrative | 1,491,008 | 1,749,751 | ||||||

| Income from Operations | 573,062 | 349,157 | ||||||

| Other Income (Expense) | ||||||||

| Interest expense | (69,270 | ) | (66,978 | ) | ||||

| Other income (expense | 7,744 | (96,985 | ) | |||||

| Total Other Income (Expense) | (61,526 | ) | (163,963 | ) | ||||

| Income before Provision for Income Taxes | 511,536 | 185,194 | ||||||

| Provision for Income Taxes | (54,564 | ) | -- | |||||

| Net Income | $ | 456,972 | $ | 185,194 | ||||

Nine months ended September 30, 2013 compared to nine months ended September 30, 2012

Contract Staffing Services:

Contract staffing services increased by $833,734 or approximately 8.8%, from $9,442,461for the nine months ended September 30, 2012 to $10,276,195 for the nine months ended September 30, 2013. The increase was due primarily to organic growth of the Company as well as the opening of two new locations in the beginning of the third quarter 2013.

Cost of Services:

Cost of services increased by $868,572 or approximately 11.8%, from $7,343,553 for the nine months ended September 31, 2012 to $8,212,125 for the nine months ended September 30, 2013. The increase was due primarily to the initial cost of opening the two new locations as well as the addition of a new account that has a lower gross profit margin than the Company’s blended average.

Gross profit:

Gross profit decreased by $34,838, or approximately 1.7%, from $2,098,908 for the nine months ended September 30, 2012 to $2,064,070 for the nine months ended September 30, 2013. The decrease was due primarily to the initial cost of opening the two new locations as well as the addition of a new account that has a lower gross profit margin than the companies blended average.

| 8 |

Selling, General and Administrative Expenses:

Selling, general and administrative expenses were $652,722 for the nine months ended September 30, 2013, a decrease of $185,591, or approximately 22.1%, from $838,313 for the nine months ended September 30, 2012. The decrease was due primarily to the Company reducing overall spending as well as the closing of the corporate office and moving it into one of our existing offices.

Payroll and Related Expenses:

Payroll and related expenses were $838,286 for the nine months ended September 30, 2013, a decrease of $73,152, or approximately 8.0%, from $911,438 for the nine months ended September 30, 2012. The decrease was due primarily to reduction in staff and reallocating their responsibilities to others already on staff.

Depreciation and Amortization Expenses:

Depreciation and amortization expenses were $5,773 for the nine months ended September 30, 2013, a decrease of $8,039, or approximately 58.2%, from $13,812 for the nine months ended September 30, 2012. The decrease was primarily due to the disposal of assets and moving from our corporate offices in November 2012 into one of our existing offices, which accounted for a large amount of depreciation in 2012.

Other Income (Expenses):

Other income (expenses) were $61,526 for the nine months ended September 30, 2013, an decrease of $102,437, or approximately 62.5%, from $163,963 for the nine months ended September 30, 2012. The decrease was primarily due to the cessation of penalties for the outstanding IRS payroll liabilities in 2013.

Net Income Before Provision for Income Taxes:

As a result of the above factors, net income before provision for income taxes of $511,536 was recognized for the nine months ended September 30, 2013 as compared to net income before provision for income taxes of $185,194 for the nine months ended September 30, 2012, an increase of $326,342 or approximately 176.2%. The increase was primarily due to a reduction in overall spending, closing of the corporate office and reduction in staff.

Year Ended December 31, 2012 compared to Year Ended December 31, 2011

The following table presents a summary of operating information by segments for the year ended December 30, 2012 and 2011:

| 2012 | 2011 | |||||||

| Net Revenues | ||||||||

| Contract staffing services | $ | 12,606,480 | $ | 8,709,654 | ||||

| Cost of Services | 9,944,098 | 7,139,306 | ||||||

| Gross Profit | 2,662,382 | 1,570,348 | ||||||

| Selling, General and Administrative | ||||||||

| Selling, general and administrative | 1,050,524 | 1,223,610 | ||||||

| Payroll and related expenses | 1,274,565 | 1,470,629 | ||||||

| Total Selling, General and Administrative | 2,325,089 | 2,694,239 | ||||||

| Income (Loss) from Operations | 337,293 | (1,123,891 | ) | |||||

| Other Expenses | ||||||||

| Interest expense | (107,675 | ) | (33,801 | ) | ||||

| Other expense | (340,737 | ) | (653,253 | ) | ||||

| Loss on disposal of assets | (80,104 | ) | -- | |||||

| Total Other Expenses | (528,516 | ) | (687,054 | ) | ||||

| Net Loss | $ | (191,223 | ) | $ | (1,810,945 | ) | ||

Contract Staffing Services:

Contract staffing services increased by $3,896,826 or approximately 44.7%, from $8,709,654 for the year ended December 31, 2011 to $12,606,480 for the year ended December 31, 2012. The increase was due primarily to organic growth of our existing customers as well as expansion resulting in two additional locations.

Cost of Services:

Cost of services increased by $2,804,792 or approximately 39.3%, from $7,139,306 for the year ended December 31, 2011 to $9,944,098 for the year ended December 31, 2012. The increase was due primarily to the corresponding increase in sales.

| 9 |

Gross profit:

Gross profit increased by $1,092,034, or approximately 69.5%, from $1,570,348 for the year ended December 31, 2011 to $2,662,382 for the year ended December 31, 2012. The increase was due primarily to the corresponding increase in sales.

Selling, General and Administrative Expenses:

Selling, general and administrative expenses were $1,050,524 for the year ended December 31, 2012, a decrease of $173,086, or approximately 14.1%, from $1,223,610 for the year ended December 31, 2011. The decrease was due primarily to expansion costs in 2011, while not having as much expansion in 2012, so that amount was decreased as well as cutting overall spending.

Payroll and Related Expenses:

Payroll and related expenses were $1,274,565 for the year ended December 31, 2012, a decrease of $196,064, or approximately 13.3%, from $1,470,629 for the year ended December 31, 2011. The decrease was due primarily to elimination of unnecessary staff in an effort to streamline costs.

Depreciation and Amortization Expenses:

Depreciation and amortization expenses were $17,386 for the year ended December 31, 2012, an increase of $11,772, or approximately 209.7%, from $5,614 for the year ended December 31, 2011. The increase was primarily due to a large amount of assets being purchased in the latter half of 2011, so there was not a full year of depreciation in 2011 as opposed to 2012.

Other Expenses:

Other expenses were $528,516 for the year ended December 31, 2012, a decrease of $158,538, or approximately 23.1%, from $687,054 for the year ended December 31, 2011. The decrease was primarily due to buyout fees in 2011 with a factoring company.

Net Loss:

As a result of the above factors, net loss of $191,223 was recognized for the year ended December 31, 2012, as compared to net loss of $1,810,945 for the year ended December 31, 2011, a decrease of $1,619,722 or approximately 89.4%. The decrease was primarily due to an increase in gross profit in 2012, a reduction in selling, general and administrative expenses, and a reduction in penalties and interest relating to outstanding payroll tax liabilities.

Liquidity and Capital Resources

Our principal sources of liquidity include cash from operations and proceeds from debt and equity financings. The debt provided net borrowing of approximately $66,309 for the nine months ended September 30, 2013.

As of September 30, 2013, we had cash balances of $23,047 as compared to $25,356 as of September 30, 2012, representing a decrease of $2,309. The decrease was primarily due to outstanding checks at September 30, 2013. At September 30, 2013, we had a working capital deficiency of $805,566.

Net cash used in operating activities was $206,365 for the nine months ended September 30, 2013 as compared to $554,752 in the first nine months of 2012. The decrease of $348,387 was primarily due to an increase in net income for the nine months ended September 30, 2013.

Net cash used in investing activities was $58,315 in the nine months ended September 30, 2013 as compared to net cash used of $76,854 in the nine months ended September 30, 2012, a decrease of $18,539, which was primarily due to no purchases of fixed assets in 2013.

| 10 |

Net cash provided by financing activities amounted to $91,333 in the nine months ended September 30, 2013, compared to net cash provided in the nine months ended September 30, 2012 of $618,365, representing a decrease in net cash flow by financing activities of $527,032. This was primarily due to less of a need to borrow from the line the of credit, and rely more on operating income.

Bank loans/Line of Credit

EmployUS has a line of credit with Crestmark Bank for working capital and capital investment and one loan from an investor made in connection with the planned merger.

| 1. | In October 2011, EmployUS entered into an account purchase agreement with Crestmark Bank to provide working capital. The account purchase agreement allows Crestmark to advance the Company funds on eligible accounts receivable at its sole discretion. The term of the facility is three years with an interest rate equal to the Prime Rate plus 2.75% per annum (6% floor), a maintenance fee of 0.6% per month of the average monthly loan balance, and a facility fee equal to 1% of the maximum loan amount. The line is secured by collateral consisting of all of the Company’s assets. The Company is currently compliant with all covenants. The balance due to Crestmark as of September 30, 2013, December 31, 2012 and 2011 was $1,268,763, $1,017,897 and $487,591 respectively. Interest and fees paid to Crestmark for the years ended December 31, 2012 and 2011 was $246,597 and $29,988, respectively. |

| 2. | On January 8, 2014, in connection with a possible equity transaction, we received a capital investment of $150,000 from 1 investor. The investor purchased our common stock at a price of $0.15 per share for a total issuance of stock of 1,000,000 shares for the $150,000 investment. |

We believe that our currently available working capital, credit facilities referred to above and the expected additional capitalization related to our planned acquisition should be adequate to sustain our operations at the current level for the next twelve months.

2014-2015 Outlook

EmployUS LTD has grown organically from one location in the beginning of 2011 to ten locations by the end of 2013 with sales exceeding $15,000,000. The 2014 – 2015 growth plan is going to be a three tiered approach. The first tier involves growing the volume of our current locations. The expectation is that we should collectively increase the sales by 20% from our existing locations. Tier two involves organic expansion. By maximizing the current relationships with our existing customers, EmployUS LTD intends to open three additional locations by the end of 2014 and then 3 additional locations in 2015. The final tier will be growth through acquisition. Due to increased regulations, rising state unemployment rates that are required to be paid by businesses, rising workers compensation rates and uncertainty regarding the Affordable Care Act, we believe that small staffing companies are prime for acquisition. EmployUS intends to pursue possibly acquiring one or two small staffing companies each year.

| 11 |

In order to successfully complete our 2014-2015 outlook, we anticipate continuing to rely on equity sales of our common shares in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing stockholders. There is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing to fund our planned activities.

Off-Balance Sheet Arrangements

None.

Quantitative and Qualitative Disclosures About Market Risk

Not applicable.

Critical Accounting Policies

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“US GAAP”) requires our management to make assumptions, estimates, and judgments that affect the amounts reported, including the notes thereto, and related disclosures of commitments and contingencies, if any. We have identified certain accounting policies that are significant to the preparation of our consolidated financial statements. These accounting policies are important for an understanding of our financial condition and results of operations. Critical accounting policies are those that are most important to the portrayal of our financial condition and results of operations and require management’s difficult, subjective, or complex judgment, often as a result of the need to make estimates about the effect of matters that are inherently uncertain and may change in subsequent periods. Certain accounting estimates are particularly sensitive because of their significance to financial statements and because of the possibility that future events affecting the estimate may differ significantly from management’s current judgments. We believe the following critical accounting policies involve the most significant estimates and judgments used in the preparation of our consolidated financial statements.

The audited consolidated financial statements include all adjustments including normal recurring adjustments necessary to present fairly the consolidated financial position, results of operations and cash flows of EmployUS for the periods presented. The results of operations for the years ended December 30, 2012 are not necessarily indicative of operating results expected for future periods.

Basis of Presentation

The accompanying consolidated financial statements of the Company are prepared in accordance with accounting principles generally accepted in the United States of America.

Basis of Consolidation

The consolidated financial statements include the accounts of our one operating subsidiary. All significant inter-company transactions and balances are eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates. Significant matters requiring the use of estimates and assumptions include, but may not be limited to, accounts receivable allowances and evaluation of impairment of long lived assets. Management believes that its estimates and assumptions are reasonable, based on information that is available at the time they are made.

| 12 |

Revenue Recognition

Contract staffing service revenues are recognized when services are rendered. The Company recognizes revenue in accordance Accounting Standards Codification (“ASC”) 605 “Revenue Recognition”, which requires that four basic criteria be met before revenue can be recognized: (i) persuasive evidence that an arrangement exists; (ii) the price is fixed or determinable; (iii) collectability is reasonable assured; and (iv) services have been rendered.

Accounts Receivable

Accounts receivable are stated at the amounts management expects to collect. An allowance for doubtful accounts is recorded based on a combination of historical experience, aging analysis and information on specific accounts. Account balances are written off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote.

Property and Equipment

Repairs and maintenance are expensed, while additions and betterments are capitalized. The cost and related accumulated depreciation of assets sold or retired are eliminated from the accounts and any gains or losses are reflected in earnings.

Fair Value Measurements

We measure our financial assets and liabilities in accordance with U.S. GAAP. The fair value of a financial instrument is the amount at which the instrument could be exchanged in a current transaction between willing parties. For certain of our financial instruments, including cash equivalents, accounts receivable, accounts payable and accrued liabilities, the carrying amount approximates fair value because of the short maturities. The fair value of debt is not determinable due to the terms of the debt and the lack of a comparable market for such debt. These tiers include:

Level 1 Inputs– Quoted prices for identical instruments in active markets.

Level 2 Inputs– Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 Inputs– Instruments with primarily unobservable value drivers.

Our financial instruments include cash, trade receivables and debt. The carrying amounts of cash and trade receivables approximate fair value due to their short maturities. We believe that our indebtedness approximates fair value based on current yields for debt instruments with similar terms.

Research and development

Research and software development costs are expensed as incurred.

Long-Lived Assets

We review the carrying value of our long-lived assets whenever events or changes in circumstances indicate that the carrying values may no longer be appropriate. Recoverability of carrying values is assessed by estimating future net cash flows from the assets. Based on management’s evaluations, no impairment charge was deemed necessary at September 30, 2013 and December 31, 2012. Impairment assessment inherently involves judgment as to assumptions about expected future cash flows and the impact of market conditions on those assumptions. Future events and changing market conditions may impact management’s assumptions as to sales prices, rental rates, costs, holding periods or other factors that may result in changes in our estimates of future cash flows. Although management believes the assumptions used in testing for impairment are reasonable, changes in any one of the assumptions could produce a significantly different result.

| 13 |

RISK FACTORS

Risks Related to Our Business

Key employees are essential to expanding our business.

Brian McLoone and Brent Callais are essential to our ability to continue to grow and expand our business. They have established relationships within the industry in which we operate. If either were to leave us, our growth strategy might be hindered, which could materially affect our business and limit our ability to increase revenue.

The Company may lose its top management without employment agreements.

Our operations depend substantially on the skills, knowledge and experience of the present management. The Company has no other full or part-time individuals devoted to the development of our Company. Furthermore, the Company does not maintain key man life insurance. Without an employment contract, we may lose the present management of the Company to other pursuits without a sufficient warning and, consequently, we may be forced to terminate our operations.

We do not have a majority of independent directors serving on our board of directors, which could present the potential for conflicts of interest.

After the Closing of the Exchange Agreement, Brian McLoone and Brent Callais are our directors. As a result, we do not have a majority of independent directors serving on our Board. In the absence of a majority of independent directors, our executive officers could establish policies and enter into transactions without independent review and approval thereof. This could present the potential for a conflict of interest between us and our stockholders, generally, and the controlling officers, stockholders or directors.

If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for shares of our Common Stock.

Effective internal controls are necessary for us to provide reliable financial reports and to effectively prevent fraud. We maintain a system of internal control over financial reporting, which is defined as a process designed by, or under the supervision of, our principal executive officer and principal financial officer, or persons performing similar functions, and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

As a public company, we will have significant requirements for enhanced financial reporting and internal controls. We will be required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which requires annual management assessments of the effectiveness of our internal controls over financial reporting. The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company.

We cannot assure you that we will not, in the future, identify areas requiring improvement in our internal control over financial reporting. We cannot assure you that the measures we will take to remediate any areas in need of improvement will be successful or that we will implement and maintain adequate controls over our financial processes and reporting in the future as we continue our growth. If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for shares of our Common Stock.

| 14 |

Lack of experience as officers of publicly-traded companies of our management team may hinder our ability to comply with Sarbanes-Oxley Act.

Following the Closing of the Exchange Agreement, it may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance staff or consultants in order to develop and implement appropriate internal controls and reporting procedures.

We compete with many other companies in the market for temporary, part-time blue-collar staffing services which may result in lower prices for our services, reduced operating margins and an inability to maintain or increase our market share.

We compete with other similarly situated companies in a highly fragmented market that includes national, regional and local service providers, as well as service providers with global operations. These companies have services that are similar to ours, and certain of these companies have substantially larger or have significantly greater financial resources than we do. There can be no assurance that we will be able to compete effectively against our competitors or timely implement new products and services. Many of our competitors attempt to differentiate themselves by offering lower priced alternatives to our staffing solutions and, it is possible, customers could elect to utilize less comprehensive solutions than the ones we offer due to the lower costs. Some competition may even be willing to accept less profitable business in order to grow revenue. Increased competition and cost pressures affecting the staffing market in general may result in lower prices for our services, reduced operating margins and the inability to maintain or increase our market share.

Our growth is dependent on the willingness of new customers to outsource their staffing work to us.

We plan to grow, in part, by capitalizing on perceived market opportunities to provide our services to new customers. These new customers must be willing to outsource services which may otherwise have been performed within their organizations. Many customers may prefer to remain with their current provider or keep their staffing needs rather than outsource such services to us.

We will employ individuals on a temporary basis and place them in our customers’ workplaces. We have limited control over our customers’ workplace environments.

We employ individuals on a temporary basis and place them in our customers' workplaces. We have limited control over our customers' workplace environments. As the employer of record of our temporary workers we incur a risk of liability for various workplace events, including claims for personal injury, wage and hour requirements, discrimination or harassment, and other actions or inactions of our temporary workers. In addition, some or all of these claims may give rise to litigation including class action litigation.

We may be unable to attract and retain sufficient qualified temporary workers.

We compete with other temporary staffing companies to meet our customer needs and we must continually attract qualified temporary workers to fill positions. Attracting and retaining some skilled temporary employees depends on factors such as desirability of the assignment, location, and the associated wages and other benefits. We have in the past experienced worker shortages and we may experience such shortages in the future. Further, if there is a shortage of temporary workers, the cost to employ these individuals could increase. If we are unable to pass those costs through to our customers, it could materially and adversely affect our business.

We may have additional tax liabilities that exceed our estimates.

We are subject to federal taxes and a multitude of state and local taxes in the United States and taxes in foreign jurisdictions. In the ordinary course of our business, there are transactions and calculations where the ultimate tax determination is uncertain. We are regularly subject to audit by tax authorities. And, we currently have tax liens on our business. The final determination of tax audits and any related litigation and the current tax liens could be materially different from our historical tax provisions and accruals. The results of an audit or litigation could materially harm our business.

| 15 |

Risks Related to Our Securities

There is no market for our common stock.

There is currently no market for our common stock. Furthermore, an active trading market for our common stock may never develop or, if developed, it may not be maintained. Our shareholders may be unable to sell their securities unless a market can be established or maintained.

The market price of our common stock may be volatile.

The market price of our common stock has been and will likely continue to be highly volatile, as is the stock market in general, and the market for OTC Bulletin Board quoted stocks in particular. Some of the factors that may materially affect the market price of our common stock are beyond our control, such as changes in financial estimates by industry and securities analysts, conditions or trends in the industry in which we operate or sales of our common stock. These factors may materially adversely affect the market price of our common stock, regardless of our performance. In addition, the public stock markets have experienced extreme price and trading volume volatility. This volatility has significantly affected the market prices of securities of many companies for reasons frequently unrelated to the operating performance of the specific companies. These broad market fluctuations may adversely affect the market price of our common stock.

Because we were engaged in a reverse merger, it may not be able to attract the attention of major brokerage firms.

Additional risks may exist since we were engaged in a “reverse merger.” Securities analysts of major brokerage firms may not provide coverage of the Company since there is little incentive to brokerage firms to recommend the purchase of the common stock. No assurance can be given that brokerage firms will want to conduct any secondary offerings on behalf of the Company in the future.

Our common stock will be considered a “penny stock.”

The SEC has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share, subject to specific exemptions. The market price of our common stock is currently less than $5.00 per share and therefore may be a “penny stock.” Brokers and dealers effecting transactions in “penny stock” must disclose certain information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase the securities. These rules may restrict the ability of brokers or dealers to sell our common stock and may affect your ability to sell shares.

The market for penny stocks has experienced numerous frauds and abuses which could adversely impact investors in our stock.

OTCBB securities are frequent targets of fraud or market manipulation, both because of their generally low prices and because OTCBB reporting requirements are less stringent than those of the stock exchanges or NASDAQ.

Patterns of fraud and abuse include:

| ● | Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; |

| ● | Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; |

| ● | “Boiler room” practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons; |

| ● | Excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and |

| ● | Wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses. |

| 16 |

Our management is aware of the abuses that have occurred historically in the penny stock market.

We have not paid dividends in the past and do not expect to pay dividends in the future, and any return on investment may be limited to the value of our stock.

We have never paid any cash dividends on our common stock and do not anticipate paying any cash dividends on our common stock in the foreseeable future and any return on investment may be limited to the value of our common stock. We plan to retain any future earning to finance growth.

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the names and ages of officers and director as of December 31, 2013. Our executive officers are elected annually by our Board of Directors. Our executive officers hold their offices until they resign, are removed by the Board, or his successor is elected and qualified.

| Name | Age | Position |

| Brian McLoone | 42 | Chief Executive Officer and Director |

| Brent Callais | 33 | Director |

Set forth below is a brief description of the background and business experience of our executive officer and director for the past five years.

Brian McLoone, age 42, brings over 20 years’ experience owning and operating various staffing companies. Most recently, Mr. McLoone served as the Vice President of Operations for Workers Temporary Staffing (2002 – 2010). Mr. McLoone managed 36 locations that were responsible for over $40,000,000.00 in annual Revenue. These locations collectively put over 20,000 people to work on an annual basis. Mr. McLoone was responsible for negotiating the terms on workers compensation and all other insurance policies. Additionally Mr. McLoone was involved in the securing of funding with different banking and financial institutions. He managed a staff of over 100 employees and was directly responsible for the day to day operations of the company as well as overseeing the risk management department. He negotiated all contract for both clients and vendors. Prior to this, Mr. McLoone was a partial owner of Advantage Leasing and Staffing (1999 – 2002). He was the vice President of Operations responsible for hiring, contract negotiations, risk management as well as determining the expansion plan for future growth of the company. Prior to starting Advantage Leasing and Staffing, Mr. McLoone spent time working as both a manager and district manager in the staffing field in both Florida and North Carolina (1991 – 1999). Brian started working in the staffing industry while attending Florida State University where he earned a Bachelor’s of Science degree.

Mr. Brian McLoone is qualified to serve as a director of this company because of his knowledge and experience in the staffing business and his prior experience working with this Company as an executive officer.

Brent Callais, age 33, currently CEO of EmployUS, has an extensive economic development track record in both the private and public sector including job creation and preservation. Prior to EmployUS, Brent served as southeast regional manager for one of the nation’s largest staffing companies, overseeing the company’s response to the BP oil spill and the deployment of more than a thousand workers per day. Prior to that, he served as corporate lobbyist for the oil and gas industry where he secured more than $300 million worth of Economic Development Grants, creating more than 3,000 jobs.

He has testified before Congress on behalf of small businesses, and is an active philanthropist and community leader focused on education and economic development. Brent graduated from Nicholls State University with a bachelor’s degree in Political Science and History. He was also inducted into the Nicholls State University Hall of Fame.

Mr. Brent Callais is qualified to serve as a director of this company because of his knowledge and experience in the staffing business and his prior experience working as President of EmployUS.

| 17 |

As of the date of this Current Report, there has not been any material plan, contract or arrangement (whether or not written) to which any of our officers or directors are a party in connection with their appointments as officers or directors of the Company.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain information regarding beneficial ownership of our common stock as of the date of closing (assuming the closing of the Exchange Agreement has been consummated) by (i) each person (or group of affiliated persons) who is known by us to own more than five percent of the outstanding shares of our common stock, (ii) each director, executive officer and director nominee, and (iii) all of our directors, executive officers and director nominees as a group. Immediately following the closing of the Exchange Agreement, we have 35,100,011 shares of common stock issued and outstanding.

Beneficial ownership is determined in accordance with SEC rules and generally includes voting or investment power with respect to securities. All share ownership figures include shares of our Common Stock issuable upon securities convertible or exchangeable into shares of our Common Stock within sixty (60) days of the Merger, which are deemed outstanding and beneficially owned by such person for purposes of computing his or her percentage ownership, but not for purposes of computing the percentage ownership of any other person.

| Name and Address | Beneficial Ownership | Percentage of Class (1) | ||||||

| Brian McLoone | 6,050,000 | 17.24 | % | |||||

| BD Callais | 6,050,000 | 17.24 | % | |||||

| All officers/directors as a group (2 persons) | 12,100,000 | 34.47 | % | |||||

| Broadsmoore Group | 7,103,800 | 20.24 | % | |||||

| Iroquois Master Fund | 1,883,309 | 5.37 | % | |||||

(1) Based on 35,100,011 shares of common stock outstanding.

We are not aware of any arrangement, including any pledge by any person of securities of the registrant or any of its parents, the operation of which may at a subsequent date result in a change in control of the registrant.

EXECUTIVE COMPENSATION

During the years ended December 31, 2013 and 2012, no compensation was paid to Liudmila Yuziuk, our former president, treasurer, secretary and director. Ms. Yuziuk resigned as our sole executive officer and director in connection with the change of control that occurred on August 27, 2013.

The following table sets forth information regarding each element of compensation that was paid or awarded to the named executive officers of EmployUS for its fiscal year ended December 31, 2013 and 2012:

| Name and Principal Position | Year | Salary

($) | Bonus ($) | Stock

Awards ($) | Option

Awards ($) | Non-Equity

Incentive Plan Compensation ($) | All Other Compensation ($) | Total

($) | ||||||||||||||||||||||||

| Brian McLoone | 2013 | $ | 159,086 | - | - | - | - | - | $ | 159,086 | ||||||||||||||||||||||

| President and Chief Executive Officer | 2012 | $ | 160,827 | - | - | - | - | - | $ | 160,827 | ||||||||||||||||||||||

Employment Agreements

We have not entered into employment agreements with our officers and directors. Additionally, we have not approved any retirement benefit plan, termination or severance provisions for any of our named executive officers.

| 18 |

Outstanding Equity Awards at Fiscal Year-End

There were no outstanding equity awards held by any of our officers as of December 31, 2013. We have not adopted a formal equity incentive plan but reserve the right for our board of directors to authorize and adopt some form of equity compensation plan for employees.

Board of Directors

All directors hold office until the next annual meeting of shareholders and until their successors have been duly elected and qualified, or until their earlier death, resignation or removal. Officers are elected by and serve at the discretion of the board.

Our directors are reimbursed for expenses incurred by them in connection with attending board meetings, but they do not receive any other compensation for serving on the board.

Related Party Transactions

In 2012, the Company rented two office spaces from related party companies, both of which are owned by Brent Callais, who is the CEO and a Member of the Company. The terms for the corporate office in New Orleans were originally $6,000 per month, from April 2011 through April 2018. In July 2011, the mortgage was refinanced and the rent was increased to $11,000 per month, for the same term. The Company paid rent of $78,540 for the nine months ended September 30, 2012 for the corporate office location. The lease was terminated in November 2012 upon sale of the building. The other location in Galliano, LA, was a month to month lease, with monthly payments of $1,200, beginning in November, 2010, and ending in January 2012. The total rent paid for the location in Galliano, LA, was $1,200 for the nine months ended September 30, 2012. The Company did not rent these office locations in 2013.

The Company has recognized income for staffing services from two related parties during the nine months ended September 30, 2013, both of which are owned by Brent Callais, who is the CEO and a Member of the Company. The total income from one party was $17,186 and $4,204 from the other during the nine months ended September 30, 2013. During the nine months ended September 30, 2012, the total income from one party was $3,965 and $3,204 from the other.

Director Independence

Currently, we have no independent directors. Because our common stock is not currently listed on a national securities exchange, we have used the definition of “independence” of The NASDAQ Stock Market to make this determination. NASDAQ Listing Rule 5605(a)(2) provides that an “independent director” is a person other than an officer or employee of the company or any other individual having a relationship which, in the opinion of the company’s board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The NASDAQ listing rules provide that a director cannot be considered independent if:

| ● | the director is, or at any time during the past three years was, an employee of the Company; |

| ● | the director or a family member of the director accepted any compensation from the Company in excess of $120,000 during any period of 12 consecutive months within the three years preceding the independence determination (subject to certain exclusions, including, among other things, compensation for board or board committee service); |

| ● | a family member of the director is, or at any time during the past three years was, an executive officer of the Company; |

| ● | the director or a family member of the director is a partner in, controlling stockholder of, or an executive officer of an entity to which the Company made, or from which the Company received, payments in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenue for that year or $200,000, whichever is greater (subject to certain exclusions); |

| 19 |

| ● | the director or a family member of the director is employed as an executive officer of an entity where, at any time during the past three years, any of the executive officers of the Company served on the compensation committee of such other entity; or |

| ● | the director or a family member of the director is a current partner of the Company’s outside auditor, or at any time during the past three years was a partner or employee of the Company’s outside auditor, and who worked on the company’s audit. |

Involvement in Certain Legal Proceedings

To our knowledge, during the past ten years, none of our directors, executive officers, promoters, control persons, or nominees has:

| ● | been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| ● | had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time; |

| ● | been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity; |

| ● | been found by a court of competent jurisdiction in a civil action or by the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| ● | been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| ● | been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Code of Ethics

We have not adopted a code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer, or persons performing similar functions, because of the small number of persons involved in the management of the Company.

| 20 |

DESCRIPTION OF SECURITIES

Authorized Capital Stock

Our authorized capital stock consists of 75,000,000 shares of common stock, par value $0.001 per share. Immediately after giving effect to the shares issued in the Closing of the reverse merger, there were 35,100,011 shares of our common stock issued and outstanding. We have not authorized the issuance of any preferred stock.

Common Stock

The following is a summary of the material rights and restrictions associated with our common stock.

The holders of our common stock currently have (i) equal ratable rights to dividends from funds legally available therefore, when, as and if declared by the Board of Directors of the Company; (ii) are entitled to share ratably in all of the assets of the Company available for distribution to holders of common stock upon liquidation, dissolution or winding up of the affairs of the Company (iii) do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights applicable thereto; and (iv) are entitled to one non-cumulative vote per share on all matters on which stock holders may vote. Please refer to the Company’s Articles of Incorporation, Bylaws and the applicable statutes of the State of Nevada for a more complete description of the rights and liabilities of holders of the Company’s securities.

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Indemnification of Directors and Officers

Under our Articles of Incorporation, no director or officer will be held personally liable to us or our stockholders for damages of breach of fiduciary duty as a director or officer unless such breach involves intentional misconduct, fraud, a knowing violation of law, or a payment of dividends in violation of the law. Under our bylaws, directors and officers will be indemnified to the fullest extent allowed by the law against all damages and expenses suffered by a director or officer being party to any action, suit, or proceeding, whether civil, criminal, administrative or investigative. This same indemnification is provided pursuant to Nevada Revised Statutes, Chapter 78.

The general effect of the foregoing is to indemnify a control person, officer or director from liability, thereby making us responsible for any expenses or damages incurred by such control person, officer or director in any action brought against them based on their conduct in such capacity, provided they did not engage in fraud or criminal activity.

Any repeal or modification of these provisions approved by our shareholders shall be prospective only, and shall not adversely affect any limitation on the liability of a director or officer of ours existing as of the time of such repeal or modification.

Anti-Takeover Effect of Nevada Law, Certain By-Law Provisions

The Nevada Business Corporation Law contains a provision governing “acquisition of controlling interest” (Nevada Revised Statutes 78.378 -78.3793). This law provides generally that any person or entity that acquires 20% or more of the outstanding voting shares of a publicly-held Nevada corporation in the secondary public or private market may be denied voting rights with respect to the acquired shares, unless a majority of the disinterested shareholders of the corporation elects to restore such voting rights in whole or in part. The control share acquisition act provides that a person or entity acquires “control shares” whenever it acquires shares that, but for the operation of the control share acquisition act, would bring its voting power within any of the following three ranges:

| ● | 20 to 331/3%; |

| ● | 331/3 to 50%; or |

| ● | more than 50%. |

A “control share acquisition” is generally defined as the direct or indirect acquisition of either ownership or voting power associated with issued and outstanding control shares. The shareholders or board of directors of a corporation may elect to exempt the stock of the corporation from the provisions of the control share acquisition act through adoption of a provision to that effect in the articles of incorporation or bylaws of the corporation. Our articles of incorporation and bylaws do not exempt our common stock from the control share acquisition act.

| 21 |

The control share acquisition act is applicable only to shares of “Issuing Corporations” as defined by the Nevada law. An Issuing Corporation is a Nevada corporation, which:

| ● | has 200 or more shareholders, with at least 100 of such shareholders being both shareholders of record and residents of Nevada; and |

| ● | does business in Nevada directly or through an affiliated corporation. |

At this time, we do not have 100 shareholders of record resident of Nevada. Therefore, the provisions of the control share acquisition act do not apply to acquisitions of our shares and will not until such time as these requirements have been met. At such time as they may apply, the provisions of the control share acquisition act may discourage companies or persons interested in acquiring a significant interest in or control of us, regardless of whether such acquisition may be in the interest of our shareholders.