UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________________ to __________________________

Commission file number: 000-55415

ENUMERAL BIOMEDICAL HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 99-0376434 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 200 CambridgePark Drive, Suite 2000 Cambridge, Massachusetts |

02140 |

| (Address of principal executive offices) | (Zip Code) |

| Registrant's telephone number, including area code: | (617) 945-9146 |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| None | Not applicable |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 Par Value Per Share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þYes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þYes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨ Yes þ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company:

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) ¨ Yes þ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter:

The aggregate market value of the registrant’s common stock, $0.001 par value per share (“Common Stock”), held by non-affiliates of the registrant, based on the last reported sale price of the Common Stock on the OTCQB at the close of business on June 30, 2015, was approximately $25,086,500. For purposes hereof, shares of Common Stock held by each executive officer and director of the registrant and entities affiliated with such executive officers and directors have been excluded from the foregoing calculation because such persons and entities may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date: 52,073,481 shares of common stock are issued and outstanding as of March 24, 2016.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2016 annual meeting of stockholders, which the registrant intends to file pursuant to Regulation 14A with the Securities and Exchange Commission not later than 120 days after the registrant’s fiscal year end of December 31, 2015, are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein.

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains forward-looking statements, including, without limitation, within the sections captioned “Item 1. - Business,” “Item 1A. - Risk Factors,” and “Item 7. - Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Any and all statements contained in this Annual Report on Form 10-K that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements, however, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Annual Report on Form 10-K may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the development of commercially viable pharmaceuticals, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”), and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our inability to obtain adequate financing, the significant length of time associated with drug development and related insufficient cash flows and resulting illiquidity, our inability to expand our business, significant government regulation of pharmaceuticals and the healthcare industry, lack of product diversification, volatility in the price of our raw materials, existing or increased competition, results of arbitration and litigation, stock volatility and illiquidity of our securities, and our failure to implement effectively our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this Annual Report on Form 10-K appears in the section captioned “Risk Factors” and elsewhere in this Annual Report on Form 10-K.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Annual Report on Form 10-K to reflect any new information or future events or circumstances or otherwise, except as required by law.

Readers should read this Annual Report on Form 10-K in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Annual Report on Form 10-K, and other documents which we may file from time to time with the SEC.

OTHER PERTINENT INFORMATION

Unless the context indicates otherwise, all references in this Annual Report on Form 10-K to “Enumeral Biomedical,” the “Company,” “we,” “us” and “our” refer to Enumeral Biomedical Holdings, Inc., and its wholly-owned subsidiaries, Enumeral Biomedical Corp. and Enumeral Securities Corporation; and references to “Enumeral” refer to Enumeral Biomedical Corp.

Unless specifically set forth to the contrary, the information which appears on our website at www.enumeral.com is not part of this Annual Report on Form 10-K.

Description of Business

Overview

We are a biopharmaceutical company focused on discovering and developing novel antibody immunotherapies that help the immune system fight cancer and other diseases. We utilize a proprietary platform technology that facilitates the rapid high resolution measurement of immune cell function within small tissue biopsy samples. Our initial focus is on the development of a pipeline of next generation monoclonal antibody drugs targeting established and novel immuno-modulatory receptors.

The concept of stimulating the immune system to fight cancer was first advanced more than a century ago, but it is only recently that the field of immuno-oncology has seen clinical success, with marketing approvals being granted for antibodies that block CTLA-4 (Yervoy® (ipilimumab)) and PD-1 (Keytruda® (pembrolizumab) and Opdivo® (nivolumab)). Use of these drugs has established that durable anti-tumor responses can be elicited in some patients by blocking the checkpoints that normally suppress the human immune response against cancer cells. The success of these drugs suggests that immuno-oncology may fundamentally alter the course of cancer treatment.

In our lead antibody program, we have characterized certain anti-PD-1 antibodies, or simply “PD-1 antibodies,” using patient biopsy samples, in an effort to identify next generation PD-1 antagonists with enhanced selectivity for the immune effector cells that carry out anti-tumor functions. We have identified two antagonist PD-1 antibodies that inhibit PD-1 activity in different ways. The distinction is that one of the antibodies (ENUM 388D4) blocks binding of the ligand PD-L1 to PD-1, while the other antibody (ENUM 288C4) does not inhibit PD-L1 binding. However, both display activity in various biological assays. In addition to our PD-1 antibody program, we are developing antibody drug candidates for a number of immunomodulatory protein targets, including TIM-3, LAG-3, OX40, TIGIT, and VISTA. We are also pursuing several antibody programs for which we have not yet publicly disclosed the targets.

Our proprietary platform technology, exclusively licensed from the Massachusetts Institute of Technology, or MIT, is a microwell array technology that detects secreted molecules (such as antibodies and cytokines) and cell surface markers, at the level of single, live cells – and enables recovery of single, live cells of interest. The platform technology can be used to achieve at least three separate, but complementary, objectives. First, we use the platform to rapidly produce antibody libraries with high diversity. Second, the platform has the potential to guide rational selection of lead candidates derived from these libraries, through characterization of immune function at the level of single cells from human biopsy samples. Third, it has the potential to identify patients more likely than others to benefit from treatment with a given therapeutic antibody. Thus, our platform is a multipurpose tool that is valuable for activities ranging from antibody discovery to target discovery to patient stratification in clinical development. The platform yields multidimensional, functional read-outs from single live cells, such as tumor infiltrating lymphocytes, or TILs, from human tumor biopsy samples, and it enables us to examine the responses of different classes of human immune cells to treatment with immuno-modulators in the context of human disease, as opposed to animal models of disease. Consequently, we call our approach The Human Approach®.

To date, our proof-of-concept corporate collaborations have provided modest revenues. However, our business has not generated (nor do we anticipate that in the foreseeable future it will generate) the cash necessary to finance our operations. We expect to continue to incur losses and use cash during fiscal year 2016, and we will require additional capital to continue our operations beyond June 2016.

Our near-term capital needs depend on many factors, including:

| · | our ability to carefully manage our costs; |

| · | the amount and timing of revenue received from grants or our collaboration and license arrangements; and |

| · | our ability to raise additional capital through public or private equity offerings, debt financings, or strategic collaborations and licensing arrangements, and/or our success in promptly establishing a strategic alternative that is in our stockholders’ best interests. |

At December 31, 2015, we had cash and cash equivalents totaling approximately $3.6 million, excluding restricted cash. As of the date of this filing, we believe we have sufficient liquidity to fund operations through June 2016. We are currently exploring a range of potential transactions, which may include public or private equity offerings, debt financings, collaborations and licensing arrangements, and/or other strategic alternatives, including a merger, sale of assets or other similar transactions. If we are unable to preserve or raise additional capital through one or more of the means listed above prior to the end of June 2016, we could face substantial liquidity problems and might be required to implement cost reduction strategies in addition to the cash conservation steps that we have already taken. These reductions could significantly affect our research and development activities, and could result in significant harm to our business, financial condition and results of operations. In addition, we may be required to downsize or wind down our operations through liquidation, bankruptcy, or a sale of our assets.

No assurance can be given that additional financing or strategic alliances and licensing arrangements will be available when needed or that, if available, such financing could be obtained on terms favorable to us or our stockholders. See Item 1A. - “Risk Factors.”

1

Our Strategy

In general, our strategy is to exploit our proprietary platform

technology to accelerate the discovery and development of monoclonal antibodies, for the treatment of cancer and other diseases.

Key elements of our strategy include:

| · | Integrating primary cell screening of our high diversity antibody libraries with cellular response profiling – both

made possible by our proprietary platform technology. Our platform enables us to screen high-diversity mammalian cell libraries

at the single cell level, in antibody discovery; and to examine rare immune cells in human biopsies to understand how different

cell types respond to treatment with targeted immuno-modulators. Eventually, our platform may enable us to identify which patients

are more likely to benefit from such treatments. We are currently pursuing this approach against a number of immunomodulatory protein

targets, including PD-1, TIM-3, LAG-3, OX40, TIGIT, and VISTA. |

| · | Advancing our PD-1 program (referred to internally as ENUM003). We are conducting pre-clinical characterization of certain PD-1 antibodies, using ex vivo human tissues, with the aim of generating next generation PD-1 antagonists for use in treating cancer. We have identified two anti-PD-1 antibodies that bind to different locations on the PD-1 target. We refer to these antibodies as ENUM 388D4 and ENUM 244C8, or simply 388D4 and 244C8. Our antibody 388D4 is a PD-1 antagonist that blocks binding of PD-L1 to PD-1. Our antibody 244C8 is a PD-1 antagonist that inhibits PD-1 function without blocking binding of PD-L1 to PD-1. We are exploring ways in which one or both of these antibodies might be used to develop desirable new PD-1 antibody-based therapies. We have preliminary evidence that 244C8 activates T cell function in a way distinct from currently marketed anti-PD-1 therapies. Through ex vivo assays performed on tumor biopsy samples, we are exploring the possibility that 244C8 causes stimulation of both adaptive (T cell) and innate (dendritic cell) function. |

| · | Future Collaborations. We seek to collaborate with companies advancing therapies that might provide superior patient benefit when combined with an immunotherapy. We believe such collaborations will enable us to improve and accelerate product development, regulatory approval, and commercialization of novel immuno-modulators from our pipeline. Such collaborations might involve antibodies, peptide therapeutics, cell therapies, or other therapeutic approaches. In addition, we seek collaborations with key opinion leaders in academic and clinical institutions to conduct preclinical, translational and investigator-sponsored studies involving our proprietary molecules. |

Our Programs

Anti-PD-1 Immunotherapy

Our lead program involves antibodies against the “Programmed Cell Death” receptor, commonly known as “PD-1.” Our PD-1 program has yielded twenty-five families of PD-1 antibodies. We are conducting functional characterization of our lead antibodies, using patient biopsy samples, in an effort to identify next generation PD-1 antagonists with enhanced selectivity for the immune effector cells that have anti-tumor functions.

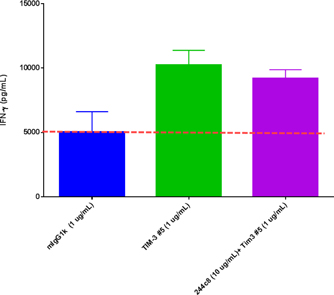

We have employed ex vivo methods to examine how TILs derived from human lung biopsies respond to various PD-1 antibodies. Measurements include production of interferon gamma (IFNγ), which is a cytokine indicative of T cell activation. We have found that approximately half of assayed biopsies harbored TILs responsive to different PD-1 antibodies. We have also found that TILs isolated from lung tumor biopsies that display elevated TIM-3 expression levels have lower responsiveness to the effects of PD-1 antibodies in ex vivo assays.

Our two lead PD-1 antibodies, 388D4 and 244C8, both enhance T cell function through reversal of PD-1-dependent immunosuppression, but they appear to act on PD-1 through different mechanisms. Antibody 388D4 blocks binding of PD-L1 to PD-1 (as do the currently-marketed PD-1 antibodies), while 244C8 does not block binding of PD-L1 to PD-1. Using TILs derived from human lung biopsy samples, we have performed experiments comparing the activities of 244C8 and a currently marketed PD-1 antibody, in reversing T cell exhaustion. In some experiments, 244C8 has appeared to restore T cell function to a higher level than did a currently-marketed PD-1 antibody, which we used as a comparator. We have also presented research results in which 244C8 has appeared to elicit cytokine secretion from cell types associated with innate immunity. Results from other experiments are consistent with the observed pattern of cytokine secretion being dependent on the activity of CD40L, a receptor involved in T cell engagement with dendritic cells, which are involved in anti-tumor immunity.

2

Despite the clinical breakthroughs achieved with the currently marketed PD-1 antibody drugs, OPDIVO® (nivolumab) and KEYTRUDA® (pembrolizumab), those drugs are not effective in all patients, or in all cancers. We hope to develop anti-PD-1 treatments for certain solid tumor indications, where effective therapies do not exist.

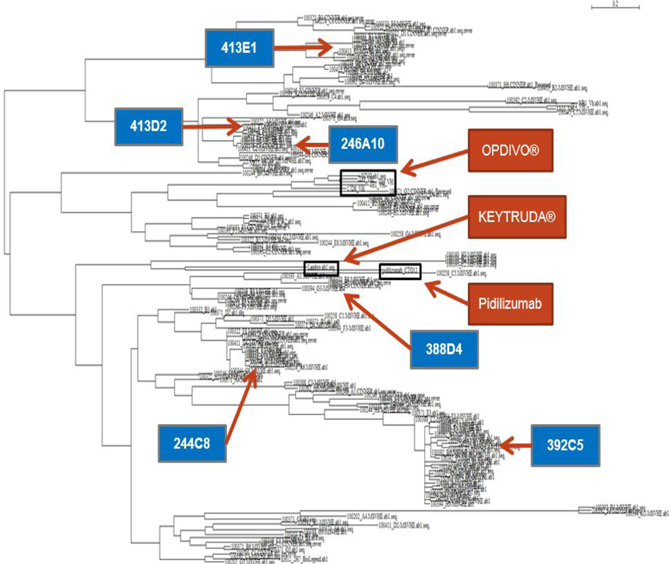

The remarkable diversity of PD-1 antibodies obtained by using our platform to screen individual primary B cells from mouse strains that possess fully intact immune systems is illustrated by the dendrogram in Figure 1. Bioinformatics analysis clusters these sequences into “families” of antibodies, based on sequence relatedness. The twenty-five families in the dendrogram are the pool from which our initial candidates have been selected for further testing and optimization. We included published sequences of various commercial and development-stage antibodies in our bioinformatics analysis. This analysis shows that our screening has identified not only antibodies similar to those described previously, but also a large number of less closely related families.

Figure 1: Dendrogram representing discovered sequences and associated “families” of antibodies in our PD-1 program. Data presented are relatedness of different antibodies based on amino acid sequences predicted by recovered variable region heavy chain genes. Sequence identifiers are our internal designations (highlighted by the blue boxes), and additional sequences representing antibodies commercialized or in development with other companies (highlighted by the red boxes).

After DNA cloning and sequence analysis, antibodies selected from different families underwent further analysis. Following recloning into expression constructs and purification, confirmatory testing was performed to determine whether the antibodies bind to PD-1 expressed on the surface of cells. Following selection of antibodies that met rigorous binding criteria, and passed initial characterization, a smaller group of antibodies underwent further testing and selection. Our antibody characterization included standard measurements of biochemical properties, and evaluation in appropriate preclinical studies. Figure 2 shows data for three therapeutic antibody candidates (and one control) binding to cynomolgus monkey PD-1.

3

ENUM 003 Antibody Binding to NHP PD-1

| Figure 2: ELISA results showing binding confirmation to cynomolgus monkey PD-1. These measurements are the first step prior to primate toxicity studies. |

Figure 3 shows the results of testing of two of our PD-1 antibodies for activity in restoring immune function of human peripheral blood mononuclear cells, or PBMCs, in the presence of PD-L1, a PD-1 ligand. In this test, human PBMCs were activated and then exposed to PD-L1, which binds to PD-1, thereby suppressing immune function of the cells. IFNγ secretion was used as an indicator of immune function. In this particular experiment, PD-L1 treatment caused IFNγ levels to decrease to 14% of the level in the untreated controls. After PD-L1 was added, a therapeutic antibody candidate, or a commercially available anti-PD-1 reagent antibody was added. The number of secreting cells was measured as an index of immune function restoration. In this test, the commercial antibody restored IFNγ secretion to 34%, antibody ENUM A10 restored secretion to 56%, and antibody ENUM C8 restored secretion to 41% of the control level.

4

Figure 3: Reversal of PD-L1-based suppression of T cell function.

In order to elucidate mechanisms of action, and to develop a next generation PD-1 antibody, it is important to know not only that the antibody binds to PD-1, but also to understand which cell types the binding modulates in human patients. We believe the ability of our platform to discriminate among cell types can be used to identify candidates that elicit an immune response associated with anti-tumor activity. This is an important advantage of The Human Approach. In addition, we believe that integrating ex vivo analysis of human tissues, at the level of single cells, will not only improve our chances of developing best-in-class therapeutics as single agents, but that it also will improve our chances of identifying rational immunotherapy combinations for testing in human clinical trials.

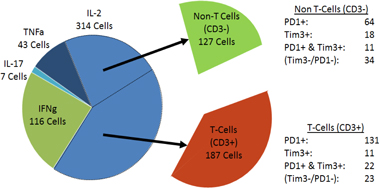

Figure 4 illustrates how data from our platform can be used to classify human cell types in terms of cellular function. Figure 4 is based on measurements of secretory activity of mucosal cells from biopsy tissue, along with the identified lineage of the functional cells. In particular, these data relate to secretion of the effector cell cytokine IL-2, specifically looking at cells expressing PD-1 and TIM-3. These markers are expressed on multiple cell types, and in some cases are co-expressed on the same cell types. This type of information can help improve our understanding of cancer disease mechanisms, and mechanisms of action of anti-cancer drugs. In turn, this understanding can be used to identify which cellular responses are desirable, in the search for improved drugs.

|

|

|

Figure 4: Distribution of cytokine secretion and cell lineage in a human mucosal biopsy sample from a CRC (colorectal cancer) tumor. | |

5

In order to test the effect of our two lead PD-1 antibodies on tumor growth, we conducted a study using a patient-derived tumor (PDX) model on humanized NSG (NOD scid gamma) mice, which are engineered to allow for in vivo study of human T cell response. This enabled in vivo testing of our PD-1 antibodies. Seventy-five humanized NSG mice were implanted with a lung tumor PDX derived from a patient with metastatic non-small cell lung carcinoma (LG1306). The mice were randomized into five cohorts (n=12 per group). Dosing and analyses were done according to scheme. As shown in Figure 5 below, 388D4 and 244C8 displayed significant in vivo anti-tumor activity when tested in a non-small cell lung cancer (or NSCLC) PDX model.

Figure 5: Tumor growth inhibition by ENUM 388D4, ENUM 244C8, pembrolizumab, and vehicle control. Lung tumor PDX (LG1306) growth was measured by tumor volume (error bars = 95% Confidence Interval).

We think The Human Approach can help inform our clinical development plan for an anti-PD1 monotherapy, based on results from our ongoing preclinical evaluations. One possible clinical goal would be to develop a PD-1 inhibitor that will yield response rates higher than those obtained with existing anti-PD-1 therapies, in approved indications. This could be tested in phase Ib/II clinical trials by enrolling Keytruda® and Opdivo® treatment failures among the patients dosed. Alternatively, or concurrently, a PD-1 antibody drug candidate might be developed in new indications with unmet clinical need, where currently marketed PD-1 inhibitors are not being developed.

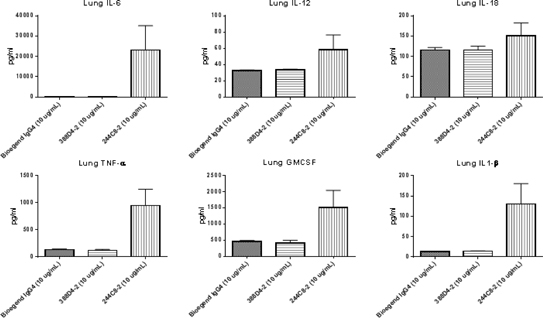

Figure 6 summarizes results from recent experiments to test the ex vivo effect of antibody 244C8 on lung biopsy tissue. Collectively, the data in Figure 6 constitute a cytokine signature that we think is consistent with antibody 244C8 eliciting activation of innate immunity.

6

Figure 6: Ex vivo cytokine production in NSCLC tumor biopsy consistent with focal activation of both innate and adaptive anti-tumor immunity.

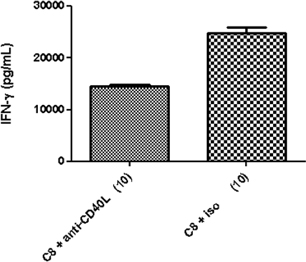

Figure 7 below shows results from a CMV (cytomegalovirus) recall assay involving blockade of PD-1 with antibody 244C8 and blockade of the CD40 ligand with a CD40 ligand antibody. These results are consistent with 244C8-based PD-1 blockade potentiating both T cell activation and antigen presenting cell (APC) activation.

Figure 7: CMV recall assay with 244C8-based PD-1 blockade with or without blockade of CD40 ligand.

We have also conducted experiments in which our anti-PD-1 antibodies appeared to be effective in reversing T cell suppression in ex vivo assays. This activity was evident from increased secretion of interferon gamma and increased expression of the IL-2 receptor alpha chain (CD25), both of which are hallmarks of T cell activation. In other studies, individual cells isolated from a human melanoma tumor biopsy were identified and characterized using our cell profiling technology. These cells were selected on the basis of functional properties, and their T cell receptor (TCR) genes were cloned and sequenced. Thus, TCR specific sequences were associated with specific cellular functions at the single cell level.

7

Anti-TIM-3 Immunotherapy

In early 2015, we initiated screening for antibodies against the “T Cell Immunoglobulin and Mucin Protein 3,” commonly known as TIM-3. This program (designated internally as ENUM005) has yielded 42 families of TIM-3 antibodies, which represent high diversity with respect to sequence relatedness. Our lead selection work in this program is ongoing. Figure 8 below is a dendrogram that illustrates the sequence diversity of our TIM-3 antibodies, in relation to each other, and in relation to TIM-3 sequences published by third parties. We have chosen clones from ten different families for scale-up. In addition to biophysical characterization, we are conducting functional characterization of potential lead antibodies, in cell based assays.

Figure 8: Dendrogram representing discovered sequences and associated “families” of antibodies in our TIM-3 program. Data are represented in terms of relatedness of different antibodies, based on amino acid sequences predicted by recovered variable region heavy chain genes. Sequence identifiers are our internal designations.

8

Figure 9 below shows the results of an experiment to measure human T cell stimulation by five of our TIM-3 antibodies, following suboptimal CD3/CD28-based stimulation of human donor PBMCs. In this experiment, the tested antibodies displayed greater potency than a commercial reagent TIM-3 antibody (F38-2e2), as well a negative (isotype) control mIgG1.

Figure 9: Stimulation of T cell activation by Enumeral TIM-3 antibodies.

Figure 10 below shows the results of an ex vivo experiment performed with biopsy material from a human NSCLC tumor containing TILs that were refractory to (not activated by) PD-1 blockade. The Enumeral TIM-3 antibody tested here displayed activity in restoring T cell effector function to the PD-1 blockade-refractory TILs.

Figure 10: Enumeral TIM-3 antibody activates PD-1 blockade-refractory NSCLC TILs ex vivo.

Our future plans for our PD-1 and TIM-3 programs, as well as our other antibody programs described below, will depend on our ability to raise additional capital through public or private equity offerings, debt financings, or strategic collaborations and licensing arrangements, and/or our success in promptly establishing a strategic alternative that is in our stockholders’ best interests.

9

Other Antibody Programs

In addition to our PD-1 program (ENUM003) and TIM-3 program (ENUM005), we have several other antibody programs, including OX40 (ENUM004), LAG-3 (ENUM006), VISTA (ENUM007), and TIGIT (ENUM009). We are also pursuing several antibody programs for which we have not yet publicly disclosed the targets.

| · | LAG-3 (ENUM006). LAG-3 (also known as CD223) is believed to be a negative immunomodulatory receptor expressed on T cells and NK cells that mediate tumor lysis. Our objective for the ENUM006 program is to generate therapeutic antibody candidates that block the interaction of LAG-3 on effector cells with cognate ligand in tumors. We initiated screening for ENUM006 in early 2015, and we have isolated the immunoglobulin (Ig) genes from antigen positive B cells. |

| · | OX40 (ENUM004). OX40 is believed to be a key activating immunomodulatory receptor expressed on CD8+ T cells, NK cells, NK-T cells and neutrophils. Our goal for the ENUM004 program is to identify therapeutic antibody candidates that can enhance activation of immune effector cells. We initiated screening for ENUM004 in the first quarter of 2015, and isolated Ig genes from recovered B cells. We are currently conducting a second immunization with a cell-based antigen presentation. |

| · | VISTA (ENUM007). VISTA (also known as PD-L3) is believed to be a negative immunomodulatory receptor expressed on lymphoid and non-lymphoid cells. Our objective for the ENUM007 program is to generate therapeutic antibody candidates that block the interaction of VISTA with cognate ligand on effector T cells. We initiated screening for ENUM007 in 2015, and screening efforts are ongoing. |

| · | TIGIT (ENUM009). TIGIT is believed to be a negative immunomodulatory receptor expressed on lymphoid cells. Our objective for the ENUM009 program is to generate therapeutic antibody candidates that can block the interaction of TIGIT (on NK or T cells) with cognate ligand on accessory cells. We have completed an immunization with a cell-based antigen presentation. |

Our Proprietary Platform Technology

In our drug discovery programs, our platform enables us to use primary cells from fully intact immune systems in various strains of mice (or other species) for antibody screening. As discussed in the Antibody Discovery section below, using primary cells from a fully intact immune system provides a significant advantage over established technologies such as phage display and mouse strains genetically engineered to produce human antibodies, because those technologies place certain limits on recovery of functional antibody diversity.

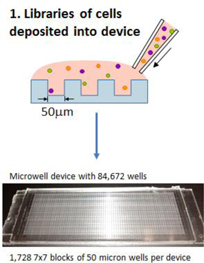

Our platform is built around a proprietary microwell array chip, which contains 84,672 spatially addressable sub-nanoliter microwells. Our microwell array chips are manufactured exclusively for us by a third-party provider, using custom molds and industrialized processes. In conjunction with the microwell array chips, we employ commercial laboratory equipment and proprietary software to create an integrated system.

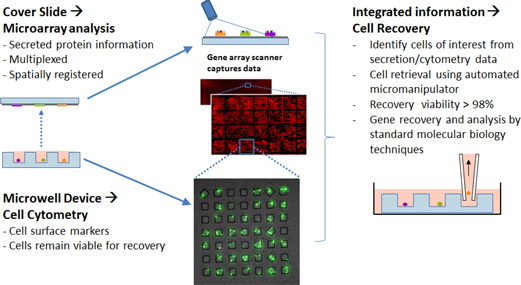

Using this system, we can analyze cells from various sources, including human peripheral blood mononuclear cells (PBMCs), bone marrow, tumor biopsy, mucosal biopsy, and cerebrospinal fluid (CSF). Figures 11A and 11B below illustrate the three major elements of our platform:

| 1) | Cell culture or cell handling, which includes preparation (or dissociation) of cells from primary tissue samples. Our system generally avoids complex cell handling processes. This provides for rapid measurements involving fragile, individual live cells (element 2, below), which can be difficult with technologies other than ours. |

| 2) | Measurement of cellular functioning at the level of single cells, including independent identification of cell surface markers and secreted proteins, such as antibodies and cytokines; and |

| 3) | Retrieval of individual cells, after which they can be subjected to molecular analyses such as reverse transcription polymerase chain reaction, or RT-PCR, RNA sequencing, and other molecular biological methods. These data link cell type (surface markers), and cell function (identified by secretion), to underlying genomic information. We believe that without our platform, this linkage of information at the single cell level would be difficult or impossible to achieve with cell-limited biopsy material from human patients. |

10

The microwells containing individual cells allow for rapid and sensitive detection of secreted factors, and eliminate the need for common procedures such as cell proliferation (for example, Enzyme-Linked ImmunoSpot Assay, or ELISPOT), cell fusion (hybridoma techniques), and cell sorting and enrichment (such as fluorescence activated cell sorting, or FACS, and B cell cloning), all of which can bias results.

Cell Loading

|

|

|

| Simple pipetting step achieves desired cell density, e.g. single cell occupancy | Secreted proteins bind to capture antibodies on cover slide | Spatially-registered custom protein microarray allows identification of cells with desired functionality for recovery |

Figure 11A: Platform Overview

Cells are loaded directly on the microwell array without manipulations that could lead to loss of cellular function or viability. This process effectively preserves the entire original population of cells for analysis. Loading is rapid, which is critical for analysis of live primary cells derived from limited biopsy materials. A glass cover slide treated with commercially available capture reagents specific to secreted proteins of interest is sealed across the top of the chip. Multiple capture reagents can be used at the same time. We routinely analyze four secreted factors in parallel, across the entire cell population. The sealed chip is incubated (usually between 2 and 6 hours). Proteins secreted in each microwell during the incubation period are captured on the slide. This yields a spatially registered protein array corresponding to each position (microwell) on the chip.

11

Analysis & Recovery

Figure 11B: Platform Overview

The cover slide is treated with conventional fluorescently-labeled detection reagents, and array scanners are used to identify proteins secreted from individual cells. In parallel, the cells are labeled with reagents specific for cell surface protein markers and examined through high-speed multiplexed imaging cytometry to determine cell lineage. Data are integrated to produce independent, unbiased measurements of lineage and function for the cells within each microwell. Based on this information, cells are retrieved by automated micromanipulation. Ongoing research and development efforts aimed at automation of all steps in our platform process are currently being supported by our Phase II research contract from the National Cancer Institute.

Antibody Discovery

Our antibody discovery programs exploit our proprietary, high diversity antibody libraries by screening primary cells from murine tissues such as splenocytes or bone marrow cells, following target-specific immunizations that are performed exclusively for us by a third party. In contrast to the limited diversity of human antibodies from transgenic mouse platforms, we employ multiple mouse strains with intact, fully diverse murine immune systems, and we use multiple adjuvants during our immunization campaigns. This avoids loss in the natural diversity of the antibodies produced in the mouse for antibody screening and selection. Our platform enables direct screening of antibody-secreting cells without any requirement for intervening cell fusion, enrichment or sorting. This direct screening enables the exceptional degree of antibody diversity provided by our system.

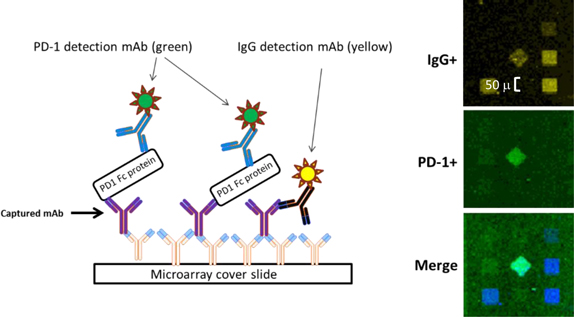

In our screening process, after secretion and capture of the antibodies, we measure the isotype, amount secreted, target specificity, and relative target affinity. This information is used to derive a priority list for retrieval of individual cells that secreted the antibodies. Cells are retrieved using an automated commercial system customized to our platform and the genes encoding the secreted antibodies are cloned through single cell RT-PCR protocols which we have optimized. Our standard procedures can result in approximately 80% recovery of paired heavy-chain and light-chain genes. Figure 12 illustrates the binding of a secreted antibody to a functionalized cover slide in the context of antibody discovery.

12

Figure 12: Detection of antibody secretion events from single cells.

Figure 13 below illustrates the detection of secreted antibodies specific for a target of interest captured on the cover slide, showing parallel detection of both antibody (Ig+) and target (Ag+) positive signals, indicating cells producing antibodies which bind to the target of interest.

Figure 13: Antibodies secreted from single cells

screened for binding to an antigen target.

Each colored square in the photo micrographs at right is 50 microns on each side.

The design of our proprietary microwell array provides for spatial registration of the secreted antibodies with the microwell containing the secreting cells. This enables retrieval of specific cells of interest. After cloning and sequencing of the antibody genes, bioinformatics analysis enables classification of the antibodies into “families.”

13

Cellular Response Profiling

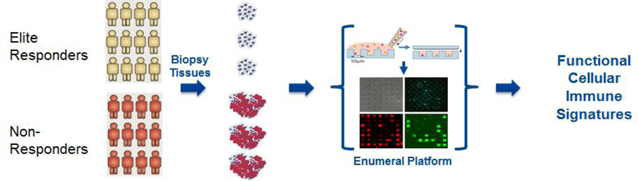

Cellular response profiling is what we call our analysis of human tissue samples to measure specific functions of individual cells, and to elucidate how cells in the human immune system respond to a given set of circumstances. As illustrated in Figure 14, we can measure the frequency and functional status of tumor-infiltrating lymphocytes to generate a functional immune “signature.” Such signatures might be generated, for example, using biopsies from patients that have responded to a particular treatment, and compared to signatures generated using biopsies from non-responders. This primary biopsy-based approach also can be used to compare among a series of antibody drug candidates, to profile the immune responses they elicit ex vivo, and to facilitate selection of those with the best immune modulation properties. Single-cell functional profiling enables simultaneous and unbiased analysis of cellular parameters from individual cells within the same population of cells, including antibodies, cytokines, other proteins, and cell lineage.

Figure 14: Profiling of human tissue samples for immunological signatures.

Certain of our methods for profiling of immune cells in the tumor microenvironment were developed under a Phase I Small Business Innovation Research contract with the National Cancer Institute in 2012. These Phase I efforts focused on characterizing the performance of our platform technology and generation of multiplexed immunological data from mucosal biopsy samples. We generated data from the primary human tissue (gut mucosa) of patients with colorectal cancer (CRC). In these studies, we examined diseased tissue (tumor), as well as normal (adjacent) tissue from each patient studied. The data demonstrated that matched normal and tumor tissues showed similar secretion levels of immunoglobulin (Ig), and notable differences in the secretion of certain cytokines.

We believe that there are measurable differences in how cells in the human immune system respond to different antibodies, even when those antibodies bind the same target (e.g., PD-1). A composite of those differences, as measured at the level of single cells, is what we call a cellular response profile. The differences in cellular response profiles may translate into differences in how certain patients respond to certain therapies.

Cellular response profiling is a versatile method that can be employed in various ways. Cellular response profiling complements our antibody programs. Once a desired cellular response profile has been defined, testing of human tissue samples on our platform can support either (or both) of two different courses of action: (1) screening for patients with tumors that display a cellular response profile indicating suitability for treatment with a particular drug; or (2) screening for antibodies that elicit a desired cellular response profile in samples from different patient subpopulations, i.e., screening for an antibody that produces higher initial response rates. Whether screening antibodies or screening patients, the concept and principles are the same. Accumulated data from cellular response profiling may lead to valuable insight into details of the mechanisms of action of different antibodies in different tissues or disease indications. In turn, this may guide selection of particular drug combinations for testing in clinical trials. These points are illustrated by our studies using ex vivo TIL analysis in our PD-1 and TIM-3 programs, as described above.

14

Collaborations

Merck

In December 2014, we entered into a collaboration with Merck Sharp & Dohme Corp., or Merck. Pursuant to our study agreement with Merck, we are conducting a specified research program using our platform technology to identify functional response of single cell types in colorectal cancer in the presence or absence of Merck’s proprietary immunomodulatory receptor (IMR) modulators. In February 2016, we and Merck subsequently amended the work plan under the study agreement to include non-small cell lung cancer tissue samples.

In this collaboration, Merck is reimbursing us for the cost of performing the work specified in the agreement, for up to a specified number of full time employees, at an agreed annual rate. In addition, Merck will make certain milestone payments to us upon the completion of specified objectives set forth in the Merck agreement and related work plan. In September 2015, we announced the achievement of the first milestone. Merck retains ownership of the results generated from the studies on the IMR modulators identified by Merck, and we retain a royalty-free, non-exclusive, non-sublicensable license to use the study results for our own internal research purposes.

National Cancer Institute (NCI)

We previously completed a Phase I research contract with the NCI to analyze B- and T-cells (at the single cell level) in parallel with cell surface markers in both diseased and healthy intestinal tissue samples from patients with colorectal cancer. This work demonstrated our capabilities in measuring samples with limited numbers of cells, such as pinch biopsies. Our final report was accepted in November 2013.

The Phase I contract provided for funding the development of assays and capabilities that our scientific team continues to use in our internal programs. An example of this is profiling human mucosal tissues, which we believe will be highly relevant in cancer immunotherapy development and, potentially, in autoimmune and inflammatory diseases as well. These capabilities may provide the basis for other collaborations.

In September 2014, we were awarded a Phase II Small Business Innovation Research contract from the NCI for up to $999,967 over two years. As part of this Phase II contract, we are developing and deploying an automated prototype system for human tissue immuno-oncology profiling at the Ragon Institute of Massachusetts General Hospital, MIT and Harvard University and also at Memorial Sloan Kettering Cancer Center. At the Ragon Institute, we are collaborating with the laboratory of Douglas S. Kwon, M.D., Ph.D., whose research focuses on the immunology of mucosal surfaces and tissues, which are home to between sixty and ninety percent of the human body’s lymphocytes. At Sloan-Kettering, we are collaborating with the laboratory of Jedd D. Wolchok, M.D., Ph.D., who played an important role in the clinical development of Yervoy® (ipilimumab) and Opdivo® (nivolumab).

M.D. Anderson

In January 2016, we entered into a collaborative research and development agreement with The University of Texas M.D. Anderson Cancer Center, or MDACC. Under this agreement, we and MDACC plan to collaborate on the discovery and development of novel monoclonal antibodies against selected targets in immuno-oncology, utilizing our antibody discovery and immune profiling platform and MDACC’s preclinical and development expertise and infrastructure.

We and MDACC will share the costs of research and development activities necessary to take development candidates through successful completion of a Phase I clinical trial. The agreement provides for a structure whereby we and MDACC are each granted the right to receive a percentage of the net income from product sales or any payments associated with licensing or otherwise partnering a program with a third party.

The agreement contemplates that, in conjunction with the research and development activities, either we or MDACC will seek to enter into licensing transactions with third parties to engage in development or commercialization activities involving the identified antibodies, subject to approval by the other party. We and MDACC also have the option of continuing collaboration efforts into advanced development and commercialization, with one party taking the lead, and both parties sharing costs equally.

15

We and MDACC each has the right to opt out and cease further funding of future collaboration activities with respect to a collaboration antibody at specified stages, provided that a party which elects to opt out may continue to be responsible for certain expenses incurred prior to such election. A party that exercises its opt out right will also have its percentage of net income from product sales or payments associated with such collaboration antibody program adjusted in accordance with the terms of the agreement.

Intellectual Property

From MIT, we have in-licensed a patent portfolio (which includes patents owned by Harvard or co-owned by MIT and The Whitehead Institute, or MIT and Massachusetts General Hospital) that we refer to as the Platform Portfolio. It broadly covers our platform technology in the United States, and also covers certain aspects of it in certain foreign countries. The license, referred to as the Platform License, gives us exclusive worldwide rights under patents and patent applications covering the platform technology. The Platform License provides us with worldwide rights under the Platform Portfolio, in all fields of use. This enables us to use the platform in drug discovery and development (including partnered programs), and the right to commercialize its application for purposes such as diagnostics. The Platform License obligates us to achieve certain diligence milestones within certain time frames.

The Platform Portfolio protects our platform technology through eight issued U.S. patents that cover various aspects of the platform technology, including the microarray apparatus, microarrays with micro-channels, a method of capturing products secreted from single cells, a method of making a microarray of secreted antibodies, microarray methods for screening antibodies, single cell cytotoxicity assays, methods of immuno-profiling, and methods of performing RT-PCR from single cells. There are also corresponding issued patents or pending applications in certain foreign jurisdictions. The basic patent coverage of our platform technology in the United States will expire in 2027. The U.S. patent on microarrays with micro-channels will expire in 2029.

We have begun to build our own patent portfolio to protect our novel antibodies and other inventions. In December 2014, we filed two provisional patent applications of which we are the sole owners. One application covers a method of using our platform for rapid identification of compounds that elicit specific, desired cellular response profiles. The second application covers novel PD-1 antibodies (and their therapeutic use), which were identified using our platform, and tested in cell-based assays. The application covers 26 individual heavy chain variable sequences and 27 individual light chain variable sequences, as well as matched pairs of heavy and light chains. Both of these provisional applications were updated and re-filed as non-provisional applications in December 2015. In addition, in March 2016 we filed a new provisional patent application that covers our TIM-3 antibodies. As we discover additional antibodies against selected therapeutics targets, we plan to file patent applications covering those antibodies and their therapeutic uses. We also plan to file patent applications that cover novel research tools and methods that we discover, and any improvements that we make in the platform technology. For example, in March 2016, we filed a new patent application covering certain small accessories that we designed to facilitate processing and imaging of microwell arrays. In addition to filing and prosecuting patent applications in the United States, we plan to file counterpart applications in Australia, Canada, Europe, Japan, and additional jurisdictions, in cases where we think such filings are likely to be cost-effective and important to our business objectives.

For some aspects of our proprietary technology, trade secret protection is more suitable than patent protection. For example, certain proprietary bioinformatics software, methods and databases, which enable us to store, analyze and interpret the large volume of data generated from our platform technology, are protected as trade secrets.

Many pharmaceutical companies, biotechnology companies and academic institutions are competing with us in the field of immunotherapy and oncology, and they have obtained, or may obtain in the future, patents potentially relevant to our business. In order to identify and mitigate the risk of third party intellectual property conflicts, we conduct freedom-to-operate studies, and where appropriate, we obtain opinion of counsel, as an ongoing part of our business operations. We are aware of certain third party patents that contain broad claims potentially relevant to certain therapeutic uses of our PD-1 antibodies. We also are aware of certain third party patents that contain claims potentially relevant to other antibodies (against other targets) in our pipeline, and certain uses of those antibodies. Based on our analyses, if any claims in these patents were asserted against us, we do not believe our activities would be found to infringe any valid claim.

16

From time to time, we may find it necessary or prudent to obtain licenses from third party patent owners. Where licenses are available at reasonable cost, such licenses are considered a normal cost of doing business. In other instances, we may use the results of our freedom-to-operate studies to guide our early stage research away from areas where we are likely to encounter obstacles in the form of third party intellectual property. We strive to identify potential third party intellectual property issues in the early stages of research in our programs in order to minimize the cost and disruption of resolving such issues. In some cases, otherwise potentially relevant third party patents will expire before marketing approval by the U.S. Food and Drug Administration is likely to have been granted. In such instances, under U.S. law, our pre-clinical and clinical activities are exempt from claims of patent infringement. This exemption is sometimes called the “safe harbor” provision of U.S. law.

The Merger and Related Transactions

Overview

We were incorporated in Nevada as Cerulean Group, Inc. on February 27, 2012, and converted to a Delaware corporation on July 10, 2014. Our original business was to develop and operate a website for self-travelers and backpackers that would allow a person with access to the Internet to build an itinerary and plan a trip. Prior to the Merger (as defined below), our Board of Directors determined to discontinue operations in this area to seek a new business opportunity. As a result of the Merger, we acquired the business of Enumeral and changed our name to Enumeral Biomedical Holdings, Inc.

Our authorized capital stock currently consists of 300,000,000 shares of common stock, par value $0.001 (the “Common Stock”), and 10,000,000 shares of “blank check” preferred stock, par value $0.001. Our Common Stock is quoted on the OTC Markets (OTCQB) under the symbol “ENUM,” which changed from “CEUL” on July 21, 2014.

Enumeral was incorporated on December 11, 2009 under the laws of the State of Delaware.

On July 25, 2014, we completed a 4.62-for-1 forward split of our Common Stock in the form of a dividend, with the result that the 6,190,000 shares of Common Stock outstanding immediately prior to the stock split became 28,597,804 shares of Common Stock outstanding immediately thereafter. All share and per share numbers in this Annual Report on Form 10-K relating to our Common Stock have been adjusted to give effect to this stock split, unless otherwise stated.

On July 31, 2014 (the “Closing Date”), our wholly owned subsidiary, Enumeral Acquisition Corp. (“Acquisition Sub”) merged with and into Enumeral (the “Merger”). Enumeral was the surviving corporation in the Merger and became our wholly owned subsidiary. All of the outstanding Enumeral stock was converted into shares of our Common Stock, as described in more detail below.

Upon the closing of the Merger and under the terms of a split-off agreement and a general release agreement (the “Split-Off Agreement”), we transferred all of our pre-Merger operating assets and liabilities to our wholly-owned special-purpose subsidiary, Cerulean Operating Corp. (“Split-Off Subsidiary”). Thereafter, pursuant to the Split-Off Agreement, we transferred all of the outstanding shares of capital stock of Split-Off Subsidiary to our pre-Merger majority stockholder, and our former sole officer and director (the “Split-Off”), in consideration of and in exchange for (i) the surrender and cancellation of an aggregate of 23,100,000 shares of our Common Stock held by such stockholder (which were cancelled and resumed the status of authorized but unissued shares of our Common Stock) and (ii) certain representations, covenants and indemnities.

As a result of the Merger and transactions effected pursuant to the Split-Off Agreement, we discontinued our pre-Merger business and acquired the business of Enumeral, and will continue the existing business operations of Enumeral as a publicly-traded company under the name Enumeral Biomedical Holdings, Inc. On the Closing Date, we changed our fiscal year from a fiscal year ending on October 31 of each year to one ending on December 31 of each year, which is the fiscal year end of Enumeral.

Also on the Closing Date, we closed a private placement offering (the “PPO”) of 21,549,510 Units of our securities, at a purchase price of $1.00 per Unit, each Unit consisting of one share of our Common Stock and a warrant to purchase one share of Common Stock at an exercise price of $2.00 per share with a term of five years (the “PPO Warrants”). Additional information concerning the PPO and PPO Warrants is presented below under “—The Merger and Related Transactions—the PPO” in this Item 1.

17

Merger Agreement

On the Closing Date, Enumeral Biomedical, Acquisition Sub and Enumeral entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”), which closed on the same date. Pursuant to the terms of the Merger Agreement, Acquisition Sub merged with and into Enumeral, which was the surviving corporation and thus became our wholly-owned subsidiary.

Pursuant to the Merger, we acquired the business of Enumeral to discover and develop novel therapeutics known as immunomodulators or immunotherapies that help the human immune system attack diseased cells. (See “Description of Business” below.)

At the closing of the Merger (a) each share of Enumeral’s common stock issued and outstanding immediately prior to the closing of the Merger was converted into 1.102121 shares of our Common Stock, (b) each share of Enumeral’s Series A Preferred Stock issued and outstanding immediately prior to the closing of the Merger was converted into 1.598075 shares of our Common Stock, (c) each share of Enumeral’s Series A-1 Preferred Stock issued and outstanding immediately prior to the closing of the Merger was converted into 1.790947 shares of our Common Stock, (d) each share of Enumeral’s Series A-2 Preferred Stock issued and outstanding immediately prior to the closing of the Merger was converted into 1.997594 shares of our Common Stock, (e) each share of Enumeral’s Series B Preferred Stock issued and outstanding immediately prior to the closing of the Merger was converted into 2.927509 shares of our Common Stock, and (f) a convertible note was converted into 3,230,869 shares of our Common Stock. As a result, an aggregate of 22,700,645 shares of our Common Stock were issued to the holders of Enumeral’s stock.

In addition, pursuant to the Merger Agreement:

| · | warrants to purchase 694,443 shares of Enumeral’s common stock issued and outstanding immediately prior to the closing of the Merger were converted into warrants to purchase shares of our Common Stock at a conversion ratio of 1.102121 for one; |

| · | warrants to purchase 41,659 shares of Enumeral’s Series A Preferred Stock issued and outstanding immediately prior to the closing of the Merger were converted into warrants to purchase shares of our Common Stock at a conversion ratio of 1.598075 for one; |

| · | warrants to purchase 144,140 shares of Enumeral’s Series B Preferred Stock issued and outstanding immediately prior to the closing of the Merger were converted into warrants to purchase shares of our Common Stock at a conversion ratio of 2.927509 for one; and |

| · | options to purchase 948,567 shares of Enumeral’s common stock issued and outstanding immediately prior to the closing of the Merger were converted into options to purchase shares of our Common Stock at a conversion ratio of 1.102121 for one. |

As a result, warrants to purchase an aggregate of 1,253,899 shares of our Common Stock and options to purchase an aggregate of 1,045,419 shares of our Common Stock were issued in connection with the Merger.

The Merger Agreement provided certain anti-dilution protection to our Common Stock holders immediately prior to the Merger (after giving effect to the Split-Off), in the event that the aggregate number of Units sold in the PPO after the final closing thereof were to exceed 15,000,000. Accordingly, based on the final amount of gross proceeds raised in the PPO, we issued 1,690,658 additional shares of Common Stock to our Common Stock holders immediately prior to the Merger.

18

The Merger Agreement contained customary representations and warranties and pre- and post-closing covenants of each party and customary closing conditions. Breaches of the representations and warranties were subject to indemnification provisions. Each of the stockholders of Enumeral as of the date of the Merger initially received in the Merger 98% of the shares to which each such stockholder is entitled, with the remaining 2% of such shares held in escrow for 18 months to satisfy post-closing claims for indemnification by us (“Indemnity Shares”). The indemnification period expired on January 31, 2016 without any claims being made and all of the Indemnity Shares were distributed to the pre-Merger stockholders of Enumeral on a pro rata basis. The Merger Agreement also contained a provision providing for a post-Merger share adjustment as a means for which claims for indemnity could have been made by the pre-Merger stockholders of Enumeral. Pursuant to this provision, up to 500,000 additional shares (“R&W Shares”) of Common Stock could have been issued to the pre-Merger stockholders of Enumeral, pro rata, during the 18-month period following the Merger for breaches of representations and warranties by us. The indemnification period expired on January 31, 2016 with no claims being made. The value of the Indemnity Shares and the R&W Shares issued pursuant to the foregoing adjustment mechanisms was fixed at $1.00 per share. The foregoing mechanisms were our exclusive remedies on one hand and the pre-Merger stockholders of Enumeral on the other hand for satisfying indemnification claims under the Merger Agreement.

The Merger was treated as a recapitalization for financial accounting purposes. Enumeral was considered the acquirer for accounting purposes, and our historical financial statements prior to the Merger have been replaced with the historical financial statements of Enumeral prior to the Merger in all filings with the SEC subsequent to the Merger.

The Merger is intended to be treated as a tax-free reorganization under Section 368 of the Internal Revenue Code of 1986, as amended.

We also agreed not to register under the Securities Act of 1933, as amended (the “Securities Act”), the resale of the shares of our Common Stock received in the Merger by our officers, directors and key employees and holders of 10% or more of our Common Stock for a period of one year following the closing of the Merger.

The Merger Agreement is filed as Exhibit 2.1 to this Annual Report on Form 10-K. All descriptions of the Merger Agreement herein are qualified in their entirety by reference to the text thereof filed as an exhibit hereto, which is incorporated herein by reference.

Split-Off

Upon the closing of the Merger and under the terms of the Split-Off Agreement and a general release agreement, we transferred all of our pre-Merger operating assets and liabilities to the Split-Off Subsidiary. Thereafter, pursuant to the Split-Off Agreement, we transferred all of the outstanding shares of capital stock of Split-Off Subsidiary to Olesya Didenko, our pre-Merger majority stockholder, and our former sole officer and director, in consideration of and in exchange for (i) the surrender and cancellation of an aggregate of 23,100,000 shares of our Common Stock held by Olesya Didenko (which were cancelled and will resume the status of authorized but unissued shares of our Common Stock) and (ii) certain representations, covenants and indemnities. All descriptions of the Split-Off agreement and the general release agreement herein are qualified in their entirety by reference to the text thereof filed as Exhibits 10.1 and 10.2 hereto, which are incorporated herein by reference.

The PPO

Concurrently with the closing of the Merger and in contemplation of the Merger, we closed our PPO in which we sold 21,549,510 Units of our securities, at a purchase price of $1.00 per Unit, each Unit consisting of one share of the our Common Stock and PPO Warrant to purchase one share of Common Stock at an exercise price of $2.00 per share and with a term of five years. The aggregate gross proceeds of the PPO were $21,549,510 (before deducting placement agent fees and expenses of approximately $3,294,000).

19

The investors in the PPO (for so long as they hold shares of our common stock) have anti-dilution protection on the shares of Common Stock included in Units purchased in the PPO and not subsequently transferred or sold (other than transfers to trusts or affiliates of such investors for the purpose of estate planning) in the event that within two years after the closing of the PPO we issue Common Stock or securities convertible into or exercisable for shares of Common Stock at a price lower than the Unit purchase price. The anti-dilution protection provisions are subject to exceptions for certain issuances, including but not limited to (a) shares of Common Stock issued in an underwritten public offering, (b) issuances of awards under our 2014 Equity Incentive Plan and (c) other exempt issuances, as set forth in the PPO Subscription Agreement.

In addition, PPO Warrants not subsequently transferred or sold (other than transfers to trusts or affiliates of such investors for the purpose of estate planning) have anti-dilution protection in the event that prior to the warrant expiration date we issue Common Stock or securities convertible into or exercisable for shares of Common Stock at a price lower than the warrant exercise price, subject to exceptions for certain issuances, including but not limited to (a) shares of Common Stock issued in an underwritten public offering, (b) issuances of awards under our 2014 Equity Incentive Plan and (c) other exempt issuances, as set forth in the PPO Warrants.

In connection with the PPO, we agreed to pay our placement agents, EDI Financial, Inc. and Katalyst Securities LLC (the “Placement Agents”), a commission equal to 10% of the gross proceeds raised from investors in the PPO. In addition, the Placement Agents collectively received warrants to purchase 10% of the number of shares of Common Stock included in the Units sold in the PPO, provided, however, that the Placement Agents were not entitled to any warrants on the sale of Units in excess of 20,000,000, with a term of five (5) years and an exercise price of $1.00 per share (the “Agent Warrants”). Any sub-agent of the Placement Agents or certain individuals identified by us that introduced investors to the PPO were entitled to share in the cash fees and warrants attributable to those investors as described above. We also agreed to pay to the Placement Agents a cash fee on the amount that any person or entity contacted by the Placement Agents, in connection with the Offering, invested in us at any time prior to the date that was eighteen (18) months after the PPO. No such fee was earned or paid.

As a result of the foregoing, the Placement Agents and their respective sub-agents were collectively paid an aggregate commission of $2,154,951 and were issued Agent Warrants to purchase an aggregate of 2,000,000 shares of our Common Stock. We were also required to reimburse the Placement Agents up to $30,000 of legal expenses incurred in connection with the PPO, in the aggregate.

We agreed to indemnify the Placement Agents and their respective sub-agents to the fullest extent permitted by law, against certain liabilities that may be incurred in connection with the PPO, including certain civil liabilities under the Securities Act, and, where such indemnification is not available, to contribute to the payments the Placement Agents and their respective sub-agents may be required to make in respect of such liabilities.

All descriptions of the PPO Warrants and the Agent Warrants herein are qualified in their entirety by reference to the text of the forms of such documents filed as Exhibits 10.5 and 10.8 hereto, which are incorporated herein by reference.

Registration Rights

In connection with the PPO, we entered into a Registration Rights Agreement, pursuant to which we have agreed to promptly, but no later than 90 calendar days from the final closing of the PPO, file a registration statement with the SEC (the “Registration Statement”) covering (a) the shares of Common Stock issued in the PPO, (b) the shares of Common Stock issuable upon exercise of the PPO Warrants, (c) the shares of Common Stock underlying the Agent Warrants, (d) up to 50% of shares of Common Stock issued in the Merger in exchange for the preferred and common stock held by the former stockholders of Enumeral prior to the Merger (the “Enumeral Stockholders”) who are not parties to a lock-up agreement (provided that any registered Enumeral Stockholder that purchased Units in the PPO having a purchase price equal to at least 50% of the total amount invested by such holder in Enumeral stock prior to the PPO, the Registration Statement will include 100% of shares of Common Stock issued in the Merger to an Enumeral Stockholder in exchange for Enumeral’s preferred and common stock held by such person) and (e) the True-Up Shares, if any (clauses (a) through (e), collectively, the “Registrable Shares”). We agreed to use commercially reasonable efforts to ensure that such Registration Statement is declared effective within 180 calendar days of filing with the SEC. The Registration Statement was filed on September 19, 2014 and declared effective on November 10, 2014. If we had been late in filing the Registration Statement or if the Registration Statement had not been declared effective within 180 days of filing with the SEC, we would have been required to pay the holders of Registrable Shares that have not been so registered, liquidated damages at a rate equal to 1.00% of the Offering Price per share for each full month that (i) we were late in filing the Registration Statement, (ii) the Registration Statement was late in being declared effective by the SEC or (iii) after the Registration Statement is declared effective, the Registration Statement ceases for any reason to remain continuously effective or the holders of the Registrable Shares are otherwise not permitted to utilize the prospectus therein to resell the Registrable Securities for a period of more than 30 consecutive trading days; provided, however, that in no event shall the aggregate of any such liquidated damages exceed 8% of the PPO offering price per share. No liquidated damages will accrue and accumulate with respect to (a) any Registrable Shares removed from the Registration Statement in response to a comment from the staff of the SEC limiting the number of shares of Common Stock which may be included in the Registration Statement (a “Cutback Comment”), or (b) after the shares may be resold under Rule 144 under the Securities Act or another exemption from registration under the Securities Act.

20

We are required to use commercially reasonable efforts to keep the Registration Statement “evergreen” for two years from the date it is declared effective by the SEC (i.e., November 10, 2016) or until Rule 144 is available to the holders of Registrable Shares who are not and have not been our affiliates with respect to all of their registrable shares, whichever is earlier.

Prior to the Merger, we were a “shell company” as defined in Rule 12b-2 under the Exchange Act. Pursuant to Rule 144(i), securities issued by a current or former shell company that otherwise meet the holding period and other requirements of Rule 144 nevertheless cannot be sold in reliance on Rule 144 until twelve (12) months after the company (a) is no longer a shell company; and (b) has filed current “Form 10 information” (as defined in Rule 144(i)) with the SEC reflecting that it is no longer a shell company, and provided that at the time of a proposed sale pursuant to Rule 144, the company is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act and has filed all reports and other materials required to be filed by Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding twelve (12) months (or for such shorter period that the issuer was required to file such reports and materials), other than Form 8-K reports. As a result, the restrictive legends on certificates for our Common Stock and Warrants cannot be removed (a) except in connection with an actual sale meeting the foregoing requirements or (b) pursuant to an effective registration statement.

The holders of Registrable Shares (including any shares of Common Stock removed from the Registration Statement as a result of a Cutback Comment) and the holders of our common stock prior to the Merger (but not holders of the shares issued to the stockholders of Enumeral in consideration for the Merger) will have two “piggyback” registration rights for such shares with respect to any registration statement filed by us following the effectiveness of the Registration Statement that would permit the inclusion of such shares, subject to customary cut-backs on a pro rata basis if the underwriter or we determine that marketing factors require a limitation on the number of shares of stock or other securities to be underwritten.

We will pay all expenses in connection with any registration obligation provided in the Registration Rights Agreement, including, without limitation, all registration, filing, stock exchange fees, printing expenses, all fees and expenses of complying with applicable securities laws, and the fees and disbursements of our counsel and of our independent accountants. Each investor will be responsible for its own sales commissions, if any, transfer taxes and the expenses of any attorney or other advisor that such investor decides to employ.

All descriptions of the Registration Rights Agreement herein are qualified in their entirety by reference to the text of the form of such document filed as Exhibit 10.9 hereto, which is incorporated herein by reference.

Composition of the Board; Voting Agreement

In connection with the Merger, the parties agreed that our Board of Directors will consist of seven members, as follows:

| (i) | six directors nominated by Enumeral, who shall be composed of |

| (a) | John J. Rydzewski, Arthur H. Tinkelenberg, Allan P. Rothstein and Barry Buckland, |

| (b) | one of whom shall be a director nominated by Harris & Harris Group, Inc. (the “H&H” Director), who is reasonably acceptable to us and who initially was Daniel Wolfe, Ph.D., until Dr.Wolfe’s resignation from the board in July 2015 (the appointment of a new director to replace Dr.Wolfe is detailed below); provided, that the right of H&H shall cease at such time as the number of shares of Common Stock owned directly by H&H is less than five percent of the total number of shares of Common Stock outstanding, and |

| (c) | one additional person to be designated by the directors specified in clauses (a) and (b) above, who is initially Robert L. Van Nostrand (who was appointed on December 1, 2014), and |

| (ii) | one independent director who shall be nominated by Montrose Capital Limited and the Placement Agents, who is reasonably acceptable to us and who is originally Paul Sekhri (who was appointed on December 16, 2014). |

21

In connection with Dr.Wolfe’s resignation from the board on July 30, 2015, the board appointed Robert J. Easton to serve as a director.

In connection with the Merger, certain of our stockholders (holding a majority of our common stock), including all of the investors in the PPO, all of our pre-Merger stockholders and certain of the Enumeral Stockholders (including all officers and directors and certain principal stockholders), entered into a Voting Agreement in which they have agreed to vote their Enumeral Biomedical stock to maintain the composition of our Board of Directors as described above.

The Voting Agreement will terminate two years from the date of closing of the Merger. All descriptions of the Voting Agreement herein are qualified in their entirety by reference to the text thereof filed as Exhibit 10.10 hereto, which is incorporated herein by reference.

Accounting Treatment; Change of Control

The Merger was accounted for as a “reverse merger,” and Enumeral is deemed to be the acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that are reflected in the consolidated financial statements prior to the Merger are those of Enumeral and are recorded at the historical cost basis of Enumeral, and the consolidated financial statements after completion of the Merger will include the assets and liabilities of Enumeral, historical operations of Enumeral and operations our company and our subsidiaries from the closing date of the Merger. As a result of the issuance of the shares of our Common Stock pursuant to the Merger, a change in control of Enumeral Biomedical occurred as of the date of consummation of the Merger. Except as described in this Annual Report on Form 10-K, no arrangements or understandings exist among present or former controlling stockholders with respect to the election of members of our Board of Directors and, to our knowledge, no other arrangements exist that might result in a change of control of Enumeral Biomedical.