As filed with the Securities and Exchange Commission on May 4, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Tenon Medical, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3841 | 45-5574718 | ||

|

(State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

104 Cooper Court

Los Gatos, CA 95032

(408) 649-5760

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Steven M. Foster

Chief Executive Officer and President

Tenon Medical, Inc.

104 Cooper Court

Los Gatos, CA 95032

(408) 649-5760

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Ross D. Carmel, Esq. |

| Jeffrey P. Wofford, Esq. |

| Carmel, Milazzo & Feil LLP |

| 55 West 39th Street, 4th Floor |

| New York, New York 10018 |

| Telephone: (212) 658-0458 |

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, please check the following box. x

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, please check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |

| Non-accelerated filer | x | Smaller reporting company | x | |

| Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATION OF THE FILING

This shelf registration statement will provide our company with the flexibility to issue and sell securities if and when deemed appropriate and in the best interest of our stockholders. We may or may not issue and sell any securities under this registration statement. Filing this registration statement merely gives us flexibility to issue registered securities if and when we deem doing so is appropriate and in the best interest of our stockholders, without any unnecessary delays. This registration statement helps us maintain an optimal state of readiness at all times.

This registration statement contains two prospectuses:

| · | a base prospectus that covers the potential offering, issuance, and sale from time to time of our common stock, preferred stock, warrants, debt securities, and units in one or more offerings with a total value of up to $50,000,000; and |

| · | a sales agreement prospectus covering the potential offering, issuance, and sale from time to time of shares of our common stock having an aggregate gross sales price of up to $6,700,000 pursuant to a equity distribution agreement with Maxim Group LLC. |

The base prospectus immediately follows this explanatory note. The specific terms of any securities to be offered pursuant to the base prospectus will be specified in a prospectus supplement to the base prospectus. The equity distribution agreement prospectus, which specifies the terms of our common stock to be sold under the equity distribution agreement, immediately follows the base prospectus. The common stock that may be offered, issued, and sold under the equity distribution agreement prospectus is included in the $50,000,000 of securities that may be offered, issued, and sold under the base prospectus. Upon termination of the equity distribution agreement, any portion of the $6,700,000 included in the sales agreement prospectus that is not sold pursuant to the sales agreement will be available for sale in other offerings pursuant to the base prospectus.

| 2 |

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated May 4, 2023

PRELIMINARY PROSPECTUS

$50,000,000

Tenon Medical, Inc.

Common Stock

Preferred Stock

Warrants

Debt Securities

Rights

Units

This prospectus will allow us to issue, from time to time at prices and on terms to be determined at or prior to the time of the offering, up to $50,000,000 of any combination of the securities described in this prospectus, either individually or in units. We may also offer common stock or preferred stock upon conversion of or exchange for the debt securities; common stock upon conversion of or exchange for the preferred stock; common stock, preferred stock or debt securities upon the exercise of warrants, rights or performance of purchase contracts; or any combination of these securities upon the performance of purchase contracts.

This prospectus describes the general terms of these securities and the general manner in which these securities will be offered. We will provide you with the specific terms of any offering in one or more supplements to this prospectus. The prospectus supplements will also describe the specific manner in which these securities will be offered and may also supplement, update or amend information contained in this document. You should read this prospectus and any prospectus supplement, as well as any documents incorporated by reference into this prospectus or any prospectus supplement, carefully before you invest.

Our securities may be sold directly by us to you, through agents designated from time to time or to or through underwriters or dealers. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus and in the applicable prospectus supplement. If any underwriters or agents are involved in the sale of our securities with respect to which this prospectus is being delivered, the names of such underwriters or agents and any applicable fees, commissions or discounts and over-allotment options will be set forth in a prospectus supplement. The price to the public of such securities and the net proceeds that we expect to receive from such sale will also be set forth in a prospectus supplement.

| 3 |

Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our securities in public primary offerings with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75.0 million. As of May 4, 2023, the aggregate market value of our outstanding common stock held by non- affiliates, or public float, was approximately $20,208,990, based on 7,742,908 shares of our outstanding common stock that were held by non-affiliates on such date and a price of $2.61 per share, which was the price at which our common stock was last sold on the Nasdaq Capital Market on March 16, 2023, calculated in accordance with General Instruction I.B.6 of Form S-3. We have not offered any securities pursuant to General Instruction I.B.6 of Form S-3 during the twelve-month period that ends on and includes the date hereof. Our common stock is listed on The Nasdaq Capital Market under the symbol “TNON.”

On May 3, 2023, the last reported sale price of our common stock was $1.84 per share. The applicable prospectus supplement will contain information, where applicable, as to any other listing, if any, on The Nasdaq Capital Market or any securities market or other securities exchange of the securities covered by the prospectus supplement. Prospective purchasers of our securities are urged to obtain current information as to the market prices of our securities, where applicable.

Investing in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks that we have described on page 6 of this prospectus under the caption “Risk Factors.” We may include specific risk factors in supplements to this prospectus under the caption “Risk Factors.” This prospectus may not be used to sell our securities unless accompanied by a prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Currently, we are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended, and are subject to reduced public company reporting requirements. Please read “Implications of Being an Emerging Growth Company.”

You should read carefully and consider the “Risk Factors” referenced on page 6 of this prospectus, as well as those contained in the applicable prospectus supplement and in the documents that are incorporated by reference herein or the applicable prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May __, 2023.

| 4 |

TABLE OF CONTENTS

| 5 |

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”), using a “shelf” registration process for the delayed offering and sale of securities pursuant to Rule 415 under the Securities Act. Under the shelf process, we may, from time to time, sell any of the securities described in this prospectus in one or more offerings and selling security holders may offer such securities owned by them from time to time.

This prospectus provides you with a general description of the securities we may offer. Each time we or selling security holders sell securities, we will provide one or more prospectus supplements that will contain specific information about the terms of the offering. The prospectus supplement may also add, update, or change information contained in this prospectus. You should read both this prospectus and the accompanying prospectus supplement together with the additional information described under the heading “Where You Can Find More Information.”

We have not authorized anyone to provide you with any additional information. This prospectus and any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities described in the accompanying prospectus supplement or an offer to sell or the solicitation of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that the information appearing in this prospectus, any prospectus supplement, the documents incorporated by reference, and any related free writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations, and prospects may have changed materially since those dates.

As used in this prospectus, unless the context otherwise requires, the terms “we,” “us,” “our,” and “our company” mean, collectively, Tenon Medical, Inc. and its subsidiaries.

| 6 |

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

This prospectus, the documents incorporated by reference herein and therein, and other written and oral statements we make from time to time contain certain “forward-looking” statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). You can identify these forward-looking statements by the fact they use words such as “could,” “expect,” “anticipate,” “estimate,” “target,” “may,” “project,” “guidance,” “intend,” “plan,” “believe,” “will,” “potential,” “opportunity,” “future,” and other words and terms of similar meaning and expression in connection with any discussion of future operating or financial performance. You can also identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. Such forward-looking statements are based on current expectations and involve inherent risks and uncertainties, including factors that could delay, divert, or change any of them, and could cause actual outcomes to differ materially from current expectations. These statements are likely to relate to, among other things, our business strategy, our research and development, our product development efforts, our ability to commercialize our product candidates, the activities of our licensees, our prospects for initiating partnerships or collaborations, the timing of the introduction of products, the effect of new accounting pronouncements, uncertainty regarding our future operating results and our profitability, anticipated sources of funds as well as our plans, objectives, expectations, and intentions.

We have included more detailed descriptions of these risks and uncertainties and other risks and uncertainties applicable to our business that we believe could cause actual results to differ materially from any forward-looking statement in the “Risk Factors” sections of this prospectus and the documents incorporated by reference herein including, but not limited to, the risk factors incorporated by reference from our filings with the SEC. We encourage you to read those descriptions carefully. Although we believe we have been prudent in our plans and assumptions, no assurance can be given that any goal or plan set forth in forward-looking statements can be achieved. We caution investors not to place significant reliance on forward-looking statements; such statements need to be evaluated in light of all the information contained and incorporated by reference in this prospectus. Furthermore, the statements speak only as of the date of each document, and we undertake no obligation to update or revise these statements.

This summary highlights selected information that is presented in greater detail elsewhere, or incorporated by reference, in this prospectus. It does not contain all of the information that may be important to you and your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including the matters set forth in the section titled “Risk Factors” and the financial statements and related notes and other information that we incorporate by reference herein, including our Annual Report on Form 10-K

Introduction

Tenon Medical, Inc. (the “Company”), was incorporated in the State of Delaware on June 19, 2012 and was headquartered in San Ramon, California until June 2021 when it relocated to Los Gatos, California. The Company is a medical device company that offers a novel, less invasive approach to the sacroiliac joint using a single, robust, titanium implant for treatment of the most common types of sacroiliac joint (the “SI-Joint”) disorders that cause lower back pain. The system features the CATAMARAN™ Fixation Device which passes through both the axial and sagittal planes of the ilium and sacrum, stabilizing and transfixing the SI joint along its longitudinal axis. The angle and trajectory of the Catamaran surgical approach is also designed to provide a pathway away from critical neural and vascular structures and into the strongest cortical bone. The Company received U.S. Food and Drug Administration (“FDA”) clearance in 2018 for The CATAMARANTM SI-Joint Fusion System (“The CATAMARAN System”). The Company commercially launched The CATAMARAN System nationally in October 2022 at the North American Spine Society meeting held in Chicago. Currently, the Company’s only commercial focus is the US market.

The Opportunity

We estimate that over 30 million American adults have chronic lower back pain.

Published clinical studies have shown that 15% to 30% of all chronic lower back pain is associated with the SI-Joint. For patients whose chronic lower back pain stems from the Sacroiliac Joint (“SI-Joint”), our experience in both clinical trials and commercial settings indicates The CATAMARAN System could be beneficial for patients who are properly diagnosed and screened for surgery by trained healthcare providers.

| 7 |

In 2019, approximately 475,000 patients in the United States were estimated to have received an aesthetic injection to temporarily alleviate pain emanating from the SI-Joint and/or to diagnose SI-Joint pain. Additionally, several non-surgical technologies have been introduced in the past 10 years to address patients who do not respond to injection therapy, including systemic oral medications and opioids.

To date, the penetration of a surgical solution for this market has been relatively low (5-7%). We believe this is due to complex surgical approaches and suboptimal implant design of existing options. The penetration of this market with an optimized surgical solution is Tenon’s focus.

We believe the SI-Joint is the last major joint to be successfully addressed by the orthopedic implant industry. Studies have shown that disability resulting from disease of the SI-Joint is comparable to the disability associated with a number of other serious orthopedic conditions, such as knee and hip arthritis and degenerative disc disease, each of which has surgical solutions where an implant is used, and a multi-billion-dollar market exists.

The SI-Joint

The SI-Joint is a strong weight bearing synovial joint situated between the lumbar spine and the pelvis and is aligned along the longitudinal load bearing axis of the human spine when in an upright posture. It functions as a force transfer conduit where it transfers axial loads bi-directionally from the spine to the pelvis and lower extremities and allows forces to be transmitted from the extremities to the spine. It also provides load sharing between the hip and spine to contribute towards attenuation of impact shock and stress from activities of daily living.

The SI-Joint is a relatively immobile joint that connects the sacrum (the spinal segment that is attached to the base of the lumbar spine at the L5 vertebra) and the ilium of the pelvis. Each SI-Joint is approximately 2mm wide and irregularly shaped.

Motion of the SI-Joint features vertical shear and rotation. Although the rotational forces about the SI-Joint are relatively low, repetitive motions created by daily activities such as walking, jogging, twisting at the hips, and jumping can increase the stresses on the SI-Joint. If the SI-Joint is compromised through injury or degeneration, the load bearing and motion restraints from the surrounding anatomical structures of the SI-Joint will be compromised resulting in abnormal stress transfers across the joint to these structures, thereby further augmenting the degenerative cascade of the SI-Joint. Eventual pain and cessation of an individual’s normal activities due to a painful and unstable SI-Joint have led to an increase in the recent development of SI-Joint stabilization devices.

| 8 |

Non-Surgical Treatment of Sacroiliac Joint Disease

Several non-surgical treatments exist for suspected sacroiliac joint pain. These conservative steps often provide desired relief for the patient. Non-surgical treatments include:

| · | Drug Therapy |

: including opiates and non-steroidal anti-inflammatory medications.

| · | Physical Therapy |

: which can involve exercises as well as massage.

| · | Intra-Articular Injections of Steroid Medications |

: which are typically performed by physicians who specialize in pain treatment or anesthesia.

| · | Radiofrequency Ablation |

: or the cauterizing of the lateral branches of the sacral nerve roots.

When conservative steps fail to deliver sustained pain relief and return to quality of life, specific diagnostic protocols are utilized to explore if a surgical option should be considered.

Diagnosis

Historically, diagnosing pain from the SI-Joint was not routinely a focus of orthopedic or neurosurgery training during medical school or residency programs. Due to its invasiveness, post-operative pain, and muscle disruption along with a difficult procedure overall, the open SI-Joint fusion procedure was rarely taught in these settings.

The emergence of various SI-Joint surgical technologies has generated a renewed discussion of SI-Joint issues. Of particular focus is the diagnostic protocol utilized to properly select patients for S-I Joint surgery. Patients with low back pain typically start with primary care physicians who often refer to pain specialists. Here, the patient will go through traditional physical therapy combined with oral medications (anti-inflammatory, narcotic, etc.). If the patient fails to respond to these steps the pain specialist may move to therapeutic injections of the SI-Joint. These injections may serve to lessen inflammation to the point that the patient is satisfied. However, the impact from these injections is often transient. In this case the patient is often referred to a trained physician to determine if the patient may be a candidate for surgical intervention. A series of provocative tests in clinic, combined with a specific injection protocol to isolate the SI-Joint as the pain generator is then utilized to confirm the need for surgical intervention. Published literature has shown this technique to be a very effective step to determine the best treatment to alleviate pain.

Limitations of Existing Treatment Options

Surgical fixation and fusion of the SI-Joint with an open surgical technique was first reported in 1908, with further reports in the 1920s. The open procedure uses plates and screws, requires a 6 to 12-inch incision and is extremely invasive. Due to the invasiveness and associated morbidity, the use of this procedure is limited to cases involving significant trauma, tumor, etc.

Less invasive surgical options along with implant design began to emerge over the past 15 years. These options feature a variety of approaches and implant designs and have been met with varying degrees of adoption. Lack of a standard and accepted diagnostic approach, complexity of approach, high morbidity of approach, abnormally high complication rates and inability to radiographically confirm fusion have all been cited as reasons for low adoption of these technologies.

The CATAMARAN™ SI-Joint Fusion System Solution

Until October 2022 Tenon sold The CATAMARAN™ SI-Joint Fusion System (“The CATAMARAN System”) to a limited number of clinician advisors to refine the product for a full commercial launch. In October 2022 Tenon initiated a full commercial launch at the NASS meeting in Chicago. The CATAMARAN System includes instruments and implants designed to prepare and fixate the SI-Joint for fusion. We believe The CATAMARAN System will address a large market opportunity with a superior product and is distinct from other competitive offerings in the following ways:

| 9 |

| · | Transfixes the SI joint |

| · | Inferior Posterior Sacroiliac Fusion Approach |

| · | Reduced Approach Morbidity |

| · | Direct And Visualized Approach to the SI-Joint |

| · | Single Implant Technique |

| · | Insertion Trajectory Away from the Neural Foramen |

| · | Insertion Trajectory Away from Major Vascular Structures |

| · | Autologous Bone Grafting in the Ilium, Sacrum and Bridge |

| · | Radiographic Confirmation of Bridging Bone Fusion of the SI-Joint |

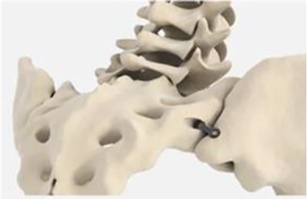

The fixation device and its key features are shown below:

|

Key Features “Pontoon” in the ilium “Pontoon” in the sacrum “Pontoons and Bridge” filled with autologous bone from drilling process Leading edge osteotome creates defect and facilitates ease of insertion |

The CATAMARAN System is a singular implant designed with several proprietary components which allow for it to be explicitly formatted to transfix the SI-Joint with a single approach and implant. This contrasts with several competitive implant systems that require multiple approach pathways and implants to achieve fixation. In addition, the Inferior Posterior approach is designed to be direct to the joint and through limited anatomical structures which may minimize the morbidity of the approach. The implant features a patented dual pontoon open cell design which enables the clinician to pack the pontoons with the patient’s own autologous bone designed to promote bone fusion across the joint. The CATAMARAN System is designed specially to resist vertical shear and rotation of the joint in which it was implanted, helping stabilize the joint in preparation for eventual fusion.

The instruments we have developed are proprietary to The CATAMARAN System and specifically designed to facilitate an Inferior Posterior approach that is unique to the system.

Tenon also has developed a proprietary 2D placement protocol as well as a protocol for 3D navigation utilizing the latest techniques in spine surgery. These Tenon advancements are intended to further enhance the safety of the procedure and encourage more physicians to adopt the procedure.

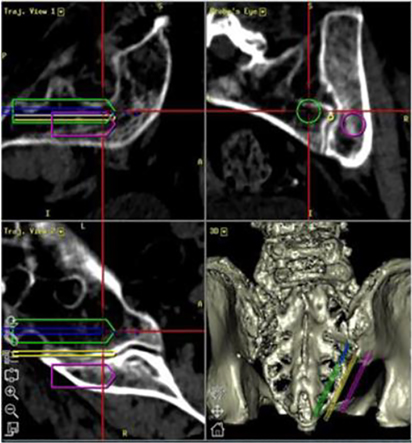

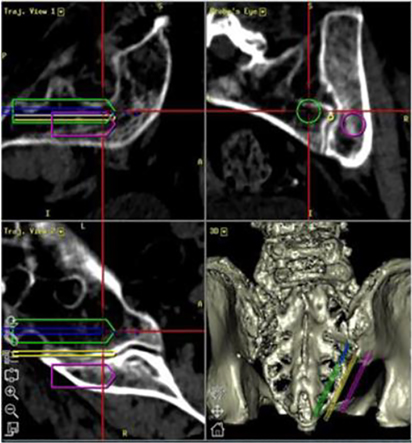

The CATAMARAN System, as mentioned previously, is placed in the densest aspect of the SI-Joint as confirmed by the pre-op planning images below:

|

Surgical Plan Key: Yellow: Guidewire Purple: Lateral Pontoon (Ilium) Green: Medial Pontoon (Sacrum)

| |

|

Notes:

Upper Right Quadrant: The green and purple pontoons represent the placement in the dense bone inferior – contrasted with the dorsal gap superiorly where competitive systems are most often placed.

Lower Right Quadrant: The yellow and purple outlines represent The CATAMARAN System pontoons, illustrating the angle of insertion is away from the sacral neuro foramen providing for a much safter trajectory for device implantation. |

| 10 |

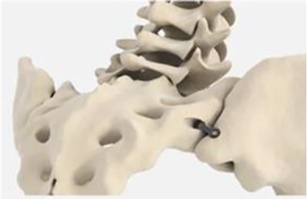

The Procedure

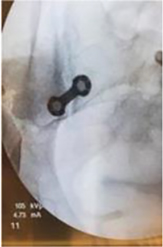

We believe The CATAMARAN System and its differentiated characteristics allow for an efficient and effective procedure designed to deliver short-term stabilization and long-term fusion that can be confirmed radiographically. Shown below is an illustration demonstrating the unique placement of The CATAMARAN System inserted Inferior Posterior and coming directly down to and transfixing the joint

|

|

| 11 |

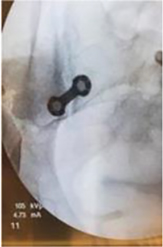

The CATAMARAN System procedure is typically performed under general anesthesia using a specially designed instrument set we provide to prepare for the Inferior Posterior access to the SI-Joint. Specially designed imaging and navigation protocols are designed to ensure the clinician has the proper Entry Point, Trajectory, Angle and Depth (ETAD™) so that the pontoons of The CATAMARAN System are placed for maximum fixation. The CATAMARAN System incorporates two pontoons and is designed so that when the system is impacted into the bone one pontoon is on the Illum side and the other is in the Sacrum side with the bridge spanning the joint, preventing shear and rotation of the joint. The device also features an open cell design where the patient’s own (autologous) bone is packed into the pontoons and the bridge to facilitate fusion across the joint. The leading edge of the bridge is designed to act as an osteotome, providing a self-created deficit upon insertion. These features are designed to create an ideal environment for bone ingrowth and fusion. Below is a fluoroscopic image of an implanted CATAMARAN Fixation Device spanning the SI-Joint.

Tenon believes the surgical approach and implant design it has developed, along with the 2D and 3D protocols for proper implantation will be received well by the clinician community who have been looking for a next generation device. Our initial clinical results indicate that The CATAMARAN System is promoting fusion across the joint as evidenced by post-op CT scans (the recognized gold standard widely accepted by the Clinical community).

| Post-Op

fluoroscopic image of implant spanning the SI-Joint |

6-Month

CT-Scan showing clear bridging bone fusion | |

|

|

A preliminary 18 case series (Michael Joseph Chaparro, MD, F.A.A.N.S., F.A.C.S.) has documented that The CATAMARAN System does in fact promote fusion across the SI-Joint, which many of our competitors have not been able to demonstrate. While products from some of our competitors use screws and triangular wedges to treat the SI-Joint, most do not effectively resist the vertical shear and twisting within the joint. This 18 patient series was presented at the North American Spine Society Annual Meeting in Chicago, IL in October 2022.

An independent biomechanical study (Lisa Ferrara, Ph.D. OrthoKinetic Technologies, LLC now part of Element) demonstrated that a single CATAMARAN SIJ Fixation Device was superior to predicate device in the areas of Fixation Strength, Shear Stiffness, Dynamic Endurance and Pullout Strength. We hold issued patents on The CATAMARAN System and its unique features including the dual pontoons and the open cell structure for bone graft packing. We also hold an issued patent for the method of placing The CATAMARAN System into the SI-Joint where one pontoon is in the ilium and the other in the sacrum.

The CATAMARAN System’s unique design has already demonstrated radiographically confirmed fusion in initial patients. We believe that this beneficial advantage along with a simpler, safer, and less painful procedure will make this the procedure of choice for most physicians. Tenon has initiated post market, IRB controlled clinical trials to demonstrate this technology delivers on these advantages.

| 12 |

Corporate Information

Our principal executive offices are located at 104 Cooper Court, Los Gatos, California 95032. Our website address is www.tenonmed.com. The information included on our website or in any social media associated with the Company is not part of this prospectus.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act; (ii) the last day of the fiscal year in which we have total annual gross revenues of $1.235 billion or more; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under applicable SEC rules. We expect that we will remain an emerging growth company for the foreseeable future, but cannot retain our emerging growth company status indefinitely and will no longer qualify as an emerging growth company on or before the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are applicable to other public companies that are not emerging growth companies.

These exemptions include:

| · | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| · | not being required to comply with the requirement of auditor attestation of our internal controls over financial reporting; |

| · | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| · | reduced disclosure obligations regarding executive compensation; and |

| · | not being required to hold a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We have taken advantage of certain reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

An emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves of this extended transition period and, as a result, we will not be required to adopt new or revised accounting standards on the dates on which adoption of such standards is required for other public reporting companies.

We are also a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies.

| 13 |

Investing in our securities involves a high degree of risk. You should carefully consider the risks described in the documents incorporated by reference in this prospectus and any prospectus supplement, as well as other information we include or incorporate by reference into this prospectus and any applicable prospectus supplement, before making an investment decision. Our business, financial condition or results of operations could be materially adversely affected by the materialization of any of these risks. The trading price of our securities could decline due to the materialization of any of these risks, and you may lose all or part of your investment. This prospectus and the documents incorporated herein by reference also contain forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks described in the documents incorporated herein by reference, including the risks described in Part I, Item 1A, Risk Factors in our most recent Annual Report on Form 10-K, together with the other information set forth in this prospectus, and in the other documents that we include or incorporate by reference into this prospectus, as updated by our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings we make with the SEC, the risk factors described under the caption “Risk Factors” in any applicable prospectus supplement and any risk factors set forth in our other filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, before making a decision about investing in our common stock. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. If any risks actually occur, our business, financial condition and results of operations may be materially and adversely affected. In such an event, the trading price of our common stock could decline and you could lose part or all of your investment.

For more information about our SEC filings, please see “Where You Can Find More Information” and “Incorporation by Reference.”

Additional risks not presently known or that we presently consider to be immaterial could subsequently materially and adversely affect our financial condition, results of operations, business, and prospects.

The principal purposes of this offering are to increase our capitalization and financial flexibility, increase our visibility in the marketplace and create a public market for our common stock. As of the date of this prospectus, we cannot specify with certainty all of the particular uses for the net proceeds to us from this offering. However, we currently intend to use the net proceeds from this offering to hire additional employees, continue the commercial launch of our product including training clinicians on The CATAMARAN System procedure, continue clinical marketing studies that are focused on capturing post-market safety and efficacy data, gathering system feedback and initiating product refinements, other sales and marketing activities and for working capital and general corporate purposes. See “Business—Research & Development.”

We will retain broad discretion in the allocation of the net proceeds from this offering and could utilize the proceeds in ways that do not necessarily improve our results of operations or enhance the value of our common stock.

Selling security holders are persons or entities that, directly or indirectly, have acquired or will from time to time acquire from us, our securities in various private transactions. Such selling security holders may be parties to registration rights agreements with us, or we otherwise may have agreed or will agree to register their securities for sale. Certain holders of our securities, as well as their transferees, pledgees, donees, or successors, all of whom we refer to as “selling security holders,” may from time to time offer and sell the securities pursuant to this prospectus and any applicable prospectus supplement.

The applicable prospectus supplement will set forth the name of each selling security holder and the number of and type of securities beneficially owned by such selling security holder that are covered by such prospectus supplement. The applicable prospectus supplement will also disclose whether any of the selling security holders have held any position or office with, have been employed by, or otherwise have had a material relationship with us during the three years prior to the date of the prospectus supplement.

| 14 |

The descriptions of the securities contained in this prospectus, together with the applicable prospectus supplements, summarize the material terms and provisions of the various types of securities that we may offer. We will describe in the applicable prospectus supplement relating to any securities the particular terms of the securities offered by that prospectus supplement. If we so indicate in the applicable prospectus supplement, the terms of the securities may differ from the terms we have summarized below. We will also include in the prospectus supplement information, where applicable, about material U.S. federal income tax considerations relating to the securities, and the securities exchange, if any, on which the securities will be listed.

We may sell from time to time common stock, preferred stock, debt securities, warrants to purchase any such securities, or any combination of the foregoing.

In this prospectus, we refer to the common stock, preferred stock, debt securities, and warrants to be sold by us collectively as “securities.”

If we issue debt securities at a discount from their original stated principal amount, then we will use the issue price, and not the principal amount, of such debt securities for purposes of calculating the total dollar amount of all securities issued under this prospectus.

This prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

General

We are authorized to issue up to 130,000,000 shares of common stock, par value $0.001 per share, with 11,251,299 shares issued and outstanding as of May 4, 2023.

Each share of our common stock has the same relative rights and is identical in all respects with each other share of common stock.

The holders of our common stock are entitled to the following rights:

Voting Rights

Each share of our common stock entitles its holder to one vote per share on all matters to be voted or consented upon by the stockholders. Holders of our common stock are not entitled to cumulative voting rights with respect to the election of directors.

Election of Directors

The holders of our common stock, voting as a separate class, shall be entitled to elect one member of our Board of Directors.

Dividend Rights

Subject to limitations under Delaware law and preferences that may apply to any shares of preferred stock that we may decide to issue in the future, holders of our common stock are entitled to receive ratably such dividends or other distributions, if any, as may be declared by our Board out of funds legally available therefor.

| 15 |

Liquidation Rights

In the event of the liquidation, dissolution or winding up of our business, the holders of our common stock are entitled to share ratably in the assets available for distribution after the payment of all of our debts and other liabilities, subject to the prior rights of the holders of our preferred stock.

Other Rights

The holders of our common stock have no subscription, redemption or conversion privileges. Our common stock does not entitle its holders to preemptive rights. All of the outstanding shares of our common stock are fully paid and non-assessable. The rights, preferences and privileges of the holders of our common stock are subject to the rights of the holders of shares of any series of preferred stock which we may issue in the future.

Exclusive Forum

Our Certificate of Incorporation provides that, unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware shall be the sole and exclusive forum for (a) any derivative action or proceeding brought on behalf of the Company, (b) any action asserting a claim of breach of a fiduciary duty owed by any director, officer, employee or agent of the Company to the Company or the Company’s stockholders, (c) any action asserting a claim arising pursuant to any provision of the Delaware General Corporation Law, our Certificate of Incorporation or Bylaws, or (d) any action asserting a claim governed by the internal affairs doctrine, in each case subject to said Court of Chancery having personal jurisdiction over the indispensable parties named as defendants therein. This exclusive forum provision may limit the ability of our stockholders to bring a claim in a judicial forum that such stockholders find favorable for disputes with us or our directors or officers, which may discourage lawsuits against us or our directors or officers. Our Certificate of Incorporation also provides that this choice of forum provision does not apply to claims arising under federal securities laws.

Section 203 of the Delaware General Corporation Law

We are subject to the provisions of Section 203 of the DGCL regulating corporate takeovers. This statute prevents certain Delaware corporations, under certain circumstances, from engaging in a “business combination” with:

| ● | a stockholder who owns 15% or more of our outstanding voting stock (otherwise known as an “interested stockholder”); |

| ● | an affiliate of an interested stockholder; or |

| ● | an associate of an interested stockholder, for three years following the date that the stockholder became an interested stockholder. |

A “business combination” includes a merger or sale of more than 10% of our assets. However, the above provisions of Section 203 do not apply if:

| ● | our board of directors approves the transaction that made the stockholder an “interested stockholder,” prior to the date of the transaction; or |

| ● | after the completion of the transaction that resulted in the stockholder becoming an interested stockholder, that stockholder owned at least 85% of our voting stock outstanding at the time the transaction commenced, other than statutorily excluded shares of common stock. |

Transfer Agent and Registrar

The transfer agent and registrar for our common stock will be VStock Transfer LLC.

| 16 |

Listing

Our common stock is listed on the Nasdaq Capital Market under the symbol “TNON”.

DESCRIPTION OF PREFERRED STOCK

This section describes the general terms and provisions of the preferred stock that we may offer by this prospectus. The prospectus supplement will describe the specific terms of the series of the preferred stock offered through that prospectus supplement. Those terms may differ from the terms discussed below. Any series of preferred stock that we issue will be governed by our certificate of incorporation, as amended, including the certificate of designations relating to such series of preferred stock, and our by-laws.

As of May 4, 2023 we had 20,000,000 authorized shares of preferred stock. We currently do not have any shares of preferred stock outstanding.

Our Board of Directors without the approval of the stockholders may issue up to 20,000,000 shares of preferred stock in one or more series and with respect to each series of preferred stock, the Board of Directors will fix the rights, preferences, privileges, and restrictions of the preferred stock of each series in the certificate of designations relating to that series. We will incorporate by reference as an exhibit to the registration statement that includes this prospectus the form of any certificate of designations that describes the terms of the series of preferred stock we are offering before the issuance of the related series of preferred stock. This description will include the following, to the extent applicable:

| ● | the title and stated value; |

| ● | the number of shares we are offering; |

| ● | the liquidation preference per share; |

| ● | the purchase price; |

| ● | the dividend rate, period and payment date, and method of calculation for dividends, if any; |

| ● | whether any dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate; |

| ● | the provisions for a sinking fund, if any; |

| ● | the provisions for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase rights; |

| ● | any listing of the preferred stock on any securities exchange or market; |

| ● | whether the preferred stock will be convertible into our common stock and, if applicable, the conversion price, or how it will be calculated, and the conversion period; |

| ● | whether the preferred stock will be exchangeable into debt securities and, if applicable, the exchange price, or how it will be calculated, and the exchange period; |

| ● | voting rights, if any, of the preferred stock; |

| 17 |

| ● | preemptive rights, if any; |

| ● | restrictions on transfer, sale, or other assignment, if any; |

| ● | whether interests in the preferred stock will be represented by depositary shares; |

| ● | a discussion of any material or special U.S. federal income tax considerations applicable to the preferred stock; |

| ● | the relative ranking and preferences of the preferred stock as to dividend rights and rights if we liquidate, dissolve, or wind up our affairs; any limitations on issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred stock as to dividend rights and rights if we liquidate, dissolve, or wind up our affairs; and |

| ● | any other specific terms, preferences, rights, or limitations of, or restrictions on, the preferred stock. |

When we issue shares of preferred stock under this prospectus, the shares, when issued in accordance with the terms of the applicable agreement, will be validity issued, fully paid, and non-assessable and will not have, or be subject to, any preemptive or similar rights.

Section 242 of DGCL provides that the holders of each class or series of stock will have the right to vote separately as a class on certain amendments to our certificate of incorporation, as amended, that would affect the class or series of preferred stock, as applicable. This right is in addition to any voting rights that may be provided for in the applicable certificate of designation.

General

As of May 4, 2023, warrants to purchase approximately 96,000 shares of our common stock with a weighted average exercise price per share of $5.00 were outstanding.

We may offer by means of this prospectus warrants for the purchase of our common stock or preferred stock. We may issue warrants separately or together with any other securities offered by means of this prospectus, and the warrants may be attached to or separate from such securities. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and a warrant agent specified therein. The warrant agent will act solely as our agent in connection with the warrants of such series and will not assume any obligation or relationship of agency or trust for or with any holders or beneficial owners of warrants.

When we refer to a series of securities in this section, we mean all securities issued as part of the same series under any applicable indenture, agreement, or other instrument. When we refer to the prospectus supplement, we mean the applicable prospectus supplement describing the specific terms of the security you purchase. The terms used in the prospectus supplement will have the meanings described in this prospectus, unless otherwise specified.

The following description of warrants does not purport to be complete and is qualified in its entirety by reference to the description of a particular series of warrants contained in an applicable prospectus supplement. For information relating to our capital stock, see “Description of Common Stock,” and “Description of Preferred Stock.”

| 18 |

Agreements

Unless otherwise provided in the applicable prospectus supplement, the following provisions will apply to any warrants we issue pursuant to this prospectus. Each series of warrants may be evidenced by certificates and may be issued under a separate indenture, agreement, or other instrument to be entered into between us and a bank that we select as agent with respect to such series. The agent, if any, will have its principal office in the United States and have a combined capital and surplus of at least $50,000,000. Warrants in book-entry form will be represented by a global security registered in the name of a depositary, which will be the holder of all the securities represented by the global security. Those who own beneficial interests in a global security will do so through participants in the depositary’s system, and the rights of these indirect owners will be governed solely by the applicable procedures of the depositary and its participants.

General Terms of Warrants

The prospectus supplement relating to a series of warrants will identify the name and address of the warrant agent, if any. The prospectus supplement will describe the following terms, where applicable, of the warrants in respect of which this prospectus is being delivered:

| · | the title and issuer of the warrants; |

| · | the aggregate number of warrants; |

| · | the price or prices at which the warrants will be issued; |

| · | the currencies in which the price or prices of the warrants may be payable; |

| · | the designation, amount, and terms of the securities purchasable upon exercise of the warrants; |

| · | the designation and terms of the other securities with which the warrants are issued and the number of warrants issued with each such security or each principal amount of security; |

| · | if applicable, the date on and after which the warrants and any related securities will be separately transferable; |

| · | any securities exchange or quotation system on which the warrants or any securities deliverable upon exercise of such securities may be listed; |

| · | the price or prices at which and currency or currencies in which the securities purchasable upon exercise of the warrants may be purchased; |

| · | the date on which the right to exercise the warrants shall commence and the date on which such right shall expire; |

| · | the minimum or maximum amount of warrants that may be exercised at any one time; |

| · | whether the warrants will be issued in fully registered for or bearer form, in global or non-global form, or in any combination of these forms; |

| · | information with respect to book-entry procedures, if any; |

| · | a discussion of certain U.S. federal income tax considerations; and |

| · | any other material terms of the warrants, including terms, procedures, and limitations relating to the exchange and exercise of the warrants. |

Exercise of Warrants

Unless otherwise provided in the applicable prospectus supplement, the following provisions will apply to any warrants we issue pursuant to this prospectus. If any warrant is exercisable for other securities or other property, the following provisions will apply. Each such warrant may be exercised at any time up to any expiration date and time mentioned in the prospectus supplement relating to those warrants. After the close of business on any applicable expiration date, unexercised warrants will become void.

| 19 |

Warrants may be exercised by delivery of the certificate representing the securities to be exercised, or in the case of global securities by delivery of an exercise notice for those warrants, together with certain information, and payment to any agent in immediately available funds, as provided in the prospectus supplement, of the required purchase amount, if any. Upon receipt of payment and the certificate or exercise notice properly executed at the office indicated in the prospectus supplement, we will, in the time period the relevant agreement provides, issue and deliver the securities or other property purchasable upon such exercise. If fewer than all of the warrants represented by such certificates are exercised, a new certificate will be issued for the remaining amount of warrants.

If mentioned in the prospectus supplement, securities may be surrendered as all or part of the exercise price for warrants.

Antidilution Provisions

Unless otherwise provided in the applicable prospectus supplement, the following provisions will apply to any warrants we issue pursuant to this prospectus. In the case of warrants to purchase common stock, the exercise price payable and the number of shares of common stock purchasable upon warrant exercise may be adjusted in certain events, including:

| · | the issuance of a stock dividend to common stockholders or a combination, subdivision, or reclassification of common stock; |

| · | the issuance of rights, warrants, or options to all common and preferred stockholders entitling them to purchase common stock for an aggregate consideration per share less than the current market price per share of common stock; |

| · | any distribution to our common stockholders of evidences of our indebtedness of assets, excluding cash dividends or distributions referred to above; and |

| · | any other events mentioned in the prospectus supplement. |

The prospectus supplement will describe which, if any, of these provisions shall apply to a particular series of warrants.

Unless otherwise specified in the applicable prospectus supplement, no adjustment in the number of shares purchasable upon warrant exercise will be required until cumulative adjustments require an adjustment of at least 1% of such number and no fractional shares will be issued upon warrant exercise, but we will pay the cash value of any fractional shares otherwise issuable.

Modification

Unless otherwise provided in the applicable prospectus supplement, the following provisions will apply to any warrants we issue pursuant to this prospectus. We and any agent for any series of warrants may amend any warrant or rights agreement and the terms of the related warrants by executing a supplemental agreement, without any such warrant holders’ consent, for the purpose of:

| · | curing any ambiguity, any defective or inconsistent provision contained in the agreement, or making any other corrections to the agreement that are not inconsistent with the provisions of the warrant certificates; |

| · | evidencing the succession of another corporation to us and its assumption of our covenants contained in the agreement and the securities; |

| · | appointing a successor depository, if the securities are issued in the form of global securities; |

| · | evidencing a successor agent’s acceptance of appointment with respect to any securities; |

| · | adding to our covenants for the benefit of securityholders or surrendering any right or power we have under the agreement; |

| · | issuing warrants in definitive form, if such securities are initially issued in the form of global securities; or |

| · | amending the agreement and the warrants as we deem necessary or desirable and that will not adversely affect the interests of the applicable warrant holders in any material respect. |

| 20 |

We and any agent for any series of warrants may also amend any agreement and the related warrants by a supplemental agreement with the consent of the holders of a majority of the warrants of any series affected by such amendment, for the purpose of adding, modifying, or eliminating any of the agreement’s provisions or of modifying the rights of the holders of warrants. However, no such amendment that:

| · | reduces the number or amount of securities receivable upon any exercise of any such security; |

| · | shortens the time period during which any such security may be exercised; |

| · | otherwise adversely affects the exercise rights of warrant holders in any material respect; or |

| · | reduces the number of securities the consent of holders of which is required for amending the agreement or the related warrants; |

may be made without the consent of each holder affected by that amendment.

Consolidation, Merger, and Sale of Assets

Unless otherwise provided in the applicable prospectus supplement, the following provisions will apply to any warrants we issue pursuant to this prospectus. Any agreement with respect to warrants will provide that we are generally permitted to merge or consolidate with another corporation or other entity. Any such agreement will also provide that we are permitted to sell our assets substantially as an entirety to another corporation or other entity or to have another entity sell its assets substantially as an entirety to us. With regard to any series of warrants, however, we may not take any of these actions unless all of the following conditions are met:

| · | if we are not the successor entity, the person formed by the consolidation or into or with which we merge or the person to which our properties and assets are conveyed, transferred, or leased must be an entity organized and existing under the laws of the United States, any state, or the District of Columbia and must expressly assume the performance of our covenants under any relevant indenture, agreement, or other instrument; and |

| · | we or that successor corporation must not immediately be in default under that agreement. |

Enforcement by Holders of Warrants

Unless otherwise provided in the applicable prospectus supplement, the following provisions will apply to any warrants we issue pursuant to this prospectus. Any agent for any series of warrants will act solely as our agent under the relevant agreement and will not assume any obligation or relationship of agency or trust for any securityholder. A single bank or trust company may act as agent for more than one issue of securities. Any such agent will have no duty or responsibility in case we default in performing our obligations under the relevant agreement or warrant, including any duty or responsibility to initiate any legal proceedings or to make any demand upon us. Any securityholder may, without the agent’s consent or consent of any other securityholder, enforce by appropriate legal action its right to exercise any warrant exercisable for any property.

Replacement of Certificates

Unless otherwise provided in the applicable prospectus supplement, the following provisions will apply to any warrants we issue pursuant to this prospectus. We will replace any destroyed, lost, stolen, or mutilated warrant or rights certificate upon delivery to us and any applicable agent of satisfactory evidence of the ownership of that certificate and of its destruction, loss, theft or mutilation, and (in the case of mutilation) surrender of that certificate to us or any applicable agent, unless we have, or the agent has, received notice that the certificate has been acquired by a bona fide purchaser. That securityholder will also be required to provide indemnity satisfactory to us and the relevant agent before a replacement certificate will be issued.

| 21 |

Title

Unless otherwise provided in the applicable prospectus supplement, the following provisions will apply to any warrants we issue pursuant to this prospectus. We, any agents for any series of warrants, and any of their agents may treat the registered holder of any certificate as the absolute owner of the securities evidenced by that certificate for any purpose and as the person entitled to exercise the rights attaching to the warrants so requested, despite any notice to the contrary.

DESCRIPTION OF DEBT SECURITIES

Any debt securities we may issue, offered by this prospectus and any accompanying prospectus supplement, will be issued under an indenture to be entered into between our company and the trustee identified in the applicable prospectus supplement. The terms of the debt securities will include those stated in the indenture and those made part of the indenture by reference to the Trust Indenture Act of 1939, as in effect on the date of the indenture. We have filed a copy of the form of indenture as an exhibit to the registration statement in which this prospectus is included. The indenture will be subject to and governed by the terms of the Trust Indenture Act of 1939.

Unless otherwise specified in the applicable prospectus supplement, the debt securities will represent direct, unsecured obligations of our company and will rank equally with all of our other unsecured indebtedness.

The following statements relating to the debt securities and the indenture are summaries, qualified in their entirety to the detailed provisions of the indenture.

General

We may issue the debt securities in one or more series with the same or various maturities, at par, at a premium, or at a discount. We will describe the particular terms of each series of debt securities in a prospectus supplement relating to that series, which we will file with the SEC.

The prospectus supplement will set forth, to the extent required, the following terms of the debt securities in respect of which the prospectus supplement is delivered:

| · | the title of the series; |

| · | the aggregate principal amount; |

| · | the issue price or prices, expressed as a percentage of the aggregate principal amount of the debt securities; |

| · | any limit on the aggregate principal amount; |

| · | the date or dates on which principal is payable; |

| · | the interest rate or rates (which may be fixed or variable) or, if applicable, the method used to determine such rate or rates; |

| · | the date or dates from which interest, if any, will be payable and any regular record date for the interest payable; |

| · | the place or places where principal and, if applicable, premium and interest, is payable; |

| · | the terms and conditions upon which we may, or the holders may require us to, redeem or repurchase the debt securities; |

| · | the denominations in which such debt securities may be issuable, if other than denominations of $1,000, or any integral multiple of that number; |

| · | whether the debt securities are to be issuable in the form of certificated debt securities (as described below) or global debt securities (as described below); |

| 22 |

| · | the portion of principal amount that will be payable upon declaration of acceleration of the maturity date if other than the principal amount of the debt securities; |

| · | the currency of denomination; |

| · | the designation of the currency, currencies, or currency units in which payment of principal and, if applicable, premium and interest, will be made; |

| · | if payments of principal and, if applicable, premium or interest, on the debt securities are to be made in one or more currencies or currency units other than the currency of denomination, the manner in which the exchange rate with respect to such payments will be determined; |

| · | if amounts of principal and, if applicable, premium and interest may be determined by reference to an index based on a currency or currencies, or by reference to a commodity, commodity index, stock exchange index, or financial index, then the manner in which such amounts will be determined; |

| · | the provisions, if any, relating to any collateral provided for such debt securities; |

| · | any addition to or change in the covenants and/or the acceleration provisions described in this prospectus or in the indenture; |

| · | any events of default, if not otherwise described below under “Events of Default”; |

| · | the terms and conditions, if any, for conversion into or exchange for shares of common stock or preferred stock; |

| · | any depositaries, interest rate calculation agents, exchange rate calculation agents, or other agents; and |

| · | the terms and conditions, if any, upon which the debt securities shall be subordinated in right of payment to other indebtedness of our company. |

We may issue discount debt securities that provide for an amount less than the stated principal amount to be due and payable upon acceleration of the maturity of such debt securities in accordance with the terms of the indenture. We may also issue debt securities in bearer form, with or without coupons. If we issue discount debt securities or debt securities in bearer form, we will describe material U.S. federal income tax considerations and other material special considerations which apply to these debt securities in the applicable prospectus supplement.

We may issue debt securities denominated in or payable in a foreign currency or currencies or a foreign currency unit or units. If we do, we will describe the restrictions, elections, and general tax considerations relating to the debt securities and the foreign currency or currencies or foreign currency unit or units in the applicable prospectus supplement.

Exchange and/or Conversion Rights

We may issue debt securities that can be exchanged for or converted into shares of common stock or preferred stock. If we do, we will describe the terms of exchange or conversion in the prospectus supplement relating to these debt securities.

Transfer and Exchange

We may issue debt securities that will be represented by either:

| · | “book-entry securities,” which means that there will be one or more global securities registered in the name of a depositary or a nominee of a depositary; or |

| · | “certificated securities,” which means that they will be represented by a certificate issued in definitive registered form. |

| 23 |

We will specify in the prospectus supplement applicable to a particular offering whether the debt securities offered will be book-entry or certificated securities.

Certificated Debt Securities

Those who hold certificated debt securities may transfer or exchange such debt securities at the trustee’s office or at the paying agent’s office or agency in accordance with the terms of the indenture. There will be no service charge for any transfer or exchange of certificated debt securities, but there may be a requirement to pay an amount sufficient to cover any tax or other governmental charge payable in connection with such transfer or exchange.

Those who hold certificated debt securities may effect the transfer of certificated debt securities and of the right to receive the principal of, premium, and/or interest, if any, on the certificated debt securities only by surrendering the certificate representing the certificated debt securities and having us or the trustee issue a new certificate to the new holder.

Global Securities

If we decide to issue debt securities in the form of one or more global securities, then we will register the global securities in the name of the depositary for the global securities or the nominee of the depositary, and the global securities will be delivered by the trustee to the depositary for credit to the accounts of the holders of beneficial interests in the debt securities.

The prospectus supplement will describe the specific terms of the depositary arrangement for debt securities of a series that are issued in global form. None of us, the trustee, any payment agent, or the security registrar will have any responsibility or liability for any aspect of the records relating to or payments made on account of beneficial ownership interests in a global debt security or for maintaining, supervising, or reviewing any records relating to these beneficial ownership interests.

No Protection in the Event of Change of Control

The indenture does not have any covenants or other provisions providing for a put or increased interest or otherwise that would afford holders of debt securities additional protection in the event of a recapitalization transaction, a change of control of our company, or a highly leveraged transaction. If we offer any covenants or provisions of this type with respect to any debt securities covered by this prospectus, we will describe them in the applicable prospectus supplement.

Covenants

Unless otherwise indicated in this prospectus or a prospectus supplement, the debt securities will not have the benefit of any covenants that limit or restrict our business or operations, the pledging of our assets, or the incurrence by us of indebtedness. We will describe in the applicable prospectus supplement any material covenants in respect of a series of debt securities.

Consolidation, Merger, and Sale of Assets

We will agree in the indenture that we will not consolidate with or merge into any other person, or convey, transfer, sell, or lease our properties and assets substantially as an entirety to any person, unless:

| · | the person formed by the consolidation or into or with which we are merged or the person to which our properties and assets are conveyed, transferred, sold, or leased, is a corporation organized and existing under the laws of the United States, any state, or the District of Columbia, or a corporation or comparable legal entity organized under the laws of a foreign jurisdiction and, if we are not the surviving person, the surviving person has expressly assumed all of our obligations, including the payment of the principal of, and premium, if any, and interest on the debt securities and the performance of the other covenants under the indenture; and |

| · | immediately after giving effect to the transaction, no event of default, and no event which, after notice or lapse of time or both, would become an event of default, has occurred and is continuing under the indenture. |

| 24 |

Events of Default

Unless otherwise specified in the applicable prospectus supplement, the following events will be events of default under the indenture with respect to debt securities of any series:

| · | we fail to pay any principal or premium, if any, when it becomes due and such default is not cured within 5 business days; |

| · | we fail to pay any interest within 30 days after it becomes due; |

| · | we fail to comply with any other covenant in the debt securities or the indenture for 60 days after written notice specifying the failure from the trustee or the holders of not less than 25% in aggregate principal amount of the outstanding debt securities of that series; and |

| · | certain events involving bankruptcy, insolvency, or reorganization of our company or any of our significant subsidiaries. |

The trustee may withhold notice to the holders of the debt securities of any series of any default, except in payment of principal of, or premium, if any, or interest on the debt securities of a series, if the trustee considers it to be in the best interest of the holders of the debt securities of that series to do so.

If an event of default (other than an event of default resulting from certain events of bankruptcy, insolvency, or reorganization) occurs, and is continuing, then the trustee or the holders of not less than 25% in aggregate principal amount of the outstanding debt securities of any series may accelerate the maturity of the debt securities. If this happens, the entire principal amount, plus the premium, if any, of all the outstanding debt securities of the affected series plus accrued interest to the date of acceleration will be immediately due and payable. At any time after the acceleration, but before a judgment or decree based on such acceleration is obtained by the trustee, the holders of a majority in aggregate principal amount of outstanding debt securities of such series may rescind and annul such acceleration if:

| · | all events of default (other than nonpayment of accelerated principal, premium, or interest) have been cured or waived; |

| · | all lawful interest on overdue interest and overdue principal has been paid; and |

| · | the rescission would not conflict with any judgment or decree. |

In addition, if the acceleration occurs at any time when we have outstanding indebtedness which is senior to the debt securities, the payment of the principal amount of outstanding debt securities may be subordinated in right of payment to the prior payment of any amounts due under the senior indebtedness, in which case the holders of debt securities will be entitled to payment under the terms prescribed in the instruments evidencing the senior indebtedness and the indenture.

If an event of default resulting from certain events of bankruptcy, insolvency, or reorganization occurs, the principal, premium, and interest amount with respect to all of the debt securities of any series will be due and payable immediately without any declaration or other act on the part of the trustee or the holders of the debt securities of that series.

The holders of a majority in principal amount of the outstanding debt securities of a series will have the right to waive any existing default or compliance with any provision of the indenture or the debt securities of that series and to direct the time, method, and place of conducting any proceeding for any remedy available to the trustee, subject to certain limitations specified in the indenture.

| 25 |

No holder of any debt security of a series will have any right to institute any proceeding with respect to the indenture or for any remedy under the indenture, unless:

| · | the holder gives to the trustee written notice of a continuing event of default; |

| · | the holders of at least 25% in aggregate principal amount of the outstanding debt securities of the affected series make a written request and offer reasonable indemnity to the trustee to institute a proceeding as trustee; |

| · | the trustee fails to institute a proceeding within 60 days after such request; and |

| · | the holders of a majority in aggregate principal amount of the outstanding debt securities of the affected series do not give the trustee a direction inconsistent with such request during such 60-day period. |