UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Amendment No. 1)

(Mark one)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the Fiscal Year Ended

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________________ to ________________

Commission

file number:

(Exact Name of Registrant as Specified in Its Charter)

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| (Address of Principal Executive Offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: N/A

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| |

The

|

Securities registered pursuant to Section 12(g) of the Act:

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ | ||

| Smaller

reporting company | |||

| Emerging

growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by the check mark whether the registration has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes ☐

The

aggregate market value of the voting and non-voting common equity held by non-affiliates (4,005,517 shares, adjusted for the Company’s

15:1 reverse stock split, and the conversion of all Series B Convertible Preferred Stock, each of which were effective February

16, 2021) computed by reference to the price at which the common equity was last sold as of June 30, 2020, the last business day

of the registrant’s most recently completed second fiscal quarter ($6.00), was $

As of April 12, 2021, there were shares of the registrant’s common stock outstanding.

Explanatory Note

| ● | Filing Exhibit 23.1, the auditor’s consent, which was inadvertently omitted from the Original 10-K; | |

| ● | Filing new certifications of the Company’s Principal Executive Officer and Principal Financial Officer as exhibits to this Amendment under Item 15 of Part IV thereof, pursuant to Rule 12b-15 of the Exchange Act; and | |

| ● | Filing a new certification of the Company’s Principal Executive Officer and Principal Financial Officer as an exhibit to this Amendment pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

The Amendment does not reflect events occurring after the date of the filing of the Original 10-K or modify or update any of the other disclosures contained therein in any way.

INDEX

Forward Looking Statements

| 2 |

PART I

Certain statements included or incorporated by reference in this annual report constitute forward-looking statements within the meaning of applicable securities laws. All statements contained in this annual report that are not clearly historical in nature are forward-looking, and the words “anticipate”, “believe”, “continue”, “expect”, “estimate”, “intend”, “may”, “plan”, “will”, “shall” and other similar expressions are generally intended to identify forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). All forward-looking statements are based on our beliefs and assumptions based on information available at the time the assumption was made. These forward-looking statements are not based on historical facts but on management’s expectations regarding future growth, results of operations, performance, future capital and other expenditures (including the amount, nature and sources of funding thereof), competitive advantages, business prospects and opportunities. Forward-looking statements involve significant known and unknown risks, uncertainties, assumptions and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from those implied by forward-looking statements. These factors should be considered carefully and prospective investors should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this annual report or incorporated by reference herein are based upon what management believes to be reasonable assumptions, there is no assurance that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this annual report or as of the date specified in the documents incorporated by reference herein, as the case may be. Important factors that could cause such differences include, but are not limited to:

| ● | the uncertainties associated with the ongoing COVID-19 pandemic, including, but not limited to uncertainties surrounding the duration of the pandemic, government orders and travel restrictions, and the effect on the global economy and consumer spending; |

| ● | the risks and additional expenses associated with international operations and operations in a country (Argentina) which has had significantly high inflation in the past; |

| ● | the uncertainties raised by a fluid political situation and fundamental policy changes that could be affected by presidential elections; |

| ● | the risks associated with a business that has never been profitable, whose business model has been restructured from time to time, and which continues to have and has significant working capital needs; |

| ● | the possibility of external economic and political factors preventing or delaying the acquisition, development or expansion of real estate projects, or adversely affecting consumer interest in our real estate offerings; |

| ● | changes in external market factors, as they relate to our emerging e-commerce business; |

| ● | changes in the overall performance of the industries in which our various business units operate; |

| ● | changes in business strategies that could be necessitated by market developments as well as economic and political considerations; |

| ● | possible inability to execute the Company’s business strategies due to industry changes or general changes in the economy generally; |

| ● | changes in productivity and reliability of third parties, counterparties, joint venturers, suppliers or contractors; and |

| ● | the success of competitors and the emergence of new competitors. |

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or performance. You should not place undue reliance on forward-looking statements contained in this annual report.

We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which such statements were made or to reflect the occurrence of unanticipated events, except as may be required by applicable securities laws.

In evaluating the Company, its business and any investment in the Company, readers should carefully consider the following factors:

Risk Factors Summary

| ● | We face significant business disruption and related risks resulting from the COVID-19 pandemic, which could have a material adverse effect on our business and results of operations, including, but not limited to, the closure of the Algodon Mansion, operated by our indirectly owned Argentinian subsidiary, The Algodon - Recoleta S.R.L. (“TAR”), and the disruption of the operations of the Algodon Wine Estates, operated by our indirectly owned Argentinian subsidiary, Algodon Wine Estates S.R.L. (“SWE”). |

| 3 |

| ● | Due to the economic hardships presented by the COVID-19 pandemic, we obtained a loan from the Paycheck Protection Program (“PPP Loan”) from the U.S. Small Business Administration (“SBA”) pursuant to the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”). Although the SBA forgave the PPP Loan in full on March 26, 2021, we may not be entitled to forgiveness under state law for the PPP Loan which could negatively impact our cash flow. | |

| ● | Economic and political instability in Argentina may adversely and materially affect our business, results of operations and financial condition. | |

| ● | Argentina’s economy may not support foreign investment or our business. | |

| ● | The Company is exposed to the risk of changes in foreign exchange rates. | |

| ● | The stability of the Argentine banking system is uncertain. | |

| ● | Government measures to preempt or respond to social unrest may adversely affect the Argentine economy and our business. | |

| ● | We are exposed to risks in relation to compliance with anti-corruption and anti-bribery laws and regulations overseas and in the U.S. Although we have internal policies and procedures designed to ensure compliance with applicable anti-corruption and anti-bribery laws and regulations, there can be no assurance that such policies and procedures will be sufficient. | |

| ● | The real estate market is uncertain in Argentina and the investment in Argentine real property is subject to economic and political risks. | |

| ● | There are limitations on the ability of foreign persons to own Argentinian real property. | |

| ● | Our business is subject to extensive domestic and foreign regulation, including regulations and laws imposed by the U.S. and Argentine governments, and additional regulations may be imposed in the future. | |

| ● | There is limited public information about real estate in Argentina. | |

| ● | The Company may be subject to certain losses that are not covered by insurance. | |

| ● | Historically, the Company’s hotel incurs overhead costs higher than the total gross margin. | |

| ● | The profitability of Algodon Wine Estates operated by SWE will depend on consumer demand for leisure and entertainment. | |

| ● | Development of the Company’s projects will proceed in phases and is subject to unpredictability in costs and expenses. | |

| ● | Climate change, or legal, regulatory or market measures to address climate change, may negatively affect our business, operations or financial performance, and water scarcity or poor water quality could negatively impact our production costs and capacity. | |

| ● | Various diseases, pests, contamination, certain weather conditions, and natural disasters may negatively affect our business, operations or financial performance, including the business, operations or financial performance of SWE relating to the operation of the Algodon Wine Estates. | |

| ● | GGI has no significant operating history and no revenue and we may not recognize any revenue from the Gaucho – Buenos Aires™ line of business in the future. | |

| ● | The markets in which we operate, and which plan to operate in are highly competitive, and such competition could cause our business to be unsuccessful. | |

| ● | Our business is subject to risks associated with importing products, and the imposition of additional duties and any changes to international trade agreements could have a material adverse effect on our business, results of operations and financial condition. | |

| ● | We may not be able to protect our intellectual property rights, which may cause us to incur significant costs. | |

| ● | GGI is only in the beginning stages of its advertising campaign. | |

| ● | Labor laws and regulations may adversely affect the Company. | |

| ● | Insiders continue to have substantial control over the Company. | |

| ● | The loss of our Chairman, President and Chief Executive Officer could adversely affect the Company’s businesses. | |

| ● | Revenues are currently insufficient to pay operating expenses and costs which may result in the inability to execute the Company’s business concept. | |

| ● | The Company is dependent upon additional financing which it may not be able to secure in the future. | |

| ● | Our level of debt may adversely affect our operations and our ability to pay our debt as it becomes due. | |

| ● | Our financial controls and procedures may not be sufficient to accurately or timely report our financial condition or results of operations, which may adversely affect investor confidence in us and, as a result, the value of our common stock. | |

| ● | We are an “emerging growth company” and our election of reduced reporting requirements applicable to emerging growth companies may make our common stock less attractive to investors. | |

| ● | Although we qualify as an emerging growth company, we also qualify as a smaller reporting company and under the smaller reporting company rules we are subject to scaled disclosure requirements that may make it more challenging for investors to analyze our results of operations and financial prospects. | |

| ● | Raising additional funds through debt or equity financing could be dilutive and may cause the market price of our common stock to decline. We still may need to raise additional funding which may not be available on acceptable terms, or at all. Failure to obtain additional capital may force us to delay, limit, or terminate our product development efforts or other operations. | |

| ● | We cannot assure you that the market price of our common stock will remain high enough to comply with Nasdaq’s ongoing listing requirements. | |

| ● | You may experience immediate and substantial dilution in the book value per share of the units you purchase. |

Please see “Risk Factors” beginning on page 23 for more details.

| 4 |

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the JOBS Act. For so long as we remain an emerging growth company, we are permitted and currently intend to rely on the following provisions of the JOBS Act that contain exceptions from disclosure and other requirements that otherwise are applicable to companies that conduct initial public offerings and file periodic reports with the SEC. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements in this prospectus and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our periodic reports and registration statements, including this prospectus; | |

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act (“SOX”); | |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements, including in this prospectus; and | |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We will remain an emerging growth company until:

| ● | the first to occur of the last day of the fiscal year (i) that follows February 19, 2026, (ii) in which we have total annual gross revenue of at least $1.07 billion or (iii) in which we are deemed to be a “large accelerated filer,” as defined in the Exchange Act, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the end of that year’s second fiscal quarter; or | |

| ● | if it occurs before any of the foregoing dates, the date on which we have issued more than $1 billion in non-convertible debt over a three-year period. |

We have elected to take advantage of certain of the reduced disclosure obligations in this prospectus and may elect to take advantage of other reduced reporting requirements in our future filings with the SEC. As a result, the information that we provide to our stockholders may be different than what you might receive from other public reporting companies in which you hold equity interests.

We have elected to avail ourselves of the provision of the JOBS Act that permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards until those standards apply to private companies. As a result, we will not be subject to new or revised accounting standards at the same time as other public companies that are not emerging growth companies.

For additional information, see the section titled “Risk Factors — Risks of being an Emerging Growth Company — We are an “emerging growth company” and the reduced disclosure requirements applicable to emerging growth companies may make our common stock less attractive to investors.

ITEM 1. BUSINESS

Recent Business Developments

| ● | Due to COVID-19, temporary closure of our hotel, restaurant, winery operations, and golf and tennis operations. Subsequent reopening of the Algodon Mansion as of November 11, 2020 and recently our winery and golf and tennis facilities with COVID-19 measures implemented. | |

| ● | Also due to COVID-19, construction on homes was temporarily halted from March to September but has resumed. | |

| ● | As of March 20, 2021, international tourism by foreign residents, except those foreign residents with direct family contact with an Argentinian, remains prohibited through April 9, 2021. | |

| ● | Reduced expenses by early termination of our office lease at 135 Fifth Avenue in New York City. |

| 5 |

| ● | On May 6, 2020, entered into a PPP Loan from the SBA pursuant to the Paycheck Protection Program (“PPP”). On March 26, 2021, the SBA forgave the PPP Loan in full. | |

| ● | In November 2020, hired a communications agency, Skoog Co., to provide exposure to all of our brands. | |

| ● | In December 2020, the independent members of our Board approved an extension to our President and CEO’s employment agreement to expire on June 30, 2021. Please see “Executive Compensation” for additional information. | |

| ● | In January 2021, Wine Enthusiast rated and reviewed our Algodon 2012 PIMA Red Blend Mendoza and awarded it 91 points. | |

| ● | On February 14, 2021, the Board approved a reverse stock split of common shares of the Company, par value of $0.01 per share, wherein each stockholder received one common share in exchange for each fifteen common shares previously held (the 15:1 reverse stock split, the “Reverse Split”). | |

| ● | On February 16, 2021, the Company effected its Reverse Stock Split and uplisted its shares to Nasdaq under the symbol “VINO,” with trading commencing on February 17, 2021. | |

| ● | On February 19, 2021, the Company sold and issued an aggregate of 1,333,334 shares of common stock and 1,533,333 warrants, for approximate gross proceeds of $8.0 million pursuant to a Form S-1 registration statement, before deducting underwriting discounts and commissions and estimated offering expenses, and issued the representative of such underwriters a common stock purchase warrant exercisable for up to 15,333 shares of common stock. | |

| ● | On March 26, 2021, the Company received notice that the SBA has forgiven the PPP Loan in full. However, the Company may be subject to tax on the forgiveness under state law. | |

| ● | On April 7, 2021, the Company paid a total of $58,001 to Mr. Mathis in connection with his voluntarily deferred compensation between March 13, 2020 and August 21, 2020. | |

| ● | On April 8, 2021, the Company’s subsidiary, Gaucho Group, Inc., entered into a seven-year lease for retail space located in Miami, Florida to sell its Gaucho – Buenos Aires™ products. |

For a more thorough discussion of the Company’s business, see “Business” on page 5 and “Recent Developments and Trends” on page 50.

Company Overview

Gaucho Group Holdings, Inc. (the “Company”) was incorporated on April 5, 1999. Effective October 1, 2018, the Company changed its name from Algodon Wines & Luxury Development, Inc. to Algodon Group, Inc., and effective March 11, 2019, the Company changed its name from Algodon Group, Inc. to Gaucho Group Holdings, Inc. (“GGH”). Through its wholly-owned subsidiaries, GGH invests in, develops and operates real estate projects in Argentina. GGH operates a hotel, golf and tennis resort, vineyard and producing winery in addition to developing residential lots located near the resort. In 2016, GGH formed a new subsidiary, Gaucho Group, Inc. and in 2018, established an e-commerce platform for the manufacture and sale of high-end fashion and accessories. The activities in Argentina are conducted through its operating entities: InvestProperty Group, LLC, Algodon Global Properties, LLC, The Algodon – Recoleta S.R.L, Algodon Properties II S.R.L., and Algodon Wine Estates S.R.L. Algodon distributes its wines in Europe under the name Algodon Wines (Europe). Most recently, the Company formed a wholly-owned subsidiary, Bacchus Collection, Inc. on March 20, 2020, which is still in the concept stage for the production of elegant wine and bar essentials.

GGH’s mission is to increase our scalability, diversify the Company’s assets, and minimize our political risk. We believe our goal of becoming the LVMH of South America (Moët Hennessy Louis Vuitton) can help us to achieve that. While we continue making excellent wine, upgrading our rooms at the Algodon Mansion, and completing the infrastructure at the vineyard, our growth area is in e-commerce through Gaucho – Buenos Aires™ because of the potential for immediate revenues and growth/scale on a global basis. The Gaucho brand also diversifies our business outside of Argentina and helps insulate us from political risk. Together with our wines, these aspects of our business have the potential to insulate us from both the economic and political fluctuations in Argentina. However, we also refer to our Risk Factors on page 23 regarding the lack of revenues of the Gaucho—Buenos Aires™ brand and its ability to generate revenue in the future.

| 6 |

The below table provides an overview of GGH’s operating entities.

| Entity Name | Abbreviation | Jurisdiction & Date of Formation |

Ownership | Business | ||||

| Gaucho Group, Inc. | GGI | Delaware, September 12, 2016 |

79% by GGH | Luxury fashion and leather accessories brand and e-commerce platform | ||||

| InvestProperty Group, LLC (“InvestProperty Group”) | IPG | Delaware, October 27, 2005 |

100% by GGH | Real estate acquisition and management in Argentina | ||||

| Algodon Global Properties, LLC | AGP | Delaware, March 17, 2008 |

100% by GGH | Holding company | ||||

| The Algodon - Recoleta S.R.L. | TAR | Argentina, September 29, 2006 |

100% by GGH through IPG, AGP and APII | Hotel owner and operating entity in Buenos Aires | ||||

| Algodon Properties II S.R.L. | APII | Argentina, March 13, 2008 |

100% by GGH through IPG and AGP | Holding company in Argentina | ||||

| Algodon Wine Estates S.R.L. | AWE | Argentina, July 16, 1998 |

100% by GGH through IPG, AGP, APII and TAR | Resort complex including real estate development and wine making in Argentina; owns vineyard, hotel, restaurant, golf and tennis resort in San Rafael, Mendoza, Argentina |

As noted above, Algodon Wine Estates S.R.L. Algodon distributes its wines in Europe under the name Algodon Wines (Europe). The previous entity acting as the Company’s wine distributor in Europe, Algodon Europe Ltd., was dissolved on August 13, 2019. In addition, the Company formed a wholly-owned subsidiary, Bacchus Collection, Inc. on March 20, 2020, which is not yet operational.

Gaucho - Buenos Aires™

Gaucho – Buenos Aires™ is a luxury leather goods and accessories brand, with a strategic focus on growing its e-commerce business, that is the result of more than a decade’s investment in Argentina’s heart and soul, featuring luxury products that merge the traditional Gaucho style with a modern twist, infused with uniqueness and modern Buenos Aires glamour. With Gaucho – Buenos Aires, GGH adds a high-end leather goods and accessories e-commerce sector to its collection of luxury assets. Our e-commerce platform is able to process and fulfill orders in the United States and internationally, and we believe this asset has the potential to achieve significant scale and add value to our company. Gaucho – Buenos Aires connects buyers with some of Argentina’s best creative talents that harness the country’s unique heritage and artisanship of products such as woven fabrics, leather goods and precious metal jewelry.

With Argentina’s recent re-engagement with importing and exporting, we believe that it is beginning to regain its status as a global cultural enclave. Once dubbed the “Paris of South America” for its exquisite Belle Époque style and entering what we believe will be a new golden age. We believe that evolving politics and tastes suggest the time is now for Buenos Aires to once again align itself with Milan, New York, Paris and London as a global fashion capital – and for Gaucho – Buenos Aires to become its ambassador. We believe there may be a sizeable appetite in the USA and beyond for our luxury products, such as fine leather goods, accessories and apparel, that deliver and reflect a unique and unmistakable Argentine point of view.

Seen in the intricate stitching of handmade leather, or the workmanship of an embossed belt buckle, the “Gaucho” style is a world-renowned symbol of Argentine craftsmanship. Though rooted in the traditions of Argentine culture, Gaucho – Buenos Aires intends to become a brand in which Argentine luxury finds its contemporary expression: merging the traditional Gaucho style with a modern twist, infused with uniqueness and modern Buenos Aires glamour.

| 7 |

We believe that Gaucho – Buenos Aires reflects the very spirit of Argentina – its grand history and its revival as a global center of luxury. Our goal is to reintroduce the world to the grandeurs of the city’s elegant past, intertwined with an altogether deeper cultural connection: the strength, honor and integrity of the Gaucho.

On September 12, 2019, during New York Fashion Week, Gaucho – Buenos Aires had its U.S. debut and press launch.

Most recently in April 2021, GGI entered into a seven-year lease for retail space located at 112 N.E. 41st Street, Suite 106, in Miami, Florida to sell its Gaucho – Buenos Aires™ products.

Our Products

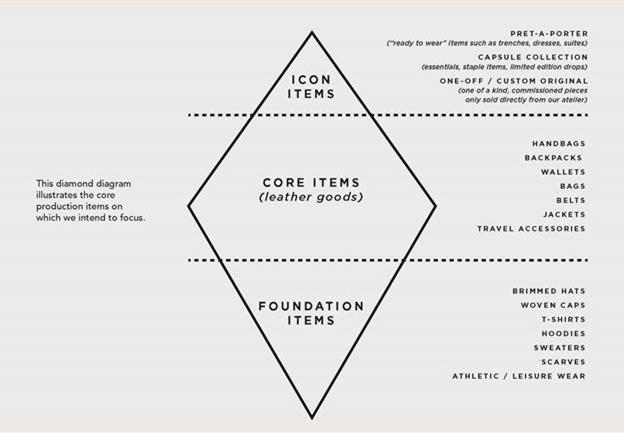

GGI’s Gaucho – Buenos Aires™ primarily sells what Argentina is well known for: leather goods and accessories, all defining the style, quality, and uniqueness of Argentina.

Gaucho – Buenos Aires’s fully optimized e-commerce platform (www.gauchobuenosaires.com) offers a commercial line of designer clothing, with an emphasis on leather goods accessories, including leather jackets, branded hoodies, t-shirts, polo shirts and ponchos. In the following 18 months, we also anticipate a strategic roll-out introducing other new products such as fragrances, a Gaucho Kids clothing line, Gaucho Casa (home goods), and Gaucho Residences as the natural evolution of the brand’s growth.

Blending the quality of a bygone era with what we believe to be a sophisticated, modern, global outlook, the brand’s handcrafted clothing and accessories herald the birth of what we hope will become Argentina’s finest designer label.

Fragrances: Homme (Men), Femme (Women), Vamos Sport (Unisex)

The fragrance collection of Gaucho – Buenos Aires™ was created by Firmenich, the world’s largest privately-owned company in the fragrance and flavor business. Founded in Geneva, Switzerland in 1895, it has created many of the world’s best-known perfumes that consumers the world over enjoy each day, including Giorgio Armani, Hugo Boss, Ralph Lauren, Kenzo, and Dolce & Gabbana. Its passion for smell and taste is at the heart of its success. It is renowned for its world-class research and creativity, as well as its thought leadership in sustainability and exceptional understanding of consumer trends. Each year, it invests 10% of its revenues in research and innovation, reflecting its continuous desire to understand, develop and distill the best that nature has to offer.

Gaucho – Buenos Aires has three fragrances ready for packaging, including a men’s fragrance Homme, a women’s fragrance Femme, and a unisex fragrance Vamos Sport.

| 8 |

Sales and Marketing Strategy / Competitive Edge

During the economic crisis in Argentina, iconic international fashion chains left the country. As scarcity is the mother of invention, this gave rise to local brands that made up for that absence. Despite the fact that, in our view, Argentina’s fashion scene is today thriving, the country lacks any international mainstream exposure. Argentina’s continuing challenges with inflation and unemployment have made it difficult for local labels to break into the global fashion landscape, and today there is not a single Argentine fashion brand that is a household name. We believe Gaucho – Buenos Aires has the ability to fill that void. Our intention is to become the leading fashion and leather accessories brand out of South America.

We have assembled a talented team who speak in the unique voice most representative of Argentina’s local fashion scene, and we believe we have the opportunity, the aptitude and the vision not only to successfully introduce this voice to the world’s fashion scene, but to become a major player in that landscape.

Our U.S.-based e-commerce website has been designed to deliver Argentine luxury goods to the U.S. marketplace and elsewhere around the globe. We believe the devaluation of the peso can have positive ramifications for the tourism industry (and Algodon’s hospitality businesses). Tourists from outside Argentina can spend more money at hotels, restaurants and other attractions with a favorable exchange rate. We intend to take advantage of the historic low and deep devaluation of the Argentine peso by producing many of our products and wine in Argentina, thereby paying for product and labor in pesos, we then intend to sell to consumers at a favorable exchange rate in USD to the U.S. and the world.

Currently, one of the few ways to buy Argentina goods is to travel there and buy local. We want to change that, and in a favorable economic and political climate, we seek to be in the forefront of opening Argentina’s luxury market to the millions of potential customers around the globe interested in luxury items from Argentina.

Our target market is upper and upper-middle class female and male millennials in urban areas of the United States and Europe. Millennials have the potential to become the largest spending generation in history, and with the popularity of midrange to high end fashion brands such as Gucci, Armani, Lululemon, and many others, we believe our millennial target market appreciates high quality clothing and accessories, and is willing to spend above the average market price for such quality items in the “affordable luxury” category.

Business Advisors

John I. Griffin, Board Advisor. Mr. Griffin is Chairman, President, Chief Executive Officer, and the sole shareholder of Maurice Pincoffs Company, Inc. headquartered in Houston, Texas USA. Pincoffs began product trading operations in 1880 and today specializes in international trade, marketing, and distribution of various products. Following 13 years of active and reserve duty, he retired from the United States Navy as Lieutenant Commander. Mr. Griffin was employed by Corning Glass Works where he was involved in plant management and international business activities and then worked outside of the United States for 13 years, first in Tokyo as President of Graco Japan K.K., a metal related manufacturing and marketing joint venture. This was followed by seven years in Paris as Vice President of Graco Inc. where he managed manufacturing and marketing companies throughout Europe as President Directeur General of Graco France S.A. and Fogautolube S.A. (France). Stationed in Brussels for two years, Mr. Griffin was President of Monroe Auto Equipment S.A. with manufacturing facilities in Belgium and Spain and marketing companies throughout Europe and the Middle East. With the acquisition of Maurice Pincoffs Company in 1978, he assumed his current position.

During his stay in Europe, Mr. Griffin was a partner in a Haut Medoc vineyard, Le Fournas Bernadotte. For several years Pincoffs was heavily involved in the wine import business as the third largest importer in Texas. Mr. Griffin served for a number of years as Founder and President of the American Institute for International Steel (Washington D.C.) and the American Institute for Imported Steel (New York City) as well as serving as a Director of the West Coast Metal Importers Association (Los Angeles). Active in the Greater Houston Partnership, Mr. Griffin was a Director of the World Trade Division and served as Chairman of the Africa Committee. He was a member of the Committee on Foreign Relations and the World Affairs Council of Houston, and a past Director of The Houston World Trade Association and the Armand Bayou Nature Center.

| 9 |

David Gilmour, Board Advisor. We believe that Mr. Gilmour is an ideal fit for our advisory board due to his shared values of product quality and philosophy, and his broad experience and successes; including having founded Fiji Water, the health & wellness products of Wakaya Perfection, as well as for cofounding with Peter Munk one of the largest gold companies in the world, Barrick Gold, and South Pacific Hotel Corporation, one of the largest hotel chains in the south pacific. Mr. Gilmour has also won multiple awards for his product packaging and designs. In the wake of the global pandemic, the world is looking more at health and wellness than ever before. With this in mind, Mr. Gilmour has taken a keen interest in the Company’s subsidiaries, including Algodon Wine Estates’ (www.algodonwineestates.com) wine, wellness, culinary and sport resort and e-commerce products, as well as its focus on promoting healthier lifestyles, wellness and rejuvenation of the mind, body and spirit. These values are strongly aligned with Mr. Gilmour’s own most recent venture of the organic wellness products of Wakaya Perfection, LLC, a purveyor of and nutritional products. As a health and wellness advocate, Mr. Gilmour’s Wakaya Perfection (www.wakaya.com) is a mission-driven wellness enterprise on the 2,200-acre island paradise of Wakaya in the Fiji archipelago which, due to its high-nutrient virgin volcanic soil, served as the brand’s very first location in the cultivation of its exclusive formula. Volcanic soil is hailed for its purity and multi-faceted rejuvenating properties that can naturally enhance the quality of lives. The brand’s production has since branched out to the main island of Fiji, as well as to Nicaragua, which possess the same high nutrient volcanic ash soil. The company continues to seek out the best volcanic ash soil in the world to continue cultivating products of the highest caliber and service global demand. Wakaya Perfection’s product line includes hand-cultivated organic ginger, turmeric, teas, and sea salts, all indigenous to the island of Wakaya. Wakaya Perfection seeks to create the world’s most powerful health and wellness commodities for the consumer of today seeking integrity in their product selection; from the quality of its source, to the soil it is grown in, and then on to the shelves. Wakaya Perfection products have been distributed through luxury hotels, resorts, fine-dining establishments and luxury department stores.

John Dunagan, Business Advisor. John Dunagan, a West Texas native, is an experienced professional in manufacturing and bottling industry. After finding success bottling with Coca-Cola, Mr. Dunagan traveled all over the United States, Europe and Asia, creating similarly focused manufacturing facilities for the drinks industry. John is now an investor and serves on the board of several companies in the Real Estate, Oil and Gas Exploration, and Defense industries. After receiving his degree from Harvard Business School, John joined the Peace Corps in Cali, Colombia, and shortly thereafter founded several companies across the country - among them Rica Rondo, a major meat processor. Between his first and second years at Harvard Business School Business School, he received a Rotary Foundation Fellowship to study at the University of Buenos Aires, Argentina. John received his Bachelor’s degree from University of Texas at Austin.

Juliano de Rossi, Creative Solutions Consultant. Juliano serves as a consultant providing valuable guidance to the GGI team, having significant experience in the high-end fashion world. We entered into an oral consulting contract with Juliano on an independent contractor basis in July 2017 for project-based work. The amount paid to Juliano is not considered material because of the project-by-project basis. He currently serves as Creative Solutions Consultant to the Net-a-Porter Group. De Rossi has 15 years’ experience in marketing and advertising for global brands and luxury retailers. He has resided in London for the past five years, working in marketing, content production and brand partnership campaigns for MatchesFashion.com and at the YOOX Net-a-Porter Group where he was responsible for leading the in-house creative solutions (design and production teams) managing multiple content productions served across all YOOX Net-a-Porter Group digital platforms, print publications and social channels. At Mr Porter, Net-A-Porter, Porter Magazine and Matchesfashion.com, he oversaw the production of top-rate campaigns, driving the content vision for the management of branded content productions including fashion shoots and video series productions for brands such as BMW, Johnnie Walker Blue Label, American Express, Piaget, Cartier, IWC, Marc Jacobs, Burberry Prorsum, Fendi, Lanvin, Crème De La Mer, Chloe, Stella McCartney, Michael Kors, and Helmut Lang.

Social Media Strategy

Our digital marketing efforts will include ongoing search engine optimization (“SEO”) campaigns and initiatives to increase website conversions and brand awareness, social media marketing via Instagram, Facebook, Amazon and Google Marketplace using micro and macro/celebrity influencers, and public relations firms specializing in the international fashion scene.

Our communications firm, Skoog Co., is currently creating an action plan to generate buzz about our brand, our designers, and our e-commerce platform. Social media star, Neels Visser, is also contacting his broad network of social influencers and micro influencers to lay the groundwork for potential partnerships and brand affiliates/ambassadors.

GGI’s Gaucho – Buenos Aires will primarily be an e-commerce store targeting U.S. customers. However we do plan on pursuing reselling retail venues both online and brick and mortar. For example, in the wake of our press launch, we received unsolicited inquiries from several high-end boutiques in Brazil interested in carrying the Gaucho – Buenos Aires™ line. There are of course numerous avenues for us to explore involving brick and mortar opportunities alone, via agencies or direct solicitation.

Online reselling avenues we expect to pursue include Net-a-Porter, MatchesFashion and at least six other high-end, reputable venues with whom we already have an established foot in the door via our networking channels.

| 10 |

We anticipate our marketing strategy will include popup shops in cities such as Austin, Dallas, Houston, Miami, Los Angeles, New York City and Aspen. With popup shops, we can for example, work with local PR companies to get the word out, as these opportunities are typically promoted via direct mail, PR and digital marketing efforts, as well as word of mouth and strategic geographic positioning.

Our online marketing efforts will also include SEO initiatives, social media marketing via Instagram, Facebook, Amazon and Google Marketplace, and retargeting ads.

Post-COVID-19, we anticipate presenting at fashion shows in in New York City, London, Paris, Milan and several other targeted cities. Gaucho – Buenos Aires presents an opportunity for global press to talk about Argentina finding its foothold once again on the global fashion scene, spotlighting our designers, our designs, and our concentration on leather goods. As there are few brands launching out of Argentina, and certainly fewer with global intentions, the press reaction to Gaucho – Buenos Aires has been extremely positive and encouraging.

Press

In early 2019, Gaucho – Buenos Aires garnered the front cover pages of Marie Claire Argentina and Vogue Italia, one of the most iconic fashion magazines on the globe, who states that Gaucho – Buenos Aires is currently “among the most interesting brands on the Argentinian scene.” Our recent press clippings since our Argentina debut in October 2018 include appearances in some of the most widely read fashion magazines in Latin American fashion, including Forbes Argentina, Revista L’Officiel, Revista Luz, Women’s Wear Daily, Nista, and others.

Gaucho – Buenos Aires Trademarks

We filed a U.S. Trademark Application (Serial No. 87743647) for the Gaucho – Buenos Aires in January 2018, and in February 2019, the U.S. Patent and Trademark Office issued a Notice of Allowance for this mark. This application covers goods and services such as apparel, leather accessories and other products, jewelry, cosmetic fragrances and home goods.

The Company intends to promote Gaucho – Buenos Aires™ so that its name and logo collectively become a recognizable trademark with international appeal. We anticipate seeking trademark protection for other marks as we develop our business and product lines.

Within six months of the Notice of Allowance date, or August 12, 2019, we were required to file a satisfactory Statement of Use if use has occurred, or file for an extension of time. The mark was then in use with some of the goods, but not others. As a result, on August 6, 2019, we filed to divide the application for the goods that were in use for which a Statement of Use was filed, and filed an Extension Request in the existing application for the remaining goods. On April 28, 2020 and October 20, 2020, the trademarks were officially registered with the United States Patent and Trademark Office. The details of the registrations are:

Registration No. 6,043,175

Registration Date: April 28, 2020

Classes: 18, 25 and 33

Goods:

Class 18 - Handbags; purses; clutch wallets and handbags; wallets; belt bags; necessaire, namely, cosmetic bags sold empty; travel bags,

Class 25 - T-shirts; tops; shirts; sweaters; hoodies; ponchos; pants; bottoms; shorts; skirts; dresses; jackets; coats; scarves; pocket squares; ties; belts; hosiery; underwear; gloves; footwear; shoes; headwear; hats; caps being headwear

Class 33 – Wines

Registration No. 6,180,633

Registration Date: October 20, 2020

Classes: 3 and 24

Goods:

Class 3 – Fragrances; perfumes

Class 24 – Bed and table linen; bed blankets; bed sheets; pillowcases; comforters; duvets; bath linen

| 11 |

In August 2019, the Company received a notice from Markaria S.A. regarding the use of Gaucho—Buenos Aires in Argentina alleging that such mark may infringe with Markaria’s work clothing brand Gaucho. At this time Markaria has only requested a nullity of the company’s trademark application in Argentina. The Company is working with its Argentine legal counsel to negotiate, distinguish and defend its use of Gaucho—Buenos Aires in Argentina. Since the COVID-19 pandemic suspended all legal cases in Argentina, there have been no notifications of any advancement of this request. The use of the mark in the United States has not been affected, which is the targeted market for the Company.

Argentina Activities

GGH, through its wholly-owned subsidiary and holding company, InvestProperty Group (“IPG”), identifies and develops specific investments in the boutique hotel, hospitality and luxury property markets and in other lifestyle businesses such as wine production and distribution, golf, tennis and real estate development. GGH also operates hotel, hospitality and related properties and is actively seeking to expand its real estate investment portfolio by acquiring additional properties and businesses in Argentina, or by entering into strategic joint ventures. Using GGH’s fine wines as its ambassador, GGH’s mission is to develop a group of real estate projects under its ALGODON® brand with the goal of developing synergies among its luxury properties.

In 2016, GGH formed a new wholly-owned subsidiary, Gaucho Group, Inc. (“GGI”), and in 2019, the entity began developing a platform and infrastructure to manufacture, distribute and sell high end products created in Argentina under the brand name Gaucho – Buenos Aires™. See Gaucho – Buenos Aires™ on page 54 above.

GGH’s senior management is based in New York City. GGH’s local operations are managed by professional staff with substantial hotel, hospitality and resort experience in Buenos Aires and San Rafael, Argentina.

Until May 31, 2020, the Company’s senior management was based at its corporate office in New York City. Due to COVID-19, we have terminated the corporate office lease and senior management works remotely. GGH’s local operations are managed by professional staff with substantial hotel, hospitality and resort experience in Buenos Aires and San Rafael, Argentina.

GGH’s Concept and Business: Repositioning of Hotel Properties, Luxury Destinations and Residential Properties

GGH, through IPG, focuses on opportunities that create value through repositioning of underperforming hotel and commercial assets such as hotel/residential/retail destinations. Repositioning means we are working to gradually increment our average fares to solidify our position as a luxury option. This trend has been well received in large metropolitan areas which have become quite competitive. We believe that the trend is now trickling down to secondary metropolitan, resort and foreign markets where there is significantly less competition from the established major operators. We continue to seek opportunities where value can be added through re-capitalization, repositioning, expansion, improved marketing and/or professional management. We believe that GGH can increase demand for all of a property’s various offerings, from its rooms, to its dining, meeting and entertainment facilities, to its retail establishments through careful branding and positioning of properties. While the maxim remains true that the three most important factors in real estate are “location, location, location,” management believes that “style and superior service” have grown in importance and can lead to increased operating revenues and capital appreciation.

Both pre- and post-COVID-19, we aim at increasing our activity, occupancy and presence in the market by using direct marketing actions (Facebook and Google Ads, Trip Advisor, Online Travel Agencies, internet presence), and expanding our net of travel agencies and operators, introducing effective changes in our direct sales capacity (new sales-oriented webpages, joint ventures with other hotel organizations, training of our reservations employees, implementing new reservation software). We have also reached out to travel industry media operators to develop new strategic relationships and we are implementing a new commercial management operation for a more aggressive approach with a sales-oriented objective. GGH has built a team of industry professionals to assist in implementing its vision toward repositioning real estate assets. See “Directors, Executive Officers and Corporate Governance” on page 60.

Plan of Operations

GGH continues to implement its growth and development strategy that includes a luxury boutique hotel, a resort estate, vineyard and winery, the sale of high-end fashion, leather goods and accessories, and a large land development project including residential houses within the vineyard. See “Algodon Wine Estates” below.

Long Term Growth Strategy

Our desire is to follow in the footsteps of global leading luxury brands such as Chanel from Paris, Burberry from London, Tom Ford from New York, and Gucci from Milan, and to establish Gaucho as “the Spirit of Argentina” representing Buenos Aires. In doing so, our mission is also to work with the intention of building a multi-billion dollar brand. We believe that through our e-commerce website, we have the potential to achieve significant scale, and add value to our company.

| 12 |

Roll-up Strategy

We believe we are now positioned to utilize the Company’s listing on Nasdaq in a sort of “roll-up strategy” to acquire other companies that fall squarely within or complement the Company’s existing and planned lines of business. For example, we might seek to acquire businesses that offer high-end fashion and accessories, or other luxury products and/or experiential hospitality experiences, the quality of which is consistent with the GGH brand. We seek to become the LVMH (“Louis Vuitton Moet Hennessy”) of South America, with the goal of becoming its most well-known luxury brand.

The Company hopes to continue to self-finance future acquisition and development projects because in countries like Argentina, having cash available to purchase land and other assets provides an advantage to buyers. Bank financing in such countries is often difficult or impossible to obtain. To be able to grow our business and expand into new projects, the Company would first want to deploy excess cash generated by operations, but significant amounts of excess cash flow is not anticipated for at least a number of years. Another option would be obtaining new investment funds from investors, including public offerings, and/or borrowing from institutional lenders. GGH may also be able to acquire property for stock instead of cash.

Cobranding and Strategic Alliances

One of GGH’s goals includes positioning its brand ALGODON® as one of luxury. In the past we have formed strategic alliances with well-established luxury brands that have strong followings to create awareness of the GGH brand and help build customer loyalty. Since its inception, GGH has been associated or co-branded with several world-class luxury brands including Relais & Châteaux, Veuve Clicquot Champagne (owned by Louis Vuitton Moët Hennessy), Nespresso, Porsche, Chanel, Hermès, Art Basel, and Andrew Harper Travel.

Catalysts for Growth

Gaucho Casa Residences

As Gaucho – Buenos Aires™ continues to expand its recognition on a domestic and international basis, another area that we can potentially create value and scale is by licensing our brand to commercial, and residential real estate developments. Current examples of such co-branded developments include: Aston Martin Residences in Miami, Bulgari Resort and Residences Dubai, Fendi Chateau Residences in Bal Harbour, Residences by Armani Casa in Miami, Mercedes House in New York, as well Porsche Design Tower in Sunny Isles Beach.

These fashion houses and automobile manufactures license their brand’s unique styles and unmistakable names to real estate developers, in an effort to create business opportunity. The mutually beneficial model could be a medium through which Gaucho – Buenos Aires™ makes its imprint on the global market. By using our distinct style – employing fine leathers, metals, and natural stones – in the design and construction of such a project, Gaucho – Buenos Aires could add intrinsic value to the parties involved. This creates potential for licensing fees, as well a portion of proceeds from property sales.

Gaucho Casa

Gaucho Casa challenges traditional lifestyle collections with its luxury textiles and home accessories rooted in the singular spirit of the gaucho aesthetic. Using high-quality natural materials sourced from countries that are pioneers in the field of eco production, such as New Zealand, Iceland and, of course, Argentina, each piece within the line embodies the rarefied heritage of Buenos Aires and its deep-rooted connection to artisanship.

Celebrating the equestrian culture that “gaucho country” is world-renowned for, we believe that the collection’s silver-plated trays, bottle accessories and more elegant homeware pieces featuring elaborate horn detailing are a perfect embodiment of the contemporary glamour of Buenos Aires. Naturally, the epic wild landscapes have had their own influences, with a curated edit of sheepskin rugs, Tibetan cashmere cushions, mohair throws and Brazilian cow-hide cushions, providing the perfect partnership of form and function – and a chic complement to the more modern details in your home. Whether you’re looking to embrace the gaucho lifestyle or bring a touch of the country to the city, Gaucho Casa offers an organic design DNA for every interior space, ideal for modern living.

| 13 |

In recent years, there has been a rise of boutique hotel home goods collections such as by Marriott, who led the way with its debut of Autograph Collection. Others that have followed include Curio by Hilton (Starwood’s Tribute Portfolio), and The Unbound Collection (part of the Hyatt Hotels group). We envision the possibility of Gaucho – Buenos Aires utilizing Algodon Mansion as a launch point for a collection of hotel bedding, pillows, linens and robes. Likewise, Argentina’s “La Belle Époque” could serve as a reliable source of inspiration for a multitude of luxury consumer goods, including home soft-furnishings. Argentina’s rich Polo heritage might also serve as a reliable foundation for a collection of high-end, contemporary leather home furnishings for anything from armchairs and sofas to lamps and photo frames.

Gaucho – Kids Collection

We envision the possibility of a designer baby and kids’ clothes collection at Gaucho – Buenos Aires, so that parents who love our brand can treat their children to a luxury line of fun, Gaucho-inspired clothing for kids. We envision building this line around the idea of creating comfy, well-made garments that allow kids to be creative in the way they dress. Gaucho Kids may include, for example, branded onesies and toddler t-shirts, whimsical prints that foster imagination and individuality, and other unique printed separates for kids who don’t mind standing out in a crowd.

Gaucho – Buenos Aires Boutique at Algodon Mansion

Located in the ground floor lobby of Algodon Mansion, the future location (anticipated opening in the fourth quarter of 2021) of our boutique store is just a stroll away from the city’s main shopping boulevards on Alvear. The Gaucho – Buenos Aires boutique will be open to receive direct foot traffic from shoppers along Montevideo. Emulating the great boutiques and ateliers of Europe’s fashion capitals, we believe that Algodon Mansion is an inspiring space in which to shop our collection. Built in 1912, the building connects us to the bygone glamor of the city’s golden age – and plays an important role in defining Gaucho Buenos Aires’ ethos and aesthetic.

Popup Shops

Popup shops are a popular trend that can be a low cost means of creating a temporary store front focusing on spreading brand awareness, communicating brand values, collecting customer data, and providing personalized experiences. This can also provide a way for Gaucho – Buenos Aires build a relationship with customers in person, while driving conversion on more cost-effective digital channels. We envision popup shops in U.S. cities such as Aspen, Austin, Dallas and Houston, Miami, Los Angeles, New York City, Berlin and Barcelona. With popup shops, we can work with local PR companies to get the word out, as these opportunities are typically promoted via direct mail, PR and digital marketing efforts, as well as word of mouth and strategic geographic positioning. We also anticipate installing a popup shop during the summer season in Punta Del Este, Uruguay, which is a popular vacation spot for wealthy Argentines and other Latin Americans.

Currency Devaluation

A currency devaluation can help Argentina tourism, enticing foreign holidaymakers seeking to make their vacation money stretch further. Vacationers looking for the most representative souvenirs of Argentina and its culture may know the country is best known for its leather. With hundreds of domestic tanneries, Argentina’s has high quality production of cow, sheep and goat leather goods such as jackets, shoes and handbags.

A devalued peso may also aid Argentina’s wine exporters by improving market competitiveness and leading to higher revenues. Additionally, non-leveraged real estate can be a hedge against inflation, and we believe that over time our land values may perform well.

While our contracts and vendors are largely payable in pesos, which is favorable to us given the current exchange rate of the peso against the U.S. dollar, the downside is that the Argentine market is somewhat closed off for our Gaucho brand goods and our wines. Even though we produce some Gaucho goods in Argentina and we are able to realize a higher margin by selling outside of Argentina, we also do have some goods produced in the U.S. at a higher cost and our margins are therefore much lower.

Further, our real estate and hotel operations are stated in U.S. dollars, which can be seen as less desirable than stating in pesos and could have a negative effect on demand for those parts of our business.

| 14 |

The ALGODON® Brand

We believe that the force and power of brand is of paramount importance in the luxury real estate/hotel market. GGH has developed the ALGODON® brand, which is inspired by both the Cotton Club days of the Roaring 20’s and the distinctive style and glamour of the 50’s Rat Pack when travel and leisure was synonymous with cultural sophistication. This brand concept was taken from the Spanish word for “cotton” and we believe that this connotes a clean and pure appreciation for the good life, a sense of refined culture, and ultimately a destination where the best elements of the illustrious past meet the affluent present. GGH is looking to attract attention and upscale demographic visitors to the ALGODON® properties and to round out the brand experience in various other forms including music, dining, wine, sports and apparel, by marketing themes that highlight active lifestyles and the pleasures of life. Management believes that these types of brand extensions will serve to reinforce the overall brand recognition and further build upon GGH’s presence in the luxury hotel segment.

Description of Specific Investment Projects

GGH has invested in two ALGODON® brand properties located in Argentina. The first property is Algodon Mansion, a Buenos Aires-based luxury boutique hotel that opened in 2010 and is owned by IPG’s subsidiary, The Algodon – Recoleta S.R.L. (“TAR”). The second property, owned by Algodon Wine Estates S.R.L., is a Mendoza-based winery and golf resort called Algodon Wine Estates, consisting of 4,138 acres, which was subdivided for residential development and expanded by acquiring adjoining wine producing properties.

Algodon Mansion

The Company, through TAR, has renovated a hotel in the Recoleta section of Buenos Aires called Algodon Mansion, a six-story mansion (including roof-top facilities and basement) located at 1647 Montevideo Street, a tree-lined street in Recoleta, one of the most desirable neighborhoods in Buenos Aires. The property is approximately 20,000 square feet and is a ten-suite high-end luxury hotel with a lounge/living room area, a patio area featuring a glass ceiling and fireplace, and a private wine tasting room. The property also includes a rooftop that houses a luxury spa and terrace pool. Each guest room is an ultra-luxury two-to-three room suite, each approximately 510-1,200 square feet. Recoleta is Buenos Aires’ embassy and luxury hotel district and has fashionable boutiques, high-end restaurants, cafés, art galleries, and opulent belle époque architecture.

| 15 |

Below is a table showing occupancy data, average daily rate and revenue per available room (“RevPAR”) for Algodon Mansion:

| TAR - Buenos Aires | ||||||||||||||||||||||||||||||||

| USD | ARS | |||||||||||||||||||||||||||||||

| For the year ended | For the year ended | |||||||||||||||||||||||||||||||

| December 31, 2019 | December 31, 2020 | Δ amount | Δ % | December 31, 2019 | December 31, 2020 | Δ amount | Δ % | |||||||||||||||||||||||||

| Occupancy level | 54 | % | 14 | % | -40 | % | -74 | % | 54 | % | 14 | % | -40 | % | -74 | % | ||||||||||||||||

| Average daily Rate (ADR) | 337 | 356 | 19 | 6 | % | 16,324 | 21,369 | 5,045 | 31 | % | ||||||||||||||||||||||

| RevPAR | 182 | 50 | -132 | -73 | % | 8,815 | 2,992 | -5,823 | -66 | % | ||||||||||||||||||||||

| Occupancy level: | It is a Hotel KPI calculation that shows the percentage of available rooms or beds being sold for a certain period of time. |

| It is important for hotels to keep track of this data on a daily basis to identify the average daily rate, forecast and apply revenue management. | |

| This ratio decreased by 74% which is explained by the Government regulations about the closing of the international border due to the intent for stop the COVID-19. TAR compared to AWE Lodge depends on international tourism. | |

| Average daily Rate (ADR): | This is a metric widely used in the hospitality industry to indicate the average realized room rental per day. |

| This is calculated by taking the average revenue earned from rooms and dividing it by the number of rooms sold. It excludes complimentary rooms and rooms occupied by staff. | |

| 2020 ADR in USD increased in comparison with previous year from USD 337 to USD 356. The same ratio in ARS has increased by 31% due to the effect of the devaluation | |

| RevPAR: | Revenue per available room (RevPAR) is a performance metric used in the hotel industry. It is calculated by multiplying a hotel’s average daily room rate (ADR) by its occupancy rate. |

| 2020 RevPAR in USD has decreased in comparison with previous year from USD 182 to USD 50 due to the low level of occupation during 2020 |

Past guests of Algodon Mansion include President Maurico Macri of Argentina, Roger Federer, Bobby Flay, Jim Courier, Andre Agassi, Pete Sampras, Mardy Fish, Salvatore Ferragamo, and Maguy Maccario Doyle, the Principality of Monaco’s Ambassador to the United States. Algodon Mansion was featured in an article by Huffington Post in January 2018, which praised the luxurious accommodations, impressive suites, and fine amenities of the hotel.

In both 2019 and 2018, Algodon Mansion was inducted to TripAdvisor’s Hall of Fame, a distinction given to recognize hotels that have won its Certificate of Excellence award for five consecutive years. Algodon Mansion won the Certificate of Excellence award for the years 2014 through 2019. The Certificate of Excellence award celebrates businesses that have continually delivered a quality customer experience, taking into account the quality, quantity and recency of reviews submitted by travelers on TripAdvisor over a 12-month period. To qualify, a business must maintain an overall TripAdvisor bubble rating of at least four out of five, have a minimum number of reviews and must have been listed on TripAdvisor for at least 12 months.

| 16 |

Algodon Wine Estates

Algodon Wine Estates S.R.L. (“AWE”) is 4,138-acre area located in the Cuadro Benegas district of San Rafael, Mendoza, now known as Algodon Wine Estates. The resort property is part of the Mendoza wine region nestled in the foothills of the Andes mountain range. This property includes a winery (whose vines date back to the mid-1940’s), a 9-hole golf course, tennis, restaurant and hotel. The estate is situated on Mendoza’s Ruta del Vino (Wine Trail). The 4,138-acre property has an impressive lineage, both in terms of wine production and golf, and features structures on the property that date back to 1921.

Algodon Wine Estates features Algodon Villa, a private lodge originally built in 1921, that has been fully restored and refurbished to its original farmhouse design of adobe walls and cane roof. The lodge offers three suites, a gallery for private gatherings, a living area that may also serve as a dining and conference room, swimming pool, and adjacent vine-covered picnic area. The Algodon Villa offers five-star service and is situated for vacationing families, business conferences, retreat travelers, golfing companions, or wine route globe trekkers. Algodon Wine Estates has also recently completed the construction of a new lodge which lies adjacent to the original one. The new lodge features six additional suites and a gallery with two fireplaces and a bar.

Below is a table showing occupancy data, ADR and RevPAR for Algodon Wine Estates:

| AWE - San Rafael | ||||||||||||||||||||||||||||||||

| USD | ARS | |||||||||||||||||||||||||||||||

| For the year ended | For the year ended | |||||||||||||||||||||||||||||||

| December 31, 2019 | December 31, 2020 | Δ amount | Δ % | December 31, 2019 | December 31, 2020 | Δ amount | Δ % | |||||||||||||||||||||||||

| Occupancy level | 20 | % | 13 | % | -7 | % | -35 | % | 20 | % | 13 | % | -7 | % | -35 | % | ||||||||||||||||

| Average daily Rate (ADR) | 219 | 215 | -4 | -2 | % | 10,318 | 15,180 | 4,862 | 47 | % | ||||||||||||||||||||||

| RevPAR | 44 | 28 | -16 | -36 | % | 2,064 | 1,973 | -91 | -4 | % | ||||||||||||||||||||||

| Occupancy level: | It is a Hotel KPI calculation that shows the percentage of available rooms or beds being sold for a certain period of time. |

| It is important for hotels to keep track of this data on a daily basis to identify the average daily rate, forecast and apply revenue management. | |

| This ratio decreased by 35% which is explained by the Government regulations about the quarantine which was set from March 19th, 2020 to late October 2020 in order to stop COVID-19 spreading. AWE compared to STAR depends on domestic tourism who was looking for open areas. | |

| Average daily Rate (ADR): | This is a metric widely used in the hospitality industry to indicate the average realized room rental per day. |

| This is calculated by taking the average revenue earned from rooms and dividing it by the number of rooms sold. It excludes complimentary rooms and rooms occupied by staff. | |

| 2020 ADR in USD is similar with previous year (USD 219 vs USD 215). The same ratio in ARS has increased by 47% due to the effect of the devaluation. | |

| RevPAR: | Revenue per available room (RevPAR) is a performance metric used in the hotel industry. It is calculated by multiplying a hotel’s average daily room rate (ADR) by its occupancy rate. |

| 2020 RevPAR in USD has decreased in comparison with previous year from USD 44 to USD 28 due to the low level of occupation during 2020. However the same 2020 ratio in ARS is similar than 2019 because the low occupation was compensated by the devaluation. |

| 17 |

In 2018, Algodon Wine Estates was inducted to TripAdvisor’s Hall of Fame, a distinction given to recognize hotels that have won its Certificate of Excellence award for five consecutive years. Algodon Wine Estates won the Certificate of Excellence award for the years 2014 through 2019. The Certificate of Excellence award celebrates businesses that have continually delivered a quality customer experience, taking into account the quality, quantity and recency of reviews submitted by travelers on TripAdvisor over a 12-month period. To qualify, a business must maintain an overall TripAdvisor bubble rating of at least four out of five, have a minimum number of reviews and must have been listed on TripAdvisor for at least 12 months.

Algodon Fine Wines

Algodon Wine Estates contains a vineyard with 290 acres of vines. Over 60 acres have been cultivated since the 1940’s, and approximately 20 acres since the 1960’s. The property produces eight varieties of grapes, including Argentina’s signature varietal, Malbec, as well as Bonarda, Cabernet Sauvignon, Merlot, Syrah, Pinot Noir, Chardonnay and Semillon. The primary difference between the old and new vines is the style of pruning. Algodon Wine Estates utilizes a boutique wine making process, typified by production of a low volume of premium wines sold at a higher than average price in the market.

In an effort to increase distribution of its wines, Algodon Wine Estates is working with a number of importers operating in some of the world’s chief markets for premium wines. In Europe, Algodon Wine Estates warehouses its wines in Amsterdam for central distribution to clients in Germany and in the U.K. through Condor Wines (www.condorwines.co.uk), which works with regional distribution partners throughout the U.K. such as hotel and restaurant chains, regional and national brewers, pub companies, wholesalers and wine merchants. In the United States, Algodon Fine Wines is available for sale online at Sherry-Lehmann.com (which ships to 39 states), at Sherry-Lehmann’s iconic retail store in New York City, at Spec’s Wines, Spirits and Finer Foods retail stores in Texas, and Wally’s Wine & Spirits retail store located in Los Angeles. GGH’s Fine Wine’s Malbec has been featured on the esteemed wine lists of West London’s The Fat Duck, a Michelin 3-Star Restaurant, and arguably the U.K.’s most famous eatery, as well as London’s Restaurant Gordon Ramsay, A Michelin 3-Star Restaurant, also the exclusive London wine club, 67 Pall Mall, and the exclusive wine list of Buenos Aires’ fine dining restaurant, Parrilla Don Julio, one of Argentina’s most high-profile eateries.

Founded in 2013, Seaview Imports is a national importer of fine wines from France, Spain, Italy, Australia, New Zealand, Argentina and Chile. Headquartered in Port Washington, NY, the company distributes its products in twenty-five select states through wholesalers and state boards. Their producers are leaders in their regions and their portfolios are all exceptional in quality and value. For further information, please visit www.seaviewimports.com.

Seaview’s philosophy in building Algodon as a brand in the United States has been to select high-profile, quality-oriented retailers whom we believe have high credibility in speaking to their wine constituency. We believe it is reasonable to conclude that consumer confidence (within the fine wine industry) can be positively influenced by the endorsement of a well-respected wine merchant. These “Algodon Brand Ambassadors” can not only promote Algodon, its history and vision, but can serve as the go-to wine shop for the shareholders, friends and family of Algodon aficionados. In tandem with building a network of brand ambassador retailers, an additional initiative is to engage a fine wine distributor in select cosmopolitan markets that can provide smaller independent retail and on-premise (restaurant) coverage.

Current Distribution Markets (as of the fourth quarter of 2020)

| 1. | California – Vinporter Retail Holdings, LLC | |

| 2. | California – dba Hollywood Burger | |

| 3. | California – dba Salvatore Italian Restaurant | |

| 4. | California – dba Sherry- Lehmann West, LLC | |

| 5. | California – dba Wally’s Wine and Spirits |

| 18 |

| 6. | California – Golden State Wine & Spirits | |

| 7. | California – Peach Systems Inc. | |

| 8. | Florida – Greystone | |

| 9. | Georgia – Georgia Crown Distributing - Atlanta | |

| 10. | Illinois – Louis Glunz Wines Inc | |

| 11. | Minnesota – Bellboy Corporation | |

| 12. | Maryland – Lanterna Distributors, Inc. | |

| 13. | New Jersey – dba Wine Chateau | |

| 14. | New Jersey – dba Wine Chateau / Le Malt | |

| 15. | New Jersey – Port Washington Imports | |

| 16. | New York – Independence Wine & Spirits of NY, LLC | |

| 17. | New York – dba Ambassador Wine & Spirits | |

| 18. | New York – dba Beekman Wine & Liquor | |

| 19. | New York – dba Estancia 460 | |

| 20. | New York – dba Nirvana | |

| 21. | New York – dba Pascalou | |

| 22. | New York – dba Tuscany Steakhouse | |

| 23. | New York – dba Friars National Association Inc. | |

| 24. | New York – dba Mister Wright | |

| 25. | New York – dba Sherry Lehman Inc. | |

| 26. | Nevada – Franco Wine | |

| 27. | Oklahoma – Elite Wine & Spirits | |

| 28. | Texas – United Wine and Spirits, LLC |

Markets - scheduled by Seaview for 2021

| 1. | New Jersey – Gary’s Wine & Marketplace (+ local wholesaler) | |

| 2. | Washington DC – Calvert Woodley | |

| 3. | Massachusetts – Table & Vine (+ local wholesaler) | |

| 4. | Oklahoma – Elite Wines & Spirits | |

| 5. | Colorado – Argonaut | |

| 6. | Minnesota – Haskell’s | |

| 7. | Missouri – Brown Derby | |

| 8. | Indiana – 21st Amendment | |

| 9. | Nevada – Lee |

None of the understandings with wine importers constitute a binding commitment by either party to produce, import or export the Company’s wines; performance by any of the parties is dependent upon numerous factors such as economic and political climate, consumer spending, weather, the Company’s ability to continue wine production operations, the market acceptance of the Company’s products, and other matters described in “Risk Factors” on page 23.

AWE uses microvinification (barrel fermentation) for its premium varietals and blends. Microvinification is commonly used in France, but is uncommon in Argentina, and Algodon Wine Estates is one of the few wineries in the country to implement this specialized process.

James Galtieri holds the title of Senior Wine Advisor on GGH’s Advisory Board. James is a founding partner and former President/CEO of Pasternak Wine Imports, a renowned national wine importer and distributor, founded in 1988 in partnership with Domaines Barons de Rothschild (Lafite). He currently maintains an advisory role to Domaines Barons de Rothschild (Lafite), and he is the current President/CEO at Seaview Imports LLC., a national wine importer (based in New York) covering the U.S. market with high-quality, exclusive wine brands. James has considerable background and experience in wine knowledge and wine market dynamics, and he is specialized in corporate management in the wine & spirit industry.

| 19 |

In the third quarter of 2020, Algodon Fine Wines launched e-commerce websites in both the U.S. and Argentina.

In September 2020, Algodon Fine Wines announced the launch of an e-commerce initiative servicing patrons in Argentina, at AlgodonWines.com.ar. The e-commerce store sells and ships Algodon wines direct from its San Rafael, Mendoza winery to consumers living in Argentina. This debut is part of an expanded effort to rollout the brand’s premium Malbec-based wines, as well as the rest of the Algodon portfolio of award-winning varietals and blends.

In September 2020, Algodon Fine Wines also launched an e-commerce initiative servicing the United States, with the backend warehousing and fulfillment provided by the California-based distributer VinPorter Wine Merchants, at AlgodonFineWines.com. The e-commerce store, powered by VinPorter, links to a virtual storefront showcasing the Algodon wines currently distributed in the U.S. This debut is part of an expanded U.S. rollout for Premium Malbec-based wines, as well as the rest of the Algodon portfolio of award-winning varietals and blends. In addition to the Algodon Fine Wines site powered by VinPorter, Algodon wines are also available throughout the U.S. both in-store and online at such retailers as Spec’s, Sherry-Lehmann, The Noble Grape and Wine-Searcher.com (among others).

Algodon’s premium wines have received a number of top awards and ratings from the world’s foremost tasting competitions including Gold Medals from the prestigious Global Masters Wine Competition, comprised of master sommeliers. Algodon’s Black Label Reserves represent the best selection from Algodon with 100% microvinified blends whose low yield produces full concentration of fruit and flavor. Algodon’s complete portfolio of fine wines is currently available in wine bars, wine shops, restaurants and hotels in Buenos Aires, Mendoza, Germany, Switzerland, Guernsey, U.K., the Netherlands and the United States.

Algodon Wine Estates – Real Estate Development