UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22762

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

(Exact name of registrant as specified in charter)

301 E. Colorado Boulevard, Suite 720

Pasadena, CA 91101

(Address of principal executive offices) (Zip code)

R. Eric Chadwick

Flaherty & Crumrine Incorporated

301 E. Colorado Boulevard, Suite 720

Pasadena, CA 91101

(Name and address of agent for service)

Registrant’s telephone number, including area code: 626-795-7300

Date of fiscal year end: November 30

Date of reporting period: May 31, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

FLAHERTY & CRUMRINE DYNAMIC PREFERRED AND INCOME FUND

To the Shareholders of Flaherty & Crumrine Dynamic Preferred and Income Fund (“DFP”):

What a difference a quarter makes. After beginning the fiscal year with weak performance, the preferred market recovered in remarkable fashion during the second fiscal quarter.1 To be fair, recovery was a story for many markets during this period, but preferreds more than held their own in comparison. Total return2 on net asset value (“NAV”) was 8.0% for the quarter and 4.4% for the first half of the fiscal year. Total return on market price of Fund shares over the same periods was 8.0% and 8.6%, respectively.

The table below shows Fund returns over various measurement periods, and they continue to be very good. The table includes performance of two indices, Barclays U.S. Aggregate and S&P 500, as proxies for bond and stock markets, respectively. While neither is a benchmark for Fund performance, they provide context for returns on broad asset categories.

TOTAL RETURN ON NET ASSET VALUE

FOR PERIODS ENDED MAY 31, 2016

| Actual Returns | Average Annualized Returns | |||||||||||||||||||

| Three Months |

Six Months |

One Year |

Three Years |

Life of Fund(1) |

||||||||||||||||

| Flaherty & Crumrine Dynamic Preferred and Income Fund | 8.0 | % | 4.4 | % | 6.8 | % | 9.8 | % | 9.7 | % | ||||||||||

| Barclays U.S. Aggregate Index(2) |

1.3 | % | 3.1 | % | 3.0 | % | 2.9 | % | 2.8 | % | ||||||||||

| S&P 500 Index(3) |

9.1 | % | 1.9 | % | 1.7 | % | 11.0 | % | 10.6 | % | ||||||||||

| (1) | Since inception on May 29, 2013. |

| (2) | The Barclays U.S. Aggregate Index is an unmanaged index considered representative of the U.S. investment grade, fixed-rate bond market. |

| (3) | The S&P 500 Index is a capitalization-weighted index of 500 common stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. |

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. In addition, NAV performance will vary from market price performance, and you may have a taxable gain or loss when you sell your shares.

Investors breathed a sigh of relief in the second fiscal quarter as earlier concerns eased. Commodity prices, such as oil and metals, not only halted their rapid declines, but in several instances rebounded to levels more than 150% above recent lows. Higher common stock prices of oil and other commodity companies, along with the stocks of banks that lend to these sectors, helped improve market sentiment broadly.

The preferred market also benefited from positive technical developments, with a marked increase in issuers redeeming securities. Issuer redemptions ($15.9 billion announced during the second fiscal quarter), combined with measured new-issue supply, provided support to prices as redemption proceeds were reinvested. Many recent redemptions were long overdue from an economic standpoint (because the

| 1 | March 1, 2016—May 31, 2016 |

| 2 | Following the methodology required by the Securities and Exchange Commission, total return assumes dividend reinvestment. |

securities had high coupons), but issuers delayed those calls primarily due to complicated rules around regulatory capital treatment of these securities. We expect issuers to call similar “legacy” securities over the next several years.

Monetary policy globally appears to be in a holding pattern, albeit still at very accommodative levels. After raising its benchmark interest rate in December 2015, the Federal Reserve has continued to wait on its next rate increase. The European Union (EU) and Japan have not expanded programs in the last quarter. However, the United Kingdom’s recent vote to exit the EU (so-called “Brexit”) may prompt easier monetary policy in the UK and possibly an increase in or extension of the European Central Bank’s asset purchase program going forward.

The U.S. economy continues to be a ray of sunshine compared to most others (even if growth is still below historical norms), and it remains to be seen how long the Federal Reserve will wait on its next rate increase. Prior to Brexit, at least one rate hike seemed probable this year, perhaps beginning as soon as July. However, with both domestic and global economic uncertainty on the rise, the Fed is expected to keep monetary policy on hold until at least September—and perhaps into 2017.

Taking a step back from what has been a volatile market this year, the fundamentally positive case for preferred securities remains largely unchanged. Investors around the world are searching for yield as interest rates remain low. Credit quality continues to be strong, and modest economic growth should restrain companies and households from over-borrowing despite low rates. New issue supply has been and should remain measured for preferred stocks, with a bias towards non-U.S. issuers going forward. Regulatory trends continue to bolster credit-worthiness at financial companies, which are the largest issuers of preferred securities. As we have said before, the ride may be bumpy as markets traverse much uncharted territory—but we believe total returns will continue to be competitive over time for preferred investors.

In the discussion topics that follow, we dig deeper into subjects mentioned here as well as others of interest to shareholders. In addition, we encourage you to visit the Fund’s website, www.preferredincome.com, for timely and important information.

Sincerely,

The Flaherty & Crumrine Portfolio Management Team

June 30, 2016

2

DISCUSSION TOPICS

(Unaudited)

The Fund’s Portfolio Results and Components of Total Return on NAV

The table below presents a breakdown of the components that comprise the Fund’s total return on NAV over both the recent six months and over the Fund’s fiscal year. These components include: (a) the total return on the Fund’s portfolio of securities; (b) any returns from hedging the portfolio against significant increases in long-term interest rates; (c) the impact of utilizing leverage to enhance returns to shareholders; and (d) the Fund’s operating expenses. When all of these components are added together, they comprise the total return on NAV.

Components of DFP’s Total Return on NAV

for the Six Months Ended May 31, 20161

| Total Return on Unleveraged Securities Portfolio |

|

3.4 | % | |||||

| Return from Interest Rate Hedging Strategy |

|

N/A | ||||||

| Impact of Leverage (including leverage expense) |

|

1.6 | % | |||||

| Expenses (excluding leverage expense) |

|

-0.6 | % | |||||

| 1 Actual, not annualized. | Total Return on NAV | 4.4 | % | |||||

For the six months ended May 31, 2016, the BofA Merrill Lynch 8% Constrained Core West Preferred & Jr Subordinated Securities IndexSM (P8JC)2 returned 3.3%. This index reflects the various segments of the preferred securities market constituting the Fund’s primary focus. Since this index return excludes all expenses and the impact of leverage, it compares most directly to the top line in the Fund’s performance table above (Total Return on Unleveraged Securities Portfolio).

Total Return on Market Price of Fund Shares

While our focus is primarily on managing the Fund’s investment portfolio, our shareholders’ actual return is comprised of the Fund’s monthly dividend payments plus changes in the market price of Fund shares. During the six-month period ending May 31, 2016, total return on market price of Fund shares was 8.6%.

Historically, the preferred securities market has experienced price volatility consistent with those of other fixed-income securities. However, since mid-2007 it has become clear that preferred-security valuations, including both the Fund’s NAV and the market price of its shares, can move dramatically when there is volatility in financial markets. The chart on top of page 4 illustrates the variability of returns on both the Fund’s NAV and market price. Many fixed-income asset classes experienced increased volatility over this period.

| 2 | The BofA Merrill Lynch 8% Constrained Core West Preferred & Jr Subordinated Securities IndexSM (P8JC) includes U.S. dollar-denominated investment-grade or below investment-grade, fixed rate, floating rate or fixed-to-floating rate, retail or institutionally structured preferred securities of U.S. and foreign issuers with issuer concentration capped at 8%. All index returns include interest and dividend income, and, unlike the Fund’s returns, are unmanaged and do not reflect any expenses. |

3

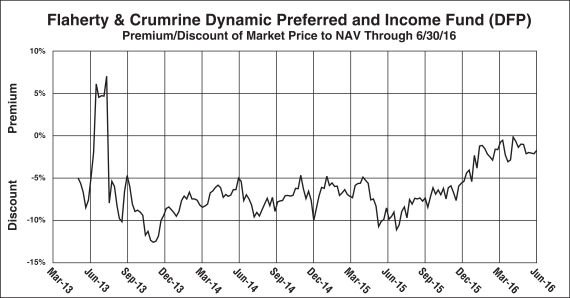

In a more perfect world, the market price of Fund shares and its NAV, as shown in the above chart, would track more closely. If so, any premium or discount (calculated as the difference between these two inputs and expressed as a percentage) would remain relatively close to zero. However, as can be seen in the chart below, this often has not been the case.

Although divergence between NAV and market price of a closed-end fund is generally driven by supply/demand imbalances affecting its market price, we can only speculate about why the relationship between the Fund’s market price and NAV hasn’t been closer.

4

Based on a closing price of $24.25 on June 30th and assuming its current monthly distribution of $0.16 does not change, the current annualized yield on market price of Fund shares is 7.9%. In our opinion, this distribution rate measures up favorably with most comparable fixed-income investment opportunities. Of course, there can be no guarantee that the Fund’s dividend will not change based on market conditions.

U.S. Economic and Credit Outlook

The U.S. economy got off to a slow start in 2016, posting growth in inflation-adjusted gross domestic product (real GDP) of just 0.8% in the first quarter. Second quarter growth looks considerably better, with economists’ real GDP estimates currently around 2.5% for the rest of 2016. That would leave overall growth of about 2% in 2016, in-line with the average pace since 2010.

Employment growth slowed significantly so far in the second quarter, from an average of 196,000 nonfarm payroll jobs per month in the first quarter to an average of just 76,000 jobs per month in April and May. (June data was not available at the time of writing.) We think this will prove to be a lagged response to Q1 developments, when jobs grew faster than the economy, and we expect employment to pick up again along with better growth. Consistent with gradual labor market tightening, wage growth remained solid, up 2.5% over 12 months ending in May.

Sector performance of the U.S. economy is mixed. On the positive side, consumer spending and housing remain strong, supported by rising income, improved household balance sheets, low interest rates and—in the case of housing—pent-up demand from years following the housing bust. Government spending is growing slowly. On the negative side, business investment is still feeling the impacts of an energy boom turned bust and shrinking exports. However, cutbacks to energy investment appear mostly done, and oil and gas prices are up from recent lows; those headwinds are diminishing. A wider trade deficit in response to weaker global growth and a sharp rally in the U.S. dollar also slowed U.S. domestic economic growth. While the dollar retreated somewhat prior to Britain’s vote to leave the European Union (“Brexit”), it has rallied again, perhaps setting the stage for greater trade drag ahead. On balance, we expect real GDP growth in the U.S. will continue around its recent 2% average pace.

Core inflation has edged up, but headline inflation remains subdued and well below the Federal Reserve’s 2% target. The overall personal consumption expenditure (PCE) deflator was up 0.9% over 12 months ending in May (latest data available); excluding food and energy, the core PCE deflator was up 1.6% over the same period, compared to 1.3% in December 2015. Rising wages and slow productivity growth are encouraging businesses to raise prices, and rising personal income is helping those higher prices stick. If energy prices stabilize or move up further, headline inflation should gradually catch up to core inflation.

Faced with slow first-quarter growth, inflation that remains below target, and uncertainty over employment, the Federal Reserve left monetary policy unchanged in the second quarter. It’s likely to do the same at the next Federal Open Market Committee (FOMC) meeting in late July, partly because June’s employment data would have to be exceptionally strong to erase doubts raised by weakness in April and May payrolls and partly because Brexit introduces economic uncertainty that might slow U.S. growth for a time. (It’s highly likely to slow growth in the UK and Europe.) If global markets are not too unsettled by Brexit, another rate hike is possible at the FOMC’s September meeting, by which time it should be clear whether recent weakness in job growth was an outlier or not.

5

If that outlook is correct, we expect the Fed will hike rates by 0.25% in September. In turn, long-term interest rates should move higher as well, but probably less than short-term rates, since markets already anticipate some Fed tightening. However, uncertainty surrounding the presidential election, Brexit and weaker economic growth abroad, or any number of unforeseen shocks could push the next tightening to December or even into 2017. Forecasting Fed actions is always difficult business, never more so than now.

Fortunately, the credit outlook is a bit less murky, if somewhat mixed. Corporate profits fell in the first quarter (latest data available), and speculative-grade nonfinancial corporate borrowers are experiencing rising rates of default and delinquency. Banks’ commercial and industrial loan portfolios are feeling some of that strain, and problem loans have risen there. However, most other loan portfolios are seeing stable or improving performance. Moreover, banks are building capital and liquidity, and their credit profiles generally continue to improve. That’s good news for the preferred market, and we remain comfortable with the Fund’s credit exposures.

This combination of modest economic growth, low interest rates and solid credit conditions provide a good foundation for preferred securities. Although shifting sentiment may make for a bumpy ride occasionally, we think preferred securities should continue to offer good risk-adjusted returns to investors, despite current uncertainties.

6

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

PORTFOLIO OVERVIEW

May 31, 2016 (Unaudited)

| % of Net Assets****† | ||||

| Holdings Generating Qualified Dividend Income (QDI) for Individuals | 66% | |||

| Holdings Generating Income Eligible for the Corporate Dividends Received Deduction (DRD) | 50% | |||

| **** | This does not reflect year-end results or actual tax categorization of Fund distributions. These percentages can, and do, change, perhaps significantly, depending on market conditions. Investors should consult their tax advisor regarding their personal situation. |

| † | Net Assets includes assets attributable to the use of leverage. |

7

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

PORTFOLIO OF INVESTMENTS

May 31, 2016 (Unaudited)

| Shares/$ Par | Value | |||||||||

|

|

Preferred Securities — 95.3% |

|||||||||

| Banking — 54.0% |

||||||||||

| 7,000 | AgStar Financial Services ACA, 6.75%, 144A**** |

$ | 7,419,562 | *(1) | ||||||

| 103,166 | Astoria Financial Corp., 6.50%, Series C |

2,725,903 | *(1) | |||||||

| Bank of America Corporation: |

||||||||||

| $ | 1,600,000 | 6.30%, Series DD |

1,702,000 | * | ||||||

| $ | 9,107,000 | 6.50%, Series Z |

9,619,269 | *(1) | ||||||

| $ | 7,350,000 | 8.00%, Series K |

7,377,562 | *(1) | ||||||

| $ | 13,105,000 | 8.125%, Series M |

13,252,431 | *(1) | ||||||

| 60,000 | Barclays Bank PLC, 7.10%, Series 3 |

1,549,200 | **(2) | |||||||

| BNP Paribas: |

||||||||||

| $ | 7,800,000 | 7.375%, 144A**** |

7,790,250 | **(1)(2) | ||||||

| $ | 2,000,000 | 7.625%, 144A**** |

2,062,500 | **(2) | ||||||

| 76,704 | Capital One Financial Corporation, 6.70%, Series D |

2,127,194 | *(1) | |||||||

| Citigroup, Inc.: |

||||||||||

| 1,170,807 | 6.875%, Series K |

32,633,318 | *(1) | |||||||

| 65,022 | 7.125%, Series J |

1,866,944 | * | |||||||

| $ | 5,000,000 | Citizens Financial Group, Inc., 5.50% |

4,854,970 | *(1) | ||||||

| CoBank ACB: |

||||||||||

| 38,100 | 6.20%, Series H, 144A**** |

3,852,862 | * | |||||||

| 3,450 | 6.25%, Series F, 144A**** |

356,967 | * | |||||||

| $ | 550,000 | 6.25%, Series I, 144A**** |

570,768 | * | ||||||

| 876,686 | Fifth Third Bancorp, 6.625%, Series I |

27,170,691 | *(1) | |||||||

| 5,000 | First Horizon National Corporation, 6.20%, Series A |

129,312 | * | |||||||

| 34,219 | First Niagara Financial Group, Inc., 8.625%, Series B |

903,467 | *(1) | |||||||

| 25,000 | First Republic Bank, 6.20%, Series B |

657,312 | * | |||||||

| Goldman Sachs Group: |

||||||||||

| 10,000 | 5.50%, Series J |

259,724 | * | |||||||

| $ | 1,170,000 | 5.70%, Series L |

1,167,075 | * | ||||||

| 54,609 | 6.30%, Series N |

1,447,684 | * | |||||||

| 531,522 | 6.375%, Series K |

14,717,844 | *(1) | |||||||

| HSBC PLC: |

||||||||||

| $ | 4,458,000 | HSBC Capital Funding LP, 10.176%, 144A**** |

6,519,825 | (1)(2) | ||||||

| $ | 1,738,000 | HSBC Holdings PLC, 6.875% |

1,755,380 | **(2) | ||||||

| 44,800 | HSBC Holdings PLC, 8.00%, Series 2 |

1,172,080 | **(2) | |||||||

| 340,800 | HSBC USA, Inc., 6.50%, Series H |

8,660,580 | * | |||||||

| 252,000 | Huntington Bancshares, Inc., 6.25%, Series D |

6,608,070 | *(1) | |||||||

| ING Groep NV: |

||||||||||

| 160,000 | 6.375% |

4,129,600 | **(1)(2) | |||||||

| 38,082 | 7.05% |

1,006,221 | **(2) | |||||||

| 3,201 | 7.20% |

84,610 | **(1)(2) | |||||||

The accompanying notes are an integral part of the financial statements.

8

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

PORTFOLIO OF INVESTMENTS (Continued)

May 31, 2016 (Unaudited)

| Shares/$ Par | Value | |||||||||

|

|

Preferred Securities — (Continued) |

|||||||||

| Banking — (Continued) |

||||||||||

| JPMorgan Chase & Company: |

||||||||||

| $ | 10,700,000 | 6.00%, Series R |

$ | 11,071,183 | *(1) | |||||

| $ | 8,000,000 | 6.75%, Series S |

8,890,000 | *(1) | ||||||

| $ | 3,331,000 | 7.90%, Series I |

3,410,111 | * | ||||||

| $ | 14,022,000 | Lloyds Banking Group PLC, 6.657%, 144A**** |

15,459,255 | **(1)(2) | ||||||

| M&T Bank Corporation: |

||||||||||

| $ | 15,425,000 | 6.450%, Series E |

16,736,125 | *(1) | ||||||

| $ | 6,789,000 | 6.875%, Series D, 144A**** |

6,814,459 | *(1) | ||||||

| Morgan Stanley: |

||||||||||

| 674,994 | 6.875%, Series F |

19,061,830 | *(1) | |||||||

| 241,200 | 7.125%, Series E |

7,212,483 | *(1) | |||||||

| PNC Financial Services Group, Inc.: |

||||||||||

| 438,413 | 6.125%, Series P |

13,135,949 | *(1) | |||||||

| $ | 11,748,000 | 6.75%, Series O |

13,084,335 | *(1) | ||||||

| $ | 8,625,000 | RaboBank Nederland, 11.00%, 144A**** |

10,587,187 | (1)(2) | ||||||

| 627,170 | Regions Financial Corporation, 6.375%, Series B |

17,273,830 | *(1) | |||||||

| Royal Bank of Scotland Group PLC: |

||||||||||

| $ | 4,825,000 | RBS Capital Trust II, 6.425% |

5,138,625 | **(1)(2) | ||||||

| 13,000 | 6.60%, Series S |

332,540 | **(2) | |||||||

| 538,500 | 7.25%, Series T |

13,828,680 | **(1)(2) | |||||||

| $ | 5,000,000 | Societe Generale SA, 8.00%, 144A**** |

5,000,500 | **(1)(2) | ||||||

| 110,378 | State Street Corporation, 5.90%, Series D |

3,108,520 | *(1) | |||||||

| 288,008 | SunTrust Banks, Inc., 5.875%, Series E |

7,595,491 | *(1) | |||||||

| 97,150 | US Bancorp, 6.50%, Series F |

2,943,888 | *(1) | |||||||

| 50,000 | Valley National Bancorp, 6.25%, Series A |

1,427,000 | * | |||||||

| Wells Fargo & Company: |

||||||||||

| 180,300 | 5.85%, Series Q |

4,787,416 | *(1) | |||||||

| $ | 9,025,000 | 7.98%, Series K |

9,510,094 | *(1) | ||||||

| Zions Bancorporation: |

||||||||||

| 10,000 | 6.30%, Series G |

272,825 | * | |||||||

| $ | 10,000,000 | 7.20%, Series J |

10,625,000 | *(1) | ||||||

|

|

|

|||||||||

| 383,458,501 | ||||||||||

|

|

|

|||||||||

| Financial Services — 0.8% |

||||||||||

| Charles Schwab Corporation: |

||||||||||

| 4,300 | 5.95%, Series D |

112,155 | * | |||||||

| 55,700 | 6.00%, Series C |

1,487,886 | *(1) | |||||||

The accompanying notes are an integral part of the financial statements.

9

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

PORTFOLIO OF INVESTMENTS (Continued)

May 31, 2016 (Unaudited)

| Shares/$ Par | Value | |||||||||

|

|

Preferred Securities — (Continued) |

|||||||||

| Financial Services — (Continued) |

||||||||||

| Deutsche Bank: |

||||||||||

| 89,000 | Deutsche Bank Contingent Capital Trust III, 7.60% |

$ | 2,300,873 | **(1)(2) | ||||||

| 8,103 | Deutsche Bank Contingent Capital Trust V, 8.05% |

215,398 | **(1)(2) | |||||||

| HSBC PLC: |

||||||||||

| 72,515 | HSBC Finance Corporation, 6.36%, Series B |

1,820,308 | * | |||||||

|

|

|

|||||||||

| 5,936,620 | ||||||||||

|

|

|

|||||||||

| Insurance — 26.2% |

||||||||||

| 385,553 | Allstate Corp., 6.625%, Series E |

10,850,425 | *(1) | |||||||

| American International Group: |

||||||||||

| $ | 280,000 | AIG Life Holdings, Inc., 7.57%, 144A**** |

333,340 | |||||||

| $ | 497,000 | AIG Life Holdings, Inc., 8.125%, 144A**** |

617,523 | |||||||

| $ | 350,000 | American International Group, Inc., 8.175% 05/15/58 |

434,875 | |||||||

| $ | 1,010,000 | Aon Corporation, 8.205% 01/01/27 |

1,295,325 | |||||||

| 317,980 | Arch Capital Group, Ltd., 6.75%, Series C |

8,506,760 | **(1)(2) | |||||||

| AXA SA: |

||||||||||

| $ | 6,550,000 | 6.379%, 144A**** |

6,951,188 | **(1)(2) | ||||||

| $ | 8,500,000 | 8.60% 12/15/30 |

11,434,200 | (1)(2) | ||||||

| 646,952 | Axis Capital Holdings Ltd., 6.875%, Series C |

17,145,845 | **(1)(2) | |||||||

| 6,000 | Delphi Financial Group, 7.376% 05/15/37 |

141,563 | ||||||||

| Endurance Specialty Holdings: |

||||||||||

| 47,000 | 6.35%, Series C |

1,235,160 | **(2) | |||||||

| 181,000 | 7.50%, Series B |

4,605,093 | **(2) | |||||||

| $ | 988,000 | Everest Re Holdings, 6.60% 05/15/37 |

812,630 | (1) | ||||||

| 137,500 | Hartford Financial Services Group, Inc., 7.875% |

4,419,594 | (1) | |||||||

| Liberty Mutual Group: |

||||||||||

| $ | 17,950,000 | 7.80% 03/15/37, 144A**** |

19,879,625 | (1) | ||||||

| $ | 8,195,000 | 10.75% 06/15/58, 144A**** |

12,067,138 | (1) | ||||||

| MetLife: |

||||||||||

| $ | 3,759,000 | MetLife, Inc., 10.75% 08/01/39 |

5,837,727 | (1) | ||||||

| $ | 17,200,000 | MetLife Capital Trust X, 9.25% 04/08/38, 144A**** |

23,607,000 | (1) | ||||||

| PartnerRe Ltd.: |

||||||||||

| 77,450 | 5.875%, Series I |

1,982,720 | **(1)(2) | |||||||

| 37,556 | 6.50%, Series G |

1,018,519 | **(1)(2) | |||||||

| 252,464 | 7.25%, Series H |

7,435,065 | **(1)(2) | |||||||

| Prudential Financial, Inc.: |

||||||||||

| $ | 5,574,000 | 5.625% 06/15/43 |

5,880,849 | (1) | ||||||

| $ | 5,848,000 | 5.875% 09/15/42 |

6,345,080 | (1) | ||||||

The accompanying notes are an integral part of the financial statements.

10

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

PORTFOLIO OF INVESTMENTS (Continued)

May 31, 2016 (Unaudited)

| Shares/$ Par | Value | |||||||||

|

|

Preferred Securities — (Continued) |

|||||||||

| Insurance — (Continued) |

||||||||||

| QBE Insurance: |

||||||||||

| $ | 10,900,000 | QBE Capital Funding III Ltd., 7.25% 05/24/41, 144A**** |

$ | 12,194,375 | (1)(2) | |||||

| Unum Group: |

||||||||||

| $ | 1,750,000 | Provident Financing Trust I, 7.405% 03/15/38 |

2,014,054 | |||||||

| W.R. Berkley Corporation: |

||||||||||

| 233,946 | 5.625% 04/30/53 |

5,959,189 | (1) | |||||||

| 96,000 | 5.75% 06/01/56 |

2,409,005 | (1) | |||||||

| 1,530 | 5.90% 03/01/56 |

39,122 | ||||||||

| XL Group PLC: |

||||||||||

| $ | 14,850,000 | XL Capital Ltd., 6.50%, Series E |

10,524,938 | (1)(2) | ||||||

|

|

|

|||||||||

| 185,977,927 | ||||||||||

|

|

|

|||||||||

| Utilities — 3.2% |

||||||||||

| Commonwealth Edison: |

||||||||||

| $ | 2,000,000 | COMED Financing III, 6.35% 03/15/33 |

2,124,520 | |||||||

| 100,000 | DTE Energy Company, 5.375% 06/01/76, Series B |

2,515,630 | ||||||||

| 121,452 | Integrys Energy Group, Inc., 6.00% |

3,195,706 | (1) | |||||||

| PPL Corp: |

||||||||||

| $ | 8,500,000 | PPL Capital Funding, Inc., 6.70% 03/30/67, Series A |

6,883,725 | (1) | ||||||

| $ | 5,500,000 | Puget Sound Energy, Inc., 6.974% 06/01/67, Series A |

4,654,375 | |||||||

| 50,000 | SCE Trust V, 5.45%, Series K |

1,433,625 | *(1) | |||||||

| $ | 2,000,000 | Southern California Edison Co., 6.25%, Series E |

2,215,000 | * | ||||||

|

|

|

|||||||||

| 23,022,581 | ||||||||||

|

|

|

|||||||||

| Energy — 4.8% |

||||||||||

| $ | 9,780,000 | DCP Midstream LLC, 5.85% 05/21/43, 144A**** |

6,699,300 | (1) | ||||||

| $ | 15,133,000 | Enbridge Energy Partners LP, 8.05% 10/01/37 |

11,709,159 | (1) | ||||||

| Enterprise Products Operating L.P.: |

||||||||||

| $ | 3,675,000 | 7.034% 01/15/68, Series B |

3,802,394 | (1) | ||||||

| $ | 3,750,000 | 8.375% 08/01/66, Series A |

3,256,736 | (1) | ||||||

| 182,195 | Kinder Morgan, Inc., 9.75%, Series A |

8,351,819 | * | |||||||

|

|

|

|||||||||

| 33,819,408 | ||||||||||

|

|

|

|||||||||

| Real Estate Investment Trust (REIT) — 4.0% |

||||||||||

| 425,148 | Alexandria Real Estate, 6.45%, Series E |

11,104,866 | (1) | |||||||

| National Retail Properties, Inc.: |

||||||||||

| 45,300 | 5.70%, Series E |

1,180,631 | (1) | |||||||

| 127,879 | 6.625%, Series D |

3,320,046 | (1) | |||||||

The accompanying notes are an integral part of the financial statements.

11

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

PORTFOLIO OF INVESTMENTS (Continued)

May 31, 2016 (Unaudited)

| Shares/$ Par | Value | |||||||||

|

|

Preferred Securities — (Continued) |

|||||||||

| Real Estate Investment Trust (REIT) — (Continued) |

||||||||||

| PS Business Parks, Inc.: |

||||||||||

| 22,908 | 5.70%, Series V |

$ | 594,291 | |||||||

| 20,867 | 5.75%, Series U |

535,447 | ||||||||

| 287,476 | 6.00%, Series T |

7,523,247 | (1) | |||||||

| 113,810 | 6.45%, Series S |

2,961,621 | (1) | |||||||

| 47,489 | Regency Centers Corporation, 6.625%, Series 6 |

1,255,253 | ||||||||

|

|

|

|||||||||

| 28,475,402 | ||||||||||

|

|

|

|||||||||

| Miscellaneous Industries — 2.3% |

||||||||||

| BHP Billiton Limited: |

||||||||||

| $ | 1,400,000 | BHP Billiton Finance U.S.A., Ltd., 6.75% 10/19/75, 144A**** |

1,453,900 | (2) | ||||||

| $ | 3,086,000 | General Electric Company, 5.00%, Series D |

3,236,443 | *(1) | ||||||

| $ | 11,700,000 | Land O’ Lakes, Inc., 8.00%, 144A**** |

11,963,250 | *(1) | ||||||

|

|

|

|||||||||

| 16,653,593 | ||||||||||

|

|

|

|||||||||

| Total Preferred Securities |

677,344,032 | |||||||||

|

|

|

|||||||||

|

|

Corporate Debt Securities — 2.5% |

|||||||||

| Banking — 2.0% |

||||||||||

| 422,286 | Texas Capital Bancshares Inc., 6.50% 09/21/42, Sub Notes |

10,858,029 | (1) | |||||||

| 100,000 | Zions Bancorporation, 6.95% 09/15/28, Sub Notes |

3,006,250 | ||||||||

|

|

|

|||||||||

| 13,864,279 | ||||||||||

|

|

|

|||||||||

| Communication — 0.4% |

||||||||||

| Qwest Corporation: |

||||||||||

| 12,000 | 6.625% 09/15/55 |

307,110 | ||||||||

| 107,483 | 7.375% 06/01/51 |

2,781,929 | ||||||||

|

|

|

|||||||||

| 3,089,039 | ||||||||||

|

|

|

|||||||||

| Miscellaneous Industries — 0.1% |

||||||||||

| 25,000 | eBay, Inc., 6.00% 02/01/56 |

650,813 | ||||||||

|

|

|

|||||||||

| 650,813 | ||||||||||

|

|

|

|||||||||

| Total Corporate Debt Securities |

17,604,131 | |||||||||

|

|

|

|||||||||

The accompanying notes are an integral part of the financial statements.

12

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

PORTFOLIO OF INVESTMENTS (Continued)

May 31, 2016 (Unaudited)

| Shares/$ Par | Value | |||||||||

|

|

Common Stock — 1.0% |

|||||||||

| Energy — 1.0% |

||||||||||

| 397,415 | Kinder Morgan, Inc. |

$ | 7,185,263 | * | ||||||

|

|

|

|||||||||

| 7,185,263 | ||||||||||

|

|

|

|||||||||

| Total Common Stock |

7,185,263 | |||||||||

|

|

|

|||||||||

|

|

Money Market Fund — 0.5% |

|||||||||

|

|

|

|||||||||

| BlackRock Liquidity Funds: |

||||||||||

| 3,471,973 | T-Fund, Institutional Class |

3,471,973 | ||||||||

|

|

|

|||||||||

| Total Money Market Fund |

3,471,973 | |||||||||

|

|

|

|||||||||

| Total Investments (Cost $686,946,298***) |

99.3% | 705,605,399 | ||||||

| Other Assets And Liabilities (Net) |

0.7% | 4,790,560 | ||||||

|

|

|

|

|

|||||

| Total Managed Assets |

100.0% | ‡ | $ | 710,395,959 | ||||

|

|

|

|

|

|||||

| Loan Principal Balance |

|

(241,300,000 | ) | |||||

|

|

|

|||||||

| Total Net Assets Available To Common Stock |

|

$ | 469,095,959 | |||||

|

|

|

|||||||

| * | Securities eligible for the Dividends Received Deduction and distributing Qualified Dividend Income. |

| ** | Securities distributing Qualified Dividend Income only. |

| *** | Aggregate cost of securities held. |

| **** | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration to qualified institutional buyers. At May 31, 2016, these securities amounted to $162,200,774 or 22.8% of total managed assets. |

| (1) | All or a portion of this security is pledged as collateral for the Fund’s loan. The total value of such securities was $433,822,040 at May 31, 2016. |

| (2) | Foreign Issuer. |

| ‡ | The percentage shown for each investment category is the total value of that category as a percentage of total managed assets. |

The accompanying notes are an integral part of the financial statements.

13

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

STATEMENT OF ASSETS AND LIABILITIES

May 31, 2016 (Unaudited)

| ASSETS: |

||||||||

| Investments, at value (Cost $686,946,298) |

$ | 705,605,399 | ||||||

| Dividends and interest receivable |

6,982,915 | |||||||

| Prepaid expenses |

103,731 | |||||||

|

|

|

|||||||

| Total Assets |

712,692,045 | |||||||

| LIABILITIES: |

||||||||

| Loan Payable |

$ | 241,300,000 | ||||||

| Payable for investment securities purchased |

1,738,000 | |||||||

| Dividends payable to Common Stock Shareholders |

16,281 | |||||||

| Investment advisory fees payable |

311,554 | |||||||

| Administration, Transfer Agent and Custodian fees payable |

57,456 | |||||||

| Servicing Agent fees payable |

39,332 | |||||||

| Professional fees payable |

58,310 | |||||||

| Accrued expenses and other payables |

75,153 | |||||||

|

|

|

|||||||

| Total Liabilities |

243,596,086 | |||||||

|

|

|

|||||||

| NET ASSETS AVAILABLE TO COMMON STOCK |

$ | 469,095,959 | ||||||

|

|

|

|||||||

| NET ASSETS AVAILABLE TO COMMON STOCK consist of: |

||||||||

| Undistributed net investment income |

$ | 1,089,737 | ||||||

| Accumulated net realized loss on investments sold |

(6,982,324 | ) | ||||||

| Unrealized appreciation of investments |

18,659,102 | |||||||

| Par value of Common Stock |

191,575 | |||||||

| Paid-in capital in excess of par value of Common Stock |

456,137,869 | |||||||

|

|

|

|||||||

| Total Net Assets Available to Common Stock |

$ | 469,095,959 | ||||||

|

|

|

|||||||

| NET ASSET VALUE PER SHARE OF COMMON STOCK: |

||||||||

| Common Stock (19,157,469 shares outstanding) |

$ | 24.49 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

14

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

STATEMENT OF OPERATIONS

For the Six Months Ended May 31, 2016 (Unaudited)

| INVESTMENT INCOME: |

||||||||

|

Dividends† |

$ | 11,143,031 | ||||||

| Interest |

10,928,093 | |||||||

|

|

|

|||||||

| Total Investment Income |

22,071,124 | |||||||

| EXPENSES: |

||||||||

| Investment advisory fees |

$ | 1,815,849 | ||||||

| Interest expenses |

1,595,280 | |||||||

| Administrator’s fees |

195,856 | |||||||

| Servicing Agent fees |

227,520 | |||||||

| Professional fees |

55,815 | |||||||

| Insurance expenses |

51,156 | |||||||

| Transfer Agent fees |

13,026 | |||||||

| Directors’ fees |

36,600 | |||||||

| Custodian fees |

31,397 | |||||||

| Compliance fees |

18,300 | |||||||

| Other |

129,028 | |||||||

|

|

|

|||||||

| Total Expenses |

4,169,827 | |||||||

|

|

|

|||||||

| NET INVESTMENT INCOME |

17,901,297 | |||||||

|

|

|

|||||||

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS |

||||||||

| Net realized loss on investments sold during the period |

(941,748 | ) | ||||||

| Change in net unrealized appreciation/(depreciation) of investments |

2,599,193 | |||||||

|

|

|

|||||||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS |

1,657,445 | |||||||

|

|

|

|||||||

| NET INCREASE IN NET ASSETS TO COMMON STOCK |

$ | 19,558,742 | ||||||

|

|

|

|||||||

| † | For Federal income tax purposes, a significant portion of this amount may not qualify for the inter-corporate dividends received deduction (“DRD”) or as qualified dividend income (“QDI”) for individuals. |

The accompanying notes are an integral part of the financial statements.

15

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE TO COMMON STOCK

| Six Months Ended May 31, 2016 (Unaudited) |

Year Ended November 30, 2015 |

|||||||

| OPERATIONS: |

||||||||

| Net investment income |

$ | 17,901,297 | $ | 34,304,236 | ||||

| Net realized gain/(loss) on investments sold during the period |

(941,748 | ) | 1,617,636 | |||||

| Change in net unrealized appreciation/(depreciation) of investments |

2,599,193 | (6,392,533 | ) | |||||

|

|

|

|

|

|||||

| Net increase in net assets resulting from operations |

19,558,742 | 29,529,339 | ||||||

| DISTRIBUTIONS: |

||||||||

| Dividends paid from net investment income to Common Stock Shareholders(1) |

(18,390,621 | ) | (36,781,021 | ) | ||||

|

|

|

|

|

|||||

| Total Distributions to Common Stock Shareholders |

(18,390,621 | ) | (36,781,021 | ) | ||||

| FUND SHARE TRANSACTIONS: |

||||||||

| Increase from shares issued under the Dividend Reinvestment |

16,481 | — | ||||||

|

|

|

|

|

|||||

| Net increase in net assets available to Common Stock resulting from Fund share transactions |

16,481 | — | ||||||

| NET INCREASE/(DECREASE) IN NET ASSETS AVAILABLE TO |

|

|

|

|

||||

| COMMON STOCK FOR THE PERIOD |

$ | 1,184,602 | $ | (7,251,682 | ) | |||

|

|

|

|

|

|||||

| NET ASSETS AVAILABLE TO COMMON STOCK: |

||||||||

| Beginning of period |

$ | 467,911,357 | $ | 475,163,039 | ||||

| Net increase/(decrease) in net assets during the period |

1,184,602 | (7,251,682 | ) | |||||

|

|

|

|

|

|||||

| End of period (including undistributed net investment income of $1,089,737 and $1,579,061, respectively) |

$ | 469,095,959 | $ | 467,911,357 | ||||

|

|

|

|

|

|||||

| (1) | May include income earned, but not paid out, in prior fiscal year. |

The accompanying notes are an integral part of the financial statements.

16

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

STATEMENT OF CASH FLOWS

For the Six Months Ended May 31, 2016 (Unaudited)

| INCREASE/(DECREASE) IN CASH |

||||

| CASH FLOWS FROM OPERATING ACTIVITIES: |

||||

| Net increase in net assets resulting from operations |

$ | 19,558,742 | ||

| ADJUSTMENTS TO RECONCILE NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS TO NET CASH PROVIDED BY OPERATING ACTIVITIES: |

||||

| Purchase of investment securities |

(43,473,740 | ) | ||

| Proceeds from disposition of investment securities |

31,919,498 | |||

| Net sales of short-term investment securities |

8,824,177 | |||

| Cash received from litigation claim |

30,860 | |||

| Decrease in dividends and interest receivable |

245,884 | |||

| Decrease in receivable for investments sold |

1,673,078 | |||

| Increase in prepaid expenses |

(54,007 | ) | ||

| Net amortization/(accretion) of premium/(discount) |

1,550,747 | |||

| Decrease in payable for investments purchased |

(223,107 | ) | ||

| Increase in payables to related parties |

7,547 | |||

| Decrease in accrued expenses and other liabilities |

(11,827 | ) | ||

| Change in net unrealized (appreciation)/depreciation of investments |

(2,599,193 | ) | ||

| Net realized gain from investments sold |

941,748 | |||

|

|

|

|||

| Net cash provided by operating activities |

18,390,407 | |||

|

|

|

|||

| CASH FLOWS FROM FINANCING ACTIVITIES: |

||||

| Dividend paid (net of reinvestment of dividends and change in |

(18,390,407 | ) | ||

|

|

|

|||

| Net cash used in financing activities |

(18,390,407 | ) | ||

|

|

|

|||

| Net increase/(decrease) in cash |

— | |||

| CASH: |

||||

| Beginning of the period |

$ | — | ||

|

|

|

|||

| End of the period |

$ | — | ||

|

|

|

|||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: |

||||

| Interest paid during the period |

$ | 1,580,336 | ||

| Reinvestment of dividends |

16,481 | |||

| Decrease of dividends payable to common stock shareholders |

(16,267 | ) | ||

The accompanying notes are an integral part of the financial statements.

17

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

FINANCIAL HIGHLIGHTS

For a Common Stock share outstanding throughout each period

Contained below is per share operating performance data, total investment returns, ratios to average net assets and other supplemental data. This information has been derived from information provided in the financial statements and market price data for the Fund’s shares.

| Six Months Ended May 31, 2016 (Unaudited) |

Year Ended November 30, |

|||||||||||||||

| For the period from May 29, 2013(1) through |

||||||||||||||||

| 2015 |

2014 |

November 30, 2013 |

||||||||||||||

| PER SHARE OPERATING PERFORMANCE: |

||||||||||||||||

| Net asset value, beginning of period |

$ | 24.43 | $ | 24.80 | $ | 22.75 | $ | 23.83 | (2) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| INVESTMENT OPERATIONS: |

||||||||||||||||

| Net investment income |

0.93 | 1.79 | 1.76 | 0.72 | ||||||||||||

| Net realized and unrealized gain/(loss) on investments |

0.09 | (0.24 | ) | 2.26 | (1.02 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total from investment operations |

1.02 | 1.55 | 4.02 | (0.30 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| DISTRIBUTIONS TO COMMON STOCK SHAREHOLDERS: |

||||||||||||||||

| From net investment income |

(0.96 | ) | (1.92 | ) | (1.97 | ) | (0.78 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total distributions to Common Stock Shareholders |

(0.96 | ) | (1.92 | ) | (1.97 | ) | (0.78 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net asset value, end of period |

$ | 24.49 | $ | 24.43 | $ | 24.80 | $ | 22.75 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Market value, end of period |

$ | 23.97 | $ | 22.99 | $ | 23.65 | $ | 19.89 | ||||||||

| Total investment return based on net asset value* |

4.45 | %*** | 7.07 | % | 19.05 | % | (0.93 | %)(3)*** | ||||||||

| Total investment return based on market value* |

8.63 | %*** | 5.65 | % | 29.86 | % | (17.44 | %)(3)*** | ||||||||

| RATIOS TO AVERAGE NET ASSETS AVAILABLE TO COMMON STOCK SHAREHOLDERS: |

||||||||||||||||

| Total net assets, end of period (in 000’s) |

$ | 469,096 | $ | 467,911 | $ | 475,163 | $ | 435,749 | ||||||||

| Operating expenses including interest expense(4) |

1.83 | %** | 1.68 | % | 1.67 | % | 1.47 | %** | ||||||||

| Operating expenses excluding interest expense |

1.13 | %** | 1.08 | % | 1.09 | % | 1.06 | %** | ||||||||

| Net investment income† |

7.87 | %** | 7.25 | % | 7.30 | % | 6.29 | %** | ||||||||

| SUPPLEMENTAL DATA:†† |

||||||||||||||||

| Portfolio turnover rate |

5 | %*** | 16 | % | 31 | % | 10 | %*** | ||||||||

| Total managed assets, end of period (in 000’s) |

$ | 710,396 | $ | 709,211 | $ | 710,663 | $ | 656,749 | ||||||||

| Ratio of operating expenses including interest expense(4)

to |

1.20 | %** | 1.12 | % | 1.12 | % | 1.07 | %** | ||||||||

| Ratio of operating expenses excluding interest expense to |

0.74 | %** | 0.72 | % | 0.73 | % | 0.77 | %** | ||||||||

| * | Assumes reinvestment of distributions at the price obtained by the Fund’s Dividend Reinvestment and Cash Purchase Plan. |

| ** | Annualized. |

| *** | Not annualized. |

| † | The net investment income ratios reflect income net of operating expenses, including interest expense. |

| †† | Information presented under heading Supplemental Data includes loan principal balance. |

| (1) | Commencement of operations. |

| (2) | Net asset value at beginning of period reflects the deduction of the sales load of $1.125 per share and offering costs of $0.05 per share paid by the shareholder from the $25.00 offering price. |

| (3) | Total return on net asset value is calculated assuming a purchase at the offering price of $25.00 on the inception date of trading (May 29, 2013) less the sales load of $1.125 and offering costs of $0.05 and the ending net asset value per share. Total return on market value is calculated assuming a purchase at the offering price of $25.00 on the inception date of trading (May 29, 2013) and the sale at the current market price on the last day of the period. Total return on net asset value and total return on market value are not computed on an annualized basis. |

| (4) | See Note 8. |

The accompanying notes are an integral part of the financial statements.

18

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

FINANCIAL HIGHLIGHTS (Unaudited) (Continued)

Per Share of Common Stock

| Total Dividends Paid |

Net Asset Value |

NYSE Closing Price |

Dividend Reinvestment Price(1) |

|||||||||||||

| December 31, 2015 |

$ | 0.1600 | $ | 24.20 | $ | 22.90 | $ | 22.87 | ||||||||

| January 29, 2016 |

0.1600 | 23.73 | 23.19 | 22.85 | ||||||||||||

| February 29, 2016 |

0.1600 | 23.14 | 22.64 | 22.68 | ||||||||||||

| March 31, 2016 |

0.1600 | 23.72 | 23.54 | 23.44 | ||||||||||||

| April 29, 2016 |

0.1600 | 23.99 | 23.96 | 23.99 | ||||||||||||

| May 31, 2016 |

0.1600 | 24.49 | 23.97 | 24.02 | ||||||||||||

| (1) | Whenever the net asset value per share of the Fund’s Common Stock is less than or equal to the market price per share on the reinvestment date, new shares issued will be valued at the higher of net asset value or 95% of the then current market price. Otherwise, the reinvestment shares of Common Stock will be purchased in the open market. |

Senior Securities

| 05/31/2016* | 11/30/2015 | 11/30/2014 | 11/30/2013 | |||||||||||||

| Total Debt Outstanding, End of Period (000s)(1) |

$ | 241,300 | $ | 241,300 | $ | 235,500 | $ | 221,000 | ||||||||

| Asset Coverage per $1,000 of Debt(2) |

2,944 | 2,939 | 3,018 | 2,972 | ||||||||||||

| * | Unaudited. |

| (1) | See Note 8. |

| (2) | Calculated by subtracting the Fund’s total liabilities (excluding the loan) from the Fund’s total assets and dividing that amount by the loan outstanding in 000’s. |

The accompanying notes are an integral part of the financial statements.

19

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

NOTES TO FINANCIAL STATEMENTS (Unaudited)

| 1. | Organization |

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated (the “Fund”) was incorporated as a Maryland corporation on October 10, 2012, and commenced operations on May 29, 2013 as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment objective is to seek total return, with an emphasis on high current income.

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The preparation of the financial statements is in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Portfolio valuation: The net asset value of the Fund’s Common Stock is determined by the Fund’s Administrator daily in accordance with the policies and procedures approved by the Board of Directors (the “Board”) of the Fund. It is determined by dividing the value of the Fund’s net assets available to Common Stock by the number of shares of Common Stock outstanding. The value of the Fund’s net assets available to Common Stock is deemed to equal the value of the Fund’s total assets less (i) the Fund’s liabilities and (ii) the aggregate liquidation value of any outstanding preferred stock.

The Fund’s preferred and debt securities are valued on the basis of current market quotations provided by independent pricing services or dealers approved by the Board of the Fund. Each quotation is based on the mean of the bid and asked prices of a security. In determining the value of a particular preferred or debt security, a pricing service or dealer may use information with respect to transactions in such investments, quotations, market transactions in comparable investments, various relationships observed in the market between investments, and/or calculated yield measures based on valuation technology commonly employed in the market for such investments. Common stocks that are traded on stock exchanges are valued at the last sale price or official close price on the exchange, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available mean price. Futures contracts and option contracts on futures contracts are valued on the basis of the settlement price for such contracts on the primary exchange on which they trade. Investments in over-the-counter derivative instruments, such as interest rate swaps and options thereon (“swaptions”), are valued using prices supplied by a pricing service, or if such prices are unavailable, prices provided by a single broker or dealer that is not the counterparty or, if no such prices are available, at a price at which the counterparty to the contract would repurchase the instrument or terminate the contract. Investments for which market quotations are not readily available or for which management determines that the prices are not reflective of current market conditions are valued at fair value as determined in good faith by or under the direction of the Board of the Fund, including reference to valuations of other securities which are comparable in quality, maturity and type.

20

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

Investments in money market instruments and all debt and preferred securities which mature in 60 days or less are valued at amortized cost. Investments in money market funds are valued at the net asset value of such funds.

Fair Value Measurements: The Fund has analyzed all existing investments to determine the significance and character of all inputs to their fair value determination. The levels of fair value inputs used to measure the Fund’s investments are characterized into a fair value hierarchy. Where inputs for an asset or liability fall into more than one level in the fair value hierarchy, the investment is classified in its entirety based on the lowest level input that is significant to that investment’s valuation. The three levels of the fair value hierarchy are described below:

| • | Level 1 – | quoted prices in active markets for identical securities | ||

| • | Level 2 – | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) | ||

| • | Level 3 – | significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) | ||

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Transfers in and out of levels are recognized at market value at the end of the period.

A summary of the inputs used to value the Fund’s investments as of May 31, 2016 is as follows:

| Total Value at May 31, 2016 |

Level 1 Quoted Price |

Level 2 Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||

| Preferred Securities |

||||||||||||||||

| Banking |

$ | 383,458,501 | $ | 326,718,277 | $ | 56,740,224 | $ | — | ||||||||

| Financial Services |

5,936,620 | 5,936,620 | — | — | ||||||||||||

| Insurance |

185,977,927 | 118,236,966 | 67,740,961 | — | ||||||||||||

| Utilities |

23,022,581 | 14,028,686 | 8,993,895 | — | ||||||||||||

| Energy |

33,819,408 | 15,410,949 | 18,408,459 | — | ||||||||||||

| Real Estate Investment Trust (REIT) |

28,475,402 | 28,475,402 | — | — | ||||||||||||

| Miscellaneous Industries |

16,653,593 | 4,690,343 | 11,963,250 | — | ||||||||||||

| Corporate Debt Securities |

||||||||||||||||

| Banking |

13,864,279 | 13,864,279 | — | — | ||||||||||||

| Communication |

3,089,039 | 3,089,039 | — | — | ||||||||||||

| Miscellaneous Industries |

650,813 | 650,813 | — | — | ||||||||||||

| Common Stock |

||||||||||||||||

| Energy |

7,185,263 | 7,185,263 | — | — | ||||||||||||

| Money Market Fund |

3,471,973 | 3,471,973 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

$ | 705,605,399 | $ | 541,758,610 | $ | 163,846,789 | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

21

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

During the reporting period, there were no transfers into Level 1 from Level 2 or into Level 2 from Level 1. During the reporting period, there were no transfers into or out of Level 3.

The fair values of the Fund’s investments are generally based on market information and quotes received from brokers or independent pricing services that are approved by the Board and are unaffiliated with the Adviser. To assess the continuing appropriateness of security valuations, management, in consultation with the Adviser, regularly compares current prices to prior prices, prices across comparable securities, actual sale prices for securities in the Fund’s portfolio, and market information obtained by the Adviser as a function of being an active market participant.

Securities with quotes that are based on actual trades or actionable bids and offers with a sufficient level of activity on or near the measurement date are classified as Level 1. Securities that are priced using quotes derived from implied values, indicative bids and offers, or a limited number of actual trades—or the same information for securities that are similar in many respects to those being valued—are classified as Level 2. If market information is not available for securities being valued, or materially-comparable securities, then those securities are classified as Level 3. In considering market information, management evaluates changes in liquidity, willingness of a broker to execute at the quoted price, the depth and consistency of prices from pricing services, and the existence of observable trades in the market.

Securities transactions and investment income: Securities transactions are recorded as of the trade date. Realized gains and losses from securities sold are recorded on the specific identified cost basis. Dividend income is recorded on ex-dividend dates. Interest income is recorded on the accrual basis. The Fund also amortizes premiums and accretes discounts on fixed income securities using the effective yield method.

Options: Purchases of options are recorded as an investment, the value of which is marked-to-market at each valuation date. When the Fund enters into a closing sale transaction, the Fund will record a gain or loss depending on the difference between the purchase and sale price.

When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability, the value of which is marked-to-market at each valuation date. When a written option expires, the Fund realizes a gain equal to the amount of the premium originally received. When the Fund enters into a closing purchase transaction, the Fund realizes a gain (or loss if the cost of the closing purchase transaction exceeds the premium received when the option was written) without regard to any unrealized gain or loss on the underlying security, and the liability related to such option is eliminated. When a call option is exercised, the Fund realizes a gain or loss from the sale of the underlying security and the proceeds from such sale are increased by the amount of the premium originally received. When a put option is exercised, the amount of the premium originally received will reduce the cost of the security which the Fund purchased upon exercise.

Repurchase agreements: The Fund may engage in repurchase agreement transactions. The Adviser reviews and approves the eligibility of the banks and dealers with which the Fund may enter into repurchase agreement transactions. The value of the collateral underlying such transactions must be at least equal at all times to the total amount of the repurchase obligations, including interest. The Fund maintains possession of the collateral through its custodian and, in the event of counterparty default, the Fund has the right to use the collateral to offset losses incurred. There is the possibility of loss to the Fund in the event the Fund is delayed or prevented from exercising its rights to dispose of the collateral securities.

22

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

Federal income taxes: The Fund intends to continue to qualify as a regulated investment company by complying with the requirements under subchapter M of the Internal Revenue Code of 1986, as amended, (the “Code”) applicable to regulated investment companies and intends to distribute substantially all of its taxable net investment income to its shareholders. Therefore, no federal income tax provision is required.

Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years (November 30, 2015, 2014 and 2013), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. The Fund’s major tax jurisdictions are federal and the State of California. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

Dividends and distributions to shareholders: The Fund expects to declare dividends on a monthly basis to holders of Common Stock (“Shareholders”). Distributions to Shareholders are recorded on the ex-dividend date. Any net realized short-term capital gains will be distributed to Shareholders at least annually. Any net realized long-term capital gains may be distributed to Shareholders at least annually or may be retained by the Fund as determined by the Fund’s Board. Capital gains retained by the Fund are subject to tax at the capital gains corporate tax rate. Subject to the Fund qualifying as a regulated investment company, any taxes paid by the Fund on such net realized long-term capital gains may be used by the Fund’s Shareholders as a credit against their own tax liabilities. The Fund may pay distributions in excess of the Fund’s net investment company taxable income and this excess would be a tax-free return of capital distributed from the Fund’s assets.

Income and capital gain distributions are determined and characterized in accordance with income tax regulations which may differ from U.S. GAAP. These differences are primarily due to (1) differing treatments of income and gains on various investment securities held by the Fund, including timing differences, (2) the attribution of expenses against certain components of taxable investment income, and (3) federal regulations requiring proportionate allocation of income and gains to all classes of shareholders.

Distributions from net realized gains for book purposes may include short-term capital gains, which are included as ordinary income for tax purposes, and may exclude amortization of premium and discount on certain fixed income securities, which are not reflected in ordinary income for tax purposes. The tax character of distributions paid during 2016 and 2015 were as follows:

| Distributions paid in fiscal year 2016 | Distributions paid in fiscal year 2015 | |||||||

| Ordinary |

Long-Term |

Ordinary |

Long-Term | |||||

| Common Stock | N/A | N/A | $36,781,201 | $0 | ||||

As of November 30, 2015, the components of distributable earnings (i.e., ordinary income and capital gain/loss) available to Shareholders, on a tax basis, were as follows:

| Capital (Loss) |

Undistributed |

Undistributed |

Net Unrealized | |||

| $(573,668) | $2,008,541 | $0 | $9,939,901 | |||

23

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

The composition of the Fund’s accumulated realized capital losses is indicated below. These losses may be carried forward and offset against future capital gains through the dates listed below. During the fiscal year ended November 30, 2015, the Fund utilized $142,279 of capital losses.

| No Expiration Short Term |

No Expiration Long Term |

Total | ||

| $161,590 | $412,078 | $573,668 | ||

Excise tax: The Code imposes a 4% nondeductible excise tax on the Fund to the extent the Fund does not distribute by the end of any calendar year at least (1) 98% of the sum of its net investment income for that year and 98.2% of its capital gains (both long-term and short-term) for its fiscal year and (2) certain undistributed amounts from previous years. The Fund paid $63,191 of federal excise taxes attributable to calendar year 2015 in March 2016.

| 3. | Derivative Instruments |

The Fund intends to use derivatives primarily to economically hedge against risks in the portfolio, namely interest rate risk and credit risk. The Fund may use options on Treasury futures contracts for the purpose of economically hedging against a significant increase in long-term interest rates. If the strategy is employed, the Fund would purchase put options on Treasury futures contracts that would increase in value if long-term interest rates increased significantly, offsetting some of the related decline in portfolio asset values. The Fund may also purchase and write call options on Treasury futures contracts to supplement the put option strategy and also to reduce the overall cost of the interest rate hedge (by earning premiums from the net sale of call options).

The Fund has the authority to use other derivatives for hedging or to increase expected return, but has not employed any of these derivatives to-date and does not anticipate broad use of these derivatives in the near future (although this may change without advance notice). Other approved derivatives strategies include: buying and selling credit default swaps, interest rate swaps and options thereon (swaptions), and options on securities. Accounting policies for specific derivatives, including the location of these items in the financial statements, are included in Note 2 as appropriate. No assurance can be given that such use of derivatives will achieve their desired purposes or, in the case of hedging, will result in an overall reduction of risk to the Fund.

The Fund did not use any derivatives during the six months ended May 31, 2016 and the fiscal year ended November 30, 2015.

Options on Financial Futures Contracts: When an interest rate hedging strategy is employed, the Fund intends to use options on financial futures contracts in much the same way as described above. The risk associated with purchasing options, and therefore the maximum loss the Fund would incur, is limited to the purchase price originally paid. The risk in writing a call option is that the Fund may forego the opportunity for profit if the market price of the underlying security increases and the option is exercised. The risk in writing a put option is that the Fund may incur a loss if the market price of the underlying security decreases and the option is exercised.

24

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

| 4. | Investment Advisory Fee, Servicing Agent Fee, Administration Fee, Transfer Agent Fee, Custodian Fee, Directors’ Fees and Chief Compliance Officer Fee |

Flaherty & Crumrine Incorporated (the “Adviser”) serves as the Fund’s investment adviser. The Fund pays the Adviser a monthly fee at an annual rate of 0.575% of the Fund’s average daily managed assets up to $200 million and 0.50% of the Fund’s average daily managed assets of $200 million or more. For purposes of calculating such a fee “managed assets” means the Fund’s net assets, plus the principal amount of loans from financial institutions or debt securities issued by the Fund, the liquidation preference of preferred stock issued by the Fund, if any, and the proceeds of any reverse repurchase agreements entered into by the Fund.

Destra Capital Investments LLC (the “Servicing Agent”) serves as the Fund’s shareholder servicing agent. As compensation for its services, the Fund pays the Servicing Agent a fee computed and paid monthly at the annual rate of 0.12% of the Fund’s Average Net Assets through the first year of the Fund’s agreement with the Servicing Agent and 0.10% of the Fund’s Average Net Assets for the remainder of the term of the agreement. For these purposes, “Average Net Assets” are the average daily net assets available to the Fund’s common shareholders.

BNY Mellon Investment Servicing (US) Inc. (“BNY Mellon”) serves as the Fund’s administrator (the “Administrator”). As Administrator, BNY Mellon calculates the net asset value of the Fund’s shares attributable to Common Stock and generally assists in all aspects of the Fund’s administration and operation. As compensation for BNY Mellon’s services as Administrator, the Fund pays BNY Mellon a monthly fee at an annual rate of 0.10% of the first $200 million of the Fund’s average daily total managed assets, 0.04% of the next $300 million of the Fund’s average daily total managed assets, 0.03% of the next $500 million of the Fund’s average daily total managed assets and 0.02% of the Fund’s average daily total managed assets above $1 billion. For purposes of calculating such fee, the Fund’s total managed assets means the total assets of the Fund (including any assets attributable to the Fund’s preferred stock that may be outstanding or otherwise attributable to the use of leverage) minus the sum of accrued liabilities (other than debt, if any, representing financial leverage).

BNY Mellon (c/o, Computershare) also serves as the Fund’s Common Stock dividend-paying agent and registrar (the “Transfer Agent”). As compensation for BNY Mellon’s services as Transfer Agent, the Fund pays BNY Mellon a monthly fee in the amount of $1,500, plus certain out of pocket expenses.

The Bank of New York Mellon (the “Custodian”) serves as the Fund’s Custodian. As compensation for the Custodian’s services as custodian, the Fund pays the Custodian a monthly fee at the annual rate of 0.01% of the first $200 million of the Fund’s average daily total managed assets, 0.008% of the next $300 million of the Fund’s average daily total managed assets, 0.006% of the next $500 million of the Fund’s average daily total managed assets, and 0.005% of the Fund’s average daily total managed assets above $1 billion. For purposes of calculating such fee, the Fund’s total managed assets means the total assets of the Fund (including any assets attributable to any Fund auction rate preferred stock that may be outstanding or otherwise attributable to the use of leverage) minus the sum of accrued liabilities (other than debt, if any, representing financial leverage).

The Fund pays each Director who is not a director, officer or employee of the Adviser a fee of $9,000 per annum, plus $750 for each in-person meeting of the Board of Directors or Audit Committee, $500 for

25

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

each in-person meeting of the Nominating Committee attended, and $250 for each telephone meeting attended. The Audit Committee Chairman receives an additional annual fee of $3,000. The Fund also reimburses all Directors for travel and out-of-pocket expenses incurred in connection with such meetings.

The Fund pays the Adviser a fee of $35,000 per annum for Chief Compliance Officer services and reimburses out-of-pocket expenses incurred in connection with providing services in this role.

| 5. | Purchases and Sales of Securities |

For the six months ended May 31, 2016, the cost of purchases and proceeds from sales of securities, excluding short-term investments, aggregated $43,473,740 and $31,919,498, respectively.

At May 31, 2016, the aggregate cost of securities for federal income tax purposes was $693,066,306, the aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost was $36,978,553 and the aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value was $24,439,460.

| 6. | Common Stock |

At May 31, 2016, 240,000,000 shares of $0.01 par value Common Stock were authorized.

Common Stock transactions were as follows:

| Six Months Ended 05/31/16 |

Year Ended 11/30/15 |

|||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Shares issued under the Dividend Reinvestment and Cash Purchase Plan |

687 | $ | 16,481 | — | $ | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 7. | Preferred Stock |

The Fund has the authority to issue 10,000,000 shares of $0.01 par value preferred stock. The Fund does not currently have any issued and outstanding shares of preferred stock.

| 8. | Committed Financing Agreement |

The Fund has entered into a committed financing agreement with BNP Paribas Prime Brokerage International, Ltd. (“Financing Agreement”) that allows the Fund to borrow on a secured basis, which the Fund uses in the normal course of business as financial leverage. Such leveraging tends to magnify both the risks and opportunities to Shareholders. As of May 31, 2016, the committed amount, and amount borrowed, under the Financing Agreement was $241.3 million.

The lender charges an annualized rate of 0.65% on the undrawn (committed) balance, and three-month LIBOR (reset quarterly) plus 0.75% on the drawn (borrowed) balance. Effective December 13, 2013, the Fund fixed the cost on $205 million of the leverage balance at a rate of 1.19% for a period of two years. The remaining leverage balance (and any increase in leverage balance) will continue to be at a variable rate. For

26

Flaherty & Crumrine Dynamic Preferred and Income Fund Incorporated

NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

the six months ended May 31, 2016, the daily weighted average annualized interest rate on the drawn balance was 1.30% and the average daily loan balance was $205,000,000. LIBOR rates may vary in a manner unrelated to the income received on the Fund’s assets, which could have either a beneficial or detrimental impact on net investment income and gains available to Shareholders.

The Fund is required to meet certain asset coverage requirements under the Financing Agreement and under the 1940 Act. In accordance with the asset coverage requirements, at least two-thirds of the Fund’s assets are expected to be pledged as collateral assuming the full committed amount is drawn. Securities pledged as collateral are identified in the portfolio of investments. If the Fund fails to meet these requirements, or maintain other financial covenants required under the Financing Agreement, the Fund may be required to repay immediately, in part or in full, the amount borrowed under the Financing Agreement. Additionally, failure to meet the foregoing requirements or covenants could restrict the Fund’s ability to pay dividends to Shareholders and could necessitate sales of portfolio securities at inopportune times. The Financing Agreement has no stated maturity, but may be terminated by either party without cause with six months’ advance notice.

Under the terms of the Financing Agreement, the lender has the ability to borrow a portion of the securities pledged as collateral against the loan (“Rehypothecated Securities”), subject to certain limits. In connection with any Rehypothecated Securities, the Fund receives a fee from the lender equal to the greater of (x) 0.05% of the value of the Rehypothecated Securities and (y) 70% of the net securities lending income. The Fund may recall any Rehypothecated Security at any time and the lender is required to return the security in a timely fashion. In the event the lender does not return the security, the Fund will have the right to, among other things, apply and set off an amount equal to 100% of the then-current fair market value of such Rehypothecated Securities against any loan amounts owed to the lender under the Financing Agreement. Rehypothecated Securities are marked-to-market daily and adjusted as necessary so the value of all Rehypothecated Securities does not exceed 100% of the loan amount under the Financing Agreement. The Fund will continue to earn and receive all dividends, interest, and other distributions on Rehypothecated Securities. Rehypothecated Securities are identified in the Portfolio of Investments, and fees earned from rehypothecation are included in the Statement of Operations.

| 9. | Portfolio Investments, Concentration and Investment Quality |