Table of Contents

As filed with the Securities and Exchange Commission on March 14, 2013

Registration No. 333-186487

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EVERTEC, INC.

(Exact name of registrant as specified in its charter)

| Puerto Rico | 7374 | 66-0783622 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Cupey Center Building

Road 176, Kilometer 1.3

San Juan, Puerto Rico 00926

(787) 759-9999

(Address, including zip code, and telephone number, including area code, of registrants’ principal executive offices)

Luisa Wert Serrano, Esq.

EVERTEC, Inc.

Cupey Center Building

Road 176, Kilometer 1.3

San Juan, Puerto Rico 00926

(787) 759-9999

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

| Rosa A. Testani, Esq. Akin Gump Strauss Hauer & Feld LLP One Bryant Park New York, NY 10036 (212) 872-8115 |

Michael J. Ohler, Esq. Cahill Gordon & Reindel LLP 80 Pine Street New York, NY 10005 (212) 701-3000 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.:

| Large Accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price (1) |

Amount of registration fee (2) | ||

| Common stock, $0.01 par value per share |

$ 100,000,000.00 | $13,640.00 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Previously paid in connection with the filing of this Registration Statement on February 6, 2013. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated March 14, 2013

| PRELIMINARY PROSPECTUS |

|

Shares

EVERTEC, Inc.

Common Stock

$ per share

This is our initial public offering. We are selling of the shares being offered hereby. The selling stockholders identified in this prospectus are selling an additional shares. We will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

We expect the public offering price to be between $ and $ per share. Currently, no public market exists for our common stock. Our shares of common stock have been approved for listing on the New York Stock Exchange (“NYSE”) under the symbol “EVTC.” Following the completion of this offering, we will remain a “controlled company” as defined under the NYSE listing rules because the group consisting of funds affiliated with Apollo Global Management, LLC and Popular, Inc. will beneficially own % of our shares of outstanding common stock, assuming the underwriters do not exercise their option to purchase up to additional shares from the selling stockholders. See “Principal and Selling Stockholders.”

We are an “emerging growth company” under applicable federal securities laws and are eligible for reduced public company reporting requirements. See “Risk Factors—Risks Related to Our Business—As an “emerging growth company” under the JOBS Act, we are permitted to, and intend to, rely on exemptions from certain reporting and disclosure requirements, which may make our future public filings different than that of other public companies.”

Investing in our common stock involves risks that are described in the “Risk Factors” section beginning on page 20 of this prospectus.

| Price to Public |

Underwriting Discounts |

Proceeds to EVERTEC, Inc. |

Proceeds to Selling Stockholders |

|||||||||||||

| Per Share |

$ | $ | $ | $ | ||||||||||||

| Total |

$ | $ | $ | $ | ||||||||||||

The underwriters also have an option to purchase up to an additional shares from the selling stockholders at the initial public offering price less the underwriting discount.

Delivery of the shares of common stock will be made on or about , 2013.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Goldman, Sachs & Co. |

J.P. Morgan | |||||||||||||||

| William Blair |

UBS Investment Bank | Popular Securities | Morgan Stanley | Deutsche Bank Securities | Credit Suisse | Citigroup | BofA Merrill Lynch | Apollo Global Securities | ||||||||

The date of this prospectus is , 2013.

Table of Contents

| Page | ||||

| 1 | ||||

| 20 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| 46 | ||||

| SELECTED HISTORICAL CONSOLIDATED AND COMBINED FINANCIAL DATA |

48 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

50 | |||

| 75 | ||||

| 87 | ||||

| 113 | ||||

| 116 | ||||

| 131 | ||||

| 136 | ||||

| 141 | ||||

| 143 | ||||

| 151 | ||||

| 157 | ||||

| 157 | ||||

| 157 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus. We have not authorized any person to provide you with any information or represent anything about us or this offering that is not contained in this prospectus. If given or made, any such other information or representation should not be relied upon as having been authorized by us. We are not making an offer in any jurisdiction where an offer or sale is not permitted. The information contained in this prospectus is current only as of its date.

Except as otherwise indicated or unless the context otherwise requires, (a) the terms “EVERTEC,” “we,” “us,” “our,” “the Company” and “our company” refer to EVERTEC, Inc. and its subsidiaries on a consolidated basis, (b) the term “Holdings” refers to EVERTEC Intermediate Holdings, LLC, but not to any of its subsidiaries and (c) the term “EVERTEC, LLC” refers to EVERTEC Group, LLC and its predecessor entities and their subsidiaries on a consolidated basis, including the operations of its predecessor entities prior to the Merger (as defined below). Neither EVERTEC nor Holdings conducts any operations other than with respect to its indirect or direct ownership of EVERTEC, LLC.

i

Table of Contents

This summary highlights key aspects of the information contained elsewhere in this prospectus and may not contain all of the information you should consider before making an investment decision. You should read this summary together with the entire prospectus, including the information presented under the heading “Risk Factors” and the more detailed information in the historical financial statements and related notes appearing elsewhere in this prospectus. For a more complete description of our business, see the “Business” section in this prospectus.

Company Overview

EVERTEC is the leading full-service transaction processing business in Latin America and the Caribbean. We are based in Puerto Rico and provide a broad range of merchant acquiring, payment processing and business process management services across 19 countries in the region. We process over 1.8 billion transactions annually, and manage the electronic payment network for over 4,100 automated teller machines (“ATM”) and over 104,000 point-of-sale (“POS”) payment terminals. According to the July 2012 Nilson Report, we are the largest merchant acquirer in the Caribbean and Central America and the sixth largest in Latin America based on total number of transactions. We own and operate the ATH network, one of the leading ATM and personal identification number (“PIN”) debit networks in Latin America. In addition, we provide a comprehensive suite of services for core bank processing, cash processing and technology outsourcing in the regions we serve. We serve a broad and diversified customer base of leading financial institutions, merchants, corporations and government agencies with ‘mission critical’ technology solutions that are essential to their operations, enabling them to issue, process and accept transactions securely, and we believe that our business is well positioned to continue to expand across the fast growing Latin American region.

We are differentiated, in part, by our diversified business model, which enables us to provide our varied customer base with a broad range of transaction processing services from a single source across numerous channels and geographic markets. We believe this single source capability provides several competitive advantages which will enable us to continue to penetrate our existing customer base with new, complementary services, win new customers, develop new sales channels and enter new markets. We believe these competitive advantages include:

| • | Our ability to package and provide a range of services across our customers’ business that often need to be sourced from different vendors; |

| • | Our ability to serve customers with disparate operations in several geographies with a single integrated technology solution that enables them to manage their business as one enterprise; and |

| • | Our ability to capture and analyze data across the transaction processing value chain to provide value-added services that are differentiated from those offered by ‘pure play’ vendors that only have the technology, capabilities and products to serve one portion of the transaction processing value chain (such as only merchant acquiring or payment processing). |

Our broad suite of services span the entire transaction processing value chain and include a range of front-end customer facing solutions as well as back-end support services. These include: (i) merchant acquiring services, which enable POS and e-commerce merchants to accept and process electronic methods of payment such as debit, credit, prepaid and electronic benefits transfer (“EBT”) cards; (ii) payment processing services, which enable financial institutions and other issuers to manage, support and facilitate the processing for credit, debit, prepaid, ATM and EBT card programs; and (iii) business process management solutions, which provide ‘mission critical’ technology solutions such as core bank processing, as well as information technology (“IT”) outsourcing and cash management services to financial institutions, enterprises and governments. We provide these services through a highly scalable, end-to-end technology platform that we manage and operate in-house. Our end-to-end technology platform includes solutions that encompass the entire transaction processing value chain. This enables us to provide ‘front-end’ processing services, such as the electronic capture and authorization of transactions at the point-of-sale, and ‘back-end’ services, such as the clearing and settlement of transactions and account reconciliation for card issuers. Our platform provides us with the broad range of capabilities, flexibility and operating leverage that enable us to innovate and develop new services, differentiate ourselves in the marketplace and generate significant operating efficiencies to continue to maximize profitability.

1

Table of Contents

We sell and distribute our services primarily through a proprietary direct sales force with strong customer relationships. We are also increasingly building a variety of indirect sales channels which enable us to leverage the distribution capabilities of partners in adjacent markets, including value-added resellers, joint ventures and merchant acquiring alliances. Given our breadth across the transaction processing value chain, our customer base is highly diversified by size, type and geographic footprint.

We benefit from an attractive business model, which is characterized by recurring revenue, significant operating margins and low capital expenditure requirements. Our revenue is recurring in nature because of the mission-critical and embedded nature of the services we provide, the high switching costs associated with these services and the multi-year contracts we negotiate with our customers. Our scalable business model creates significant operating efficiencies. In addition, our business model enables us to continue to grow our business organically without significant additional capital expenditures.

We generate revenues based primarily on transaction fees paid by our merchants and financial institutions in our Merchant Acquiring and Payment Processing segments and on transaction fees or fees based on number of accounts on file in our Business Solutions segment. Our total revenues increased from $276.3 million for the year ended December 31, 2009 to $341.7 million for the year ended December 31, 2012, representing a compound annual growth rate (“CAGR”) of 7%. Our Adjusted EBITDA (as defined below in Note 3 to “—Summary Historical Consolidated and Combined Financial Data”) increased from $117.6 million for the year ended December 31, 2009 to $169.6 million for the year ended December 31, 2012, representing a CAGR of 13%. Our Adjusted Net Income (as defined below in Note 3 to “—Summary Historical Consolidated and Combined Financial Data”) increased from $58.2 million for the year ended December 31, 2009 to $84.4 million for the year ended December 31, 2012, representing a CAGR of 13%.

History and Separation from Popular

We have a 25 year operating history in the transaction processing industry. Prior to the Merger on September 30, 2010, EVERTEC, LLC was 100% owned by Popular, Inc. (“Popular”), the largest financial institution in the Caribbean, and operated substantially as an independent entity within Popular. In September 2010, Apollo Global Management, LLC, a leading private equity investor, acquired a 51% interest in EVERTEC and shortly thereafter, we began the transition to a separate, stand-alone entity. As a stand-alone company, we have made substantial investments in our technology and infrastructure, recruited various senior executives with significant transaction processing experience in Latin America, enhanced our profitability through targeted productivity and cost savings actions and broadened our footprint beyond the markets historically served.

We continue to benefit from our relationship with Popular. Popular is our largest customer, acts as one of our largest merchant referral partners and sponsors us with the card associations (such as Visa or MasterCard), enabling merchants to accept these card associations’ credit card transactions. Popular also provides merchant sponsorship as one of the participants of the ATH network, enabling merchants to connect to the ATH network and accept ATH debit card transactions. We provide a number of critical products and services to Popular, which are governed by a 15-year Amended and Restated Master Services Agreement (the “Master Services Agreement”) that runs through 2025. For more information on the Master Services Agreement and other related party agreements, see “—Principal Stockholders” and “Certain Relationships and Related Party Transactions—Related Party Transactions in Connection with the Closing of the Merger.”

Industry Trends

Shift to Electronic Payments

The ongoing migration from cash, check and other paper methods of payment to electronic payments continues to benefit the transaction processing industry globally. This migration is driven by factors including customer convenience, marketing efforts by financial institutions, card issuer rewards and the development of new

2

Table of Contents

forms of payment. We believe that the penetration of electronic payments in the markets where we principally operate is significantly lower relative to more mature U.S. and European markets and that this ongoing shift will continue to generate substantial growth opportunities for our business.

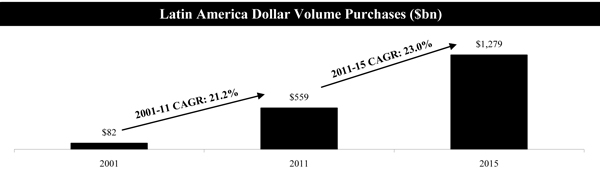

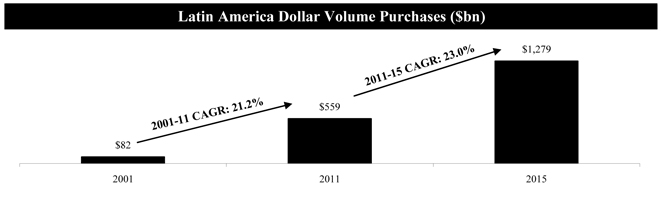

Fast Growing Latin American and Caribbean Financial Services and Payments Markets

Currently, the adoption of banking products, including electronic payments, in the Latin American and Caribbean region is lower relative to the mature U.S. and European markets. As these markets continue to evolve and grow, the emergence of a larger and more sophisticated consumer base will influence and drive an increase in card and electronic payments usage. According to the November 2011 and May 2012 Nilson Reports, the Latin American payments market is projected to continue to grow at a CAGR of 23.0% through 2015 (as illustrated in the chart below) and represents the second fastest growing market in the world.

We believe that the attractive characteristics of our markets and our leadership positions across multiple services and sectors will continue to drive growth and profitability in our businesses.

Ongoing Technology Outsourcing Trends

Financial institutions globally are facing significant challenges including the entrance of non-traditional competitors, the compression of margins on traditional products, significant channel proliferation and increasing regulation that could potentially curb profitability. Many of these institutions have traditionally fulfilled their IT needs through legacy computer systems, operated by the institution itself. Legacy systems are generally highly proprietary, inflexible and costly to operate and maintain and we believe the trend to outsource in-house technology systems and processes by financial institutions will continue. According to estimates published by Gartner Dataquest Market Statistics in January 2013, the banking and securities sector in Latin America is forecasted to have $29 billion of annual IT expenditures by 2016. We believe our ability to provide integrated, open, flexible, customer-centric and efficient IT products and services cater to the evolving needs of our customers, particularly for small- and mid-sized financial institutions in the Latin American markets in which we operate.

Industry Innovation

The electronic payments industry experiences ongoing technology innovation. Emerging payment technologies such as prepaid cards, contactless payments, payroll cards, mobile commerce, online “wallets” and innovative POS devices facilitate the continued shift away from cash, check and other paper methods of payment. According to the 2012 World Payments Report, the number of online payments for e-commerce activities and number of payments using mobile devices are projected to grow at compound annual growth rates of 20.0% and 52.7%, respectively from 2009 to 2013. The increasing demand for new and flexible payment options catering to a wider range of consumer segments is driving growth in the electronic payment processing sector.

3

Table of Contents

Our Competitive Strengths

Market Leadership in Latin America and the Caribbean

We believe we have an inherent competitive advantage relative to U.S. competitors based on our ability to locally leverage our infrastructure, as well as our first-hand knowledge of the Latin American and Caribbean markets, language and culture. We have built leadership positions across the transaction processing value chain in the geographic markets that we serve, which we believe will enable us to continue to penetrate our core markets and provide advantages to enter new markets. According to the July 2012 Nilson Report, we are the sixth largest merchant acquirer in Latin America and the largest in the Caribbean and Central America based on total number of transactions. We own and operate the ATH network, one of the leading ATM and PIN debit networks in Latin America. The ATH network and processing businesses processed over one billion transactions in 2012, which according to management estimates, makes ATH branded products the most frequently used electronic method of payment in Puerto Rico, exceeding the total transaction volume of Visa, MasterCard, American Express and Discover, combined. Given our scale and customer base of top tier financial institutions and government entities, we believe we are the leading card issuer and core bank processor in the Caribbean and the only non-bank provider of cash processing services to the U.S. Federal Reserve in the Caribbean. We believe our competitive position and strong brand recognition increases card acceptance, driving usage of our proprietary network, and presents opportunities for future strategic relationships.

Diversified Business Model Across the Transaction Processing Value Chain

Our leadership position in the region is driven in part by our diversified business model which provides the full range of merchant acquiring, payment processing and business solutions services to financial institutions, merchants, corporations and government agencies across different geographies. We offer end-to-end technology solutions through a single provider and we have the ability to tailor and customize the features and functionality of all our products and services to the specific requirements of our customers in various industries and across geographic markets. We believe the breadth of our offerings enables us to penetrate our customer base from a variety of perspectives and positions us favorably to cross-sell our other offerings over time. For example, we may host a client’s electronic cash register software (part of the Business Solutions segment), acquire transactions that originate at that electronic cash register (part of the Merchant Acquiring segment), route the transaction through the ATH network (part of the Payment Processing segment), and finally settle the transaction between the client and the issuer bank (part of the Payment Processing segment). In addition, we can serve customers with disparate operations in several geographies with a single integrated technology solution that enables them to access one processing platform and manage their business as one enterprise. We believe these services are becoming increasingly complementary and integrated as our customers seek to capture, analyze and monetize the vast amounts of data that they process across their enterprises. As a result, we are able to capture significant value across the transaction processing value chain and believe that this combination of attributes represents a differentiated value proposition vis-à-vis our competitors who have a limited product and service offering.

Broad and Deep Customer Relationships and Recurring Revenue Business Model

We have built a strong and long-standing portfolio of top tier financial institution, merchant, corporate and government customers across Latin America and the Caribbean, which provide us with a reliable, recurring revenue base and powerful references that have helped us expand into new channels and geographic markets. Customers representing approximately 99% of our 2011 revenue continued to be customers in 2012, due to the mission-critical and embedded nature of the services provided and the high switching costs associated with these services. Our Payment Processing and Merchant Acquiring segments, as well as certain business lines representing the majority of our Business Solutions segment, generate recurring revenues that collectively accounted for approximately 87% of our total revenues in 2012. We receive recurring revenues from services based on our customers’ on-going daily commercial activity such as processing loans, hosting accounts and information on our servers, and processing everyday payments at grocery stores, gas stations and similar establishments. We generally provide these services under one to five year contracts, often with automatic renewals. We also provide a few project-based services that generate non-recurring revenues in our Business Solutions segment such as IT consulting for a specific project or integration. Additionally, we entered into a 15-year Master Services Agreement with Popular on September 30, 2010. We provide a number of critical payment processing and business solutions

4

Table of Contents

products and services to Popular and benefit from the bank’s distribution network and continued support. Through our long-standing and diverse customer relationships, we are able to gain valuable insight into trends in the marketplace that allows us to identify new market opportunities. In addition, we believe the recurring nature of our business model provides us with significant revenue and earnings stability.

Highly Scalable, End-to-End Technology Platform

Our diversified business model is supported by our highly scalable, end-to-end technology platform which allows us to provide a full range of transaction processing services and develop and deploy a broad suite of technology solutions to our customers at low incremental costs and increasing operating efficiencies. We have spent over $130 million over the last five years on technology investments to continue to build the capacity and functionality of our platform and we have been able to achieve attractive economies of scale with flexible product development capabilities. We have a proven ability to seamlessly leverage our existing platforms to develop new products and services and expand in new markets. We believe that our platform will increasingly allow us to provide differentiated services to our customers and facilitate further expansion into new sales channels and geographic markets.

Experienced Management Team with a Strong Track Record of Execution

We have grown our revenue organically by introducing new products and services and expanding our geographic footprint throughout Latin America. We have a proven track record of creating value from operational and technology improvements and capitalizing on cross-selling opportunities. We have combined new leadership at EVERTEC, bringing many years of industry experience, with long-standing leadership at the operating business level. In 2012, Peter Harrington, former President of Latin America and Canada for First Data Corporation, joined our management team as our President and Chief Executive Officer. Also, in 2012, Philip Steurer, former Senior Vice President of Latin America for First Data Corporation, joined our management team as our Chief Operating Officer. Mr. Harrington and Mr. Steurer both have extensive experience managing and growing transaction processing businesses in Latin America as well as North America, Asia and Europe. In addition, we successfully executed our separation from Popular, transitioning EVERTEC from a division of a larger company to a stand-alone entity with public company best practices. Instrumental to this transition was our Chief Financial Officer Juan J. Román, former CFO of Triple-S Management, a publicly listed insurance company. Collectively our management team benefits from an average of over 20 years of industry experience and we believe they are well positioned to continue to drive growth across business lines and regions.

Our Growth Strategy

We intend to grow our business by continuing to execute on the following business strategies:

Continue Cross-Sales to Existing Customers

We seek to grow revenue by continuing to sell additional products and services to our existing merchant, financial institution, corporate and government customers. We intend to broaden and deepen our customer relationships by leveraging our full suite of end-to-end technology solutions. For example, we believe that there is significant opportunity to cross-sell our network services, ATM point-of-sale processing and card issuer processing services to our over 180 existing financial institution customers, particularly in markets outside of Puerto Rico. We will also seek to continue to cross-sell value added services into our existing merchant base of over 25,000 locations.

Leverage Our Franchise to Attract New Customers in the Markets We Currently Serve

We intend to attract new customers by leveraging our comprehensive product and services offering, the strength of our brand and our leading end-to-end technology platform. Furthermore, we believe we are uniquely positioned to develop new products and services to take advantage of our access to and position in markets we currently serve. For example, in markets we serve outside of Puerto Rico, we believe there is a significant opportunity to penetrate small to medium financial institutions with our products and services, as well as to penetrate governments with offerings such as EBT.

5

Table of Contents

Expand in the Latin American Region

We believe there is substantial opportunity to expand our businesses in the Latin American region. We believe that we have a competitive advantage relative to U.S. competitors based on our ability to locally leverage our infrastructure, breadth of products and services as well as our first-hand knowledge of Latin American markets, language and culture. Significant growth opportunities exist in a number of large markets such as Colombia, México, Chile and Argentina. We also believe that there is an opportunity to provide our services to existing financial institution customers in other regions where they operate. Additionally, we continually evaluate our strategic plans for geographic expansion, which can be achieved through joint ventures, partnerships, alliances or strategic acquisitions.

Develop New Products and Services

Our experience with our customers provides us with insight into their needs and enables us to continuously develop new transaction processing services. We plan to continue growing our merchant, financial institution, corporate and government customer base by developing and offering additional value-added products and services to cross-sell along with our core offerings. We intend to continue to focus on these and other new product opportunities in order to take advantage of our leadership position in the transaction processing industry in the Latin American and Caribbean region.

6

Table of Contents

Our Business

We offer our customers end-to-end products and solutions across the transaction processing value chain from a single source across numerous channels and geographic markets, as further described below.

Merchant Acquiring

According to the July 2012 Nilson Report, we are the largest merchant acquirer in the Caribbean and Central America and the sixth largest in Latin America based on total number of transactions. Our Merchant Acquiring business provides services to merchants at over 25,000 locations that allow them to accept electronic methods of payment such as debit, credit, prepaid and EBT cards carrying the ATH, Visa, MasterCard, Discover and American Express brands. Our full suite of merchant acquiring services includes, but is not limited to, the underwriting of each merchant’s contract, the deployment of POS devices and other equipment necessary to capture merchant transactions, the processing of transactions at the point-of-sale, the settlement of funds with the participating financial institution, detailed sales reports and customer support. In 2012, our Merchant Acquiring business processed over 280 million transactions.

Our Merchant Acquiring business generated $69.6 million, or 20.4%, of total revenues and $33.8 million, or 26.6%, of total segment income from operations for the year ended December 31, 2012.

Payment Processing

We are the largest card processor and network services provider in the Caribbean. We provide an innovative and diversified suite of payment processing services to blue chip regional and global corporate customers, government agencies, and financial institutions across Latin American and the Caribbean. These services provide the infrastructure technology necessary to facilitate the processing and routing of payments across the transaction processing value chain.

At the point-of-sale, we sell transaction processing technology solutions, similar to the services in our Merchant Acquiring business, to other merchant acquirers to enable them to service their own merchant customers. We also offer terminal driving solutions to merchants, merchant acquirers (including our Merchant Acquiring business) and financial institutions, which provide the technology to securely operate, manage and monitor POS terminals and ATMs. We also rent POS devices to financial institution customers who seek to deploy them across their own businesses. We currently provide technology services for over 4,100 ATMs and over 104,000 POS terminals in the region and are continuously certifying new machines and devices to expand this reach.

To connect the POS terminals to card issuers, we own and operate the ATH network, one of the leading ATM and PIN debit networks in Latin America. The ATH network connects the merchant or merchant acquirer to the card issuer and enables transactions to be routed or “switched” across the transaction processing value chain. The ATH network offers the technology, communications standards, rules and procedures, security and encryption, funds settlement and common branding that allow consumers, merchants, merchant acquirers, ATMs, card issuer processors and card issuers to conduct commerce seamlessly, across a variety of channels, similar to the services provided by Visa and MasterCard. The ATH network and processing businesses processed over one billion transactions in 2012. Over 70% of all ATM transactions and over 80% of all debit transactions in Puerto Rico are processed through the ATH network.

To enable financial institutions, governments and other businesses to issue and operate a range of payment products and services, we offer an array of card processing and other payment technology services, such as internet and mobile banking software services, bill payment systems and EBT solutions. Financial institutions and certain retailers outsource to us certain card processing services such as card issuance, processing card applications, cardholder account maintenance, transaction authorization and posting, fraud and risk management services, and settlement. Our payment products include electronic check processing, automated clearing house (“ACH”), lockbox, online, interactive voice response and web-based payments through personalized websites, among others.

We have been the only provider of EBT services to the Puerto Rican government since 1998, processing approximately $2.5 billion in volume annually. Our EBT application allows certain agencies to deliver government benefits to participants through a magnetic card system and serves over 840,000 active participants.

Our Payment Processing business accounted for $94.8 million, or 27.7%, of total revenues and $53.7 million, or 42.1%, of total segment income from operations for the year ended December 31, 2012.

7

Table of Contents

Business Solutions

We provide our financial institution, corporate and government customers with a full suite of business process management solutions including specifically core bank processing, network hosting and management, IT consulting services, business process outsourcing, item and cash processing, and fulfillment. In addition, we believe we are the only non-bank provider of cash processing services to the U.S. Federal Reserve in the Caribbean.

Our Business Solutions business accounted for $177.3 million, or 51.9%, of total revenues and $39.8 million, or 31.3%, of total segment income from operations for the year ended December 31, 2012.

Risk Factors

Participating in this offering involves substantial risk. Our ability to execute our strategy also is subject to certain risks. The risks described under the heading “Risk Factors” immediately following this summary may cause us not to realize the full benefits of our competitive strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the more significant challenges and risks we face include the following:

| • | our high level of indebtedness; |

| • | our reliance on our relationship with Popular; |

| • | the continuing market position of the ATH network despite competition and potential shifts in consumer payment preferences; |

| • | the geographical concentration of our business in Puerto Rico; |

| • | operating an international business in multiple regions with potential political and economic instability, including Latin America; |

| • | our dependence on our processing systems, technology infrastructure, security systems and fraudulent payment detection systems and our ability to develop, install and adopt new software, technology and computing systems; |

| • | the impacts of being subject to regulatory oversight and examination, including the possibility of being restricted from engaging in certain new activities or businesses, whether organically or by acquisition; |

| • | our ability to execute our geographic expansion and corporate development strategies; |

| • | we will be a “controlled company” after this offering and Apollo and Popular will continue to control all matters affecting us; and |

| • | evolving industry standards, changes in the regulatory environment and adverse changes in global economic, political and other conditions. |

Before you participate in this offering, you should carefully consider all of the information in this prospectus, including matters set forth under the heading “Risk Factors.”

EVERTEC, Inc. (formerly Carib Latam Holdings, Inc.) is a Puerto Rico corporation organized in April 2012. EVERTEC’s main operating subsidiary, EVERTEC Group, LLC (formerly EVERTEC, LLC and EVERTEC, Inc.) was organized in 1988 and was formerly a wholly-owned subsidiary of Popular. On September 30, 2010, pursuant to an Agreement and Plan of Merger (as amended, the “Merger Agreement”), EVERTEC, LLC became a wholly-owned subsidiary of EVERTEC Intermediate Holdings, LLC (formerly Carib Holdings, LLC and Carib Holdings, Inc.), with Apollo owning approximately 51% and Popular owning approximately 49% of the then outstanding voting capital stock of Holdings (the “Merger”). See “Certain Relationships and Related Party Transactions” for additional information regarding the Merger Agreement.

8

Table of Contents

On April 13, 2012, EVERTEC, Inc. was formed in order to act as the new parent company of Holdings and its subsidiaries, including EVERTEC, LLC, and shortly thereafter Holdings and EVERTEC, LLC were converted from Puerto Rico corporations to Puerto Rico limited liability companies for the purpose of improving the consolidated tax efficiency of our company. See “Certain Relationships and Related Party Transactions—Related Party Transactions After the Closing of the Merger—Reorganization.” Prior to such Reorganization, EVERTEC, LLC was a corporation known as EVERTEC, Inc. and Holdings was a corporation known as Carib Holdings, Inc.

Our principal executive offices are located at Cupey Center Building, Road 176, Kilometer 1.3, San Juan, Puerto Rico 00926 and our telephone number is (787) 759-9999. Our website is www.evertecinc.com. We make our website content available for information purposes only. We do not incorporate the information on our website into this prospectus, and you should not consider it part of this prospectus. You should not rely upon the information on our website for investment purposes.

9

Table of Contents

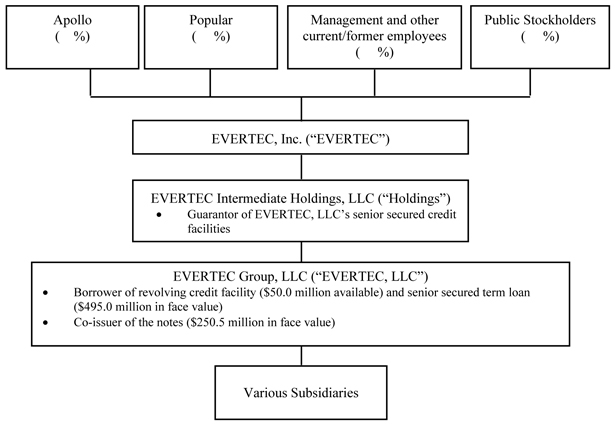

Ownership and Corporate Structure

The following chart summarizes our corporate organization as of December 31, 2012 after giving effect to this offering (assuming no exercise of the underwriters’ option to purchase up to additional shares of common stock from the selling stockholders).

Principal Stockholders

Apollo: AP Carib Holdings, Ltd. (“Apollo”), an investment vehicle indirectly managed by Apollo Management VII, L.P. (“Apollo Management”), an affiliate of Apollo Global Management, LLC (together with its subsidiaries, including Apollo Management, “AGM”), acquired an approximately 51% indirect ownership interest in EVERTEC, LLC as part of the Merger, and after the consummation of this offering, will own approximately % of our common stock (or % if the underwriters exercise their option to purchase additional shares in full). AGM is a leading global alternative investment manager with offices in New York, Los Angeles, London, Frankfurt, Luxembourg, Singapore, Hong Kong and Mumbai. As of December 31, 2012, AGM and its subsidiaries had assets under management of approximately $113 billion invested in its private equity, credit and real estate businesses.

Popular: Popular retained an approximately 49% indirect ownership interest in EVERTEC, LLC as part of the Merger and after the consummation of this offering, will own approximately % of our common stock (or % if the underwriters exercise their option to purchase additional shares in full). Popular, Inc. (NASDAQ: BPOP), whose principal banking subsidiary’s history dates back to 1893, is the No. 1 bank holding company by both assets and deposits based in Puerto Rico, and, as of December 31, 2012, ranks 44th by assets among U.S. bank holding companies. In the United States, Popular has established a community-banking franchise providing a broad range of financial services and products with branches in New York, New Jersey, Illinois, Florida and California. In 2010, Popular raised $1.15 billion in proceeds from a public equity offering, and successfully completed an FDIC-assisted acquisition of Westernbank Puerto Rico.

10

Table of Contents

In connection with the Merger, we entered into several agreements with Apollo and Popular, including a Stockholder Agreement with Apollo, Popular and our other stockholders (as amended, the “Stockholder Agreement”) and a 15-year Master Services Agreement with Popular. Under the Stockholder Agreement, Apollo and Popular were granted significant control over matters requiring board or stockholder approval, including the election of directors, amendment of our organizational documents and certain corporate transactions such as issuances of equity, acquisition or disposition of significant assets, incurring debt for borrowed money, and entering into significant contracts and related party transactions. In accordance with the Stockholder Agreement, our Board is currently comprised of five directors nominated by Apollo, three directors nominated by Popular and one management director. Subject to certain exceptions and adjustments and applicable law, each of Apollo and Popular will have these director nomination rights so long as it owns, together with its affiliates, at least 25% of our outstanding voting common stock. Each of Apollo and Popular has agreed to vote all of the shares of our voting common stock owned by it and its affiliates, and to take all other actions within its control, to cause the election of directors nominated in accordance with the Stockholder Agreement. Similarly, we have agreed to take all actions within our control necessary and desirable to cause the election of directors nominated in accordance with the Stockholder Agreement. Immediately after this offering, Apollo and Popular will own % and %, respectively (or % and %, respectively, if the underwriters’ option to purchase up to additional shares of common stock from the selling stockholders is exercised in full), of our outstanding common stock and as a result will continue to have the power to nominate and control the election of directors at our annual meetings. The Stockholder Agreement also grants certain demand and piggyback registration rights to Apollo, Popular and the other parties thereto. Under the Stockholder Agreement, we agreed not to engage in any business (including commencing operations in any country in which we do not currently operate), subject to certain exceptions, if such activity would reasonably require Popular or an affiliate of Popular to seek regulatory approval from, or provide notice to, any bank regulatory authority. Under the Master Services Agreement, we provide a number of critical payment processing and business solutions products and services to Popular, who agreed to continue to utilize our services on an exclusive basis on commercial terms consistent with the terms of our historical relationship. For more information on the Stockholder Agreement, Master Services Agreement and other agreements, with Apollo and Popular, see “Certain Relationships and Related Party Transactions.”

11

Table of Contents

The Offering

| Issuer |

EVERTEC, Inc. |

| Common stock offered by us |

shares |

| Common stock offered by selling stockholders |

shares |

| Common stock to be outstanding immediately after the offering |

shares |

| Underwriters’ option to purchase additional shares of common stock in this offering |

The selling stockholders have granted to the underwriters a 30-day option to purchase up to additional shares, respectively, at the initial public offering price less underwriting discounts. |

| Common stock voting rights |

Each share of our common stock will entitle its holder to one vote. |

| Dividend policy |

We currently intend to retain all future earnings, if any, for use in the operation of our business and to fund future growth. The decision whether to pay dividends will be made by our board of directors (our “Board”) in light of conditions then existing, including factors such as our financial condition, earnings, available cash, business opportunities, legal requirements, restrictions in our debt agreements and other contracts, and other factors our Board deems relevant. See “Dividend Policy.” |

| Use of proceeds |

We estimate that our net proceeds from this offering will be approximately $ million after deducting the estimated underwriting discounts and other expenses of $ million payable by us, assuming the shares are offered at $ per share, which represents the midpoint of the range set forth on the front cover of this prospectus. We intend to use the net cash proceeds for general corporate purposes. We will not receive any proceeds from the sale of our common stock by the selling stockholders. See “Use of Proceeds.” |

| Listing |

Our shares of common stock have been approved for listing on the NYSE under the trading symbol “EVTC.” |

| Risk factors |

You should carefully read and consider the information set forth under “Risk Factors” beginning on page 20 of this prospectus and all other information set forth in this prospectus before deciding to invest in our common stock. |

12

Table of Contents

| Conflicts of interest |

Each of Apollo Global Securities, LLC, an affiliate of Apollo, and Popular Securities, Inc., an affiliate of Popular, will be an underwriter of this offering. Since each of Apollo and Popular owns more than 10% of our outstanding common stock, a “conflict of interest” would be deemed to exist under Rule 5121(f)(5)(B) of the Conduct Rules of the Financial Industry Regulatory Authority, or FINRA. In addition, because Apollo and Popular as selling stockholders will receive more than 5% of the proceeds of this offering, a “conflict of interest” would be deemed to exist under Rule 5121(f)(5)(C)(ii) of the Conduct Rules of FINRA. Accordingly, we intend that this offering will be made in compliance with the applicable provisions of Rule 5121. Since neither Apollo Global Securities, LLC nor Popular Securities, Inc. is primarily responsible for managing this offering, pursuant to FINRA Rule 5121(a)(1)(A), the appointment of a qualified independent underwriter is not necessary. As such, neither Apollo Global Securities, LLC nor Popular Securities, Inc. will confirm sales to accounts in which it exercises discretionary authority without the prior written consent of the customer. See “Underwriting (Conflicts of Interest)” and “Use of Proceeds.” |

| Directed Share Program |

At our request, the underwriters have reserved for sale, at the initial public offering price, up to 5% of the shares offered by this prospectus for sale to some of our employees, officers and directors and certain other persons who are otherwise associated with us. If these persons purchase reserved shares, it will reduce the number of shares available for sale to the general public. Any reserved shares that are not so purchased will be offered by the underwriters to the general public on the same terms as the other shares offered by this prospectus. Reserved shares purchased by our officers and directors will be subject to the lock-up provisions described in “Underwriting (Conflicts of Interest)—Lock-Up Agreements.” |

Except as otherwise indicated, all of the information in this prospectus assumes or reflects:

| • | the for one stock split described below has been completed; |

| • | no exercise of the underwriters’ option to purchase up to additional shares of common stock from the selling stockholders; |

| • | an initial offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus; |

| • | the conversion of all outstanding shares of our Class B Non-Voting Common Stock into shares of our voting common stock on a one-for-one basis; and |

| • | our amended and restated certificate of incorporation and amended and restated bylaws are in effect, pursuant to which the provisions described under “Description of Capital Stock” will become operative. |

Prior to the effectiveness of the registration statement filed with the SEC in connection with this offering and of which this prospectus is a part, we will increase our authorized shares of common stock and effect a stock split, whereby (1) each of the holders of our Class A Common Stock will receive shares of our Class A Common Stock for each share of our Class A Common Stock it holds immediately prior to such stock split and (2) each of the holders of our Class B Non-Voting Common Stock will receive shares of our Class B Non-Voting Common Stock for each share of Class B Non-Voting Common Stock it holds immediately prior to such stock split. Immediately prior to the effectiveness of the above-referenced registration statement, all of our outstanding Class B Non-Voting Common Stock will be converted into shares of our Class A Common Stock on a one-for-one basis. Further, upon the effectiveness of our amended and restated certificate of incorporation, which will occur immediately prior to the completion of this offering, we will redesignate our Class A Common Stock as common stock and, thereafter, we will only have one class of common stock.

The number of shares of common stock to be outstanding after completion of this offering is based on shares of our common stock to be sold by us and the selling stockholders in this offering and, except where we state otherwise, the information with respect to our common stock we present in this prospectus, including as set forth above:

13

Table of Contents

| • | does not give effect to shares of our common stock issuable upon the exercise of outstanding options as of , 2013, at a weighted-average exercise price of $ per share; and |

| • | does not give effect to shares of common stock reserved for future issuance under the Equity Incentive Plans (as defined in “Management —Executive Compensation”). |

You should refer to the section entitled “Risk Factors” for an explanation of certain risks of investing in our common stock.

14

Table of Contents

Summary Historical Consolidated and Combined Financial Data

We have presented in this prospectus selected historical combined financial data of EVERTEC Business Group (“Predecessor”) and selected historical consolidated financial data of EVERTEC and Holdings (Successor) during the periods presented. We have also presented in this prospectus the audited consolidated financial statements of EVERTEC as of and for the years ended December 31, 2012 and 2011, which have been prepared, in each case, in accordance with GAAP.

The summary consolidated financial data as of and for the year ended December 31, 2011 and 2012 have been derived from the audited consolidated financial statements of EVERTEC and related notes appearing elsewhere in this prospectus. The summary historical consolidated financial data as of December 31, 2010 and for the three months ended December 31, 2010 have been derived from the audited consolidated financial statements of Holdings not included in this prospectus. Also, the summary historical combined financial data for the nine months ended September 30, 2010 have been derived from the audited combined financial statements of EVERTEC Business Group (Predecessor) not included in this prospectus. The summary historical combined financial data for the year ended December 31, 2009 has been derived from the unaudited combined financial statements of EVERTEC Business Group (Predecessor) not included in this prospectus.

The results of operations for any period are not necessarily indicative of the results to be expected for any future period and the historical consolidated and combined financial data presented below and elsewhere in this prospectus does not necessarily reflect what our financial position, results of operations and cash flows would have been had we operated as a separate stand-alone entity during the Predecessor period. The summary historical consolidated and combined financial data set forth below should be read in conjunction with, and are qualified by reference to, “Capitalization,” “Selected Historical Consolidated and Combined Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes thereto appearing elsewhere in this prospectus.

15

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED AND COMBINED FINANCIAL DATA

| Predecessor | Successor | |||||||||||||||||||

| (Dollar amounts in thousands) | Year ended December 31, 2009 |

Nine

months ended September 30, 2010 |

Three months ended December 31, 2010 (1) |

Year ended December 31, 2011 |

Year

ended December 31, 2012 |

|||||||||||||||

| Statement of Income Data: |

||||||||||||||||||||

| Revenues: |

||||||||||||||||||||

| Merchant acquiring, net |

$ | 48,744 | $ | 39,761 | $ | 14,789 | $ | 61,997 | $ | 69,591 | ||||||||||

| Payment processing |

74,728 | 56,777 | 21,034 | 85,691 | 94,801 | |||||||||||||||

| Business solutions |

152,827 | 118,482 | 46,586 | 173,434 | 177,292 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

276,299 | 215,020 | 82,409 | 321,122 | 341,684 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating costs and expenses |

||||||||||||||||||||

| Cost of revenues, exclusive of depreciation and amortization shown below |

150,070 | 113,246 | 41,839 | 155,377 | 158,860 | |||||||||||||||

| Selling, general and administrative expenses |

25,639 | 27,000 | 8,392 | 33,339 | 31,686 | |||||||||||||||

| Depreciation and amortization |

24,500 | 19,425 | 17,722 | 69,891 | 71,492 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating costs and expenses |

200,209 | 159,671 | 67,953 | 258,607 | 262,038 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from operations |

76,090 | 55,349 | 14,456 | 62,515 | 79,646 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Non-operating income (expenses) |

||||||||||||||||||||

| Interest income |

1,048 | 360 | 118 | 797 | 320 | |||||||||||||||

| Interest expense |

(91 | ) | (70 | ) | (13,436 | ) | (50,957 | ) | (54,331 | ) | ||||||||||

| Earnings of equity method investments |

3,508 | 2,270 | — | 833 | 564 | |||||||||||||||

| Other (expenses) income: |

||||||||||||||||||||

| Voluntary Retirement Program (“VRP”) expense |

— | — | — | (14,529 | ) | — | ||||||||||||||

| Merger and advisory-related costs |

— | — | (34,848 | ) | — | — | ||||||||||||||

| Other income (expenses) |

7,942 | 2,276 | (1,316 | ) | (3,672 | ) | (8,491 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total other income (expense) |

7,942 | 2,276 | (36,164 | ) | (18,201 | ) | (8,491 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-operating income (expenses) |

12,407 | 4,836 | (49,482 | ) | (67,528 | ) | (61,938 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes |

88,497 | 60,185 | (35,026 | ) | (5,013 | ) | 17,708 | |||||||||||||

| Income tax expense (benefit) |

30,659 | 23,017 | (14,450 | ) | (29,227 | ) | (59,658 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) from continuing operations |

57,838 | 37,168 | (20,576 | ) | 24,214 | 77,366 | ||||||||||||||

| Net income from discontinued operations |

1,813 | 117 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | 59,651 | $ | 37,285 | $ | (20,576 | ) | $ | 24,214 | $ | 77,366 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other Financial Data: |

||||||||||||||||||||

| EBITDA(2) |

$ | 112,040 | $ | 79,320 | $ | (3,986 | ) | $ | 115,038 | $ | 143,211 | |||||||||

| Adjusted EBITDA(2) |

117,575 | 92,290 | 36,508 | 149,118 | 169,586 | |||||||||||||||

| Adjusted Net Income(2) |

58,223 | 49,420 | 14,702 | 71,625 | 84,443 | |||||||||||||||

| Cash interest expense(3) |

91 | 70 | 12,861 | 43,394 | 49,643 | |||||||||||||||

| Capital expenditures |

22,701 | 30,468 | 10,541 | 21,858 | 27,262 | |||||||||||||||

| Net cash provided by (used in) operating activities from continuing operations |

65,464 | 63,701 | (16,752 | ) | 69,371 | 82,664 | ||||||||||||||

| Net cash provided (used in) by investing activities from continuing operations |

(2,692 | ) | 16,153 | (496,598 | ) | (31,747 | ) | (27,042 | ) | |||||||||||

| Net cash (used in) provided by financing activities from continuing operations |

(77,710 | ) | (65,796 | ) | 539,990 | (36,623 | ) | (86,188 | ) | |||||||||||

| Balance Sheet Data (at period end): |

||||||||||||||||||||

|

Cash(4) |

$ | 11,891 | $ | — | $ | 55,199 | $ | 56,200 | $ | 25,634 | ||||||||||

| Working capital(5) |

82,272 | — | 62,226 | 87,267 | 33,078 | |||||||||||||||

| Total assets |

243,445 | — | 1,092,179 | 1,046,860 | 977,745 | |||||||||||||||

| Total long-term liabilities |

481 | — | 673,736 | 615,713 | 758,395 | |||||||||||||||

| Total debt |

1,413 | — | 562,173 | 523,833 | 763,756 | |||||||||||||||

| Total net debt (6) |

— | — | 506,974 | 467,633 | 738,122 | |||||||||||||||

| Total equity |

211,475 | — | 339,613 | 366,176 | 122,455 | |||||||||||||||

16

Table of Contents

| (1) | We define the “three months ended December 31, 2010” as the financial results of Holdings for the period from its inception on June 25, 2010 to December 31, 2010, consisting primarily of merger and advisory-related costs incurred prior to the Merger on September 30, 2010, and following the Merger consisting primarily of EVERTEC, LLC results of operations. |

| (2) | EBITDA, Adjusted EBITDA and Adjusted Net Income are supplemental measures of our performance that are not required by, or presented in accordance with, GAAP. They are not measurements of our financial performance under GAAP and should not be considered as alternatives to net income or any other performance measures derived in accordance with GAAP or as alternatives to cash flows from operating activities, as indicators of cash flows or as measures of our liquidity. |

| We define “EBITDA” as earnings before interest, taxes, depreciation and amortization. We define “Adjusted EBITDA” as EBITDA as further adjusted to exclude unusual items and other adjustments described below. We define “Adjusted Net Income” as net income as adjusted to exclude unusual items and other adjustments described below. |

| We caution investors that amounts presented in accordance with our definitions of EBITDA, Adjusted EBITDA and Adjusted Net Income may not be comparable to similar measures disclosed by other issuers, because not all issuers and analysts calculate EBITDA, Adjusted EBITDA and Adjusted Net Income in the same manner. We present EBITDA and Adjusted EBITDA because we consider them important supplemental measures of our performance and believe they are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. In addition, our presentation of Adjusted EBITDA for the periods presented is consistent with the equivalent measurements that are contained in the senior secured credit facilities and the indenture governing the notes in testing EVERTEC, LLC’s compliance with the covenants therein such as interest coverage and debt incurrence. We use Adjusted Net Income to measure our overall profitability because it better reflects our cash flow generation by capturing the actual cash taxes paid rather than our tax expense as calculated under GAAP and excludes the impact of the non-cash amortization and depreciation that was created as a result of the Merger. In addition, in evaluating EBITDA, Adjusted EBITDA and Adjusted Net Income, you should be aware that in the future we may incur expenses such as those excluded in calculating them. Further, our presentation of these measures should not be construed as an inference that our future operating results will not be affected by unusual or nonrecurring items. |

Some of the limitations of EBITDA, Adjusted EBITDA and Adjusted Net Income are as follows:

| • | they do not reflect cash outlays for capital expenditures or future contractual commitments; |

| • | they do not reflect changes in, or cash requirements for, working capital; |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect cash requirements for such replacements; |

| • | in the case of EBITDA and Adjusted EBITDA, they do not reflect interest expense, or the cash requirements necessary to service interest, or principal payments, on indebtedness; |

| • | in the case of EBITDA and Adjusted EBITDA, they do not reflect income tax expense or the cash necessary to pay income taxes; and |

| • | other companies, including other companies in our industry, may not use EBITDA, Adjusted EBITDA and Adjusted Net Income or may calculate EBITDA, Adjusted EBITDA and Adjusted Net Income differently than as presented in this prospectus, limiting their usefulness as a comparative measure. |

17

Table of Contents

A reconciliation of net income to EBITDA, Adjusted EBITDA and Adjusted Net Income is provided below:

| Predecessor | Predecessor | Successor | Successor | |||||||||||||||||

| (Dollar amounts in thousands) | Year ended December 31, 2009 |

Nine months ended September 30, 2010 |

Three months ended December 31, 2010 |

Year ended December 31, 2011 |

Year

ended December 31, 2012 |

|||||||||||||||

| Net income (loss) |

$ | 57,838 | $ | 37,168 | $ | (20,576 | ) | $ | 24,214 | $ | 77,366 | |||||||||

| Income tax expense (benefit) |

30,659 | 23,017 | (14,450 | ) | (29,227 | ) | (59,658 | ) | ||||||||||||

| Interest (income) expense |

(957 | ) | (290 | ) | 13,318 | 50,160 | 54,011 | |||||||||||||

| Depreciation and amortization |

24,500 | 19,425 | 17,722 | 69,891 | 71,492 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

112,040 | 79,320 | (3,986 | ) | 115,038 | 143,211 | ||||||||||||||

| Stand-alone cost savings and software maintenance reimbursement(a) |

6,411 | 4,930 | 36 | 2,570 | 2,429 | |||||||||||||||

| Disposals(b) |

(9,440 | ) | (3,916 | ) | 60 | — | — | |||||||||||||

| Equity income(c) |

47 | (852 | ) | 1,514 | 635 | 1,057 | ||||||||||||||

| Compensation and benefits(d) |

(629 | ) | 6,976 | (408 | ) | 15,970 | 3,795 | |||||||||||||

| Pro forma cost reduction adjustments(e) |

— | — | — | — | 2,150 | |||||||||||||||

| Pro forma VRP benefits(f) |

— | — | 1,584 | 4,751 | — | |||||||||||||||

| Transaction, refinancing and other non-recurring fees(g) |

1,246 | 565 | 37,113 | 8,015 | 15,246 | |||||||||||||||

| Management fees(h) |

— | — | — | 2,532 | 2,982 | |||||||||||||||

| Westernbank EBITDA(i) |

7,900 | 5,267 | — | — | — | |||||||||||||||

| Purchase accounting(j) |

— | — | 595 | (393 | ) | (1,284 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

117,575 | 92,290 | 36,508 | 149,118 | 169,586 | |||||||||||||||

| Pro forma EBITDA adjustments(k) |

(14,221 | ) | (8,727 | ) | (1,425 | ) | (4,755 | ) | (2,150 | ) | ||||||||||

| Operating depreciation and amortization(l) |

(23,690 | ) | (18,881 | ) | (7,401 | ) | (28,935 | ) | (31,287 | ) | ||||||||||

| Cash interest income (expense)(m) |

957 | 290 | (12,533 | ) | (42,165 | ) | (48,921 | ) | ||||||||||||

| Cash income taxes(n) |

(22,398 | ) | (15,552 | ) | (448 | ) | (1,638 | ) | (2,785 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted Net Income |

$ | 58,223 | $ | 49,420 | $ | 14,701 | $ | 71,625 | $ | 84,443 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | For the years ended December 31, 2011 and 2012, primarily represents reimbursements received for certain software maintenance expenses as part of the Merger. For the year ended December 31, 2009 and the 2010 periods, primarily represents stand-alone net savings for costs historically allocated to EVERTEC by Popular which did not continue post closing of the merger. The allocations were primarily based on a percentage of revenues or costs (and not based on actual costs incurred) and related to corporate functions such as accounting, tax, treasury, payroll and benefits, risk management, institutional marketing, legal, public relations and compliance. The allocations amounted to $9.8 million and $7.5 million for the year ended December 31, 2009 and the nine months ended September 30, 2010, respectively, which were partially offset by estimated annual stand-alone costs of $3.4 million and $2.6 million for the same respective periods. |

| (b) | Relates to adjustments on the disposal of investments and businesses as follows: (i) removal of the gain resulting from the sale of Visa stock, (ii) removal of the EBITDA of the Health Care Division which was sold to Inmediata Health Group, Corp. a medical transaction processing company, in April 2008 (in exchange for an equity interest in Inmediata Health Group, Corp.) and gain realized on this transaction, (iii) removal of the gain realized on the sale of our equity interest in Inmediata Health Group, Corp., in April 2010 and related equity income, (iv) removal of the allocations previously charged to our discontinued Venezuela operations and (v) the write-off of certain investment securities during the three months ended December 31, 2010. |

| (c) | Represents the elimination of historical non-cash equity in earnings of investments reported in net income from our 53.97% equity ownership in CONTADO and 31.11% equity ownership in Serfinsa prior to September 30, 2010 and 19.99% equity ownership of CONTADO after March 31, 2011, net of cash dividends received from CONTADO. Cash dividends from CONTADO were $1.9 million and $1.5 million for the year ended December 31, 2009 and nine months ended September 30, 2010. Cash dividends from CONTADO for the years ended December 31, 2011 and 2012 were $1.5 million and $1.6 million, respectively. |

18

Table of Contents

| See “Certain Relationships and Related Party Transactions—Related Party Transactions After the Closing of the Merger—CONTADO and Serfinsa.” |

| (d) | For the year ended December 31, 2012 mainly represents a one-time payment of $2.2 million as a result of the former CEO’s employment modification agreement and other adjustments related to non-cash equity based compensation. For the year ended December 31, 2011 mainly represents one-time costs related to the VRP and other adjustments related to non-cash equity based compensation. For the 2010 periods primarily represents non-recurring bonuses and the payroll tax impact of awards given to certain of our employees in connection with the Merger, partially offset by estimated costs for the anticipated reinstatement of EVERTEC’s matching contribution plan that was suspended in March 2009 and reinstated in March 2011. |

| (e) | Reflects the pro forma effect of the expected net savings primarily in compensation and benefits from the reduction of certain temporary employees and, and professional services. This pro forma amount was calculated using the net amount of actual expenses for temporary employees and professional services for the 12 month period prior to their replacement and/or elimination net of the incremental cost of the new full-time employees that were hired. |

| (f) | For the year ended December 31, 2011 and the three months ended December 31, 2010, adjustment represents the pro forma net savings in compensation and benefits related to the employees that participated in the VRP. The pro forma impact was calculated using the actual payroll, benefit and bonus payments of employees participating in the VRP for the 12 month period prior to their termination. |

| (g) | Represents primarily: (i) the transaction costs, such as due diligence costs, legal and other advisors fees incurred in connection with the Merger of approximately $34.8 million for the three months ended December 31, 2010; (ii) costs associated with the issuance and refinancing of EVERTEC’s debt of approximately $2.4 million and $8.8 million for the years ended December 31, 2011 and 2012, respectively; (iii) costs associated with certain non-recurring corporate transactions, including, for example, costs related to EVERTEC Group’s conversion to an LLC and the distributions made to our stockholders during 2012 of $4.0 million and $3.9 million for the years ended December 31, 2011 and 2012, respectively; and (iv) a non-recurring, non-cash asset write-off of $1.6 million in the year ended December 31, 2012 and other non-recurring expenses of $1.6 million in the year ended December 31, 2011. |

| (h) | Represents the management fee payable to our equity sponsors which commenced in January 2011. See “Certain Relationships and Related Party Transactions—Related Party Transactions in Connection with the Closing of the Merger—Consulting Agreements.” |

| (i) | Represents an estimated adjustment for additional EBITDA related to the Westernbank business. Banco Popular de Puerto Rico (“Banco Popular”) acquired Westernbank’s Puerto Rico operations on April 30, 2010, and we did not realize the impact of these additional volumes and associated revenues until the third quarter of 2010. The estimate was arrived at using the pricing schedule in the Master Services Agreement as well as management’s estimated related costs of the contribution of additional business volume. The estimate of Westernbank EBITDA was added to previous periods for comparative purposes, and reflects the estimated, rather than observed, impact. See “—Principal Stockholders” and “—Key Relationship with Popular.” |

| (j) | Represents the elimination of the effects of purchase accounting impacts associated with (i) certain customer service and software related arrangements where we receive reimbursements from Popular; and (ii) EVERTEC’s rights and obligations to buy equity interests in CONTADO and Serfinsa. |

| (k) | Represents the elimination of EBITDA adjustments to reflect the pro forma benefit related to headcount reductions in 2010, post merger stand-alone cost savings and the VRP described in notes (a), (d) and (e) above. |

| (l) | Represents operating depreciation and amortization expense which excludes amounts generated as a result of the Merger. |

| (m) | Represents interest expense adjusted to exclude non-cash amortization of the debt issue cost, premium and accretion of discount. |

| (n) | Represents cash taxes paid for each period presented. |

| (3) | Represents cash interest expense accrued during each period related to our indebtedness (excluding amortization of discount, premiums and debt issuance costs). |

| (4) | Excludes restricted cash of $3.7 million, $6.1 million, $5.3 million and $4.9 million as of December 31, 2009, 2010, 2011 and 2012, respectively. |

| (5) | Working capital is defined as the excess of current assets over current liabilities. |

| (6) | Total net debt is defined as total debt (including short-term borrowings) less cash. |

19

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, as well as other information contained in this prospectus, before investing in our common stock. If any of the following risks actually occur, our business, financial condition, operating results or cash flow could be materially and adversely affected. Additional risks and uncertainties not presently known to us or not believed by us to be material may also negatively impact us.

Risks Related to Our Business

We expect to continue to derive a significant portion of our revenue from Popular.

Our services to Popular account for a significant portion of our revenues, and we expect that our services to Popular will continue to represent a significant portion of our revenues for the foreseeable future. In 2012, products and services billed through Popular accounted for approximately 44% of our total revenues, of which approximately 83% (or approximately 37% of total revenues) are derived from core bank processing and related services for Popular and approximately 17% (or approximately 7% of total revenues) are transaction processing activities driven by third parties. If Popular were to terminate, or fail to perform under, the Master Services Agreement or our other material agreements with Popular, our revenues could be significantly reduced. See “Certain Relationships and Related Party Transactions.”

In 2012, our next largest customer, the Government of Puerto Rico represented approximately 9% of our total revenues. Our revenues from the Government of Puerto Rico span numerous individual agencies and public corporations.

We depend, in part, on our merchant relationships and our alliance with Banco Popular, a wholly-owned subsidiary of Popular, to grow our Merchant Acquiring business. If we are unable to maintain these relationships and this alliance, our business may be adversely affected.