AIRBNB, INC.

888 Brannan Street

San Francisco, CA 94103

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

To Be Held Virtually on June 1, 2023

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 2023 Annual Meeting of Stockholders of Airbnb, Inc. (the “Annual Meeting”) will be held on June 1, 2023, at 9:30 a.m., Pacific Daylight Time, virtually via a live webcast. Please visit www.proxydocs.com/ABNB and enter your control number included in your Notice Regarding the Availability of Proxy Materials, on the instructions accompanying your proxy materials, or on your proxy card for details on how to attend the Annual Meeting. At the Annual Meeting, stockholders will consider and vote on the following matters:

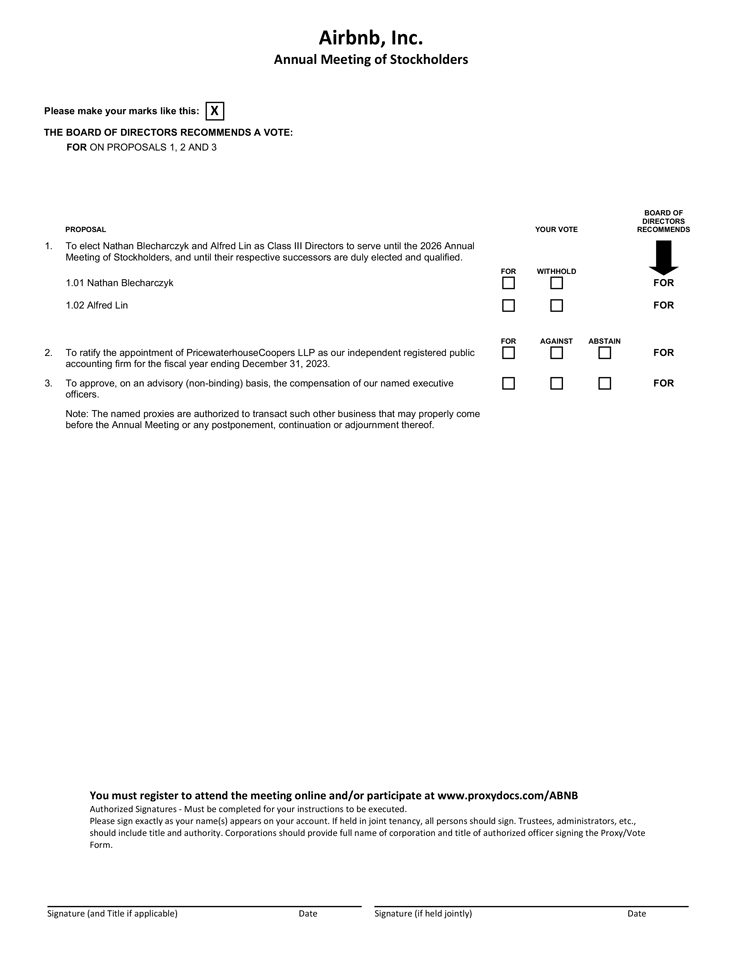

| 1. | To elect Nathan Blecharczyk and Alfred Lin as Class III Directors to serve until the 2026 Annual Meeting of Stockholders, and until their respective successors are duly elected and qualified; |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; and |

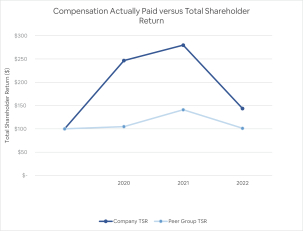

| 3. | To approve, on an advisory (non-binding) basis, the compensation of our named executive officers. |

The stockholders will also act on any other business that may properly come before the Annual Meeting or any postponement, continuation or adjournment thereof.

Stockholders of record at the close of business on April 6, 2023 are entitled to notice of, and to vote at, the Annual Meeting or any postponement, continuation, or adjournment thereof. A complete list of such stockholders will be open to the examination of any stockholder for a period of ten days prior to the Annual Meeting for a purpose germane to the meeting and will be open to the examination of any stockholder during the whole time of the meeting.

Your vote is very important to us, and it is important to us that your shares are represented regardless of the number of shares you may hold. Whether you choose to participate in the Annual Meeting online or not, you can be sure your shares are represented at the meeting if you are a stockholder of record by promptly voting electronically over the Internet or via the toll-free telephone number provided, or, if you request to receive paper copies of these materials by mail, by returning your completed proxy card in the pre-addressed, postage-paid return envelope. If your shares are held in street name, you may return your completed voting instruction card to your broker. If, for any reason, you desire to revoke or change your proxy, you may do so at any time before it is exercised, such that submitting your proxy now will not prevent you from voting your shares at the Annual Meeting. The proxy is solicited by the board of directors of Airbnb, Inc.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

Our proxy materials, including the Proxy Statement for the Annual Meeting and Annual Report on Form 10-K for the fiscal year ended December 31, 2022, are being made available on our website at https://investors.airbnb.com, as well as at the following website: www.proxydocs.com/ABNB. We are providing access to our proxy materials over the Internet under the rules adopted by the U.S. Securities and Exchange Commission.

| By Order of the Board of Directors, |

|

| Brian Chesky Chairperson of the Board of Directors Chief Executive Officer |

| April 21, 2023 |