Table of Contents

As filed with the Securities and Exchange Commission on January 24, 2014

Registration No. 333-184476

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 4

TO

FORM S-11

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

Resource Real Estate Opportunity REIT II, Inc.

(Exact name of registrant as specified in its charter)

1845 Walnut Street, 18th Floor

Philadelphia, Pennsylvania 19103

(215) 231-7050

(Address, including zip code, and telephone number, including area code, of the registrant’s principal executive offices)

Alan F. Feldman

Chief Executive Officer

Resource Real Estate Opportunity REIT II, Inc.

1845 Walnut Street, 18th Floor

Philadelphia, Pennsylvania 19103

(215) 231-7050

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Robert H. Bergdolt, Esq.

Laura K. Sirianni, Esq.

DLA Piper LLP (US)

4141 Parklake Avenue, Suite 300

Raleigh, North Carolina 27612-2350

(919) 786-2000

Approximate date of commencement of proposed sale to public: As soon as practicable after the effectiveness of the registration statement.

If any of the securities on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check One):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if smaller reporting company) | Smaller Reporting Company | x | |||

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the SEC and various states is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED JANUARY 24, 2014

Maximum Offering – 110,000,000 Shares of Common Stock

Minimum Offering – 200,000 Shares of Common Stock

Resource Real Estate Opportunity REIT II, Inc. is a recently formed Maryland corporation that intends to take advantage of our Sponsor’s dedicated multifamily investing and lending platforms to invest in multifamily assets across the entire spectrum of investments in order to provide you with growing cash flow and increasing asset values. Our targeted portfolio will consist, at the time of acquisition, of commercial real estate assets, principally (i) underperforming multifamily rental properties which we will renovate and stabilize in order to increase rents, (ii) distressed real estate owned by financial institutions, usually as a result of foreclosure, and non-performing or distressed loans, including first- and second-priority mortgage loans and other loans which we will resolve, and (iii) performing loans, including first- and second-priority mortgage loans and other loans we originate or purchase either directly or with a co-investor or joint venture partner. We believe multiple opportunities exist within the multifamily industry today and will continue to present themselves over the next few years to real estate investors who possess the following characteristics: (i) extensive experience in multifamily investing, (ii) strong management platforms specializing in operational and financial performance optimization, (iii) financial sophistication allowing them to benefit from complex opportunities and (iv) the overall scale and breadth of a national real estate platform in both the equity and debt markets. We intend to qualify as a real estate investment trust (“REIT”), beginning with the taxable year that will end December 31, 2014. We are an “emerging growth company” under federal securities laws.

We are offering up to 100,000,000 shares of common stock in our primary offering for $10 per share, with volume discounts available to investors who purchase more than $1,000,000 of shares through the same participating broker-dealer. Discounts are also available for other categories of investors. We are also offering up to 10,000,000 shares pursuant to our distribution reinvestment plan at a purchase price initially equal to $9.50 per share. This offering will terminate on or before (unless extended by our board of directors for an additional year or as otherwise permitted by applicable securities law).

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 29 to read about risks you should consider before buying shares of our common stock. These risks include the following:

| • | No public market currently exists for our shares of common stock, and our charter does not require our directors to seek stockholder approval to liquidate our assets by a specified date nor list our shares on an exchange by a specified date. |

| • | We set the offering price arbitrarily. This price is unrelated to the book or net value of our assets or to our expected operating income. |

| • | We have no operating history, and as of the date of this prospectus, our total assets consist of our advisor’s initial investment in us of $200,000. We have not identified any investments to acquire with the proceeds from this offering and are considered to be a blind pool. In addition, you will not have the opportunity to evaluate our investments before we make them. |

| • | We are dependent on our advisor and its affiliates to select investments and conduct our operations and this offering. Our advisor has no operating history and no experience operating a public company. |

| • | We will pay substantial fees and expenses to our advisor, its affiliates and broker-dealers, which payments increase the risk that you will not earn a profit on your investment. |

| • | Our executive officers and some of our directors will face conflicts of interest. |

| • | We may lack diversification if we do not raise substantially more than the minimum offering. |

| • | There are restrictions on the ownership and transferability of our shares of common stock. See “Description of Shares—Restriction on Ownership of Shares.” |

| • | Our charter permits us to pay distributions from any source without limitation, including from offering proceeds, borrowings, sales of assets or waivers or deferrals of fees otherwise owed to our advisor. |

| • | We may change our targeted investments without stockholder consent. |

| • | Some of the other programs sponsored by our sponsor have experienced adverse business developments or conditions. |

Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any other state securities regulator has approved or disapproved of our common stock, determined if this prospectus is truthful or complete or passed on or endorsed the merits of this offering. Any representation to the contrary is a criminal offense.

This investment involves a high degree of risk. You should purchase these securities only if you can afford a complete loss of your investment. The use of projections or forecasts in this offering is prohibited. No one is permitted to make any oral or written predictions about the cash benefits or tax consequences you will receive from your investment.

| Price to Public |

Selling Commissions |

Dealer Manager Fee |

Net Proceeds (Before Expenses) |

|||||||||||||

| Primary Offering |

||||||||||||||||

| Per Share |

$ | 10.00 | * | $ | 0.70 | * | $ | 0.30 | * | $ | 9.00 | |||||

| Total Minimum |

$ | 2,000,000 | * | $ | 140,000 | * | $ | 60,000 | * | $ | 1,800,000 | |||||

| Total Maximum |

$ | 1,000,000,000 | * | $ | 70,000,000 | * | $ | 30,000,000 | * | $ | 900,000,000 | |||||

| Distribution Reinvestment Plan |

||||||||||||||||

| Per Share |

$ | 9.50 | $ | 0.00 | $ | 0.00 | $ | 9.50 | ||||||||

| Total Maximum |

$ | 95,000,000 | $ | 0.00 | $ | 0.00 | $ | 95,000,000 | ||||||||

| * | Discounts are available for some categories of investors. Reductions in commissions and fees will result in corresponding reductions in the purchase price. |

The dealer manager, Resource Securities, Inc., our affiliate, is not required to sell any specific number or dollar amount of shares but will use its best efforts to sell the shares offered. The minimum permitted purchase is $2,500. We will not sell any shares unless we raise gross offering proceeds of $2,000,000 from persons who are not affiliated with us or our advisor by . Pending satisfaction of this condition, all subscription payments will be placed in an account held by the escrow agent, UMB Bank, NA, in trust for our subscribers’ benefit, pending release to us. If we do not raise gross offering proceeds of $2,000,000 by , we will promptly return all funds in the escrow account (including interest), and we will stop selling shares. We will not deduct any fees if we return funds from the escrow account.

The date of this prospectus is .

Table of Contents

The shares we are offering through this prospectus are suitable only as a long-term investment for persons of adequate financial means and who have no need for liquidity in this investment. Because there is no public market for our shares, you will have difficulty selling your shares.

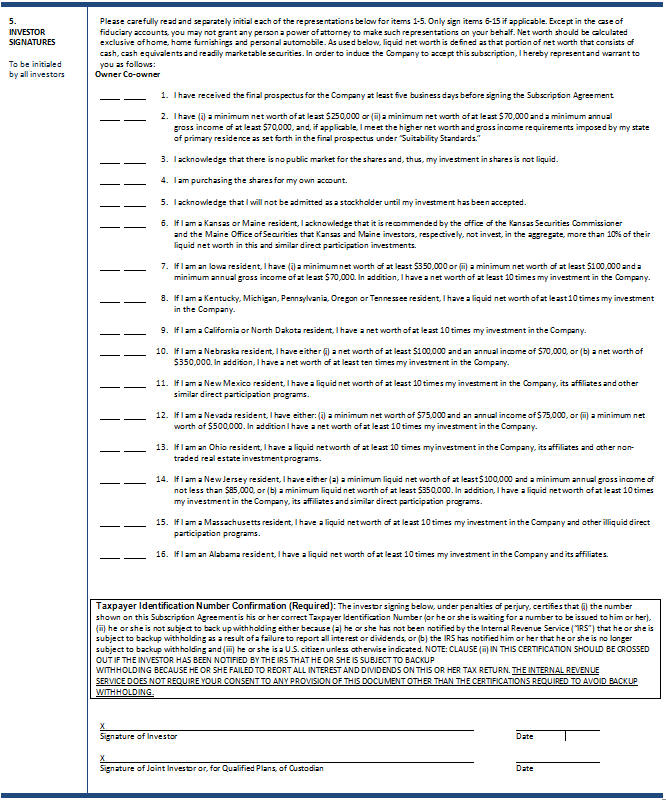

In consideration of these factors, we have established suitability standards for investors in this offering and subsequent purchasers of our shares. These suitability standards require that a purchaser of shares have either:

| • | a net worth of at least $250,000; or |

| • | gross annual income of at least $70,000 and a net worth of at least $70,000. |

In addition, the states listed below have established suitability requirements that are more stringent than ours and investors in these states are directed to the following special suitability standards:

| • | Kansas and Maine– It is recommended by the office of the Kansas Securities Commissioner and the Maine Office of Securities that Kansas and Maine investors, respectively, not invest, in the aggregate, more than 10% of their liquid net worth in this and similar direct participation investments. |

| • | California and North Dakota—Investors must have a net worth of at least 10 times their investment in us. |

| • | Kentucky, Michigan, Pennsylvania, Oregon and Tennessee – Investors must have a liquid net worth of at least 10 times their investment in us. |

| • | Iowa – Investors must have either (a) a net worth of $350,000 or (b) a gross annual income of $70,000 and a net worth of at least $100,000. In addition, investors must have a net worth of at least 10 times their investment in us. |

| • | Massachusetts – Investors must have a liquid net worth of at least 10 times their investment in us and other illiquid direct participation program investments. |

| • | Nebraska – Investors must have either (a) a net worth of at least $100,000 and an annual income of $70,000, or (b) a net worth of $350,000. In addition, investors must have a net worth of at least 10 times their investment in us. |

| • | Nevada – Investors must have either: (i) a minimum net worth of $75,000 and an annual income of $75,000, or (ii) a minimum net worth of $500,000. In addition, investors must have a net worth of at least 10 times their investment in us. |

| • | New Jersey – Investors must have either, (a) a minimum liquid net worth of at least $100,000 and a minimum annual gross income of not less than $85,000, or (b) a minimum liquid net worth of at least $350,000. In addition, investors must have a liquid net worth of at least 10 times their investment in us, our affiliates, and other direct participation programs. |

| • | New Mexico – Investors must have a liquid net worth of at least 10 times their investment in us, our affiliates and other similar direct participation programs. |

i

Table of Contents

| • | Ohio – Investors must have a liquid net worth of at least 10 times their investment in us, our affiliates and other non-traded real estate investment programs. |

| • | Alabama – Investors must have a liquid net worth of at least 10 times their investment in us and our affiliates. |

In addition, because the minimum offering amount is less than $150 million, Pennsylvania investors are cautioned to carefully evaluate our ability to fully accomplish our stated objectives and to inquire as to the current dollar volume of subscriptions.

For purposes of determining the suitability of an investor, net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings and automobiles. As used above, liquid net worth is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities. In the case of sales to fiduciary accounts, these suitability standards must be met by the fiduciary account, by the person who directly or indirectly supplied the funds for the purchase of the shares if such person is the fiduciary or by the beneficiary of the account.

Our sponsor, those selling shares on our behalf and participating broker-dealers and registered investment advisors recommending the purchase of shares in this offering must make every reasonable effort to determine that the purchase of shares in this offering is a suitable and appropriate investment for each stockholder based on information provided by the stockholder regarding the stockholder’s financial situation and investment objectives. See “Plan of Distribution—Suitability Standards” for a detailed discussion of the determinations regarding suitability that we require.

ii

Table of Contents

| i | ||||

| 1 | ||||

| 29 | ||||

| 29 | ||||

| 36 | ||||

| 38 | ||||

| 47 | ||||

| Risks Related to Investments in Real Estate-Related Debt Assets |

59 | |||

| 63 | ||||

| 66 | ||||

| 72 | ||||

| 74 | ||||

| 75 | ||||

| 78 | ||||

| 78 | ||||

| 79 | ||||

| 82 | ||||

| 83 | ||||

| Limited Liability and Indemnification of Directors, Officers, Employees and Other Agents |

83 | |||

| 84 | ||||

| 85 | ||||

| 87 | ||||

| 89 | ||||

| 92 | ||||

| 93 | ||||

| 99 | ||||

| 100 | ||||

| Our Affiliates’ Interests in Other Resource Real Estate Programs |

100 | |||

| Receipt of Fees and Other Compensation by Our Advisor and its Affiliates |

102 | |||

| Fiduciary Duties Owed by Some of Our Affiliates to Our Advisor and Our Advisor’s Affiliates |

104 | |||

| 104 | ||||

| 104 | ||||

| 105 | ||||

| 112 | ||||

| 112 | ||||

| 113 | ||||

| 114 | ||||

| 116 | ||||

| 117 | ||||

| 124 | ||||

| 125 | ||||

| 127 | ||||

| 131 | ||||

| 131 | ||||

| 131 | ||||

| 132 | ||||

| 132 | ||||

| 133 | ||||

| 133 | ||||

| Investment Limitations Under the Investment Company Act of 1940 |

135 | |||

| Disclosure Policies with Respect to Future Probable Acquisitions |

138 | |||

| 138 |

iii

Table of Contents

| 139 | ||||

| 139 | ||||

| 140 | ||||

| 140 | ||||

| 141 | ||||

| 142 | ||||

| 143 | ||||

| 146 | ||||

| 151 | ||||

| 152 | ||||

| 168 | ||||

| 169 | ||||

| 173 | ||||

| 174 | ||||

| 175 | ||||

| 176 | ||||

| 176 | ||||

| 178 | ||||

| 178 | ||||

| 180 | ||||

| 180 | ||||

| 180 | ||||

| 180 | ||||

| 184 | ||||

| 184 | ||||

| 185 | ||||

| 187 | ||||

| 187 | ||||

| Advance Notice for Stockholder Nominations for Directors and Proposals of New Business |

188 | |||

| 188 | ||||

| 189 | ||||

| 190 | ||||

| 190 | ||||

| 191 | ||||

| 191 | ||||

| 194 | ||||

| 199 | ||||

| 201 | ||||

| 201 | ||||

| 201 | ||||

| 201 | ||||

| 202 | ||||

| 202 | ||||

| 203 | ||||

| 203 | ||||

| 204 | ||||

| 204 | ||||

| 205 | ||||

| 205 | ||||

| Compensation of Dealer Manager and Participating Broker-Dealers |

205 | |||

| 209 | ||||

| 210 | ||||

| 211 | ||||

| 211 | ||||

| 212 |

iv

Table of Contents

| 213 | ||||

| 213 | ||||

| 213 | ||||

| 214 | ||||

| F-1 | ||||

| A-1 | ||||

| B-1 | ||||

| C-1 |

v

Table of Contents

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus, including the information set forth in “Risk Factors,” for a more complete understanding of this offering. Except where the context suggests otherwise, the terms “we,” “us” and “our” refer to Resource Real Estate Opportunity REIT II, Inc. and its subsidiaries; “Operating Partnership” refers to our operating partnership, RRE Opportunity OP II, LP; “advisor” refers to Resource Real Estate Opportunity Advisor II, LLC; “Resource Real Estate Opportunity Manager II” refers to our property manager, Resource Real Estate Opportunity Manager II, LLC; “Resource Real Estate” refers to our sole sponsor, Resource Real Estate, Inc.; and “Resource America” refers to Resource America, Inc., the parent corporation of our sponsor.

What is Resource Real Estate Opportunity REIT II, Inc.?

Resource Real Estate Opportunity REIT II, Inc. is a recently formed Maryland corporation that intends to take advantage of our Sponsor’s dedicated multifamily investing and lending platforms to invest in multifamily assets across the entire spectrum of investments in order to provide you with growing cash flow and increasing asset values. Our targeted portfolio will consist, at the time of acquisition, of commercial real estate assets, principally (i) underperforming multifamily rental properties which we will renovate and stabilize in order to increase rents, (ii) distressed real estate owned by financial institutions, usually as a result of foreclosure, and non-performing or distressed loans, including first- and second-priority mortgage loans and other loans which we will resolve, and (iii) performing loans, including first- and second-priority mortgage loans and other loans we originate or purchase either directly or with a co-investor or joint venture partner. We anticipate acquiring approximately 40% of our total assets in category (i) listed above, 35% of total assets in category (ii) listed above, and 25% of our total assets in category (iii) listed above. We believe multiple opportunities exist within the multifamily industry today and will continue to present themselves over the next few years to real estate investors who possess the following characteristics: (i) extensive experience in multifamily investing, (ii) strong management platforms specializing in operational and financial performance optimization, (iii) financial sophistication allowing them to benefit from complex opportunities and (iv) the overall scale and breadth of a national real estate platform in both the equity and debt markets. Our mailing address is 1845 Walnut Street, 18th Floor, Philadelphia, Pennsylvania 19103. Our telephone number is (215) 231-7050, our fax number is (215) 640-6320 and our email address is info@resourcereit.com. We also maintain an Internet site at http://www.resourcereit2.com at which there is additional information about us and our affiliates, but the contents of that site are not incorporated by reference in or otherwise a part of this prospectus.

We were incorporated in the State of Maryland on September 28, 2012 and we currently do not own any real estate assets. We intend to qualify as a REIT beginning with the taxable year that will end December 31, 2014. Because we have not yet identified any specific assets to acquire, we are considered to be a blind pool.

Our external advisor, Resource Real Estate Opportunity Advisor II, LLC, will conduct our operations and manage our portfolio of real estate investments, all subject to the supervision of our board of directors. We have no paid employees.

1

Table of Contents

What is a REIT?

In general, a REIT is an entity that:

| • | combines the capital of many investors to acquire or provide financing for real estate investments; |

| • | allows individual investors to invest in a professionally managed, large-scale, diversified real estate portfolio through the purchase of interests, typically shares, in the REIT; |

| • | is required to pay distributions to investors of at least 90% of its annual REIT taxable income (computed without regard to the dividends paid deduction and excluding net capital gain); and |

| • | avoids the “double taxation” treatment of income that normally results from investments in a corporation because a REIT is not generally subject to federal corporate income taxes on that portion of its income distributed to its stockholders, provided certain income tax requirements are satisfied. |

However, under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), REITs are subject to numerous organizational and operational requirements. If we fail to qualify for taxation as a REIT in any year after electing REIT status, our income will be taxed at regular corporate rates, and we may be precluded from qualifying for treatment as a REIT for the four-year period following our failure to qualify. Even if we qualify as a REIT for federal income tax purposes, we may still be subject to state and local taxes on our income and property and to federal income and excise taxes on our undistributed income.

Why does Resource Real Estate Opportunity REIT II Focus Primarily on the U.S. Apartment Market?

First, the nation’s nearly 100 million renters represent one-third of the housing market. However, because of demographic shifts, economic challenges and changing consumer preferences, renter households as a whole continue to become a larger portion of the overall housing picture. Almost 3.8 million new renter households were formed between 2005 and 2010, growing their ranks from 33.7 million to 37.4 million renter households, according to the U.S. Census Bureau. The trends driving households into apartments are expected to continue, and strengthening of the economy will also lead to more overall household formations, a key driver of all housing demand. The recession derailed the creation of roughly 2.1 million households as people doubled up or delayed moving out from their parents’ homes. As the economy improves and household formation rates begin returning to normal, as many as 7 million renter households could be created this decade.

The housing crisis challenged many Americans’ notions of homeownership. In addition, many individuals and communities have struggled with foreclosures and falling home values but also job losses, higher down payment requirements and stricter mortgage underwriting standards have made homeownership less attainable and desirable for many people. Homeownership rates have declined from a historical high of 69.2% in the fourth quarter of 2004 to 65.3% in the third quarter of 2013. For each one percentage point decline in homeownership, there is a shift of approximately 1.1 million households to the rental market.

There has been a long-running change in what constitutes the “typical” American household. For generations, married couples with children dominated our housing markets. But those households have fallen from 44% of all households in 1960 to just 20% today, and that number continues to decrease. By one estimate, 86% of household growth between 2000 and 2040 is expected to be those without children. Furthermore, young adults in their 20s and empty nesters in their 50s and older—those most likely to seek housing options other than single-family houses—will be the fastest growing population segments in

2

Table of Contents

the next decade. The almost 80-million strong Generation Y, also known as the Echo Boom generation, is hitting its peak renting years. In 2010, the oldest members of Gen Y were 33. By 2015, there will be 67 million people aged 20 to 34—the prime years for renting.

The current state of the existing apartment supply in the United States is old and in need of renovation. The median age of the existing apartment supply in the nation has nearly doubled from 23 years in 1985 to 39 years as of 2011. Almost 80% of the nation’s large apartment communities were built prior to 1990, and 66% built prior to 1980. In addition to the aging apartment stock, new supply of apartment completions is far below historical norms, as demonstrated in the table below:

| Average Annual Multifamily Completions 1970 – 2012 (5+ units in structure) |

||||

| 1970’s |

509,340 | |||

| 1980’s |

422,910 | |||

| 1990’s |

223,790 | |||

| 2000’s |

275,380 | |||

| 2010’s |

144,667 | |||

| Source: U.S. Census Bureau, New Residential Construction. Updated 8/2013. |

||||

The new supply of apartments is and has been well below the 300,000 new units annually most demographic analysts believe is needed just to meet expected apartment demand. In addition, future apartment supply is expected to be constrained by rising construction costs in both labor and materials. Experts in the field predict an increase in construction costs in the near future. Furthermore, any recovery of the single family housing construction would likely make the cost of construction increase at a higher rate as the demand for labor and materials would significantly increase.

We believe that demand for apartments in the United States will continue to increase due to demographic shifts, economic challenges and changing consumer preferences. Furthermore, the existing apartment inventory is old and inadequate to serve the increasing demand for rentals and that new supply of apartments will be significantly constrained by the rising cost of new construction. Therefore, we believe that the overall supply and demand imbalance will continue to offer significant opportunities throughout the next decade to apartment owners who understand how to opportunistically benefit from this imbalance and have the experience and management infrastructure to execute such opportunistic strategies.

3

Table of Contents

Second, our sponsor has focused on the multifamily sector, which includes student housing and senior residential, with its last 10 funds and will focus this program on multifamily rental property investments because apartments have traditionally produced the highest risk-adjusted investment returns compared to other property sectors. According to the National Council of Real Estate Investment Fiduciaries, over the past 30 years apartments have produced higher returns with lower volatility than the other major real estate sectors, which include office, retail industrial, hospitality and healthcare. Furthermore, according to data from the National Bureau of Economic Research and the National Council of Real Estate Investment Fiduciaries, multifamily rental properties have demonstrated returns during recessionary periods that are higher than those of other major property classes, and have been an effective inflation hedge due to the short term of the typical apartment lease, which is generally 12 months or less. Our sponsor also believes that some of the key factors for investing in multifamily rental properties include stable access to debt, due in part to the lending activities of government-sponsored entities, the Federal National Mortgage Association (“Fannie Mae”) and the Federal Home Loan Mortgage Corporation (“Freddie Mac”), lower cost of debt capital and the ability to support more debt with the same level of risk.

Finally, our sponsor also has an affiliated property management subsidiary with experience in leasing, managing, and rehabilitating multifamily rental properties. We believe that, in general, the multifamily property management industry has not maintained pace with the increasing demands of multifamily residents for higher levels of customer services and the need to deploy more technology and modern sales and marketing techniques to acquire new residents. Therefore, in 2007, our sponsor introduced a retail and hospitality based strategy through Resource Residential, our multifamily property management affiliate. Our retail and hospitality based strategy offers multifamily property management that is based around the overall experience provided to potential and existing residents, in addition to the first-class services provided to them. We believe that the customer service leaders in the hospitality and retail industries provide applicable templates for the types of experiences and customer services that today’s renters demand. In addition, we believe revenue-enhancing and cost-cutting technologies can improve the overall operating efficiencies of our properties and contribute to stronger profitability.

What are the Market Opportunities for Resource Real Estate Opportunity REIT II?

We believe multiple opportunities exist within the multifamily industry today and will continue to present themselves over the next few years to real estate investors who possess the following characteristics: (i) extensive experience in multifamily investing, (ii) strong management platforms specializing in operational and financial performance optimization, (iii) financial sophistication allowing them to benefit from complex opportunities and (iv) the overall scale and breadth of a national real estate platform in both the equity and debt markets. We seek to utilize our Sponsor’s dedicated multifamily investing and lending platforms to take advantage of the full range of opportunities across the entire multifamily spectrum of investments.

One of our primary opportunistic activities will be to acquire underperforming multifamily properties that will benefit from strong management and capital infusions for renovations to improve the overall appearance and quality of the assets. We intend to buy apartment properties that are cash flowing or expected to be cash flowing soon after acquisition with the potential for near-term capital appreciation resulting from unit and exterior upgrades and enhanced property management. These assets, generally are Class B or B- properties built in the 1970s and 1980s in cities demonstrating a stable multifamily supply and the ability to attract a young, creative and educated labor force. According to the U.S. Census Bureau, during the 20-year period from 1970 to 1989, over 9.3 million housing units were

4

Table of Contents

completed in the United States within structures containing five or more units, which is substantially higher than the approximately 5 million units completed between 1990 and 2009. Apartments completed between 1970 and 1989 are now 25 to 44 years old and many of these apartments have not had substantial renovations in their lifetimes. Therefore, we believe that there is a large inventory of un-renovated apartments built in the 1970s and 1980s to acquire and renovate. Resource Real Estate has a dedicated acquisition team that includes personnel who have been integral to the acquisition of underperforming properties for the multifamily funds offered by our sponsor over the past ten years.

In addition to acquiring properties in need of renovations, we believe that the disruption in the commercial real estate and credit markets that began with the 2007 credit crisis continues to present an attractive environment to acquire distressed U.S. commercial real estate and real estate-related debt. High levels of leverage in the multifamily sector of commercial real estate, and the management intensive nature of multifamily rental properties create specific problems for multifamily borrowers who lack strong internal multifamily-specific asset and property management capabilities. Real Capital Analytics (“RCA”) reported that, although the level of distress has been declining as financial institutions resolve more assets through sales and restructuring, the total amount of outstanding distressed multifamily assets in the United States was still $27.6 billion as of October 2013. Furthermore, RCA reports that there was $151 billion of total outstanding distressed U.S. real estate as of October 2013. We believe that the default rate in the multifamily sector will remain higher than historical experience due to the combination of high amounts of leverage placed on properties and the intensity of asset management required by multifamily operators to service their debt costs. We believe that Resource Real Estate’s capabilities in managing multifamily properties will allow us to capitalize on the distress in the multifamily sector. We believe that Resource Real Estate and its affiliates’ experience in investing in discounted and distressed real estate, coupled with Resource Real Estate and its affiliates’ experience in underwriting and acquiring multifamily properties, asset and property management abilities and contacts in the banking industry should allow us to capitalize on these investment opportunities.

We also believe opportunities exist in directly lending to real estate borrowers who are acquiring or refinancing multifamily properties, and we intend to originate loans directly to such borrowers. Lending presents us an opportunity to benefit from the positive trends in the multifamily industry, while being senior to an equity investor and typically receiving regular cash interest payments. Direct lending enables us to better control the structure of the loans and to maintain direct relationships with the borrowers. We intend to invest in first- and second-priority mortgages, as well as mezzanine loans that are senior to the borrower’s equity in, and subordinate to a first mortgage loan on, a property. Mezzanine loans are secured by pledges of ownership interests, in whole or in part, in entities that directly own the real property. In addition, we may require other collateral to secure mezzanine loans, including letters of credit, personal guarantees of the principals of the borrower, or collateral unrelated to the property. We may also invest in preferred equity or subordinate interests in whole loans. Resource Real Estate has a dedicated nationwide lending team that includes senior personnel who have been with Resource Real Estate since 2005.

What is your investment approach for this real estate program?

We seek to acquire cash flowing assets at a discount to their perceived value, increase their cash flowing potential, and then sell or finance them when market conditions warrant. With respect to underperforming properties, selected REO properties and properties we acquire or control through foreclosure or restructuring, we expect to enhance their value by instituting significant renovations to update their appearance, aggressively market them and increase occupancy in order to realize steady current income as well as capital appreciation. With respect to discounted loans, we may either negotiate full or discounted payoffs with the borrowers, restructure the loans or acquire title to the underlying properties through receipt of a deed in lieu or through a foreclosure proceeding. Finally, with respect to performing real estate loans, we will seek to originate or purchase loans secured directly or indirectly by real estate that will generate steady interest income from the underlying real estate.

5

Table of Contents

Are there any risks involved in an investment in your shares?

Investing in our common stock involves a high degree of risk. You should carefully review the “Risk Factors” section of this prospectus beginning on page 29, which contains a detailed discussion of the material risks that you should consider before you invest in our common stock. Some of the more significant risks relating to an investment in our shares include the following:

| • | No public market currently exists for our shares of common stock, and our charter does not require our directors to seek stockholder approval to liquidate our assets by a specified date nor list our shares on an exchange by a specified date. If you are able to sell your shares, you would likely have to sell them at a substantial discount from their public offering price. |

| • | We established the offering price of our shares on an arbitrary basis. This price may not be indicative of the price at which our shares would trade if they were listed on an exchange or actively traded, and this price bears no relationship to the book or net value of our assets or to our expected operating income. |

| • | We have no operating history. As of the date of this prospectus, our total assets consist of our advisor’s initial investment in us of $200,000. Because we have not identified any real estate assets to acquire with proceeds from this offering we are considered a blind pool, and you will not have an opportunity to evaluate our investments before we make them, making an investment in us more speculative. |

6

Table of Contents

| • | We are dependent on our advisor to select investments and conduct our operations. Our advisor has no operating history and no experience operating a public company. This inexperience makes our future performance difficult to predict. |

| • | Our executive officers and some of our directors are also officers, directors, managers or key professionals of our advisor, our dealer manager and other affiliated Resource Real Estate entities. As a result, they will face conflicts of interest, including significant conflicts created by our advisor’s compensation arrangements with us and other programs sponsored by Resource Real Estate and conflicts in allocating time among us and these other programs. These conflicts could result in action or inaction that is not in the best interests of our stockholders. |

| • | We will pay substantial fees to and expenses of our advisor, its affiliates and participating broker-dealers, which payments increase the risk that you will not earn a profit on your investment. For a summary of these fees, see “Prospectus Summary—What are the fees that you will pay to the advisor and its affiliates?” |

| • | Our advisor and its affiliates will receive fees in connection with transactions involving the acquisition and management of our investments. These fees will be based on the cost of the investment, and not based on the quality of the investment or the quality of the services rendered to us. This may influence our advisor to recommend riskier transactions to us. |

| • | There is no limit on the amount we can borrow to acquire a single real estate investment, but pursuant to our charter, we may not leverage our assets with debt financing such that our borrowings would be in excess of 300% of our net assets unless a majority of the members of our conflicts committee find substantial justification for borrowing a greater amount. Examples of such a substantial justification include obtaining funds for the following: (i) to repay existing obligations, (ii) to pay sufficient distributions to maintain REIT status, or (iii) to buy an asset where an exceptional acquisition opportunity presents itself and the terms of the debt agreement and the nature of the asset are such that the debt does not increase the risk that we would become unable to meet our financial obligations as they became due. Based on current lending market conditions, we believe we will leverage our assets with debt financing that causes our total liabilities to be approximately 55% to 60% of our assets. |

| • | Our charter prohibits the ownership of more than 9.8% of our common stock, unless exempted by our board of directors, which may inhibit transfers of our common stock and large investors from desiring to purchase your shares of common stock. |

| • | Our advisor owns 50,000 shares of our convertible stock, which we may refer to as “convertible stock.” The convertible stock is non-voting, is not entitled to any distributions and is a separate class of stock from the common stock to be issued in this offering. Under limited circumstances, these shares may be converted into shares of our common stock, satisfying our obligation to pay our advisor an incentive fee and diluting our stockholders’ interest in us. Generally, our convertible stock will convert into shares of common stock when one of two events occurs. First, it will convert if we have paid distributions to common stockholders such that aggregate distributions are equal to 100% of the price at which we sold our outstanding shares of common stock plus an amount sufficient to produce a 7% cumulative, non-compounded, annual return at that price. Alternatively, the convertible stock will convert if we list our shares of common stock on a national securities exchange and, on the 31st trading day after listing, the value of our company based on the average trading price of our shares of common stock since the listing, plus prior distributions, combine to meet the same |

7

Table of Contents

| 7% return threshold for our common stockholders. Our advisor can influence whether and when our common stock is listed for trading on a national securities exchange or our assets are liquidated, and their interests in our convertible stock could influence their judgment with respect to listing or liquidation. |

| • | We may lack property diversification if we do not raise substantially more than the minimum offering. |

| • | Our charter permits us to pay distributions from any source without limitation, including from offering proceeds, borrowings, sales of assets or waivers or deferrals of fees otherwise owed to our advisor. To the extent these distributions exceed our net income or net capital gain, a greater proportion of your distributions will generally represent a return of capital as opposed to current income or gain, as applicable. Our organizational documents do not limit the amount of distributions we can fund from sources other than from cash flows from operations. If our cash flow from operations is insufficient to cover our distributions, we expect to use the proceeds from this offering, the proceeds from the issuance of securities in the future or proceeds from borrowings to pay distributions. |

| • | We may experience adverse business developments or conditions similar to those affecting certain programs sponsored by our sponsor, which could limit our ability to make distributions and could decrease the value of your investment. |

| • | Disruptions in the financial markets and sluggish economic conditions could adversely affect our ability to implement our business strategy and generate returns to you. |

| • | Our failure to qualify as a REIT for federal income tax purposes would reduce the amount of income we have available for distribution and limit our ability to make distributions to our stockholders. |

| • | We may change our targeted investments without stockholder consent, which could adversely affect the value of our common stock and our ability to make distributions to you. |

| • | Investments in non-performing real estate assets involve greater risks than investments in stabilized performing assets and make our future performance more difficult to predict. |

What are your investment objectives?

Our principal investment objectives are to:

| • | preserve, protect and return your capital contribution; |

| • | provide current income to you in the form of cash distributions through increased cash flow from operations or targeted asset sales; |

| • | realize growth in the value of our investments; and |

| • | enable you to realize a return of your investment by either liquidating our assets or listing our shares on a national securities exchange within three to six years after the termination of this primary offering. |

8

Table of Contents

See the “Investment Objectives and Policies” section of this prospectus for a more complete description of our investment policies and charter-imposed investment restrictions.

What is the role of the board of directors?

We operate under the direction of our board of directors, the members of which are accountable to us and our stockholders as fiduciaries. We have five members on our board of directors, three of whom are independent of our advisor and its affiliates. Our charter requires that a majority of our directors be independent of our advisor and creates a committee of our board consisting solely of all of our independent directors. This committee, which we call the conflicts committee, is responsible for reviewing the performance of our advisor and must approve other matters set forth in our charter. See “Conflicts of Interest—Certain Conflict Resolution Measures.” Our directors are elected annually by the stockholders.

Who is your advisor?

Resource Real Estate Opportunity Advisor II, LLC is our advisor. Our advisor is a limited liability company that was formed in the State of Delaware on October 1, 2012. Our advisor has no operating history and no experience managing a public company. However, our advisor will provide substantive advisory services to us and will be supported by our sponsor, Resource Real Estate, Inc., and its personnel in providing such services to us. See below for a description of our sponsor, Resource Real Estate, Inc.

Will your advisor make an investment in us?

Yes. In order to more closely align our investment objectives and goals with those of our advisor, prior to the termination of this offering, our advisor will invest 1% of the first $100,000,000 invested in us by non-affiliated investors in this offering, or up to $1,000,000. Previously, our advisor invested $200,000 in us through the purchase of 20,000 shares of our common stock at $10.00 per share. Prior to commencement of this offering, our advisor will exchange 5,000 shares of our common stock for 50,000 shares of our convertible stock.

What will the advisor do?

Our advisor will manage our day-to-day operations and our portfolio of real estate investments, and will provide asset-management, marketing, investor relations and other administrative services on our behalf, all subject to the supervision of our board of directors. We expect to enter into a management agreement with Resource Real Estate Opportunity Manager II, our affiliate, to provide property management services for most, if not all, of the properties or other real estate-related assets we acquire, provided our advisor is able to control the operational management of such acquisitions. Resource Real Estate Opportunity Manager II may subcontract with an affiliate or third party to provide day-to-day property management, construction management or other property specific functions, as applicable, for the properties it manages.

Our sponsor, Resource Real Estate, and its team of real estate professionals, including Jonathan Z. Cohen, Alan F. Feldman and Kevin M. Finkel, acting through our advisor, will make most of the decisions regarding the selection, negotiation, financing and disposition of real estate investments. A majority of our board of directors and a majority of the conflicts committee will approve significant proposed real estate property investments and real estate-related debt investments.

9

Table of Contents

What is the experience of your sponsor?

We believe Resource Real Estate and its affiliates have a significant amount of experience in buying, managing, operating and disposing of discounted real estate investments and a number of relationships in the real estate and financial services markets that together we believe put our advisor in an excellent position to operate and manage our company. Specifically, our advisor believes that the following entities and factors highlight the resources that it may use to compete in the discounted real estate asset marketplace:

| • | Resource Real Estate manages a portfolio of multifamily rental properties and other real estate assets valued at approximately $2.1 billion as of September 30, 2013 of which approximately $564.0 million represents multifamily rental properties that were underperforming at the time of acquisition. Resource Real Estate and its affiliates have been acquiring and managing these types of assets for over ten years. Our advisor uses Resource Real Estate’s knowledge and experience in the industry to assist us in meeting our investment objectives of locating, acquiring and renovating underperforming properties to turn them into stable cash flowing assets. |

| • | Resource Real Estate and its affiliates have been active in the discounted real estate asset market since 1991, acquiring and disposing of assets representing almost $800 million in value as of September 30, 2013. Historically, Resource Real Estate’s affiliates focused on the purchase of non-performing commercial real estate loans at discounts to their outstanding loan balances and the appraised value of their underlying properties. As of March 31, 2013, Resource Real Estate and its affiliates have formed joint ventures with a number of institutional investors that have invested approximately $291.7 million in assets similar to those that we may acquire. As a result of many programs and products, Resource Real Estate has a breadth of experience in the acquisition, ownership, management and resolution of discounted real estate assets. Our advisor uses Resource Real Estate’s knowledge and experience in the discounted real estate asset marketplace to assist us in meeting our investment objectives. |

| • | Resource Real Estate manages a portfolio of over $1 billion in aggregate principal amount of mortgage assets, discounted mortgage loans and related property interests as of September 30, 2013. |

| • | Resource Financial Institution Group, Inc. (“Resource Financial”), an affiliate of our sponsor, is a specialized asset management company that invests in banks, thrifts and other financial services companies. As of September 30, 2013, Resource Financial and its affiliates manage $2.93 billion in bank investments. |

| • | Resource Financial provides our advisor with contacts in the financial services industry, including investment banks, brokerage firms, commercial banks and loan originators, that may be sources of real estate investments for us. |

| • | Resource Real Estate Management, Inc., d/b/a “Resource Residential,” an affiliate of our sponsor, is a property management company that, as of September 30, 2013, manages over 65 multifamily rental properties for our sponsor in 20 states with over 18,700 units. It has almost 500 employees. The senior managers and employees of Resource Residential, acting through Resource Real Estate Opportunity Manager II, will assist in providing property management as well as construction management services to us. |

10

Table of Contents

| • | In order to more closely align our investment objectives and goals with those of our advisor, prior to the termination of our initial public offering, our advisor has agreed to invest 1% of the first $100,000,000 invested in us by non-affiliated investors, or up to $1,000,000. |

Who is the parent of your sponsor?

Resource America is the parent corporation of our sponsor. Resource America is a publicly-traded corporation listed on the Nasdaq Global Select Market under the symbol “REXI.” Resource America is a specialized asset management company that evaluates, originates, services and manages investment opportunities through its commercial finance, real estate and financial fund management operating segments. Resource America sponsored a New York Stock Exchange publicly-traded REIT, Resource Capital Corp. (“Resource Capital”) in 2005 and a non-traded REIT, Resource Real Estate Opportunity REIT, Inc. (“Resource Opportunity REIT”) that commenced a private offering in September 2009 followed by a public offering that commenced in June 2010 and terminated in December 2013. As of September 30, 2013, Resource America manages over $15.3 billion in assets.

11

Table of Contents

Will you use leverage?

We may use leverage for our assets and may obtain such leverage in one of three ways: (1) REIT-level financing; (2) individual investment financing and (3) seller financing. Although there is no limit on the amount we can borrow to acquire a single real estate investment, we may not leverage our assets with debt financing such that our borrowings would be in excess of 300% of our net assets unless a majority of our conflicts committee find substantial justification for borrowing a greater amount. Examples of such a substantial justification include obtaining funds for the following: (i) to repay existing obligations, (ii) to pay sufficient distributions to maintain REIT status, or (iii) to buy an asset where an exceptional acquisition opportunity presents itself and the terms of the debt agreement and the nature of the asset are such that the debt does not increase the risk that we would become unable to meet our financial obligations as they became due. Based on current lending market conditions, we expect to leverage our assets so that our total liabilities do not exceed 55% to 60% of our assets.

How will you structure the ownership and operation of your assets?

We plan to own substantially all of our assets and conduct our operations through RRE Opportunity OP II, LP, which we refer to as our Operating Partnership in this prospectus. We are the sole general partner of our Operating Partnership and, as of the date of this prospectus, our wholly owned subsidiary, RRE Opportunity Holdings II, LLC, is the sole limited partner of our Operating Partnership. We will present our financial statements, operating partnership income, expenses, and depreciation on a consolidated basis with RRE Opportunity Holdings II, LLC and our Operating Partnership. Neither subsidiary will file a federal income tax return. All items of income, gain, deduction (including depreciation), loss and credit will flow through our Operating Partnership and RRE Opportunity Holdings II, LLC to us as each of these subsidiary entities will be disregarded for federal tax purposes. These tax items will not generally flow through us to our investors however. Rather, our net income and net capital gain will effectively flow through us to the stockholders as and when dividends are paid to our stockholders. Because we plan to conduct substantially all of our operations through our Operating Partnership, we are considered an UPREIT.

What is an “UPREIT”?

UPREIT stands for “Umbrella Partnership Real Estate Investment Trust.” An UPREIT is a REIT that holds all or substantially all of its properties through a partnership in which the REIT holds a general partner or limited partner interest, approximately equal to the value of capital raised by the REIT through sales of its capital stock. Using an UPREIT structure may give us an advantage in acquiring properties from persons who may not otherwise sell their properties because of unfavorable tax results. Generally, a sale of property directly to a REIT is a taxable transaction to the selling property owner. In

12

Table of Contents

an UPREIT structure, a seller of a property who desires to defer taxable gain on the sale of his property may transfer the property to the UPREIT in exchange for limited partnership units in the partnership and defer taxation of gain until the seller later exchanges his limited partnership units on a one-for-one basis for REIT shares or for cash pursuant to the terms of the limited partnership agreement.

What is the impact of being an “emerging growth company”?

We do not believe that being an “emerging growth company,” as defined by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), will have a significant impact on our business or this offering. We have elected to opt out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act. This election is irrevocable. Also, because we are not a large accelerated filer or an accelerated filer under Section 12b-2 of the Securities Exchange Act of 1934 (the “Exchange Act”), and will not be for so long as our shares of common stock are not traded on a securities exchange, we are not subject to auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002. In addition, so long as we are externally managed by our advisor, we do not expect to be required to seek stockholder approval of executive compensation and “golden parachute” compensation arrangements pursuant to Section 14A(a) and (b) of the Exchange Act. We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period or if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any June 30.

What conflicts of interest will your advisor face?

Our advisor and its affiliates will experience conflicts of interest in connection with the management of our business. All of our executive officers, our non-independent directors and our key real estate professionals will face these conflicts because of their affiliation with our advisor and other Resource Real Estate-sponsored programs. Some of the material conflicts that our advisor and its affiliates will face include the following:

| • | Our sponsor and its team of real estate professionals at our advisor must determine which investment opportunities to recommend to us or another Resource Real Estate-sponsored program or joint venture or affiliate of our sponsor; |

| • | The real estate professionals employed by our sponsor and Resource America provide services for those companies and Resource Capital as well as our company; |

| • | Our sponsor and its team of real estate professionals at our advisor may structure the terms of joint ventures between us and other Resource Real Estate-sponsored programs; |

| • | Our advisor and its affiliates must determine which property and leasing managers to retain and may retain Resource Real Estate Opportunity Manager II, an affiliate, to manage and lease some or all of our properties and to manage our real estate-related debt investments; |

| • | Our sponsor and its team of real estate professionals at our advisor and its affiliates (including our dealer manager, Resource Securities) will have to allocate their time between us and other real estate programs and activities in which they are involved; |

| • | Our advisor and its affiliates will receive fees in connection with transactions involving the purchase, management and sale of our assets regardless of the quality of the asset acquired or the services provided to us; |

13

Table of Contents

| • | Our advisor and its affiliates, including our dealer manager, Resource Securities, will also receive fees in connection with our offerings of equity securities; |

| • | The negotiations of the advisory agreement, the dealer manager agreement and the management agreement (including the substantial fees our advisor and its affiliates will receive thereunder) were not at arm’s length; and |

| • | We may internalize our management by acquiring assets and the key real estate professionals at our advisor and its affiliates for consideration that would be negotiated at that time. The payment of such consideration could result in dilution to your interest in us and could reduce the net income per share and funds from operations per share attributable to your investment. Additionally, in an internalization transaction, the real estate professionals at our advisor that become our employees may receive more compensation than they receive from our advisor or its affiliates. These possibilities may provide incentives to our advisor or these individuals to pursue an internalization transaction rather than an alternative strategy, even if such alternative strategy might otherwise be in our stockholders’ best interests. |

See the “Conflicts of Interest” section of this prospectus for a detailed discussion of the various conflicts of interest relating to your investment, as well as the procedures that we have established to mitigate a number of these potential conflicts.

14

Table of Contents

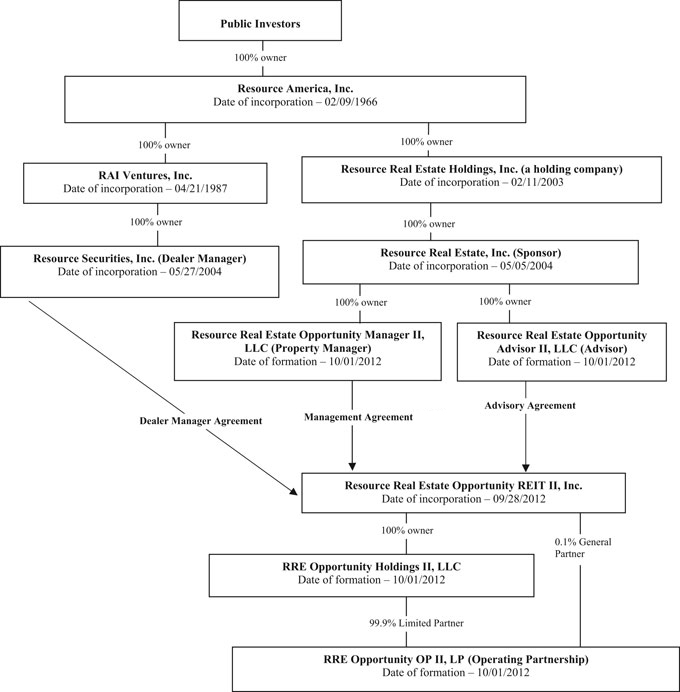

What is the ownership structure of the company and the Resource Real Estate entities that perform service for you?

The following chart shows the ownership structure of the various Resource Real Estate entities that perform or are likely to perform important services for us as of the date of this prospectus.

15

Table of Contents

What are the fees that you will pay to the advisor and its affiliates?

Our advisor and its affiliates will receive compensation and reimbursement for services relating to this offering and the investment and management of our assets. The most significant items of compensation are included in the table below. Selling commissions and dealer manager fees may vary for different categories of purchasers. This table assumes the shares are sold through distribution channels associated with the highest possible selling commissions and dealer manager fees and assumes a $9.50 price for each share sold through our distribution reinvestment plan. No selling commissions or dealer manager fees are payable on shares sold through our distribution reinvestment plan.

| Form of Compensation |

Determination of Amount |

Estimated Amount for Minimum Offering/ Maximum Offering | ||

| Organization and Offering Stage | ||||

| Selling Commissions |

Up to 7.0% of gross offering proceeds before reallowance of commissions earned by participating broker-dealers, except no selling commissions are payable on shares sold under the distribution reinvestment plan. Resource Securities, our dealer manager, will reallow 100% of commissions earned to participating broker-dealers. | $140,000/$70,000,000 | ||

| Dealer Manager Fee |

Up to 3.0% of gross offering proceeds, except no dealer manager fee is payable on shares sold under the distribution reinvestment plan. Resource Securities may reallow to any participating broker-dealer a portion of the gross offering proceeds attributable to that participating broker-dealer as a marketing fee. See “Plan of Distribution.” | $60,000/$30,000,000 | ||

| Other Organization and Offering Expenses |

Pursuant to the terms of our advisory agreement, once we raise the minimum offering amount, we will reimburse our advisor for organization and offering expenses it may incur on our behalf, but only to the extent that such reimbursement will not cause organization and offering expenses (other than selling commissions and the dealer manager fee) to exceed 2.5% of gross offering proceeds as of the termination of this offering. However, if we raise the maximum offering amount in the primary offering and under the distribution reinvestment plan, we expect organization and offering expenses (other than selling commissions and the dealer manager fee) to be $17,442,108 or 1.74% of gross offering proceeds. These organization and offering expenses include all actual expenses (other than selling commissions and the dealer manager fee), including reimbursements to our advisor for the portion of named executive officer salaries allocable to activities related to this offering, to be incurred on our behalf and paid by us in connection with the offering. | $50,000/$17,442,108 | ||

16

Table of Contents

| Form of Compensation |

Determination of Amount |

Estimated Amount for Minimum Offering/ Maximum Offering | ||

| Acquisition and Development Stage | ||||

| Acquisition Fees |

2.0% of the cost of investments acquired by us, or the amount funded by us to acquire or originate loans, including acquisition expenses and any debt attributable to such investments. The computation of Acquisition Fees paid to Advisor will also include amounts incurred or reserved for capital expenditures that will be used to provide funds for capital improvements and repairs applied to any real property investment acquired where we plan to add value. | $34,118 (minimum offering and no debt)/ $46,453 (minimum offering and leverage of 60% of the cost of our investments)/ $17,207,017 (maximum offering and no debt)/ $43,017,544 (maximum offering and leverage of 60% of the cost of our investments) | ||

| Acquisition Expenses |

Reimbursement for all out-of-pocket expenses incurred in connection with the selection and acquisition of properties or other real estate-related debt investments, whether or not we ultimately acquire the property or the other real estate-related debt investment. | Actual amounts are dependent upon acquisition activity and therefore cannot be determined at the present time. | ||

| Debt Financing Fee |

0.5% of the amount of any debt financing obtained or assumed; provided, however, that the sum of the debt financing fee, the construction management fee paid to our property manager and its affiliates, and the acquisition fees and expenses described above may not exceed 6.0% of the contract price of the property unless a majority of the board of directors (including a majority of the members of the conflicts committee) not otherwise interested in the transaction determines that such fee is commercially competitive, fair and reasonable to us. In no event will the debt financing fee be paid more than once in respect of the same debt. For example, upon refinancing, our advisor would only receive 0.5% of the incremental amount of additional debt financing obtained in the refinancing. | Actual amounts are dependent upon the amount of any debt financed and upon other factors, such as whether the debt is incurred in connection with the acquisition of a property or subsequent to the acquisition and therefore cannot be determined at the present time. | ||

| Construction Management Fee |

5.0% of actual aggregate cost to construct improvements, or to repair, rehab or reconstruct a property; provided, however, that the sum of the construction management fee paid to our property manager and its affiliates, the debt financing fee and the acquisition fee described above, and acquisition expenses may not exceed 6.0% of the contract price of the property unless a majority of the board of directors (including a majority of the members of the conflicts committee) not otherwise interested in the transaction determines that such fee is commercially competitive, fair and reasonable to us. | Actual amounts are dependent upon usual and customary construction management fees for particular projects and therefore the amount cannot be determined at the present time. | ||

17

Table of Contents

| Form of Compensation |

Determination of Amount |

Estimated Amount for Minimum Offering/ Maximum Offering | ||

| Operational Stage | ||||

| Property Management/ Debt Servicing Fees | With respect to real property investments, 4.5% of the actual gross cash receipts from the operation of the property; provided that for properties that are less than 75% occupied upon taking possession or if our business plan includes reducing occupancy to less than 75% during the first year thereafter, the property manager will receive a minimum property management fee for the first 12 months of ownership in an amount equal to $40 per unit per month for multifamily rental properties or $0.05 per square foot per month for other types of properties. With respect to real estate-related debt investments managed by our property manager or its affiliates, 2.75% of gross income received from these investments. The fee attributable on our real estate-related debt investments will cover our property manager’s services in monitoring the performance of our real estate-related debt investments, including (i) collecting amounts owed to us, (ii) reviewing on an as-needed basis the properties serving, directly or indirectly, as collateral for the real estate-related debt investments, the owners of those properties and the markets in general and (iii) maintaining escrow accounts, monitoring advances, monitoring loan covenants, and reviewing insurance compliance. | Actual amounts are dependent upon gross revenues of specific properties and actual management fees or property management fees or will be dependent upon the total equity and debt capital we raise and the results of our operations and therefore cannot be determined at the present time. | ||

| Asset Management Fee | Monthly fee equal to one-twelfth of 1.0% of the cost of each asset, without deduction for depreciation, bad debts or other non-cash reserves. For purposes of this calculation, “cost” will equal the amount actually paid (including acquisition fees and expenses) to purchase each asset we acquire, including any debt attributable to the asset, provided that, with respect to any properties we develop, construct or improve, cost will include the amount budgeted or expended by us for the development, construction or improvement of an asset. The asset management fee will be based only on the portion of the cost attributable to our investment in an asset if we do not own all or a majority of an asset and do not manage or control the asset. | The actual amounts are dependent upon the total equity and debt capital we raise and the results of our operations; we cannot determine these amounts at the present time. | ||

| Other Operating Expenses | We reimburse the expenses incurred by our advisor in connection with its provision of services to us, including our allocable share of costs for advisor personnel and overhead, including allocable personnel salaries and other employment expenses. However, we will not reimburse our advisor or its affiliates for employee costs in connection with services for which our advisor earns acquisition fees or disposition fees. Also, we will only reimburse for the allocable salaries and benefits our advisor or its affiliates may pay to our executive officers to the extent these expenses are related to organization and offering activities subject to the limit described above under “other organization and offering expenses.” | Actual amounts are dependent upon the results of our operations; we cannot determine these amounts at the present time. | ||

18

Table of Contents

| Form of Compensation |

Determination of Amount |

Estimated Amount for Minimum Offering/ Maximum Offering | ||

| Disposition Fees | For substantial assistance in connection with the sale of investments, we will pay our advisor or its affiliates the lesser of (i) one-half of the aggregate brokerage commission paid or, if none is paid, the amount that customarily would be paid at a market rate or (ii) 2.0% of the contract sales price of each real estate investment, loan, debt-related security, or other investment sold (including mortgage-backed securities or collateralized debt obligations issued by a subsidiary of ours as part of a securitization transaction). The conflicts committee will determine whether the advisor or its affiliate has provided substantial assistance to us in connection with the sale of an asset. We will not pay a disposition fee upon the maturity, prepayment or workout of a loan or other real estate-related debt investment; however, if we take ownership of a property as a result of a workout or foreclosure of a loan or we provide substantial assistance during the course of a workout, we will pay a disposition fee upon the sale of such property or disposition of such loan or other real estate-related debt investment. | Actual amounts are dependent upon aggregate asset value and therefore cannot be determined at the present time. | ||

| Common Stock Issuable Upon Conversion of Convertible Stock | Our convertible stock will be of no value unless our common stockholders realize or have an opportunity to realize a stated minimum return as a result of our cumulative distributions or the trading price of our shares on a national securities exchange. As a result, our convertible stock is economically similar to a back-end incentive fee, which many other non-traded REITs have agreed to pay to their external advisors.

Our convertible stock will convert into shares of common stock on one of two events. First, it will convert if we have paid distributions to common stockholders such that aggregate distributions are equal to 100% of the price at which we sold our outstanding shares of common stock plus an amount sufficient to produce a 7% cumulative, non-compounded, annual return at that price. Alternatively, the convertible stock will convert if we list our shares of common stock on a national securities exchange and, on the 31st trading day after listing, the value of our company based on the average trading price of our shares of common stock since the listing, plus prior distributions, combine to meet the same 7% return threshold for our common stockholders. Each of these two events is a “Triggering Event.” For more information, see “Description of Shares—Convertible Stock.” |

Actual amounts depend on the value of our company at the time the convertible stock converts or becomes convertible and therefore cannot be determined at the present time. | ||

How many real estate investments do you currently own?

We currently do not own any properties or other real estate investments. Because we have not yet identified any specific assets to acquire, we are considered to be a blind pool. As acquisitions become probable, we will supplement this prospectus to provide information regarding the likely acquisition to the extent material to an investment decision with respect to our common stock. We will also describe material changes to our portfolio, including the closing of property acquisitions, by means of a supplement to this prospectus.

Will you acquire properties or other assets in joint ventures?

Probably. Among other reasons, joint venture investments permit us to own interests in large assets without unduly restricting the diversity of our portfolio. We may also want to acquire properties and other investments through joint ventures in order to diversify our portfolio by investment size, investment type or investment risk. In determining whether to invest in a particular joint venture, our advisor will evaluate the real estate assets that such joint venture owns or is being formed to own under the same criteria as our other investments. We may enter into joint ventures with affiliates of our advisor or with third parties.

19

Table of Contents

What steps will you take to make sure you purchase environmentally compliant properties?

We will attempt to obtain or review a Phase I environmental assessment of each property we purchase but with respect to a property underlying a real estate-related debt investment that we purchase we will obtain as much environmental data as is available, which may or may not include a current Phase I environmental assessment. In the event that we are unable to gain access to a property when buying real estate debt secured by such property to conduct a new Phase I environmental assessment, we will review the most recent Phase I environmental assessment provided by the seller and review publicly available environmental records. In addition, we will attempt to obtain a representation from the seller that, to its knowledge, the property is not contaminated with hazardous materials. We will not close the purchase of any property unless we are generally satisfied with the environmental status of the property.

If I buy shares, will I receive distributions and how often?

We have not paid any distributions as of the date of this prospectus. We expect our board of directors to authorize and declare distributions based on daily record dates, and we expect to pay these distributions on a monthly basis. Thus, once we commence paying distributions, you will begin accruing distributions immediately upon our acceptance of your subscription. We have not established a minimum distribution level, and our charter does not require that we make distributions to our stockholders; however, we expect our board of directors to consider the payment of a monthly cash distribution after we make our first real estate investment. We may also make special stock distributions. The timing and amount of distributions will be determined by our board of directors in its sole discretion and may vary from time to time. No distributions will be made with respect to shares of convertible stock.