UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2020

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 333-189731

DIEGO PELLICER WORLDWIDE, INC.

(Name of registrant as specified in its charter)

| Delaware | 33-1223037 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

6160 Plumas Street, Suite 100, Reno, NV 89519

(Address of principal executive offices) (Zip Code)

(516) 900-3799

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated Filer | ☐ | Accelerated Filer | ☐ | |||

| Non-accelerated Filer | ☐ | Small Reporting Company | ☒ | |||

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of July 1, 2020 there were 135,187,691 shares of common stock issued and outstanding.

TABLE OF CONTENTS

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this “Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Report and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

| 3 |

PART I – FINANCIAL INFORMATION

DIEGO PELLICER WORLDWIDE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| March 31, | December 31, | |||||||

| 2020 | 2019 | |||||||

| Unaudited | ||||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 91,225 | $ | 317,446 | ||||

| Accounts receivable | 465,596 | 391,273 | ||||||

| Prepaid expenses | 8,111 | 12,111 | ||||||

| Total current assets | 564,932 | 720,830 | ||||||

| Other receivables | 997,435 | 788,177 | ||||||

| Security deposits | 150,000 | 150,000 | ||||||

| Right of Use Assets | 2,844,535 | 3,009,163 | ||||||

| Total assets | $ | 4,556,902 | $ | 4,668,170 | ||||

| Liabilities and deficiency in stockholders' equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 500,593 | $ | 514,196 | ||||

| Accrued payable - related party | 1,322,538 | 1,293,238 | ||||||

| Accrued expenses | 652,062 | 587,707 | ||||||

| Notes payable - related party | 140,958 | 140,958 | ||||||

| Notes payable | 133,403 | 133,403 | ||||||

| Convertible notes, net of discount and costs | 2,738,465 | 2,352,530 | ||||||

| Derivative liabilities | 4,941,435 | 5,024,321 | ||||||

| Lease Liabilities | 669,207 | 676,336 | ||||||

| Warrant liabilities | 870 | 967 | ||||||

| Total current liabilities | 11,099,531 | 10,723,656 | ||||||

| Lease Liabilities, net of current portion | 2,122,738 | 2,299,152 | ||||||

| Total liabilities | 13,222,269 | 13,022,808 | ||||||

| Redeemable convertible preferred stock, Series C, par value $.00001 per share; 1,500,000 shares authorized, 195,800 and 140,000 shares issued and outstanding, net of discount of $167,412 and $131,250, respectively | 28,338 | 8,750 | ||||||

| Deficiency in stockholders' equity: | ||||||||

| Preferred stock, Series A and B, par value $.0001 per share; 5,000,000 shares authorized, none issued and outstanding | — | — | ||||||

| Common stock, par value $.000001 per share; 840,000,000 shares authorized,127,693,963 and 113,926,332 shares issued, respectively | 128 | 114 | ||||||

| Additional paid-in capital | 43,688,457 | 43,478,139 | ||||||

| Stock to be issued | 156,290 | 127,261 | ||||||

| Accumulated deficit | (52,538,580 | ) | (51,968,902 | ) | ||||

| Total deficiency in stockholders' equity | (8,693,705 | ) | (8,363,388 | ) | ||||

| Total liabilities and deficiency in stockholders' equity | $ | 4,556,902 | $ | 4,668,170 | ||||

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

| 4 |

DIEGO PELLICER WORLDWIDE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| Three Months Ended | Three Months Ended | |||||||

| March 31, 2020 | March 31, 2019 | |||||||

| Revenues | ||||||||

| Net rental revenue | $ | 384,031 | 450,015 | |||||

| Rental expense | (290,793 | ) | (280,724 | ) | ||||

| Gross profit | 93,238 | 169,291 | ||||||

| Operating expenses: | ||||||||

| General and administrative expenses | 267,003 | 484,155 | ||||||

| Selling expense | 6,804 | 13,913 | ||||||

| Depreciation expense | — | 69,798 | ||||||

| Loss from operations | (180,569 | ) | (398,575 | ) | ||||

| Other income (expense) | ||||||||

| Other income (expense) | 32,891 | 42 | ||||||

| Interest expense | (667,577 | ) | (771,257 | ) | ||||

| Extinguishment of debt | 1,932 | — | ||||||

| Change in derivative liabilities | 302,004 | 957,311 | ||||||

| Change in value of warrants | 97 | (39,422 | ) | |||||

| Total other income (loss) | (330,653 | ) | 146,674 | |||||

| Provision for taxes | — | — | ||||||

| Net loss | (511,222 | ) | (251,901 | ) | ||||

| Deemed dividend on preferred stock | (58,456 | ) | — | |||||

| (569,678 | ) | (251,901 | ) | |||||

| Income (loss) per share - basic | $ | (0.00 | ) | $ | (0.01 | ) | ||

| Income (loss) per share - diluted | $ | (0.00 | ) | $ | (0.01 | ) | ||

| Weighted average common shares outstanding - basic | 122,673,197 | 36,793,777 | ||||||

| Weighted average common shares outstanding - diluted | 122,673,197 | 36,793,777 | ||||||

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

| 5 |

Diego Pellicer Worldwide, Inc.

Consolidated Statements of Stockholders' Deficit

For the Three months Ended March 31, 2020 and 2019

| Redeemable Convertible Preferred Stock | Common Stock | Preferred Stock | Additional | Accumulated | Common Stock | |||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Paid-in Capital | Deficit | to be issued | Total | |||||||||||||||||||||||||||||||

| Balance - December 31, 2018 | — | $ | — | 28,287,414 | $ | 28 | $ | — | $ | — | $ | 40,405,703 | $ | (49,354,030 | ) | $ | 710,838 | $ | (8,264,191 | ) | ||||||||||||||||||||

| Issuance of common shares for services | 2,847,250 | 3 | 364,875 | (312,854 | ) | 52,024 | ||||||||||||||||||||||||||||||||||

| Issuance of common shares for services - related parties | 315,017 | 315,017 | ||||||||||||||||||||||||||||||||||||||

| Common stock issued upon conversion of notes payable | 12,677,461 | 13 | 893,975 | (133,018 | ) | 760,970 | ||||||||||||||||||||||||||||||||||

| Fair value of warrants and options granted for services | 40,595 | 40,595 | ||||||||||||||||||||||||||||||||||||||

| Net loss | (251,901 | ) | (251,901 | ) | ||||||||||||||||||||||||||||||||||||

| Balance - March 31, 2019 | — | $ | — | 43,812,125 | $ | 44 | $ | — | $ | — | $ | (41,705,148 | ) | $ | (49,605,931 | ) | $ | 579,983 | $ | (7,347,486 | ) | |||||||||||||||||||

| Redeemable Convertible Preferred Stock | Common Stock | Preferred Stock | Additional | Accumulated | Common Stock | |||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Paid-in Capital | Deficit | to be issued | Total | |||||||||||||||||||||||||||||||

| Balance - December 31, 2019 | 140,000 | $ | 8,750 | 113,926,332 | $ | 114 | $ | — | $ | — | $ | 43,478,139 | $ | (51,968,902 | ) | $ | 127,261 | $ | (8,363,388 | ) | ||||||||||||||||||||

| Common Stock payable authorized for services | — | — | — | — | — | — | 2,003 | 2,003 | ||||||||||||||||||||||||||||||||

| Common Stock payable authorized for services - related parties | — | — | — | — | — | — | 27,026 | 27,026 | ||||||||||||||||||||||||||||||||

| Fair value of warrants and options granted for services | — | — | — | — | 40,595 | — | 40,595 | |||||||||||||||||||||||||||||||||

| Common stock issued upon conversion of notes payable and accrued interest | — | — | 13,767,631 | 14 | 169,723 | — | 169,737 | |||||||||||||||||||||||||||||||||

| Series C preferred stock issued for cash, net of costs and discounts | 55,800 | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||

| Accrued dividends and accretion of conversion feature on Series C preferred stock | — | 19,588 | — | — | — | (19,588 | ) | (19,588 | ) | |||||||||||||||||||||||||||||||

| Deemed dividends related to conversion feature of Series C preferred stock | — | — | — | — | — | (38,868 | ) | (38,868 | ) | |||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | — | (511,222 | ) | (511,222 | ) | |||||||||||||||||||||||||||||||

| Balance - March 31, 2020 | 195,800 | $ | 28,338 | 127,693,963 | $ | 128 | $ | — | $ | — | $ | 43,688,457 | $ | (52,538,580 | ) | $ | 156,290 | $ | (8,693,705 | ) | ||||||||||||||||||||

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

| 6 |

DIEGO PELLICER WORLDWIDE, INC.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOW

(Unaudited)

| Three Months Ended | Three Months Ended | |||||||

| March 31, 2020 | March 31, 2019 | |||||||

| Cash flows from operating activities: | ||||||||

| Net income (loss) | $ | (511,222 | ) | $ | (251,901 | ) | ||

| Adjustments to reconcile net income (loss) to net | ||||||||

| Depreciation | — | 69,798 | ||||||

| Change in fair value of derivative liability | (302,004 | ) | (957,311 | ) | ||||

| Change in value of warrants | (97 | ) | 39,422 | |||||

| Amortization of debt related cost | 584,071 | 519,135 | ||||||

| Extinguishment of debt | (1,932 | ) | 157,365 | |||||

| Stock based compensation | 69,624 | 357,635 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (74,323 | ) | (76,011 | ) | ||||

| Prepaid expenses | 4,000 | 32,194 | ||||||

| Deferred rent receivable | — | (178,210 | ) | |||||

| Other receivables | (209,258 | ) | (8,248 | ) | ||||

| Accounts payable | (13,603 | ) | (15,437 | ) | ||||

| Accrued liability - related parties | 29,300 | 61,024 | ||||||

| Accrued expenses | 70,638 | 63,412 | ||||||

| Lease liabilities | (18,915 | ) | 15,562 | |||||

| Contingent liabilities | — | (61,660 | ) | |||||

| Cash used by operating activities | (373,721 | ) | (233,231 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Debt costs | — | (8,225 | ) | |||||

| Proceeds from convertible notes payable | 100,000 | 359,725 | ||||||

| Repayments of convertible notes payable | (2,500 | ) | — | |||||

| Proceeds from sale of Preferred Stock, net | 50,000 | — | ||||||

| Cash provided by financing activities | 147,500 | 351,500 | ||||||

| Net increase (decrease) in cash | (226,221 | ) | 118,269 | |||||

| Cash, beginning of period | 317,446 | 60,437 | ||||||

| Cash, end of period | $ | 91,225 | $ | 178,706 | ||||

| Cash paid for interest | $ | — | $ | — | ||||

| Cash paid for taxes | $ | — | $ | — | ||||

| Supplemental schedule of noncash financial activities: | ||||||||

| Notes converted to stock | $ | 89,000 | $ | 450,212 | ||||

| Accrued interest converted to stock | $ | 6,282 | $ | 31,345 | ||||

| Value of derivative liability extinguished upon conversion and pay off of notes and accrued interest | $ | 101,764 | $ | 577,340 | ||||

| Accounts payable and accrued expenses paid with common stock | $ | — | $ | 50,000 | ||||

| Common stock payable authorized for services | $ | 29,029 | $ | — | ||||

| Debt discount extinguished from note conversion | $ | 25,377 | $ | — | ||||

| Accrued dividends and accretion of conversion feature on Series C preferred stock | $ | 19,588 | $ | — | ||||

| Deemed dividends related to conversion feature of Series C preferred stock | $ | 38,868 | $ | — | ||||

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

| 7 |

Diego Pellicer Worldwide, Inc.

March 31, 2020 and 2019

Notes to the Consolidated Financial Statements

Note 1 – Organization and Operations

History

On March 13, 2015, Diego Pellicer Worldwide, Inc. (the Company) (f/k/a Type 1 Media, Inc.) closed on a merger and share exchange agreement by and among (i) the Company, and (ii) Diego Pellicer World-wide 1, Inc., a Delaware corporation, (“Diego”), and (iii) Jonathan White, the majority shareholder of the Company. Diego was merged with and into the Company with the Company to continue as the surviving corporation in the merger. The Company succeeded to and assumed all the rights, assets, liabilities, debts, and obligations of Diego.

Prior to the merger, 3,135,000 shares of Type 1 Media, Inc. were issued and outstanding. The principal owners of the Company agreed to transfer their 2,750,000 issued and outstanding shares to a third party in consideration for $169,000 and cancellation of their 2,750,000 shares. The remaining issued and outstanding shares are still available for trading in the marketplace. At the time of the merger, Type 1 Media, Inc. had no assets or liabilities. Accordingly, the business conducted by Type 1 prior to the merger is not being operated by the combined entity post-merger.

At the closing of the merger, Diego common stock issued and outstanding immediately prior to the closing of the merger was exchanged for the right to receive one share of the surviving corporation for each share of Diego. An aggregate of 1,081,613 common shares of the surviving corporation were issued to the holders of Diego in exchange for their common shares representing approximately 74% of the combined entity.

The merger has been accounted for as a reverse merger and recapitalization in which Diego is treated as the accounting acquirer and Diego Pellicer Worldwide, Inc. is the surviving corporation.

Business Operations

The Company leases real estate to licensed marijuana operators providing complete turnkey growing space, processing space, recreational and medical retail sales space and related facilities to licensed marijuana growers, processors, dispensary and recreational store operators. Additionally, the Company plans to explore ancillary opportunities in the regulated marijuana industry as well as offering for wholesale distribution branded non-marijuana clothing and accessories.

The properties generating rents in 2019 and 2020 are as follows:

| Purpose | Size | City | State | |||||||||

| Retail store (recreational and medical) | 3,300 sq. | Denver | CO | |||||||||

| Cultivation warehouse | 18,600 sq. | Denver | CO | |||||||||

| Cultivation warehouse | 14,800 sq. | Denver | CO | |||||||||

| Retail store (recreational and medical) - Sold in May 2019 | 4,500 sq. | Seattle | WA |

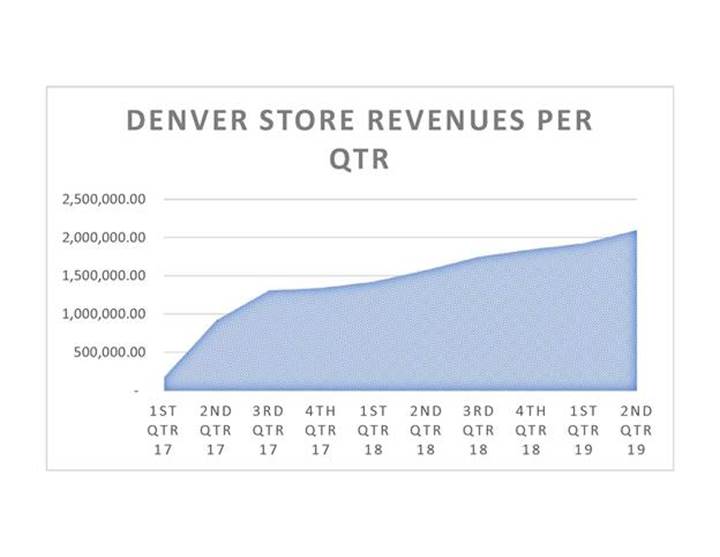

The Company’s three properties in Denver, CO are leased

to Royal Asset Management, LLC (“Royal Asset Management”). Royal Asset Management opened the Diego Denver branded

flagship store in February 2017. This store known as “Diego Colorado”. The retail facilities have shown steady growth

in sales since its opening. For the other two properties subleased, Royal Asset Management uses these properties for its cultivation

facilities in Denver, CO. Production at these facilities began in late 2016. The Company is currently is exploring the acquisition

of this entity, and the parties are in negotiation.

In regards to the Seattle property, on May 6, 2019, the Company entered into an agreement with a third party, and sold the Seattle leased location. The sale provided $550,000 in capital and executive resources for expansion which the company allocated to its efforts in a new location and cannabis grow facilities in Colorado .

| 8 |

Note 2 - Significant and Critical Accounting Policies and Practices

The management of the Company is responsible for the selection and use of appropriate accounting policies and the appropriateness of accounting policies and their application. Critical accounting policies and practices are those that are both most important to the portrayal of the Company's financial condition and results and require management's most difficult, subjective, or complex judgments, often because of the need to make estimates about the effects of matters that are inherently uncertain. The Company's significant and critical accounting policies and practices are disclosed below as required by generally accepted accounting principles.

Basis of Presentation

The accompanying consolidated financial statements and related notes have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”) and presented in accordance with accounting principles generally accepted in the United States of America (US GAAP).

The accompanying consolidated balance sheet at December 31, 2019, has been derived from audited consolidated financial statements, but does not include all disclosures required by accounting principles generally accepted in the United States of America ("U.S. GAAP"). The accompanying unaudited condensed consolidated financial statements as of March 31, 2020 and for the three months ended March 31, 2020 and 2019, have been prepared in accordance with U.S. GAAP for interim financial information and with the instructions to Form 10-Q and Article 8 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements, and should be read in conjunction with the audited consolidated financial statements and related notes to the financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 as filed with the U.S. Securities and Exchange Commission ("SEC") on the opinion of management, all material adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation have been made to the condensed consolidated financial statements. The condensed consolidated financial statements include all material adjustments (consisting of normal recurring accruals) necessary to make the condensed consolidated financial statements not misleading as required by Regulation S-X Rule 10-01. Operating results for the three months ended March 31, 2020 are not necessarily indicative of the results that may be expected for the year ending December 31, 2020 or any future periods.

Principles of Consolidation

The financial statements include the accounts of Diego Pellicer Worldwide, Inc., and its wholly-owned subsidiary Diego Pellicer World-wide 1, Inc. Intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates. These estimates and assumptions include valuing equity securities and derivative financial instruments issued in financing transactions and share based payment arrangements, the collectability of accounts receivable and other receivables (See Note 6), valuation of right of use assets and lease liabilities and deferred taxes and related valuation allowances.

Certain estimates, including evaluating the collectability of accounts receivable, could be affected by external conditions, including those unique to our industry, and general economic conditions. It is possible that these external factors could influence our estimates that could cause actual results to differ from our estimates. The Company intends to re-evaluate all its accounting estimates at least quarterly based on these conditions and record adjustments when necessary.

Fair Value Measurements

The Company evaluates its financial instruments to determine if such instruments are derivatives or contain features that qualify as embedded derivatives. For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair value reported in the consolidated statements of operations. The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is evaluated at the end of each reporting period. Derivative instrument liabilities are classified in the balance sheet as current or non-current based on whether net-cash settlement of the derivative instrument could be required within 12 months of the balance sheet date.

Fair Value of Financial Instruments

As required by the Fair Value Measurements and Disclosures Topic of the FASB ASC, fair value is measured based on a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value as follows:

Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2: Quoted prices in markets that are not active, or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability; and

Level 3: Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (supported by little or no market activity).

Fair value estimates discussed herein are based upon certain market assumptions and pertinent information available to management as of March 31, 2020 and December 31, 2019. The respective carrying value of certain on-balance-sheet financial instruments approximated their fair values. These financial instruments include cash, prepaid expenses and accounts payable. Fair values were assumed to approximate carrying values for cash and payables because they are short term in nature and their carrying amounts approximate fair values or they are payable on demand.

| 9 |

The following table reflects assets and liabilities that are measured at fair value on a recurring basis (in thousands):

| As of March 31, 2020 | Fair Value Measurement Using | |||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Derivative liabilities | $ | — | $ | — | $ | 4,941 | $ | 4,941 | ||||||||

| Stock warrant liabilities | — | — | 1 | 1 | ||||||||||||

| $ | — | $ | — | $ | 4,942 | $ | 4,942 | |||||||||

| As of December 31, 2019 | Fair Value Measurement Using | |||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Derivative Liabilities | $ | — | $ | — | $ | 5,024 | $ | 5,024 | ||||||||

| Stock warrant Liabilities | — | — | 1 | 1 | ||||||||||||

| $ | — | $ | — | $ | 5,025 | $ | 5,025 | |||||||||

Derivative liabilities and stock warrant liberties were valued use Binomial Option Pricing Model in calculating the embedded conversion features for the three months ended March 31, 2020 and the year ended December 31, 2019 .

Cash

The Company maintains cash balances at various financial institutions. Accounts at each institution are insured by the Federal Deposit Insurance Corporation, and the National Credit Union Share Insurance Fund, up to $250,000. The Company's accounts at these institutions may, at times, exceed the federal insured limits. The Company has not experienced any losses in such accounts.

Revenue recognition

In accordance with ASC 842, Leases , the Company recognizes rent income on a straight-line basis over the lease term to the extent that collection is considered probable. As a result the Company been recognizing rents as they become payable.

During the initial term of the lease, management has a policy of partial rent forbearance when the tenant first opens the facility to assure that the tenant has the opportunity for success. Management may be required to exercise considerable judgment in estimating revenue to be recognized.

When management concludes that the Company is the owner of tenant improvements, management records the cost to construct the tenant improvements as a capital asset. In addition, management records the cost of certain tenant improvements paid for or reimbursed by tenants as capital assets when management concludes that the Company is the owner of such tenant improvements. For these tenant improvements, management records the amount funded or reimbursed by tenants as deferred revenue, which is amortized as additional rental income over the term of the related lease. When management concludes that the tenant is the owner of tenant improvements for accounting purposes, management records the Company’s contribution towards those improvements as a lease incentive, which is amortized as a reduction to rental revenue on a straight-line basis over the term of the lease.

The Company has adopted the new revenue recognition guidelines in accordance with ASC 606, Revenue from Contracts with Customers (ASC 606), commencing from January 1, 2019. The adoption of ASU 2016-10 did not have a material impact on the financial statements and related disclosures since the Company is primarily a lessor for revenue purposes and recognizes rent income under ASC 842, Leases.

The Company analyzes its contracts to assess that they are within the scope and in accordance with ASC 606. In determining the appropriate amount of revenue to be recognized as the Company fulfills its obligations under each of its agreements, whether for goods and services or licensing, the Company performs the following steps: (i) identification of the promised goods or services in the contract; (ii) determination of whether the promised goods or services are performance obligations including whether they are distinct in the context of the contract; (iii) measurement of the transaction price, including the constraint on variable consideration; (iv) allocation of the transaction price to the performance obligations based on estimated selling prices; and (v) recognition of revenue when (or as) the Company satisfies each performance obligation.

Advertising

During the three months ended March 31, 2020 and 2019, advertising expense was $6,804 and $13,913, respectively.

| 10 |

Income Taxes

Income taxes are provided for using the liability method of accounting in accordance with the Income Taxes Topic of the FASB ASC. Deferred tax assets and liabilities are determined based on differences between the financial reporting and tax basis of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. A valuation allowance is established when necessary to reduce deferred tax assets to the amount expected to be realized and when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. The computation of limitations relating to the amount of such tax assets, and the determination of appropriate valuation allowances relating to the realizing of such assets, are inherently complex and require the exercise of judgment. As additional information becomes available, the Company continually assesses the carrying value of their net deferred tax assets.

Common Stock Purchase Warrants and Other Derivative Financial Instruments

The Company classifies as equity any contracts that require physical settlement or net-share settlement or provide us a choice of net cash settlement or settlement in our own shares (physical settlement or net-share settlement) provided that such contracts are indexed to our own stock as defined in ASC Topic 815-40 "Contracts in Entity's Own Equity." The Company classifies as assets or liabilities any contracts that require net-cash settlement including a requirement to net cash settle the contract if an event occurs and if that event is outside our control or give the counterparty a choice of net-cash settlement or settlement in shares. The Company assesses classification of its common stock purchase warrants and other free-standing derivatives at each reporting date to determine whether a change in classification between assets and liabilities is required.

Stock-Based Compensation

The Company recognizes compensation expense for stock-based compensation in accordance with ASC Topic 718. The Company calculates the fair value of the award on the date of grant using the Black-Scholes method for stock options and the quoted price of our common stock for unrestricted shares; the expense is recognized over the service period for awards expected to vest. The estimation of stock-based awards that will ultimately vest requires judgment, and to the extent actual results or updated estimates differ from original estimates, such amounts are recorded as a cumulative adjustment in the period estimates are revised. The Company considers many factors when estimating expected forfeitures, including types of awards, employee class, and historical experience. The adoption of new standard did not have a material impact on the Company’s Consolidated Financial Statements.

Income (loss) per common share

The Company utilizes ASC 260, “Earnings per Share” for calculating the basic and diluted loss per share. In accordance with ASC 260, the basic and diluted loss per share is computed by dividing net loss available to common stockholders by the weighted average number of common shares outstanding. Diluted net loss per share is computed similar to basic loss per share except that the denominator is adjusted for the potential dilution that could occur if stock options, warrants, and other convertible securities were exercised or converted into common stock. Potentially dilutive securities are not included in the calculation of the diluted loss per share if their effect would be anti-dilutive. The Company has 926,023,386 and 195,518,293 common stock equivalents at March 31, 2020 and 2019, respectively. For the three months ended March 31, 2020, the potential shares were excluded from the shares used to calculate diluted earnings per share as their inclusion would reduce net loss per share.

Legal and regulatory environment

The cannabis industry is subject to numerous laws and regulations of federal, state and local governments. These laws and regulations include, but are not limited to, matters such as licensure, accreditation, and different taxation between federal and state. Federal government activity may increase in the future with respect to companies involved in the cannabis industry concerning possible violations of federal statutes and regulations.

Management believes that the Company is in compliance with local, state and federal regulations, while no regulatory inquiries have been made, compliance with such laws and regulations can be subject to future government review and interpretation, as well as regulatory actions unknown or unasserted at this time.

| 11 |

Note 3 - Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. The Company has incurred losses since inception, its current liabilities exceed its current assets by $10,534,599, and has an accumulated deficit of $52,538,580 at March 31, 2020. These factors raise substantial doubt about its ability to continue as a going concern over the next twelve months. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

There are future noncash charges in connection with financing such as a change in derivative liability that will affect income but have no effect on cash flow.

Although the Company has been successful raising additional capital, there is no assurance that the company will sell additional shares of stock or borrow additional funds. The Company's inability to raise additional cash could have a material adverse effect on its financial position, results of operations, and its ability to continue in existence. These financial statements do not include any adjustments that might result from the outcome of this uncertainty. Management believes that the Company's future success is dependent upon its ability to achieve profitable operations, generate cash from operating activities and obtain additional financing. There is no assurance that the Company will be able to generate sufficient cash from operations, sell additional shares of stock or borrow additional funds. However, cash generated from lease revenues is currently exceeding lease costs, but is insufficient to cover operating expenses.

| 12 |

Note 4 - Property and Equipment

As of March 31, 2020 and December 31, 2019, fixed assets and the estimated lives used in the computation of depreciation are as follows:

| Estimated | ||||||||||

| Useful Lives | March 31, 2020 | December 31, 2019 | ||||||||

| Leasehold improvements | 10 years | 515,450 | 515,450 | |||||||

| Less: Accumulated depreciation and amortization | (515,450 | ) | (515,450 | ) | ||||||

| Property and equipment, net | $ | — | $ | — | ||||||

During the three months ended March 31, 2020 and 2019, the Company recorded depreciation expense of $0 and $69,797, respectively.

Note 5 – Accounts Receivables and Other Receivables

As disclosed in Note 1, the Company subleases three properties in Colorado to Royal Asset Management. At March 31, 2020, the Company had outstanding receivables from the subleases totaling $465,596, and during the three months ended March 31, 2020, the Company’s subleases with Royal Asset Management accounted for 100% of the Company’s revenues.

In addition to the receivables from the subleases, the Company has agreed to provide Royal Asset Management and affiliates of Royal Asset Management up to aggregate amount of $1,030,000 in financing. These notes accrue interest at the rates ranging from 12% to 18% per annum. As of March 31, 2020 and December 31, 2019, the outstanding balance of these notes receivable total $1,226,301 and $1,017,143, respectively, including accrued interest of $186,355 and $153,509. The amount presented in our balance sheet is $997,435 and $788,177, which represents the $1,226,301 and $1,017,143 due to us, less $228,966 and $228,966 that we owe to Royal Asset Management for leasehold improvements. The notes are secured by a UCC filing and also $400,000 of the balance is personally guaranteed by the managing member of Royal Asset Management. During the three months ended March 31, 2020, we loaned additional $214,394 and received payment of $38,082 under these contracts.

If we do acquire Royal Asset Management, part of the purchase price will be paid through receivables that are owed to us.

Note 6 – Other Assets

Security deposits: Security deposits reflect the deposits on various property leases, most of which require for two months’ rental expense in the form of a deposit. On May 6, 2019, $20,000 security deposit related to the Seattle leased location were expensed due to the sale of the Seattle leased location. As of March 31, 2020 and December 31, 2019, the remaining balance was $150,000 and $150,000, respectively.

Deposits – end of lease: These deposits represent an additional two months of rent on various property leases that apply to the “end-of- lease” period. During the year ended December 31, 2019, we adopted ASC Topic 842, Leases, as the result we reclassified remaining balance of prepaid rent to right of use assets and leases liabilities. As of March 31, 2020 and December 31, 2019, the remaining balance was $0.

Note 7 – Related Party Transactions

As of March 31, 2020 and December 31, 2019, the Company has accrued compensation to CEO, CFO and Director in the amount of $205,141, and $155,841, respectively. As of March 31, 2020 and December 31, 2019, accrued payable due to former officers were $1,117,397 and $1,137,397. For the three months ended March 31, 2020 and 2019, total cash-based compensation to related parties was $90,000 and $48,275, respectively. For the three months ended March 31, 2020 and 2019, total share-based compensation to related parties was $67,621 and $355,612 respectively. These amounts are included in general and administrative expenses in the accompanying financial statements.

From 2017 to 2019, Mr . Gonfiantini, CEO, personally and through his Company, Crystal Bay Financial LLC, loaned an aggregate amount of $1,020,000 to Royal Asset Management. These notes accrue interest at 17%-18% per annum, and require monthly payment approximately from $5,000 to $20,000. These notes are personally guaranteed by the managing member of Royal Asset Management, and secured by certain equipment and other tangible properties of Royal Asset Management. Among these notes, $500,000 note was also secured by the medical marijuana licenses held by Royal Asset Management.

At March 31, 2020, the Company owed Mr. Throgmartin, former CEO (See Note 11), $140,958 pursuant to a promissory note dated August 12, 2016. This note accrued interest at the rate of 8% per annum and payable upon the earlier date of (i) the second anniversary date of the promissory notes, (ii) the date all of the current investor notes, in the outstanding aggregate principal and accrued interest amount of approximately $1,480,000 at September 30, 2016, have been paid in full and the Company has achieved gross revenues of at least $3,000,000 over any consecutive 12-month period. The balance of related party note was $140,958 and $140,958 at March 31, 2020 and December 31, 2019, respectively. As of March 31, 2020, the note was past the maturity date, however the Company has not yet received a default notice.

| 13 |

Note 8 – Notes Payable

On August 31, 2015, the Company issued a note in the amount of $126,000 with third parties for use as operating capital. The note was amended to include accrued interest on October 31, 2016 and extended the maturity date to October 31, 2018. As of March 31, 2020 and December 31, 2019 the outstanding principal balance of the note was $133,403. As of March 31, 2020, the note was past the maturity date, however the Company has not yet received a default notice.

Note 9 – Convertible Notes Payable

The Company has issued several convertible notes which are outstanding. The note holders shall have the right to convert principal and accrued interest outstanding into shares of common stock at a discounted price to the market price of our common stock. The conversion feature was recognized as an embedded derivative and was valued using a Binomial Option Pricing Model that resulted in a derivative liability of $4,648,746 and $4,834,190 at March 31, 2020 and December 31, 2019, respectively. All notes accrue interest ranging from 8% to 12% and will mature in 2020. In connection with the issuance of certain of these notes, the Company also issued warrants to purchase its common stock.

Several convertible note holders elected to convert their notes to stock during the three months ended March 31, 2020. The table below provides the note payable activity for the three months ended March 31, 2020, and also a reconciliation of the beginning and ending balances for the derivative liabilities measured using fair significant unobservable inputs (Level 3) for the three months ended March 31, 2020:

| Convertible Notes | Discount | Convertible Notes, Net of Discount | Derivative Liabilities | |||||||||||||

| Balance, December 31, 2019 | $ | 3,266,775 | $ | 914,245 | $ | 2,352,530 | $ | 4,834,190 | ||||||||

| Issuance of convertible notes | 103,000 | 103,000 | — | 232,013 | ||||||||||||

| Conversion of convertible notes | (89,000 | ) | (25,377 | ) | (63,623 | ) | (97,838 | ) | ||||||||

| Repayment of convertible notes | (2,500 | ) | — | (2,500 | ) | (3,925 | ) | |||||||||

| Change in fair value of derivatives | — | — | — | (315,692 | ) | |||||||||||

| Amortization | — | (452,058 | ) | 452,058 | — | |||||||||||

| Balance March 31, 2020 | $ | 3,278,275 | $ | 539,810 | $ | 2,738,465 | $ | 4,648,748 | ||||||||

During the three months ended March 31, 2020, the Company entered into a convertible note in an aggregate amount of $103,000 which a twelve months maturity, bearing 12% interest per annum. The note is convertible at 35% discount to the average of the two lowest Volume Weighted Average Prices (VWAPs) during the previous ten (10) trading days to the date of a Conversion Notice. The conversion feature related were determined in the amount of $135,710 using Binomial Option Pricing Model.

During the three months ended March 31, 2020, $2,500 of note principal and $819 of accrued interest were repaid to a debt holder.

During the three months ended March 31, 2020, $89,000 of notes, $6,282 of accrued interest and $210 additional fee was converted into 13,767,631 shares of common stock. A loss on extinguishment of debt of $1,993, extinguishment of debt discount of $25,377 and reduction of derivative liabilities of $97,838 have been recorded related to these conversions. As of March 31, 2020, several convertible notes in aggregate principal of $215,000 were past their maturity dates, however the Company has not yet received a default notice.

On July 17, 2018, the Company entered into a certain Equity and Debt Restructure Agreement with two, long-time investors in the Company (the “Restructure Agreement”). Pursuant to the material terms of the Restructure Agreement, the investors agreed to return and cancel their collective 2,774,093 restricted Company common shares, which had been received from the prior conversion of their older convertible notes, in exchange for the Company’s issue to them recast convertible promissory notes. Accordingly, on the same date, these investors were each issued a First Priority Secured Promissory Note (the “Note” or “Notes”), in the principal amount of $1,683,558 and $545,607, respectively. In connection with this transaction, one of these investors agreed to loan the Company an additional $700,000. In 2018, the Company has received $220,000 cash proceeds of the additional $700,000 loan. Fair value of 2,774,093 restricted Company common shares were determined in the amount of $443,855 using market price and fair value of the embedded conversion feature were determined in the amount of $3,555,888 using Black Sholes Merton Option Model. As the result of the transaction, the Company recorded $2,892,033 in financing costs, and $2,449,275 as debt discount during year ended December 31, 2018. On March 29, 2019, the Company received $100,000 cash proceeds from the additional $700,000 loan. The conversion feature related to $100,000 were determined in the amount of $154,861 using Binomial Option Pricing Model. During year ended December 31, 2019, the Company received $380,000 cash proceeds from the additional $700,000 loan. The conversion feature related to $380,0000 were determined in the amount of $586,710 using Binomial Option Pricing Model. During the year ended December 31, 2019, we recorded $206,710 loss related to financing costs and $380,000 as debt discount.

| 14 |

The following assumptions were used in the Binomial Option Pricing Model in calculating the embedded conversion features and current liabilities for the three months ended March 31, 2020 and 2019.

| March 31, 2020 | March 31, 2019 | ||||||

| Risk-free interest rates | 0.11 – 1.58 | % | 1.53 – 2.60 | % | |||

| Expected life (years) | 0.25 – 1.00 | 0.08 – 1.25 | |||||

| Expected dividends | 0 | % | 0 | % | |||

| Expected volatility | 179-214 | % | 70-557 | % | |||

Note 10 – Stockholders’ Equity (Deficit)

Series C Preferred Stock

On December 16, 2019, Diego Pellicer Worldwide sold 140,000 of its Series C Convertible Preferred Shares, with an annual accruing dividend of 10%, to Geneva Roth Remark Holdings, Inc. (“Geneva”), for $130,000 pursuant to a Series C Preferred Purchase Agreement with Geneva. To accommodate this transaction, Registrant’s Board of Directors approved and filed a certain Certificate of Designations with the Secretary of State of Delaware, designating 1,500,000 of its available preferred shares as Series C Preferred Convertible Stock, Stated Value of $1.00 per share, and with a par value of $0.0001 per share. This Certificate of Designations provides Registrant with the opportunity to redeem the Series C Shares at various increased prices at time intervals up to the 6-month anniversary of the closing and mandates full redemption on the 24-month anniversary. Geneva may convert the Series C Shares into Registrant’s common shares, commencing on the 6-month anniversary of the closing at a 30% discount to the public market price. The Company recorded a derivative liability of $165,218, valued using a Binomial Option Pricing Model, associated with Series C Preferred Shares. On December 31, 2019, the fair value of the conversion feature was a derivative liability of $190,131, valued using a Binomial Option Pricing Model, associated with Series C Preferred Shares. The Series C Preferred Stock is classified as temporary equity due to that the shares are immediately convertible at the option of the note holder. During the year ended Decembers 31, 2019, we recorded $8,750 accretion of discount. As of December 31, 2019, there were 140,000 shares outstanding and a discount of $131,250. On March 31, 2020, the fair value of the conversion feature was a derivative liability of $210,347, valued using a Binomial Option Pricing Model, associated with Series C Preferred Shares. During the three months ended March 31, 2020, we recorded $12,639 accretion of discount and $4,343 of accrued dividend. As of March 31, 2020, there were 140,000 shares outstanding and a discount of $118,611.

On March 3, 2020, Diego Pellicer Worldwide sold 55,800 of its Series C Convertible Preferred Shares, with an annual accruing dividend of 10%, to Geneva Roth Remark Holdings, Inc. (“Geneva”), for $50,000 pursuant to a Series C Preferred Purchase Agreement with Geneva. The Company recorded a derivative liability of $88,868 valued using a Binomial Option Pricing Model, associated with Series C Preferred Shares. On March 31, 2020, the fair value of the conversion feature was a derivative liability of $82,342, valued using a Binomial Option Pricing Model, associated with Series C Preferred Shares. The Series C Preferred Stock is classified as temporary equity due to that the shares are immediately convertible at the option of the note holder. During the three months ended March 31, 2020, we recorded $2,170 accretion of discount and $436 of accrued dividend. As of March 31, 2020, there were 55,800 shares outstanding and a discount of $53,630.

The following assumptions were used in the Binomial Option Pricing Model in calculating the embedded conversion features and current liabilities for the three months ended March 31, 2020 and the year ended December 31, 2019.

| March 31, 2020 | December 31, 2019 | ||||||

| Risk-free interest rates | 0.23 – 0.71 | % | 1.58 – 1.66 | % | |||

| Expected life (years) | 1.70 – 2.00 | 1.95 – 2.00 | |||||

| Expected dividends | 0 | % | 0 | % | |||

| Expected volatility | 246-251 | % | 248-250 | % | |||

Common Stock

During the three months ended March 31, 2020:

$89,000 of notes, $6,282 of accrued interest and $210 additional fee was converted into 13,767,631 shares of common stock. A loss on extinguishment of debt of $1,993, extinguishment of debt discount of $25,377 and reduction of derivative liabilities of $97,838 have been recorded related to these conversions. As of March 31, 2020, 35,844 shares, valued at $35,844 for debt conversion were authorized, but not issued as of March 31, 2020.

As March 31, 2020, 406,160 shares, valued at $13,601 for services were authorized, but not issued as of March 31, 2020. These were classified as shares to be issued at March 31, 2020.

| 15 |

As March 31, 2020, 4,951,781 shares, valued at $106,842 for related party services were authorized, but not issued as of March 31, 2020. These were classified as shares to be issued at March 31, 2020.

During the three months ended March 31, 2019:

Holders of convertible notes converted $450,212 of notes, and $31,345 of accrued interest was converted into 12,242,678 shares of common stock and 434,783 shares were issued which were authorized as of December 31, 2018. A gain on extinguishment of debt of $130,031 has been recorded related to these conversions.

We issued 878,579 shares of common stock, valued at $50,000, for services. Additionally, 44,584 shares, valued at $2,024 for services, were authorized but not issued as of March 31, 2019. We issued 1,968,671 shares of common stock that were authorized in 2018 and classified as shares to be issued at December 31, 2018.

We authorized 4,380,509 shares, valued at 315,017 for share-based compensation to related parties. These were classified as shares to be issued at March 31, 2018.

Common stock warrant activity:

The Company has determined that certain of its warrants are subject to derivative accounting. The table below provides a reconciliation of the beginning and ending balances for the warrant liabilities measured using fair significant unobservable inputs (Level 3) for the three months ended March 31, 2020:

| Balance at December 31, 2019 | $ | 967 | ||

| Issuance of warrants | — | |||

| Change in fair value during period | (97 | ) | ||

| Balance at March 31, 2020 | $ | 870 |

The following assumptions were used in calculations of the Binomial Option Pricing Model for the periods ended March 31, 2020 and the year ended December 31, 2019.

| March 31, 2020 | December 31, 2019 | |||||||

| Annual dividend yield | 0 | % | 0 | % | ||||

| Expected life (years) | 0.42-7.4 | 0.42 – 8.13 | ||||||

| Risk-free interest rate | 1.60 – 1.83 | % | 1.56 – 2.40 | % | ||||

| Expected volatility | 189 - 236 | % | 165 - 318 | % | ||||

The following represents a summary of all common stock warrant activity:

| Number of Warrants |

Weighted Average Exercise Price |

Weighted Average Remaining Contractual Term | ||||||||||||

| Balance outstanding, December 31, 2019 | 211,826 | $ | 10.08 | 3.51 | ||||||||||

| Expired | (23,750 | ) | 30.00 | - | ||||||||||

| Balance outstanding, March 31, 2020 | 188,076 | $ | 7.57 | 3.69 | ||||||||||

| Exercisable, March 31, 2020 | 188,076 | $ | 7.57 | 3.69 | ||||||||||

Common stock option activity:

The Company maintains an Equity Incentive Plan pursuant of which 124,000 shares of Common Stock are reserved for issuance thereunder. This Plan was established to award certain founding members, who were instrumental in the development of the Company, as well as key employees, directors and consultants, and to promote the success of the Company’s business. The terms allow for each option to vest immediately, with a term no greater than 10 years from the date of grant, at an exercise price equal to par value at date of the grant. As of March 31, 2020, 88,750 shares had been granted, with 10,000 of those shares granted with warrants attached. There remain 35,250 shares available for future grants.

During the three months ended March 31, 2020 and 2019, the Company recorded total option expense of $40,595 . Unamortized stock option expense at March 31, 2020 is $46,011, which will be charged to expense in remaining months of 2020. The aggregate intrinsic value of stock options outstanding at March 31, 2020 is $0.

| 16 |

The following represents a summary of all common stock option activity:

| Number of Options |

Weighted Average Exercise Price |

Weighted Average Remaining Contractual Term | ||||||||||||

| Balance outstanding, December 31, 2019 | 172,479 | $ | 5.29 | 5.47 | ||||||||||

| Granted | — | — | ||||||||||||

| Balance outstanding, March 31, 2020 | 172,479 | $ | 5.29 | 5.22 | ||||||||||

| Exercisable, March 31, 2020 | 162,479 | $ | 5.25 | 5.47 | ||||||||||

Note 11 – COMMITMENTS AND CONTINGENCIES

Leases

The Company leases property under operating leases. Property leases include retail and warehouse space with fixed rent payments and lease terms ranging from three to five years. The Company is obligated to pay the lessor for maintenance, real estate taxes, insurance and other operating expenses on certain property leases. These expenses are variable and are not included in the measurement of the lease asset or lease liability. These expenses are recognized as variable lease expense when incurred.

The Company records the lease asset and lease liability at the present value of lease payments over the lease term. The leases typically do not provide an implicit rate; therefore, the Company uses its estimated incremental borrowing rate at the time of lease commencement to discount the present value of lease payments. The Company’s discount rate for operating leases at March 31, 2020 was 12%. Leases often include rental escalation clauses, renewal options and/or termination options that are factored into the determination of lease payments when appropriate. Lease expense is recognized on a straight-line basis over the lease term to the extent that collection is considered probable. As a result the Company been recognizing rents as they become payable. Our weighted-average remaining lease term is 3.99 years.

As of March 31, 2020, the maturities of operating leases liabilities are as follows (in thousands):

| Operating Leases | ||||

| 2020 | $ | 718 | ||

| 2021 | 863 | |||

| 2022 | 719 | |||

| 2023 | 733 | |||

| 2024 | 445 | |||

| 2025 and beyond | 45 | |||

| Total | 3,523 | |||

| Less: amount representing interest | (731 | ) | ||

| Present value of future minimum lease payments | 2,792 | |||

| Less: current obligations under leases | 669 | |||

| Long-term lease obligations | $ | 2,123 | ||

| 17 |

Rent expense is recognized on a straight-line basis over the life of the lease. Rent expense consists of the following:

| Three months ended | |||

| March 31, 2020 | |||

| Operating lease costs | $ | 249,225 | |

| Variable rent costs | 41,568 | ||

| Total rent expense | $ | 290,793 | |

Other information related to leases is as follows:

| Three months ended | |||

| March 31, 2020 | |||

| Other information: | |||

| Cash paid for amounts included in the measurement of lease liabilities: | |||

| Operating cash flows from operating leases | $ | 290,793 | |

| Weighted-average remaining lease term - operating leases | 3.99 | yr | |

| Weighted-average discount rate - operating leases | 12 | % | |

The Company recognized sublease income of $384,031 and $450,015 during the three months ended March 31, 2020 and 2019, respectively.

These three leases have three to five years terms with optional extension, expiration dates range from July 2021 to June 2025, and monthly base rent approximately $20,000-$40,000 plus variable NNN.

As of March 31, 2020, the maturities of expected base sublease income are as follows (in thousands):

| Operating Leases | ||||

| Remaining of 2020 | $ | 921 | ||

| 2021 | 1,079 | |||

| 2022 | 855 | |||

| 2023 | 868 | |||

| 2024 | 550 | |||

| 2025 and beyond | 58 | |||

| Total | $ | 4,331 |

Employment Agreements

As a condition of their employment, the Board of Directors approved employment agreements with three key executives. These agreement provided that additional shares will be granted each year over the term of the agreement should their shares as a percentage of the total shares outstanding fall below prescribed ownership percentages. Nello Gofiniatini III, who became the Company’s CEO in October 2019 receives an annual grant of additional shares each year to maintain his ownership percentage at 10% of the outstanding stock. The Company’s CFO received a similar grant each to maintain his ownership percentage at 2% of the outstanding stock. In addition, prior to his departure in October 2019, Ron Throgmartin, the Company’s previous CEO, would receive a grant of additional shares to maintain his ownership at 7.5% of the Company’s outstanding stock. During the three months ended March 31, 2020, the Company accrued compensation expense of approximately $27,026 on 1,652,116 shares of common stock under these agreements.

| 18 |

Departure of Executive Officer

On January 30, 2019, the Company executed a Separation Agreement and Release with David Thompson, its former Senior Vice President- Finance, finalizing his departure from the Company as an employee. Pursuant to its material terms, the Company agreed to pay Mr. Thompson aggregate cash payments of $206,250 , based upon the Company’s receipt of certain gross sales receipts derived from its Alameda Store in Colorado, and certain stock grants based upon the Company’s outstanding common shares as of February 1, 2019, including a stock grant of 53,717 restricted common shares for accrued salary and 122,934 restricted common shares in exchange for his approximate 122,000 of stock options. During the three months ended March 31, 2020 and the year ended December 31, 2019, $0 and $9,450 were paid under this agreement. As of March 31, 2020 and December 31, 2019, the outstanding balance was $196,800, and is included in Accrued payable – related party in the accompanying Consolidated Balance Sheet.

On October 29, 2019, Diego Pellicer Worldwide, Inc. (“Registrant”) accepted the resignation of Ron Throgmartin from his positions as CEO, President and Director. Mr. Throgmartin’s resignation was not the result of any disagreements with Registrant’s plan of operations, policies or management. On the same date, Registrant appointed Christopher D. Strachan, Registrant’s Chief Financial Officer, to membership on Registrant’s Board of Directors and appointed Nello Gonfiatini III, Regiatrant’s Chief Operations Officer, to the additional post of Chief Executive Officer.

Ron Throgmartin signed a 5-year term Separation Agreement which, among other matters, terminated his Employment Agreement, as amended. On the date of the Separation Agreement, the Company acknowledged it owed Mr. Throgmartin the amount of $517,252.06 in principle and accrued interest of note payable, salary and fees, accrued during the 5 years of his employment. In addition, the Corporation further acknowledged that it will pay Mr Throgmartin fifty (50%) percent of his compensation due under the remaining Employment Agreement, or $614,583.33 under certain condition, which the Company accrued in full as the date of Mr Throgmartin’s separation. This agreement provides that the Registrant will pay him $5,000 monthly against his accrued salary/fees and 50% of future compensation due under his terminated Employment Agreement, with certain accelerated payments in the event Registrant’s financial results attain certain EBITA benchmarks. Registrant shall have the right to require Mr. Throgmartin to provide consulting services to Registrant for a per diem fee of $500.

Note 13 – Subsequent Events

The Company evaluated subsequent events and transactions that occur after the balance sheet date up to the date that the consolidated financial statements are available to be issued. Any material events that occur between the balance sheet date and the date that the consolidated financial statements were available for issuance are disclosed as subsequent events, while the consolidated financial statements are adjusted to reflect any conditions that existed at the balance sheet date. Based upon this review, except as disclosed within the footnotes or as discussed below, the Company did not identify any recognized or non-recognized subsequent events that would have required adjustment or disclosure in the consolidated financial statements.

On May 13, 2020, the company issued 2,049,386 shares of common stock to a former officer per his separation agreement.

On May 13, 2020, the company issued 504,583 shares of common stock to Mr. Strachan for services rendered.

On June 17, 2020, the company converted 39,048 shares of series C preferred stock into 4,939,759 shares of common stock.

On January 30, 2020, the World Health Organization (“WHO”) announced a global health emergency in response to a new strain of a coronavirus (the “COVID-19 outbreak”). In March 2020, the WHO classified the COVID-19 outbreak as a pandemic based on the rapid increase in exposure globally. The full impact of the COVID-19 outbreak continues to evolve as of the date of this report. Management is actively monitoring the global situation and its effects on the Company’s industry, financial condition, liquidity, and operations. Given the daily evolution of the COVID-19 outbreak and the global responses to curb its spread, the Company is not able to estimate the effects of the COVID-19 outbreak on its results of operations, financial condition, or liquidity for fiscal year 2020. However, if the pandemic continues, it may have a material adverse effect on the Company’s results of future operations, financial position, and liquidity in fiscal year 2020.

| 19 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF OPERATIONS

The following discussion and analysis of the results of operations and financial condition of Diego Pellicer Worldwide, Inc. (the “Company”, “we”, “us” or “our”) should be read in conjunction with the financial statements of Diego Pellicer Worldwide, Inc. and the notes to those financial statements that are included elsewhere in this Form 10-Q. This discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under the Risk Factors and Business sections in the financial statements and footnotes included in the Company’s Form 10-K filed on June 2, 2020 for the year ended December 31, 2019. Words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions are used to identify forward-looking statements.

Overview

Diego Pellicer Worldwide, Inc. was established on August 26, 2013 to take advantage of growing market for legalized cannabis being made possible by the escalating legislation allowing for the legalization of cannabis operations in the majority of states:

The industry is operating under stringent regulations within the various state jurisdictions. The Company’s primary business plan is twofold: First to lease various properties to licensed operators in these jurisdictions to grow, process and sell cannabis and related products, and the second the Diego Pellicer Management Company, will license the upscale Diego Pellicer brand to qualified operators and receive royalty payments, while providing expertise in retail, product and manufacturing from Diego’s accomplished management team with extensive industry experience, The Company will also provide educational training, compliance consultation, branding, and related accessories to their tenants. These leases and management agreements are expected to provide substantial streams of income. We believe that as laws evolve, it is possible that we will have the opportunity to participate directly in these operations. Accordingly, the Company will selectively negotiate an option on our tenants’ operating company.

| 20 |

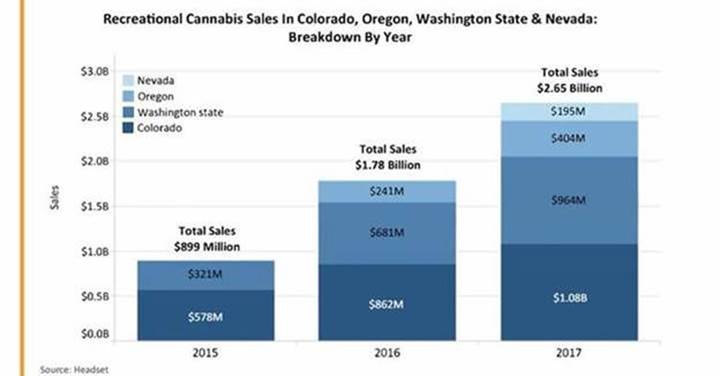

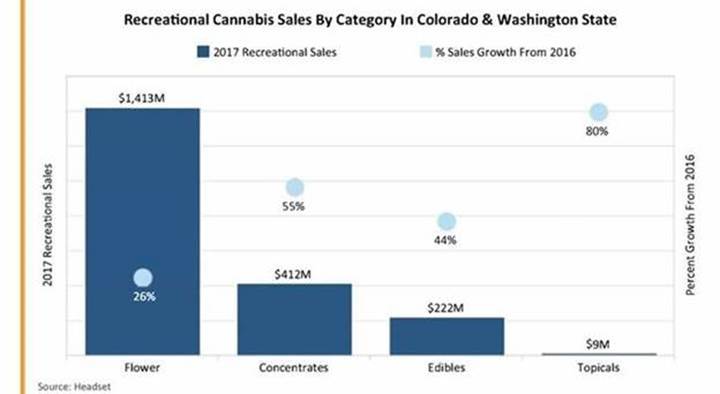

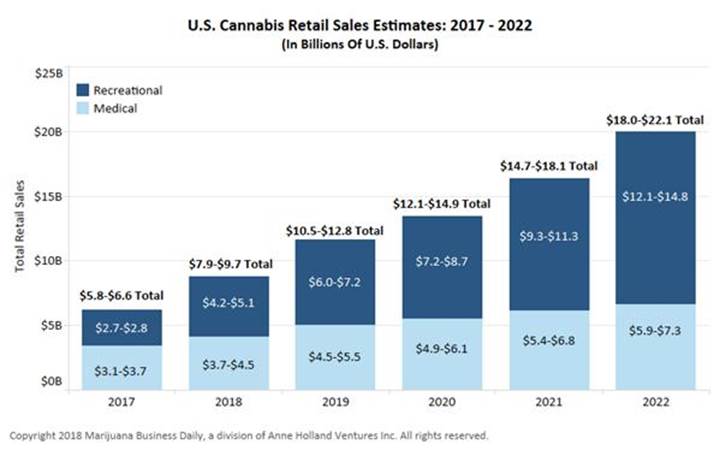

The Company has already established four facilities in markets that have experienced high growth, Washington and Colorado. This growth is illustrated in the tables below:

Source: Headset & 2018 Marijuana Business Daily, a division of Anne Holland Ventures Inc.

The legalization taking place in other states such as California and Florida present opportunities many times that of Washington and Colorado. The Company is exploring opportunities in Oregon, California and Florida and is getting inquiries from other potential operators in other jurisdictions.

| 21 |

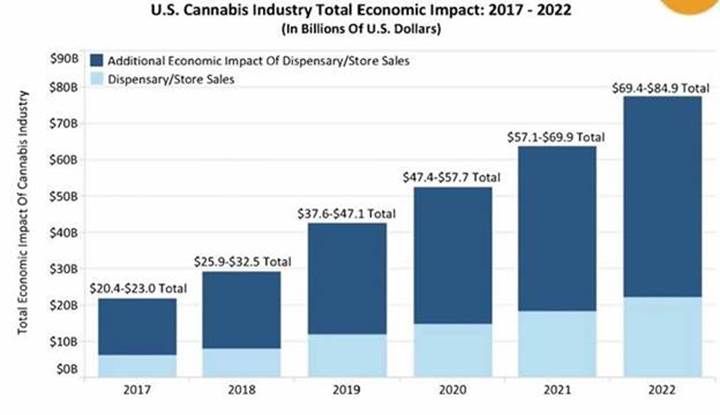

This market is projected to grow rapidly in the future as this chart below illustrates:

Source: Marijuana Business Daily

Summary

The Company’s primary business objective is to lease various properties to licensed operators to grow, process and retail cannabis and related products. By developing a premium brand name, building upscale facilities, and providing quality accessories to a market where financing is difficult to obtain, these subleases are designed to provide a substantial stream of income. We believe that as laws evolve, it is possible that we will have the opportunity to participate directly in these operations as well.

2018 was a year of growth for Diego Pellicer Worldwide. All tenants were open and generating lease revenue. The tenants were showing steady revenue increases and operating improvements. The business model was being proven. The brand name was getting national recognition and garnered the “Most Valuable Brand of the Year” at the 2018 National Cannabis Business Awards beating out tough national competition including MedMen™, The Clinic, Lightshade and Olio. Diego was also honored as the “Best Retail Center” for the second year in a row, defeating other highly regarded names including LiveWell, The Clinic, The Green Solutions, Euflora and Kind Love.

2019 was a time of continued growth and a change of focus for the Company. An effective and experienced team was assembled from within our operators to develop our newly formed management company, and to complement the current executives with knowledge and experience in real estate operations, banking, site selection, branding, facility design, corporate finance, investor relations, store management, and grow expertise, Additional capital needed to be raised in order to have sufficient capital to help support our operators expand within their markets, and to begin the expansion into different markets in the US. Much of the Company’s debt was renegotiated, and additional commitments were formalized for the expansion in the Colorado market. New markets had to be explored, new alliances forged, and opportunities prioritized.

Diego is exploring opportunities in California, Colorado, Nevada, Washington and other states. The Company will continue to raise capital to finance that expansion. This should result in increased revenues for the future and increased opportunities into new markets.

Opportunity in an untapped industry with multi-billion-dollar potential

The demand for marijuana products is a multi-billion-dollar market that has only recently begun to become mainstream. Many challenges face the marijuana entrepreneur. Therein lies the opportunity.

| 22 |

Regulation and reality

Total demand for marijuana in the United States, including the black market, is around $52.5 billion, according to estimates. That becomes a very conservative estimate of the size of the market in the United States. Distribution was driven underground for years by the Controlled Substance Act passed by Congress nearly 50 years ago. The favorable public opinion towards the legalization is rapidly changing the political attitude toward marijuana not only on the state level but on the federal level. If the Federal Government legalized marijuana nationwide, sales might start out around that level, but would likely rise as cannabis gained mainstream acceptance and the market evolved. Eventually, marijuana could surpass cigarette sales with the potential to rival beer in terms of overall sales.

Financing and banking

As doubts remain, financing is still a challenge for this industry with banks in many states not only avoiding lending to these businesses but also refusing deposits because of complicated FDIC requirements. Financing has been largely equity raises, vendor financing, and expensive convertible debt. However, with the legalization and subsequent public capital raises in Canada and the change in the political attitude, there has been an indication of more interest by institutional investors in providing capital to this industry and more banks are accepting deposits.

A fragmented industry

Most industries evolve through the same business cycle. Many small independent companies initially operate in fragmented markets in the early stages. Then there is a consolidation of the industry, with the consolidators thriving and the independent companies dwindling. The larger companies have access to less expensive capital, lower costs, better merchandising, brand name recognition, and more efficient operations. This what we offer our tenants when negotiating the lease: an agreement to acquire them when marijuana is federally legalized. This gives the tenant the ultimate opportunity to participate in the rapid consolidation that we believe will happen when marijuana is federally legalized. This consolidation will result in companies that have heretofore been unable to participate in the rapidly growing industry to be scrambling to enter the space. Diego and its tenants will already be established and consolidated. As an exit strategy, we want to position Diego to be a likely candidate for acquisition or a major player in the marketplace.

The opportunity

The first mover advantage will continue to be possible for those willing to deal with the regulatory, banking, and financial challenges in today’s market. The fragmented market, the shortage of executives skilled in challenges of the industry, scarcity of brand names, provides a company like Diego, who has proven their business model, to be a consolidator in this industry.

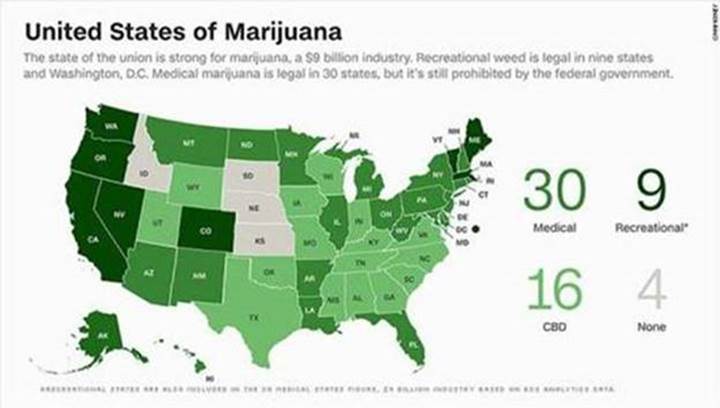

States with legalized marijuana

Thirty three states and the District of Columbia have laws broadly legalizing marijuana in some form. Ten states and the District of Columbia have legalized marijuana for recreational use with the largest market by far, California, becoming legal.

The majority of all states allow for use of medical marijuana under certain circumstances. Some states have also decriminalized the possession of small amounts of marijuana. The industry is operating under stringent regulations within the various state jurisdictions.

| 23 |

This map shows current state laws and recently approved ballot measures legalizing marijuana for medical or recreational purposes. 2

There are 9,397 active licenses for marijuana businesses in the U.S., according to Ed Keating, chief data officer for Cannabiz Media, which tracks marijuana licenses. This includes cultivators, manufacturers, retailers, dispensaries, distributors, deliverers and test labs. Now 306 million Americans live in a jurisdiction that has legalized some form of cannabis use.3 BDS Analytics estimates that the industry paid $1 billion in state taxes in 2016 and owes another $1.4 billion for 2017.4

1 “Illegal Pot Sales Topped $46.4 Billion in 2016, and that’s Good News for Marijuana Entrepreneurs,” Inc., January 17, 2017, Will Yakowicz.

2 CNN Money , “The Legal Marijuana Market is Booming,” January 31, 2018, by Aaron Smith

3 Frontier Financial Group, ‘The Cannabis Industry Annual Report: 2017 Legal Marijuana Outlook,”

4 CNN Money , “The Legal Marijuana Market is Booming,” January 31, 2018, by Aaron Smith

The recent legalization in states such as California and probable legalization in Florida present opportunities many times that of Washington and Colorado. The Company is exploring opportunities in Oregon, California and Florida and is getting inquiries from other potential operators in other jurisdictions such as Michigan.

States introducing and expanding legalized marijuana laws

The legalized cannabis market has grown considerably bigger, with Canada federally legalizing recreational marijuana in 2018 and Eastern states in the U.S. rushing towards legalization.

In May 2019, Colorado Governor Polis signed into law House Bill 19-1090. It is generally referred to as the "Public Company" bill because it allows public companies to own Colorado marijuana licenses for the first time. This law went into effect on November 1, 2019.

Recent developments at the federal level

Pressures from the states with legalized cannabis industries have been exerted by those state’s Senators and Congressmen. Both informal and formal efforts have been increased by these states. The following are the most recent:

In an April 2018 conversation with Republican U.S. Sen. Cory Gardner, President Donald Trump pledged to keep the Department of Justice from interfering with state cannabis laws and, perhaps more significantly, support legislation protecting state-legal marijuana businesses. White House officials later confirmed the president's policy stance.

| 24 |

Several bills have been introduced to Congress seeking to reform federal marijuana laws in different ways, including the removal of cannabis from the list of controlled substances, allowing MJ companies to access traditional banking services and amending the IRS code to more fairly tax cannabis businesses.

Similar bills have been introduced in previous sessions of Congress, but none have gained significant traction. This time, however, may be different, as marijuana reform has become a bipartisan issue that has the support of many prominent Republicans.

Senate Majority Leader Mitch McConnell, for example, introduced a bill in April to remove federal barriers on hemp, while former Republican House Speaker John Boehner recently disclosed his involvement with a large, multistate cannabis company.