UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2017

Commission File Number: 333-189731

DIEGO PELLICER WORLDWIDE, INC.

(Name of registrant as specified in its charter)

| Delaware | 33-1223037 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

9030 Seward Park Ave, S, #501, Seattle, WA 98118

(Address of principal executive offices) (Zip Code)

(516) 900-3799

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated Filer | [ ] | Accelerated Filer | [ ] | |

| Non-accelerated Filer | [ ] | Small Reporting Company | [X] | |

| (Do not check if smaller reporting company) | Emerging Growth Company | [ ] | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

As of August 28, 2017 there were 57,708,297 shares of common stock issued and outstanding.

TABLE OF CONTENTS

| Page | ||

| PART I – FINANCIAL INFORMATION | ||

| Item 1. | Financial Statements | 4 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 17 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 22 |

| Item 4. | Controls and Procedures | 22 |

| PART II – OTHER INFORMATION | ||

| Item 1. | Legal Proceedings | 24 |

| Item 1A. | Risk Factors | 24 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 24 |

| Item 3. | Defaults Upon Senior Securities | 24 |

| Item 4. | Mine Safety Disclosures | 24 |

| Item 5. | Other Information | 24 |

| Item 6. | Exhibits | 24 |

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this “Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Report and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

| 3 |

PART I – FINANCIAL INFORMATION

DIEGO PELLICER WORLDWIDE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| June 30, 2017 | December 31, 2016 | |||||||

| Assets | ||||||||

| Current Assets: | ||||||||

| Cash and equivalents | $ | 8,544 | $ | 51,333 | ||||

| Accounts receivable | 144,503 | - | ||||||

| Prepaid expenses | 71,717 | 482,765 | ||||||

| Inventory | 32,400 | 47,025 | ||||||

| Total current assets | 257,164 | 581,123 | ||||||

| Property and equipment, net | 626,547 | 758,112 |

||||||

| Investments, at cost | - | 43,333 | ||||||

| Security deposits | 320,000 | 320,000 | ||||||

| Other assets | 8,000 | - | ||||||

| Total assets | $ | 1,211,711 | $ | 1,702,568 |

||||

| Liabilities and Stockholder's Deficit | ||||||||

| Current liabilities: | ||||||||

| Accounts Payable | $ | 543,014 | $ | 823,797 | ||||

| Accrued Payable - Related Party | 814,233 | 509,294 | ||||||

| Accrued Expenses | 316,224 | 1,207,803 | ||||||

| Notes Payable - Related Party | 307,312 | 307,312 | ||||||

| Notes Payable | 126,000 | 1,310,678 |

||||||

| Convertible Note, net of discount | 2,645,300 | 334,156 | ||||||

| Deferred rent | 269,765 | 107,957 | ||||||

| Deferred Revenue | 53,000 | 53,000 | ||||||

| Derivative liabilities | 5,783,534 | 338,282 | ||||||

| Warrant Liabilities | 311,216 | - | ||||||

| Total current liabilities | 11,169,598 | 4,992,279 | ||||||

| Deferred revenue | 289,000 | 316,000 | ||||||

| Total liabilities | 11,458,598 | 5,308,279 | ||||||

| Stockholder's deficit | ||||||||

| Series A and B Preferred Stock, $0.0001 par value, 5,000,000 shares authorized, 0 share issued and outstanding as of June 30, 2017 and December 31, 2016 | - | - | ||||||

| Common Stock, $0.000001 par value, 95,000,000 shares authorized, 52,598,307 and 49,081,878 shares were issued and outstanding as of June 30, 2017 and December 31, 2016, respectively | 53 | 49 | ||||||

| Additional paid-in capital | 26,002,501 | 24,508,365 | ||||||

| Stock to be issued | 157,096 | - | ||||||

| Accumulated deficit | (36,406,537 | ) | (28,114,125 | ) | ||||

| Total stockholder's deficit | (10,246,886 | ) | (3,605,711 | ) | ||||

| Total liabilities and stockholder's deficit | $ | 1,211,711 | $ | 1,702,568 |

||||

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

| 4 |

DIEGO PELLICER WORLDWIDE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| Three Months Ended | Three Months Ended | Six Months Ended | Six Months Ended | |||||||||||||

| June 30 2017 | June 30 2016 | June 30, 2017 | June 30, 2016 | |||||||||||||

| REVENUES | ||||||||||||||||

| Net Rental Revenue | $ | 545,035 | 149,601 | $ | 854,997 | $ | 222,868 | |||||||||

| Rental Expense | (289,918 | ) | (278,921 | ) | (637,121 | ) | (573,663 | ) | ||||||||

| Gross Profit | $ | 255,117 | $ | (129,320 | ) | $ | 217,876 | $ | (350,795 | ) | ||||||

| Operating expenses: | ||||||||||||||||

| General and administrative expenses | 1,674,826 | 2,648,745 | 2,567,821 | 3,342,927 | ||||||||||||

| Selling Expense | 33,877 | - | 33,889 | - | ||||||||||||

| Depreciation Expense | 108,710 | - | 239,499 | - | ||||||||||||

| Income (Loss) from Operations | $ | (1,562,296 | ) | $ | (2,778,065 | ) | $ | (2,623,333 | ) | $ | (3,693,722 | ) | ||||

| Other Income (Expense) | ||||||||||||||||

| Licensing Revenue | 13,500 | 13,500 | 27,000 | 27,000 | ||||||||||||

| Other Income (Expense) | 3,061 | - | 45,830 | - | ||||||||||||

| Interest Expense | (446,762 | ) | (58,370 | ) | (734,998 | ) | (105,656 | ) | ||||||||

| Impairment Loss | (15,833 | ) | - | (82,478 | ) | - | ||||||||||

| Extinguishment of Debt | (5,607,836 | ) | - | (5,607,836 | ) | |||||||||||

| Change in derivative liabilities | 943,780 | 110,360 | 994,619 | 106,336 | ||||||||||||

| Change in value of Warrants | (311,216 | ) | - | (311,216 | ) | - | ||||||||||

| Total Other Income (Loss) | $ | (5,421,306 | ) | $ | 65,490 | $ | (5,669,079 | ) | $ | 27,680 | ||||||

| Provision for taxes | - | - | - | - | ||||||||||||

| NET INCOME (LOSS) | $ | (6,983,602 | ) | $ | (2,712,575 | ) | $ | (8,292,412 | ) | $ | (3,666,04 | 2) | ||||

| Loss per share - basic and fully diluted | (0.13 | ) | (0.07 | ) | (0.16 | ) | (0.09 | ) | ||||||||

| Weighted average common shares outstanding - basic and fully diluted | 52,598,308 | 41,312,180 | 52,598,308 | 39,568,485 | ||||||||||||

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

| 5 |

DIEGO PELLICER WORLDWIDE, INC.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOW

(Unaudited)

| Six Months Ended | Six Months Ended | |||||||

| June 30, 2017 | June 30, 2016 | |||||||

| Operating Activities | ||||||||

| Net Loss | $ | (8,292,412 | ) | $ | (3,666,042 |

) | ||

| Adjustments to reconcile net loss to net cash used in operations: | ||||||||

| Depreciation and amortization | 239,499 | - | ||||||

| Amortization of Debt Costs | - | 4,141 | ||||||

| Amortization of discount | 190,984 | - | ||||||

| Share-based compensation | 1,527,713 | 2,792,544 | ||||||

| Impairment on investment | 82,478 | - | ||||||

| Change in fair value of derivative liabilities | (994,619 | ) | (106,336 | ) | ||||

| Extinguishment of Debt | 5,607,836 | - | ||||||

| Change in value of warrants | 311,216 | - | ||||||

| Change in operating assets and liabilities: | ||||||||

| Change in accounts receivable | (144,503 | ) | (151,538 | ) | ||||

| Change in inventory | 14,624 | (8,096 | ) | |||||

| Prepaid expenses | 411,048 | 24,476 | ||||||

| Change in other assets | (8,000 | ) | (33,152 | ) | ||||

| Change in accounts payable | (302,862 | ) | 512,912 | |||||

| Change in accrued liability - Related party | 304,939 | 360,400 | ||||||

| Change in accrued liability | 388,511 | - | ||||||

| Change in deferred rent | 161,808 | (43,174 | ) | |||||

| Change in deferred revenue | (27,000 | ) | (27,000 | ) | ||||

| Net cash provided in operating activities | (528,739 | ) | (340,865 | ) | ||||

| Investing Activities | ||||||||

| Purchase of property and equipment | (125,000 | ) | (394,090 | ) | ||||

| Net cash used in investing activities | (125,000 | ) | (394,090 | ) | ||||

| Financing Activities | ||||||||

| Proceeds from note payable | - | 470,000 | ||||||

| Proceeds from sale of common stock | - | 245,001 | ||||||

| Proceeds from convertible notes payable | 740,000 | - | ||||||

| Repayment of notes payable | (129,050 | ) | - | |||||

| Net cash provided by financing activities | 610,950 | $ | 715,001 | |||||

| Net (Decrease) increase in Cash | (42,789 | ) | (19,954 | ) | ||||

| Cash - beginning of period | 51,333 | 36,001 | ||||||

| Cash - end of the period | $ | 8,544 | $ | 16,047 | ||||

| Cash paid for interest | $ | - | $ | - | ||||

| Cash paid for income taxes | $ | - | $ | - | ||||

| Supplemental noncash financing activities: | ||||||||

| Stock issued for debt settlement | $ | 50,000 | $ | - | ||||

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

| 6 |

Diego Pellicer Worldwide, Inc.

June 30, 2017 and 2016

Notes to the Consolidated Financial Statements

Note 1 – Organization and Operations

History

On March 13, 2015 (the “closing date”), Diego Pellicer Worldwide, Inc. f/k/a Type 1 Media, Inc. (the “Company”) closed on a merger and share exchange agreement by and among (i) the Company, and (ii) Diego Pellicer World-wide, Inc., a Delaware corporation, (“Diego”), and (iii) Jonathan White, the majority shareholder of the Company. Diego was merged with and into the Company, with the Company to continue as the surviving corporation in the Merger and the Company succeeding to and assuming all the rights, assets, liabilities, debts, and obligations of Diego.

The Merger has been accounted for as a reverse merger and recapitalization in which Diego is treated as the accounting acquirer and Diego Pellicer Worldwide, Inc. is the surviving legal entity.

Business Operations

The Company leases real estate to licensed marijuana operators providing complete turnkey growing space, processing space, recreational and medical retail sales space and related facilities to licensed marijuana growers, processors, dispensary and recreational store operators. Additionally, the Company plans to explore ancillary opportunities in the regulated marijuana industry as well as offering for wholesale distribution branded non-marijuana clothing and accessories.

Until Federal law allows, the Company will not grow, harvest, process, distribute or sell marijuana or any other substances that violate the laws of the United States of America or any other country.

Note 2 – Significant Accounting Policies and Practices

The management of the Company is responsible for the selection and use of appropriate accounting policies and the appropriateness of accounting policies and their application. Critical accounting policies and practices are those that are both most important to the portrayal of the Company’s financial condition and results and require management’s most difficult, subjective, or complex judgments, often because of the need to make estimates about the effects of matters that are inherently uncertain. The Company’s significant and critical accounting policies and practices are disclosed below as required by generally accepted accounting principles.

Basis of Presentation

The accompanying condensed consolidated financial statements of Diego Pellicer Worldwide, Inc. were prepared in accordance with the instructions to Form 10-Q and, therefore, do not include all disclosures required for financial statements prepared in conformity with U.S. GAAP.

This Form 10-Q relates to the three months and six months ended June 30, 2017 (the “Current Quarter”) and the three months and six months ended June 30, 2016 (the “Prior Quarter”). The Company’s annual report on Form 10-K for the year ended December 31, 2016 (“2016 Form 10-K”) includes certain definitions and a summary of significant accounting policies and should be read in conjunction with this Form 10-Q. All material adjustments which, in the opinion of management, are necessary for a fair statement of the results for the interim periods have been reflected. The results for the Current Quarter are not necessarily indicative of the results to be expected for the full year.

| 7 |

New accounting pronouncements

In August 2014, the Financial Accounting Standards Board (“FASB”) issued Presentation of Financial Statements — Going Concern. This standard requires management to evaluate for each annual and interim reporting period whether it is probable that the reporting entity will not be able to meet its obligations as they become due within one year after the date that the financial statements are issued. If the entity is in such a position, the standard provides for certain disclosures depending on whether or not the entity will be able to successfully mitigate its going concern status. This guidance is effective for annual periods ending after December 15, 2016 and interim periods within annual periods beginning after December 15, 2016. Early application is permitted. The Company does not anticipate that this adoption will have a significant impact on its consolidated financial position, results of operations, or cash flows.

In July 2015, the FASB issued Accounting Standards Update (“ASU”) No. 2015-11, Inventory, which requires an entity to measure inventory within the scope at the lower of cost and net realizable value. Net realizable value is the estimated selling prices in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation. The effective date for the standard is for fiscal years beginning after December 15, 2016.

In September 2015, the FASB issued ASU No. 2015-16, Business Combinations (Topic 805): Simplifying the Accounting for Measurement-Period Adjustments. To simplify the accounting for adjustments made to provisional amounts recognized in a business combination, the amendments eliminate the requirement to retrospectively account for those adjustments. For public business entities, the amendments are effective for fiscal years beginning after December 15, 2015, including interim periods within those fiscal years. The amendments should be applied prospectively to adjustments to provisional amounts that occur after the effective date with earlier application permitted for financial statements that have not been issued.

In May 2014, the FASB issued No. 2014-09, Revenue from Contracts with Customers, which supersedes the revenue recognition requirements in Accounting Standards Codification 605 - Revenue Recognition and most industry-specific guidance throughout the Codification. The standard requires that an entity recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. In August 2015, the FASB approved a one-year deferral of the effective date of the new revenue recognition standard. Public business entities, certain not-for-profit entities, and certain employee benefit plans should apply the guidance in ASU 2014-09 to annual reporting periods beginning after December 15, 2017, including interim reporting periods within that reporting period. Earlier application is permitted only as of annual reporting periods beginning after December 31, 2016, including interim reporting periods within that reporting period. In March 2016, the FASB issued ASU 2016-08, Revenue from Contracts with Customers (Topic 606), Principal versus Agent Considerations (Reporting Revenue versus Net). In April 2016, the FASB issued ASU 2016-10, Revenue from Contracts with Customers (Topic 606), Identifying Performance Obligations and Licensing. In May 2016, the FASB issued ASU 2016-11, Revenue from Contracts with Customers (Topic 606) and Derivatives and Hedging (Topic 815) - Rescission of SEC Guidance Because of ASU 2014-09 and 2014-16, and ASU 2016-12, Revenue from Contracts with Customers (Topic 606) - Narrow Scope Improvements and Practical Expedients. These ASUs clarify the implementation guidance on a few narrow areas and adds some practical expedients to the guidance Topic 606. The Company is evaluating the effect that these ASUs will have on its consolidated financial statements and related disclosures.

In February 2016, the FASB issued guidance that requires a lessee to recognize assets and liabilities arising from leases on the balance sheet. Previous GAAP did not require lease assets and liabilities to be recognized for most leases. Additionally, companies are permitted to make an accounting policy election not to recognize lease assets and liabilities for leases with a term of 12 months or less. For both finance leases and operating leases, the lease liability should be initially measured at the present value of the remaining contractual lease payments. The recognition, measurement and presentation of expenses and cash flows arising from a lease by a lessee will not significantly change under this new guidance. This new guidance is effective for us as of the first quarter of fiscal year 2020. The Company is evaluating the effect that this ASU will have on its consolidated financial statements and related disclosures.

| 8 |

On March 30, 2016, the FASB issued ASU No. 2016-09, Improvements to Employee Share-Based Payment Accounting, which includes amendments to accounting for income taxes at settlement, forfeitures, and net settlements to cover withholding taxes. The amendments in ASU 2016-09 are effective for public companies for fiscal years beginning after December 31, 2016, and interim periods within those annual periods.

In August 2016, the FASB issued ASU No. 2016-15, Classification of Certain Cash Receipts and Cash Payments. ASU 2016-15 clarifies the presentation and classification of certain cash receipts and cash payments in the statement of cash flows. This ASU is effective for public business entities for fiscal years, and interim periods within those years, beginning after December 15, 2017. Early adoption is permitted. The Company is currently assessing the potential impact of ASU 2016-15 on its financial statements and related disclosures.

In October 2016, the FASB issued ASU No. 2016-16—Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other Than Inventory. This ASU improves the accounting for the income tax consequences of intra-entity transfers of assets other than inventory. For public business entities, the amendments in this update are effective for annual reporting periods beginning after December 15, 2017, including interim reporting periods within those annual reporting periods. Early adoption is permitted. The Company does not anticipate that the adoption of this ASU will have a significant impact on its consolidated financial statements.

The Company believes that other recently issued accounting pronouncements and other authoritative guidance for which the effective date is in the future either will not have an impact on its accounting or reporting or that such impact will not be material to its financial position, results of operations and cash flows when implemented.

Reclassifications

Certain reclassifications have been made to the prior years’ financial statements to conform to the current year presentation. These reclassifications had no effect on previously reported results of operations, shareholders equity or accumulated deficit.

Use of Estimates

The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates. These estimates and assumptions include valuing equity securities and derivative financial instruments issued in financing transactions and share based payment arrangements, determining the fair value of the warrants received for the licensing agreement, the collectability of accounts receivable and deferred taxes and related valuation allowances.

Certain estimates, including evaluating the collectability of accounts receivable, could be affected by external conditions, including those unique to our industry, and general economic conditions. It is possible that these external factors could influence our estimates that could cause actual results to differ from our estimates. The Company intends to re-evaluate all its accounting estimates at least quarterly based on these conditions and record adjustments when necessary.

Fair Value Measurements

The Company evaluates its financial instruments to determine if such instruments are derivatives or contain features that qualify as embedded derivatives. For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair value reported in the condensed consolidated statements of operations. The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is evaluated at the end of each reporting period. Derivative instrument liabilities are classified in the balance sheet as current or non-current based on whether net-cash settlement of the derivative instrument could be required within 12 months of the balance sheet date.

| 9 |

Fair Value of Financial Instruments

As required by the Fair Value Measurements and Disclosures Topic of the FASB ASC, fair value is measured based on a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value as follows:

Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2: Quoted prices in markets that are not active, or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability; and

Level 3: Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (supported by little or no market activity).

Fair value estimates discussed herein are based upon certain market assumptions and pertinent information available to management as of June 30, 2017 and December 31, 2016. The respective carrying value of certain on-balance-sheet financial instruments approximated their fair values. These financial instruments include cash, prepaid expenses and accounts payable. Fair values were assumed to approximate carrying values for cash and payables because they are short term in nature and their carrying amounts approximate fair values or they are payable on demand.

Cash

The Company maintains cash balances at various financial institutions. Accounts at each institution are insured by the Federal Deposit Insurance Corporation, and the National Credit Union Share Insurance Fund, up to $250,000. The Company’s accounts at these institutions may, at times, exceed the federal insured limits. The Company has not experienced any losses in such accounts.

Property and Equipment, and Depreciation Policy

Property and equipment are stated at cost less accumulated depreciation. Depreciation is provided for on a straight-line basis over the useful lives of the assets. Leasehold improvements are amortized over the term of the lease. Expenditures for additions and improvements are capitalized; repairs and maintenance are expensed as incurred.

The Company intends to take depreciation or amortization on a straight-line basis for all properties, beginning when they are put into service, using the following life expectancy:

Equipment – 5 years

Leasehold Improvements – 10 years, or the term of the lease, whichever is shorter

Buildings – 20 years

Inventory

The Company’s inventory is stated at the lower of cost or estimated realizable value, with cost primarily determined on a cost basis on the first-in, first-out (“FIFO”) method. Inventory consists of finished goods.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are presented at their face amount, less an allowance for doubtful accounts, on the balance sheets. Accounts receivable consist of revenue earned and currently due from sub lessee. We evaluate the collectability of accounts receivable based on a combination of factors. We recognize reserves for bad debts based on estimates developed using standard quantitative measures that incorporate historical write-offs and current economic conditions. As of June 30, 2017, the outstanding balance allowance for doubtful accounts is $9,908.

| 10 |

The policy for determining past due status is based on the contractual payment terms of each customer. Once collection efforts by the Company and its collection agency are exhausted, the determination for charging off uncollectible receivables is made.

Revenue recognition

The Company recognizes revenue from rent, tenant reimbursements, and other revenue sources once all the following criteria are met in accordance with SEC Staff Accounting Bulletin 104, Revenue Recognition: (a) the agreement has been fully executed and delivered; (b) services have been rendered; (c) the amount is fixed or determinable; and (d) the collectability of the amount is reasonably assured. Thus, during the initial term of the lease, management has a policy of partial rent forbearance when the tenant first opens the facility to assure that the tenant has the opportunity for success.

When the collectability is reasonably assured, in accordance with ASC Topic 840 “Leases” as amended and interpreted, minimum annual rental revenue is recognized for rental revenues on a straight-line basis over the term of the related lease.

When management concludes that the Company is the owner of tenant improvements, management records the cost to construct the tenant improvements as a capital asset. In addition, management records the cost of certain tenant improvements paid for or reimbursed by tenants as capital assets when management concludes that the Company is the owner of such tenant improvements. For these tenant improvements, management records the amount funded or reimbursed by tenants as deferred revenue, which is amortized as additional rental income over the term of the related lease. When management concludes that the tenant is the owner of tenant improvements for accounting purposes, management records the Company’s contribution towards those improvements as a lease incentive, which is amortized as a reduction to rental revenue on a straight-line basis over the term of the lease.

In January 2014, the Company entered into an agreement to license certain intellectual property to an unrelated company. In consideration, the Company received warrants to purchase shares of the licensee’s common stock, The value of the warrants were recorded as an investment and the deferred revenue was being amortized over the ten year term of the licensing agreement.

Leases as Lessor

The Company currently leases properties in locations that meet the regulatory criteria applicable to cannabis operations by the respective regulatory jurisdiction and acceptable to sub-lessees for the sale, production, and development of their products. The Company evaluates the lease to determine its appropriate classification as an operating or capital lease for financial reporting purposes. The Company leases are currently all classified as operating leases.

Minimum base rent is recorded on a straight-line basis over the lease term after an initial period during which the tenant is establishing the business and during which the Company may forbear some or all of the rent. The Company is more likely than not to forbear some or all of the rental income which it considers uncollectable during the tenant’s initial ramp-up period (see Revenue Recognition above). The tenant is still liable for the full rent, although the collectability may be unlikely and the Company may not expect to collect it.

Leases as Lessee

The Company recognizes rent expense on a straight-line basis over the non-cancelable lease term and certain option renewal periods where failure to exercise such options would result in an economic penalty in such amount that renewal appears, at the inception of the lease, to be reasonably assured. Deferred rent is presented on current liabilities section on the consolidated balance sheets.

| 11 |

Income Taxes

Income taxes are provided for using the liability method of accounting in accordance with the Income Taxes Topic of the FASB ASC. Deferred tax assets and liabilities are determined based on differences between the financial reporting and tax basis of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. A valuation allowance is established when necessary to reduce deferred tax assets to the amount expected to be realized and when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. The computation of limitations relating to the amount of such tax assets, and the determination of appropriate valuation allowances relating to the realizing of such assets, are inherently complex and require the exercise of judgment. As additional information becomes available, the Company continually assesses the carrying value of their net deferred tax assets.

Preferred Stock

The Company applies the guidance enumerated in ASC Topic 480 “Distinguishing Liabilities from Equity” when determining the classification and measurement of preferred stock. Preferred shares subject to mandatory redemption are classified as liability instruments and are measured at fair value. The Company classifies conditionally redeemable preferred shares which includes preferred shares that feature redemption rights that are either within the control of the holder or subject to redemption upon the occurrence of uncertain events not solely within our control, as temporary equity. At all other times, it classifies its preferred shares in stockholders’ equity. Preferred shares do not feature any redemption rights within the holders’ control or conditional redemption features not within our control. Accordingly, all issuances of preferred stock are presented as a component of consolidated stockholders’ equity.

Common Stock Purchase Warrants and Other Derivative Financial Instruments

The Company classifies as equity any contracts that require physical settlement or net-share settlement or provide us a choice of net cash settlement or settlement in our own shares (physical settlement or net-share settlement) provided that such contracts are indexed to our own stock as defined in ASC Topic 815-40 “Contracts in Entity’s Own Equity.” The Company classifies as assets or liabilities any contracts that require net-cash settlement including a requirement to net cash settle the contract if an event occurs and if that event is outside our control or give the counterparty a choice of net-cash settlement or settlement in shares. The Company assesses classification of its common stock purchase warrants and other free-standing derivatives at each reporting date to determine whether a change in classification between assets and liabilities is required.

Stock-Based Compensation

The Company recognizes compensation expense for stock-based compensation in accordance with ASC Topic 718. The Company calculates the fair value of the award on the date of grant using the Black-Scholes method for stock options and the quoted price of our common stock for unrestricted shares; the expense is recognized over the service period for awards expected to vest. The estimation of stock-based awards that will ultimately vest requires judgment, and to the extent actual results or updated estimates differ from original estimates, such amounts are recorded as a cumulative adjustment in the period estimates are revised. The Company considers many factors when estimating expected forfeitures, including types of awards, employee class, and historical experience.

Earnings (loss) per common share

Earnings (loss) per share is provided in accordance with ASC Subtopic 260-10. The Company presents basic loss per share (“EPS”) and diluted EPS on the face of statements of operations. Basic EPS is computed by dividing reported earnings (loss) by the weighted average shares outstanding. Loss per common share has been computed using the weighted average number of common shares outstanding during the year.

| 12 |

Note 3 – Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. The Company has incurred losses since inception, its current liabilities exceed its current assets by $10,912,434, and has an accumulated deficit of $36,406,537 at June 30, 2017. These factors, among others raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Management believes that the Company’s future success is dependent upon its ability to achieve profitable operations, generate cash from operating activities and obtain additional financing. There is no assurance that the Company will be able to generate sufficient cash from operations, sell additional shares of stock or borrow additional funds. The Company’s inability to obtain additional cash could have a material adverse effect on its financial position, results of operations, and its ability to continue in existence. These financial statements do not include any adjustments that might result from the outcome of this uncertainty.

The Company intends to continue to raise additional capital to be used for ongoing expenses, capital expenditures or repayment of debt. When, in the opinion of the Company, the tenants achieve sufficient profitability to pay full rents, rental revenues should exceed rental expense for the four subleased properties.

Note 4 – Investment

In January 2014, the Company entered into an agreement with Plandai Biotechnology, Inc. (a publicly traded company) to license to them certain intellectual property rights in exchange for warrants to purchase 1,666,667 shares of Plandai Biotechnology, Inc. common stock. This licensing agreement carries a 10-year term with an exercise price of $0.01 per share. The Company was to obtain certain trademark rights certified by the government. The warrant has a restriction on them requiring that the sale of such shares must reach a certain traded price of $0.50 per share. In 2014, the Company used a third-party appraisal firm to ascertain the fair value of warrants held by the Company, which was determined to be $525,567 at the date of issuance. During the year ended December 31, 2016, the Company recorded an impairment loss of $73,334. The Company recorded an additional impairment loss for the six months ended June 30, 2017 of $43,333.

Note 5– Property and Equipment

As of June 30, 2017, and December 31, 2016, fixed assets and the estimated lives used in the computation of depreciation are as follows:

| Estimated | ||||||||||

| Useful Lives | June 30, 2017 | December 31, 2016 | ||||||||

| Machinery and equipment | 5 years | - | $ | 39,145 | ||||||

| Leasehold improvements | 10 years | 853,413 | 728,413 | |||||||

| Less: Accumulated depreciation and amortization | (226,866 | ) | (9,447 | ) | ||||||

| Property and equipment, net | $ | 626,547 | $ | 758,111 | ||||||

Note 6 – Other Assets

Security deposits: Security deposits reflect the deposits on various property leases, most of which require for two months’ rental expense in the form of a deposit. These have remained unchanged, and are reported as $170,000 for December 31, 2016, and for June 30, 2017.

Deposits – end of lease: These deposits represent an additional two months of rent on various property leases that apply to the “end-of- lease” period. These have remained unchanged, and are reported as $150,000 for December 31, 2016, and for June 30, 2017.

| 13 |

Note 7– Notes Payable

On April 11, 2017, the Company issued two convertible notes (see Note 8). These were issued to refinance the following notes:

On May 20, 2015, the Company issued a note in total amount of $450,000 with third parties for use as operating capital. As of December 31, 2016, the outstanding principle balance of the note was $450,000.

On July 8, 2015, the Company issued a note in total amount of $135,628 with third parties for use as operating capital. As of December 31, 2016, the outstanding principle balance of the note is $135,628.

On February 8, 2016, the Company issued notes in total amount of $470,000 with third parties, bearing interest at 12% per annum with a maturity date of February 7, 2017. As of December 31, 2016, the outstanding principle balance of the note is $470,000.

In accordance with in accordance with FASB Codification- Liabilities, 470-50-40-10, these liabilities were considered extinguished and the cost of the new financing of $5,607,836 was expensed in the quarter ended June 30, 2017.

On August 31, 2015, the Company issued a note in total amount of $126,000 with third parties for use as operating capital. The notes payable agreements required the Company to repay the principal, together with 5% annual interest by the maturity date of October 31, 2015 or the closing of a financing whereby the company receives a minimum of $126,000. In connection with the issuance of these notes, the Company issued 126,000 shares of common stock. The Company allocated the proceeds of the notes and equity based on the relative fair value at inception. The Company allocated $84,000 to the common stock and $42,000 to the debt. The difference between the face value of the notes and the allocated value has been accreted to interest expense over the life of the loan. As of June 30, 2017, and December 31, 2016, the outstanding principal balance of the note is $126,000

Note 8 – Convertible Note Payable

In addition to the two notes issued on April 11, 2017 referred to in Footnote 7, the Company issued several convertible notes in the second quarter ended June 30, 2017, The convertible notes require the Company to repay the principal, together with interest. The note holder shall have the right to convert the amount outstanding into shares of common stock at a discounted price. The conversion feature was recognized as an embedded derivative and was valued using a Black Scholes model that resulted in a derivative liability of $5,694,844 for the quarter ended June 30, 2017. In connection with the issuance of certain of these notes, the Company also issued warrants to purchase its common stock. The Company allocated the proceeds of the notes and warrants based on the relative fair value at inception for these notes. The company recorded a derivative liability of $88,690 for accrued interest relating to these notes.

The table below provides a reconciliation of the beginning and ending balances for the liabilities measured using fair significant unobservable inputs (Level 3):

| Convertible notes |

Discount | Convertible Note Net of Discount |

Derivative Liabilities |

|||||||||||||

| Balance, December 31, 2016 | 370,500 | 36,344 | 334,156 | 338,282 | ||||||||||||

| Issuance of convertible notes | 2,923,842 | 575,945 | 2,347,897 | 6,036,297 | ||||||||||||

| Conversion of convertible notes | (50,000 | ) | (13,247 | ) | (36,753 | ) | (85,022 | ) | ||||||||

| Change in fair value of derivatives | - | - | - | (683,403 | ) | |||||||||||

| Balance June 30, 2017 | $ | 3,244,342 | $ | 599,042 | $ | 2,645,300 | $ | 5,694,844 | ||||||||

The following assumptions were used in calculations of the Black Scholes model for the period ended June 30, 2017 and 2016.

| 14 |

| June 30, 2017 | June 30, 2016 | |||||||

| Risk-free interest rates | 0.52-1.38 | % | 0.20-1.01 | % | ||||

| Expected life | 0.49-1.99 year | 0.25-1 year | ||||||

| Expected dividends | 0 | % | 0 | % | ||||

| Expected volatility | 157-284 | % | 142-252 | |||||

| Diego Pellicer Worldwide, Inc. Common Stock fair value | $ | 0.28-0.28 | $ | 0.20 -0.77 | ||||

Note 9 – Stockholder’s Equity (Deficit)

As a condition of their employment, the Board of Directors approved employment agreements with two new executives. This agreement provided among other things that additional shares will be granted each year over the term of the agreement should their shares as granted by this agreement fall below an ownership percentage of 7.5% of the outstanding stock. In addition, the board of directors affirmed an oral commitment that will entitle the CEO an annual grant of additional shares each year should his ownership percentage fall below of 10% of the outstanding stock. The Company has recorded an expense in the quarter ended June 30, 2017 related to the shares which will be issuable under these agreements for $157,096. For the six months ended June 30, 2017 the Company issued shares and options as equity compensation and signing bonuses in the amount of $1,527,713.

The following table presents our warrants and option features which have no observable market data and are derived using Black-Scholes measured at fair value on a recurring basis, using Level 3 inputs, as of December 31, 2016 and June 30, 2017:

For

the Six June 30, 2017 |

For the Year Ended December 31, 2016 |

|||||||

| Annual dividend yield | 0 | % | 0 | % | ||||

| Expected life (years) | 3-10 | 5 | ||||||

| Risk-free interest rate | 1.10 – 2.34 | % | 0.90 | % | ||||

| Expected volatility | 232 - 234 | 266 | ||||||

The following represents a summary of all common stock warrant activity:

Number

of Warrants |

Weighted

Average Price |

Weighted

Average Contractual Term |

||||||||||

| Balance outstanding, December 31, 2016 | 2,027,313 | $ | 1.18 | 3.43 | ||||||||

| Granted | 2,650,000 | - | - | |||||||||

| Balance outstanding, June 30, 2017 | 4,677,313 | $ | 0.65 | 5.34 | ||||||||

| Exercisable, June 30, 2017 | 4,677,313 | $ | 0.65 | 5.34 | ||||||||

The Company maintains an Equity Incentive Plan pursuant to which 2,480,000 shares of Common Stock are reserved for issuance thereunder. This Plan was established to award certain founding members, who were instrumental in the development of the Company, as well as key employees, directors and consultants, and to promote the success of the Company’s business. The terms allow for each option to vest immediately, with a term no greater than 10 years from the date of grant, at an exercise price equal to par value at date of the grant. As of June 30, 2017, no shares had been granted under the plan.

| 15 |

Options have been granted to several executives and consultants as contractual incentives as shown below:

| Number of Options | Weighted Average Exercise Price | Weighted Average Remaining Contractual Term | ||||||||||

| Balance outstanding, March 31, 2017 | 5,899,180 | $ | 0.30 | 4.50 | ||||||||

| Granted | - | - | - | |||||||||

| Exercised | - | - | - | |||||||||

| Forfeited | - | - | - | |||||||||

| Expired | - | - | - | |||||||||

| Balance outstanding, June 30, 2017 | 5,899,180 | $ | 0.26 | 8.67 | ||||||||

| Exercisable, June 30, 2017 | 200,000 | $ | 0.30 | 4.01 | ||||||||

Note 10 – COMMITMENTS AND CONTINGENCIES

The Company’s business is to lease property in appropriate and desirable locations, and to make available such property for sub-lease to specifically assigned businesses that grow, process, and sell certain products to the general public. Currently the Company has four (4) separate properties under lease in the states of Colorado and Washington.

In Colorado, there are three properties leased in 2017 and 2016. Properties were leased for a three (3) to five (5) year period with an option for an additional five (5) years, and carry terms requiring triple net (NNN) conditions. Each of the properties, except for one, have fixed monthly rentals (exclusive of the triple net terms). In Washington, there is one property which was leased in 2014. The property was leased for a five (5) year period with an option for an additional five (5) years, and carry terms requiring triple net (NNN) conditions. The property has an escalating annual rental (exclusive of the triple net terms).

As of June 30, 2017, the aggregate remaining minimal annual lease payments under these operating leases were as follows:

| 2017 | $ | 564,549 | ||

| 2018 | 1,075,271 | |||

| 2019 | 681,504 | |||

| 2020 | 76,163 | |||

| Total | $ | 2,397,487 |

Rent expense for the Company’s operating leases for the three months ended June 30, 2017 and 2016 was $289,918 and $278,921, respectively and for the 6 months ending June 30, 2017 and 2016 was $637,121 and $573,663, respectively.

Note 11 – Subsequent Events

In July 2017, the company closed two convertible notes, one for $63,000 and one for $163,500. Both notes provide that the borrower can convert the principle and accrued interest to a discounted value of common stock at the discretion of the borrower. In addition to the note, 5,109,990 security shares were issued to the note holders.

| 16 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF OPERATIONS

The following discussion and analysis of the results of operations and financial condition of Diego Pellicer Worldwide, Inc. (the “Company”, “we”, “us” or “our”) should be read in conjunction with the financial statements of Diego Pellicer Worldwide, Inc. and the notes to those financial statements that are included elsewhere in this Form 10-Q. This discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under the Risk Factors and Business sections in the financial statements and footnotes included in the Company’s Form 10-K filed on May 31, 2017 for the year ended December 31, 2016. Words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions are used to identify forward-looking statements.

Overview

Diego Pellicer Worldwide, Inc. was established on August 26, 2013 to take advantage of growing market for legalized cannabis being made possible by the escalating legislation allowing for the legalization of cannabis operations in the majority of states:

The industry is operating under stringent regulations within the various state jurisdictions. The company’s primary business plan is to lease, at a premium, various property to licensed operators in these jurisdictions to grow, process and sell cannabis and related products. The Company will also provide educational training, compliance consultation, branding, and related accessories to their tenants. These leases are expected provide a substantial stream of income. We believe that as laws evolve, it is possible that we will have the opportunity to participate directly in these operations. Accordingly, the Company will selectively negotiate an option on our tenants’ operating company.

| 17 |

The company has already established four facilities in markets that have experienced high growth, Washington and Colorado. This growth is illustrated in the tables below:

Source: Washington State Liquor and Cannabis Board and Colorado Department of Revenue

The legalization taking place in other states such as California and Florida present opportunities many time that of Washington and Colorado. The Company is exploring opportunities in Oregon, California and Florida and is getting inquiries from other potential operators in other jurisdictions.

| 18 |

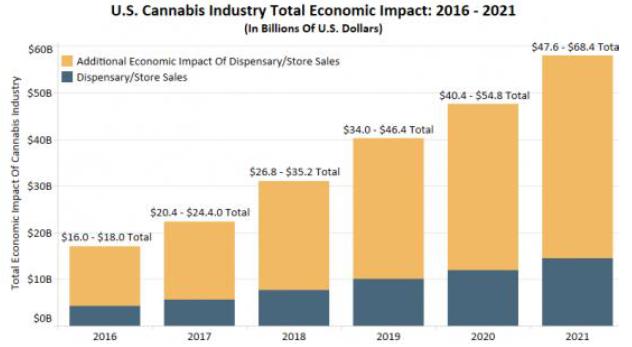

This market is projected to grow rapidly in the future as this chart below illustrates:

Source: Marijuana Business Daily

TRANSITION COSTS

This past six months has been a time of great transition for the company. An effective and experienced team had to be assembled to complement the current executives with knowledge and experience in real estate operations, banking, site selection, branding, facility design, corporate finance, investor relations, Additional capital needed to be raised in order to have sufficient cash to finish construction of the four facilities, build more facilities, and achieve a positive cash flow. Much of the Company’s debt was delinquent needed to be repaid or renegotiated. All the while, new markets had to be explored, new alliances forged and new opportunities prioritized.

Two executives joined the team in the first quarter after having been serving in a consulting capacity since the summer of 2016. One had been the CEO of a publicly traded company for 15 years the other had been a member on the boards of public companies, owned banks, and had extensive real estate operational and negotiation experience. We also engaged an advisor with extensive experience in national brand retail site selection, a consultant for branding and design that had been instrumental in the design of Apple stores and other facilities, and a world-renowned architect to design and standardize our retail facilities.

$740,000 in new capital was raised. New markets explored. Four facilities were opened and generating rents. Delinquent notes were renegotiated. The Company used options to convert to common stock and warrants of common stock to pay for these costs. The non-cash costs of $5,607,836 associated with renegotiating these notes are not capitalized but rather expensed in accordance with GAAP in the six months ended June 30, 2017.

Thus, much of the loss shown on the Income Statement in 2017 is the result of these transitional non-cash expenditures.

| 19 |

RESULTS OF OPERATIONS

After rental expense, the gross margins on the lease were as follows:

| Three Months Ended | Three Months Ended | Increase (Decrease) | ||||||||||||||

| June 30, 2017 | June 30, 2016 | $ | % | |||||||||||||

| Total revenues | ||||||||||||||||

| Rental Income | $ | 545,035 |

$ | 149,601 |

$ | 395,434 |

264 | % | ||||||||

| Rent expense | (289,918 | ) | (278,921 | ) | 10,997 | 4 | % | |||||||||

| Gross Profit | $ | 255,117 | $ | (129,320 | ) | $ | 384,437 | 297 | % | |||||||

| General and administrative expense | 1,674,826 | 2,648,745 | (973,919 | ) | (37 | )% | ||||||||||

| Selling expense | 33,877 | - | 33,877 | * | % | |||||||||||

| Depreciation expense | 108,710 | - | 108,710 | * | % | |||||||||||

| Loss from operations | $ | (1,562,296 | ) | $ | (2,778,065 | ) | $ | (1,215,769 | ) | (44 | )% | |||||

| Six Months Ended | Six Months Ended | Increase (Decrease) | ||||||||||||||

| June 30, 2017 | June 30, 2016 | $ | % | |||||||||||||

| Total revenues | ||||||||||||||||

| Rental Income | $ | 854,997 | $ | 222,868 | $ | 632,129 |

284 | % | ||||||||

| Rent expense | (637,121 | ) | (573,663 | ) | 63,458 | 11 | % | |||||||||

| Gross Profit | $ | 217,876 | $ | (350,795 |

) | $ | 568,671 |

162 |

% | |||||||

| General and administrative expense | 2,567,821 | 3,342,928 |

(775,107 |

) | (23 |

)% | ||||||||||

| Selling expense | 33,889 | - | 33,889 |

* | % | |||||||||||

| Depreciation expense | 239,499 | - | 239,499 |

* | % | |||||||||||

| Loss from operations | $ | (2,623,333 | ) | $ | (3,693,722 |

) | $ | (1,070,389 | ) | (29 | )% | |||||

* Not divisible by zero

Gross profit. Rent revenue exceeded rental expense by $255,117 and 217,876 for the three and six months ended June 30, 2017 respectively, compared to a loss of $129,320 and $350,795 for the for the three and six months ended June 30, 2017 respectively. The increase in gross profit was primarily attributable to rental income from the opening of various locations for our tenants.

General and administrative. Our general and administrative expenses for the three and six months ended June 30, 2017 were $1,674,826, and $2,567,821 respectively, compared to $2,648,745 and $3,342,928 for the three and six months ended June 30, 2016 respectively. The decrease of $775,107 was mostly attributable to a reduction in salaries during the six months ended June 30, 2017.

| 20 |

Three Months Ended | Three Months Ended | Increase (Decrease) | ||||||||||||||

| June 30, 2017 | June 30, 2016 | $ | % | |||||||||||||

| Other income (expense): | ||||||||||||||||

| Interest expense | $ | (446,762 | ) | $ | (58,370 | ) | $ | (388,392 | ) | 665 | % | |||||

| Other income and expense | (5,607,108 | ) | 13,500 | (5,620,608 | ) | (41,634 | )% | |||||||||

| Change in fair value of derivative and warrant liabilities | 632,564 | 110,360 | 522,204 | 473 | % | |||||||||||

| Net other income | $ | (5,421,306 | ) | $ | 65,490 | $ | (5,486,796 | ) | (8,378 | )% | ||||||

Six Months Ended | Six Months Ended | Increase (Decrease) | ||||||||||||||

| June 30, 2017 | June 30, 2016 | $ | % | |||||||||||||

| Other income (expense): | ||||||||||||||||

| Interest expense | $ | (734,998 | ) | $ | (105,656 | ) | $ | (629,342 | ) | (596 | )% | |||||

| Other income and expense | (7,087,480 | ) | 27,000 | (7,114,480 | ) | (26,350 | )% | |||||||||

| Change in fair value of derivative and warrant liabilities | 683,403 | 106,336 | 410,774 | (372 | )% | |||||||||||

| Net other income | $ | (5,669,079 | ) | $ | 27,680 | $ | (6,023,759 | ) | (21,762 | )% | ||||||

* Not divisible by zero

The increase of $6,023,759 for the six months ended June 30, 2017 over the six months ended June 30, 2016 was largely the result of the expensing of the entire financing costs for the convertible notes issued in the second quarter in connection with the refinancing of notes that had come due.

LIQUIDITY AND CAPITAL RESOURCES

| Six Months Ended | Six Months Ended | Increase (Decrease) | ||||||||||||||

| June 30, 2017 | June 30, 2016 | $ | % | |||||||||||||

| Net Cash used in operating activities | $ | (528,739 | ) | $ | (340,865 | ) | (187,874 | ) | $ | 55 | % | |||||

| Net Cash used in investing activities | (125,000 | ) | (394,090 | ) | $ | 269,090 | (68 | )% | ||||||||

| Net Cash used by financing activities | 610,950 | 715,001 | 104,051 | (15 | )% | |||||||||||

| Net Increase in Cash | (42,789 | ) | (19,954 | ) | 22,835 | 114 | % | |||||||||

| Cash - beginning of period | 51,333 | 36,001 | 15,332 | 43 | % | |||||||||||

| Cash - end of period | $ | 8,544 | $ | 16,047 | $ | (7,503 | ) | (47 | )% | |||||||

Net Cash used in Operating Activities. For the Six months ended June 30, 2017, the operations used net cash of $528,739 due to a net loss.

Investing Activities. The cash used in investing activities for the six months ended June 30, 2017 of $125,000 for acquisition of property and equipment for facility construction.

Financing Activities. During the Six months ended June 30, 2017, $740,000 in proceeds were from convertible notes payable and there was a repayment of 129,050 for a note payable. During the Six months ended June 30, 2016, we received $715,001 from proceeds from note payable.

| 21 |

Non-Cash Investing and Financing Activities. Non-cash activities for the six months ended June 30, 2017 was the conversion of a convertible note for $50,000 in principal and $3,303 in interest. 469,260 shares of common stock were issued for this conversion.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

ITEM 4. CONTROLS AND PROCEDURES.

We carried out an evaluation required by Rule 13a-15 of the Exchange Act under the supervision and with the participation of our management, including our principal executive officer and principal financial officer, of the effectiveness of the design and operation of the Company’s “disclosure controls and procedures” and “internal control over financial reporting” as of the end of the period covered by this Report.

Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act that are designed to ensure that information required to be disclosed in our reports filed or submitted to the SEC under the Exchange Act is recorded, processed, summarized and reported within the time periods specified by the SEC’s rules and forms, and that information is accumulated and communicated to management, including the principal executive and financial officer as appropriate, to allow timely decisions regarding required disclosures. Our principal executive officer and principal financial officer evaluated the effectiveness of disclosure controls and procedures as of the end of the period covered by this Annual Report (the “Evaluation Date”), pursuant to Rule 13a-15(b) under the Exchange Act.

Based on that evaluation, our principal executive officer and principal financial officer concluded that, as of the Evaluation Date, our disclosure controls and procedures were not effective to ensure that information required to be disclosed in our reports under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to management, including our principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure, due to material weaknesses in our control environment and financial reporting process.

Limitations on the Effectiveness of Controls

Our management, including our principal executive officer and principal financial officer, does not expect that our Disclosure Controls and internal controls will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision- making can be faulty, and that breakdowns can occur because of a simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management or board override of the control.

| 22 |

The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions; over time, controls may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate.

Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

Changes in Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting during the three months ended June 30, 2017 that materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

| 23 |

We are currently not involved in any litigation that we believe could have a material adverse effect on our financial condition or results of operations. There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our company or any of our subsidiaries, threatened against or affecting our company, our common stock, any of our subsidiaries or of our companies or our subsidiaries’ officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

None.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

None.

| Exhibits | ||

| 31.1 | Certification of Principal Executive Officer of the Registrant pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| 31.2 | Certification of Principal Financial Officer of the Registrant pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| 32.1* | Certification of Principal Executive Officer pursuant to 18U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

| 32.2* | Certification of Principal Financial Officer of the Registrant pursuant to 18U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

| 101.INS | XBRL Instance Document | |

| 101.SCH | XBRL Taxonomy Schema | |

| 101.CAL | XBRL Taxonomy Calculation Linkbase |

| 24 |

| 101.DEF | XBRL Taxonomy Definition Linkbase | |

| 101.LAB | XBRL Taxonomy Label Linkbase | |

| 101.PRE | XBRL Taxonomy Presentation Linkbase |

*In accordance with SEC Release 33-8238, Exhibit 32.1 and 32.2 are being furnished and not filed.

| 25 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| DIEGO PELLICER WORLDWIDE, INC. | ||

| Date: August 29, 2017 | By: | /s/ Ron Throgmartin |

| Ron Throgmartin, Chief Executive Officer | ||

| (Principal Executive Officer) | ||

| 26 |