Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-196965

The information in this preliminary prospectus supplement and the accompanying prospectus is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell nor do they seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion.

Preliminary Prospectus Supplement dated June 23, 2014.

Prospectus Supplement

(To Prospectus dated June 23, 2014)

Shares

$100,000,000

Ordinary Shares

Prothena Corporation plc is offering $100,000,000 of its ordinary shares.

Our ordinary shares are listed on The NASDAQ Global Select Market under the symbol “PRTA.” On June 20, 2014, the last reported sale price of our ordinary shares on The NASDAQ Global Select Market was $23.63 per ordinary share.

We are an “emerging growth company” as that term is defined under the federal securities laws of the United States and, as such, may elect to comply with certain reduced public company reporting requirements for this prospectus supplement and future filings.

Entities managed by Woodford Investment Management LLP have indicated an interest in purchasing approximately $50 million of our ordinary shares in this offering at the public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, fewer or no shares to these entities and these entities could determine to purchase more, fewer or no shares in this offering. Any ordinary shares sold to these entities will be purchased by the underwriters at the public offering price without the underwriting discount.

Investing in our ordinary shares involves risks that are described in the “Risk Factors” section beginning on page S-6 of this prospectus supplement.

| Per Share |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount (1)(2) |

$ | $ | ||||||

| Proceeds, before expenses, to Prothena Corporation plc |

$ | $ | ||||||

| (1) | See “Underwriting” in this prospectus supplement for a description of the compensation payable to the underwriters. |

| (2) | No underwriting discount will apply to any ordinary shares sold to entities managed by Woodford Investment Management LLP. |

We have granted to the underwriters the right to subscribe for up to an aggregate of $15,000,000 of additional ordinary shares at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ordinary shares to investors on or about , 2014.

| BofA Merrill Lynch | Credit Suisse | RBC Capital Markets | ||

| Wedbush PacGrow Life Sciences | Ladenburg Thalmann | |||

The date of this prospectus supplement is , 2014.

Table of Contents

| S-1 | ||||

| S-5 | ||||

| S-6 | ||||

| S-34 | ||||

| S-35 | ||||

| S-36 | ||||

| S-37 | ||||

| S-38 | ||||

| S-39 | ||||

| MATERIAL UNITED STATES FEDERAL INCOME TAX CONSEQUENCES TO U.S. HOLDERS |

S-40 | |||

| CERTAIN IRISH TAX CONSEQUENCES RELATING TO THE HOLDING OF OUR ORDINARY SHARES |

S-45 | |||

| S-47 | ||||

| S-54 | ||||

| S-54 | ||||

| WHERE YOU CAN FIND MORE INFORMATION | S-54 | |||

| 1 | ||||

| WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE |

2 | |||

| 4 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 22 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

Neither we nor the underwriters have authorized anyone to provide you with information that is different from that contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell ordinary shares and seeking offers to buy ordinary shares only in jurisdictions where offers and sales are permitted. The information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus is accurate only as of the date on the front of this prospectus supplement, regardless of the time of delivery of this prospectus supplement or any sale of our ordinary shares.

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering of ordinary shares and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus dated June 23, 2014, provides more general information about our ordinary shares. To the extent the information contained in this prospectus supplement differs or varies from the information contained in the accompanying prospectus or the documents incorporated by reference, you should rely on the information in this prospectus supplement. Generally, when we refer to the prospectus, we are referring to this prospectus supplement and the accompanying prospectus combined.

Prothena and our logo are our trademarks and are used in this prospectus supplement and the accompanying prospectus. This prospectus supplement and the accompanying prospectus also include

S-i

Table of Contents

trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, our trademarks and tradenames referred to in this prospectus supplement and the accompanying prospectus appear without the ™ symbol, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and tradenames.

For investors outside the United States: Neither we nor the underwriters have taken any action that would permit this offering or possession or distribution of this prospectus supplement and the accompanying prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons who have come into possession of this prospectus supplement and the accompanying prospectus in a jurisdiction outside the United States are required to inform themselves about and to observe any restrictions relating to this offering and the distribution of this prospectus supplement and the accompanying prospectus.

S-ii

Table of Contents

The items in the following summary are described in more detail later or incorporated by reference in this prospectus supplement and the accompanying prospectus. This summary provides an overview of selected information and does not contain all of the information you should consider before buying our ordinary shares. Therefore, you should read the entire prospectus supplement and the accompanying prospectus carefully (including the documents incorporated by reference herein), especially the “Risk Factors” section beginning on page S-6 and our consolidated financial statements (which we refer to as our “Financial Statements”) and the related notes incorporated by reference in this prospectus supplement and the accompanying prospectus, before deciding to invest in our ordinary shares. In this prospectus supplement and the accompanying prospectus, unless the context otherwise requires, references to “we,” “us,” “our,” or “Prothena,” refer to Prothena Corporation plc.

Overview

We are a clinical stage biotechnology company focused on the discovery, development and commercialization of novel antibodies for the potential treatment of diseases that involve protein misfolding or cell adhesion. We focus on therapeutic monoclonal antibodies directed specifically to disease causing proteins. Our antibody-based product candidates target a number of potential indications including AL and AA forms of amyloidosis (NEOD001), Parkinson’s disease and other related synucleinopathies (PRX002) and novel cell adhesion targets involved in inflammatory diseases and cancers (PRX003). Our lead programs consist of two clinical development programs and one late stage preclinical program:

| • | NEOD001 is a monoclonal antibody that specifically targets the amyloid that accumulates in both AL and AA forms of amyloidosis. NEOD001 was granted orphan drug designation for the treatment of AL and AA amyloidosis by the U.S. Food and Drug Administration, or FDA, in 2012 and for the treatment of AL amyloidosis by the European Medicines Agency, or EMA, in 2013. The ongoing multi-center Phase 1 clinical trial is evaluating the safety, tolerability, pharmacokinetics and immunogenicity of NEOD001 in patients with AL amyloidosis and persistent organ dysfunction. The study is designed to define a maximally tolerated dose and/or recommended dose(s) for Phase 2/3. The study is also evaluating exploratory biomarkers for cardiac, renal and hepatic function. We anticipate initiating a Phase 2/3 trial of NEOD001 in the fourth quarter of 2014. |

| • | PRX002 is a monoclonal antibody targeting alpha-synuclein whose efficacy has been tested in various cellular and animal models of synuclein-related disease. Passive immunization with 9E4, the murine version of PRX002, in multiple transgenic mouse models of Parkinson’s disease reduced the appearance of synuclein pathology, protected synaptic connections and improved performance by the mice in behavioral testing. PRX002 may slow or reduce the progressive neurodegeneration associated with synuclein misfolding and/or the cell-to-cell transmission of the pathogenic forms of synuclein. In December 2013, we entered into a License, Development, and Commercialization Agreement, or the License Agreement, with F. Hoffmann-La Roche Ltd and Hoffmann-La Roche Inc., or collectively, Roche, to develop and commercialize, and in the United States, co-develop and potentially co-promote, certain anti-alpha-synuclein antibodies, including PRX002, for the treatment of Parkinson’s disease and other related synucleinopathies, which are referred to in this prospectus supplement collectively as “Licensed Products.” Under the terms of the License Agreement, upon the satisfaction of certain milestones, we may receive up to an aggregate of $600 million in upfront and milestone payments, of which we have received upfront and milestone payments totaling $45.0 million in the first half of 2014. In the United States, we and Roche will share all development and commercialization costs, as well as profits, on a 70/30 basis (70% Roche |

S-1

Table of Contents

| and 30% Prothena), for PRX002 in the Parkinson’s disease indication, as well as any other Licensed Products and/or indications for which we opt in to co-develop and co-fund. Outside the United States, Roche will have sole responsibility for developing and commercializing PRX002 and will pay us up to double-digit royalties on net sales. We initiated a Phase 1 trial of PRX002 in April 2014. |

| • | PRX003 is a monoclonal antibody targeting MCAM (melanoma cell adhesion molecule) for the potential treatment of inflammatory diseases and cancers. We have advanced PRX003 into manufacturing and preclinical safety testing. We anticipate initiating a Phase 1 trial of PRX003 in 2015. |

Our strategy is to identify antibody candidates for clinical development and commercialization by applying our extensive expertise in generating novel therapeutic antibodies and working with collaborators having expertise in specific animal models of disease.

We are a public limited company formed under the laws of Ireland. On December 20, 2012, we separated from Elan Corporation Limited (formerly Elan Corporation, plc), or Elan, which subsequently became a wholly owned subsidiary of Perrigo Company plc, or Perrigo. Our ordinary shares trade on The NASDAQ Global Select Market under the symbol PRTA.

Recent Developments

NEOD001

In April 2014, we announced interim findings from the ongoing Phase 1 clinical trial of NEOD001 and presented these interim results at the XIV International Symposium on Amyloidosis, or ISA, conference in Indianapolis, Indiana.

Of the 18 patients enrolled in the study as of March 11, 2014, ten patients (56%) with cardiac involvement had pre-specified baseline levels of the N-terminal prohormone of brain natriuretic peptide, or NT-proBNP, that were > 650 pg/mL (required baseline level for evaluation). In the study, patients with cardiac involvement improve (“response”) or worsen (“progression”) based on pre-defined NT-proBNP criteria. NT-proBNP is a biomarker for heart failure that is being used on an exploratory basis in this Phase 1 trial as a marker of AL disease progression or response. The pre-defined NT-proBNP response criteria is a >30% and >300 pg/mL decrease in patients with baseline NT-proBNP >650 pg/mL. The pre-defined NT-proBNP progression criteria is a >30% and >300 pg/mL increase in patients with baseline NT-proBNP >650 pg/mL. Patients who are not NT-proBNP responders or progressors are considered to be stable.

Evidence of Cardiac Biomarker Activity

Of the ten patients with NT-proBNP screening values of >650 pg/mL, nine patients had at least one post-baseline NT-proBNP determination as of the interim cut-off date. Of those nine evaluable patients, eight patients either met the response criteria based on a decrease in NT-proBNP or were considered stable, and the remaining patient met the progression criteria based on an increase of NT-proBNP. Specifically, five of nine (56%) patients had NT-proBNP levels that decreased to a level that met pre-defined response criteria, three of nine (33%) patients had stable NT-proBNP levels, and one of nine (11%) patients had NT-proBNP levels that increased to a level that met pre-defined progression criteria.

S-2

Table of Contents

Safety and Tolerability

The interim Phase 1 data demonstrated that NEOD001 appeared to be generally safe and well-tolerated at the doses studied. The most frequently reported adverse events (reported by > 10% patients) as of the data cut-off date were: dyspnea (n=4), fatigue (n=3), cough (n=1), diarrhea (n=2), hyponatremia (n=2), insomnia (n=2), productive cough (n=2) and upper respiratory infection (n=2). No dose limiting toxicities were observed. A total of four patients had discontinued the trial as of the March 11, 2014 data cut-off: two due to organ progression; one due to hematological progression; and one due to withdrawal of consent.

Pharmacokinetics and Immunogenicity

The interim pharmacokinetic data suggested a terminal elimination half-life across all dose levels of approximately 12 days and supported the 28-day dosing interval utilized in the study. Immunogenicity, including anti-NEOD001 response, was not observed in any patient through the interim cut-off date.

PRX002

In April 2014, we initiated a Phase 1 clinical trial of PRX002. The study is a randomized, double-blind, placebo-controlled, single ascending dose study in healthy subjects. It is designed to assess PRX002 for safety, tolerability, pharmacokinetics and immunogenicity. As a result of the initiation of this trial, we received a $15.0 million milestone payment from Roche under the License Agreement, bringing the total amount received to date under the License Agreement to $45.0 million.

Research and Development Pipeline

Lead Programs

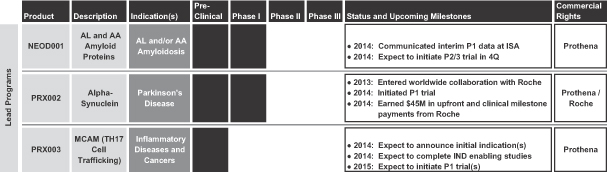

Our research and development pipeline includes three lead therapeutic antibody programs that we intend to advance: NEOD001 for the potential treatment of AL and AA amyloidosis; PRX002 for the potential treatment of Parkinson’s disease and other related synucleinopathies; and PRX003 for the potential treatment of inflammatory diseases and cancers.

The following table summarizes the status and anticipated upcoming milestones of our research and development pipeline for our lead programs:

S-3

Table of Contents

Discovery Programs

Our pipeline also includes several discovery stage programs for which we are testing the efficacy of antibodies in preclinical models of disease. We are also generating additional novel antibodies against other targets involved in protein misfolding or cell adhesion for characterization in vivo and in vitro. If promising, we expect that some of these antibodies will advance to preclinical development.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. For further information, please see “Risk Factors—For as long as we are an emerging growth company, we will be exempt from certain reporting requirements, including those relating to accounting standards and disclosure about our executive compensation, that apply to other public companies.”

S-4

Table of Contents

| Ordinary shares we are offering |

$100,000,000 of ordinary shares (or $115,000,000 of ordinary shares if the underwriters exercise in full their option to subscribe for additional shares). |

| Ordinary shares to be outstanding after the offering |

ordinary shares (or ordinary shares if the underwriters exercise in full their option to subscribe for additional shares). |

| Use of proceeds |

We currently intend to use the net proceeds from this offering for the continued research and development of our product candidates, including clinical trials for PRX003 and drug discovery activities, preclinical and clinical trials for potential product candidates targeting misfolded proteins for potentially multiple indications. Net proceeds not used for the development of these product candidates may be used for working capital and other general corporate purposes. Our management will have broad discretion over the use of the net proceeds from this offering. See “Use of Proceeds” on page S-36 of this Prospectus Supplement. |

| Risk factors |

See “Risk Factors” beginning on page S-6 and other information included in this prospectus supplement and the accompanying prospectus for a discussion of factors that you should consider carefully before deciding to invest in our ordinary shares. |

| Symbol on The NASDAQ Global Select Market |

“PRTA” |

Entities managed by Woodford Investment Management LLP have indicated an interest in purchasing approximately $50 million of our ordinary shares in this offering at the public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, fewer or no shares to these entities and these entities could determine to purchase more, fewer or no shares in this offering. Any ordinary shares sold to these entities will be purchased by the underwriters at the public offering price without the underwriting discount.

The number of ordinary shares to be outstanding after this offering is based on 21,904,780 ordinary shares outstanding as of March 31, 2014, and excludes the following:

| • | 2,433,981 ordinary shares issuable upon the exercise of outstanding options as of March 31, 2014 having a weighted-average exercise price of approximately $12.19 per share; and |

| • | 167,500 ordinary shares reserved for issuance pursuant to future awards under our 2012 Long Term Incentive Plan as of March 31, 2014 (plus an additional 2,900,000 ordinary shares reserved for issuance pursuant to future awards under our Amended and Restated 2012 Long Term Incentive Plan, as approved by our shareholders on May 21, 2014). |

Unless otherwise indicated, all information in this prospectus supplement assumes:

| • | no exercise of options outstanding as of March 31, 2014; and |

| • | no exercise of the underwriters’ option to subscribe for additional ordinary shares. |

S-5

Table of Contents

Investing in our ordinary shares involves a high degree of risk. You should carefully consider the risks described below, as well as the other information included in and incorporated by reference in this prospectus supplement and the accompanying prospectus, including our Financial Statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” included in our periodic reports filed with the Securities and Exchange Commission and incorporated by reference into this prospectus supplement and the accompanying prospectus, before deciding whether to invest in our ordinary shares. The occurrence of any of the events or developments described below could harm our business, financial condition, results of operations and growth prospects. In such an event, the market price of our ordinary shares could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

Risks Relating to Our Financial Position, Our Need for Additional Capital and Our Business

We anticipate that we will incur losses for the foreseeable future and we may never sustain profitability.

We may not generate the cash that is necessary to finance our operations in the foreseeable future. We incurred net losses of $41.0 million, $41.4 million and $29.7 million for the years ended December 31, 2013, 2012 and 2011, respectively. Although we achieved net income of $17.9 million in the first quarter of 2014, primarily as a result of the $30.0 million upfront milestone payment under the License Agreement, we expect to incur substantial losses for the foreseeable future as we:

| • | conduct our Phase 1 clinical trials for NEOD001 and PRX002 and initiate additional clinical trials, if supported by the results of these Phase 1 trials; |

| • | develop and commercialize our product candidates, including NEOD001, PRX002 and PRX003 and any other antibodies targeting alpha-synuclein pursuant to our License Agreement with Roche; |

| • | complete preclinical development of other product candidates and initiate clinical trials, if supported by positive preclinical data; and |

| • | pursue our early stage research and seek to identify additional drug candidates and potentially acquire rights from third parties to drug candidates through licenses, acquisitions or other means. |

We must generate significant revenue to achieve and maintain profitability. Even if we succeed in discovering, developing and commercializing one or more drug candidates, we may not be able to generate sufficient revenue and we may never be able to sustain profitability.

We will require additional capital to fund our operations, and if we are unable to obtain such capital, we will be unable to successfully develop and commercialize drug candidates.

As of March 31, 2014, we had cash and cash equivalents of $195.1 million. In addition, we received a $15.0 million clinical milestone payment from Roche in May 2014. Although we believe, based on our current business plans, that our existing cash and cash equivalents will be sufficient to meet our obligations for at least the next twelve months, we anticipate that we will require additional capital in the future in order to continue the research and development of our drug candidates. Our future capital requirements will depend on many factors that are currently unknown to us, including, without limitation:

| • | the timing of initiation, progress, results and costs of our clinical trials, including our Phase 1 clinical trials for NEOD001 and PRX002, and our development and commercialization activities, including our portion of similar costs relating to PRX002 in the United States pursuant to our License Agreement with Roche; |

S-6

Table of Contents

| • | the results of our research and preclinical studies; |

| • | the costs of clinical manufacturing and of establishing commercial manufacturing arrangements; |

| • | the costs of preparing, filing, and prosecuting patent applications and maintaining, enforcing, and defending intellectual property-related claims; |

| • | our ability to establish research collaborations, strategic collaborations, licensing or other arrangements; |

| • | the costs to satisfy our obligations under potential future collaborations; and |

| • | the timing, receipt, and amount of revenues or royalties, if any, from any approved drug candidates. |

We have based our expectations relating to liquidity and capital resources on assumptions that may prove to be wrong, and we could use our available capital resources sooner than we currently expect. Because of the numerous risks and uncertainties associated with the development and commercialization of our product candidates, we are unable to estimate the amounts of increased capital outlays and operating expenses associated with completing the development of our current product candidates.

We are not able to provide specific estimates of the timelines or total costs to complete the ongoing Phase 1 clinical trial for NEOD001 or PRX002. Under the License Agreement with Roche, we are responsible for 30% of all development and commercialization costs for PRX002 for the treatment of Parkinson’s disease in the United States, and for any future Licensed Products and/or indications that we opt to co-develop in the United States, in each case unless we elect to opt out of profit and loss sharing. Our right to co-develop PRX002 and other Licensed Products under the License Agreement will terminate if we commence certain studies for a competitive product that treats Parkinson’s disease or other indications that we opted to co-develop. In addition, our right to co-promote PRX002 and other Licensed Products will terminate if we commence a Phase 3 study for a competitive product that treats Parkinson’s disease.

In the pharmaceutical industry, the research and development process is lengthy and involves a high degree of risk and uncertainty. This process is conducted in various stages and, during each stage, there is a substantial risk that product candidates in our research and development pipeline will experience difficulties, delays or failures. This makes it difficult to estimate the total costs to complete our ongoing clinical trials and to estimate anticipated completion dates with any degree of accuracy, which raises concerns that attempts to quantify costs and provide estimates of timing may be misleading by implying a greater degree of certainty than actually exists.

In order to develop and obtain regulatory approval for our product candidates we will need to raise substantial additional funds. We expect to raise any such additional funds through public or private equity or debt financings, collaborative agreements with corporate partners or other arrangements. We cannot assure you that additional funds will be available when we need them on terms that are acceptable to us, or at all. General market conditions may make it very difficult for us to seek financing from the capital markets. If we raise additional funds by issuing equity securities, substantial dilution to existing shareholders would result. If we raise additional funds by incurring debt financing, the terms of the debt may involve significant cash payment obligations as well as covenants and specific financial ratios that may restrict our ability to operate our business. We may be required to relinquish rights to our technologies or drug candidates or grant licenses on terms that are not favorable to us in order to raise additional funds through strategic alliances, joint ventures or licensing arrangements.

If adequate funds are not available on a timely basis, we may be required to:

| • | terminate or delay clinical trials or other development for one or more of our drug candidates; |

S-7

Table of Contents

| • | delay arrangements for activities that may be necessary to commercialize our drug candidates; |

| • | curtail or eliminate our drug research and development programs that are designed to identify new drug candidates; or |

| • | cease operations. |

In addition, if we do not meet our payment obligations to third parties as they come due, we may be subject to litigation claims. Even if we are successful in defending against these claims, litigation could result in substantial costs and distract management, and may have unfavorable results that could further adversely impact our financial condition.

Our historical financial information is not necessarily representative of the results we would have achieved as a separate, publicly traded company and may not be a reliable indicator of our future results.

Our financial results previously were included within the consolidated results of Elan; however, we were not directly subject to the reporting and other requirements of the Exchange Act until our separation from Elan on December 20, 2012, which we refer to in this prospectus supplement as the “Separation and Distribution.” The historical financial information we have included or incorporated by reference in this report may not reflect what our results of operations, financial position and cash flows would have been had we been an independent, publicly traded company during the periods presented or what our results of operations, financial position and cash flows will be in the future. This is primarily because:

| • | our historical financial information reflects allocations for services historically provided to us by Elan, which allocations may not reflect the costs we will incur for similar services in the future as an independent company; |

| • | subsequent to the completion of the Separation and Distribution, the cost of capital for our business may be higher than Elan’s cost of capital prior to the Separation and Distribution because Elan’s current cost of debt will likely be lower than ours; and |

| • | our historical financial information does not reflect changes that we have incurred as a result of the separation of the Prothena Business from Elan, including changes in the cost structure, personnel needs, financing and operations of the contributed business as a result of the separation from Elan and from reduced economies of scale. |

We are also responsible for the additional costs associated with being an independent, public company, including costs related to corporate governance and compliance with the rules of The NASDAQ Stock Market, or NASDAQ, and the SEC. In addition, we incur costs and expenses, including professional fees, to comply with Irish corporate and tax laws and financial reporting requirements and costs and expenses incurred in connection with holding the meetings of our board of directors, or our Board, in Ireland. Prior to the Separation and Distribution, the Prothena Business was operated by Elan as part of its broader corporate organization, rather than as an independent company. Elan or one of its affiliates performed various corporate functions for us, including, but not limited to, legal, treasury, accounting, auditing, risk management, information technology, human resources, corporate affairs, tax administration, certain governance functions and external reporting. Our historical financial results include allocations of corporate expenses from Elan for these and similar functions. These allocations of cash and non-cash expenses are less than the comparable expenses we have incurred thus far as a separate publicly traded company. Therefore, our consolidated Financial Statements may not be indicative of our future performance as an independent company. For additional information about our past financial performance and the basis of presentation of our consolidated Financial Statements, please see “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated Financial Statements and the notes thereto included in the periodic reports filed with the SEC that are incorporated by reference into this prospectus supplement.

S-8

Table of Contents

Our future success depends on our ability to retain key personnel and to attract, retain and motivate qualified personnel.

We are highly dependent on key personnel, including Dr. Dale Schenk, our President and Chief Executive Officer. There can be no assurance that we will be able to retain Dr. Schenk or any of our key personnel. The loss of the services of Dr. Schenk or any other person on which we become highly dependent might impede the achievement of our research and development objectives. Recruiting and retaining qualified scientific personnel will also be critical to our success. We may not be able to attract and retain these personnel on acceptable terms given the competition among numerous pharmaceutical and biotechnology companies for similar personnel. We also experience competition for the hiring of scientific personnel from universities and research institutions.

Our collaborators, prospective collaborators and suppliers may need assurances that our financial resources and stability on a stand-alone basis are sufficient to satisfy their requirements for doing or continuing to do business with us.

Some of our collaborators, prospective collaborators and suppliers may need assurances that our financial resources and stability on a stand-alone basis are sufficient to satisfy their requirements for doing or continuing to do business with us. If our collaborators, prospective collaborators or suppliers are not satisfied with our financial resources and stability, it could have a material adverse effect on our ability to develop our drug candidates, enter into licenses or other agreements and on our business, financial condition or results of operations.

The agreements we have entered into with Elan involve conflicts of interest and therefore may have materially disadvantageous terms to us.

We have entered into certain agreements with Elan in connection with the Separation and Distribution, which set forth the main terms of the separation and provide a framework for our initial relationship with Elan. These agreements may have terms that are materially disadvantageous to us or are otherwise not as favorable as those that might be negotiated between unaffiliated third parties. In December 2013, Elan was acquired by Perrigo and in February 2014, Perrigo caused Elan to sell all of its shares of Prothena in an underwritten offering. As a result of the acquisition of Elan by Perrigo and the subsequent sale of all of its shares of Prothena, Perrigo/Elan may be less willing to collaborate with us in connection with the agreements to which we and Elan are a party and other matters.

Risks Related to the Discovery, Development and Regulatory Approval of Drug Candidates

Our success is largely dependent on the success of our research and development programs, which are at an early stage. Our drug candidates are still in early stages of development and we may not be able to successfully discover, develop, obtain regulatory approval for or commercialize any drug candidates.

The success of our business depends substantially upon our ability to discover, develop, obtain regulatory approval for and commercialize our drug candidates successfully. Our research and development programs are prone to the significant and likely risks of failure inherent in drug development. We intend to continue to invest most of our time and financial resources in our research and development programs. Although we have initiated Phase 1 clinical trials for each of NEOD001 and PRX002, there is no assurance that these clinical trials will support further development of these drug candidates. In addition, we currently do not, and may never, have any other drug candidates in clinical trials and we have not identified drug candidates for many of our research programs.

Before obtaining regulatory approvals for the commercial sale of any drug candidate for a target indication, we must demonstrate with substantial evidence gathered in adequate and well-controlled clinical

S-9

Table of Contents

trials, and, with respect to approval in the United States, to the satisfaction of the FDA or, with respect to approval in other countries, similar regulatory authorities in those countries, that the drug candidate is safe and effective for use for that target indication. Satisfaction of these and other regulatory requirements is costly, time consuming, uncertain, and subject to unanticipated delays. Despite our efforts, our drug candidates may not:

| • | offer improvement over existing, comparable products; |

| • | be proven safe and effective in clinical trials; or |

| • | meet applicable regulatory standards. |

Positive results in preclinical studies of a drug candidate may not be predictive of similar results in humans during clinical trials, and promising results from early clinical trials of a drug candidate may not be replicated in later clinical trials. Interim results of a clinical trial do not necessarily predict final results. A number of companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in late-stage clinical trials even after achieving promising results in early-stage development. Accordingly, the results from completed preclinical studies and clinical trials for our drug candidates may not be predictive of the results we may obtain in later stage trials or studies. Our preclinical studies or clinical trials may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional preclinical studies or clinical trials, or to discontinue clinical trials altogether.

Furthermore, we have not marketed, distributed or sold any products. Our success will, in addition to the factors discussed above, depend on the successful commercialization of our drug candidates, which may require:

| • | obtaining and maintaining commercial manufacturing arrangements with third-party manufacturers; |

| • | collaborating with pharmaceutical companies or contract sales organizations to market and sell any approved drug; or |

| • | acceptance of any approved drug in the medical community and by patients and third-party payors. |

Many of these factors are beyond our control. We do not expect any of our drug candidates to be commercially available for several years and some or all may never become commercially available. Accordingly, we may never generate revenues through the sale of products.

If clinical trials of our drug candidates are prolonged, delayed, suspended or terminated, we may be unable to commercialize our drug candidates on a timely basis, which would require us to incur additional costs and delay our receipt of any revenue from potential product sales.

We cannot predict whether we will encounter problems with our Phase 1 clinical trials for NEOD001 or PRX002, or any future clinical trials that will cause us or any regulatory authority to delay or suspend those clinical trials or delay the analysis of data derived from them. A number of events, including any of the following, could delay the completion of our planned clinical trials and negatively impact our ability to obtain regulatory approval for, and to market and sell, a particular drug candidate:

| • | conditions imposed on us by the FDA or any foreign regulatory authority regarding the scope or design of our clinical trials; |

| • | delays in obtaining, or our inability to obtain, required approvals from institutional review boards, or IRBs, or other reviewing entities at clinical sites selected for participation in our clinical trials; |

| • | insufficient supply or deficient quality of our drug candidates or other materials necessary to conduct our clinical trials; |

S-10

Table of Contents

| • | delays in obtaining regulatory agency agreement for the conduct of our clinical trials; |

| • | lower than anticipated enrollment and retention rate of subjects in clinical trials for a variety of reasons, including size of patient population, nature of trial protocol, the availability of approved effective treatments for the relevant disease and competition from other clinical trial programs for similar indications; |

| • | serious and unexpected drug-related side effects experienced by patients in clinical trials; or |

| • | failure of our third-party contractors to meet their contractual obligations to us in a timely manner. |

Clinical trials may also be delayed or terminated as a result of ambiguous or negative interim results. In addition, a clinical trial may be suspended or terminated by us, the FDA, the IRBs at the sites where the IRBs are overseeing a trial, or a data safety monitoring board, or DSMB, overseeing the clinical trial at issue, or other regulatory authorities due to a number of factors, including:

| • | failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols; |

| • | inspection of the clinical trial operations or trial sites by the FDA or other regulatory authorities resulting in the imposition of a clinical hold; |

| • | varying interpretation of data by the FDA or other regulatory authorities; |

| • | requirement by the FDA or other regulatory authorities to perform additional studies; |

| • | failure to achieve primary or secondary endpoints or other failure to demonstrate efficacy; |

| • | unforeseen safety issues; or |

| • | lack of adequate funding to continue the clinical trial. |

Additionally, changes in regulatory requirements and guidance may occur and we may need to amend clinical trial protocols to reflect these changes. Amendments may require us to resubmit our clinical trial protocols to regulatory authorities and IRBs for reexamination, which may impact the cost, timing or successful completion of a clinical trial.

We do not know whether our clinical trials will be conducted as planned, will need to be restructured or will be completed on schedule, if at all. Delays in our clinical trials will result in increased development costs for our drug candidates. In addition, if we experience delays in the completion of, or if we terminate, any of our clinical trials, the commercial prospects for our drug candidates may be harmed and our ability to generate product revenues will be jeopardized. Furthermore, many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of a drug candidate.

The regulatory approval processes of the FDA and comparable foreign authorities are lengthy, time consuming and inherently unpredictable, and if we are ultimately unable to obtain regulatory approval for our drug candidates, our business will be substantially harmed.

The time required to obtain approval by the FDA and comparable foreign authorities is inherently unpredictable but typically takes many years following the commencement of clinical trials and depends upon numerous factors, including the substantial discretion of the regulatory authorities. In addition, approval policies,

S-11

Table of Contents

regulations, or the type and amount of clinical data necessary to gain approval may change during the course of a drug candidate’s clinical development and may vary among jurisdictions. We have not obtained regulatory approval for any drug candidate and it is possible that none of our existing drug candidates or any drug candidates we may seek to develop in the future will ever obtain regulatory approval.

Our drug candidates could fail to receive regulatory approval for many reasons, including the following:

| • | the FDA or comparable foreign regulatory authorities may disagree with the design or implementation of our clinical trials; |

| • | we may be unable to demonstrate to the satisfaction of the FDA or comparable foreign regulatory authorities that a drug candidate is safe and effective for its proposed indication; |

| • | the results of clinical trials may not meet the level of statistical significance required by the FDA or comparable foreign regulatory authorities for approval; |

| • | we may be unable to demonstrate that a drug candidate’s clinical and other benefits outweigh its safety risks; |

| • | the FDA or comparable foreign regulatory authorities may disagree with our interpretation of data from preclinical studies or clinical trials; |

| • | the data collected from clinical trials of our drug candidates may not be sufficient to support the submission of a Biologics License Application, or BLA, or other submission or to obtain regulatory approval in the United States or elsewhere; |

| • | the FDA or comparable foreign regulatory authorities may fail to approve the manufacturing processes or facilities of third-party manufacturers with which we contract for clinical and commercial supplies; or |

| • | the approval policies or regulations of the FDA or comparable foreign regulatory authorities may significantly change in a manner rendering our clinical data insufficient for approval. |

This lengthy approval process as well as the unpredictability of future clinical trial results may result in our failing to obtain regulatory approval to market our drug candidates, which would significantly harm our business, results of operations and prospects. In addition, even if we were to obtain approval, regulatory authorities may approve any of our drug candidates for fewer or more limited indications than we request, may not approve the price we intend to charge for our products, may grant approval contingent on the performance of costly post-marketing clinical trials, or may approve a drug candidate with a label that does not include the labeling claims necessary or desirable for the successful commercialization of that drug candidate. Any of the foregoing scenarios could materially harm the commercial prospects for our drug candidates.

We rely on obtaining and maintaining orphan drug exclusivity for NEOD001, if approved, but cannot ensure that we will enjoy market exclusivity in a particular market.

NEOD001 has been granted orphan drug designation by the FDA for the treatment of AL and AA amyloidosis and by the European Medicines Agency, or EMA, for the treatment of AL amyloidosis. Under the Orphan Drug Act, the FDA may designate a product as an orphan drug if it is intended to treat a rare disease or condition, defined as a disease or condition that affects a patient population of fewer than 200,000 in the United States, or a patient population greater than 200,000 in the United States where there is no reasonable expectation that the cost of developing the drug will be recovered from sales in the United States. In the European Union, the EMA’s Committee for Orphan Medicinal Products, or COMP, grants orphan drug designation to promote the

S-12

Table of Contents

development of products that are intended for the diagnosis, prevention, or treatment of a life-threatening or chronically debilitating condition affecting not more than five in 10,000 persons in the European Union. Additionally, designation is granted for products intended for the diagnosis, prevention, or treatment of a life-threatening, seriously debilitating or serious and chronic condition when, without incentives, it is unlikely that sales of the drug in the European Union would be sufficient to justify the necessary investment in developing the drug or biological product or where there is no satisfactory method of diagnosis, prevention, or treatment, or, if such a method exists, the medicine must be of significant benefit to those affected by the condition.

In the United States, orphan drug designation entitles a party to financial incentives such as opportunities for grant funding towards clinical trial costs, tax advantages, and user-fee waivers. In addition, if a product receives the first FDA approval for the indication for which it has orphan designation, the product is entitled to orphan drug exclusivity, which means the FDA may not approve any other application to market the same drug for the same indication for a period of seven years, except in limited circumstances, such as a showing of clinical superiority over the product with orphan exclusivity or where the manufacturer is unable to assure sufficient product quantity. In the European Union, orphan drug designation entitles a party to financial incentives such as reduction of fees or fee waivers and ten years of market exclusivity following drug or biological product approval. This period may be reduced to six years if the orphan drug designation criteria are no longer met, including where it is shown that the product is sufficiently profitable not to justify maintenance of market exclusivity.

Even though we have obtained orphan drug designation for NEOD001 in the United States and Europe, we may not be the first to obtain marketing approval for any particular orphan indication due to the uncertainties associated with developing pharmaceutical products. Further, even if we obtain orphan drug designation for a product, that exclusivity may not effectively protect the product from competition from different drugs with different active moieties which may be approved for the same condition. Orphan drug designation neither shortens the development time or regulatory review time of a drug nor gives the drug any advantage in the regulatory review or approval process. Even if one of our drug candidates receives orphan exclusivity, the FDA may still approve other drugs that have a different active ingredient for use in treating the same indication or disease, or may approve an application to market the same drug for the same indication that shows clinical superiority over our product. Furthermore, the FDA may waive orphan exclusivity if we are unable to manufacture sufficient supply of our product.

Even if our drug candidates receive regulatory approval in the United States, we may never receive approval or commercialize our products outside of the United States.

In order to market any products outside of the United States, we must establish and comply with numerous and varying regulatory requirements of other countries regarding safety and efficacy. Approval procedures vary among countries and can involve additional product testing and additional administrative review periods. The time required to obtain approval in other countries might differ from that required to obtain FDA approval. The regulatory approval process in other countries may include all of the risks detailed above regarding FDA approval in the United States as well as other risks. Regulatory approval in one country does not ensure regulatory approval in another, but a failure or delay in obtaining regulatory approval in one country may have a negative effect on the regulatory process in others. Failure to obtain regulatory approval in other countries or any delay or setback in obtaining such approval would impair our ability to develop foreign markets for our drug candidates.

Both before and after marketing approval, our drug candidates are subject to ongoing regulatory requirements and continued regulatory review, and if we fail to comply with these continuing requirements, we could be subject to a variety of sanctions and the sale of any approved products could be suspended.

Both before and after regulatory approval to market a particular drug candidate, the manufacturing, labeling, packaging, adverse event reporting, storage, advertising, promotion, distribution and record keeping

S-13

Table of Contents

related to the product are subject to extensive, ongoing regulatory requirements. These requirements include submissions of safety and other post-marketing information and reports, registration, as well as continued compliance with current good manufacturing practice, or cGMP, requirements and current good clinical practice, or cGCP, requirements for any clinical trials that we conduct post-approval. Any regulatory approvals that we receive for our drug candidates may also be subject to limitations on the approved indicated uses for which the product may be marketed or to the conditions of approval, or contain requirements for potentially costly post-marketing testing, including Phase IV clinical trials, and surveillance to monitor the safety and efficacy of the drug candidate. Later discovery of previously unknown problems with a product, including adverse events of unanticipated severity or frequency, or with our third-party manufacturers or manufacturing processes, or failure to comply with the regulatory requirements of the FDA and other applicable U.S. and foreign regulatory authorities could subject us to administrative or judicially imposed sanctions, including:

| • | restrictions on the marketing of our products or their manufacturing processes; |

| • | warning letters; |

| • | civil or criminal penalties; |

| • | fines; |

| • | injunctions; |

| • | product seizures or detentions; |

| • | import or export bans; |

| • | voluntary or mandatory product recalls and related publicity requirements; |

| • | suspension or withdrawal of regulatory approvals; |

| • | total or partial suspension of production; and |

| • | refusal to approve pending applications for marketing approval of new products or supplements to approved applications. |

The FDA’s policies may change and additional government regulations may be enacted that could prevent, limit or delay regulatory approval of our drug candidates. If we are slow or unable to adapt to changes in existing requirements or the adoption of new requirements or policies, or if we are not able to maintain regulatory compliance, we may lose any marketing approval that we may have obtained, which would adversely affect our business, prospects and ability to achieve or sustain profitability.

If side effects are identified during the time our drug candidates are in development or after they are approved and on the market, we may choose to or be required to perform lengthy additional clinical trials, discontinue development of the affected drug candidate, change the labeling of any such products, or withdraw any such products from the market, any of which would hinder or preclude our ability to generate revenues.

Undesirable side effects caused by our drug candidates could cause us or regulatory authorities to interrupt, delay or halt clinical trials and could result in a more restrictive label or the delay or denial of regulatory approval by the FDA or other comparable foreign authorities. The drug-related side effects could affect patient recruitment or the ability of enrolled patients to complete the trial or result in potential product liability claims. Any of these occurrences may harm our business, financial condition and prospects significantly. Even if any of our drug candidates receives marketing approval, as greater numbers of patients use a drug

S-14

Table of Contents

following its approval, an increase in the incidence of side effects or the incidence of other post-approval problems that were not seen or anticipated during pre-approval clinical trials could result in a number of potentially significant negative consequences, including:

| • | regulatory authorities may withdraw their approval of the product; |

| • | regulatory authorities may require the addition of labeling statements, such as warnings or contraindications; |

| • | we may be required to change the way the product is administered, conduct additional clinical trials or change the labeling of the product; |

| • | we could be sued and held liable for harm caused to patients; and |

| • | our reputation may suffer. |

Any of these events could substantially increase the costs and expenses of developing, commercializing and marketing any such drug candidates or could harm or prevent sales of any approved products.

We deal with hazardous materials and must comply with environmental laws and regulations, which can be expensive and restrict how we do business.

Some of our research and development activities involve the controlled storage, use, and disposal of hazardous materials. We are subject to federal, state, and local laws and regulations governing the use, manufacture, storage, handling, and disposal of these hazardous materials. Although we believe that our safety procedures for the handling and disposing of these materials comply with the standards prescribed by these laws and regulations, we cannot eliminate the risk of accidental contamination or injury from these materials. In the event of an accident, state or federal authorities may curtail our use of these materials, and we could be liable for any civil damages that result, which may exceed our financial resources and may seriously harm our business. Because we believe that our laboratory and materials handling policies and practices sufficiently mitigate the likelihood of materials liability or third-party claims, we currently carry no insurance covering such claims. An accident could damage, or force us to shut down, our operations.

Risks Related to the Commercialization of Our Drug Candidates

Even if any of our drug candidates receives regulatory approval, if such approved product does not achieve broad market acceptance, the revenues that we generate from sales of the product will be limited.

Even if any drug candidates we may develop or acquire in the future obtain regulatory approval, they may not gain broad market acceptance among physicians, healthcare payors, patients and the medical community. The degree of market acceptance for any approved drug candidate will depend on a number of factors, including:

| • | the indication and label for the product and the timing of introduction of competitive products; |

| • | demonstration of clinical safety and efficacy compared to other products; |

| • | prevalence and severity of adverse side effects; |

| • | availability of coverage and adequate reimbursement from managed care plans and other third-party payors; |

| • | convenience and ease of administration; |

S-15

Table of Contents

| • | cost-effectiveness; |

| • | other potential advantages of alternative treatment methods; and |

| • | the effectiveness of marketing and distribution support of the product. |

Consequently, even if we discover, develop and commercialize a product, the product may fail to achieve broad market acceptance and we may not be able to generate significant revenue from the product

The success of PRX002 in the U.S. is dependent upon the strength and performance of our collaboration with Roche. If we fail to maintain our existing collaboration with Roche, such termination would likely have a material adverse effect on our ability to commercialize PRX002 and our business. Furthermore, if we opt out of profit and loss sharing with Roche, our revenues from PRX002 will be reduced.

The success of sales of PRX002 in the U.S. will be dependent on the ability of Roche to successfully develop in collaboration with us, and launch and commercialize PRX002, if approved by the FDA, pursuant to the License Agreement we entered into in December 2013. Our collaboration with Roche is complex, particularly in the context of our U.S. commercialization of PRX002, with respect to financial provisions, allocations of responsibilities, cost estimates and the respective rights of the parties in decision making. Accordingly, significant aspects of the commercialization of PRX002 require Roche to execute its responsibilities under the arrangement, or require Roche’s agreement or approval, prior to implementation, which could cause significant delays that may materially impact the potential success of PRX002 in the U.S. In addition, Roche may under some circumstances independently develop products that compete with PRX002, or Roche may decide to not commit sufficient resources to the marketing and distribution of PRX002. If we are not able to collaborate effectively with Roche on plans and efforts to develop and commercialize PRX002, our business could be materially adversely affected.

Furthermore, the terms of the License Agreement provide that Roche has the ability to terminate such arrangement for any reason after the first anniversary of the License Agreement at any time upon 90 days’ notice (if prior to first commercial sale) or 180 days’ notice (if after first commercial sale). For example, Roche may determine that the outcomes of clinical trials have made PRX002 a less attractive commercial product and terminate our collaboration. If the License Agreement is terminated, our business and our ability to generate revenue from sales of PRX002 could be substantially harmed as we will be required to develop our own sales and marketing organization or enter into another strategic collaboration in order to commercialize PRX002 in the U.S. Such efforts may not be successful and, even if successful, would require substantial time and resources to carry out.

The manner in which Roche launches PRX002, including the timing of launch and potential pricing, will have a significant impact on the ultimate success of PRX002 in the U.S, and the success of the overall commercial arrangement with Roche. If launch of commercial sales of PRX002 in the U.S. by Roche is delayed or prevented, our revenue will suffer and our stock price may decline. Further, if launch and resulting sales by Roche are not deemed successful, our business would be harmed and our stock price may decline. Any lesser effort by Roche in its PRX002 sales and marketing efforts may result in lower revenue and thus lower profits with respect to the U.S. The outcome of Roche’s commercialization efforts in the United States could also have a negative effect on investors’ perception of potential sales of PRX002 outside of the U.S., which could also cause a decline in our stock price.

Furthermore, pursuant to the License Agreement, we are responsible for 30% of all development and commercialization costs for PRX002 for the treatment of Parkinson’s disease in the U.S., and for any future Licensed Products and/or indications that we opt to co-develop, in each case unless we elect to opt out of profit and loss sharing. If we elect to opt out of profit and loss sharing, we will instead receive sales milestones and royalties, and our revenue, if any, from PRX002 will be reduced.

S-16

Table of Contents

Moreover, under the terms of the License Agreement, we rely on Roche to provide us estimates of their costs, revenue and revenue adjustments and royalties, which estimates we use in preparing our quarterly and annual financial reports. If the underlying assumptions on which Roche’s estimates were based prove to be incorrect, actual results or revised estimates supplied by Roche that are materially different from the original estimates could require us to adjust the estimates included in our reported financial results. If material, these adjustments could require us to restate previously reported financial results, which could have a negative effect on our stock price.

Our ability to receive any significant revenue from PRX002 will be dependent on Roche’s efforts and our participation in profit and loss sharing, and may result in lower levels of income than if we marketed or developed our product candidates entirely on our own. Roche may not fulfill its obligations or carry out marketing activities for PRX002 as diligently as we would like. We could also become involved in disputes with Roche, which could lead to delays in or termination of commercialization programs and time-consuming and expensive litigation or arbitration. If Roche terminates or breaches the License Agreement, or otherwise decides not to complete its obligations in a timely manner, the chances of successfully developing or marketing PRX002 would be materially and adversely affected.

Outside of the United States, we are solely dependent on the efforts and commitments of Roche, either directly or through third parties, to further commercialize PRX002. If Roche’s efforts are unsuccessful, our ability to generate future product sales from PRX002 outside the United States would be significantly reduced.

Under our License Agreement, outside of the United States, Roche has responsibility for developing and commercializing PRX002 and any future Licensed Products targeting alpha-synuclein. As a consequence, any progress and commercial success outside of the United States is dependent solely on Roche’s efforts and commitment to the program. For example, Roche may delay, reduce or terminate development efforts relating to PRX002 outside of the United States, or under some circumstances independently develop products that compete with PRX002, or decide not to commit sufficient resources to the marketing and distribution of PRX002.

In the event that Roche does not diligently commercialize PRX002, the License Agreement provides us the right to terminate the License Agreement in connection with a material breach uncured for 90 days after notice thereof. However, our ability to enforce the provisions of the License Agreement so as to obtain meaningful recourse within a reasonable timeframe is uncertain. Further, any decision to pursue available remedies including termination would impact the potential success of PRX002, including inside the United States, and we may choose not to terminate as we may not be able to find another partner and any new collaboration likely will not provide comparable financial terms to those in our arrangement with Roche. In the event of our termination, this may require us to commercialize PRX002 on our own, which is likely to result in significant additional expense and delay. Significant changes in Roche’s business strategy, resource commitment and the willingness or ability of Roche to complete its obligations under our arrangement could materially affect the potential success of the product. Furthermore, if Roche does not successfully develop and commercialize PRX002 outside of the United States, our potential to generate future revenue outside of the United States would be significantly reduced.

If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to market and sell approved products, we may be unable to generate product revenue.

We do not currently have an organization for the sales, marketing and distribution of pharmaceutical products. In order to market any products that may be approved by the FDA, we must build our sales, marketing, managerial and other non-technical capabilities or make arrangements with third parties to perform these services. We have entered into the License Agreement with Roche for the development of PRX002 and may develop our own sales force and marketing infrastructure to co-promote PRX002 in the United States for the treatment of Parkinson’s disease and any future Licensed Products approved for Parkinson’s disease in the United States. If we exercise our co-promotion option and are unable to develop our own sales force and marketing infrastructure to effectively commercialize PRX002 or other Licensed Products, our ability to generate

S-17

Table of Contents

additional revenue from potential sales of PRX002 or such products in the United States may be harmed. In addition, our right to co-promote PRX002 and other Licensed Products will terminate if we commence a Phase 3 study for a competitive product that treats Parkinson’s disease. For our other approved products, if we are unable to establish adequate sales, marketing and distribution capabilities, whether independently or with third parties, we may not be able to generate product revenue and may not become profitable.

If government and third-party payors fail to provide coverage and adequate reimbursement rates for any of our drug candidates that receive regulatory approval, our revenue and prospects for profitability will be harmed.

In both domestic and foreign markets, our sales of any future products will depend in part upon the availability of reimbursement from third-party payors. Such third-party payors include government health programs such as Medicare, managed care providers, private health insurers, and other organizations. There is significant uncertainty related to the third-party coverage and reimbursement of newly approved drugs. Coverage and reimbursement may not be available for any drug that we or our collaborators commercialize and, even if these are available, the level of reimbursement may not be satisfactory. Third-party payors often rely upon Medicare coverage policy and payment limitations in setting their own reimbursement policies. Third-party payors are also increasingly attempting to contain healthcare costs by demanding price discounts or rebates limiting both coverage and the amounts that they will pay for new drugs, and, as a result, they may not cover or provide adequate payment for our drug candidates. We might need to conduct post-marketing studies in order to demonstrate the cost-effectiveness of any future products to such payors’ satisfaction. Such studies might require us to commit a significant amount of management time and financial and other resources. Our future products might not ultimately be considered cost-effective. Adequate third-party reimbursement might not be available to enable us to maintain price levels sufficient to realize an appropriate return on investment in product development. If coverage and adequate reimbursement are not available or reimbursement is available only to limited levels, we or our collaborators may not be able to successfully commercialize any product candidates for which marketing approval is obtained.

The regulations that govern marketing approvals, pricing, coverage and reimbursement for new drugs vary widely from country to country. Current and future legislation may significantly change the approval requirements in ways that could involve additional costs and cause delays in obtaining approvals. Some countries require approval of the sale price of a drug before it can be marketed. In many countries, the pricing review period begins after marketing or licensing approval is granted. In some foreign markets, prescription pharmaceutical pricing remains subject to continuing governmental control even after initial approval is granted. As a result, we or our collaborators might obtain marketing approval for a drug in a particular country, but then be subject to price regulations that delay commercial launch of the drug, possibly for lengthy time periods, and negatively impact our ability to generate revenue from the sale of the drug in that country. Adverse pricing limitations may hinder our ability to recoup our investment in one or more drug candidates, even if our drug candidates obtain marketing approval.

U.S. and foreign governments continue to propose and pass legislation designed to reduce the cost of healthcare. In the United States, we expect that there will continue to be federal and state proposals to implement similar governmental controls. In addition, recent changes in the Medicare program and increasing emphasis on managed care in the United States will continue to put pressure on pharmaceutical product pricing. For example, in 2010, the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act, collectively, the Healthcare Reform Law, was enacted. The Healthcare Reform Law substantially changes the way healthcare is financed by both governmental and private insurers and significantly affects the pharmaceutical industry. Among the provisions of the Healthcare Reform Law of importance to the pharmaceutical industry are the following:

| • | an annual, nondeductible fee on any entity that manufactures or imports certain branded prescription drugs and biologic agents, apportioned among these entities according to their market share in certain government healthcare programs; |

S-18

Table of Contents

| • | an increase in the minimum rebates a manufacturer must pay under the Medicaid Drug Rebate Program to 23.1% and 13.0% of the average manufacturer price for branded and generic drugs, respectively; |

| • | expansion of healthcare fraud and abuse laws, including the False Claims Act and the Anti-Kickback Statute, new government investigative powers and enhanced penalties for non-compliance; |

| • | a new Medicare Part D coverage gap discount program, under which manufacturers must agree to offer 50 percent point-of-sale discounts off negotiated prices of applicable brand drugs to eligible beneficiaries during their coverage gap period, as a condition for the manufacturer’s outpatient drugs to be covered under Medicare Part D; |

| • | extension of manufacturers’ Medicaid rebate liability to covered drugs dispensed to individuals who are enrolled in Medicaid managed care organizations; |

| • | expansion of eligibility criteria for Medicaid programs by, among other things, allowing states to offer Medicaid coverage to additional individuals and by adding new mandatory eligibility categories for certain individuals with income at or below 133% of the federal poverty level, thereby potentially increasing a manufacturer’s Medicaid rebate liability; |

| • | a licensure framework for follow-on biologic products; |

| • | expansion of the entities eligible for discounts under the Public Health Service pharmaceutical pricing program; |

| • | new requirements under the federal Open Payments program and its implementing regulations; |

| • | a new requirement to annually report drug samples that manufacturers and distributors provide to physicians; and |

| • | a new Patient-Centered Outcomes Research Institute to oversee, identify priorities in, and conduct comparative clinical effectiveness research, along with funding for such research. |

In addition, other legislative changes have been proposed and adopted since the Healthcare Reform Law was enacted. These changes include aggregate reductions to Medicare payments to providers of up to 2% per fiscal year, which went into effect on April 1, 2013 and will stay in effect through 2024 unless additional Congressional action is taken. On January 2, 2013, President Obama signed into law the American Taxpayer Relief Act of 2012, which, among other things, further reduced Medicare payments to several types of providers and increased the statute of limitations period for the government to recover overpayments to providers from three to five years. These new laws may result in additional reductions in Medicare and other healthcare funding, which could have a material adverse effect on customers for our drugs, if approved, and, accordingly, our financial operations.

We expect that the Healthcare Reform Law, as well as other healthcare reform measures that may be adopted in the future, may result in more rigorous coverage criteria and in additional downward pressure on the price that we receive for any approved drug. Legislation and regulations affecting the pricing of pharmaceuticals might change before our drug candidates are approved for marketing. Any reduction in reimbursement from Medicare or other government healthcare programs may result in a similar reduction in payments from private payors. The implementation of cost containment measures or other healthcare reforms may prevent us from being able to generate revenue, attain profitability or commercialize our drugs.

S-19

Table of Contents

There can be no assurance that our drug candidates, if they are approved for sale in the United States or in other countries, will be considered medically reasonable and necessary for a specific indication, that they will be considered cost-effective by third-party payors, that coverage or an adequate level of reimbursement will be available, or that third-party payors’ reimbursement policies will not adversely affect our ability to sell our drug candidates profitably if they are approved for sale.

The markets for our drug candidates are subject to intense competition. If we are unable to compete effectively, our drug candidates may be rendered noncompetitive or obsolete.

The research, development and commercialization of new drugs is highly competitive. We will face competition with respect to all drug candidates we may develop or commercialize in the future from pharmaceutical and biotechnology companies worldwide. The key factors affecting the success of any approved product will be its indication, label, efficacy, safety profile, drug interactions, method of administration, pricing, coverage, reimbursement and level of promotional activity relative to those of competing drugs.

Furthermore, many large pharmaceutical and biotechnology companies, academic institutions, governmental agencies and other public and private research organizations are pursuing the development of novel drugs that target the same indications we are targeting with our research and development program. We face, and expect to continue to face, intense and increasing competition as new products enter the market and advanced technologies become available. Many of our competitors have:

| • | significantly greater financial, technical and human resources than we have and may be better equipped to discover, develop, manufacture and commercialize drug candidates; |

| • | more extensive experience in preclinical testing and clinical trials, obtaining regulatory approvals and manufacturing and marketing pharmaceutical products; |

| • | drug candidates that have been approved or are in late-stage clinical development; and/or |

| • | collaborative arrangements in our target markets with leading companies and research institutions |