UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: October 31, 2019

[_] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from: _____________________

Commission file number: 000-55008

ORGANICELL REGENERATIVE MEDICINE, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 47-4180540 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

4045 Sheridan Ave, Suite 239

Miami, FL 33140

(Address of principal executive offices)

(888) 963-7881

(Issuer’s telephone number)

Securities registered under Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| None | N/A | N/A |

Securities registered under Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | ||

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $4,154,116 based on the closing price of $0.052 per share of common stock and 79,886,847 shares of common stock of the Registrant held by non-affiliates on April 30, 2019, the last business day of the Registrant’s mostly recently completed second fiscal quarter.

As of September 30, 2020, there were 875,194,450 shares of common stock, $0.001 par value per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

| i |

This Annual Report on Form 10-K and certain information incorporated herein by reference contain forward-looking statements and information within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. This information includes assumptions made by, and information currently available to management, including statements regarding future economic performance and financial condition, liquidity and capital resources, acceptance of our products by the market, and management’s plans and objectives. In addition, certain statements included in this and our future filings with the Securities and Exchange Commission (“SEC”), in press releases, and in oral and written statements made by us or with our approval, which are not statements of historical fact, are forward-looking statements. Words such as “may,” “could,” “should,” “would,” “believe,” “expect,” “expectation,” “anticipate,” “estimate,” “intend,” “seeks,” “plan,” “project,” “continue,” “predict,” “will,” “should,” and other words or expressions of similar meaning are intended by us to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are found at various places throughout this report and in the documents incorporated herein by reference. These statements are based on our current expectations about future events or results and information that is currently available to us, involve assumptions, risks, and uncertainties, and speak only as of the date on which such statements are made.

Forward-looking statements include, but are not limited to, the following:

| n | Our products’ advantages; | |

| n | Expectations regarding our future growth; | |

| n | Expectations regarding available cash resources to fund current operations and future growth; | |

| n | Our ability to comply with regulations governing the production and sale of our products; | |

| n | Our ability to receive regulatory approvals; | |

| n | Market opportunities for our services and products; | |

| n | Our ability to compete effectively; | |

| n | Our ability to respond to market forces; and | |

| n | Our ability to protect our intellectual property. |

Actual results and outcomes may differ materially from those expressed or implied in these forward-looking statements. Factors that may cause such a difference include, but are not limited to, those discussed in Part I, Item 1A, “Risk Factors,” below. Except as expressly required by the federal securities laws, we undertake no obligation to update any such factors, or to publicly announce the results of, or changes to any of the forward-looking statements contained herein to reflect future events, developments, changed circumstances, or for any other reason.

Unless otherwise noted, as used herein, the terms “Organicell Regenerative Medicine”, “Organicell”, the “Company”, “we”, “our” and “us” refer to Organicell Regenerative Medicine, Inc., a Nevada corporation formerly known as Biotech Product Services and Research, Inc., and its subsidiaries consolidated as a combined entity.

| 1 |

Overview

We are engaged in the health care industry, principally focusing on supplying products and services related to the growing field of regenerative anti-aging medicine (“RAAM”). Our focus is the processing, distribution and supply of biologically processed cellular and tissue-based products developed from internally-based research and development activities and/or from other state-of-the-art RAAM-related products developed by third parties under exclusive and/or favorable supply arrangements and to provide other related services used in the regenerative medicine field (“RAAM Products”). Organicell distributes and supplies the RAAM Products and market RAAM-related services to the health care industry through a doctors and clinics (collectively, the “Providers”).

From November 2016 to February 2018, we operated our own laboratory facilities to process and distribute RAAM Products developed through trade secrets acquired in connection with the employment of newly hired executives during November 2016 and March 2017. During this time, we also implemented an in-house sales force and made arrangements with newly identified independent distributors to sell our RAAM Products.

In February 2018, we sold or transferred our laboratory facilities and all related assets (“Sale”), including intellectual property rights, to Vera Acquisition LLC, a Utah limited liability company (“Vera”). From the date of the Sale until the Company’s new laboratory facility became operational, as described below, the Company relied on short-term supply agreements with third party manufacturers to provide it with the products it sold and distributed to its customers.

Commencing in February 2019, the Company began taking steps to once again operate a placental tissue bank processing laboratory in Miami, Florida for the purpose of performing research and development and the manufacturing and processing of anti-aging and cellular therapy derived products. This new laboratory facility became operational in May 2019 and thereupon, the Company began producing products that are now being sold and distributed to its customers.

The Company has actively taken steps to meet compliance with current and anticipated United States Food and Drug Administration (“FDA”) regulations expected to be enforced beginning in May 2021 requiring that the sale of products that fall under Section 351 of the Public Health Services Act pertaining to marketing traditional biologics and human cells, tissues and cellular and tissue based products (“HCT/Ps”) can only be sold pursuant to an approved biologics license application (“BLA”). To date, the Company has obtained approximately 14 Investigation New Drug (“IND”), emergency IND (“eIND”) and/or non-emergency IND (“non-eIND”) approvals from the FDA, including applicable Institutional Review Board (“IRB”) approvals which authorized the Company to commence clinical trials or treatments in connection with the use of the Company’s products and related treatment protocols. The Company is aggressively pursuing efforts to commence and complete the clinical studies as well as obtaining approval to commence additional studies for other specific indications it has identified that the use of its products will provide more favorable and desired health related benefits for patients seeking alternative treatment options than are currently available.

COVID-19 Impact To Economy And Business Environment

The current outbreak of the novel coronavirus (“COVID-19”) and resulting impact to the United States economic environments began to take hold during March 2020. The adverse public health developments and economic effects of the COVID-19 outbreak in the United States, have adversely affected the demand for our products and services by our customers and from patients of our customers as a result of quarantines, facility closures and social distancing measures put into effect in connection with the COVID-19 outbreak and which currently still continue to have a negative impact to our business and the economy. These restrictions have adversely affected the Company’s sales, results of operations and financial condition. In response to the COVID-19 outbreak, the Company (a) has accelerated its research and development activities, particularly in regards to potential health benefits of the Company’s products in addressing various health concerns associated with COVID-19 and (b) is aggressively seeking to raise additional debt and/or equity financing to support working capital requirements until sale for its products to providers resumes to levels pre COVID-19.

There is no assurance as to when the adverse impact to the United States and worldwide economies resulting from the COVID-19 outbreak will be eliminated, if at all, and whether any new or recurring pandemic outbreaks will occur again in the future causing similar or worse devastating impact to the United States and worldwide economies and to our business.

| 2 |

Developments During Fiscal 2018 and 2019:

After the completion of the Sale of our laboratory facilities and all related assets, including intellectual property rights, to Vera in February 2018, the Company remained in the business of selling and distributing regenerative biologic therapies based on amnion placental tissue derived products to doctors and hospitals but was required to depend on third party supply agreements, rather than from products manufactured internally by ANU, for the supply of these advanced biologically processed cellular and tissue based products.

Since the Sale was completed, including the departure of several key executives in connection therewith, the Company had difficulty in generating sufficient revenues and, as a result, continued to have a lack of working capital to meet current operating costs, hiring of additional sales personnel, pay past due accounts payable obligations to its vendors, pay past due and/or current salaries to its remaining management or fund potential growth opportunities.

On April 23, 2018, the Company and Management and Business Associates, LLC, a Florida limited liability company (“MBA”), executed a Plan and Agreement of Reorganization (“Reorganization”) whereby the Company agreed to issue to MBA an aggregate of 222,425,073 shares of its common stock of the Company, representing at the time 51% of the outstanding shares of common stock of the Company on fully-diluted basis, for $0.001 per share (or an aggregate of $222,425), in consideration for Mr. Manuel Iglesias’ agreement to serve as the Company’s Chief Executive Officer and a member of the Board of the Company. Manuel E. Iglesias is the sole Manager of MBA and thus may be deemed to control MBA. The Reorganization was effective as of April 13, 2018 (“Effective Date”).

On May 21, 2018, the Company filed a Certificate of Amendment with the Secretary of State of Nevada to change the Company’s name from Biotech Products Services and Research, Inc. to Organicell Regenerative Medicine, Inc., effective June 20, 2018 in order to express more clearly the Company’s focus in the stem cell business (the “Name Change”). However, due to the Company’s failing to have the required Exchange Act reports filed with the SEC at the time of the filing, FINRA did not announce or effectuate the Name Change in the marketplace. If the Company intends to proceed with the Name Change, the Company will be required to submit a new Issuer Company-Related Notification Form for approval upon the Company becoming current in its Exchange Act filings.

On June 14, 2018, the Company filed a Certificate of Withdrawal with the Secretary of State of Nevada thereby withdrawing and terminating all previously issued designations of the Company’s Series A Preferred Stock and Series B Preferred Stock. On June 1, 2018, the Company submitted an Issuer Company-Related Notification Form (“June 1 Notification Form”) with the Financial Industry Regulatory Agency (“FINRA”) pursuant to Rule 10b-17 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding the Name Change and Reverse Split.

During February 2019, the Company began arranging to once again operate a new laboratory facility in Miami, Florida for the purpose of performing research and development, production and manufacturing of anti-aging and cellular therapy products. This new laboratory facility became operational in May 2019 and during the same period, the Company began producing and distributing the products that are being sold and distributed to its customers. The Company believes that this strategy will provide the Company with competitive advantages and greater assurances that it can continue to comply with expected future FDA regulations.

On September 24, 2019, due to the Company’s limited success since the Reorganization in stabilizing revenues and the growing urgency for the Company to remain compliant and meet the anticipated new and more stringent regulatory deadlines to be imposed by the FDA in connection with the Company’s products and operations that were previously announced to go into effect in May 2021, the Board determined that it would require the services of a full-time CEO with the requisite expertise and experience to lead the Company as it (a) moves forward with its strategy to expand its research and development efforts and submit IND applications for FDA approval to commence clinical trials for its products to assure that the Company, its operations and its products remain compliant with FDA regulations and (b) implements additional strategies to minimize the potential impact in the future on sales of its products as a result of future changes in FDA regulations and/or restrictions associated with clinical trials that are utilizing the products that are currently being sold by the Company. Accordingly, the Board voted to remove Manuel Iglesias from his position as CEO of the Company. The Board has since appointed Albert Mitrani to serve as the Company’s CEO.

| 3 |

In connection with the Company’s ongoing research and development efforts and the Company’s efforts to meet compliance with current and anticipated United States Food and Drug Administration (“FDA”) regulations expected to be enforced beginning in May 2021 requiring that the sale of products that fall under Section 351 of the Public Health Services Act pertaining to marketing traditional biologics and human cells, tissues and cellular and tissue based products (“HCT/Ps”) can only be sold pursuant to an approved biologics license application (“BLA”), the Company has obtained certain Investigation New Drug (“IND”), emergency IND (“eIND”) and/or non-emergency IND (“non-eIND”) approvals from the FDA, including applicable Institutional Review Board (“IRB”) approvals which authorized the Company to commence clinical trials or treatments in connection with the use of the Company’s products and related treatment protocols. The status of the Company’s current IND’s, eIND’s, non-eIND’s submitted and approved for past or planned treatments and/or clinical trials are described below:

Company’s FDA approved phase I/II IND, eIND’s and non-eIND’s:

| 1. | IND # 19881 approved on 04/30/2020 - A Phase I/II Randomized, Double Blinded, Placebo Trial to Evaluate the Safety and Potential Efficacy of Intravenous Infusion of OrganicellTM Flow for the Treatment of Moderate to Severe Acute Respiratory Syndrome (SARS) Related to COVID-19 Infection vs Placebo. IRB was approved by the Institute of Regenerative and Cellular Medicine (“IRCM”) on 06/04/2020 (approval number: IRCM-2020-254). Clinical trial is currently in process. | |

| 2. | eIND#22370 approved on 05/11/2020 - Treatment for Acute hypoxic respiratory failure with ARDS secondary to COVID-19 infection for single patient. | |

| 3. | eIND#22371 approved on 05/11/2020 - Treatment for Acute hypoxic respiratory secondary to bilateral pneumonia secondary to COVID-19 with ARDS for single patient. | |

| 4. | eIND#22897 approved on 05/29/2020 – Treatment for Acute respiratory failure with hypoxia, secondary to COVID-19 with ARDS for single patient. | |

| 5. | eIND#25426 approved on 07/24/2020 - Treatment of COVID-19 positive for single patient. | |

| 6. | eIND#25888 approved on 8/01/2020 - Treatment of post COVID-19 complication for single patient | |

| 7. | eIND#26560 approved on 8/17/2020 - Treatment of post-COVID-19 complications for single patient. | |

| 8. | eIND#26561 approved on 8/17/2020 - Treatment of post-COVID-19 complications for single patient. | |

| 9. | eIND#26676 approved on 8/20/2020 - Treatment of respiratory failure due to COVID-19 infection for single patient. | |

| 10. | eIND#26700 approved on 8/21/2020 - Treatment for ARDS associated with COVID-19 for single patient. | |

| 11. | eIND#26776 approved on 8/25/2020 - Treatment of COVID-19 positive for single patient. | |

| 12. | eIND#26777 approved on 8/25/2020 - Treatment of COVID-19 positive for single patient. | |

| 13. | eIND#26864 approved on 9/05/2020 - Treatment of COVID-19 positive for single patient. | |

| 14. | Non-eIND#26821 approved on 9/22/2020 - Treatment of post COVID-19 complications for single patient. | |

| 15. | Expanded Access to ZofinTM (OrganicellTM Flow) approved on 09/24/2020 - Treatment of Patients with COVID-19 Outpatient and Inpatient Population. IRB pending. | |

| 16. | A Phase II Multicenter, Randomized, Double Blinded, Placebo Trial to Evaluate the Efficacy and Safety of Intramuscular Injections of ZofinTM Comparing with Intravenous Infusions for the Treatment of Post COVID-19 Complications and Severe Sequelae vs Placebo. IND submitted on 09/28/2020. Pending IND and IRB approval. |

The Company is aggressively pursuing efforts to commence and complete the above described clinical studies as well as obtaining approval to commence additional studies for other specific indications it has identified that the use of its products will provide more favorable and desired health related benefits for patients seeking alternative treatment options than are currently available. The ability of the Company to succeed in these efforts is subject to among other things, the Company having sufficient available working capital to fund the substantial costs of completing clinical trials, which the Company currently does not have, and ultimately the approval from the FDA.

| 4 |

Industry Overview

Health Care Industry Overview:

The traditional health care industry in the United States is predominantly controlled by the rules of the Centers for Medicare & Medicaid Services (“CMS”) (wwws.cms.gov) and commercial health insurance companies. This control limits patients’ access to alternative medical therapies, that recent medical literature demonstrates highly beneficial outcomes in the field of anti-aging and regenerative medicine. Traditional allopathic medicine of health care provided to patients in the United States relies on government and commercial health insurance for payment of the costs associated with their day-to-day health care. Because of this close relationship, physicians must follow government and commercial insurers guidelines in order to stay in the plans and receive reimbursement. Physicians are restricted in their ability to expand the nature of the treatments provided beyond industry practices because of legal ramifications and/or lack of knowledge concerning protocol of cutting-edge anti-aging and regenerative medical treatments.

Despite the above, anecdotal and medical literature has shown an increased demand by patients for access to alternative medical therapies and treatments. Patients are seeking these alternatives to traditional allopathic medicine, due to the adverse events associated with traditional pharmaceuticals, risks associated with surgeries, and that traditional medicine and insurers are not addressing wellness or preventive medicine sufficiently. To address a wide variety of aging issues, safe alternatives to pathologies, including access to other treatments and pharmaceuticals and to achieve beneficial “elective” health treatments, we intend utilize the latest regenerative technologies. These alternative pathways to date have had significant restrictions because of regulations imposed by the FDA, other regulatory bodies and insurers due to lack of randomized controlled studies, yet many published case series demonstrate safety and efficacy. Patients and consumers are looking to safe alternatives compared more traditional medicine, including the following:

| · | Cellular/ Tissue based therapies |

| o | Adipose-derived stromal vascular fraction |

| o | Bone marrow-derived stem cell therapies |

| o | Peripheral blood derived therapies (i.e., platelet rich plasma); |

| o | Placental-based therapies |

| Ø | Technology documented since 1910 for safety and efficacy, tissue processed from human amniotic membrane and fluid, donated by consenting mothers delivering a full-term healthy baby by scheduled Caesarean section, avoiding any ethical or moral concerns, proven safety record, case series documented success in a multitude of systemic and local pathologies |

| o | Growth factor, cytokine therapies |

| · | Anti-Aging |

| o | Supplements |

| Ø | Vitamin |

| Ø | Mineral |

| Ø | Medical foods |

| o | Weight control |

| o | Topical lotions and creams for the largest organ the skin |

| · | Nontraditional medical alternatives |

| o | Acupuncture |

| o | Naturopathic |

| o | Chiropractic |

| · | Self-directed |

| o | Meditation |

| o | Yoga |

| o | Tai Chi |

| 5 |

Currently, patients who desire alternative treatments rely on the following options:

| n | Medical Tourism |

| o | In United States |

| o | Off-shore United States |

| Ø | Central and South America |

| Ø | Caribbean |

| Ø | Europe |

| n | Consulting directly with physicians knowledgeable in providing regenerative medical services |

| n | Unlicensed life coaches |

Business Strategy

Current Business Strategy:

Our current business strategy is to achieve the following goals and milestones:

Develop and expand operations to provide for growth of our revenues for the sales and distribution of RAAM related products;

| o | Increase revenues for RAAM related products; |

| · | Hiring of additional in-house sales personnel |

| · | Selectively engaging independent distributors |

| · | Marketing private label products to distributors |

| · | Increasing market recognition for our Organicell brand from: |

| Ø | marketing and participating in industry trade shows |

| o | Expand our sales market outside of the United States |

| o | Increase the number of RAAM product offerings for various modalities using proprietary processing, formulas and administration techniques |

| o | Extending our referral network of Providers based on: |

| · | Superior product offerings |

| · | Demonstrating a realistic and executable regulatory roadmap to assure Company and product compliance with current and anticipated FDA regulations |

| · | Developing and providing educational support to Providers regarding our products and regulatory concerns |

| 6 |

Execute on current strategy to assure the Company’s ability to maintain compliance with existing and the anticipated changes to FDA regulations regarding the use and sale of our current products published in November 2017 and expected to take effect by May 2021, as well as readiness to respond to ongoing future changes to those regulations:

| o | Perform clinical based studies associated with the use of our products (independently and/or in conjunction with Providers and/or Manufacturers) and seek accelerated approval for each product application in accordance with the 21st Century Cures Act (“Cures Act”) and/or through the granting of an FDA-approved biologics application (BLA) to allow products to be lawfully marketed and/or sold in the United States in accordance with newly established FDA guidelines outlined in November 2017 expected to take effect by May 2021; and | |

| o | Continue to build out our lab facilities to meet expected production and research requirements; and | |

| o | Engage high profile and industry recognized medical advisors and scientists to help identify new and emerging technologies concerning biologics and to assure our Products remain cutting edge and competitive to products offered by other companies; and | |

| o | Identify alternative products and services to (a) offset any potential decline in revenues resulting from FDA limitations on the sales and distribution of our existing products currently being sold and distributed as a result of our commencement of clinical trials using such products and/or future expected FDA restrictions on RAAM products and (b) provide our Providers with alternative product and treatment options to remain competitive with the market and our Providers to meet the needs and demands of their patients; and | |

| o | Expand our sales market and network of Providers outside of the United States | |

| o | Identify sources of exclusive and superior suppliers of RAAM products; and | |

| o | Identify strategic relationships to acquire existing Providers and/or suppliers or owners of IP associated with additional desired RAAM products; and |

| o | Engage new researchers that bring additional expertise and capacity to develop ongoing research and development and growth opportunities for additional RAAM-related products. |

Secure additional working capital;

| o | Fund shortfalls in working capital to fund ongoing expenses and required payments to vendors and creditors until revenues are stabilized; and | |

| o | Fund ongoing costs to pursue clinical trials; and | |

| o | Fund capital expenditures associated with maintaining compliance of our facilities and products; and | |

| o | Fund our strategy to develop and expand our revenues for the sales and distribution of RAAM related products described above; and | |

| o | Hire additional personnel to support our growth and planned expansion; and | |

| o | Enhance our CRM, e-commerce and ERP capabilities to facilitate marketing, sales and distribution functionality and accounting for our operations. |

Enhance Company Corporate Governance;

| o | Revisit previously announced plans to complete a reverse split, and a reduction in the authorized shares outstanding. The Company believes a reverse split will bring value to the issued and outstanding shares of the Company by limiting dilution of operating results by an excessive number of shares overhanging the market; | |

| o | Appoint additional independent members to the Board of Directors that will provide overall industry expertise and fulfill audit committee and independent director requirements to meet listing requirements for the national stock exchanges; and | |

| o | Continue to develop and expand the Company’s internal control policies |

Potential Effects of COVID-19 Pandemic

The current outbreak of the novel coronavirus (“COVID-19”) and resulting impact to the United States economic environments began to take hold during March 2020. The adverse public health developments and economic effects of the COVID-19 outbreak in the United States, have adversely affected the demand for our products and services by our customers and from patients of our customers as a result of quarantines, facility closures and social distancing measures put into effect in connection with the COVID-19 outbreak and which currently still continue to have a negative impact to our business and the economy. These restrictions have adversely affected the Company’s sales, results of operations and financial condition. In response to the COVID-19 outbreak, the Company (a) has accelerated its research and development activities, particularly in regards to potential health benefits of the Company’s products in addressing various health concerns associated with COVID-19 and (b) is aggressively seeking to raise additional debt and/or equity financing to support working capital requirements until sale for its products to providers resumes to levels pre COVID-19.

| 7 |

There is no assurance as to when the adverse impact to the United States and worldwide economies resulting from the COVID-19 outbreak will be eliminated, if at all, and whether any new or recurring pandemic outbreaks will occur again in the future causing similar or worse devastating impact to the United States and worldwide economies.

Market Overview

The population of the United States and the developed world is getting older and living longer. According to a United States Consensus Bureau’s report, “An Aging World: 2015,” America’s 65-and-over population is projected to nearly double over the next three decades, ballooning from 48 million to 88 million by 2050 and that worldwide, the 65-and-over population will more than double to 1.6 billion by 2050. According to the report, in 2015, 14.9% of the U.S. population was 65 or over and the United States was the 48th oldest country out of 228 countries and areas in the world in 2015. Baby boomers began reaching age 65 in 2011 and by 2050 the older share of the U.S. population will increase to 22.1%.

The world average age of death has increased by 35 years since 1970, with declines in death rates in all age groups, including those aged 60 and older (Source: Institute for Health Metrics and Evaluation, 2013; Mathers et al., 2015). The leading causes of death are shifting, in part because of increasing longevity. Between 1990 and 2013, the number of deaths from non-communicable diseases (“NCDs”) has increased by 42%; and the largest increases in the proportion of global deaths took place among the population aged 80 and over. An estimated 42.8% of deaths worldwide occur in the population aged 70 and over, with 22.9% in the population aged 80 and over.

Also, according to the Center for Disease Control (“CDC”), “Medical Tourism” (a term commonly used to describe people traveling outside their home country for medical treatment) is a worldwide, multibillion-dollar phenomenon that is expected to grow substantially in the next 5–10 years. Studies have estimated that hundreds of thousands of medical tourists travel from the United States annually and that patients pursue medical care abroad for a variety of reasons, including a desire to receive a procedure or therapy not available in their country of residence. Common categories of procedures that US travelers pursue during medical tourism trips include orthopedic surgery, cosmetic surgery, cardiology (cardiac surgery), oncologic care, and dentistry. Common destinations include Thailand, Mexico, Singapore, India, Malaysia, Cuba, Brazil, Argentina, and Costa Rica.

If we are able to implement our intended business plan, we believe that we will be well situated to address this increased consumer demand for alternative medical treatments.

Marketing and Sales

Currently, we market our RAAM products and services to a network of Providers through in-house, contracted sales personnel and/or from independent distributors. As of October 31, 2019, we had two salespeople who marketed our RAAM products and services by using social media outlets, medical conferences and seminars and from development of prior and newly identified Providers and related professional relationships. In addition, we had arrangements with several independent distributors that were marketing and distributing our products. We intend in the future to expand our in-house sales force and independent distributors as our working capital improves, our product line expands and as volumes increase. We also intend to develop and offer ongoing training seminars to provide the best possible information on the latest advances on anti-aging, and regenerative medicine to Providers.

Sources and Availability of Raw Materials and the Names of Principal Suppliers

From the completion of the Sale in February 2018 through April 2019, we purchased all of our RAAM Products through supply arrangements directly with third-party manufacturers or indirectly from distributors of other third-party manufacturers.

Beginning May 2019, we once again began to manufacture our own RAAM Products in our newly developed Miami, Florida laboratory facilities and acquired the required raw materials and supplies for our RAAM research and development and the manufacturing of our RAAM placental-related products from unaffiliated third-party laboratories pursuant Supply Arrangements.

| 8 |

In the event any one or more of our current suppliers are unwilling or unable to sell us required raw materials and/or products, for any reason, we may not be able to provide replacement products to our customers, or if other supply arrangements can be made, the replacement products and terms may not be as favorable.

Dependence on One or a Few Major Customers

During the year ended October 31, 2019, one customer accounted for approximately 12.2% of our revenues. Our RAAM business is not expected to be dependent on any one or more customers, especially as our customer and distribution network expands. We expect that our customer and consumers will be broad based and throughout the United States and worldwide.

Patents, Trademarks, Licenses, Franchises, Concessions, Royalty Agreements or Labor Contracts

The table below sets forth a summary of our intellectual property rights.

| Patents: | None |

| Patent Applications: |

OrganicellTM has a U.S. Provisional Patent Application on file for its OrganicellTM line of products and the proprietary techniques used in during processing perinatal fluid. U.S. Provisional Patent Application No. 63/008,355 Titled: COMPOSITIONS COMPRISING NANOPARTICLES, METHOD OF MAKING AND USES THEREOF Filed: April 10, 2020 Inventor: Maria Ines Mitrani Applicant: Organicell Regenerative Medicine, Inc. Conversion Filing Deadline: April 10, 2021 Assignment: MARIA INES MITRANI (Assignor), ORGANICELL REGENERATIVE MEDICINE, INC. (Assignee) Recorded: April 15, 2020 Real/Frame: 052403 / 0365 |

| Trademarks: |

Word Mark: ZOFIN Goods/Services: Biologically derived products developed from perinatal tissue material for medical, regenerative and aesthetic purposes Serial Number: 90050511 Filing Date: July 13, 2020 Owner: Organicell Regenerative Medicine, Inc. Status: Pending, awaiting examination

Word Mark: Organicell Goods/Services: Biologically derived products developed from perinatal tissue material for medical, regenerative and aesthetic purposes Serial Number: 88903989 Filing Date: May 6, 2020 Owner: Organicell Regenerative Medicine, Inc. Status: Office Action issued August 8, 2020

|

| 9 |

Word Mark: Organicell Goods/Services: Non-medicated anti-aging serum; non-medicated skin serums; all of the aforementioned goods are made in whole or in substantial part of organic ingredients Serial Number: 87311045 Filing Date: January 23, 2017 Owner: Organicell Regenerative Medicine, Inc. Registration Number: 5289671 Registration Date: September 19, 2017 Status: Live

Word Mark: PATIENT PURE X - PPX Goods/Services: plasma extracts for medical use, namely, plasma extract containing purified and concentrated exosomes derived from whole human blood Serial Number: 88771931 Filing Date: January 24, 2020 Owner: Organicell Regenerative Medicine, Inc. Status: Notice of Allowance issued July 28, 2020

Word Mark: PATIENT PURE X - PPX Goods/Services: plasma processing services for others, namely, extracting purified and concentrated exosomes based on whole blood harvested from patients for use by hospitals, clinics, or other organizations or persons involved in delivering healthcare services to patients Serial Number: 88771934 Filing Date: January 24, 2020 Owner: Organicell Regenerative Medicine, Inc. Status: Notice of Allowance issued August 18, 2020 | |

| Registered Copyrights: | None |

| Domain Names: | www.organicell.com |

| IP Licenses: |

None |

| 10 |

The status of the Company’s current IND’s, eIND’s, non-eIND’s submitted and approved for past or planned treatments and/or clinical trials are described below:

Company’s FDA approved phase I/II IND, eIND’s and non-eIND’s:

| 1. | IND # 19881 approved on 04/30/2020 - A Phase I/II Randomized, Double Blinded, Placebo Trial to Evaluate the Safety and Potential Efficacy of Intravenous Infusion of OrganicellTM Flow for the Treatment of Moderate to Severe Acute Respiratory Syndrome (SARS) Related to COVID-19 Infection vs Placebo. IRB was approved by the Institute of Regenerative and Cellular Medicine (“IRCM”) on 06/04/2020 (approval number: IRCM-2020-254). Clinical trial is currently in process. | |

| 2. | eIND#22370 approved on 05/11/2020 - Treatment for Acute hypoxic respiratory failure with ARDS secondary to COVID-19 infection for single patient. | |

| 3. | eIND#22371 approved on 05/11/2020 - Treatment for Acute hypoxic respiratory secondary to bilateral pneumonia secondary to COVID-19 with ARDS for single patient. | |

| 4. | eIND#22897 approved on 05/29/2020 – Treatment for Acute respiratory failure with hypoxia, secondary to COVID-19 with ARDS for single patient. | |

| 5. | eIND#25426 approved on 07/24/2020 - Treatment of COVID-19 positive for single patient. | |

| 6. | eIND#25888 approved on 8/01/2020 - Treatment of post COVID-19 complication for single patient. | |

| 7. | eIND#26560 approved on 8/17/2020 - Treatment of post-COVID-19 complications for single patient. | |

| 8. | eIND#26561 approved on 8/17/2020 - Treatment of post-COVID-19 complications for single patient. | |

| 9. | eIND#26676 approved on 8/20/2020 - Treatment of respiratory failure due to COVID-19 infection for single patient. | |

| 10. | eIND#26700 approved on 8/21/2020 - Treatment for ARDS associated with COVID-19 for single patient. | |

| 11. | eIND#26776 approved on 8/25/2020 - Treatment of COVID-19 positive for single patient. | |

| 12. | eIND#26777 approved on 8/25/2020 - Treatment of COVID-19 positive for single patient. | |

| 13. | eIND#26864 approved on 9/05/2020 - Treatment of COVID-19 positive for single patient. | |

| 14. | Non-eIND#26821 approved on 9/22/2020 - Treatment of post COVID-19 complications for single patient. | |

| 15. | Expanded Access to ZofinTM (OrganicellTM Flow) approved on 09/24/2020 - Treatment of Patients with COVID-19 Outpatient and Inpatient Population. IRB pending. | |

| 16. | A Phase II Multicenter, Randomized, Double Blinded, Placebo Trial to Evaluate the Efficacy and Safety of Intramuscular Injections of ZofinTM Comparing with Intravenous Infusions for the Treatment of Post COVID-19 Complications and Severe Sequelae vs Placebo. IND submitted on 09/28/2020. Pending IND and IRB approval. |

Pursuant to our employment agreements with our executives, all work product that is created, prepared, produced, authored, edited, amended, conceived or reduced to practice by each executive individually or jointly with others during the period of their employment by the Company and relating in any way to the business or contemplated business, research or development of the Company (regardless of when or where the Work Product is prepared or whose equipment or other resources is used in preparing the same), as well as any and all rights in and to copyrights, trade secrets, trademarks (and related goodwill), patents and other intellectual property rights therein arising in any jurisdiction throughout the world and all related rights of priority under international conventions with respect thereto, including all pending and future applications and registrations thereof, and continuations, divisions, continuations-in-part, reissues, extensions and renewals thereof (collectively, "Intellectual Property Rights"), the sole and exclusive property of the Company. All of the Work Product consisting of copyrightable subject matter shall be deemed "work made for hire" as defined in 17 U.S.C. § 101 and such copyrights are therefore owned by the Company or if not applicable, deemed to be irrevocably assigned to the Company, for no additional consideration. The Intellectual Property Rights in any “Pre-existing Materials” included contained in the Work Product shall be retained by the executive but the executive shall be deemed to have granted to the Company an irrevocable, worldwide, unlimited, royalty-free license to use, publish, reproduce, display, distribute copies of, and prepare derivative works based upon, such Pre-Existing Materials and derivative works thereof. The Company may not assign, transfer and sublicense such rights to others without executive’s consent, other than to a wholly-owned subsidiary of the Company. The executive shall provide written notice to the Company’s Chief Executive Officer therein notifying the Company new intellectual property including the Pre-Existing Materials.

Competition

The regenerative medicine field is highly competitive and subject to rapid technological change and regulation. Companies compete on the basis of product efficacy, pricing, and ease of handling/logistics. A critically important factor for growth in the US market is third-party reimbursement, which is difficult to obtain, and the process can be time-consuming and expensive. We expect that it will take some time before RAAM products will be widely accepted under health insurance coverage. In addition, growth of this industry is expected to expand as additional research and development into the benefits of regenerative products and specific products becomes more widely accepted as a result of FDA mandated or optional clinical trials are performed by industry stakeholders.

| 11 |

As stated previously, there is a growing urgency in the industry for companies to meet the anticipated new and more stringent regulatory deadlines to be imposed by the FDA in connection with regulation of RAAM products that were previously announced to go into effect in May 2021. As a result of these concerns, the Company and our competitors are expected to need to pursue research and development efforts and submit IND applications for FDA approval to commence clinical trials for RAAM products being sold to assure that their respective operations and products remain compliant with FDA regulations and there is no adverse impact to future operations. In addition, the Company believes that the ability to demonstrate that products and operations comply with regulations are important factors for companies in the industry to be successful in the future.

We intend to perform clinical trials for our RAAM Products for the purpose of obtaining biologics license status from the FDA to provide us with advantages over our competitors, including acceleration for acceptance of our products in traditional insurance plans, compliance with FDA regulations and to provide our customers with superior education and support of the benefits of our products. Initially we are positioning ourselves as a cash-based health care alternative for consumers that can provide higher levels of improvement, that is not available from traditional allopathic medicine at this time.

The Company competes in multiple areas of clinical treatment where regenerative biomaterials may be employed to modulate inflammation, enhance healing and reduce scar tissue formation: advanced wound care treatment, spine, orthopedic, surgery and sports medicine.

The primary competitive products in this space include autologous serums derived from blood, bone marrow, and adipose tissue (Regenexx) and allograft products derived from amniotic fluid or amniotic membrane, umbilical cord blood or umbilical cord tissue matrix, or from culture-expanded perinatal cells. Our competitors are primarily producer-distributor companies which include Predictive Biotech, Kimera Labs, MiMedix Group, Inc., Invitrx Therapeutics, Liveyon, BioD (“dermaSciences”), and Direct Biologics, as well as a number of distributors who sell white-labeled products from those producer-distributor entities. Additionally, there are a variety of accredited blood, bone, and soft tissue banks that we will be competing against, including Utah Cord Bank and Cord for Life.

As stated previously, the demand for RAAM products is very high and expected to grow with the growing baby boomer generation getting older, the increase in patients desiring to seek health care options outside of traditional therapies, the growing trend in the desire of individuals to remain active longer in life and the ongoing rise in health care costs which RAAM products may provide a more efficient and economical alternative for certain conditions.

Government Regulation

General

The Company’s operations are subject to FDA regulations in connection with the sales and distribution of its RAAM products. In addition, the Company relies on supply agreements with birth tissue recovery companies, supply manufacturers and/or third party distributors for the supply of RAAM products and/or the Company’s intended objectives to conduct research and development and clinical trials of RAAM products, all of whom are required to comply with FDA regulations. We anticipate these regulations will be heavily enforced and subject to more restrictive regulations by the FDA in the future. A summary of the current FDA regulations is set forth below:

FDA Premarket Clearance and Approval Requirements

Tissue Products

Currently the products that are sold by the Company are derived from human tissue that is purchased by the Company and processed directly in the Company’s laboratory facilities. At times when the Company did not manufacture its own products, the products sold were manufactured and processed by third party manufacturers. As discussed below, some tissue-based products are regulated solely under Section 361 of the Public Health Service Act as human cells, tissues and cellular and tissue-based products, or HCT/Ps, which do not require premarket clearance or approval by the FDA. Other tissue products are regulated as biologics and, in order to be lawfully marketed in the United States, require an FDA-approved BLA.

| 12 |

The FDA is continually changing and formulating new guidelines for this industry. In addition, the FDA has published some additional draft guidelines related to this industry and the ultimate form of the regulations are not yet known.

Products Regulated as HCT/Ps

The FDA has specific regulations governing human cells, tissues and cellular and tissue-based products, or HCT/Ps. An HCT/P is a product containing or consisting of human cells or tissue intended for transplantation into a human patient. HCT/Ps that meet the criteria for regulation solely under Section 361 of the Public Health Service Act (so-called “361 HCT/Ps”) are not subject to approval requirements and they are subject to post-market regulatory requirements.

To be a 361 HCT/P, a product generally should meet following criteria:

| · | Be minimally manipulated, no structural change, or be mixed with anything; |

| · | Be intended for homologous use, essentially used for the same purpose that it was used in the donor; |

| · | Its manufacture must not involve combination with another article, except for water, crystalloids or a sterilizing, preserving or storage agent; and |

| · | It must not be dependent upon the metabolic activity of living cells for its primary function. |

Products Regulated as Biologics- The BLA Pathway

The typical steps for obtaining FDA approval of a BLA to market a biologic product in the U.S. include:

| · | Completion of preclinical laboratory tests, animal studies and formulations studies under the FDA’s good laboratory practices regulations; |

| · | Submission to the FDA of an Investigational New Drug Application (“IND”) for human clinical testing, which must become effective before human clinical trials may begin and which must include independent Institutional Review Board (“IRB”) approval at each clinical site before the trials may be initiated; |

| · | Performance of adequate and well-controlled clinical trials in accordance with Good Clinical Practices to establish the safety and efficacy of the product for each indication; |

| · | Submission to the FDA of a Biologics License Application for marketing the product, which includes, among other things, reports of the outcomes and full data sets of the clinical trials, and proposed labeling and packaging for the product; |

| · | Satisfactory completion of an FDA Advisory Committee review; and |

| · | Satisfactory completion of an FDA inspection of the manufacturing facility or facilities at which the product is produced to assess compliance with Current Good Manufacturing Practices (“cGMP”) regulations. |

| 13 |

Generally, clinical trials are conducted in three phases:

| · | Phase I trials typically involve a small number of healthy volunteers and are designed to provide information about the product safety. |

| · | Phase II trials are conducted in a larger but limited group of patients afflicted with a specific diagnosis in order to determine preliminary efficacy, and to identify possible adverse effects. |

| o | Dosage studies are designated as Phase IIA and efficacy studies are designated as Phase IIB. |

| · | Phase III clinical trials are generally large-scale, multi-center, comparative trials conducted with patients who have a specific condition in order to provide statistically valid proof of efficacy, as well as safety and potency. |

| · | In some cases, the FDA will require Phase IV, or post-marketing trials, to collect additional data after a product is on the market. |

The process of obtaining an approved BLA requires the expenditure of substantial time, effort and financial resources and may take years to complete.

FDA Post-Market Regulation

Tissue processors are required to register as an establishment with the FDA. We intend on becoming a registered establishment, accredited by the American Association of Tissue Banks (“AATB”) for the storage and distribution of tissue products that we purchase directly or indirectly from third party manufacturers. Once we are registered, we will be required to comply with regulations, including those regulations regarding storage, controls, access, labeling, record keeping, security, processes, compliance with established Good Tissue Practices, and documentation associated with the sale of our products by our customers to their patients. Our facilities will be subject to periodic inspections to assess our records and determination of our compliance with the regulations.

Products covered by a BLA, 510(k) clearance, or a PMA are subject to numerous additional regulatory requirements, which include, among others, compliance with cGMP, which imposes certain procedural, substantive and record keeping requirements, labeling regulations, the FDA’s general prohibition against promoting products for unapproved or “off-label” uses, and additional adverse event reporting.

Other Regulation Specific to Tissue Products

The AATB, has issued operating standards for tissue banking, whether manufacturing and/or storing products as a distributor of manufactured products by third parties. Compliance with these standards is a requirement in order to become a licensed tissue bank.

21st Century Cures Act

In December 2016, President Obama signed the 21st Century Cures Act (the “Act”) into law. The Act includes many provisions that aim to speed up the process of bringing new drugs and devices to market. One of the Act’s most significant amendments to the Federal Food, Drug and Cosmetic Act will allow the FDA to grant accelerated approval to regenerative medicine products, while also providing the agency with wide discretion on creating new approaches to regenerative medicine. This legislative development is the result of increased pressure from patients and other stakeholders to move regenerative medicine advancements more quickly from the lab into the clinic.

| 14 |

Specifically, the new accelerated approval pathway authorized by the Act allows certain regenerative medicine products to be designated as “regenerative advanced therapy” and become eligible for priority review by FDA. To qualify for this pathway, the product must be aimed at a serious disease and have the potential to deal with currently unmet medical needs. It must also meet the Act’s new definition of a regenerative advanced therapy, which is defined as “cell therapy, therapeutic tissue engineering products, human cell and tissue products, and combination products using any such therapies or products, except for those regulated solely under section 361 of the Public Health Service Act.” This broad definition would seem to encompass the majority of regenerative medicine products known to be currently in the development stages.

As with the existing accelerated approval pathway for drugs and biologics, this new regulatory pathway would allow a regenerative medicine product to be approved for marketing based on surrogate or intermediate clinical trial endpoints rather than longer term clinical outcomes. The use of such endpoints can decrease the number, duration, and complexity of clinical trials that are needed to prove a longer-term outcome. Subsequently, a sponsor would have to conduct confirmatory clinical trials to ensure that the surrogate or intermediate endpoint was in fact predictive of patients’ clinical response to the product, otherwise the accelerated approval could be withdrawn.

The Act also requires the FDA to work with the National Institute of Standards and Technology (“NIST”) and other stakeholders to develop standards and consensus definitions for regenerative medicine products. Such standards are expected to play a large role in advancing this nascent industry by allowing companies to rely on FDA-recognized standards, rather than creating and validating their own as is the case today.

The Act attempts to create a research network and a public-private partnership to assist developers in generating definitive evidence about whether their proposed therapies indeed provide clinical benefits that are hoped for. The Act also requires the FDA to track and report the number and type of applications filed for regenerative medicine products, including the number of products approved through the new accelerated approval pathway. The law also includes provisions that require the FDA to publish guidance on how it will design and implement an approval process for regenerative medicine devices.

November 2017 FDA Guidelines

In November 2017, the FDA released four guidance documents (two final, two draft) in an effort to implement a “comprehensive policy framework” for existing laws and regulations governing regenerative medicine products, including human cells, tissues, and cellular and tissue-based products (“HCT/Ps”). These guidance documents build upon the previous regulatory framework for these products, which was completed in 2005. A guidance document cannot alter a regulation, but can clarify how the FDA intends to enforce the regulation. The Comprehensive regenerative medicine policy framework intends to spur innovation, efficient access to potentially transformative products, while ensuring safety & efficacy.

The framework builds upon the FDA’s existing risk-based regulatory approach to more clearly describe what products are regulated as drugs, devices, and/or biological products. Further, two of the guidance documents propose an efficient, science-based process for helping to ensure the safety and effectiveness of these therapies, while supporting development in this area. The suite of guidance documents also defines a risk-based framework for how the FDA intends to focus its enforcement actions against those products that raise potential significant safety concerns. This modern framework is intended to balance the agency’s commitment to safety with mechanisms to drive further advances in regenerative medicine so innovators can bring new, effective therapies to patients as quickly and safely as possible. The policy also delivers on important provisions of the Act.

Final Guidance Documents

The two final guidance documents clarify the FDA’s interpretation of the risk-based criteria manufacturers use to determine whether a product is subject to the FDA’s premarket review.

The first guidance provides greater clarity around when cell and tissue-based products would be exempted from the established regulations if they are removed from and implanted into the same individual within the same surgical procedure and remain in their original form. The second final guidance helps stakeholders better understand how existing regulatory criteria apply to their products by clarifying how the agency interprets the existing regulatory definitions “minimal manipulation” and “homologous use.” As this field advances, the FDA has noted that there are a growing number of regenerative medicine products subject to FDA premarket authorization. These guidance documents will help explain how the FDA will provide a risk-based framework for its oversight. The policy framework defines how the FDA intends to take action against unsafe products while facilitating continued innovation of promising technologies.

| 15 |

To accomplish this goal, the guidance document has clarified the FDA’s view of “minimal manipulation” and “homologous use.” These are two concepts that are defined in current regulation to establish the legal threshold for when a product is subject to the FDA’s premarket approval requirements. By further clarifying these terms in the final guidance, the FDA is applying a modern framework for its oversight.

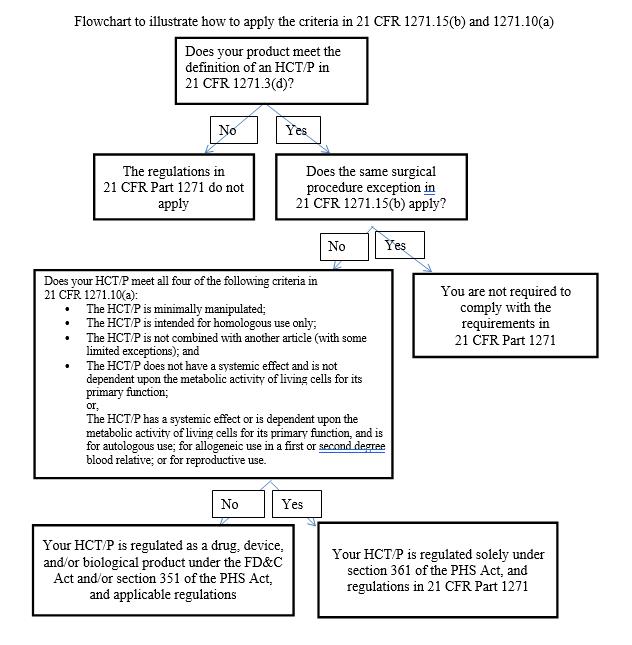

FDA regulations at 21 C.F.R. Part 1271, previous draft guidance documents, and untitled letters establish the agency’s approach to regulating HCT/Ps. Some HCT/Ps are exempt from premarket approval and are subject to regulation solely under section 361 of the Public Health Service Act (“PHS Act”) (so-called “361 HCT/Ps”) whereas others require premarket approval (i.e., as a drug, device, or biologic) (so-called “351 HCT/Ps”). Both 361 HCT/Ps and 351 HCT/Ps are subject to FDA requirements (at Part 1271) for registration and listing, donor-eligibility, current good tissue practices, and other requirements intended to prevent transmission of communicable diseases. Those that are the subject of the “same surgical procedure” exception – are exempt from both premarket approval requirements and the requirements of Part 1271. This regime is outlined in a flow chart, which is one of the few new features of the final guidance documents and is presented below:

| 16 |

Enforcement Discretion

In order to allow manufacturers of products time to comply with the requirements, the FDA announced that it intended (originally through November 2020) to exercise enforcement discretion for certain products that are subject to the FDA’s premarket review under the existing regulations, but are not currently meeting these requirements. The FDA does not intend to exercise such enforcement discretion for those products that pose a potential significant safety concern. Going forward, the FDA will apply a risk-based approach to enforcement, taking into account how products are being administered as well as the diseases and conditions for which they are being used. This risk-based approach allows product manufacturers time to engage with the FDA, as to determine if they need to submit a marketing authorization application and, if so, submit their application to the FDA for approval.

On July 20, 2020, the FDA announced it was extending the enforcement discretion policy an additional six months through May 2021 as a result of the challenges presented by the COVID-19 pandemic.

The FDA’s enforcement discretion policy for IND and premarket approval requirements does not apply to products that have been associated with reported safety concerns or have the potential to cause significant safety concerns to patients. The FDA has stepped up its oversight of cellular and related products in recent years and has issued compliance actions, including numerous warning and untitled letters, and pursued litigation for serious violations of the law, including some involving patient harm.

Although the FDA has not changed its basic approach to regulating HCT/Ps, the FDA intends to exercise enforcement discretion up through May 2021 with regard to 351 HCT/Ps requiring premarket approval. The guidance states that, in order to “give manufacturers time to determine if they need to submit an IND or marketing application in light of this guidance,” the FDA intends to exercise enforcement discretion (i.e., the Agency may permit marketing without an approved marketing application) if the HCT/P “is intended for autologous use and its use does not raise reported safety concerns or potential significant safety concerns.”

The FDA has indicated it intends to focus enforcement actions on “products with higher risk,” taking into account factors such as non-autologous (allogeneic) use, the route of administration, the site of administration, and whether the product is intended for homologous or non-homologous use. For example, HCT/Ps administered via intravenous injection or infusion, aerosol inhalation, intraocular injection, or injection or infusion into the central nervous system, will be prioritized over HCT/Ps administered by intradermal, subcutaneous, or intra-articular injection. Similarly, HCT/Ps intended for non-homologous use, particularly those intended to treat serious or life-threatening conditions, “are more likely to raise significant safety concerns than HCT/Ps intended for homologous use”.

The Company believes that the new regulatory restrictions being implemented by the FDA are intended to assure that all parties involved in the chain of gathering, processing, distributing and/or administrating RAAM related products have met the required standards to assure that the manufacturing, marketing the administration of the RAAM regulated products are not misleading and are performed in a safe and ethical manner and in accordance with the “objective intent” of the manufacturer.

New Draft Guidance Documents

The two draft guidances provide important information to help spur development and access to innovative regenerative therapies. The first draft guidance, which builds off the regenerative medicine provisions in the Act, addresses how the FDA intends to simplify and streamline its application of the regulatory requirements for devices used in the recovery, isolation, and delivery of regenerative medicine advanced therapies, including combination products. The guidance specifies that devices intended for use with a specific RMAT may, together with the RMAT, be considered to comprise a combination product.

| 17 |

The second draft guidance describes the expedited programs that may be available to sponsors of regenerative medicine therapies, including the new Regenerative Medicine Advanced Therapy (“RMAT”) designation created by the 21st Century Cures Act, Priority Review, and Accelerated Approval. In addition, the guidance describes the regenerative medicine therapies that may be eligible for RMAT designation – including cell therapies, therapeutic tissue engineering products, human cell and tissue products, and combination products using any such therapies or products, as well as gene therapies that lead to a durable modification of cells or tissues (including genetically modified cells).

Fraud, Abuse and False Claims

We are directly and indirectly subject to various federal and state laws governing relationships with healthcare providers and pertaining to healthcare fraud and abuse, including anti-kickback laws. In particular, the federal Anti-Kickback Statute prohibits persons from knowingly and willfully soliciting, offering, receiving or providing remuneration, directly or indirectly, in exchange for or to induce either the referral of an individual, or the furnishing, arranging for or recommending a good or service for which payment may be made in whole or part under federal healthcare programs, such as the Medicare and Medicaid programs. (See 42 U.S.C. § 1320a-7b). Penalties for violations include criminal penalties and civil sanctions such as fines, imprisonment and possible exclusion from Medicare, Medicaid and other federal healthcare programs. The Anti-Kickback Statute is broad and prohibits many arrangements and practices that are lawful in businesses outside of the healthcare industry. In implementing the statute, the Office of Inspector General of the U.S. Department of Health and Human Services (“OIG”) has issued a series of regulations, known as the “safe harbors.” These safe harbors set forth provisions that, if all their applicable requirements are met, will assure healthcare providers and other parties that they will not be prosecuted under the Anti-Kickback Statute.

AdvaMed has established guidelines and protocols for medical device manufacturers in their relationships with healthcare professionals on matters including research and development, product training and education, grants and charitable contributions, support of third-party educational conferences, and consulting arrangements. Adoption of the AdvaMed Code by a medical device manufacturer is voluntary, and while the OIG and other federal and state healthcare regulatory agencies encourage its adoption and may look to the AdvaMed Code, they do not view adoption of the AdvaMed Code as proof of compliance with applicable laws. We have incorporated the principles of the AdvaMed Code in our standard operating procedures, sales force training programs, and relationships with health care professionals.

Manufacturing (Processing)

From February 2018, when we sold our manufacturing assets to a third party in connection with the Sale through April 2019, we relied upon third party manufacturers and processors. In May 2019, we opened our new placental tissue bank processing laboratory in Miami, Florida and resumed operations of a placental tissue bank processing laboratory in Miami, Florida.

During the period that we were not manufacturing our own products, the products we sold to our customers were delivered directly to them by the manufacturer of the products. Now that we are once again are operating a laboratory facility, we intend on becoming a registered establishment, accredited by the American Association of Tissue Banks (“AATB”) for the storage and distribution of tissue products that we purchase directly or indirectly from third party manufacturers.

Our laboratory and distribution facilities are subject to periodic unannounced inspections by regulatory authorities based on the activities we may be engaged, and may undergo compliance inspections conducted by the FDA and corresponding state and foreign agencies based on our operations. We intend to seek American Association Blood Banks (“AABB”) or AATB accreditation in connection with the storage of products we intend to distribute.

| 18 |

Placental Donation Program

During the times that we operated our laboratory facilities, we purchased placental tissue that was used in our minimally manipulated 361 compliant process to produce allografts to be used in regenerative therapy specialties from several birth tissue recovery companies. During this time, we were able to procure an adequate supply of tissue to meet our anticipated demand. We do not expect there will be any shortages of placental tissue and/or birth tissue supply companies for our future processing requirements.

Environmental Laws

From the date of the Sale in February 2018 through April 2019, we did not process or directly handle biomedical materials. Beginning in May 2019, we operated laboratory facilities that process or directly handled biomedical materials whereby we receive and/or generate wastes that are required to be disposed. We contract with third parties for the transport, treatment, and disposal of the waste that we obtain and at all times plan on being compliant with applicable laws and regulations promulgated by the Resource Conservation and Recovery Act, the U.S. Environmental Protection Agency and similar state agencies.

During the period from the Sale through May 2019, we sold products that were purchased from third party manufacturers. All of our shipments prior to December 2018, were delivered directly from the product manufacturers to our customers and accordingly we did not take possession of any product at any time.

Employees

At October 31, 2019, we had six full-time employees and no part-time employees. We also engaged two other persons as consultants that assisted with various administrative activities. From time to time, the Company engages independent contractors for sales and administration activities. There are no collective bargaining agreements.

Corporate History and Change in Control

The Company was incorporated in the state of Nevada on August 9, 2011 as Bespoke Tricycles Inc. for the purpose of designing, manufacturing, and selling vending tricycles for commercial customers. On June 24, 2015, Albert Mitrani, our Chairman, Chief Executive Officer and President, purchased an aggregate of 135,000,000 shares of common stock of Bespoke Tricycles, Inc. from John Goodhew, representing approximately 87.8% of the then issued and outstanding shares of the Company on a fully-diluted basis and constituting a change in control of the Company. The transaction was in accordance with the terms and provisions of the stock purchase agreement, dated May 29, 2015 (“Mitrani Purchase Agreement”), by and among the Company, Mr. Mitrani and Mr. Goodhew. The purchase price of $40,000 for the shares was paid by Mr. Mitrani to Mr. Goodhew on June 24, 2016. In connection with the execution and delivery of the Mitrani Purchase Agreement, as of May 29, 2015, Mr. Goodhew resigned as the sole officer of the Company and appointed Albert Mitrani to the Board of Directors and as the sole officer of the Company. Mr. Goodhew remained on the Board of Directors of the Company.

On August 6, 2015, Mr. Mitrani returned 60,120,000 shares of common stock of the Company to the Company for cancellation. As a result, Mr. Mitrani’s ownership was 74,880,000 shares of common stock of the Company, representing approximately 80% of the 93,600,000 shares of common stock issued and outstanding on such date.

On September 1, 2015, the Company filed a Certificate of Amendment with the Secretary of State of Nevada therein changing its name to Biotech Products Services and Research, Inc. and increasing the amount of authorized common stock from 90 million (90,000,000) shares to 250 million (250,000,000) shares. The amount authorized “blank check” preferred stock remained 10 million (10,000,000) and the par value of the common stock and preferred stock remained $0.001 per share.

| 19 |

On September 17, 2015, the Company completed an eighteen-for-one (18:1) forward split of the Company’s issued and outstanding common stock. Unless otherwise noted, the disclosure in this Annual Report on Form 10-K, including the consolidated audited financial statements contained herein, reflect a retroactive adjustment for the forward stock split. The forward stock split had no effect on the authorized capital stock of the Company.

On November 1, 2016, the Company filed a Certificate of Designation with the Secretary of State of Nevada therein designating out of the 10,000,000 authorized shares of Preferred Stock, a class of Preferred Stock as “Series A Non-Convertible Preferred Stock” consisting of 100 shares (the “Series A Certificate of Designation “). On March 2, 2017, the Company filed with the Secretary of State of Nevada an amendment to increase the number of shares provided for in the Series A Certificate of Designation from 100 shares to 400 shares. Generally, the outstanding shares of Series A Non-Convertible Preferred Stock shall vote together with the shares of common stock and other voting securities of the Company as a single class and, regardless of the number of shares of Series A Non-Convertible Preferred Stock outstanding, and as long as at least one share of Series A Non-Convertible Preferred Stock is outstanding, such shares shall represent eighty percent (80%) of all votes entitled to be voted at any annual or special meeting of stockholders of the Company or action by written consent of stockholders. Each outstanding share of the Series A Non-Convertible Preferred Stock shall represent its proportionate share of the 80% which is allocated to the outstanding shares of Series A Non-Convertible Preferred Stock.

On November 1, 2016, the Company filed a Certificate of Designation with the Secretary of State of Nevada therein designating out of the 10,000,000 authorized shares of Preferred Stock, a class of Preferred Stock as “Series B Convertible Preferred Stock” consisting of 1,000,000 shares (“Series B Certificate of Designation”). Each holder of Series B Preferred Stock shall have the right, at such holder’s option, at any time or from time to time from and after the day immediately following the date the Series B Preferred Stock is first issued, to convert each share of Series B Preferred Stock into 20 fully-paid and non-assessable shares of common stock.

On June 6, 2017, pursuant to the Nevada Revised Statutes and the Bylaws of the Company, the Board of Directors of the Company and the stockholders holding the Company’s outstanding Series A Preferred Stock, having the voting equivalency of 80% of the outstanding capital stock, approved the filing of an amendment to the Articles of Incorporation of the Company to increase the authorized amount of common stock from 250,000,000 to 750,000,000, without changing the par value of the common stock or authorized number and par value of “blank check” Preferred Stock. On June 19, 2017, the Company filed a Definitive 14C with the SEC regarding the corporate action. On June 22, 2017, the Company filed a Certificate of Amendment to the Company’s Articles of Incorporation with the Secretary of State of Nevada to effectuate the corporate action on July 10, 2017.

On April 23, 2018, in connection with the Reorganization, the Company issued MBA an aggregate of 222,425,073 shares of common stock of the Company, representing at the time a 51% fully diluted equity interest in the Company at a price of $0.001 per share (an aggregate value of $222,425). The foregoing issuance resulted in a change in control of the Company.

On May 8, 2018, the Company received the written consent of the Board of Directors of the Company (“Board”) and, on May 9, 2018, the written consent of the shareholders holding a majority in interest of the voting power of the Company (86.9%) adopting resolutions which authorized the Company to amend its Articles of Incorporation to change the name of the Company from "Biotech Products Services and Research, Inc." to “Organicell Regenerative Medicine, Inc.” The Company filed a Certificate of Amendment with the Nevada Secretary of State and, effective June 20, 2018, the Company’s name has been changed to Organicell Regenerative Medicine, Inc.