UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001- 35760

SILVER BAY REALTY TRUST CORP.

(Exact name of registrant as specified in its charter)

|

Maryland |

|

90-0867250 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer Identification No.) |

|

601 Carlson Parkway, Suite 250 |

|

55305 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(952) 358 4400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange on Which Registered |

|

Common Stock, $0.01 par value |

|

New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o |

|

Accelerated filer o |

|

|

|

|

|

Non-accelerated filer x |

|

Smaller reporting company o |

|

(Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of June 30, 2012, there was no established public trading market for the registrant’s securities and the registrant had no voting common stock held by non-affiliates.

As of February 28, 2013, 39,313,929 shares of Common Stock, par value $0.01 per share, of Silver Bay Realty Trust Corp. were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates by reference certain information from the definitive proxy statement to be filed for the registrant’s 2013 Annual Meeting of Stockholders. The registrant intends to file the proxy statement with the Securities and Exchange Commission within 120 days of December 31, 2012.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and its exhibits contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

The forward-looking statements contained in this report reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from those expressed in any forward-looking statement. Statements regarding the following subjects, among others, may be forward-looking:

· our ability to execute business and investment strategy effectively;

· our projected operating results;

· the rates of defaults on, early terminations of or non-renewal of leases by residents;

· our ability to identify properties to acquire and complete acquisitions;

· our ability to gain possession and renovate properties;

· our ability to successfully lease and operate acquired properties;

· projected operating costs;

· rental rates or vacancy rates;

· our ability to obtain financing arrangements;

· interest rates and the market value of our target assets;

· our ability to maintain our qualification as a REIT for U.S. federal income tax purposes;

· availability of qualified personnel;

· estimates relating to our ability to make distributions to our stockholders in the future;

· our understanding of our competition; and

· market trends in our industry, real estate values, the debt securities markets or the general economy.

For a discussion of some of the factors that could cause our actual results to differ materially from any forward-looking statements, see the discussion on risk factors in Item 1A, “Risk Factors,” and in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in this Annual Report on Form 10-K and other risks and uncertainties detailed in this and our other reports and filings with the Securities and Exchange Commission, or SEC. The forward-looking statements in this Annual Report on Form 10-K represent our views as of the date of this Annual Report on Form 10-K. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable laws. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this Annual Report on Form 10-K.

Silver Bay Realty Trust Corp. is an externally-managed Maryland corporation focused on the acquisition, renovation, leasing and management of single-family properties in selected markets in the United States. Our principal financial objective is to generate attractive risk-adjusted returns for our stockholders over the long term, primarily through dividends and secondarily through capital appreciation.

We generate virtually all of our revenue by leasing our portfolio of single-family properties. We currently own single-family properties in Arizona, California, Florida, Georgia, Nevada, North Carolina, Ohio and Texas. We view our target markets as desirable because we believe they have an oversupply of properties that can be acquired at attractive prices, favorable demographics and long-term economic trends and healthy demand for rental properties. As of December 31, 2012, we owned approximately 3,400 single-family homes in our target markets.

Geographic Distribution of Portfolio

(the percentages are based on the number of properties as of December 31, 2012 in each market)

Silver Bay Realty Trust Corp. was incorporated in Maryland in June 2012 and conducts its business and owns all of its properties through Silver Bay Operating Partnership L.P., or the Operating Partnership, a Delaware limited partnership. Silver Bay Realty Trust Corp.’s wholly owned subsidiary, Silver Bay Management LLC, or the General Partner, is the sole general partner of the Operating Partnership. Silver Bay Realty Trust Corp. has no material assets or liabilities other than its investment in the Operating Partnership. As of December 31, 2012, Silver Bay Realty Trust Corp. owned, through a combination of direct and indirect interests, 99.9% of the partnership interests in the Operating Partnership. Except as otherwise required by the context, references to the “Company,” “Silver Bay,” “we,” “us” and “our” refer collectively to Silver Bay Realty Trust Corp., the Operating Partnership and the direct and indirect subsidiaries of each. We are externally managed by PRCM Real Estate Advisers LLC, or our Manager.

We completed our initial public offering and certain formation transactions in December 2012 in which we received net proceeds of approximately $263.3 million (including the closing of the underwriters’ overallotment option on January 7, 2013 by which we received net proceeds of approximately $34.8 million) and acquired an initial portfolio of more than 3,300 single-family properties. Prior to that time, we had no substantive operations though, as described below under the heading “Business — Formation Transactions” we are considered a continuation of our Predecessor’s business operations.

We intend to elect to qualify as a real estate investment trust, or REIT, for U.S. federal tax purposes, commencing with the portion of our taxable year ended December 31, 2012. We believe that our organization and method of operation will enable us to meet the requirements for qualification and taxation as a REIT. As a REIT, we generally will not be subject to federal income tax on the taxable income that we distribute to our stockholders. If we fail to qualify as a REIT in any taxable year, we will be subject to

federal income tax at regular corporate rates. Even if we qualify for taxation as a REIT, we may be subject to some federal, state and local taxes on our income or property. In addition, the income of any taxable REIT subsidiary, or TRS, that we own will be subject to taxation at regular corporate rates.

Our principal executive office is located at 601 Carlson Parkway, Suite 250, Minnetonka, Minnesota 55305. Our telephone number is (952) 358-4400. Our web address is www.silverbayrealtytrustcorp.com. Our common stock is listed on the New York Stock Exchange, or the NYSE, under the symbol “SBY.” Our Manager’s executive office is located at 601 Carlson Parkway, Suite 250, Minnetonka, Minnesota 55305.

Business Strategy

Our strategy is to acquire, renovate, lease and manage single-family properties located in our target markets. We acquire properties with the goal of generating rental income by leasing our properties at attractive yields to qualified residents. We intend to hold our properties over the long term. Although we may consider the opportunistic disposition of assets, we have no pre-set investment horizon that would require their sale.

Target Markets

We employ a top-down selection process in our investment strategy. We start by identifying what we believe are the most attractive markets for developing a single-family rental business by evaluating existing and projected housing dynamics. Housing prices and rental demand are driven in part by macroeconomic and demographics factors. We scrutinize many of these factors including existing supply of homes, vacancy rates, prior and projected population and household growth, prior and projected migration, regional building activity, mortgage delinquency figures, employment trends, income ratios and price-to-rent ratios.

Our current target markets are:

· Phoenix, AZ

· Tucson, AZ

· Northern CA (currently consisting of Contra Costa, Napa, Sacramento and Solano counties)

· Southern CA (currently consisting of Colton, Riverside and San Bernardino counties)

· Jacksonville, FL

· Orlando, FL

· Southeast FL (currently consisting of Broward and Miami-Dade counties)

· Tampa, FL

· Atlanta, GA

· Charlotte, NC

· Las Vegas, NV

· Columbus, OH

· Dallas, TX

· Houston, TX

We recently entered the Jacksonville, FL Southeast Florida, Columbus, OH and Houston, TX, markets but did not own any homes in those markets as of December 31, 2012. We continue to evaluate and monitor potential new markets.

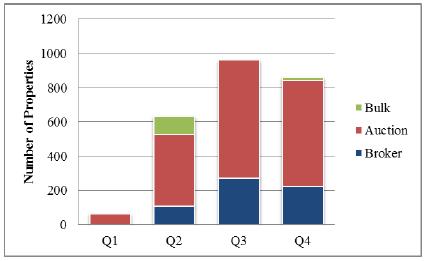

Acquisitions

We acquire single-family properties in our target markets through a variety of acquisition channels, including foreclosure auctions, online auctions, brokers, multiple listing services, short sales and bulk purchases from institutions or investor groups. We use a multi-market and multi-channel investment strategy to provide flexibility in deploying capital and to diversify our portfolio, mitigate risk and avoid overexposure to any single market. We continue to seek expansion of our acquisition channels. Acquisitions may be financed from various sources, including proceeds from the sale of equity securities, retained cash flow, future debt financings or the issuance of common units in the Operating Partnership. The issuance of common units in the Operating Partnership may enable the sellers to defer, in whole or in part, the recognition of taxable income or gain that might otherwise result from the sales.

We combine our multi-channel acquisition infrastructure with a disciplined property selection process that incorporates local knowledge to better understand the fundamentals of the housing markets in which we operate. Our Manager’s regional market infrastructure consists of personnel working and residing in our target markets who have extensive local-market knowledge and relationships across various constituencies. For acquisitions in the Phoenix, Northern and Southern California, Jacksonville, Orlando, Southeast Florida, Atlanta, Charlotte, Las Vegas, Columbus, Dallas and Houston markets, our Manager uses its internal teams of approximately 35 brokers and sales agents. Our Manager relies on third parties to provide such services in the Tampa and Tucson markets and will evaluate future markets on a case-by-case basis.

Property Renovation

Most of the properties we acquire require renovation and standardization before they are ready for leasing. We refer to the process of possessing, renovating, marketing and leasing a property as property stabilization. Our renovation and maintenance approach is generally consistent across our various acquisition channels. We maintain system-wide standards for our properties that are implemented at the local level and directed at increasing attractiveness to potential residents, reducing future maintenance expense and increasing the long-term value of the property. Our Manager’s operating subsidiary uses a mix of internal project managers and third-party property managers to oversee the work of local contractors engaged to renovate our properties.

Leasing and Management

The single-family rental business requires hands-on asset management capabilities and an integrated infrastructure to manage a large-scale portfolio that is geographically dispersed. Our Manager uses a structure that combines centralization of oversight functions with a strong local presence and expertise. Our Manager uses internal teams in the Phoenix, Southeast Florida and Atlanta markets and relies on third parties to provide property management services in the Tucson, Northern and Southern California, Jacksonville, Orlando, Tampa, Las Vegas, Charlotte, Columbus, Dallas and Houston markets. Our leasing and management strategy centers on finding quality residents and reducing resident turnover. To accomplish this goal, we focus on providing quality and consistency in our customer service, maintenance, leasing and marketing operations.

Technology

Technology plays an important role in assisting us to build and manage a portfolio of geographically disperse assets. Our Manager has developed and continues to develop a technological infrastructure with tools that:

· efficiently and consistently screen target properties for acquisition;

· allow real-time monitoring of our portfolio; and

· provide a secure cloud-based environment with mobile accessibility.

Formation Transactions

In connection with our initial public offering in December 2012, we completed a series of contribution and merger transactions, or the Formation Transactions, through which we acquired an initial portfolio, or our Initial Portfolio, of more than 3,300 single-family properties from Two Harbors Investment Corp., or Two Harbors, and the owners of the membership interests of entities managed by Provident, or the Provident Entities, in consideration of 23,917,642 shares of our common stock, 1,000 shares of our 10% cumulative redeemable preferred stock, 27,459 common units in the Operating Partnership and approximately $5.3 million in cash.

Acquisition of Two Harbors Property Investment LLC (now known as Silver Bay Property Investment LLC), or Silver Bay Property or our Predecessor, accounted for more than 2,400 properties in our Initial Portfolio. Silver Bay Property began acquiring this portfolio of single-family residential properties to rent for income and to hold for investment in the first quarter of 2012. Acquisition of the Provident Entities accounted for 881 properties in our Initial Portfolio. Provident began acquiring, renovating, managing and overseeing the leasing of these single-family properties in 2009, acquiring properties in Arizona, Florida, Georgia and Nevada through the Provident Entities, five private limited liability companies for which Provident served as the managing member.

For accounting purposes, our Predecessor was considered the acquiring or surviving entity, meaning our balance sheet reflects the historical assets and liabilities of our Predecessor at historical cost. The contribution of the Provident Entities, on the other hand, was accounted for as an acquisition under the purchase method of accounting, meaning the assets and liabilities of the Provident Entities were recorded at the estimated fair value of the acquired assets and assumed liabilities. As a result of the Formation transactions, we are considered a continuation of our Predecessor’s business operations.

Our Manager

We are externally managed by PRCM Real Estate Advisers LLC, or our Manager. We rely on our Manager, and our Manager’s wholly owned operating subsidiary, Silver Bay Property Corp., to provide or obtain on our behalf the personnel and services necessary for us to conduct our business as we have no employees of our own.

Our Manager is a joint venture between Provident Real Estate Advisors LLC, or Provident, and an affiliate of Pine River Capital Management L.P., or Pine River. Our Manager’s wholly owned operating subsidiary currently employs more than 80 people and is a licensed real estate broker in the markets where we acquire properties. Prior to our initial public offering, our Manager provided property management and acquisition services to the entities that we acquired in the Formation Transactions. Our Manager and its operating subsidiary will provide its services in managing and acquiring single-family properties exclusively to us through December 2015.

Our Manager’s headquarters are located in Minnetonka, Minnesota, and its operating subsidiary has offices in:

· Minnetonka, MN

· Phoenix, AZ

· Northern and Southern CA

· Jacksonville, FL

· Orlando, FL

· Southeast FL

· Atlanta, GA

· Charlotte, NC

· Las Vegas, NV

· Columbus, OH

· Dallas, TX

· Houston, TX

In addition to having exclusive access to our Manager’s technology infrastructure and its acquisition and property management teams in our target markets, we benefit from the knowledge and experience that our Manager derives from its relationships with Pine River and Provident. Provident, a private capital management firm based in Minnesota, engaged in the acquisition, renovation, management and leasing of a portfolio of predominantly single-family properties between 2009 and 2012. In building and managing this portfolio, Provident developed a network of vendors, service providers and third-party property managers along with institutional knowledge related to the acquisition and management of single-family properties. Our Manager benefited from these relationships and experience by, where prudent, further developing such relationships and by hiring key members of Provident’s management team. Pine River is a global asset management firm with institutional capabilities in asset valuation and management, capital markets, financial transactions, managing new ventures, risk management, compliance and reporting. Pine River has valuable industry and analytical expertise, extensive long-term relationships in the financial community and established fixed-income, mortgage and real estate investment experience. In addition, Pine River’s experience in launching and managing Two Harbors, a publicly traded mortgage REIT, provides our Manager with knowledge, expertise and experience to assist in managing Silver Bay as a public company.

Management Agreements

Advisory Management Agreement

We have entered into an advisory management agreement with our Manager. Pursuant to this management agreement, our Manager designs and implements our business strategy and administers our business activities and day-to-day operations, subject to oversight by our board of directors. Our Manager is responsible for, among other duties: (1) performing and administering all our day-to-day operations, (2) determining investment criteria in cooperation with our board of directors, (3) sourcing, analyzing and executing asset acquisitions, sales and financings, (4) performing asset management duties and (5) performing certain financial, accounting and tax management services. Our Manager has agreed not to provide these services to anyone other than us, our subsidiaries and any future joint venture in which we are an investor, prior to December 19, 2015. In addition, our Manager and Pine River have agreed not to compete with us, our subsidiaries or any of our future joint ventures before December 19, 2015.

Under the management agreement, our Manager is compensated on a fee plus pass-through-of-expenses basis. We pay our Manager 0.375% of the daily average of our fully diluted market capitalization for the preceding quarter (a 1.5% annual rate), less any property management fees received by our Manager’s operating subsidiary or its affiliates under the property management and acquisition services agreement described below. This advisory management fee is also reduced through December 19, 2013 by an amount equal to the additional consideration that we have agreed to pay to Two Harbors and the prior members of the Provident Entities, as described below under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Results of Operations — Expenses — Advisory Management Fee.” We also reimburse our Manager for all expenses incurred on our behalf or otherwise in connection with the operation of its business, other than compensation for our Chief Executive Officer and personnel providing data analytics directly supporting the investment function. If our Manager provides services to a party other than us or one of our subsidiaries, a portion of these expenses will be allocated to and reimbursed by such other party in a fair and equitable manner as determined by our Manager in good faith; our Manager is not currently providing such third party services.

For purposes of calculating the advisory management fee, our fully diluted market capitalization on a given day is calculated in accordance with following formula:

Fully Diluted Market Capitalization = FMVCommon × (OutCommon + OutCommonEquiv) – AECommonEquiv

where:

|

FMVCommon = |

(1) if our common stock is then listed on a national stock exchange, the closing price per share for the last preceding day on which there was a sale of such shares, (2) if our common stock is not then listed on a national stock exchange but is traded on an over-the-counter market, the average of the closing bid and asked prices for our common stock in such over-the-counter market for the last preceding date on which there was a sale of such shares in such market or (3) if neither (1) nor (2) applies, such value as the compensation committee of our board of directors determines in good faith |

|

|

|

|

OutCommon = |

the number of shares of common stock issued and outstanding on such day |

|

|

|

|

OutCommonEquiv = |

the maximum number of shares of common stock issuable pursuant to outstanding rights, options or warrants to subscribe for, purchase or otherwise acquire our common stock or securities convertible into our common stock (including common units of the Operating Partnership) that are in the money and held by people other than us or one of our subsidiaries on such day |

|

|

|

|

AECommonEquiv = |

the aggregate consideration payable to the company upon the redemption, exercise, conversion and/or exchange of any outstanding rights, options or warrants to subscribe for, purchase or otherwise acquire our common stock or securities convertible into our common stock (including common units of the Operating Partnership) that are in the money and held by people other than us or one of our subsidiaries on such day |

The value of the 10% cumulative redeemable preferred stock issued as part of the Formation Transactions and, any additional preferred stock or securities convertible into or exchangeable for, or rights, options or warrants to subscribe for, purchase or otherwise acquire our preferred stock, was determined as described in the management agreement and added to the calculation of fully diluted market capitalization. If the Operating Partnership issues any equity interest that is not otherwise captured by the formula above, or securities convertible, redeemable, exercisable or otherwise exchangeable for any equity interest in the Operating Partnership, the value of such equity interests will be determined as described in the management agreement and added to the calculation of fully diluted market capitalization.

The initial term of the management agreement expires on December 19, 2015 and will be automatically renewed for a one-year term on such date and each anniversary thereafter unless terminated. Upon termination of the management agreement by us for reasons other than cause, or by our Manager for cause that we are unwilling or unable to timely cure, we will pay our Manager a termination fee equal to 4.5% of the daily average of our fully diluted market capitalization in the quarter preceding such termination.

Property Management and Acquisition Services Agreement

We have also entered into a property management and acquisition services agreement with our Manager’s operating subsidiary. Under this agreement, our Manager’s operating subsidiary acquires additional single-family properties on our behalf and manages our properties. Our Manager’s operating subsidiary has agreed not to provide these services to anyone other than us and our affiliates prior to December 19, 2015.

Our Manager’s operating subsidiary receives a property management fee equal to 5% of certain costs and expenses incurred by it in the operation of its business that are reimbursed by us. This property management fee reduces the advisory management fee paid to our Manager on a dollar for dollar basis. We reimburse our Manager’s operating subsidiary for all expenses incurred on our behalf. Additionally, for so long as it provides services exclusively to us, we will reimburse our Manager’s operating subsidiary for all costs and expenses incurred by it in the operation of its business, including the compensation of its employees. If our Manager’s operating subsidiary provides services to a party other than us or one of our subsidiaries, a portion of the corresponding expenses incurred by our Manager in doing so will be allocated to and reimbursed by such other party as reasonably determined by our Manager’s operating subsidiary in good faith; our Manager’s operating subsidiary is not currently providing any such third party services. This agreement will continue in effect until it is terminated in accordance with its terms.

Financing Strategy

To date, we have had no indebtedness. However, we may use debt to increase potential returns to our stockholders in the future and are currently in discussions with potential lenders for a revolving credit facility that could be used to fund future acquisitions and renovations and provide us with additional working capital. As the stabilized portion of our portfolio grows, we expect to use debt in a manner consistent with multifamily REITs, which we view as using moderate leverage of 30-50%. This is not a near-term target. Our decision to use debt will be based on our Manager’s assessment of a variety of factors, including the cash flow generation capability of assets, the availability of credit on favorable terms, any prepayment penalties and restrictions on refinancing, the credit quality of our assets and our outlook for borrowing costs relative to the unlevered yields on our assets. Our decision to use debt will not be subject to the approval of our stockholders. We are not restricted by our governing documents in the amount of debt that we may use. We may, however, be limited or restricted in the amount of debt we may employ by the terms and provisions of any financing or other agreements that we may enter into in the future.

Competition

The residential rental market has historically been fragmented in both its ownership and operations. We face competition from local owners and operators as well as an emerging class of institutional managers. When acquiring single-family properties, we face competition from individual investors, private pools of capital and other institutional buyers which may increase the prices for properties that we would like to purchase and reduce our ability to achieve our desired portfolio size or expected yields. We also compete for desirable residents against the same entities as well as multifamily lessors. However, we believe that being an early institutional participant in this sector, having an integrated and scalable platform with local market presence and using our wealth of existing in-house expertise will give us competitive advantages.

Investment Guidelines

Our board of directors has adopted the following investment guidelines:

· no investment will be made that would cause us or any of our subsidiaries to fail to qualify as a REIT for U.S. federal income tax purposes;

· no investment will be made that would cause us to be required to register as an investment company under the Investment Company Act of 1940;

· our investments will be limited to (a) single-family properties and investments that are directly related to the acquisition, maintenance, ownership and leasing thereof, provided that bulk purchases of assets that are within this guideline may include other assets to the extent the purchase of such other assets is necessary in order to effect such bulk purchases; and (b) up to 5% of the company’s assets may consist of other investments; and

· until appropriate investments can be identified, we may invest available cash in interest-bearing and short-term investments that are consistent with (i) our intention to qualify as a REIT and (ii) our and our subsidiaries’ exemption from “investment company” status under the Investment Company Act of 1940.

Our board of directors will review our investment portfolio and our compliance with our investment guidelines from time to time as it deems appropriate or necessary. These investment guidelines may be modified by our board without the approval of our stockholders, and although we are not required to, we intend to disclose any such changes or waivers to our investment guidelines in the periodic reports we file with the SEC.

Regulation

General

Our properties are subject to various covenants, laws and ordinances, and certain of our properties are also subject to the rules of the various homeowners’ associations where such properties are located. We believe that we are in compliance with such covenants, laws, ordinances and rules and our leasing terms require that our residents agree to comply with such covenants, laws, ordinances and rules.

Fair Housing Act

The Fair Housing Act, or FHA, its state law counterparts and the regulations promulgated by U.S. Department of Housing and Urban Development and various state agencies, prohibit discrimination in housing on the basis of race or color, national origin, religion, sex, familial status (including children under the age of 18 living with parents or legal custodians, pregnant women and people securing custody of children under the age of 18) or handicap (disability) and, in some states, on financial capability and other bases. We believe that we are in compliance with the FHA and other regulations.

Environmental Matters

As an owner of real estate, we are subject to various federal, state and local environmental laws, regulations and ordinances and also could be liable to third parties as a result of environmental contamination or noncompliance at our properties even if we no longer own such properties. See the discussion under Item 1A, “Risk Factors,” under the caption “We may be subject to unknown or contingent liabilities or restrictions related to properties that we acquire for which we may have limited or no recourse.”

REIT Qualification

We intend to elect to qualify as a REIT commencing with our initial taxable year ended on December 31, 2012. Our qualification as a REIT depends upon our ability to meet on a continuing basis, through actual investment and operating results, various requirements under the Internal Revenue Code of 1986, as amended, or the Code, relating to, among other things, the sources of our gross income, the composition and values of our assets, our distribution levels and the diversity of ownership of our shares. We believe that we have been organized in conformity with the requirements for qualification and taxation as a REIT under the Code, and that we conduct our operations in a manner that will enable us to meet the requirements for qualification and taxation as a REIT going forward.

As long as we qualify as a REIT, we generally will not be subject to U.S. federal income tax on the REIT taxable income that we distribute to our stockholders. If we fail to qualify as a REIT in any taxable year and do not qualify for certain statutory relief, we will be subject to U.S. federal income tax at regular corporate rates and may be precluded from qualifying as a REIT for the subsequent four taxable years following the year during which we lose our REIT qualification. Even if we qualify for taxation as a REIT, we may be subject to certain U.S. federal, state and local taxes on our income or property. In addition, any TRS we own will be subject to U.S. federal, state and local taxes on its income or property.

David N. Miller is our Chief Executive Officer, President and a member of our board of directors. Mr. Miller has been a director and executive officer since August 2012. Beginning in 2011, Mr. Miller served as a Managing Director of Pine River Capital Management L.P. and Two Harbors Investment Corp., where he focused on strategy and new business development, including the formation and development of Silver Bay and the single family property rental business. From 2008 to 2011, Mr. Miller served in various roles at the U.S. Department of Treasury, including as the Chief Investment Officer of the Troubled Asset Relief Program (TARP) where he was instrumental in building various investment programs and business units and overseeing the investment portfolio. From 2007 to 2008, Mr. Miller was a portfolio manager at HBK Capital Management focusing on equity investments. From 1998 through 2007, he held various positions at Goldman, Sachs & Co., including as a Vice President in the Special Situations Investing Group (2004-2007) where he focused on proprietary investments in debt and equity and as a financial analyst in the investment banking division (1998-2001) where he focused on corporate finance and mergers and acquisitions. Mr. Miller received an MBA from Harvard Business School and a B.A. in Economics from Dartmouth College. We believe Mr. Miller is an appropriate director because of his management role and knowledge of the operations of our Manager and our Manager’s operating subsidiary as well as his general investment expertise.

Christine Battist is our Chief Financial Officer and Treasurer. Ms. Battist has been an executive officer since our incorporation in June 2012. Prior to this appointment, Ms. Battist served as Managing Director at Two Harbors Investment Corp. overseeing investor and media relations beginning in 2011. From 2005 to 2011, Ms. Battist served in various financial roles at The

Mosaic Company [NYSE: MOS], first as Director of Financial Compliance from 2005 to 2007, leading the company’s inaugural global Sarbanes Oxley design and implementation after its merger, then as Director Investor Relations from 2007 to 2011. Ms. Battist was instrumental in leading Mosaic’s investor relations during its formative years and through the spin-off and secondary offering of shares held by Mosaic’s largest and private stockholder in 2011. Prior to joining the Mosaic Company, Ms. Battist was Director of Internal Audit for Tuesday Morning Corporation [NASDAQ: TUES] from 2003 to 2005. Ms. Battist began her career with PricewaterhouseCoopers LLP, spending a decade in ever-increasing roles and responsibilities, overseeing financial audit engagements for public companies in the U.S. capital and debt markets, including leading acquisition and carve-out transactions. She received a B.B.A. from St. Norbert College and is licensed as a Certified Public Accountant (inactive) in the State of Texas.

Patrick Freydberg is our Chief Operating Officer. Mr. Freydberg has been an executive officer since August 2012. From 2003 to 2012 Mr. Freydberg served as President and Chief Operating Officer of Northbrook Partners, LLC, a multifamily real estate management company with over $1.2 billion in assets under management for BlackRock and RREEF Real Estate. From 2001 to 2003 Mr. Freydberg was a Regional Manager for SSR Realty Advisors, the pension fund advisory division of MetLife, where he ran operations for SSR’s multifamily real estate investments in the Northeast. Prior to that, Mr. Freydberg was a Director of Asset Management for Insignia/Douglas Elliman and was responsible for management of a portfolio of 5,000 distressed REO units for Citibank, the Federal Deposit Insurance Corporation and other institutions. Mr. Freydberg received an MBA from the Johnson School of Management at Cornell University and a B.S. in Engineering from Cornell University. Mr. Freydberg is a licensed real estate broker in New York and Connecticut.

Timothy O’Brien is our General Counsel and Secretary. Mr. O’Brien has been an executive officer since our incorporation in June 2012. Mr. O’Brien is a Partner of Pine River and has served as General Counsel and Chief Compliance Officer of Pine River since 2007. Mr. O’Brien is also General Counsel of Two Harbors but will resign that position as of March 1, 2013. From 2004 to 2006, Mr. O’Brien served as Vice President and General Counsel of NRG Energy, Inc., a publicly listed power generation company. Mr. O’Brien served as Deputy General Counsel of NRG Energy, Inc. from 2000 to 2004 and Assistant General Counsel from 1996 to 2000. Prior to joining NRG Energy, Inc., Mr. O’Brien was an associate at the law firm of Sheppard Mullin in Los Angeles and San Diego, California. He received a J.D. from the University of Minnesota Law School and a B.A. in History from Princeton University.

Employees

We are managed by our Manager pursuant to the management agreement between our Manager and us. Each of our officers is an employee or partner of Pine River. We have no employees of our own.

Available Information

Our website address is www.silverbayrealtytrustcorp.com. We make available, free of charge on our website (on the Investor Relations page under “SEC Filings”), our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports, as are filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, as well as our proxy statements with respect to our annual meetings of stockholders, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Our Exchange Act reports filed with, or furnished to, the SEC are also available at the SEC’s website at www.sec.gov.

We intend to webcast our earnings calls and certain events we participate in or host with members of the investment community on our investor relations website. Additionally, we provide notifications of news or announcements regarding our financial performance, including SEC filings, investor events, press and earnings releases as part of our investor relations website. Investors and others can receive notifications of new information posted on our investor relations website in real time by signing up for email alerts and RSS feeds. Further corporate governance information, including charters for our board committees, our Code of Business Conduct and Ethics, and our whistleblowing procedures, are available on our website on the Investor Relations page. The contents of our website referred to in this Annual Report on Form 10-K are not intended to be incorporated by reference into this Form 10-K or in any other report or document we file with the SEC, and any references to our website is intended to be inactive textual references only.

Set forth below are the risks that we believe are material to our stockholders. You should carefully consider the following risks in evaluating our company and our business. The occurrence of any of the following risks could materially adversely impact our financial condition, results of operations, cash flow, the market price of our common stock and our ability, among other things, to make distributions to our stockholders, which in turn could cause our stockholders to lose all or a part of their investment. Some statements in the following risk factors constitute forward-looking statements. Please refer to the section entitled “Special Note Regarding Forward-Looking Statements” at the beginning of this Annual Report on Form 10-K.

Risks Related to Our Business

We are an early entrant employing a new and untested business model in a new industry with no proven track record, which makes our business difficult to evaluate.

The large-scale single-family rental industry is relatively new in the United States. Until very recently, the single-family rental business consisted primarily of private and individual investors in local markets and was managed individually or by small, local property managers. We were formed on the assumption that a company can acquire and operate single-family properties on a large-scale basis and achieve attractive yields employing a disciplined approach to acquisitions and renovations, economies of scale in marketing and management and developing a brand-name presence. This is a new business model that has not been tested on a national scale. Our assumptions are unproven, and if they prove to be incorrect, then we may fail to provide the financial returns that investors hope or expect to receive.

Our investment strategy involves purchasing a large number of residential properties and leasing them to suitable residents. We are unaware of any other public REIT that is currently attempting to implement this strategy on the scale that we intend to pursue. No peer companies exist with an established track record from which to predict whether our investment strategy can be implemented successfully over time. While past performance is not indicative of future results, it will be difficult to evaluate our potential future performance without the benefit of established track records from companies implementing a similar investment strategy. We may encounter unanticipated problems implementing our investment strategy, which may have a material adverse effect on our results of operations and our ability to make distributions on our common stock and may cause our stock price to decline significantly. Accordingly, no assurance can be given that we will be successful in implementing our investment strategy or that we will be successful in achieving our objective of providing attractive risk-adjusted returns to our stockholders over the long term.

We believe the acquisition, operation and management of multifamily residential properties is the most comparable established business model to our business, but in contrast to multifamily operations, the geographic dispersion of single-family properties creates significantly greater operational and maintenance challenges and, potentially, significantly higher per-unit operating costs. In addition, because each home has unique features, appliances and building materials, we believe the renovations, maintenance, marketing and operational tasks are far more varied and demanding than in a typical multifamily setting. We cannot provide any assurance that operating a large portfolio of single-family rental properties can be executed in a cost-effective and profitable manner or that our business plan will succeed.

We have a limited operating history and may not be able to operate our business successfully or generate sufficient cash flows to make or sustain distributions to our stockholders.

Silver Bay Realty Trust Corp. was organized in June 2012 and has a limited operating history. More than half of the homes we owned as of December 31, 2012 had been acquired within the preceding six months and a substantial number of those were still in the process of stabilization. We define stabilization as the period of time during which properties are not generating revenue because we are gaining possession, conducting renovations or marketing and leasing such properties. There is no long-term historical financial data available for Silver Bay Property, our acquired properties or other companies in the single-family rental industry to assist investors in assessing our earnings potential or whether we can operate profitably. We cannot assure you that we will be able to operate our business successfully or implement our operating policies and strategies as described in this Annual Report. The results of our operations will depend on many factors, including:

· the availability of additional properties that meet our criteria and our ability to purchase such properties on favorable terms;

· real estate appreciation or depreciation in our target markets;

· our ability to contain renovation, maintenance, marketing and other operating costs for our properties;

· our ability to maintain high occupancy rates and target rent levels;

· general economic conditions in our target markets, such as changes in employment and household earnings and expenses;

· costs that are beyond our control, including title litigation, litigation with residents or tenant organizations, legal compliance, real estate taxes, homeowners’ association fees and insurance;

· judicial and regulatory developments affecting landlord-tenant relations that may affect or delay our ability to dispossess or evict occupants or increase rents;

· judicial and regulatory developments affecting banks’ and other mortgage holders’ ability to foreclose on delinquent borrowers;

· reversal of population, employment or homeownership trends in target markets; and

· competition from other investors entering the single-family rental market.

Our Manager is still building its operational expertise and infrastructure, and it is dependent upon new employees and third-party service providers to manage and operate its properties.

Our Manager has been building its operational expertise by hiring new employees and establishing relationships with third-party service providers. Most of these employees and relationships are relatively new to our Manager, and as we grow and expand into new markets, our Manager will need to hire and train additional employees and find additional third-party resources and will need to retain these employees and third-party resources. In addition, our Manager is establishing new infrastructure and processes related to residential management and leasing, brand development, tracking, accounting systems and billing and payment processing.

Building operational expertise and establishing infrastructure are difficult, expensive and time-consuming tasks, and we can expect problems to arise despite the best efforts of our Manager and its affiliates. There is a significant risk that operational problems will have an adverse effect upon our financial performance, especially in newer markets.

We are dependent on our investment in a single asset class, making our profitability and balance sheet more vulnerable to a downturn or slowdown in the housing sector or other economic factors.

We expect to concentrate our investments in single-family properties. As a result, we are subject to risks inherent in investments in a single type of property. A downturn or slowdown in the rental demand for single-family housing may have more pronounced effects on the cash available for distribution or on the value of our assets than if we had more fully diversified our investments.

Virtually all of our revenue comes from our rental operations, which are subject to many risks, including decreasing rental rates, increased competition for residents, increased lease default rates and increased resident turnover. As a result of various factors, including competitive pricing pressure or adverse conditions in our target markets, a general economic downturn and the desirability of our properties compared to other properties in our target markets, we may be unable to realize our asking rents across the properties in our portfolio, which will negatively affect our ability to generate cash flow. In addition, rental rates for expiring leases may be higher than starting rental rates for new leases. We also compete for residents with numerous other housing alternatives. We anticipate that our properties will compete directly with multifamily properties as well as condominiums and other single-family homes which are available for rent or purchase in the markets in which our properties are located. The ownership and management of such properties is diffuse and often highly localized, and some operators may have lower operating costs than we do. This competitive environment could have a material adverse effect on our ability to lease our properties as well as on the rents we may charge.

Our operating results and cash flows would be adversely affected if a significant number of our residents were unable to meet their lease obligations. High unemployment and other adverse changes in the economic conditions in our target markets could result in substantial resident defaults. In the event of a resident default or bankruptcy, we may experience delays in enforcing our rights as landlord and obtaining possession of the premises, may incur legal, maintenance and other costs in protecting our investment and re-leasing the property and may be unable to re-lease the property at the rental rate previously received. These events and others could reduce the amount of distributions available to our stockholders, reduce the value of our properties and cause the value of your investment to decline.

We intend to continue to expand our scale of operations and make acquisitions even if the rental and housing markets are not as favorable as they have been in recent months, which could reduce our yield per share.

Silver Bay Property and the Provident Entities benefited in the purchase of the properties in our Initial Portfolio from a confluence of factors and market conditions which have resulted in homes being available at prices that are below replacement cost and, we believe, below their value as rental properties, based on anticipated cash flows. We expect that in the future housing prices will stabilize and return to more normalized levels, and therefore future acquisitions may be more costly than the homes that comprised our Initial Portfolio. There are many factors that may cause a recovery in the housing market that would result in future acquisitions becoming more expensive and possibly less attractive than recent past and present opportunities, including:

· improvements in the overall economy and job market;

· reductions in the supply of residential properties compared to demand;

· a resumption of consumer lending activity and greater availability of consumer credit;

· improvements in the pricing and terms of mortgage-backed securities;

· the emergence of increased competition for single-family assets from private investors and entities with similar investment objectives to ours; and

· tax or other government incentives that encourage homeownership.

Although we believe there will be benefits to increasing our scale of operations, our Manager’s acquisition platform and property management operations represent a significant ongoing expense to us. These expenses include, among others, costs associated with establishing and maintaining fully staffed regional brokerage offices, inspections and due diligence, transaction costs, landlord-tenant and legal compliance, and renovating and marketing costs. In addition, we expect that recently acquired properties in the process of stabilization will be unproductive assets generating no revenue for up to six months after acquisition.

We have not adopted and do not expect to adopt a policy of making future acquisitions only if they are accretive to existing yields and distributable cash. We will continue to invest significant resources developing our Manager’s acquisition and property management platforms and we plan to continue acquiring properties as long as we believe such properties offer an attractive total return opportunity. Accordingly, future acquisitions may have lower yield characteristics than our current portfolio and if such future acquisitions are funded through equity issuances, the yield and distributable cash per share will be reduced and the value of our common stock may decline.

We may need additional capital or may seek to employ debt to expand our portfolio, and such financing may not be available.

To date, all of our properties have been purchased for cash and we have no outstanding indebtedness. However, we may use debt to obtain additional capital or increase potential returns to our stockholders in the future. We may be unable to leverage our assets or obtain additional financing. We may also be limited or restricted in the amount of debt we may employ by the terms and provisions of any financing or other agreements that we may enter into in the future and such agreements may contain covenants restricting our operating flexibility.

We have many competitors and may not become an industry leader.

Recently, several institutional investors have begun acquiring single-family homes on a large scale. The entry into this market of large, well-capitalized institutional investors, including us, are relatively recent trends, which we expect to intensify in the near future. Several other REITs and other funds have recently deployed, or are expected to deploy in the near future, significant amounts of capital to these asset categories, and may have investment objectives that overlap and compete with ours. In acquiring our target assets, we compete with a variety of institutional investors, including other REITs, specialty finance companies, public and private funds and other financial institutions. Many of our competitors may be larger and have greater financial, technical, leasing, marketing and other resources than we do. Some competitors may have a lower cost of funds and access to funding sources that may not be available to us. At this time, neither we nor any other company has established a market-leading position, and even if we succeed in becoming an industry leader there can be no assurance that it will confer any long-term competitive advantage or positive financial results.

Our dependence upon third parties for key services may harm our financial results or reputation if the third parties fail to perform.

We have entered into agreements with third parties to provide some of the services required under the management agreement and the property management and acquisition services agreement, including acquisition services, property management, leasing, renovation and maintenance. For example, we currently use third-party property managers for approximately half of our current properties, and we also use third-party acquisition personnel in Tucson, AZ and Tampa, FL. Selecting, managing and supervising these third-party service providers require significant management resources and expertise. Poor performance by third-party service providers, especially those who interact with residents in our properties, will reflect poorly on us and could significantly damage our reputation among desirable residents. In the event of fraud or misconduct by a third-party property manager, we could also be exposed to material liability and be held responsible for damages, fines and/or penalties. If our Manager does not select, manage and supervise appropriate third parties for these services, our reputation and financial results may suffer.

Notwithstanding our efforts to implement and enforce strong policies and practices regarding service providers, we may not successfully detect and prevent fraud, incompetence or theft by our third-party service providers. In addition, any delay in identifying a third-party service provider or removal or termination of existing third-party service providers would require us to seek new vendors or providers, which would create delays and adversely affect our operations.

Many factors affect the single-family residential rental market and if rents in our target markets do not increase sufficiently to keep pace with rising costs of operations, our income and distributable cash will decline.

The success of our business model will depend, in part, on conditions in the single-family rental market in our target markets. Our asset acquisitions will be premised on assumptions about occupancy and rent levels, and if those assumptions prove to be inaccurate, our cash flows and profitability will be reduced. Rental rates and occupancy levels have benefited in recent periods from macro trends affecting the U.S. economy and residential real estate markets in particular, including:

· a tightening of credit that has made it more difficult to finance home purchases, combined with efforts by consumers generally to reduce their exposure to credit;

· weak economic and employment conditions that have increased foreclosure rates and made it more difficult for families to remain in their homes that were purchased prior to the housing market downturn;

· declining real estate values that have challenged the traditional notion that homeownership is a stable investment; and

· the unprecedented level of vacant housing comprising the real estate owned, or REO, inventory held for sale by banks, government-sponsored entities and other mortgage lenders or guarantors.

We do not expect these favorable trends to continue indefinitely. Eventually, a strengthening of the U.S. economy and job growth, coupled with government programs designed to keep home owners in their homes and/or other factors may contribute to a stabilization or reversal of the current trend that favors renting rather than homeownership. In addition, we expect that as investors like us increasingly seek to capitalize on opportunities to purchase undervalued housing assets and convert them to productive uses, the supply of single-family rental properties will decrease and the competition for residents may intensify. A softening of the rental market in our target areas would reduce our rental income and profitability.

Mortgage loan modification programs and future legislative action may adversely affect the number of available properties that meet our investment criteria.

The U.S. government, through the Federal Reserve, the Federal Housing Administration and the Federal Deposit Insurance Corporation, has implemented a number of programs designed to provide homeowners with assistance in avoiding residential mortgage loan foreclosures, including the Home Affordable Modification Program, which seeks to provide relief to homeowners whose mortgages are in or may be subject to foreclosure, and the Home Affordable Refinance Program, which allows certain borrowers who are underwater on their mortgage but current on their mortgage payments to refinance their loans. Several states, including states in which our current target markets are located, have adopted or are considering similar legislation. These programs and other loss mitigation programs may involve, among other things, the modification or refinancing of mortgage loans or providing homeowners with additional relief from loan foreclosures. Such loan modifications and other measures are intended and designed to lead to fewer foreclosures, which will decrease the supply of properties that meet our investment criteria.

The pace of residential foreclosures is unpredictable and subject to numerous factors. In recent periods there has been a backlog of foreclosures due to a combination of volume constraints and legal actions, including those brought by the U.S. Department of Justice, or DOJ, the Department of Housing and Urban Development, or HUD, and State Attorneys General against mortgage servicers alleging wrongful foreclosure practices. Financial institutions have also been subjected to regulatory restrictions and limitations on foreclosure activity by the Federal Deposit Insurance Corporation. Legal claims brought or threatened by the DOJ, HUD and 49 State Attorneys General against the five largest residential mortgage servicers in the country were settled in 2012. As part of this approximately $25 billion settlement, a portion of the settlement funds will be directed to homeowners seeking to avoid foreclosure through mortgage modifications, and servicers are required to adopt specified measures to reduce mortgage obligations in certain situations. It is expected that the settlement will help many homeowners avoid foreclosures that would otherwise have occurred in the near term, and with lower monthly payments and mortgage debts, for years to come. It is also foreseeable that other residential mortgage servicing companies that were not among the five included in the initial $25 billion settlement will agree to similar settlements that will further reduce the supply of houses in the process of foreclosure.

In addition, numerous federal and state legislatures have considered, proposed or adopted legislation to constrain foreclosures, or may do so in the future. For example, in 2012, California enacted a law imposing new limitations on foreclosures while a request for a loan modification is pending. The Dodd-Frank Act also created the Consumer Financial Protection Bureau, which supervises and enforces federal consumer protection laws as they apply to banks, credit unions, and other financial companies, including mortgage servicers. It remains uncertain as to whether any of these measures will have a significant impact on foreclosure volumes or what the timing of that impact would be. If foreclosure volumes were to decline significantly, we would expect REO inventory levels to decline or to grow at a slower pace, which would make it more difficult to find target assets at attractive prices and

might constrain our growth or reduce our long-term profitability. Also, the number of families seeking rental housing might be reduced by such legislation, reducing rental housing demand in our target markets.

Claims of deficiencies in the foreclosure process may result in rescission of our purchases at auction or reduce the supply of foreclosed properties available to us.

Allegations of deficiencies in foreclosure practices could result in claims challenging the validity of some foreclosures that have occurred to date, potentially placing our claim of ownership to the properties at risk. Our title insurance policies may not provide adequate protection in such instances or such proceedings may result in a complete loss without compensation.

Each state has its own laws governing the procedures to foreclose on mortgages and deeds of trust, and state laws generally require strict compliance with these laws in both judicial and non-judicial foreclosures. Recently, courts and administrative agencies have been more actively involved in enforcing state laws governing foreclosures, and in some circumstances have imposed new rules and requirements regarding foreclosures. Some courts have delayed or prohibited foreclosures based on alleged failures to comply with proper transfers of title, notice, identification of parties in interest, documentation and other legal requirements. Further, foreclosed owners and their legal representatives, including some prominent and well-financed legal firms, have brought litigation questioning the validity and finality of foreclosures that have already occurred. These developments may slow or reduce the supply of foreclosed houses available to us for purchase and may call into question the validity of our title to houses acquired at foreclosure, or result in rescission rights or other borrower remedies, which could result in a loss of a property purchased by us that may not be covered by title insurance, an increase in litigation costs incurred with respect to properties obtained through foreclosure, or delays in stabilizing and leasing such properties promptly after acquisition.

Our underwriting criteria and evaluation of properties involves a number of assumptions that may prove inaccurate, which may cause us to overpay for our properties or incur significant costs to renovate and market a property.

In determining whether a particular property meets our investment criteria, we make a number of assumptions, including assumptions related to estimated time of possession and estimated renovation costs and time frames, annual operating costs, market rental rates and potential rent amounts, time from purchase to leasing and resident default rates. These assumptions may prove inaccurate, causing us to pay too much for properties we acquire or to overvalue our properties or causing our properties not to perform as we expect, and adjustments to the assumptions we make in evaluating potential purchases may result in fewer properties qualifying under our investment criteria.

Furthermore, the properties we acquire are likely to vary materially in terms of time to possession, renovation, quality and type of construction, location and hazards. Our success depends on our ability to estimate accurately the time and expense required to possess, renovate, repair, upgrade and rent properties and to keep them maintained in rentable condition.

The recent market and regulatory environments relating to single-family residential properties have been changing rapidly, making future trends difficult to forecast. For example, an increasing number of homeowners now wait for an eviction notice or eviction proceedings to commence before vacating foreclosed premises, which significantly increases the period between the acquisition and leasing of a property. In recent months, approximately half of the properties we have acquired at auction have been occupied, requiring us to remove or evict the prior occupants before we begin our renovations. The accuracy of the assumptions we use in our underwriting criteria will affect our operating results.

The types of properties on which our acquisition strategy focuses have an increased risk of damage due to vandalism, mold and infestation, which may require extensive renovation prior to renting.

Our acquisition strategy predominately targets distressed single-family properties that often involve defaults by homeowners on their home loan obligations. For multiple reasons, distressed properties may be in worse physical condition than other similar properties. When a homeowner falls behind on a mortgage, the homeowner may cease to maintain the property in good condition, may vandalize it, or may abandon the property altogether. Vacant and neglected homes are subject to increased risks of vandalism, theft, mold, infestation, general deterioration, illegal occupation and other maintenance problems that may worsen without appropriate attention and remediation. We generally will not hire independent third-party home inspectors to inspect properties before purchase and will instead rely primarily on the acquisition employees of our Manager’s operating subsidiary to conduct detailed interior visual inspections when possible. Though we intend to inspect our portfolio properties periodically, we may not become aware of conditions such as water infiltration, mold or infestation until significant damage has been done to our property requiring extensive remediation and repairs as well as providing substitute housing for a resident.

Certain of our older properties may contain lead-based paint, which we may be required to remove or could expose us to liability, either of which would adversely affect our operating results.

Approximately 30% of the properties we owned as of December 31, 2012 are over 30 years old, and those premises may contain lead-based paint. The existence of lead paint is especially a concern in residential units and can cause health problems, particularly for children. A structure built prior to 1978 may contain lead-based paint and may present a potential exposure to lead; however, structures built after 1978 are not likely to contain lead-based paint. Federal and state laws impose certain disclosure requirements and restrict and regulate renovation activities on housing built before 1978. Violation of these restrictions could result in fines or criminal liability, and we could be subject to liability arising from lawsuits alleging personal injury or related claims. Although we attempt to comply with all such regulations, we have not conducted tests on the properties in our Initial Portfolio to determine the presence of lead-based paint and we cannot guarantee that we will not incur any material liabilities as a result of the presence of lead paint in our properties.

A substantial portion of our properties are purchased at auction, where we generally are not able to conduct a thorough inspection before purchasing the properties, and we may not accurately assess the extent of renovations required.

Over 70% of our properties owned as of December 31, 2012 were purchased at auction and approximately 120 properties were purchased in bulk sales. When we purchase properties at auction or in bulk sales, we generally do not have the opportunity to conduct interior inspections and may not be able to access a property to conduct more than the most cursory of exterior inspections. These inspection processes may fail to reveal major defects associated with properties we acquire, which may result in renovation and maintenance costs and time frames that exceed our estimates and negatively affect our financial results and earnings.

The costs and time to secure possession and control of a newly acquired property may exceed our current assumptions, increasing the costs and delaying our receipt of revenue from the property.

Upon acquiring a new property, we may have to evict occupants who are in unlawful possession before we can secure possession and control of the property. The holdover occupants may be the former owners or tenants of a property, or they may be squatters or others who are illegally in possession. Securing control and possession from these occupants can be both costly and time-consuming. If these costs and delays exceed our expectations in a large proportion of our newly acquired properties, our financial performance may suffer because of the increased expenses or the unexpected delays incurred in turning the properties into revenue-producing assets.

We may not have control over timing and costs arising from renovation of properties, which may adversely affect our earnings and distributable cash.

We expect that nearly all of our properties will require some level of renovation immediately upon their acquisition or in the future following expiration of a lease or otherwise. We may acquire properties that we plan to extensively renovate. We may also acquire properties that we expect to be in good condition only to discover unforeseen defects and problems that require extensive renovation and capital expenditures. In addition, we will be required to make ongoing capital improvements and replacements and may need to perform significant renovations from time to time to reposition properties in the rental market. Our homes have infrastructure and appliances of varying ages and conditions. Consequently, we expect that our Manager will routinely retain independent contractors and trade professionals to perform physical repair work and we will be exposed to all of the risks inherent in property renovation, including potential cost overruns, increases in labor and materials costs, delays by contractors in completing work, delays in the timing of receiving necessary work permits, certificates of occupancy and poor workmanship. Although we do not expect that renovation difficulties on any individual property will be significant to our overall results, if our assumptions regarding the costs or timing of renovation across our portfolio prove to be materially inaccurate, our earnings and distributable cash may be adversely affected.

We may be subject to unknown or contingent liabilities or restrictions related to properties that we acquire for which we may have limited or no recourse.

Assets and entities that we have acquired or may acquire in the future, including our Initial Portfolio acquired in the Formation Transactions, may be subject to unknown or contingent liabilities for which we may have limited or no recourse against the sellers. Unknown or contingent liabilities might include liabilities for or with respect to liens attached to properties, unpaid real estate tax, utilities or homeowners’ association, or HOA, charges for which a subsequent owner remains liable, clean-up or remediation of environmental conditions or code violations, claims of customers, vendors or other persons dealing with the acquired entities and tax liabilities. Purchases of single-family properties acquired at auction, in short sales, from lenders or in bulk purchases typically involve few or no representations or warranties with respect to the properties and may allow us limited or no recourse against the sellers. Such properties also often have unpaid tax, utility and HOA liabilities for which we may be obligated but fail to anticipate. As a result, the total amount of costs and expenses that we may incur with respect to liabilities associated with acquired properties and entities may

exceed our expectations, which may adversely affect our operating results and financial condition. Additionally, these properties may be subject to covenants, conditions or restrictions that restrict the use or ownership of such properties, including prohibitions on leasing. We may not discover such restrictions during the acquisition process and such restrictions may adversely affect our ability to operate such properties as we intend.

Our operating performance is subject to risks associated with the real estate industry that could reduce the rent we receive, decrease the value of our properties and adversely affect our financial condition.

Real estate investments are subject to various risks and fluctuations and cycles in value and demand, many of which are beyond our control. Certain events may decrease cash available for dividends as well as the value of our properties. These events include:

· adverse changes in national or local real estate, economic and demographic conditions;

· vacancies or our inability to rent our homes on favorable terms or at favorable rental rates;

· adverse changes in financial conditions of buyers, sellers and tenants of properties;

· inability to collect rent from residents;

· reduced demand for single-family home rentals and changes in the relative popularity of properties and neighborhoods;

· increased supply of single-family homes and availability of financing;

· increases in expenses, including insurance costs, labor costs, energy prices, real estate assessments and other taxes and costs of compliance with laws, regulations and governmental policies to the extent that we are unable to pass on these increases to our residents;

· the effects of rent controls, stabilization laws and other laws or covenants regulating rental rates; and

· changes in, and changes in enforcement of, laws, regulations and governmental policies, including health, safety, environmental, rental property, zoning and tax laws, governmental fiscal policies and the Americans with Disabilities Act of 1990.