UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10–K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended July 31, 2016

Commission file number: 000-55233

Diamante Minerals Inc. | ||

(Exact name of registrant as specified in its charter) |

Nevada |

| 27-3816969 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

203-1634 Harvey Avenue Kelowna, British Columbia, Canada V1Y 6G2 | ||

(Address of principal executive offices) | ||

| ||

250-860-8599 | ||

(Registrant’s telephone number, including area code) | ||

| ||

(Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation SK (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10K or any amendment to this Form 10K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one).

Large accelerated filer o |

| Accelerated filer o |

Non-accelerated filer o |

| Smaller reporting company x |

(Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes x No o

As of October 28, 2016, there were 52,042,286 shares of the issuer’s common stock, par value $0.001, outstanding.

DIAMANTE MINERALS, INC.

FORM 10-K

FOR THE YEAR ENDED JULY 31, 2016

| PAGE | |

| ||

| ||

Item 1. | 3 | |

Item 1A. | 5 | |

Item 1B. | 10 | |

Item 2 | 10 | |

Item 3. | 13 | |

Item 4. | 13 | |

| ||

| ||

Item 5. | 14 | |

Item 6. | 14 | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 15 |

Item 7A. | 20 | |

Item 8. | 20 | |

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 20 |

Item 9A. | 20 | |

Item 9B. | 22 | |

| ||

| ||

Item 10. | 23 | |

Item 11. | 25 | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 26 |

Item 13. | Certain Relationships and Related Transactions and Director Independence | 27 |

Item 14. | 27 | |

| ||

| ||

Item 15. | 29 | |

| 44 |

| Table of Contents |

As used in this Annual Report on Form 10K (this "Report"), references to the "Company," the "Registrant," "we," "our" or "us" refer to Diamante Minerals, Inc., unless the context otherwise indicates.

Our Company qualifies as an “emerging growth company” as defined in section 3(a) of the Exchange Act, and we will continue to qualify as an “emerging growth company” until the earliest to occur of: (a) the last day of the fiscal year during which our Company has total annual gross revenues of US$1,000,000,000 (as such amount is indexed for inflation every 5 years by the Securities and Exchange Commission) or more; (b) the last day of the fiscal year of our Company following the fifth anniversary of the date of the first sale of common equity securities of the Company pursuant to an effective registration statement under the United States Securities Act of 1933, as amended; (c) the date on which our Company has, during the previous 3-year period, issued more than US$1,000,000,000 in non-convertible debt; or (d) the date on which the Company is deemed to be a “large accelerated filer”, as defined in Exchange Act Rule 12b–2. We filed a registration statement on Form S-1 under the Securities Act on November 8, 2012, which was declared effective by the SEC on March 11, 2013. Therefore, we will continue to qualify as an emerging growth company only until July 31, 2018 (being the last day of the fiscal year following the fifth anniversary of the date of the first sale of common stock pursuant to the Form S-1, unless we otherwise cease to qualify as an emerging growth company.

Cautionary Statement Regarding Forward-Looking Information

Certain statements contained in this report, including statements regarding the anticipated development and expansion of our business, our intent, belief or current expectations, primarily with respect to the future operating performance of the Company and other statements contained herein regarding matters that are not historical facts, are "forward-looking" statements. You can identify forward-looking statements by those that are not historical in nature, particularly those that use terminology such as "may," "will," "should," "expects," "anticipates," "contemplates," "estimates," "believes," "plans," "projected," "predicts," "potential," or "continue" or the negative of these similar terms. Future filings with the Securities and Exchange Commission, future press releases and future oral or written statements made by us or with our approval, which are not statements of historical fact, may contain forward-looking statements. Because such statements include risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. All forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they are made, except as required by federal securities and any other applicable law.

Overview

We were incorporated in the State of Nevada on October 26, 2010. On March 11, 2014, we filed a Certificate of Amendment to our Articles of Incorporation with the Secretary of State of the State of Nevada to (i) change our name from "Oconn Industries Corp." to "Diamante Minerals, Inc." and (ii) increase the number of authorized shares of our common stock from 75,000,000 shares to 300,000,000 shares.

On February 10, 2014, we entered into a letter agreement with Mineracao Batovi Ltda. (“Mineracao Batovi”), a Brazilian mineral exploration and mining company, to acquire up to a 75% interest in a diamond exploration project located to the north of Paranatinga in Mato Grosso, Brazil (the "Batovi Diamond Project") and form a joint venture valued at approximately $12 million. The letter agreement has been superseded by our definitive agreement with Mineracao Batovi that was executed and delivered on November 20, 2014. As described in more detail below, we will be required to contribute $1,000,000 in cash to Mineracao Batovi in order to acquire an initial 20% equity interest in that company. Mineracao Batovi holds the mineral claims underlying the Batovi Diamond Project. We may earn an additional 29% equity interest in Mineracao Batovi by funding a further $2,000,000 of exploration expenses no later than November 20, 2017.

Our Company is an exploration stage company; at present, there is no assurance that a commercially viable mineral deposit exists on the properties comprising the Batovi Diamond Project in which we hold the right to earn up to a 75% indirect interest, as described in more detail below.

| 3 |

| Table of Contents |

As discussed elsewhere in this annual report, pursuant to an agreement dated January 22, 2016, we have acquired a limited royalty on the first 2,000 ounces of gold that may be produced per month at Petaquilla Minerals Ltd.’s Molejon Gold Mine located in Donoso District, Colon Province, Republic of Panama. Our royalty right is contingent on our advancing to Blendcore LLC, as borrower and as the operator of certain proposed operations at the Molejon Gold Mine, the final tranche of a loan in the total principal amount of $250,000. The funds are to be advanced in accordance with a budget for the restart of processing of stockpiled ore at the Mine, which has been annexed to the loan agreement dated January 22, 2016 among our Company, Blendcore and Petaquilla Minerals’ subsidiary, Petaquilla Gold, S.A. As of July 31, 2016, our Company had advanced $215,000 to Blendcore under the loan agreement.

We currently have no interests in any other mineral exploration projects, and we are a shell company for the purposes of the Securities Act of 1933, as amended.

Competition

The mining industry is intensely competitive in all its phases and the Company competes with other companies that have greater financial resources and technical capacity. The Company continues to compete with a number of companies for the acquisition of mineral properties. The ability for the Company to replace or increase its mineral reserves and mineral resources in the future will depend on its ability to develop its present properties and also to select and acquire economic producing properties or prospects for diamond extraction.

Licenses, permits and approvals

The Company's operations require licenses, permits and approvals from various governmental authorities. Such licenses and permits are subject to change in various circumstances and certain permits and approvals are required to be renewed from time to time. Additional permits or permit renewals will need to be obtained in the future. The granting, renewal and continued effectiveness of these permits and approvals are, in most cases, subject to some level of discretion by the applicable regulatory authority. Certain governmental approval and permitting processes are subject to public comment and can be appealed by project opponents, which may result in significant delays or in approvals being withheld or withdrawn.

Should the Company not be able to obtain or maintain all necessary licenses and permits as are required to explore and develop its properties, commence construction or operation of mining facilities and properties under exploration or development, or to maintain continued operations that economically justify the cost, it could materially and adversely affect the Company's operations.

Foreign operations risk

The Company's current potential significant projects are located in Brazil. Foreign countries exposes the Company to risks that may not otherwise be experienced if its operations were domestic. The risks include, but are not limited to, environmental protection, land use, water use, health safety, labor, restrictions on production, price controls, currency remittance, and maintenance of mineral tenure and expropriation of property. For example, changes to regulations in Brazil relating to royalties, allowable production, importing and exporting of diamonds and environmental protection, may result in the Company not receiving an adequate return on investment capital.

Although the operating environments in Brazil is considered favorable compared to those in other developing countries, there are still political risks. These risks include, but are not limited to: terrorism, hostage taking, military repression, expropriation, extreme fluctuations in currency exchange rates, high rates of inflation and labor unrest. Changes in mining or investment policies or shifts in political attitudes in these countries may also adversely affect the Company's business. In addition, there may be greater exposure to a risk of corruption and bribery (including possible prosecution under the federal Corruption of Foreign Public Officials Act). Also, in the event of a dispute arising in foreign operations, the Company may be subject to the exclusive jurisdiction of foreign courts and may be hindered or prevented from enforcing its rights. Furthermore, it is possible that future changes in taxes in any of the countries in which the Company operates will adversely affect the Company's operations and economic returns.

Intellectual Property

We have no intellectual property.

| 4 |

| Table of Contents |

Employees

We have no employees other than our executive officer, who is our sole director, and our chief financial officer. All functions including development, strategy, negotiations and administration are currently being provided by our executive officer.

We have identified the following material risks and uncertainties which reflect our outlook and conditions known to us as of the date of this Annual Report. These material risks and uncertainties should be carefully reviewed by our stockholders and any potential investors in evaluating the Company, our business and the market value of our common stock. Furthermore, any one of these material risks and uncertainties has the potential to cause actual results, performance, achievements or events to be materially different from any future results, performance, achievements or events implied, suggested or expressed by any forward-looking statements made by usor by persons acting on our behalf.

There is no assurance that we will be successful in preventing the material adverse effects that any one or more of the following material risks and uncertainties may cause on our business, prospects, financial condition and operating results, which may result in a significant decrease in the market price of our common stock. Furthermore, there is no assurance that these material risks and uncertainties represent a complete list of the material risks and uncertainties facing us. There may be additional risks and uncertainties of a material nature that, as of the date of this Quarterly Report, we are unaware of or that we consider immaterial that may become material in the future, any one or more of which may result in a material adverse effect on us. You could lose all or a significant portion of your investment due to any one of these material risks and uncertainties.

Risks Related to Our Company and Business

Evaluating our future performance may be difficult since we are a shell company with negative cash flow and accumulated deficit to date.

We have entered into a Joint Venture Agreement dated November 20, 2014 pursuant to which we are required to contribute $1,000,000 in cash to Mineracao Batovi Ltda., a Brazilian company which holds the mineral claims underlying the Batovi Diamond Project, in return for a 20% equity interest in Mineracao Batovi. However, we are a shell company (as such term is defined in Rule 405 under the Securities Act of 1933, as amended), and, since our inception on October 26, 2010 through July 31, 2016, we have incurred a net loss of $1,440,558. As a result of our limited financial and operating history, including our negative cash flow and net losses to date, it may be difficult to evaluate our future performance.

There is no assurance that we will be successful in securing financing, and substantial doubt exists as to our ability to continue our operations over the next twelve months.

The continuation of our Company as a going concern is dependent upon our ability to obtain adequate financing. We anticipate that we will need $2,400,000 to fund the next 12 months of our operations, which amount includes the $1,000,000 in cash that we would have to contribute to Mineracao Batovi in order to earn our initial 20% interest in that company, and the balance of $35,000 that we have agreed to advance to Blendcore LLC as part of a loan in the total principal amount of $250,000. However, given our limited financial and operating history and our status as a shell company, there is no assurance that we will be successful in securing any form of financing. Accordingly, substantial doubt exists as to whether we will be able to continue our operations over the next twelve months.

Even if we are successful in acquiring our initial interest in Mineracao Batovi, our reliance on equity financings is expected to continue, and there is no assurance that such financing will be available when required.

Even if we are successful in acquiring our initial interest in Mineracao Batovi, our reliance on equity financings is expected to continue for the foreseeable future, and the availability of such financing will be dependent on many factors beyond our control including, but not limited to, the market price of diamonds, the volatility in the global financial markets affecting our stock price and the status of the worldwide economy, any one of which may cause significant challenges in our ability to access additional financing, including access to the equity and credit markets.

| 5 |

| Table of Contents |

Diamond exploration and mining activities are inherently subject to numerous significant risks and uncertainties, and actual results may differ significantly from expectations or anticipated amounts. Furthermore, exploration programs conducted on the Batovi Diamond Project may not result in the establishment of ore bodies that contain commercially recoverable diamonds.

Diamond exploration and mining activities are inherently subject to numerous significant risks and uncertainties, many beyond our control, including, but not limited to: (i) unanticipated ground and water conditions; (ii) unusual or unexpected geological formations; (iii) the occurrence of unusual weather or operating conditions and other force majeure events; (iv) lower than expected ore grades; (v) industrial accidents; (vi) delays in the receipt of or failure to receive necessary government permits; (vii) delays in transportation; (viii) availability of contractors and labor; (ix) government permit restrictions and regulation restrictions; (x) unavailability of materials and equipment; and (xi) the failure of equipment or processes to operate in accordance with specifications or expectations. These risks and uncertainties could result in: delays, reductions or stoppages in exploration or development work and any future mining activities; increased capital and/or extraction costs; damage to, or destruction of, the Batovi Diamond Project, extraction facilities or other properties; personal injuries; environmental damage; monetary losses; and legal claims.

Success in diamond exploration and mining is dependent on many factors, including, without limitation, the experience and capabilities of a company’s management, the availability of geological expertise and the availability of sufficient funds to conduct the exploration program. Even if an exploration program is successful and commercially recoverable diamond- or gold-bearing ore bodies are established, it may take a number of years from the initial phases of drilling and identification of the mineralization until extraction is possible, during which time the economic feasibility of extraction may change such that the diamonds cease to be economically recoverable.

Diamond exploration is frequently non-productive due, for example, to poor exploration results or the inability to establish ore bodies that contain commercially recoverable diamonds, in which case the project may be abandoned and written-off. Furthermore, Mineracao Batovi will not be able to benefit from exploration efforts and recover the expenditures that are incurred on exploration programs if Mineracao Batovi does not establish ore bodies that contain commercially recoverable diamonds and develop the Batovi Diamond Project into profitable mining activities, and there is no assurance that Mineracao Batovi will be successful in doing so.

Whether an ore body contains commercially recoverable diamonds depends on many factors including, without limitation: (i) the particular attributes, including material changes to those attributes, of the ore body such as size, grade, recovery rates and proximity to infrastructure; (ii) the market price of diamonds, which may be volatile; and (iii) government regulations and regulatory requirements including, without limitation, those relating to environmental protection, permitting and land use, taxes, land tenure and transportation.

Our ability to earn a royalty in respect of gold produced from the Molejon Gold Mine is subject to certain risks and contingencies, including the ability of the operator to recover sufficient quantities of gold from stockpiled ore over the life of the royalty from the planned processing operations.

In regards to the Loan Agreement with Blendcore and Petaquilla Gold, our Company bears the risk that the planned processing of stockpiled ore at the Molejon Gold Mine will not recover sufficient quantities of gold to cover the repayment of the loan, in either the initial royalty term or, if needed, the extended royalty term. The loan has been guaranteed by Petaquilla Gold, as the title holder of the property, and is secured by a first charge over that portion of stockpiled ore on the title holder’s mine site. Should the agreement reach this point, our Company would bear the same risks faced by Blendcore and Petaquilla Gold, as operator and title holder, respectively, of having to process the stockpiled ore including, without limitation (i) the particular attributes, including material changes to those attributes, of the stockpile such as recovery rates and ability to procure infrastructure to process it; (ii) the market price of gold, which may be volatile; and (iii) government regulations and regulatory requirements including, without limitation, those relating to environmental protection, taxes, land tenure and transportation.

Petaquilla Minerals Ltd., the indirect owner of the Molejon Gold Mine, was delisted from the Toronto Stock Exchange in 2015 and has had its registration under section 12 of the Exchange Act revoked. It is unclear what impact, if any, Petaquilla Minerals’ circumstances – including any potential solvency issues - will have on the planned ore processing operations at the Molejon Gold Mine, or on Petaquilla Gold’s interests in the Molegjon Gold Mine.

| 6 |

| Table of Contents |

Petaquilla Gold, the owner of minerals sourced from the Molejon Gold Mine, is a subsidiary of Petaquilla Minerals Ltd., a British Columbia company whose common shares were delisted from the Toronto Stock Exchange in 2015, and whose registration under the Exchange Act was revoked by the SEC on September 23, 2016 pursuant to section 12(j) of the Exchange Act. Petaquilla Minerals’ ability to continue as a going concern is unclear to our Company’s management, and it is unclear what impact, if any, Petaquilla Minerals’ circumstances – including any potential solvency issues - will have on the planned ore processing operations at the Molejon Gold Mine, and whether Petaquilla Gold’s interests in the Molejon Gold Mine will be subject to claims by third parties.

We do not insure against all of the risks we face in our operations.

In general, where coverage is available and not prohibitively expensive relative to the perceived risk, we will maintain insurance against such risk, subject to exclusions and limitations. We currently maintain insurance against certain risks including general commercial liability claims and certain physical assets used in our operations, subject to exclusions and limitations, however, we do not maintain insurance to cover all of the potential risks and hazards associated with our operations. We may be subject to liability for environmental, pollution or other hazards associated with our or Mineracao Batovi’s exploration activities, which we may not be insured against, which may exceed the limits of our insurance coverage or which we may elect not to insure against because of high premiums or other reasons. Furthermore, we cannot provide assurance that any insurance coverage we currently have will continue to be available at reasonable premiums or that such insurance will adequately cover any resulting liability.

Mineracao Batovi holds mineral rights in Brazil, a foreign jurisdiction which could be subject to additional risks due to political, taxation, economic and cultural factors.

Our business plan contemplates our acquisition of an initial 20% equity interest in Mineracao Batovi, a company incorporated in Brazil. Operations in foreign jurisdictions outside of the U.S., especially in developing countries, may be subject to additional risks as they may have different political, regulatory, taxation, economic and cultural environments that may adversely affect the value or continued viability of our rights. These additional risks include, but are not limited to: (i) changes in governments or senior government officials; (ii) changes to existing laws or policies on foreign investments, environmental protection, mining and ownership of mineral interests; (iii) renegotiation, cancellation, expropriation and nationalization of existing permits or contracts; (iv) foreign currency controls and fluctuations; and (v) civil disturbances, terrorism and war.

In the event of a dispute arising from our anticipated future involvement in the Batovi Diamond Project, we may be subject to the exclusive jurisdiction of foreign courts or may not be successful in subjecting foreign persons to the jurisdiction of the courts in the United States or Canada. We may also be hindered or prevented from enforcing our rights with respect to a government entity or instrumentality because of the doctrine of sovereign immunity. Any adverse or arbitrary decision of a foreign court may have a material and adverse impact on our business, prospects, financial condition and results of operations.

The title to Mineracao Batovi’s mineral property interests may be challenged.

Although we have undertaken reasonable due diligence to confirm that Mineracao Batovi has taken reasonable measures to ensure proper title to its interests in the Batovi Diamond Project and other assets, there is no guarantee that the title to any of such interests will not be challenged. No assurance can be given that Mineracao will be able to secure the grant or the renewal of existing mineral rights and tenures on terms satisfactory to it, or that governments in the jurisdictions in which it operates will not revoke or significantly alter such rights or tenures or that such rights or tenures will not be challenged or impugned by third parties, including local governments, aboriginal peoples or other claimants. Mineracao Batovi’s mineral properties may be subject to prior unregistered agreements, transfers or claims, and title may be affected by, among other things, undetected defects. A successful challenge to the precise area and location of Mineracao Batovi’s claims could result in it being unable to explore or operate on its properties as permitted or being unable to enforce its rights with respect to its properties.

We depend on certain key personnel, and our success will depend on our continued ability to retain and attract such qualified personnel.

Our success is dependent on the efforts, abilities and continued service of certain senior officers and key employees and consultants. A loss of service from any one of these individuals may adversely affect our operations, and we may have difficulty or may not be able to locate and hire a suitable replacement.

| 7 |

| Table of Contents |

Certain directors and officers may be subject to conflicts of interest.

Our sole director, who also serves as our Chief Executive Officer, and our Chief Financial Officer are involved in other business ventures including similar capacities with other private or publicly-traded companies. Such individuals may have significant responsibilities to these other business ventures, including consulting relationships, which may require significant amounts of their available time. Conflicts of interest may include decisions on how much time to devote to our business affairs and what business opportunities should be presented to us. For example, a conflict of interest might arise where our sole director or our Chief Financial Officer becomes aware of a corporate opportunity that would be interest not only to our Company, but also to another mining company of which he or she is also a director or officer; or it is foreseeable that our Company could become involved in a mineral property option or joint venture agreement in respect of a mineral exploration or mine development project in which such a company holds an interest. For a description of the directorships and/or offices held by our sole director and our Chief Financial Officer in other companies engaged in natural resource exploration and development and related industries, please see the discussion under the heading, “Directors, Executive Officers and Corporate Governance - Directors and Executive Officers.”

The laws of the State of Nevada and our Articles of Incorporation may protect our directors and officers from certain types of lawsuits.

The laws of the State of Nevada provide that our sole director and officers will not be liable to the Company or its stockholders for monetary damages for all but certain types of conduct as directors and officers of the Company. Our Bylaws provide for broad indemnification powers to all persons against all damages incurred in connection with our business to the fullest extent provided or allowed by law. These indemnification provisions may require us to use our limited assets to defend our directors and officers against claims, and may have the effect of preventing stockholders from recovering damages against our directors and officers caused by their negligence, poor judgment or other circumstances.

Our sole director and our officers are residents outside of the U.S., and it may be difficult for stockholders to enforce within the U.S. any judgments obtained against such director or officers.

Our sole director, who also serves as our Chief Executive Officer, and our Chief Financial Officer are nationals and/or residents of countries other than the U.S., and all or a substantial portion of such persons' assets are located outside of the U.S. As a result, it may be difficult for investors to effect service of process on such director and officers, or enforce within the U.S. any judgments obtained against such director and officers, including judgments predicated upon the civil liability provisions of the securities laws of the U.S. or any state thereof. Consequently, stockholders may be effectively prevented from pursuing remedies against such director and officers under U.S. federal securities laws. In addition, stockholders may not be able to commence an action in a Canadian court predicated upon the civil liability provisions under U.S. federal securities laws.

Our management has determined that our disclosure controls and procedures, and our internal control over financial reporting are not effective. In any event disclosure controls and procedures and internal control over financial reporting, no matter how well designed and operated, are designed to obtain reasonable, and not absolute, assurance as to its reliability and effectiveness.

Management’s evaluation on the effectiveness of disclosure controls and procedures is designed to ensure that information required for disclosure in our public filings is recorded, processed, summarized and reported on a timely basis to our senior management, as appropriate, to allow timely decisions regarding required disclosure. Management’s report on internal control over financial reporting is designed to provide reasonable assurance that transactions are properly authorized, assets are safeguarded against unauthorized or improper use and transactions are properly recorded and reported. Our management has concluded that our disclosure controls and procedures, and our internal control over financial reporting, were ineffective as of the end of our fiscal year ended July 31, 2016. In any event, any system of controls, no matter how well designed and operated, is based in part upon certain assumptions designed to obtain reasonable, and not absolute, assurance as to its reliability and effectiveness. Our failure to maintain effective disclosure controls and procedures may result in our inability to continue meeting our reporting obligations in a timely manner, qualified audit opinions or restatements of our financial reports, any one of which may affect the market price for our common stock and our ability to access the capital markets.

| 8 |

| Table of Contents |

Risks Related to Our Common Stock

Broker-dealers may be discouraged from effecting transactions in our common shares because they are considered a penny stock and are subject to the penny stock rules. This could severely limit the market liquidity of the shares.

Our common stock currently constitutes “penny stock”. Subject to certain exceptions, for the purposes relevant to us, “penny stock” includes any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share. Rules 15g-1 through 15g-9 promulgated under the United States Securities Exchange Act of 1934, as amended, impose sales practice and disclosure requirements on certain brokers-dealers who engage in certain transactions involving a “penny stock.” In particular, a broker-dealer selling penny stock to anyone other than an established customer or “accredited investor” (generally, an individual with net worth in excess of $1,000,000 or an annual income exceeding $200,000, or $300,000 together with his or her spouse), must make a special suitability determination for the purchaser and must receive the purchaser’s written consent to the transaction prior to sale, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer’s account and information with respect to the limited market in penny stocks.

The additional sales practice and disclosure requirements imposed upon broker-dealers may discourage broker-dealers from effecting transactions in our shares, which could severely limit the market liquidity of the shares and impede the sale of our shares in the secondary market.

In the event that an investment in our shares is for the purpose of deriving dividend income or in expectation of an increase in market price of our shares from the declaration and payment of dividends, the investment will be compromised because we do not intend to pay dividends.

We have never paid a dividend to our shareholders and we intend to retain our cash for the continued development of our business. Accordingly, we do not intend to pay cash dividends on our common stock in the foreseeable future. As a result, a return on investment will be solely determined by the ability to sell the shares in the secondary market.

Historically, the market price of our common stock has been and may continue to fluctuate significantly.

Our stock is thinly traded and trading in our stock is volatile. In addition, the global markets generally have experienced significant and increased volatility in the past, and have been impacted by the effects of mass sub-prime mortgage defaults and liquidity problems of the asset-backed commercial paper market, resulting in a number of large financial institutions requiring government bailouts or filing for bankruptcy. The effects of these past events and any similar events in the future may continue to or further affect the global markets, which may directly affect the market price of our common stock and our accessibility for additional financing. Although this volatility may be unrelated to specific company performance, it can have an adverse effect on the market price of our shares which, historically, has fluctuated significantly and may continue to do so in the future.

In addition to the volatility associated with general economic trends and market conditions, the market price of our common stock could decline significantly due to the impact of any one or more events, including, but not limited to, the following: (i) our inability to raise the financing required to fund the acquisition of our initial 20% equity interest in Mineracao Batovi; (ii) changes in the global market for diamonds; (iii) failure to meet market expectations on Mineracao Batovi’s exploration activities; (iv) sales of a large number of our shares held by certain stockholders including institutions and insiders; (v) legal claims brought forth against us; and (vi) introduction of technological innovations by competitors or in competing technologies.

A prolonged decline in the market price of our common stock could affect our ability to obtain additional financing which would adversely affect our operations.

Historically, we have relied on equity financing as the primary source of funding. A prolonged decline in the market price of our common stock or a reduction in our accessibility to the global markets may result in our inability to secure the financing required to fund the acquisition of our initial 20% equity interest in Mineracao Batovi, or to seek additional financing, which would have an adverse effect on our operations.

| 9 |

| Table of Contents |

Additional issuances of our common stock may result in significant dilution to our existing shareholders and reduce the market value of their investment.

We are authorized to issue 300,000,000 shares of common stock of which 52,042,286 shares were issued and outstanding as of October 28, 2016. Future issuances for financings, mergers and acquisitions, exercise of stock options and share purchase warrants and for other reasons may result in significant dilution to and be issued at prices substantially below the price paid for our shares held by our existing stockholders. Significant dilution would reduce the proportionate ownership and voting power held by our existing stockholders, and may result in a decrease in the market price of our shares.

Item 1B. Unresolved Staff Comments

Not applicable.

Our executive offices are located at 203 – 1634 Harvey Ave, Kelowna, BC, Canada, V1Y 6G2. We believe that this office space will be adequate for the foreseeable future.

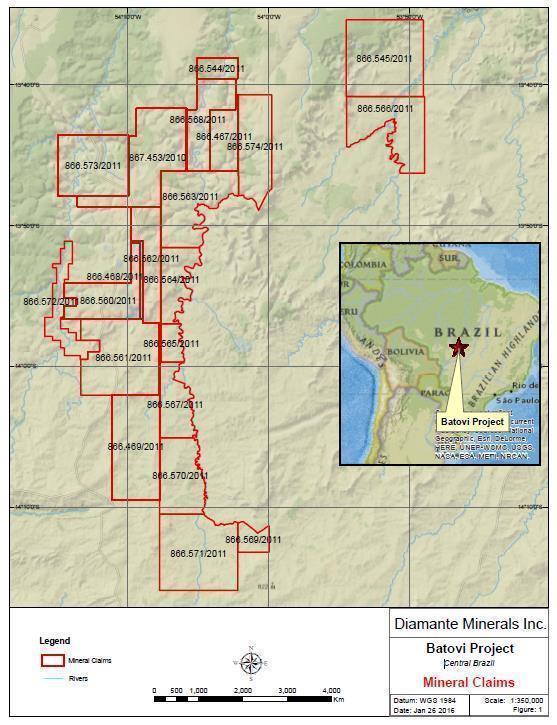

As described under the heading “Plan of Operation” below, our Company has entered into a definitive Joint Venture Agreement with Mineracao Batovi pursuant to which we may acquire up to a 75% interest in the Batovi Diamond Project. This project covers 21 claims held by Mineraco Batovi as federal exploration licenses, covering a total area of approximately 109,688 hectares, as more particularly described in the following table and map:

Township/Area | Claim Number | Recording Date | Expiration Date | Area (hectares) |

Mato Grosso | 866.467/2011 | 05/30/2011 | 2/9/2019 | 3,051.04 |

Mato Grosso | 866.468/2011 | 05/30/2011 | 2/3/2018 | 348.13 |

Mato Grosso | 866.469/2011 | 05/30/2011 | 5/5/2018 | 8,414.68 |

Mato Grosso | 866.544/2011 | 06/22/2011 | 3/9/2018 | 1,446.25 |

Mato Grosso | 866.545/2011 | 06/22/2011 | 3/9/2018 | 9,934.17 |

Mato Grosso | 866.560/2011 | 06/28/2011 | 3/9/2018 | 5,026.23 |

Mato Grosso | 866.561/2011 | 06/28/2011 | 3/9/2018 | 9,439.19 |

Mato Grosso | 866.562/2011 | 06/28/2011 | 3/9/2018 | 4,113.14 |

Mato Grosso | 866.563/2011 | 06/28/2011 | 3/9/2018 | 7,112.30 |

Mato Grosso | 866.564/2011 | 06/28/2011 | 3/9/2018 | 3,511.58 |

Mato Grosso | 866.565/2011 | 06/28/2011 | 3/9/2018 | 1,371.85 |

Mato Grosso | 866.566/2011 | 06/28/2011 | 3/9/2018 | 6,861.69 |

Mato Grosso | 866.567/2011 | 06/28/2011 | 3/9/2018 | 3,569.48 |

Mato Grosso | 866.568/2011 | 06/28/2011 | 3/9/2018 | 4,424.19 |

Mato Grosso | 866.569/2011 | 06/28/2011 | 3/9/2018 | 1,311.55 |

Mato Grosso | 866.570/2011 | 06/28/2011 | 3/9/2018 | 5,357.18 |

Mato Grosso | 866.571/2011 | 06/28/2011 | 5/5/2018 | 9,534.95 |

Mato Grosso | 866.572/2011 | 06/28/2011 | 2/9/2019 | 3,322.88 |

Mato Grosso | 866.573/2011 | 06/29/2011 | 3/9/2018 | 7,199.99 |

Mato Grosso | 866.574/2011 | 06/30/2011 | 3/9/2018 | 5,776.71 |

Mato Grosso | 867.453/2010 | 05/06/2010 | 2/3/2018 | 8,560.40 |

| 109,687.58 |

| 10 |

| Table of Contents |

We currently hold no direct or indirect interest in the Batovi Diamond Project. Pursuant to the Joint Venture Agreement, we are required to contribute $1,000,000 in cash to Mineracao Batovi in order to acquire our initial 20% equity interest in that company. As Mineracao Batovi holds the rights to the Batovi Diamond Project, our interest in the Batovi Diamond Project would be limited to our shareholdings in Mineracao Batovi.

The Batovi Diamond Project

The Batovi Diamond Project is located in the State of Mato Grosso, in west-central Brazil, approximately 360 kilometers northeast of Cuiaba, the state capital.

| 11 |

| Table of Contents |

The Batovi Diamond Project is accessible from Cuiaba by main and secondary roads. One would travel east from Cuiaba on paved road BR-070 220 kilometers to Primavera do Leste before heading 140 kilometers north on partially paved road MT-130 to Paranatinga. An all-weather gravel road connects Paranatinga to the project area, which lies 120 kilometers to the north.

In addition, Paranatinga has an airport that is suitable for charter aircraft.

Currently there is no plant or equipment on the project site.

In Brazil, exploration licenses are issued by the Director General of the Departamento Nacional de Produção Mineral (translated as the National Department of Mineral Production and referred to in this quarterly report as the “DNPM”). An exploration license is granted for an initial term of up to three years and can be renewed once if the license holder submits an interim report on the exploration work completed to date which justifies further exploration.

An annual exploration fee must be paid to the DNPM to keep an exploration license in good standing. The exploration fee is assessed at the rate of R$2.02 per hectare for each year during the initial term of the license, and at the rate of R$3.95 per hectare for each year during the renewal term. Mineracao Batovi has provided documentation to us evidencing that its exploration licenses comprising the Batovi Diamond Project are in good standing.

| 12 |

| Table of Contents |

The Batovi Diamond Project represents an opportunity for the potential discovery of primary diamond bearing kimberlite intrusives. Due diligence documents provided by Mineraco Batovi confirm that the general area is host to over 40 known kimberlite intrusives which were discovered by DeBeers and Rio Tinto who explored the area between 1967 to about 1997. Historically, a number of the kimberlites were evaluated as possible sources of large, high quality alluvial diamonds found in the area in small, artisanal alluvial mining operations. Although limited testing of the discovered kimberlites returned a few small stones from some of the kimberlites, they were generally not found to be significantly diamondiferous. This suggests that diamond bearing kimberlites which are the source of the large alluvial diamonds found in the project area have yet to be discovered.

Mineracao Batovi has followed up this historic work with limited exploration activities at a cost of approximately CDN$4.7 million, and has identified possible individual diamond indicator mineral trains on the property.

Since we have not funded the $1,000,000 payment required to be made to Mineracao Batovi in order to acquire our initial 20% equity interest in the Batovi Diamond Project, we are not in a position to assume our duties as the operator as contemplated by the Joint Venture Agreement. However, if we are able to fund such $1,000,000, we anticipate that a majority of the proceeds will be applied to fund exploration work aimed at defining the potential source kimberlites of the indicator mineral trains.

Typically, geophysical surveys are used to locate potential kimberlites. Geophysical surveys measure the physical properties of the rocks below them. It is hoped that the kimberlites would have contrasting physical properties to the surrounding rocks. The proposed geophysical survey would detect both the conductivity and magnetic signature of the underlying rocks. It is expected that the kimberlites would differ from the surrounding host rocks in terms of these physical properties.

If we earn our initial 20% equity interest in Mineracao Batovi and assume our role as the operator of the project, we anticipate that our first step will be to commission an airborne electromagnetic geophysical survey over certain areas preliminarily identified by Mineracao Batovi as having the potential to host diamond bearing kimberlites. Mobilizing an airborne survey system to the project area could take a couple of months after execution of the survey contract. The airborne survey itself should take less than a month. Thereafter, the survey data will have to be extensively manipulated to allow its use. We anticipate that such analytical manipulation would require one to two months to complete. We estimate that the airborne survey will cost approximately $500,000.

Any priority targets identified by the airborne survey will need to be tested, likely by drilling. The length and scope of any such drill program – and the appropriate drill and associated equipment required - will depend on the nature and number of targets, but we anticipate that it would likely take several months to complete. Until the results of the geophysical survey are complete, it is difficult to ascertain what the cost of this target testing phase will be, but we estimate that the initial round of drilling will likely cost between $300,000 to $500,000.

Any future work would be contingent upon the initial round of testing generating positive results. Should a kimberlite be discovered with potentially economic diamond content, we expect that the next phases of work would be delineation drilling followed by bulk sampling and, if warranted, a feasibility study.

The Batovi Diamond Project is centered on the perennial Batovi River; it is conceivable that this would provide a water source for any future operations. We have not investigated what steps would be required or what arrangements will have to be made to secure water rights.

There is currently no power grid at the project area. If future exploration activities justify development at the project site which will give rise to substantial power requirements, diesel generators will have to be installed, or arrangements will have to be made to fund the extension of the power grid from Paranatinga which is located 120 kilometers to the south of the project area.

There are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or security holder is a party adverse to the Company or has a material interest adverse to the Company.

Item 4. Mine Safety Disclosures

Not applicable.

| 13 |

| Table of Contents |

Market Information

Our common stock has been quoted on the OTCQB under the symbol "OCOO" since July 29, 2013 and "DIMN" subsequent to April 2014 in connection with the forward split. Prior to July 29, 2014, there was no active market for our common stock.

The market for our common stock is limited and can be volatile. The following table sets forth the high and low bid prices relating to our common stock on the OTCQB on a quarterly basis for the periods indicated, as reported by OTC Markets Group. The quotations reflect interdealer prices, without retail markup, markdown or commission, and may not represent actual transactions.

Quarter Ended | High | Low |

July 31, 2016 | $0.46 | $0.17 |

April 30, 2016 | $0.55 | $0.18 |

January 31, 2016 | $0.8499 | $0.3651 |

October 31, 2015 | $0.64 | $0.2501 |

July 31, 2015 | $1.20 | $0.4303 |

April 30, 2015 | $2.29 | $0.90 |

January 31, 2015 | $3.09 | $1.01 |

October 31, 2014 | $3.16 | $1.73 |

The last reported bid price of our common stock on the OTCQB on October 27, 2016 was $0.1843.

Dividend Policy

The Company has never paid dividends on its common stock and does not anticipate that it will pay dividends in the foreseeable future. It intends to use any future earnings for the expansion of its business. Any future determination of applicable dividends will be made at the discretion of the board of directors and will depend on the results of operations, financial condition, capital requirements and other factors deemed relevant.

Holders

As of October 28, 2016, there were 52,042,286 shares of common stock issued and outstanding, which were held by 27 stockholders of record.

Equity Compensation Plans

We do not have any equity compensation plans.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

There were no sales of unregistered securities that were not previously reported.

Purchases of Equity Securities by the Small Business Issuer and Affiliated Purchasers

None.

Item 6. Selected Financial Data.

Not applicable.

| 14 |

| Table of Contents |

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion should be read in conjunction with the Company's financial statements, which are included

elsewhere in this Annual Report on Form 10K. Certain statements contained in this Annual Report, including statements regarding the development of the Company's business, the intent, belief or current expectations of the Company, its directors or its officers, primarily with respect to the future operating performance of the Company and other statements contained herein regarding matters that are not historical facts, are "forward-looking" statements. Because such statements include risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements.

Plan of Operation

As described above, on November 20, 2014, we entered into a formal joint venture agreement (the “Joint Venture Agreement”) with Mineracao Batovi which contemplates the Company acquiring an interest in Mineracao Batovi to develop, finance and operate the Batovi Diamond Project. Pursuant to the Joint Venture Agreement, we must contribute $1,000,000 in cash to Mineracao Batovi in order to acquire an initial 20% equity interest in that company. Mineracao Batovi holds the mineral claims underlying the Batovi Diamond Project. We may earn an additional 29% equity interest in Mineracao Batovi by funding a further $2,000,000 of exploration expenses no later than November 20, 2017.

The Joint Venture Agreement provides that Mineracao Batovi is to be managed by a board of directors comprised of two representatives from each of our Company and Mineracao Batovi, provided that if we fail to earn an additional 29% equity interest in Mineracao Batovi by November 20, 2017, the board of directors will be comprised of three representatives of the existing Mineracao Batovi management and one representative of our Company. We will cease to be entitled to any representation on Mineracao Batovi's board of directors if our Company’s equity interest is reduced to 10% or less.

Certain specified matters are subject to the approval of at least three of the four members of Mineracao Batovi's board of directors, including the adoption of the project's annual budget and any amendments thereto, the scope and purpose of a feasibility study for the Batovi project (including the determination that the study is positive), and the decision to mine and commence commercial production.

Until we earn the additional 29% equity interest in Mineracao Batovi, and so long as we elect to participate in the joint venture, we will bear 100% of Mineracao Batovi’s expenses (up to the total amount of $3,000,000, including Diamante’s initial $1,000,000 contribution to Mineracao Batovi), provided that all such expenses are first approved in writing by our Company’s representatives on Mineracao Batovi’s board of directors.

The parties originally agreed to cause the joint venture company to engage Kel-Ex Development Ltd., a privately-held British Columbia corporation that is under common control with Mineracao Batovi, to carry out exploration activities on the Batovi Diamond Project in accordance with approved budgets. Kel-Ex was to be entitled to charge a 10% administration fee on all exploration expenditures incurred under $50,000 and 5% on all exploration expenditures incurred over $50,000. In addition, we have issued 2,700,000 fully-paid and non-assessable common shares to Kel-Ex Development under the Joint Venture Agreement. By our Company's letter agreement dated February 27, 2015, effective upon acceptance by Mineracao Batovi and Kel-Ex on March 9, 2015, the parties amended the Joint Venture Agreement to provide that the Company would be engaged to act as operator of the Batovi Diamond Project on terms whereby our Company will be entitled to charge a 10% administration fee on all exploration expenditures incurred under $50,000 and 5% on all exploration expenditures incurred over $50,000. Our Company has discretion to subcontract with third parties, including Kel-Ex, to enable it to fulfill its role as operator.

On January 22, 2016, we entered into a loan agreement (the “Loan Agreement”) with Blendcore LLC, a Delaware corporation (“Blendcore”), and Petaquilla Gold, S.A., a Panama corporation (“Petaquilla Gold”), pursuant to which our Company has agreed to advance a loan in the principal amount of US$250,000 to Blendcore (the “Loan”). Petaquilla Gold, as the owner of minerals sourced from the Molejon Gold Mine located in Donoso District, Colon Province of Panama (the “Mine”), has engaged Blendcore, as master contractor, to act as operator in connection with the restarting of the processing of stockpiled ore at the Mine. Petaquilla Gold is a subsidiary of Petaquilla Minerals Ltd., a British Columbia company whose common shares were delisted from the Toronto Stock Exchange in 2015, and whose registration under the Exchange Act was revoked by the SEC on September 23, 2016 pursuant to section 12(j) of the Exchange Act.

| 15 |

| Table of Contents |

The Loan proceeds are to be applied by Blendcore in that capacity in accordance with a use-of-funds budget (the “Budget”) that has been annexed to the Loan Agreement. Petaquilla Gold is a party to the Loan Agreement in its capacity as the title holder of the minerals, but is not entitled to receive any advances under the Loan Agreement.

Pursuant to the terms of the Loan Agreement, the Loan is to be advanced in three tranches as follows:

- $50,000 was advanced upon execution of the Loan Agreement;

- $100,000 was required to be advanced within 2 weeks from the execution of the Loan Agreement, and was in fact advanced on January 27, 2016; and

- $100,000 will be advanced as required in accordance with the Budget.

As of July 31, 2016, we had advanced $215,000 to Blendcore under the Loan Agreement.

In exchange for the provision of the Loan, our Company is to receive a royalty of 12.5% on the first 1,000 ounces of gold produced per month for 12 months (the “Royalty Period”). The Royalty Period is to commence once production ramps up to 1,000 ounces per month. For monthly production between 1,001 and 2,000 ounces of gold per month, our Company is to receive a reduced royalty of 5%. In addition to the royalty stream, our Company has a right of first option to provide funding for the expansion and development of the Mine.

Under the terms of the Loan Agreement, the Loan is to be forgiven provided that there is at least 12,000 ounces of gold produced during the Royalty Period. Upon the completion of the Royalty Period, our Company has the option to extend the royalty for a further 12 month period through the provision of a second $250,000 loan on substantially the same terms as the initial Loan. This right shall survive the royalty agreement by a period of one year.

Petaquilla Gold and Blendcore have entered into a Collateral Assignment Agreement dated January 11, 2016 (the “Collateral Assignment Agreement”; a copy of which is annexed to the Loan Agreement), pursuant to which Petaquilla Gold has collaterally assigned to Blendcore such number of ounces of gold from that which is mined at the Mine as shall be necessary to enable Blendcore to satisfy its obligations to our Company under the Loan Agreement. By letter of authorization dated January 18, 2016, Petaquilla Gold has consented to the transfer by Blendcore to our Company of Blendcore’s rights under the Collateral Assignment Agreement.

Limited Operating History; Need for Additional Capital

As discussed below under the heading, “Liquidity and Capital Resources,” we will be unable to earn our initial 20% equity interest Mineracao Batovi, or to pay the additional $1,400,000 in expenditures that we anticipate will be required within 12 months of acquiring such interest to advance the Batovi Diamond Project, if we are unable to source additional financing.

We currently have no plans or arrangements to obtain financing through private offerings of debt or equity. Equity financing would result in additional dilution to existing stockholders. We currently have no agreements or arrangements to obtain funds through bank loans, lines of credit or any other sources. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. Since the Company has no such arrangements or plans currently in effect, our inability to raise funds for the above purposes will have a severe negative impact on our ability to remain a viable company.

There is limited historical financial information about us upon which to base an evaluation of our performance. We are a start-up company and have not generated any revenues. We cannot guarantee success of our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources and possible cost overruns due to price and cost increases in services and products.

Outside of the employment agreements with the chief executive and chief financial officers, there are presently no agreements, arrangements, commitments, or specific understandings, either verbally or in writing, between our sole officer and director and the Company.

| 16 |

| Table of Contents |

Results of Operations

We have generated no revenues since inception and have incurred $963,470 in operating expenses for the fiscal year ended July 31, 2016.

The following table provides selected financial data for the years ended July 31, 2016 and July 31, 2015.

Balance Sheet Data

Balance Sheet Date |

| July 31, 2016 |

|

| July 31, 2015 |

| ||

|

|

|

|

|

|

| ||

Cash |

| $ | 390,660 |

|

| $ | 734,386 |

|

Total Assets |

| $ | 8,382,920 |

|

| $ | 8,726,386 |

|

Total Liabilities |

| $ | 817,167 |

|

| $ | 166,979 |

|

Stockholders’ Equity |

| $ | 7,565,754 |

|

| $ | 8,559,407 |

|

For the years ended July 31, 2016 and July 31, 2015

Revenues

The Company is a shell company and did not generate any revenues during the years ended July 31, 2016 and July 31, 2015.

Total operating expenses

For the year ended July 31, 2016, total operating expenses were $748,470, comprised of general and administrative expenses of $35,857, management fees of $602,242, and professional fees in the amount of $110,555. For the year ended July 31, 2015, total operating expenses were $5,552,579, comprised of general and administrative expenses of $22,408, management fees of $184,293, professional fees of $184,293 and stock based compensation of $5,191,122.

Net loss

For the year ended July 31, 2016, the Company had a net loss of $993,654, as compared to a net loss for the year ended July 31, 2015 of $5,552,025. For the period October 26, 2010 (inception) to July 31, 2016, the Company incurred a net loss of $1,410,374.

Liquidity and Capital Resources

As of July 31, 2016, the Company had a cash balance of $390,660. Unless we are able to source additional financing, we will be unable to fund the $1,000,000 cash contribution that we required to make to Mineracao Batovi in order to earn our initial 20% equity interest in that company, or to pay the additional $1,400,000 in expenditures that we anticipate will be required within 12 months of acquiring such interest to advance the Batovi Diamond Project. There can be no assurance that additional capital will be available to the Company.

If we are unable to fund the $1,000,000 cash contribution to Mineracao Batovi, we believe that we would have sufficient working capital for the next 12 months. We would, in that case, have sufficient capital resources to fund the balance of $35,000 to be advanced under our loan agreement with Blendcore, as borrower, and Petaquilla Gold, and to meet our other working capital needs. However, we would be precluded from acquiring our initial 20% equity interest in Mineracao Batovi. Further, our ability to earn an additional 29% equity interest in Mineracao Batovi (for a total 49% equity interest) is contingent on our ability to fund a further $2,000,000 of exploration expenses no later than November 20, 2017.

Cash Flows

|

| Twelve Months Ended |

|

| Twelve Months Ended |

| ||

|

| July 31, 2016 |

|

| July 31, 2015 |

| ||

| Cash Flows used in Operating Activities |

| $ | (128,726 | ) |

| $ | (181,467 | ) |

| Cash Flows provided by (used in) Investing Activities |

|

| (215,000 | ) |

|

| - |

|

| Cash Flows provided by Financing Activities |

|

| - |

|

|

| - |

|

| Net (decrease) increase in Cash During the Period |

| $ | (343,726 | ) |

| $ | (181,467 | ) |

| 17 |

| Table of Contents |

As of July 31, 2016, the Company had a cash balance of $390,660 compared to $734,386 as of July 31, 2015. The decrease in cash was due to Company expenditures during the year; no funds were brought into the Company during the year.

As of July 31, 2016, the Company had total liabilities of $756,997 compared with total liabilities of $166,979 as of July 31, 2015. The increase in total liabilities was primarily attributed to management fees payable.

As of July 31, 2016, the Company had working capital deficiency of $426,247 compared with working capital of $567,407 as of July 31, 2015. The decrease in working capital was attributed to the decrease in cash and the increase in management fees payable.

Cash Flow from Operating Activities

During the year ended July 31, 2016, the Company used $128,726 in cash from operating activities compared to cash used by operating activities of $181,467 during the year ended July 31, 2015.

Cash Flow from Investing Activities

During the year ended July 31, 2016, the Company used $215,000 in cash from investing activities; the Company used no cash for investing activities in the year ended July 31, 2015.

Cash Flow from Financing Activities

During the years ended July 31, 2016 and 2015, the Company received no cash from financing activities.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

Going Concern Consideration

As at July 31, 2016, the Company has a loss from operations of $993,654 and an accumulated deficit of $1,440,558 and has earned no revenues since inception. The Company intends to fund operations through equity financing arrangements, which may be insufficient to fund its capital expenditures, working capital and other cash requirements for the year ending July 31, 2017.

Our auditors have issued a going concern opinion on our audited financial statements for the year ended July 31, 2016. This means that there is substantial doubt that we can continue as an ongoing business for the next twelve months unless we obtain additional capital to pay for our expenses. We may in the future attempt to obtain financing through private offerings of debt or equity. Equity financing would result in additional dilution to existing stockholders. We currently have no agreements or arrangements to obtain funds through bank loans, lines of credit or any other sources. There is no assurance we will ever be successful doing so.

Critical Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates. The Company's periodic filings with the Securities and Exchange Commission include, where applicable, disclosures of estimates, assumptions, uncertainties and markets that could affect the financial statements and future operations of the Company.

Cash and Cash Equivalents

Cash and cash equivalents include cash in banks, money market funds, and certificates of term deposits with maturities of less than three months from inception, which are readily convertible to known amounts of cash and which, in the opinion of management, are subject to an insignificant risk of loss in value. The Company had $390,660 and $734,386 in cash and cash equivalents at July 31, 2016 and 2015, respectively.

Fair value of financial instruments

The carrying amounts reported in the balance sheet for accounts payable and accrued liabilities and other current liabilities approximate fair value because of their immediate or short term maturity.

| 18 |

| Table of Contents |

Concentrations of Credit Risk

The Company's financial instruments that are exposed to concentrations of credit risk primarily consist of its cash and cash equivalents and related party payables it will likely incur in the near future. The Company places its cash and cash equivalents with financial institutions of high credit worthiness. At times, its cash and cash equivalents with a particular financial institution may exceed any applicable government insurance limits. The Company's management plans to assess the financial strength and credit worthiness of any parties to which it extends funds, and as such, it believes that any associated credit risk exposures are limited.

Recent Accounting Pronouncements

In June 2014, the Financial Accounting Standards Board issued Accounting Standards Update No. 201410,

Which eliminated certain financial reporting requirements of companies previously identified as "Development Stage Entities" (Topic 915). The amendments in this ASU simplify accounting guidance by removing all incremental financial reporting requirements for development stage entities. The amendments also reduce data maintenance and, for those entities subject to audit, audit costs by eliminating the requirement for development stage entities to present inception-to-date information in the statements of income, cash flows, and shareholder equity. Early application of each of the amendments is permitted for any annual reporting period or interim period for which the entity's financial statements have not yet been issued (public business entities) or made available for issuance (other entities). Upon adoption, entities will no longer present or disclose any information required by Topic 915. The Company has adopted this standard.

In May 2014, FASB issued Accounting Standards Update (ASU) No. 201409, Revenue from Contracts with Customers. The revenue recognition standard affects all entities that have contracts with customers, except for certain items. The new revenue recognition standard eliminates the transaction- and industry-specific revenue recognition guidance under current GAAP and replaces it with a principle-based approach for determining revenue recognition. Public entities are required to adopt the revenue recognition standard for reporting periods beginning after December 15, 2016, and interim and annual reporting periods thereafter. Early adoption is not permitted for public entities. The Company has reviewed the applicable ASU and has not, at the current time, quantified the effects of this pronouncement, however it believes that there will be no material effect on the financial statements.

In June 2014, FASB issued Accounting Standards Update (ASU) No. 201412 Compensation — Stock Compensation (Topic 718), Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite Service Period. A performance target in a share-based payment that affects vesting and that could be achieved after the requisite service period should be accounted for as a performance condition under Accounting Standards Codification (ASC) 718, Compensation — Stock Compensation. As a result, the target is not reflected in the estimation of the award's grant date fair value. Compensation cost would be recognized over the required service period, if it is probable that the performance condition will be achieved. The guidance is effective for annual periods beginning after 15 December 2015 and interim periods within those annual periods. Early adoption is permitted. The Company has not yet adopted this ASU. Management has reviewed the ASU and believes there will be no significant impact on the Company's financial statements.

In August 2014, FASB issued Accounting Standards Update (ASU) No. 201415 Preparation of Financial Statements – Going Concern (Subtopic 20540), Disclosure of Uncertainties about an Entity's Ability to Continue as a Going Concern. Under generally accepted accounting principles (GAAP), continuation of a reporting entity as a going concern is presumed as the basis for preparing financial statements unless and until the entity's liquidation becomes imminent. Preparation of financial statements under this presumption is commonly referred to as the going concern basis of accounting. If and when an entity's liquidation becomes imminent, financial statements should be prepared under the liquidation basis of accounting in accordance with Subtopic 20530, Presentation of Financial Statements—Liquidation Basis of Accounting. Even when an entity's liquidation is not imminent, there may be conditions or events that raise substantial doubt about the entity's ability to continue as a going concern. In those situations, financial statements should continue to be prepared under the going concern basis of accounting, but the amendments in this Update should be followed to determine whether to disclose information about the relevant conditions and events. The amendments in this Update are effective for the annual period ending after December 15, 2016, and for annual periods and interim periods thereafter. Early application is permitted. The Company will evaluate the going concern considerations in this ASU, however, at the current period, management does not believe that it has met the conditions which would subject these financial statements for additional disclosure.

| 19 |

| Table of Contents |

In January 2015, FASB issued Accounting Standards Update (ASU) No. 201501 Income Statement – Extraordinary and Unusual Items, Simplifying Income Statement Presentation by Eliminating the Concept of Extraordinary Items. Under generally accepted accounting principles (GAAP), if an event or transaction met the criteria for extraordinary classification, an entity was required to segregate the extraordinary item from the results of ordinary operations and show the item separately in the income statement, net of tax, after income from continuing operations. The entity was also required to disclose applicable income taxes and either present or disclose earnings-per-share data applicable to the extraordinary item. Eliminating the concept of extraordinary items will save time and reduce costs for preparers because they will not have to assess whether a particular event or transaction event is extraordinary (even if they ultimately would conclude it is not). This also alleviates uncertainty for preparers, auditors, and regulators because auditors and regulators no longer will need to evaluate whether a preparer treated an unusual and/or infrequent item appropriately. The guidance is effective for annual periods beginning after 15 December 2015 and interim periods within those annual periods. Early adoption is permitted. The Company has not yet adopted this ASU. Management has reviewed the ASU and believes there will be no significant impact on the Company's financial statements.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Not applicable.

The financial statement information for the fiscal year ended July 31, 2016 as listed below are included beginning on page F-1 of this Form 10-K:

· Report of Independent Registered Public Accounting Firm

· Balance Sheets

· Statement of Operations

· Statements of Shareholders’ Equity

· Statements of Cash Flow

· Notes to Financial Statements

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

There were no disagreements with accountants on accounting and financial disclosure of a type described in Item 304 (a)(1)(iv) or any reportable event as described in Item 304 (a)(1)(v) of Regulation SK.

Item 9A. Controls and Procedures

Evaluation of Disclosure Controls

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our reports filed under the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms, and that such information is accumulated and communicated to our management, including our president (our principal executive officer, principal financial officer and principal accounting officer) to allow for timely decisions regarding required disclosure.

As of July 31, 2016, we carried out an evaluation, under the supervision and with the participation of our president (our principal executive officer) and chief financial officer (our principal financial officer), of the effectiveness of the design and operation of our disclosure controls and procedures. Based on the foregoing, our president (our principal executive officer) and our chief financial officer (our principal financial officer) concluded that our disclosure controls and procedures were not effective as of July 31, 2016, the end of the period covered by this Annual Report.

| 20 |

| Table of Contents |

Management's Report On Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting. As defined in Rules 13a15(f) under the Securities Exchange Act of 1934, internal control over financial reporting is a process designed by, or under the supervision of, the Company's principal executive, principal operating and principal financial officers, or persons performing similar functions, and effected by the Company's board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America.

The Company's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records, that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the Company's assets; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of the Company's management and directors; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.