united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22756

Advisors Preferred Trust

(Exact name of registrant as specified in charter)

1445 Research Blvd, Suite 530, Rockville, MD 20850

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2734

Date of fiscal year end: 12/31

Date of reporting period: 12/31/22

Item 1. Reports to Stockholders.

Annual Report

December 31, 2022

Investor Class Shares (QGLDX)

Advisor Class Shares (QGLCX)

1-855-650-QGLD(7453)

www.advisorspreferred.com

December 31, 2022

Dear Shareholders,

This Annual Report for The Gold Bullion Strategy Fund (“Fund”) covers the period from January 1, 2022 to December 31, 2022. Flexible Plan Investments, Ltd. serves as the sub-advisor to The Gold Bullion Strategy Fund. During the period, the Fund returned -4.59% (as measured by Investor Class shares), compared with a return of -0.74% in the S&P GSCI Gold Index, while the S&P 500 TR Index returned -18.11%. The sub-index of the S&P GSCI provides investors with a reliable and publicly available benchmark tracking the COMEX gold future.

Gold’s performance was largely affected by two major themes: U.S. Dollar strength and interest rate hikes. Gold surged through early March 2022 as Russia invaded Ukraine and global markets tumbled. However, this rally was short lived as gold was down roughly 9% on a year-to-date basis by the end of September, battling headwinds from a strong U.S. Dollar and aggressive interest rate hikes from the Federal Reserve.

Gold’s reversal in the fourth quarter of 2022 coincided with a decline in the U.S. Dollar through the end of the year. The Fed continued interest rate hikes, totally seven such increases for 2022, which pushed the federal funds rate to a 14 year high.

Historically, gold has performed well against a weak dollar and rising interest rates. These themes have created an environment spurring renewed interest in gold as it rounded out the year on a positive note with rate hikes poised to continue and the U.S. Dollar losing strength.

The Gold Bullion Strategy Fund seeks returns that reflect the daily performance of the price of gold bullion and, as such, is a vehicle for investors to capture potential returns resulting from those movements. To meet its goal, the Fund utilizes gold bullion-related futures contracts and exchange-traded funds (ETFs). Additionally, in an effort to reflect the daily performance of the price of gold bullion net of fees, the Fund invests in investment-grade fixed income corporate notes and bonds, with an objective of generating interest income to partially offset those fees. The Fund’s underperformance versus the S&P GSCI Gold Index for the period can largely be attributed to unfavorable effects from rising interest rates and fund expenses.

The Fund continues to endeavor to execute its strategy consistently, regardless of the market environment or perceived outlook for gold. As always, the advisor and sub-advisor reiterate the value of gold in portfolios as a diversifier given its historically low correlation to most other asset classes.

We encourage our investors to maintain a long-term perspective as the market reacts to inevitable challenges and opportunities. As an asset class, gold historically has been uncorrelated with other asset classes and has tended to provide a valuable hedge to investor portfolios in times of market volatility or economic and geopolitical uncertainty. We thank you for your confidence in The Gold Bullion Strategy Fund and its potential to help you achieve your financial goals.

| Best regards, | |

| Jerry Wagner | Catherine Ayers-Rigsby |

| Flexible Plan Investments, Ltd. | Advisors Preferred |

1

| The Gold Bullion Strategy Fund |

| Portfolio Review (Unaudited) |

| December 31, 2022 |

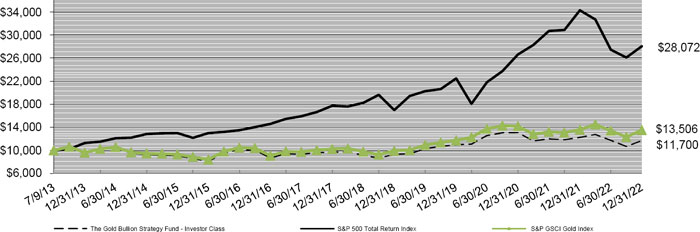

The Fund’s performance figures* for the year ended December 31, 2022, as compared to its benchmarks:

| Annualized | |||||

| Since Inception | Since Inception | ||||

| One Year | Three Years | Five Years | April 19, 2016 | July 9, 2013 | |

| The Gold Bullion Strategy Fund - Investor Class | (4.59)% | 2.18% | 3.66% | N/A | 1.67% |

| The Gold Bullion Strategy Fund - Advisor Class | (5.17)% | 1.57% | 3.04% | 2.17% | N/A |

| S&P 500 Total Return Index ** | (18.11)% | 7.66% | 9.42% | 11.45% | 11.50% |

| S&P GSCI Gold Index*** | (0.74)% | 4.75% | 5.68% | 4.63% | 3.22% |

| * | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. The Fund’s Investor and Advisor Class total fund operating expense ratio including acquired fund fees and expenses (AFFE), as provided in the Fund’s prospectus dated May 1, 2022, was 1.42% and 2.01%, respectively. For performance information current to the most recent month-end, please call 1-855-650-7453. Investors should consider the investment objective, risks, and charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains these as well as other information about the Fund and should be read carefully before investing. A prospectus or summary prospectus may be obtained free of charge by calling toll-free 1-855-375-3060. |

| ** | The S&P 500 Total Return Index is an unmanaged composite of 500 large capitalization companies and includes the reinvestment of dividends. This index is widely used by professional investors as a performance benchmark for large-cap stocks. Investors cannot invest directly in an index. |

| *** | The S&P GSCI Gold Index, a sub-index of the S&P GSCI, provides investors with a reliable and publicly available benchmark tracking the COMEX gold future. The index is designed to be tradable, readily accessible to market participants, and cost efficient to implement. Investors cannot directly invest in an index. |

Comparison

of the Change in Value of a $10,000 Investment

Since Inception through December 31, 2022 +

Past performance is not necessarily indicative of future results.

| + | Inception date is July 9, 2013 |

As of December 31, 2022, the Fund’s holdings by types of investments are as follows:

| Holdings by Type of Investment ǂ: | % of Net Assets | |||

| Exchange Traded Funds: | ||||

| Fixed Income Funds | 6.2 | % | ||

| Commodity Fund | 0.8 | % | ||

| Certificate of Deposit | 6.6 | % | ||

| Corporate Bonds | 18.1 | % | ||

| Short-Term Investments | 42.7 | % | ||

| Collateral for Securities Loaned | 2.6 | % | ||

| Other Assets In Excess of Liabilities | 23.0 | % | ||

| 100.0 | % | |||

| ǂ | The Holdings by Type of Investment detailed do not include derivative exposure. |

Please refer to the Consolidated Portfolio of Investments in this annual report for a detailed listing of the Fund’s holdings.

2

| THE GOLD BULLION STRATEGY FUND |

| CONSOLIDATED SCHEDULE OF INVESTMENTS |

| December 31, 2022 |

| Shares | Fair Value | |||||||

| EXCHANGE-TRADED FUNDS — 7.0% | ||||||||

| COMMODITY - 0.8% | ||||||||

| 6,417 | SPDR Gold Shares(a),(b) | $ | 1,088,580 | |||||

| FIXED INCOME - 6.2% | ||||||||

| 80,000 | iShares 0-3 Month Treasury Bond ETF(e) | 8,011,200 | ||||||

| TOTAL EXCHANGE-TRADED FUNDS (Cost $9,063,404) | 9,099,780 | |||||||

| Principal | Coupon Rate | |||||||||||

| Amount ($) | (%) | Maturity | ||||||||||

| CORPORATE BONDS — 18.1% | ||||||||||||

| AUTOMOTIVE — 0.7% | ||||||||||||

| 1,000,000 | Toyota Motor Credit Corporation | 0.5000 | 06/18/24 | 939,064 | ||||||||

| BANKING — 2.3% | ||||||||||||

| 1,000,000 | Canadian Imperial Bank of Commerce | 3.1000 | 04/02/24 | 976,639 | ||||||||

| 1,000,000 | Mitsubishi UFJ Financial Group, Inc. | 3.4070 | 03/07/24 | 979,834 | ||||||||

| 1,000,000 | PNC Financial Services Group, Inc. (The) | 3.9000 | 04/29/24 | 988,621 | ||||||||

| 2,945,094 | ||||||||||||

| DIVERSIFIED INDUSTRIALS — 0.7% | ||||||||||||

| 1,000,000 | General Electric Company | 3.4500 | 05/15/24 | 975,758 | ||||||||

| ELECTRIC UTILITIES — 1.5% | ||||||||||||

| 1,000,000 | Enel Generacion Chile S.A. | 4.2500 | 04/15/24 | 988,090 | ||||||||

| 1,000,000 | WEC Energy Group, Inc. | 0.8000 | 03/15/24 | 948,159 | ||||||||

| 1,936,249 | ||||||||||||

| ENTERTAINMENT CONTENT — 0.8% | ||||||||||||

| 1,000,000 | Walt Disney Company | 7.7500 | 01/20/24 | 1,032,149 | ||||||||

| GAS & WATER UTILITIES — 0.8% | ||||||||||||

| 1,000,000 | Thomson Reuters Corporation | 3.8500 | 09/29/24 | 969,490 | ||||||||

| INSTITUTIONAL FINANCIAL SERVICES — 2.2% | ||||||||||||

| 1,000,000 | Bank of New York Mellon Corporation | 0.5000 | 04/26/24 | 944,500 | ||||||||

| 1,000,000 | Brookfield Finance, Inc. | 4.0000 | 04/01/24 | 985,277 | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

3

| THE GOLD BULLION STRATEGY FUND |

| CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2022 |

| Principal | Coupon Rate | |||||||||||

| Amount ($) | (%) | Maturity | Fair Value | |||||||||

| CORPORATE BONDS — 18.1% (Continued) | ||||||||||||

| INSTITUTIONAL FINANCIAL SERVICES — 2.2% (Continued) | ||||||||||||

| 1,000,000 | Goldman Sachs Group, Inc. | 0.8000 | 03/25/24 | $ | 943,958 | |||||||

| 2,873,735 | ||||||||||||

| MACHINERY — 0.7% | ||||||||||||

| 1,000,000 | Parker-Hannifin Corporation | 2.7000 | 06/14/24 | 963,895 | ||||||||

| MEDICAL EQUIPMENT & DEVICES — 0.8% | ||||||||||||

| 1,000,000 | Becton Dickinson and Company | 3.3630 | 06/06/24 | 977,793 | ||||||||

| OIL & GAS SERVICES & EQUIPMENT — 0.8% | ||||||||||||

| 1,000,000 | Schlumberger Holdings Corp.(c) | 3.7500 | 05/01/24 | 982,826 | ||||||||

| REAL ESTATE INVESTMENT TRUSTS — 0.8% | ||||||||||||

| 1,000,000 | Welltower, Inc. | 3.6250 | 03/15/24 | 979,078 | ||||||||

| RETAIL - CONSUMER STAPLES — 0.7% | ||||||||||||

| 1,000,000 | 7-Eleven, Inc.(c) | 0.8000 | 02/10/24 | 951,917 | ||||||||

| SPECIALTY FINANCE — 0.8% | ||||||||||||

| 1,000,000 | Capital One Financial Corp | 3.9000 | 01/29/24 | 988,239 | ||||||||

| TECHNOLOGY HARDWARE — 1.5% | ||||||||||||

| 1,000,000 | Apple, Inc. | 3.0000 | 02/09/24 | 980,730 | ||||||||

| 1,000,000 | Hewlett Packard Enterprise Company | 1.4500 | 04/01/24 | 955,879 | ||||||||

| 1,936,609 | ||||||||||||

| TECHNOLOGY SERVICES — 0.8% | ||||||||||||

| 1,000,000 | International Business Machines Corporation | 3.0000 | 05/15/24 | 973,421 | ||||||||

| TELECOMMUNICATIONS — 0.7% | ||||||||||||

| 1,000,000 | Verizon Communications, Inc. | 0.7500 | 03/22/24 | 949,724 | ||||||||

| TRANSPORTATION & LOGISTICS — 1.5% | ||||||||||||

| 1,000,000 | Ryder System, Inc. | 3.6500 | 03/18/24 | 980,292 | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

4

| THE GOLD BULLION STRATEGY FUND |

| CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2022 |

| Principal | Coupon Rate | |||||||||||

| Amount ($) | (%) | Maturity | Fair Value | |||||||||

| CORPORATE BONDS — 18.1% (Continued) | ||||||||||||

| TRANSPORTATION & LOGISTICS — 1.5% (Continued) | ||||||||||||

| 1,000,000 | Union Pacific Corporation | 3.6460 | 02/15/24 | $ | 985,309 | |||||||

| 1,965,601 | ||||||||||||

| TOTAL CORPORATE BONDS (Cost $24,610,506) | 23,340,642 | |||||||||||

| CERTIFICATE OF DEPOSIT — 6.6% | ||||||||||||

| AUTOMOTIVE - 0.7% | ||||||||||||

| 1,000,000 | BMW Bank of North America | 0.5500 | 07/30/24 | 938,721 | ||||||||

| BANKING - 5.9% | ||||||||||||

| 1,000,000 | Goldman Sachs Bank USA | 1.8000 | 01/30/23 | 998,116 | ||||||||

| 1,000,000 | Greenstate Credit Union | 0.5000 | 07/19/24 | 938,548 | ||||||||

| 1,000,000 | State Bank of India | 0.6000 | 08/30/24 | 936,493 | ||||||||

| 1,000,000 | Synchrony Bank | 0.6500 | 09/17/24 | 935,676 | ||||||||

| 1,000,000 | Texas Exchange Bank SSB | 0.5000 | 07/09/24 | 939,597 | ||||||||

| 1,000,000 | Toyota Financial Savings Bank | 0.5500 | 08/05/24 | 938,108 | ||||||||

| 1,000,000 | UBS Bank USA | 0.5500 | 08/12/24 | 936,931 | ||||||||

| 1,000,000 | Wells Fargo National Bank West | 1.9000 | 01/30/23 | 998,199 | ||||||||

| 7,621,668 | ||||||||||||

| TOTAL CERTIFICATE OF DEPOSIT (Cost $8,998,367) | 8,560,389 | |||||||||||

| Shares | ||||||||

| SHORT-TERM INVESTMENTS — 42.7% | ||||||||

| MONEY MARKET FUNDS — 42.7% | ||||||||

| 43,317,119 | Fidelity Government Portfolio, Class I, 4.06%(d) | 43,317,119 | ||||||

| 11,803,218 | First American Government Obligations Fund, Class Z, 4.04%(d) | 11,803,218 | ||||||

| TOTAL MONEY MARKET FUNDS (Cost $55,120,337) | 55,120,337 | |||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $55,120,337) | 55,120,337 | |||||||

The accompanying notes are an integral part of these consolidated financial statements.

5

| THE GOLD BULLION STRATEGY FUND |

| CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2022 |

| Units | Fair Value | |||||||

| COLLATERAL FOR SECURITIES LOANED — 2.6% | ||||||||

| 3,368,100 | Mount Vernon Liquid Assets Portfolio, LLC, 4.56%(d) (f) | $ | 3,368,100 | |||||

| TOTAL COLLATERAL FOR SECURITIES LOANED (Cost $3,368,100) | ||||||||

| TOTAL INVESTMENTS — 77.0% (Cost $101,160,714) | $ | 99,489,248 | ||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES — 23.0% | 29,739,552 | |||||||

| NET ASSETS - 100.0% | $ | 129,228,800 | ||||||

| OPEN FUTURES CONTRACTS | ||||||||||||||

| Number of Contracts | Open Long Futures Contracts | Expiration | Notional Amount | Unrealized Appreciation | ||||||||||

| 704 | COMEX Gold 100 Troy Ounces Future(b) | 02/24/2023 | $ | 128,803,840 | $ | 4,014,357 | ||||||||

| TOTAL FUTURES CONTRACTS | ||||||||||||||

| ETF | - Exchange-Traded Fund |

| (a) | Non-income producing security. |

| (b) | All or a portion of this investment is a holding of the GBSF Fund Ltd. |

| (c) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. The security may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of December 31, 2022 the total market value of 144A securities is $1,934,743 or 1.5% of net assets. |

| (d) | Rate disclosed is the seven-day effective yield as of December 31, 2022. |

| (e) | All or a portion of the security is on loan. Total loaned securities had a value of $3,274,578 at December 31, 2022. |

| (f) | Security purchased with cash proceeds of securities lending collateral. |

The accompanying notes are an integral part of these consolidated financial statements.

6

| The Gold Bullion Strategy Fund |

| Consolidated Statement of Assets and Liabilities |

| December 31, 2022 |

| ASSETS | ||||

| Investment securities: | ||||

| At cost | $ | 101,160,714 | ||

| At value (a) | $ | 99,489,248 | ||

| Cash | 25,243,569 | |||

| Deposit with broker for futures contracts | 4,400,606 | |||

| Unrealized appreciation on futures contracts | 4,014,357 | |||

| Dividends and interest receivable | 456,855 | |||

| Receivable for Fund shares sold | 78,554 | |||

| Prepaid expenses and other assets | 58,850 | |||

| TOTAL ASSETS | 133,742,039 | |||

| LIABILITIES | ||||

| Payable for Fund shares repurchased | 926,974 | |||

| Collateral on securities loaned (See note 9) | 3,368,100 | |||

| Investment advisory fees payable | 80,857 | |||

| Payable to related parties | 57,580 | |||

| Payable for investments purchased | 34,938 | |||

| Distribution (12b-1) fees payable | 28,165 | |||

| Shareholder service fees payable | 16,625 | |||

| TOTAL LIABILITIES | 4,513,239 | |||

| NET ASSETS | $ | 129,228,800 | ||

| Composition of Net Assets: | ||||

| Paid in capital | $ | 133,062,016 | ||

| Accumulated deficit | (3,833,216 | ) | ||

| NET ASSETS | $ | 129,228,800 | ||

| Net Asset Value Per Share: | ||||

| Investor Class Shares: | ||||

| Net Assets | $ | 128,653,882 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 6,072,439 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share | $ | 21.19 | ||

| Advisor Class Shares: | ||||

| Net Assets | $ | 574,918 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 27,733 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share | $ | 20.73 | ||

| (a) | Includes loaned securities with a value of $3,274,578. |

The accompanying notes are an integral part of these consolidated financial statements.

7

| The Gold Bullion Strategy Fund |

| Consolidated Statement of Operations |

| For the Year Ended December 31, 2022 |

| INVESTMENT INCOME | ||||

| Dividends | $ | 397,184 | ||

| Interest | 1,245,814 | |||

| Securities lending | 34,091 | |||

| TOTAL INVESTMENT INCOME | 1,677,089 | |||

| EXPENSES | ||||

| Investment advisory fees | 1,047,757 | |||

| Distribution (12b-1) fees - Investor Class Shares | 347,522 | |||

| Distribution (12b-1) fees - Advisor Class Shares | 6,921 | |||

| Administrative service fees | 220,020 | |||

| Shareholder service fees - Investor Class Shares | 208,513 | |||

| Miscellaneous expenses | 9,000 | |||

| TOTAL EXPENSES | 1,839,733 | |||

| NET INVESTMENT LOSS | (162,644 | ) | ||

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FUTURES CONTRACTS | ||||

| Net realized gain (loss) from: | ||||

| Investments | (1,924,307 | ) | ||

| Futures contracts | (8,336,577 | ) | ||

| Net Realized Loss on Investments and Futures Contracts | (10,260,884 | ) | ||

| Net change in unrealized appreciation (depreciation) on: | ||||

| Investments | (1,174,204 | ) | ||

| Futures contracts | 1,136,187 | |||

| Net Change in Unrealized Depreciation on Investments and Futures Contracts | (38,017 | ) | ||

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS AND FUTURES CONTRACTS | (10,298,901 | ) | ||

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (10,461,545 | ) | |

The accompanying notes are an integral part of these consolidated financial statements.

8

| The Gold Bullion Strategy Fund |

| Consolidated Statements of Changes in Net Assets |

| For the | For the | |||||||

| Year Ended | Year Ended | |||||||

| December 31, 2022 | December 31, 2021 | |||||||

| INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS | ||||||||

| Net investment loss | $ | (162,644 | ) | $ | (812,141 | ) | ||

| Net realized loss on investments and futures contracts | (10,260,884 | ) | (3,307,584 | ) | ||||

| Distributions from underlying investment companies | — | 35,397 | ||||||

| Net change in unrealized depreciation on investments and futures contracts | (38,017 | ) | (3,685,909 | ) | ||||

| Net decrease in net assets resulting from operations | (10,461,545 | ) | (7,770,237 | ) | ||||

| SHARES OF BENEFICIAL INTEREST | ||||||||

| Proceeds from shares sold: | ||||||||

| Investor Class | 339,717,662 | 219,675,713 | ||||||

| Advisor Class | 297,280 | 615,588 | ||||||

| Payments for shares redeemed | ||||||||

| Investor Class | (329,728,013 | ) | (205,972,607 | ) | ||||

| Advisor Class | (400,794 | ) | (210,690 | ) | ||||

| Net increase from shares of beneficial interest transactions | 9,886,135 | 14,108,004 | ||||||

| NET INCREASE (DECREASE) IN NET ASSETS | (575,410 | ) | 6,337,767 | |||||

| NET ASSETS | ||||||||

| Beginning of year | 129,804,210 | 123,466,443 | ||||||

| End of year | $ | 129,228,800 | $ | 129,804,210 | ||||

| SHARE ACTIVITY | ||||||||

| Investor Class: | ||||||||

| Shares Sold | 15,748,075 | 9,917,178 | ||||||

| Shares Redeemed | (15,486,939 | ) | (9,303,100 | ) | ||||

| Net increase in shares of beneficial interest outstanding | 261,136 | 614,078 | ||||||

| Advisor Class: | ||||||||

| Shares Sold | 13,470 | 28,061 | ||||||

| Shares Redeemed | (19,530 | ) | (9,594 | ) | ||||

| Net increase (decrease) in shares of beneficial interest outstanding | (6,060 | ) | 18,467 | |||||

The accompanying notes are an integral part of these consolidated financial statements.

9

| The Gold Bullion Strategy Fund |

| Consolidated Financial Highlights |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Year |

| Investor Class | ||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018 | ||||||||||||||||

| Net asset value, beginning of year | $ | 22.21 | $ | 23.69 | $ | 21.86 | $ | 21.43 | $ | 22.62 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (loss) (a) | (0.02 | ) | (0.15 | ) | (0.04 | ) | 0.18 | 0.09 | ||||||||||||

| Net realized and unrealized gain (loss) | (1.00 | ) | (1.33 | ) | 4.22 | 3.38 | (1.02 | ) | ||||||||||||

| Total income (loss) from investment operations | (1.02 | ) | (1.48 | ) | 4.18 | 3.56 | (0.93 | ) | ||||||||||||

| Less distributions: | ||||||||||||||||||||

| Distributions from net investment income | — | — | (2.35 | ) | (3.13 | ) | (0.26 | ) | ||||||||||||

| Total distributions | — | — | (2.35 | ) | (3.13 | ) | (0.26 | ) | ||||||||||||

| Net asset value, end of year | $ | 21.19 | $ | 22.21 | $ | 23.69 | $ | 21.86 | $ | 21.43 | ||||||||||

| Total return (b) | (4.59 | )% | (6.25 | )% | 19.28 | % | 16.95 | % | (4.08 | )% | ||||||||||

| Net assets, end of year (in 000s) | $ | 128,654 | $ | 129,065 | $ | 123,107 | $ | 81,048 | $ | 42,274 | ||||||||||

| Ratios/Supplemental Data: | ||||||||||||||||||||

| Ratio of net expenses to average net assets (c) | 1.31 | % | 1.35 | % | 1.43 | % | 1.42 | % | 1.41 | % | ||||||||||

| Ratios of net investment income (loss) to average net assets (c,d) | (0.11 | )% | (0.67 | )% | (0.17 | )% | 0.79 | % | 0.41 | % | ||||||||||

| Portfolio turnover rate | 143 | % | 162 | % | 229 | % | 190 | % | 167 | % | ||||||||||

| (a) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the year. |

| (b) | Total return assumes reinvestment of all distributions. |

| (c) | The ratios of expenses to average net assets and net investment income (loss) to average net assets do not reflect the expenses of the underlying investment companies in which the Fund invests. |

| (d) | Recognition of net investment income (loss) by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

The accompanying notes are an integral part of these consolidated financial statements.

10

| The Gold Bullion Strategy Fund |

| Consolidated Financial Highlights |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Year |

| Advisor Class | ||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018 | ||||||||||||||||

| Net asset value, beginning of year | $ | 21.86 | $ | 23.46 | $ | 21.68 | $ | 21.28 | $ | 22.51 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (loss) (a) | (0.16 | ) | (0.28 | ) | (0.19 | ) | 0.05 | (0.05 | ) | |||||||||||

| Net realized and unrealized gain (loss) | (0.97 | ) | (1.32 | ) | 4.18 | 3.36 | (1.00 | ) | ||||||||||||

| Total income (loss) from investment operations | (1.13 | ) | (1.60 | ) | 3.99 | 3.41 | (1.05 | ) | ||||||||||||

| Less distributions: | ||||||||||||||||||||

| Distributions from net investment income | — | — | (2.21 | ) | (3.01 | ) | (0.18 | ) | ||||||||||||

| Total distributions | — | — | (2.21 | ) | (3.01 | ) | (0.18 | ) | ||||||||||||

| Net asset value, end of year | $ | 20.73 | $ | 21.86 | $ | 23.46 | $ | 21.68 | $ | 21.28 | ||||||||||

| Total return (b) | (5.17 | )% | (6.82 | )% | 18.55 | % (e) | 16.32 | % (e) | (4.68 | )% | ||||||||||

| Net assets, end of year (in 000s) | $ | 575 | $ | 739 | $ | 359 | $ | 290 | $ | 978 | ||||||||||

| Ratios/Supplemental Data: | ||||||||||||||||||||

| Ratio of net expenses to average net assets (c) | 1.91 | % | 1.94 | % | 2.03 | % | 2.01 | % | 2.01 | % | ||||||||||

| Ratios of net investment income (loss) to average net assets (d) | (0.77 | )% | (1.26 | )% | (0.76 | )% | 0.20 | % | (0.24 | )% | ||||||||||

| Portfolio turnover rate | 143 | % | 162 | % | 229 | % | 190 | % | 167 | % | ||||||||||

| (a) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the year. |

| (b) | Total return assumes reinvestment of all distributions. |

| (c) | The ratios of expenses to average net assets and net investment income (loss) to average net assets do not reflect the expenses of the underlying investment companies in which the Fund invests. |

| (d) | Recognition of net investment income (loss) by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (e) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

The accompanying notes are an integral part of these consolidated financial statements.

11

| The Gold Bullion Strategy Fund |

| Notes to Consolidated Financial Statements |

| December 31, 2022 |

| 1. | ORGANIZATION |

The Gold Bullion Strategy Fund (the “Fund”) is a diversified series of Advisors Preferred Trust (the “Trust”), a statutory trust organized under the laws of the State of Delaware on August 15, 2012 and registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund seeks returns that reflect the performance of the price of gold bullion.

The Fund currently offers two classes of shares, Investor and Advisor classes of shares each of which are offered at Net Asset Value (“NAV”). The Fund’s Investor class commenced operations on July 9, 2013 and the Advisor class commenced operations on April 19, 2016. The Fund may issue an unlimited number of shares of beneficial interest in one or more share classes. Generally, all shares of the Fund have equal rights and privileges, except for class-specific features, rights and expenses. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund’s income, expenses (other than class-specific distribution and service fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its consolidated financial statements. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”). The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services – Investment Companies.

Securities Valuation – The Fund calculates its daily NAV per share at the close of regular trading on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m., Eastern time) (the “NYSE Close”) on each day that the NYSE is open. Fund securities are valued each day at the last quoted sales price on each security’s primary exchange, and securities traded or dealt in upon one or more securities exchanges (whether domestic or foreign) for which market quotations were readily available and not subject to restrictions against resale will be valued at the last quoted sales price on the primary exchange or, in the absence of a sale on the primary exchange, at the mean of the current bid and ask on the primary exchange. Securities primarily traded in the National Association of Securities Dealers’ Automated Quotation System (“NASDAQ”) National Market System for which market quotations are readily available shall be valued using the NASDAQ price. Futures are valued at 4:00 p.m. Eastern Time or, in the absence of a settled price, at the last bid price on the day of valuation. Debt securities (other than short-term obligations) are valued each day by an independent pricing service approved by the Trust’s Board of Trustees (the “Board”) based on methods which include consideration of: yields or prices of securities of comparable quality, coupon, maturity and type, indications as to values from dealers, and general market conditions or market quotations from a major market maker in the securities. The independent pricing service does not distinguish between smaller-sized bond positions known as “odd lots” and larger institutional-sized bond positions known as “round lots”. The Fund may fair value a particular bond if the advisor does not believe that the round lot value provided by the independent pricing service reflects fair value of the Fund’s holding. Investments in open-end investment companies are valued at net asset value. Short-term debt obligations having 60 days or less remaining until maturity, at time of purchase, may be valued at amortized cost.

GBSF Fund Limited (“GBSF Ltd.”) is a wholly-owned and controlled foreign subsidiary of the Fund that can invest in gold-bullion related exchange-traded funds (“ETFs”), exchange traded notes (“ETNs”), physical gold bullion and derivatives. See “Consolidation of Subsidiary” for additional information.

The Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities will be valued at their fair value as determined using the “fair value” procedures approved by the Trust’s Board. The Board has delegated execution of these procedures to a fair value committee

12

| The Gold Bullion Strategy Fund |

| Notes to Consolidated Financial Statements (Continued) |

| December 31, 2022 |

composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) advisor and/or sub-advisor. The committee may also enlist third party consultants such as a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist in determining a security-specific fair value. The Board reviews and ratifies the execution of this process and the resultant fair value prices at least quarterly to assure the process produces reliable results.

Fair Valuation Process – As noted above, the fair value committee is composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) advisor and/or sub-advisor. The applicable investments are valued collectively via inputs from each of these groups. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source), (ii) securities for which, in the judgment of the advisor, the prices or values available do not represent the fair value of the instrument. Factors which may cause the advisor to make such a judgment include, but are not limited to, the following: only a bid price or an asked price is available; the spread between bid and asked prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; (iv) securities with respect to which an event that will affect the value thereof has occurred (a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior to the Fund’s calculation of its net asset value. Specifically, interests in commodity pools or managed futures pools are valued on a daily basis by reference to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. Restricted or illiquid securities, such as private investments or non-traded securities are valued via inputs from the advisor based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If the advisor is unable to obtain a current bid from such independent dealers or other independent parties, the fair value committee shall determine the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

Valuation of Investment Companies – The Fund may invest in portfolios of open-end or closed-end investment companies (the “Underlying Funds”). The Underlying Funds value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value to the methods established by the board of directors/trustees of the Underlying Funds.

Open-ended investment companies are valued at their respective net asset values as reported by such investment companies. The shares of many closed-end investment companies, after their initial public offering, frequently trade at a price per share, which is different than the net asset value per share. The difference represents a market premium or market discount of such shares. There can be no assurances that the market discount or market premium on shares of any closed-end investment company purchased by the Fund will not change.

Units of Mount Vernon Liquid Assets Portfolio, LLC are not traded on or exchange and are valued at the investment company’s NAV per unit as provided by the Underlying Fund’s administrator.

The Fund utilizes various methods to measure the fair value of all of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or

13

| The Gold Bullion Strategy Fund |

| Notes to Consolidated Financial Statements (Continued) |

| December 31, 2022 |

liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the inputs used as of December 31, 2022 for the Fund’s investments measured at fair value:

| Assets* | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Investments: | ||||||||||||||||

| Corporate Bonds | $ | — | $ | 23,340,642 | $ | — | $ | 23,340,642 | ||||||||

| Certificate of Deposit | — | 8,560,389 | — | 8,560,389 | ||||||||||||

| Exchange-Traded Funds | 9,099,780 | — | — | 9,099,780 | ||||||||||||

| Money Market Funds | 55,120,337 | — | — | 55,120,337 | ||||||||||||

| Collateral for Securities Loaned | 3,368,100 | — | — | 3,368,100 | ||||||||||||

| Total Investments | $ | 67,588,217 | $ | 31,901,031 | $ | — | $ | 99,489,248 | ||||||||

| Derivatives: | ||||||||||||||||

| Futures Contracts | $ | 4,014,357 | $ | — | $ | — | $ | 4,014,357 | ||||||||

| Total Assets | $ | 4,014,357 | $ | — | $ | — | $ | 4,014,357 | ||||||||

| * | Refer to the Consolidated Portfolio of Investments for industry classifications. |

The Fund did not hold any Level 3 securities during the current year.

Consolidation of Subsidiary – The consolidated financial statements of the Fund include the accounts of GBSF Ltd., a wholly-owned subsidiary. All inter-company accounts and transactions have been eliminated in consolidation. The Fund may invest up to 25% of its total assets in GBSF Ltd., which acts as an investment vehicle in order to affect certain investments consistent with the Fund’s investment objectives and policies. The subsidiary commenced operations on July 9, 2013 and is an exempted Cayman Islands company with limited liability.

A summary of the Fund’s investment in GBSF Ltd. is as follows:

| Inception Date | GBSF Ltd. Net Assets at | % of Net Assets at | |

| of GBSF Ltd. | December 31, 2022 | December 31, 2022 | |

| GBSF Ltd. | 7/09/2013 | $21,308,269 | 16.49% |

Security Transactions and Related Income – Security transactions are accounted for on trade date. Interest income is recognized on an accrual basis. Discounts are accreted and premiums are amortized on securities purchased over the lives of the respective securities using the effective yield method. Dividend income is

14

| The Gold Bullion Strategy Fund |

| Notes to Consolidated Financial Statements (Continued) |

| December 31, 2022 |

recorded on the ex-dividend date. Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

Dividends and distributions to shareholders – Dividends from net investment income, if any, are declared and paid quarterly. Distributable net realized capital gains, if any, are declared and distributed annually in December. Dividends from net investment income and distributions from net realized gains are recorded on ex-dividend date and are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are considered either temporary (i.e., deferred losses, capital loss carry forwards) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax basis treatment; temporary differences do not require reclassification. These reclassifications have no effect on net assets, results from operations or net asset value per share of the Fund.

Federal Income Tax – It is the Fund’s policy to continue to qualify as a regulated investment company by complying with the provisions of the Internal Revenue Code that are applicable to regulated investment companies and to distribute substantially all of its taxable income and net realized gains to shareholders. Therefore, no federal income tax provision is required.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions expected to be taken on returns filed. The Fund identifies its major tax jurisdictions as U.S. Federal and foreign jurisdictions where the Fund makes significant investments; however, the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Consolidated Statement of Operations. During the year, the Fund did not incur any interest or penalties.

For tax purposes, GBSF Ltd. is an exempted Cayman Islands investment company. GBSF Ltd. has received an undertaking from the Government of the Cayman Islands exempting it from all local income, profits and capital gains taxes. No such taxes are levied in the Cayman Islands at the present time. For U.S. income tax purposes, GBSF Ltd. is a Controlled Foreign Corporation and as such is not subject to U.S. income tax. However, a portion of GBSF Ltd.’s net income and capital gain, to the extent of its earnings and profits, will be included each year in the Fund’s investment company taxable income.

Expenses – Expenses of the Trust that are directly identifiable to a specific fund are charged to that fund. Expenses, which are not readily identifiable to a specific fund, are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative sizes of the funds in the Trust.

Indemnification – The Trust indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the risk of loss due to these warranties and indemnities appears to be remote.

| 3. | RISKS |

Principal Investment Risk – As with all mutual funds, there is the risk that you could lose money through your investment in the Fund. The Fund is not intended to be a complete investment program. Many factors affect the Fund’s net asset value and performance. The following risks apply to the Fund through its direct investments as well as indirectly through investments in Underlying Funds and the subsidiary (GBSF Ltd.).

15

| The Gold Bullion Strategy Fund |

| Notes to Consolidated Financial Statements (Continued) |

| December 31, 2022 |

General Market Risk – The risk that the value of the Fund’s shares will fluctuate based on the performance of the Fund’s investments and other factors affecting the commodities and/or securities market generally.

Unexpected local, regional or global events, such as war; acts of terrorism; financial, political or social disruptions; natural, environmental or man-made disasters; the spread of infectious illnesses or other public health issues; and recessions and depressions could have a significant impact on the Fund and its investments and may impair market liquidity. Such events can cause investor fear, which can adversely affect the economies of nations, regions and the market in general, in ways that cannot necessarily be foreseen. An outbreak of infectious respiratory illness known as COVID-19, which is caused by a novel coronavirus (SARS-CoV-2), was first detected in China in December 2019 and subsequently spread globally. This coronavirus has resulted in, among other things, travel restrictions, closed international borders, enhanced health screenings at ports of entry and elsewhere, disruption of and delays in healthcare service preparation and delivery, prolonged quarantines, significant disruptions to business operations, market closures, cancellations and restrictions, supply chain disruptions, lower consumer demand, and significant volatility and declines in global financial markets, as well as general concern and uncertainty. The impact of COVID-19 has adversely affected, and other infectious illness outbreaks that may arise in the future could adversely affect, the economies of many nations and the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty.

Cash Accounts – At times, the Fund may invest cash in a short-term deposit sweep vehicle program. Such deposits are in amounts at any such depositary institution not in excess of the Federal Deposit Insurance Corporation (“FDIC”) or National Credit Union Share Insurance Fund standard maximum deposit insurance amount such that funds are insured across the various banks or credit unions at which such funds are deposited. StoneCastle Cash Management, LLC (“StoneCastle”) provides ministerial deposit placement assistance to the Fund with respect to the Fund’s short-term deposit sweep vehicle program. These deposits are not custodied by StoneCastle. These amounts are included as Cash on the Consolidated Statement of Assets and Liabilities to the extent they are held by the Fund as of December 31, 2022.

Exchange-Traded Funds – The Fund may invest in ETFs. ETFs are a type of index fund bought and sold on a securities exchange. An ETF trades like common stock and typically represents a fixed portfolio of securities designed to track the performance and dividend yield of a particular domestic or foreign market index. The Fund may purchase an ETF to temporarily gain exposure to a portion of the U.S. or a foreign market while awaiting purchase of underlying securities. The risks of owning an ETF generally reflect the risks of owning the underlying securities they are designed to track, although the lack of liquidity on an ETF could result in it being more volatile. Additionally, ETFs have fees and expenses that reduce their value.

Mutual Fund and ETN Risk – Mutual funds and ETNs are subject to investment advisory or management and other expenses, which will be indirectly paid by the Fund. Each is subject to specific risks, depending on investment strategy. Also, each may be subject to leverage risk, which will magnify losses. ETNs are subject to default risks.

Futures Contracts – The Fund is subject to commodity risk in the normal course of pursuing its investment objective. The Fund may purchase or sell futures contracts to gain exposure to, or hedge against, changes in the value of commodities, equities and interest rates. Initial margin deposits required upon entering into futures contracts are satisfied by the segregation of specific securities or cash as collateral for the account of the broker (the Fund’s agent in acquiring the futures position). During the period the futures contracts are open, changes in the value of the contracts are recognized as unrealized gains or losses by “marking to market” on a daily basis to reflect the value of the contracts at the end of each day’s trading. Variation margin payments are received or made depending upon whether unrealized gains or losses are incurred. When the contracts are closed, the Fund recognizes a realized gain or loss equal to the difference between the proceeds from, or cost of, the closing transaction and the Fund’s basis in the contract. If the Fund was unable to liquidate a futures contract and/or enter into an offsetting closing transaction, the Fund would continue to be subject to market risk with respect to the value of the contracts and continue to be required to maintain the margin deposits on the futures contracts. The Fund segregates cash having a value at least equal to the amount of the current obligation under any open

16

| The Gold Bullion Strategy Fund |

| Notes to Consolidated Financial Statements (Continued) |

| December 31, 2022 |

futures contract. Risks may exceed amounts recognized in the Consolidated Statement of Assets and Liabilities. With futures, there is minimal counterparty credit risk to the Fund since futures are exchange traded and the exchange’s clearinghouse, as counterparty to all exchange traded futures, guarantees the futures against default.

Derivatives Risk – Futures are subject to inherent leverage that may magnify Fund losses. These derivatives may not provide an effective substitute for gold bullion because changes in derivative prices may not track those of the underlying gold bullion. Also, over-the-counter forwards are subject to counterparty default risk.

Gold Risk – The price of Gold may be volatile and gold bullion-related ETFs, ETNs and derivatives may be highly sensitive to the price of Gold. The price of gold bullion can be significantly affected by international monetary and political developments such as currency devaluation or revaluation, central bank movements, economic and social conditions within a country, transactional or trade imbalances, or trade or currency restrictions between countries.

| 4. | INVESTMENT TRANSACTIONS |

For the year ended December 31, 2022, cost of purchases and proceeds from sales of portfolio securities, other than short-term investments, amounted to $90,017,232 and $123,532,685, respectively.

| 5. | OFFSETTING OF FINANCIAL ASSETS AND DERIVATIVE ASSETS |

The Fund’s policy is to recognize a gross asset or liability equal to the unrealized appreciation/(depreciation) on futures contracts. During the year ended December 31, 2022, the Fund was subject to a master netting arrangement. The following table shows additional information regarding the offsetting of assets and liabilities at December 31, 2022:

| Gross Amounts Not Offset in the | ||||||||||||||||||||||||

| Consolidated Statement of Assets | ||||||||||||||||||||||||

| Assets: (A) | & Liabilities | |||||||||||||||||||||||

| Liabilities: (L) | ||||||||||||||||||||||||

| Gross Amounts | Gross Amounts | Net Amount of Asset | ||||||||||||||||||||||

| Presented in the | Offset in the | or Liabilities | ||||||||||||||||||||||

| Consolidated | Consolidated | Presented in the | Financial | Cash Collateral | ||||||||||||||||||||

| Statement of | Statement of Assets | Statement of Assets | Instruments | (Received) or | ||||||||||||||||||||

| Description | Assets & Liabilities | & Liabilities | & Liabilities | Pledged | Pledged (1) | Net Amount | ||||||||||||||||||

| Futures Contracts (A) | $ | 4,014,357 | $ | — | $ | 4,014,357 | $ | — | $ | — | $ | 4,014,357 | ||||||||||||

| Securities lending (L) | 3,274,578 | — | 3,274,578 | — | (3,274,578 | ) | — | |||||||||||||||||

| Total | $ | 7,288,935 | $ | — | $ | 7,288,935 | $ | — | $ | (3,274,578 | ) | $ | 4,014,357 | |||||||||||

| (1) | Detailed collateral amounts are presented in the Consolidated Statement of Assets and Liabilities. |

Impact of Derivatives on the Consolidated Statement of Assets and Liabilities and Consolidated Statement of Operations

The following is a summary of the location of derivative investments on the Fund’s Consolidated Statement of Assets and Liabilities as of December 31, 2022:

| Derivative Investment Type | Location on the Consolidated Statement of Assets and Liabilities |

| Futures Contracts | Unrealized appreciation on futures contracts |

At December 31, 2022, the fair value of the derivative instruments was as follows:

| Asset Derivatives | ||||||||

| Derivative Investment Type | Commodity Risk | Total | ||||||

| Futures Contracts | $ | 4,014,357 | $ | 4,014,357 | ||||

17

| The Gold Bullion Strategy Fund |

| Notes to Consolidated Financial Statements (Continued) |

| December 31, 2022 |

The following is a summary of the location of derivative investments on the Fund’s Consolidated Statement of Operations for the year ended December 31, 2022:

| Derivative Investment Type | Location on the Consolidated Statement of Operations |

| Futures Contracts | Net realized loss from futures contracts |

| Net change in unrealized appreciation on futures contracts | |

The following is a summary of the Fund’s realized gain (loss) and unrealized appreciation (depreciation) on derivative investments recognized in the Consolidated Statement of Operations categorized by primary risk exposure for the year ended December 31, 2022:

| Realized loss on derivatives recognized in the Consolidated Statement of Operations | ||||||||

| Derivative Investment Type | Commodity Risk | Total | ||||||

| Futures Contracts | $ | (8,336,577 | ) | $ | (8,336,577 | ) | ||

| Change in unrealized appreciation on derivatives recognized in the Consolidated Statement of Operations | ||||||||

| Derivative Investment Type | Commodity Risk | Total | ||||||

| Futures Contracts | $ | 1,136,187 | $ | 1,136,187 | ||||

The derivative instruments outstanding as of December 31, 2022 as disclosed in the Consolidated Schedule of Investments and in the Notes to Consolidated Financial Statements and the amounts of realized and changes in unrealized gains and losses on derivative instruments during the year as disclosed in the Consolidated Statement of Operations serve as indicators of the volume of derivative activity for the Fund.

The Fund uses derivative instruments as part of its principal investment strategy to achieve its investment objective. For additional discussion on the risks associated with the derivative instruments, see Note 2.

| 6. | INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

Advisors Preferred LLC (“Advisor”), serves as investment adviser to the Fund. The Advisor has engaged Flexible Plan Investments, Ltd. (the “Sub-Advisor”) to serve as the sub-advisor to the Fund. Sub-Advisor expenses are the responsibility of the Advisor.

Pursuant to an advisory agreement with the Fund, the Advisor, under the oversight of the Board, directs the daily operations of the Fund and supervises the performance of administrative and professional services provided by others. As compensation for its services and the related expenses borne by the Advisor, the Fund pays the Advisor a fee, computed and accrued daily and paid monthly, at an annual rate of 0.75% of the Fund’s average daily net assets. Pursuant to the advisory agreement, the Advisor earned $1,047,757 in advisory fees for the year ended December 31, 2022.

Pursuant to a liquidity program administrator agreement with the Fund, the Advisor, provides a liquidity program administrator who, directs the operations of the Fund’s liquidity risk management program. As compensation for its services and the related expenses borne by the Advisor, the Fund pays the Advisor out of pocket expenses and an annual fee of $9,000. The liquidity program administrator agreement became effective June 1, 2021. Pursuant to the liquidity program administrator agreement, the Advisor earned $9,000 in fees for the year ended December 31, 2022.

Ultimus Fund Solutions, LLC (“UFS”), provides administration, fund accounting, and transfer agent services to the Trust. Pursuant to separate servicing agreements with UFS, the Fund pays UFS customary fees for providing administration, fund accounting and transfer agent services to the Fund as shown in the consolidated Statement of Operations under Administrative services fees. Under the terms of the Fund’s agreement with UFS, UFS pays for certain operating expenses of the Fund. Certain officers of the Trust are also officers of UFS, and are not paid any fees directly by the Fund for serving in such capacities.

18

| The Gold Bullion Strategy Fund |

| Notes to Consolidated Financial Statements (Continued) |

| December 31, 2022 |

In addition, certain affiliates of UFS provide services to the Fund as follows:

Blu Giant, LLC (“Blu Giant”), an affiliate of UFS, provides EDGAR conversion and filing services as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, Blu Giant receives customary fees from the Fund. These expenses are the responsibility of UFS.

The Board has adopted a Distribution Plan and Agreement (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. The Plan provides that a monthly service and/or distribution fee is calculated by the Investor and Advisor class at an annual rate of up to 0.25% and 1.00%, respectively, of their average daily net assets and is paid to Ceros Financial Services, Inc. (the “Distributor” or “Ceros”), a registered broker/dealer and an affiliate of the Advisor, and principal underwriter of the Fund, to provide compensation for ongoing shareholder servicing or services and-or maintenance of accounts, not otherwise required to be provided by the Advisor. The Plan is a compensation plan, which means that compensation is provided regardless of 12b-1 expenses incurred. For the year ended December 31, 2022, pursuant to the Plan, Investor and Advisor Class shares paid $347,522 and $6,921, respectively.

The Board has adopted a Shareholder Servicing Plan (the “Servicing Plan”) on the Investor class. The Servicing Plan provides that a monthly service fee is calculated by the Fund at an annual rate of up to 0.15% (currently set at 0.15%), of its average daily net assets of the Investor class and is paid to Ceros to provide compensation for ongoing shareholder servicing or service and/or maintenance accounts, not otherwise required to be provided by the Advisor. For the year ended December 31, 2022, Investor Class shares paid $208,513.

Each Trustee who is not an “interested person” of the Trust or Advisor is compensated at a rate of $72,000 per year plus $2,500 minimum per meeting for certain special meetings, which varies based on the matters submitted, as well as for reimbursement for any reasonable expenses incurred attending the meetings, paid quarterly. The “interested persons” who serve as Trustees of the Trust receive no compensation for their services as Trustees. None of the executive officers receive compensation from the Trust. Interested trustees of the Trust are also officers or employees of the Advisor and its affiliates. The Advisor pays Trustee fees.

During the year ended December 31, 2022, Ceros executed trades on behalf of the Fund and received $41,079 in trade commissions.

| 7. | AGGREGATE UNREALIZED APPRECIATION AND DEPRECIATION – TAX BASIS |

The identified cost of investments in securities owned by the Fund for federal income tax purposes excluding futures, and its respective gross unrealized appreciation and depreciation at December 31, 2022, were as follows:

| Gross Unrealized | Gross Unrealized | Net Unrealized | ||||||||||||

| Tax Cost | Appreciation | (Depreciation) | Depreciation | |||||||||||

| $ | 101,163,373 | $ | 5,937,549 | $ | (3,597,317 | ) | $ | 2,340,232 | ||||||

| 8. | DISTRIBUTIONS TO SHAREHOLDERS AND TAX COMPONENTS OF CAPITAL |

There were no distributions paid during the fiscal years ended December 31, 2022, and December 31, 2021.

As of December 31, 2022, the components of distributable earnings/(accumulated deficit) on a tax basis were as follows:

| Undistributed | Undistributed | Post October Loss | Capital Loss | Other | Unrealized | Total | ||||||||||||||||||||

| Ordinary | Long-Term | and | Carry | Book/Tax | Appreciation/ | Distributable Earnings/ | ||||||||||||||||||||

| Income | Gains | Late Year Loss | Forwards | Differences | (Depreciation) | (Accumulated Deficit) | ||||||||||||||||||||

| $ | — | $ | — | $ | — | $ | (4,919,572 | ) | $ | (1,253,876 | ) | $ | 2,340,232 | $ | (3,833,216 | ) | ||||||||||

19

| The Gold Bullion Strategy Fund |

| Notes to Consolidated Financial Statements (Continued) |

| December 31, 2022 |

The difference between book basis and tax basis undistributed net investment income, unrealized appreciation and accumulated realized losses is primarily attributable to the tax deferral of losses on wash sales and tax adjustments for the Fund’s holding in GBSF Ltd.

At December 31, 2022, the Fund had capital loss carryforwards for federal income tax purposes available to offset future capital gains as follows:

| Non-Expiring | Non-Expiring | |||||||||||||

| Short-Term | Long-Term | Total | CLCF Utilized | |||||||||||

| $ | 2,066,997 | $ | 2,852,575 | $ | 4,919,572 | $ | — | |||||||

Permanent book and tax differences, primarily attributable to tax adjustments for net operating losses and the Fund’s holding in GBSF Ltd., resulted in reclassifications for the year ended December 31, 2022, as follows:

| Paid | ||||||

| In | Distributable Earnings/ | |||||

| Capital | (Accumulated Deficit) | |||||

| $ | (6,479,183 | ) | $ | 6,479,183 | ||

| 9. | CONTROL OWNERSHIP |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates presumption of control of the fund pursuant to Section 2(a)(9) of the 1940 Act. As of December 31, 2022, Axos Clearing LLC held approximately 59% of the Fund, for the benefit of its customers.

| 10. | SECURITIES LENDING |

The Fund has entered into a securities lending arrangement (the “Agreement”) with U.S. Bank (the “Lending Agent”). Under the terms of the Agreement, the Fund is authorized to loan securities to the Lending Agent. In exchange, the Fund receives cash and “non-cash” or “securities” collateral in the amount of at least 105% of the value of any loaned securities that are foreign securities or 102% of the value of any other loaned securities marked-to-market daily. Loans shall be marked to market daily and the margin restored in the event collateralization is below 100% of the value of securities loaned. The value of securities loaned is disclosed in a footnote on the Consolidated Statement of Assets and Liabilities and on the Consolidated Schedule of Investments. Securities lending income is disclosed in the Fund’s Consolidated Statement of Operations. Although risk is mitigated by the collateral, the Fund could experience a delay in recovering its securities and possible loss of income or value if the Lending Agent fails to return the securities on loan. The Fund’s cash collateral received in securities lending transactions is invested in the Mount Vernon Liquid Assets Portfolio, LLC, a privately offered liquidity fund, as presented below. The investment objective is to seek to maximize current income to the extent consistent with the preservation of capital and liquidity and maintain a stable NAV of $1.00 per unit.

As of December 31, 2022, the Fund loaned securities which were collateralized by short-term investment securities or cash and equivalent. The value of securities on loan and the value of the related overnight and continuous collateral were $3,274,578 and $3,368,100, respectively.

20

| The Gold Bullion Strategy Fund |

| Notes to Consolidated Financial Statements (Continued) |

| December 31, 2022 |

| 11. | UNDERLYING INVESTMENT IN OTHER INVESTMENT COMPANY |

The Fund currently invests greater than 25% of its assets in the corresponding investment. The Fund may redeem its investment from the investment at any time if the Advisor or Sub-Advisor determines that it is in the best interest of the Fund and its shareholders to do so. The performance of the Fund will be directly affected by the performance of the investment. The financial statements of the investment, including the schedule of investments, can be found at the Securities and Exchange Commission’s website www.sec.gov and should be read in conjunction with the Fund’s financial statements. At December 31, 2022, the Fund was invested in the following:

| Investment | Percentage of Net Assets | |||

| Fidelity Government Portfolio, Class I | 33.5 | % | ||

| 12. | SUBSEQUENT EVENTS |

Subsequent events after the date of the Consolidated Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has determined that no events or transactions occurred requiring adjustment or disclosure in the financial statements.

21

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To

the Shareholders of The Gold Bullion Strategy Fund and

Board of Trustees of Advisors Preferred Trust

Opinion on the Financial Statements

We have audited the accompanying consolidated statement of assets and liabilities, including the consolidated schedule of investments, of The Gold Bullion Strategy Fund (the “Fund”), a series of Advisors Preferred Trust, as of December 31, 2022, the related consolidated statement of operations for the year then ended, the consolidated statements of changes in net assets for each of the two years in the period then ended, the related notes, and the consolidated financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2022, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2022, by correspondence with the custodians and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies advised by Advisors Preferred, LLC since 2012.

COHEN & COMPANY, LTD.

Chicago, Illinois

February 23, 2023

COHEN & COMPANY, LTD.

800.229.1099 | 866.818.4538 fax | cohencpa.com

Registered with the Public Company Accounting Oversight Board

22

| The Gold Bullion Strategy Fund |

| Expense Example (Unaudited) |

| December 31, 2022 |

As a shareholder of The Gold Bullion Strategy Fund, you incur ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in The Gold Bullion Strategy Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2022 through December 31, 2022.

Table 1. Actual Expenses

The “Actual Expenses” line in the table below provides information about actual account values and actual expenses. You may use the information below; together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Table 2. Hypothetical Example for Comparison Purposes

The “Hypothetical” line in the table below provides information about hypothetical account values and hypothetical expenses based on The Gold Bullion Strategy Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or redemption fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Table 1 | ||||

| Actual Expenses |

Annualized Expense Ratio |

Beginning Account Value 7/1/2022 |

Ending Account Value 12/31/2022 |

Expenses

Paid During Period * 7/1/2022-12/31/2022 |

| Investor Class | 1.33% | $1,000.00 | $995.80 | $6.67 |

| Advisor Class | 1.92% | $1,000.00 | $992.30 | $9.66 |

| Table 2 | ||||

| Hypothetical (5% return before expenses) |

Annualized Expense Ratio |

Beginning Account Value 7/1/2022 |

Ending Account Value 12/31/2022 |

Expenses

Paid During Period * 7/1/2022-12/31/2022 |

| Investor Class | 1.33% | $1,000.00 | $1,018.52 | $6.75 |

| Advisor Class | 1.92% | $1,000.00 | $1,015.50 | $9.78 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the number of days in the period (184) divided by the number of days in the fiscal year (365). |

23

| The Gold Bullion Strategy Fund |

| SUPPLEMENTAL INFORMATION (Unaudited) |

| December 31, 2022 |

Approval of the Renewal of the Investment Advisory and Sub-Advisory Agreements for The Gold Bullion Strategy Fund (and subsidiary)

At a video conference meeting held on May 11, 2022 (the “Meeting”), held in accordance with relief granted by the U.S. Securities and Exchange Commission (the “SEC”) to ease certain governance obligations required under the Investment Company Act of 1940, as amended (the “1940 Act”) in light of travel concerns related to the COVID-19 pandemic (the “SEC Relief Order”)the Board of Trustees (the “Board”) of Advisors Preferred Trust (the “Trust”), including a majority of Trustees who are not “interested persons” (the “Independent Trustees”), as such term is defined under Section 2(a)(19) of the 1940 Act, considered the renewal of the investment advisory agreement (the ” Advisory Agreement’) between Advisors Preferred, LLC (the “Adviser”) and the Trust, on behalf of The Gold Bullion Strategy Fund (and subsidiary) (“Gold Fund” and “GBSF Fund Limited”, respectively); and the renewal of each sub-advisory agreement (the ” Sub-Advisory Agreement”) between the Adviser and Flexible Plan Investments, Ltd. (the “Sub-Adviser” or “FPI”). The Directors of the GBSF Fund Limited, a wholly owned foreign subsidiary of Gold Fund, approved an investment advisory agreement between GBSF Fund Limited and the Adviser (the “Subsidiary Advisory Agreement”) as well as a sub-advisory agreement (the “Subsidiary Sub-Advisory Agreement”) between the Adviser and FPI with respect to the GBSF Fund Limited. The Fund level agreements and subsidiary agreements are referred to collectively for convenience and references to the Fund include the subsidiary as the context indicates. The Trustees’ and Directors’ deliberations are presented as collective deliberations as they were conducted concurrently and refences to the Board also include the Directors.

In connection with the Board’s consideration and approval of the renewal of the Advisory Agreement and Sub-Advisory Agreements, (together the “Advisory Agreements”) the Adviser and Sub-Adviser provided the Board in advance of the Meeting with written materials, which included information regarding: (a) a description of the investment management personnel of the Adviser and Sub-Adviser; (b) the Adviser’s and Sub-Adviser’s operations and the Adviser’s financial condition; (c) the Adviser’s proposed brokerage practices (including any soft dollar arrangements); (d) the level of the advisory fees proposed to be charged compared with the fees charged to comparable mutual funds or accounts; (e) the Gold Fund anticipated level of profitability to the Adviser and Sub-Adviser from related operations; (f) the Adviser’s and Sub-Adviser’s compliance policies and procedures; and (g) information regarding the performance of Gold Fund as compared to their respective benchmarks and Morningstar categories. The Board’s review of the materials and deliberations are presented contemporaneously given the overlapping considerations, paralleled issues and conclusions drawn by the Board. The Board members relied upon the advice of independent legal counsel and their own business judgment in determining the material factors to be considered in evaluating the Advisory Agreements.

Moreover, each Trustee may have afforded different weight to the various factors in reaching conclusions with respect to the Agreements. The Board reviewed the quality of work and abilities of the Adviser and its relationship with FPI and the performance of the Gold Fund. In light of Fund’s performance and the compliance/review relationship with the FPI, the Board concluded that the Adviser had sufficient quality and depth of personnel, resources, investment methods and compliance policies and procedures essential to performing its duties to the Gold Fund. The Board conducted some of its deliberations on a joint basis for the Adviser and FPI given the close working relationship of the Adviser and Sub-Adviser and conducted their deliberations on a consolidated basis for the Gold Fund and its subsidiary.

24

| The Gold Bullion Strategy Fund |

| SUPPLEMENTAL INFORMATION (Unaudited) (Continued) |

| December 31, 2022 |