| [X] |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| [ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

|

Maryland

|

46-0778087

|

|

|

(State or Other Jurisdiction

|

(I.R.S. Employer Identification No.)

|

|

|

of Incorporation or Organization)

|

||

|

2221 Olympic Boulevard

|

||

|

Walnut Creek, California

|

94595

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

|

(925) 935-3840

|

||

|

Registrant’s Telephone Number,

|

||

|

Including Area Code

|

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

Common Stock, par value $0.01 per share

|

NYSE American

|

|

|

Large accelerated filer [ ]

|

Accelerated filer [X]

|

|

|

Non-accelerated filer [ ]

|

Smaller reporting company [X]

|

Emerging growth company [ ]

|

PART I

|

|

|

Page |

| Item 1. |

Business | |

| Item 1A. |

Risk Factors | 11 |

| Item 1B. |

Unresolved Staff Comments | 33 |

| Item 2. |

Properties | 33 |

| Item 3. |

Legal Proceedings | 37 |

| Item 4. |

Mine Safety Disclosures | 37 |

|

ORM Stockholders’

Equity |

Loans

|

Real Estate

Properties

|

Net Income

Attributable to Common Stockholders

|

||||||||||

|

2018……………………….

|

$

|

191,358,782

|

$

|

142,682,243

|

$

|

56,642,510

|

$

|

6,889,531

|

|||||

|

2017……………………….

|

$

|

200,989,727

|

$

|

146,171,650

|

$

|

80,466,125

|

$

|

8,679,848

|

|||||

|

2016……………………….

|

$

|

215,527,877

|

$

|

129,682,311

|

$

|

113,123,398

|

$

|

24,409,770

|

|||||

|

2015……………………….

|

$

|

194,979,998

|

$

|

106,743,807

|

$

|

153,838,412

|

$

|

23,569,116

|

|||||

|

2014……………………….

|

$

|

184,571,858

|

$

|

68,033,511

|

$

|

163,016,805

|

$

|

7,929,629

|

|||||

|

Number of Loans

|

Amount

|

Percent

|

||||

|

Senior loans

|

56

|

$

|

137,808,788

|

96.58%

|

||

|

Junior loans

|

3

|

4,873,455

|

3.42%

|

|||

|

59

|

$

|

142,682,243

|

100.00%

|

|||

|

Maturing on or before December 31, 2018 (past maturity)

|

11

|

$

|

26,790,826

|

18.78%

|

||

|

Maturing on or between January 1, 2019 and

December 31, 2020

|

45

|

108,821,628

|

76.27%

|

|||

|

Maturing on or between January 1, 2021 and

March 1, 2028

|

3

|

7,069,789

|

4.95%

|

|||

|

59

|

$

|

142,682,243

|

100.00%

|

|||

|

Commercial

|

48

|

$

|

132,519,461

|

92.88%

|

||

|

Residential

|

7

|

5,209,357

|

3.65%

|

|||

|

Land

|

4

|

4,953,425

|

3.47%

|

|||

|

59

|

$

|

142,682,243

|

100.00%

|

|||

|

·

|

$4,514,000 in cash and cash equivalents and restricted cash required to transact our business and/or in

conjunction with contingency and escrow reserve requirements;

|

|

·

|

$56,643,000 in real estate held for sale and investment;

|

|

·

|

$2,697,000 in deferred tax assets;

|

|

·

|

$2,139,000 in investment in limited liability company;

|

|

·

|

$1,105,000 in interest and other receivables;

|

|

·

|

$351,000 in deferred financing costs, net; and

|

|

·

|

$417,000 in other assets.

|

· payments on the loan become delinquent;

· the loan is past maturity;

· it learns of physical changes to the property securing the loan or to the area in which the property is located; or

· it learns of changes to the economic condition of the borrower or of leasing activity of the property securing the loan.

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||

|

Delinquent/Impaired Loans

|

$

|

11,862,000

|

$

|

8,534,000

|

$

|

4,884,000

|

$

|

8,694,000

|

$

|

22,316,000

|

|||||

|

Loans Foreclosed

|

$

|

1,937,000

|

$

|

—

|

$

|

1,079,000

|

$

|

—

|

$

|

7,671,000

|

|||||

|

Total Loans

|

$

|

142,682,000

|

$

|

146,172,000

|

$

|

129,682,000

|

$

|

106,744,000

|

$

|

68,034,000

|

|||||

|

Percent of Delinquent Loans to Total Loans

|

8.31%

|

5.84%

|

3.77%

|

8.14%

|

32.80%

|

||||||||||

|

·

|

Reduced Management Fee: The

Amendment revises the management fee by making permanent the recent “Interim Management Fee” adjustment described above along with an additional adjustment such that the “Management Fee”, calculated and payable to the Manager monthly in

arrears, equals (i) one-twelfth (1/12) multiplied by (ii) (a) 1.50% of the first $300,000,000 of the Company’s Stockholders’ Equity (as defined in the Amendment), and (b) 1.25% of the Stockholders’ Equity that is greater than

$300,000,000.

|

|

·

|

Company to Receive 30% of Loan Fees:

The Company will receive thirty-percent (30%) of the gross fees and commissions paid to the Manager in connection with the Company making or investing in mortgage loans, including thirty-percent (30%) of gross fees paid in connection with

the extension or modification of any loans, with the exception of certain miscellaneous administration fees collected in association with loan funding, demand, and partial release fees, with the remaining seventy-percent (70%) of such

fees to be paid to the Manager.

|

|

·

|

Company to Receive 30% of Late

Payment Charges: The Company will receive thirty-percent (30%) of all late payment charges from borrowers on loans owned by the Company, with the remaining seventy-percent (70%) to be paid to the Manager.

|

|

·

|

Elimination of Service Fees:

The Company will no longer pay the Manager any servicing fees for the Manager’s services as servicing agent with respect to any of its mortgage loans.

|

|

·

|

Elimination of Certain Expense

Reimbursements: The Company will no longer reimburse the Manager for salary and related salary expense of the Manager's non-management and non-supervisory personnel.

|

|

·

|

the ratio of the amount of the investment to the value of the property by which it is secured;

|

|

·

|

the property’s potential for capital appreciation;

|

|

·

|

expected levels of rental and occupancy rates;

|

|

·

|

current and projected cash flow generated by the property;

|

|

·

|

potential for rental rate increases;

|

|

·

|

the marketability of the investment;

|

|

·

|

geographic location of the property;

|

|

·

|

the condition and use of the property;

|

|

·

|

the property’s income-producing capacity;

|

|

·

|

the quality, experience and creditworthiness of the borrower;

|

|

·

|

general economic conditions in the area where the property is located; and

|

|

·

|

any other factors that OFG believes are relevant.

|

|

·

|

OFG makes or purchases such loans in its own name and temporarily holds title thereto for the purpose of facilitating the acquisition

of such loans, and provided that such loans are purchased by us for a price no greater than the cost of such loans to OFG (except for compensation in accordance with the terms of the Management Agreement and the charter);

|

|

·

|

There is no other benefit arising out of such transactions to OFG;

|

|

·

|

Such loans are not in default, and;

|

|

·

|

Such loans otherwise satisfy, among other things, the following requirements:

|

|

·

|

We will not make or invest in loans on any one property if at the time of acquisition of the loan the aggregate

amount of all loans outstanding on the property, including loans by the Company, would exceed an amount equal to 80% of the appraised value of the property as determined by independent appraisal, unless substantial justification exists

because of the presence of other documented underwriting criteria.

|

|

·

|

We will limit any single loan and limit the loans to any one borrower to not more than 10% of our total assets as

of the date the loan is made or purchased.

|

|

·

|

We will not invest in or make loans on unimproved real property in an amount in excess of 25% of our total assets.

|

|

·

|

the Ready Capital stockholders and the ORM stockholders may be prevented from realizing the anticipated benefits

of the Merger;

|

|

·

|

the market price of Ready Capital Common Stock or ORM Common Stock could decline significantly;

|

|

·

|

reputational harm due to the adverse perception of any failure to successfully consummate the Merger;

|

|

·

|

Ready Capital and the Company being required, under certain circumstances, to pay to the other party a

termination fee or expense amount;

|

|

·

|

incurrence of substantial costs relating to the proposed Merger, such as legal, accounting, financial advisor,

filing, printing and mailing fees; and

|

|

·

|

the attention of Ready Capital’s and the Company’s management and employees may be diverted from their day-to-day

business and operational matters as a result of efforts relating to attempting to consummate the Merger.

|

|

|

•

|

Judicial foreclosure is subject to the delays of protracted litigation. Although we expect non-judicial foreclosure to be quicker, our

collateral may deteriorate and decrease in value during any delay in foreclosing on it;

|

|

|

|

|

•

|

The borrower’s right of redemption during foreclosure proceedings can deter the sale of our collateral and can for practical purposes

require us to manage the property;

|

|

|

||

|

|

•

|

Unforeseen environmental hazards may subject us to unexpected liability and procedural delays in exercising our rights;

|

|

|

||

|

|

•

|

The rights of senior or junior secured parties in the same property can create procedural hurdles for us when we foreclose on

collateral;

|

|

•

|

We may not be able to pursue deficiency judgments after we foreclose on collateral; and

|

|

|

•

|

State and federal bankruptcy laws can prevent us from pursuing any actions, regardless of the progress in any of these suits or

proceedings.

|

|

|

•

|

the application of the loan proceeds to the construction or rehabilitation project must be assured;

|

|

|

•

|

the completion of planned construction or rehabilitation may require additional financing by the borrower; and

|

|

|

•

|

permanent financing of the property may be required in addition to the construction or rehabilitation loan.

|

|

|

•

|

their position is subordinate in the event of default; and

|

|

|

•

|

there could be a requirement to cure liens of a senior loan holder, and, if this is not done, we would lose our entire interest in the

loan.

|

|

|

•

|

earning less income and reduced cash flows on foreclosed properties than could be earned and received on loans;

|

|

•

|

incurring costs to carry, and in some cases make repairs or improvements to these assets, which requires additional liquidity and

results in additional expenses that could exceed our original estimates and impact our operating results;

|

|

|

|

||

|

|

•

|

not being able to realize sufficient amounts from sales of the properties to avoid losses;

|

|

•

|

not being able to sell properties, which are not liquid assets, in a timely manner when we need to increase liquidity through asset

sales;

|

|

|

|

•

|

properties being acquired with one or more co-owners (called tenants-in-common) where development or sale requires written agreement or

consent by all; without timely agreement or consent, we could suffer a loss from being unable to develop or sell the property;

|

|

|

||

|

|

•

|

maintaining occupancy of the properties;

|

|

|

•

|

controlling operating expenses;

|

|

|

•

|

coping with general and local market conditions;

|

|

•

|

complying with changes in laws and regulations pertaining to taxes, use, zoning and environmental protection;

|

|

|

•

|

possible liability for injury to persons and property;

|

|

|

•

|

possible uninsured losses related to environmental events such as earthquakes, fires, floods and/or mudslides; and

|

|

|

•

|

possible liability for environmental remediation.

|

|

|

|

•

|

Reliance upon the skill and financial stability of third party developers and contractors;

|

|

|

•

|

Inability to obtain governmental permits;

|

|

|

•

|

Delays in construction of improvements;

|

|

|

•

|

Increased costs during development and the need to obtain additional financing to pay for the development and reduced liquidity and

capital available for us to invest in new loans; and

|

|

|

•

|

Economic and other factors affecting the timing or price of sale or the leasing of developed property, including competition with

entities seeking to dispose of similar properties.

|

|

|

•

|

economic recession in that area;

|

|

|

•

|

overbuilding of commercial or residential properties; and

|

|

|

•

|

relocations of businesses outside the area due to factors such as costs, taxes and the regulatory environment.

|

|

|

•

|

Responding to such actions by activist stockholders can disrupt our operations, are costly and time-consuming, and divert the attention

of our Board and senior management team from the pursuit of business strategies, which could adversely affect our results of operations and financial condition;

|

|

|

•

|

Perceived uncertainties as to our future direction as a result of changes to the composition of our Board may lead to the perception of

a change in the direction of the business, instability or lack of continuity which may be exploited by our competitors, cause concern to our current or potential borrower clients, may result in the loss of potential business opportunities

and make it more difficult to attract and retain qualified personnel and business partners;

|

|

•

|

these types of actions could cause significant fluctuations in our stock price based on temporary or speculative market perceptions or

other factors that do not necessarily reflect the underlying fundaments and prospects of our business; and

|

|

|

|

•

|

if individuals are elected to our Board with a specific agenda, it may adversely affect our ability to effectively implement our

business strategy and create additional value for our stockholders.

|

|

|

•

|

additional increases in loans defaulting or becoming non-performing or being written off;

|

|

|

•

|

actual or anticipated variations in our operating results or our distributions to stockholders;

|

|

•

|

sales of (or the inability to sell in a timely manner) and prices we receive for significant real estate properties;

|

|

|

|

•

|

publication of research reports about us or the real estate industry, or changes in recommendations or in estimated financial results by

securities analysts who provide research to the marketplace on us, our competitors or our industry;

|

|

|

•

|

changes in market valuations of similar companies;

|

|

|

•

|

changes in tax laws affecting REITs;

|

|

|

•

|

adverse market reaction to any increased indebtedness we incur; and

|

|

|

•

|

general market and economic conditions, including, among other things, actual and projected interest rates and the market for the types

of assets that we hold or invest in.

|

|

·

|

the general reputation of REITs and the attractiveness of our equity securities in comparison to other equity securities, including

securities issued by other real estate related companies;

|

|

·

|

our financial performance; and

|

|

·

|

general stock and credit market conditions.

|

|

·

|

Board Classification. As a

result of the election under Subtitle 8, our Board is classified into three separate classes of directors. At each annual meeting of the stockholders of the Company, the successors to the class of directors whose term expires at that

meeting will be elected to hold office for a term continuing until the annual meeting of stockholders held in the third year following the year of their election and until their successors are elected and qualified.

|

|

·

|

Removal of Directors. As a

result of the election to be subject to Section 3-804 of the MGCL, the removal of directors will require the affirmative vote of at least two-thirds of all of the votes entitled to be cast by the stockholders generally in the election of

directors.

|

|

·

|

Board Size. The election to be

subject to Section 3-804 of the MGCL also provides that our Board has the exclusive right to set the number of directors on the Board. This election did not result in substantive change to the requirements already provided in the

Company’s charter and bylaws.

|

|

·

|

Vacancies on the Board. As a

result of the election to be subject to Section 3-804 of the MGCL, our Board has the exclusive right, by the affirmative vote of a majority of the remaining directors, even if the remaining directors do not constitute a quorum, to fill

vacancies on the Board, and any director elected by the Board to fill a vacancy will hold office for the remainder of the full term of the class of directors in which the vacancy occurred and until his or her successor is elected and

qualified.

|

|

·

|

Special Meetings Called at the

Request of Stockholders. As a result of the election to be subject to Section 3-805 of the MGCL, special meetings of stockholders called at the request of stockholders may now be called by the Secretary of the Company only on the

written request of the stockholders entitled to cast at least a majority of all the votes entitled to be cast at the meeting.

|

|

|

•

|

actual receipt of an improper benefit or profit in money, property or services; or

|

|

•

|

a final judgment based upon a finding of active and deliberate dishonesty by the director or officer that was material to the cause of

action adjudicated.

|

|

·

|

The Company’s (or related entities) title to all properties is held as fee simple.

|

|

·

|

There are mortgages or encumbrances to third parties on one of our real estate properties (see below for Tahoe

Stateline Venture, LLC (“TSV”)).

|

|

·

|

Of the thirteen properties held, six of the properties are income-producing. Only minor renovations and repairs to

the properties are currently being made or planned (other than continued tenant improvements on real estate held for sale and investment).

|

|

·

|

The Manager believes that all properties owned by the Company are adequately covered by customary casualty insurance.

|

|

|

December 31, 2018

|

December 31, 2017

|

||||

|

Commercial buildings, Roseville, California – transferred from Held for Investment in 2018

|

$

|

482,609

|

$

|

—

|

||

|

Undeveloped, industrial land, San Jose, California – transferred from Held for Investment in 2018

(sold in January 2019)

|

1,850,343

|

—

|

||||

|

Undeveloped land, Auburn, California (formerly part of golf course owned by Darkhorse Golf Club,

LLC) – transferred from Held for Investment in 2018

|

103,198

|

—

|

||||

|

Office condominium complex (2 units - sold in January 2019), Roseville, California – transferred

from Held for Investment in 2018

|

389,881

|

—

|

||||

|

73 improved, residential lots, Auburn, California (held within Zalanta Resort at the Village, LLC

(“ZRV”))

|

4,121,867

|

4,121,867

|

||||

|

Undeveloped, residential land, Coolidge, Arizona – transferred from held for investment in 2017

|

1,017,600

|

1,017,600

|

||||

|

Golf course, Auburn, California (held within Lone Star Golf, Inc.) – sold in 2018

|

—

|

1,999,449

|

||||

|

12 condominium and 3 commercial units, Tacoma, Washington (held within Broadway & Commerce,

LLC) – transferred from Held for Investment in 2018

|

2,239,125

|

—

|

||||

|

2 improved residential lots, Coeur D’Alene, Idaho – 1 lot sold in 2018

|

266,103

|

350,897

|

||||

|

Marina and yacht club with 179 boat slips, Isleton, California (held within Brannan Island, LLC)

|

1,269,650

|

2,207,675

|

||||

|

2 vacant houses and 20 acres of residential land, San Ramon, California – obtained through

foreclosure in 2018

|

2,062,729

|

—

|

||||

|

Unimproved, residential and commercial land, Bethel Island, California (held within Sandmound

Marina, LLC) – sold in 2018

|

—

|

2,338,233

|

||||

|

Assisted living facility, Bensalem, Pennsylvania – sold in 2018

|

—

|

5,253,125

|

||||

|

Retail complex and residential condominium units (12 and 23 units in 2018 and 2017), South Lake

Tahoe, California (held within ZRV) - 11 and 7 units sold in 2018 and 2017

|

20,290,685

|

32,260,603

|

||||

|

Residential land, South Lake Tahoe, California (held within Zalanta Resort at the Village - Phase

II, LLC (“ZRV II”)) - transferred to Held for Investment in 2018

|

—

|

6,561,023

|

||||

|

$

|

34,093,790

|

$

|

56,110,472

|

|||

|

|

December 31, 2018

|

December 31, 2017

|

|||||

|

Commercial buildings, Roseville, California – transferred to Held for Sale in 2018

|

$

|

—

|

$

|

492,350

|

|||

|

Undeveloped, industrial land, San Jose, California - transferred to Held for Sale in 2018

|

—

|

1,914,870

|

|||||

|

Undeveloped land, Auburn, California (formerly part of golf course owned by DarkHorse Golf Club,

LLC) – transferred to Held for Sale in 2018

|

—

|

103,198

|

|||||

|

Office condominium complex (13 units in 2017), Roseville, California – transferred to Held for

Sale in 2018

|

—

|

2,865,002

|

|||||

|

1/7th interest in single family home, Lincoln City, Oregon - sold in 2018

|

—

|

93,647

|

|||||

|

12 condominium and 3 commercial units, Tacoma, Washington (held within Broadway & Commerce,

LLC) – transferred to Held for Sale in 2018

|

—

|

2,263,348

|

|||||

|

Retail Complex, South Lake Tahoe, California (held within TSV)

|

15,987,697

|

16,623,238

|

|||||

|

Residential land, South Lake Tahoe, California (held within ZRV II) – transferred from Held for

Sale in 2018

|

6,561,023

|

—

|

|||||

|

$

|

22,548,720

|

$

|

24,355,653

|

||||

|

2018

|

2017

|

2016

|

|||||||

|

Average Annual Rental per Square Foot

|

$

|

69.68

|

$

|

67.48

|

$

|

61.45

|

|||

|

Federal Tax Basis of Depreciable Assets (all Commercial Buildings and Improvements)

|

$

|

17,589,399

|

$

|

17,581,911

|

$

|

17,579,856

|

|||

|

Depreciation Rate

|

Various

|

Various

|

Various

|

||||||

|

Depreciation Method

|

MACRS Straight Line

|

MACRS Straight Line

|

MACRS Straight Line

|

||||||

|

Depreciable Life

|

5-39 Years

|

5-39 Years

|

5-39 Years

|

||||||

|

Realty Tax Rate (1)

|

1.0830

|

%

|

1.0871

|

%

|

1.0860

|

%

|

|||

|

Annual Realty Taxes

|

$

|

97,088

|

$

|

98,322

|

$

|

192,253

|

|||

|

(1) Millage rate per Taxable Value.

|

|||||||||

|

2018

|

2017

|

2016 (2)

|

|||||||

|

Average Annual Rental per Square Foot

|

$

|

67.44

|

$

|

66.00

|

$

|

N/A

|

|||

|

Federal Tax Basis of Depreciable Assets (all Commercial Buildings and Improvements)

|

$

|

N/A

|

$

|

N/A

|

$

|

N/A

|

|||

|

Depreciation Rate (3)

|

N/A

|

N/A

|

N/A

|

||||||

|

Depreciation Method (3)

|

N/A

|

N/A

|

N/A

|

||||||

|

Depreciable Life (3)

|

N/A

|

N/A

|

N/A

|

||||||

|

Realty Tax Rate (1)

|

1.0830

|

%

|

1.0871

|

%

|

N/A

|

||||

|

Annual Realty Taxes

|

$

|

88,282

|

$

|

89,140

|

$

|

N/A

|

|||

|

(1) Millage rate per Taxable Value.

|

|||||||||

|

(2) Construction of retail/residential complex was completed in 2017. Thus, this data is not applicable in 2016.

|

|||||||||

|

(3) The ZRV properties are not being depreciated as all of the retail and residential units are held for sale.

|

|||||||||

|

Year of

Lease

Expiration

December 31,

|

Number of

Leases Expiring

Within the

Year

|

Rentable Square

Footage Subject

to Expiring

Leases

|

Final Annualized

Base Rent

Under Expiring

Leases (1)

|

Percentage of Gross Annual Rental Represented by Such Leases

|

|||||||

|

2019

|

5

|

11,497

|

$

|

921,868

|

38.3%

|

||||||

|

2020

|

2

|

1,635

|

121,075

|

5.0%

|

|||||||

|

2021

|

1

|

1,000

|

68,666

|

2.8%

|

|||||||

|

2022

|

1

|

4,553

|

341,060

|

14.2%

|

|||||||

|

2023

|

1

|

788

|

55,191

|

2.3%

|

|||||||

|

2024

|

3

|

9,614

|

645,225

|

26.8%

|

|||||||

|

2025

|

—

|

—

|

—

|

—%

|

|||||||

|

2025

|

—

|

—

|

—

|

—%

|

|||||||

|

2027

|

1

|

1,011

|

92,328

|

3.8%

|

|||||||

|

2028

|

1

|

2,297

|

164,015

|

6.8%

|

|||||||

|

15

|

32,395

|

$

|

2,409,428

|

100.0%

|

|||||||

|

(1)

|

“Final Annualized Base Rent” for each lease scheduled to expire represents the cash rental rate of base rents,

excluding tenant reimbursements, in the final month prior to expiration multiplied by 12. Tenant reimbursements generally include payment of a portion of real estate taxes, operating expenses and common area maintenance and utility charges.

|

||||||||||

|

Occupancy % (1)

|

||||||

|

Property Description/Location

|

Year Foreclosed

|

2018

|

2017

|

2016

|

2015

|

2014

|

|

Commercial buildings, Roseville, California

|

2001

|

100.0%

|

85.2%

|

91.2%

|

100.0%

|

81.2%

|

|

Office condominium complex (2 units at 12/31/18), Roseville, California

|

2008

|

0.0%

|

72.6%

|

76.0%

|

62.9%

|

70.5%

|

|

12 condominium and 3 commercial units, Tacoma, Washington

|

2011

|

80.4%

|

80.4%

|

80.4%

|

80.4%

|

75.8%

|

|

Retail complex, South Lake Tahoe, California (TSV)

|

2013

|

100.0%

|

86.7%

|

91.1%

|

95.5%

|

75.0%

|

|

Retail complex, South Lake Tahoe, California (ZRV)

|

2013

|

47.6%

|

22.5%

|

N/A

|

N/A

|

N/A

|

|

Industrial building/land, Santa Clara, California (1850 De La Cruz, LLC)

|

2005

|

100.0%

|

100.0%

|

100.0%

|

100.0%

|

100.0%

|

|

Notes:

|

||||||

|

(1) Calculated by dividing net rentable square feet included in leases signed on or before December 31, 2018 at the property by the aggregate net rentable square feet of the property.

|

||||||

|

Year of

Lease

Expiration

December 31,

|

Number of

Leases

Expiring

Within the

Year

|

Rentable

Square Footage

Subject to

Expiring

Leases

|

Final

Annualized Base Rent

Under

Expiring

Leases (1)

|

|||||||

|

2019

|

7

|

13,407

|

$

|

948,490

|

||||||

|

2020

|

4

|

12,355

|

185,362

|

|||||||

|

2021

|

3

|

4,200

|

111,866

|

|||||||

|

2022

|

1

|

4,553

|

341,060

|

|||||||

|

2023

|

2

|

201,643

|

778,597

|

|||||||

|

2024

|

3

|

9,614

|

645,224

|

|||||||

|

2025

|

—

|

—

|

—

|

|||||||

|

2026

|

—

|

—

|

—

|

|||||||

|

2027

|

1

|

1,011

|

92,328

|

|||||||

|

2028

|

1

|

2,297

|

164,015

|

|||||||

|

22

|

249,080

|

$

|

3,266,942

|

|||||||

| (1) |

“Final Annualized Base Rent” for each lease scheduled to expire represents the cash rental rate of base rents, excluding tenant reimbursements, in the final

month prior to expiration multiplied by 12. Tenant reimbursements generally include payment of a portion of real estate taxes, operating expenses and common area maintenance and utility charges.

|

|

Leased

Square

Feet

|

Annualized

Base Rent (1)

|

Expiration

Date

|

Renewal

Options

|

|||

|

Tenant Name

|

||||||

|

Avis Rent A Car (1850 De La Cruz) (2) (3)

|

200,855

|

$

|

642,737

|

7/15/2023

|

1-5 yr. Option

|

|

|

Up Shirt Creek (TSV) (3)

|

4,689

|

351,509

|

9/30/2019

|

2-5 yr. Options

|

||

|

Powder House (TSV) (3)

|

5,778

|

493,145

|

9/30/2019

|

2-5 yr. Options

|

||

|

Powder House (ZRV)

|

4,553

|

314,157

|

4/30/2022

|

2-5 yr. Options

|

||

|

Big Vista (ZRV) (4)

|

2,340

|

154,440

|

5/31/2024

|

2-5 yr. Options

|

||

|

McP’s Pub Tahoe (TSV)

|

5,777

|

329,763

|

10/31/2024

|

2-5 yr. Options

|

||

|

Taste of Europe (TSV)

|

2,297

|

130,851

|

4/30/2028

|

2-5 yr. Options

|

| (1) |

Annualized Base Rent represents the current monthly Base Rent, excluding tenant reimbursements, for each lease in effect at December 31, 2018 multiplied by

12. Tenant reimbursements generally include payment of a portion of real estate taxes, operating expenses and common area maintenance and utility charges.

|

|

Period Ended

|

||||||

|

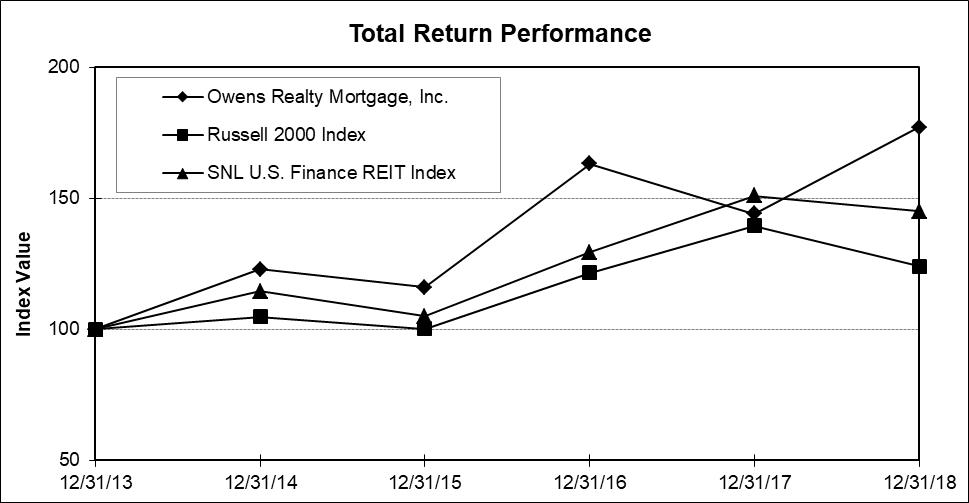

Index

|

12/31/13

|

12/31/14

|

12/31/15

|

12/31/16

|

12/31/17

|

12/31/18

|

|

Owens Realty Mortgage, Inc.

|

100.00

|

122.98

|

116.07

|

163.10

|

144.14

|

177.05

|

|

Russell 2000

|

100.00

|

104.89

|

100.26

|

121.63

|

139.44

|

124.09

|

|

SNL U.S. Finance REIT

|

100.00

|

114.52

|

105.02

|

129.36

|

150.94

|

145.09

|

|

|

As of or For the Years Ended December 31,

|

|||||||||||||||

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||||

|

Operating Data:

|

||||||||||||||||

|

Interest income

|

$

|

12,281,261

|

$

|

10,840,730

|

$

|

8,922,142

|

$

|

8,277,004

|

$

|

5,382,019

|

||||||

|

Rental income

|

4,129,261

|

4,505,385

|

7,977,400

|

12,791,096

|

12,268,214

|

|||||||||||

|

Other revenues

|

386,499

|

187,013

|

179,449

|

175,451

|

170,018

|

|||||||||||

|

Total revenue

|

16,797,021

|

15,533,128

|

17,078,991

|

21,243,551

|

17,820,251

|

|||||||||||

|

Real estate operating expenses

|

3,858,962

|

4,980,900

|

7,045,848

|

8,510,110

|

8,158,038

|

|||||||||||

|

Depreciation and amortization

|

761,717

|

1,138,515

|

1,258,305

|

2,052,181

|

2,255,577

|

|||||||||||

|

Management fees

|

2,906,333

|

3,546,085

|

3,286,470

|

2,051,134

|

1,726,945

|

|||||||||||

|

Interest expense

|

2,132,776

|

1,587,695

|

2,859,294

|

1,938,113

|

1,161,822

|

|||||||||||

|

(Reversal of) provision for loan losses

|

(239,144

|

)

|

(360,012

|

)

|

1,284,896

|

(1,026,909

|

)

|

(1,869,733

|

)

|

|||||||

|

Impairment losses on real estate properties

|

1,053,161

|

1,423,286

|

3,227,807

|

1,589,434

|

179,040

|

|||||||||||

|

Other expenses

|

3,484,667

|

2,596,641

|

1,882,338

|

1,618,266

|

1,821,601

|

|||||||||||

|

Total expenses

|

13,958,472

|

14,913,110

|

20,844,958

|

16,732,329

|

13,433,290

|

|||||||||||

|

Operating income (loss)

|

2,838,549

|

620,018

|

(3,765,967

|

)

|

4,511,222

|

4,386,961

|

||||||||||

|

Gain on sales of real estate, net

|

4,610,824

|

14,728,921

|

24,497,763

|

21,818,553

|

3,243,359

|

|||||||||||

|

Gain on foreclosure of loans

|

—

|

—

|

—

|

—

|

464,754

|

|||||||||||

|

Settlement expense

|

—

|

(2,627,436

|

)

|

—

|

—

|

—

|

||||||||||

|

Net income before income taxes

|

7,449,373

|

12,721,503

|

20,731,796

|

26,329,775

|

8,095,074

|

|||||||||||

|

Income tax (expense) benefit

|

(559,842

|

)

|

(4,041,655

|

)

|

7,248,977

|

(93,335

|

)

|

—

|

||||||||

|

Net income

|

6,889,531

|

8,679,848

|

27,980,773

|

26,236,440

|

8,095,074

|

|||||||||||

|

Net income attributable to non-controlling interests

|

—

|

—

|

(3,571,003

|

)

|

(2,667,324

|

)

|

(165,445

|

)

|

||||||||

|

Net income attributable to common stockholders

|

$

|

6,889,531

|

$

|

8,679,848

|

$

|

24,409,770

|

$

|

23,569,116

|

$

|

7,929,629

|

||||||

|

Earnings per common share (basic and diluted)

|

$

|

0.79

|

$

|

0.85

|

$

|

2.38

|

$

|

2.22

|

$

|

0.74

|

||||||

|

Dividends declared per common share

|

$

|

0.76

|

$

|

0.38

|

$

|

0.32

|

$

|

0.41

|

$

|

0.27

|

||||||

|

Balance Sheet Data:

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||

|

Loans, net

|

$

|

141,204,055

|

$

|

144,343,844

|

$

|

126,975,489

|

$

|

104,901,361

|

$

|

65,164,156

|

||||||

|

Real estate held for sale

|

34,093,790

|

56,110,472

|

75,843,635

|

100,191,166

|

59,494,339

|

|||||||||||

|

Real estate held for investment

|

22,548,720

|

24,355,653

|

37,279,763

|

53,647,246

|

103,522,466

|

|||||||||||

|

Other assets

|

11,223,475

|

14,201,304

|

19,463,568

|

13,254,472

|

13,742,960

|

|||||||||||

|

Total assets

|

209,070,040

|

239,011,273

|

259,562,455

|

271,994,245

|

241,923,921

|

|||||||||||

|

Total indebtedness

|

14,526,903

|

31,747,433

|

38,361,934

|

66,374,544

|

49,019,549

|

|||||||||||

|

Total liabilities

|

17,711,258

|

38,021,546

|

44,034,578

|

72,485,398

|

53,177,310

|

|||||||||||

|

Non-controlling interests

|

—

|

—

|

—

|

4,528,849

|

4,174,753

|

|||||||||||

|

Total equity

|

191,358,782

|

200,989,727

|

215,527,877

|

199,508,847

|

188,746,611

|

|||||||||||

|

Book value per share

|

$

|

22.56

|

$

|

22.10

|

$

|

21.03

|

$

|

19.03

|

$

|

17.14

|

||||||

|

·

|

the level of foreclosures and related loan and real estate losses experienced;

|

|

·

|

the income or losses from foreclosed properties prior to the time of disposal;

|

|

·

|

the amount of cash available to invest in loans;

|

|

·

|

the amount of borrowing to finance loan investments and our cost of funds on such borrowing;

|

|

·

|

the level of real estate lending activity in the markets serviced;

|

|

·

|

the ability to identify and lend to suitable borrowers;

|

|

·

|

the interest rates we are able to charge on loans; and

|

|

·

|

the level of delinquencies on loans.

|

|

·

|

Capitalize on market lending opportunity by leveraging existing origination network to expand our commercial real estate loan

portfolio.

|

|

·

|

Enhance and reposition our commercial real estate assets through the investment of capital and strategic management.

|

|

·

|

Increase liquidity available for lending activities by focusing on opportunities to remove real estate assets from our balance sheet.

|

|

·

|

Manage leverage to marginally expand sources of liquidity while maintaining a conservative balance sheet.

|

|

·

|

The Company sold two real estate properties in January 2019 for net sales proceeds totaling $2,706,000 and gain totaling $466,000.

|

|

·

|

The Company extended the maturity dates on five loans that were past maturity as of December 31, 2018 with principal balances totaling

approximately $15,010,000 in January and February 2019.

|

|

|

Year Ended December 31,

|

Increase/(Decrease)

|

|||||||||||

|

2018

|

2017

|

Amount

|

Percent

|

||||||||||

|

Revenues:

|

|||||||||||||

|

Interest and related income from loans

|

$

|

12,281,261

|

$

|

10,840,730

|

$

|

1,440,531

|

13

|

%

|

|||||

|

Rental and other income from real estate properties

|

4,129,261

|

4,505,385

|

(376,124

|

)

|

(8)

|

%

|

|||||||

|

Other income

|

386,499

|

187,013

|

199,486

|

107

|

%

|

||||||||

|

Total revenues

|

16,797,021

|

15,533,128

|

1,263,893

|

8

|

%

|

||||||||

|

Expenses:

|

|||||||||||||

|

Management fees to Manager

|

2,906,333

|

3,546,085

|

(639,752

|

)

|

(18)

|

%

|

|||||||

|

Servicing fees to Manager

|

95,143

|

362,411

|

(267,268

|

)

|

(74)

|

%

|

|||||||

|

General and administrative expense

|

3,389,524

|

2,234,230

|

1,155,294

|

52

|

%

|

||||||||

|

Rental and other expenses on real estate properties

|

3,858,962

|

4,980,900

|

(1,121,938

|

)

|

(23)

|

%

|

|||||||

|

Depreciation and amortization

|

761,717

|

1,138,515

|

(376,798

|

)

|

(33)

|

%

|

|||||||

|

Interest expense

|

2,132,776

|

1,587,695

|

545,081

|

34

|

%

|

||||||||

|

(Recovery of) provision for loan losses

|

(239,144

|

)

|

(360,012

|

)

|

120,868

|

(34)

|

%

|

||||||

|

Impairment losses on real estate properties

|

1,053,161

|

1,423,286

|

(370,125

|

)

|

(26)

|

%

|

|||||||

|

Total expenses

|

13,958,472

|

14,913,110

|

(954,638

|

)

|

(6)

|

%

|

|||||||

|

Operating income

|

2,838,549

|

620,018

|

2,218,531

|

nm

|

|||||||||

|

Gain on sales of real estate, net

|

4,610,824

|

14,728,921

|

(10,118,097

|

)

|

(69)

|

%

|

|||||||

|

Settlement expense

|

—

|

(2,627,436

|

)

|

2,627,436

|

(100)

|

%

|

|||||||

|

Net income before income taxes

|

7,449,373

|

12,721,503

|

(5,272,130

|

)

|

(41)

|

%

|

|||||||

|

Income tax expense

|

(559,842

|

)

|

(4,041,655

|

)

|

3,481,813

|

(86)

|

%

|

||||||

|

Net income

|

$

|

6,889,531

|

$

|

8,679,848

|

$

|

(1,790,317

|

)

|

(20)

|

%

|

||||

|

|

Year Ended December 31,

|

Increase/(Decrease)

|

|||||||||||

|

2017

|

2016

|

Amount

|

Percent

|

||||||||||

|

Revenues:

|

|||||||||||||

|

Interest and related income from loans

|

$

|

10,840,730

|

$

|

8,922,142

|

$

|

1,918,588

|

22

|

%

|

|||||

|

Rental and other income from real estate properties

|

4,505,385

|

7,977,400

|

(3,472,015

|

)

|

(44)

|

%

|

|||||||

|

Other income

|

187,013

|

179,449

|

7,564,

|

4

|

%

|

||||||||

|

Total revenues

|

15,533,128

|

17,078,991

|

(1,545,863

|

)

|

(9)

|

%

|

|||||||

|

Expenses:

|

|||||||||||||

|

Management fees to Manager

|

3,546,085

|

3,286,470

|

259,615

|

8

|

%

|

||||||||

|

Servicing fees to Manager

|

362,411

|

298,770

|

63,641

|

21

|

%

|

||||||||

|

General and administrative expense

|

2,234,230

|

1,568,890

|

665,340

|

42

|

%

|

||||||||

|

Rental and other expenses on real estate properties

|

4,980,900

|

7,060,526

|

(2,079,626

|

)

|

(29)

|

%

|

|||||||

|

Depreciation and amortization

|

1,138,515

|

1,258,305

|

(119,790

|

)

|

(10)

|

%

|

|||||||

|

Interest expense

|

1,587,695

|

2,859,294

|

(1,271,599

|

)

|

(44)

|

%

|

|||||||

|

(Recovery of) provision for loan losses

|

(360,012

|

)

|

1,284,896

|

(1,644,908

|

)

|

nm

|

|||||||

|

Impairment losses on real estate properties

|

1,423,286

|

3,227,807

|

(1,804,521

|

)

|

(56)

|

%

|

|||||||

|

Total expenses

|

14,913,110

|

20,844,958

|

(5,931,848

|

)

|

(28)

|

%

|

|||||||

|

Operating income (loss)

|

620,018

|

(3,765,967

|

)

|

4,385,985

|

nm

|

||||||||

|

Gain on sales of real estate, net

|

14,728,921

|

24,497,763

|

(9,768,842

|

)

|

(40)

|

%

|

|||||||

|

Settlement expense

|

(2,627,436

|

)

|

—

|

(2,627,436

|

)

|

100

|

%

|

||||||

|

Net income before income taxes

|

12,721,503

|

20,731,796

|

(8,010,293

|

)

|

(39)

|

%

|

|||||||

|

Income tax (expense) benefit

|

(4,041,655

|

)

|

7,248,977

|

(11,290,632

|

)

|

nm

|

|||||||

|

Net income

|

8,679,848

|

27,980,773

|

(19,300,925

|

)

|

(69)

|

%

|

|||||||

|

Net income attributable to non-controlling interests

|

—

|

(3,571,003

|

)

|

3,571,003

|

(100)

|

%

|

|||||||

|

Net income attributable to common stockholders

|

$

|

8,679,848

|

$

|

24,409,770

|

$

|

(15,729,922

|

)

|

(64)

|

%

|

||||

|

December 31,

2018

|

December 31,

2017

|

|||||||

|

By Property Type:

|

||||||||

|

Commercial

|

$

|

132,519,461

|

$

|

127,873,281

|

||||

|

Residential

|

5,209,357

|

13,170,795

|

||||||

|

Land

|

4,953,425

|

5,127,574

|

||||||

|

$

|

142,682,243

|

$

|

146,171,650

|

|||||

|

By Position:

|

||||||||

|

Senior loans

|

$

|

137,808,788

|

$

|

142,782,492

|

||||

|

Junior loans

|

4,873,455

|

3,389,158

|

||||||

|

$

|

142,682,243

|

$

|

146,171,650

|

|||||

|

December 31,

2018

|

December 31,

2017

|

||||||

|

Commercial Real Estate Loans:

|

|||||||

|

Office

|

$

|

26,052,765

|

$

|

29,480,103

|

|||

|

Retail

|

57,108,646

|

32,329,395

|

|||||

|

Storage

|

5,996,619

|

15,807,016

|

|||||

|

Apartment

|

15,382,892

|

24,582,181

|

|||||

|

Hotel

|

8,985,000

|

11,777,351

|

|||||

|

Industrial

|

2,856,911

|

2,690,000

|

|||||

|

Warehouse

|

3,000,000

|

3,000,000

|

|||||

|

Marina

|

3,638,121

|

3,580,000

|

|||||

|

Assisted care

|

7,550,858

|

1,650,000

|

|||||

|

Golf course

|

1,550,000

|

1,212,851

|

|||||

|

Restaurant

|

397,649

|

1,764,384

|

|||||

|

$

|

132,519,461

|

$

|

127,873,281

|

||||

|

|

Fixed

Interest Rate |

Variable

Interest Rate |

Total

|

|||||||||

|

Year ending December 31:

|

||||||||||||

|

2018 (past maturity)

|

$

|

21,874,240

|

$

|

4,916,586

|

$

|

26,790,826

|

||||||

|

2019

|

55,144,317

|

15,780,197

|

70,924,514

|

|||||||||

|

2020

|

4,319,448

|

33,577,666

|

37,897,114

|

|||||||||

|

2021

|

5,519,317

|

1,351,912

|

6,871,229

|

|||||||||

|

Thereafter (through 2028)

|

198,560

|

—

|

198,560

|

|||||||||

|

$

|

87,055,882

|

$

|

55,626,361

|

$

|

142,682,243

|

|||||||

|

December 31, 2018

|

December 31, 2017

|

||||||||||

|

|

Balance

|

Percentage

|

Balance

|

Percentage

|

|||||||

|

California

|

$

|

98,865,551

|

69.29%

|

$

|

110,884,117

|

75.86%

|

|||||

|

Arizona

|

—

|

—%

|

815,890

|

0.56%

|

|||||||

|

Colorado

|

6,447,573

|

4.52%

|

4,380,616

|

3.00%

|

|||||||

|

Hawaii

|

1,445,964

|

1.01%

|

1,450,000

|

0.99%

|

|||||||

|

Illinois

|

—

|

—%

|

1,364,384

|

0.93%

|

|||||||

|

Indiana

|

—

|

—%

|

388,793

|

0.27%

|

|||||||

|

Michigan

|

8,985,000

|

6.30%

|

10,714,764

|

7.33%

|

|||||||

|

Nevada

|

—

|

—%

|

1,653,107

|

1.13%

|

|||||||

|

Ohio

|

—

|

—%

|

3,755,000

|

2.57%

|

|||||||

|

Pennsylvania

|

5,519,317

|

3.87%

|

—

|

—%

|

|||||||

|

Texas

|

17,565,952

|

12.31%

|

6,625,000

|

4.53%

|

|||||||

|

Washington

|

—

|

—%

|

3,159,460

|

2.16%

|

|||||||

|

Wisconsin

|

3,852,886

|

2.70%

|

980,519

|

0.67%

|

|||||||

|

$

|

142,682,243

|

100.00%

|

$

|

146,171,650

|

100.00%

|

||||||

|

2018

|

2017

|

2016

|

|||||||

|

Balance, beginning of period

|

$

|

1,827,806

|

$

|

2,706,822

|

$

|

1,842,446

|

|||

|

(Recovery of) provision for loan losses

|

(239,144

|

)

|

(360,012

|

)

|

1,284,896

|

||||

|

Charge-offs

|

(186,708

|

)

|

(546,004

|

)

|

(447,520

|

)

|

|||

|

Recoveries

|

76,234

|

27,000

|

27,000

|

||||||

|

Balance, end of period

|

$

|

1,478,188

|

$

|

1,827,806

|

$

|

2,706,822

|

|||

|

2018

|

2017

|

2016

|

|||||||

|

Balance, beginning of period

|

$

|

80,466,125

|

$

|

113,123,398

|

$

|

153,838,412

|

|||

|

Real estate acquired through foreclosure

|

2,062,729

|

—

|

700,800

|

||||||

|

Investments in real estate properties

|

496,826

|

11,274,904

|

29,061,735

|

||||||

|

Amortization of deferred financing costs capitalized to construction project

|

—

|

76,260

|

119,471

|

||||||

|

Sales of real estate properties

|

(24,609,167

|

)

|

(41,505,148

|

)

|

(66,183,589

|

)

|

|||

|

Impairment losses on real estate properties

|

(1,053,161

|

)

|

(1,423,286

|

)

|

(3,227,807

|

)

|

|||

|

Depreciation of properties held for investment

|

(720,842

|

)

|

(1,080,003

|

)

|

(1,185,624

|

)

|

|||

|

Balance, end of period

|

$

|

56,642,510

|

$

|

80,466,125

|

$

|

113,123,398

|

|||

|

|

Net Sales Proceeds

|

Gain (Loss)

|

|||||

|

Assisted living facility, Bensalem, Pennsylvania*

|

$

|

5,470,700

|

$

|

(494,786

|

)

|

||

|

Residential condominium units (11 units), South Lake Tahoe, California (held within ZRV)**

|

13,558,657

|

1,114,255

|

|||||

|

Office condominium complex (10 units – 7 sales), Roseville, California

|

5,995,715

|

3,561,143

|

|||||

|

1/7th interest in single family home, Lincoln City, Oregon

|

88,161

|

(9,486

|

)

|

||||

|

One improved residential lot, Coeur D’Alene, Idaho

|

392,120

|

303,519

|

|||||

|

Golf course, Auburn, California (held within Lone Star Golf, Inc.)***

|

2,176,047

|

136,178

|

|||||

|

Unimproved, residential and commercial land, Bethel Island, California

|

2,284,260

|

—

|

|||||

|

$

|

29,965,660

|

$

|

4,610,823

|

||||

|

* Net sales proceeds included carryback loan of $5,875,000, net of $468,705 discount ($5,406,295 net).

** Net sales proceeds included two carryback loans totaling $1,462,500.

***Net sales proceeds included two carryback loans totaling $1,810,270. One with a principal balance of $260,000 was repaid during 2018.

|

|||||||

|

|

Net Sales Proceeds**

|

Gain (Loss)

|

|||||

|

Commercial and residential land under development, South Lake Tahoe, California (held within TSV)

|

$

|

42,329,110

|

$

|

13,210,826

|

|||

|

Seven condominium units, South Lake Tahoe, California (held within ZRV)

|

10,578,517

|

997,239

|

|||||

|

Two office condominium units, Roseville, California

|

978,431

|

515,959

|

|||||

|

Marina with 52 boat slips and campground, Bethel Island, California (held within Sandmound

Marina, LLC)

|

967,825

|

(1,646

|

)

|

||||

|

Office condominium complex, Oakdale, California (held within East G, LLC)

|

732,389

|

(150

|

)

|

||||

|

Undeveloped, residential land, Marysville, California

|

398,483

|

(4,717

|

)

|

||||

|

One improved, residential lot, West Sacramento, California*

|

154,901

|

3,108

|

|||||

|

Unimproved, residential and commercial land, Gypsum, Colorado

|

139,467

|

(31

|

)

|

||||

|

1,000 square feet of commercial floor coverage area (held within TSV)

|

50,000

|

8,333

|

|||||

|

$

|

56,329,123

|

$

|

14,728,921

|

||||

|

* There is deferred gain related to this sale of $93,233 as of December 31, 2017.

|

|||||||

|

** Includes carryback notes receivable totaling $450,000.

|

|||||||

|

|

Net Sales Proceeds**

|

Gain (Loss)

|

|||||

|

Light industrial building, Paso Robles, California

|

$

|

6,023,679

|

$

|

4,557,979

|

|||

|

Commercial building in building complex, Roseville, California

|

455,132

|

280,836

|

|||||

|

169 condominium units and 160 unit renovated and unoccupied apartment building, Miami, Florida

(held within TOTB Miami, LLC)*

|

74,072,951

|

19,292,364

|

|||||

|

61 condominium units, Lakewood, Washington (held within Phillips Road, LLC)

|

5,030,384

|

846,998

|

|||||

|

2 improved, residential lots, Auburn, California (held within ZRV)

|

186,353

|

89,675

|

|||||

|

Medical office condominium complex, Gilbert, Arizona (held within ZRV)

|

3,793,870

|

(30,010

|

)

|

||||

|

Unimproved, residential and commercial land, Gypsum, Colorado (three separate sales)

|

1,434,273

|

(540,079

|

)

|

||||

|

$

|

90,966,642

|

$

|

24,497,763

|

||||

|

* $32,881,000 of proceeds were used to pay off debt securing the properties and $7,934,000 was distributed to the non-controlling

interest.

|

|||||||

|

** Includes carryback note receivable of $1,595,000.

|

|||||||

|

·

|

prevailing economic conditions;

|

|

·

|

our historical loss experience;

|

|

·

|

the types and dollar amounts of loans in the portfolio;

|

|

·

|

borrowers’ financial condition and adverse situations that may affect the borrowers’ ability to pay;

|

|

·

|

evaluation of industry trends;

|

|

·

|

review and evaluation of loans identified as having loss potential; and

|

|

·

|

estimated net realizable value or fair value of the underlying collateral.

|

|

•

|

fund future loan investments;

|

||

|

•

|

to develop, improve and maintain real estate properties;

|

||

|

•

|

to repay principal and interest on our borrowings;

|

||

|

•

|

to pay our expenses, including compensation to our Manager;

|

||

|

•

|

to pay U.S. federal, state, and local taxes of our TRSs;

|

||

|

•

|

to distribute annually a minimum of 90% of our REIT taxable income and to make investments in a manner that enables us to maintain our

qualification as a REIT; and

|

||

|

•

|

to make tax payments associated with undistributed capital gains.

|

|

•

|

the use of our cash and cash equivalent balances of $1,014,000 (not including restricted cash) as of December 31, 2018;

|

||

|

•

|

cash generated from operating activities, including interest income from our loan portfolio and income generated from our real estate

properties;

|

||

|

•

|

proceeds from the sales of real estate properties;

|

||

|

•

|

proceeds from our line of credit;

|

||

|

•

|

proceeds from future borrowings including additional lines of credit; and

|

||

|

•

|

proceeds from potential future offerings of our equity securities.

|

|

Year Ended December 31,

|

|||||||||

|

2018

|

2017

|

2016

|

|||||||

|

Net cash provided by (used in) operating activities

|

$

|

4,860,977

|

$

|

(1,695,167

|

)

|

$

|

(763,292

|

)

|

|

|

Net cash provided by investing activities

|

30,629,671

|

28,071,852

|

)

|

40,542,620

|

|||||

|

Net cash used in financing activities

|

(36,647,163

|

)

|

(27,640,112

|

)

|

(41,326,298

|

)

|

|||

|

|

|

Payment due by Period

|

|

|||||||||||||||||||||||||||

|

Contractual Obligations

|

|

Total

|

|

|

Less Than

1 Year |

|

|

1-3

Years |

|

|

3-5

Years |

|

|

More Than

5 Years |

|

|||||||||||||||

|

Recourse indebtedness:

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Line of credit payable (1)

|

|

$

|

1,728,000

|

|

|

$

|

—

|

|

|

$

|

1,728,000

|

|

|

$

|

—

|

|

|

$

|

—

|

|

||||||||||

|

Loan payable on real estate

|

|

|

12,872,556

|

|

|

|

387,136

|

|

|

|

12,485,420

|

|

|

|

—

|

|

|

|

—

|

|

||||||||||

|

Total recourse indebtedness

|

|

|

14,600,556

|

387,136

|

14,213,420

|

—

|

—

|

|

||||||||||||||||||||||

|

Non-recourse indebtedness:

|

|

|||||||||||||||||||||||||||||

|

Notes payable on real estate

|

|

|

—

|

—

|

—

|

—

|

—

|

|

||||||||||||||||||||||

|

Total non-recourse indebtedness

|

|

|

—

|

—

|

—

|

—

|

—

|

|

||||||||||||||||||||||

|

Total indebtedness

|

|

14,600,556

|

387,136

|

14,213,420

|

—

|

—

|

|

|||||||||||||||||||||||

|

Interest payable (2)

|

|

|

1,234,032

|

|

|

|

635,151

|

|

|

|

598,881

|

|

|

|

—

|

|

|

|

—

|

|

||||||||||

|

Funding commitments to borrowers (3)

|

|

|

29,301,255

|

|

|

|

29,301,255

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

||||||||||

|

Total Obligations

|

|

$

|

45,135,843

|

|

|

$

|

30,323,542

|

|

|

$

|

14,812,301

|

|

|

$

|

—

|

|

|

$

|

—

|

|

||||||||||

|

(1)

|

As of December 31, 2018, the Company had the ability to borrow $47,235,000 on its line of credit.

|

|||||||||||||||||||||||||||||

|

(2)

|

Variable-rate indebtedness assumes a prime rate of 5.5% (actual rate at December 31, 2018) through the original maturity date of the

financing. Interest payable is based on balances outstanding as of December 31, 2018.

|

|||||||||||||||||||||||||||||

|

(3)

|

Amounts represent the commitments we have made to fund borrowers in our existing lending arrangements as of December 31, 2018.

|

|||||||||||||||||||||||||||||

|

December 31, 2018 Consolidated Financial Statements:

|

||

|

Supplemental Schedules:

|

||

|

Assets

|

2018

|

2017

|

||||

|

Cash, cash equivalents and restricted cash

|

$

|

4,514,301

|

$

|

5,670,816

|

||

|

Loans, net of allowance for loan losses of $1,478,188 in 2018 and $1,827,806 in 2017

|

141,204,055

|

144,343,844

|

||||

|

Interest and other receivables

|

1,104,638

|

2,430,457

|

||||

|

Other assets, net of accumulated depreciation and amortization of $85,944 in 2018 and $309,686 in

2017

|

416,615

|

725,341

|

||||

|

Deferred financing costs, net of accumulated amortization of $82,635 in 2018 and $265,276 in 2017

|

351,199