UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

For

the quarterly period ended

For the transition period from ____________ to ____________

Commission

file number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As

of August 12, 2024,

PART 1. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

BAIYU HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

As of June 30, 2024 and December 31, 2023

(Expressed in U.S. dollars, except for the number of shares)

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Loans receivable from third parties | ||||||||

| Inventories, net | ||||||||

| Other current asset | ||||||||

| Total current assets | ||||||||

| Non-Current Assets | ||||||||

| Plant and equipment, net | ||||||||

| Goodwill | ||||||||

| Intangible assets, net | ||||||||

| Right-of-use assets, net | ||||||||

| Total non-current assets | ||||||||

| Total Assets | $ | $ | ||||||

| LIABILITIES AND EQUITY | ||||||||

| Current Liabilities | ||||||||

| Bank borrowings | ||||||||

| Third party loans payable | ||||||||

| Contract liabilities | ||||||||

| Income tax payable | ||||||||

| Lease liabilities | ||||||||

| Other current liabilities | ||||||||

| Convertible promissory notes | ||||||||

| Total current liabilities | ||||||||

| Non-Current Liabilities | ||||||||

| Deferred tax liabilities | ||||||||

| Due to related parties | ||||||||

| Total non-current liabilities | ||||||||

| Total liabilities | ||||||||

| Commitments and Contingencies (Note 17) | ||||||||

| Equity | ||||||||

| Common stock (par value $ | ||||||||

| Additional paid-in capital | ||||||||

| Statutory surplus reserve | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Accumulated other comprehensive loss | ( | ) | ( | ) | ||||

| Total BAIYU Shareholders’ Equity | ||||||||

| Non-controlling interest | ( | ) | ( | ) | ||||

| Total Equity | ||||||||

| Total Liabilities and Equity | $ | $ | ||||||

| * |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

1

BAIYU HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS)

(Expressed in U.S. dollars, except for the number of shares)

| For the Three Months Ended June 30, | For the Six Months Ended June 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenues | ||||||||||||||||

| - Sales of commodity products – third parties | $ | $ | $ | $ | ||||||||||||

| - Supply chain management services – third parties | ||||||||||||||||

| Total revenue | ||||||||||||||||

| Cost of revenues | ||||||||||||||||

| - Commodity product sales-third parties | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| - Supply chain management services-third parties | ( | ) | ( | ) | ( | ) | ||||||||||

| Total operating costs | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Gross loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Operating expenses | ||||||||||||||||

| Selling, general, and administrative expenses | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Total operating expenses | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Net Operating Loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Other income (expenses), net | ||||||||||||||||

| Interest income | ||||||||||||||||

| Interest expenses | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Amortization of beneficial conversion feature relating to issuance of convertible promissory notes | - | ( | ) | ( | ) | ( | ) | |||||||||

| Other expense, net | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Total other income, net | ||||||||||||||||

| Net income (loss) before income taxes | ( | ) | ( | ) | ||||||||||||

| Income tax expenses | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Net income (loss) | ( | ) | ( | ) | ||||||||||||

| Less: Net loss attributable to non-controlling interests | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Net income (loss) attributable to BAIYU Holdings, Inc.’s Stockholders’ | ( | ) | ( | ) | ||||||||||||

| Comprehensive Loss | ||||||||||||||||

| Net income (loss) | ( | ) | ( | ) | ||||||||||||

| Foreign currency translation adjustments | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Comprehensive Loss | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| Less: Total comprehensive loss attributable to non-controlling interests | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Comprehensive income (loss) attributable to BAIYU Holdings, Inc.’s Stockholders | $ | ( | ) | $ | ( | ) | $ | $ | ( | ) | ||||||

| Income per share - basic and diluted | ||||||||||||||||

| Continuing Operation- income (loss) per share – basic* | $ | $ | ( | ) | $ | $ | ( | ) | ||||||||

| Continuing Operation- income (loss) per share –diluted* | $ | $ | ( | ) | $ | $ | ( | ) | ||||||||

| Weighted Average Shares Outstanding-Basic* | ||||||||||||||||

| Weighted Average Shares Outstanding- Diluted* | ||||||||||||||||

| * |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

2

BAIYU HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(Expressed in U.S. dollars, except for the number of shares)

| Common Stock | Additional paid-in | Accumulated | Surplus | Accumulated other comprehensive | Non- controlling | Total | ||||||||||||||||||||||||||

| Shares | Amount | capital | Deficit | Reserve | Income (loss) | interests | Equity | |||||||||||||||||||||||||

| Balance as of December 31, 2022 | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||||

| Issuance of common stocks in connection with private placements | ||||||||||||||||||||||||||||||||

| Issuance of common stocks pursuant to exercise of convertible promissory notes | ||||||||||||||||||||||||||||||||

| Issuance of common stocks pursuant to ATM transaction | ||||||||||||||||||||||||||||||||

| Issuance of common stock pursuant to stock incentive stock plan | ||||||||||||||||||||||||||||||||

| Beneficial conversion feature relating to issuance of convertible promissory notes | - | |||||||||||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||

| Foreign currency translation adjustments | - | ( | ) | ( | ) | |||||||||||||||||||||||||||

| Balance as of June 30, 2023 | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||||

| Balance as of December 31, 2023 | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||||

| Issuance of common stocks in connection with private placements | ||||||||||||||||||||||||||||||||

| Issuance of common stocks pursuant to exercise of convertible promissory notes | ||||||||||||||||||||||||||||||||

| Net income (loss) | - | ( | ) | |||||||||||||||||||||||||||||

| Foreign currency translation adjustments | - | ( | ) | ( | ) | |||||||||||||||||||||||||||

| Balance as of June 30, 2024 | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||||

| * | On October 30, 2023, the Company completed a 50:1 reverse stock split of our common stock issued and outstanding. All shares and associated amounts have been retroactively restated to reflect the reverse stock split. See Note 13 - Reverse stock split of common stock. |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

3

BAIYU HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(Expressed in U.S. dollars, except for the number of shares)

| Common Stock | Additional paid-in | Accumulated | Surplus | Accumulated other comprehensive | Non- controlling | Total | ||||||||||||||||||||||||||

| Shares | Amount | capital | Deficit | Reserve | Income (loss) | interests | Equity | |||||||||||||||||||||||||

| Balance as of March 31, 2023 | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||||

| Issuance of common stock pursuant to exercise of convertible promissory notes | ||||||||||||||||||||||||||||||||

| Issuance of common stock pursuant to stock incentive stock plan | ||||||||||||||||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||

| Foreign currency translation adjustments | - | ( | ) | ( | ) | |||||||||||||||||||||||||||

| Balance as of June 30, 2023 | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||||

| Balance as of March 31, 2024 | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||||

| Issuance of common stocks in connection with private placements | ||||||||||||||||||||||||||||||||

| Issuance of common stocks pursuant to exercise of convertible promissory notes | ||||||||||||||||||||||||||||||||

| Net income (loss) | - | ( | ) | |||||||||||||||||||||||||||||

| Foreign currency translation adjustments | - | ( | ) | ( | ) | |||||||||||||||||||||||||||

| Balance as of June 30, 2024 | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||||

| * | On October 30, 2023, the Company completed a 50:1 reverse stock split of our common stock issued and outstanding. All shares and associated amounts have been retroactively restated to reflect the reverse stock split. See Note 13 - Reverse stock split of common stock. |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

4

BAIYU HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Six Months Ended June 30, 2024 and 2023

(Expressed in U.S. dollar)

| For the Six Months Ended June 30, | ||||||||

| 2024 | 2023 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net income (loss) | $ | $ | ( | ) | ||||

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | ||||||||

| Depreciation of plant and equipment | ||||||||

| Amortization of intangible assets | ||||||||

| Amortization of right of use assets | ||||||||

| Amortization of discount on convertible promissory notes | ||||||||

| Amortization of beneficial conversion feature relating to issuance of convertible promissory notes | ||||||||

| Interest expense for convertible promissory notes | ||||||||

| Deferred tax liabilities | ( | ) | ( | ) | ||||

| Share-based payment stock to service providers | ||||||||

| Inventories impairment | ( | ) | ||||||

| Inventories | ||||||||

| Loan receivables | ( | ) | ||||||

| Other current assets | ( | ) | ||||||

| Prepayments | ( | ) | ( | ) | ||||

| Contract liabilities | ||||||||

| Due from third parties | ( | ) | ( | ) | ||||

| Due from related parties | ( | ) | ||||||

| Due to related parties | ( | ) | ||||||

| Accounts payable | ( | ) | ||||||

| Income tax payable | ||||||||

| Other current liabilities | ||||||||

| Lease liabilities | ( | ) | ( | ) | ||||

| Due to third party loans payable | ||||||||

| Net cash (used in)/provided by operating activities | ( | ) | ||||||

| Cash Flows from Investing Activities: | ||||||||

| Purchases of plant and equipment | ( | ) | ||||||

| Payment made on loans to third parties | ( | ) | ||||||

| Proceeds from loans of third parties | ||||||||

| Security deposits | ( | ) | ||||||

| Net cash used in investing activities | ( | ) | ( | ) | ||||

| Cash Flows from Financing Activities: | ||||||||

| Proceeds from issuance of common stock under ATM transaction | ||||||||

| Proceeds from issuance of common stock under private placement transactions | ||||||||

| Proceeds from convertible promissory notes | ||||||||

| Net cash provided by financing activities | ||||||||

| Effect of exchange rate changes on cash and cash equivalents | ( | ) | ( | ) | ||||

| Net (decrease)/increase in cash and cash equivalents | ( | ) | ||||||

| Cash and cash equivalents at beginning of period | ||||||||

| Cash and cash equivalents at end of period | $ | $ | ||||||

| Supplemental Cash Flow Information | ||||||||

| Cash paid for interest expenses | $ | $ | ||||||

| Supplemental disclosure of non-cash investing and financing activities | ||||||||

| Issuance of common stocks in connection with conversion of convertible promissory notes | $ | $ | ||||||

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

5

1. ORGANIZATION AND BUSINESS DESCRIPTION

BAIYU Holding, Inc. is a Delaware corporation, incorporated under the laws of the state of Delaware.

| Name | Background | Ownership | ||

| HC High Summit Holding Limited (“HC High BVI”) | A BVI company Incorporated on March 22, 2018 A holding company | |||

| TD Internet of Things Technology Company Limited (“TD Internet Technology”) (Formerly Named: Tongdow Block Chain Information Technology Company Limited) | A Hong Kong company Incorporated on February 14, 2020 A holding company | |||

| Hainan Baiyu Cross-border E-commerce Co., Ltd. (“Hainan Baiyu”) | A Hong Kong company Incorporated on June 19, 2002 A holding company | |||

| Zhong Hui Dao Ming Investment Management Limited (“ZHDM HK”) | A Hong Kong company Incorporated on June 19, 2002 A holding company | |||

| Hong Kong Tongyuan Energy Storage Smart Electric Co., Ltd (“Tongdow HK”) (Formerly Named: Tongdow E-trade Limited) | A Hong Kong company Incorporated on November 25, 2010 A holding company | |||

| Shanghai Jianchi Supply Chain Co., Ltd. (“Shanghai Jianchi”) | A PRC company and deemed a wholly foreign owned enterprise (“WFOE”) Incorporated on April 2, 2020 Registered capital of $10 million A holding company | |||

| Tongdow (Hainan) Data Technology Co., Ltd. (“Tondow Hainan”) | A PRC limited liability company Incorporated on July 16, 2020 | |||

| Hainan Jianchi Import and Export Co., Ltd. (“Hainan Jianchi”) | A PRC limited liability company Incorporated on December 21, 2020 Registered capital of $7,632,772 (RMB50 million) with registered capital of $0 (RMB0) paid-up |

6

| Shenzhen Baiyu Jucheng Data Techonology Co., Ltd. (“Shenzhen Baiyu Jucheng”) | A PRC limited liability company Incorporated on December 30, 2013 Registered capital of $1,417,736 (RMB10 million) with registered capital fully paid-up | |||

| Shenzhen Qianhai Baiyu Supply Chain Co., Ltd. (“Qianhai Baiyu”) | A PRC limited liability company Incorporated on August 17, 2016 Registered capital of $4,523,857 (RMB30 million) with registered capital of $736,506 (RMB5 million) paid-up | |||

| Shenzhen Tongdow Internet Technology Co., Ltd. (“Shenzhen Tongdow”) | A PRC limited liability company Incorporated on November 11, 2014 Registered capital of $1,628,320 (RMB10 million) with registered capital of $1,628,320 (RMB10 million) paid-up | |||

| Yangzhou Baiyu Venture Capital Co. Ltd. (“Yangzhou Baiyu Venture”) | A PRC limited liability company Incorporated on April 19, 2021 Registered capital of $30 million with registered capital of $7 million paid-up | |||

| Yangzhou Baiyu Cross-broder E-commerce Co., Ltd. (“Yangzhou Baiyu E-commerce”) | A PRC limited liability company Incorporated on May 14, 2021 Registered capital of $30 million (RMB200 million) with registered capital of $7 million (RMB48 million) paid-up | |||

| Zhejiang Baiyu Lightweight New Material Co., Ltd. (“Zhejiang Baiyu”) | Incorporated on August 5, 2022 Registered capital of $1,483,569 (RMB10 million) | |||

| Baiyu International Supply Chain PTE. LTD | ||||

| Beijing Baiyu Jucheng Technology Co., LTD | A PRC limited liability company Incorporated on January 19, 2024 Registered capital of $140,515 (RMB1 million) | |||

| Electra New Energy Vehicle Inc |

7

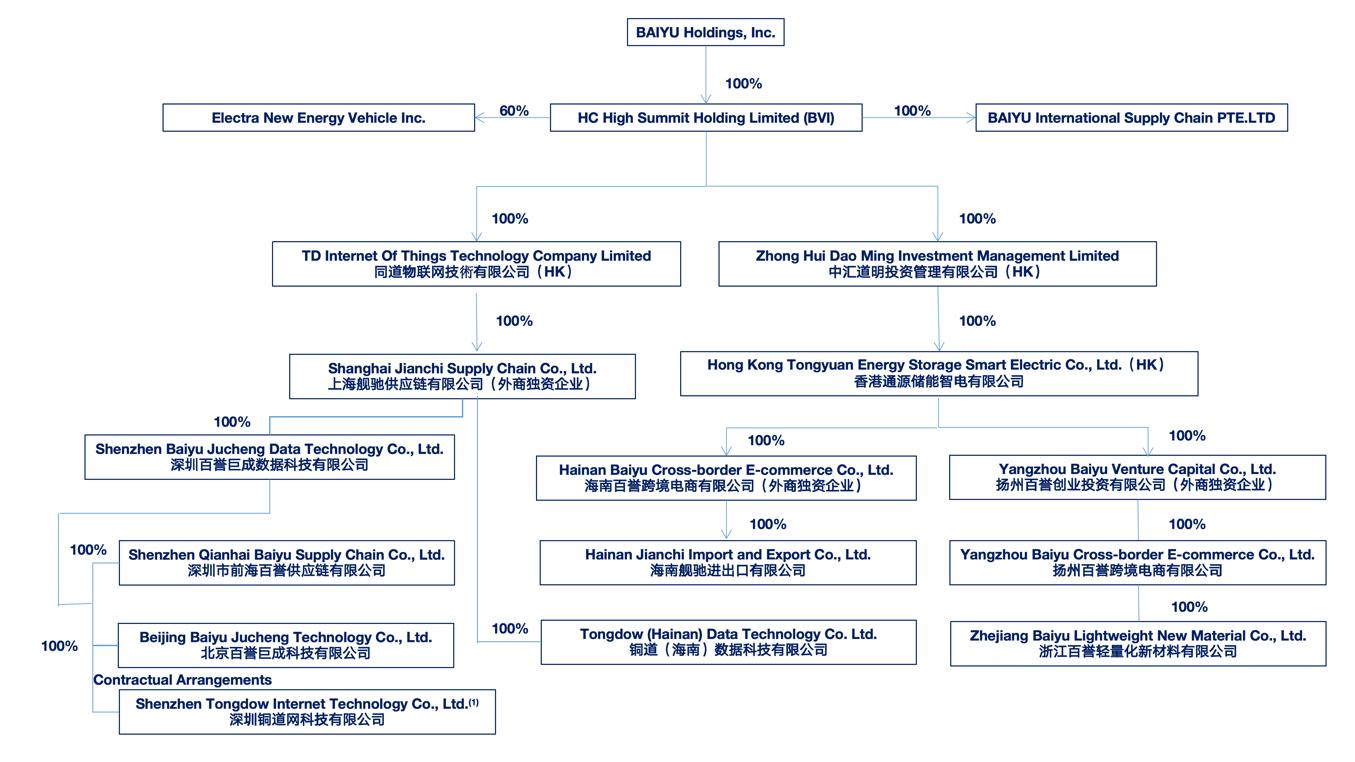

The following diagram illustrates our corporate structure as of June 30, 2024.

| (1) | A variable interest entity. |

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). All transactions and balances among the Company and its subsidiaries have been eliminated upon consolidation.

The unaudited interim condensed consolidated financial information as of June 30, 2024 and for the six months ended June 30, 2024 and 2023 have been prepared, pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). Certain information and footnote disclosures, which are normally included in annual condensed consolidated financial statements prepared in accordance with U.S. GAAP, have been omitted pursuant to those rules and regulations. The unaudited interim condensed consolidated financial information should be read in conjunction with the consolidated financial statements and the notes thereto, included in the Company’s Form 10-K for the fiscal year ended December 31, 2023 previously filed with the SEC on March 22, 2024.

In the opinion of management, all adjustments (which include normal recurring adjustments) necessary to present a fair statement of the Company’s unaudited condensed consolidated financial position as of June 30, 2024 and its unaudited condensed consolidated results of operations for the six months ended June 30, 2024 and 2023, and its unaudited condensed consolidated cash flows for the six months ended June 30, 2024 and 2023, as applicable, have been made. The interim results of operations are not necessarily indicative of the operating results for the fiscal year or any future periods.

8

(b) Use of estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. On an ongoing basis, management reviews these estimates using the currently available information. Changes in facts and circumstances may cause the Company to revise its estimates. Significant accounting estimates reflected in the financial statements include: (i) useful lives and residual value of long-lived assets; (ii) the impairment of long-lived assets and investments; (iii) the valuation allowance of deferred tax assets; (iv) estimates of allowance for doubtful accounts, including loans receivable from third parties and related parties; (v) valuation of Inventory; and (vi) contingencies and litigation.

(c) Foreign currency translation

The Company’s financial information is presented in U.S. dollars (“USD”). The functional currency of the Company is the Chinese Yuan Renminbi (“RMB”), the currency of PRC. Any transactions which are denominated in currencies other than RMB are translated into RMB at the exchange rate quoted by the People’s Bank of China prevailing at the dates of the transactions, and exchange gains and losses are included in the statements of operations as foreign currency transaction gain or loss. The consolidated financial statements of the Company have been translated into U.S. dollars in accordance with ASC 830, Foreign Currency Matters. The financial information is first prepared in RMB and then translated into U.S. dollars at period-end exchange rates for assets and liabilities and average exchange rates for revenue and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred. The effects of foreign currency translation adjustments are included as a component of accumulated other comprehensive income (loss) in stockholders’ equity. Cash flows from the Company’s operations are calculated based upon the local currencies using the average translation rate. As a result, amounts related to assets and liabilities reported on the statements of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheets.

(d) Convertible promissory notes

Convertible promissory notes are recognized initially at fair value, net of upfront fees, debt discounts or premiums, debt issuance costs and other incidental fees. Upfront fees, debt discounts or premiums, debt issuance costs and other incidental fees are recorded as a reduction of the proceeds received and the related accretion is recorded as interest expense in the consolidated income statements over the estimated term of the facilities using the effective interest method.

(e) Beneficial conversion feature

The Company evaluates the conversion feature to determine whether it was beneficial as described in ASC 470-20. The intrinsic value of a beneficial conversion feature inherent to a convertible note payable, which is not bifurcated and accounted for separately from the convertible notes payable and may not be settled in cash upon conversion, is treated as a discount to the convertible notes payable. This discount is amortized over the period from the date of issuance to the date the notes are due using the effective interest method. If the notes payable are retired prior to the end of their contractual term, the unamortized discount is expensed in the period of retirement to interest expense. In general, the beneficial conversion feature is measured by comparing the effective conversion price, after considering the relative fair value of detachable instruments included in the financing transaction, if any, to the fair value of the shares of common stock at the commitment date to be received upon conversion.

9

(f) Recent accounting pronouncement

In November 2023, the FASB issued guidance to enhance disclosure of expenses of a public entity’s reportable segments. The new guidance requires a public entity to disclose: (1) on an annual and interim basis, significant segment expenses that are regularly provided to the chief operating decision maker (CODM) and included within each reported measure of segment profit or loss, (2) on an annual and interim basis, an amount for other segment items (the difference between segment revenue less the significant expenses disclosed under the significant expense principle and each reported measure of segment profit or loss), including a description of its composition, (3) on an annual and interim basis, information about a reportable segment’s profit or loss and assets previously required to be disclosed only on an annual basis, and (4) the title and position of the CODM and an explanation of how the CODM uses the reported measure(s) of segment profit or loss in assessing segment performance and how to allocate resources. The new guidance also clarifies that if the CODM uses more than one measure of a segment’s profit or loss, one or more of those measures may be reported and requires that a public entity that has a single reportable segment provide all the disclosures required by the amendments in this update and all existing segment disclosures. The guidance is effective for the current fiscal year 2024 annual reporting, and in the first quarter of 2025 for interim period reporting, with early adoption permitted. Upon adoption, this guidance should be applied retrospectively to all prior periods presented. We do not expect the adoption of this accounting standard to have an impact on our Consolidated Financial Statements.

In

December 2023, the FASB issued guidance to enhance transparency of income tax disclosures. On an annual basis, the new guidance requires

a public entity to disclose: (1) specific categories in the rate reconciliation, (2) additional information for reconciling items that

are equal to or greater than

In July 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. The amendments in ASU 2023-07 improve reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. The amendments in ASU 2023-07 improve financial reporting by requiring disclosure of incremental segment information on an annual and interim basis for all public entities to enable investors to develop more decision-useful financial analyses. The amendments are effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. Early adoption is permitted. The adoption of this guidance did not have a material impact on its financial position, results of operations and cash flows.

In December 2023, the FASB issued ASU 2023-08: Intangibles-Goodwill and Other-Crypto Assets (Subtopic 350-60). For annual and interim reporting periods, the amendments in this Update require that an entity, including an entity that is subject to industry-specific guidance, disclose the following information: (1) The name, cost basis, fair value, and number of units for each significant crypto asset holding and the aggregate fair values and cost bases of the crypto asset holdings that are not individually significant, (2) For crypto assets that are subject to contractual sale restrictions, the fair value of those crypto assets, the nature and remaining duration of the restriction(s), and the circumstances that could cause the restriction(s) to lapse.

Other accounting standards that have been issued or proposed by FASB that do not require adoption until a future date are not expected to have a material impact on the consolidated financial statements upon adoption. The Company does not discuss recent pronouncements that are not anticipated to have an impact on or are unrelated to its consolidated financial condition, results of operations, cash flows or disclosures.

10

3. LOANS RECEIVABLE FROM THIRD PARTIES

| June 30, 2024 | December 31, 2023 | |||||||

| Loans receivable from third parties | $ | $ | ||||||

As of June 30, 2024, the Company has fourteen

loan agreements compared with thirteen loan agreements on December 31, 2023. The Company provided loans aggregating $

Interest income of $

As of June 30, 2024 and December 31, 2023, there was no allowance recorded as the Company considers all of the loans receivable fully collectible.

4. INVENTORIES, NET

| June 30, 2024 | December 31, 2023 | |||||||

| Aluminum ingots | $ | $ | ||||||

| Inventories, net | $ | $ | ||||||

For the six months ended June 30, 2024, the Company did not accrue or charge back any impairment as the impaired inventories have been sold.

5. OTHER CURRENT ASSETS

| June 30, 2024 | December 31, 2023 | |||||||

| Other current assets: | ||||||||

| Deposit | $ | $ | ||||||

| Interest receivables | ||||||||

| Prepayments | ||||||||

| Others | ||||||||

| Total | $ | $ | ||||||

11

6. PLANT AND EQUIPMENT, NET

| June 30, 2024 | December 31, 2023 | |||||||

| Cost: | ||||||||

| Office equipment | $ | $ | ||||||

| Accumulated depreciation: | ||||||||

| Office equipment | $ | ( | ) | $ | ( | ) | ||

| Plant and equipment, net | $ | $ | ||||||

Depreciation expense was $

7. GOODWILL

| Acquisition of Qianhai Baiyu | Contractual arrangement with Tongdow Internet Technology | Total | ||||||||||

| Balance as of December 31, 2022 | $ | $ | $ | |||||||||

| Foreign currency translation adjustments | ( | ) | ( | ) | ( | ) | ||||||

| Balance as of December 31, 2023 | ||||||||||||

| Foreign currency translation adjustments | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||

| Balance as of June 30, 2024 | ||||||||||||

Based on an assessment of the qualitative factors, management determined that it is more-likely-than-not that the fair value of the reporting unit is in excess of its carrying amount. Therefore, management concluded that it was not necessary to proceed with the two-step goodwill impairment test. No impairment loss or other changes were recorded, except for the influence of foreign currency translation for the six months ended June 30, 2024 and the year ended December 31, 2023.

8. INTANGIBLE ASSETS

| June 30, 2024 | December 31, 2023 | |||||||

| Customer relationships | $ | $ | ||||||

| Software copyright | ||||||||

| Total | ||||||||

| Less: accumulative amortization | ( | ) | ( | ) | ||||

| Intangible assets, net | $ | $ | ||||||

12

The Company’s intangible assets consist

of customer relationships and software copyrights. Customer relationships are generally recorded in connection with acquisitions at their

fair value, one kind of software copyright was purchased in March 2021 and the other kind of software copyright was recorded in connection

with the contractual arrangement with Shenzhen Tongdow Internet Technology Co., Ltd. in October 2022. Intangible assets with estimable

lives are amortized, generally on a straight-line basis, over their respective estimated useful lives:

Amortization expense for the six months ended

June 30, 2024 and 2023 was $

No impairment loss was made against the intangible assets during the six months ended June 30, 2024.

| Period ending June 30, 2024: | Amount | |||

| current year | $ | |||

| 2025 | ||||

| 2026 | ||||

| 2027 | ||||

| 2028 | ||||

| Thereafter | ||||

| Total: | $ | |||

9. BANK BORROWINGS

| June 30, 2024 | December 31, 2023 | |||||||

| Short-term bank loans: | ||||||||

| Loan from Baosheng County Bank | $ | $ | ||||||

| Loan from Bank of Communications | ||||||||

| Total | $ | $ | ||||||

In August 2022, Qianhai Baiyu entered into five

loan agreements with Baosheng County Bank to borrow a total amount of RMB

In August 2023, Qianhai Baiyu entered into a

loan agreement with the Bank of Communications, borrowing a total of RMB

13

10. LEASES

The Company leases an office space under non-cancelable

operating leases, with a term of

The Company determines whether a contract is, or contains, a lease at inception of the contract and whether that lease meets the classification criteria of a finance or operating lease. When available, the Company uses the rate implicit in the lease to discount lease payments to present value; however, most of the Company’s leases do not provide a readily determinable implicit rate. Therefore, the Company discounts lease payments based on an estimate of its incremental borrowing rate.

The Company’s lease agreements do not contain any material residual value guarantees or material restrictive covenants.

| June 30, 2024 | December 31, 2023 | |||||||

| Right-of-use assets, net | $ | $ | ||||||

| Lease Liabilities-current | $ | $ | ||||||

| Total | $ | $ | ||||||

| Remaining lease term and discount rate: | ||||

| Weighted average remaining lease term (years) | ||||

| Weighted average discount rate | % | |||

For the six months ended June 30, 2024 and 2023,

the Company charged total amortization of right-of-use assets of $

| Period ended June 30, 2024: | Amount | |||

| current year | $ | |||

| Total lease payments | ||||

| Less: imputed interest | ||||

| Present value of lease liabilities | ||||

11. OTHER CURRENT LIABILITIES

| June 30, 2024 | December 31, 2023 | |||||||

| Accrued payroll and benefit | $ | $ | ||||||

| Other tax payable | ||||||||

| Accrued expenses | ||||||||

| Others | ||||||||

| Total | $ | $ | ||||||

14

12. CONVERTIBLE PROMISSORY NOTES

| June 30, 2024 | December 31, 2023 | |||||||

| Convertible promissory notes – principal | $ | $ | ||||||

| Convertible promissory notes – discount | ( | ) | ||||||

| Convertible promissory notes – interest | ||||||||

| Convertible promissory notes, net | $ | $ | ||||||

On May 6, 2022, the Company entered into a securities

purchase agreement with Streeterville Capital, LLC (“Streeterville”), a Utah limited liability company, pursuant to which

the Company issued Streeterville a convertible promissory note in the original principal amount of $

On March 13, 2023, the Company entered into a

securities purchase agreement with Streeterville, pursuant to which the Company issued Streeterville a convertible promissory note in

the original principal amount of $

The above two unsettled convertible promissory

notes, issued on May 6, 2022 and March 13, 2023, have a maturity date of 12 months with an interest rate of

For the above two unsettled convertible promissory

notes, upon evaluation, the Company determined that the Agreements contained embedded beneficial conversion features which met the definition

of Debt with Conversion and Other Options covered under the Accounting Standards Codification topic 470 (“ASC 470”). According

to ASC 470, an embedded beneficial conversion feature present in a convertible instrument shall be recognized separately at issuance by

allocating a portion of the proceeds equal to the intrinsic value of that feature to additional paid-in capital. Pursuant to the agreements,

the Company shall recognize embedded beneficial conversion features three months after commitment date of $

15

13. EQUITY

Common stock issued in private placements

On January 9, 2023, the Company entered into a

certain securities purchase agreement with Ms. Huiwen Hu, an affiliate of the Company, and certain other purchasers who are non-U.S. Persons

(as defined in Regulation S under the Securities Act of 1933, as amended), pursuant to which the Company agreed to sell an aggregate of

On July 31, 2023, the Company entered into a certain

securities purchase agreement with Mr. Wenhao Cui, an affiliate of the Company, and certain other purchasers who are non-U.S. Persons

(as defined in Regulation S under the Securities Act of 1933, as amended), pursuant to which the Company agreed to sell an aggregate of

On November 16, 2023, the Company entered into

a certain securities purchase agreement with certain purchasers who are non-U.S. Persons (as defined in Regulation S under the Securities

Act of 1933, as amended), pursuant to which the Company agreed to sell an aggregate of

Solely for accounting purposes, the number of shares and the purchase price per share discussed above have been retroactively restated to reflect the reverse stock split. Please refer to “Note 13 - Reverse Stock Split of Common Stock” for further details.

On June 7, 2024, the Company entered into a certain

securities purchase agreement with certain purchasers who are non-U.S. Persons (as defined in Regulation S under the Securities Act of

1933, as amended), pursuant to which the Company agreed to sell an aggregate of

Settlement and Restated Common Stock Purchase Agreement

On December 12, 2022,

the Company entered into a Settlement and Restated Common Stock Purchase Agreement (the “Restated Agreement”) with White Lion

Capital, LLC (the “Investor”). Pursuant to the Restated Agreement, in consideration for the Investor’s execution and

delivery of, and performance under the Restated Agreement, the Company agreed to issue to the Investor

According to the agreement, the company has issued

Common stock issued pursuant to the conversion of convertible promissory notes

The Company settled the convertible promissory

note issued on May 6, 2022 of $

16

The Company settled convertible promissory notes issued on March 13,

2023 of $

Solely for accounting purposes, the number of shares and the purchase price per share have been retroactively restated to reflect the reverse stock split. Please refer to “Note 13 - Reverse Stock Split of Common Stock” for further details.

Reverse stock split of common stock

On October 30, 2023, The Company completed a

The reverse stock split applied to the issued shares of the Company on the date of the reverse stock split and does not have any retroactive effect on the Company’s shares prior to that date. However, for accounting purposes only, references to our ordinary shares in this quarterly report are stated as having been retroactively adjusted and restated to give effect to the reverse stock split, as if the reverse stock split had occurred by the relevant earlier date.

Share Issuances to Service Providers

In June 2023, the Company issued under its 2023

Stock Incentive Plan a total of

Common stocks issued for exercise of warrants by holders of warrants

Warrants

| Number of shares | Weighted average life | Weighted average exercise price | Intrinsic Value | |||||||||||

| Balance of warrants outstanding as of December 31, 2023 | $ | |||||||||||||

| Granted | - | |||||||||||||

| Exercised | - | $ | ||||||||||||

| Balance of warrants outstanding as of June 30, 2024 | $ | - | ||||||||||||

As of June 30, 2024, the Company had

In connection with

The Warrants ended on June 30, 2024 are subject to anti-dilution provisions to reflect stock dividends and splits or other similar transactions, but not as a result of future securities offerings at lower prices. The warrants did not meet the definition of liabilities or derivatives, and as such they are classified as equity.

17

14. INCOME PER SHARE

Basic income per share is computed by dividing

the net profit or loss by the weighted average number of common shares outstanding during the period. As of June 30, 2024, the principal

amount and interest expense of convertible promissory notes are $

The number of warrants is excluded from the computation as the anti-dilutive effect.

| For the Six Months Ended June 30, | ||||||||

| 2024 | 2023 | |||||||

| Net income (loss) | $ | $ | ( | ) | ||||

| Weighted Average Shares Outstanding-Basic | ||||||||

| Weighted Average Shares Outstanding-Diluted | ||||||||

| Net income (loss) per share - basic and diluted | ||||||||

| Net income (loss) per share – basic | $ | $ | ( | ) | ||||

| Net income (loss) per share – diluted | $ | $ | ( | ) | ||||

15. INCOME TAXES

The Enterprise Income Tax Law of the People’s

Republic of China (“PRC tax law”), which was effective on January 1, 2008, stipulates those domestic enterprises and

foreign-invested enterprises are subject to a uniform tax rate of

The Company evaluates the level of authority for

each uncertain tax position (including the potential application of interest and penalties) based on the technical merits and measures

the unrecognized benefits associated with the tax positions. For the six months ended June 30, 2024, the Company had no unrecognized tax

benefits. Due to uncertainties surrounding future utilization, the Company estimates there will not be sufficient future income to realize

the deferred tax assets for certain subsidiaries and a VIE. As of June 30, 2024 and December 31, 2023, the Company had deferred tax assets

of $

The Company does not anticipate any significant increase to its liability for unrecognized tax benefit within the next 12 months. The Company will classify interest and penalties related to income tax matters, if any, in income tax expense.

For the six months ended June 30, 2024 and 2023,

the Company had current income tax expenses of $

The Company accounts for uncertainty in income

taxes using a two-step approach to recognizing and measuring uncertain tax positions. The first step is to evaluate the tax position for

recognition by determining if the weight of available evidence indicates that it is more likely than not that the position will be sustained

on audit, including resolution of related appeals or litigation processes, if any. The second step is to measure the tax benefit as the

largest amount that is more than

18

16. RELATED PARTY TRANSACTIONS AND BALANCES

| 1) |

| Name | Relationship with the Company | |

| Guangzhou Chengji Investment Development Co., Ltd. (“Guangzhou Chengji”) | ||

| Yunfeihu International E-commerce Group Co., Ltd (“Yunfeihu”) | ||

| Shenzhen Tongdow International Trade Co., Ltd. (“TD International Trade”) | ||

| Beijing Tongdow E-commerce Co., Ltd. (“Beijing TD”) | ||

| Shanghai Tongdow Supply Chain Management Co., Ltd. (“Shanghai TD”) | ||

| Guangdong Tongdow Xinyi Cable New Material Co., Ltd. (“Guangdong TD”) | ||

| Yangzhou Lishunwu E-commerce Co., Ltd. (Formerly named: Yangzhou Tongdow E-commerce Co., Ltd.) (“Yangzhou TD”) | ||

| Ningbo Xinwurong Supply Chain Management Co., Ltd. (Formerly named: Tongdow (Zhejiang) Supply Chain Management Co., Ltd.) (“Zhejiang TD”) | ||

| Shenzhen Meifu Capital Co., Ltd. (“Shenzhen Meifu”) | ||

| Shenzhen Tiantian Haodian Technology Co., Ltd. (“TTHD”) | ||

| Hainan Tongdow International Trade Co., Ltd. (“Hainan TD”) | ||

| Yunfeihu modern logistics Co., Ltd. (“Yunfeihu Logistics”) | ||

| Shenzhen Tongdow Jingu Investment Holding Co., Ltd. (“Shenzhen Jingu”) | ||

| Tongdow E-commerce Group Co., Ltd. (“TD E-commerce”) | ||

| Katie Ou |

| 2) | Balances with related parties |

| - |

| June 30, 2024 |

December 31, 2023 |

|||||||

| TD E-commerce | $ | $ | ||||||

| Total due to related party | $ | $ | ||||||

The amount due to related parties are non-trade in nature, unsecured, non-interest bearing and are not expected to be repaid in the next six months.

19

17. COMMITMENTS AND CONTINGENCIES

| 1) | Commitments |

a Non-cancellable operating leases

| Payment due by June 30 | ||||||||||||||||

| Total | 2024 | 2025 | 2026 | |||||||||||||

| Operating lease commitments for property management expenses under lease agreements | $ | $ | $ | $ | ||||||||||||

| 2) | Contingencies |

None.

18. Risks and uncertainties

(1) Credit risk

Assets that potentially subject the Company to

a significant concentration of credit risk primarily consist of cash and cash equivalents and trade receivables with its customers. The

maximum exposure of such assets to credit risk is their carrying amount as of the balance sheet dates. As of June 30, 2024, approximately

$

The Company’s operations are carried out in Mainland China. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC as well as by the general state of the PRC’s economy. In addition, the Company’s business may be influenced by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, rates and methods of taxation, and the extraction of mining resources, among other factors.

(2) Liquidity risk

The Company is also exposed to liquidity risk which is the risk that it is unable to provide sufficient capital resources and liquidity to meet its commitments and business needs. Liquidity risk is controlled by the application of financial position analysis and monitoring procedures. When necessary, the Company will turn to other financial institutions and the owners to obtain short-term funding to meet the liquidity shortage.

(3) Foreign currency risk

Substantially all of the Company’s operating activities and the Company’s major assets and liabilities are denominated in RMB, which is not freely convertible into foreign currencies. All foreign exchange transactions take place either through the Peoples’ Bank of China (“PBOC”) or other authorized financial institutions at exchange rates quoted by PBOC. Approval of foreign currency payments by the PBOC or other regulatory institutions requires submitting a payment application form together with suppliers’ invoices and signed contracts.

The value of RMB is subject to changes in central government policies and to international economic and political developments affecting supply and demand in the China Foreign Exchange Trading System market. Where there is a significant change in value of RMB, the gains and losses resulting from translation of financial statements of a foreign subsidiary will be significantly affected.

20

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Balance sheet items, except for equity accounts | ||||||||

| For the six months ended June 30, | ||||||||

| 2024 | 2023 | |||||||

| Items in the statements of operations and comprehensive income (loss), and statements of cash flows | ||||||||

(4) Economic and political risks

The Company’s operations are conducted in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environment in the PRC, and by the general state of the PRC economy.

(5) Risks related to industry

The Company sells precious products to customers through our industrial relationship. Sales contracts are entered into with each customer. The Company is the principal under the precious metal direct sales model as the Company controls the products with the ability to direct the use of, and obtain all the remaining benefits from the precious metal products substantially before they are sold to its customers. The Company has a single performance obligation to sell metal products to the buyers. The Company estimates the amount of variable consideration, including sales return using the expected value method and includes variable consideration in the transaction price to the extent that it is probable that a significant reversal will not occur. Revenue for precious metal trading under the direct sales model is recognized at a point in time when the single performance obligation is satisfied when the products are delivered to the customer. We are under the risk of the economic environment in general and specific to the precious metal industry and China as well as changes to the existing governmental regulations.

Commodity trading in China is subject to seasonal fluctuations, which may cause our revenues to fluctuate from quarter to quarter. We generally experience less user traffic and purchase orders during national holidays in China, particularly during the Chinese New Year holiday season in the first quarter of each year. Consequently, the first quarter of each calendar year generally contributes the smallest portion of our annual revenues. Furthermore, as we are substantially dependent on sales of precious metals, our quarterly revenues and results of operations are likely to be affected by price fluctuation under macroeconomic circumstances these years.

As our revenues have grown rapidly in recent years, these factors are difficult to discern based on our historical results, which, therefore, should not be relied on to predict our future performance. Our financial condition and results of operations for future periods may continue to fluctuate. As a result, the trading price of our stock may fluctuate from time to time due to seasonality.

19. SUBSEQUENT EVENTS

The Company has reviewed its operations for potential disclosure or financial statement impacts related to events occurring after June 30, 2024, but prior to the release of the unaudited consolidated financial statements contained in this quarterly report on Form 10-Q were issued.

There were no additional subsequent event disclosures or financial statement impacts related to events occurring after June 30, 2024 that warranted adjustment to or disclosure in these unaudited consolidated financial statements.

21

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

As of June 30, 2024, the Company had two business lines, which are the commodities trading business and supply chain management services.

Commodities trading business

The commodities trading business primarily involves purchasing non-ferrous metal products, such as aluminum ingots, copper, silver, and gold, from metal and mineral suppliers and then selling to customers. In connection with the Company’s commodity sales, in order to help customers to obtain sufficient funds to purchase various metal products and also help upstream metal and mineral suppliers to sell their metal products, the Company launched its supply chain management service in December 2019. The Company primarily generates revenues from selling bulk non-ferrous commodity products and providing related supply chain management services in the PRC.

For the six months ended June 30, 2024, the Company recorded revenue of $54,552,223 from its commodities trading business and $2,811 from its supply chain management services, respectively.

The Company sources bulk commodity products from non-ferrous metal and mines or its designated distributors and then sells to manufacturers who need these metals in large quantities. The Company works with suppliers in the sourcing of commodities. Major suppliers include various metal and mineral suppliers such as Kunsteel Group, Baosteel Group, Aluminum Corporate of China Limited, Yunnan Benyuan, Yunnan Tin, and Shanghai Copper. The Company’s target customers include large infrastructure companies such as China National Electricity, Datang Power, China Aluminum Foshan International Trade, Tooke Investment (China), CSSC International Trade Co., Ltd., Shenye Group, and Keliyuan.

Supply Chain Management Services

We offer a distribution service to bulk suppliers of precious metals by acting as a sales intermediary, procuring small to medium-sized buyers through our own professional sales team and channels and distributing the bulk precious metals of the suppliers. Upon executing a purchase order from our sourced buyers, we charge the suppliers a commission fee ranging from 1% to 2% of the distribution order, depending on the size of the order. We also offer some other supply chain management services business. For the six months ended June 30, 2024, the Company generated revenue from supply chain management services of $2,811 from three third-party customers, compared with a commodity distribution services revenue of $35,407 with four third-party customers for the same period in 2023.

Competition

The Company mainly competes against other large domestic commodity metal product trading service providers such as Xiamen International Trade and Yijian Shares. Currently, the principal competitive factors in the non-ferrous metal commodities trading business are price, product availability, quantity, service, and financing terms for purchases and sales of commodities.

Applicable Government Regulations

Shenzhen Baiyu Jucheng has obtained all material approvals, permits, licenses and certificates required for our metal product trading operations, including registrations from the local business and administrative department authorizing the purchase of raw materials.

Key Factors Affecting Our Results of Operation

The commodities trading industry has been experiencing decreasing demand as a result of China’s overall economic slowdown. We expect competition in the commodities trading business to persist and intensify.

We commenced our commodities trading business in late November 2019. Over the past five years, we have expanded our operations and diversified our product offerings. Our future success depends on our ability to sustain growth and maintain profitability. Our limited operating history makes it difficult to evaluate our business and future prospects. Our future prospects may face risks and challenges typically encountered by a company with a limited operating history in an emerging and rapidly evolving industry, including, among other things,

| ● | Profitability: Maintaining and enhancing our profitability through efficient operations and cost management; |

| ● | Competitive Position: Strengthening our competitive position in the commodities trading industry in China by leveraging our established networks and market knowledge. |

22

| ● | Strategic Implementation: Effectively implementing our growth strategies and adapting to market competition and customer preferences, including potential expansion into new geographical markets.; and |

| ● | Human Resources: Successfully recruiting, training, and retaining qualified managerial and other personnel to support our growth and operational needs. |

Our business requires a significant amount of capital, particularly for the purchase of bulk commodities and expansion into new markets where we currently do not have operations. We continue to seek opportunities to optimize our operations, improve financial performance, and manage risks associated with our business.

Results of Operations

Three Months Ended June 30, 2024 as Compared to Three Months Ended June 30, 2023

| For the Three Months Ended June 30, | Change | |||||||||||||||

| 2024 | 2023 | Amount | % | |||||||||||||

| Revenues | ||||||||||||||||

| - Sales of commodity products – third parties | $ | 26,462,542 | $ | 34,483,239 | $ | (8,020,697 | ) | (23 | )% | |||||||

| - Supply chain management services | 345 | 29,057 | (28,712 | ) | (99 | )% | ||||||||||

| Total Revenues | 26,462,887 | 34,512,296 | (8,049,409 | ) | (23 | )% | ||||||||||

| Cost of revenues | ||||||||||||||||

| - Commodity product sales – third parties | (26,491,421 | ) | (34,537,021 | ) | 8,045,600 | (23 | )% | |||||||||

| - Supply chain management services | - | (23,343 | ) | 23,343 | (100 | )% | ||||||||||

| Total operating cost | (26,491,421 | ) | (34,560,364 | ) | 8,068,943 | (23 | )% | |||||||||

| Gross loss | (28,534 | ) | (48,068 | ) | 19,534 | (41 | )% | |||||||||

| Operating expenses | ||||||||||||||||

| Selling, general, and administrative expenses | (2,363,888 | ) | (8,330,851 | ) | 5,966,963 | (72 | )% | |||||||||

| Total operating expenses | (2,363,888 | ) | (8,330,851 | ) | 5,966,963 | (72 | )% | |||||||||

| Other income, net | ||||||||||||||||

| Interest income | 6,489,635 | 4,908,288 | 1,581,347 | 32 | % | |||||||||||

| Interest expenses | (108,160 | ) | (113,235 | ) | 5,075 | (4 | )% | |||||||||

| Amortization of beneficial conversion feature relating to convertible promissory notes | - | (264,390 | ) | 264,390 | (100 | )% | ||||||||||

| Other loss, net | (28,631 | ) | (5,620 | ) | (23,011 | ) | 409 | % | ||||||||

| Total other income, net | 6,352,844 | 4,525,043 | 1,827,801 | 40 | % | |||||||||||

| Net income (loss) before income taxes | 3,960,422 | (3,853,876 | ) | 7,814,298 | 203 | % | ||||||||||

| Income tax expenses | (1,379,637 | ) | (984,354 | ) | (395,283 | ) | 40 | % | ||||||||

| Net income (loss) | $ | 2,580,785 | $ | (4,838,230 | ) | $ | 7,419,015 | 153 | % | |||||||

23

Revenue

For the three months ended June 30, 2024, we generated revenue from the following two sources, including (1) revenue from sales of commodity products, and (2) revenue from supply chain management services. Total revenue decreased by $8,049,409 or 23%, from $34,512,296 for the three months ended June 30, 2023 to $26,462,887 for the three months ended June 30, 2024, among which revenue from commodity trading and supply chain management accounted for 99.99% and 0.01% of our total revenue for the three months ended June 30, 2024. For the three months ended June 30, 2023, revenue from commodity trading and supply chain management accounted for 99.90% and 0.10% of our total revenue for the three months ended June 30, 2023. The decrease was mainly affected by the market environment: the industry was in a situation of both weak supply and weak demand, and the internal competition was also fierce.

| (1) | Revenue from sales of commodity products |

For the three months ended June 30, 2024, the Company sold non-ferrous metals to fourteen third-party customers at fixed prices compared with thirteen third-party customers for the same period in 2023, and earned revenues when the product ownership was transferred to its customers. The Company earned revenues of $26,462,542 from sales of commodity products for the three months ended June 30, 2024 compared with $34,483,239 for the three months ended June 30, 2023, with a decrease of $8,020,697 or 23%. The decrease of revenue from sales of commodity products is mainly due to the decrease in the average unit sales price of zinc ingots from $3.23 per kilogram for the three months ended June 30, 2023 to $2.59 per kilogram for the three months ended June 30, 2024. And based on a downward trend in FY2024, the annual consumption of zinc plating in China is declining year by year.

| (2) | Revenue from supply chain management services |

In connection with the Company’s commodity sales, in order to help customers to obtain sufficient funds to purchase various metal products and also help upstream metal and mineral suppliers sell their metal products, the Company launched its supply chain management service business in December 2019, which primarily consisted of loan recommendation services and distribution services.

For the three months ended June 30, 2024, the Company recorded revenue of $345 from supply chain management services to third-party customers, compared with $29,057 to third-party customers for the same period in 2023. The decrease in revenue from sales of commodity products is mainly due to the downsizing of the zinc plating market, coupled with a reduction in customers amid fierce competition.

Cost of revenue

Our cost of revenue primarily includes the cost of revenue associated with commodity product sales and the cost of revenue associated with management services of the supply chain. Total cost of revenue decreased by $8,068,943 or 23% from $34,560,364 for the three months ended June 30, 2023 to $26,491,421 for the three months ended June 30, 2024. The decreased cost of revenue is in line with the decrease in revenue.

Cost of revenue associated with commodity trading

The cost of revenue primarily consists of purchase costs of non-ferrous metal products. For the three months ended June 30, 2024, the Company purchased non-ferrous metal products of $26,491,421 from 11 third-party vendors compared with $34,537,021 from 11 third-party vendors for the three months ended June 30, 2023, mainly because the industry was in a situation of weak supply.

24

Selling, general, and administrative expenses

Selling, general and administrative expenses decreased from $8,330,851 for the three months ended June 30, 2023 to $2,363,888 for the three months ended June 30, 2024, representing a decrease of $5,966,963, or 72%. Selling, general and administrative expenses primarily consisted of salary and employee benefits, office rental expenses, amortizations of intangible assets and convertible notes, professional service fees and finance offering related fees. The decrease was mainly attributable to stock-based compensation expenses of $5,698,000 resulting from the issuance a total of 11,000,000 shares of common stock to service providers for the three months ended June 30, 2023 in comparison to zero in such expenses for the three months ended June 30, 2024.

Interest income

Interest income was primarily generated from loans made to third parties and related parties. For the three months ended June 30, 2024, interest income was $6,489,635 representing an increase of $1,581,347, or 32% from $4,908,288 for the three months ended June 30, 2023. The increase was due to the growth of loans made to third party vendors for the three months ended June 30, 2024. The balance of loan receivables was $290.61 million as of June 30, 2024 which was $50.18 million higher than that as of June 30, 2023.

Amortization of beneficial conversion feature and relative fair value of warrants relating to convertible promissory notes

For the three months ended June 30, 2024, the item represented the amortization of beneficial conversion feature of nil relating to the convertible promissory notes.

For the three months ended June 30, 2023, the item represented the amortization of beneficial conversion feature of $264,390 relating to the convertible promissory notes.

Net income (loss)

As a result of the foregoing, net income for the three months ended June 30, 2024 was $2,580,785, representing an increase of $7,419,015 from net loss of $4,838,230 for the three months ended June 30, 2023.

Six Months Ended June 30, 2024 as Compared to Six Months Ended June 30, 2023

| For the Six Months Ended June 30, | Change | |||||||||||||||

| 2024 | 2023 | Amount | % | |||||||||||||

| Revenues | ||||||||||||||||

| - Sales of commodity products – third parties | $ | 54,552,223 | $ | 69,054,527 | $ | (14,502,304 | ) | (21 | )% | |||||||

| - Supply chain management services | 2,811 | 35,407 | (32,596 | ) | (92 | )% | ||||||||||

| Total Revenues | 54,555,034 | 69,089,934 | (14,534,900 | ) | (21 | )% | ||||||||||

| Cost of revenues | ||||||||||||||||

| - Commodity product sales – third parties | (54,636,244 | ) | (69,190,260 | ) | 14,554,016 | (21 | )% | |||||||||

| - Supply chain management services | (16 | ) | (23,383 | ) | 23,367 | (100 | )% | |||||||||

| Total operating cost | (54,636,260 | ) | (69,213,643 | ) | 14,577,383 | (21 | )% | |||||||||

| Gross loss | (81,226 | ) | (123,709 | ) | 42,483 | (34 | )% | |||||||||

| Operating expenses | ||||||||||||||||

| Selling, general, and administrative expenses | (5,071,071 | ) | (11,073,912 | ) | 6,002,841 | (54 | )% | |||||||||

| Total operating expenses | (5,071,071 | ) | (11,073,912 | ) | 6,002,841 | (54 | )% | |||||||||

| Other income, net | ||||||||||||||||

| Interest income | 12,759,098 | 9,357,288 | 3,401,810 | 36 | % | |||||||||||

| Interest expenses | (229,598 | ) | (223,222 | ) | (6,376 | ) | 3 | % | ||||||||

| Amortization of beneficial conversion feature relating to convertible promissory notes | (92,552 | ) | (485,042 | ) | 392,490 | (81 | )% | |||||||||

| Other loss, net | (2,713 | ) | (1,097 | ) | (1,616 | ) | 147 | % | ||||||||

| Total other income, net | 12,434,235 | 8,647,927 | 3,786,308 | 44 | % | |||||||||||

| Net income (loss) before income taxes | 7,281,938 | (2,549,694 | ) | 9,831,632 | 386 | % | ||||||||||

| Income tax expenses | (2,702,351 | ) | (1,837,259 | ) | (865,092 | ) | 47 | % | ||||||||

| Net income (loss) | $ | 4,579,587 | $ | (4,386,953 | ) | $ | 8,966,540 | 204 | % | |||||||

25

Revenue

For the six months ended June 30, 2024, we generate revenue from the following two sources, including (1) revenue from sales of commodity products, and (2) revenue from supply chain management services. Total revenue decreased by $14,534,900 or 21%, from $69,089,934 for the six months ended June 30, 2023 to $54,555,034 for the six months ended June 30, 2024, among which revenue from sales of commodity products and supply chain management accounted for 99.99% and 0.01%, respectively. The decrease was mainly affected by the market environment: the industry was in a situation of both weak supply and weak demand, and the internal competition was also fierce.

| (1) | Revenue from sales of commodity products |

For the six months ended June 30, 2024, the Company sold non-ferrous metals to fourteen third-party customers at fixed prices compared with thirteen third-party customers for the same period in 2023, and earned revenues when the product ownership was transferred to its customers. The Company earned revenues of $54,552,223 from sales of commodity products for the six months ended June 30, 2024 compared with $69,054,527 for the six months ended June 30, 2023, with a decrease of $14,502,304 or 21%. The decrease of revenue from sales of commodity products is mainly due to the decrease in the average unit sales price of zinc ingots from $3.32 per kilogram for the six months ended June 30, 2023 to $2.76 per kilogram for the six months ended June 30, 2024. And based on a downward trend in FY2024, the annual consumption of zinc plating in China is declining year by year.

| (2) | Revenue from supply chain management services |

In connection with the Company’s commodity sales, in order to help customers to obtain sufficient funds to purchase various metal products and also help upstream metal and mineral suppliers sell their metal products, the Company launched its supply chain management service business in December 2019, which primarily consisted of loan recommendation services and distribution services.

For the six months ended June 30, 2024, the Company recorded revenue of $2,811 from supply chain management services to third-party customers compared with $35,407 to third-party customers for the same period in 2023. The decrease in revenue from sales of commodity products is mainly due to the downsizing of the zinc plating market, as well as less customers in the fierce competition.

Cost of revenue

Our cost of revenue primarily includes the cost of revenue associated with commodity product sales and the cost of revenue associated with management services of the supply chain. Total cost of revenue decreased by $14,577,383 or 21% from $69,213,643 for the six months ended June 30, 2023 to $54,636,260 for the six months ended June 30, 2024. The decreased cost of revenue is in line with the decrease in revenue.

Cost of revenue associated with commodity trading

The cost of revenue primarily consists of purchase costs of non-ferrous metal products.

For the six months ended June 30, 2024, the Company purchased non-ferrous metal products of $54,636,244 from 11 third-party vendors compared with $69,190,260 from 11 third-party vendors for the six months ended June 30, 2023.

26

Selling, general, and administrative expenses

Selling, general and administrative expenses decreased from $11,073,912 for the six months ended June 30, 2023 to $5,071,071 for the six months ended June 30, 2024, representing a decrease of $6,002,841, or 54%. Selling, general and administrative expenses primarily consisted of salary and employee benefits, office rental expenses, amortizations of intangible assets and convertible notes, professional service fees and finance offering related fees. The decrease was mainly attributable to stock-based compensation expenses of $5,698,000 resulting from the issuance a total of 11,000,000 shares of common stock to service providers for the six months ended June 30, 2023 in comparison to zero in such expenses for the six months ended June 30, 2024.

Interest income

Interest income was primarily generated from loans made to third parties and related parties. For the six months ended June 30, 2024, interest income was $12,759,098 representing an increase of $3,401,810, or 36% from $9,357,288 for the six months ended June 30, 2023. The increase was due to the growth of loans made to third party vendors for the six months ended June 30, 2024.

Amortization of beneficial conversion feature and relative fair value of warrants relating to convertible promissory notes

For the six months ended June 30, 2024, the item represented the amortization of beneficial conversion feature of $92,552 relating to the convertible promissory notes.

For the six months ended June 30, 2023, the item represented the amortization of beneficial conversion feature of $485,042 relating to the convertible promissory notes.

Net income (loss)

As a result of the foregoing, net income for the six months ended June 30, 2024 was $ 4,579,587, representing an increase of $8,966,540 from negative $4,386,953 for the six months ended June 30, 2023.

Cash Flows and Capital Resources

We have financed our operations primarily through shareholder contributions, cash flow from operations, borrowings from third parties and related parties, and equity financing through private placement and public offerings.

As reflected in the accompanying unaudited consolidated financial statements, for the six months ended June 30, 2024, the Company reported cash outflows of $34,598,947 from operating activities. As of June 30, 2024, the Company has working capital of approximately $261.97 million.

During the six months ended June 30, 2024, the cash used in investing activities was $668.

The Company expects to use the proceeds from the equity financing as working capital to expand its commodities trading business.

Based on the foregoing capital market activities, the management believes that the Company will continue as a going concern in the following 12 months.

27

Statement of Cash Flows

The following table sets forth a summary of our cash flows. For the six months ended June 30, 2024 and 2023, respectively:

| For the six months Ended June 30, |

||||||||

| 2024 | 2023 | |||||||

| Net Cash (Used in)/Provided by Operating Activities | $ | (34,598,947 | ) | $ | 7,181,538 | |||

| Net Cash Used in Investing Activities | (668 | ) | (51,297,876 | ) | ||||

| Net Cash Provided by Financing Activities | 36,900,000 | 45,909,073 | ||||||

| Effect of exchange rate changes on cash and cash equivalents | (3,561,043 | ) | (1,407,011 | ) | ||||

| Net (decrease)/increase in cash and cash equivalents | (1,260,658 | ) | 385,724 | |||||

| Cash and cash equivalents at beginning of period | 1,516,358 | 893,057 | ||||||

| Cash and cash equivalents at end of period | $ | 255,700 | $ | 1,278,781 | ||||

Net Cash Used in Operating Activities

During the six months ended June 30, 2024, we had a cash outflow from operating activities of $34,598,947, a decrease of $41,780,485 from a cash inflow of $7,181,538 for the six months ended June 30, 2023. We incurred a net income for the six months ended June 30, 2024 of $4,579,587, an increase of $8,966,540 from the six months ended June 30, 2023, during which we recorded a net loss of $4,386,953.

In addition to the change in profitability, the increase in net cash used in operating activities was the result of several factors, including:

| ● | Non-cash effects adjustments include amortization of beneficial conversion feature of convertible promissory notes of $92,552, amortization of intangible assets of $3,980,926, accrual convertible interest expense of $215,428 and amortization of discount on convertible promissory notes of $66,667. |

| ● | An increase of $7,010,798 of advances from customers due to increase of revenue. |

| ● | A decrease of $5,424,107 of advances to suppliers due to increase of purchase. |

| ● | A decrease of $50,799,780 of loan receivables due to increase of funds lending to upstream industries. |

Net Cash Used in Investing Activities

Net cash used in investing activities for the six months ended June 30, 2024 was $668 as compared to net cash used in investing activities of $51,297,876 for the six months ended June 30, 2023.

The cash used in investing activities for the six months ended June 30, 2023 was mainly for the loans disbursed to third parties of $122,487,487, partly offset by the collected loans from third partis of $71,203,793.

28

Net Cash Provided by Financing Activities

During the six months ended June 30, 2024, the cash provided by financing activities was mainly attributable to cash raised of $36,900,000 from the issuance of 30,000 shares of common stock.

During the six months ended June 30, 2023, the cash provided by financing activities was mainly attributable to cash raised of $42,350,000 from the issuance of 35,000,000 shares of common stock, cash raised of $559,073 from the issuance of 689,306 shares of common stock, cash raised of $3,000,000 from the issuance of unsecured senior convertible promissory notes in the aggregate principal amount of $3,320,000.

Off-balance Sheet Arrangements

We did not have any off-balance sheet arrangements as of June 30, 2024.

Contractual Obligations

As of June 30, 2024, the Company had one lease arrangement with an unrelated third party. The lease term is 24 months, which will expire in November 2024. As of the date of this report, the Company cannot reasonably assess whether it will renew the lease term. The lease commitment was as following table:

| Less than | ||||||||||||||||

| Total | 1 year | 1-2 years | Thereafter | |||||||||||||

| Contractual obligations: | ||||||||||||||||

| Operating lease | $ | 4,092 | $ | 4,092 | $ | - | $ | - | ||||||||

| Total | $ | 4,092 | $ | 4,092 | $ | - | $ | - | ||||||||

Critical Accounting Policies

Please refer to Note 2 of the Condensed Consolidated Financial Statements included in this Form 10-Q for details of our critical accounting policies.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Based on an evaluation under the supervision and with the participation of the Company’s management, the Company’s principal executive officer and principal financial officer have concluded that the Company’s disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act were not effective as of June 30, 2024.

29

Certain personnel primarily responsible for preparing our financial statements require additional requisite levels of knowledge, experience and training in the application of U.S. GAAP commensurate with our financial reporting requirements. The management thought that in light of the inexperience of our accounting staff with respect to the requirements of U.S. GAAP-based reporting and SEC rules and regulations, we did not maintain effective controls and did not implement adequate and proper supervisory review to ensure that significant internal control deficiencies can be detected or prevented.

Management’s assessment of the control deficiency over accounting and finance personnel as of June 30, 2024 includes:

| ● | our lack of sufficient financial reporting and accounting personnel with appropriate knowledge of the U.S. GAAP and the SEC reporting requirements to properly address complex U.S. GAAP accounting issues and to prepare and review consolidated financial statements and related disclosures to fulfill U.S. GAAP and SEC financial reporting requirements. |

| ● | our lack of comprehensive accounting policies and procedures manual in accordance with U.S. GAAP. Neither we nor our independent registered public accounting firm undertook a comprehensive assessment of our internal control for purposes of identifying and reporting material weaknesses and other deficiencies in our internal control over financial reporting. Had we performed a formal assessment of our internal control over financial reporting or had our independent registered public accounting firm performed an audit of our internal control over financial reporting, additional deficiencies may have been identified. |

Following the identification of the material weaknesses and control deficiencies, we have taken the following remedial measures: engaging an external consulting firm to assist us with assessment of Sarbanes-Oxley compliance requirements and improvement of overall internal control.