Exhibit 99.1

Investors and Media:

Jonathan Lock & Ryan Rendino

(630) 824-1987

SUNCOKE ENERGY PARTNERS, L.P. ANNOUNCES STRONGEST EVER

QUARTERLY OPERATING PERFORMANCE WITH THIRD QUARTER 2017 RESULTS

| • | Net income attributable to SXCP was $22.6 million in the third quarter 2017, up $1.3 million versus the same prior year period |

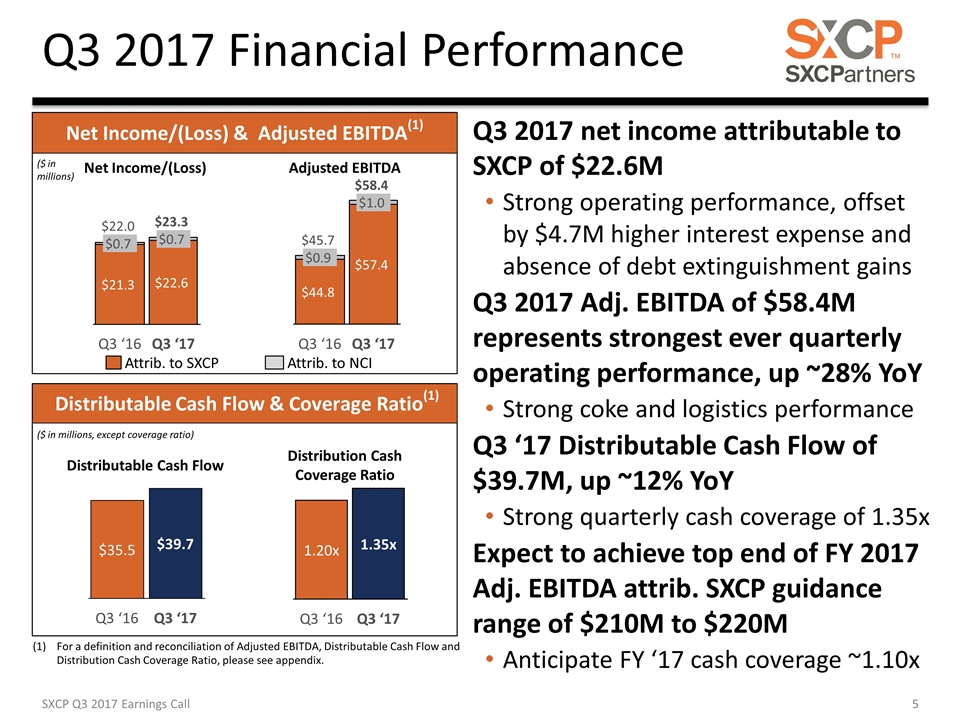

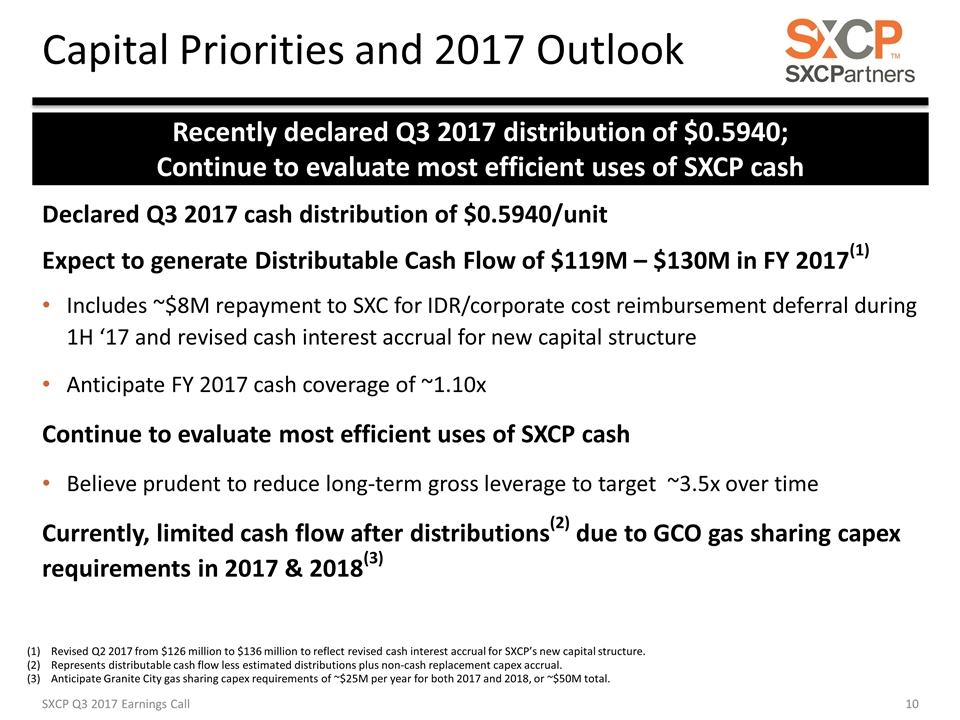

| • | Adjusted EBITDA attributable to SXCP was $57.4 million for the quarter, up $12.6 million or ~28% versus the prior year period due to higher sales volumes in our logistics business as well as improved coke performance |

| • | Declared third quarter 2017 distribution of $0.5940 per unit; third quarter 2017 Distributable Cash Flow (“DCF”) and Distribution Cash Coverage Ratio (“Cash Coverage”) of $39.7 million and 1.35x, respectively |

| • | Handled first shipment of crushed stone (aggregates) for new customer at CMT facility; also successfully handled first trial shipments of rail-borne petcoke in early-October |

| • | Well positioned to achieve top end of full-year 2017 Adjusted EBITDA attributable to SXCP guidance of $210 million to $220 million |

Lisle, Ill. (October 26, 2017) - SunCoke Energy Partners, L.P. (NYSE: SXCP) today reported results for the third quarter 2017, which reflect strong operating results across SXCP’s coke and logistics businesses. The third quarter also benefited from the timing of scheduled outages at our cokemaking facilities.

“Our third quarter operating performance was the best in SXCP’s history after adjusting for the timing impact related to Convent’s deferred revenue in the fourth quarter of each year,” said Fritz Henderson, Chairman, President and Chief Executive Officer of SunCoke Energy, Inc. “This record-setting quarter, coupled with our performance in the first half of the year, position us to achieve the top end our full-year 2017 Adjusted EBITDA guidance.”

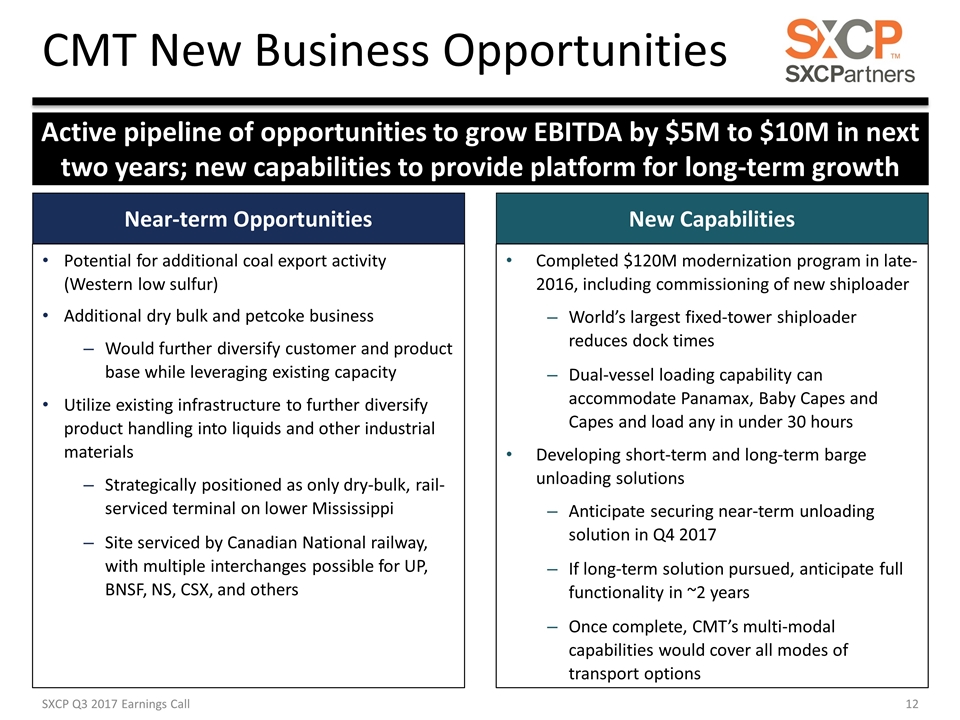

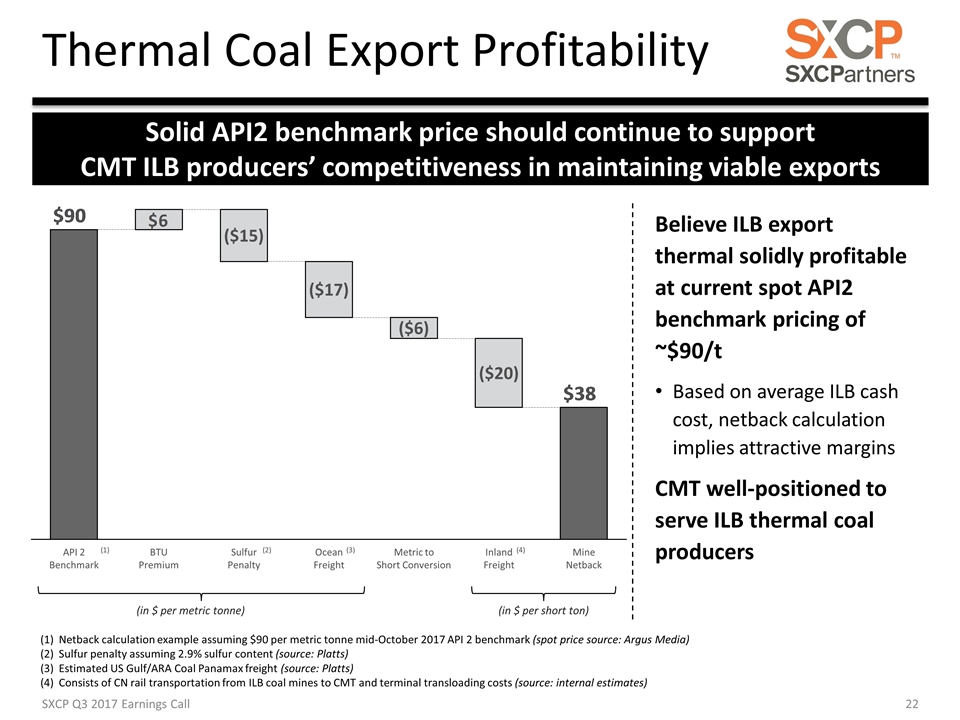

During the quarter, SunCoke’s Convent Marine Terminal received its first shipment of crushed stone (aggregates) under a multi-year contract with firm use commitments. In addition, the terminal also successfully handled its first trial shipments of rail-borne petcoke for two refinery customers in early-October.

Henderson continued, “Our team has aggressively pursued new opportunities for diversifying our product and customer mix since acquiring Convent in mid-2015, and we are pleased with the progress we have made over the last few quarters. Going forward, we believe that we can leverage the terminal’s capabilities to enter new vertical markets, expand existing products and grow Adjusted EBITDA by $5 million to $10 million over the next two years.”

THIRD QUARTER RESULTS

| Three Months Ended September 30, | ||||||||||||

| (Dollars in millions) |

2017 | 2016 | Increase/ (Decrease) |

|||||||||

| Revenues |

$ | 214.0 | $ | 185.5 | $ | 28.5 | ||||||

| Adjusted EBITDA(1) |

$ | 58.4 | $ | 45.7 | $ | 12.7 | ||||||

| Net (loss) income attributable to SXCP |

$ | 22.6 | $ | 21.3 | $ | 1.3 | ||||||

| (1) | See definition of Adjusted EBITDA and reconciliation elsewhere in this release. |

Revenues in third quarter 2017 increased $28.5 million from the same prior year period, reflecting the pass-through of higher coal prices in our Domestic Coke segment as well as higher sales volumes in our Coal Logistics segment.

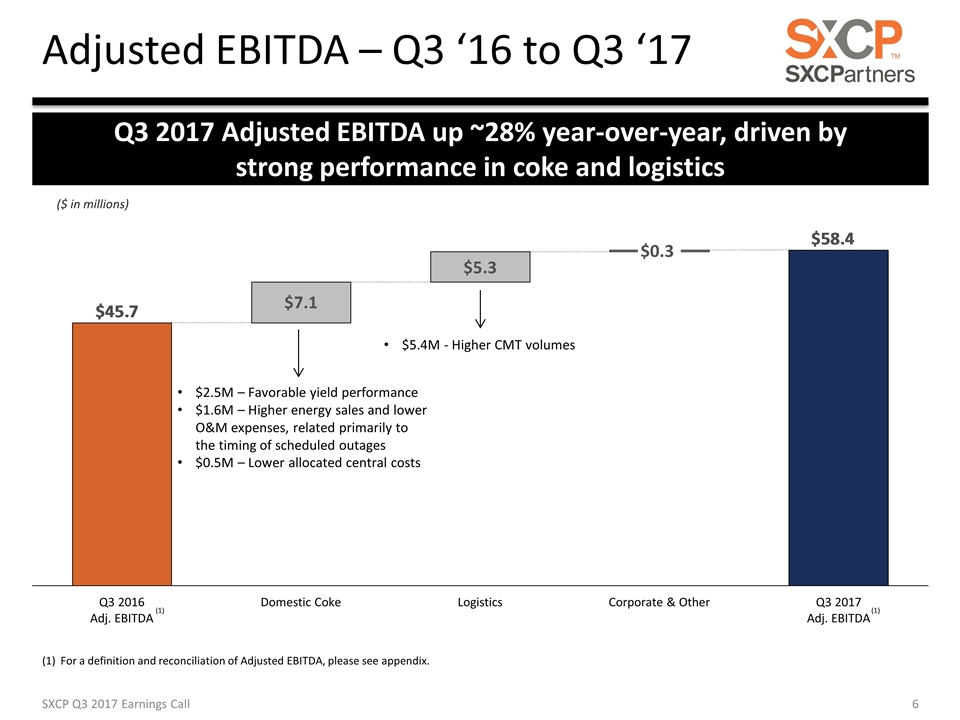

Adjusted EBITDA in the quarter increased $12.7 million primarily due to improved performance at our Domestic Coke segment as well as higher sales volumes in our Coal Logistics segment compared to the same prior year period.

Net income attributable to SXCP in the third quarter 2017 was $22.6 million, up slightly from the same prior year period. The improved operating results discussed above were partially offset by a $4.7 million unfavorable impact of higher interest expense and the absence of extinguishment gains in the current year period associated with our debt activities in both years. Further offsetting our favorable operating performance was slightly higher depreciation expense in the current year, partially related to the installation of our the new shiploader at CMT, and higher taxes associated with the increase in Illinois state tax rates during the third quarter of 2017.

THIRD QUARTER SEGMENT INFORMATION

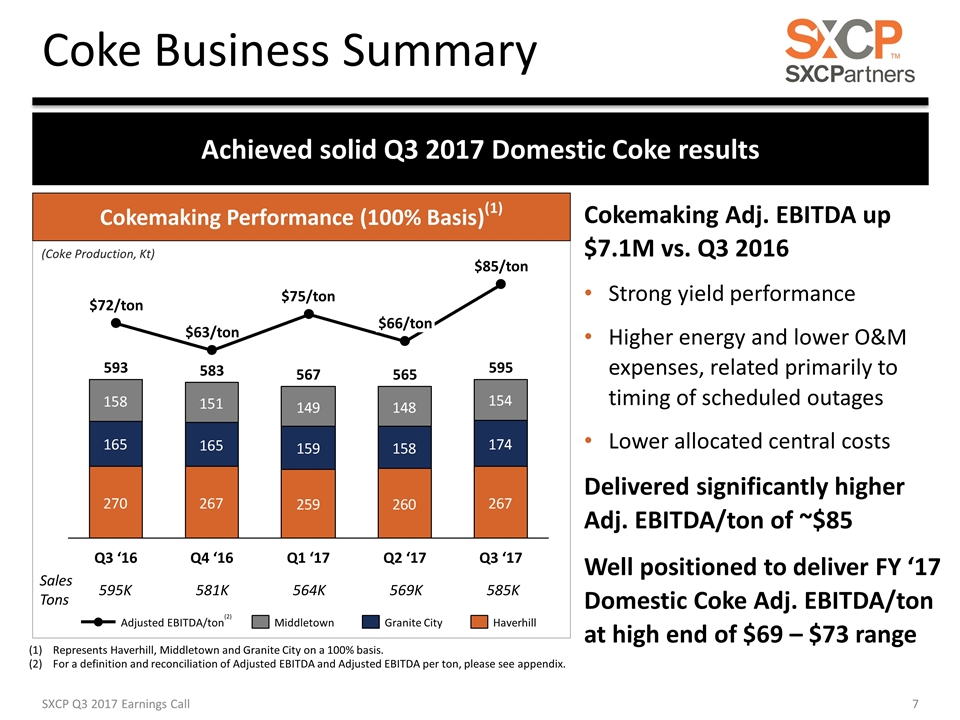

Domestic Coke

Domestic Coke consists of cokemaking facilities and heat recovery operations at our Haverhill, Middletown and Granite City cokemaking facilities, located in Franklin Furnace and Middletown, Ohio, and Granite City, Illinois, respectively.

| Three Months Ended September 30, | ||||||||||||

| (Dollars in millions, except per ton amounts) |

2017 | 2016 | Increase/ (Decrease) |

|||||||||

| Revenues |

$ | 193.4 | $ | 170.8 | $ | 22.6 | ||||||

| Adjusted EBITDA(1) |

$ | 50.0 | $ | 42.9 | $ | 7.1 | ||||||

| Sales Volume (thousands of tons) |

585 | 595 | (10 | ) | ||||||||

| Adjusted EBITDA per ton(2) |

$ | 85.47 | $ | 72.10 | $ | 13.37 | ||||||

| (1) | See definition of Adjusted EBITDA and reconciliation elsewhere in this release. |

| (2) | Reflects Domestic Coke Adjusted EBITDA divided by Domestic Coke sales volumes. |

| • | Revenues increased $22.6 million, reflecting the pass-through of higher coal prices. |

| • | Adjusted EBITDA increased $7.1 million, reflecting an improved operating performance driven by favorable coal-to-coke yields, which increased Adjusted EBITDA $2.5 million, the favorable benefit of a portion of our 2017 outage costs falling outside of the third quarter and a lower allocation of costs from SunCoke. |

2

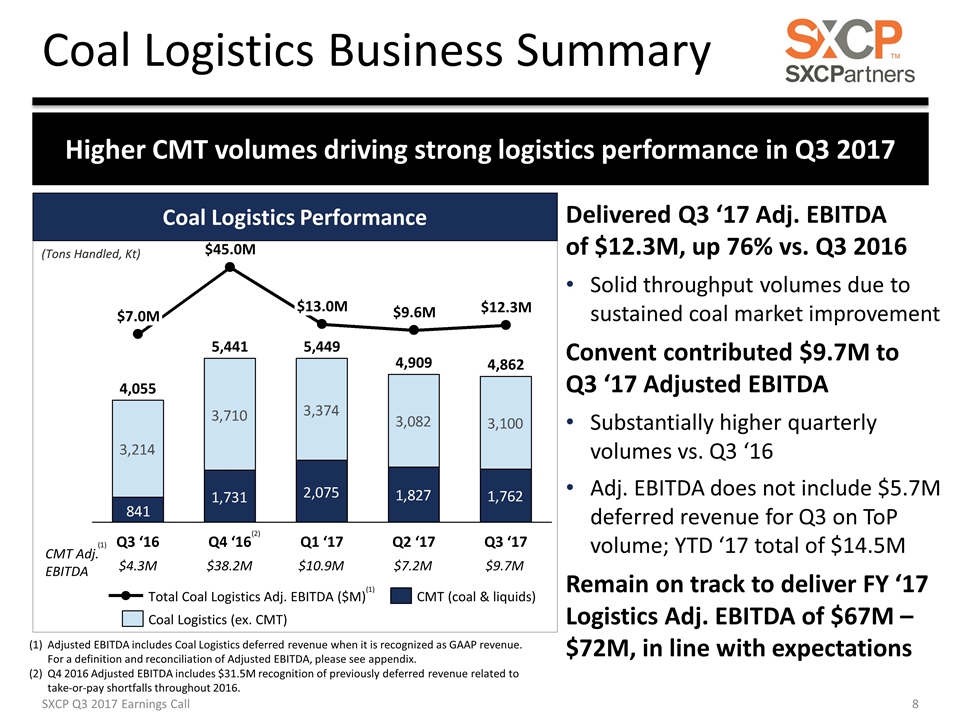

Coal Logistics

Coal Logistics consists of the coal handling and mixing services operated by SXCP at Convent Marine Terminal (“CMT”) located on the Mississippi river in Louisiana, Lake Terminal in East Chicago, Indiana and Kanawha River Terminals, LLC (“KRT”), which has terminals along the Ohio and Kanawha rivers in West Virginia.

| Three Months Ended September 30, | ||||||||||||

| (Dollars in millions, except per ton amounts) |

2017 | 2016 | Increase/ (Decrease) |

|||||||||

| Revenues |

$ | 20.6 | $ | 14.7 | $ | 5.9 | ||||||

| Intersegment sales |

$ | 1.6 | $ | 1.5 | $ | 0.1 | ||||||

| Adjusted EBITDA(1) |

$ | 12.3 | $ | 7.0 | $ | 5.3 | ||||||

| Tons handled (thousands of tons)(2) |

4,862 | 4,055 | 807 | |||||||||

| CMT take-or-pay shortfall tons (thousands of tons)(3) |

1,005 | 1,748 | (743 | ) | ||||||||

| (1) | See definition of Adjusted EBITDA and reconciliation elsewhere in this release. |

| (2) | Reflects inbound tons handled during the period. |

| (3) | Reflects tons billed under take-or-pay contracts where services have not yet been performed. |

| • | Revenues and Adjusted EBITDA were up $5.9 million and $5.3 million, respectively, driven by higher sales volumes at our CMT terminal in the current year period, which included a nominal amount of business from new customers. |

Corporate and Other

Corporate and other expenses were $3.9 million, an improvement over the prior year period of $0.3 million, reflecting favorable period-over-period mark-to-market adjustments in deferred compensation caused by changes in the Partnership’s unit price.

3

RELATED COMMUNICATIONS

We will host our quarterly earnings call at 10:00 a.m. Eastern Time (9:00 a.m. Central Time) today. The conference call will be webcast live and archived for replay in the Investors section of www.suncoke.com. Investors may participate in this call by dialing 1-833-236-5757 in the U.S. or 1-647-689-4185 if outside the U.S., confirmation code 89455983.

SUNCOKE ENERGY PARTNERS, L.P.

SunCoke Energy Partners, L.P. (NYSE: SXCP) is a publicly traded master limited partnership that manufactures high-quality coke used in the blast furnace production of steel and provides export and domestic coal handling services to the coke, coal, steel and power industries. In our cokemaking business, we utilize an innovative heat-recovery technology that captures excess heat for steam or electrical power generation and have long-term, take-or-pay coke contracts that pass through commodity and certain operating costs. Our coal handling terminals have the collective capacity to blend and transload more than 35 million tons of coal each year and are strategically located to reach Gulf Coast, East Coast, Great Lakes and international ports. SXCP’s General Partner is a wholly owned subsidiary of SunCoke Energy, Inc. (NYSE: SXC), which has more than 50 years of cokemaking experience serving the integrated steel industry. To learn more about SunCoke Energy Partners, L.P., visit our website at www.suncoke.com.

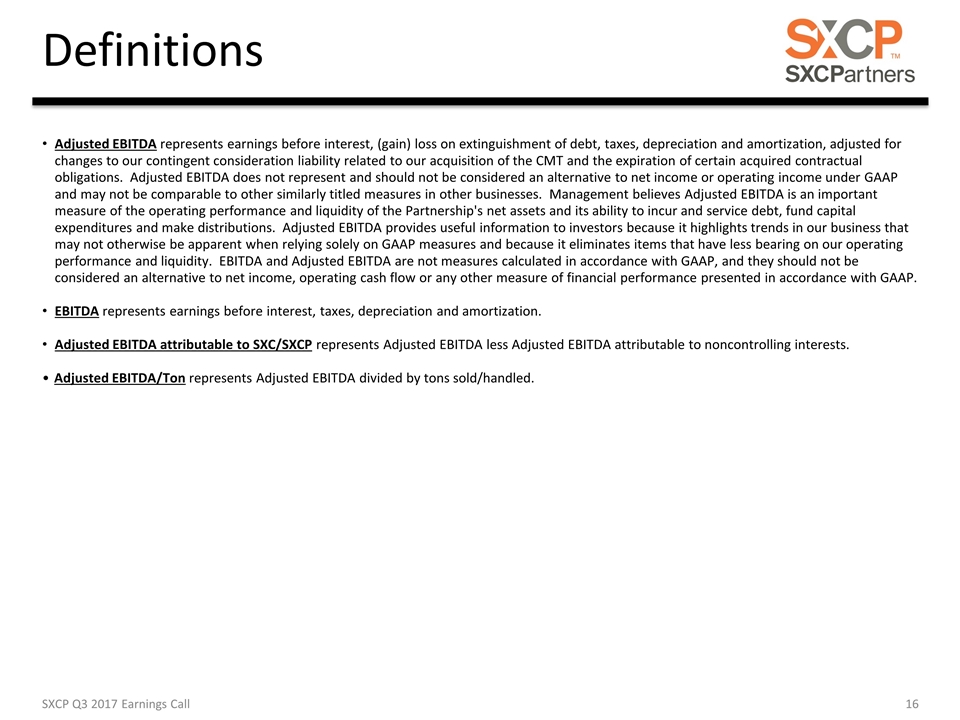

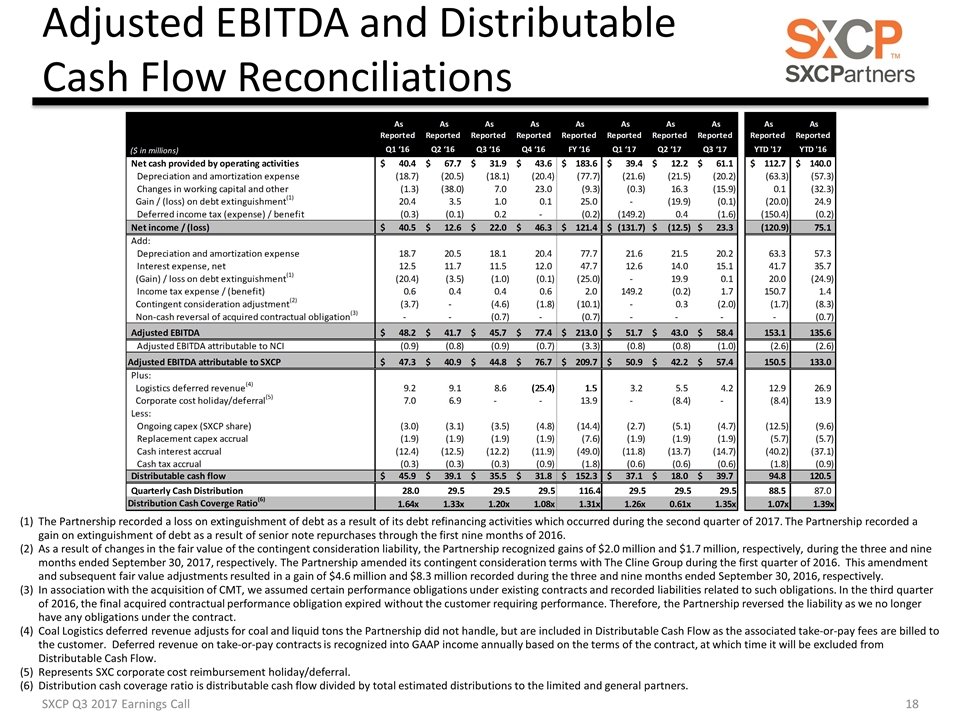

DEFINITIONS

| • | Adjusted EBITDA represents earnings before interest, loss (gain) on extinguishment of debt, taxes, depreciation and amortization, adjusted for changes to our contingent consideration liability related to our acquisition of CMT and the expiration of certain acquired contractual obligations. Adjusted EBITDA does not represent and should not be considered an alternative to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance and liquidity of the Partnership’s net assets and its ability to incur and service debt, fund capital expenditures and make distributions. Adjusted EBITDA provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance and liquidity. EBITDA and Adjusted EBITDA are not measures calculated in accordance with GAAP, and they should not be considered an alternative to net income, operating cash flow or any other measure of financial performance presented in accordance with GAAP. |

| • | Adjusted EBITDA attributable to SXCP equals Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests. |

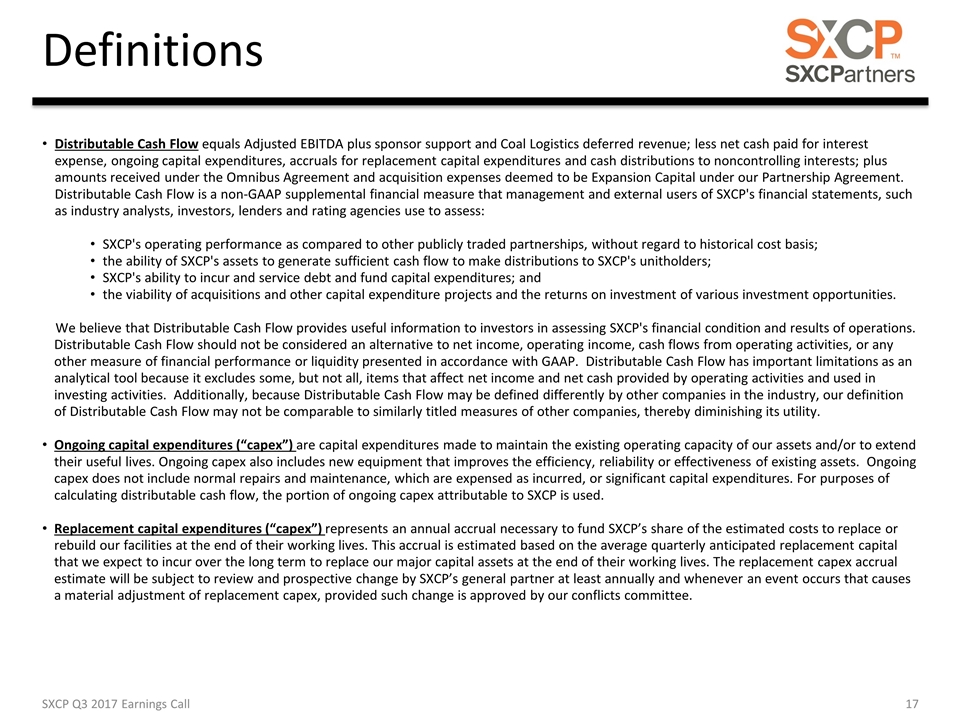

| • | Distributable Cash Flow equals Adjusted EBITDA plus sponsor support and Coal Logistics deferred revenue; less net cash paid for interest expense, ongoing capital expenditures, accruals for replacement capital expenditures and cash distributions to noncontrolling interests; plus amounts received under the Omnibus Agreement and acquisition expenses deemed to be Expansion Capital under our Partnership Agreement. Distributable Cash Flow is a non-GAAP supplemental financial measure that management and external users of SXCP’s financial statements, such as industry analysts, investors, lenders and rating agencies use to assess: |

| • | SXCP’s operating performance as compared to other publicly traded partnerships, without regard to historical cost basis; |

| • | the ability of SXCP’s assets to generate sufficient cash flow to make distributions to SXCP’s unitholders; |

| • | SXCP’s ability to incur and service debt and fund capital expenditures; and |

4

| • | the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities. |

We believe that Distributable Cash Flow provides useful information to investors in assessing SXCP’s financial condition and results of operations. Distributable Cash Flow should not be considered an alternative to net income, operating income, cash flows from operating activities, or any other measure of financial performance or liquidity presented in accordance with GAAP. Distributable Cash Flow has important limitations as an analytical tool because it excludes some, but not all, items that affect net income and net cash provided by operating activities and used in investing activities. Additionally, because Distributable Cash Flow may be defined differently by other companies in the industry, our definition of Distributable Cash Flow may not be comparable to similarly titled measures of other companies, thereby diminishing its utility.

| • | Ongoing capital expenditures (“capex”) are capital expenditures made to maintain the existing operating capacity of our assets and/or to extend their useful lives. Ongoing capex also includes new equipment that improves the efficiency, reliability or effectiveness of existing assets. Ongoing capex does not include normal repairs and maintenance, which are expensed as incurred, or significant capital expenditures. For purposes of calculating distributable cash flow, the portion of ongoing capex attributable to SXCP is used and includes capital expenditures included in working capital at the end of the period. |

| • | Replacement capital expenditures (“capex”) represents an annual accrual necessary to fund SXCP’s share of the estimated costs to replace or rebuild our facilities at the end of their working lives. This accrual is estimated based on the average quarterly anticipated replacement capital that we expect to incur over the long term to replace our major capital assets at the end of their working lives. The replacement capex accrual estimate will be subject to review and prospective change by SXCP’s general partner at least annually and whenever an event occurs that causes a material adjustment of replacement capex, provided such change is approved by our conflicts committee. |

FORWARD-LOOKING STATEMENTS

Some of the statements included in this press release constitute “forward-looking statements.” Forward-looking statements include all statements that are not historical facts and may be identified by the use of such words as “believe,” “expect,” “plan,” “project,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions. Forward-looking statements are inherently uncertain and involve significant known and unknown risks and uncertainties (many of which are beyond the control of SXCP) that could cause actual results to differ materially.

Such risks and uncertainties include, but are not limited to, domestic and international economic, political, business, operational, competitive, regulatory, and/or market factors affecting SXCP, as well as uncertainties related to: pending or future litigation, legislation or regulatory actions; liability for remedial actions or assessments under existing or future environmental regulations; gains and losses related to acquisition, disposition or impairment of assets; recapitalizations; access to, and costs of, capital; the effects of changes in accounting rules applicable to SXCP; and changes in tax, environmental and other laws and regulations applicable to SXCP’s businesses.

Forward-looking statements are not guarantees of future performance, but are based upon the current knowledge, beliefs and expectations of SXCP management, and upon assumptions by SXCP concerning future conditions, any or all of which ultimately may prove to be inaccurate. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. SXCP does not intend, and expressly disclaims any obligation, to update or alter its forward-looking statements (or associated cautionary language), whether as a result of new information, future events or otherwise after the date of this press release except as required by applicable law.

5

SXCP has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement made by SXCP. For information concerning these factors, see SXCP’s Securities and Exchange Commission filings such as its annual and quarterly reports and current reports on Form 8-K, copies of which are available free of charge on SXCP’s website at www.suncoke.com. All forward-looking statements included in this press release are expressly qualified in their entirety by such cautionary statements. Unpredictable or unknown factors not discussed in this release also could have material adverse effects on forward-looking statements.

6

SunCoke Energy Partners, L.P.

Consolidated Statements of Operations

(Unaudited)

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| (Dollars and units in millions, except per unit amounts) | ||||||||||||||||

| Revenues |

||||||||||||||||

| Sales and other operating revenue |

$ | 214.0 | $ | 185.5 | $ | 610.2 | $ | 561.4 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Costs and operating expenses |

||||||||||||||||

| Cost of products sold and operating expenses |

146.2 | 125.5 | 431.0 | 388.3 | ||||||||||||

| Selling, general and administrative expenses |

7.4 | 9.0 | 24.4 | 28.5 | ||||||||||||

| Depreciation and amortization expense |

20.2 | 18.1 | 63.3 | 57.3 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total costs and operating expenses |

173.8 | 152.6 | 518.7 | 474.1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

40.2 | 32.9 | 91.5 | 87.3 | ||||||||||||

| Interest expense, net |

15.1 | 11.5 | 41.7 | 35.7 | ||||||||||||

| Loss (gain) on extinguishment of debt(1) |

0.1 | (1.0 | ) | 20.0 | (24.9 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before income tax expense |

25.0 | 22.4 | 29.8 | 76.5 | ||||||||||||

| Income tax expense(2) |

1.7 | 0.4 | 150.7 | 1.4 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

23.3 | 22.0 | (120.9 | ) | 75.1 | |||||||||||

| Less: Net income (loss) attributable to noncontrolling interests |

0.7 | 0.7 | (1.3 | ) | 1.9 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) attributable to SunCoke Energy Partners, L.P. |

$ | 22.6 | $ | 21.3 | $ | (119.6 | ) | $ | 73.2 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| General partner’s interest in net income |

$ | 1.9 | $ | 1.8 | $ | 1.8 | $ | 13.6 | ||||||||

| Limited partners’ interest in net income (loss) |

$ | 20.7 | $ | 19.5 | $ | (121.4 | ) | $ | 59.6 | |||||||

| Net income (loss) per common unit (basic and diluted) |

$ | 0.45 | $ | 0.42 | $ | (2.63 | ) | $ | 1.29 | |||||||

| Weighted average common units outstanding (basic and diluted) |

46.2 | 46.2 | 46.2 | 46.2 | ||||||||||||

| (1) | The Partnership recorded a loss on extinguishment of debt as a result of its debt refinancing activities during the second and third quarters of 2017. The Partnership recorded a gain on extinguishment of debt as a result of senior note repurchases in 2016. |

| (2) | In January 2017, the Internal Revenue Service (“IRS”) announced its decision to exclude cokemaking as a qualifying income generating activity in its final regulations (the “Final Regulations”) issued under section 7704(d)(1)(E) of the Internal Revenue Code relating to the qualifying income exception for publicly traded partnerships. However, the Final Regulations include a transition period for activities that were reasonably interpreted to be qualifying income and carried on by publicly traded partnerships prior to the Final Regulations. The Partnership previously received a will-level opinion from its counsel, Vinson & Elkins LLP, that the Partnership’s cokemaking operations generated qualifying income prior to the Final Regulations. Therefore, the Partnership believes it had a reasonable basis to conclude its cokemaking operations were considered qualifying income before the issuance of the new regulations and as such expects to maintain its treatment as a partnership through the transition period. Cokemaking entities in the Partnership will become taxable as corporations on January 1, 2028, after the transition period ends. |

As a result of the Final Regulations, the Partnership recorded deferred income tax expense of $148.6 million to setup its initial deferred income tax liability during the first quarter of 2017, primarily related to differences in the book and tax basis of fixed assets, which are expected to exist at the end of the 10-year transition period when the cokemaking operations become taxable.

7

SunCoke Energy Partners, L.P.

Consolidated Balance Sheets

| September 30, 2017 | December 31, 2016 | |||||||

| (Unaudited) | ||||||||

| (Dollars in millions) | ||||||||

| Assets |

||||||||

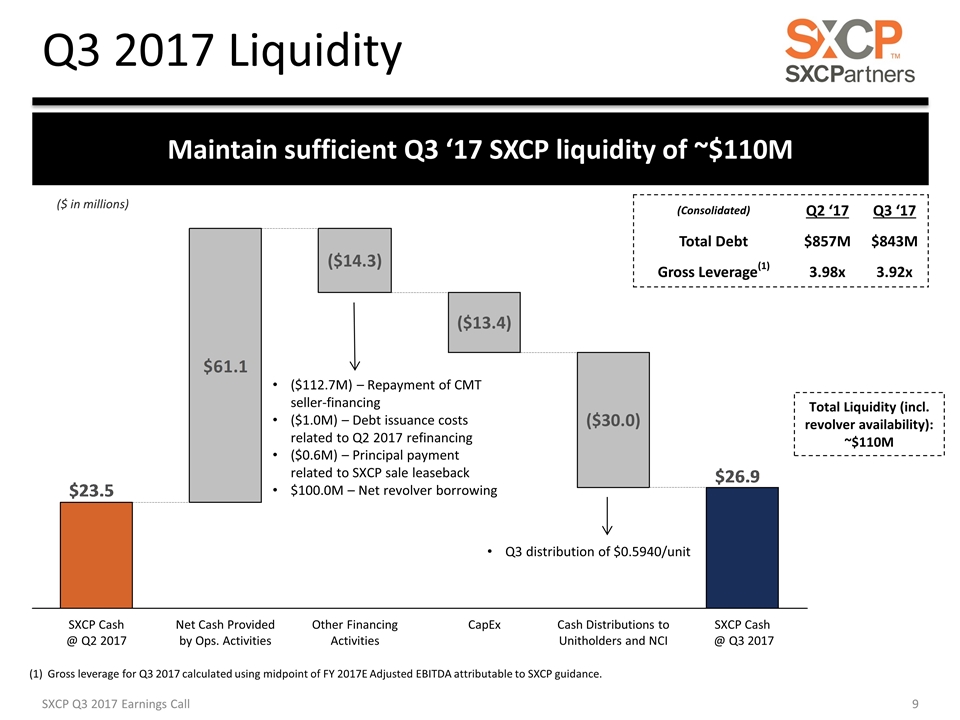

| Cash and cash equivalents |

$ | 26.9 | $ | 41.8 | ||||

| Receivables |

46.0 | 39.7 | ||||||

| Receivables from affiliate, net |

2.6 | — | ||||||

| Inventories |

85.3 | 66.9 | ||||||

| Other current assets |

5.2 | 1.6 | ||||||

|

|

|

|

|

|||||

| Total current assets |

166.0 | 150.0 | ||||||

|

|

|

|

|

|||||

| Properties, plants and equipment (net of accumulated depreciation of $405.5 million and $352.6 million at September 30, 2017 and December 31, 2016, respectively) |

1,268.6 | 1,294.9 | ||||||

| Goodwill |

73.5 | 73.5 | ||||||

| Other intangible assets, net |

168.9 | 176.7 | ||||||

| Deferred charges and other assets |

0.8 | 0.9 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 1,677.8 | $ | 1,696.0 | ||||

|

|

|

|

|

|||||

| Liabilities and Equity |

||||||||

| Accounts payable |

$ | 69.5 | $ | 47.0 | ||||

| Accrued liabilities |

14.5 | 11.7 | ||||||

| Deferred revenue |

16.6 | 2.5 | ||||||

| Current portion of long-term debt and financing obligation |

2.6 | 4.9 | ||||||

| Interest payable |

17.0 | 14.7 | ||||||

| Payable to affiliate, net |

— | 4.7 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

120.2 | 85.5 | ||||||

|

|

|

|

|

|||||

| Long-term debt and financing obligation |

816.3 | 805.7 | ||||||

| Deferred income taxes |

188.3 | 37.9 | ||||||

| Other deferred credits and liabilities |

10.0 | 13.2 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

1,134.8 | 942.3 | ||||||

|

|

|

|

|

|||||

| Equity |

||||||||

| Held by public: |

||||||||

| Common units (issued 18,829,226 and 20,800,181 units at September 30, 2017 and December 31, 2016, respectively) |

185.2 | 296.9 | ||||||

| Held by parent: |

||||||||

| Common units (issued 27,396,673 and 25,415,696 units at September 30, 2017 and December 31, 2016, respectively) |

318.5 | 410.3 | ||||||

| General partner interest |

27.9 | 32.1 | ||||||

|

|

|

|

|

|||||

| Partners’ capital attributable to SunCoke Energy Partners, L.P. |

531.6 | 739.3 | ||||||

| Noncontrolling interest |

11.4 | 14.4 | ||||||

|

|

|

|

|

|||||

| Total equity |

543.0 | 753.7 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 1,677.8 | $ | 1,696.0 | ||||

|

|

|

|

|

|||||

8

SunCoke Energy Partners, L.P.

Consolidated Statements of Cash Flows

(Unaudited)

| Nine Months Ended September 30, | ||||||||

| 2017 | 2016 | |||||||

| (Dollars in millions) | ||||||||

| Cash Flows from Operating Activities: |

||||||||

| Net (loss) income |

$ | (120.9 | ) | $ | 75.1 | |||

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: |

||||||||

| Depreciation and amortization expense |

63.3 | 57.3 | ||||||

| Deferred income tax expense |

150.4 | 0.2 | ||||||

| Loss (gain) on extinguishment of debt |

20.0 | (24.9 | ) | |||||

| Changes in working capital pertaining to operating activities: |

||||||||

| Receivables |

(6.3 | ) | 2.1 | |||||

| Receivables (payables) from affiliate, net |

(5.9 | ) | 6.2 | |||||

| Inventories |

(18.4 | ) | 9.2 | |||||

| Accounts payable |

16.6 | 5.0 | ||||||

| Accrued liabilities |

2.8 | 1.2 | ||||||

| Deferred revenue |

14.1 | 25.5 | ||||||

| Interest payable |

2.3 | (11.2 | ) | |||||

| Other |

(5.3 | ) | (5.7 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

112.7 | 140.0 | ||||||

|

|

|

|

|

|||||

| Cash Flows from Investing Activities: |

||||||||

| Capital expenditures |

(23.3 | ) | (30.1 | ) | ||||

| Decrease in restricted cash |

0.1 | 17.0 | ||||||

| Other investing activities |

— | 2.1 | ||||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(23.2 | ) | (11.0 | ) | ||||

|

|

|

|

|

|||||

| Cash Flows from Financing Activities: |

||||||||

| Proceeds from issuance of long-term debt |

620.6 | — | ||||||

| Repayment of long-term debt |

(644.9 | ) | (60.8 | ) | ||||

| Proceeds from financing obligation |

— | 16.2 | ||||||

| Repayment of financing obligation |

(1.8 | ) | (0.5 | ) | ||||

| Proceeds from revolving credit facility |

268.0 | 20.0 | ||||||

| Repayment of revolving credit facility |

(240.0 | ) | (25.0 | ) | ||||

| Debt issuance costs |

(14.9 | ) | (0.2 | ) | ||||

| Distributions to unitholders (public and parent) |

(89.7 | ) | (86.8 | ) | ||||

| Distributions to noncontrolling interest (SunCoke Energy, Inc.) |

(1.7 | ) | (2.8 | ) | ||||

| Capital contributions from SunCoke |

— | 8.4 | ||||||

|

|

|

|

|

|||||

| Net cash used in financing activities |

(104.4 | ) | (131.5 | ) | ||||

|

|

|

|

|

|||||

| Net decrease in cash and cash equivalents |

(14.9 | ) | (2.5 | ) | ||||

| Cash and cash equivalents at beginning of period |

41.8 | 48.6 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 26.9 | $ | 46.1 | ||||

|

|

|

|

|

|||||

| Supplemental Disclosure of Cash Flow Information |

||||||||

| Interest paid |

$ | 38.3 | $ | 49.8 | ||||

9

SunCoke Energy Partners, L.P.

Segment Operating Data

The following tables set forth financial and operating data for the three and nine months ended September 30, 2017 and 2016:

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| (Dollars in millions) | ||||||||||||||||

| Sales and other operating revenues: |

||||||||||||||||

| Domestic Coke |

$ | 193.4 | $ | 170.8 | $ | 548.6 | $ | 517.2 | ||||||||

| Coal Logistics |

20.6 | 14.7 | 61.6 | 44.2 | ||||||||||||

| Coal Logistics intersegment sales |

1.6 | 1.5 | 4.9 | 4.7 | ||||||||||||

| Elimination of intersegment sales |

(1.6 | ) | (1.5 | ) | (4.9 | ) | (4.7 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Sales and other operating revenues |

$ | 214.0 | $ | 185.5 | $ | 610.2 | $ | 561.4 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA(1): |

||||||||||||||||

| Domestic Coke |

$ | 50.0 | $ | 42.9 | $ | 130.0 | $ | 130.3 | ||||||||

| Coal Logistics |

12.3 | 7.0 | 34.9 | 18.2 | ||||||||||||

| Corporate and Other |

(3.9 | ) | (4.2 | ) | (11.8 | ) | (12.9 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Adjusted EBITDA |

$ | 58.4 | $ | 45.7 | $ | 153.1 | $ | 135.6 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Coke Operating Data: |

||||||||||||||||

| Domestic Coke capacity utilization (%) |

103 | 103 | 100 | 102 | ||||||||||||

| Domestic Coke production volumes (thousands of tons) |

595 | 593 | 1,727 | 1,751 | ||||||||||||

| Domestic Coke sales volumes (thousands of tons) |

585 | 595 | 1,718 | 1,755 | ||||||||||||

| Domestic Coke Adjusted EBITDA per ton(2) |

$ | 85.47 | $ | 72.10 | $ | 75.67 | $ | 74.25 | ||||||||

| Coal Logistics Operating Data: |

||||||||||||||||

| Tons handled (thousands of tons)(3) |

4,862 | 4,055 | 15,220 | 12,028 | ||||||||||||

| CMT take-or-pay shortfall tons (thousands of tons)(4) |

1,005 | 1,748 | 2,505 | 5,002 | ||||||||||||

| (1) | See definition of Adjusted EBITDA and reconciliation elsewhere in this release. |

| (2) | Reflects Domestic Coke Adjusted EBITDA divided by Domestic Coke sales volumes. |

| (3) | Reflects inbound tons handled during the period. |

| (4) | Reflects tons billed under take-or-pay contracts where services have not yet been performed. |

10

SunCoke Energy Partners, L.P.

Reconciliations of Non-GAAP Information

Net Cash Provided by Operating Activities

to Net Income (Loss) and Adjusted EBITDA

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| (Dollars in millions) | ||||||||||||||||

| Net cash provided by operating activities |

$ | 61.1 | $ | 31.9 | $ | 112.7 | $ | 140.0 | ||||||||

| Subtract: |

||||||||||||||||

| Depreciation and amortization expense |

20.2 | 18.1 | 63.3 | 57.3 | ||||||||||||

| Loss (gain) on extinguishment of debt |

0.1 | (1.0 | ) | 20.0 | (24.9 | ) | ||||||||||

| Deferred income tax expense (benefit) |

1.6 | (0.2 | ) | 150.4 | 0.2 | |||||||||||

| Changes in working capital and other |

15.9 | (7.0 | ) | (0.1 | ) | 32.3 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

$ | 23.3 | $ | 22.0 | $ | (120.9 | ) | $ | 75.1 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Add: |

||||||||||||||||

| Depreciation and amortization expense |

$ | 20.2 | $ | 18.1 | $ | 63.3 | $ | 57.3 | ||||||||

| Interest expense, net |

15.1 | 11.5 | 41.7 | 35.7 | ||||||||||||

| Loss (gain) on extinguishment of debt |

0.1 | (1.0 | ) | 20.0 | (24.9 | ) | ||||||||||

| Income tax expense, net |

1.7 | 0.4 | 150.7 | 1.4 | ||||||||||||

| Contingent consideration adjustments(1) |

(2.0 | ) | (4.6 | ) | (1.7 | ) | (8.3 | ) | ||||||||

| Non-cash reversal of acquired contractual obligation(2) |

— | (0.7 | ) | — | (0.7 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA(3) |

$ | 58.4 | $ | 45.7 | $ | 153.1 | $ | 135.6 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Subtract: |

||||||||||||||||

| Adjusted EBITDA attributable to noncontrolling interest (4) |

1.0 | 0.9 | 2.6 | 2.6 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA attributable to SunCoke Energy Partners, L.P. |

$ | 57.4 | $ | 44.8 | $ | 150.5 | $ | 133.0 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | As a result of changes in the fair value of the contingent consideration liability, the Partnership recognized gains of $2.0 million and $1.7 million during the three and nine months ended September 30, 2017, respectively. The Partnership amended its contingent consideration terms with The Cline Group during the first quarter of 2016. This amendment and subsequent fair value adjustments resulted in a gain of $4.6 million and $8.3 million recorded during the three and nine months ended September 30, 2016, respectively. |

| (2) | In association with the acquisition of CMT, we assumed certain performance obligations under existing contracts and recorded liabilities related to such obligations. In the third quarter of 2016, the final acquired contractual performance obligation expired without the customer requiring performance. Therefore, the Partnership reversed the liability as we no longer have any obligations under the contract. |

| (3) | In accordance with the SEC’s May 2016 update to its guidance on the appropriate use of non-GAAP financial measures, Adjusted EBITDA does not include Coal Logistics deferred revenue until it is recognized as GAAP revenue. |

| (4) | Reflects net income attributable to noncontrolling interest adjusted for noncontrolling interest’s share of interest, taxes, income, and depreciation and amortization. |

11

SunCoke Energy Partners, L.P.

Reconciliations of Non-GAAP Information

Net Cash Provided by Operating Activities

to Net Loss to Adjusted EBITDA and

Distributable Cash Flow

| Three Months Ended September 30, | ||||||||

| 2017 | 2016 | |||||||

| (Dollars in millions) | ||||||||

| Net cash provided by operating activities |

$ | 61.1 | $ | 31.9 | ||||

| Less: |

||||||||

| Depreciation and amortization expense |

20.2 | 18.1 | ||||||

| Loss on debt extinguishment |

0.1 | (1.0 | ) | |||||

| Deferred income tax expense |

1.6 | (0.2 | ) | |||||

| Changes in working capital and other |

15.9 | (7.0 | ) | |||||

|

|

|

|

|

|||||

| Net income |

$ | 23.3 | $ | 22.0 | ||||

|

|

|

|

|

|||||

| Add: |

||||||||

| Depreciation and amortization expense |

20.2 | 18.1 | ||||||

| Interest expense, net |

15.1 | 11.5 | ||||||

| Loss on extinguishment of debt |

0.1 | (1.0 | ) | |||||

| Income tax expense |

1.7 | 0.4 | ||||||

| Contingent consideration adjustments(1) |

(2.0 | ) | (4.6 | ) | ||||

| Non-cash reversal of acquired contractual obligation(2) |

— | (0.7 | ) | |||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | 58.4 | $ | 45.7 | ||||

|

|

|

|

|

|||||

| Less: |

||||||||

| Adjusted EBITDA attributable to noncontrolling interest |

1.0 | 0.9 | ||||||

|

|

|

|

|

|||||

| Adjusted EBITDA attributable to SXCP |

$ | 57.4 | $ | 44.8 | ||||

|

|

|

|

|

|||||

| Plus: |

||||||||

| Coal Logistics deferred revenue(3) |

4.2 | 8.6 | ||||||

| Less: |

||||||||

| Ongoing capex |

4.7 | 3.5 | ||||||

| Replacement capex accrual |

1.9 | 1.9 | ||||||

| Cash interest accrual |

14.7 | 12.2 | ||||||

| Cash tax accrual(4) |

0.6 | 0.3 | ||||||

|

|

|

|

|

|||||

| Distributable cash flow |

$ | 39.7 | $ | 35.5 | ||||

|

|

|

|

|

|||||

| Quarterly Cash Distribution |

$ | 29.5 | $ | 29.5 | ||||

| Distribution Coverage Ratio(5) |

1.35 | 1.20 | ||||||

| (1) | As a result of changes in the fair value of the contingent consideration liability, the Partnership recognized gains of $2.0 million during the three months ended September 30, 2017. The Partnership amended its contingent consideration terms with The Cline Group during the first quarter of 2016. This amendment and subsequent fair value adjustments resulted in a gain of $4.6 million during the three months ended September 30, 2016, respectively. |

| (2) | In association with the acquisition of CMT, we assumed certain performance obligations under existing contracts and recorded liabilities related to such obligations. In the third quarter of 2016, the final acquired contractual performance obligation expired without the customer requiring performance. Therefore, the Partnership reversed the liability as we no longer have any obligations under the contract. |

| (3) | Coal Logistics deferred revenue adjusts for coal and liquid tons the Partnership did not handle, but are included in Distributable Cash Flow as the associated take-or-pay fees are billed to the customer. Deferred revenue on take-or-pay contracts is recognized into GAAP income annually based on the terms of the contract, at which time it will be excluded from Distributable Cash Flow. |

| (4) | Cash tax impact from the operations of Gateway Cogeneration Company LLC, which is an entity subject to income taxes for federal and state purposes at the corporate level. |

| (5) | Distribution cash coverage ratio is distributable cash flow divided by total estimated distributions to the limited and general partners. |

12

SunCoke Energy Partners, L.P.

Reconciliations of Non-GAAP Information

Estimated 2017 Net Cash Provided by Operating Activities

to Net Loss to Consolidated Adjusted EBITDA

and Distributable Cash Flow

| 2017 | ||||||||

| Low | High | |||||||

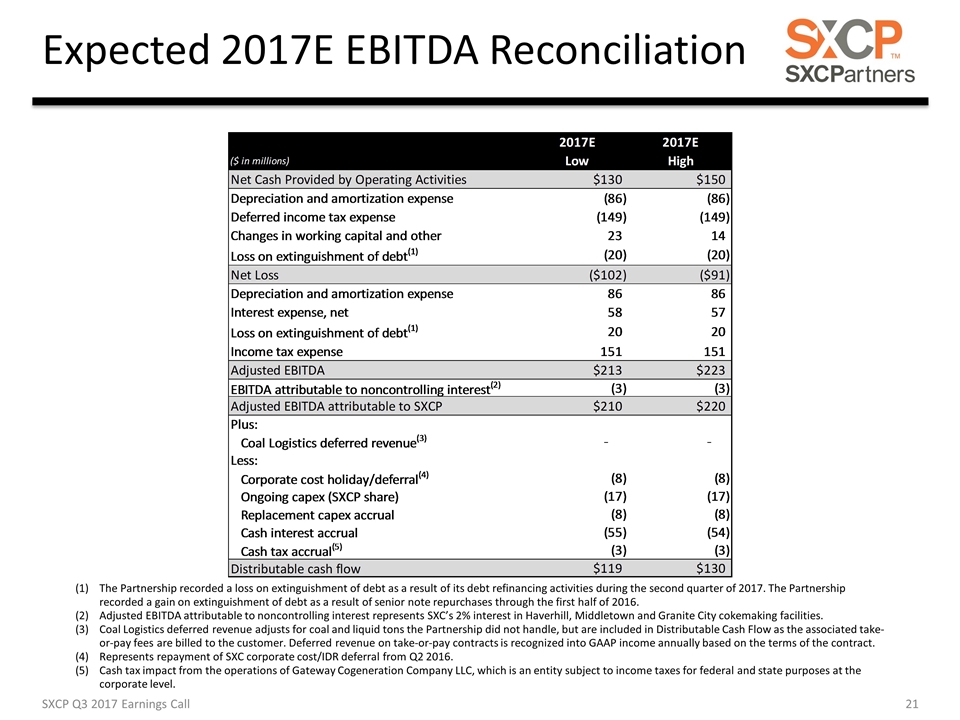

| Net Cash Provided by Operating Activities |

$ | 130 | $ | 150 | ||||

| Subtract: |

||||||||

| Depreciation and amortization expense |

86 | 86 | ||||||

| Deferred income tax expense |

149 | 149 | ||||||

| Changes in working capital and other |

(23 | ) | (14 | ) | ||||

| Loss on extinguishment of debt |

20 | 20 | ||||||

|

|

|

|

|

|||||

| Net loss |

$ | (102 | ) | $ | (91 | ) | ||

|

|

|

|

|

|||||

| Add: |

||||||||

| Depreciation and amortization expense |

86 | 86 | ||||||

| Interest expense, net |

58 | 57 | ||||||

| Loss on extinguishment of debt |

20 | 20 | ||||||

| Income tax expense |

151 | 151 | ||||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | 213 | $ | 223 | ||||

|

|

|

|

|

|||||

| Subtract: Adjusted EBITDA attributable to noncontrolling interest(1) |

3 | 3 | ||||||

|

|

|

|

|

|||||

| Adjusted EBITDA attributable to SunCoke Energy Partners, L.P. |

$ | 210 | $ | 220 | ||||

|

|

|

|

|

|||||

| Subtract: |

||||||||

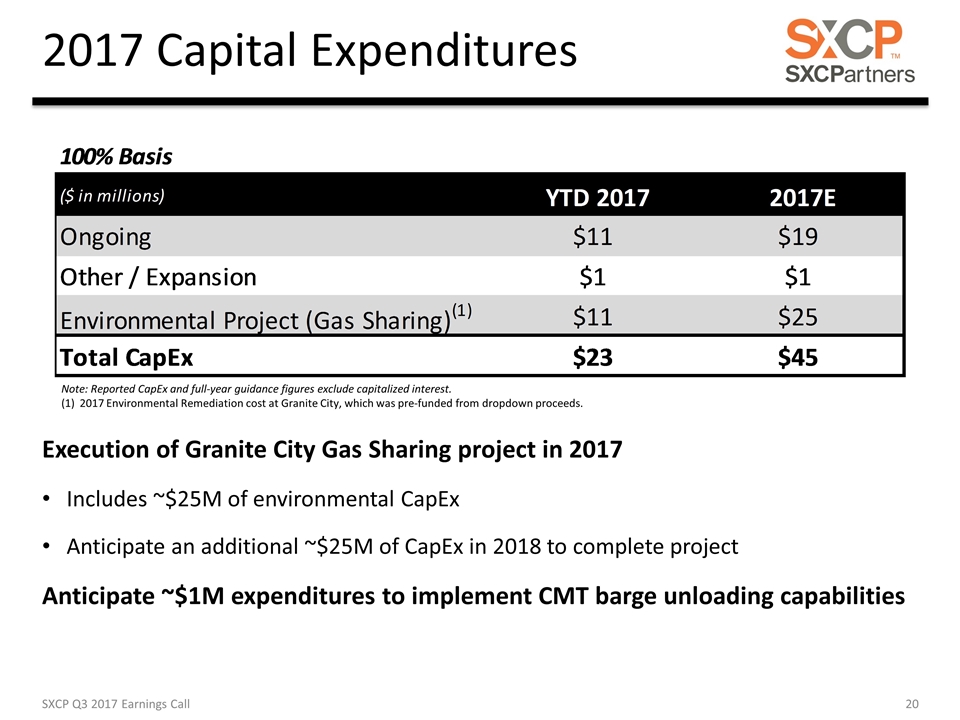

| Corporate cost holiday / deferral(2) |

8 | 8 | ||||||

| Ongoing capex (SXCP share) |

17 | 17 | ||||||

| Replacement capex accrual |

8 | 8 | ||||||

| Cash interest accrual |

55 | 54 | ||||||

| Cash tax accrual(3) |

3 | 3 | ||||||

|

|

|

|

|

|||||

| Estimated distributable cash flow |

$ | 119 | $ | 130 | ||||

|

|

|

|

|

|||||

| (1) | Reflects net income attributable to noncontrolling interest adjusted for noncontrolling interest’s share of interest, taxes, income, and depreciation and amortization. |

| (2) | Represents repayment of SXC corporate cost/IDR deferral from Q2 2016. |

| (3) | Cash tax impact from the operations of Gateway Cogeneration Company LLC, which is an entity subject to income taxes for federal and state purposes at the corporate level. |

13