Exhibit 99.2

Investors & Media:

Lisa Ciota: 630-824-1987

SUNCOKE ENERGY PARTNERS, L.P. ANNOUNCES FIRST QUARTER 2014 EARNINGS

AND ACQUISITION OF ADDITIONAL INTEREST IN COKEMAKING FACILITIES

| • | Net income attributable to SXCP in first quarter 2014 was $13.2 million, or $0.41 per unit |

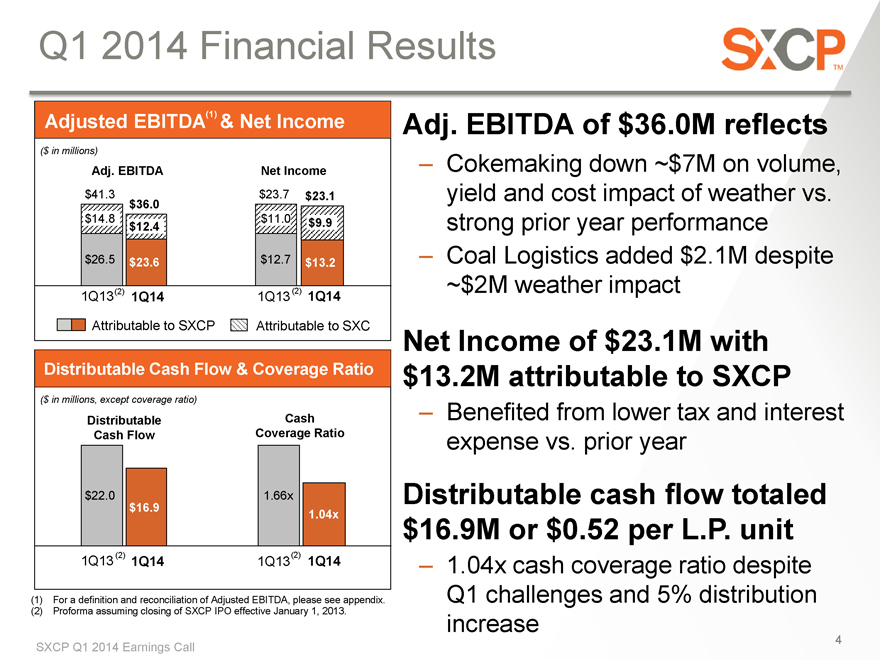

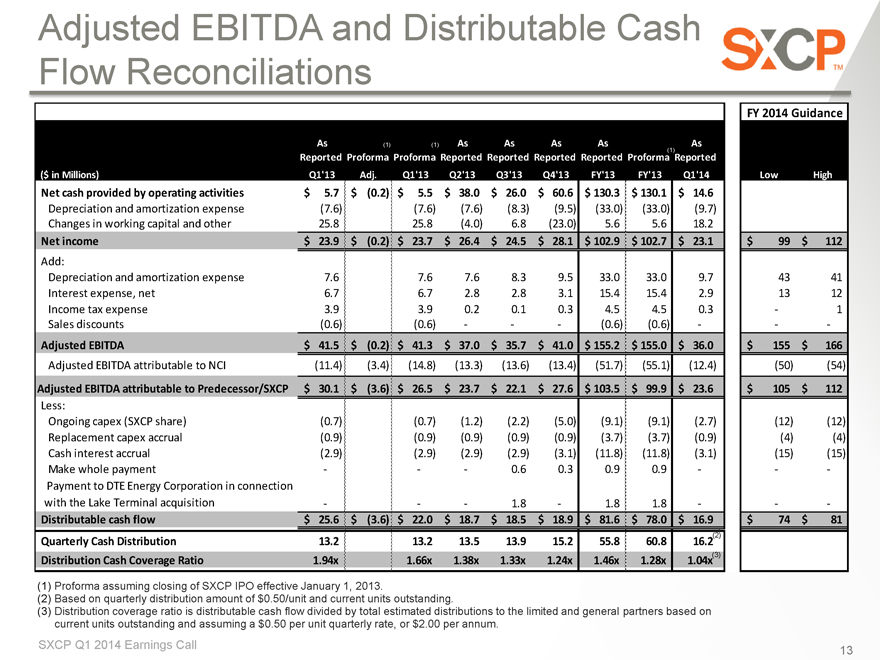

| • | Adjusted EBITDA of $36.0 million in first quarter 2014 reflects the impact of severe winter weather on our cokemaking and coal logistics businesses |

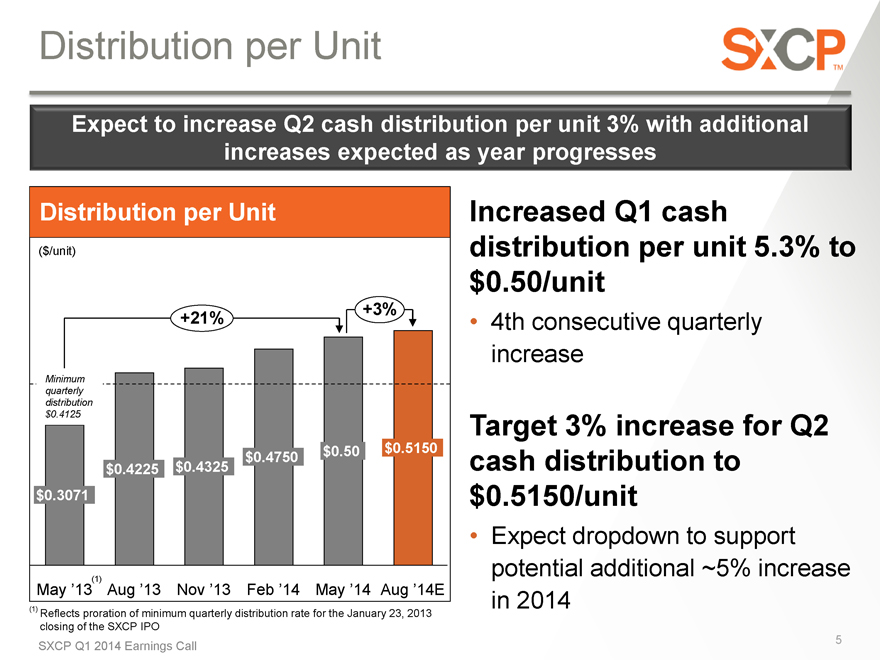

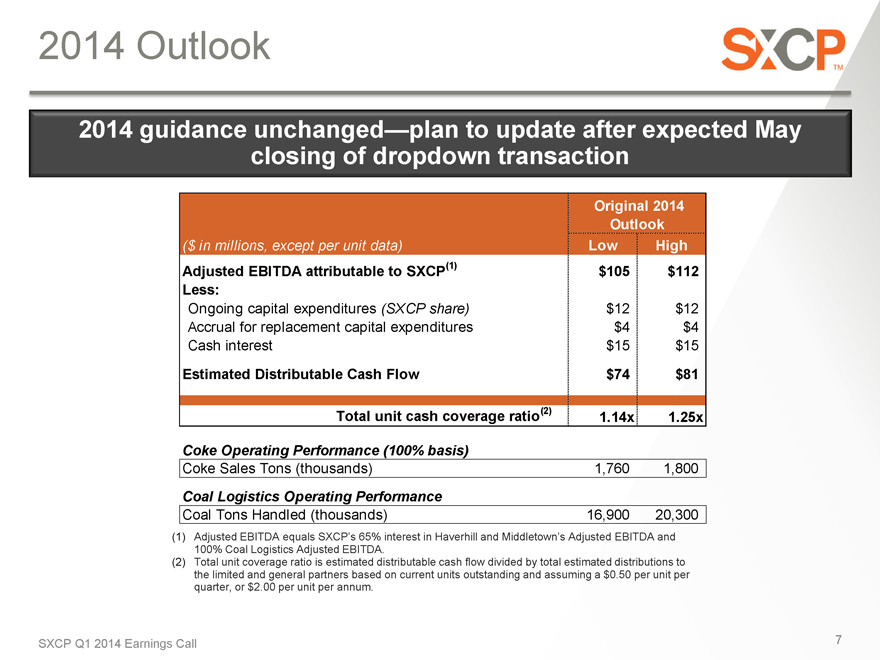

| • | Distributable cash flow in first quarter 2014 totaled $16.9 million, supporting a 5.3 percent increase in the cash distribution rate to $0.50 per unit for the May 30, 2014 payment and resulting in a cash coverage ratio of 1.04x based on current units outstanding |

| • | Anticipate increasing second quarter cash distribution payable in August 2014 to $0.515 per unit |

| • | Executed agreement to acquire an additional 33 percent interest in the Haverhill and Middletown cokemaking facilities for total consideration of $365 million |

| • | Acquisition is expected to be immediately accretive, increasing distributable cash flow per limited partner unit by an estimated 7 percent to 8 percent |

Lisle, IL (April 23, 2014) - SunCoke Energy Partners, L.P. (NYSE: SXCP) today reported first quarter 2014 net income attributable to SXCP of $13.2 million, or $0.41 per unit. Performance in first quarter 2014 was impacted by severe winter weather. First quarter 2013 net income attributable to SXCP of $11.8 million, or $0.37 per unit, is not comparable as it reflects a shortened quarter due to the timing of the closing of our initial public offering on January 24, 2013.

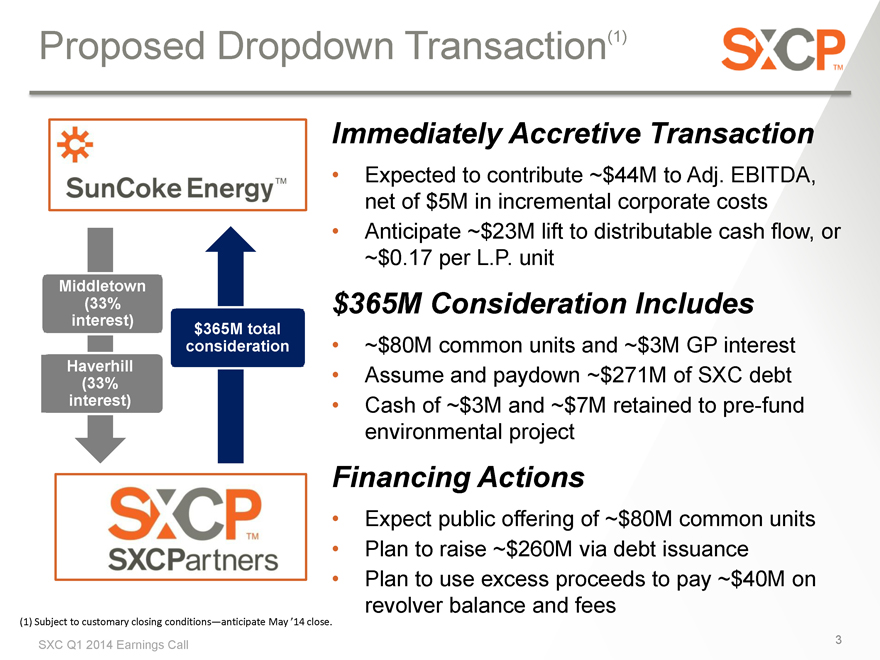

SXCP also announced that on April 23, 2014 it entered into a contribution agreement with its sponsor, SunCoke Energy, Inc. (NYSE: SXC), to acquire an additional 33 percent interest in the Haverhill and Middletown cokemaking facilities for total consideration of $365 million. When closed, the transaction will increase SXCP’s ownership interest in these facilities to 98 percent, up from the current 65 percent level.

“The extreme cold weather this past winter impacted our cokemaking and coal logistics businesses, resulting in lower than expected performance in the first quarter. Nevertheless, we still generated nearly $17 million of distributable cash flow, which enabled us to increase cash distributions per unit for the fourth consecutive quarter,” said Fritz Henderson, Chairman and Chief Executive Officer of SXCP. “This is a track record we intend to build on as we pursue plans to acquire all of our sponsor’s domestic cokemaking assets over time. Today’s agreement to acquire an additional 33 percent interest in our Haverhill and Middletown facilities is the next step in this plan and supports our goal to increase cash distributions per unit by at least 8 percent to 10 percent annually over the next three years.”

CONTRIBUTION AGREEMENT

In connection with the agreement to acquire an additional 33 percent interest in the Haverhill and Middletown cokemaking facilities, we intend to issue approximately $80 million of common units and $3 million of general partner interests in consideration for the contribution. In addition, we plan to assume and repay approximately $271 million of outstanding SXC debt and other liabilities. The $271 million debt assumption and repayment obligation

1

consists of approximately $100 million of SXC’s outstanding term loan debt and $171 million of principal and estimated premium of SXC’s 7.625 percent senior notes. The cash portion of the consideration will be approximately $10 million, of which we expect to retain approximately $7 million to pre-fund SXC’s obligation to indemnify us for the anticipated cost of an environmental remediation project at Haverhill.

We expect to fund the debt assumption and cash portions of the consideration with approximately $80 million of net proceeds from the sale of common units to the public and $260 million from the issuance of debt. Proceeds from the offerings will also be used to repay approximately $40 million outstanding on our revolving credit facility, pay transaction fees and for general corporate purposes.

The additional interest in the Haverhill and Middletown cokemaking facilities we will acquire under the contribution agreement is expected to generate on an annual basis Adjusted EBITDA attributable to SXCP of approximately $44 million, net of incremental allocated corporate costs, and add $23 million to distributable cash flow. We expect this acquisition to be immediately accretive, increasing distributable cash flow per limited partner unit by an estimated 7 percent to 8 percent, or $0.17 per limited partner unit, after consideration for general partner and incentive distribution rights payments.

We expect to close the acquisition of the Haverhill and Middletown interests in May 2014, subject to customary closing conditions for such transactions and the completion of the associated financing transactions. The terms of the contribution agreement, and the acquisition of the interests in Haverhill and Middletown, have been approved by the conflicts committee of our general partner’s Board of Directors, which consists entirely of independent directors. The conflicts committee was advised by Tudor, Pickering, Holt & Co.

FIRST QUARTER 2014 RESULTS

| Three Months Ended March 31, | ||||||||||||

| (in millions) |

2014 | 2013 | Increase/ (Decrease) |

|||||||||

| Revenues |

$ | 161.4 | $ | 184.9 | $ | (23.5 | ) | |||||

| Operating income |

26.3 | 34.5 | (8.2 | ) | ||||||||

| Adjusted EBITDA (1) |

36.0 | 41.5 | (5.5 | ) | ||||||||

| Net income attributable to SXCP/Predecessor |

13.2 | 15.3 | (2.1 | ) | ||||||||

| Less: Predecessor net income prior to initial public offering on January 24, 2013 |

— | 3.5 | (3.5 | ) | ||||||||

| Net income attributable to SXCP subsequent to initial public offering |

13.2 | 11.8 | 1.4 | |||||||||

| (1) | See definition of Adjusted EBITDA and reconciliation elsewhere in this release. |

Revenues were $161.4 million in first quarter 2014, a decline of $23.5 million from same prior year period due to the pass-through of lower coal prices and lower coke sales volumes, partly offset by $11.7 million of revenue generated by our new Coal Logistics business.

Operating income and Adjusted EBITDA fell $8.2 million and $5.5 million in first quarter 2014 to $26.3 million and $36.0 million, respectively, compared to strong prior year performance. These declines reflect the impact of severe winter weather, which drove lower yields and production in our cokemaking business, and was partly offset by our new Coal Logistics business. The portion of Adjusted EBITDA attributable to SXCP was $23.6 million in first quarter 2014.

First quarter 2014 net income attributable to SXCP was $13.2 million, or $0.41 per unit. Prior year net income attributable to SXCP of $11.8 million, or $0.37 per unit, in first quarter 2013 is not comparable as it reflects a

2

shortened quarter due to the timing of the closing of our initial public offering on January 24, 2013. Other factors affecting the year-over-year comparison of net income include the decline in operating income described above, partly offset by lower financing costs versus prior year which included expenses related to the early paydown of a term loan and fees associated with the issuance of new debt.

FIRST QUARTER SEGMENT INFORMATION

Domestic Coke

Domestic Coke segment consists of our current 65 percent ownership interest in SXC’s Haverhill and Middletown cokemaking facilities, located in Franklin Furnace and Middletown, Ohio, respectively.

Severe winter weather drove lower yields and production as well as higher operating costs, contributing to coke sales volumes falling 35 thousand tons year-over-year to 413 thousand tons and Adjusted EBITDA declining $6.2 million to $35.3 million in first quarter 2014. Prior year performance benefited from exceptionally strong coal-to-coke yields.

Coal Logistics

The Coal Logistics segment was formed as a result of our acquisitions of Lake Terminal in third quarter 2013 and KRT in fourth quarter 2013.

Coal Logistics handled 4,359 thousand tons of coal, contributing $2.1 million to Adjusted EBITDA. This lower than expected Adjusted EBITDA performance reflects higher costs and lower volumes at Lake Terminal due to weather impact.

Corporate and Other

Corporate and other costs were $1.4 million in first quarter 2014. Prior to the formation of our Coal Logistics segment in third quarter 2013, corporate costs were included in Domestic Coke segment results.

CASH DISTRIBUTIONS

On April 21, 2014, the Board of Directors of SXCP’s general partner declared a quarterly cash distribution of $0.50 per limited partnership unit, an increase of 5.3 percent over the previous quarter’s cash distribution rate of $0.4750. This cash distribution will be paid May 30, 2014 to unit holders of record on May 15, 2014.

RELATED COMMUNICATIONS

We will host an investor conference call tomorrow at 9:00 a.m. Eastern Time (8:00 a.m. Central Time). This conference call will be webcast live and archived for replay on the Investor Relations section of www.sxcpartners.com. Participants can listen in by dialing 1-800-471-6718 (domestic) or 1-630-691-2735 (international) and referencing confirmation 37014046. Please log in or dial in at least 10 minutes prior to the start time to ensure a connection. A replay of the call will be available for two weeks by calling 1-888-843-7419 (domestic) or 1-630-652-3042 (international) and referencing confirmation 3701 4046#.

UPCOMING EVENTS

We plan to participate in the following investor conferences:

| • | Brean Capital 2014 Global Resources & Infrastructure Conference on May 28, 2014 in New York, NY |

| • | National Association of Publicly Traded Partnerships 2014 MLP Investor Conference on May 21-22, 2014 in Ponte Vedra Beach, FL |

3

SUNCOKE ENERGY PARTNERS PREDECESSOR

Financial results for periods prior to the January 24, 2013 closing of SXCP’s initial public offering represent the financial results of SXCP’s predecessor, which was comprised of 100 percent of the cokemaking operations and related assets of SXC’s Haverhill and Middletown facilities. These financial results include all revenues, costs, assets and liabilities attributed to the predecessor after the elimination of all significant intercompany accounts and transactions. Upon the closing of the IPO, SXC contributed a 65 percent interest in the predecessor to SXCP. Our financial reporting reflects SXC’s 35 percent ownership interest in these facilities as a noncontrolling interest.

NOTICE

This statement is intended to serve as qualified notice to nominees as provided for under Treasury Regulation Section 1.1446-4(b)(4) and (d) given by a publicly traded partnership for the nominee to be treated as a withholding agent. Please note that SXCP’s quarterly cash distributions are treated as partnership distributions for federal income tax purposes and that 100 percent of these distributions to foreign investors are attributable to income that is effectively connected with a United States trade or business. Accordingly, all of SXCP’s distributions to a nominee on behalf of foreign investors are subject to federal income tax withholding at the highest marginal tax rate for individuals or corporations, as applicable. Nominees, and not SXCP, are treated as the withholding agents responsible for withholding on the distributions received by them on behalf of foreign investors.

ABOUT SUNCOKE ENERGY PARTNERS, L.P.

SunCoke Energy Partners, L.P. (NYSE: SXCP) is a publicly-traded master limited partnership that manufactures coke used in the blast furnace production of steel and provides coal handling services to the coke, steel and power industries. Our advanced, heat recovery cokemaking process produces consistently high-quality coke, captures waste heat to generate steam or electricity, and reduces environmental impacts. Our coal handling terminals have the collective capacity to blend and transload more than 30 million tons of coal annually and are strategically located to enable material delivery to U.S. ports in the Gulf Coast, East Coast and Great Lakes. Our General Partner is a wholly owned subsidiary of SunCoke Energy, Inc. (NYSE: SXC), the largest independent producer of coke in the Americas, with 50 years of cokemaking experience and an international reputation for leadership, innovation and environmental stewardship in our industry.

DEFINITIONS

| • | Adjusted EBITDA represents earnings before interest, taxes, depreciation, depletion and amortization (“EBITDA”) adjusted for sales discounts and the interest, taxes, depreciation, depletion and amortization attributable to our equity method investment. EBITDA reflects sales discounts included as a reduction in sales and other operating revenue. The sales discounts represent the sharing with customers of a portion of nonconventional fuel tax credits, which reduce our income tax expense. However, we believe our Adjusted EBITDA would be inappropriately penalized if these discounts were treated as a reduction of EBITDA since they represent sharing of a tax benefit that is not included in EBITDA. Accordingly, in computing Adjusted EBITDA, we have added back these sales discounts. Our Adjusted EBITDA also includes EBITDA attributable to our equity method investment. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance of the Company’s net assets and provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance. Adjusted EBITDA is a measure of operating performance that is not |

4

| defined by GAAP, does not represent and should not be considered a substitute for net income as determined in accordance with GAAP. Calculations of Adjusted EBITDA may not be comparable to those reported by other companies. |

| • | Adjusted EBITDA attributable to SXC/SXCP equals Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests. |

| • | Distributable Cash Flow equals Adjusted EBITDA less net cash paid for interest expense, on-going capital expenditures, accruals for replacement capital expenditures, and cash distributions to noncontrolling interests; plus amounts received under the Omnibus Agreement and acquisition expenses deemed to be Expansion Capital under our Partnership Agreement. Distributable Cash Flow is a non-GAAP supplemental financial measure that management and external users of the Partnership’s financial statements, such as industry analysts, investors, lenders and rating agencies use to assess: |

| • | the Partnership’s operating performance as compared to other publicly traded partnerships, without regard to historical cost basis; |

| • | the ability of the Partnership’s assets to generate sufficient cash flow to make distributions to the Partnership’s unitholders; |

| • | the Partnership’s ability to incur and service debt and fund capital expenditures; and |

| • | the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities. |

The Partnership believes that Distributable Cash Flow provides useful information to investors in assessing the Partnership’s financial condition and results of operations. Distributable Cash Flow should not be considered an alternative to net income, operating income, cash flows from operating activities, or any other measure of financial performance or liquidity presented in accordance with generally accepted accounting principles (GAAP). Distributable Cash Flow has important limitations as an analytical tool because it excludes some, but not all, items that affect net income and net cash provided by operating activities and used in investing activities. Additionally, because Distributable Cash Flow may be defined differently by other companies in the industry, the Partnership’s definition of Distributable Cash Flow may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

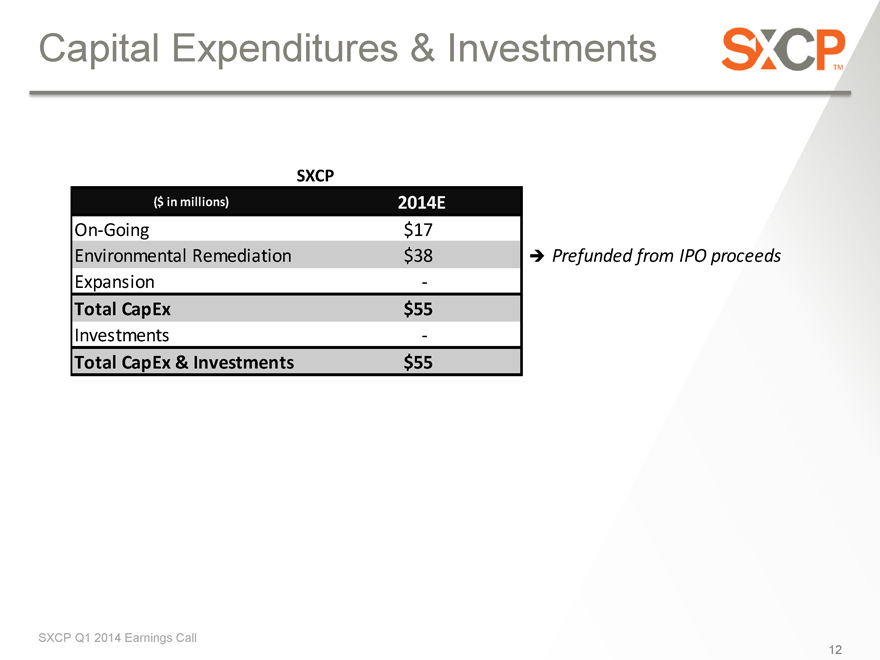

| • | Ongoing capital expenditures (“capex”) are capital expenditures made to maintain the existing operating capacity of our assets and/or to extend their useful lives. Ongoing capex also includes new equipment that improves the efficiency, reliability or effectiveness of existing assets. Ongoing capex does not include normal repairs and maintenance, which are expensed as incurred, or significant capital expenditures. For purposes of calculating distributable cash flow, the portion of ongoing capex attributable to SXCP is used |

| • | Replacement capital expenditures (“capex”) represents an annual accrual necessary to fund SXCP’s share of the estimated costs to replace or rebuild our facilities at the end of their working lives. This accrual is estimated based on the average quarterly anticipated replacement capital that we expect to incur over the long term to replace our major capital assets at the end of their working lives. The replacement capex accrual estimate will be subject to review and prospective change by SXCP’s general partner at least annually and whenever an event occurs that causes a material adjustment of replacement capex, provided such change is approved by our conflicts committee. |

FORWARD LOOKING STATEMENTS

Some of the statements included in this press release constitute “forward looking statements.” Forward-looking statements include all statements that are not historical facts and may be identified by the use of such words as “believe,” “expect,” “plan,” “project,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions. Forward-looking statements are inherently uncertain and involve significant known and unknown risks and uncertainties (many of which are beyond the control of the Company) that could cause actual results to differ materially.

5

Such risks and uncertainties include, but are not limited to domestic and international economic, political, business, operational, competitive, regulatory, and/or market factors affecting the Company, as well as uncertainties related to: pending or future litigation, legislation, or regulatory actions; liability for remedial actions or assessments under existing or future environmental regulations; gains and losses related to acquisition, disposition or impairment of assets; recapitalizations; access to, and costs of, capital; the effects of changes in accounting rules applicable to the Company; and changes in tax, environmental and other laws and regulations applicable to the Company’s businesses.

Forward-looking statements are not guarantees of future performance, but are based upon the current knowledge, beliefs and expectations of Company management, and upon assumptions by the Company concerning future conditions, any or all of which ultimately may prove to be inaccurate. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company does not intend, and expressly disclaims any obligation, to update or alter its forward-looking statements (or associated cautionary language), whether as a result of new information, future events or otherwise after the date of this press release except as required by applicable law.

The Company has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement made by the Company. For information concerning these factors, see the Company’s Securities and Exchange Commission filings such as its annual and quarterly reports and current reports on Form 8-K, copies of which are available free of charge on the Company’s website at www.sxcpartners.com. All forward-looking statements included in this press release are expressly qualified in their entirety by such cautionary statements. Unpredictable or unknown factors not discussed in this release also could have material adverse effects on forward-looking statements.

###

6

SunCoke Energy Partners, L.P.

Combined and Consolidated Statements of Income

(Unaudited)

| Three Months Ended March 31, | ||||||||

| 2014 | 2013 | |||||||

| (Dollars and units in millions, except per unit amounts) |

||||||||

| Revenues |

||||||||

| Sales and other operating revenue |

$ | 161.4 | $ | 184.9 | ||||

|

|

|

|

|

|||||

| Costs and operating expenses |

||||||||

| Cost of products sold and operating expenses |

120.5 | 138.4 | ||||||

| Selling, general and administrative expenses |

4.9 | 4.4 | ||||||

| Depreciation and amortization expense |

9.7 | 7.6 | ||||||

|

|

|

|

|

|||||

| Total costs and operating expenses |

135.1 | 150.4 | ||||||

|

|

|

|

|

|||||

| Operating income |

26.3 | 34.5 | ||||||

| Interest expense, net |

2.9 | 6.7 | ||||||

|

|

|

|

|

|||||

| Income before income tax expense |

23.4 | 27.8 | ||||||

| Income tax expense |

0.3 | 3.9 | ||||||

|

|

|

|

|

|||||

| Net income |

23.1 | 23.9 | ||||||

| Less: Net income attributable to noncontrolling interests |

9.9 | 8.6 | ||||||

|

|

|

|

|

|||||

| Net income attributable to SunCoke Energy Partners, L.P./Predecessor |

13.2 | 15.3 | ||||||

| Less: Predecessor net income prior to initial public offering on January 24, 2013 |

— | 3.5 | ||||||

|

|

|

|

|

|||||

| Net income attributable to SunCoke Energy Partners, L.P. subsequent to initial public offering |

$ | 13.2 | $ | 11.8 | ||||

|

|

|

|

|

|||||

| General partner’s interest in net income |

$ | 0.4 | $ | 0.2 | ||||

| Common unitholders’ interest in net income |

$ | 6.4 | $ | 5.8 | ||||

| Subordinated unitholders’ interest in net income |

$ | 6.4 | $ | 5.8 | ||||

| Weighted average common units outstanding (basic and diluted) |

15.7 | 15.7 | ||||||

| Weighted average subordinated units outstanding (basic and diluted) |

15.7 | 15.7 | ||||||

| Net income per common unit (basic and diluted) |

$ | 0.41 | $ | 0.37 | ||||

| Net income per subordinated unit (basic and diluted) |

$ | 0.41 | $ | 0.37 | ||||

7

SunCoke Energy Partners, L.P.

Consolidated Balance Sheets

| March 31, 2014 | December 31, 2013 | |||||||

| (Unaudited) | ||||||||

| (Dollars in millions) | ||||||||

| Assets |

||||||||

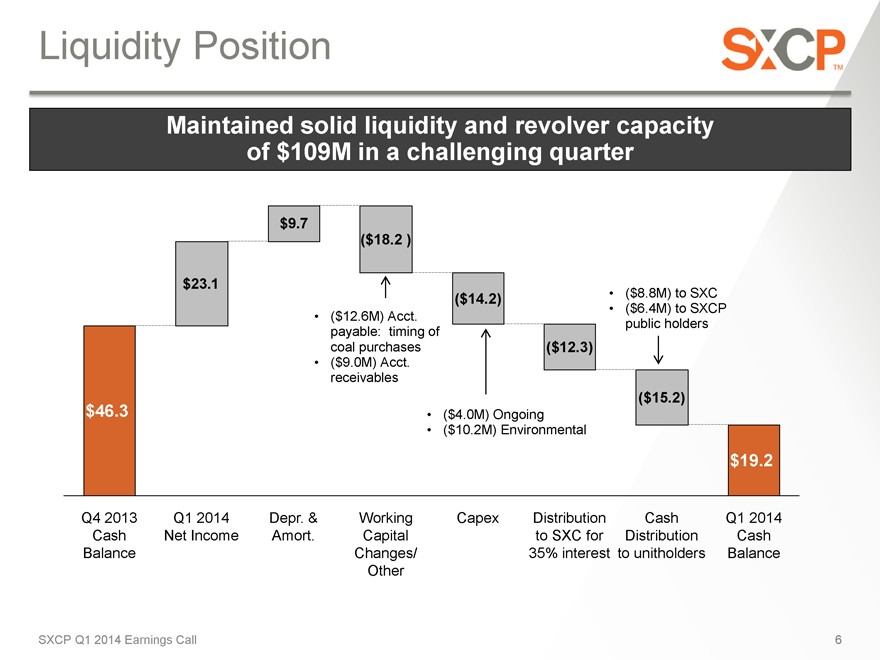

| Cash and cash equivalents |

$ | 19.2 | $ | 46.3 | ||||

| Receivables |

29.2 | 20.2 | ||||||

| Receivables from affiliates, net |

— | 6.4 | ||||||

| Inventories |

56.6 | 59.3 | ||||||

| Other current assets |

3.2 | 1.7 | ||||||

|

|

|

|

|

|||||

| Total current assets |

108.2 | 133.9 | ||||||

|

|

|

|

|

|||||

| Properties, plants and equipment, net |

875.4 | 871.1 | ||||||

| Goodwill and other intangible assets, net |

15.8 | 16.0 | ||||||

| Deferred charges and other assets |

7.1 | 6.5 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 1,006.5 | $ | 1,027.5 | ||||

|

|

|

|

|

|||||

| Liabilities and Equity |

||||||||

| Accounts payable |

$ | 45.7 | $ | 58.7 | ||||

| Accrued liabilities |

5.2 | 6.4 | ||||||

| Short-term debt |

40.0 | 40.0 | ||||||

| Interest payable |

1.8 | 4.6 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

92.7 | 109.7 | ||||||

|

|

|

|

|

|||||

| Long-term debt |

149.7 | 149.7 | ||||||

| Deferred income taxes |

3.1 | 2.8 | ||||||

| Other deferred credits and liabilities |

0.7 | 0.6 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

246.2 | 262.8 | ||||||

|

|

|

|

|

|||||

| Equity |

||||||||

| Held by public: |

||||||||

| Common units (issued and outstanding 13,504,125 and 13,503,456 units at March 31, 2014 and December 31, 2013, respectively) |

239.9 | 240.8 | ||||||

| Held by parent: |

||||||||

| Common units (issued and outstanding 2,209,697 units at March 31, 2014 and December 31, 2013) |

40.9 | 41.0 | ||||||

| Subordinated units (issued and outstanding 15,709,697 units at March 31, 2014 and December 31, 2013) |

289.4 | 290.4 | ||||||

| General partner interest (2% interest) |

8.3 | 8.3 | ||||||

|

|

|

|

|

|||||

| Partners’ capital attributable to SunCoke Energy Partners, L.P. |

578.5 | 580.5 | ||||||

| Noncontrolling interest |

181.8 | 184.2 | ||||||

|

|

|

|

|

|||||

| Total equity |

760.3 | 764.7 | ||||||

|

|

|

|

|

|||||

| Total liabilities and partners’ net equity |

$ | 1,006.5 | $ | 1,027.5 | ||||

|

|

|

|

|

|||||

8

SunCoke Energy Partners, L.P.

Combined and Consolidated Statements of Cash Flows

(Unaudited)

| Three Months Ended March 31, | ||||||||

| 2014 | 2013 | |||||||

| (Dollars in millions) | ||||||||

| Cash Flows from Operating Activities: |

||||||||

| Net income |

$ | 23.1 | $ | 23.9 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||

| Depreciation and amortization expense |

9.7 | 7.6 | ||||||

| Deferred income tax expense |

0.3 | 3.9 | ||||||

| Changes in working capital pertaining to operating activities: |

||||||||

| Receivables |

(9.0 | ) | (36.4 | ) | ||||

| Receivables from affiliate, net |

6.4 | — | ||||||

| Inventories |

2.7 | 4.5 | ||||||

| Accounts payable |

(12.6 | ) | 9.5 | |||||

| Accrued liabilities |

(1.2 | ) | (13.9 | ) | ||||

| Interest payable |

(2.8 | ) | 2.1 | |||||

| Payable to affiliate |

— | 2.4 | ||||||

| Other |

(2.0 | ) | 2.1 | |||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

14.6 | 5.7 | ||||||

|

|

|

|

|

|||||

| Cash Flows from Investing Activities: |

||||||||

| Capital expenditures |

(14.2 | ) | (5.7 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(14.2 | ) | (5.7 | ) | ||||

|

|

|

|

|

|||||

| Cash Flows from Financing Activities: |

||||||||

| Proceeds from issuance of common units of SunCoke Energy Partners, L.P., net of offering costs |

— | 232.0 | ||||||

| Proceeds from issuance of long-term debt |

— | 150.0 | ||||||

| Repayment of long-term debt |

— | (225.0 | ) | |||||

| Debt issuance costs |

— | (5.9 | ) | |||||

| Proceeds from revolving credit facility |

16.0 | — | ||||||

| Repayment of revolving facility |

(16.0 | ) | — | |||||

| Distributions to unitholders (public and parent) |

(15.2 | ) | — | |||||

| Distributions to noncontrolling interest |

(12.3 | ) | (44.9 | ) | ||||

|

|

|

|

|

|||||

| Net cash (used in) provided by financing activities |

(27.5 | ) | 106.2 | |||||

|

|

|

|

|

|||||

| Net (decrease) increase in cash |

(27.1 | ) | 106.2 | |||||

| Cash at beginning of period |

46.3 | — | ||||||

|

|

|

|

|

|||||

| Cash at end of period |

$ | 19.2 | $ | 106.2 | ||||

|

|

|

|

|

|||||

9

SunCoke Energy Partners, L.P.

Segment Operating Data

| Three Months Ended March 31, | ||||||||

| 2014 | 2013 | |||||||

| (Unaudited) | ||||||||

| (Dollars in millions) | ||||||||

| Sales and other operating revenues: |

||||||||

| Domestic Coke |

$ | 149.7 | $ | 184.9 | ||||

| Coal Logistics |

11.7 | — | ||||||

| Coal Logistics intersegment sales |

1.1 | — | ||||||

| Elimination of intersegment sales |

(1.1 | ) | — | |||||

|

|

|

|

|

|||||

| Total |

$ | 161.4 | $ | 184.9 | ||||

|

|

|

|

|

|||||

| Adjusted EBITDA(1): |

||||||||

| Domestic Coke |

$ | 35.3 | $ | 41.5 | ||||

| Coal Logistics |

2.1 | — | ||||||

| Corporate and Other (2) |

(1.4 | ) | — | |||||

|

|

|

|

|

|||||

| Total |

$ | 36.0 | $ | 41.5 | ||||

|

|

|

|

|

|||||

| Coke Operating Data: |

||||||||

| Domestic Coke capacity utilization (%) |

102 | 109 | ||||||

| Domestic Coke production volumes (thousands of tons) |

414 | 442 | ||||||

| Domestic Coke sales volumes (thousands of tons) |

413 | 448 | ||||||

| Domestic Coke Adjusted EBITDA per ton(3) |

$ | 85.47 | $ | 92.63 | ||||

| Coal Logistics Operating Data: |

||||||||

| Tons handled (thousands of tons) |

4,359 | — | ||||||

| Coal Logistics Adjusted EBITDA per ton handled(4) |

$ | 0.48 | $ | — | ||||

| (1) | See definition of Adjusted EBITDA and reconciliation to GAAP elsewhere in this release. |

| (2) | Prior to the third quarter of 2013, the Partnership had only one reportable segment; therefore corporate and other expenses were included in Domestic Coke segment results. |

| (3) | Reflects Domestic Coke Adjusted EBITDA divided by Domestic Coke sales volumes. |

| (4) | Reflects Coal Logistics Adjusted EBITDA divided by Coal Logistics tons handled. |

10

SunCoke Energy Partners, L.P.

Reconciliations of Non-GAAP Information

Adjusted EBITDA to Net Income

| Three Months Ended March 31, | SunCoke Energy Partners, L.P. Predecessor |

SunCoke Energy Partners, L.P. |

||||||||||||||

| 2014 | 2013 | Period from January 1, 2013 to January 23, 2013 |

Period from January 24, 2013 to March 31, 2013 |

|||||||||||||

| (Dollars in millions) | ||||||||||||||||

| Adjusted EBITDA attributable to SunCoke Energy Partners, L.P./Predecessor |

$ | 23.6 | $ | 30.1 | $ | 9.7 | $ | 20.4 | ||||||||

| Add: Adjusted EBITDA attributable to noncontrolling interest(1) |

12.4 | 11.4 | — | 11.4 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA |

36.0 | 41.5 | 9.7 | 31.8 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Subtract: |

||||||||||||||||

| Depreciation and amortization expense |

9.7 | 7.6 | 1.9 | 5.7 | ||||||||||||

| Interest expense, net |

2.9 | 6.7 | 0.6 | 6.1 | ||||||||||||

| Income tax expense |

0.3 | 3.9 | 3.7 | 0.2 | ||||||||||||

| Sales discounts provided to customers due to sharing of nonconventional fuel tax credits(2) |

— | (0.6 | ) | — | (0.6 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | 23.1 | $ | 23.9 | $ | 3.5 | $ | 20.4 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Reflects net income attributable to noncontrolling interest adjusted for noncontrolling interest share of interest, taxes and depreciation. |

| (2) | At December 31, 2012, we had $12.4 million in accrued sales discounts to be paid to our customer at our Haverhill facility. During the first quarter of 2013, we settled this obligation for $11.8 million which resulted in a gain of $0.6 million. This gain is recorded in sales and other operating revenue on our combined and consolidated statement of income. |

11

SunCoke Energy Partners, L.P.

Reconciliations of Non-GAAP Information

Reconciliation of Adjusted EBITDA and

Distributable Cash Flow to Net Income

| Three Months Ended March 31, | ||||||||

| 2014 | 2013 | |||||||

| (Dollars in millions) | ||||||||

| Net cash provided by operating activities |

$ | 14.6 | $ | 5.7 | ||||

| Depreciation |

(9.7 | ) | (7.6 | ) | ||||

| Changes in working capital and other |

18.2 | 25.8 | ||||||

|

|

|

|

|

|||||

| Net income |

$ | 23.1 | $ | 23.9 | ||||

|

|

|

|

|

|||||

| Add: |

||||||||

| Depreciation and amortization expense |

$ | 9.7 | $ | 7.6 | ||||

| Interest expense, net |

2.9 | 6.7 | ||||||

| Income tax expense |

0.3 | 3.9 | ||||||

| Sales discounts |

— | (0.6 | ) | |||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | 36.0 | $ | 41.5 | ||||

|

|

|

|

|

|||||

| Adjusted EBITDA attributable to NCI |

(12.4 | ) | (11.4 | ) | ||||

|

|

|

|

|

|||||

| Adjusted EBITDA attributable to Predecessor/SXCP |

$ | 23.6 | $ | 30.1 | ||||

|

|

|

|

|

|||||

| Less: |

||||||||

| Ongoing capex (SXCP share) |

(2.7 | ) | (0.7 | ) | ||||

| Replacement capex accrual |

(0.9 | ) | (0.9 | ) | ||||

| Cash interest accrual |

(3.1 | ) | (2.9 | ) | ||||

|

|

|

|

|

|||||

| Distributable cash flow |

$ | 16.9 | $ | 25.6 | ||||

|

|

|

|

|

|||||

| Quarterly Cash Distribution(1) |

$ | 16.2 | $ | 13.2 | ||||

| Distribution Coverage Ratio(1) |

1.04x | 1.94x | ||||||

| (1) | Quarterly cash distribution and the distribution coverage ratio for the first quarter of 2014 are based on total units outstanding as of March 31, 2014. |

12