As filed with the Securities and Exchange Commission on 12/27/2013

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

(811-22721) | |||||||

|

| ||||||||

|

KKR Alternative Corporate Opportunities Fund | ||||||||

|

(Exact name of registrant as specified in charter) | ||||||||

|

| ||||||||

|

555 California Street, 50th Floor San Francisco, CA |

|

94101 | ||||||

|

(Address of principal executive offices) |

|

(Zip code) | ||||||

|

| ||||||||

|

Nicole J. Macarchuk, Esq. KKR Asset Management LLC 555 California Street, 50th Floor San Francisco, CA 94101 | ||||||||

|

(Name and address of agent for service) | ||||||||

|

| ||||||||

|

Registrant’s telephone number, including area code: |

(415) 315-3620 |

| ||||||

|

| ||||||||

|

Date of fiscal year end: |

October 31, 2013 |

| ||||||

|

| ||||||||

|

Date of reporting period: |

October 31, 2013 |

| ||||||

Item 1. Reports to Stockholders.

KKR Alternative Corporate

Opportunities Fund

Annual Report

October 31, 2013

|

|

Alternative Corporate Opportunities Fund |

October 31, 2013 |

Table of Contents

|

Management Discussion of Fund Performance |

1 |

|

Performance Information |

4 |

|

Schedule of Investments |

5 |

|

Statement of Assets and Liabilities |

12 |

|

Statement of Operations |

13 |

|

Statement of Changes in Net Assets |

14 |

|

Financial Highlights |

15 |

|

Notes to Financial Statements |

16 |

|

Report of Independent Registered Public Accounting Firm |

27 |

|

Disclosure of Fund Expenses |

28 |

|

Trustees and Officers |

29 |

|

Additional Information |

31 |

|

Privacy Notice |

32 |

The KKR Alternative Corporate Opportunities Fund (the “Fund”) files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Fund voted proxies relating to portfolio securities during the most recent period ended June 30 will be available (i) without charge, upon request, by calling 855-859-3943; and (ii) on the Commission’s website at http://www.sec.gov.

Management Discussion of Fund Performance

Annual Report

This report provides management’s discussion of fund performance for the KKR Alternative Corporate Opportunities Fund (the “Fund”). In our first annual report for the Fund, we look forward to updating you on some of the broad economic trends in both the United States and abroad and how they are impacting the investment environment in which the Fund operates.

Looking Back on the Markets

We launched the Fund last year amidst a market backdrop which was increasingly driven by policymaking by elected officials and central bank officials across the globe. We believe this has been a steady theme in the aftermath of the global financial crisis of 2007-2009. The European Central Bank (“ECB”) President Mario Draghi’s “bumble bee” speech in July 2012, in which he indicated that the ECB was ready to do whatever it takes to preserve the euro, launched a risk rally that gained momentum throughout the second half of 2012. Today, we find the search for yield continues against a backdrop of exceptionally low interest rates and repeated injections of liquidity through central bank asset purchases around the world. The end of 2012 saw the United States reach a last-minute political deal to avert a fiscal crisis, and in October 2013, a two-week shutdown of the federal government resulted in extending the debt ceiling to February 7, 2014.

Nonetheless, we believe the U.S. economy will continue to press forward with modest GDP growth. The Federal Reserve has signaled continued accommodative policy, suppressing views that intermediate-term rates would rise quickly and thereby extending the constructive macroeconomic environment for risk assets. We continue to see attractive value in credit products on a relative basis and believe high yield and spread products stand to benefit from the Federal Reserve’s renewed accommodative monetary policy.

Most recently, after seeing the Chicago Board Options Exchange Market Volatility Index (“VIX”) soar 32.76% in the second quarter, volatility flat-lined in the third quarter with the VIX returning -1.54%. Investors looking for yield have reacted by turning to the bond markets. Additionally, we have witnessed a resurgence of high yield ETFs in recent months, with approximately $10 billion added in the 10-week period ended October 23, 2013. Flows for loans followed a similar pattern to high yield ETFs throughout the third quarter, although October did see the pace of retail inflows taper with lessening rate concerns. The period of June through October saw $23.3 billion enter the loan asset class, with weekly inflows of slightly more than +$600 million in October alone.(1)

Fund Performance

The Fund is a non-diversified, closed-end management investment company. The Fund seeks to achieve its investment objective primarily by focusing on corporate opportunities and investing in fixed-income and equity securities with a credit-oriented point of view. The Fund seeks to tactically and dynamically allocate capital across companies’ capital structures where KKR Asset Management LLC (the “Adviser”) believes its rigorous due diligence process has identified compelling investment opportunities. These investment opportunities generally arise where the Adviser has identified one of the following three broad investment strategies: issuer distress, event-driven misvaluations of securities, or capital market inefficiencies.

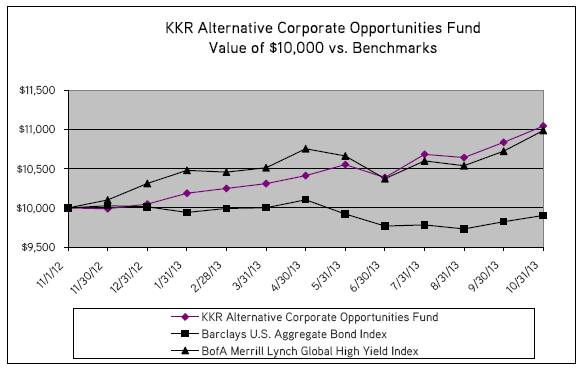

The Fund commenced operations on November 1, 2012. The following represents full-year performance and portfolio characteristics as of October 31, 2013:

As of the year ended October 31, 2013, the Fund held 43.2% of its net assets in high yield corporate debt, 31.2% of its net assets in first and second lien leveraged loans, 6.1% of its net assets in common stock and 6.2% of its net assets in preferred stock. The Fund’s 101 investments represented obligations and equity interests in 80 companies diversified across 18 distinct industries. The top ten issuers represented 42.2% of the total holdings in the Fund while the top five industry groups represented 56.9% of the Fund’s total

(1) Source: JP Morgan High Yield and Leveraged Loan Research as of November 1, 2013.

holdings. 77.0% of the Fund’s holdings represented investments in U.S. companies. The Fund’s Securities and Exchange Commission (“SEC”) 30-day yield as of October 31, 2013 was 4.58% and the Fund’s duration was approximately five years.

For the fiscal year ended October 31, 2013, the Fund’s returns were 10.46%. During the same period, the Barclays U.S. Aggregate Bond Index and the Bank of America Merrill Lynch Global High Yield Index returned -0.95% and 9.89%, respectively.

Business Updates

On October 18, 2013, KKR & Co L.P. (together with the Fund’s Adviser and its other affiliates, “KKR”) announced a transaction to acquire 100% of Avoca Capital (“Avoca”), a leading European credit manager with approximately €6 billion/$8 billion of assets under management across 21 funds and separate accounts. Avoca was established in 2002 and operates across five European credit strategies including Senior Secured Loans, Credit Opportunities, Long/Short Credit, Global Convertible Bonds, Structured and Illiquid Credit. We believe Avoca’s investment philosophy complements that of the Adviser, and the acquisition represents a significant expansion of KKR’s capabilities in the rapidly growing market for European public credit. We believe that the Avoca acquisition could offer an incremental source of investment ideas for the Fund. We believe this acquisition, expected to close in the first quarter of 2014, offers exciting investment opportunities for KKR as a whole.

We thank you for your partnership and continued investment in the Fund. We look forward to continued communications and will keep you apprised of the progress of the Fund specifically and the leveraged finance market place generally. Information about the Fund is available on our website at kkrfunds.com.

Disclosures

The Bank of America Merrill Lynch Global High Yield Index tracks the performance of USD, EUR, GBP and CAD-denominated below investment grade corporate debt publicly issued in the major domestic or Eurobond markets. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of USD 100 million, EUR 100 million, GBP 50 million or CAD 100 million. Original issue zero coupon bonds, Eurodollar bonds, 144a securities (with and without registration rights), and pay-in-kind securities (including toggle notes) are included in the index. Callable perpetual securities are included provided they are at least one year from the first call date. Fixed-to-floating rate securities are included provided they are callable within the fixed rate period and are at least one year from the last call prior to the date the bond transitions from a fixed to a floating rate security. Contingent capital securities, including those with automatic principal write-down provisions, are included in the index provided they do not have an automatic common equity conversion, unless the conversion is activated by a regulatory authority in which case they are included. Other hybrid capital securities, such as those that potentially convert into preference shares, those with both cumulative and non-cumulative coupon deferral provisions, and those with alternative coupon satisfaction mechanisms, are also included in the index. Securities issued or marketed primarily to retail investors, equity-linked securities, securities in legal default, hybrid securitized corporates, taxable and tax-exempt U.S. municipal securities and DRD-eligible securities are excluded from the index.

Index constituents are capitalization-weighted based on their current amount outstanding times the market price plus accrued interest. Accrued interest is calculated assuming next-day settlement. Cash flows from bond payments that are received during the month are retained in the index until the end of the month and then are removed as part of the rebalancing. Cash does not earn any reinvestment income while it is held in the index. The index is rebalanced on the last calendar day of the month, based on information available up to and including the third business day before the last business day of the month. No changes are made to constituent holdings other than on month end rebalancing dates.

The Barclays U.S. Aggregate Bond Index is composed of approximately 8,000 publicly traded bonds including U.S. government, mortgage-backed, corporate and Yankee bonds. The index is weighted by the market value of the bonds included in the index.

The Chicago Board Options Exchange (CBOE) Volatility Index (VIX) reflects the market’s expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. The VIX reflects the market’s estimate of future volatility, based on the weighted average of the implied volatilities for a wide range of strikes. The first and second month expirations are used until 8 days from expiration, then the second and third are used.

It is not possible to invest directly in an index.

Past performance is not an indication of future results. Returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, expense limitations and the effects of compounding. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. The Fund’s Adviser waived a portion of its management fee and/or reimbursed Fund expenses during the period shown. Had the Adviser not done so, the Fund’s total returns would have been lower. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. Total investment return and principal value of your investment will fluctuate, and your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. An investment in the Fund involves risk, including the loss of principal. For a discussion of the Fund’s risks, see Risk Considerations, Note 3 to the financial statements. Call 855-859-3943 or visit www.kkrfunds.com for performance results current to the most recent calendar quarter-end.

Must be preceded or accompanied by a prospectus.

The Fund is non-diversified. The Fund has been organized as a closed-end management investment company. Closed-end funds differ from open-end management investment companies (commonly known as mutual funds) in that investors in a closed-end fund do not have the right to redeem their shares on a daily basis. Shares of closed-end funds are subject to investment risks, including the possible loss of principal. The Fund intends to invest in securities and other obligations of companies that are experiencing significant financial or business distress, including companies involved in bankruptcy or other reorganization and liquidation proceedings which involve a substantial degree of risk, require a high level of analytical sophistication for successful investment and active monitoring. The Fund may invest without limit in securities that, at the time of investment, are illiquid. The value of investments will fluctuate in response to among many factors affecting the particular company, as well as broader market and economic condition. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic orpolitical instability in other nations.

The Fund’s investments in expectation of a specific event or catalyst can result in losses if the event fails to occur or it does not have the effect foreseen. Investments in various types of debt securities and instruments may be unsecured or unrated, are subject to the risk of non-payment, and may have speculative characteristics. Investments in below investment grade (commonly referred to as “junk” or high-yield) instruments may be particularly susceptible to economic downturns, which could cause losses. The Fund may invest in illiquid and restricted securities that may be difficult to dispose of at a fair price when the Fund believes it is desirable to do so. Derivative investments have risks, including the imperfect correlation between the value of such instruments and the underlying assets of the Fund. The Fund’s investments in securities or other instruments of non-U.S. issuers or borrowers may be traded in undeveloped, inefficient and less liquid markets and may experience greater price volatility and changes in value. The use of leverage by the Fund managers may accelerate the velocity of potential losses. The risk of loss from a short sale is unlimited because the Fund must purchase the shorted security at a higher price to complete the transaction and there is no upper limit for the security price. The use of options, swaps, and derivatives by the Fund has the potential to significantly increase the Fund’s volatility. Bond and bond funds generally decrease in value as interest ratesrise. Mortgage-backed securities are subject to prepayment risk and extension risk and therefore react differently to changes in interest rates than other bonds. Small movements in interest rates may quickly and significantly reduce the value of certain mortgage-backed securities.

Performance Information

|

Average Annual Total Returns |

|

Since Inception |

|

|

|

|

|

|

|

KKR Alternative Corporate Opportunities Fund |

|

10.46 |

% |

|

Barclays U.S. Aggregate Bond Index |

|

(0.95 |

)% |

|

BofA Merrill Lynch Global High Yield Index |

|

9.89 |

% |

Schedule of Investments

|

|

|

Par† |

|

Value |

| ||

|

HIGH YIELD SECURITIES - 43.2% |

|

|

|

|

| ||

|

Banks - 2.2% |

|

|

|

|

| ||

|

SquareTwo Financial Corp. |

|

|

|

|

| ||

|

11.625%, 04/01/2017 |

|

820,000 |

|

$ |

867,150 |

| |

|

|

|

|

|

|

| ||

|

Capital Goods - 4.0% |

|

|

|

|

| ||

|

Bombardier, Inc. |

|

|

|

|

| ||

|

6.125%, 01/15/2023 (a) (j) |

|

28,000 |

|

28,350 |

| ||

|

Builders FirstSource, Inc. |

|

|

|

|

| ||

|

7.625%, 06/01/2021 (a) |

|

313,000 |

|

325,520 |

| ||

|

Great Lakes Dredge & Dock Corp. |

|

|

|

|

| ||

|

7.375%, 02/01/2019 |

|

37,000 |

|

38,018 |

| ||

|

Jeld-Wen Escrow Corp. |

|

|

|

|

| ||

|

12.250%, 10/15/2017 (a) |

|

295,000 |

|

337,037 |

| ||

|

Maxim Crane Works LP (Maxim Finance Corp.) |

|

|

|

|

| ||

|

12.250%, 04/15/2015 (a) |

|

366,000 |

|

376,980 |

| ||

|

New Enterprise Stone & Lime Co., Inc. |

|

|

|

|

| ||

|

13.000%, 03/15/2018 (d) |

|

461,890 |

|

484,984 |

| ||

|

|

|

|

|

1,590,889 |

| ||

|

Consumer Durables & Apparel - 4.2% |

|

|

|

|

| ||

|

Algeco Scotsman Global Sarl |

|

|

|

|

| ||

|

10.750%, 10/15/2019 (a) (j) |

|

317,000 |

|

328,888 |

| ||

|

Hot Topic, Inc. |

|

|

|

|

| ||

|

9.250%, 06/15/2021 (a) |

|

1,257,000 |

|

1,316,707 |

| ||

|

|

|

|

|

1,645,595 |

| ||

|

Consumer Services - 0.9% |

|

|

|

|

| ||

|

Education Management Corp. |

|

|

|

|

| ||

|

15.000%, 07/01/2018 |

|

319,921 |

|

347,114 |

| ||

|

|

|

|

|

|

| ||

|

Diversified Financials - 0.2% |

|

|

|

|

| ||

|

FTI Consulting, Inc. |

|

|

|

|

| ||

|

6.000%, 11/15/2022 |

|

60,000 |

|

61,200 |

| ||

|

|

|

|

|

|

| ||

|

Health Care Equipment & Services - 1.2% |

|

|

|

|

| ||

|

CRC Health Group, Inc. |

|

|

|

|

| ||

|

10.750%, 02/01/2016 |

|

70,000 |

|

70,350 |

| ||

|

IMS Health, Inc. |

|

|

|

|

| ||

|

7.375%, 09/01/2018 (a) (d) |

|

36,000 |

|

37,215 |

| ||

|

Select Medical Corp. |

|

|

|

|

| ||

|

6.375%, 06/01/2021 |

|

382,000 |

|

368,630 |

| ||

|

|

|

|

|

476,195 |

| ||

|

Insurance - 3.5% |

|

|

|

|

| ||

|

Ambac Assurance Corp. |

|

|

|

|

| ||

|

5.100%, 06/07/2020 (a) |

|

341,000 |

|

303,490 |

| ||

|

Towergate Finance PLC |

|

|

|

|

| ||

|

10.500%, 02/15/2019 (a) (j) |

|

GBP |

646,000 |

|

1,098,160 |

| |

|

|

|

|

|

1,401,650 |

| ||

|

Materials - 7.5% |

|

|

|

|

| ||

|

American Rock Salt Co. LLC |

|

|

|

|

| ||

|

8.250%, 05/01/2018 (a) |

|

1,020,000 |

|

989,400 |

| ||

|

Cemex Materials LLC |

|

|

|

|

| ||

|

7.700%, 07/21/2025 (a) |

|

830,000 |

|

875,650 |

| ||

See notes to financial statements.

|

|

|

Par† |

|

Value |

| ||

|

HIGH YIELD SECURITIES - 43.2% (continued) |

|

|

|

|

| ||

|

Materials - 7.5% (continued) |

|

|

|

|

| ||

|

Cemex SAB de CV |

|

|

|

|

| ||

|

9.500%, 06/15/2018 (a) (j) |

|

59,000 |

|

$ |

67,112 |

| |

|

Kerling PLC |

|

|

|

|

| ||

|

10.625%, 02/01/2017 (a) (j) |

|

EUR |

169,000 |

|

244,376 |

| |

|

Kleopatra Acquisition Corp. |

|

|

|

|

| ||

|

11.000%, 08/15/2017 (a) (d) |

|

EUR |

363,000 |

|

539,687 |

| |

|

Pinnacle Agriculture Holdings LLC |

|

|

|

|

| ||

|

9.000%, 11/15/2020 (a) |

|

252,000 |

|

263,340 |

| ||

|

|

|

|

|

2,979,565 |

| ||

|

Media - 6.6% |

|

|

|

|

| ||

|

Catalina Marketing Corp. |

|

|

|

|

| ||

|

N/A, 11/15/2015 (a) (e) |

|

985,000 |

|

805,237 |

| ||

|

Cequel Communications Holdings LLC |

|

|

|

|

| ||

|

5.125%, 12/15/2021 (a) |

|

22,000 |

|

21,340 |

| ||

|

Charter Communications, Inc. |

|

|

|

|

| ||

|

6.625%, 01/31/2022 |

|

75,000 |

|

77,625 |

| ||

|

Good Sam Enterprises LLC |

|

|

|

|

| ||

|

11.500%, 12/01/2016 (f) (g) |

|

470,000 |

|

512,300 |

| ||

|

Intelsat Jackson Holdings SA |

|

|

|

|

| ||

|

5.500%, 08/01/2023 (a) (j) |

|

163,000 |

|

157,295 |

| ||

|

Norcell Sweden Holding 2 AB |

|

|

|

|

| ||

|

10.750%, 09/29/2019 (a) (j) |

|

EUR |

322,000 |

|

484,196 |

| |

|

TL Acquisitions, Inc. |

|

|

|

|

| ||

|

11.500%, 04/15/2020 (a) (f) (g) (h) (i) |

|

748,000 |

|

553,520 |

| ||

|

|

|

|

|

2,611,513 |

| ||

|

Retailing - 5.8% |

|

|

|

|

| ||

|

Gymboree Corp. |

|

|

|

|

| ||

|

9.125%, 12/01/2018 |

|

419,000 |

|

405,383 |

| ||

|

J.C. Penney Corp., Inc. |

|

|

|

|

| ||

|

7.950%, 04/01/2017 |

|

5,000 |

|

4,025 |

| ||

|

7.650%, 08/15/2016 |

|

21,000 |

|

17,167 |

| ||

|

7.625%, 03/01/2097 |

|

5,000 |

|

3,325 |

| ||

|

7.400%, 04/01/2037 |

|

1,147,000 |

|

779,960 |

| ||

|

6.375%, 10/15/2036 |

|

676,000 |

|

452,920 |

| ||

|

5.650%, 06/01/2020 |

|

152,000 |

|

113,430 |

| ||

|

The Bon-Ton Department Stores, Inc. |

|

|

|

|

| ||

|

8.000%, 06/15/2021 |

|

537,000 |

|

506,123 |

| ||

|

|

|

|

|

2,282,333 |

| ||

|

Software & Services - 3.6% |

|

|

|

|

| ||

|

CompuCom Systems, Inc. |

|

|

|

|

| ||

|

7.000%, 05/01/2021 (a) |

|

39,000 |

|

38,415 |

| ||

|

Epicor Software Corp. |

|

|

|

|

| ||

|

9.000%, 06/15/2018 (a) (d) |

|

852,000 |

|

873,300 |

| ||

|

iPayment Investors LP |

|

|

|

|

| ||

|

10.250%, 05/15/2018 |

|

670,000 |

|

515,900 |

| ||

|

|

|

|

|

1,427,615 |

| ||

|

Technology Hardware & Equipment - 2.0% |

|

|

|

|

| ||

|

Artesyn Technologies, Inc. |

|

|

|

|

| ||

|

9.750%, 10/15/2020 (a) |

|

114,000 |

|

117,420 |

| ||

|

Avaya, Inc. |

|

|

|

|

| ||

|

9.000%, 04/01/2019 (a) |

|

146,000 |

|

146,730 |

| ||

See notes to financial statements.

|

|

|

Par† |

|

Value |

| ||

|

HIGH YIELD SECURITIES - 43.2% (continued) |

|

|

|

|

| ||

|

Technology Hardware & Equipment - 2.0% (continued) |

|

|

|

|

| ||

|

CommScope, Inc. |

|

|

|

|

| ||

|

6.625%, 06/01/2020 (a) (d) |

|

466,000 |

|

$ |

476,485 |

| |

|

Live Nation Entertainment, Inc. |

|

|

|

|

| ||

|

7.000%, 09/01/2020 (a) |

|

55,000 |

|

58,437 |

| ||

|

|

|

|

|

799,072 |

| ||

|

Telecommunication Services - 1.3% |

|

|

|

|

| ||

|

GCI, Inc. |

|

|

|

|

| ||

|

8.625%, 11/15/2019 |

|

87,000 |

|

92,438 |

| ||

|

6.750%, 06/01/2021 |

|

279,000 |

|

269,932 |

| ||

|

Sprint Corp. |

|

|

|

|

| ||

|

7.875%, 09/15/2023 (a) |

|

111,000 |

|

120,435 |

| ||

|

T-Mobile USA, Inc. |

|

|

|

|

| ||

|

6.625%, 11/15/2020 |

|

19,000 |

|

20,093 |

| ||

|

|

|

|

|

502,898 |

| ||

|

Utilities - 0.2% |

|

|

|

|

| ||

|

Calpine Corp. |

|

|

|

|

| ||

|

5.875%, 01/15/2024 (a) |

|

58,000 |

|

58,145 |

| ||

|

|

|

|

|

|

| ||

|

TOTAL HIGH YIELD SECURITIES (amortized cost $16,898,644) |

|

|

|

17,050,934 |

| ||

|

|

|

|

|

|

| ||

|

LEVERAGED LOANS - 31.2% |

|

|

|

|

| ||

|

Capital Goods - 8.3% |

|

|

|

|

| ||

|

Data Device Corp., TL 1L B 06/12 |

|

|

|

|

| ||

|

8.000%, 07/11/2018 (b) |

|

12,860 |

|

12,699 |

| ||

|

Quinn Group Ltd., TL 1L A1 12/11 |

|

|

|

|

| ||

|

6.992%, 12/02/2016 (b) (g) (j) |

|

EUR |

410,953 |

|

489,156 |

| |

|

Wheelabrator Allevard SA, TL 1L B1 07/05 |

|

|

|

|

| ||

|

5.492%, 05/29/2015 (b) (g) (j) |

|

EUR |

885,039 |

|

913,266 |

| |

|

Wheelabrator Allevard SA, TL 1L B2 07/05 |

|

|

|

|

| ||

|

3.617%, 05/29/2015 (b) (g) (j) |

|

EUR |

118,218 |

|

121,989 |

| |

|

Wheelabrator Allevard SA, TL 1L B4 07/05 |

|

|

|

|

| ||

|

3.617%, 05/29/2015 (b) (g) (j) |

|

EUR |

104,304 |

|

107,631 |

| |

|

Wheelabrator Allevard SA, TL 1L B5 07/05 |

|

|

|

|

| ||

|

3.617%, 05/29/2015 (b) (g) (j) |

|

EUR |

263,705 |

|

272,116 |

| |

|

Wheelabrator Allevard SA, TL 1L C1 07/05 |

|

|

|

|

| ||

|

4.117%, 05/31/2016 (b) (g) (j) |

|

EUR |

885,039 |

|

913,266 |

| |

|

Wheelabrator Allevard SA, TL 1L C2 07/05 |

|

|

|

|

| ||

|

4.117%, 07/29/2014 (b) (g) (j) |

|

EUR |

75,691 |

|

78,105 |

| |

|

Wheelabrator Allevard SA, TL 1L C4 07/05 |

|

|

|

|

| ||

|

4.117%, 05/31/2016 (b) (g) (j) |

|

EUR |

104,304 |

|

107,631 |

| |

|

Wheelabrator Allevard SA, TL 1L C5 07/05 |

|

|

|

|

| ||

|

4.117%, 05/31/2016 (b) (g) (j) |

|

EUR |

263,705 |

|

272,116 |

| |

|

|

|

|

|

3,287,975 |

| ||

|

Consumer Durables & Apparel - 5.2% |

|

|

|

|

| ||

|

Algeco Scotsman Global Sarl, TL PIK 04/13 |

|

|

|

|

| ||

|

15.750%, 05/01/2018 (d) (g) (j) |

|

1,110,608 |

|

1,092,560 |

| ||

|

Easton-Bell Sports, Inc., TL 1L PIK 11/06 |

|

|

|

|

| ||

|

11.500%, 12/31/2015 (d) (g) |

|

947,404 |

|

947,404 |

| ||

|

|

|

|

|

2,039,964 |

| ||

|

Consumer Services - 2.2% |

|

|

|

|

| ||

|

American Casino & Entertainment Properties LLC, TL 2L 07/13 |

|

|

|

|

| ||

|

11.250%, 01/03/2020 (b) |

|

595,595 |

|

614,952 |

| ||

See notes to financial statements.

|

|

|

Par† |

|

Value |

| |

|

LEVERAGED LOANS - 31.2% (continued) |

|

|

|

|

| |

|

Consumer Services - 2.2% (continued) |

|

|

|

|

| |

|

Education Management Corp., TL 1L C3 02/07 |

|

|

|

|

| |

|

8.250%, 03/30/2018 (b) |

|

272,006 |

|

$ |

273,366 |

|

|

|

|

|

|

888,318 |

| |

|

Energy - 0.5% |

|

|

|

|

| |

|

Willbros United States Holding, Inc., TL 1L B 07/13 |

|

|

|

|

| |

|

11.000%, 08/05/2019 (b) |

|

183,270 |

|

185,866 |

| |

|

|

|

|

|

|

| |

|

Food, Beverage & Tobacco - 1.9% |

|

|

|

|

| |

|

Arysta Lifescience SPC LLC, TL 2L 05/13 |

|

|

|

|

| |

|

8.250%, 11/30/2020 (b) (j) |

|

584,728 |

|

588,988 |

| |

|

CSM Bakery Products, TL 2L 07/13 |

|

|

|

|

| |

|

8.500%, 07/03/2021 (b) |

|

163,962 |

|

165,670 |

| |

|

|

|

|

|

754,658 |

| |

|

Health Care Equipment & Services - 0.2% |

|

|

|

|

| |

|

CHG Healthcare Services, Inc., TL 2L 11/12 |

|

|

|

|

| |

|

9.000%, 11/19/2020 (b) |

|

76,177 |

|

77,573 |

| |

|

|

|

|

|

|

| |

|

Insurance - 1.2% |

|

|

|

|

| |

|

Sedgwick Claims Management Service, Inc., TL 2L 06/13 |

|

|

|

|

| |

|

8.000%, 12/12/2018 (b) |

|

355,615 |

|

362,283 |

| |

|

StoneRiver Holdings, Inc., TL 2L 05/13 |

|

|

|

|

| |

|

8.500%, 05/30/2020 (b) |

|

109,185 |

|

110,550 |

| |

|

|

|

|

|

472,833 |

| |

|

Materials - 0.1% |

|

|

|

|

| |

|

Continental Building Products LLC, TL 2L 07/13 |

|

|

|

|

| |

|

8.500%, 02/26/2021 (b) |

|

56,980 |

|

57,265 |

| |

|

|

|

|

|

|

| |

|

Media - 4.2% |

|

|

|

|

| |

|

Learfield Communications, Inc., TL 2L 10/13 |

|

|

|

|

| |

|

8.750%, 10/08/2021 (b) |

|

15,300 |

|

15,644 |

| |

|

NEP Broadcasting LLC, TL 2L 01/13 |

|

|

|

|

| |

|

9.500%, 07/22/2020 (b) |

|

24,972 |

|

25,744 |

| |

|

TL Acquisitions, Inc., TL 1L 07/07 |

|

|

|

|

| |

|

4.750%, 07/03/2014 (b) (f) (g) (h) (i) |

|

1,829,081 |

|

1,350,100 |

| |

|

TL Acquisitions, Inc., TL 1L B Ext 07/07 |

|

|

|

|

| |

|

7.750%, 07/05/2017 (b) (f) (g) (h) (i) |

|

349,361 |

|

257,437 |

| |

|

|

|

|

|

1,648,925 |

| |

|

Retailing - 1.4 % |

|

|

|

|

| |

|

Guitar Center, Inc., TL 1L Ext 10/07 |

|

|

|

|

| |

|

6.370%, 04/09/2017 (b) |

|

73,421 |

|

71,524 |

| |

|

Hudson’s Bay Co., TL 2L 10/13 |

|

|

|

|

| |

|

8.250%, 10/07/2021 (b) (j) |

|

103,135 |

|

106,165 |

| |

|

J.C. Penney Corp., Inc., TL 1L 05/13 |

|

|

|

|

| |

|

6.000%, 05/22/2018 (b) |

|

40,360 |

|

39,146 |

| |

|

The J Jill Group, Inc., TL 1L 04/11 |

|

|

|

|

| |

|

10.000%, 04/29/2017 (b) (g) |

|

334,607 |

|

334,607 |

| |

|

|

|

|

|

551,442 |

| |

|

Software & Services - 3.5% |

|

|

|

|

| |

|

Digital Insight Corporation, TL 2L 08/13 |

|

|

|

|

| |

|

8.750%, 08/01/2020 (b) (g) |

|

11,443 |

|

11,538 |

| |

|

EZE Castle Software, Inc., TL 2L 04/13 |

|

|

|

|

| |

|

8.750%, 04/05/2021 (b) |

|

181,207 |

|

184,303 |

| |

See notes to financial statements.

|

|

|

Par† |

|

Value |

| |

|

LEVERAGED LOANS - 31.2% (continued) |

|

|

|

|

| |

|

Software & Services - 3.5% (continued) |

|

|

|

|

| |

|

Infor Global Solutions European Finance Sarl, TL PIK 03/07 |

|

|

|

|

| |

|

12.875%, 05/05/2017 (d) |

|

73,600 |

|

$ |

77,832 |

|

|

iPayment Investors LP, TL 1L B 05/11 |

|

|

|

|

| |

|

6.750%, 05/08/2017 (b) |

|

239,790 |

|

234,395 |

| |

|

P2 Energy Solutions, Inc., TL 2L 10/13 |

|

|

|

|

| |

|

N/A, 04/30/2021 (b) (c) |

|

111,260 |

|

112,372 |

| |

|

RedPrairie Corporation, TL 2L 12/12 |

|

|

|

|

| |

|

11.250%, 12/21/2019 (b) |

|

309,127 |

|

320,719 |

| |

|

Travelport LLC, TL 1L 06/13 |

|

|

|

|

| |

|

6.250%, 06/26/2019 (b) |

|

306,282 |

|

312,759 |

| |

|

Travelport LLC, TL 2L 04/13 |

|

|

|

|

| |

|

9.500%, 01/31/2016 (b) |

|

123,773 |

|

128,673 |

| |

|

|

|

|

|

1,382,591 |

| |

|

Technology Hardware & Equipment - 1.0% |

|

|

|

|

| |

|

Websense, Inc., TL 2L 06/13 |

|

|

|

|

| |

|

8.250%, 12/24/2020 (b) |

|

381,546 |

|

382,977 |

| |

|

|

|

|

|

|

| |

|

Telecommunication Services - 1.5% |

|

|

|

|

| |

|

Integra Telecom Holdings, Inc., TL 2L 02/13 |

|

|

|

|

| |

|

9.750%, 02/21/2020 (b) |

|

540,353 |

|

557,634 |

| |

|

Lightower Fiber LLC, TL 2L 04/13 |

|

|

|

|

| |

|

8.000%, 04/12/2021 (b) |

|

42,831 |

|

43,580 |

| |

|

|

|

|

|

601,214 |

| |

|

|

|

|

|

|

| |

|

TOTAL LEVERAGED LOANS (amortized cost $11,651,470) |

|

|

|

12,331,601 |

| |

|

|

|

|

|

|

| |

|

|

|

Shares |

|

|

| |

|

COMMON STOCKS - 6.1% |

|

|

|

|

| |

|

Automobiles & Components - 0.7% |

|

|

|

|

| |

|

General Motors Co. |

|

7,673 |

|

283,517 |

| |

|

|

|

|

|

|

| |

|

Capital Goods - 0.8% |

|

|

|

|

| |

|

Great Lakes Dredge & Dock Corp. |

|

40,000 |

|

324,800 |

| |

|

|

|

|

|

|

| |

|

Health Care Equipment & Services - 1.8% |

|

|

|

|

| |

|

Amedisys, Inc. |

|

42,053 |

|

684,623 |

| |

|

Gentiva Health Services, Inc. (f) (g) (i) |

|

3,653 |

|

41,827 |

| |

|

|

|

|

|

726,450 |

| |

|

Insurance - 1.1% |

|

|

|

|

| |

|

Assured Guaranty Ltd. (j) |

|

20,220 |

|

414,510 |

| |

|

|

|

|

|

|

| |

|

Materials - 1.1% |

|

|

|

|

| |

|

Stillwater Mining Co. |

|

41,570 |

|

453,529 |

| |

|

|

|

|

|

|

| |

|

Software & Services - 0.1% |

|

|

|

|

| |

|

Verint Systems, Inc. |

|

959 |

|

35,022 |

| |

|

|

|

|

|

|

| |

|

Technology Hardware & Equipment - 0.2% |

|

|

|

|

| |

|

Comverse, Inc. |

|

2,183 |

|

68,939 |

| |

See notes to financial statements.

|

|

|

Shares |

|

Value |

| |

|

COMMON STOCKS - 6.1% (continued) |

|

|

|

|

| |

|

Utilities - 0.3% |

|

|

|

|

| |

|

U.S. Power Generating Co. |

|

15,868 |

|

$ |

107,268 |

|

|

|

|

|

|

|

| |

|

TOTAL COMMON STOCKS (cost $2,060,599) |

|

|

|

2,414,035 |

| |

|

|

|

|

|

|

| |

|

PREFERRED STOCKS - 6.2% |

|

|

|

|

| |

|

Banks - 2.5% |

|

|

|

|

| |

|

Federal Home Loan Mortgage Corp., Series Z |

|

|

|

|

| |

|

8.375% (i) |

|

67,863 |

|

481,149 |

| |

|

Federal National Mortgage Association, Series S |

|

|

|

|

| |

|

8.250% (i) |

|

73,256 |

|

520,850 |

| |

|

|

|

|

|

1,001,999 |

| |

|

Household & Personal Products - 3.7% |

|

|

|

|

| |

|

Harbinger Group, Inc. |

|

|

|

|

| |

|

8.000% (g) |

|

916 |

|

1,463,768 |

| |

|

|

|

|

|

|

| |

|

TOTAL PREFERRED STOCKS (cost $1,933,816) |

|

|

|

2,465,767 |

| |

|

|

|

|

|

|

| |

|

TOTAL INVESTMENTS (amortized cost $32,544,529) - 86.7% |

|

|

|

34,262,337 |

| |

|

OTHER ASSETS EXCEEDING LIABILITIES, NET - 13.3% |

|

|

|

5,264,548 |

| |

|

NET ASSETS - 100.0% |

|

|

|

$ |

39,526,885 |

|

† In U.S. Dollars unless otherwise indicated.

(a) Securities exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold to qualified institutional buyers in transactions exempt from registration. The value of these securities as of October 31, 2013 was $11,042,871 and represented 27.9% of net assets.

(b) Variable rate security, the coupon rate shown is the effective rate as of October 31, 2013.

(c) Unsettled bank loan. Interest rate not available as of October 31, 2013.

(d) Represents payment-in-kind security which may pay interest/dividend in additional par/shares.

(e) Zero coupon security.

(f) Security considered restricted due to the Adviser’s knowledge of material non-public information. The value of these securities as of October 31, 2013 was $2,715,184 and represented 6.9% of net assets.

(g) Security considered illiquid, as defined by the Securities and Exchange Commission. The total value of these securities as of October 31, 2013 was $9,840,337 and represented 24.9% of net assets.

(h) Security in default.

(i) Non-income producing security.

(j) Non-U.S. security.

EUR Euro

GBP Great British Pound

The following are the details of the restricted securities held by the Fund:

|

|

|

|

|

|

|

|

|

|

|

% of |

| ||

|

|

|

|

|

Acquisition |

|

Amortized |

|

|

|

Net |

| ||

|

|

|

Par/Shares |

|

date(s) |

|

Cost |

|

Value |

|

Assets |

| ||

|

Gentiva Health Services, Inc. |

|

3,653 |

|

07/03/2013 – 07/09/2013 |

|

$ |

32,456 |

|

$ |

41,827 |

|

0.1 |

% |

|

Good Sam Enterprises LLC, 11.500%, 12/01/2016 |

|

470,000 |

|

11/15/2012 - 04/10/2013 |

|

498,653 |

|

512,300 |

|

1.3 |

% | ||

See notes to financial statements.

|

|

|

Par |

|

Acquisition |

|

Amortized |

|

Value |

|

% of |

| ||

|

TL Acquisitions, Inc., 11.500%, 04/15/2020 |

|

748,000 |

|

11/09/2012- 03/22/2013 |

|

$ |

589,891 |

|

$ |

553,520 |

|

1.4 |

% |

|

TL Acquisitions, Inc., TL 1L 07/07, 4.750%, 07/03/2014 |

|

1,829,081 |

|

11/09/2012- 06/04/2013 |

|

1,441,155 |

|

1,350,100 |

|

3.4 |

% | ||

|

TL Acquisitions, Inc, TL 1L B Ext 07/07, 7.750%, 07/05/2017 |

|

349,361 |

|

03/06/2013- 05/09/2013 |

|

264,844 |

|

257,437 |

|

0.7 |

% | ||

|

Country Weightings |

|

|

|

|

(% of Net Assets) |

|

|

|

|

|

|

|

|

|

United States |

|

66.7 |

% |

|

France |

|

7.1 |

% |

|

Luxembourg |

|

4.0 |

% |

|

United Kingdom |

|

3.4 |

% |

|

Japan |

|

1.5 |

% |

|

Sweden |

|

1.2 |

% |

|

Ireland |

|

1.2 |

% |

|

Bermuda |

|

1.1 |

% |

|

Canada |

|

0.3 |

% |

|

Mexico |

|

0.2 |

% |

|

|

|

86.7 |

% |

|

Other Assets Exceeding Liabilities, Net |

|

13.3 |

% |

|

|

|

100.0 |

% |

The list of the open forward foreign currency contracts held by the Fund as of October 31, 2013 is as follows:

|

|

|

|

|

|

|

Unrealized |

| |||

|

Settlement |

|

Currency to |

|

Currency to |

|

Appreciation |

| |||

|

Date |

|

Deliver |

|

Receive |

|

(Depreciation) |

| |||

|

1/10/2014 |

|

EUR |

1,330,000 |

|

USD |

1,805,993 |

|

$ |

(25,731 |

) |

|

1/10/2014 |

|

GBP |

548,000 |

|

USD |

878,173 |

|

2,299 |

| |

|

|

|

|

|

|

|

$ |

(23,432 |

) | ||

A summary of the counterparties for the open forward foreign currency contracts held by the Fund at October 31, 2013 is as follows:

|

|

|

|

|

|

|

|

|

Unrealized |

| |||

|

|

|

Settlement |

|

Currency to |

|

Currency to |

|

Appreciation |

| |||

|

Counterparty |

|

Date |

|

Deliver |

|

Receive |

|

(Depreciation) |

| |||

|

JPMorgan Chase & Co. |

|

1/10/2014 |

|

$ |

(2,660,734 |

) |

$ |

2,684,166 |

|

$ |

(23,432 |

) |

See notes to financial statements.

Statement of Assets and Liabilities

|

Assets |

|

|

| |

|

Investments, at value (amortized cost $32,544,529) |

|

$ |

34,262,337 |

|

|

Cash and cash equivalents |

|

7,759,362 |

| |

|

Unrealized appreciation on forward foreign currency contracts |

|

2,299 |

| |

|

Receivable for investments sold |

|

915,911 |

| |

|

Interest receivable |

|

567,104 |

| |

|

Receivable from Adviser |

|

115,124 |

| |

|

Prepaid expenses |

|

14,256 |

| |

|

Total assets |

|

43,636,393 |

| |

|

Liabilities |

|

|

| |

|

Payable for investments purchased |

|

3,956,137 |

| |

|

Unrealized depreciation on forward foreign currency contracts |

|

25,731 |

| |

|

Trustees’ fees |

|

3,002 |

| |

|

Administration fees |

|

17,131 |

| |

|

Other accrued expenses |

|

107,507 |

| |

|

Total liabilities |

|

4,109,508 |

| |

|

Net assets |

|

$ |

39,526,885 |

|

|

Net Assets |

|

|

| |

|

Paid-in capital — (100,000,000 shares authorized — $0.001 par value) |

|

$ |

37,397,515 |

|

|

Accumulated net investment income |

|

87,133 |

| |

|

Accumulated net realized gain on investments, written option, forward foreign currency contracts and foreign currency transactions |

|

409,454 |

| |

|

Net unrealized appreciation on investments, forward foreign currency contracts, foreign currency contracts and deferred Trustees’ fees |

|

1,632,783 |

| |

|

Net assets |

|

$ |

39,526,885 |

|

|

Net asset value, price per share |

|

$ |

10.69 |

|

See notes to financial statements.

Statement of Operations

For the year ended October 31, 2013*

|

Investment income |

|

|

| |

|

Interest income |

|

$ |

1,647,926 |

|

|

Dividend income |

|

56,758 |

| |

|

Other income |

|

774 |

| |

|

Total investment income |

|

1,705,458 |

| |

|

Expenses |

|

|

| |

|

Offering costs |

|

497,534 |

| |

|

Investment advisory fees |

|

375,671 |

| |

|

Legal fees |

|

351,000 |

| |

|

Administration fees |

|

78,118 |

| |

|

Shareholder reporting expense |

|

76,858 |

| |

|

Trustees’ fees |

|

63,255 |

| |

|

Transfer agency fees |

|

48,524 |

| |

|

Audit and tax fees |

|

42,154 |

| |

|

Custodian fees |

|

16,554 |

| |

|

Registration fees |

|

11,363 |

| |

|

Other expenses |

|

46,572 |

| |

|

Total expenses |

|

1,607,603 |

| |

|

Less |

|

|

| |

|

Investment advisory fees waived |

|

(375,671 |

) | |

|

Expenses reimbursed by Adviser |

|

(721,159 |

) | |

|

Net expenses |

|

510,773 |

| |

|

Net investment income |

|

1,194,685 |

| |

|

Net realized gain (loss) on |

|

|

| |

|

Investments |

|

458,817 |

| |

|

Written option |

|

4,201 |

| |

|

Forward foreign currency contracts and foreign currency transactions |

|

(89,969 |

) | |

|

Net change in unrealized appreciation (depreciation) on |

|

|

| |

|

Investments |

|

1,539,701 |

| |

|

Forward foreign currency contracts and foreign currency transactions |

|

93,246 |

| |

|

Deferred Trustees’ fees |

|

(164 |

) | |

|

Net realized and unrealized gain on investments, forward foreign currency contracts, written option, foreign currency transactions and deferred Trustees’ fees |

|

2,005,832 |

| |

|

Net increase in net assets resulting from operations |

|

$ |

3,200,517 |

|

* Commenced operations on November 1, 2012.

See notes to financial statements.

Statement of Changes in Net Assets

|

|

|

Year Ended |

| |

|

Operations |

|

|

| |

|

Net investment income |

|

$ |

1,194,685 |

|

|

Net realized gain on investments, written option, forward foreign currency contracts and foreign currency transactions |

|

373,049 |

| |

|

Net change in unrealized appreciation on investments, forward foreign currency contracts, foreign currency transactions and deferred Trustees’ fees |

|

1,632,783 |

| |

|

Net increase in net assets resulting from operations |

|

3,200,517 |

| |

|

Dividends to shareholders from |

|

|

| |

|

Net investment income |

|

(1,071,147 |

) | |

|

Total dividends |

|

(1,071,147 |

) | |

|

Capital transactions(1) |

|

|

| |

|

Proceeds from shares issued |

|

37,297,515 |

| |

|

Net increase in net assets from capital shares transactions |

|

37,297,515 |

| |

|

Net increase in net assets |

|

39,426,885 |

| |

|

Net assets |

|

|

| |

|

Beginning of year |

|

100,000 |

| |

|

End of year |

|

$ |

39,526,885 |

|

|

Accumulated net investment income |

|

$ |

87,133 |

|

* Commenced operations on November 1, 2012.

(1) For Capital Share Transactions, see Note 5 in the notes to the financial statements.

See notes to financial statements.

Financial Highlights

|

|

|

Year Ended |

| |

|

Per share operating performance |

|

|

| |

|

Net asset value, beginning of year |

|

$ |

10.00 |

|

|

Income from operations (1) |

|

|

| |

|

Net investment income |

|

0.41 |

| |

|

Net realized and unrealized gain |

|

0.62 |

| |

|

Total income from operations |

|

1.03 |

| |

|

Dividends from Net investment income |

|

(0.34 |

) | |

|

Total dividends |

|

(0.34 |

) | |

|

Net asset value, end of year # |

|

$ |

10.69 |

|

|

Total return |

|

10.46 |

% | |

|

Ratios to average net assets |

|

|

| |

|

Expenses, after management fees waived and expenses reimbursed by Adviser |

|

1.70 |

% | |

|

Expenses, before management fees waived and expenses reimbursed by Adviser |

|

5.34 |

% | |

|

Net investment income, after management fees waived and expenses reimbursed by Adviser |

|

3.97 |

% | |

|

Net investment income, before management fees waived and expenses reimbursed by Adviser |

|

0.33 |

% | |

|

Supplemental data |

|

|

| |

|

Net assets, end of year (000’s) |

|

$ |

39,527 |

|

|

Portfolio turnover rate |

|

93.53 |

% | |

(1) Per share calculations were performed using average shares.

* Commenced operations on November 1, 2012.

# The net asset value of the Fund is also the market price of the Fund.

See notes to financial statements.

Notes to Financial Statements

1. Organization

KKR Alternative Corporate Opportunities Fund (the “Fund”) was organized on July 16, 2012 as a statutory trust under the laws of the state of Delaware. The Fund is a closed-end management investment company. The Fund commenced operations on November 1, 2012. The Fund’s investment objective is to generate an attractive total return consisting of a high level of current income and capital appreciation. The Fund is non-diversified for purposes of the Investment Company Act of 1940, as amended (the “1940 Act”). KKR Asset Management LLC serves as the Fund’s investment adviser (the “Adviser”).

KKR Alternative Opportunities Fund P, an affiliated fund of the Adviser, invests substantially all of its assets in the Fund.

2. Summary of Significant Accounting Policies

Basis of Presentation — The accompanying financial statements are presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and are stated in United States (“U.S.”) dollars. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in these financial statements. Actual results could differ from those estimates.

Valuation of Investments — The Board of Trustees (the “Board”) of the Fund has adopted valuation policies and procedures to ensure investments are valued in a manner consistent with GAAP as required by the 1940 Act. The Board has delegated primary responsibility in ensuring these valuation policies and procedures are followed, including those relating to fair valuation, to the Adviser.

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Where available, fair value is based on observable market prices or parameters, or derived from such prices or parameters. Where observable prices or inputs are not available, valuation models are applied. These valuation techniques involve some level of management estimation and judgment, the degree of which is dependent on the price transparency for the instruments or market and the instruments’ complexity for disclosure purposes. Assets and liabilities recorded at fair value on the Statement of Assets and Liabilities are categorized based upon the level of judgment associated with the inputs used to measure their value. Hierarchical levels, as defined under GAAP, are directly related to the amount of subjectivity associated with the inputs to fair valuations of these assets and liabilities, and are as follows:

Level 1 — Inputs are unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date.

The type of assets generally included in this category is common stock listed in active markets.

Level 2 — Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 inputs include quoted prices for similar instruments in active markets, and inputs other than quoted prices that are observable for the asset or liability.

The types of assets and liabilities generally included in this category are high yield securities, leveraged loans, common and certain preferred stock not actively traded and financial instruments classified as derivatives.

Level 3 — Inputs are unobservable inputs for the asset or liability, and include situations where there is little, if any, market activity for the asset or liability.

The types of assets generally included in this category are leveraged loans and certain preferred stock not actively traded.

A significant decrease in the volume and level of activity for the asset or liability is an indication that transactions or quoted prices may not be representative of fair value because in such market conditions there may be increased instances of transactions that are not orderly. In those circumstances, further analysis of transactions or quoted prices is needed, and a significant adjustment to the transactions or quoted prices may be necessary to estimate fair value.

The availability of observable inputs can vary depending on the financial asset or liability and is affected by a wide variety of factors, including, for example, the type of product, whether the product is new, whether the product is traded on an active exchange or in the secondary market, and the current market condition. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised by the Fund in determining fair value is greatest for instruments categorized in Level 3. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement in its entirety falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The Fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and consideration of factors specific to the asset. The variability of the observable inputs affected by the factors described above may cause transfers between Levels 1, 2 and/or 3, which the Fund recognizes at the beginning of the reporting period the inputs change.

Many financial assets and liabilities have bid and ask prices that can be observed in the marketplace. Bid prices reflect the highest price that the Fund and others are willing to pay for an asset. Ask prices represent the lowest price that the Fund and others are willing to accept for an asset. For financial assets and liabilities with inputs that are based on bid-ask prices, the Fund does not require that fair value always be a predetermined point in the bid-ask range. The Fund’s policy is to allow for mid-market pricing and adjust to the point within the bid-ask range that meets the Fund’s best estimate of fair value.

Depending on the relative liquidity in the markets for certain assets, the Fund may transfer assets to Level 3 if it determines that observable quoted prices, obtained directly or indirectly, are not available. The valuation techniques used for the assets and liabilities that are valued using Level 3 of the fair value hierarchy are described below.

Leveraged Loan: Leveraged loans are initially valued at transaction price and is subsequently valued using market data for similar instruments (e.g., recent transactions or broker quotes), comparisons to benchmark, derivative indices or valuation models. Valuation models are based on yield analysis techniques, where the key inputs are based on relative value analysis, which incorporates similar instruments from similar issuers. In addition, an illiquidity discount is applied where appropriate.

Preferred Stock: Preferred stock is initially valued at transaction price and is subsequently valued using observable market prices, if available, or internally developed models in the absence of readily observable market prices. Valuation models are generally based on market and income (discounted cash flow) approaches, in which various internal and external factors are considered, or yield analysis techniques, where the key inputs are based on relative value analysis, which incorporates similar instruments from similar issuers. Factors include key financial inputs and recent public and private transactions for comparable investments. Key inputs used for the discounted cash flow approach include the weighted average cost of capital and assumed inputs used to calculate terminal values, such as earnings before interest, taxes, depreciation and amortization (“EBIDTA”) exit multiples. The fair value recorded for a particular investment will generally be within the range suggested by the two approaches. Upon completion of the valuations conducted, an illiquidity discount is applied where appropriate.

Valuation Process

The Adviser has a valuation committee (the “Valuation Committee”), whose members consist of the Adviser’s Head of Asset Management, Chief Financial Officer, General Counsel and certain other employees of the Adviser. The Valuation Committee is responsible for approving pricing sources and procedures and for oversight of the Adviser’s pricing practices, including determining the valuation of investments in circumstances where no external pricing data for an investment is available.

Investments are generally valued based on quotations from third party pricing services, unless such a quotation is unavailable or is determined to be unreliable or inadequately representing the fair value of the particular assets. In that case, valuations are based on either valuation data obtained from one or more other third party pricing sources, including broker dealers selected by the Adviser, or will reflect the Valuation Committee’s good faith determination of fair value based on other factors considered relevant. The valuation process involved in Level 3 measurements for assets and liabilities is completed monthly based on the methodology and assumptions that are used in estimating the value of the investment that are approved by the Valuation Committee on at least a monthly basis and is designed to subject the valuation of Level 3 investments to an appropriate level of consistency, oversight, and review. For assets classified as Level 3, the investment professionals of the Adviser are responsible for preliminary valuations based on various factors including their evaluation of financial and operating data, company specific developments, market valuations of comparable companies and model projections discussed above. All valuations are approved by the Valuation Committee.

The following table presents information about the Fund’s assets and liabilities measured on a recurring basis as of October 31, 2013, and indicates the fair value hierarchy of the inputs utilized by the Fund to determine such fair value:

|

|

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

| ||||

|

Investments and Cash Equivalent |

|

|

|

|

|

|

|

|

| ||||

|

High Yield Securities |

|

$ |

— |

|

$ |

17,050,934 |

|

$ |

— |

|

$ |

17,050,934 |

|

|

Leveraged Loans |

|

— |

|

11,049,590 |

|

1,282,011 |

|

12,331,601 |

| ||||

|

Common Stocks |

|

2,306,767 |

|

107,268 |

|

— |

|

2,414,035 |

| ||||

|

Preferred Stocks |

|

— |

|

1,001,999 |

|

1,463,768 |

|

2,465,767 |

| ||||

|

Cash Equivalent |

|

7,745,175 |

|

— |

|

— |

|

7,745,175 |

| ||||

|

Total Investments and Cash Equivalent |

|

$ |

10,051,942 |

|

$ |

29,209,791 |

|

$ |

2,745,779 |

|

$ |

42,007,512 |

|

|

|

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

| ||||

|

Financial Derivative Instruments |

|

|

|

|

|

|

|

|

| ||||

|

Assets - Foreign Currency Contracts |

|

$ |

— |

|

$ |

2,299 |

|

$ |

— |

|

$ |

2,299 |

|

|

Liabilities - Foreign Currency Contracts |

|

— |

|

(25,731) |

|

— |

|

(25,731 |

) | ||||

|

Total Financial Derivative Instruments |

|

$ |

— |

|

$ |

(23,432) |

|

$ |

— |

|

$ |

(23,432 |

) |

The following is a reconciliation of the investments in which significant unobservable inputs (Level 3) were used in determining fair value:

|

|

|

Leveraged Loans |

|

Preferred Stock |

|

Common Stock |

| |||

|

Balance, beginning of the year |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

Purchases |

|

1,348,900 |

|

1,236,600 |

|

190 |

| |||

|

Sales and paydowns |

|

(66,889 |

) |

— |

|

(190 |

) | |||

|

Change in unrealized appreciation |

|

— |

|

227,168 |

|

— |

| |||

|

Balance, end of the year |

|

$ |

1,282,011 |

|

$ |

1,463,768 |

|

$ |

— |

|

|

Change in unrealized gains/(losses) included in earnings related to securities still held at reporting date |

|

$ |

— |

|

$ |

227,168 |

|

$ |

— |

|

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the reporting year ended October 31, 2013. There were no transfers between levels during the

reporting year ended October 31, 2013, based on the input level assigned under the hierarchy at the beginning of each reporting period.

The following table summarizes the quantitative inputs and assumptions used for items categorized as Level 3 assets as of October 31, 2013. The disclosures below also include qualitative information on the sensitivity of the fair value measurements to changes in the significant unobservable inputs.

|

Financial Asset |

|

Fair Value as |

|

Valuation |

|

Unobservable Inputs |

|

Ranges |

| |

|

Leveraged Loans |

|

$ |

1,282,011 |

|

Yield Analysis |

|

Yield |

|

10.7% - 12.6% |

|

|

|

|

|

|

|

|

Net Leverage |

|

1.8x - 6.2x |

| |

|

|

|

|

|

|

|

EBIDTA Multiple |

|

5.0x - 9.5x |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Market |

|

|

|

|

| |

|

Preferred Stock |

|

1,463,768 |

|

Comparables |

|

EBIDTA Multiple |

|

5.3x |

| |

The Adviser utilizes several unobservable pricing inputs and assumptions in determining the fair value of its Level 3 investments. These unobservable pricing inputs and assumptions may differ by security and in the application of the Fund’s valuation methodologies. The reported fair value estimates could vary materially if the Adviser had chosen to incorporate different unobservable pricing inputs and other assumptions or, for applicable investments, if the Adviser only used either the discounted cash flow methodology or the market comparables methodology instead of assigning a weighting to both methodologies. The unobservable inputs used to determine fair value of recurring Level 3 assets may have similar or diverging impacts on valuation. Significant increases and decreases in these inputs in isolation and interrelationships between those inputs could result in significantly higher or lower fair value measurement.

For the year ended of October 31, 2013, there have been no significant changes to the Fund’s fair value methodologies.

Investment Transactions — Investment transactions are accounted for on the trade date, the date the order to buy or sell is executed. Amortization and accretion is calculated using the effective interest method over the holding period of the investment. Realized gains and losses are calculated on the specific identified cost basis.

Cash and Cash Equivalents — Cash and cash equivalents includes cash on hand, cash held in banks and highly liquid investments with original maturities of three or fewer months.

Restricted Cash — Restricted cash represents amounts that are held by third parties under certain of the Fund’s derivative transactions. Such cash is excluded from cash and cash equivalents in the Statement of Assets and Liabilities. Interest income earned on restricted cash is recorded in other income on the Statement of Operations.

Foreign Currency Transactions — The books and records of the Fund are maintained in U.S. dollars. All investments denominated in foreign currency are converted to the U.S. dollar using prevailing exchange rates at the end of the reporting period. Income, expenses, gains and losses on investments denominated in foreign currency are converted to the U.S. dollar using the prevailing exchange rates on the dates when the transactions occurred.

The Fund bifurcates that portion of the results of operations resulting from changes in foreign exchange rates on investments and interest from the fluctuations arising from changes in market prices of securities held.

Derivative Contracts — The Fund may utilize option contracts or other permissible financial intermediaries. Option contract transactions may be transacted on security exchanges or in the over-the-counter market. When option contracts are purchased over-the-counter, the Fund bears the risk that the counterparty that wrote the

option will be unable or unwilling to perform its obligations under the option contract. Option contracts may also be illiquid and, in such cases, the Fund may have difficulty closing out its position. Over-the-counter option contracts also may include options on baskets of specific securities. The Fund may purchase and sell call and put options on specific securities and stock indices listed on national security exchanges or traded in the over-the-counter market for hedging purposes and non-hedging purposes in seeking to achieve the investment objectives of the Fund.