Exhibit 99.1

CyrusOne Reports Third Quarter 2013 Earnings

Record 62,000 CSF Leased and Revenue Growth of 19%

DALLAS (November 6, 2013) - Global data center service provider CyrusOne Inc (NASDAQ: CONE), which specializes in providing highly reliable enterprise-class, carrier-neutral data center properties to the Fortune 1000, today announced third quarter 2013 earnings.

Third Quarter Highlights

• | Record leasing of 62,000 colocation square feet, a 68% increase from the prior quarter and over 500% of the amount leased in the third quarter of 2012, including the previously announced lease signed in July for the San Antonio facility |

• | Revenue of $67.5 million increased 19% over the third quarter of 2012. Normalized FFO and AFFO increased 44% and 46%, respectively, over the third quarter of 2012. Adjusted EBITDA growth of 21% over the third quarter of 2012 |

• | Completely leased the San Antonio data center one year ahead of schedule, leased over 60% of the Phoenix data center, and pre-leased over 25% of the second data hall in the Carrollton facility |

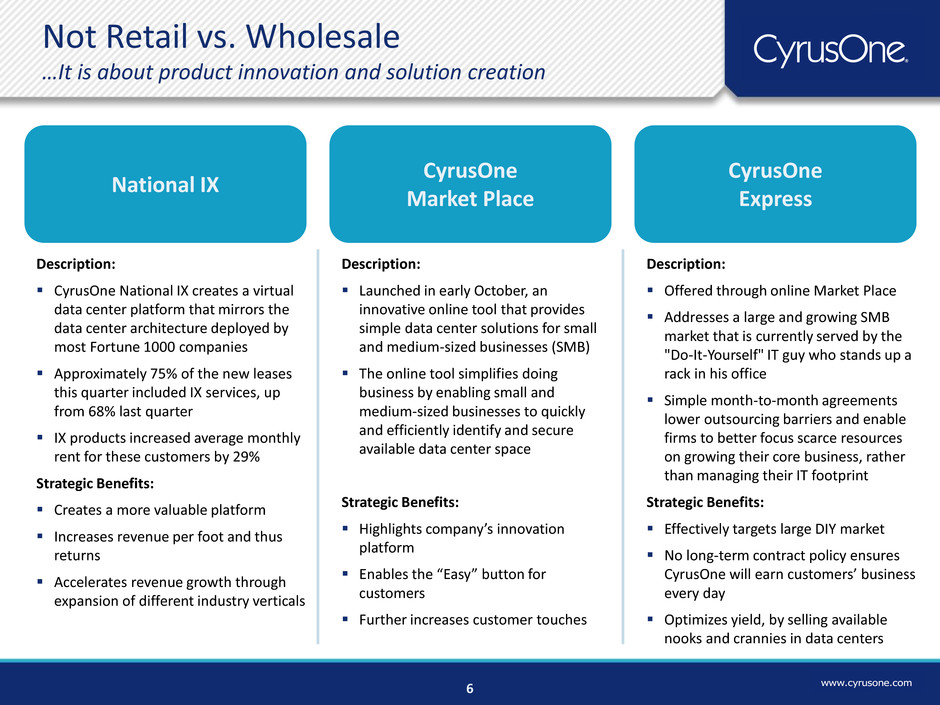

• | Launched CyrusOne Market Place and CyrusOne Express in early October, an innovative online tool and product line that provide simple and efficient data center solutions for small and medium sized businesses |

• | Added six Fortune 1000 companies as new customers, bringing total Fortune 1000 customers to 128 |

“Our results this quarter highlight the broad strength of the platform we have created. This platform is uniquely focused on providing data center solutions to Fortune 1000 customers, who continue to trust CyrusOne to manage their most mission critical applications. This was our strongest leasing quarter ever and positions us well to meet our annual financial guidance for 2013,” said Gary Wojtaszek, president and chief executive officer of CyrusOne. “We are excited about the recent launch of the CyrusOne Market Place and CyrusOne Express, which, in addition to the CyrusOne National Internet Exchange (IX) product that was launched last quarter, highlight the creativity and innovation CyrusOne brings to the market.”

Financial Results

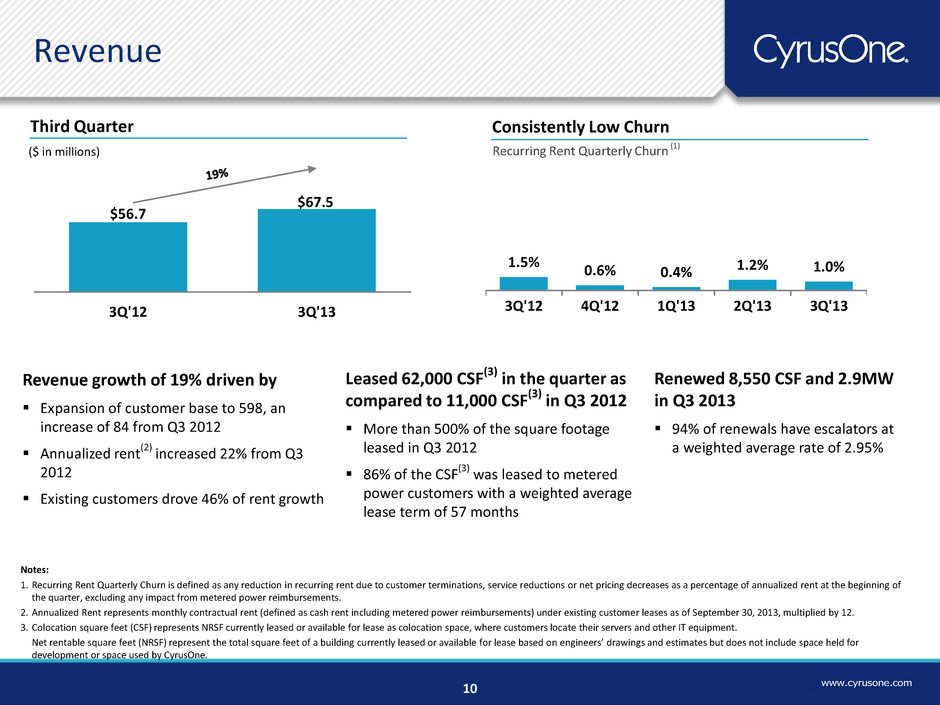

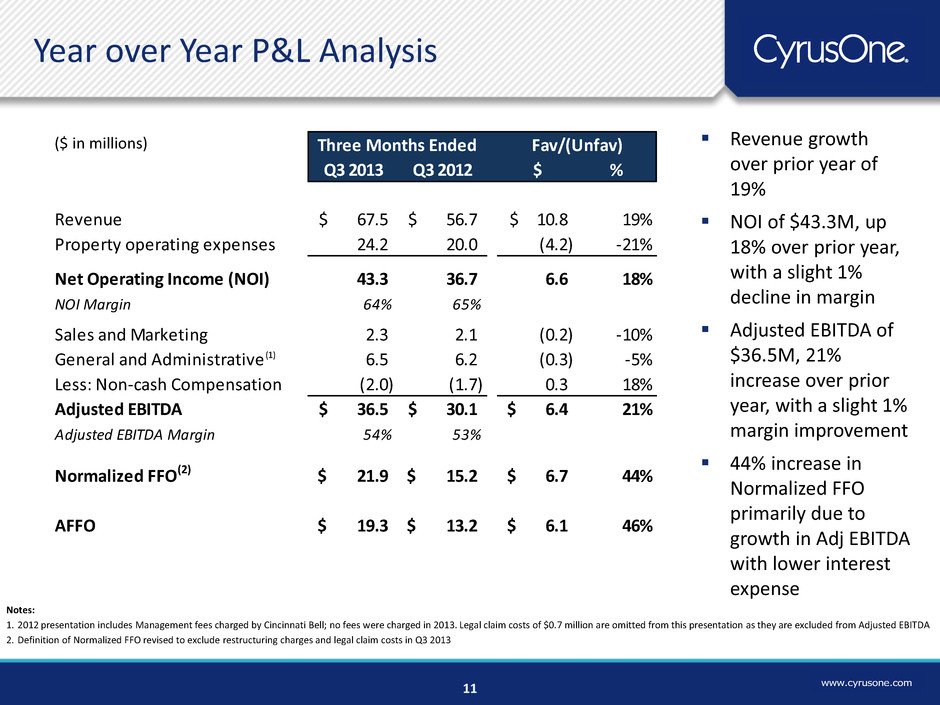

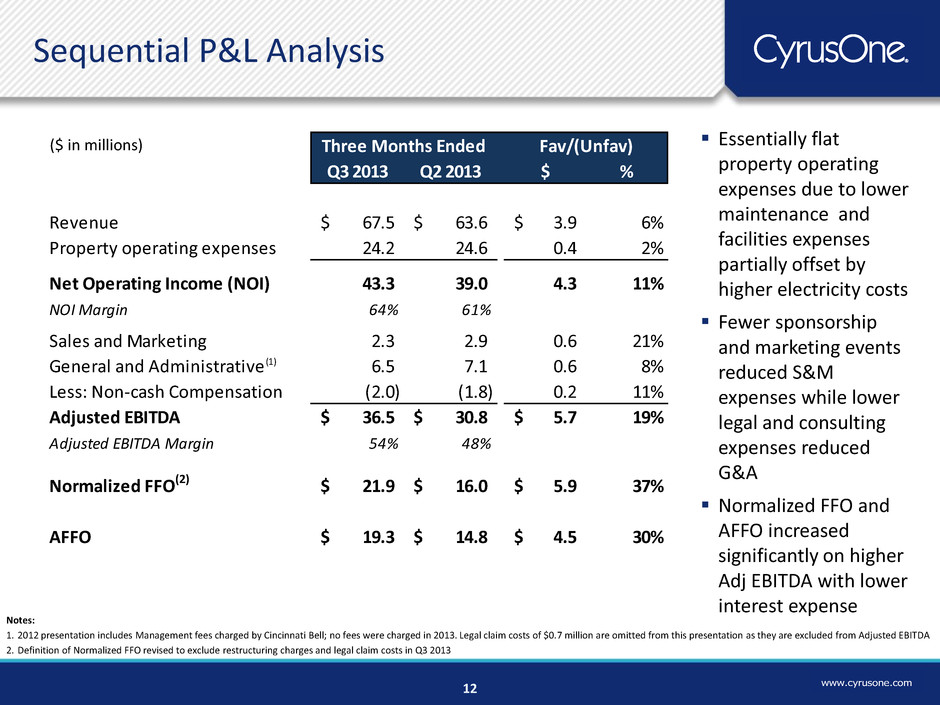

Revenue was $67.5 million for the third quarter, compared to $56.7 million for the same period in 2012, or an increase of 19%. Revenue growth was entirely organic and driven by strong leasing activity from the past several quarters. Operating income improved $0.8 million from the third quarter of 2012 as increased revenue of $10.8 million was offset by increased property operating expenses of $4.2 million, general and administrative expenses of $1.9 million and depreciation and amortization of $5.1 million, partially offset by fewer non-recurring charges. Net loss was $2.2 million for the third quarter, compared to a net loss of $2.8 million in the same period in 2012.

Net operating income (NOI)1 was $43.3 million for the third quarter, compared to $36.7 million in the same period in 2012, an increase of 18%. The increase in NOI was primarily due to the increase in revenue, partially offset by additional property operating costs from new facilities and expansions at existing facilities. Adjusted EBITDA2 was $36.5 million for the third quarter, compared to $30.1 million in the same period in 2012, an increase of 21%. The Adjusted EBITDA margin of 54.1% in the third quarter improved from 53.1% in the same period in 2012.

Normalized Funds From Operations (Normalized FFO)3 was $21.9 million for the third quarter, compared to $15.2 million in the same period in 2012, an increase of 44%. The increase in Normalized FFO was primarily due to growth in Adjusted EBITDA with lower interest expense as the company is using cash on hand to fund future growth. Normalized FFO per diluted common share or common share equivalent4 was $0.33 in the third quarter of 2013. Adjusted Funds From Operations (AFFO)5 was $19.3 million for the third quarter, compared to $13.2 million in the same period in 2012, an increase of 46%.

Leasing Activity

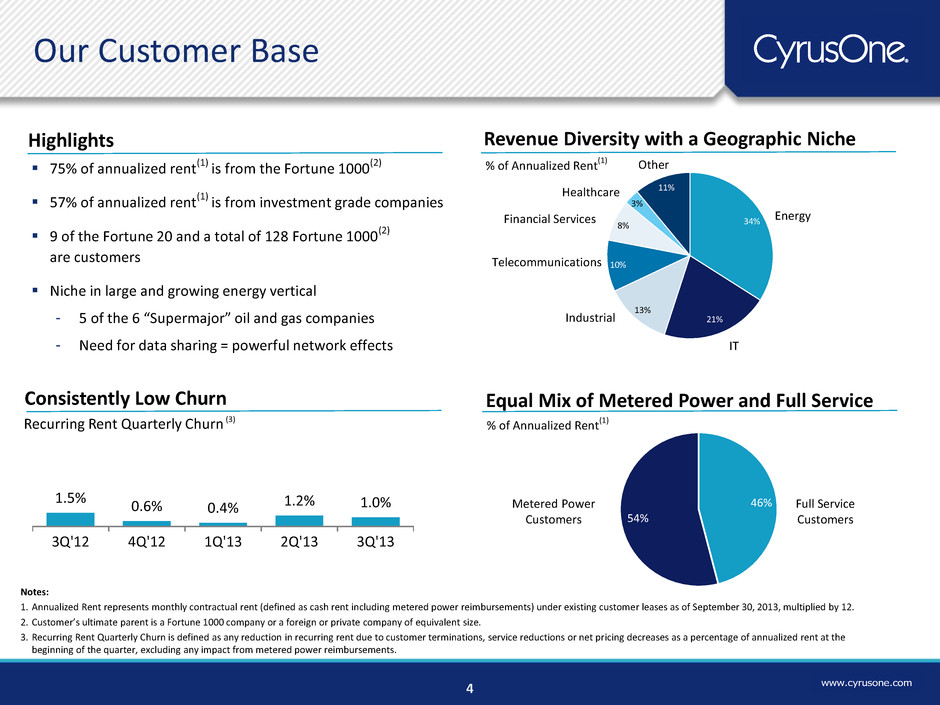

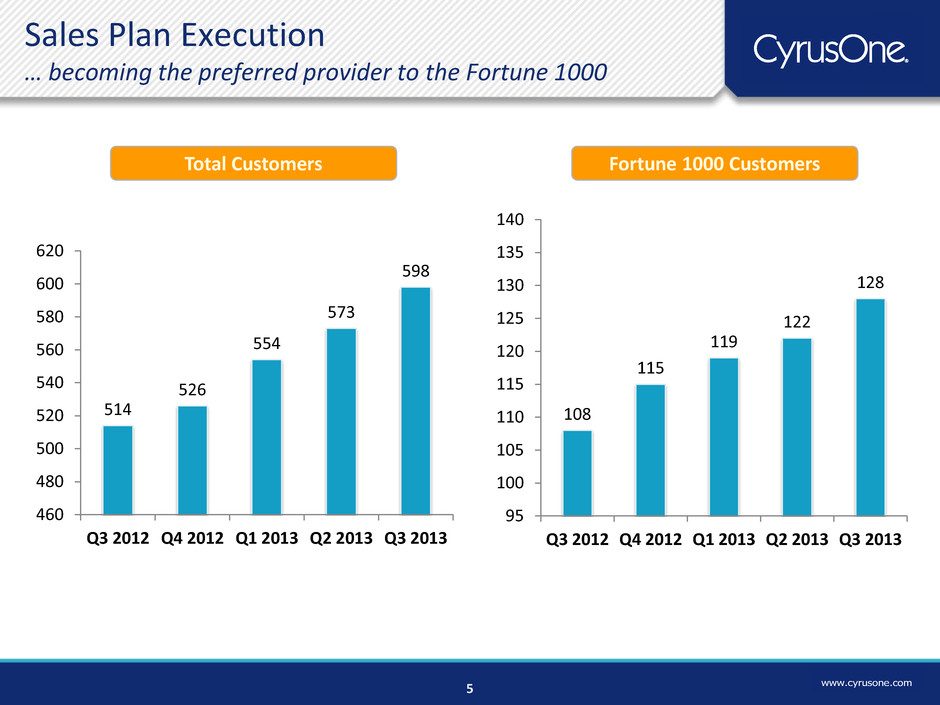

CyrusOne leased approximately 62,000 colocation square feet (CSF) or 12.8 MW of power in the third quarter, compared to 11,000 CSF in the same period in 2012. The company added six new Fortune 10006 customers in the period, bringing the total to 128 Fortune 1000 companies and 598 customers in total as of September 30, 2013. The weighted average lease term of the new leases based on square footage was 57 months, and approximately 86% of the CSF was leased to metered customers with the remainder leased on a full service basis. Recurring rent churn7 for the third quarter of 2013 was 1.0%, compared to 1.5% for the third quarter of 2012.

The CyrusOne National IX continued to gain traction as approximately 75% of new leases included IX services, up from 68% last quarter. The broad and increased acceptance of the IX suite of services highlights the benefits of our innovative connectivity solution. The CyrusOne National IX creates a virtual data center platform that mirrors the data center architecture deployed by most Fortune 1000 companies. This quarter, IX products increased average rent by 29% for those customers that signed new leases with interconnectivity.

Portfolio Utilization and Development

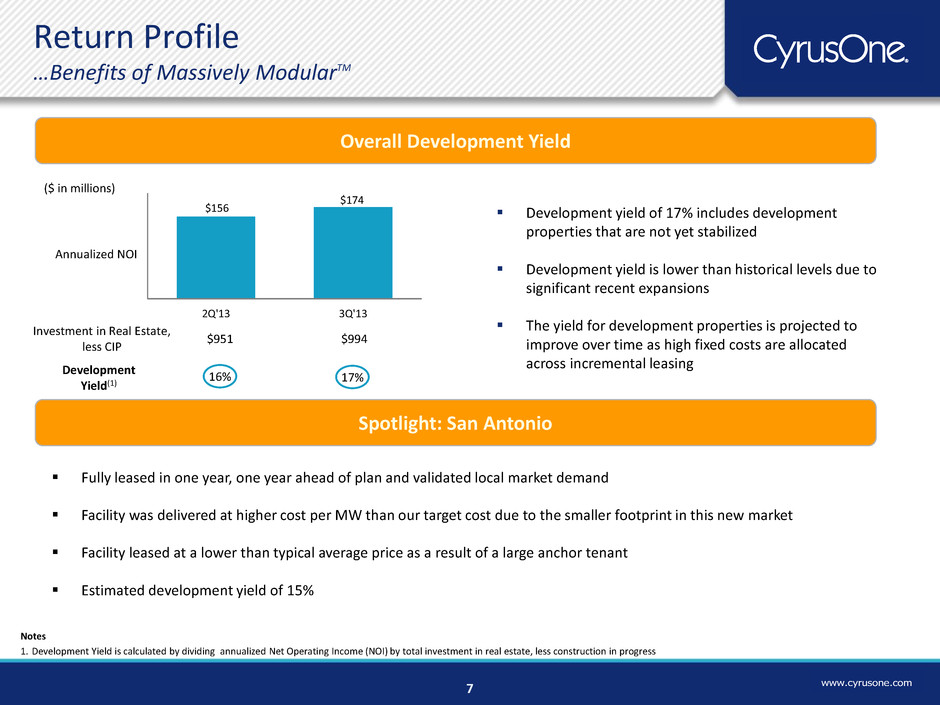

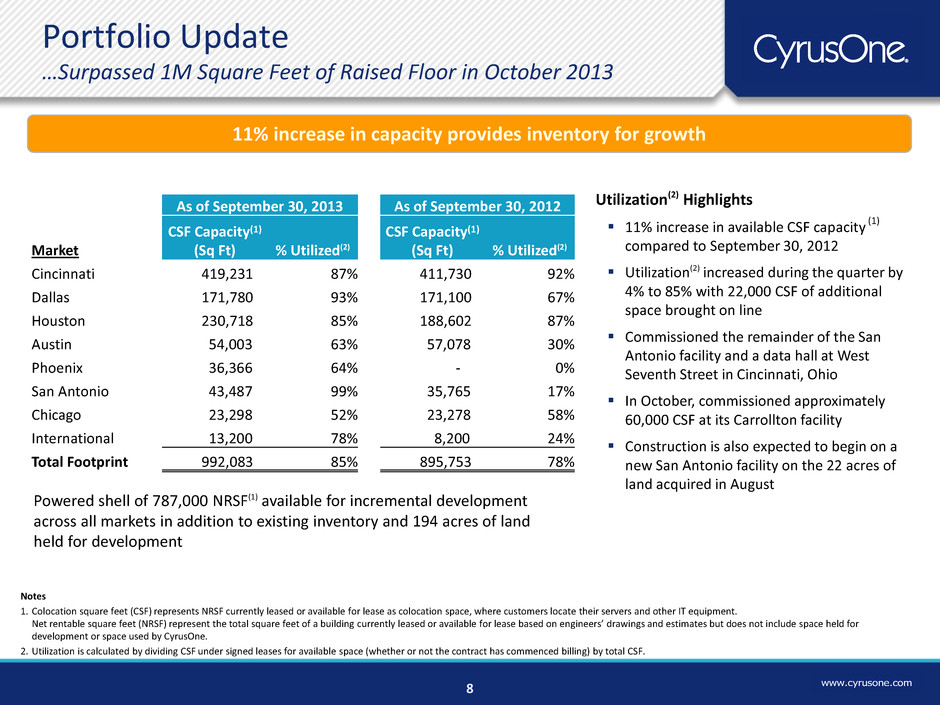

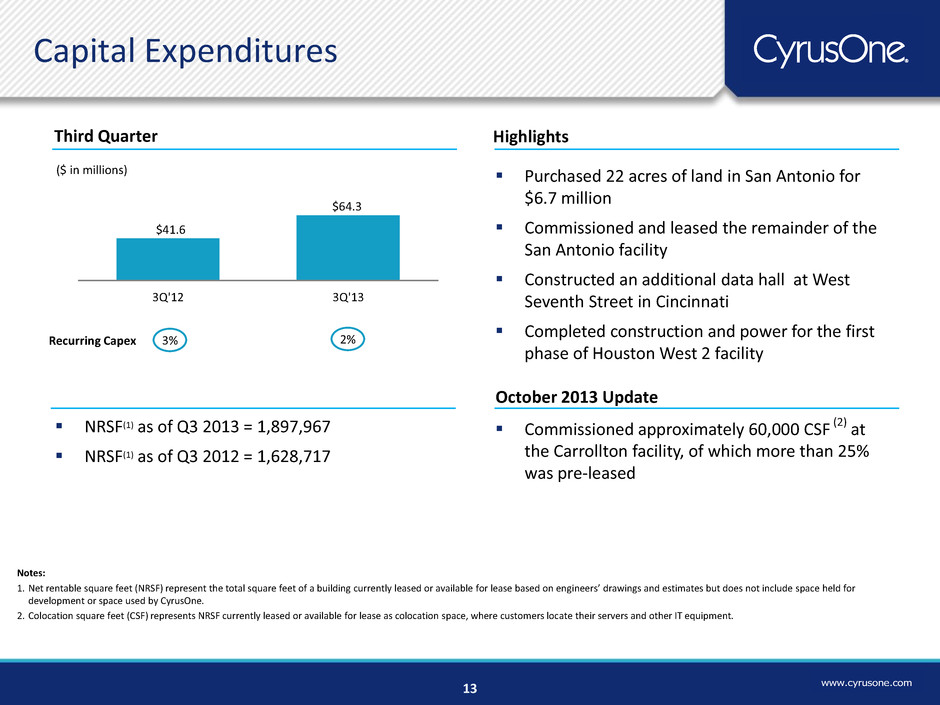

CSF available as of September 30, 2013 were approximately 992,000 across 25 facilities, an increase of approximately 96,000, or 11%, from a year ago. In the third quarter of 2013, the company added 22,000 CSF. Construction of an additional data hall was completed at West Seventh Street in Cincinnati, Ohio, which is the company’s flagship data center in Cincinnati and one of the largest carrier hotels in the Midwest. The company also commissioned and leased the remainder of the San Antonio facility. CSF utilization8 for the third quarter was 85%, compared to 78% in the same period in 2012 and 81% in the second quarter of 2013. In October, the company commissioned approximately 60,000 CSF at its Carrollton facility, of which more than 25% was pre-leased. Lastly, construction on a new San Antonio facility on the 22 acres of land acquired in August will commence in the fourth quarter.

Balance Sheet and Liquidity

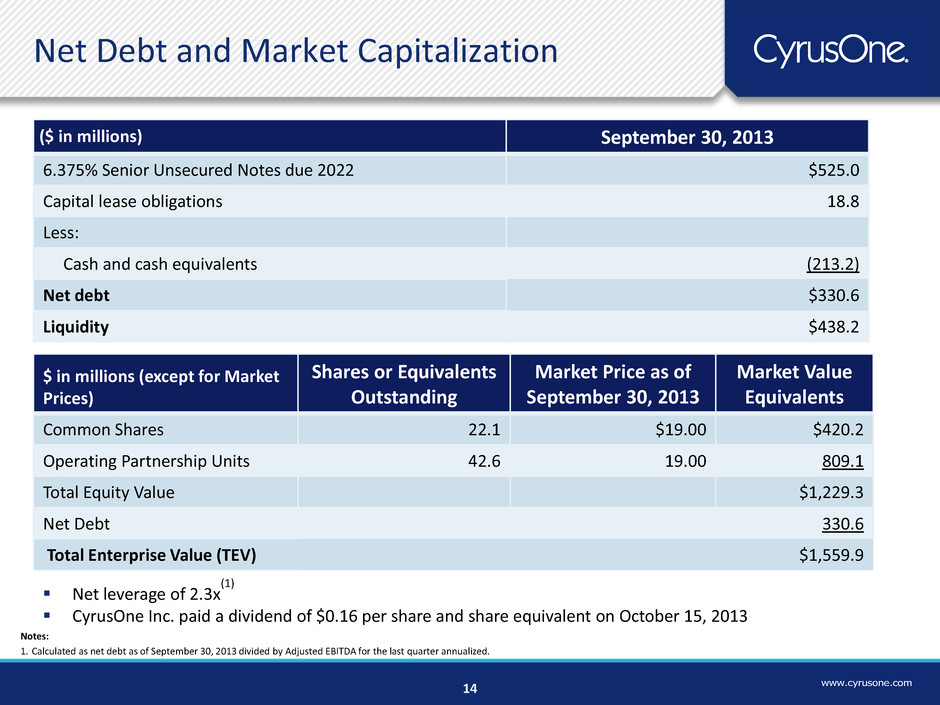

As of September 30, 2013, the company had $543.8 million of long-term debt, cash and cash equivalents of $213.2 million, and an undrawn $225.0 million senior secured revolving credit facility. Net debt9 was $330.6 million as of September 30, 2013, or approximately 21% of the company's total enterprise value or 2.3x Adjusted EBITDA annualized. Available liquidity10 was $438.2 million as of September 30, 2013.

Dividend

On September 4, 2013, the company announced a dividend of $0.16 per share of common stock and common stock equivalent for the third quarter of 2013. The dividend was paid on October 15, 2013 to shareholders of record at the close of business on September 27, 2013.

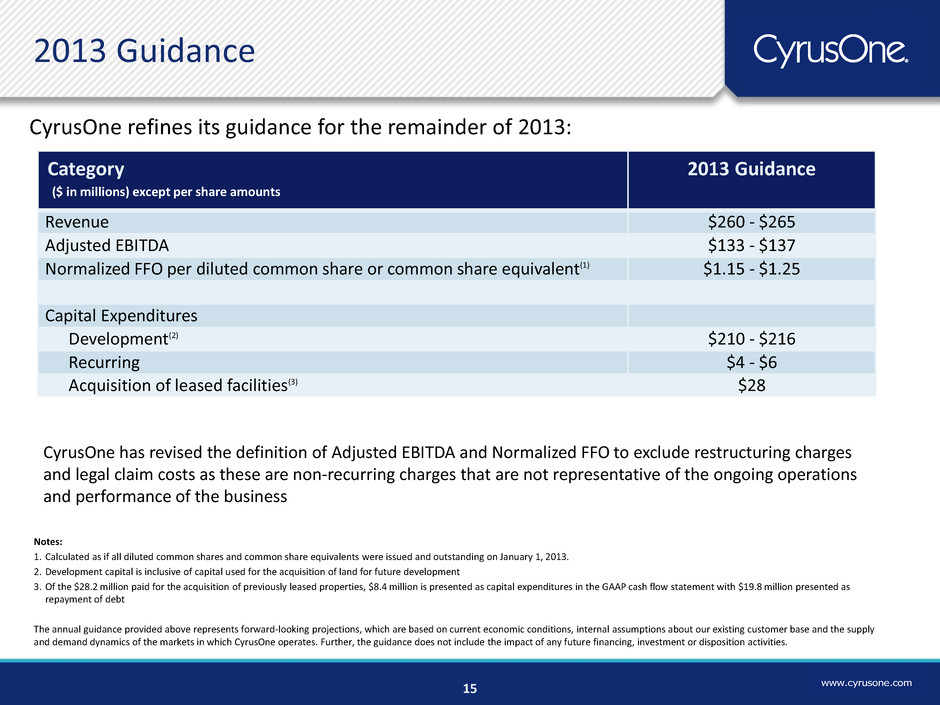

2013 Guidance

CyrusOne is refining guidance for the full-year of 2013 at this time with improved visibility on results. Revenue guidance ranges has been narrowed to $260 to $265 million from the prior range of $260 of $270 million. Also, the capital expenditures categories for development and land acquisition have been combined.

Category | Guidance |

Revenue | $260 - $265 million |

Adjusted EBITDA | $133 - $137 million |

Normalized FFO per diluted common share or common share equivalent* | $1.15 - $1.25 |

Capital Expenditures | |

Development | $210 - $216 million |

Recurring | $4 - $6 million |

Acquisition of Leased Facilities** | $28 million |

* Calculated as if all diluted common shares and common share equivalents were issued and outstanding on January 1, 2013.

** Inclusive of all amounts spent on acquisition of leased facilities, including dollars not reported through the capital expenditures captions on the GAAP cash flow statement.

The annual guidance provided above represents forward-looking projections, which are based on current economic conditions, internal assumptions about the company's existing customer base and the supply and demand dynamics of the markets in which CyrusOne operates. Further, the guidance does not include the impact of any future financing, investment or disposition activities.

Upcoming Conferences and Events

• | REITWorld 2013: NAREIT's Annual Convention for All Things REIT on November 13-15 in San Francisco |

• | Raymond James Systems, Semiconductors, Software and Supply Chain Conference on December 9-10 in New York |

• | Citi 2014 Internet Media & Telecom Conference on January 6-8 in Las Vegas |

Conference Call Details

CyrusOne will host a conference call on November 6, 2013 at 5:00 PM Eastern Time (4:00 PM Central Time) to discuss its results for the third quarter of 2013. A live webcast of the conference call will also be available on the investor relations page of the company's website at http://investor.cyrusone.com/index.cfm. The conference call dial-in number is 1-866-652-5200, and the international dial-in number is 1-412-317-6060. Passcode for the call is 10036203. A replay will be available one hour after the conclusion of the earnings call on November 6, 2013, until 9:00 AM (ET) on November 14, 2013. The U.S. toll-free replay dial-in number is 1-877-344-7529 and the international replay dial-in number is 1-412-317-0088. Replay passcode is 10036203. An archived version of the webcast will also be available on the investor relations page of the company's website at http://investor.cyrusone.com/index.cfm.

Safe Harbor

This release contains forward-looking statements regarding future events and our future results that are subject to the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are statements that could be deemed forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as "expects," "anticipates," "predicts," "projects," "intends," "plans," "believes," "seeks," "estimates," "continues," "endeavors," "strives," "may," variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance (including annual guidance for the remainder of 2013), our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances are forward-looking statements. Readers are cautioned these forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially and adversely from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this release and those discussed in other documents we file with the Securities and Exchange Commission (SEC). More information on potential risks and uncertainties is available in our recent filings with the SEC, including CyrusOne's Form 10-K report and Form 8-K reports. Actual results may differ materially and adversely from those expressed in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason.

Use of Non-GAAP Financial Measures

This press release contains certain non-GAAP financial measures that management believes are helpful in understanding the company's business, as further discussed within this press release. These financial measures, which include Funds From Operations, Normalized Funds From Operations, Net Operating Income, Adjusted Funds From Operations, Adjusted EBITDA, and Net debt should not be construed as being more important than or substitutes for comparable GAAP measures. Detailed reconciliations of these non-GAAP financial measures to comparable GAAP financial measures have been included in the tables distributed with this release and are available in the Investor Relations section of www.cyrusone.com.

Management uses FFO, Normalized FFO, NOI, AFFO and Adjusted EBITDA as supplemental performance measures because they provide performance measures that, when compared year over year, capture trends in occupancy rates, rental rates and operating costs. Management uses net debt as a supplemental measure of the Company’s liquidity and financial health. The company also believes that, as widely recognized measures of the performance and financial position of real estate investment trusts (REITs) and other companies, these measures are used by investors as a basis to compare its operating performance and financial position with that of other companies. Other companies may not calculate these measures in the same manner, and, as presented, they may not be comparable to others. Therefore, FFO, Normalized FFO, NOI, AFFO and Adjusted EBITDA should be considered only as supplements to net income as measures of our performance. FFO, Normalized FFO, NOI, AFFO and Adjusted EBITDA should not be used as measures of liquidity nor as indicative of funds available to fund the company's cash needs, including the ability to make distributions. These measures also should not be used as supplements to or substitutes for cash flow from operating activities computed in accordance with U.S. GAAP.

1Net Operating Income (NOI) is defined as revenue less property operating expenses. Unlike operating income, net operating income excludes depreciation and amortization (including deferred leasing costs). Net operating income also excludes certain costs that are not property specific, but rather support our entire portfolio, such as sales and marketing costs (consisting of salaries and benefits for our internal sales staff, travel and entertainment, office supplies, marketing and advertising costs) and general and administrative costs (consisting of salaries and benefits of our senior management and support functions, legal and consulting costs, and other administrative costs). CyrusOne has not historically incurred any tenant improvement costs.

2Adjusted EBITDA is defined as net (loss) income before noncontrolling interests as defined by U.S. GAAP plus interest expense, other income, income tax (benefit) expense, depreciation and amortization, restructuring charges, legal claim costs, transaction costs and transaction-related compensation, including acquisition pursuit costs, loss on sale of receivables to affiliate, non-cash compensation, (gain) loss on extinguishment of debt, asset impairments, (gain) loss on sale of real estate improvements, and other special items.

3Normalized Funds From Operations (Normalized FFO) is defined as Funds From Operations (FFO) plus transaction costs, including acquisition pursuit costs, transaction-related compensation, (gain) loss on extinguishment of debt, restructuring charges, legal claim costs and other special items. FFO represents net (loss) income before noncontrolling interests computed in accordance with U.S. GAAP, real estate-related depreciation and amortization, amortization of customer relationship intangibles, real estate and customer relationship intangible impairments, and (gain) loss from sales of real estate improvements. Because the value of the customer relationship intangibles is inextricably connected to the real estate acquired, CyrusOne believes the amortization and impairments of such intangibles is analogous to real estate depreciation and impairments; therefore, the company adds the customer relationship intangible amortization and impairments back for similar treatment with real estate depreciation and impairments. CyrusOne's customer relationship intangibles are primarily associated with the acquisition of Cyrus Networks in 2010 and, at the time of acquisition, represented 22% of the value of the assets acquired.

4Normalized FFO per diluted common share or common share equivalent is defined as Normalized FFO divided by the average diluted common shares and common share equivalents outstanding for the quarter, which were approximately 64.7 million for the third quarter of 2013.

5Adjusted Funds From Operations (AFFO) is defined as Normalized FFO plus amortization of deferred financing costs, non-cash compensation, and non-real estate depreciation and amortization, less deferred revenue and straight line rent adjustments, leasing commissions, recurring capital expenditures, and non-cash corporate income tax benefit and expense.

6Fortune 1000 customers include subsidiaries whose ultimate parent is a Fortune 1000 company or a foreign or private company of equivalent size.

7Recurring rent churn is calculated as any reduction in recurring rent due to customer terminations, service reductions or net pricing decreases as a percentage of annualized rent at the beginning of the period, excluding any impact from metered power reimbursements or other usage-based billing.

8Utilization rate is calculated by dividing CSF under signed leases for available space (whether or not the contract has commenced billing) by total CSF. Utilization rate differs from percent leased presented in the Data Center Portfolio table because utilization rate excludes office space and supporting infrastructure net rentable square footage and includes CSF for signed leases that have not commenced billing.

9Net debt is defined as long-term debt and capital lease obligations, offset by cash, cash equivalents, and temporary cash investments.

10Available liquidity is calculated as cash, cash equivalents, and temporary cash investments on hand plus the undrawn capacity on CyrusOne's corporate revolving credit facility.

About CyrusOne

CyrusOne (NASDAQ: CONE) specializes in highly reliable enterprise-class, carrier-neutral data center properties. The company provides mission-critical data center facilities that protect and ensure the continued operation of IT infrastructure for more than 575 customers, including nine of the Fortune 20 and more than 100 of the Fortune 1000 companies.

CyrusOne's data center offerings provide the flexibility, reliability, and security that enterprise customers require and are delivered through a tailored, customer service-focused platform designed to foster long-term relationships. CyrusOne is committed to full transparency in communication, management, and service delivery throughout its 25 data centers worldwide.

# # #

Investor Relations:

Idalia Rodriguez or Jamie Lillis

972-350-0060

investorrelations@cyrusone.com

CyrusOne Inc.

Combined Statements of Operations

(Dollars in millions, except per share amounts)

(Unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||||

Change | Change | |||||||||||||||||||||||||||

2013 | 2012 | $ | % | 2013 | 2012 | $ | % | |||||||||||||||||||||

Revenue | $ | 67.5 | $ | 56.7 | $ | 10.8 | 19% | $ | 191.2 | $ | 162.8 | $ | 28.4 | 17% | ||||||||||||||

Costs and expenses: | ||||||||||||||||||||||||||||

Property operating expenses | 24.2 | 20.0 | 4.2 | 21% | 68.9 | 55.3 | 13.6 | 25% | ||||||||||||||||||||

Sales and marketing | 2.3 | 2.1 | 0.2 | 10% | 8.0 | 5.8 | 2.2 | 38% | ||||||||||||||||||||

General and administrative | 7.2 | 5.3 | 1.9 | 36% | 21.2 | 15.4 | 5.8 | 38% | ||||||||||||||||||||

Transaction-related compensation | — | — | — | n/m | 20.0 | — | 20.0 | n/m | ||||||||||||||||||||

Depreciation and amortization | 23.9 | 18.8 | 5.1 | 27% | 68.6 | 52.9 | 15.7 | 30% | ||||||||||||||||||||

Restructuring charges | 0.7 | — | 0.7 | n/m | 0.7 | — | 0.7 | n/m | ||||||||||||||||||||

Transaction costs | 0.7 | 0.6 | 0.1 | 17% | 1.2 | 1.3 | (0.1 | ) | (8)% | |||||||||||||||||||

Management fees charged by CBI | — | 0.9 | (0.9 | ) | n/m | — | 2.1 | (2.1 | ) | n/m | ||||||||||||||||||

Loss on sale of receivables to affiliate | — | 1.3 | (1.3 | ) | n/m | — | 3.7 | (3.7 | ) | n/m | ||||||||||||||||||

Asset impairments | — | — | — | n/m | — | 13.3 | (13.3 | ) | n/m | |||||||||||||||||||

Total costs and expenses | 59.0 | 49.0 | 10.0 | 20% | 188.6 | 149.8 | 38.8 | 26% | ||||||||||||||||||||

Operating income | 8.5 | 7.7 | 0.8 | 10% | 2.6 | 13.0 | (10.4 | ) | (80)% | |||||||||||||||||||

Interest expense | 10.5 | 11.3 | (0.8 | ) | (7)% | 32.2 | 31.2 | 1.0 | 3% | |||||||||||||||||||

Other income | (0.1 | ) | — | (0.1 | ) | n/m | (0.1 | ) | — | (0.1 | ) | n/m | ||||||||||||||||

Loss on extinguishment of debt | — | — | — | n/m | 1.3 | — | 1.3 | n/m | ||||||||||||||||||||

Loss before income taxes | (1.9 | ) | (3.6 | ) | 1.7 | (47)% | (30.8 | ) | (18.2 | ) | (12.6 | ) | 69% | |||||||||||||||

Income tax (expense) benefit | (0.3 | ) | 0.7 | (1.0 | ) | (143)% | (1.2 | ) | 4.7 | (5.9 | ) | n/m | ||||||||||||||||

Net loss | (2.2 | ) | (2.9 | ) | 0.7 | (24)% | (32.0 | ) | (13.5 | ) | (18.5 | ) | n/m | |||||||||||||||

Gain on sale of real estate improvements | — | 0.1 | (0.1 | ) | n/m | — | 0.1 | (0.1 | ) | n/m | ||||||||||||||||||

Net loss attributed to Predecessor | — | (2.8 | ) | 2.8 | (100)% | (20.2 | ) | (13.4 | ) | (6.8 | ) | n/m | ||||||||||||||||

Noncontrolling interest in net loss | 1.4 | — | 1.4 | n/m | 7.8 | — | 7.8 | n/m | ||||||||||||||||||||

Net loss attributed to common stockholders | $ | (0.8 | ) | $ | — | $ | (0.8 | ) | n/m | $ | (4.0 | ) | $ | — | $ | (4.0 | ) | n/m | ||||||||||

Loss per common share - basic and diluted | $ | (0.05 | ) | n/a | $ | (0.22 | ) | n/a | ||||||||||||||||||||

CyrusOne Inc.

Combined Balance Sheets

(Dollars in millions)

(Unaudited)

September 30, | December 31, | Change | |||||||||||||

2013 | 2012 | $ | % | ||||||||||||

Assets | |||||||||||||||

Investment in real estate: | |||||||||||||||

Land | $ | 81.5 | $ | 44.5 | $ | 37.0 | 83 | % | |||||||

Buildings and improvements | 778.2 | 722.5 | 55.7 | 8 | % | ||||||||||

Equipment | 134.3 | 52.4 | 81.9 | n/m | |||||||||||

Construction in progress | 63.2 | 64.2 | (1.0 | ) | (2 | )% | |||||||||

Subtotal | 1,057.2 | 883.6 | 173.6 | 20 | % | ||||||||||

Accumulated depreciation | (218.6 | ) | (176.7 | ) | (41.9 | ) | 24 | % | |||||||

Net investment in real estate | 838.6 | 706.9 | 131.7 | 19 | % | ||||||||||

Cash and cash equivalents | 213.2 | 16.5 | 196.7 | n/m | |||||||||||

Rent and other receivables | 33.9 | 33.2 | 0.7 | 2 | % | ||||||||||

Restricted cash | — | 6.3 | (6.3 | ) | n/m | ||||||||||

Goodwill | 276.2 | 276.2 | — | 0% | |||||||||||

Intangible assets, net | 89.9 | 102.6 | (12.7 | ) | (12 | )% | |||||||||

Due from affiliates | 0.9 | 2.2 | (1.3 | ) | (59 | )% | |||||||||

Other assets | 67.2 | 67.0 | 0.2 | 0% | |||||||||||

Total assets | $ | 1,519.9 | $ | 1,210.9 | $ | 309.0 | 26 | % | |||||||

Liabilities and Equity | |||||||||||||||

Accounts payable and accrued expenses | $ | 67.8 | $ | 37.1 | $ | 30.7 | 83 | % | |||||||

Deferred revenue | 55.1 | 52.8 | 2.3 | 4 | % | ||||||||||

Due to affiliates | 7.0 | 2.9 | 4.1 | n/m | |||||||||||

Capital lease obligations | 18.8 | 32.2 | (13.4 | ) | (42 | )% | |||||||||

Long-term debt | 525.0 | 525.0 | — | 0% | |||||||||||

Other financing arrangements | 55.8 | 60.8 | (5.0 | ) | (8 | )% | |||||||||

Total liabilities | 729.5 | 710.8 | 18.7 | 3 | % | ||||||||||

Shareholders’ Equity / Parent’s net investment: | |||||||||||||||

Preferred stock, $.01 par value, 100,000,000 authorized; no shares issued or outstanding | — | — | — | n/m | |||||||||||

Common stock, $.01 par value, 500,000,000 shares authorized and 22,116,172 shares issued and outstanding at September 30, 2013 | 0.2 | — | 0.2 | n/m | |||||||||||

Common stock, $.01 par value, 1,000 shares authorized and 100 shares issued and outstanding at December 31, 2012 | — | — | — | n/m | |||||||||||

Paid in capital | 339.4 | 7.1 | 332.3 | n/m | |||||||||||

Accumulated deficit | (14.2 | ) | — | (14.2 | ) | n/m | |||||||||

Partnership capital | — | 493.0 | (493.0 | ) | n/m | ||||||||||

Total shareholders’ equity / parent’s net investment | 325.4 | 500.1 | (174.7 | ) | (35 | )% | |||||||||

Noncontrolling interests | 465.0 | — | 465.0 | n/m | |||||||||||

Total Equity | 790.4 | 500.1 | 290.3 | 58 | % | ||||||||||

Total liabilities and shareholders’ equity / parent’s net investment | $ | 1,519.9 | $ | 1,210.9 | $ | 309.0 | 26 | % | |||||||

CyrusOne Inc.

Combined Statements of Operations

(Dollars in millions, except per share amounts)

(Unaudited)

For the three months ended: | September 30, | June 30, | March 31, | December 31, | September 30, | |||||||||||||||

2013 | 2013 | 2013 | 2012 | 2012 | ||||||||||||||||

Revenue | $ | 67.5 | $ | 63.6 | $ | 60.1 | $ | 58.0 | $ | 56.7 | ||||||||||

Costs and expenses: | ||||||||||||||||||||

Property operating expenses | 24.2 | 24.6 | 20.1 | 20.6 | 20.0 | |||||||||||||||

Sales and marketing | 2.3 | 2.9 | 2.8 | 4.0 | 2.1 | |||||||||||||||

General and administrative | 7.2 | 7.1 | 6.9 | 5.4 | 5.3 | |||||||||||||||

Transaction-related compensation | — | — | 20.0 | — | — | |||||||||||||||

Depreciation and amortization | 23.9 | 23.0 | 21.7 | 20.4 | 18.8 | |||||||||||||||

Restructuring charges | 0.7 | — | — | — | — | |||||||||||||||

Transaction costs | 0.7 | 0.4 | 0.1 | 4.4 | 0.6 | |||||||||||||||

Management fees charged by CBI | — | — | — | 0.4 | 0.9 | |||||||||||||||

(Gain) loss on sale of receivables to affiliate | — | — | — | (0.4 | ) | 1.3 | ||||||||||||||

Asset impairments | — | — | — | — | — | |||||||||||||||

Total costs and expenses | 59.0 | 58.0 | 71.6 | 54.8 | 49.0 | |||||||||||||||

Operating income (loss) | 8.5 | 5.6 | (11.5 | ) | 3.2 | 7.7 | ||||||||||||||

Interest expense | 10.5 | 10.8 | 10.9 | 10.5 | 11.3 | |||||||||||||||

Other income | (0.1 | ) | — | — | — | — | ||||||||||||||

Loss on extinguishment of debt | — | 1.3 | — | — | — | |||||||||||||||

Loss before income taxes | (1.9 | ) | (6.5 | ) | (22.4 | ) | (7.3 | ) | (3.6 | ) | ||||||||||

Income tax (expense) benefit | (0.3 | ) | (0.3 | ) | (0.6 | ) | 0.4 | 0.7 | ||||||||||||

Net loss from continuing operations | (2.2 | ) | (6.8 | ) | (23.0 | ) | (6.9 | ) | (2.9 | ) | ||||||||||

Gain on sale of real estate improvements | — | — | — | — | 0.1 | |||||||||||||||

Net loss attributed to Predecessor | — | — | (20.2 | ) | (6.9 | ) | (2.8 | ) | ||||||||||||

Noncontrolling interest in net loss | 1.4 | 4.5 | 1.9 | — | — | |||||||||||||||

Net loss attributed to common stockholders | $ | (0.8 | ) | $ | (2.3 | ) | $ | (0.9 | ) | $ | — | $ | — | |||||||

Loss per common share - basic diluted | $ | (0.05 | ) | $ | (0.12 | ) | $ | (0.05 | ) | n/a | n/a | |||||||||

CyrusOne Inc.

Combined Balance Sheets

(Dollars in millions)

(Unaudited)

September 30, 2013 | June 30, 2013 | March 31, 2013 | December 31, 2012 | September 30, 2012 | ||||||||||||||||

Assets | ||||||||||||||||||||

Investment in real estate: | ||||||||||||||||||||

Land | $ | 81.5 | $ | 74.6 | $ | 44.4 | $ | 44.5 | $ | 41.2 | ||||||||||

Buildings and improvements | 778.2 | 778.5 | 740.7 | 722.5 | 666.5 | |||||||||||||||

Equipment | 134.3 | 97.4 | 68.7 | 52.4 | 43.2 | |||||||||||||||

Construction in progress | 63.2 | 48.2 | 92.6 | 64.2 | 56.6 | |||||||||||||||

Subtotal | 1,057.2 | 998.7 | 946.4 | 883.6 | 807.5 | |||||||||||||||

Accumulated depreciation | (218.6 | ) | (208.7 | ) | (192.1 | ) | (176.7 | ) | (162.9 | ) | ||||||||||

Net investment in real estate | 838.6 | 790.0 | 754.3 | 706.9 | 644.6 | |||||||||||||||

Cash and cash equivalents | 213.2 | 267.1 | 328.6 | 16.5 | 3.2 | |||||||||||||||

Rent and other receivables | 33.9 | 27.2 | 30.0 | 33.2 | — | |||||||||||||||

Restricted cash | — | — | 2.6 | 6.3 | 10.4 | |||||||||||||||

Goodwill | 276.2 | 276.2 | 276.2 | 276.2 | 276.2 | |||||||||||||||

Intangible assets, net | 89.9 | 94.1 | 98.4 | 102.6 | 106.7 | |||||||||||||||

Due from affiliates | 0.9 | 1.6 | 23.2 | 2.2 | 9.6 | |||||||||||||||

Other assets | 67.2 | 63.6 | 60.7 | 67.0 | 40.1 | |||||||||||||||

Total assets | $ | 1,519.9 | $ | 1,519.8 | $ | 1,574.0 | $ | 1,210.9 | $ | 1,090.8 | ||||||||||

Liabilities and Equity | ||||||||||||||||||||

Accounts payable and accrued expenses | $ | 67.8 | $ | 59.3 | $ | 78.7 | $ | 37.1 | $ | 41.9 | ||||||||||

Deferred revenue | 55.1 | 52.8 | 51.7 | 52.8 | 52.1 | |||||||||||||||

Due to affiliates | 7.0 | 7.7 | 8.2 | 2.9 | — | |||||||||||||||

Capital lease obligations | 18.8 | 19.8 | 31.0 | 32.2 | 38.0 | |||||||||||||||

Long-term debt | 525.0 | 525.0 | 525.0 | 525.0 | — | |||||||||||||||

Related party notes payable | — | — | — | — | 612.1 | |||||||||||||||

Other financing arrangements | 55.8 | 54.0 | 62.9 | 60.8 | 49.2 | |||||||||||||||

Total liabilities | 729.5 | 718.6 | 757.5 | 710.8 | 793.3 | |||||||||||||||

Shareholders’ Equity / Parent’s net investment: | ||||||||||||||||||||

Preferred stock, $.01 par value, 100,000,000 authorized; no shares issued or outstanding | — | — | — | — | — | |||||||||||||||

Common stock, $.01 par value, 500,000,000 shares authorized and 22,116,172 shares issued and outstanding at September 30, 2013 | 0.2 | 0.2 | 0.2 | — | — | |||||||||||||||

Common stock, $.01 par value, 1,000 shares authorized and 100 shares issued and outstanding at December 31, 2012 | — | — | — | — | — | |||||||||||||||

Paid in capital | 339.4 | 337.5 | 335.7 | 7.1 | — | |||||||||||||||

Accumulated deficit | (14.2 | ) | (9.7 | ) | (3.9 | ) | — | — | ||||||||||||

Partnership capital | — | — | — | 493.0 | 297.5 | |||||||||||||||

Total shareholders’ equity / parent’s net investment | 325.4 | 328.0 | 332.0 | 500.1 | 297.5 | |||||||||||||||

Noncontrolling interests | 465.0 | 473.2 | 484.5 | — | — | |||||||||||||||

Total Equity | 790.4 | 801.2 | 816.5 | 500.1 | 297.5 | |||||||||||||||

Total liabilities and shareholders’ equity / parent’s net investment | $ | 1,519.9 | $ | 1,519.8 | $ | 1,574.0 | $ | 1,210.9 | $ | 1,090.8 | ||||||||||

CyrusOne Inc.

Reconciliation of Statement of Operations for the Three Months Ended March 31, 2013

(Dollars in millions, except per share amounts)

(Unaudited)

Predecessor | Successor | Combined | ||||||||||

January 1, 2013 to January 23, 2013 | January 24, 2013 to March 31, 2013 | Three Months Ended March 31, 2013 | ||||||||||

Revenue | $ | 15.1 | $ | 45.0 | $ | 60.1 | ||||||

Costs and expenses: | ||||||||||||

Property operating expenses | 4.8 | 15.3 | 20.1 | |||||||||

Sales and marketing | 0.7 | 2.1 | 2.8 | |||||||||

General and administrative | 1.5 | 5.4 | 6.9 | |||||||||

Transaction-related compensation | 20.0 | — | 20.0 | |||||||||

Depreciation and amortization | 5.3 | 16.4 | 21.7 | |||||||||

Transaction costs | 0.1 | — | 0.1 | |||||||||

Total costs and expenses | 32.4 | 39.2 | 71.6 | |||||||||

Operating income (loss) | (17.3 | ) | 5.8 | (11.5 | ) | |||||||

Interest expense | 2.5 | 8.4 | 10.9 | |||||||||

Loss before income taxes | (19.8 | ) | (2.6 | ) | (22.4 | ) | ||||||

Income tax (expense) benefit | (0.4 | ) | (0.2 | ) | (0.6 | ) | ||||||

Net loss | (20.2 | ) | (2.8 | ) | (23.0 | ) | ||||||

Net loss attributed to Predecessor | (20.2 | ) | — | (20.2 | ) | |||||||

Noncontrolling interest in net loss | — | 1.9 | 1.9 | |||||||||

Net loss attributed to common stockholders | $ | — | $ | (0.9 | ) | $ | (0.9 | ) | ||||

Loss per common share - basic and diluted | n/a | $ | (0.05 | ) | $ | (0.05 | ) | |||||

CyrusOne Inc.

Reconciliation of Statement of Operations for the Nine Months Ended September 30, 2013

(Dollars in millions, except per share amounts)

(Unaudited)

Predecessor | Successor | Combined | ||||||||||

January 1, 2013 to January 23, 2013 | January 24, 2013 to September 30, 2013 | Nine Months Ended September 30, 2013 | ||||||||||

Revenue | $ | 15.1 | $ | 176.1 | $ | 191.2 | ||||||

Costs and expenses: | ||||||||||||

Property operating expenses | 4.8 | 64.1 | 68.9 | |||||||||

Sales and marketing | 0.7 | 7.3 | 8.0 | |||||||||

General and administrative | 1.5 | 19.7 | 21.2 | |||||||||

Transaction-related compensation | 20.0 | — | 20.0 | |||||||||

Depreciation and amortization | 5.3 | 63.3 | 68.6 | |||||||||

Restructuring charges | — | 0.7 | 0.7 | |||||||||

Transaction costs | 0.1 | 1.1 | 1.2 | |||||||||

Total costs and expenses | 32.4 | 156.2 | 188.6 | |||||||||

Operating income (loss) | (17.3 | ) | 19.9 | 2.6 | ||||||||

Interest expense | 2.5 | 29.7 | 32.2 | |||||||||

Other income | — | (0.1 | ) | (0.1 | ) | |||||||

Loss on extinguishment of debt | — | 1.3 | 1.3 | |||||||||

Loss before income taxes | (19.8 | ) | (11.0 | ) | (30.8 | ) | ||||||

Income tax (expense) benefit | (0.4 | ) | (0.8 | ) | (1.2 | ) | ||||||

Net loss | (20.2 | ) | (11.8 | ) | (32.0 | ) | ||||||

Net loss attributed to Predecessor | (20.2 | ) | — | (20.2 | ) | |||||||

Noncontrolling interest in net loss | — | 7.8 | 7.8 | |||||||||

Net loss attributed to common stockholders | $ | — | $ | (4.0 | ) | $ | (4.0 | ) | ||||

Loss per common share - basic and diluted | n/a | $ | (0.22 | ) | $ | (0.22 | ) | |||||

CyrusOne Inc.

Net Operating Income and Reconciliation of Net Loss to Adjusted EBITDA

(Dollars in millions)

(Unaudited)

Nine Months Ended | Three Months Ended | |||||||||||||||||||||||||||||||||

September 30, | Change | September 30, | June 30, | March 31, | December 31, | September 30, | ||||||||||||||||||||||||||||

2013 | 2012 | $ | % | 2013 | 2013 | 2013 | 2012 | 2012 | ||||||||||||||||||||||||||

Net Operating Income | ||||||||||||||||||||||||||||||||||

Revenue | $ | 191.2 | $ | 162.8 | $ | 28.4 | 17% | $ | 67.5 | $ | 63.6 | $ | 60.1 | $ | 58.0 | $ | 56.7 | |||||||||||||||||

Property operating expenses | 68.9 | 55.3 | 13.6 | 25% | 24.2 | 24.6 | 20.1 | 20.6 | 20.0 | |||||||||||||||||||||||||

Net Operating Income (NOI) | $ | 122.3 | $ | 107.5 | $ | 14.8 | 14% | $ | 43.3 | $ | 39.0 | $ | 40.0 | $ | 37.4 | $ | 36.7 | |||||||||||||||||

NOI as a % of Revenue | 64.0 | % | 66.0 | % | 64.1 | % | 61.3 | % | 66.6 | % | 64.5 | % | 64.7 | % | ||||||||||||||||||||

Reconciliation of Net Loss to Adjusted EBITDA: | ||||||||||||||||||||||||||||||||||

Net loss | $ | (32.0 | ) | $ | (13.4 | ) | $ | (18.6 | ) | n/m | $ | (2.2 | ) | $ | (6.8 | ) | $ | (23.0 | ) | $ | (6.9 | ) | $ | (2.8 | ) | |||||||||

Adjustments: | ||||||||||||||||||||||||||||||||||

Interest expense | 32.2 | 31.2 | 1.0 | 3% | 10.5 | 10.8 | 10.9 | 10.5 | 11.3 | |||||||||||||||||||||||||

Other income | (0.1 | ) | — | (0.1 | ) | n/m | (0.1 | ) | — | — | — | — | ||||||||||||||||||||||

Income tax (benefit) expense | 1.2 | (4.7 | ) | 5.9 | n/m | 0.3 | 0.3 | 0.6 | (0.4 | ) | (0.7 | ) | ||||||||||||||||||||||

Depreciation and amortization | 68.6 | 52.9 | 15.7 | 30% | 23.9 | 23.0 | 21.7 | 20.4 | 18.8 | |||||||||||||||||||||||||

Restructuring charges | 0.7 | — | 0.7 | n/m | 0.7 | — | — | — | — | |||||||||||||||||||||||||

Legal claim costs | 0.7 | — | 0.7 | n/m | 0.7 | — | — | — | — | |||||||||||||||||||||||||

Transaction costs | 1.2 | 1.3 | (0.1 | ) | (8)% | 0.7 | 0.4 | 0.1 | 4.4 | 0.6 | ||||||||||||||||||||||||

Loss on sale of receivables to affiliate | — | 3.7 | (3.7 | ) | n/m | — | — | — | (0.4 | ) | 1.3 | |||||||||||||||||||||||

Non-cash compensation | 5.0 | 2.6 | 2.4 | 92% | 2.0 | 1.8 | 1.2 | 0.8 | 1.7 | |||||||||||||||||||||||||

Asset impairments | — | 13.3 | (13.3 | ) | n/m | — | — | — | — | — | ||||||||||||||||||||||||

Loss on extinguishment of debt | 1.3 | — | 1.3 | n/m | — | 1.3 | — | — | — | |||||||||||||||||||||||||

Gain on sale of real estate improvements | — | (0.1 | ) | 0.1 | n/m | — | — | — | — | (0.1 | ) | |||||||||||||||||||||||

Transaction-related compensation | 20.0 | — | 20.0 | n/m | — | — | 20.0 | — | — | |||||||||||||||||||||||||

Adjusted EBITDA | $ | 98.8 | $ | 86.8 | $ | 12.0 | 14% | $ | 36.5 | $ | 30.8 | $ | 31.5 | $ | 28.4 | $ | 30.1 | |||||||||||||||||

Adjusted EBITDA as a % of Revenue | 51.7 | % | 53.3 | % | 54.1 | % | 48.4 | % | 52.4 | % | 49.0 | % | 53.1 | % | ||||||||||||||||||||

CyrusOne Inc.

Reconciliation of Net Loss to FFO, Normalized FFO, and AFFO

(Dollars in millions)

(Unaudited)

Nine Months Ended | Three Months Ended | ||||||||||||||||||||||||||||||||||

September 30, | Change | September 30, 2013 | June 30, 2013 | March 31, 2013 | December 31, 2012 | September 30, 2012 | |||||||||||||||||||||||||||||

2013 | 2012 | $ | % | ||||||||||||||||||||||||||||||||

Reconciliation of Net Loss to FFO and Normalized FFO: | |||||||||||||||||||||||||||||||||||

Net income (loss) | $ | (32.0 | ) | $ | (13.4 | ) | $ | (18.6 | ) | n/m | $ | (2.2 | ) | $ | (6.8 | ) | $ | (23.0 | ) | $ | (6.9 | ) | $ | (2.8 | ) | ||||||||||

Adjustments: | |||||||||||||||||||||||||||||||||||

Real estate depreciation and amortization | 50.6 | 37.5 | 13.1 | 35 | % | 17.8 | 16.9 | 15.9 | 15.4 | 13.6 | |||||||||||||||||||||||||

Amortization of customer relationship intangibles | 12.6 | 12.1 | 0.5 | 4 | % | 4.2 | 4.2 | 4.2 | 3.9 | 4.0 | |||||||||||||||||||||||||

Real estate impairments | — | 11.7 | (11.7 | ) | n/m | — | — | — | — | (0.1 | ) | ||||||||||||||||||||||||

Customer relationship intangible impairments | — | 1.5 | (1.5 | ) | n/m | — | — | — | — | — | |||||||||||||||||||||||||

Gain on sale of real estate improvements | — | (0.1 | ) | 0.1 | n/m | — | — | — | — | (0.1 | ) | ||||||||||||||||||||||||

Funds from Operations (FFO) | $ | 31.2 | $ | 49.3 | (18.1 | ) | n/m | $ | 19.8 | $ | 14.3 | $ | (2.9 | ) | $ | 12.4 | $ | 14.6 | |||||||||||||||||

Transaction-related compensation | 20.0 | — | 20.0 | n/m | — | — | 20.0 | — | — | ||||||||||||||||||||||||||

Loss on extinguishment of debt | 1.3 | — | 1.3 | n/m | — | 1.3 | — | — | — | ||||||||||||||||||||||||||

Restructuring charges | 0.7 | — | 0.7 | n/m | 0.7 | — | — | — | — | ||||||||||||||||||||||||||

Legal claim costs | 0.7 | — | 0.7 | n/m | 0.7 | — | — | — | — | ||||||||||||||||||||||||||

Transaction costs | 1.2 | 1.3 | (0.1 | ) | (8 | )% | $ | 0.7 | $ | 0.4 | $ | 0.1 | 4.4 | 0.6 | |||||||||||||||||||||

Normalized Funds from Operations (Normalized FFO) | $ | 55.1 | $ | 50.6 | $ | 4.5 | 9 | % | $ | 21.9 | $ | 16.0 | $ | 17.2 | $ | 16.8 | $ | 15.2 | |||||||||||||||||

Normalized FFO per diluted common share or common share equivalent* | $ | 0.85 | n/a | $ | — | n/m | $ | 0.33 | 0.25 | 0.27 | n/a | n/a | |||||||||||||||||||||||

Reconciliation of Normalized FFO to AFFO: | |||||||||||||||||||||||||||||||||||

Normalized FFO | $ | 55.1 | $ | 50.6 | 4.5 | 9 | % | $ | 21.9 | $ | 16.0 | $ | 17.2 | $ | 16.8 | $ | 15.2 | ||||||||||||||||||

Adjustments: | |||||||||||||||||||||||||||||||||||

Amortization of deferred financing costs | 2.8 | — | 2.8 | n/m | 0.5 | 1.7 | 0.6 | 0.3 | — | ||||||||||||||||||||||||||

Non-cash compensation | 5.0 | 2.6 | 2.4 | 92 | % | 2.0 | 1.8 | 1.2 | 0.8 | 1.7 | |||||||||||||||||||||||||

Non-real estate depreciation and amortization | 5.4 | 3.4 | 2.0 | 59 | % | 1.9 | 1.9 | 1.6 | 1.1 | 1.2 | |||||||||||||||||||||||||

Deferred revenue and straight line rent adjustments | (9.7 | ) | (6.0 | ) | (3.7 | ) | 62 | % | (3.7 | ) | (3.7 | ) | (2.3 | ) | (2.3 | ) | (2.0 | ) | |||||||||||||||||

Leasing commissions | (5.1 | ) | (3.3 | ) | (1.8 | ) | 55 | % | (1.7 | ) | (2.5 | ) | (0.9 | ) | (1.1 | ) | (1.0 | ) | |||||||||||||||||

Recurring capital expenditures | (2.3 | ) | (2.3 | ) | — | — | % | (1.6 | ) | (0.4 | ) | (0.3 | ) | (1.6 | ) | (1.0 | ) | ||||||||||||||||||

Corporate income tax (benefit) expense | 0.4 | (5.3 | ) | 5.7 | n/m | — | — | 0.4 | (0.5 | ) | (0.9 | ) | |||||||||||||||||||||||

Adjusted Funds from Operations (AFFO) | $ | 51.6 | $ | 39.7 | $ | 11.9 | 30 | % | $ | 19.3 | $ | 14.8 | $ | 17.5 | $ | 13.5 | $ | 13.2 | |||||||||||||||||

* | Assumes diluted common shares and common share equivalents were outstanding as of January 1, 2013 for the Three Months Ended March 31, 2013. |

CyrusOne Inc.

Market Capitalization Summary and Reconciliation of Net Debt

(Unaudited)

Market Capitalization

Shares or Equivalents Outstanding | Market Price as of September 30, 2013 | Market Value Equivalents (in millions) | |||||||||

Common shares | 22,116,172 | $ | 19.00 | $ | 420.2 | ||||||

Operating Partnership units | 42,586,835 | $ | 19.00 | 809.1 | |||||||

Net Debt | 330.6 | ||||||||||

Total Enterprise Value (TEV) | $ | 1,559.9 | |||||||||

Net Debt as a % of TEV | 21.2 | % | |||||||||

Net Debt to LQA Adjusted EBITDA | 2.3x | ||||||||||

Reconciliation of Net Debt

(Dollars in millions) | September 30, | June 30, | March 31, | December 31, | ||||||||||||

2013 | 2013 | 2013 | 2012 | |||||||||||||

Long-term debt | $ | 525.0 | $ | 525.0 | $ | 525.0 | $ | 525.0 | ||||||||

Capital lease obligations | 18.8 | 19.8 | 31.0 | 32.2 | ||||||||||||

Less: | ||||||||||||||||

Cash and cash equivalents | (213.2 | ) | (267.1 | ) | (328.6 | ) | (16.5 | ) | ||||||||

Net Debt | $ | 330.6 | $ | 277.7 | $ | 227.4 | $ | 540.7 | ||||||||

CyrusOne Inc.

Colocation Square Footage (CSF) and Utilization

(Unaudited)

As of September 30, 2013 | As of December 31, 2012 | As of September 30, 2012 | ||||||||||||||||

Market | CSF Capacity (Sq Ft) | % Utilized | CSF Capacity (Sq Ft) | % Utilized | CSF Capacity (Sq Ft) | % Utilized | ||||||||||||

Cincinnati | 419,231 | 87 | % | 411,730 | 92 | % | 411,730 | 92 | % | |||||||||

Dallas | 171,780 | 93 | % | 171,100 | 69 | % | 171,100 | 67 | % | |||||||||

Houston | 230,718 | 85 | % | 188,602 | 93 | % | 188,602 | 87 | % | |||||||||

Austin | 54,003 | 63 | % | 57,078 | 32 | % | 57,078 | 30 | % | |||||||||

Phoenix | 36,366 | 64 | % | 36,222 | 0% | — | 0% | |||||||||||

San Antonio | 43,487 | 99 | % | 35,765 | 61 | % | 35,765 | 17 | % | |||||||||

Chicago | 23,298 | 52 | % | 23,278 | 52 | % | 23,278 | 58 | % | |||||||||

International | 13,200 | 78 | % | 8,200 | 52 | % | 8,200 | 24 | % | |||||||||

Total Footprint | 992,083 | 85 | % | 931,975 | 78 | % | 895,753 | 78 | % | |||||||||

CyrusOne Inc.

2013 Guidance

(Unaudited)

Full Year 2013 | ||

Revenue | $260 - $265 million | |

Adjusted EBITDA | $133 - $137 million | |

Normalized FFO per diluted common share or common share equivalent* | $1.15 - $1.25 | |

Capital Expenditures | ||

Development | $210 - $216 million | |

Recurring | $4 - $6 million | |

Acquisition of Leased Facilities** | $28 million | |

* | Calculated as if all diluted common shares and common share equivalents were issued and outstanding as of January 1, 2013. |

** | Inclusive of all amounts spent on acquisition of leased facilities, including dollars not reported through the capital expenditures captions on the GAAP cash flow statement. |

CyrusOne Inc.

Data Center Portfolio

As of September 30, 2013

(Unaudited)

Operating Net Rentable Square Feet (NRSF)(a) | Powered Shell Available for Future Development (NRSF)(h) | Available UPS Capacity (MW)(i) | ||||||||||||||||||||||||

Facilities | Metropolitan Area | Annualized Rent(b) | Colocation Space (CSF)(c) | Office & Other(d) | Supporting Infrastructure (e) | Total(f) | Percent Leased(g) | |||||||||||||||||||

Southwest Fwy. (Galleria) | Houston | $ | 45,273,693 | 63,469 | 17,259 | 23,203 | 103,931 | 90 | % | — | 14 | |||||||||||||||

Westway Park Blvd. (Houston West 1) | Houston | 41,053,448 | 112,133 | 12,735 | 37,636 | 162,504 | 96 | % | 3,000 | 28 | ||||||||||||||||

S. State Hwy 121 Business (Lewisville)* | Dallas | 36,208,463 | 108,687 | 11,399 | 59,346 | 179,432 | 91 | % | — | 18 | ||||||||||||||||

West Seventh Street (7th St.)*** | Cincinnati | 34,743,159 | 211,672 | 5,744 | 171,561 | 388,977 | 88 | % | 37,000 | 13 | ||||||||||||||||

Fujitec Drive (Lebanon) | Cincinnati | 19,386,260 | 65,303 | 36,261 | 49,159 | 150,723 | 76 | % | 72,000 | 14 | ||||||||||||||||

Industrial Road (Florence) | Cincinnati | 14,942,902 | 52,698 | 46,848 | 40,374 | 139,920 | 94 | % | — | 9 | ||||||||||||||||

Knightsbridge Drive (Hamilton)* | Cincinnati | 12,231,822 | 46,565 | 1,077 | 35,336 | 82,978 | 90 | % | — | 10 | ||||||||||||||||

W. Frankford Road (Carrollton) | Dallas | 7,256,565 | 47,438 | 19,706 | 35,592 | 102,736 | 57 | % | 441,000 | 3 | ||||||||||||||||

Westover Hills Blvd. (San Antonio 1) | San Antonio | 6,162,321 | 43,487 | 2,351 | 35,955 | 81,793 | 97 | % | 23,000 | 12 | ||||||||||||||||

Parkway Dr. (Mason) | Cincinnati | 5,877,943 | 34,072 | 26,458 | 17,193 | 77,723 | 99 | % | — | 4 | ||||||||||||||||

E. Ben White Blvd. (Austin 1)* | Austin | 5,682,784 | 16,223 | 21,376 | 7,516 | 45,115 | 95 | % | — | 2 | ||||||||||||||||

Midway Rd.** | Dallas | 5,397,262 | 8,390 | — | — | 8,390 | 100 | % | — | 1 | ||||||||||||||||

Metropolis Drive (Austin 2) | Austin | 5,375,381 | 37,780 | 4,128 | 18,444 | 60,352 | 38 | % | — | 5 | ||||||||||||||||

Kestral Way (London)** | London | 4,492,884 | 10,000 | — | — | 10,000 | 99 | % | — | 1 | ||||||||||||||||

Springer Street (Lombard) | Chicago | 2,283,510 | 13,516 | 4,115 | 12,230 | 29,861 | 59 | % | 29,000 | 3 | ||||||||||||||||

Marsh Ln.** | Dallas | 2,073,446 | 4,245 | — | — | 4,245 | 100 | % | — | — | ||||||||||||||||

Westway Park Blvd. (Houston West 2) | Houston | 1,776,560 | 42,116 | 3,065 | 31,344 | 76,525 | 26 | % | 77,000 | 6 | ||||||||||||||||

Goldcoast Drive (Goldcoast) | Cincinnati | 1,517,714 | 2,728 | 5,280 | 16,481 | 24,489 | 100 | % | 14,000 | 1 | ||||||||||||||||

E. Monroe Street (Monroe St.) | South Bend | 1,161,531 | 6,350 | — | 6,478 | 12,828 | 65 | % | 4,000 | — | ||||||||||||||||

North Fwy. (Greenspoint)** | Houston | 1,034,598 | 13,000 | 1,449 | — | 14,449 | 100 | % | — | — | ||||||||||||||||

Bryan St.** | Dallas | 1,029,418 | 3,020 | — | — | 3,020 | 58 | % | — | — | ||||||||||||||||

South Ellis Street (Phoenix) | Phoenix | 816,715 | 36,366 | 36,135 | 38,411 | 110,912 | 28 | % | 76,000 | 3 | ||||||||||||||||

Crescent Circle (Blackthorn)* | South Bend | 734,883 | 3,432 | — | 5,125 | 8,557 | 49 | % | 11,000 | — | ||||||||||||||||

McAuley Place (Blue Ash)* | Cincinnati | 551,268 | 6,193 | 6,950 | 2,166 | 15,309 | 71 | % | — | — | ||||||||||||||||

Jurong East (Singapore)** | Singapore | 325,240 | 3,200 | — | — | 3,200 | 12 | % | — | 2 | ||||||||||||||||

Total | $ | 257,389,770 | 992,083 | 262,336 | 643,550 | 1,897,969 | 80 | % | 787,000 | 143 | ||||||||||||||||

* | Indicates properties in which we hold a leasehold interest in the building shell and land. All data center infrastructure has been constructed by us and owned by us. |

** | Indicates properties in which we hold a leasehold interest in the building shell, land, and all data center infrastructure. |

*** | The information provided for the West Seventh Street (7th St.) property includes data for two facilities, one of which we lease and one of which we own. |

(a) | Represents the total square feet of a building under lease or available for lease based on engineers’ drawings and estimates but does not include space held for development or space used by CyrusOne. |

(b) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of September 30, 2013, multiplied by 12. For the month of September 2013, customer reimbursements were $22.9 million annualized and consisted of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers’ utilization of power and the suppliers’ pricing of power. From October 1, 2011 through September 30, 2013, customer reimbursements under leases with separately metered power constituted between 7.2% and 9.7% of annualized rent. After giving effect to abatements, free rent and other straight-line adjustments, our annualized effective rent as of September 30, 2013 was $274,859,776. Our annualized effective rent was greater than our annualized rent as of September 30, 2013 because our positive straight-line and other adjustments and amortization of deferred revenue exceeded our negative straight-line adjustments due to factors such as the timing of contractual rent escalations and customer prepayments for services. |

(c) | CSF represents the NRSF at an operating facility that is currently leased or readily available for lease as colocation space, where customers locate their servers and other IT equipment. |

(d) | Represents the NRSF at an operating facility that is currently leased or readily available for lease as space other than CSF, which is typically office and other space. |

(e) | Represents infrastructure support space, including mechanical, telecommunications and utility rooms, as well as building common areas. |

(f) | Represents the NRSF at an operating facility that is currently leased or readily available for lease. This excludes existing vacant space held for development. |

(g) | Percent leased is determined based on NRSF being billed to customers under signed leases as of September 30, 2013 divided by total NRSF. Leases signed but not commenced as of September 30, 2013 are not included. Supporting infrastructure has been allocated to leased NRSF on a proportionate basis for purposes of this calculation. |

(h) | Represents space that is under roof that could be developed in the future for operating NRSF, rounded to the nearest 1,000. |

(i) | UPS Capacity (also referred to as critical load) represents the aggregate power available for lease to and exclusive use by customers from the facility’s installed universal power supplies (UPS) expressed in terms of megawatts. The capacity presented is for non-redundant megawatts, as we can develop flexible solutions to our customers at multiple resiliency levels. May not foot due to rounding. |

CyrusOne Inc.

NRSF Under Development

As of September 30, 2013

(Dollars in millions)

(Unaudited)

NRSF Under Development(a) | |||||||||||||||||||||||||||

Under Development | Under Development Costs(b) | ||||||||||||||||||||||||||

Facilities | Metropolitan Area | Colocation Space (CSF) | Office & Other | Supporting Infrastructure | Powered Shell(c) | Total | Actual to Date | Estimated Costs to Completion | Total | ||||||||||||||||||

Westway Park Blvd (Houston West 2) | Houston | — | 8,000 | — | — | 8,000 | $ | — | $ | 1 | $ | 1 | |||||||||||||||

W Frankford Road (Carrollton) | Dallas | 60,000 | — | 28,000 | — | 88,000 | 12 | 7 | 19 | ||||||||||||||||||

Total | 60,000 | 8,000 | 28,000 | — | 96,000 | $ | 12 | $ | 8 | $ | 20 | ||||||||||||||||

(a) | Represents NRSF at a facility for which substantial activities have commenced to prepare the space for its intended use. |

(b) | Represents management’s estimate of the total costs required to complete the current NRSF under development. There may be an increase in costs if customers require greater power density. |

(c) | Represents NRSF under construction that, upon completion, will be powered shell available for future development into operating NRSF. |

CyrusOne Inc.

Customer Diversification(a)

As of September 30, 2013

(Unaudited)

Principal Customer Industry | Number of Locations | Annualized Rent(b) | Percentage of Portfolio Annualized Rent(c) | Weighted Average Remaining Lease Term in Months(d) | |||||||||

1 | Telecommunications (CBI)(e) | 7 | $ | 23,710,914 | 9.2 | % | 31.0 | ||||||

2 | Energy | 2 | 19,032,482 | 7.4 | % | 2.8 | |||||||

3 | Energy | 4 | 14,942,972 | 5.8 | % | 4.4 | |||||||

4 | Research and Consulting Services | 3 | 13,208,719 | 5.1 | % | 0.3 | |||||||

5 | Telecommunication Services | 1 | 10,056,455 | 3.9 | % | 50.0 | |||||||

6 | Information Technology | 3 | 7,440,740 | 2.9 | % | 43.1 | |||||||

7 | Financials | 1 | 6,000,225 | 2.3 | % | 80.0 | |||||||

8 | Telecommunication Services | 1 | 5,013,892 | 1.9 | % | 67.0 | |||||||

9 | Information Technology | 1 | 4,845,316 | 1.9 | % | 27.0 | |||||||

10 | Consumer Staples | 1 | 4,743,436 | 1.8 | % | 102.9 | |||||||

11 | Energy | 2 | 4,731,000 | 1.8 | % | 34.0 | |||||||

12 | Information Technology | 3 | 4,625,641 | 1.8 | % | 55.7 | |||||||

13 | Energy | 1 | 4,101,396 | 1.6 | % | 13.7 | |||||||

14 | Information Technology | 1 | 4,006,477 | 1.6 | % | 89.0 | |||||||

15 | Energy | 3 | 3,870,111 | 1.5 | % | 7.1 | |||||||

16 | Information Technology | 2 | 3,831,921 | 1.5 | % | 89.0 | |||||||

17 | Energy | 1 | 3,612,639 | 1.4 | % | 32.3 | |||||||

18 | Consumer Discretionary | 1 | 3,303,607 | 1.3 | % | 3.2 | |||||||

19 | Information Technology | 2 | 3,283,480 | 1.3 | % | 36.1 | |||||||

20 | Energy | 1 | 3,236,416 | 1.3 | % | 13.6 | |||||||

$ | 147,597,839 | 57.3 | % | 31.2 | |||||||||

(a) | Includes affiliates. |

(b) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of September 30, 2013, multiplied by 12. For the month of September 2013, our total portfolio annualized rent was $257.4 million, and customer reimbursements were $22.9 million annualized, consisting of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers’ utilization of power and the suppliers’ pricing of power. From October 1, 2011 through September 30, 2013, customer reimbursements under leases with separately metered power constituted between 7.2% and 9.7% of annualized rent. After giving effect to abatements, free rent and other straight-line adjustments, our annualized effective rent for our total portfolio as of September 30, 2013 was $274,859,776. Our annualized effective rent was greater than our annualized rent as of September 30, 2013 because our positive straight-line and other adjustments and amortization of deferred revenue exceeded our negative straight-line adjustments due to factors such as the timing of contractual rent escalations and customer prepayments for services. |

(c) | Represents the customer’s total annualized rent divided by the total annualized rent in the portfolio as of September 30, 2013, which was approximately $257.4 million. |

(d) | Weighted average based on customer’s percentage of total annualized rent expiring and is as of September 30, 2013, assuming that customers exercise no renewal options and exercise all early termination rights that require payment of less than 50% of the remaining rents. Early termination rights that require payment of 50% or more of the remaining lease payments are not assumed to be exercised because such payments approximate the profitability margin of leasing that space to the customer, such that we do not consider early termination to be economically detrimental to us. |

(e) | Includes information for both Cincinnati Bell Technology Solutions (CBTS) and Cincinnati Bell Telephone and two customers that have contracts with CBTS. We expect the contracts for these two customers to be assigned to us, but the consents for such assignments have not yet been obtained. Excluding these customers, Cincinnati Bell Inc. and subsidiaries represented 3.6% of our annualized rent as of September 30, 2013. |

CyrusOne Inc.

Lease Distribution

As of September 30, 2013

(Unaudited)

NRSF Under Lease(a) | Number of Customers(b) | Percentage of All Customers | Total Leased NRSF(c) | Percentage of Portfolio Leased NRSF | Annualized Rent(d) | Percentage of Annualized Rent | |||||||||||||

0-999 | 447 | 79 | % | 81,819 | 5 | % | $ | 33,655,624 | 13 | % | |||||||||

1,000-2,499 | 39 | 7 | % | 66,987 | 4 | % | 15,444,873 | 6 | % | ||||||||||

2,500-4,999 | 27 | 5 | % | 102,141 | 7 | % | 20,661,725 | 8 | % | ||||||||||

5,000-9,999 | 23 | 4 | % | 162,750 | 11 | % | 51,439,853 | 20 | % | ||||||||||

10,000+ | 31 | 5 | % | 1,099,879 | 73 | % | 136,187,695 | 53 | % | ||||||||||

Total | 567 | 100 | % | 1,513,576 | 100 | % | $ | 257,389,770 | 100 | % | |||||||||

(a) | Represents all leases in our portfolio, including colocation, office and other leases. |

(b) | Represents the number of customers in our portfolio leasing data center, office and other space. |

(c) | Represents the total square feet at a facility under lease and that has commenced billing, excluding space held for development or space used by CyrusOne. A customer’s leased NRSF is estimated based on such customer’s direct CSF or office and light-industrial space plus management’s estimate of infrastructure support space, including mechanical, telecommunications and utility rooms, as well as building common areas. |

(d) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of September 30, 2013, multiplied by 12. For the month of September 2013, customer reimbursements were $22.9 million annualized and consisted of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers’ utilization of power and the suppliers’ pricing of power. From October 1, 2011 through September 30, 2013, customer reimbursements under leases with separately metered power constituted between 7.2% and 9.7% of annualized rent. After giving effect to abatements, free rent and other straight-line adjustments, our annualized effective rent as of September 30, 2013 was $274,859,776. Our annualized effective rent was greater than our annualized rent as of September 30, 2013 because our positive straight-line and other adjustments and amortization of deferred revenue exceeded our negative straight-line adjustments due to factors such as the timing of contractual rent escalations and customer prepayments for services. |

CyrusOne Inc.

Lease Expirations

As of September 30, 2013

(Unaudited)

Year(a) | Number of Leases Expiring(b) | Total Operating NRSF Expiring | Percentage of Total NRSF | Annualized Rent(c) | Percentage of Annualized Rent | Annualized Rent at Expiration(d) | Percentage of Annualized Rent at Expiration | |||||||||||||||

Available | 384,393 | 20 | % | |||||||||||||||||||

Month-to-Month | 216 | 36,552 | 2 | % | $ | 8,979,903 | 3 | % | $ | 8,979,903 | 3 | % | ||||||||||

Remainder of 2013 | 289 | 217,844 | 11 | % | 57,815,166 | 22 | % | 57,886,248 | 20 | % | ||||||||||||

2014 | 612 | 228,146 | 12 | % | 45,403,980 | 18 | % | 45,455,010 | 16 | % | ||||||||||||

2015 | 487 | 252,150 | 13 | % | 38,832,786 | 15 | % | 40,535,270 | 15 | % | ||||||||||||

2016 | 338 | 84,138 | 5 | % | 31,379,039 | 12 | % | 36,536,531 | 13 | % | ||||||||||||

2017 | 112 | 228,329 | 12 | % | 27,250,450 | 11 | % | 30,982,627 | 11 | % | ||||||||||||

2018 | 86 | 114,447 | 6 | % | 18,914,460 | 7 | % | 22,343,777 | 8 | % | ||||||||||||

2019 | 9 | 96,271 | 5 | % | 5,432,091 | 2 | % | 5,849,905 | 2 | % | ||||||||||||

2020 | 20 | 115,930 | 6 | % | 8,150,441 | 3 | % | 10,384,144 | 4 | % | ||||||||||||

2021 | 9 | 30,754 | 2 | % | 4,133,641 | 2 | % | 4,577,392 | 2 | % | ||||||||||||

2022 | 6 | 40,087 | 2 | % | 7,138,173 | 3 | % | 10,406,465 | 4 | % | ||||||||||||

2023 - Thereafter | 21 | 68,928 | 4 | % | 3,959,640 | 2 | % | 4,581,453 | 2 | % | ||||||||||||

Total | 2,205 | 1,897,969 | 100 | % | $ | 257,389,770 | 100 | % | $ | 278,518,725 | 100 | % | ||||||||||

(a) | Leases that were auto-renewed prior to September 30, 2013 are shown in the calendar year in which their current auto-renewed term expires. Unless otherwise stated in the footnotes, the information set forth in the table assumes that customers exercise no renewal options and exercise all early termination rights that require payment of less than 50% of the remaining rents. Early termination rights that require payment of 50% or more of the remaining lease payments are not assumed to be exercised because such payments approximate the profitability margin of leasing that space to the customer, such that we do not consider early termination to be economically detrimental to us. |

(b) | Number of leases represents each agreement with a customer. A lease agreement could include multiple spaces and a customer could have multiple leases. |

(c) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of September 30, 2013, multiplied by 12. For the month of September 2013, customer reimbursements were $22.9 million annualized and consisted of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers’ utilization of power and the suppliers’ pricing of power. From October 1, 2011 through September 30, 2013, customer reimbursements under leases with separately metered power constituted between 7.2% and 9.7% of annualized rent. After giving effect to abatements, free rent and other straight-line adjustments, our annualized effective rent as of September 30, 2013 was $274,859,776. Our annualized effective rent was greater than our annualized rent as of September 30, 2013 because our positive straight-line and other adjustments and amortization of deferred revenue exceeded our negative straight-line adjustments due to factors such as the timing of contractual rent escalations and customer prepayments for services. |

(d) | Represents the final monthly contractual rent under existing customer leases that had commenced as of September 30, 2013, multiplied by 12. |