united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22718

Two Roads Shared Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450, Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Rich Malinowski, Gemini Fund Services, LLC.

4221 North 203rd Street, Suite 100, Elkhorn, Nebraska 68022

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2600

Date of fiscal year end: 7/31

Date of reporting period: 7/31/20

ITEM 1. REPORTS TO SHAREHOLDERS.

Hanlon Managed Income Fund

| Class A | HANAX | |

| Class C | HANCX | |

| Class I | HANIX | |

| Class R | HANRX |

Hanlon Tactical Dividend and Momentum Fund

| Class A | HTDAX | |

| Class C | HTDCX | |

| Class I | HTDIX | |

| Class R | HTDRX |

Annual Report

July 31, 2020

www.HanlonFunds.com

1-844-828-3212

Distributed by Northern Lights Distributors, LLC

Member FINRA

This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing contained herein is to be considered an offer of sale or solicitation of an offer to buy shares of the Funds. Such offering is made only by a prospectus, which contains information about each Fund’s investment objective, risks, fees and expenses. Investors are reminded to read the Funds’ prospectus carefully before investing in the Funds.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website www.hanlonfunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically or to continue receiving paper copies of shareholder reports, which are available free of charge, by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you.

| Dear Fellow Shareholders, |

|

| Sean Hanlon, CFP® |

| CEO and Co-Chief Investment Officer |

The Hanlon Managed Income Fund’s (“the Fund”) investment strategy attempts to achieve our core tactical mission of providing current income, capital preservation, and positive risk-adjusted returns; although there is no guarantee that we will meet these objectives. The Fund is designed to adjust to changes in market conditions, shifting to cash when we identify signs of potential market downturns. Shareholders can use the Managed Income Fund to attempt to generate, although there is no guarantee, potentially higher returns than the traditional “40” portion of aggregate bond exposure of the classic “60/40” balanced portfolio.

| Thank you, |

|

1

| Commentary |

Note: The following commentary pertains to the Fund’s annual reporting period from August 1, 2019 to July 31, 2020.

US fixed income markets were starting to show signs of concern in late January, as Treasury yields fell below 2% as news of the COVID-19 outbreak in China began to raise concerns over slowing global growth. These concerns would soon explode into a global pandemic, forcing global central banks to abandon all thoughts of fiscal tightening and instead unleash an unprecedented influx of stimulus measures. In the US, the Fed’s “hold-steady” policy on interest rates was quickly thrown out the window, with the Central Bank electing to swiftly cut rates by 50 basis points on March 3rd, followed by an emergency 1% cut on March 16th, leaving the target federal funds rate at just 0-25 basis points.

As dramatic as these cuts were, arguably more extreme was the Fed’s foray into corporate debt markets, which many have pointed out is in violation of the Federal Reserve Act of 1913. The Fed was able skirt the illegality of violating its own charter via a loophole in which the Treasury made the purchase on behalf of the central bank, however, the end result remains that the US Federal Reserve is now effectively backstopping US corporations. The Fed was willing to extend this bailout even beyond investment grade companies, allowing a portion of the bond purchases to be allocated to high yield, or “junk” debt.

The market’s reaction to this unprecedented government intervention was predictable. The market turned on a dime, from sheer panic to frenzied buying upon announcement of the program. Arguably, the Fed accomplished its mission of stabilizing corporate debt markets simply by announcing the policy shift, and probably didn’t even need to carry through with the purchases. The Fed did hold true to its word, however, and now holds $3.6 billion in corporate bonds, a small fraction of the $750 billion capacity it authorized.

While many free market proponents will decry the Fed’s intervention into the corporate bond markets as a socialist overreach and a restriction on “creative destruction”, high yield bondholders who were staring down the -22% (using performance of the iShares iBoxx High Yield Bond ETF, HYG) collapse from February 20th to March 23rd were certainly celebrating. HYG saw its best day ever, jumping 6.6% on April 8th. High yield bonds have since recovered nearly all their losses for the year, which is shocking considering the extreme levels of unemployment and mounting corporate defaults.

The COVID-19 pandemic, and the ensuing central bank response, have changed the narrative regarding how far the US central bank will intervene. While the Fed is acting with an admirable goal of limiting the economic impact of what is effectively a natural disaster, its actions do raise questions over whether or not the cure will be worse than the sickness over the long term as the consequences of unlimited money printing play out.

Performance Update

| The Hanlon Managed Income Fund (“the Fund”) invests in a variety of fixed income asset classes, including High Yield and Investment Grade Corporate Bonds, Bank Loans, International Developed Market Bonds, Emerging Market Bonds, Convertible Bonds, Municipal Bonds, REITs, and Preferred Stocks. In addition, the Fund can also invest in equities, primarily utilizing ETFs focused on high-dividend-paying stocks. |

2

| High Yield Bonds represented the largest asset class exposure in the fund with a 48% allocation at the start of the period. The Fund began the second half of the annual period with a 43% allocation to cash. The remaining exposure was allocated among high yield bonds, investment grade corporate bonds, convertible bonds, bank loans, and REITs. High yield bond exposure was increased in mid-February, bringing cash levels down to roughly 9%, however these positions were exited on February 25th in adherence to the Fund’s tactical trading signals. The trade was well-timed, as it allowed the Fund to sidestep the severe selloff in high yield. From the February 20th peak to the March 23rd trough, the iShares iBoxx High Yield ETF (HYG) fell over 22% while the Fund experienced less than half the drawdown, falling just 9.4%. |

As previously mentioned, the rebound in high yield, spurred by the US Federal Reserve’s foray into corporate debt markets, was rapid. Unfortunately, the fund’s tactical signals, which are price-based and quantitative in nature, and cannot predict shifts in central bank policy, continued to call for cautious positioning during the high yield bounce back. The Fund did gradually add back exposure, reducing cash to just 3% by the end of the semiannual period, but most of the market’s gains occurred in the period immediately following the selloff therefore the fund lagged broader fixed income markets from the March 23rd bottom.

For the period from 8/1/2019 – 7/31/2020 the Fund’s Class I shares returned -2.62%. The Fund is benchmarked against 3-month Treasury Bills, which returned 1.30% during the same period. As of July 31st, 2020, the Fund had the following weightings.

The views in this report are those of the Fund’s management. This report contains certain forward-looking statements about factors that may affect the performance of the Fund in the future. These statements are based on the Fund’s management’s predictions and expectations concerning certain future events such as the performance of the economy as a whole and of specific industry sectors. Management believes these forward-looking statements are reasonable, although they are inherently uncertain and difficult to predict.

| 1168 NLD – 9/15/2020 |

3

| Dear Fellow Shareholders, |

|

| Sean Hanlon, CFP® |

| CEO and Co-Chief Investment Officer |

We launched the Hanlon Tactical Dividend and Momentum Fund (“TDM”, “the Fund”) with the goal of protecting our shareholders from large market drawdowns and providing positive, risk-adjusted returns; although there is no guarantee that we will meet these objectives. The Fund invests in the 11 major equity economic sectors, weighted up to their respective S&P 500 market capitalizations. This approach attempts to closely track the broader equity market during times when the market is steadily advancing. When a given sector displays relative weakness, we will attempt to reduce or eliminate exposure, while remaining in the other sectors. In extreme times, we may exit the markets completely and ride out the volatility in cash or short-term fixed income positions.

| Thank you, |

|

4

| Commentary |

Note: The following commentary pertains to the Fund’s annual reporting period from August 1, 2019 to July 31, 2020.

US equity markets experienced extreme volatility during the second half of the annual reporting period (2/1/20-7/31/20) as the COVID-19 pandemic triggered a global shutdown in commerce, transportation, and manufacturing. It is interesting to look back at our last semiannual letter, when the threat of COVID-19 was listed among other potential “black swan” events and reflect on how dramatically the world has changed in 6 short months. While the COVID shutdown was unprecedented, it was met with a staggering amount of support in the form of government stimulus programs and central bank intervention directly into financial markets. The US Federal Reserve authorized nearly $6 trillion to support financial markets, while legislators authorized an additional $3.7 trillion, with more currently being negotiated. The result was an extremely violent plunge followed by a period of frenzied buying, as the narrative has now shifted to risk-on with many investors wagering global central banks and lawmakers will continue to throw unfathomable amounts of money at the pandemic.

There has been much debate over the long-run implications of printing trillions of dollars and effectively socializing financial losses in some cases. On one hand, the pandemic can be considered on par with a natural disaster, and it is easy to justify a social safety net for business as well as individuals impacted through no fault of their own. The counterargument holds that intervening in financial markets prevents “creative destruction”, allowing so-called zombie companies access to credit markets that only prolongs their slow demise. While there have been some head-scratching misallocation of capital - such as a nearly-900% spike in Hertz (HTZ) stock after the company filed for bankruptcy – the market is effectively separating the winners from losers as it looks towards the post-COVID economy. Evidence of this can be found in the outperformance of the Nasdaq relative to the S&P 500 and Dow Jones Industrial Average, spurred by overweight exposure to the Technology sector.

Technology was already the leader during the prior semiannual period (8/1/19-1/31/20), and while the sector (measured by the SPDR Technology Sector ETF XLK) fell alongside broader markets during the initial COVID-19 selloff, it rebounded more dramatically off the March 23rd bottom as investors began to place a premium on companies that can thrive without traditional physical infrastructure. The crowding into technology stocks has pushed the Tech sector up to around 28% of the S&P 500 market capitalization, compared to less than 19% a decade prior.

| After Technology, the Consumer Discretionary Sector posted the best performance during the semiannual period, however much of that can be attributed to a near-25% weighting to Amazon (AMZN) which derives most of its profits from its cloud-computing Amazon Web Services business, and could arguably be considered a Tech company as well. On the other end of the spectrum, the dismal news for Energy companies continued, as the COVID-19 shutdown absolutely decimated demand, sending oil prices briefly negative in a historic selloff. Financial firms also lagged, hit with a double whammy of extremely low interest rates and mounting loan delinquencies and defaults. |

5

| Performance Update |

The Hanlon Tactical Dividend and Momentum Fund (“TDM”, the “Fund”) was invested in all sectors aside from Energy as of February 1st. By March 4th, the Fund had exited several sectors to raise its cash position to roughly 42%. Cash reached 68% on March 13th, and by March 20th the Fund was fully defensive in 100% cash. Due to the severity of the market selloff and the quantitative, signal-driven nature of the Fund, reinvestment of the Cash positions did not occur until May 11th, when roughly 23% of the assets were redeployed into the Healthcare and Technology sectors. The Fund scaled back up in early June to around 64% invested by June 8th. At the end of the semiannual period, the Fund was roughly 73% invested.

The Fund aims to provide lower volatility than the broad S&P 500 Index, particularly in times of severe market stress. From the February 19th peak to the March 23rd trough, the Fund experienced roughly half of the drawdown experienced by the S&P 500 Index, with the Fund down 16.9% compared to a 33.8% decline in the S&P 500. The S&P was able to stage a dramatic recovery, however, thanks to quick action from the Federal Reserve and lawmakers. As a result, the Fund’s Class I shares lost 2.50% during the annual period, lagging the broad S&P 500 Index which was able to quickly recover to gain 11.96% during the same timeframe. As of July 31st, 2020, the Fund had the below weightings:

The views in this report are those of the Fund’s management. This report contains certain forward-looking statements about factors that may affect the performance of the Fund in the future. These statements are based on the Fund’s management’s predictions and expectations concerning certain future events such as the performance of the economy as a whole and of specific industry sectors. Management believes these forward-looking statements are reasonable, although they are inherently uncertain and difficult to predict.

| 1167-NLD-9/15/2020 |

6

| Hanlon Managed Income Fund |

| PORTFOLIO REVIEW (Unaudited) |

| July 31, 2020 |

The Fund’s performance figures* for each periods ended July 31, 2020, compared to its benchmark:

| One Year | Since Inception (a) | |

| Hanlon Managed Income Fund - Class A | (2.88)% | 0.33% |

| Hanlon Managed Income Fund - Class A with load | (8.46)% | (0.88)% |

| Hanlon Managed Income Fund - Class C | (3.50)% | (0.31)% |

| Hanlon Managed Income Fund - Class I | (2.62)% | 0.57% |

| Hanlon Managed Income Fund - Class R | (2.97)% | 0.26% |

| Bloomberg Barclays Capital U.S. Treasury Bill 1-3 Month Index (b) | 1.30% | 1.15% |

Comparison of the Change in Value of a $100,000 Investment

| * | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Returns greater than 1 year are annualized. The total annual operating expenses as stated in the fee table of the Fund’s prospectus dated November 28, 2019 are 2.06%, 2.81%, 1.81% and 2.21%, for Class A, Class C, Class I and Class R shares, respectively. Hanlon Investment Management, Inc. (the “Advisor”) has contractually agreed to reduce the Fund’s fees and/or absorb expenses of the Fund until at least November 28, 2020 to ensure that total annual Fund operating expenses (exclusive of any front-end or contingent deferred loads; brokerage fees and commissions; expenses of other investment companies in which the Fund may invest (“acquired fund fees and expenses”); borrowing costs, such as interest and dividend expense on securities sold short; taxes; and extraordinary expenses, such as litigation expenses) of the Fund do not exceed 1.70%, 2.45%, 1.45%, and 1.85% of average daily net assets attributable to Class A, Class C, Class I, and Class R shares, respectively. This agreement may be terminated with respect to the Fund by the Board of Trustees on 60 days’ written notice to the Advisor. These expense reimbursements are subject to possible recoupment from the Fund in future years on a rolling three-year basis (within three years after the fees have been waived or reimbursed) if such recoupment can be achieved without exceeding the foregoing expense limits as well as any expense limitation that was in effect at the time the waiver or reimbursement was made. Class A Shares are subject to a maximum sales charge of 5.75% imposed on purchases. Class C shares are subject to a contingent deferred sales charge of 1.00% on redemptions made within one year of purchase. For investments in Class A shares of $1 million or more, there is a contingent deferred sales charge of 1.00% on redemptions made within one year of purchase. For performance information current to the most recent month-end, please call 1-844-828-3212. |

| (a) | Inception date is September 9, 2015. |

| (b) | The Bloomberg Barclays Capital U.S. Treasury Bill 1-3 Month Index includes all publicly issued zero-coupon U.S. Treasury Bills that have a remaining maturity of less than 3 months and more than 1 month, are rated investment grade, and have $250 million or more of outstanding face value. In addition, the securities must be denominated in U.S. dollars and must be fixed rate and non convertible. Unlike a mutual fund, an index does not reflect any trading costs or management fees. Investors cannot directly invest in an index. |

| Portfolio Composition as of July 31, 2020 | ||||

| Holdings By Investment Type | % of Net Assets | |||

| Exchange Traded Funds - Debt | 93.7 | % | ||

| Collateral For Securities Loaned | 10.9 | % | ||

| Exchange Traded Fund - Commodity | 3.9 | % | ||

| Money Market Fund | 3.6 | % | ||

| Liabilities In Excess of Other Assets | (12.1 | )% | ||

| 100.0 | % | |||

Please refer to the Portfolio of Investments in this annual report for a detailed listing of the Fund’s holdings.

7

| Hanlon Tactical Dividend and Momentum Fund |

| PORTFOLIO REVIEW (Unaudited) |

| July 31, 2020 |

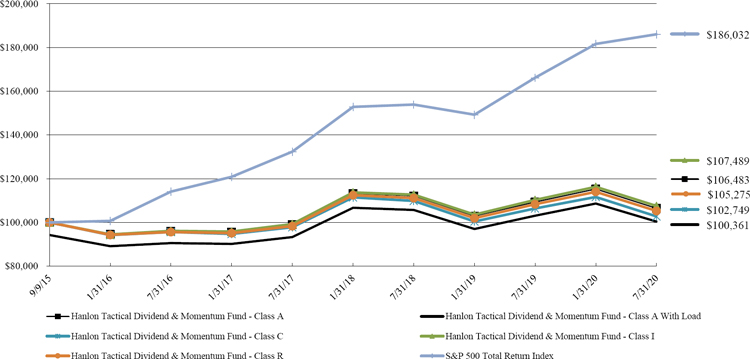

The Fund’s performance figures* for each periods ended July 31, 2020, compared to its benchmark:

| One Year | Since Inception (a) | |

| Hanlon Tactical Dividend and Momentum Fund - Class A | (2.63)% | 1.29% |

| Hanlon Tactical Dividend and Momentum Fund - Class A with load | (8.20)% | 0.07% |

| Hanlon Tactical Dividend and Momentum Fund - Class C | (3.42)% | 0.56% |

| Hanlon Tactical Dividend and Momentum Fund - Class I | (2.50)% | 1.49% |

| Hanlon Tactical Dividend and Momentum Fund - Class R | (2.81)% | 1.06% |

| S&P 500 Total Return Index (b) | 11.96% | 13.53% |

Comparison of the Change in Value of a $100,000 Investment

| * | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Returns greater than 1 year are annualized. The total annual operating expenses as stated in the fee table of the Fund’s prospectus dated November 28, 2019 are 1.78%, 2.53%, 1.53% and 1.93% for Class A, Class C, Class I and Class R shares, respectively. The Advisor has contractually agreed to reduce the Fund’s fees and/or absorb expenses of the Fund until at least November 28, 2020 to ensure that total annual Fund operating expenses (exclusive of any front-end or contingent deferred loads; brokerage fees and commissions; expenses of other investment companies in which the Fund may invest (“acquired fund fees and expenses”); borrowing costs, such as interest and dividend expense on securities sold short; taxes; and extraordinary expenses, such as litigation expenses) of the Fund do not exceed 1.70%, 2.45%, 1.45%, and 1.85% of average daily net assets attributable to Class A, Class C, Class I, and Class R shares, respectively. This agreement may be terminated with respect to the Fund by the Board of Trustees on 60 days’ written notice to the Advisor. These expense reimbursements are subject to possible recoupment from the Fund in future years on a rolling three-year basis (within three years after the fees have been waived or reimbursed) if such recoupment can be achieved without exceeding the foregoing expense limits as well as any expense limitation that was in effect at the time the waiver or reimbursement was made. Class A shares are subject to a maximum sales charge imposed on purchases of 5.75%. Class C shares are subject to a contingent deferred sales charge of 1.00% on redemptions made within one year of purchase. For investments in Class A shares of $1 million or more, there is a contingent deferred sales charge of 1.00% on redemptions made within one year of purchase. For performance information current to the most recent month-end, please call 1-844-828-3212. |

| (a) | Inception date is September 9, 2015. |

| (b) | The S&P 500 Total Return Index is an unmanaged free-float capitalization-weighted index which measures the performance of 500 large-cap common stocks actively traded in the United States. Unlike a mutual fund, an index does not reflect any trading costs or management fees. Investors cannot directly invest in an index. |

| Portfolio Composition as of July 31, 2020 | ||||

| Holdings By Investment Type | % of Net Assets | |||

| Exchange Traded Funds - Equity | 73.2 | % | ||

| Money Market Fund | 27.0 | % | ||

| Liabilities in Excess of Other Assets | (0.2 | )% | ||

| 100.0 | % | |||

Please refer to the Portfolio of Investments in this annual report for a detailed listing of the Fund’s holdings.

8

| Hanlon Managed Income Fund |

| PORTFOLIO OF INVESTMENTS |

| July 31, 2020 |

| Shares | Fair Value | |||||||

| EXCHANGE TRADED FUNDS - 97.6% | ||||||||

| COMMODITY FUND - 3.9% | ||||||||

| 209,325 | iShares Gold Trust * ^ | $ | 3,947,870 | |||||

| TOTAL COMMODITY FUND (Cost - $3,633,195) | ||||||||

| DEBT FUNDS - 93.7% | ||||||||

| 156,039 | iShares 0-5 Year High Yield Corporate Bond ETF | 6,932,813 | ||||||

| 173,783 | iShares iBoxx High Yield Corporate Bond ETF | 14,839,330 | ||||||

| 181,192 | SPDR Bloomberg Barclays Convertible Securities ETF | 11,757,549 | ||||||

| 139,901 | SPDR Bloomberg Barclays High Yield Bond ETF | 14,843,496 | ||||||

| 265,811 | SPDR Bloomberg Barclays Short Term High Yield Bond ETF | 6,924,377 | ||||||

| 489,573 | VanEck Vectors Fallen Angel High Yield Bond ETF ^ | 15,000,517 | ||||||

| 121,615 | Vanguard Intermediate-Term Corporate Bond ETF | 11,775,980 | ||||||

| 104,616 | Vanguard Long-Term Corporate Bond ETF | 11,725,361 | ||||||

| TOTAL DEBT FUNDS (Cost - $90,780,053) | 93,799,423 | |||||||

| TOTAL EXCHANGE TRADED FUNDS (Cost - $94,413,248) | 97,747,293 | |||||||

| SHORT-TERM INVESTMENTS - 14.5% | ||||||||

| COLLATERAL FOR SECURITIES LOANED - 10.9% | ||||||||

| 1,327,330 | Dreyfus Government Cash Management, Investor Class 0.06% + (a) | 1,327,330 | ||||||

| 9,631,170 | Milestone Treasury Obligations Fund, Institutional Class 0.01% + (a)(b) | 9,631,170 | ||||||

| TOTAL COLLATERAL FOR SECURITIES LOANED (Cost - $10,958,500) | 10,958,500 | |||||||

| MONEY MARKET FUND - 3.6% | ||||||||

| 3,589,798 | Morgan Stanley Institutional Liquidity Funds - Treasury Securities Portfolio, Institutional Class, 0.02% + | 3,589,798 | ||||||

| (Cost - $3,589,798) | ||||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost - $14,548,298) | 14,548,298 | |||||||

| TOTAL INVESTMENTS - 112.1% (Cost - $108,961,546) | $ | 112,295,591 | ||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (12.1)% | (12,177,606 | ) | ||||||

| NET ASSETS - 100.0% | $ | 100,117,985 | ||||||

ETF - Exchange Traded Fund

SPDR - Standard & Poor’s Depositary Receipt

| * | Non income producing security. |

| ^ | All or a portion of this security is on loan. The market value of loaned securities is $11,018,595. |

| + | Money market fund; interest rate reflects seven-day effective yield on July 31, 2020. |

| (a) | Security was purchased with cash received as collateral for securities on loan at July 31, 2020. Total collateral had a value of $10,958,500 at July 31, 2020. Additional collateral received from the borrower not disclosed in the Portfolio of Investments had a value of $189,078 as of July 31, 2020. |

| (b) | The Milestone Treasury Obligations Fund is managed by CLS Investments, LLC, an affiliate of the Distributor. |

The accompanying notes are an integral part of these financial statements.

9

| Hanlon Tactical Dividend and Momentum Fund |

| PORTFOLIO OF INVESTMENTS |

| July 31, 2020 |

| Shares | Fair Value | |||||||

| EXCHANGE TRADED FUNDS - 73.2% | ||||||||

| EQUITY FUNDS - 73.2% | ||||||||

| 193,006 | Communication Services Select Sector SPDR Fund | $ | 11,219,439 | |||||

| 82,772 | Consumer Discretionary Select Sector SPDR Fund | 11,339,764 | ||||||

| 114,934 | Consumer Staples Select Sector SPDR Fund | 7,206,362 | ||||||

| 140,919 | Health Care Select Sector SPDR Fund ^ | 14,871,182 | ||||||

| 42,993 | Materials Select Sector SPDR Fund ^ | 2,595,058 | ||||||

| 186,352 | Technology Select Sector SPDR Fund | 20,578,851 | ||||||

| 24,563 | Vanguard Information Technology ETF | 7,252,717 | ||||||

| TOTAL EXCHANGE TRADED FUNDS (Cost - $70,273,015) | 75,063,373 | |||||||

| SHORT-TERM INVESTMENTS - 27.0% | ||||||||

| MONEY MARKET FUND - 27.0% | ||||||||

| 27,708,182 | Morgan Stanley Institutional Liquidity Funds - Treasury Securities Portfolio, Institutional Class, 0.02% + | 27,708,182 | ||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost - $27,708,182) | ||||||||

| TOTAL INVESTMENTS - 100.2% (Cost - $97,981,197) | $ | 102,771,555 | ||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (0.2)% | (212,792 | ) | ||||||

| NET ASSETS - 100.0% | $ | 102,558,763 | ||||||

ETF - Exchange Traded Fund

SPDR - Standard & Poor’s Depositary Receipt

| ^ | All or a portion of this security is on loan. The market value of loaned securities is $17,164,862. Collateral received from the borrower not disclosed in the Portfolio of Investments had a value of $17,602,878 as of July 31, 2020. |

| + | Money market fund; interest rate reflects seven-day effective yield on July 31, 2020. |

The accompanying notes are an integral part of these financial statements.

10

| Hanlon Funds |

| STATEMENTS OF ASSETS AND LIABILITIES |

| July 31, 2020 |

| Hanlon Managed | Hanlon Tactical | |||||||

| Income Fund | Dividend and Momentum Fund | |||||||

| ASSETS | ||||||||

| Investment securities: | ||||||||

| Investments at cost | $ | 108,961,546 | $ | 97,981,197 | ||||

| Investments at value | $ | 112,295,591 | $ | 102,771,555 | ||||

| Receivable for fund shares sold | 6,690 | 12,295 | ||||||

| Dividends and interest receivable | 2,282 | 962 | ||||||

| Securities lending income receivable | — | 2,372 | ||||||

| Prepaid expenses and other assets | 30,931 | 27,777 | ||||||

| TOTAL ASSETS | 112,335,494 | 102,814,961 | ||||||

| LIABILITIES | ||||||||

| Securities lending collateral | 10,958,500 | — | ||||||

| Payable for investments purchased | 898,209 | — | ||||||

| Payable for Fund shares repurchased | 150,629 | 66,107 | ||||||

| Investment advisory fees payable | 101,897 | 85,888 | ||||||

| Payable to related parties | 35,049 | 31,147 | ||||||

| Distribution (12b-1) fees payable | 5,220 | 8,513 | ||||||

| Accrued expenses and other liabilities | 68,005 | 64,543 | ||||||

| TOTAL LIABILITIES | 12,217,509 | 256,198 | ||||||

| NET ASSETS | $ | 100,117,985 | $ | 102,558,763 | ||||

| COMPOSITION OF NET ASSETS: | ||||||||

| Paid in capital | $ | 128,934,075 | $ | 107,137,198 | ||||

| Accumulated losses | (28,816,090 | ) | (4,578,435 | ) | ||||

| NET ASSETS | $ | 100,117,985 | $ | 102,558,763 | ||||

| NET ASSET VALUE PER SHARE: | ||||||||

| Class A Shares: | ||||||||

| Net Assets | $ | 7,168,990 | $ | 8,669,157 | ||||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 818,897 | 822,848 | ||||||

| Net asset value (Net Assets ÷ Shares Outstanding) and redemption price per share | $ | 8.75 | $ | 10.54 | ||||

| Maximum offering price per share (net asset value plus maximum sales charge of 5.75%) (a) | $ | 9.28 | $ | 11.18 | ||||

| Class C Shares: | ||||||||

| Net Assets | $ | 1,216,237 | $ | 1,086,899 | ||||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 140,475 | 106,893 | ||||||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (b) | $ | 8.66 | $ | 10.17 | ||||

| Class I Shares: | ||||||||

| Net Assets | $ | 83,766,093 | $ | 75,871,323 | ||||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 9,612,922 | 7,292,043 | ||||||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share | $ | 8.71 | $ | 10.40 | ||||

| Class R Shares: | ||||||||

| Net Assets | $ | 7,966,665 | $ | 16,931,384 | ||||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 913,597 | 1,633,133 | ||||||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share | $ | 8.72 | $ | 10.37 | ||||

| (a) | For investments in Class A shares of $1 million or more, there is a deferred sales charge of 1.00% of the original purchase price on redemptions made within one year of purchase. |

| (b) | Class C shares sold within one year of purchases are subject to a contingent deferred sales charge of 1.00% of the original purchase price. |

The accompanying notes are an integral part of these financial statements.

11

| Hanlon Funds |

| STATEMENTS OF OPERATIONS |

| For the Year Ended July 31, 2020 |

| Hanlon Managed | Hanlon Tactical | |||||||

| Income Fund | Dividend and Momentum Fund | |||||||

| INVESTMENT INCOME | ||||||||

| Dividends | $ | 3,358,335 | $ | 1,359,235 | ||||

| Interest | 384,628 | 373,243 | ||||||

| Securities lending income (net of fees) | 130,125 | 34,887 | ||||||

| TOTAL INVESTMENT INCOME | 3,873,088 | 1,767,365 | ||||||

| EXPENSES | ||||||||

| Investment advisory fees | 1,160,125 | 1,147,712 | ||||||

| Distribution (12b-1) fees: | ||||||||

| Class A | 20,796 | 26,145 | ||||||

| Class C | 14,797 | 13,931 | ||||||

| Class R | 35,725 | 79,521 | ||||||

| Third party administrative service fees | 114,309 | 99,652 | ||||||

| Administration fees | 96,310 | 95,817 | ||||||

| Transfer agent fees | 82,807 | 47,499 | ||||||

| Registration fees | 51,054 | 52,054 | ||||||

| Accounting services fees | 48,105 | 48,481 | ||||||

| Legal fees | 25,009 | 25,507 | ||||||

| Custodian fees | 21,196 | 14,101 | ||||||

| Audit fees | 20,395 | 20,695 | ||||||

| Compliance officer fees | 18,000 | 16,999 | ||||||

| Trustees’ fees and expenses | 16,999 | 16,999 | ||||||

| Insurance expense | 16,492 | 16,041 | ||||||

| Printing and postage expenses | 11,006 | 10,499 | ||||||

| Other expenses | 4,500 | 4,500 | ||||||

| TOTAL EXPENSES | 1,757,625 | 1,736,153 | ||||||

| NET INVESTMENT INCOME | 2,115,463 | 31,212 | ||||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||||||

| Net realized loss from security transactions | (5,478,670 | ) | (4,085,966 | ) | ||||

| Distributions of realized gains from underlying investment companies | 7,668 | — | ||||||

| Net change in unrealized appreciation on investments | 371,268 | 907,155 | ||||||

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | (5,099,734 | ) | (3,178,811 | ) | ||||

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (2,984,271 | ) | $ | (3,147,599 | ) | ||

The accompanying notes are an integral part of these financial statements.

12

| Hanlon Managed Income Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| For the | For the | |||||||

| Year Ended | Year Ended | |||||||

| July 31, 2020 | July 31, 2019 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment income | $ | 2,115,463 | $ | 5,403,793 | ||||

| Net realized loss from security transactions | (5,478,670 | ) | (7,087,644 | ) | ||||

| Distributions of realized gains from underlying investment companies | 7,668 | — | ||||||

| Net change in unrealized appreciation on investments | 371,268 | 2,570,432 | ||||||

| Net increase (decrease) in net assets resulting from operations | (2,984,271 | ) | 886,581 | |||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| From return of capital: | ||||||||

| Class A | (20,125 | ) | (9,898 | ) | ||||

| Class C | (2,468 | ) | (1,710 | ) | ||||

| Class I | (299,673 | ) | (109,577 | ) | ||||

| Class R | (19,521 | ) | (9,898 | ) | ||||

| Distributions paid | ||||||||

| Class A | (160,672 | ) | (387,940 | ) | ||||

| Class C | (22,765 | ) | (66,778 | ) | ||||

| Class I | (1,955,979 | ) | (4,693,521 | ) | ||||

| Class R | (160,314 | ) | (379,455 | ) | ||||

| Net decrease in net assets resulting from distributions to shareholders | (2,641,517 | ) | (5,658,777 | ) | ||||

| FROM SHARES OF BENEFICIAL INTEREST | ||||||||

| Proceeds from shares sold: | ||||||||

| Class A | 630,627 | 2,034,840 | ||||||

| Class C | 202,830 | 155,730 | ||||||

| Class I | 7,642,311 | 9,943,700 | ||||||

| Class R | 1,694,601 | 1,213,566 | ||||||

| Net asset value of shares issued in reinvestment of distributions: | ||||||||

| Class A | 157,310 | 336,757 | ||||||

| Class C | 17,656 | 49,823 | ||||||

| Class I | 128,750 | 242,277 | ||||||

| Class R | 179,835 | 389,353 | ||||||

| Payments for shares redeemed: | ||||||||

| Class A | (3,449,862 | ) | (4,910,936 | ) | ||||

| Class C | (668,786 | ) | (1,454,719 | ) | ||||

| Class I | (31,013,389 | ) | (51,037,839 | ) | ||||

| Class R | (3,621,252 | ) | (3,469,820 | ) | ||||

| Net decrease in net assets resulting from shares of beneficial interest | (28,099,369 | ) | (46,507,268 | ) | ||||

| TOTAL DECREASE IN NET ASSETS | (33,725,157 | ) | (51,279,464 | ) | ||||

| NET ASSETS | ||||||||

| Beginning of Year | 133,843,142 | 185,122,606 | ||||||

| End of Year | $ | 100,117,985 | $ | 133,843,142 | ||||

| SHARE ACTIVITY | ||||||||

| Class A: | ||||||||

| Shares Sold | 70,138 | 223,904 | ||||||

| Shares Reinvested | 17,173 | 37,317 | ||||||

| Shares Redeemed | (379,299 | ) | (537,385 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (291,988 | ) | (276,164 | ) | ||||

| Class C: | ||||||||

| Shares Sold | 22,432 | 16,884 | ||||||

| Shares Reinvested | 1,938 | 5,587 | ||||||

| Shares Redeemed | (75,409 | ) | (163,005 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (51,039 | ) | (140,534 | ) | ||||

| Class I: | ||||||||

| Shares Sold | 865,019 | 1,097,375 | ||||||

| Shares Reinvested | 14,149 | 26,939 | ||||||

| Shares Redeemed | (3,495,090 | ) | (5,593,773 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (2,615,922 | ) | (4,469,459 | ) | ||||

| Class R: | ||||||||

| Shares Sold | 192,451 | 132,435 | ||||||

| Shares Reinvested | 19,695 | 43,346 | ||||||

| Shares Redeemed | (409,452 | ) | (382,428 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (197,306 | ) | (206,647 | ) | ||||

The accompanying notes are an integral part of these financial statements.

13

| Hanlon Tactical Dividend and Momentum Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| For the | For the | |||||||

| Year Ended | Year Ended | |||||||

| July 31, 2020 | July 31, 2019 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment income | $ | 31,212 | $ | 387,326 | ||||

| Net realized gain (loss) from security transactions | (4,085,966 | ) | 10,406,209 | |||||

| Net change in unrealized appreciation (depreciation) on investments | 907,155 | (14,672,482 | ) | |||||

| Net decrease in net assets resulting from operations | (3,147,599 | ) | (3,878,947 | ) | ||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| From return of capital: | ||||||||

| Class A | (6,353 | ) | (1,701 | ) | ||||

| Class I | (50,501 | ) | (14,196 | ) | ||||

| Class R | (12,455 | ) | — | |||||

| Distributions paid | ||||||||

| Class A | (41,492 | ) | (2,201 | ) | ||||

| Class I | (562,519 | ) | (330,705 | ) | ||||

| Class R | (48,647 | ) | — | |||||

| Net decrease in net assets resulting from distributions to shareholders | (721,967 | ) | (348,803 | ) | ||||

| FROM SHARES OF BENEFICIAL INTEREST | ||||||||

| Proceeds from shares sold: | ||||||||

| Class A | 1,187,818 | 1,947,498 | ||||||

| Class C | 158,687 | 127,444 | ||||||

| Class I | 5,717,642 | 9,548,550 | ||||||

| Class R | 2,112,604 | 2,688,517 | ||||||

| Net asset value of shares issued in reinvestment of distributions: | ||||||||

| Class A | 46,072 | 3,683 | ||||||

| Class I | 26,606 | 13,568 | ||||||

| Class R | 61,102 | — | ||||||

| Payments for shares redeemed: | ||||||||

| Class A | (4,193,097 | ) | (3,460,974 | ) | ||||

| Class C | (543,130 | ) | (664,012 | ) | ||||

| Class I | (20,127,000 | ) | (23,654,274 | ) | ||||

| Class R | (7,561,265 | ) | (6,069,001 | ) | ||||

| Net decrease in net assets resulting from shares of beneficial interest | (23,113,961 | ) | (19,519,001 | ) | ||||

| TOTAL DECREASE IN NET ASSETS | (26,983,527 | ) | (23,746,751 | ) | ||||

| NET ASSETS | ||||||||

| Beginning of Year | 129,542,290 | 153,289,041 | ||||||

| End of Year | $ | 102,558,763 | $ | 129,542,290 | ||||

| SHARE ACTIVITY | ||||||||

| Class A: | ||||||||

| Shares Sold | 109,155 | 183,665 | ||||||

| Shares Reinvested | 4,056 | 372 | ||||||

| Shares Redeemed | (397,360 | ) | (321,148 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (284,149 | ) | (137,111 | ) | ||||

| Class C: | ||||||||

| Shares Sold | 14,776 | 12,295 | ||||||

| Shares Redeemed | (53,053 | ) | (63,948 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (38,277 | ) | (51,653 | ) | ||||

| Class I: | ||||||||

| Shares Sold | 540,022 | 884,200 | ||||||

| Shares Reinvested | 2,376 | 1,389 | ||||||

| Shares Redeemed | (1,906,828 | ) | (2,226,744 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (1,364,430 | ) | (1,341,155 | ) | ||||

| Class R: | ||||||||

| Shares Sold | 206,300 | 251,456 | ||||||

| Shares Reinvested | 5,460 | — | ||||||

| Shares Redeemed | (727,664 | ) | (573,211 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (515,904 | ) | (321,755 | ) | ||||

The accompanying notes are an integral part of these financial statements.

14

| Hanlon Managed Income Fund |

| FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period |

| Class A | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Period Ended | ||||||||||||||||

| July 31, | July 31, | July 31, | July 31, | July 31, | ||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 (1) | ||||||||||||||||

| Net asset value, beginning of period | $ | 9.19 | $ | 9.42 | $ | 9.81 | $ | 10.15 | $ | 10.00 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment income (2) | 0.15 | 0.31 | 0.32 | 0.35 | 0.22 | |||||||||||||||

| Net realized and unrealized gain (loss) on investments | (0.41 | ) | (0.22 | ) | (0.40 | ) | (0.21 | ) | 0.07 | |||||||||||

| Total from investment operations | (0.26 | ) | 0.09 | (0.08 | ) | 0.14 | 0.29 | |||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.16 | ) | (0.31 | ) | (0.31 | ) | (0.36 | ) | (0.14 | ) | ||||||||||

| Net realized gains | — | — | — | (0.12 | ) | — | ||||||||||||||

| Return of capital | (0.02 | ) | (0.01 | ) | (0.00 | ) (3) | (0.00 | ) (3) | — | |||||||||||

| Total distributions | (0.18 | ) | (0.32 | ) | (0.31 | ) | (0.48 | ) | (0.14 | ) | ||||||||||

| Net asset value, end of period | $ | 8.75 | $ | 9.19 | $ | 9.42 | $ | 9.81 | $ | 10.15 | ||||||||||

| Total return (4) | (2.88 | )% | 1.12 | % | (0.79 | )% | 1.28 | % | 2.97 | % (5) | ||||||||||

| Net assets, at end of period (000’s) | $ | 7,169 | $ | 10,204 | $ | 13,072 | $ | 30,566 | $ | 56,249 | ||||||||||

| Ratio of expenses to average net assets (6) | 1.70 | % | 1.68 | % | 1.67 | % | 1.50 | % | 1.40 | % (7) | ||||||||||

| Ratio of net investment income to average net assets (6,8) | 1.70 | % | 3.35 | % | 3.30 | % | 3.47 | % | 2.54 | % (7) | ||||||||||

| Portfolio Turnover Rate | 721 | % | 484 | % | 157 | % | 933 | % | 599 | % (5) | ||||||||||

| (1) | The Hanlon Managed Income Fund commenced operations on September 9, 2015. |

| (2) | Per share amounts calculated using the average shares method, which appropriately presents the per share data for the period. |

| (3) | Represents less than $0.005 per share. |

| (4) | Total returns are historical in nature and exclude the effect of applicable sales charges and assumes reinvestment of dividends. |

| (5) | Not annualized. |

| (6) | The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

| (7) | Annualized. |

| (8) | Recognition of net investment income by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

The accompanying notes are an integral part of these financial statements.

15

| Hanlon Managed Income Fund |

| FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period |

| Class C | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Period Ended | ||||||||||||||||

| July 31, | July 31, | July 31, | July 31, | July 31, | ||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 (1) | ||||||||||||||||

| Net asset value, beginning of period | $ | 9.12 | $ | 9.36 | $ | 9.74 | $ | 10.09 | $ | 10.00 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment income (2) | 0.08 | 0.25 | 0.23 | 0.26 | 0.22 | |||||||||||||||

| Net realized and unrealized gain (loss) on investments | (0.39 | ) | (0.24 | ) | (0.37 | ) | (0.20 | ) | 0.04 | |||||||||||

| Total from investment operations | (0.31 | ) | 0.01 | (0.14 | ) | 0.06 | 0.26 | |||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.13 | ) | (0.24 | ) | (0.24 | ) | (0.29 | ) | (0.17 | ) | ||||||||||

| Net realized gains | — | — | — | (0.12 | ) | — | ||||||||||||||

| Return of capital | (0.02 | ) | (0.01 | ) | (0.00 | ) (3) | (0.00 | ) (3) | — | |||||||||||

| Total distributions | (0.15 | ) | (0.25 | ) | (0.24 | ) | (0.41 | ) | (0.17 | ) | ||||||||||

| Net asset value, end of period | $ | 8.66 | $ | 9.12 | $ | 9.36 | $ | 9.74 | $ | 10.09 | ||||||||||

| Total return (4) | (3.50 | )% | 0.23 | % | (1.40 | )% | 0.55 | % | 2.73 | % (5) | ||||||||||

| Net assets, at end of period (000’s) | $ | 1,216 | $ | 1,746 | $ | 3,107 | $ | 2,907 | $ | 2,315 | ||||||||||

| Ratio of expenses to average net assets (6) | 2.45 | % | 2.43 | % | 2.42 | % | 2.25 | % | 2.22 | % (7) | ||||||||||

| Ratio of net investment income to average net assets (6,8) | 0.88 | % | 2.79 | % | 2.38 | % | 2.58 | % | 2.52 | % (7) | ||||||||||

| Portfolio Turnover Rate | 721 | % | 484 | % | 157 | % | 933 | % | 599 | % (5) | ||||||||||

| (1) | The Hanlon Managed Income Fund commenced operations on September 9, 2015. |

| (2) | Per share amounts calculated using the average shares method, which appropriately presents the per share data for the period. |

| (3) | Represents less than $0.005 per share. |

| (4) | Total returns are historical in nature and exclude the effect of applicable sales charges and assumes reinvestment of dividends. |

| (5) | Not annualized. |

| (6) | The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

| (7) | Annualized. |

| (8) | Recognition of net investment income by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

The accompanying notes are an integral part of these financial statements.

16

| Hanlon Managed Income Fund |

| FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period |

| Class I | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Period Ended | ||||||||||||||||

| July 31, | July 31, | July 31, | July 31, | July 31, | ||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 (1) | ||||||||||||||||

| Net asset value, beginning of period | $ | 9.14 | $ | 9.38 | $ | 9.76 | $ | 10.10 | $ | 10.00 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment income (loss) (2) | 0.17 | 0.33 | 0.34 | 0.37 | (0.05 | ) (3) | ||||||||||||||

| Net realized and unrealized gain (loss) on investments | (0.40 | ) | (0.22 | ) | (0.38 | ) | (0.22 | ) | 0.35 | |||||||||||

| Total from investment operations | (0.23 | ) | 0.11 | (0.04 | ) | 0.15 | 0.30 | |||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.17 | ) | (0.34 | ) | (0.34 | ) | (0.37 | ) | (0.20 | ) | ||||||||||

| Net realized gains | — | — | — | (0.12 | ) | — | ||||||||||||||

| Return of capital | (0.03 | ) | (0.01 | ) | (0.00 | ) (4) | (0.00 | ) (4) | — | |||||||||||

| Total distributions | (0.20 | ) | (0.35 | ) | (0.34 | ) | (0.49 | ) | (0.20 | ) | ||||||||||

| Net asset value, end of period | $ | 8.71 | $ | 9.14 | $ | 9.38 | $ | 9.76 | $ | 10.10 | ||||||||||

| Total return (5) | (2.62 | )% | 1.27 | % | (0.43 | )% | 1.61 | % | 3.05 | % (6) | ||||||||||

| Net assets, at end of period (000’s) | $ | 83,766 | $ | 111,722 | $ | 156,565 | $ | 340,624 | $ | 500,760 | ||||||||||

| Ratio of expenses to average net assets (7) | 1.45 | % | 1.43 | % | 1.42 | % | 1.25 | % | 1.36 | % (8) | ||||||||||

| Ratio of net investment income (loss) to average net assets (7,9) | 1.89 | % | 3.64 | % | 3.52 | % | 3.72 | % | (0.48 | )% (3,8) | ||||||||||

| Portfolio Turnover Rate | 721 | % | 484 | % | 157 | % | 933 | % | 599 | % (6) | ||||||||||

| (1) | The Hanlon Managed Income Fund commenced operations on September 9, 2015. |

| (2) | Per share amounts calculated using the average shares method, which appropriately presents the per share data for the period. |

| (3) | The amount of net investment loss on investment per share for the period ended July 31, 2016 does not accord with the amounts in the Statements of Operations due to the timing of purchases and sales of Fund shares in relation to fluctuating market values. |

| (4) | Represents less than $0.005 per share. |

| (5) | Total returns are historical in nature and exclude the effect of applicable sales charges and assumes reinvestment of dividends. |

| (6) | Not annualized. |

| (7) | The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

| (8) | Annualized. |

| (9) | Recognition of net investment income by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

The accompanying notes are an integral part of these financial statements.

17

| Hanlon Managed Income Fund |

| FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period |

| Class R | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Period Ended | ||||||||||||||||

| July 31, | July 31, | July 31, | July 31, | July 31, | ||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 (1) | ||||||||||||||||

| Net asset value, beginning of period | $ | 9.16 | $ | 9.40 | $ | 9.78 | $ | 10.12 | $ | 10.00 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment income (2) | 0.13 | 0.29 | 0.29 | 0.33 | 0.25 | |||||||||||||||

| Net realized and unrealized gain (loss) on investments | (0.40 | ) | (0.22 | ) | (0.37 | ) | (0.21 | ) | 0.06 | |||||||||||

| Total from investment operations | (0.27 | ) | 0.07 | (0.08 | ) | 0.12 | 0.31 | |||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.15 | ) | (0.30 | ) | (0.30 | ) | (0.34 | ) | (0.19 | ) | ||||||||||

| Net realized gains | — | — | — | (0.12 | ) | — | ||||||||||||||

| Return of capital | (0.02 | ) | (0.01 | ) | (0.00 | ) (3) | (0.00 | ) (3) | — | |||||||||||

| Total distributions | (0.17 | ) | (0.31 | ) | (0.30 | ) | (0.46 | ) | (0.19 | ) | ||||||||||

| Net asset value, end of period | $ | 8.72 | $ | 9.16 | $ | 9.40 | $ | 9.78 | $ | 10.12 | ||||||||||

| Total return (4) | (2.97 | )% | 0.86 | % | (0.82 | )% | 1.13 | % | 3.20 | % (5) | ||||||||||

| Net assets, at end of period (000’s) | $ | 7,967 | $ | 10,171 | $ | 12,379 | $ | 17,829 | $ | 30,376 | ||||||||||

| Ratio of expenses to average net assets (6) | 1.85 | % | 1.83 | % | 1.82 | % | 1.65 | % | 1.67 | % (7) | ||||||||||

| Ratio of net investment income to average net assets (6,8) | 1.44 | % | 3.23 | % | 3.03 | % | 3.36 | % | 2.86 | % (7) | ||||||||||

| Portfolio Turnover Rate | 721 | % | 484 | % | 157 | % | 933 | % | 599 | % (5) | ||||||||||

| (1) | The Hanlon Managed Income Fund commenced operations on September 9, 2015. |

| (2) | Per share amounts calculated using the average shares method, which appropriately presents the per share data for the period. |

| (3) | Represents less than $0.005 per share. |

| (4) | Total returns are historical in nature and exclude the effect of applicable sales charges and assumes reinvestment of dividends. |

| (5) | Not annualized. |

| (6) | The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

| (7) | Annualized. |

| (8) | Recognition of net investment income by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

The accompanying notes are an integral part of these financial statements.

18

| Hanlon Tactical Dividend and Momentum Fund |

| FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period |

| Class A | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Period Ended | ||||||||||||||||

| July 31, | July 31, | July 31, | July 31, | July 31, | ||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 (1) | ||||||||||||||||

| Net asset value, beginning of period | $ | 10.87 | $ | 11.15 | $ | 9.87 | $ | 9.58 | $ | 10.00 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment income (loss) (2) | (0.01 | ) (3) | 0.02 | 0.01 | 0.05 | 0.06 | ||||||||||||||

| Net realized and unrealized gain (loss) on investments | (0.27 | ) | (0.30 | ) | 1.30 | 0.24 | (0.45 | ) | ||||||||||||

| Total from investment operations | (0.28 | ) | (0.28 | ) | 1.31 | 0.29 | (0.39 | ) | ||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.04 | ) | (0.00 | ) (4) | (0.03 | ) | — | (0.03 | ) | |||||||||||

| Return of capital | (0.01 | ) | (0.00 | ) (4) | (0.00 | ) (4) | — | — | ||||||||||||

| Total distributions | (0.05 | ) | (0.00 | ) (4) | (0.03 | ) | — | (0.03 | ) | |||||||||||

| Net asset value, end of period | $ | 10.54 | $ | 10.87 | $ | 11.15 | $ | 9.87 | $ | 9.58 | ||||||||||

| Total return (5) | (2.63 | )% | (2.48 | )% | 13.28 | % | 3.03 | % | (3.92 | )% (6) | ||||||||||

| Net assets, at end of period (000’s) | $ | 8,669 | $ | 12,038 | $ | 13,867 | $ | 20,812 | $ | 53,517 | ||||||||||

| Ratio of expenses to average net assets (7) | 1.66 | % | 1.64 | % | 1.62 | % | 1.53 | % | 1.40 | % (8) | ||||||||||

| Ratio of net investment income (loss) to average net assets (7,9) | (0.11 | )% (3) | 0.14 | % | 0.13 | % | 0.57 | % | 0.75 | % (8) | ||||||||||

| Portfolio Turnover Rate | 293 | % | 226 | % | 48 | % | 384 | % | 579 | % (6) | ||||||||||

| (1) | The Hanlon Tactical Dividend & Momentum Fund commenced operations on September 9, 2015. |

| (2) | Per share amounts calculated using the average shares method, which appropriately presents the per share data for the period. |

| (3) | The amount of net investment loss on investment per share for the period ended does not accord with the amounts in the Statements of Operations due to the timing of purchases and sales of Fund shares in relation to fluctuating market values. |

| (4) | Represents less than $0.005 per share. |

| (5) | Total returns are historical in nature and exclude the effect of applicable sales charges and assumes reinvestment of dividends. |

| (6) | Not annualized. |

| (7) | The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

| (8) | Annualized. |

| (9) | Recognition of net investment income by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

The accompanying notes are an integral part of these financial statements.

19

| Hanlon Tactical Dividend and Momentum Fund |

| FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period |

| Class C | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Period Ended | ||||||||||||||||

| July 31, | July 31, | July 31, | July 31, | July 31, | ||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 (1) | ||||||||||||||||

| Net asset value, beginning of period | $ | 10.53 | $ | 10.87 | $ | 9.68 | $ | 9.53 | $ | 10.00 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment loss (2,3) | (0.09 | ) | (0.07 | ) | (0.06 | ) | (0.03 | ) | (0.00 | ) (4) | ||||||||||

| Net realized and unrealized gain (loss) on investments | (0.27 | ) | (0.27 | ) | 1.25 | 0.24 | (0.44 | ) | ||||||||||||

| Total from investment operations | (0.36 | ) | (0.34 | ) | 1.19 | 0.21 | (0.44 | ) | ||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | — | — | — | (0.06 | ) | (0.03 | ) | |||||||||||||

| Total distributions | — | — | — | (0.06 | ) | (0.03 | ) | |||||||||||||

| Net asset value, end of period | $ | 10.17 | $ | 10.53 | $ | 10.87 | $ | 9.68 | $ | 9.53 | ||||||||||

| Total return (5) | (3.42 | )% | (3.13 | )% | 12.29 | % | 2.28 | % | (4.38 | )% (6) | ||||||||||

| Net assets, at end of period (000’s) | $ | 1,087 | $ | 1,529 | $ | 2,140 | $ | 2,997 | $ | 2,778 | ||||||||||

| Ratio of expenses to average net assets (7) | 2.41 | % | 2.39 | % | 2.37 | % | 2.28 | % | 2.23 | % (8) | ||||||||||

| Ratio of net investment loss to average net assets (7,9) | (0.88 | )% (3) | (0.64 | )% | (0.61 | )% | (0.31 | )% | (0.08 | )% (3,8) | ||||||||||

| Portfolio Turnover Rate | 293 | % | 226 | % | 48 | % | 384 | % | 579 | % (6) | ||||||||||

| (1) | The Hanlon Tactical Dividend & Momentum Fund commenced operations on September 9, 2015. |

| (2) | Per share amounts calculated using the average shares method, which appropriately presents the per share data for the period. |

| (3) | The amount of net investment loss on investment per share for the period ended does not accord with the amounts in the Statements of Operations due to the timing of purchases and sales of Fund shares in relation to fluctuating market values. |

| (4) | Represents less than $0.005 per share. |

| (5) | Total returns are historical in nature and exclude the effect of applicable sales charges and assumes reinvestment of dividends. |

| (6) | Not annualized. |

| (7) | The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

| (8) | Annualized. |

| (9) | Recognition of net investment income by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

The accompanying notes are an integral part of these financial statements.

20

| Hanlon Tactical Dividend and Momentum Fund |

| FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period |

| Class I | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Period Ended | ||||||||||||||||

| July 31, | July 31, | July 31, | July 31, | July 31, | ||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 (1) | ||||||||||||||||

| Net asset value, beginning of period | $ | 10.74 | $ | 11.02 | $ | 9.77 | $ | 9.58 | $ | 10.00 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment income (loss) (2) | 0.01 | 0.04 | 0.04 | 0.07 | (0.02 | ) (3) | ||||||||||||||

| Net realized and unrealized gain (loss) on investments | (0.27 | ) | (0.28 | ) | 1.28 | 0.24 | (0.37 | ) | ||||||||||||

| Total from investment operations | (0.26 | ) | (0.24 | ) | 1.32 | 0.31 | (0.39 | ) | ||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.07 | ) | (0.04 | ) | (0.07 | ) | (0.12 | ) | (0.03 | ) | ||||||||||

| Return of capital | (0.01 | ) | (0.00 | ) (4) | (0.00 | ) (4) | — | — | ||||||||||||

| Total distributions | (0.08 | ) | (0.04 | ) | (0.07 | ) | (0.12 | ) | (0.03 | ) | ||||||||||

| Net asset value, end of period | $ | 10.40 | $ | 10.74 | $ | 11.02 | $ | 9.77 | $ | 9.58 | ||||||||||

| Total return (5) | (2.50 | )% | (2.18 | )% | 13.53 | % | 3.28 | % | (3.88 | )% (6) | ||||||||||

| Net assets, at end of period (000’s) | $ | 75,871 | $ | 92,978 | $ | 110,151 | $ | 137,869 | $ | 289,029 | ||||||||||

| Ratio of expenses to average net assets (7) | 1.41 | % | 1.39 | % | 1.37 | % | 1.28 | % | 1.44 | % (8) | ||||||||||

| Ratio of net investment income (loss) to average net assets (7,9) | 0.13 | % | 0.38 | % | 0.39 | % | 0.81 | % | (0.17 | )% (3,8) | ||||||||||

| Portfolio Turnover Rate | 293 | % | 226 | % | 48 | % | 384 | % | 579 | % (6) | ||||||||||

| (1) | The Hanlon Tactical Dividend & Momentum Fund commenced operations on September 9, 2015. |

| (2) | Per share amounts calculated using the average shares method, which appropriately presents the per share data for the period. |

| (3) | The amount of net investment loss on investment per share for the period ended July 31, 2016 does not accord with the amounts in the Statements of Operations due to the timing of purchases and sales of Fund shares in relation to fluctuating market values. |

| (4) | Represents less than $0.005 per share. |

| (5) | Total returns are historical in nature and exclude the effect of applicable sales charges and assumes reinvestment of dividends. |

| (6) | Not annualized. |

| (7) | The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

| (8) | Annualized. |

| (9) | Recognition of net investment income by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

The accompanying notes are an integral part of these financial statements.

21

| Hanlon Tactical Dividend and Momentum Fund |

| FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period |

| Class R | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Period Ended | ||||||||||||||||

| July 31, | July 31, | July 31, | July 31, | July 31, | ||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 (1) | ||||||||||||||||

| Net asset value, beginning of period | $ | 10.70 | $ | 10.98 | $ | 9.73 | $ | 9.53 | $ | 10.00 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment income (loss) (2) | (0.03 | ) (3) | (0.00 | ) (4) | (0.00 | ) (4) | 0.04 | 0.05 | ||||||||||||

| Net realized and unrealized gain (loss) on investments | (0.27 | ) | (0.28 | ) | 1.27 | 0.23 | (0.49 | ) | ||||||||||||

| Total from investment operations | (0.30 | ) | (0.28 | ) | 1.27 | 0.27 | (0.44 | ) | ||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.02 | ) | — | (0.02 | ) | (0.07 | ) | (0.03 | ) | |||||||||||

| Return of capital | (0.01 | ) | — | (0.00 | ) (4) | — | — | |||||||||||||

| Total distributions | (0.03 | ) | — | (0.02 | ) | (0.07 | ) | (0.03 | ) | |||||||||||

| Net asset value, end of period | $ | 10.37 | $ | 10.70 | $ | 10.98 | $ | 9.73 | $ | 9.53 | ||||||||||

| Total return (5) | (2.81 | )% | (2.55 | )% | 13.03 | % | 2.85 | % | (4.38 | )% (6) | ||||||||||

| Net assets, at end of period (000’s) | $ | 16,931 | $ | 22,998 | $ | 27,131 | $ | 33,952 | $ | 85,499 | ||||||||||

| Ratio of expenses to average net assets (7) | 1.81 | % | 1.79 | % | 1.77 | % | 1.68 | % | 1.66 | % (8) | ||||||||||

| Ratio of net investment income (loss) to average net assets (7,9) | (0.26 | )% (3) | (0.01 | )% | (0.03 | )% | 0.45 | % | 0.56 | % (8) | ||||||||||

| Portfolio Turnover Rate | 293 | % | 226 | % | 48 | % | 384 | % | 579 | % (6) | ||||||||||

| (1) | The Hanlon Tactical Dividend & Momentum Fund commenced operations on September 9, 2015. |

| (2) | Per share amounts calculated using the average shares method, which appropriately presents the per share data for the period. |

| (3) | The amount of net investment loss on investment per share for the period ended does not accord with the amounts in the Statements of Operations due to the timing of purchases and sales of Fund shares in relation to fluctuating market values. |

| (4) | Represents less than $0.005 per share. |

| (5) | Total returns are historical in nature and exclude the effect of applicable sales charges and assumes reinvestment of dividends. |

| (6) | Not annualized. |

| (7) | The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

| (8) | Annualized. |

| (9) | Recognition of net investment income by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

The accompanying notes are an integral part of these financial statements.

22

| Hanlon Funds |

| NOTES TO FINANCIAL STATEMENTS |

| July 31, 2020 |

| 1. | ORGANIZATION |

The Hanlon Managed Income Fund and the Hanlon Tactical Dividend and Momentum Fund (each a “Fund” and together the “Funds”), are each a series of shares of beneficial interest of the Two Roads Shared Trust (the “Trust”), a statutory trust organized under the laws of the State of Delaware on June 8, 2012, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Funds commenced operations on September 9, 2015. The investment objective of the Hanlon Managed Income Fund is to provide current income, capital preservation and positive risk-adjusted returns. As of September 9, 2018, the Fund is a diversified fund and must comply with the diversification requirements of Section 5(b)(1) of the 1940 Act. Prior to September 9, 2018, the Fund was non-diversified. The investment objective of the Hanlon Tactical Dividend and Momentum Fund is to provide capital appreciation and current income, and the Fund is diversified.

The Funds each offer Class A, Class C, Class I and Class R shares. Class A shares of each Fund are offered at net asset value plus a maximum sales charge of 5.75%. Class C, Class I and Class R shares of each Fund are offered at net asset value. Investments of more than $1 million in Class A shares of each Fund are subject to a contingent deferred sales charge of 1.00% of the original purchase price on redemptions made within one year of purchase. Class C shares of each Fund are subject to a contingent deferred sales charge of 1.00% of the original purchase price on redemptions made within one year of purchase. Each share class represents an interest in the same assets of the Fund and classes are identical except for differences in their fees and ongoing service and distribution charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. Each Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Funds in preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies”.

Security Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the primary exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ Official Closing Price (“NOCP”). In the absence of a sale such securities shall be valued at the mean between the last bid and ask prices on the day of valuation. Debt securities, including U.S. government obligation (other than short-term obligations) are valued each day by an independent pricing service approved by the Trust’s Board of Trustees (the “Board”) based on methods which include consideration of: yields or prices of securities of comparable quality, coupon, maturity and type, indications as to values from dealers, and general market conditions or market quotations from a major market maker in the securities. The independent pricing service does not distinguish between smaller-sized bond positions known as “odd lots” and larger institutional -sized bond positions known as “round lots”. The Fund may fair value a particular bond if the adviser does not believe that the round lot value provided by the independent pricing service reflects fair value of the Fund’s holding. Investments valued in currencies other than the U.S. dollar are converted to U.S. dollars using exchange rates obtained from pricing services. Short-term debt obligations having 60 days or less remaining until maturity, at time of purchase, may be valued at amortized cost. Investments in open-end investment companies are valued at net asset value.

The Funds may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities will be valued using the “fair value” procedures approved by the Board. The Board has delegated execution of these procedures to a fair value committee composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) advisor. The committee may also enlist third party consultants such as a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist in determining a security-specific fair value. The Board has also engaged a third party valuation firm to, as needed, attend valuation meetings held by the Trust, review minutes of such meetings and report to the Board on a quarterly basis. The Board reviews and ratifies the execution of this process and the resultant fair value prices at least quarterly to assure the process produces reliable results.

23

| Hanlon Funds |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| July 31, 2020 |

Valuation of Underlying Funds – The Funds may invest in portfolios of open-end or closed-end investment companies (the “Underlying Funds”). The Underlying Funds value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value to the methods established by the board of directors of the Underlying Funds.

Open-ended funds are valued at their respective net asset values as reported by such investment companies. The shares of many closed-end investment companies, after their initial public offering, frequently trade at a price per share, which is different than the net asset value per share. The difference represents a market premium or market discount of such shares. There can be no assurances that the market discount or market premium on shares of any closed-end investment company purchased by a Fund will not change.

Exchange Traded Funds – The Funds may invest in exchange traded funds (“ETFs”). ETFs are a type of index fund bought and sold on a securities exchange. An ETF trades like common stock and represents a fixed portfolio of securities designed to track the performance and dividend yield of a particular domestic or foreign market index. The Funds may purchase an ETF to gain exposure to a portion of the U.S. or a foreign market. The risks of owning an ETF generally reflect the risks of owning the underlying securities they are designed to track, although the lack of liquidity on an ETF could result in it being more volatile. Additionally, ETFs have fees and expenses that reduce their value.

Fair Valuation Process – The applicable investments are valued collectively via inputs from each group within the fair value committee. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source); (ii) securities for which, in the judgment of the advisor, the prices or values available do not represent the fair value of the instrument; factors which may cause the advisor to make such a judgment include, but are not limited to, the following: only a bid price or an asked price is available; the spread between bid and asked prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; and (iv) securities with respect to which an event that will affect the value thereof has occurred (a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior to a Fund’s calculation of its net asset value. Specifically, interests in commodity pools or managed futures pools are valued on a daily basis by reference to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. Restricted or illiquid securities, such as private investments or non-traded securities are valued via inputs from the advisor based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If the advisor is unable to obtain a current bid from such independent dealers or other independent parties, the fair value committee shall determine the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

The Funds utilize various methods to measure the fair value of all of each Fund’s investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Funds have the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.