united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22718

Two Roads Shared Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450, Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Richard Malinowski, Gemini Fund Services, LLC.

80 Arkay Drive Suite 110, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 10/31

Date of reporting period: 10/31/19

ITEM 1. REPORTS TO SHAREHOLDERS.

Annual Report

October 31, 2019

| Class A | RAALX |

| Class C | RACLX |

| Class I | RAILX |

| Class Y | RAYLX |

www.conductorfunds.com

1-844-GO-RAILX (1-844-467-2459)

This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which contains information about the Fund’s investment objective, risks, fees and expenses. Investors are reminded to read the prospectus carefully before investing in the Fund.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website www.conductorfunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically or to continue receiving paper copies of shareholder reports, which are available free of charge, by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you.

December 2019

First, let us begin by welcoming you to the sixth yearly update for the Conductor Global Equity Value Fund, (the “Fund”). We always look forward to keeping you updated regularly on the status of the various positions in the portfolio and the global market and economic trends that affect our positioning.

Like the prior year fiscal year, FY 2019 has been defined by market volatility, political uncertainty, and declining economic momentum around the globe. Still, performance across all equity markets looked better than FY 2018 as markets rebounded off the sharp downturn experienced in fall 2018. Relative performance in many of our target equity market segments once again lagged as geopolitical and economic issues weighed. Owing to trade uncertainty and other factors, and following the pattern observed for much of the past decade, international stocks underperformed those in the United States, while emerging market stocks, despite entering the year near historically low valuations, continued to underperform stocks in the developed world. Global value stocks and stocks in the small and mid-capitalization space, particularly sensitive to uncertainty and two global market segments from which the vast majority of the companies in the Conductor portfolio originate, underperformed again. Nonetheless, we still believe that value remains positioned to outperform growth in coming years and international stocks are positioned to outperform US stocks. Value stocks are significantly undervalued relative to growth stocks looking at historical mean. International stocks, especially emerging market companies, are also significantly undervalued compared to their US counterparts on a historical basis.

From 10/31/2018 to 10/31/2019, the MSCI World Index was up 13.39%, while the MSCI All Country World Index was up 13.25%. The MSCI All Country World Value index was up 9.11%, while the MSCI All Country World Growth Index was up 17.43%. The MSCI All Country Small and Mid-Cap Index was up 10.75% versus 13.35% for the MSCI All Country Large-Cap Index. The MSCI EAFE, covering ex-US developed countries, was up 11.75%, while the MSCI Emerging Markets Index was up 12.27%. The S&P 500 was up 14.32%.

Over the same time span, the Conductor Global Equity Value Fund Class Y was up 3.59%.

Disclosures:

The referenced indices are shown for general market comparisons and are not meant to represent the Fund. Investors cannot directly invest in an index; unmanaged index returns do not reflect any fees, expenses or sales charges.

The Fund’s maximum sales charge for Class “A” shares is 5.75%. The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future

1

results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s investment adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, at least until March 1, 2020, to ensure that total annual Fund operating expenses (exclusive of any front-end or contingent deferred loads; brokerage fees and commissions; expenses of other investment companies in which the Fund may invest (“acquired fund fees and expenses”); borrowing costs, such as interest and dividend expense on securities sold short; taxes; and extraordinary expenses, such as litigation expenses) will not exceed 2.15%, 2.90%, 1.90%, and 1.25% of average daily net assets attributable to Class A, Class C, Class I, and Class Y shares, respectively. These expense reimbursements are subject to possible recoupment from the Fund in future years on a rolling three-year basis (within the three years after the fees have been waived or reimbursed) if such recoupment can be achieved without exceeding the foregoing expense limits as well as any expense limitation that was in effect at the time the reimbursement was made. Please review the fund’s prospectus for more information regarding the fund’s fees and expenses. For performance information current to the most recent month-end, please call toll-free 844-467-2459 or by visiting www.conductorfunds.com.

The views in this report are those of the Fund’s management. This report contains certain forward-looking statements about factors that may affect the performance of the fund in the future. These statements are based on the Fund’s management’s predictions and expectations concerning certain future events, such as the performance of the economy on the whole and of specific industry sectors. Management believes these forward-looking statements are reasonable, although they are inherently uncertain and difficult to predict.

2

Global Year in Review:

Continuing many of the themes from 2018, Fiscal Year 2019 was defined by economic and geopolitical uncertainty around the world. From the threats of a global trade “war” to the overhang surrounding the UKs seemingly never-ending exit from the EU, global equity investors had plenty to digest. Corporate earnings growth stalled broadly for the first time in a decade. On a positive note, global central banks began reversing the monetary policy “tightening” that defined 2018. As discussed above, even with uncertainly, equity market investors in the US and abroad took a “glass half-full” approach, especially in US growth stocks pushing stocks in the US to ever-higher valuations.

| ● | Global Economic Growth Erosion Continues: As observed during the 2018 fiscal year, year-over-year real GDP growth continued tracking downwards over the course of the year across the developed and emerging world. Policy uncertainty, primarily through the global trade channel, upended decision making for corporations and individuals, which especially impacted global business investment. |

| ○ | United States: Real YoY GDP declines from 3.1% in calendar Q3:2018 to 2.1% in calendar Q3:2019 |

| ○ | EuroZone: Real YoY GDP declines from 1.6% in calendar Q3:2018 to 1.2% in calendar Q3:2019 |

| ○ | China: Real YoY GDP declines from 6.7% in calendar Q3:2018 to 6.2% in calendar Q3:2019 |

| ● | Global Corporate Earnings Erosion: Reflecting the less robust economic growth described above, corporate earnings numbers stalled around the globe for the first time since the Great Recession. In the United States, the S&P 500 posted slightly negative year-over-year earnings growth in Q3:2019. A similar situation unfolded in other equity markets around the world, from the UK to France to Japan. |

| ● | Global Central Banks Reverse Course: |

| ○ | The US Federal Reserve Fed Funds target rate was 2.25% entering the fiscal year. After one more 25 basis point policy rate hike to 2.50% in late 2018, cuts towards the end of the fiscal year brought the policy rate down to 1.75% by the end of the fiscal year providing a shot in the arm to equity bulls. |

| ○ | EuroZone: Eurozone headline policy rates stayed the same over the past year at 0%, with departing ECB head Mario Draghi announcing additional stimulus measures towards the end of the fiscal year. |

| ○ | Emerging Markets: Central banks across the emerging world have cut policy rates significantly over the course of 2019, with Brazil cutting by 200 bps and Turkey by 1200 bps. |

| ● | US Trade War Threats Persist: Trade war threats continued to be the primary factor undermining more robust business investment and economic growth around the world. Throughout the year, trade negotiations between the US and |

3

China see-sawed back and forth, with markets oftentimes turned upside down on short notice by off the cuff “tweets” and haphazard public communiques. After the close of the 2019 fiscal year, China and the Trump Administration outlined a “Phase 1” agreement on trade that markets, judging by a late calendar year run to the upside, judged to be a sufficient step to a future calming of the waters. Likewise, residual uncertainty surrounding the successor to the NAFTA agreement began melting away at the end of the 2019 fiscal year and into the early part of the new fiscal year as the US Congress and Trump Administration announced that agreement had been reached to advance the revised trade bill.

| ● | Brexit Remained a Complicated Mess: The more things change, the more they remain the same. Britain’s post 2016 Brexit vote attempt to find a clear path out of the exit mess went nowhere fast. Former Prime Minister Theresa May’s kick the can down the road Brexit plan was defeated multiple times in Parliament. The repeated defeats and perpetual governmental stalemate forced May’s announced resignation and the ascension of Boris Johnson to the premiership in July 2019. Initially, global markets became unnerved at the prospect, pushed publicly by Johnson, of a complete and clean break from the EU without an agreement. Eventually, Johnson, forced by Parliament, backed down and accepted a Brexit extension and orderly retreat from the brink. Instead, as the fiscal year turned from 2019 to 2020, Johnson moved to call new elections, which early in FY 2020 led to a decisive victory for his Conservative/Tory party, helping to fuel a late calendar year move in stocks to the upside. |

| ● | Emerging Market Stocks, Small/Mid-Cap Stocks, and International Stocks Underperform again; Dollar Steady vs. Other Currencies: Despite increasingly favorable valuation differentials, International equities were unable to outperform US stocks again during the fiscal year. Aforementioned policy uncertainty and a steadily advancing dollar for the first 11/12ths of the fiscal year helped compress sentiment. Continuing the theme observed in a few of the bullet points above, the very last days of the fiscal year saw a tidying up of some of the elements weighing on relative performance in some of these markets, namely the dollar index began weakening bringing it back essentially to where it started the fiscal year. This boosted emerging and developed international indices at the very end of the fiscal year, a trend that has continued into FY 2020, enhanced by decreasing trade tensions in the 2020 FY (so far) and less agitation from persistent irritants like Brexit (so far). |

4

Conductor Global: Portfolio Positioning

Below, we provide the sector and geographic exposure breakdowns for the Conductor Global Equity Value portfolio, both at fiscal year-end 2018 and fiscal year-end 2019. Of note, we break out the sector and geographic exposures embedded in any ETF exposure to show the true risk allocations and exposures. We also include the sector and geographic performance data for the MSCI All Country World Index (the “ACWI”) as a frame of reference rather than MSCI World. Like our portfolio, the ACWI has exposure to Emerging markets while the MSCI World does not.

| Sector 10/31/18 | Fund Portfolio % | ACWI % | Differential |

| Cash | 6.33% | 0.39% | 5.94% |

| Consumer Disc. | 22.26% | 10.46% | 11.81% |

| Consumer Staples | 0.39% | 8.24% | -7.86% |

| Energy | 9.66% | 6.44% | 3.22% |

| Financials/RE | 19.30% | 20.28% | -0.98% |

| Funds (VXX) | 0.00% | 0.00% | 0.00% |

| Health Care | 5.16% | 11.92% | -6.76% |

| Industrials | 10.03% | 10.33% | -0.31% |

| Info Tech | 2.27% | 15.41% | -13.14% |

| Materials | 7.76% | 4.81% | 2.95% |

| Communication Svcs | 7.57% | 8.55% | -0.98% |

| Utilities | 9.26% | 3.17% | 6.09% |

| Sector 10/31/19 | Fund Portfolio % | ACWI % | Differential |

| Cash | 7.89% | 0.33% | 7.56% |

| Consumer Disc. | 15.26% | 10.71% | 4.55% |

| Consumer Staples | 3.55% | 8.07% | -4.52% |

| Energy | 4.11% | 5.15% | -1.05% |

| Financials/RE | 13.21% | 19.96% | -6.75% |

| Funds (VXX) | 0.00% | 0.00% | 0.00% |

| Health Care | 2.68% | 11.71% | -9.02% |

| Industrials | 10.25% | 10.26% | -0.01% |

| Info Tech | 19.59% | 17.01% | 2.58% |

| Materials | 4.41% | 4.71% | -0.30% |

| Communication Svcs | 8.27% | 8.75% | -0.48% |

| Utilities | 10.78% | 3.33% | 7.45% |

5

| ACWI Sector Performance 10/31/18 to 10/31/19 | Performance % |

| Consumer Disc. | 14.95% |

| Consumer Staples | 13.78% |

| Energy | -5.37% |

| Financials | 9.95% |

| Real Estate | 23.08% |

| Health Care | 10.57% |

| Industrials | 14.72% |

| Info Tech | 22.86% |

| Materials | 8.21% |

| Communication Svcs | 15.47% |

| Utilities | 21.96% |

| Region 10/31/18 | Fund Portfolio % | ACWI % | Differential |

| Africa/Mid East | 1.74% | 0.99% | 0.75% |

| Asia Pacific | 23.72% | 18.02% | 5.70% |

| Central Asia | 0.27% | 0.94% | -0.67% |

| Eastern Europe | 4.10% | 0.64% | 3.46% |

| Funds (VXX) | 0.00% | 0.00% | 0.00% |

| North America | 54.93% | 57.34% | -2.41% |

| South/Central Am. | 0.71% | 1.21% | -0.51% |

| Western Europe | 13.87% | 20.51% | -6.63% |

| Not Classified | 0.66% | 0.35% | 0.31% |

6

| Region 10/31/19 | Fund Portfolio % | ACWI % | Differential |

| Africa/Mid East | 4.21% | 1.20% | 3.00% |

| Asia Pacific | 40.54% | 18.52% | 22.01% |

| Central Asia | 0.71% | 0.99% | -0.28% |

| Eastern Europe | 0.37% | 0.73% | -0.35% |

| Funds (VXX) | 0.00% | 0.00% | 0.00% |

| North America | 28.93% | 57.02% | -28.08% |

| South/Central Am. | 9.13% | 1.17% | 7.95% |

| Western Europe | 15.50% | 20.06% | -4.56% |

| Not Classified | 0.61% | 0.30% | 0.31% |

| ACWI Region Performance 10/31/18 to 10/31/19 (USD) | Performance % |

| United States (S&P 500) | 14.32% |

| Europe | 11.73% |

| Japan | 9.89% |

| Asia AC ex-Japan | 13.55% |

| EM Latin America | 8.11% |

Portfolio Positioning and Relative Performance Observations:

As a reminder, the investment process for adding individual equities to the Conductor Global Equity Value Fund is not thematically oriented but focused on quantitative fundamental metrics. The Fund screens global equities using a variety of traditional cash flow, income statement, and balance sheet ratios and adds companies exhibiting valuation ratios at levels below the overall levels for the relevant global indices. The typical portfolio company also exhibits lower quantitative probabilities for bankruptcy (i.e. better balance sheet health) at time of entry than the median company in global indices. To help avoid “value traps” and manage risk, the Fund also employs momentum-based technical rules to assist with stock selection. Likewise, technical rules help govern when positions should be removed from the portfolio. Finally, the Fund employs a top down model incorporating macroeconomic data, valuation data, and index-level technical data to assess overall market risk. During times of extremely high risk, the Adviser believes the Fund has the capability of significantly reducing risk exposures. Overall, the shifts in exposures listed above and briefly described below are simply governed by the models we employ, not any qualitative judgment by the portfolio manager as to which sectors or geographies should out or underperform in the future.

SECTOR

| ● | Overall, as the year progressed, sector reallocation trended towards a more neutral risk posture relative the prior fiscal year. The portfolio maintained a market |

7

neutral to overweight posture in more “defensively” oriented sectors like Utilities and Telecom but flowed away from some economically sensitive sectors such as consumer discretionary that the manager considers overvalued. One sector that bucked the trend was Information Technology, which can be considered offensively oriented or defensively oriented depending on the subset of names. We added significantly to exposure in this sector, but not in the “growth” segments typically associated with IT. Instead, we picked up exposure in undervalued/underperforming names, primarily in ex-US geographies.

| ● | In regard to sector attribution relative to the MSCI All Country World Index, allocation among the sectors was relatively neutral as far as affecting the portfolio’s underperformance. Instead, for the first time in the history of the fund, selection was the biggest contributor to underperformance, especially in the consumer discretionary and industrials sectors. We suspect style, i.e. our heavy exposure to value over growth, and size, was a large driver of the negative selection contribution. Size exposure, i.e. our exposure to small cap was certainly a big contributor to selection underperformance (see below). Overall, a significant majority of underperformance came from Consumer Discretionary and Industrials names. Utilities was a bright spot contributing approximately +2% to performance relative to the index. Surprisingly, our IT sector names contributed close to +1% in relative performance. |

GEOGRAPHY

| ● | In terms of geographic allocation, entering fiscal year 2019 the portfolio’s exposures to US and international stocks was roughly in line with the overall ACWI benchmark. By the end of FY 2019, the portfolio shifted dramatically back towards international stocks reflecting the notable underperformance trend among the US small-cap stocks we held at the beginning of the fiscal year, and reflecting the growing valuation gap between US and ex-US stocks over the course of the year in favor of international stocks. Exposure at the end of FY 2019 to international stocks was significantly higher than benchmark levels. Moving forward, the manager expects exposure to remain meaningfully allocated towards international exposure owing to the relative undervaluation of ex-US stocks relative to US stocks. |

| ● | Looking at attribution from a geographic perspective, North American/US stocks were the biggest weight on relative performance against global benchmarks, costing the portfolio over five percentage points in relative performance. As with the sector discussion above, most of this underperformance is attributable to “selection”, and like the discussion above, most of this selection-oriented underperformance was due to style (value) and size (small-cap) underperformance (again see “Market Cap” below). Asia-Pacific stocks cost the portfolio approximately 2.5% in relative performance due to similar dynamics experienced in the North American segment of the portfolio. In contrast, South American stocks provided a nice boost, adding approximately 3.5% to relative |

8

performance. This strong contribution is tied to the strong relative contribution of the utilities sector discussed above; most of the South American portion of the portfolio was allocated to Brazilian utility names.

MARKET CAP

| ● | Large Cap names in the portfolio averaged approximately 52.63% of exposure over the course of the fiscal year vs. 98% for the benchmark. Large Cap names in the portfolio added approximately 1% to relative performance. |

| ● | Mid/Small Cap exposure, representing a weighted average of approximately 39% this year, was a major drag on performance relative to the broader MSCI AC World index, costing the portfolio nearly 7% in relative performance during the fiscal year. |

OTHER

| ● | The portfolio did not maintain any exposure to other investment instruments such as volatility ETFs, futures, or options. |

| ● | Over the course of the 2019 Fiscal Year, the weighted average cash balance in the fund was approximately 8.1%. As such, cash drag cost us approximately 1% of relative performance. |

9

Portfolio Characteristics

The portfolio as currently constructed continues to reflect our value and quality orientations. The gaps between portfolio and benchmark valuation metrics have actually widened over the past year. Weighted average levels for portfolio and benchmark valuation metrics (since portfolio inception) can be found in the following table:

| Valuation Metric | Fund Portfolio | ACWI |

| EV/EBITDA, TTM | 7.35x | 11.97x |

| Price to Book | 1.59x | 2.40x |

| Price to Earnings, TTM | 13.83x | 19.66x |

| Price to Cash Flow, TTM | 8.64x | 12.83x |

| EV to Sales | 0.87x | 2.04x |

| Debt to Equity | 70.52% | 139.91% |

| Dividend Yield | 3.88% | 2.39% |

Disclosures:

Investing in the Fund carries certain risks. Adverse changes in currency exchange rates may erode or reverse any potential gains from the Fund’s investments. The risk of investing in emerging market securities, primarily increased foreign investment risk. Investments in foreign securities could subject the Fund to greater risks including currency fluctuation, economic conditions, and different governmental and accounting standards. There is a risk that issuers and counterparties will not make payments on securities and other investments held by the Fund, resulting in losses to the Fund. Investments in lesser-known, small and medium capitalization companies may be more vulnerable than larger, more established organizations. There can be a higher portfolio turnover due to active and frequent trading that may result in higher transactional and brokerage costs. The Adviser from time to time employs various hedging techniques. The success of the Fund’s hedging strategy will be subject to the Adviser’s ability to correctly assess the degree of correlation between the performance of the instruments used in the hedging strategy and the performance of the investments in the portfolio being hedged. The risk on a short sale is the risk of loss if the value of a security sold short increases prior to the delivery date, since the Fund must pay more for the security than it received from the purchaser in the short sale. Therefore, the risk of loss may be unlimited.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Conductor Fund. This and other information about the Fund is contained in the prospectus and should be read carefully before investing. The prospectus for both funds can be obtained by calling toll free 1-844-GO-RAILX or www.conductorfunds.com. The Fund is distributed by Northern Lights Distributors,

10

LLC., Member FINRA IronHorse Capital Management and Northern Lights Distributors, LLC are not affiliated.

Definitions:

MSCI World Index: The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of the following 23 developed market country indexes: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 46 country indexes comprising 23 developed and 23 emerging market country indexes. The developed market country indexes included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indexes included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

S&P 500 Index: The S&P 500 Index is a broad-based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

MSCI Emerging Markets Index: The MSCI Emerging Markets Index is a free float- adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 21 emerging market country indexes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

MSCI Europe Index: The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The MSCI Europe Index consists of the following 15 developed market country indexes: Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom.

11

MSCI Index Variants

The MSCI Global Standard Indexes include large and mid-cap segments and provide exhaustive coverage of these size segments. The indexes target a coverage range of around 85% of the free float-adjusted market capitalization in each market. The Large Cap Indexes target a coverage range of around 70% of the free float-adjusted market capitalization in each market and the Mid Cap Indexes target a coverage range of around 15% of the free float-adjusted market capitalization in each market.

The MSCI Global Small Cap Indexes provide an exhaustive representation of the small cap size segment. The indexes target companies that are in the Investable Market Index (IMI) but that are not in the Standard Index in each market.

The MSCI Global Value and Growth Indexes cover the full range of MSCI Developed, Emerging and All Country Indexes across large, mid and small cap size segmentations. They are also cover large and mid-cap size segments for the MSCI Frontier Markets Indexes. The indexes are constructed using an approach that provides a precise definition of style using eight historical and forward-looking fundamental data points for every security. Each security is placed into either the Value or Growth Indexes or may be partially allocated to both (with no double counting). The objective of this index design is to divide constituents of an underlying MSCI Equity Index into respective value and growth indexes, each targeting 50% of the free float adjusted market capitalization of the underlying market index.

TOPIX: An index that measures stock prices on the Tokyo Stock Exchange (TSE). This capitalization-weighted index lists all firms that are considered to be under the ‘first section’ on the TSE, which groups all of the large firms on the exchange into one pool. The second section groups all of the remaining smaller firms.

EV/EBITDA: A ratio used to determine the value of a company. The enterprise multiple looks at a firm as a potential acquirer would, because it takes debt into account - an item which other multiples like the P/E ratio do not include.

Price to Book: A ratio used to compare a stock’s market value to its book value. It is calculated by dividing the current closing price of the stock by the latest quarter’s book value per share.

P/E trailing 12 month: The sum of a company’s price-to-earnings, calculated by taking the current stock price and dividing it by the trailing earnings per share for the past 12 months. This measure differs from forward P/E, which uses earnings estimates for the next four quarters.

Altman Z-score: The output of a credit-strength test that gauges a publicly traded manufacturing company’s likelihood of bankruptcy. The Altman Z-score, is based on five

12

financial ratios that can be calculated from data found on a company’s annual 10K report. The Altman Z-score is calculated as follows:

Z-Score = 1.2A + 1.4B + 3.3C + 0.6D + 1.0E

Where:

A = Working Capital/Total Assets

B = Retained Earnings/Total Assets

C = Earnings Before Interest & Tax/Total Assets

D = Market Value of Equity/Total Liabilities

E = Sales/Total Assets

A score below 1.8 means the company is probably headed for bankruptcy, while companies with scores above 3.0 are not likely to go bankrupt. The lower/higher the score, the lower/higher the likelihood of bankruptcy.

The views in this report are those of the Fund’s management. This report contains certain forward-looking statements about factors that may affect the performance of the Fund in the future. These statements are based on the Fund’s management’s predictions and expectations concerning certain future events such as the performance of the economy as a whole and of specific industry sectors. Management believes these forward-looking statements are reasonable, although they are inherently uncertain and difficult to predict.

9097-NLD-12/20/2019

13

| Conductor Global Equity Value Fund |

| Portfolio Review (Unaudited) |

| October 31, 2019 |

The Fund’s performance figures* for the periods ended October 31, 2019, compared to its benchmark:

| Annualized | |||||||

| Since | |||||||

| Commencement | |||||||

| of Operations | Since Inception | Since Inception | Since Inception | ||||

| One Year | Three Years | Five Years | 12/27/2013 (a) | 4/15/2014 | 9/17/2015 | 4/19/16 | |

| Class A with Load (b) | (2.96) | 5.60% | 5.42% | N/A | 4.99% | N/A | N/A |

| Class A | 2.94% | 7.70% | 6.68% | N/A | 6.10% | N/A | N/A |

| Class C | 2.10% | 6.90% | N/A | N/A | N/A | 7.02% | N/A |

| Class I | 3.14% | 7.94% | 6.92% | 5.55% | N/A | N/A | N/A |

| Class Y | 3.59% | 8.58% | N/A | N/A | N/A | N/A | 9.06% |

| MSCI All Country World Value Index (c) | 8.22% | 8.37% | 4.75% | 4.82% | 4.85% | 7.78% | 7.92% |

| MSCI World Total Return Index (d) | 13.35% | 12.49% | 8.19% | 7.95% | 8.34% | 10.32% | 10.92% |

* The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Each waiver or reimbursement by Ironhorse Capital LLC (the “Advisor”) is subject to repayment by the Fund within the three fiscal years following the fiscal year in which that particular expense is incurred, if the Fund is able to make the repayment without exceeding the expense limitation in effect at the time of the waiver and the repayment is approved by the Board of Trustees. The Advisor has contractually agreed to reduce the Fund’s fees and/or absorb expenses of the Fund until at least March 1, 2020 to ensure that total annual Fund operating expenses (exclusive of any front-end or contingent deferred loads; brokerage fees and commissions; expenses of other investment companies in which the Fund may invest (“acquired fund fees and expenses”); borrowing costs, such as interest and dividend expense on securities sold short; taxes; and extraordinary expenses, such as litigation expenses) do not exceed 2.15%, 2.90%, 1.90% and 1.25% of average daily net assets attributable to Class A, Class C, Class I and Class Y shares, respectively. This agreement may be terminated by the Fund’s Board of Trustees on 60 days’ written notice to the Advisor. These expense reimbursements are subject to possible recoupment from the Fund in future years on a rolling three year basis (within the three years after the fees have been waived or reimbursed) if such recoupment can be achieved without exceeding the foregoing expense limits as well as any expense limitation that was in effect at the time the reimbursement was made. Class A Shares are subject to a maximum sales charge of 5.75% imposed on purchases. Per the fee table in the February 28, 2019 prospectus, the Fund’s total annual operating expense ratio before expense waivers, if any, is 1.87%, 2.61%, 1.61%, and 1.61% for Class A, Class C, Class I, and Class Y shares, respectively. For performance information current to the most recent month-end, please call toll-free 1-844-GO-RAILX.

| (a) | The inception date of Class I is December 26, 2013. Class I commenced operations on December 27, 2013. |

| (b) | Class A with load total return is calculated using the maximum sales charge of 5.75% |

| (c) | Effective February 28, 2019, the Fund’s primary benchmark is the MSCI All Country World Value Index. The MSCI All Country World Value Index captures large and mid-cap securities exhibiting overall value style characteristics across 23 developed markets countries and 24 emerging markets countries. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield. Investors cannot invest directly in an index or benchmark. |

| (d) | The MSCI World Total Return Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Total Return Index consists of 23 developed market country indexes. You cannot invest directly in an index. |

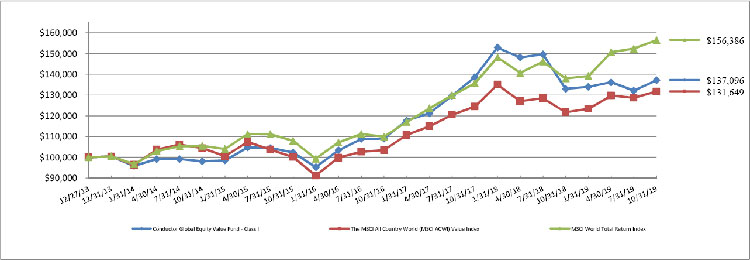

Comparison of the Change in Value of a $100,000 Investment ^

| ^ | Performance shown is for Class I shares. The performance of the Fund’s other classes may be greater or less than the line shown due to differences in loads and fees paid by shareholders in different share classes. |

| Portfolio Composition as of October 31, 2019 | ||||

| Holdings by Industry/Asset Class | % of Net Assets | |||

| Exchange Traded Funds | 33.9 | % | ||

| Electronics | 10.7 | % | ||

| Short-Tem Investments | 7.7 | % | ||

| Auto Parts & Equipment | 4.2 | % | ||

| Computers | 3.8 | % | ||

| Oil & Gas | 3.4 | % | ||

| Home Builders | 3.2 | % | ||

| Retail | 3.1 | % | ||

| Semiconductors | 3.1 | % | ||

| Food | 2.6 | % | ||

| Other** | 23.5 | % | ||

| Other Assets and Liabilities - Net | 0.8 | % | ||

| 100.0 | % | |||

| ** | Other represents less than 2.6% weightings in the following industries: Chemicals, Commercial Services, Diversified Financial Services, Electrical Components & Equipment, Gas, Iron/Steel, Machinery-Construction & Mining, Machinery- Diversified, Miscellaneous Manufacturing, Office/Business Equipment, Real Estate, Software, Telecommunications, Transportation and Water. |

Please refer to the Portfolio of Investments in this annual report for a detailed analysis of the Fund’s holdings.

14

| Conductor Global Equity Value Fund |

| PORTFOLIO OF INVESTMENTS |

| October 31, 2019 |

| Shares | Value | |||||||

| COMMON STOCKS - 57.6% | ||||||||

| AUTO PARTS & EQUPIMENT - 4.2% | ||||||||

| 24,500 | Bridgestone Corp. | $ | 1,017,973 | |||||

| 17,100 | Faurecia SE | 798,026 | ||||||

| 26,900 | TS Tech Co. Ltd. | 861,539 | ||||||

| 23,115 | Valeo SA | 860,819 | ||||||

| 3,538,357 | ||||||||

| CHEMICALS - 1.0% | ||||||||

| 24,000 | Taiyo Holdings Co. Ltd. | 869,771 | ||||||

| COMMERCIAL SERVICES - 1.8% | ||||||||

| 188,300 | Qualicorp SA | 1,503,865 | ||||||

| COMPUTERS - 3.8% | ||||||||

| 388,000 | Foxconn Technology Co. Ltd. | 829,733 | ||||||

| 40,000 | NEC Networks & System Integration Corp. | 1,262,561 | ||||||

| 115,000 | Phison Electronics Corp. | 1,045,680 | ||||||

| 3,137,974 | ||||||||

| DIVERSIFIED FINANCIAL SERVICES - 2.3% | ||||||||

| 16,600 | Deluxe Corp. | 860,378 | ||||||

| 29,000 | Synchrony Financial | 1,025,730 | ||||||

| 1,886,108 | ||||||||

| ELECTRICAL COMPONENTS & EQUIPMENT - 1.1% | ||||||||

| 21,600 | Mabuchi Motor Co. Ltd. | 875,168 | ||||||

| ELECTRONICS - 10.7% | ||||||||

| 28,050 | Benchmark Electronics, Inc. | 950,895 | ||||||

| 315,000 | FLEXium Interconnect, Inc. | 1,131,829 | ||||||

| 24,000 | Hitachi High-Technologies Corp. | 1,493,179 | ||||||

| 20,000 | Inaba Denki Sangyo Co. Ltd. | 918,775 | ||||||

| 45,600 | Japan Aviation Electronics Industry Ltd. | 849,474 | ||||||

| 49,500 | Nitto Kogyo Corp. | 1,040,005 | ||||||

| 466,000 | Pegatron Corp. | 904,867 | ||||||

| 25,250 | Sanmina Corp. * | 775,933 | ||||||

| 27,800 | Tokyo Seimitsu Co. Ltd. | 892,911 | ||||||

| 8,957,868 | ||||||||

| FOOD - 2.6% | ||||||||

| 407,000 | Metcash Ltd. | 791,171 | ||||||

| 46,146 | Pilgrim’s Pride Corp. * | 1,400,993 | ||||||

| 2,192,164 | ||||||||

| GAS - 1.9% | ||||||||

| 63,058 | Cia de Gas de Sao Paulo | 1,557,386 | ||||||

The accompanying notes are an integral part of these financial statements.

15

| Conductor Global Equity Value Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| October 31, 2019 |

| Shares | Value | |||||||

| HOME BUILDERS - 3.2% | ||||||||

| 150,010 | Barratt Developments PLC | $ | 1,226,753 | |||||

| 115,725 | Crest Nicholson Holdings PLC | 583,136 | ||||||

| 66,300 | Haseko Corp. | 855,561 | ||||||

| 2,665,450 | ||||||||

| IRON/STEEL - 2.0% | ||||||||

| 273,190 | Fortescue Metals Group Ltd. ^ | 1,672,094 | ||||||

| MACHINERY-CONSTRUCTION & MINING - 1.2% | ||||||||

| 25,600 | Hitachi Ltd. | 955,455 | ||||||

| MACHINERY-DIVERSIFIED - 1.0% | ||||||||

| 14,000 | Okuma Corp. | 836,503 | ||||||

| MISCELLANEOUS MANUFACTURING - 1.1% | ||||||||

| 32,400 | Glory Ltd. | 953,939 | ||||||

| OFFICE/BUSINESS EQUIPMENT - 1.1% | ||||||||

| 41,600 | Canon Marketing Japan, Inc. | 880,161 | ||||||

| OIL & GAS - 3.4% | ||||||||

| 331,400 | Qatar Fuel QSC | 2,013,405 | ||||||

| 352,800 | Thai Oil PCL | 800,273 | ||||||

| 2,813,678 | ||||||||

| REAL ESTATE - 2.5% | ||||||||

| 207,755 | EZ TEC Empreendimentos e Participacoes SA | 2,119,769 | ||||||

| RETAIL - 3.1% | ||||||||

| 42,800 | Buckle, Inc. (The) | 895,376 | ||||||

| 40,500 | Saizeriya Co. Ltd. | 919,518 | ||||||

| 9,500 | Shimamura Co. Ltd. | 804,679 | ||||||

| 2,619,573 | ||||||||

| SEMICONDUCTORS - 3.1% | ||||||||

| 36,900 | Dialog Semiconductor PLC * | 1,659,775 | ||||||

| 42,330 | Tower Semiconductor Ltd. *^ | 935,585 | ||||||

| 2,595,360 | ||||||||

| SOFTWARE - 0.9% | ||||||||

| 42,100 | DeNA Co. Ltd. | 717,628 | ||||||

| TELECOMMUNICATIONS - 1.1% | ||||||||

| 32,400 | NTT DOCOMO, Inc. | 888,250 | ||||||

The accompanying notes are an integral part of these financial statements.

16

| Conductor Global Equity Value Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| October 31, 2019 |

| Shares | Value | |||||||

| TRANSPORTATION - 2.5% | ||||||||

| 45,140 | Go-Ahead Group PLC | $ | 1,194,774 | |||||

| 7,144 | Hyundai Glovis Co. Ltd. | 925,377 | ||||||

| 2,120,151 | ||||||||

| WATER - 2.0% | ||||||||

| 123,600 | Cia de Saneamento Basico do Estado de Sao Paulo * | 1,685,497 | ||||||

| TOTAL COMMON STOCKS (Cost - $39,055,203) | 48,042,169 | |||||||

| EXCHANGE TRADED FUNDS - 33.9% | ||||||||

| EQUITY FUNDS - 33.9% | ||||||||

| 79,350 | iShares Global Commercial Services ETF | 4,656,258 | ||||||

| 105,201 | iShares Global Financials ETF ^ | 6,919,070 | ||||||

| 93,652 | iShares Global Utilities ETF | 5,469,277 | ||||||

| 135,085 | Vanguard FTSE Developed Markets ETF | 5,727,604 | ||||||

| 131,250 | Vanguard FTSE Emerging Markets ETF | 5,492,812 | ||||||

| TOTAL EXCHANGE TRADED FUNDS - (Cost - $26,891,137) | 28,265,021 | |||||||

| SHORT-TERM INVESTMENTS - 7.7% | ||||||||

| INVESTMENT PURCHASED AS SECURITIES LENDING COLLATERAL - 0.8% | ||||||||

| 651,600 | Dreyfus Cash Management Fund - Institutional Class, 1.96% + (a) | 651,600 | ||||||

| MONEY MARKET FUND - 6.9% | ||||||||

| 5,784,769 | Dreyfus Cash Management Fund - Institutional Class, 1.96% + | 5,787,083 | ||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost - $6,436,369) | 6,438,683 | |||||||

| TOTAL INVESTMENTS - 99.2% (Cost - $72,382,709) | $ | 82,745,873 | ||||||

| OTHER ASSETS AND LIABILITIES - NET - 0.8% | 653,753 | |||||||

| TOTAL NET ASSETS - 100.0% | $ | 83,399,626 | ||||||

| * | Non-income producing security. |

| ^ | All or a portion of the security is on loan. Total loaned securities had a value of $2,304,369 at October 31, 2019. |

| + | Money market fund; interest rate reflects seven day effective yield on October 31, 2019. |

| (a) | Security was purchased with cash received as collateral for securities on loan as of October 31, 2019. Total collateral had a value of $651,600 at October 31, 2019. Additional collateral received from the borrower not disclosed in the Portfolio of Investments had a value of $1,787,027 as of October 31, 2019. |

The accompanying notes are an integral part of these financial statements.

17

| Conductor Global Equity Value Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| October 31, 2019 |

| Portfolio Composition as of October 31, 2019 | ||||

| Holdings by Country | % of Market Value | |||

| Global ETF | 34.2 | % | ||

| Japan | 21.6 | % | ||

| United States | 14.9 | % | ||

| Brazil | 8.3 | % | ||

| Britain | 5.7 | % | ||

| Taiwan | 4.7 | % | ||

| Australia | 3.0 | % | ||

| Qatar | 2.4 | % | ||

| France | 2.0 | % | ||

| Isreal | 1.1 | % | ||

| South Korea | 1.1 | % | ||

| Thailand | 1.0 | % | ||

| 100.0 | % | |||

The accompanying notes are an integral part of these financial statements.

18

| Conductor Global Equity Value Fund |

| Statement of Assets and Liabilities |

| October 31, 2019 |

| ASSETS | ||||

| Securities, at cost | $ | 72,382,709 | ||

| Securities, at fair value | $ | 82,745,873 | ||

| Receivable for securities sold | 2,263,771 | |||

| Dividends and interest receivable | 444,348 | |||

| Prepaid expenses and other assets | 170,760 | |||

| TOTAL ASSETS | 85,624,752 | |||

| LIABILITIES | ||||

| Collateral on securities loaned (see note 8) | 651,600 | |||

| Payable for investments purchased | 1,464,549 | |||

| Payable for fund shares redeemed | 20,520 | |||

| Investment advisory fees payable | 80,451 | |||

| Payable to related parties | 4,798 | |||

| Distribution (12b-1) fees payable | 1,569 | |||

| Accrued expenses and other liabilities | 1,639 | |||

| TOTAL LIABILITIES | 2,225,126 | |||

| NET ASSETS | $ | 83,399,626 | ||

| NET ASSETS CONSIST OF: | ||||

| Paid in capital | $ | 79,233,461 | ||

| Accumulated earnings | 4,166,165 | |||

| NET ASSETS | $ | 83,399,626 |

The accompanying notes are an integral part of these financial statements.

19

| Conductor Global Equity Value Fund |

| Statement of Assets and Liabilities (Continued) |

| October 31, 2019 |

| NET ASSET VALUE PER SHARE: | ||||

| Class A Shares: | ||||

| Net Assets | $ | 2,088,148 | ||

| Shares of beneficial interest outstanding [$0 par value, unlimited shares authorized] | 173,876 | |||

| Net asset value (Net Assets ÷ Shares Outstanding) and redemption price per share (a) | $ | 12.01 | ||

| Maximum offering price per share (maximum sales charge of 5.75%) | $ | 12.74 | ||

| Class C Shares: | ||||

| Net Assets | $ | 1,361,176 | ||

| Shares of beneficial interest outstanding [$0 par value, unlimited shares authorized] | 114,959 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (a) | $ | 11.84 | ||

| Class I Shares: | ||||

| Net Assets | $ | 52,142,152 | ||

| Shares of beneficial interest outstanding [$0 par value, unlimited shares authorized] | 4,319,761 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (a) | $ | 12.07 | ||

| Class Y Shares: | ||||

| Net Assets | $ | 27,808,150 | ||

| Shares of beneficial interest outstanding [$0 par value, unlimited shares authorized] | 2,257,531 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (a) | $ | 12.32 |

| (a) | Redemptions made within 30 days of purchase may be assessed a redemption fee of 1.00%. |

The accompanying notes are an integral part of these financial statements.

20

| Conductor Global Equity Value Fund |

| Statement of Operations |

| For the Year Ended October 31, 2019 |

| INVESTMENT INCOME | ||||

| Dividend Income (Foreign Taxes Withheld $102,438) | $ | 2,890,029 | ||

| Interest Income | 142,189 | |||

| Securities Lending Income | 51,256 | |||

| TOTAL INVESTMENT INCOME | 3,083,474 | |||

| EXPENSES | ||||

| Investment advisory fees | 1,097,823 | |||

| Distribution (12b-1) fees: | ||||

| Class A | 6,025 | |||

| Class C | 15,212 | |||

| Administrative services fees | 51,718 | |||

| Registration fees | 57,600 | |||

| Third party administrative services fees | 45,391 | |||

| Custodian fees | 65,043 | |||

| Transfer agent fees | 35,445 | |||

| Audit fees | 29,231 | |||

| Accounting services fees | 22,559 | |||

| Legal fees | 27,296 | |||

| Printing and postage expenses | 14,165 | |||

| Compliance officer fees | 19,993 | |||

| Trustees fees and expenses | 9,214 | |||

| Insurance expense | 5,698 | |||

| Other expenses | 7,031 | |||

| TOTAL EXPENSES | 1,509,444 | |||

| Less: Fees waived by the Advisor (Class Y) | (130,925 | ) | ||

| NET EXPENSES | 1,378,519 | |||

| NET INVESTMENT INCOME | 1,704,955 | |||

| REALIZED AND UNREALIZED GAIN/(LOSS) | ||||

| Net realized loss from: | ||||

| Investments | (5,818,280 | ) | ||

| Foreign currency translations | (255,381 | ) | ||

| Realized loss on investments and foreign currency transactions | (6,073,661 | ) | ||

| Net change in unrealized appreciation of: | ||||

| Investments | 6,646,414 | |||

| Foreign currency translations | 2,695 | |||

| Unrealized appreciation on investments and foreign currency translations | 6,649,109 | |||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | 575,448 | |||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 2,280,403 |

The accompanying notes are an integral part of these financial statements.

21

| Conductor Global Equity Value Fund |

| Statements of Changes in Net Assets |

| For the Year Ended | For the Year Ended | |||||||

| October 31, | October 31, | |||||||

| 2019 | 2018 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment income | $ | 1,704,955 | $ | 856,606 | ||||

| Net realized gain/(loss) from investments and foreign currency translations | (6,073,661 | ) | 7,887,614 | |||||

| Net change in unrealized appreciation/(depreciation) of investments and foreign currency translations | 6,649,109 | (14,945,444 | ) | |||||

| Net increase/(decrease) in net assets resulting from operations | 2,280,403 | (6,201,224 | ) | |||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| Total Distributions Paid: | ||||||||

| Class A | (297,412 | ) | (35,894 | ) | ||||

| Class C | (152,054 | ) | (5,912 | ) | ||||

| Class I | (5,408,051 | ) | (884,018 | ) | ||||

| Class Y | (3,719,978 | ) | (437,197 | ) | ||||

| Net decrease in net assets resulting from distributions to shareholders | (9,577,495 | ) | (1,363,021 | ) | ||||

| FROM SHARES OF BENEFICIAL INTEREST | ||||||||

| Proceeds from shares sold: | ||||||||

| Class A | 200,620 | 2,071,439 | ||||||

| Class C | 164,334 | 863,012 | ||||||

| Class I | 657,483 | 1,406,086 | ||||||

| Class Y | 9,889,360 | 37,261,254 | ||||||

| Net asset value of shares issued in reinvestment of distributions: | ||||||||

| Class A | 276,374 | 33,572 | ||||||

| Class C | 150,021 | 5,912 | ||||||

| Class I | 4,755,569 | 768,793 | ||||||

| Class Y | 3,546,864 | 412,095 | ||||||

| Redemption fee proceeds: | ||||||||

| Class A | — | 38 | ||||||

| Class Y | — | 20 | ||||||

| Payments for shares redeemed: | ||||||||

| Class A | (1,177,857 | ) | (2,485,290 | ) | ||||

| Class C | (441,850 | ) | (446,330 | ) | ||||

| Class I | (1,792,702 | ) | (1,920,743 | ) | ||||

| Class Y | (27,103,774 | ) | (8,217,254 | ) | ||||

| Net increase/(decrease) in net assets from shares of beneficial interest | (10,875,558 | ) | 29,752,604 | |||||

| TOTAL INCREASE/(DECREASE) IN NET ASSETS | (18,172,650 | ) | 22,188,359 | |||||

| NET ASSETS | ||||||||

| Beginning of Year | 101,572,276 | 79,383,917 | ||||||

| End of Year | $ | 83,399,626 | $ | 101,572,276 | ||||

The accompanying notes are an integral part of these financial statements.

22

| Conductor Global Equity Value Fund |

| Statements of Changes in Net Assets (Continued) |

| For the Year Ended | For the Year Ended | |||||||

| October 31, | October 31, | |||||||

| 2019 | 2018 | |||||||

| SHARE ACTIVITY | ||||||||

| Class A: | ||||||||

| Shares Sold | 17,137 | 142,557 | ||||||

| Shares Reinvested | 24,379 | 2,356 | ||||||

| Shares Redeemed | (103,344 | ) | (172,801 | ) | ||||

| Net decrease in shares of beneficial interest outstanding | (61,828 | ) | (27,888 | ) | ||||

| Class C: | ||||||||

| Shares Sold | 13,799 | 59,549 | ||||||

| Shares Reinvested | 13,408 | 424 | ||||||

| Shares Redeemed | (39,127 | ) | (31,493 | ) | ||||

| Net increase/(decrease) in shares of beneficial interest outstanding | (11,920 | ) | 28,480 | |||||

| Class I: | ||||||||

| Shares Sold | 55,991 | 96,918 | ||||||

| Shares Reinvested | 415,838 | 53,588 | ||||||

| Shares Redeemed | (153,832 | ) | (131,608 | ) | ||||

| Net increase in shares of beneficial interest outstanding | 317,997 | 18,898 | ||||||

| Class Y: | ||||||||

| Shares Sold | 851,414 | 2,503,747 | ||||||

| Shares Reinvested | 305,523 | 28,291 | ||||||

| Shares Redeemed | (2,250,127 | ) | (558,676 | ) | ||||

| Net increase/(decrease) in shares of beneficial interest outstanding | (1,093,190 | ) | 1,973,362 | |||||

The accompanying notes are an integral part of these financial statements.

23

| Conductor Global Equity Value Fund |

| Financial Highlights |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout each Period |

| Class A Shares | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Year Ended | ||||||||||||||||

| October 31, | October 31, | October 31, | October 31, | October 31, | ||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Net asset value, beginning of period | $ | 13.00 | $ | 13.75 | $ | 10.84 | $ | 10.20 | $ | 9.80 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment income/(loss) (1) | 0.19 | 0.05 | 0.01 | (0.03 | ) | 0.00 | (6) | |||||||||||||

| Net realized and unrealized gain/(loss) on investments | 0.10 | (0.63 | ) | 2.90 | 0.67 | 0.40 | ||||||||||||||

| Total from investment operations | 0.29 | (0.58 | ) | 2.91 | 0.64 | 0.40 | ||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.18 | ) | (0.15 | ) | — | — | — | |||||||||||||

| Net realized gains | (1.10 | ) | (0.02 | ) | — | — | — | |||||||||||||

| Total distributions | (1.28 | ) | (0.17 | ) | — | — | — | |||||||||||||

| Paid-in-Capital From Redemption Fees | — | 0.00 | (6) | — | — | — | ||||||||||||||

| Net asset value, end of period | $ | 12.01 | $ | 13.00 | $ | 13.75 | $ | 10.84 | $ | 10.20 | ||||||||||

| Total return (2) | 2.94 | % | (4.33 | )% | 26.85 | % | 6.27 | % | 4.08 | % | ||||||||||

| Net assets, at end of period (000’s) | $ | 2,088 | $ | 3,065 | $ | 3,624 | $ | 1,887 | $ | 1,109 | ||||||||||

| Ratio of gross expenses to average net assets (3)(4) | 1.94 | % | 1.81 | % | 1.95 | % | 2.37 | % | 2.49 | % | ||||||||||

| Ratio of net expenses to average net assets (4) | 1.94 | % | 2.11 | % (7) | 2.15 | % (7) | 2.14 | % | 2.18 | % | ||||||||||

| Ratio of net investment income/(loss) to average net assets (4)(5) | 1.59 | % | 0.36 | % | 0.06 | % | (0.33 | )% | 0.02 | % | ||||||||||

| Portfolio Turnover Rate | 108 | % | 141 | % | 90 | % | 123 | % | 86 | % | ||||||||||

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (2) | Total returns are historical and assume changes in share price and reinvestment of dividends and distributions. Total returns for periods less than one year are not annualized. Total returns shown exclude the effect of the maximum applicable sales charges of 5.75% and, if applicable, wire redemption fees. Had the Advisor not waived its fees, the returns would have been lower. |

| (3) | Represents the ratio of expenses to average net assets absent fee waivers by the Advisor. |

| (4) | The ratios of expenses and net investment income/(loss) to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

| (5) | Recognition of net investment income/(loss) by the Fund is affected by the timing of the declaration of the dividends by the underlying investment companies in which the Fund invests. |

| (6) | Amount represents less than $0.005. |

| (7) | Represents the ratio of expenses to average net assets inclusive of the Advisor’s recapture of waived/reimbursed fees from prior periods. |

The accompanying notes are an integral part of these financial statements.

24

| Conductor Global Equity Value Fund |

| Financial Highlights |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout each Period |

| Class C Shares | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Period Ended | ||||||||||||||||

| October 31, | October 31, | October 31, | October 31, | October 31, | ||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 (1) | ||||||||||||||||

| Net asset value, beginning of period | $ | 12.82 | $ | 13.55 | $ | 10.76 | $ | 10.20 | $ | 9.94 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment income/(loss) (2) | 0.10 | (0.06 | ) | (0.09 | ) | (0.11 | ) | 0.03 | ||||||||||||

| Net realized and unrealized gain/(loss) on investments | 0.10 | (0.61 | ) | 2.88 | 0.67 | 0.23 | ||||||||||||||

| Total from investment operations | 0.20 | (0.67 | ) | 2.79 | 0.56 | 0.26 | ||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.08 | ) | (0.04 | ) | — | — | — | |||||||||||||

| Net realized gains | (1.10 | ) | (0.02 | ) | — | — | — | |||||||||||||

| Total distributions | (1.18 | ) | (0.06 | ) | — | — | — | |||||||||||||

| Net asset value, end of period | $ | 11.84 | $ | 12.82 | $ | 13.55 | $ | 10.76 | $ | 10.20 | ||||||||||

| Total return (3) | 2.10 | % | (4.99 | )% | 25.93 | % | 5.49 | % | 2.62 | % | ||||||||||

| Net assets, at end of period (000’s) | $ | 1,361 | $ | 1,626 | $ | 1,333 | $ | 258 | $ | 21 | (9) | |||||||||

| Ratio of gross expenses to average net assets (5)(7) | 2.69 | % | 2.55 | % | 2.69 | % | 3.11 | % | 3.18 | % (6) | ||||||||||

| Ratio of net expenses to average net assets (7) | 2.69 | % | 2.86 | % (10) | 2.90 | % (10) | 2.88 | % | 2.93 | % (6) | ||||||||||

| Ratio of net investment income/(loss) to average net assets (7)(8) | 0.83 | % | (0.42 | )% | (0.70 | )% | (1.05 | )% | 2.52 | % (6) | ||||||||||

| Portfolio Turnover Rate | 108 | % | 141 | % | 90 | % | 123 | % | 86 | % (4) | ||||||||||

| (1) | The Conductor Global Equity Value Fund Class C commenced investment operations on September 17, 2015. |

| (2) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (3) | Total returns are historical and assume changes in share price and reinvestment of dividends and distributions. Total returns for periods of less than one year are not annualized. Total returns shown exclude the effect of sales charges and, if applicable, wire redemption fees. Had the Advisor not waived its fees, the returns would have been lower. |

| (4) | Not annualized. |

| (5) | Represents the ratio of expenses to average net assets absent fee waivers by the Advisor. |

| (6) | Annualized. |

| (7) | The ratios of expenses and net investment income/(loss) to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

| (8) | Recognition of net investment income/(loss) by the Fund is affected by the timing of the declaration of the dividends by the underlying investment companies in which the Fund invests. |

| (9) | Actual net assets, not rounded. |

| (10) | Represents the ratio of expenses to average net assets inclusive of the Advisor’s recapture of waived/reimbursed fees from prior periods. |

The accompanying notes are an integral part of these financial statements.

25

| Conductor Global Equity Value Fund |

| Financial Highlights |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout each Period |

| Class I Shares | ||||||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Year Ended | ||||||||||||||||

| October 31, | October 31, | October 31, | October 31, | October 31, | ||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Net asset value, beginning of period | $ | 13.09 | $ | 13.86 | $ | 10.90 | $ | 10.23 | $ | 9.81 | ||||||||||

| Activity from investment operations: | ||||||||||||||||||||

| Net investment income/(loss) (1) | 0.22 | 0.09 | 0.03 | (0.01 | ) | 0.00 | (2) | |||||||||||||

| Net realized and unrealized gain/(loss) on investments | 0.10 | (0.64 | ) | 2.93 | 0.68 | 0.42 | ||||||||||||||

| Total from investment operations | 0.32 | (0.55 | ) | 2.96 | 0.67 | 0.42 | ||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.24 | ) | (0.20 | ) | — | — | — | |||||||||||||

| Net realized gains | (1.10 | ) | (0.02 | ) | — | — | — | |||||||||||||

| Total distributions | (1.34 | ) | (0.22 | ) | — | — | — | |||||||||||||

| Net asset value, end of period | $ | 12.07 | $ | 13.09 | $ | 13.86 | $ | 10.90 | $ | 10.23 | ||||||||||

| Total return (3) | 3.14 | % | (4.09 | )% | 27.16 | % | 6.55 | % | 4.28 | % | ||||||||||

| Net assets, at end of period (000s) | $ | 52,142 | $ | 52,383 | $ | 55,185 | $ | 45,923 | $ | 37,977 | ||||||||||

| Ratio of gross expenses to average net assets (4)(5) | 1.70 | % | 1.55 | % | 1.71 | % | 2.11 | % | 2.20 | % | ||||||||||

| Ratio of net expenses to average net assets (5) | 1.70 | % | 1.86 | % (7) | 1.90 | % (7) | 1.87 | % | 1.95 | % | ||||||||||

| Ratio of net investment income/(loss) to average net assets (5)(6) | 1.83 | % | 0.62 | % | 0.28 | % | (0.06 | )% | 0.02 | % | ||||||||||

| Portfolio Turnover Rate | 108 | % | 141 | % | 90 | % | 123 | % | 86 | % | ||||||||||

| (1) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (2) | Represents less than $0.005 per share. |

| (3) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gain distributions, if any. Total returns for periods of less than one year are not annualized. Had the Advisor not waived its fees, the returns would have been lower. |

| (4) | Represents the ratio of expenses to average net assets absent fee waivers by the Advisor. |

| (5) | The ratios of expenses and net investment income/(loss) to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

| (6) | Recognition of net investment income/(loss) by the Fund is affected by the timing of the declaration of the dividends by the underlying investment companies in which the Fund invests. |

| (7) | Represents the ratio of expenses to average net assets inclusive of the Advisor’s recapture of waived/reimbursed fees from prior periods. |

The accompanying notes are an integral part of these financial statements.

26

| Conductor Global Equity Value Fund |

| Financial Highlights |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout the Period |

| Class Y Shares | ||||||||||||||||

| Year Ended | Year Ended | Year Ended | Period Ended | |||||||||||||

| October 31, | October 31, | October 31, | October 31, | |||||||||||||

| 2019 | 2018 | 2017 | 2016 (1) | |||||||||||||

| Net asset value, beginning of period | $ | 13.28 | $ | 13.97 | $ | 10.91 | $ | 10.28 | ||||||||

| Activity from investment operations: | ||||||||||||||||

| Net investment income (2) | 0.27 | 0.19 | 0.12 | 0.01 | ||||||||||||

| Net realized and unrealized gain/(loss) on investments | 0.11 | (0.66 | ) | 2.94 | 0.62 | |||||||||||

| Total from investment operations | 0.38 | (0.47 | ) | 3.06 | 0.63 | |||||||||||

| Less distributions from: | ||||||||||||||||

| Net investment income | (0.24 | ) | (0.20 | ) | — | — | ||||||||||

| Net realized gains | (1.10 | ) | (0.02 | ) | — | — | ||||||||||

| Total distributions | (1.34 | ) | (0.22 | ) | — | — | ||||||||||

| Paid-in-Capital From Redemption Fees | — | 0.00 | (9) | — | — | |||||||||||

| Net asset value, end of period | $ | 12.32 | $ | 13.28 | $ | 13.97 | $ | 10.91 | ||||||||

| Total return (3) | 3.59 | % | (3.48 | )% | 28.05 | % | 6.13 | % | ||||||||

| Net assets, at end of period | $ | 27,808 | $ | 44,498 | $ | 19,242 | $ | 845 | ||||||||

| Ratio of gross expenses to average net assets (5)(7) | 1.65 | % | 1.55 | % | 1.68 | % | 2.04 | % (6) | ||||||||

| Ratio of net expenses to average net assets (7) | 1.25 | % | 1.25 | % | 1.25 | % | 1.39 | % (6) | ||||||||

| Ratio of net investment income to average net assets (7)(8) | 2.23 | % | 1.27 | % | 0.93 | % | 0.24 | % (6) | ||||||||

| Portfolio Turnover Rate | 108 | % | 141 | % | 90 | % | 123 | % (4) | ||||||||

| (1) | The Conductor Global Equity Value Fund Class Y commenced investment operations on April 19, 2016. |

| (2) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (3) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gain distributions, if any. Total returns for periods of less than one year are not annualized. Had the Advisor not waived its fees, the returns would have been lower. |

| (4) | Turnover is calculated based on Fund level and is not annualized. |

| (5) | Represents the ratio of expenses to average net assets absent fee waivers by the Advisor. |

| (6) | Annualized. |

| (7) | The ratios of expenses and net investment income/(loss) to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

| (8) | Recognition of net investment income/(loss) by the Fund is affected by the timing of the declaration of the dividends by the underlying investment companies in which the Fund invests. |

| (9) | Amount represents less than $0.005. |

The accompanying notes are an integral part of these financial statements.

27

| Conductor Global Equity Value Fund |

| NOTES TO FINANCIAL STATEMENTS |

| October 31, 2019 |

| 1. | ORGANIZATION |

The Conductor Global Equity Value Fund (the “Fund”) is a series of shares of beneficial interest of the Two Roads Shared Trust (the “Trust”), a statutory trust organized under the laws of the State of Delaware on June 8, 2012, and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified, open-end management investment company. The Fund offers Class A, Class C, Class I, and Class Y shares. The Fund commenced investment operations for Class I shares on December 27, 2013. Class A shares commenced investment operations on April 15, 2014. Class C shares commenced investment operations on September 17, 2015. Class Y shares commenced investment operations on April 19, 2016. The investment objective is to provide long-term risk-adjusted total return.

Class A shares are offered at net asset value (“NAV”) plus a maximum sales charge of 5.75%. Each share class represents an interest in the same assets of the Fund and classes are identical except for differences in their sales charge structures and ongoing service and distribution charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies” including FASB Accounting Standard Update ASU 2013-08.

Security Valuation – Securities, including exchange traded funds, listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ Official Closing Price. In the absence of a sale such securities shall be valued at mean between the last bid and ask prices on the day of valuation. Debt securities (other than short -term obligations) are valued each day by an independent pricing service approved by the Board of Trustees (the “Board”) using methods which include current market quotations from a major market maker in the securities and based on methods which include the consideration of yields or prices of securities of comparable quality, coupon, maturity and type. Short-term debt obligations having 60 days or less remaining until maturity, at time of purchase, may be valued at amortized cost. Investments in open-end investment companies are valued at net asset value.

Securities in which the Fund invests may be traded in markets that close before 4:00 p.m. Eastern Time (“ET”). Normally, developments that occur between the close of the foreign markets and 4:00 p.m. ET will not be reflected in the Fund’s NAV. However, the Fund may determine that such developments are so significant that they will materially affect the value of the Fund’s securities, and the Fund may adjust the previous closing prices to reflect what the Board believes to be the fair value of these securities as of 4:00 p.m. ET. The Fund utilizes fair value prices as provided by an independent pricing vendor on a daily basis for those securities traded on a foreign exchange.

Valuation of Underlying Funds – The Fund may invest in portfolios of open-end or closed-end investment companies (the “Underlying Funds”). The Underlying Funds value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value to the methods established by the board of directors of the Underlying Funds.

Open-end funds are valued at their respective net asset values as reported by such investment companies. The shares of many closed-end investment companies, after their initial public offering, frequently trade at a price per share, which is different than the net asset value per share. The difference represents a market premium or market discount of such shares.

28

| Conductor Global Equity Value Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| October 31, 2019 |

There can be no assurances that the market discount or market premium on shares of any closed-end investment company purchased by the Fund will not change.

Exchange Traded Funds – The Fund may invest in exchange traded funds (“ETFs”). ETFs are a type of index fund bought and sold on a securities exchange. An ETF trades like common stock and represents a fixed portfolio of securities designed to track the performance and dividend yield of a particular domestic or foreign market index. The Fund may purchase an ETF to temporarily gain exposure to a portion of the U.S. or a foreign market. The risks of owning an ETF generally reflect the risks of owning the underlying securities they are designed to track, although the lack of liquidity on an ETF could result in it being more volatile. Additionally, ETFs have fees and expenses that reduce their value.

The Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities will be valued using the “fair value” procedures approved by the Board. The Board has delegated execution of these procedures to a fair value committee composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) advisor. The committee may also enlist third party consultants such a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist in determining a security-specific fair value. The Board has also engaged a third party valuation firm to, as needed, attend valuation meetings held by the Trust, review minutes of such meetings and report to the Board on a quarterly basis. The Board reviews and ratifies the execution of this process and the resultant fair value prices at least quarterly to assure the process produces reliable results.

Fair Valuation Process – The applicable investments are valued collectively via inputs from each group within the fair value committee. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source); (ii) securities for which, in the judgment of the advisor, the prices or values available do not represent the fair value of the instrument; factors which may cause the advisor to make such a judgment include, but are not limited to, the following: only a bid price or an asked price is available; the spread between bid and asked prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; and (iv) securities with respect to which an event that will affect the value thereof has occurred (a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior to a Fund’s calculation of its net asset value. Specifically, interests in commodity pools or managed futures pools are valued on a daily basis by reference to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. Restricted or illiquid securities, such as private investments or non-traded securities are valued via inputs from the advisor based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If the advisor is unable to obtain a current bid from such independent dealers or other independent parties, the fair value committee shall determine the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

The Fund utilizes various methods to measure the fair value of all of their investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

29

| Conductor Global Equity Value Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| October 31, 2019 |

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.