JMI-6.30.2014-10Q

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

| |

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended June 30, 2014

OR

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

JAVELIN MORTGAGE INVESTMENT CORP.

(Exact name of registrant as specified in its charter)

|

| | |

Maryland | 001-35673 | 45-5517523 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

3001 Ocean Drive, Suite 201, Vero Beach, FL 32963

(Address of principal executive offices)(zip code)

(772) 617-4340

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer o | Accelerated filer x | Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO x

The number of outstanding shares of the Registrant’s common stock as of August 1, 2014 was 11,999,084.

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

TABLE OF CONTENTS

|

| | |

PART I. FINANCIAL INFORMATION | |

Item 1. | Financial Statements | |

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 3. | Quantitative and Qualitative Disclosures about Market Risk | |

Item 4. | Controls and Procedures | |

PART II. OTHER INFORMATION | |

Item 1. | Legal Proceedings | |

Item 1A. | Risk Factors | |

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |

Item 3. | Defaults Upon Senior Securities | |

Item 4. | Mine Safety Disclosures | |

Item 5. | Other Information | |

Item 6. | Exhibits | |

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except per share amounts)

(Unaudited)

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

|

| | | | | | | |

| June 30, 2014 | | December 31, 2013 |

Assets | | | |

Cash | $ | 22,397 |

| | $ | 41,524 |

|

Cash collateral posted to counterparties | 462 |

| | 648 |

|

Agency Securities, available for sale, at fair value (including pledged securities of $1,180,339 and $770,172) | 1,196,872 |

| | 801,777 |

|

Non-Agency Securities, trading, at fair value (including pledged securities of $155,783 and $143,080) | 155,783 |

| | 143,399 |

|

Linked Transactions, net, at fair value (including pledged securities of $126,250 and $140,945) | 14,448 |

| | 16,322 |

|

Derivatives, at fair value | 25,474 |

| | 59,703 |

|

Accrued interest receivable | 3,072 |

| | 2,336 |

|

Prepaid and other assets | 475 |

| | 623 |

|

Total Assets | $ | 1,418,983 |

| | $ | 1,066,332 |

|

Liabilities and Stockholders’ Equity | | | |

Liabilities: | | | |

Repurchase agreements | $ | 1,233,195 |

| | $ | 839,405 |

|

Cash collateral posted by counterparties | 23,766 |

| | 53,314 |

|

Accrued interest payable | 819 |

| | 611 |

|

Accounts payable and other accrued expenses | 451 |

| | 1,722 |

|

Total Liabilities | $ | 1,258,231 |

| | $ | 895,052 |

|

| | | |

Commitments and Contingencies (Note 11) |

| |

|

| | | |

Stockholders’ Equity: | | | |

Preferred stock, $0.001 par value, 25,000 shares authorized, none issued and outstanding at June 30, 2014 and December 31, 2013 | — |

| | — |

|

Common stock, $0.001 par value, 250,000 shares authorized, 11,999 and 11,993 shares issued and outstanding at June 30, 2014 and December 31, 2013 | 12 |

| | 12 |

|

Additional paid-in capital | 244,038 |

| | 243,951 |

|

Accumulated deficit | (90,974 | ) | | (69,540 | ) |

Accumulated other comprehensive income (loss) | 7,676 |

| | (3,143 | ) |

Total Stockholders’ Equity | $ | 160,752 |

| | $ | 171,280 |

|

Total Liabilities and Stockholders’ Equity | $ | 1,418,983 |

| | $ | 1,066,332 |

|

See notes to condensed consolidated financial statements.

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| For the Quarter Ended | | For the Six Months Ended |

| June 30, 2014 | | June 30, 2013 | | June 30, 2014 | | June 30, 2013 |

Interest Income: | | | | | | | |

Agency Securities, net of amortization of premium | $ | 8,031 |

| | $ | 9,336 |

| | $ | 16,476 |

| | $ | 16,480 |

|

Non-Agency Securities, including discount accretion | 2,410 |

| | 1,832 |

| | 4,712 |

| | 3,692 |

|

Total Interest Income | $ | 10,441 |

| | $ | 11,168 |

| | $ | 21,188 |

| | $ | 20,172 |

|

Interest expense | (1,769 | ) | | (1,924 | ) | | (3,300 | ) | | (3,651 | ) |

Net interest income | $ | 8,672 |

| | $ | 9,244 |

| | $ | 17,888 |

| | $ | 16,521 |

|

Other Income (Loss): | | | | | | | |

Realized gain (loss) on sale of Agency Securities (reclassified from Other comprehensive income (loss)) | (34 | ) | | — |

| | 8,776 |

| | — |

|

Gain (loss) on Non-Agency Securities | 288 |

| | (5,635 | ) | | 1,121 |

| | (3,426 | ) |

Realized loss on short sale of U.S. Treasury Securities | — |

| | (390 | ) | | — |

| | (390 | ) |

Unrealized net gain (loss) and net interest income (loss) from Linked Transactions | 2,950 |

| | (2,288 | ) | | 7,460 |

| | (2,288 | ) |

Unrealized loss on sale of U.S. Treasury Securities sold short | — |

| | (2,716 | ) | | — |

| | (2,716 | ) |

Subtotal | $ | 3,204 |

| | $ | (11,029 | ) | | $ | 17,357 |

| | $ | (8,820 | ) |

Realized loss on derivatives (1) | (3,097 | ) | | (1,989 | ) | | (6,203 | ) | | (2,939 | ) |

Unrealized gain (loss) on derivatives | (15,703 | ) | | 43,181 |

| | (35,732 | ) | | 46,626 |

|

Subtotal | $ | (18,800 | ) | | $ | 41,192 |

| | $ | (41,935 | ) | | $ | 43,687 |

|

Total Other Income (Loss) | $ | (15,596 | ) | | $ | 30,163 |

| | $ | (24,578 | ) | | $ | 34,867 |

|

Expenses: | | | | | | | |

Management fee | 915 |

| | 790 |

| | 1,828 |

| | 1,352 |

|

Professional fees | 422 |

| | 138 |

| | 1,164 |

| | 333 |

|

Insurance | 111 |

| | 56 |

| | 220 |

| | 112 |

|

Board compensation | 233 |

| | 67 |

| | 357 |

| | 150 |

|

Other | 171 |

| | 119 |

| | 380 |

| | 226 |

|

Total expenses | $ | 1,852 |

| | $ | 1,170 |

| | $ | 3,949 |

| | $ | 2,173 |

|

Net income (loss) before taxes | (8,776 | ) | | 38,237 |

| | (10,639 | ) | | 49,215 |

|

Income tax expense | — |

| | — |

| | — |

| | (2 | ) |

Net Income (Loss) | $ | (8,776 | ) | | $ | 38,237 |

| | $ | (10,639 | ) | | $ | 49,213 |

|

Net Income (Loss) per common share: | $ | (0.73 | ) | | $ | 3.56 |

| | $ | (0.89 | ) | | $ | 5.39 |

|

Weighted average common shares outstanding | 11,996 |

| | 10,731 |

| | 11,928 |

| | 9,124 |

|

Dividends | | | | | | | |

Common stock dividends declared | $ | 5,398 |

| | $ | 7,935 |

| | $ | 10,795 |

| | $ | 13,110 |

|

Common stock dividends declared per share | $ | 0.45 |

| | $ | 0.69 |

| | $ | 0.90 |

| | $ | 1.38 |

|

Common shares of record-end of period | 11,999 |

| | 13,500 |

| | 11,999 |

| | 13,500 |

|

| |

(1) | Interest expense related to our interest rate swap contracts is recorded in realized loss on derivatives on the condensed consolidated statements of operations. For additional information, see Note 10 to the condensed consolidated financial statements. |

See notes to condensed consolidated financial statements.

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| For the Quarter Ended | | For the Six Months Ended |

| June 30, 2014 | | June 30, 2013 | | June 30, 2014 | | June 30, 2013 |

Net Income (Loss) | $ | (8,776 | ) | | $ | 38,237 |

| | $ | (10,639 | ) | | $ | 49,213 |

|

Other comprehensive income (loss): | | | | | | | |

Reclassification adjustment for realized (gain) loss on sale of Agency Securities | 34 |

| | — |

| | (8,776 | ) | | — |

|

Net unrealized gain (loss) on available for sale Agency Securities | 14,297 |

| | (77,461 | ) | | 19,595 |

| | (93,301 | ) |

Other comprehensive income (loss) | $ | 14,331 |

| | $ | (77,461 | ) | | $ | 10,819 |

| | $ | (93,301 | ) |

Comprehensive Income (Loss) | $ | 5,555 |

| | $ | (39,224 | ) | | $ | 180 |

| | $ | (44,088 | ) |

See notes to condensed consolidated financial statements.

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

(in thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | |

| Shares | | Par Amount | | Additional Paid-in Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Income (Loss) | | Total |

Balance, January 1, 2014 | 11,993 |

| | $ | 12 |

| | $ | 243,951 |

| | $ | (69,540 | ) | | $ | (3,143 | ) | | $ | 171,280 |

|

Common stock dividends declared | — |

| | — |

| | — |

| | (10,795 | ) | | — |

| | (10,795 | ) |

Stock based board compensation, net of withholding requirements | 6 |

| | — |

| | 87 |

| | — |

| | — |

| | 87 |

|

Net loss | — |

| | — |

| | — |

| | (10,639 | ) | | — |

| | (10,639 | ) |

Other comprehensive income | — |

| | — |

| | — |

| | — |

| | 10,819 |

| | 10,819 |

|

Balance, June 30, 2014 | 11,999 |

| | $ | 12 |

| | $ | 244,038 |

| | $ | (90,974 | ) | | $ | 7,676 |

| | $ | 160,752 |

|

See notes to condensed consolidated financial statements.

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(Unaudited)

|

| | | | | | | |

| For the Six Months Ended |

| June 30, 2014 | | June 30, 2013 |

Cash Flows From Operating Activities: | | | |

Net income (loss) | $ | (10,639 | ) | | $ | 49,213 |

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |

| | |

|

Net amortization of premium on Agency Securities | 1,350 |

| | 2,627 |

|

Net change in discount on Non-Agency Securities | (326 | ) | | 596 |

|

Realized gain on sale of Agency Securities | (8,776 | ) | | — |

|

(Gain) loss on Non-Agency Securities | (1,121 | ) | | 3,426 |

|

Unrealized net (gain) loss and net interest income from Linked Transactions | (7,460 | ) | | 2,288 |

|

Stock based Board compensation | 87 |

| | — |

|

Gain on short sale of U.S. Treasury Securities | — |

| | 390 |

|

Changes in operating assets and liabilities: | | | |

Increase in accrued interest receivable | (736 | ) | | (2,264 | ) |

(Increase) decrease in prepaid and other assets | 148 |

| | (155 | ) |

(Increase) decrease in derivatives, at fair value | 34,229 |

| | (43,650 | ) |

Increase in accrued interest payable | 208 |

| | 27 |

|

Increase (decrease) in accounts payable and other accrued expenses | (1,271 | ) | | 174 |

|

Net cash provided by operating activities | $ | 5,693 |

| | $ | 12,672 |

|

Cash Flows From Investing Activities: | | | |

Purchases of Agency Securities | (1,161,461 | ) | | (858,581 | ) |

Purchases of Non-Agency Securities | (12,020 | ) | | (33,275 | ) |

Cash receipts (disbursements) on Linked Transactions | 3,369 |

| | (11,015 | ) |

Principal repayments of Agency Securities | 43,659 |

| | 43,042 |

|

Principal repayments of Non-Agency Securities | 7,048 |

| | 10,246 |

|

Proceeds from sales of Agency Securities | 740,952 |

| | — |

|

Disbursements on reverse repurchase agreements | — |

| | (1,008,393 | ) |

Receipts from reverse repurchase agreements | — |

| | 771,375 |

|

Change in cash collateral, net | (29,362 | ) | | (8,798 | ) |

Net cash used in investing activities | $ | (407,815 | ) | | $ | (1,095,399 | ) |

Cash Flows From Financing Activities: | | | |

Issuance of common stock, net of expenses | — |

| | 113,217 |

|

Proceeds from repurchase agreements | 4,059,645 |

| | 5,207,875 |

|

Principal repayments on repurchase agreements | (3,665,855 | ) | | (4,447,735 | ) |

Proceeds from sales of U.S. Treasury Securities | — |

| | 304,228 |

|

Purchases of U.S. Treasury Securities | — |

| | (70,126 | ) |

Common stock dividends paid | (10,795 | ) | | (13,110 | ) |

Net cash provided by financing activities | $ | 382,995 |

| | $ | 1,094,349 |

|

Net increase (decrease) in cash | (19,127 | ) | | 11,622 |

|

Cash - beginning of period | 41,524 |

| | 36,316 |

|

Cash - end of period | $ | 22,397 |

| | $ | 47,938 |

|

Supplemental Disclosure: | | | |

Cash paid during the period for interest | $ | 8,969 |

| | $ | 3,560 |

|

Non-Cash Investing and Financing Activities: | | | |

Unrealized gain (loss) on investment in available for sale Agency Securities | $ | 19,595 |

| | $ | (93,301 | ) |

Linked Transaction value of purchased Non-Agency Securities | $ | 5,965 |

| | $ | — |

|

See notes to condensed consolidated financial statements.

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

(Unaudited)

Note 1 – Basis of Presentation

The accompanying consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X promulgated by the Securities and Exchange Commission (the “SEC”). Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of only normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the quarter and six months ended June 30, 2014 are not necessarily indicative of the results that may be expected for the calendar year ending December 31, 2014. These unaudited financial statements should be read in conjunction with the audited financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2013.

The condensed consolidated financial statements include the accounts of JAVELIN Mortgage Investment Corp. and its subsidiary. All intercompany accounts and transactions have been eliminated. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates affecting the accompanying financial statements include the valuation of MBS (as defined below) and derivative instruments.

Note 2 – Organization and Nature of Business Operations

References to “we,” “us,” “our,” "JAVELIN" or the “Company” are to JAVELIN Mortgage Investment Corp. References to "ARRM" are to ARMOUR Residential Management LLC, a Delaware limited liability company.

We are an externally managed Maryland corporation formed on June 18, 2012 and managed by ARRM, an investment advisor registered with the SEC (see Note 15, “Related Party Transactions” for additional discussion). We invest primarily in fixed rate and hybrid adjustable rate mortgage backed securities. Some of these securities are issued or guaranteed by a United States (“U.S.”) Government-sponsored entity (“GSE”), such as the Federal National Mortgage Association (Fannie Mae), the Federal Home Loan Mortgage Corporation (Freddie Mac), or guaranteed by the Government National Mortgage Administration (Ginnie Mae) (collectively, “Agency Securities”). Other securities backed by residential mortgages in which we invest, for which the payment of principal and interest is not guaranteed by a GSE or government agency (collectively, “Non-Agency Securities” and together with Agency Securities, “MBS”), may benefit from credit enhancement derived from structural elements such as subordination, over collateralization or insurance. We also may invest in collateralized commercial mortgage backed securities and other mortgage related investments, including mortgage loans, mortgage related derivatives and mortgage servicing rights. From time to time, a portion of our assets may be invested in unsecured notes and bonds issued by GSEs, U.S. Treasuries and money market instruments, subject to certain income tests we must satisfy for our qualification as a real estate investment trust (“REIT”). Our charter permits us to invest in Agency Securities and Non-Agency Securities.

We have elected to be taxed as a REIT under the Internal Revenue Code (the “Code”). Our qualification as a REIT depends on our ability to meet, on a continuing basis, various complex requirements under the Code relating to, among other things, the sources of our gross income, the composition and values of our assets, our distribution levels and the concentration of ownership of our capital stock. We believe that we are organized in conformity with the requirements for qualification as a REIT under the Code and our manner of operations enables us to meet the requirements for taxation as a REIT for federal income tax purposes.

As a REIT, we will generally not be subject to federal income tax on the taxable REIT income that we currently distribute to our stockholders. If we fail to qualify as a REIT in any taxable year and do not qualify for certain statutory relief provisions, we will be subject to federal income tax at regular corporate rates. Even if we qualify as a REIT for federal income tax purposes, we may still be subject to some federal, state and local taxes on our income.

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

(Unaudited)

Note 3 – Summary of Significant Accounting Policies

Cash

Cash includes cash on deposit with financial institutions. We may maintain deposits in federally insured financial institutions in excess of federally insured limits. However, management believes we are not exposed to significant credit risk due to the financial position and creditworthiness of the depository institutions in which those deposits are held.

Cash Collateral Posted To/By Counterparties

Cash collateral posted to/by counterparties represents cash posted by us to counterparties or posted by counterparties to us as collateral for our interest rate swap contracts (including swaptions) and repurchase agreements on our MBS.

MBS, at Fair Value

We generally intend to hold most of our MBS for extended periods of time. We may, from time to time, sell any of our MBS as part of the overall management of our MBS portfolio. Management determines the appropriate classifications of the securities at the time they are acquired and evaluates the appropriateness of such classifications at each balance sheet date.

Purchases and sales of our MBS are recorded on the trade date. However, if on the purchase settlement date, a repurchase agreement is used to finance the purchase of an MBS with the same counterparty and such transactions are determined to be linked, then the MBS and linked repurchase borrowing will be reported on the same settlement date as Linked Transactions (see below).

Agency Securities

At June 30, 2014 and December 31, 2013, all of our Agency Securities were classified as available for sale securities. Agency Securities classified as available for sale are reported at their estimated fair values with unrealized gains and losses excluded from earnings and reported as part of the condensed consolidated statements of comprehensive income (loss).

We evaluate Agency Securities for other than temporary impairment at least on a quarterly basis and more frequently when economic or market concerns warrant such evaluation. We consider an impairment to be other than temporary if we (1) have the intent to sell the Agency Securities, (2) believe it is more likely than not that we will be required to sell the securities before recovery (for example, because of liquidity requirements or contractual obligations) or (3) a credit loss exists. Impairment losses recognized establish a new cost basis for the related Agency Securities.

Non-Agency Securities

At June 30, 2014 and December 31, 2013, all of our Non-Agency Securities were classified as trading securities. Non-Agency Securities classified as trading are reported at their estimated fair values with unrealized gains and losses included in other income (loss) as a component of the statements of operations. We estimate future cash flows for each Non-Agency Security and then discount those cash flows based on our estimates of current market yield for each individual security. We then compare our calculated price with our pricing services and/or dealer marks. Our estimates for future cash flows and current market yields incorporate such factors as coupons, prepayment speeds, defaults, delinquencies and severities.

Accrued Interest Receivable and Payable

Accrued interest receivable includes interest accrued between payment dates on MBS. Accrued interest payable includes interest payable on our repurchase agreements.

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

(Unaudited)

Repurchase Agreements

We finance the acquisition of our MBS through the use of repurchase agreements. Our repurchase agreements are secured by our MBS and bear interest rates that have historically moved in close relationship to the Federal Funds Rate and the London Interbank Offered Rate (“LIBOR”). Under these repurchase agreements, we sell MBS to a lender and agree to repurchase the same MBS in the future for a price that is higher than the original sales price. The difference between the sales price that we receive and the repurchase price that we pay represents interest paid to the lender. A repurchase agreement operates as a financing arrangement (with the exception of repurchase agreements accounted for as a component of a Linked Transaction described below) under which we pledge our MBS as collateral to secure a loan which is equal in value to a specified percentage of the estimated fair value of the pledged collateral. We retain beneficial ownership of the pledged collateral. At the maturity of a repurchase agreement, we are required to repay the loan and concurrently receive back our pledged collateral from the lender or, with the consent of the lender, we may renew such agreement at the then prevailing interest rate. The repurchase agreements may require us to pledge additional assets to the lender in the event the estimated fair value of the existing pledged collateral declines.

In addition to the repurchase agreement financing discussed above, we may enter into reverse repurchase agreements with certain of our repurchase agreement counterparties. Under a typical reverse repurchase agreement, we purchase U.S. Treasury Securities from a borrower in exchange for cash and agree to sell the same securities in the future in exchange for a price that is higher than the original purchase price. The difference between the purchase price originally paid and the sale price represents interest received from the borrower. Reverse repurchase agreement receivables and repurchase agreement liabilities are presented net when they meet certain criteria, including being with the same counterparty, being governed by the same master repurchase agreement ("MRA"), settlement through the same brokerage or clearing account and maturing on the same day. We did not have any reverse repurchase agreements outstanding at June 30, 2014 or December 31, 2013.

Obligations to Return Securities Received as Collateral, at Fair Value

At certain times, we also sell to third parties the U.S. Treasury Securities received as collateral for reverse repurchase agreements and recognize the resulting obligation to return said U.S. Treasury Securities as a liability on our condensed consolidated balance sheets. Interest is recorded on the repurchase agreements, reverse repurchase agreements and U.S. Treasury Securities sold short on an accrual basis and presented as net interest expense. Both parties to the transaction have the right to make daily margin calls based on changes in the fair value of the collateral received and/or pledged. We did not have any obligations to return securities received as collateral at June 30, 2014 or December 31, 2013.

Derivatives, at Fair Value

We recognize all derivatives as either assets or liabilities at fair value on our condensed consolidated balance sheets. All changes in the fair values of our derivatives are reflected in our condensed consolidated statements of operations. We designate derivatives as hedges for tax purposes and any unrealized derivative gains or losses do not affect our distributable net taxable income.

Linked Transactions

The initial purchase of Non-Agency Securities and the related contemporaneous repurchase financing of such MBS with the same counterparty are considered part of the same arrangement, or a “Linked Transaction,” when certain criteria are met. Our acquisition of a Non-Agency Security and a related repurchase financing provided by the seller are generally considered to be linked if the initial transfer of and repurchase financing are contractually contingent, or there is a limited secondary market for the purchased security. The components of a Linked Transaction are evaluated on a combined basis and in totality, accounted for as a forward contract and reported as “Linked Transactions” on our balance sheets. Changes in the fair value of the Non-Agency Securities and repurchase liabilities underlying the Linked Transactions and associated interest income and expense are reported as “unrealized net gains and net interest income from Linked Transactions” on our statements of operations and are not included in other comprehensive loss. When the linking criteria are no longer met, the initial transfer (i.e., the purchase of a security) and repurchase financing will no longer be treated as a Linked Transaction and will be evaluated and reported separately as a MBS purchase and repurchase financing.

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

(Unaudited)

Preferred Stock

At June 30, 2014, we were authorized to issue up to 25,000 shares of preferred stock, par value $0.001 per share, with such designations, voting and other rights and preferences as may be determined from time to time by our Board of Directors ("Board") or a committee thereof. We have not issued any preferred stock to date.

Common Stock

At June 30, 2014, we were authorized to issue up to 250,000 shares of common stock, par value $0.001 per share, with such designations, voting and other rights and preferences as may be determined from time to time by our Board. We had 11,999 shares of common stock issued and outstanding at June 30, 2014 and 11,993 shares of common stock issued and outstanding at December 31, 2013.

Common Stock Repurchased

On October 30, 2013, we announced that our Board had authorized a stock repurchase program of up to 2,000 shares of our common stock outstanding (the “Repurchase Program”). On March 5, 2014, our Board increased the authorization to 3,000 shares of our common stock outstanding. Under the Repurchase Program, shares may be purchased in the open market, including block trades, through privately negotiated transactions, or pursuant to a trading plan separately adopted in the future. The timing, manner, price and amount of any repurchases will be at our discretion, subject to the requirements of the Securities Exchange Act of 1934, as amended, and related rules. We are not required to repurchase any shares under the Repurchase Program and it may be modified, suspended or terminated at any time for any reason. We do not intend to purchase shares from our Board or other affiliates. Under Maryland law, such repurchased shares are treated as authorized but unissued shares. For the six months ended June 30, 2014, we did not repurchase any shares under our Repurchase Program. At June 30, 2014, there were 1,493 remaining shares authorized for repurchase under our Repurchase Program.

Revenue Recognition

Interest income is earned and recognized on Agency Securities based on their unpaid principal balance and their contractual terms. Premiums and discounts associated with the purchase of Agency Securities are amortized or accreted into interest income over the actual lives of the securities, reflecting actual prepayments as they occur.

Interest income on Non-Agency Securities is recognized using the effective yield method over the life of the securities based on the future cash flows expected to be received. Future cash flow projections and related effective yields are determined for each security and updated quarterly. Other than temporary impairments, which establish a new cost basis in the security for purposes of calculating effective yields, are recognized when the fair value of a security is less than its cost basis and there has been an adverse change in the future cash flows expected to be received. Other changes in future cash flows expected to be received are recognized prospectively over the remaining life of the security.

Comprehensive Income (Loss)

Comprehensive income (loss) refers to changes in equity during a period from transactions and other events and circumstances from non-owner sources. It includes all changes in equity during a period, except those resulting from investments by owners and distributions to owners.

Note 4 – Recent Accounting Pronouncements

In June 2014, the Financial Accounting Standards Board released ASU No. 2014-11, Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures, Transfers and Servicing (Topic 860). The amendment changes the accounting for repurchase financing transactions, that is, a transfer of a financial asset financed by a repurchase agreement with the same counterparty. Currently, certain of these transactions are combined and accounted for as a forward contract and reported as "Linked Transactions" on our balance sheets. Under the amendment, these arrangements will no longer be presented as Linked Transactions on our balance sheets but will instead be accounted for as purchases of Non-Agency trading securities and repurchase agreement liabilities.

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

(Unaudited)

The amendment also changes the accounting for repurchase-to-maturity transactions to secured borrowing accounting. We do not currently have, and do not contemplate having, repurchase-to-maturity transactions.

The accounting changes are effective for the Company beginning on January 1, 2015 and early adoption is prohibited. We currently account for Linked Transactions and Non-Agency Securities all on a fair value basis. Accordingly, we expect the adoption of this amendment will have no effect on our results of operations or our accumulated deficit.

The amendment also requires certain additional disclosures about repurchase agreements beginning in the second quarter of 2015.

Note 5 – Fair Value of Financial Instruments

Our valuation techniques for financial instruments use observable and unobservable inputs. Observable inputs reflect readily obtainable data from third party sources, while unobservable inputs reflect management’s market assumptions. The ASC Topic No. 820 “Fair Value Measurement” classifies these inputs into the following hierarchy:

Level 1 Inputs - Quoted prices for identical instruments in active markets.

Level 2 Inputs - Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 Inputs - Prices determined using significant unobservable inputs. Unobservable inputs may be used in situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment at the end of the period). Unobservable inputs reflect management’s assumptions about the factors that market participants would use in pricing an asset or liability, and would be based on the best information available.

The following describes the valuation techniques used for our assets and liabilities measured at fair value, as well as the general classification of such instruments pursuant to the valuation hierarchy. Any transfers between levels are assumed to occur at the beginning of the reporting period.

Cash - Cash includes cash on deposit with financial institutions. The carrying amount of cash is deemed to be its fair value and is classified as Level 1. Cash balances posted by us to counterparties or held by us from counterparties as collateral are classified as Level 2.

Agency Securities, Available for Sale - Fair value for the Agency Securities in our MBS portfolio is based on obtaining a valuation for each Agency Security from third party pricing services and/or dealer quotes. The third party pricing services use common market pricing methods that may include pricing models that may incorporate such factors as coupons, prepayment speeds, spread to the Treasury curves and interest rate swap curves, duration, periodic and life caps and credit enhancement. If the fair value of an Agency Security is not available from the third party pricing services or such data appears unreliable, we obtain quotes from up to three dealers who make markets in similar Agency Securities. In general, the dealers incorporate common market pricing methods, including a spread measurement to the Treasury curve or interest rate swap curve as well as underlying characteristics of the particular Agency Security including coupon, periodic and life caps, collateral type, rate reset period and seasoning or age of the Agency Security. Management reviews pricing used to ensure that current market conditions are properly reflected. This review includes, but is not limited to, comparisons of similar market transactions or alternative third party pricing services, dealer quotes and comparisons to a third party pricing model. Fair values obtained from the third party pricing services for similar instruments are classified as Level 2 securities if the inputs to the pricing models used are consistent with the Level 2 definition. If quoted prices for a security are not reasonably available from the third party pricing service, but dealer quotes are, the security will be classified as a Level 2 security. If neither is available, management will determine the fair value based on characteristics of the security that we receive from the issuer and based on available market information received from dealers and classify it as a Level 3 security. At June 30, 2014 and December 31, 2013, all of our Agency Security fair values are classified as Level 2 based on the inputs used by our third party pricing services and dealer quotes.

Non-Agency Securities Trading - The fair value for the Non-Agency Securities in our MBS portfolio is based on estimates prepared by our Portfolio Management group, which organizationally reports to our Chief Investment Officer. In preparing the estimates, our Portfolio Management group uses commercially available and proprietary models and data as well as market

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

(Unaudited)

intelligence gained from discussions with, and transactions by, other market participants. We estimate the fair value of our Non-Agency Securities by estimating the future cash flows for each Non-Agency Security and then discounting those cash flows based on our estimates of current market yield for each individual security. Our estimates for future cash flows and current market yields incorporate such factors as collateral type, bond structure and priority of payments, coupons, prepayment speeds, defaults, delinquencies and severities. Quarterly, we compare our estimates of fair value of our Non-Agency Securities with pricing from third party pricing services, dealer marks received and recent purchase and financing transaction history to validate our assumptions of cash flow and market yield and calibrate our models. Fair values calculated in this manner are considered Level 3. At June 30, 2014 and December 31, 2013, all of our Non-Agency Security fair values are calculated in this manner and therefore were classified as Level 3.

Repurchase Agreements - The fair value of repurchase agreements reflects the present value of the contractual cash flows discounted at the estimated LIBOR based market interest rates at the valuation date for repurchase agreements with a term equivalent to the remaining term to interest rate repricing, which may be at maturity, of our repurchase agreements. The fair value of the repurchase agreements approximates their carrying amount due to the short-term nature of these financial instruments. Our repurchase agreements are classified as Level 2.

Obligations to Return Securities Received as Collateral - The fair value of the obligations to return securities received as collateral are based upon the prices of the related U.S. Treasury Securities obtained from a third party pricing service, which are indicative of market activity. Such obligations are classified as Level 1.

Derivative Transactions - The fair values of our interest rate swap contracts and interest rate swaptions are valued using third party pricing services that may incorporate current interest rate curves, forward interest rate curves and market spreads to interest rate curves. Management compares pricing used to dealer quotes to ensure that the current market conditions are properly reflected. The fair values of our interest rate swap contracts and our interest rate swaptions are classified as Level 2.

Linked Transactions - The Non-Agency Securities underlying our Linked Transactions are valued using similar techniques to those used for our other Non-Agency Securities. The value of the underlying Non-Agency Security is then netted against the carrying amount (which approximates fair value) of the repurchase agreement at the valuation date. The fair value of Linked Transactions also includes accrued interest receivable on the Non-Agency Security and accrued interest payable on the underlying repurchase agreement. Our Linked Transactions are classified as Level 3.

The following tables provide a summary of our assets that are measured at fair value on a recurring basis at June 30, 2014 and December 31, 2013.

|

| | | | | | | | | | | | | | | |

| Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | | Balance at June 30, 2014 |

Assets at Fair Value: | | | | | | | |

Agency Securities, available for sale | $ | — |

| | $ | 1,196,872 |

| | $ | — |

| | $ | 1,196,872 |

|

Non-Agency Securities, trading | $ | — |

| | $ | — |

| | $ | 155,783 |

| | $ | 155,783 |

|

Linked Transactions, net | $ | — |

| | $ | — |

| | $ | 14,448 |

| | $ | 14,448 |

|

Derivatives | $ | — |

| | $ | 25,474 |

| | $ | — |

| | $ | 25,474 |

|

There were no transfers of assets or liabilities between levels of the fair value hierarchy during the quarter and six months ended June 30, 2014.

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | | Balance at December 31, 2013 |

Assets at Fair Value: | | | | | | | |

Agency Securities, available for sale | $ | — |

| | $ | 801,777 |

| | $ | — |

| | $ | 801,777 |

|

Non-Agency Securities, trading | $ | — |

| | $ | — |

| | $ | 143,399 |

| | $ | 143,399 |

|

Linked Transactions, net | $ | — |

| | $ | — |

| | $ | 16,322 |

| | $ | 16,322 |

|

Derivatives | $ | — |

| | $ | 59,703 |

| | $ | — |

| | $ | 59,703 |

|

There were no transfers of assets or liabilities between levels of the fair value hierarchy during the year ended December 31, 2013.

The following tables provide a summary of the carrying values and fair values of our financial assets and liabilities not carried at fair value but for which fair value is required to be disclosed at June 30, 2014 and December 31, 2013.

|

| | | | | | | | | | | | | | | | | | | |

| June 30, 2014 | | Fair Value Measurements using: |

| Carrying Value | | Fair Value | | Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) |

Financial Assets: | | | | | | | | | |

Cash | $ | 22,397 |

| | $ | 22,397 |

| | $ | 22,397 |

| | $ | — |

| | $ | — |

|

Cash collateral posted to counterparties | $ | 462 |

| | $ | 462 |

| | $ | — |

| | $ | 462 |

| | $ | — |

|

Accrued interest receivable | $ | 3,072 |

| | $ | 3,072 |

| | $ | — |

| | $ | 3,072 |

| | $ | — |

|

Financial Liabilities: | | | | | | | | | |

Repurchase agreements | $ | 1,233,195 |

| | $ | 1,233,195 |

| | $ | — |

| | $ | 1,233,195 |

| | $ | — |

|

Cash collateral posted by counterparties | $ | 23,766 |

| | $ | 23,766 |

| | $ | — |

| | $ | 23,766 |

| | $ | — |

|

Accrued interest payable | $ | 819 |

| | $ | 819 |

| | $ | — |

| | $ | 819 |

| | $ | — |

|

|

| | | | | | | | | | | | | | | | | | | |

| December 31, 2013 | | Fair Value Measurements using: |

| Carrying Value | | Fair Value | | Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) |

Financial Assets: | | | | | | | | | |

Cash | $ | 41,524 |

| | $ | 41,524 |

| | $ | 41,524 |

| | $ | — |

| | $ | — |

|

Cash collateral posted to counterparties | $ | 648 |

| | $ | 648 |

| | $ | — |

| | $ | 648 |

| | $ | — |

|

Accrued interest receivable | $ | 2,336 |

| | $ | 2,336 |

| | $ | — |

| | $ | 2,336 |

| | $ | — |

|

Financial Liabilities: | | | | | | | | | |

Repurchase agreements | $ | 839,405 |

| | $ | 839,405 |

| | $ | — |

| | $ | 839,405 |

| | $ | — |

|

Cash collateral posted by counterparties | $ | 53,314 |

| | $ | 53,314 |

| | $ | — |

| | $ | 53,314 |

| | $ | — |

|

Accrued interest payable | $ | 611 |

| | $ | 611 |

| | $ | — |

| | $ | 611 |

| | $ | — |

|

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

(Unaudited)

The following tables provide a summary of the changes in Level 3 assets measured at fair value on a recurring basis for the quarter and six months ended June 30, 2014 and June 30, 2013.

|

| | | | | | | | | | | | | | | | |

Non-Agency Securities | | For the Quarter Ended | | For the Six Months Ended |

| | June 30, 2014 | | June 30, 2013 | | June 30, 2014 | | June 30, 2013 |

Balance, beginning of period | | $ | 142,409 |

| | $ | 136,752 |

| | $ | 143,399 |

| | $ | 129,946 |

|

Purchase of Non-Agency Securities, at cost | | 16,735 |

| | 23,518 |

| | 17,985 |

| | 33,275 |

|

Principal repayments of Non-Agency Securities | | (3,648 | ) | | (5,371 | ) | | (7,048 | ) | | (10,246 | ) |

Gain (loss) on Non-Agency Securities | | 288 |

| | (5,635 | ) | | 1,121 |

| | (3,426 | ) |

Net change in discount on Non-Agency Securities | | (1 | ) | | (311 | ) | | 326 |

| | (596 | ) |

Balance, end of period | | $ | 155,783 |

| | $ | 148,953 |

| | $ | 155,783 |

| | $ | 148,953 |

|

Gain (loss) on Non-Agency Securities | | $ | 288 |

| | $ | (5,635 | ) | | $ | 1,121 |

| | $ | (3,426 | ) |

|

| | | | | | | | | | | | | | | | |

Linked Transactions | | For the Quarter Ended | | For the Six Months Ended |

| | June 30, 2014 | | June 30, 2013 | | June 30, 2014 | | June 30, 2013 |

Balance, beginning of period | | $ | 20,069 |

| | $ | — |

| | $ | 16,322 |

| | $ | — |

|

Linked Transaction value of purchased Non-Agency Securities | | (5,965 | ) | | — |

| | (5,965 | ) | | — |

|

Cash (receipts) disbursements on Linked Transactions | | (2,606 | ) | | 11,015 |

| | (3,369 | ) | | 11,015 |

|

Unrealized net gain (loss) and net interest income from Linked Transactions | | 2,950 |

| | (2,288 | ) | | 7,460 |

| | (2,288 | ) |

Balance, end of period | | $ | 14,448 |

| | $ | 8,727 |

| | $ | 14,448 |

| | $ | 8,727 |

|

Gains (losses) on Linked Transactions | | $ | 2,950 |

| | $ | (2,288 | ) | | $ | 7,460 |

| | $ | (2,288 | ) |

The significant unobservable inputs used in the fair value measurement of our Level 3 Non-Agency Securities (inclusive of Non-Agency Securities underlying Linked Transactions) include assumptions for underlying loan collateral cumulative default rates and loss severities in the event of default, as well as discount rates.

The following tables present the range of our estimates of cumulative default and loss severities, together with the discount rates implicit in our Level 3 Non-Agency Security fair values (inclusive of Non-Agency Securities underlying Linked Transactions) at June 30, 2014 and December 31, 2013. See Note 8, "Linked Transactions" for additional discussion of Non-Agency Securities that are accounted for as a component of Linked Transactions.

June 30, 2014

|

| | | | | | | | |

Unobservable Level 3 Input | Minimum | | Weighted Average | | Maximum |

Cumulative default | 0.00 | % | | 9.05 | % | | 30.05 | % |

Loss severity (life) | 4.80 | % | | 35.16 | % | | 73.10 | % |

Discount rate | 2.59 | % | | 4.70 | % | | 6.50 | % |

Delinquency (life) | 0.40 | % | | 9.52 | % | | 38.60 | % |

Voluntary prepayments (life) | 7.00 | % | | 9.08 | % | | 12.70 | % |

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

(Unaudited)

December 31, 2013

|

| | | | | | | | |

Unobservable Level 3 Input | Minimum | | Weighted Average | | Maximum |

Cumulative default | 0.00 | % | | 6.99 | % | | 33.27 | % |

Loss severity (life) | 0.00 | % | | 31.20 | % | | 62.60 | % |

Discount rate | 4.01 | % | | 5.32 | % | | 6.50 | % |

Delinquency (life) | 0.00 | % | | 9.74 | % | | 29.50 | % |

Voluntary prepayments (life) | 6.70 | % | | 9.74 | % | | 14.80 | % |

Significant increases or decreases in any of these inputs in isolation would result in a significantly lower or higher fair value measurement. Generally, a change in the assumption used for the probability of cumulative default is accompanied by a directionally similar change in the assumption used for the loss severity and a directionally opposite change in the assumption used for voluntary prepayment rates (life). However, given the interrelationship between loss estimates and the discount rate, overall Non-Agency Security market conditions would likely have a more significant impact on our Level 3 fair values than changes in any one unobservable input.

Note 6 – Agency Securities, Available for Sale

All of our Agency Securities are classified as available for sale securities and, as such, are reported at their estimated fair value and changes in fair value are reported as part of the statements of comprehensive income. At June 30, 2014, investments in Agency Securities accounted for 88.5% of our MBS portfolio and 80.9% of our total MBS portfolio inclusive of the Non-Agency Securities underlying our Linked Transactions. As of December 31, 2013, investments in Agency Securities accounted for 84.8% of our MBS portfolio and 73.8% of our total MBS portfolio inclusive of the Non-Agency Securities underlying our Linked Transactions (see Note 8, “Linked Transactions” for additional discussion of Non-Agency Securities that are accounted for as a component of Linked Transactions).

We evaluated our Agency Securities with unrealized losses at June 30, 2014, June 30, 2013 and December 31, 2013, to determine whether there was an other than temporary impairment. The decline in value of our Agency Securities in 2013 was solely due to market conditions and not the credit quality of the assets. All of our Agency Securities are issued and guaranteed by GSEs. The GSEs have a long term credit rating of AA+. At June 30, 2014 and December 31, 2013, we also considered whether we intended to sell Agency Securities and whether it was more likely than not that we could meet our liquidity requirements and contractual obligations without selling Agency Securities. There was no other than temporary impairment for the quarter and six months ended June 30, 2014 and June 30, 2013. In December 2013, anticipating portfolio repositioning sales in the first quarter of 2014, we concluded that the December 31, 2013 unrealized losses on our 25-year and 30-year fixed rate Agency Securities represented an other than temporary impairment. Accordingly, we recognized losses totaling $(44,300) in our 2013 statements of operations, thereby establishing a new cost basis for Agency Securities with aggregate fair value of $744,600 as of December 31, 2013. We also determined that at December 31, 2013, there was no other than temporary impairment of our other Agency Securities, which are primarily 20-year and 15-year fixed rate securities.

At June 30, 2014, we had the following securities in an unrealized gain or loss position as presented below. The components of the carrying value of our Agency Securities at June 30, 2014 are also presented below. All of our Agency Securities are fixed rate securities with a weighted average coupon of 3.23% at June 30, 2014.

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

(Unaudited)

June 30, 2014

|

| | | | | | | | | | | | | | | | | | |

| | Amortized Cost | | Gross Unrealized Loss | | Gross Unrealized Gain | | Fair Value | Percent of Total |

Fannie Mae | | | | | | | | | |

Multi-Family MBS | | $ | 55,043 |

| | $ | (37 | ) | | $ | 839 |

| | $ | 55,845 |

| 4.70 | % |

15 Year Fixed | | 1,085,631 |

| | (489 | ) | | 8,115 |

| | 1,093,257 |

| 91.30 | % |

20 Year Fixed | | 48,522 |

| | (1,031 | ) | | 279 |

| | 47,770 |

| 4.00 | % |

Total Fannie Mae | | $ | 1,189,196 |

| | $ | (1,557 | ) | | $ | 9,233 |

| | $ | 1,196,872 |

| 100.00 | % |

Total Agency Securities | | $ | 1,189,196 |

| | $ | (1,557 | ) | | $ | 9,233 |

| | $ | 1,196,872 |

| |

As of December 31, 2013, we had the following securities in an unrealized gain or loss position as presented below. The components of the carrying value of our Agency Securities as of December 31, 2013 are also presented below. All of our Agency Securities were fixed rate securities with a weighted average coupon of 3.48% as of December 31, 2013.

December 31, 2013

|

| | | | | | | | | | | | | | | | | | |

| | Amortized Cost | | Gross Unrealized Loss | | Gross Unrealized Gain | | Fair Value | Percent of Total |

Fannie Mae | | | | | | | | | |

15 Year Fixed | | $ | 29,336 |

| | $ | (1,057 | ) | | $ | — |

| | $ | 28,279 |

| 3.53 | % |

20 Year Fixed | | 30,974 |

| | (2,086 | ) | | — |

| | 28,888 |

| 3.60 | % |

25 Year Fixed | | 52,944 |

| | — |

| | — |

| | 52,944 |

| 6.60 | % |

30 Year Fixed | | 691,666 |

| | — |

| | — |

| | 691,666 |

| 86.27 | % |

Total Fannie Mae | | $ | 804,920 |

| | $ | (3,143 | ) | | $ | — |

| | $ | 801,777 |

| 100.00 | % |

Total Agency Securities | | $ | 804,920 |

| | $ | (3,143 | ) | | $ | — |

| | $ | 801,777 |

| |

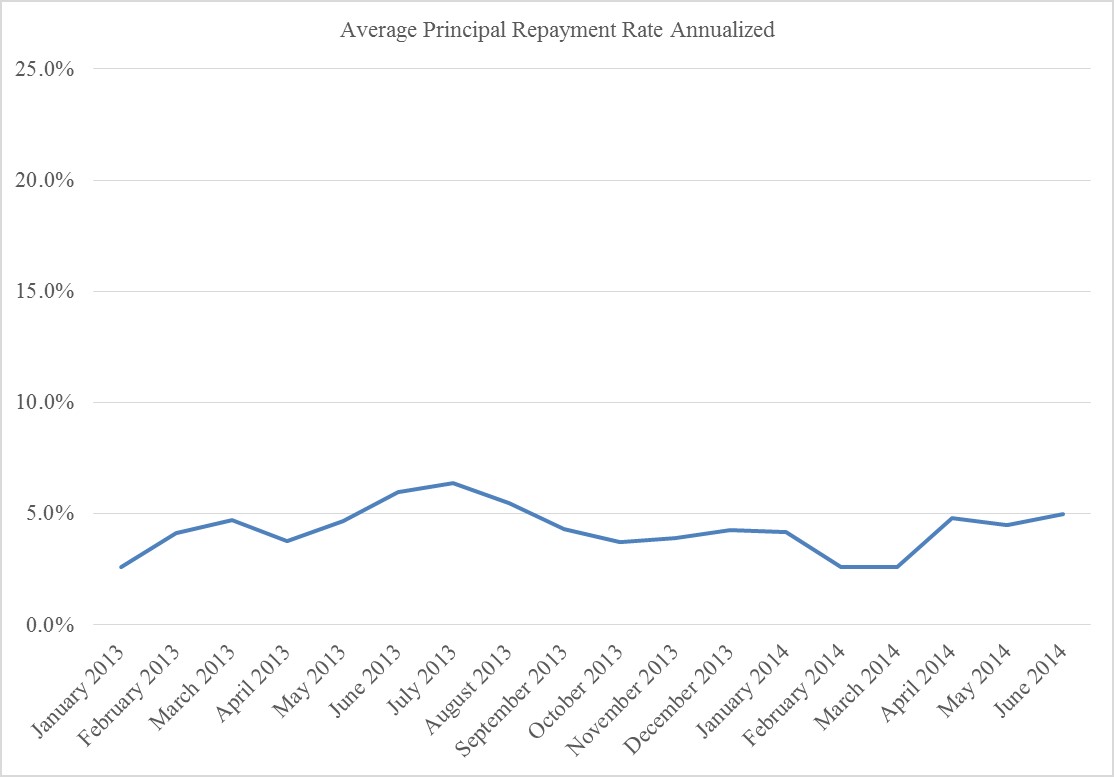

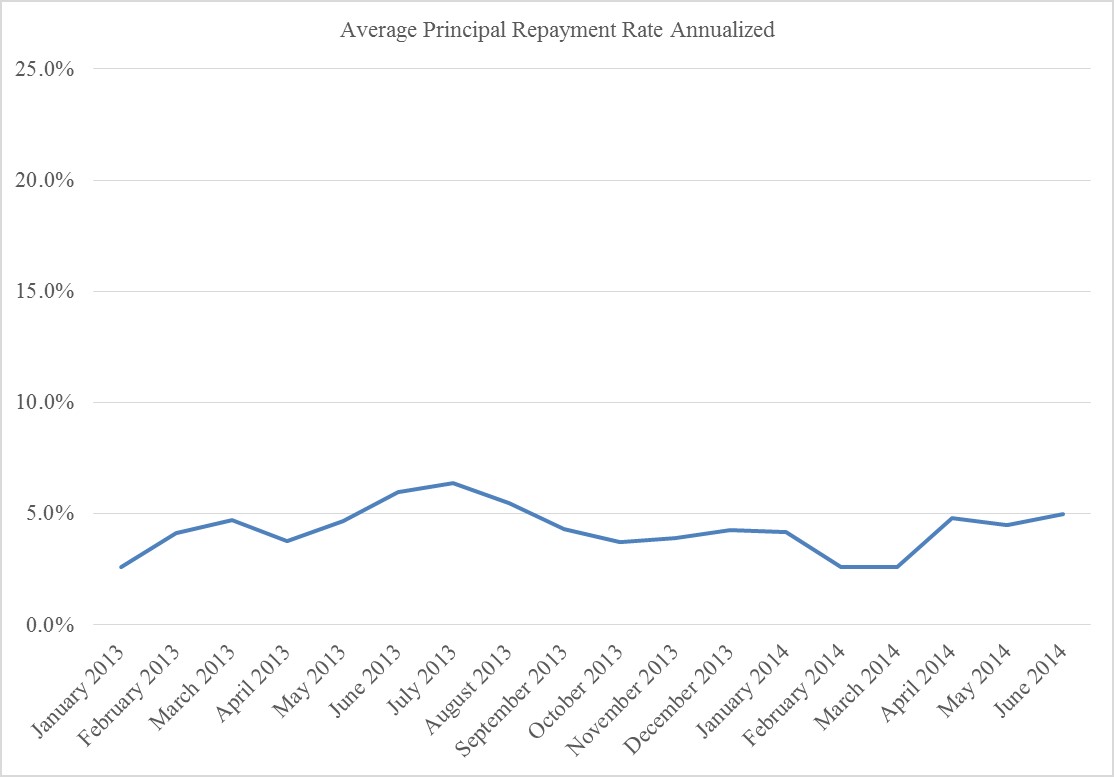

Actual maturities of Agency Securities are generally shorter than stated contractual maturities because actual maturities of Agency Securities are affected by the contractual lives of the underlying mortgages, periodic payments of principal and prepayments of principal.

The following table summarizes the weighted average lives of our Agency Securities at June 30, 2014 and December 31, 2013.

|

| | | | | | | | | | | | | | | | |

| | June 30, 2014 | | December 31, 2013 |

Weighted Average Life of all Agency Securities | | Fair Value | | Amortized Cost | | Fair Value | | Amortized Cost |

Less than one year | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Greater than or equal to one year and less than three years | | 57,314 |

| | 56,944 |

| | — |

| | — |

|

Greater than or equal to three years and less than five years | | 1,059,441 |

| | 1,051,998 |

| | 28,279 |

| | 29,336 |

|

Greater than or equal to five years | | 80,117 |

| | 80,254 |

| | 773,498 |

| | 775,584 |

|

Total Agency Securities | | $ | 1,196,872 |

| | $ | 1,189,196 |

| | $ | 801,777 |

| | $ | 804,920 |

|

We use a third party model to calculate the weighted average lives of our Agency Securities. Weighted average life is calculated based on expectations for estimated prepayments for the underlying mortgage loans of our Agency Securities. These estimated prepayments are based on assumptions such as interest rates, current and future home prices, housing policy and borrower incentives. The weighted average lives of our Agency Securities at June 30, 2014 and December 31, 2013 in the table above are based upon market factors, assumptions, models and estimates from the third party model and also incorporate management’s judgment and experience. The actual weighted average lives of our Agency Securities could be longer or shorter than estimated.

The following table presents the unrealized losses and estimated fair value of our Agency Securities by length of time that such securities have been in a continuous unrealized loss position at June 30, 2014 and December 31, 2013.

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Unrealized Loss Position For: |

| | Less than 12 Months | | 12 Months or More | | Total |

As of | | Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses |

June 30, 2014 | | $ | 5,018 |

| | $ | (37 | ) | | $ | 54,139 |

| | $ | (1,520 | ) | | $ | 59,157 |

| | $ | (1,557 | ) |

December 31, 2013 | | $ | — |

| | $ | — |

| | $ | 57,167 |

| | $ | (3,143 | ) | | $ | 57,167 |

| | $ | (3,143 | ) |

During the six months ended June 30, 2014, we sold $743,647 of our Agency Securities, to reposition our portfolio, which resulted in realized gains of $8.8 million. We did not have any sales of Agency Securities for the quarter ended June 30, 2014, however, we realized a loss of $(34) due to a settlement adjustment on the Agency Securities sales in the first quarter. During the quarter and six months ended June 30, 2013, we did not sell any Agency Securities.

Note 7 – Non-Agency Securities, Trading

All of our Non-Agency Securities are classified as trading securities and reported at their estimated fair value. Fair value changes are reported in the statements of operations in the period in which they occur.

During the quarter ended June 30, 2014, we completed the purchase of Non-Agency Securities with a fair value of $16,735 that were previously treated as Linked Transactions with repayment at maturity of related repurchase agreement borrowings of $10,770.

At June 30, 2014, investments in Non-Agency Securities accounted for 11.5% of our MBS portfolio and 19.1% of our total MBS portfolio inclusive of the Non-Agency Securities underlying our Linked Transactions (see Note 8,“Linked Transactions” for additional discussion of Non-Agency Securities that are accounted for as a component of Linked Transactions).

|

| | | | | | | | | | | | | | | |

| | Non-Agency Securities |

June 30, 2014 | | Fair Value | | Amortized Cost | | Principal Amount | | Weighted Average Coupon |

Prime Fixed | | $ | 53,761 |

| | $ | 53,303 |

| | $ | 60,687 |

| | 5.00 | % |

Prime Hybrid | | 16,202 |

| | 14,745 |

| | 19,840 |

| | 3.02 | % |

Prime Floater | | 3,840 |

| | 3,261 |

| | 3,250 |

| | 5.12 | % |

Alt-A Fixed | | 73,185 |

| | 69,997 |

| | 88,469 |

| | 5.87 | % |

Alt-A Hybrid | | 8,795 |

| | 8,231 |

| | 10,473 |

| | 2.48 | % |

Total Non-Agency Securities | | $ | 155,783 |

| | $ | 149,537 |

| | $ | 182,719 |

| | 5.07 | % |

At December 31, 2013, investments in Non-Agency Securities accounted for 15.2% of our total MBS portfolio and 26.2% of our total MBS portfolio inclusive of the Non-Agency Securities underlying our Linked Transactions (see Note 8,“Linked Transactions” for additional discussion of Non-Agency Securities that are accounted for as a component of Linked Transactions).

|

| | | | | | | | | | | | | | | |

| | Non-Agency Securities |

December 31, 2013 | | Fair Value | | Amortized Cost | | Principal Amount | | Weighted Average Coupon |

Prime Fixed | | $ | 51,515 |

| | $ | 51,922 |

| | $ | 57,995 |

| | 4.96 | % |

Prime Hybrid | | 17,067 |

| | 15,705 |

| | 21,253 |

| | 3.36 | % |

Prime Floater | | 2,117 |

| | 2,001 |

| | 2,000 |

| | 5.41 | % |

Alt-A Fixed | | 63,582 |

| | 61,554 |

| | 77,922 |

| | 5.85 | % |

Alt-A Hybrid | | 9,118 |

| | 8,494 |

| | 11,091 |

| | 2.59 | % |

Total Non-Agency Securities | | $ | 143,399 |

| | $ | 139,676 |

| | $ | 170,261 |

| | 5.02 | % |

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

(Unaudited)

Prime/Alt-A Non-Agency Securities at June 30, 2014 and December 31, 2013 include senior tranches in securitization trusts issued between 2004 and 2007, and are collateralized by residential mortgages originated between 2002 and 2007. The loans were originally considered to be either prime or one tier below prime credit quality. Prime mortgage loans are residential mortgage loans that are considered the highest tier with the most stringent underwriting standards within the Non-Agency mortgage market, but do not carry any credit guarantee from either a U.S. Government agency or GSE. These loans were originated during a period when underwriting standards were generally weak and housing prices have dropped significantly subsequent to their origination. As a result, there is still material credit risk embedded in these vintage tranches. Alt-A, or alternative A-paper, mortgage loans are considered riskier than prime mortgage loans and less risky than sub-prime mortgage loans and are typically characterized by borrowers with less than full documentation, lower credit scores, higher loan to value ratios and a higher percentage of investment properties. These securities were generally rated below investment grade at June 30, 2014 and December 31, 2013.

The following table summarizes the weighted average lives of our Non-Agency Securities at June 30, 2014 and December 31, 2013.

|

| | | | | | | | | | | | | | | | |

| | June 30, 2014 | | December 31, 2013 |

Weighted Average Life of all Non-Agency Securities | | Fair Value | | Amortized Cost | | Fair Value | | Amortized Cost |

Less than one year | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Greater than or equal to one year and less than three years | | — |

| | — |

| | — |

| | — |

|

Greater than or equal to three years and less than five years | | 4,724 |

| | 4,641 |

| | 36,581 |

| | 35,254 |

|

Greater than or equal to five years | | 151,059 |

| | 144,896 |

| | 106,818 |

| | 104,422 |

|

Total Non-Agency Securities | | $ | 155,783 |

| | $ | 149,537 |

| | $ | 143,399 |

| | $ | 139,676 |

|

We use a third party model to calculate the weighted average lives of our Non-Agency Securities. Weighted average life is calculated based on expectations for estimated prepayments for the underlying mortgage loans of our Non-Agency Securities. These estimated prepayments are based on assumptions such as interest rates, current and future home prices, housing policy and borrower incentives. The weighted average lives of our Non-Agency Securities at June 30, 2014 and December 31, 2013 in the table above are based upon market factors, assumptions, models and estimates from the third party model and also incorporate management’s judgment and experience. The actual weighted average lives of our Non-Agency Securities could be longer or shorter than estimated.

The following table presents the unrealized losses and estimated fair value of our Non-Agency Securities by length of time that such securities have been in a continuous unrealized loss position at June 30, 2014 and December 31, 2013.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Unrealized Loss Position For: |

| | Less than 12 months | | 12 Months or More | | Total |

As of | | Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses |

June 30, 2014 | | $ | 2,703 |

| | $ | (168 | ) | | $ | 5,978 |

| | $ | (328 | ) | | $ | 8,681 |

| | $ | (496 | ) |

December 31, 2013 | | $ | 42,096 |

| | $ | (1,089 | ) | | $ | — |

| | $ | — |

| | $ | 42,096 |

| | $ | (1,089 | ) |

Our Non-Agency Securities are subject to risk of loss with regard to principal and interest payments and at June 30, 2014 and December 31, 2013, have generally either been assigned below investment grade ratings by rating agencies, or have not been rated. We evaluate each investment based on the characteristics of the underlying collateral and securitization structure, rather than relying on the ratings assigned by rating agencies.

In April 2014, we entered in to a long term collateral exchange agreement whereby we will receive custody of approximately $50.0 million of U.S. Treasury Securities or receive cash for two years (declining to $30.0 million for a third year) in exchange for pledging certain of our Non-Agency Securities. At June 30, 2014, the $155,783 of Non-Agency Securities on our condensed consolidated balance sheet includes securities pledged under this agreement with a fair value of $47,721. At June 30, 2014, collateral received under this agreement consisted of $22,483 of cash, which is treated as repurchase agreement borrowings on our condensed consolidated balance sheet and $12,153 of U.S. Treasury Securities in our custody which are not reflected on our condensed consolidated balance sheet.

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

(Unaudited)

Note 8 – Linked Transactions

Our Linked Transactions are evaluated on a combined basis, reported as forward (derivative) instruments and presented as assets on our balance sheets at fair value. The fair value of Linked Transactions reflect the value of the underlying Non-Agency MBS, linked repurchase agreement borrowings and accrued interest receivable and payable on such instruments. Our Linked Transactions are not designated as hedging instruments and, as a result, the change in the fair value and net interest income from Linked Transactions is reported in other income on our statements of operations.

The following tables present information about our Non-Agency Securities and repurchase agreements underlying our Linked Transactions at June 30, 2014 and December 31, 2013. Our Non-Agency Securities underlying our Linked Transactions represent approximately 8.54% and 13.0% of our overall investment in MBS at June 30, 2014 and December 31, 2013, respectively.

June 30, 2014

|

| | | | | | | | | | | | | | | | | | | | | | | | |

Linked Repurchase Agreements | | Linked Non-Agency Securities |

Maturity or Repricing | | Balance | | Weighted Average Interest Rate | | Non-Agency MBS | | Fair Value | | Amortized Cost | | Par/Current Face | | Weighted Average Coupon Rate |

Within 30 days | | $ | 5,072 |

| | 1.91 | % | | Prime | | $ | 110,846 |

| | $ | 109,709 |

| | $ | 114,306 |

| | 3.11 | % |

31 days to 60 days | | 36,605 |

| | 1.03 | % | | Alt-A | | 15,404 |

| | 14,760 |

| | 19,190 |

| | 6.05 | % |

61 days to 90 days | | 63,752 |

| | 0.98 | % | | Total | | $ | 126,250 |

| | $ | 124,469 |

| | $ | 133,496 |

| | 3.47 | % |

Greater than 90 days | | 6,310 |

| | 2.03 | % | | | | | | | | | | |

Total | | $ | 111,739 |

| | 1.10 | % | | | | |

| | |

| | |

| | |

|

Not included in the tables above is $63 of accrued interest payable from Linked Transactions included in our condensed consolidated balance sheet at June 30, 2014.

December 31, 2013

|

| | | | | | | | | | | | | | | | | | | | | | | | |

Linked Repurchase Agreements | | Linked Non-Agency Securities |

Maturity or Repricing | | Balance | | Weighted Average Interest Rate | | Non-Agency MBS | | Fair Value | | Amortized Cost | | Par/Current Face | | Weighted Average Coupon Rate |

Within 30 days | | $ | 8,177 |

| | 1.88 | % | | Prime | | $ | 112,956 |

| | $ | 116,631 |

| | $ | 121,571 |

| | 3.00 | % |

31 days to 60 days | | 44,974 |

| | 1.23 | % | | Alt-A | | 27,989 |

| | 27,788 |

| | 35,822 |

| | 4.71 | % |

61 days to 90 days | | 71,389 |

| | 1.09 | % | | Total | | $ | 140,945 |

| | $ | 144,419 |

| | $ | 157,393 |

| | 3.34 | % |

Greater than 90 days | | — |

| | 0.00 | % | | | | | | | | | | |

Total | | $ | 124,540 |

| | 1.19 | % | | | | | | | | | | |

Not included in the tables above is $83 of accrued interest payable from Linked Transactions included in our condensed consolidated balance sheet as of December 31, 2013.

The following table presents certain information about the components of the unrealized net gains and net interest income from Linked Transactions included in our condensed consolidated statements of operations for the quarter and six months ended June 30, 2014 and June 30, 2013.

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | For the Quarter Ended | | For the Six Months Ended |

Unrealized Net Gain and Net Interest Income from Linked Transactions | | June 30, 2014 | | June 30, 2013 | | June 30, 2014 | | June 30, 2013 |

Interest income attributable to MBS underlying Linked Transactions | | $ | 1,300 |

| | $ | 39 |

| | $ | 2,869 |

| | $ | 39 |

|

Interest expense attributable to linked repurchase agreements underlying Linked Transactions | | (161 | ) | | (915 | ) | | (450 | ) | | (915 | ) |

Change in fair value of Linked Transactions included in earnings | | 1,811 |

| | (1,412 | ) | | 5,041 |

| | (1,412 | ) |

Unrealized net gain (loss) and net interest income (loss) from Linked Transactions | | $ | 2,950 |

| | $ | (2,288 | ) | | $ | 7,460 |

| | $ | (2,288 | ) |

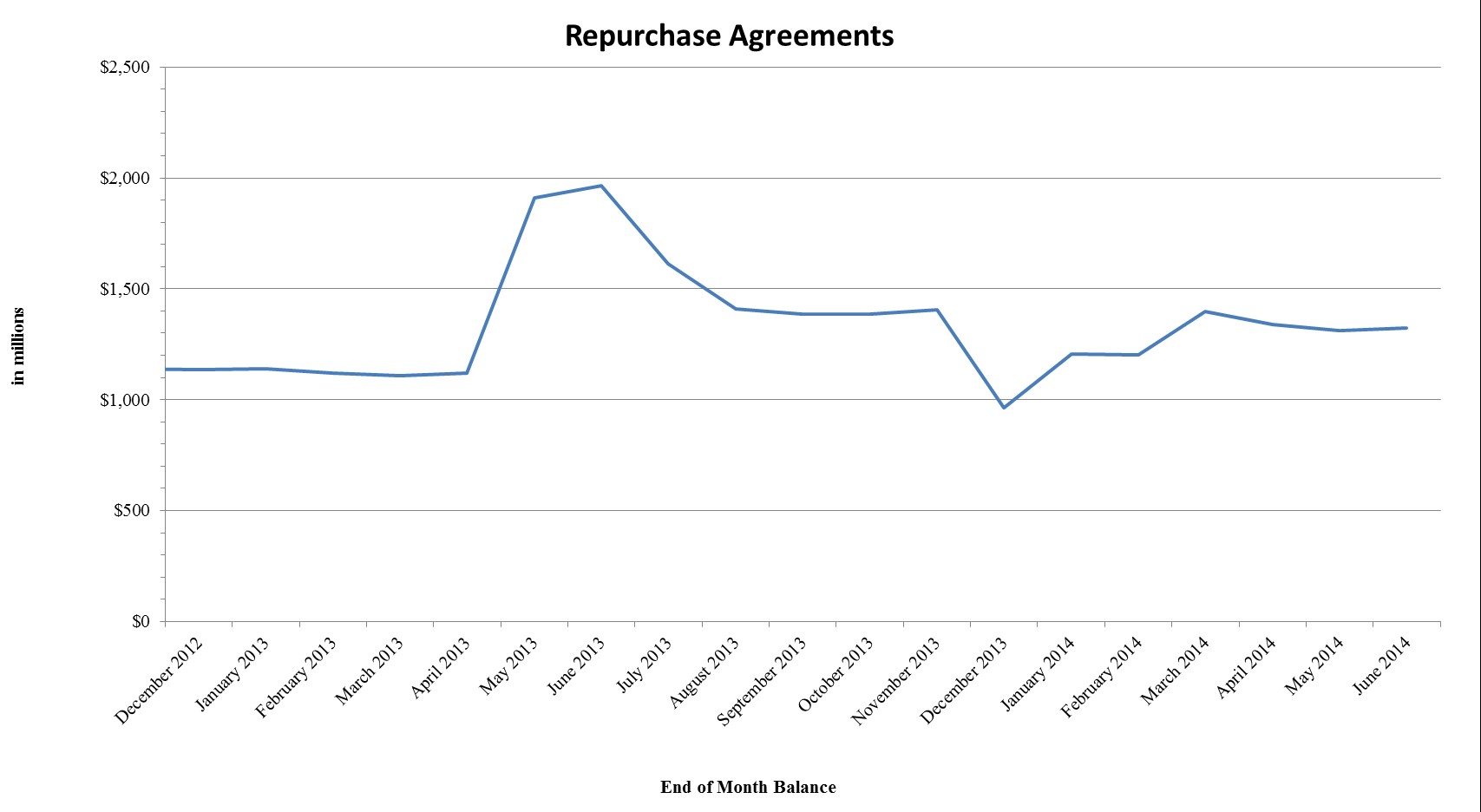

Note 9 – Repurchase Agreements

At June 30, 2014, we had MRAs with 29 counterparties and had $1,233,195 in outstanding borrowings with 23 of those counterparties. At December 31, 2013, we had MRAs with 27 counterparties and had $839,405 in outstanding borrowings with 20 of those counterparties. See Note 8, “Linked Transactions” for additional discussion of repurchase agreements that are accounted for as a component of Linked Transactions.

The following tables represent the contractual repricing and other information regarding our repurchase agreements to finance our MBS purchases at June 30, 2014 and December 31, 2013.

|

| | | | | | | | | | | | |

June 30, 2014 | | Repurchase Agreements | | Weighted Average Contractual Rate | | Weighted Average Maturity in days | | Haircut for Repurchase Agreements (1) |

Agency Securities | | $ | 1,126,421 |

| | 0.34 | % | | 39 | | 4.79 | % |

Non-Agency Securities | | 106,774 |

| | 1.95 | % | | 242 | | 24.46 | % |

Total or Weighted Average | | $ | 1,233,195 |

| | 0.48 | % | | 57 | | 6.49 | % |

(1) The Haircut represents the weighted average margin requirement, or the percentage amount by which the collateral value must exceed the loan amount.

|

| | | | | | | | | | | | |

December 31, 2013 | | Repurchase Agreements | | Weighted Average Contractual Rate | | Weighted Average Maturity in days | | Haircut for Repurchase Agreements (1) |

Agency Securities | | $ | 731,782 |

| | 0.42 | % | | 33 | | 4.90 | % |

Non-Agency Securities | | 107,623 |

| | 1.96 | % | | 46 | | 25.39 | % |

Total or Weighted Average | | $ | 839,405 |

| | 0.61 | % | | 35 | | 7.53 | % |

(1) The Haircut represents the weighted average margin requirement, or the percentage amount by which the collateral value must exceed the loan amount.

|

| | | | | | | | | | | | | | |

| | June 30, 2014 | | December 31, 2013 |

Maturing or Repricing | | Repurchase Agreements | | Weighted

Average

Contractual Rate | | Repurchase Agreements | | Weighted

Average

Contractual Rate |

Within 30 days | | $ | 657,358 |

| | 0.47 | % | | $ | 380,744 |

| | 0.67 | % |

31 days to 60 days | | 288,287 |

| | 0.39 | % | | 408,054 |

| | 0.49 | % |

61 days to 90 days | | 165,429 |

| | 0.46 | % | | 40,362 |

| | 1.00 | % |

Greater than 90 days | | 122,121 |

| | 0.81 | % | | 10,245 |

| | 2.10 | % |

Total or Weighted Average | | $ | 1,233,195 |

| | 0.48 | % | | $ | 839,405 |

| | 0.61 | % |

JAVELIN MORTGAGE INVESTMENT CORP. and Subsidiary

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except per share amounts)

(Unaudited)

We have 10 repurchase agreement counterparties that individually account for between 5% and 10% of our aggregate borrowings. In total, these counterparties account for approximately 68.50% of our repurchase agreement borrowings outstanding at June 30, 2014.

During the quarter and six months ended June 30, 2014, we did not purchase or sell any U.S. Treasury Securities. During the quarter and six months ended June 30, 2013, we sold short $301,903 of U.S. Treasury Securities and purchased $70,126 resulting in a realized loss of $(390). The outstanding balance resulted in an unrealized loss of $(2,716).

Note 10 – Derivatives

In addition to the Linked Transactions described in Note 8, “Linked Transactions,” we enter into derivative transactions to manage our interest rate risk exposure. These transactions include entering into interest rate swap contracts and interest rate swaptions. These transactions are designed to lock in funding costs for repurchase agreements associated with our assets in such a way to help assure the realization of net interest margins. Such transactions are based on assumptions about prepayments on our Agency Securities which, if not realized, will cause transaction results to differ from expectations. Our derivatives are carried on our balance sheets as assets or as liabilities at their fair value. We do not designate our derivatives as cash flow hedges and as such, we recognize changes in the fair value of these derivatives through earnings.

We have agreements with our swap (including swaption) counterparties that provide for the posting of collateral based on the fair values of our interest rate swap contracts. Through this margin process, either we or our swap counterparty may be required to pledge cash or Agency Securities as collateral. Collateral requirements vary by counterparty and change over time based on the fair value, notional amount and remaining term of the contracts. Certain interest rate swap contracts provide for cross collateralization and cross default with repurchase agreements and other contracts with the same counterparty.

Interest rate swaptions generally provide us the option to enter into an interest rate swap agreement at a certain point of time in the future with a predetermined notional amount, stated term and stated rate of interest in the fixed leg and interest rate index on the floating leg.

The following tables present information about interest rate swap contracts and interest rate swaptions which are included in derivatives on the accompanying condensed consolidated balance sheets as of June 30, 2014 and December 31, 2013.

June 30, 2014

|

| | | | | | | | | | | | | | | | | | | |

Derivative Type | | Remaining / Underlying Term | | Weighted Average Remaining Swap / Option Term (Months) | | Weighted Average Rate | | Notional Amount | | Asset Fair Value (1) | | Liability Fair Value (1) |

Interest rate swap contracts | | 0-12 Months | | 0 | | 0.00 | % | | $ | — |

| | $ | — |

| | $ | — |

|

Interest rate swap contracts | | 13-24 Months | | 0 | | 0.00 | % | | — |

| | — |

| | — |

|

Interest rate swap contracts | | 25-36 Months | | 0 | | 0.00 | % | | — |

| | — |

| | — |

|

Interest rate swap contract | | 37-48 Months | | 43 | | 0.73 | % | | 100,000 |

| | 950 |

| | — |

|

Interest rate swap contracts | | 49-60 Months | | 0 | | 0.00 | % | | — |

| | — |

| | — |

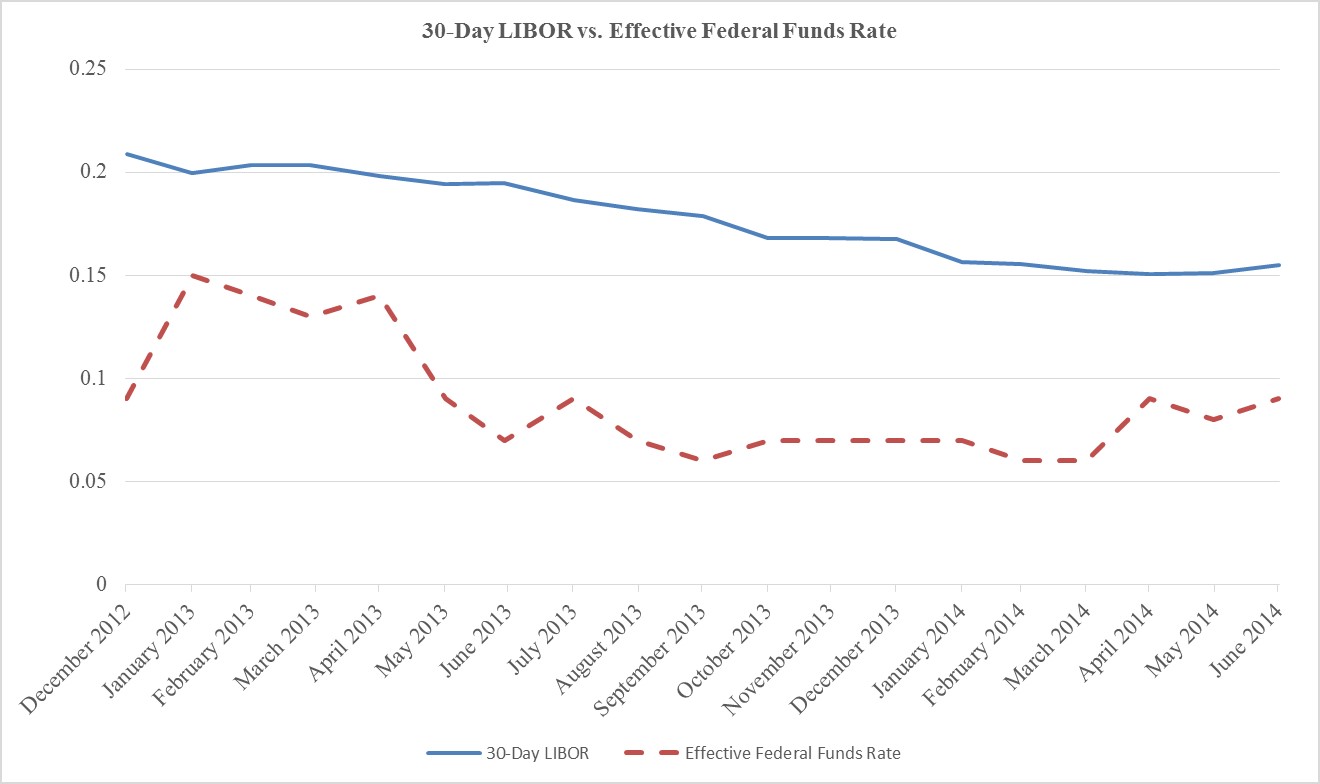

|