UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2015

or

☐ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission File Number: 001-35629

TILE SHOP HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

45-5538095 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

14000 Carlson Parkway,

Plymouth, Minnesota 55441

(Address of principal executive

offices, including zip code)

(763) 852-2988

(Registrant’s telephone number,

including area code)

Securities registered pursuant to

Section 12(b) of the Act:

|

Title of each class |

Name of each exchange on which registered |

|

Common Stock, $0.0001 par value |

The NASDAQ Stock Market LLC |

Securities registered pursuant to

Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form -10K or any amendment to this Form 10K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12-b2 of the Exchange Act.

|

Large accelerated filer ☒ |

Accelerated filer ☐ |

Non-accelerated filer ☐ |

Smaller reporting company ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately: $534,784,518. For purposes of this calculation, the Company has included any shares held by Nabron International Inc. as shares held by non-affiliates.

At February 19, 2016, the registrant had 51,437,973 shares of Common Stock outstanding.

TILE SHOP HOLDINGS, INC. FORM 10-K

|

TABLE OF CONTENTS | |||

|

|

|

| |

|

PART I |

|

| |

|

|

ITEM 1. |

BUSINESS |

1 |

|

|

ITEM 1A. |

RISK FACTORS |

6 |

|

|

ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

14 |

|

|

ITEM 2. |

PROPERTIES |

14 |

|

|

ITEM 3. |

LEGAL PROCEEDINGS |

14 |

|

|

ITEM 4. |

MINE SAFETY DISCLOSURES |

15 |

|

|

|

| |

|

PART II |

|

| |

|

|

ITEM 5. |

MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

16 |

|

|

ITEM 6. |

SELECTED FINANCIAL DATA |

18 |

|

|

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

19 |

|

|

ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

29 |

|

|

ITEM 8. |

CONSOLIDATED FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

29 |

|

|

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

29 |

|

|

ITEM 9A. |

CONTROLS AND PROCEDURES |

30 |

|

|

ITEM 9B. |

OTHER INFORMATION |

31 |

|

|

|

| |

|

PART III |

|

| |

|

|

ITEM 10. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

32 |

|

|

ITEM 11. |

EXECUTIVE COMPENSATION |

38 |

|

|

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

47 |

|

|

ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

49 |

|

|

ITEM 14. |

PRINCIPAL ACCOUNTING FEES AND SERVICES |

50 |

|

|

|

| |

|

PART IV |

|

| |

|

|

ITEM 15. |

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES |

52 |

|

|

|

|

|

|

SIGNATURES |

|

76 | |

|

|

|

|

|

|

POWER OF ATTORNEY |

77 | ||

PART I

ITEM 1. BUSINESS

Overview

The Tile Shop was founded in 1985. We offer a wide selection of manufactured and natural stone tiles, setting and maintenance materials, and related accessories in retail locations across much of the United States. Our assortment includes over 4,000 products from around the world that consist of natural stone, ceramic, porcelain, glass, and metal tiles. Natural stone products including marble, granite, quartz, sandstone, travertine, slate, and onyx tiles. The majority of our tile products are sold under our proprietary Rush River and Fired Earth brands. We purchase our tile products, accessories and tools directly from our network of vendors. We manufacture our own setting and maintenance materials, such as thinset, grout and sealers under our Superior brand name. As of December 31, 2015, we operated 114 stores in 31 states, with an average size of approximately 21,800 square feet. We also sell our products on our website.

We believe that our long-term vendor relationships, together with our design, manufacturing and distribution capabilities, enable us to offer a broad assortment of high-quality products to our customers, who are primarily homeowners and professionals, at competitive prices. We have invested significant resources to develop our proprietary brands and product sources and believe that we are a leading retailer of stone and ceramic tiles, accessories, and related materials in the United States.

In 2015, we reported net sales and income from operations of $293.0 million and $29.2 million, respectively. Our 2014 and 2013 net sales were $257.2 million and $229.6 million, respectively, and our 2014 and 2013 income from operations was $21.6 million and $33.1 million, respectively. We opened 7 new stores in 2015 and intend to open 9 to 12 stores in 2016. As of fiscal year end 2015 and 2014, we had total assets of $245.4 million and $252.2 million, respectively.

Organizational History

Tile Shop Holdings, Inc. (“Holdings”, and together with its wholly owned subsidiaries, the “Company”, or “we”) was incorporated in Delaware in June 2012. On August 21, 2012, Holdings consummated the transactions contemplated pursuant to that certain Contribution and Merger Agreement dated as of June 27, 2012, among Holdings, JWC Acquisition Corp., a publicly-held Delaware corporation (“JWCAC”), The Tile Shop, LLC, a privately-held Delaware limited liability company (“The Tile Shop”), and certain other parties. Through a series of transactions, The Tile Shop was contributed to and became a subsidiary of Holdings and Holdings effected a business combination with and became a successor issuer to JWCAC. These transactions are referred to herein as the “Business Combination.”

Competitive Strengths

We believe that the following factors differentiate us from our competitors and position us to continue to grow our specialty tile business.

Inspiring Customer Experience In each store, our products are brought to life by showcasing a broad array of the items we offer in approximately 50 different mockups, or vignettes, of bathrooms, kitchens, fireplaces, foyers, and other distinct spaces. Our stores are spacious, well-lit, and organized by product type to simplify our customers’ shopping experience.

Broad Product Assortment at Attractive Prices We offer over 4,000 manufactured and natural tile products, setting and maintenance materials, accessories, and tools. We are able to maintain competitive prices by purchasing tile and accessories directly from producers and manufacturing our own setting and maintenance materials.

Customer Service and Satisfaction Our sales personnel are highly-trained and knowledgeable about the technical and design aspects of our products. We offer weekly do-it-yourself classes in all of our stores. In addition, we provide one-on-one installation training as required to meet customer needs. We accept returns up to six months following the date of the sale, with no restocking fees.

Worldwide Sourcing Capabilities We have long-standing relationships with our tile vendors throughout the world and work with them to design products exclusively for us. We believe that these direct relationships differentiate us from our competitors.

Proprietary Branding We sell the majority of our products under our proprietary brand names, which help us to differentiate our products from those of our competitors. We offer products across a range of price points and quality levels that allow us to target discrete market segments and to appeal to diverse groups of customers.

Centralized Distribution System We service our retail locations from four distribution centers. Our distribution centers, located in Michigan, Oklahoma, Virginia, and Wisconsin, are positioned to cost effectively service our existing stores.

Strategic Plan

Key elements of our strategy include:

Develop Store Talent – During 2015, our initiatives to improve hiring and training practices resulted in significant reductions in sales associate turnover and increases to average manager tenure. We plan to continue placing an emphasis on cultivating talent in our stores through recruiting, ongoing education and mentorship efforts. A key element of this strategy involves our Market Managers who are responsible for developing talent and driving profitability within a market. Market Managers are seasoned store managers who reinforce best practices to grow sales, expand product knowledge, enhance profitability and develop a team that is able to produce new leadership candidates. We plan to have Market Managers assigned to all stores in 2016. Additionally, we have created a new Senior Assistant Store Manager position for our top performing Assistant Store Managers who complete all requisite training programs and also distinguish themselves as high profile Store Manager candidates. We believe the ongoing emphasis placed on the combination of recruiting, training and mentorship will continue to reduce turnover and produce the next generation of store leaders to support our long-term growth plans.

Grow Professional Sales – During 2015, our initiatives focused on the professional customer resulted in a significant increase in professional customer sales and mix relative to total company sales. The professional customer includes tile contractors, custom home builders and designers. Key elements of this strategy included joining national and local trade organizations, developing marketing strategies, hosting in-store events, enhancing our assortment of tool products and refining our credit policies. We believe that our value propositions including a six month return policy, no restocking fees, store hours, tiered discounts, product availability, wide assortment, private label setting material, in house credit, free design support and job site delivery are un-paralleled in the marketplace. Our professional strategy enables our store associates to develop relationships with professionals in their trade area. Our corporate marketing team supports the stores by developing traffic and “leads” through trade organization memberships, direct marketing, co-hosting events in our showrooms and other forms of digital marketing primarily, email marketing. We continuously expand our assortment and merchandising square footage of installation materials and tools to meet the changing and growing needs of our professional customers. We have also implemented training programs and a standard operating process to assist new store sales associates to quickly and successfully develop revenues from professional customers. Creating awareness and increasing the frequency of professional visits to our stores continue to be important elements of our revenue growth plans in 2016 and future periods.

Increase Store Unit Growth – We believe we have exceptional opportunities to continue to add stores in existing markets and expand into new markets. We plan to increase our existing store base by 8 to 12 percent each year over the next several years. During 2016, we will focus on opening new stores in existing markets where we will be able to leverage economies of scale in marketing, distribution, and store talent. Additionally, we plan to pursue opportunities to further enhance the return on our new store investments by selecting smaller retail spaces that provides us the opportunity to reduce the initial investment to build a new store and the ongoing occupancy costs.

Sales Model

We principally sell our products directly to homeowners and professionals. With regard to individual customers, we believe that due to the average cost and relative infrequency of a tile purchase, many of our individual customers conduct extensive research using multiple channels before making a purchase decision. Our sales strategy emphasizes customer service by providing comprehensive and convenient educational tools on our website and in our stores for our customers to learn about our products and the tile installation process. Our website contains a broad range of information regarding our tile products, setting and maintenance materials, and accessories. Customers can order samples, view catalogs, or purchase products from either our stores or website. Customers can choose to have their purchases delivered or picked up at one of our stores. We believe this strategy also positions us well with professional customers who are influenced by the preferences of individual homeowners.

Our stores are designed to emphasize our products in a visually appealing showroom format. Our average store is approximately 21,800 square feet, with approximately 19,000 square feet devoted to the showroom and the balance being warehouse space, which is used primarily to hold customer orders waiting to be picked up or delivered. Our stores are typically accessible from major roadways and have significant visibility to passing traffic. We can adapt to a range of existing buildings, whether free-standing or in shopping centers.

Unlike many of our competitors, we devote a substantial portion of our retail store space to showrooms, including samples of our over 4,000 products and approximately 50 different vignettes of bathrooms, kitchens, fireplaces, foyers, outdoor living, and other distinct spaces that showcase our products. Our showrooms are designed to provide our customers with a better understanding of how to integrate various types of tile in order to create an attractive presentation in their homes. Most stores are also equipped with a training center designed to teach customers how to properly install tile.

A typical store staff consists of a manager, an assistant manager, and five to fifteen staff, including both sales and warehouse associates. Our store managers are responsible for store operations and for overseeing our customers’ shopping experience.

We offer financing to customers through a branded credit card provided by a third-party consumer finance company. These credit cards, which can only be used in our stores and on our website, give customers the opportunity to purchase tile from our stores at a discounted price.

Marketing

We utilize a variety of marketing strategies and programs to acquire and retain customers. Our customers include both consumers and trade professionals. Our advertising primarily consists of digital media, direct marketing including email and postal mail, in store events, mobile and traditional media vehicles including newspaper circular/print ads, radio, television and video. We continually test and learn from new media and adjust our programs based on performance.

Our e-commerce site, tileshop.com supports desktop, tablet and mobile devices and is designed for consumers, trade professionals and industry stakeholders to learn about; our brand, our value propositions, our product assortment and installation techniques, and to look up our store locations. On social media, #TheTileShop provides current and prospective customers a high level of brand engagement to share their designs and finished projects in our inspiration gallery. Tileshop.com also serves as a commerce platform for our customers who want to purchase products within or outside of our physical store footprint. Products can be delivered to a job site, home or store location.

Products

We offer a complete assortment of tile products, generally sourced directly from our vendors, including natural stone, ceramic, porcelain, glass, and metal tiles. Natural stone products include, marble, granite, quartz, sandstone, travertine, slate, and onyx tiles. Our wide assortment of trim pieces, mosaics, pencils, listellos and other unique products encourage our customers to make a fashion statement with their tile project. This also helps deliver a high level of customer satisfaction and drives repeat business. We also offer a broad range of setting and maintenance materials, such as thinset, grout, sealers, and accessories, including installation tools, shower and bath shelves, drains, and similar products. We sell most of our products under our proprietary brand names, including Superior Adhesives & Chemicals, Superior Tools & Supplies, Rush River, and Fired Earth. In total, we offer over 4,000 different tile, setting and maintenance materials and accessory products. In 2015, our net sales were 53% from natural stone products, 35% from ceramic and porcelain products, and 12% from setting, maintenance and related accessory products. These amounts compare to 52% from natural stone products, 34% from ceramic and porcelain products, and 14% from setting, maintenance and other related accessory products in 2014.

Manufacturers

We have long-standing relationships with our vendors throughout the world and work with them to design products exclusively for us. We believe that these direct relationships differentiate us from our competitors, who generally purchase products through distributors.

We currently purchase tile products from approximately 165 different suppliers. Our top ten tile vendors accounted for 41% of our tile purchases in 2015. We believe that alternative and competitive suppliers are available for most of our products. In 2015, 68% of our purchased product was sourced from Asia, 13% from Europe, 17% from North America and 2% from South America. Our foreign purchases are primarily negotiated and paid for in U.S. dollars.

Distribution and Order Fulfillment

We take possession of our products in the country of origin and arrange for transportation to our distribution centers located in Michigan, Oklahoma, Virginia and Wisconsin. We also manufacture our setting and maintenance materials at these locations. We maintain a large inventory of products in order to quickly fulfill customer orders.

We fulfill customer orders primarily by shipping our products to our stores where customers can either pick them up or arrange for home delivery. Orders placed on our website are shipped directly to customers’ homes from our distribution centers or a local store. We continue to evaluate logistics alternatives to best service our retail store base and our customers. We believe that our existing distribution facilities will continue to play an integral role in our growth strategy, and we expect to establish one or more additional distribution centers in the next five years to support geographic expansion of our retail store base.

Competition

The retail tile market is highly-fragmented. We compete directly with large national home centers that offer a wide range of home improvement products. In addition, we also compete with regional and local specialty retailers of tile, factory-direct stores, a large number of privately-owned, single-site stores, and on-line only competitors. We also compete indirectly with companies that sell other types of floor coverings, including wood floors, carpet, and vinyl sheet. The barriers to entry into the retail tile industry are relatively low and new or existing tile retailers could enter our markets and increase the competition that we face. Many of our competitors enjoy competitive advantages over us, such as greater name recognition, longer operating histories, more varied product offerings, and greater financial, technical, and other resources.

We believe that the key competitive factors in the retail tile industry include:

|

|

• |

product assortment; |

|

|

• |

product presentation; |

|

|

• |

customer service; |

|

|

• |

store location; |

|

|

• |

immediacy of inventory; and |

|

|

• |

price. |

We believe that we compete favorably with respect to each of these factors by providing a highly diverse selection of products to our customers, at an attractive value, in appealing and convenient retail store locations, with exceptional customer service and on-site instructional opportunities. Further, while some larger factory-direct competitors manufacture their own products, many of our competitors purchase their tile from domestic manufacturers or distributors when they receive an order from a customer. As a result, we believe that it takes these retailers longer than us to deliver products to customers and that their prices tend to be higher than our prices. We also believe that we offer a broader range of products and stronger in-store customer support than these competitors.

Employees

As of December 31, 2015, we had 1,410 employees, 1,330 of whom were full-time and none of whom were represented by a union. Of these employees, 1,077 work in our stores, 67 work in corporate, store support, infrastructure or similar functions, and 266 work in distribution and manufacturing facilities. We believe that we have good relations with our employees.

Property and Trademarks

We have registered and unregistered trademarks for all of our brands, including 18 registered trademarks. We regard our intellectual property as having significant value and our brands are an important factor in the marketing of our products. Accordingly, we have taken, and continue to take, appropriate steps to protect our intellectual property.

Government Regulation

We are subject to extensive and varied federal, state and local government regulation in the jurisdictions in which we operate, including laws and regulations relating to our relationships with our employees, public health and safety, zoning, and fire codes. We operate each of our stores, offices, and distribution and manufacturing facilities in accordance with standards and procedures designed to comply with applicable laws, codes, and regulations.

Our operations and properties are also subject to federal, state and local laws and regulations relating to the use, storage, handling, generation, transportation, treatment, emission, release, discharge and disposal of hazardous materials, substances and wastes and relating to the investigation and cleanup of contaminated properties, including off-site disposal locations. We do not incur significant costs complying with environmental laws and regulations. However, we could be subject to material costs, liabilities, or claims relating to environmental compliance in the future, especially in the event of changes in existing laws and regulations or in their interpretation.

Products that we import into the United States are subject to laws and regulations imposed in conjunction with such importation, including those issued and enforced by U.S. Customs and Border Protection. We work closely with our suppliers to ensure compliance with the applicable laws and regulations in these areas.

Financial Information about Geographic Areas

Nearly all of our revenues are generated within the United States and nearly all of our long-lived assets are located within the United States as well. In 2014, we opened a sourcing office based in China.

Available Information

We are subject to the reporting requirements of the Securities Exchange Act of 1934 and its rules and regulations (the “1934 Act”). The 1934 Act requires us to file periodic reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Copies of these reports, proxy statements and other information can be read and copied at the SEC Public Reference Room, 100 F Street, N.E., Washington D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains a Web site that contains reports, proxy statements, and other information regarding issuers that file electronically with the SEC. These materials may be obtained electronically by accessing the SEC’s Web site at http://www.sec.gov.

We maintain a Web site at www.tileshop.com, the contents of which are not part of or incorporated by reference into this Annual Report on Form 10-K. We make our Annual Reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments to those reports available on our Web site, free of charge, as soon as reasonably practicable after such reports have been filed with or furnished to the SEC. Our Code of Business Conduct and Ethics, as well as any waivers from and amendments to the Code of Business Conduct and Ethics, are also posted on our Web site.

ITEM 1A. RISK FACTORS

The following are significant factors known to us that could adversely affect our business, financial condition, or operating results, as well as adversely affect the value of an investment in our common stock. These risks could cause our actual results to differ materially from our historical experience and from results predicted by forward-looking statements. All forward-looking statements made by us are qualified by the risks described below. There may be additional risks that are not presently material or known. You should carefully consider each of the following risks and all other information set forth in this Annual Report on Form 10-K.

Our business, financial condition and operating results are dependent on general economic conditions and discretionary spending by our customers, which in turn are affected by a variety of factors beyond our control. If such conditions deteriorate, our business, financial condition and operating results may be adversely affected.

Our business, financial condition and operating results are affected by general economic conditions and discretionary spending by our customers. Such general economic conditions and discretionary spending are beyond our control and are affected by, among other things:

|

|

• |

the housing market, including housing turnover and home values; |

|

|

• |

consumer confidence in the economy; |

|

|

• |

unemployment trends; |

|

|

• |

consumer debt levels; |

|

|

• |

consumer credit availability; |

|

|

• |

data security and privacy concerns; |

|

|

• |

energy prices; |

|

|

• |

interest rates and inflation; |

|

|

• |

slower rates of growth in real disposable personal income; |

|

|

• |

natural disasters and unpredictable weather; |

|

|

• |

tax rates and tax policy; and |

|

|

• |

other matters that influence consumer confidence and spending. |

If such conditions deteriorate, our business, financial condition and operating results may be adversely affected. In addition, increasing volatility in financial and capital markets may cause some of the above factors to change with a greater degree of frequency and magnitude than in the past.

Our ability to grow and remain profitable may be limited by direct or indirect competition in the retail tile industry, which is highly competitive.

The retail tile industry in the United States is highly competitive. Participants in the tile industry compete primarily based on product variety, customer service, store location, and price. There can be no assurance that we will be able to continue to compete favorably with our competitors in these areas. Our store competitors include large national home centers, regional and local specialty retailers of tile, factory direct stores, privately-owned, single-site stores and online only competitors. We also compete indirectly with companies that sell other types of floor coverings, including wood floors, carpet, and vinyl sheet. In the past, we have faced periods of heightened competition that materially affected our results of operations. Certain of our competitors have greater name recognition, longer operating histories, more varied product offerings, and substantially greater financial and other resources than us. Accordingly, we may face periods of intense competition in the future that could have a material adverse effect on our planned growth and future results of operations. Moreover, the barriers to entry into the retail tile industry are relatively low. New or existing retailers could enter our markets and increase the competition that we face. In addition, manufacturers and vendors of tile and related products, including those whose products we currently sell, could enter the United States retail tile market and start directly competing with us. Competition in existing and new markets may also prevent or delay our ability to gain relative market share. Any of the developments described above could have a material adverse effect on our planned growth and future results of operations.

If we fail to successfully manage the challenges that our planned growth poses or encounter unexpected difficulties during our expansion, our revenues and profitability could be materially adversely affected.

One of our long term objectives is to increase revenues and profitability through market share gains. Our ability to achieve market share growth, however, is contingent upon our ability to open new stores and achieve operating results in new stores at the same level as our similarly situated current stores. We anticipate opening 9 to 12 stores in fiscal year 2016. There can be no assurance that we will be able to open stores in new markets at the rate required to achieve market leadership in such markets, identify and obtain favorable store sites, arrange favorable leases for stores, or obtain governmental and other third-party consents, permits, and licenses needed to open or operate stores in a timely manner, train and hire a sufficient number of qualified managers for new stores, attract a strong customer base and brand familiarity in new markets, or successfully compete with established retail tile stores in the new markets that we enter. Failure to open new stores in an effective and cost-efficient manner could place us at a competitive disadvantage as compared to retailers who are more adept than us at managing these challenges, which, in turn, could negatively affect our overall operating results.

Our same store sales fluctuate due to a variety of economic, operating, industry and environmental factors and may not be a fair indicator of our overall performance.

Our same store sales have experienced fluctuations, which can be expected to continue. Numerous factors affect our same store sales results, including among others, the timing of new and relocated store openings, the relative proportion of new and relocated stores to mature stores, cannibalization resulting from the opening of new stores in existing markets, changes in advertising and other operating costs, the timing and level of markdowns, changes in our product mix, weather conditions, retail trends, the retail sales environment, economic conditions, inflation, the impact of competition, and our ability to execute our business strategy efficiently. As a result, same store sales or operating results may fluctuate, and may cause the price of our securities to fluctuate significantly. Therefore, we believe that period-to-period comparisons of our same store sales may not be a reliable indicator of our future overall operating performance.

We intend to open additional stores in both our existing markets and new markets, which poses both the possibility of diminishing sales by existing stores in our existing markets and the risk of a slow ramp-up period for stores in new markets.

Our expansion strategy includes plans to open 9 to 12 additional stores primarily in existing markets during 2016. Because our stores typically draw customers from their local areas, additional stores may draw customers away from nearby existing stores and may cause same store sales performance at those existing stores to decline, which may adversely affect our overall operating results. Additionally, stores in new markets typically have a ramp-up period before sales become steady enough for such stores to be profitable. Our ability to open additional stores will be dependent on our ability to promote and/or recruit enough qualified field managers, store managers, assistant store managers, and sales associates. The time and effort required to train and supervise a large number of new managers and associates, and integrate them into our culture may divert resources from our existing stores. If we are unable to profitably open additional stores in both new and existing markets and limit the adverse impact of those new stores on existing stores, it may reduce our same store sales and overall operating results during the implementation of our expansion strategy.

Our expansion strategy will be dependent upon, and limited by, the availability of adequate capital.

Our expansion strategy will require additional capital for, among other purposes, opening new stores, distribution centers, and manufacturing facilities as well as entering new markets. Such capital expenditures will include researching real estate and consumer markets, lease, inventory, property and equipment costs, integration of new stores and markets into company-wide systems and programs, and other costs associated with new stores and market entry expenses and growth. If cash generated internally is insufficient to fund capital requirements, we will require additional debt or equity financing. Adequate financing may not be available or, if available, may not be available on terms satisfactory to us. In addition, our credit facility may limit the amount of capital expenditures that we may make annually, depending on our leverage ratio. If we fail to obtain sufficient additional capital in the future or we are unable to make capital expenditures under our credit facility, we could be forced to curtail our expansion strategies by reducing or delaying capital expenditures relating to new stores and new market entry. As a result, there can be no assurance that we will be able to fund our current plans for the opening of new stores or entry into new markets.

If we fail to identify and maintain relationships with a sufficient number of suppliers, our ability to obtain products that meet our high quality standards at attractive prices could be adversely affected.

We purchase flooring and other products directly from suppliers located around the world. However, we do not have long-term contractual supply agreements with our suppliers that obligate them to supply us with products exclusively or at specified quantities or prices. As a result, our current suppliers may decide to sell products to our competitors and may not continue selling products to us. In order to retain the competitive advantage that we believe results from these relationships, we need to continue to identify, develop and maintain relationships with qualified suppliers that can satisfy our high standards for quality and our requirements for flooring and other products in a timely and efficient manner at attractive prices. The need to develop new relationships will be particularly important as we seek to expand our operations and enhance our product offerings in the future. The loss of one or more of our existing suppliers or our inability to develop relationships with new suppliers could reduce our competitiveness, slow our plans for further expansion and cause our net sales and operating results to be adversely affected.

We source the over 4,000 products that we stock and sell from approximately 165 domestic and international vendors. We source a large number of those products from foreign manufacturers, including 41% of our products from a group of ten suppliers located in Asia, Europe and the United States. We generally take title to these products sourced from foreign vendors overseas and are responsible for arranging shipment to our distribution centers. Financial instability among key vendors, political instability, trade restrictions, tariffs, currency exchange rates, and transport capacity and costs are beyond our control and could negatively impact our business if they seriously disrupt the movement of products through our supply chain or increased the costs of our products.

If our suppliers do not use ethical business practices or comply with applicable laws and regulations, our reputation could be harmed due to negative publicity and we could be subject to legal risk.

We do not control the operations of our suppliers. Accordingly, we cannot guarantee that our suppliers will comply with applicable environmental and labor laws and regulations or operate in a legal, ethical, and responsible manner. Violation of environmental, labor or other laws by our suppliers or their failure to operate in a legal, ethical, or responsible manner, could reduce demand for our products if, as a result of such violation or failure, we attract negative publicity. Further, such conduct could expose us to legal risks as a result of the purchase of products from non-compliant suppliers.

If customers are unable to obtain third-party financing at satisfactory rates, sales of our products could be materially adversely affected.

Our business, financial condition, and results of operations have been, and may continue to be affected, by various economic factors. Deterioration in the current economic environment could lead to reduced consumer and business spending, including by our customers. It may also cause customers to shift their spending to products that we either do not sell or that generate lower profitably for us. Further, reduced access to credit may adversely affect the ability of consumers to purchase our products. This potential reduction in access to credit may adversely impact our ability to offer customers credit card financing through third party credit providers on terms similar to those offered currently, or at all. In addition, economic conditions, including decreases in access to credit, may result in financial difficulties leading to restructuring, bankruptcies, liquidations and other unfavorable events for our customers, which may adversely impact our industry, business, and results of operations.

Any failure by us to successfully anticipate consumer trends may lead to loss of consumer acceptance of our products, resulting in reduced revenues.

Our success depends on our ability to anticipate and respond to changing trends and consumer demands in a timely manner. If we fail to identify and respond to emerging trends, consumer acceptance of our merchandise and our image with current or potential customers may be harmed, which could reduce our revenues. Additionally, if we misjudge market trends, we may significantly overstock unpopular products and be forced to reduce the sales price of such products, which would have a negative impact on our gross profit and cash flow. Conversely, shortages of products that prove popular could also reduce our revenues.

We depend on a few key employees, and if we lose the services of any our executive officers, we may not be able to run our business effectively.

Our future success depends in part on our ability to attract and retain key executive, merchandising, marketing, and sales personnel. Our executive officers include Chris Homeister, Chief Executive Officer; Kirk Geadelmann, Chief Financial Officer; Carl Randazzo, Senior Vice President — Retail; and Joseph Kinder, Senior Vice President — Operations. We have employment and non-compete arrangements with each of Messrs. Homeister, Geadelmann, Kinder, and Randazzo. If any of these executive officers ceases to be employed by us, we would have to hire additional qualified personnel. Our ability to successfully hire other experienced and qualified executive officers cannot be assured, and may be difficult because we face competition for these professionals from our competitors, our suppliers and other companies operating in our industry. As a result, the loss or unavailability of any of our executive officers could have a material adverse effect on us.

We have entered into a $125.0 million credit facility. The burden of this additional debt could adversely affect us, make us more vulnerable to adverse economic or industry conditions, and prevent us from fulfilling our debt obligations or from funding our expansion strategy.

We have entered into a credit facility with Fifth Third Bank., Bank of America, N.A., and The Huntington National Bank, for $125.0 million, including a term loan of $50.0 million and a revolving credit facility of $75.0 million. The terms of our credit facility and the burden of the indebtedness incurred thereunder could have serious consequences for us, such as:

|

|

• |

limiting our ability to obtain additional financing to fund our working capital, capital expenditures, debt service requirements, expansion strategy, or other needs; |

|

|

• |

placing us at a competitive disadvantage compared to competitors with less debt; |

|

|

• |

increasing our vulnerability to, and reducing our flexibility in planning for, adverse changes in economic, industry, and competitive conditions; and |

|

|

• |

increasing our vulnerability to increases in interest rates if borrowings under the credit facility are subject to variable interest rates. |

Our credit facility also contains negative covenants that limit our ability to engage in specified types of transactions. These covenants limit our ability to, among other things:

|

|

• |

incur indebtedness; |

|

|

• |

create liens; |

|

|

• |

engage in mergers or consolidations; |

|

|

• |

sell assets (including pursuant to sale and leaseback transactions); |

|

|

• |

pay dividends and distributions or repurchase our capital stock; |

|

|

• |

make investments, acquisitions, loans, or advances; |

|

|

• |

make capital expenditures; |

|

|

• |

repay, prepay, or redeem certain indebtedness; |

|

|

• |

engage in certain transactions with affiliates; |

|

|

• |

enter into agreements limiting subsidiary distributions; |

|

|

• |

enter into agreements limiting the ability to create liens; |

|

|

• |

amend our organizational document in a way that has a material effect on the lenders or administrative agent under our credit facility; and |

|

|

• |

change our lines of business. |

A breach of any of these covenants could result in an event of default under our credit facility. Upon the occurrence of an event of default, the lender could elect to declare all amounts outstanding under such facility to be immediately due and payable and terminate all commitments to extend further credit, or seek amendments to our debt agreements that would provide for terms more favorable to such lender and that we may have to accept under the circumstances. If we were unable to repay those amounts, the lender under our credit facility could proceed against the collateral granted to them to secure that indebtedness.

If we fail to hire, train, and retain qualified store managers, sales associates, and other employees, our enhanced customer service could be compromised and we could lose sales to our competitors.

A key element of our competitive strategy is to provide product expertise to our customers through our extensively trained, commissioned sales associates. If we are unable to attract and retain qualified personnel and managers as needed in the future, including qualified sales personnel, our level of customer service may decline, which may decrease our revenues and profitability.

If we are unable to renew or replace current store leases or if we are unable to enter into leases for additional stores on favorable terms, or if one or more of our current leases is terminated prior to expiration of its stated term and we cannot find suitable alternate locations, our growth and profitability could be negatively impacted.

We currently lease all of our store locations. Many of our current leases provide us with the unilateral option to renew for several additional rental periods at specific rental rates. Our ability to re-negotiate favorable terms on an expiring lease or to negotiate favorable terms for a suitable alternate location, and our ability to negotiate favorable lease terms for additional store locations, could depend on conditions in the real estate market, competition for desirable properties, our relationships with current and prospective landlords, or on other factors that are not within our control. Any or all of these factors and conditions could negatively impact our growth and profitability.

Compliance with laws or changes in existing or new laws and regulations or regulatory enforcement priorities could adversely affect our business.

We must comply with various laws and regulations at the local, regional, state, federal, and international levels. These laws and regulations change frequently and such changes can impose significant costs and other burdens of compliance on our business and vendors. Any changes in regulations, the imposition of additional regulations, or the enactment of any new legislation that affect employment/labor, trade, product safety, transportation/logistics, energy costs, health care, tax, or environmental issues, or compliance with the Foreign Corrupt Practices Act, could have an adverse impact on our financial condition and results of operations. Changes in enforcement priorities by governmental agencies charged with enforcing existing laws and regulations can increase our cost of doing business.

We may also be subject to audits by various taxing authorities. Changes in tax laws in any of the multiple jurisdictions in which we operate, or adverse outcomes from tax audits that we may be subject to in any of the jurisdictions in which we operate, could result in an unfavorable change in our effective tax rate, which could have an adverse effect on our business and results of operations.

As our stores are generally concentrated in the midwest, mid-Atlantic, south and northeast regions of the United States, we are subject to regional risks.

We have a high concentration of stores in the midwest, mid-Atlantic, south and northeast regions. If these markets individually or collectively suffer an economic downturn or other significant adverse event, there could be an adverse impact on same store sales, revenues, and profitability, and the ability to implement our planned expansion program. Any natural disaster, extended adverse weather or other serious disruption in these markets due to fire, tornado, hurricane, or any other calamity could damage inventory and could result in decreased revenues.

Our results may be adversely affected by fluctuations in material and energy costs.

Our results may be affected by the prices of the materials used in the manufacture of tile, setting and maintenance materials, and related accessories that we sell. These prices may fluctuate based on a number of factors beyond our control, including: oil prices, changes in supply and demand, general economic conditions, labor costs, competition, import duties, tariffs, currency exchange rates, and government regulation. In addition, energy costs have fluctuated dramatically in the past and may fluctuate in the future. These fluctuations may result in an increase in our transportation costs for distribution from the manufacturer to our distribution center and from our regional distribution centers to our retail stores, utility costs for our distribution and manufacturing centers and retail stores, and overall costs to purchase products from our vendors.

We may not be able to adjust the prices of our products, especially in the short-term, to recover these cost increases in materials and energy. A continual rise in material and energy costs could adversely affect consumer spending and demand for our products and increase our operating costs, both of which could have a material adverse effect on our financial condition and results of operations.

Our success is highly dependent on our ability to provide timely delivery to our customers, and any disruption in our delivery capabilities or our related planning and control processes may adversely affect our operating results.

Our success is due in part to our ability to deliver products quickly to our customers, which relies on successful planning and distribution infrastructure, including ordering, transportation and receipt processing, and the ability of suppliers to meet distribution requirements. Our ability to maintain this success depends on the continued identification and implementation of improvements to our planning processes, distribution infrastructure, and supply chain. We also need to ensure that our distribution infrastructure and supply chain keep pace with our anticipated growth and increased number of stores. The cost of these enhanced processes could be significant and any failure to maintain, grow, or improve them could adversely affect our operating results. Our business could also be adversely affected if there are delays in product shipments due to freight difficulties, strikes, or other difficulties at our suppliers’ principal transport providers, or otherwise.

Natural disasters, changes in climate and geo-political events could adversely affect our operating results.

The threat or occurrence of one or more natural disasters or other extreme weather events, whether as a result of climate change or otherwise, the threat or outbreak of terrorism, civil unrest or other hostilities or conflicts, could materially adversely affect our financial performance. These events may result in damage to, or destruction or closure of, our stores, distribution centers and other properties. Such events can also adversely affect our work force and prevent employees and customers from reaching our stores and other properties, can modify consumer purchasing patterns and decrease disposable income, and can disrupt or disable portions of our supply chain and distribution network.

Our ability to control labor costs is limited, which may negatively affect our business.

Our ability to control labor costs is subject to numerous external factors, including prevailing wage rates, the impact of legislation or regulations governing healthcare benefits or labor relations, such as the Affordable Care Act, and health and other insurance costs. If our labor and/or benefit costs increase, we may not be able to hire or maintain qualified personnel to the extent necessary to execute our competitive strategy, which could adversely affect our results of operations.

Our business operations could be disrupted if our information technology systems fail to perform adequately or we are unable to protect the integrity and security of our customer information.

We depend upon our information technology systems in the conduct of all aspects of our operations. If our information technology systems fail to perform as anticipated, we could experience difficulties in virtually any area of our operations, including but not limited to replenishing inventories or delivering products to store locations in response to consumer demands. It is also possible that our competitors could develop better online platforms than us, which could negatively impact our internet sales. Any of these or other systems-related problems could, in turn, adversely affect our revenues and profitability.

In connection with payment card sales and other transactions, including bank cards, debit cards, credit cards and other merchant cards, we process and transmit confidential banking and payment card information. Additionally, as part of our normal business activities, we collect and store sensitive personal information related to our employees, customers, vendors and other parties. Despite our security measures, our information technology and infrastructure may be vulnerable to criminal cyber-attacks or security incidents due to employee error, malfeasance or other vulnerabilities. Any such incidents could compromise our networks and the information stored there could be accessed, publicly disclosed, lost or stolen. Third parties may have the technology and know-how to breach the security of this information, and our security measures and those of our banks, merchant card processing and other technology vendors may not effectively prohibit others from obtaining improper access to this information. The techniques used by criminals to obtain unauthorized access to sensitive data change frequently and often are not recognized until launched against a target; accordingly, we may be unable to anticipate these techniques or implement adequate preventative measures.

Many states have enacted laws requiring companies to notify individuals of data security breaches involving their personal data. These mandatory disclosures regarding a security breach often lead to widespread negative publicity, which may cause our customers to lose confidence in the effectiveness of our data security measures. Any security breach, whether successful or not, would harm our reputation and could cause the loss of customers.

Our insurance coverage and self-insurance reserves may not cover future claims.

We maintain various insurance policies for employee health and workers’ compensation. We are self-insured on certain health insurance plans and are responsible for losses up to a certain limit for these respective plans. In 2014, we became self-insured with regard to workers’ compensation coverage, in which case we are responsible for losses up to certain retention limits on both a per-claim and aggregate basis.

For policies under which we are responsible for losses, we record a liability that represents our estimated cost of claims incurred and unpaid as of the balance sheet date. Our estimated liability is not discounted and is based on a number of assumptions and factors, including historical trends and economic conditions, and is closely monitored and adjusted when warranted by changing circumstances. Fluctuating healthcare costs, our significant growth rate and changes from our past experience with workers’ compensation claims could affect the accuracy of estimates based on historical experience. Should a greater amount of claims occur compared to what was estimated or medical costs increase beyond what was expected, our accrued liabilities might not be sufficient and we may be required to record additional expense. Unanticipated changes may produce materially different amounts of expense than that reported under these programs, which could adversely impact our operating results.

We are involved in a number of legal proceedings and, while we cannot predict the outcomes of such proceedings and other contingencies with certainty, some of these outcomes could adversely affect our business, financial condition and results of operations.

We are, and may become involved in shareholder, consumer, employment, tort or other litigation. We cannot predict with certainty the outcomes of these legal proceedings. The outcome of some of these legal proceeding could require us to take, or refrain from taking, actions which could negatively affect our operations or could require us to pay substantial amounts of money adversely affecting our financial condition and results of operations. Additionally, defending against lawsuits and proceedings may involve significant expense and diversion of management's attention and resources.

The market price of our securities may decline and/or be volatile.

Our common stock price may be volatile and all or part of any investment in our common stock may be lost.

The market price of our common stock could fluctuate significantly. Those fluctuations could be based on various factors in addition to those otherwise described in this report, including:

|

|

● |

our operating performance and the performance of our competitors; |

|

|

● |

the public’s reaction to our filings with the SEC, our press releases and other public announcements; |

|

|

● |

changes in recommendations or earnings estimates by research analysts who follow The Tile Shop or other companies in our industry; |

|

|

● |

variations in general economic conditions; |

|

|

● |

actions of our current stockholders, including sales of common stock by our directors and executive officers; |

|

|

● |

the arrival or departure of key personnel; and |

|

|

● |

other developments affecting us, our industry or our competitors. |

In addition, the stock market may experience significant price and volume fluctuations. These fluctuations may be unrelated to the operating performance of particular companies but may cause declines in the market price of our common stock. The price of our common stock could fluctuate based upon factors that have little or nothing to do with our company or its performance.

We are a holding company with no business operations of our own and depend on cash flow from The Tile Shop to meet our obligations.

We are a holding company with no business operations of our own or material assets other than the equity of our subsidiaries. All of our operations are conducted by our subsidiary, The Tile Shop. As a holding company, we will require dividends and other payments from our subsidiaries to meet cash requirements. The terms of any future credit facility may restrict our subsidiaries from paying dividends and otherwise transferring cash or other assets to us, although our current facility does not restrict this action. If there is an insolvency, liquidation, or other reorganization of any of our subsidiaries, our stockholders likely will have no right to proceed against their assets. Creditors of those subsidiaries will be entitled to payment in full from the sale or other disposal of the assets of those subsidiaries before us, as an equity holder, would be entitled to receive any distribution from that sale or disposal. If The Tile Shop is unable to pay dividends or make other payments to us when needed, we will be unable to satisfy our obligations.

Concentration of ownership may have the effect of delaying or preventing a change in control.

Our directors, executive officers, and certain holders of more than 5% of our common stock, including Nabron International Inc., together with their affiliates, beneficially hold approximately 40% of our outstanding shares of common stock. As a result, these stockholders, if acting together, have the ability to influence the outcome of corporate actions requiring stockholder approval. This concentration of ownership may have the effect of delaying or preventing a change in control and might adversely affect the market price of our securities.

Anti-takeover provisions contained in our certificate of incorporation and bylaws, as well as provisions of Delaware law, could impair a takeover attempt.

Our certificate of incorporation and bylaws contain provisions that could have the effect of delaying or preventing changes in control or changes in our management without the consent of our board of directors. These provisions include:

|

|

• |

a classified board of directors with three-year staggered terms, which may delay the ability of stockholders to change the membership of a majority of our board of directors; |

|

|

• |

no cumulative voting in the election of directors, which limits the ability of minority stockholders to elect director candidates; |

|

|

• |

the exclusive right of our board of directors to elect a director to fill a vacancy created by the expansion of the board of directors or the resignation, death, or removal of a director, which prevents stockholders from being able to fill vacancies on our board of directors; |

|

|

• |

the ability of our board of directors to determine to issue shares of preferred stock and to determine the price and other terms of those shares, including preferences and voting rights, without stockholder approval, which could be used to significantly dilute the ownership of a hostile acquirer; |

|

|

• |

a prohibition on stockholder action by written consent, which forces stockholder action to be taken at an annual or special meeting of our stockholders; |

|

|

• |

the requirement that a special meeting of stockholders may be called only by the chairman of the board of directors, the chief executive officer, or the board of directors, which may delay the ability of our stockholders to force consideration of a proposal or to take action, including the removal of directors; |

|

|

• |

limiting the liability of, and providing indemnification to, our directors and officers; |

|

|

• |

controlling the procedures for the conduct and scheduling of stockholder meetings; |

|

|

• |

providing the board of directors with the express power to postpone previously scheduled annual meetings of stockholders and to cancel previously scheduled special meetings of stockholders; |

|

|

• |

providing that directors may be removed prior to the expiration of their terms by stockholders only for cause; and |

|

|

• |

advance notice procedures that stockholders must comply with in order to nominate candidates to our board of directors or to propose matters to be acted upon at a stockholders’ meeting, which may discourage or deter a potential acquiror from conducting a solicitation of proxies to elect the acquiror’s own slate of directors or otherwise attempting to obtain control of us. |

These provisions, alone or together, could delay hostile takeovers and changes in control of us or changes in our management.

As a Delaware corporation, we are also subject to provisions of Delaware law, including Section 203 of the Delaware General Corporation Law, which prevents some stockholders holding more than 15% of our outstanding common stock from engaging in certain business combinations without approval of the holders of substantially all of our outstanding common stock. Any provision of our certificate of incorporation or bylaws or Delaware law that has the effect of delaying or deterring a change in control could limit the opportunity for our stockholders to receive a premium for their shares of our common stock, and could also affect the price that some investors are willing to pay for our common stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

As of December 31, 2015, we operated 114 stores located in 31 states with an average square footage of approximately 21,800 square feet. The table below sets forth the locations (alphabetically by state) of our 114 stores in operation as of December 31, 2015.

|

State |

Stores |

|

State |

Stores |

|

State |

Stores |

|

State |

Stores |

|

Arkansas |

1 |

|

Illinois |

10 |

|

Missouri |

4 |

|

Pennsylvania |

5 |

|

Arizona |

2 |

|

Indiana |

3 |

|

North Carolina |

4 |

|

Rhode Island |

1 |

|

Colorado |

3 |

|

Kansas |

2 |

|

Nebraska |

1 |

|

South Carolina |

2 |

|

Connecticut |

2 |

|

Kentucky |

3 |

|

New Jersey |

5 |

|

Tennessee |

3 |

|

Delaware |

1 |

|

Massachusetts |

3 |

|

New Mexico |

1 |

|

Texas |

9 |

|

Florida |

4 |

|

Maryland |

4 |

|

New York |

7 |

|

Virginia |

6 |

|

Georgia |

2 |

|

Michigan |

6 |

|

Ohio |

8 |

|

Wisconsin |

3 |

|

Iowa |

1 |

|

Minnesota |

6 |

|

Oklahoma |

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

114 |

We lease all of our stores. Our 15,000 square foot headquarters in Plymouth, Minnesota is attached to our retail store. We own four regional facilities used for distribution of purchased product and manufacturing of setting and maintenance materials, located in Spring Valley, Wisconsin; Ottawa Lake, Michigan; Ridgeway, Virginia; and Durant, Oklahoma, which consist of 51,000, 271,000, 134,000, and 150,000 square feet, respectively.

We believe that our material property holdings are suitable for our current operations and purposes. We intend to open 9 to 12 new retail locations in 2016.

ITEM 3. LEGAL PROCEEDINGS

The Company, two of its former executive officers, five of its outside directors, and certain companies affiliated with the directors, are defendants in a consolidated class action brought under the federal securities laws and now pending in the United States District Court for the District of Minnesota under the caption Beaver County Employees’ Retirement Fund, et al. v. Tile Shop Holdings, Inc., et al. Several related actions were filed in 2013, and then consolidated. The plaintiffs are three investors who seek to represent a class or classes consisting of (1) all purchasers of Tile Shop common stock between August 22, 2012 and January 28, 2014 (the “alleged class period”), seeking to pursue remedies under the Securities Exchange Act of 1934; and (2) all purchasers of Tile Shop common stock pursuant and/or traceable to the Company’s December 2012 registration statements, seeking to pursue remedies under the Securities Act of 1933. Six firms who were underwriters in the December 2012 secondary public offering are also named as defendants. In their consolidated amended complaint (the “complaint”), the plaintiffs allege that during the alleged class period, certain defendants made false or misleading statements of material fact in press releases and SEC filings about the Company’s relationships with its vendors, its gross margins, and its supply chain and producer relationships, and that defendants failed to disclose certain related party transactions. The complaint asserts claims under Sections 11, 12(a)(2), and 15 of the Securities Act of 1933, and under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934. In addition to attorney’s fees and costs, the plaintiffs seek to recover damages on behalf of the members of the purported classes. The defendants are vigorously defending the matter. The matter is now in discovery.

The Company also is a Defendant in a consolidated action brought derivatively on behalf of the Company by two shareholders of the Company. One action was first filed in the United States District Court for the District of Minnesota, and then voluntarily dismissed and re-filed in the Court of Chancery for the State of Delaware (“Delaware Chancery Court”). The second action was filed in Delaware Chancery Court. The two actions have since been consolidated by the Delaware Chancery Court under the caption In re Tile Shop Holdings, Inc. Stockholder Derivative Litigation. On July 31, 2015, the plaintiff-shareholders filed their Verified Consolidated Stockholder Derivative Complaint (“complaint”). The complaint names as defendants six members of the Company’s Board of Directors, and a former employee of the Company. The complaint tracks many of the same factual allegations as have been made in the above-described federal securities class action. It alleges that the defendant-directors breached their fiduciary duties by failing to adopt adequate internal controls for the Company, by approving false and misleading statements issued by the Company, by causing the Company to violate generally accepted accounting principles and SEC regulations, by engaging in or approving alleged insider trading, and by permitting the Company’s primary product to contain illegal amounts of lead. The complaint also alleges claims for insider trading and unjust enrichment. The complaint seeks damages, disgorgement, an award of attorneys’ fees and other expenses, and an order compelling changes to the Company’s corporate governance and internal procedures. On November 2, 2015, defendants filed a motion to dismiss the derivative action, or in the alternative, to stay it pending resolution of the Beaver County Employees’ Retirement Fund action described above. Subsequently, the parties entered into a stipulation, and the Court entered an Order, staying the derivative action until resolution of the Beaver County Employees’ Retirement Fund action described above, or until a mutually agreeable resolution of the derivative action.

Given the uncertainty of litigation and the preliminary stage of these cases, the Company cannot reasonably estimate the possible loss or range of loss that may result from these actions. The Company maintains directors and officers liability insurance policies that may reduce the Company’s exposure, if any. In the event the Company incurs a loss, the Company will pursue recoveries to the maximum extent available under these policies.

The Company is also, from time to time, subject to claims and disputes arising in the normal course of business. In the opinion of management, while the outcome of such claims and disputes cannot be predicted with certainty, the Company’s ultimate liability in connection with these matters is not expected to have a material adverse effect on the results of operations, financial position, or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES

None.

Part II

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is traded on The NASDAQ Stock Market under the symbol “TTS”. The following table shows the high and low sale prices per share of our common stock as reported on The NASDAQ Stock Market for the periods indicated:

|

Common Stock |

||||||||||

|

|

Quarter |

High |

Low |

|||||||

|

Fiscal 2014 |

First | $ | 18.67 | $ | 12.40 | |||||

|

|

Second | $ | 16.69 | $ | 11.75 | |||||

|

|

Third | $ | 15.94 | $ | 9.06 | |||||

|

|

Fourth | $ | 10.15 | $ | 6.94 | |||||

|

Fiscal 2015 |

First | $ | 12.55 | $ | 6.95 | |||||

|

|

Second | $ | 15.25 | $ | 11.51 | |||||

|

|

Third | $ | 15.00 | $ | 11.32 | |||||

|

|

Fourth | $ | 17.50 | $ | 11.67 | |||||

As of February 19, 2016, we had approximately 29 holders of record of our common stock. This figure does not include the number of persons whose securities are held in nominee or “street” name accounts through brokers.

As of February 19, 2016, we had outstanding a total of 51,437,973 shares of common stock and no warrants. The last reported sales price for our common stock on February 19, 2016 was $13.26.

Dividends

We have never declared or paid, and do not anticipate declaring or paying, cash dividends on our common stock in the foreseeable future. While our board of directors may consider whether or not to institute a dividend policy, it is our present intention to retain any earnings for use in our business operations. In addition, our credit facility restricts our ability to pay dividends.

Securities Authorized for Issuance Under Equity Compensation Plans

For information on our equity compensation plans, refer to Item 12, “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.”

Recent Sales of Unregistered Securities

None.

Issuer Purchases of Equity Securities

None.

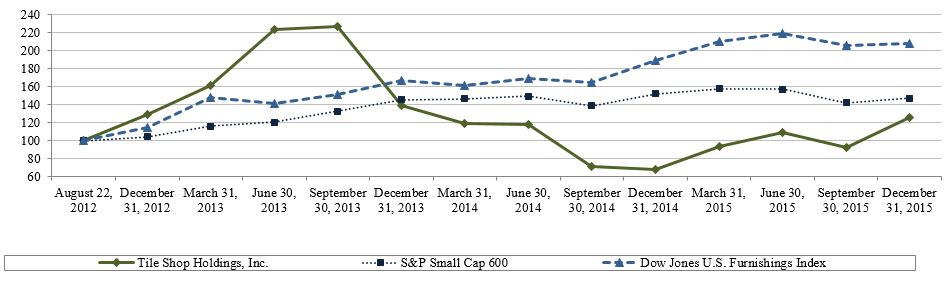

Stock Performance Graph

The graph and table below present the Company’s cumulative total stockholder returns relative to the performance of the S&P SmallCap 600 and the Dow Jones U.S. Furnishings Index for the period commencing August 22, 2012, the date of the Business Combination, and ending December 31, 2015, the last trading day of fiscal 2015. The comparison assumes $100 invested at the close of trading on August 22, 2012 in (i) the Company’s common stock, (ii) the stocks comprising the S&P SmallCap 600, and (iii) the stocks comprising the Dow Jones U.S. Furnishings Index. All values assume that all dividends were reinvested on the date paid. The points on the graph represent fiscal quarter-end amounts based on the last trading day in each fiscal quarter. The stock price performance included in the line graph below is not necessarily indicative of future stock price performance.

|

Tile Shop Holdings, Inc. |

S&P Small Cap 600 |

Dow Jones U.S. Furnishings Index |

||||||||||

|

August 22, 2012 |

$ | 100.00 | $ | 100.00 | $ | 100.00 | ||||||

|

December 31, 2012 |

$ | 129.46 | $ | 104.15 | $ | 114.95 | ||||||

|

March 31, 2013 |

$ | 161.62 | $ | 116.13 | $ | 148.24 | ||||||

|

June 30, 2013 |

$ | 222.77 | $ | 120.31 | $ | 141.74 | ||||||

|

September 30, 2013 |

$ | 226.85 | $ | 132.82 | $ | 150.66 | ||||||

|

December 31, 2013 |

$ | 139.00 | $ | 145.45 | $ | 167.14 | ||||||

|

March 31, 2014 |

$ | 118.85 | $ | 146.67 | $ | 161.37 | ||||||

|

June 30, 2014 |

$ | 117.62 | $ | 149.24 | $ | 169.03 | ||||||

|

September 30, 2014 |

$ | 71.15 | $ | 138.77 | $ | 164.83 | ||||||

|

December 31, 2014 |

$ | 68.31 | $ | 151.90 | $ | 188.82 | ||||||

|

March 31, 2015 |

$ | 93.15 | $ | 157.39 | $ | 210.44 | ||||||

|

June 30, 2015 |

$ | 109.15 | $ | 157.17 | $ | 219.24 | ||||||

|

September 30, 2015 |

$ | 92.15 | $ | 142.09 | $ | 205.78 | ||||||

|

December 31, 2015 |

$ | 126.15 | $ | 146.80 | $ | 207.54 | ||||||

ITEM 6. SELECTED FINANCIAL DATA

The following table sets forth selected historical financial information derived from (i) our audited financial statements included elsewhere in this report as of December 31, 2015, and 2014 for the years ended December 31, 2015, 2014 and 2013 (ii) our audited financial statements not included elsewhere in this report as of December 31, 2013 and 2012 and for the year ended December 31, 2012 (iii) The Tile Shop’s audited financial statements not included in this report as of December 31, 2011 and for the years ended December 31, 2011. The following selected financial data should be read in conjunction with the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and the related notes appearing elsewhere in this report.

|

As of December 31, or for the year ended December 31, |

||||||||||||||||||||

|

2015 |

2014 |

2013 |

2012 |

2011 |

||||||||||||||||

|

(in thousands, except per share) |

||||||||||||||||||||

|

Statement of Income Data |

||||||||||||||||||||

|

Net sales |

$ | 292,987 | $ | 257,192 | $ | 229,564 | $ | 182,650 | $ | 152,717 | ||||||||||

|

Cost of sales |

89,377 | 78,300 | 68,755 | 49,626 | 40,321 | |||||||||||||||

|

Gross profit |

203,610 | 178,892 | 160,809 | 133,024 | 112,396 | |||||||||||||||

|

Selling, general and administrative expenses |