UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2015,

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Numbers: 001-36840

GREENHAVEN COAL FUND

(Registrant)

(Exact name of Registrant as specified in its charter)

| Delaware |

90-6214629

| |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

| c/o GreenHaven Coal Services LLC | ||

| 3340 Peachtree Rd, Suite 1910 | ||

| Atlanta, Georgia | 30326 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (404)-239-7942

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted to its web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to post such files). Yes þ No £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large Accelerated Filer ¨ |

Accelerated Filer ¨ | Non-Accelerated Filer ¨ | Smaller reporting company þ | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

Indicate the number of outstanding Shares as of June 30, 2015: 25,050 Shares.

GREENHAVEN COAL FUND

QUARTER ENDED JUNE 30, 2015

| PART 1. FINANCIAL INFORMATION | 2 | |

| ITEM 1. FINANCIAL STATEMENTS | ||

| GreenHaven Coal Fund Financial Statements | ||

| Statements of Financial Condition for June 30, 2015 (unaudited) and December 31, 2014 | 3 | |

| Unaudited Schedule of Investments at June 30, 2015 | 4 | |

| Unaudited Statement of Income and Expenses for the Three Months Ended June 30, 2015 and Six Months Ended June 30, 2015 | 5 | |

| Unaudited Statement of Changes in Shareholders’ Equity for the Six Months Ended June 30, 2015 | 6 | |

| Unaudited Statement of Cash Flows for the Six Months Ended June 30, 2015 | 7 | |

| ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 16 | |

| ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 19 | |

| ITEM 4. CONTROLS AND PROCEDURES | 20 | |

| PART II. OTHER INFORMATION | 21 | |

| ITEM 1. Legal Proceedings | 21 | |

| ITEM 1A. Risk Factors | 21 | |

| ITEM 2. Unregistered Sales of Equity Securities and Use of Proceeds | 21 | |

| ITEM 3. Defaults Upon Senior Securities | 21 | |

| ITEM 4. Reserved | 21 | |

| ITEM 5. Other Information | 21 | |

| ITEM 6. Exhibits | 22 | |

| SIGNATURES | 22 | |

| EXHIBIT INDEX | 23 | |

| EX-3.1 GreenHaven Coal Fund Second Amended and Restated Turst Agreement | ||

| EX-31.1 SECTION 302 Certification of CEO | ||

| EX-31.2 SECTION 302 Certification of CFO | ||

| EX-32.1 SECTION 906 Certification of CEO | ||

| EX-32.2 SECTION 906 Certification of CFO | ||

| EX-101 Interactive Data Files |

| 2 |

GreenHaven Coal Fund

Statements of Financial Condition

June 30, 2015 (unaudited) and December 31, 2014

June 30, 2015 (unaudited) |

December

31, 2014 |

|||||||

| Assets | ||||||||

| Equity in broker trading accounts: | ||||||||

| Cash held by broker | $ | 951,753 | $ | 1,500 | ||||

| Net unrealized appreciation on futures contracts | 42,500 | — | ||||||

| Prepaid brokerage fees and expenses | 1,683 | — | ||||||

| Total assets | $ | 995,936 | $ | 1,500 | ||||

| Liabilities and shareholders’ equity | ||||||||

| Management fee payable to related party | 755 | — | ||||||

| Total liabilities | $ | 755 | $ | — | ||||

| Shareholders’ equity | ||||||||

| Paid in capital – 25,050 and 50 redeemable shares issued and outstanding as of June 30, 2015 and December 31, 2014, respectively | 1,304,975 | 1,500 | ||||||

| Accumulated deficit | (309,794 | ) | — | |||||

| Total shareholders’ equity | 995,181 | 1,500 | ||||||

| Total liabilities and shareholders’ equity | $ | 995,936 | $ | 1,500 | ||||

| Net asset value per share | $ | 39.73 | $ | 30.00 | ||||

See accompanying notes to unaudited financial statements

| 3 |

GreenHaven Coal Fund

Unaudited Schedule of Investments

June 30, 2015

| Description | Percentage of Net Assets |

Fair Value |

Notional Value |

|||||||||

| Unrealized Appreciation on Futures Contracts | ||||||||||||

| Coal API2 ARA SWP (5 contracts, settlement date December 31, 2015) | 1.31 | % | $ | 13,100 | $ | 302,500 | ||||||

| Coal API2 ARA SWP (5 contracts, settlement date November 27, 2015) | 1.34 | 13,300 | 302,500 | |||||||||

| Coal API2 ARA SWP (6 contracts, settlement date October 30, 2015) | 1.62 | 16,100 | 363,000 | |||||||||

| Net Unrealized Appreciation on Futures Contracts | 4.27 | % | $ | 42,500 | $ | 968,000 | ||||||

See accompanying notes to unaudited financial statements

| 4 |

GreenHaven Coal Fund

Unaudited Statement of Income and Expenses

For the Three Months Ended June 30, 2015

and Six Months Ended June 30, 2015*

| Three Months Ended |

Six Months Ended |

|||||||

| June 30, 2015 | June 30, 2015 | |||||||

| Income | ||||||||

| Interest Income | $ | — | $ | — | ||||

| Expenses | ||||||||

| Management fee to related party | 5,169 | 11,282 | ||||||

| Brokerage fees and expenses | 1,632 | 3,562 | ||||||

| Total expenses | 6,801 | 14,844 | ||||||

| Net Investment Loss | (6,801 | ) | (14,844 | ) | ||||

| Realized and Net Change in Unrealized Gain (Loss) on Investments and Futures Contracts | ||||||||

| Realized Loss on | ||||||||

| Futures Contracts | (169,950 | ) | (337,450 | ) | ||||

| Net Realized Loss | (169,950 | ) | (337,450 | ) | ||||

| Net Change in Unrealized Gain on | ||||||||

| Futures Contracts | 142,100 | 42,500 | ||||||

| Net Change in Unrealized Gain | 142,100 | 42,500 | ||||||

| Net Realized and Unrealized Loss on Investments and Futures Contracts | (27,850 | ) | (294,950 | ) | ||||

| Net Loss | $ | (34,651 | ) | $ | (309,794 | ) | ||

* Commenced trading operations on the NYSE Arca on February 20, 2015.

See accompanying notes to unaudited financial statements

| 5 |

GreenHaven Coal Fund

Unaudited Statement of Changes in Shareholders’ Equity

For the Six Months Ended June 30, 2015*

| Total | ||||||||||||||||

| Paid In | Accumulated | Shareholders’ | ||||||||||||||

| Units | Capital | Deficit | Equity | |||||||||||||

| Balance at December 31, 2014 | 50 | $ | 1,500 | $ | — | $ | 1,500 | |||||||||

| Capital Contribution on Original Units | — | 500 | — | 500 | ||||||||||||

| Creation of Limited Units | 150,000 | 6,000,000 | — | 6,000,000 | ||||||||||||

| Redemption of Limited Units | (125,000 | ) | (4,697,025 | ) | — | (4,697,025 | ) | |||||||||

| Net Loss: | ||||||||||||||||

| Net Investment loss | — | — | (14,844 | ) | (14,844 | ) | ||||||||||

| Net realized loss on Investments and Futures Contracts | — | — | (337,450 | ) | (337,450 | ) | ||||||||||

| Net change in unrealized gain on Futures Contracts | — | — | 42,500 | 42,500 | ||||||||||||

| Balance at June 30, 2015 (unaudited) | 25,050 | $ | 1,304,975 | $ | (309,794 | ) | $ | 995,181 | ||||||||

* Commenced trading operations on the NYSE Arca on February 20, 2015

See accompanying notes to unaudited financial statements

| 6 |

GreenHaven Coal Fund

Unaudited Statement of Cash Flows

For the Six Months Ended June 30, 2015*

| Cash flow from operating activities: | ||||

| Net Loss | $ | (309,794 | ) | |

| Adjustments to reconcile net loss to net cash used for operating activities: | ||||

| Unrealized appreciation on investments and futures contracts | (42,500 | ) | ||

| Increase in accrued expenses | 755 | |||

| Increase in prepaid brokerage fees and expenses | (1,683 | ) | ||

| Net cash used for operating activities | (353,222 | ) | ||

| Cash flows from financing activities: | ||||

| Proceeds from creation of Limited Units | 6,000,000 | |||

| Additional capital contribution | 500 | |||

| Redemption of Limited Units | (4,697,025 | ) | ||

| Net cash provided by financing activities | 1,303,475 | |||

| Net change in cash | 950,253 | |||

| Cash held by broker at the beginning of the period | 1,500 | |||

| Cash held by broker at end of period | $ | 951,753 | ||

* Commenced trading operations on the NYSE Arca on February 20, 2015.

See accompanying notes to unaudited financial statements

| 7 |

GreenHaven Coal Fund

Notes to Unaudited Financial Statements

June 30, 2015

(1) Organization

GreenHaven Coal Fund (the “Fund”), formerly GreenHaven Coal Index Fund, was formed as a Delaware statutory trust on June 18, 2012 and commenced operations on February 20, 2015. The business of the Fund is limited to (i) creating and redeeming common units of beneficial interest in the Fund (“Shares”) in minimum blocks of 25,000 Shares (“Baskets”) on a continuous basis, and (ii) investing proceeds in a portfolio of Rotterdam Coal futures contracts (“Coal Futures”) and U.S. Treasuries. The Fund’s sponsor is GreenHaven Coal Services, LLC, a Georgia limited liability company (the “Sponsor”). The Sponsor serves as the Fund’s commodity pool operator and sponsor under the Fund’s trust agreement, and is responsible for the day-to-day operations of the Fund. Shares of the Fund are offered on NYSE Arca stock exchange under the symbol “TONS”.

The Fund’s investment objective is to provide its investors (“Shareholders”) with exposure to daily changes in the price of Coal Futures, before Fund liabilities and expenses. The Fund intends to achieve this objective by investing substantially all of its assets in Coal Futures traded on the Chicago Mercantile Exchange (the “CME”) under the symbol “MTF”. The Fund will invest in Coal Futures on a non-discretionary basis (i.e., without regard to whether the value of the Fund is rising or falling over any particular period). Additional specifications for CME Coal Futures can be found at the CME’s website: www.cmegroup.com. The Fund will also invest a portion of its net assets in U.S. Treasuries and other high quality short-term fixed income securities for deposit with the Fund’s commodity brokers as margin.

The proceeds from the offering of Shares are invested in the Fund (See Note 7 for details of the procedures for creation and redemption of Shares in the Fund).

The Sponsor and the Shareholders share in any profits and losses of the Fund in proportion to the percentage interest owned by each.

The Sponsor and the Fund retain the services of third party service providers to the extent necessary to operate the ongoing operations of the Fund. (See Note (2)).

Unaudited Interim Financial Information

The financial statements as of June 30, 2015 included herein are unaudited. In the opinion of the Sponsor, the unaudited financial statements have been prepared on the same basis as an annual financial statement and include all adjustments, which are of the normal recurring nature, necessary for a fair statement of the Fund’s financial position, investments, results of operations and cash flows. Interim results are not necessarily indicative of the results that will be achieved for the year or for any other interim period or for any future year.

(2) Service Providers and Related Party Agreements

(a) ”Trustee” – Christiana Trust is the sole trustee for the Fund. The Trustee is a division of Wilmington Saving Fund Society, FSB, and is headquartered in Wilmington, DE.

(b) ”Sponsor” – GreenHaven Coal Services, LLC is responsible for the day to day operations of the Fund. The Sponsor charges the Fund a management fee for its services. GreenHaven Coal Services, LLC is a Georgia limited liability company with operations in Atlanta, GA.

| 8 |

(c) “Administrator” - The Bank of New York Mellon Corporation has been appointed by the Sponsor as the administrator, custodian and transfer agent of the Fund, and has entered into separate administrative, custodian, transfer agency and service agreements (collectively referred to as the “Administration Agreement”). Pursuant to the Administration Agreement, the Administrator performs or supervises the services necessary for the operation and administration of the Fund (other than making investment decisions), including receiving calculations of the assets minus the liabilities of the Fund (the “Net Asset Value”), accounting and other fund administrative services. As the Fund’s transfer agent, the Administrator processes additions and redemptions of shares. These transactions are processed on Depository Trust Company’s (“DTC”) book entry system. The Administrator retains certain financial books and records, including: Basket creation and redemption books and records, fund accounting records, ledgers with respect to assets, liabilities, capital, income and expenses, the registrar, transfer journals and related details and trading and related documents received from futures commission merchants. The Bank of New York Mellon Corporation is based in New York, New York.

(d) “Commodity Broker” — Morgan Stanley & Co. LLC (“MS&Co.”) is the Fund’s Commodity Broker. In its capacity as the Commodity Broker, it executes and clears each of the Fund’s futures transactions and performs certain administrative services for the Fund. MS&Co. is based in New York, New York.

(e) “Execution Broker” — TFS Energy Futures LLC (“TEF”) is the Fund’s initial Execution Broker. The Execution Broker will execute certain of the Fund’s over-the-counter transactions and perform certain administrative services for the Fund. TEF is based in New York, New York.

(f)

“Marketing Agent” — ALPS Distributors, Inc. is the Fund’s Distributor, and assists the Sponsor and the

Administrator with certain functions and duties relating to the creation and redemption of Baskets, including receiving and processing

orders from the Fund’s Authorized Participants to create and redeem Baskets, coordinating the processing of such orders

and related functions and duties. The Marketing Agent retains all marketing materials and Basket creation and redemption books

and records at c/o ALPS Distributors, Inc., 1290 Broadway, Suite 1100, Denver, CO 80203; Telephone number (303) 623-2577 .

Investors may contact the Marketing Agent toll-free in the U.S. at (800) 320-2577. The Fund has entered into a Distribution

Services Agreement with the Marketing Agent.

.

Investors may contact the Marketing Agent toll-free in the U.S. at (800) 320-2577. The Fund has entered into a Distribution

Services Agreement with the Marketing Agent.

The Marketing Agent is affiliated with ALPS Mutual Fund Services, Inc., a Denver-based service provider of administration, fund accounting, transfer agency and shareholder services for mutual funds, closed-end funds and exchange-traded funds.

(g) “Authorized Participant” — Authorized Participants may create or redeem Shares of the Fund. Each Authorized Participant must (1) be a registered broker-dealer or other securities market participant such as a bank or other financial institution which is not required to register as a broker-dealer to engage in securities transactions, (2) be a participant in the DTC, and (3) have entered into an agreement (“Participant Agreement”) with the Fund. The Participant Agreement sets forth the procedures for the creation and redemption of Baskets of Shares and for the delivery of cash required for such creations or redemptions. A list of the current Authorized Participants can be obtained from the Administrator. A similar agreement by the Fund sets forth the procedures for the creation and redemption of Baskets of Shares by the Fund.

(3) Summary of Significant Accounting Policies

(a) Use of Estimates

The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the amounts of reported income and expenses. Actual results could differ from those estimates.

(b) Recently Issued Accounting Standards

No recently promulgated accounting standards are expected to have an effect on the Fund’s financial statements.

| 9 |

(c) Cash Held by Broker

The Fund defines cash held by broker to be highly liquid investments, with original maturities of three months or less when acquired. MS&Co allows the Fund to apply its Treasury Bill portfolio towards its initial margin requirement for the Fund’s futures positions, hence all cash held by the broker is unrestricted cash. The cash and Treasury Bill positions are held in segregated accounts at MS&Co and are not insured by the Federal Deposit Insurance Corporation.

(d) United States Treasury Obligations

The Fund records purchases and sales of United States Treasury Obligations on a trade date basis. These holdings are marked to market based on quoted market closing prices. The Fund holds United States Treasury Obligations for deposit with the commodity broker as margin for trading and holding against initial margin of the open futures contracts. Interest income is recognized on an accrual basis when earned. Premiums and discounts are amortized or accreted over the life of the United States Treasury Obligations.

(e) Income Taxes

The Fund is classified as a partnership, for U.S. federal income tax purposes. Accordingly the Fund is subject to U.S. federal, state, or local income taxes. No provision for federal, state, or local income taxes has been made in the accompanying financial statements, as investors are individually liable for income taxes, if any, on their allocable share of the Fund’s income, gain, loss, deductions and other items.

The Fund accounts for uncertainty in income taxes pursuant to the applicable accounting standard, which provides measurement, presentation and disclosure guidance related to uncertain tax positions. The guidance addresses how tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under this topic, the Fund may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position are measured based on the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate resolution.

(f) Futures Contracts

The Fund purchases and holds commodity futures contracts for investment purposes. These contracts are recorded on a trade date basis and open contracts are valued daily at settlement prices provided by the relevant exchanges. In the Statement of Financial Condition, futures contracts are presented at their published settlement prices on the last business day of the period, in accordance with the fair value accounting standard. Since these contracts are actively traded in markets that are directly observable and which provide readily available price quotes, their market value is deemed to be their fair value under the fair value accounting standard. (See Note 4 — Fair Value Measurements).

However, when market closing prices are not available, the Sponsor may value an asset of the Fund pursuant to such other principles as the Sponsor deems fair and equitable so long as such principles are consistent with the fair value accounting standard. Realized gains (losses) and changes in unrealized appreciation (depreciation) on open positions are determined on a specific identification basis and recognized in the consolidated statement of income and expenses in the period in which the contract is closed or the changes occur, respectively.

(g) Subsequent Events

For purposes of disclosure in the financial statements, the Fund has evaluated events occurring during the period ended, June 30, 2015 and through the date the financial statements were issued.

The evaluation did not result in any subsequent events that necessitated disclosures and/or adjustments.

| 10 |

(4) Fair Value Measurements

The existing guidance for fair value measurements establishes the authoritative definition for fair value, sets out a framework for measuring fair value and outlines the required disclosures regarding fair value measurements. Fair value is the price that would be received to sell an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants at the measurement date. The Fund uses a three-tier fair value hierarchy based upon observable and unobservable inputs as follows:

Level 1 — Quoted prices (unadjusted) in active markets for identical assets or liabilities that the reporting entity can access at the measurement date.

Level 2 — Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly.

Level 3 — Unobservable inputs for the asset or liability.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The assets of the Fund are either exchange-traded securities or government securities that are valued using dealer and broker quotations or other inputs that are observable or can be corroborated by observable market data.

A summary of the Fund’s assets and liabilities at fair value as of June 30, 2015, classified according to the levels used to value them, is as follows:

Assets | Quoted

Prices in | Other | Significant | Totals | ||||||||||||

| Futures Contracts | $ | 42,500 | - | - | $ | 42,500 | ||||||||||

There were no transfers between Level 1 and Level 2 for the Fund during the period ended June 30, 2015. The Fund did not hold any Level 3 securities during the period ended June 30, 2015.

(5) Derivative Instruments and Hedging Activities

The Fund uses derivative instruments as part of its principal investment strategy to achieve its investment objective.

At June 30, 2015, the fair value of derivative instruments was as follows:

| Derivative Instruments | Asset Derivatives | Liability Derivatives | Net Derivatives | |||||||

| Futures Contracts | $ | 42,500 | $ | - | $ | 42,500 | ||||

The following is a summary of the realized and unrealized gains and losses of the derivative instruments utilized by the Fund for the six months ended June 30, 2015:

| Derivative Instruments | Realized Loss on Derivative Instruments |

Net Change

in Unrealized Loss on Derivative Instruments |

||||||

| Futures Contracts | $ | (337,450 | ) | $ | 42,500 | |||

| 11 |

(6) Financial Instrument Risk

In the normal course of its business, the Fund may be party to financial instruments with off-balance sheet risk. The term “off-balance sheet risk” refers to an unrecorded potential liability that, even though it does not appear on the statements of financial condition, may result in a future obligation or loss. The financial instruments used by the Fund are commodity futures, whose values are based upon an underlying asset and generally represent future commitments which have a reasonable possibility to be settled in cash or through physical delivery. These instruments are traded on an exchange and are standardized contracts.

Market risk is the potential for changes in the value of the financial instruments traded by the Fund due to market changes, including fluctuations in commodity prices. In entering into these contracts, there exists a market risk that such contracts may be significantly influenced by conditions, resulting in such contracts being less valuable. If the markets should move against all of the futures interest positions at the same time, and the Sponsor was unable to offset such positions, the Fund could experience substantial losses.

Credit risk is the possibility that a loss may occur due to the failure of an exchange clearinghouse to perform according to the terms of a contract. Credit risk with respect to exchange-traded instruments is reduced to the extent that an exchange or clearing organization acts as counterparty to the transactions. The Fund’s risk of loss in the event of counterparty default is typically limited to the amounts recognized in the statement of assets and liabilities and not represented by the contract or notional amounts of the instruments.

The Fund has not utilized, nor does it expect to utilize in the future, special purpose entities to facilitate off-balance sheet financing arrangements and has no loan guarantee arrangements or off-balance sheet arrangements of any kind other than agreements entered into in the normal course of business.

(7) Share Creations and Redemptions

As described in the Fund’s Prospectus, the creation and redemption procedures allow only Authorized Participants to create and redeem Shares directly from the Fund. Proceeds from sales of shares of the Fund are invested directly in the Fund. Retail investors seeking to purchase or sell Shares on any day are expected to execute such transactions in the secondary market, on the NYSE-Arca, at the market price per Share, rather than in connection with the creation or redemption of Baskets.

(a) Creation of Shares

On any business day, an Authorized Participant may place an order with the Marketing Agent to create one or more Baskets. Creation orders are accepted only on a “business day” during which the NYSE Arca is open for regular trading. Purchase orders must be placed no later than 10:00 a.m., New York time, on each business day the NSYE Arca is open for regular trading. The day on which the Marketing Agent receives a valid purchase order is the purchase order date.

The total payment required to create each Basket is the Net Asset Value of 25,000 Shares on the purchase order date, but only if the required payment is timely received. To calculate the Net Asset Value, the Administrator will use the CME settlement price (typically determined after 5:00 p.m. New York time) for the Coal Futures traded on the CME.

Because orders to purchase Baskets must be placed no later than 10:00 a.m., New York time, but the total payment required to create a Basket typically will not be determined until after 5:00 p.m., New York time, on the date the purchase order is received, Authorized Participants will not know the total amount of the payment required to create a Basket at the time they submit an irrevocable purchase order. The Net Asset Value and the total amount of the payment required to create a Basket could rise or fall substantially between the time an irrevocable purchase order is submitted and the time the amount of the purchase price in respect thereof is determined.

An Authorized Participant who places a purchase order is required to transfer to the Administrator the required amount of U.S. Treasuries and/or cash by the end of the next business day following the purchase order date. Upon receipt of the deposit amount, the Administrator will direct DTC to credit the number of Baskets ordered to the Authorized Participant’s DTC account on the next business day following the purchase order date.

| 12 |

The Sponsor acting by itself or through the Administrator or Marketing Agent may suspend the right of purchase, or postpone the purchase settlement date, for any period during which the NYSE Arca or other exchange on which the Shares are listed is closed, other than for customary holidays or weekends, or when trading is restricted or suspended. None of the Sponsor, the Marketing Agent or the Administrator will be liable to any person or in any way for any loss or damages that may result from any such suspension or postponement.

The Sponsor acting by itself or through the Administrator or the Marketing Agent may reject a purchase order if (1) it determines that the purchase order is not in proper form, (2) circumstances outside the control of the Sponsor make it, for all practical purposes, not feasible to process creations of Baskets, such as during force majeure events, or (3) the Sponsor believes that it or the Fund would be in violation of any securities or commodities rules or regulations regarding position limits or otherwise by accepting a creation. None of the Administrator, the Marketing Agent or the Sponsor will be liable for the rejection of any purchase order.

(b) Redemption of Shares

The approved procedures by which an Authorized Participant can redeem one or more Baskets mirror in reverse the procedures for the creation of Baskets. On any business day, an Authorized Participant may place an order with the Marketing Agent to redeem one or more Baskets. Redemption orders must be placed no later than 10:00 a.m., New York time, on each business day The day on which the Marketing Agent receives a valid redemption order is the redemption order date.

By placing a redemption order, an Authorized Participant agrees to deliver the Baskets to be redeemed through DTC’s book-entry system to the Fund not later than 12:00 p.m., New York time, on the business day immediately following the redemption order date. By placing a redemption order, and prior to receipt of the redemption distribution, an Authorized Participant’s DTC account will be charged the non-refundable transaction fee due for the redemption order.

The redemption distribution from the Fund consists of the cash redemption amount equal to the Net Asset Value of the number of Basket(s) requested in the Authorized Participant’s redemption order on the redemption order date. To calculate the NAV, the Administrator will use the CME settlement price (typically determined after 5:00 p.m. New York time) for the Coal Futures traded on the CME. Because orders to redeem Baskets must be placed no later than 10:00 a.m., New York time, but the total amount of redemption proceeds typically will not be determined until after 5:00 p.m., New York time, on the date the redemption order is received, Authorized Participants will not know the total amount of the redemption proceeds at the time they submit an irrevocable redemption order. The Net Asset Value and the total amount of redemption proceeds could rise or fall substantially between the time an irrevocable redemption order is submitted and the time the amount of redemption proceeds in respect thereof is determined.

The redemption distribution due from the Fund is delivered to the Authorized Participant at 12:00 p.m., New York time, on the business day immediately following the redemption order date if, by such time, the Fund’s DTC account has been credited with the Baskets to be redeemed. If the Fund’s DTC account has not been credited with all of the Baskets to be redeemed by such time, the redemption distribution is delivered to the extent of whole Baskets received. Any remainder of the redemption distribution is delivered on the next business day to the extent of remaining whole Baskets received if the Administrator receives the fee applicable to the extension of the redemption distribution date which the Sponsor may, from time to time, determine and the remaining Baskets to be redeemed are credited to the Fund’s DTC account by 12:00 p.m., New York time, on such next business day. Any further outstanding amount of the redemption order shall be canceled. The Sponsor may cause the redemption distribution notwithstanding that the Baskets to be redeemed are not credited to the Fund’s DTC account by 12:00 p.m., New York time, on the business day immediately following the redemption order date if the Authorized Participant has collateralized its obligation to deliver the Baskets through DTC’s book entry system on such terms as the Administrator and the Sponsor may from time to time agree upon.

| 13 |

The Sponsor acting by itself or through the Administrator or the Marketing Agent may suspend the right of redemption, or postpone the redemption settlement date, (1) for any period during which the NYSE Arca is closed, other than customary weekend or holiday closings, or for any period when trading on the NYSE Arca is suspended, (2) for any period during which an emergency exists as a result of which the redemption distribution is not reasonably practicable, or (3) in the event any price limits imposed by the CME or the CFTC are reached and the Sponsor believes that permitting redemptions under such circumstances may adversely impact investors. None of the Sponsor, the Marketing Agent or the Administrator will be liable to any person or in any way for any loss or damages that may result from any such suspension or postponement.

The Sponsor acting by itself or through the Marketing Agent or the Administrator may reject a redemption order if the order is not in proper form as described in the Prospectus or if the fulfillment of the order, in the opinion of the Sponsor’s counsel, might be unlawful. None of the Administrator, the Marketing Agent or the Sponsor will be liable for the rejection of any redemption order.

(8) Operating Expenses, Organizational and Offering Costs

(a) Management Fee

The Fund pays the Sponsor a management fee (the “Management Fee”) monthly in arrears, in an amount equal to 0.95% per annum of the Net Asset Value of the Fund for the day to day operation of the Fund. The Fund also pays an amount equal to 0.30% per annum of the Net Asset Value of the Fund for brokerage fees and other expenses.

The management fees incurred during the three and six months ended June 30, 2015 were $5,169 and $11,282, respectively. The Management Fees are charged to the Fund and paid to the Sponsor.

(b) Organization and Offering Expenses

The fees and expenses incurred in connection with the organization of the Fund and the offering of the Shares were paid by the Sponsor. The Sponsor, under certain circumstances, may be reimbursed by the Fund in the future in connection with the payment of the organizational and offering fees and expenses.

(c) Brokerage Commissions, Fees, and Routine Operational, Administrative, and Other Ordinary Expenses

The Sponsor currently does not expect brokerage commissions and fees as well as routine operational, administrative and other ordinary expenses for which the Funds are responsible, including, but not limited to, the fees and expenses of the Trustee, legal and accounting fees and expenses, tax preparation expenses, filing fees, and printing, mailing and duplication costs, to exceed 0.30% of the Net Asset Value of the Fund in any year, although the actual amount of such fees and expenses in any year may be greater. The Fund’s brokerage commissions and fees and routine operational, administrative and other ordinary expenses are accrued at a rate of 0.30% per annum in the aggregate. Of the amounts so accrued, the Fund first pays brokerage commissions and fees, and secondly from the remainder of the amounts so accrued, reimburses the Sponsor first for the Fund’s ongoing operational, administrative, professional and other ordinary fees and expenses (other than any marketing-related fees and expenses), and second, the Fund’s organizational and offering fees and expenses.

Brokerage commissions and fees are charged against the Fund’s assets on a per transaction basis. The brokerage commissions, trading fees and routine operational, administrative, and other ordinary expenses incurred for the three and six months ended June 30, 2015 were $1,632 and $3,562, respectively.

| 14 |

(d) Unusual Fees and Expenses

The Fund will pay all its unusual fees and expenses, if any. Such unusual fees and expenses, by their nature, are unpredictable in terms of timing and amount. There have been no unusual fees or expenses since the Fund commenced investment operations on February 20, 2015.

(9) Termination

The term of the Fund is perpetual, but the Fund may be dissolved at any time and for any reason, or for no reason at all, by the Sponsor with written notice to the Shareholders. Any termination of the Fund will result in the compulsory redemption of all outstanding Shares.

(10) Profit and Loss Allocations and Distributions

The Sponsor and the Shareholders will share in any profits and losses of the Fund attributable to the Fund in proportion to the percentage interest owned by each. Distributions may be made at the sole discretion of the Sponsor on a pro-rata basis in accordance with the respective capital balances of the Shareholders.

(11) Commitments and Contingencies

The Sponsor, either in its own capacity or in its capacity as the Sponsor and on behalf of the Fund, has entered into various service agreements that contain a variety of representations, or provide indemnification provisions related to certain risks service providers undertake in performing services which are in the best interest of the Fund. As of June 30, 2015 no claims had been received by the Fund and it was therefore not possible to estimate the Fund’s potential future exposure under such indemnification provisions.

(12) Net Asset Value and Financial Highlights

The Fund is presenting the following Net Asset Value and financial highlights related to investment performance and operations for a Share outstanding for the three and six-months ended June 30, 2015. The net investment loss and total expense ratios have been annualized. The total return at Net Asset Value is based on the change in Net Asset Value of the Shares during the period and the total return at market value is based on the change in market value of the Shares on the NYSE Arca during the period. An individual investor’s return and ratios may vary based on the timing of capital transactions.

| Three

Months Ended June 30, 2015 |

Six

Months Ended June 30, 2015* |

|||||||

| Net Asset Value | ||||||||

| Net asset value per Share, beginning of period | $ | 38.17 | $ | 30.00 | ||||

| Capital contribution on original units | - | 10.00 | ||||||

| Net assets value per Share, beginning of period (commencement of trading) | 38.17 | 40.00 | ||||||

| Net realized and change in unrealized gain (loss) from investments (iii) | 1.68 | (0.09 | ) | |||||

| Net investment loss | (0.12 | ) | (0.18 | ) | ||||

| Net increase (decrease) in net assets from operations | 1.56 | (0.27 | ) | |||||

| Net asset value per Share, end of period | $ | 39.73 | $ | 39.73 | ||||

| Market value per Share, beginning of period | $ | 39.30 | $ | 40.00 | ||||

| Market value per Share, end of the period | 39.00 | 39.00 | ||||||

| Ratio to average net assets (i) | ||||||||

| Net investment loss | (1.29 | )% | (1.27 | )% | ||||

| Total expenses | 1.29 | % | 1.27 | % | ||||

| Total Return, at net assets value (ii) | 4.09 | % | (0.68 | )% | ||||

| Total Return, at market value (ii) | (0.77 | )% | (2.50 | )% | ||||

* Commenced trading operations on the NYSE Arca on February 20, 2015.

(i) Percentages are annualized.

(ii) Percentages are not annualized.

(iii) The amount of net gain from securities (both realized and unrealized) per share does not accord with the amounts reported in the Statements of Operations due to the timing of purchases and redemptions of Fund shares during the period.

| 15 |

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

Overview / Introduction

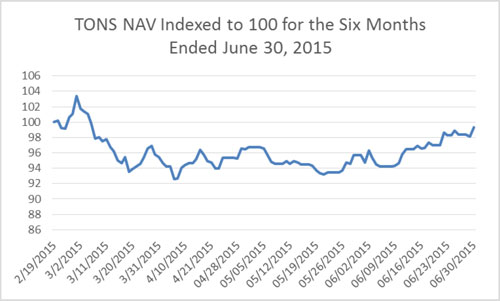

The initial offering period for GreenHaven Coal Fund (the “Fund”) began and ended on February 19, 2015 during which time 150,000 Shares were sold at $40 per share for total proceeds of $6,000,000. The entire proceeds were received by the Fund which then invested in Coal Futures. Shares were then listed for trading on the NYSE Arca on February 20, 2015, marking the beginning of the continuous offering period. The ticker symbol of the Fund is “TONS”.

Performance Summary

There is no performance history prior to the beginning of trading on February 20, 2015. For performance history see “Results of Operations” section below.

Net Asset Value

The Administrator calculates a daily Net Asset Value per Share of the Fund, based on closing prices of the underlying futures contracts. The first such calculation during the continuous offering period was as on the commencement of trading operations on February 20, 2015, the first day of trading on the NYSE Arca,.

Critical Accounting Policies

The Fund’s critical accounting policies are as follows:

Preparation of the financial statements and related disclosures in conformity with U.S. generally accepted accounting principles requires the application of appropriate accounting rules and guidance, as well as the use of estimates, and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, revenue and expense and related disclosure of contingent assets and liabilities during the reporting period of the financial statements and accompanying notes. The Fund’s application of these policies involves judgments and actual results may differ from the estimates used.

The Fund holds a significant portion of its assets in futures contracts and U.S. Treasuries, both of which are recorded on a trade date basis and at fair value in the consolidated financial statements, with changes in fair value reported in the statements of income and expenses. Generally, fair values are based on quoted market closing prices. However, when market closing prices are not available, the Sponsor may value an asset of the Fund pursuant to policies the Sponsor has adopted, which are consistent with normal industry standards.

The use of fair value to measure financial instruments, with related unrealized gains or losses recognized in earnings in each period, is fundamental to the Fund’s financial statements. The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (the exit price).

The Fund values U.S. Treasuries using broker and dealer quotations. The Fund values commodity futures contracts using the quotations from the futures exchanges where the futures contracts are traded. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). The hierarchy gives the highest priority to unadjusted quoted prices for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement.

| 16 |

When market closing prices are not available, the Sponsor may value an asset of the Fund pursuant to policies the Sponsor has adopted, which are consistent with normal industry standards.

Realized gains (losses) and changes in unrealized gain (loss) on open positions are determined on a specific identification basis and recognized in the statements of income and expenses in the period in which the contract is closed or the changes occur, respectively.

Capital Resources

The Fund had no commitments for capital expenditures as of June 30, 2015. Currently, the Fund invests only in U.S Treasuries and in long positions in exchange-traded commodity futures contracts. Therefore, it has no expectation of entering into commitments for capital expenditures at any time in the near future.

Off-Balance Sheet Arrangements and Contractual Obligations

As of June 30, 2015 the Fund had no commitments or contractual obligations other than its long positions in futures contracts as detailed in the Unaudited Schedule of Investments included herein. Typically, those positions require the Fund to deposit initial margin funds with its Commodity Broker in amounts equal to approximately 10% of the notional value of the contracts. Also, the Fund may be required to make additional margin deposits if prices fall for the underlying commodities. Since the Fund is not leveraged, it holds in reserve the shareholder funds not required for margin and invests these in U.S. Treasuries. These funds are available to meet variation margin calls.

In the normal course of its business, the Fund is party to financial instruments with off-balance sheet risk. The term “off-balance sheet risk” refers to an unrecorded potential liability that, even though it does not appear on the balance sheet, may result in a future obligation or loss. The financial instruments used by the Fund are commodity futures, whose values are based upon an underlying asset and generally represent future commitments which have a reasonable possibility to be settled in cash or through physical delivery. The financial instruments are traded on an exchange and are standardized contracts.

The Fund has not utilized, nor does it expect to utilize in the future, special purpose entities to facilitate off-balance sheet financing arrangements and has no loan guarantee arrangements or off-balance sheet arrangements of any kind, The Fund’s contractual obligations are with the Sponsor and the Commodity Broker. Management Fee payments made to the Sponsor are calculated as a fixed percentage of the Fund’s Net Asset Value. Commission payments to the Commodity Broker are on a contract-by-contract, or round-turn, basis. As such, the Sponsor cannot anticipate the amount of payments that will be required under these arrangements for future periods as future Net Asset Values are not known until a future date.

| 17 |

Results of Operations

FOR THE PERIOD FROM FEBRUARY 20, 2015 TO JUNE 30, 2015

The Fund was launched on February 19, 2015 at $40.00 per share and listed for trading on the NYSE Arca on February 20, 2015.

Performance Summary Since Inception

| Date | NAV | Total Shares | Net Assets | 1 Month | 3 Months | Since Inception | ||||||||||||||||||

| 2/20/2015 | $ | 40.09 | 150,050 | $ | 6,015,505 | |||||||||||||||||||

| 2/28/2015 | $ | 41.36 | 150,050 | $ | 6,206,068 | 3.17 | % | |||||||||||||||||

| 3/31/2015 | $ | 38.17 | 150,050 | $ | 5,727,409 | -7.71 | % | -4.79 | % | |||||||||||||||

| 4/30/2015 | $ | 38.58 | 25,050 | $ | 966,429 | 1.07 | % | -3.77 | % | |||||||||||||||

| 5/31/2015 | $ | 38.29 | 25,050 | $ | 959,165 | -0.75 | % | -7.42 | % | -4.49 | % | |||||||||||||

| 6/30/2015 | $ | 39.73 | 25,050 | $ | 995,237 | 3.76 | % | 4.09 | % | -0.90 | % | |||||||||||||

The Fund seeks to provide investors with exposure to the daily change in the price of Coal Futures, before expenses and liabilities of the Fund. For the six-months ended June 30, 2015, the Fund’s Net Asset Value returned -0.90%.

| 18 |

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

The following discussion and analysis may forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “outlook” and “estimate,” as well as similar words and phrases, signify forward-looking statements. The Fund’s forward-looking statements are not guarantees of future results and conditions, and important factors, risks and uncertainties may cause the Fund’s actual results to differ materially from those expressed in the Fund’s forward-looking statements.

You should not place undue reliance on any forward-looking statements. Except as expressly required by Federal securities laws, the Sponsor undertakes no obligation to publicly update or revise any forward-looking statements or the risks, uncertainties or other factors described in this Report, as a result of new information, future events or changed circumstances or for any other reason after the date of Report.

The Fund aims to provide investors with exposure to the daily change in the price of Coal Futures, before expenses and liabilities of the Fund. The value of the Shares relates directly to the value of the commodity futures and other assets held by the Fund and fluctuations in the price of these assets could materially adversely affect an investment in the Shares. The value of the Shares relate directly to the value of the Fund’s portfolio, less the liabilities (including estimated accrued but unpaid expenses) of the Fund. The price of the Coal Futures may fluctuate widely based on many factors. Some of those factors are:

| • | the location, availability, quality and price of competing fuels such as natural gas and oil, and alternative energy sources such as hydroelectric and nuclear power; | ||

| • | technological developments in the traditional and alternative energy industries; | ||

| • | global demand for electricity and steel; | ||

| • | energy, environmental, fiscal, and other governmental programs and policies; | ||

| • | weather and other environmental conditions; | ||

| • | global or regional political, economic or financial events and conditions; | ||

| • | global coal inventories, production rates and productions costs; | ||

•

•

|

currency exchange rates;

the general sentiment of market participants; and

| ||

| • | acts of international or domestic terrorism. | ||

None of these factors can be controlled by the Sponsor. Even if current and correct information as to substantially all factors are known or thought to be known, prices still will not always react as predicted. The profitability of the Fund will depend on whether its portfolio increases in value over time. If the value increases, the Fund will only be profitable if such increases exceed the fees and expenses of the Fund. If these values do not increase, the Fund will not be profitable and will incur losses.

Quantifying the Fund’s Trading Risk

The Fund’s primary market risk exposures are subject to numerous uncertainties, contingencies and risks. Government interventions, defaults and expropriations, illiquid markets, the emergence of dominant fundamental factors, political upheavals, changes in historical price relationships, an influx of new market participants, increased regulation and many other factors could result in material losses as well as in material changes to the risk exposures of the Fund. There can be no assurance that the Fund’s current market exposure will not change materially. Investors may lose all or substantially all of their investment in the Fund.

| 19 |

Non-Trading Risk

The Fund may invest its excess funds in short-term U.S. Treasuries. These instruments are not coupon-bearing and therefore trade at a discount to their value at maturity. The Fund expects that the market risk of holding these investments is not material.

Qualitative Disclosures Regarding Non-Trading Risk Exposures

The Fund is unaware of any (i) anticipated known demands, commitments or capital expenditures; (ii) material trends, favorable or unfavorable, in its capital resources; or (iii) trends or uncertainties that will have a material effect on operations.

Qualitative Disclosures Regarding Means of Managing Risk Exposure

Under ordinary circumstances, the Sponsor’s discretionary power is limited to determining whether the Fund will make a distribution. Under emergency or extraordinary circumstances, the Sponsor’s discretionary powers increase, but remain circumscribed. These special circumstances, for example, include certain natural or man-made disasters. The Sponsor does not apply risk management techniques. The Fund initiates positions only on the “long” side of the market and does not employ “stop-loss” techniques.

ITEM 4. CONTROLS AND PROCEDURES.

Disclosure controls and procedures

Disclosure controls and procedures (as defined in Rule 13a-15(e) under the Exchange Act) are controls and other procedures of an issuer that are designed to ensure that information required to be disclosed by the issuer in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated to the issuer’s management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

Under the supervision and with the participation of the management of the Sponsor, including its chief executive officer and principal financial officer, the Fund carried out an evaluation of the effectiveness of the design and operation of its disclosure controls and procedures. Based upon that evaluation, the chief executive officer and principal financial officer concluded that the Fund’s disclosure controls and procedures with respect to the Fund were effective as of the end of the period covered by this report.

Changes in Internal Control over Financial Reporting

During the three months ended June 30, 2015, the Fund made no changes to its internal control over financial reporting that materially affected, or are reasonably likely to materially affect, its internal control over financial reporting.

| 20 |

PART II. OTHER INFORMATION

Item 1. Legal Proceedings.

Not Applicable.

Item 1A. Risk Factors.

Not Applicable.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

(a) None.

(b) For the three months ended June 30, 2015, 125,000 shares were redeemed for $4,697,025 and no shares were created. On June 30, 2015, 25,050 shares of the Fund were outstanding for a market capitalization of $976,950, based on June 30, 2015 closing price of $39.00 on the NYSE Arca.

(c) The following table shows the number of Shares redeemed (purchased back by the Fund, or “Issuer”) from Authorized Participants for each month during the quarter ended June 30, 2015:

| Issuer Purchases of Equity Securities | ||||||||||||||||

| Maximum Number (or | ||||||||||||||||

| Total Number of | Approximate Dollar | |||||||||||||||

| Shares Purchased as | Value) of Shares That | |||||||||||||||

| Part of Publicly | May Yet Be Purchased | |||||||||||||||

| Total Number of | Average Price | Announced Plans or | Under the Plans or | |||||||||||||

| Period | Shares Redeemed | Paid per Share | Programs | Programs | ||||||||||||

| April 1, 2015 to April 30, 2015 | 125,000 | $ | 37.58 | N/A | N/A | |||||||||||

| May 1, 2015 to May 31, 2015 | - | $ | - | N/A | N/A | |||||||||||

| June 1, 2015 to June 30, 2015 | - | $ | - | N/A | N/A | |||||||||||

| Total | 125,000 | $ | 37.58 | |||||||||||||

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Mine Safety Disclosures

None.

Item 5. Other Information.

None.

| 21 |

Item 6. Exhibits.

| Exhibit | ||

| Number | Description of Document | |

| 3.1 | Greenhaven Coal Fund Second Amended and Restated Trust Agreement by and between GreenHaven Coal Services, LLC, as sponsor, and Christiana Trust, a division of Wilmington Savings Fund Society, FSB, as trustee, dated January 6, 2015 (incorporated by reference to the Greenhaven Coal Fund’s registration statement on Form S-1/A filed on February 9, 2015).

| |

| 31.1 | Certification of Chief Executive Officer pursuant to Exchange Act Rules 13a-14 and 15d-14 (filed herewith) | |

| 31.2 | Certification of Principal Financial Officer pursuant to Exchange Act Rules 13a-14 and 15d-14 (filed herewith) | |

| 32.1 | Certification of Chief Executive Officer pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (furnished herewith) | |

| 32.2 | Certification of Principal Financial Officer pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (furnished herewith)

| |

| 101. | Interactive Data Files. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| GreenHaven Coal Fund | ||||||

| By: | GreenHaven Coal Services LLC, its Sponsor |

|||||

| Date: August 7, 2015 | By: | /s/ Ashmead Pringle Name: Ashmead Pringle |

||||

| Title: Chief Executive Officer | ||||||

| Date: August 7, 2015 | By: | /s/ Cooper Anderson Name: Cooper Anderson |

||||

| Title: Chief Financial Officer | ||||||

| 22 |

EXHIBIT INDEX

| Exhibit | Page | |||

| Number | Description of Document | Number | ||

| 3.1 | Greenhaven Coal Fund Second Amended and Restated Trust Agreement by and between GreenHaven Coal Services, LLC, as sponsor, and Christiana Trust, a division of Wilmington Savings Fund Society, FSB, as trustee, dated January 6, 2015 (incorporated by reference to the Greenhaven Coal Fund’s registration statement on Form S-1/A filed on February 9, 2015).

|

|||

| 31.1 | Certification of Chief Executive Officer pursuant to Exchange Act Rules 13a-14 and 15d-14 (filed herewith) | E-1 | ||

| 31.2 | Certification of Principal Financial Officer pursuant to Exchange Act Rules 13a-14 and 15d-14 (filed herewith) | E-2 | ||

| 32.1 | Certification of Chief Executive Officer pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (furnished herewith) | E-3 | ||

| 32.2 | Certification of Principal Financial Officer pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (furnished herewith)

|

E-4 | ||

| 101. | Interactive Data Files. |

| 23 |