Table of Contents

Filed pursuant to Rule 424(b)(3)

Registration No. 333-182301

PROSPECTUS

WisdomTree Coal Fund

(f/k/a GreenHaven Coal Fund)

9,750,000 Shares

The WisdomTree Coal Fund (f/k/a the GreenHaven Coal Fund) is offering its Shares representing units of fractional undivided beneficial interest in and ownership of the Fund. The Fund’s Sponsor and commodity pool operator is WisdomTree Coal Services, LLC (f/k/a GreenHaven Coal Services, LLC). The Fund’s Sub-Adviser and commodity trading advisor is GreenHaven Advisors LLC. The Fund’s Trustee is Christiana Trust, a division of Wilmington Savings Fund Society, FSB. The Shares are listed on the NYSE Arca under the symbol “TONS.”

The Fund’s investment objective is to provide investors with exposure to daily changes in the price of Coal Futures, before Fund liabilities and expenses. The Fund pursues this objective by investing substantially all of its assets in a three month strip of the nearest calendar quarter of Rotterdam coal futures contracts traded on the Chicago Mercantile Exchange. The Fund also realizes interest income from its holdings in U.S. Treasuries (if any). See “The Fund—Investment Objective” and “Use of Proceeds.”

The Fund continuously offers and redeems Baskets of 25,000 Shares to and from Authorized Participants at a price equal to the Fund’s net asset value per Share of 25,000 Shares. See “Creation and Redemption of Shares.” Authorized Participants, in turn, may offer such Shares to the public at a per Share offering price that varies depending on, among other factors, the trading price of the Shares, the NAV, and the supply of and demand for the Shares at the time of the offer. Shares initially comprising the same Basket but offered by the Authorized Participants to the public at different times may have different offering prices. Except when aggregated in Baskets, the Shares are not redeemable securities. An Authorized Participant may receive commissions or fees from investors who purchase Shares through their commission or fee-based brokerage accounts. Subscription proceeds received from Authorized Participants will be immediately released to the Fund. The offering of Shares will terminate on the third anniversary of the registration statement of which this prospectus is a part unless prior thereto a new registration statement is filed.

The Fund is treated as a partnership for U.S. federal income tax purposes. Each investor in the Fund will receive a Schedule K-1 that reports such investor’s allocable portion of partnership tax items. The Sponsor anticipates making this form available to investors on or before April 15 each year following the taxable year to which it relates.

The Fund qualifies as an “emerging growth company” as defined under the Jumpstart Our Business Startups Act. “Emerging growth company” does not mean that the Fund is a “growth” type of investment vehicle or that it will utilize a “growth” investment strategy. See “The Fund—Emerging Growth Company Status.”

Investing in the Shares involves significant risk. See “Risk Factors” beginning on Page 7. The Fund is not a mutual fund registered under the Investment Company Act of 1940, as amended, and is not subject to regulation thereunder.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION, NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OFFERED IN THIS PROSPECTUS, OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED ON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

The Shares are neither interests in nor obligations of the Sponsor, the Trustee, the Sub-Adviser or any of their respective affiliates. The Shares are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

This prospectus is in two parts: a disclosure document and a statement of additional information. These parts are bound together, and both contain important information.

| Per Share | Per Basket | |||||||

| Price of the Shares (1) |

$ | 40.85 | $ | 1,021,250 | ||||

| (1) | Based on closing net asset value on June 30, 2016. The price may vary based on net asset value in effect on a particular day. |

The date of this prospectus is July 27, 2016

Table of Contents

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT FUTURES TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED TO THIS POOL AT PAGES 25 THROUGH 27 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGE 24.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGES 7 THROUGH 16.

THIS POOL HAS LIMITED TRADING AND PERFORMANCE HISTORY.

THIS PROSPECTUS DOES NOT INCLUDE ALL OF THE INFORMATION OR EXHIBITS IN THE REGISTRATION STATEMENT OF THE FUND. YOU CAN READ AND COPY THE ENTIRE REGISTRATION STATEMENT AT THE PUBLIC REFERENCE FACILITIES MAINTAINED BY THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) IN WASHINGTON, D.C.

THE FUND FILES QUARTERLY AND ANNUAL REPORTS WITH THE SEC. YOU CAN READ AND COPY THESE REPORTS AT THE SEC PUBLIC REFERENCE FACILITIES IN WASHINGTON, D.C. PLEASE CALL THE SEC AT 1-800-SEC-0330 FOR FURTHER INFORMATION.

THE FILINGS OF THE FUND ARE POSTED AT THE SEC’S WEBSITE AT WWW.SEC.GOV.

NO DEALER, SALESMAN OR ANY OTHER PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION NOT CONTAINED IN THIS PROSPECTUS, AND, IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE FUND, THE SPONSOR, THE SUB-ADVISER, THE AUTHORIZED PARTICIPANTS OR ANY OTHER PERSON.

THIS PROSPECTUS DOES NOT CONSTITUTE AN OFFER OR SOLICITATION TO SELL OR A SOLICITATION OF AN OFFER TO BUY, NOR SHALL THERE BE ANY OFFER, SOLICITATION, OR SALE OF THE SHARES IN ANY JURISDICTION IN WHICH SUCH OFFER, SOLICITATION OR SALE IS NOT AUTHORIZED OR TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE ANY SUCH OFFER, SOLICITATION, OR SALE.

THE BOOKS AND RECORDS OF THE FUND ARE MAINTAINED AS FOLLOWS:

| • | BASKET CREATION AND REDEMPTION BOOKS AND RECORDS AND CERTAIN FINANCIAL BOOKS AND RECORDS (INCLUDING FUND ACCOUNTING RECORDS, LEDGERS WITH RESPECT TO ASSETS, LIABILITIES, CAPITAL, INCOME AND EXPENSES, THE REGISTRAR, TRADING AND RELATED DOCUMENTS RELATED TO CUSTODY OF ASSETS FROM THE FUND’S COMMODITY BROKERS, TRANSFER JOURNALS AND RELATED DETAILS) ARE MAINTAINED BY STATE STREET BANK AND TRUST COMPANY, ONE LINCOLN STREET, BOSTON, MASSACHUSETTS 02110, TELEPHONE NUMBER (866) 909-9473; |

i

Table of Contents

| • | TRADING RECORDS AND RELATED REPORTS AND OTHER ITEMS RECEIVED FROM THE FUND’S COMMODITY BROKERS AND COUNTERPARTIES ARE MAINTAINED BY GREENHAVEN ADVISORS LLC, 3340 PEACHTREE ROAD, SUITE 1910, ATLANTA, GEORGIA 30326, TELEPHONE NUMBER (404) 389-9744; AND |

| • | ALL OTHER BOOKS AND RECORDS OF THE FUND (INCLUDING MARKETING MATERIALS, MINUTE BOOKS AND OTHER GENERAL CORPORATE RECORDS) ARE MAINTAINED AT THE FUND’S PRINCIPAL OFFICE, C/O WISDOMTREE COAL SERVICES, LLC, 245 PARK AVENUE, 35TH FLOOR, NEW YORK, NEW YORK 10167, TELEPHONE NUMBER (866) 909-9473. |

SHAREHOLDERS WILL HAVE THE RIGHT, DURING NORMAL BUSINESS HOURS, TO HAVE ACCESS TO AND COPY (UPON PAYMENT OF REASONABLE REPRODUCTION COSTS) SUCH BOOKS AND RECORDS IN PERSON OR BY THEIR AUTHORIZED ATTORNEY OR AGENT. MONTHLY ACCOUNT STATEMENTS CONFORMING TO COMMODITY FUTURES TRADING COMMISSION (THE “CFTC”) AND THE NATIONAL FUTURES ASSOCIATION (THE “NFA”) REQUIREMENTS ARE POSTED ON THE SPONSOR’S WEBSITE AT WWW.WISDOMTREE.COM. ADDITIONAL REPORTS MAY BE POSTED ON THE SPONSOR’S WEBSITE IN THE DISCRETION OF THE SPONSOR OR AS REQUIRED BY REGULATORY AUTHORITIES. THERE WILL SIMILARLY BE DISTRIBUTED TO SHAREHOLDERS, NOT MORE THAN 90 DAYS AFTER THE CLOSE OF EACH OF THE FUND’S FISCAL YEARS, CERTIFIED AUDITED FINANCIAL STATEMENTS AND (IN NO EVENT LATER THAN APRIL 15 OF THE IMMEDIATELY FOLLOWING YEAR) THE TAX INFORMATION RELATING TO SHARES OF THE FUND NECESSARY FOR THE PREPARATION OF SHAREHOLDERS’ ANNUAL FEDERAL INCOME TAX RETURNS.

AUTHORIZED PARTICIPANTS MAY BE REQUIRED TO DELIVER A PROSPECTUS WHEN TRANSACTING IN SHARES. SEE “PLAN OF DISTRIBUTION.”

ii

Table of Contents

[Page Intentionally Left Blank]

iii

Table of Contents

GREENHAVEN COAL FUND

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

All statements other than statements of historical fact included or incorporated by reference in this prospectus, including without limitation, statements regarding (i) the Fund’s future performance, projected costs and plans and objectives, (ii) the Sponsor’s and/or the Sub-Adviser’s strategy, future operations and objectives, and (iii) matters effecting the commodities markets, changes in the commodities markets and indices that track such movements, are forward-looking statements. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative thereof, variations thereon or similar terminology. These statements are only predictions, and actual events or results may differ materially. These statements are based upon certain assumptions and analyses of the Sponsor founded on a variety of considerations, including but not limited to the Sponsor’s perception of historical trends, current conditions and expected future developments. Important factors that could cause actual results to differ materially from the forward-looking statements described herein, referred to herein as cautionary statements, are disclosed under “Risk Factors” and elsewhere in this prospectus. Such factors include but are not limited to general economic, market and business conditions, changes in laws or regulations, and other world economic and political developments. Consequently, all of the forward-looking statements made in this prospectus are qualified by these cautionary statements, and there can be no assurance that actual results or developments described herein will be realized or, even if substantially realized, that such results or developments will result in the expected consequences to, or have the expected effects on, the Fund, the Sponsor or the value of the Shares.

iv

Table of Contents

The following is only a summary of the information contained in this prospectus. The following summary does not contain or summarize all of the information about the Fund and the units of fractional undivided beneficial interest in and ownership of the Fund (the “Shares”) described in this prospectus that is material and/or which may be important to investors. Investors are urged to read the entire prospectus, including the section entitled “Risk Factors” and the exhibits attached to the registration statement of which this prospectus is a part, before making an investment decision regarding the Shares.

The Fund and the Sponsor

The WisdomTree Coal Fund is a commodity pool that was organized as a Delaware statutory trust on June 18, 2012, pursuant to the Trust’s Declaration of Trust and Trust Agreement (as amended, the “Trust Agreement”). See “The Trust Agreement.” The Fund was originally named “GreenHaven Coal Fund” and changed its name to “WisdomTree Coal Fund” effective on January 4, 2016.

WisdomTree Coal Services, LLC is the Fund’s sponsor (the “Sponsor”) and commodity pool operator (“CPO”). The Sponsor was formed as a Georgia limited liability company on March 14, 2012. The Sponsor became registered with the Commodity Futures Trading Commission (the “CFTC”) as a CPO, and approved as a member of the National Futures Association (the “NFA”), on June 12, 2012. Effective January 1, 2016, the Sponsor is a wholly-owned subsidiary of WisdomTree Investments Inc. (“WTI”), which was registered as a principal with the NFA with respect to the Fund on or about January 4, 2016. WTI is located in New York, New York.

Effective January 1, 2016, in accordance with the terms of a Unit Purchase Agreement dated October 29, 2015, GreenHaven Group LLC sold to WTI 100% of the issued and outstanding membership interest in the Sponsor. WTI, as the sole member, effected the Sponsor’s name change from “GreenHaven Coal Services, LLC” to “WisdomTree Coal Services, LLC” on January 4, 2016. Under the Georgia Limited Liability Company Act and the governing documents of the Sponsor, WTI is not responsible for the debts, obligations and liabilities of the Sponsor solely by reason of being the Sponsor’s sole member. See “The Sponsor and the Sub-Adviser—The Sponsor.”

Christiana Trust, a division of Wilmington Savings Fund Society, FSB, is the sole Trustee of the Fund. The Trustee has delegated to the Sponsor certain powers and authority to manage the business and affairs of the Fund. See “The Trustee” and “The Trust Agreement.”

GreenHaven Advisors LLC serves as the commodity trading advisor to the Fund (the “Sub-Adviser”).

The principal executive offices of the Fund and the Sponsor are located at 245 Park Avenue, 35th Floor, New York, New York 10167. The telephone number is (866) 909-9473.

Investment Objective; Use of Proceeds

The Fund’s investment objective is to provide investors with exposure to the daily change in the price of Coal Futures, before expenses and liabilities of the Fund. The Fund pursues this objective by investing substantially all of its assets in a three month strip of the nearest calendar quarter of Rotterdam coal futures contracts (“Coal Futures”) traded via the CME Group, Inc.’s (“CME”) (i) Globex (“CME Globex”) and (ii) Clearport clearing services (“CME Clearport”) trading platforms (collectively, the “CME Facilities”) depending on liquidity and otherwise at the Sponsor’s discretion. Currently, the trading of Coal Futures on the CME Facilities principally occurs on the CME Clearport. Accordingly, as of the date of this prospectus, the Fund executes trades of Coal Futures primarily on CME Clearport. However, if increased liquidity develops in Coal Futures on CME Globex, the Sponsor may seek to trade primarily on CME Globex. The Fund also realizes interest income from its holdings in U.S. Treasuries, as further described below.

Under normal market conditions, the Fund pursues its investment objective by purchasing Rotterdam Coal Futures that are traded on the CME Facilities, including smaller sized “mini” contracts (if they are available) which represent a portion of the normal futures contracts, to the greatest extent possible, without being leveraged or exceeding relevant position limits. The term “under normal market conditions” includes, but is not limited to, the absence of extreme volatility or trading halts in the coal futures markets or the financial markets generally; operational issues causing dissemination of inaccurate market information; or force majeure events such as system failures, natural or man-made disasters, acts of God, armed conflicts, acts of terrorism, riots or labor disruptions or any similar intervening circumstance.

The Fund executes trades to purchase block traded (“Block Traded”) Coal Futures via CME ClearPort by placing purchase orders with an Execution Broker. The Execution Broker identifies a selling counterparty and simultaneously with completion of the transaction, the Block Traded Coal Futures are entered in CME ClearPort by the Execution Broker, thereby completing the transaction and creating a cleared futures transaction. If the CME does not accept the transaction for any reason, the transaction is considered null and void and of no legal effect. As a result, the Sponsor expects that all of the Fund’s positions in Coal Futures, whether traded on the CME ClearPort Block Trade entry systems (as initially planned) or on CME Globex (which may occur in the future), will be cleared by CME clearing member firms, thereby minimizing counterparty risk.

1

Table of Contents

The Fund intends to hold the three month strip of the nearest calendar quarter of Coal Futures contracts traded on the CME Facilities. The four calendar quarters are January, February, and March (“Q1”); April, May, and June (“Q2”); July, August, and September (“Q3”); and October, November, and December (“Q4”). The Fund intends to invest an equal tonnage (equal number of futures contracts) in each of the three months comprising the nearby calendar quarter.

Four times a year, the Fund will attempt to roll its positions in the nearby calendar quarter to the next calendar quarter over 5 business days on a pro-rata basis. The first roll day is the 2nd Monday of the month prior to the nearby calendar quarter. For example, if the Fund was currently holding the Q1 calendar quarter, it would roll over a 5 business day period starting on the 2nd Monday in December, and each day during the roll period the Fund would decrease the percentage of its portfolio that is in Q1 by 20% and increase its percentage in Q2 by 20%.

The Fund also realizes interest income from its holdings in U.S. Treasuries, which may be posted as margin or otherwise held to cover the Fund’s notional exposure to Coal Futures. The Sponsor or Sub-Adviser, as delegated by the Sponsor, will deposit a portion of the Fund’s net assets with a Commodity Broker or other custodian to be used to meet its current or potential margin or collateral requirements in connection with its investments in Coal Futures. The Fund uses only U.S. Treasuries, cash and/or cash equivalents to satisfy these requirements. Up to 10% of the Fund’s assets are expected to be committed as margin and/or collateral for Coal Futures. However, from time to time, the percentage of assets committed as margin or collateral may be substantially more, or less, than 10%. The remaining portion of the Fund’s assets will be held in U.S. Treasuries, cash and/or cash equivalents by a Commodity Broker in its capacity as the Fund’s custodian. All interest income earned on these investments is retained for the Fund’s benefit. See “Use of Proceeds.”

The Sponsor is authorized by the Fund in its sole judgment to employ, establish the terms of employment for, and terminate commodity trading advisors or futures commission merchants of the Fund. The Fund was created to provide investors with a cost-effective and convenient way to gain exposure to daily changes in the price of Coal Futures. See “The Fund—Investment Objective.” The Sponsor does not intend to operate the Fund in a fashion such that its net asset value (“NAV”) per Share will equal, in dollar terms, the spot price of coal at any particular delivery location, any spot price coal indexes, or any particular coal futures contract. The Fund is intended to be used as a diversification opportunity as part of a complete investment portfolio, not a complete investment program.

Fund Expenses

The Sponsor’s predecessor paid all of the costs and expenses incurred in connection with the Fund’s organization and the continuous offering of the Shares through December 31, 2015, and the Sponsor will continue to pay the costs and expenses incurred in connection with the continuous offering of the Shares, including the Fund’s ordinary and ongoing administrative costs and expenses and the fees payable to the Sub-Adviser and certain of the Fund’s other advisers. In certain circumstances, the Sponsor may be reimbursed by the Fund for such costs and expenses. The Fund will pay the Sponsor a fee for its services provided to the Fund (the “Sponsor Fee”), and is responsible for the payment of all of the Fund’s brokerage and extraordinary fees and expenses. See “Charges—Fees and Expenses.”

The Offering

| Offering of the Shares | The Fund continuously offers Baskets of 25,000 Shares to certain authorized participants (each an “Authorized Participant”) at a price based on the NAV per Share. See “Authorized Participants.” Authorized Participants, in turn, may offer Shares to the public at offering prices that are expected to be influenced by a variety of factors. An Authorized Participant may receive commissions or fees from investors who purchase Shares through their commission or fee-based brokerage accounts. See “Description of the Shares” and “Creation and Redemption of Shares.” | |||

| Exchange Symbol | The Shares are listed on the NYSE Arca under the symbol “TONS.” | |||

| CUSIP | 97718T 105 | |||

| Affiliates and Agents | Sponsor | WisdomTree Coal Services, LLC | ||

| Sub-Adviser | GreenHaven Advisors LLC | |||

| Trustee | Christiana Trust, a division of Wilmington Savings Fund Society, FSB | |||

| Commodity Broker | Morgan Stanley & Co. LLC | |||

2

Table of Contents

| Execution Broker | TFS Energy Futures LLC | |||

| Administrator (and Transfer Agent) | State Street Bank and Trust Company | |||

| Distributor | Foreside Fund Services LLC | |||

| Creation and Redemption of Shares |

The Fund creates and redeems Shares from time to time, but only in one or more whole Baskets. Except when aggregated in Baskets, the Shares are not redeemable securities. Authorized Participants pay a transaction fee of $200 per creation or redemption order to the Administrator. See “Creation and Redemption of Shares.” | |||

| Authorized Participants | Baskets may be created or redeemed only by Authorized Participants. Each Authorized Participant must (1) be a registered broker-dealer or other securities market participant such as a bank or other financial institution that is not required to register as a broker-dealer to engage in securities transactions, (2) be a participant in The Depository Trust Company (“DTC”), and (3) have entered into a participant agreement with the Fund (the “Participant Agreement”). See “Authorized Participants.” | |||

| Net Asset Value | The NAV equals the market value of the Fund’s total assets less total liabilities calculated in accordance with GAAP. Under the Fund’s current operational procedures, the Administrator calculates the NAV once each NYSE Arca trading day. The Administrator uses the CME settlement price (typically determined after 5:00 p.m. New York time) for the contracts traded on the CME Facilities. The NAV for a particular trading day is released after 5:00 p.m. New York time and will be posted at www.wisdomtree.com. The Sponsor anticipates that the NYSE Arca will disseminate the indicative fund value on a per Share basis every 15 seconds during regular NYSE Arca trading hours. | |||

| Segregated Accounts/ Interest Income |

The Sponsor estimates that (i) approximately 10% of the NAV will be held as margin deposits in segregated accounts with a Commodity Broker, in accordance with applicable CFTC rules, and (ii) approximately 90% of the NAV will be held to pay current obligations and as reserves in the form of U.S. Treasuries, cash and/or cash equivalents in segregated accounts with a Commodity Broker. The Fund is credited with all interest earned on its deposits. See “Use of Proceeds.” | |||

| Clearance and Settlement | The Shares are evidenced by global certificates on deposit with DTC and registered in the name of Cede & Co., as nominee for DTC. The Shares are available only in book-entry form. Registered or beneficial owners of the Shares (“Shareholders”) may hold their Shares through DTC, if they are participants in DTC, or indirectly through entities that are participants in DTC. See “The Securities Depository; Book-Entry Only System; Global Security.” | |||

| U.S. Federal Income Tax Considerations |

The Fund is classified as a partnership for U.S. federal income tax purposes. Accordingly, it is expected that the Fund will not incur U.S. federal income tax liability and each beneficial owner of the Shares will have tax liability on its allocable share of the Fund’s income, gain, loss, deduction and other items. See “Certain Material U.S. Federal Income Tax Considerations.” | |||

| Distributions | The Fund will make distributions at the discretion of the Sponsor. Because the Sponsor does not presently intend to make ongoing distributions, a Shareholder’s income tax liability with respect to Shares held will, in all likelihood, exceed any distributions from the Fund. See “Description of the Shares—Distributions” and “Certain Material U.S. Federal Income Tax Considerations.” | |||

| Reports to Shareholders | The Sponsor furnishes annual reports of the Fund in the manner required by the rules and regulations of the United States Securities and Exchange Commission (the “SEC”), in addition to reports required by the CFTC and the NFA, including, but not limited to, annual audited financial statements examined and certified by an independent registered public accounting firm, and any other reports required by any other governmental authority that has jurisdiction over the activities of the Fund. Monthly account statements conforming to CFTC and NFA requirements, as well as the annual and quarterly reports and other filings made with the SEC, are posted at www.wisdomtree.com. Shareholders of record will also be provided with appropriate information to permit them to file U.S. federal and state income tax returns (on a timely basis) with respect to Shares held. Additional reports may be posted at www.wisdomtree.com at the discretion of the Sponsor or as required by regulatory authorities. See “The Trust Agreement—Reports to Shareholders.” | |||

| Termination Events | The Fund may be dissolved at any time and for any reason by the Sponsor with written notice to the Shareholders. See “The Trust Agreement—Fund Termination Events.” | |||

3

Table of Contents

| Mandatory Redemption | If the Sponsor gives at least 15 days’ written notice to a Shareholder, then the Sponsor may for any reason, in its sole discretion, require the mandatory redemption of all or part of the Shares held by any such Shareholder at the NAV per Share calculated as of the date of redemption; provided, however, that the provision of the written notice to a Shareholder does not obligate the Fund to affect any redemption. If the Sponsor does not give at least 15 days’ written notice to a Shareholder, then it may only require mandatory redemption of all or any portion of the Shares held by any such Shareholder in the following circumstances: | |||

| (i) the Shareholder made a misrepresentation to the Fund or the Sponsor in connection with its purchase of Shares; or | ||||

| (ii) the Shareholder’s ownership of Shares would result in the violation of any law or regulation applicable to the Fund or a Shareholder. | ||||

| The primary purpose of this mandatory redemption authority is to ensure that the Fund complies with applicable regulatory and listing requirements, including CFTC or futures position limits, that may restrict the size of the Fund and the investment portfolio. The Sponsor anticipates that it will exercise this authority only to the extent that it reasonably believes is necessary or appropriate for the Fund to comply with applicable legal and listing requirements and only after first exercising commercially reasonable efforts to comply with the applicable requirements without exercise of such redemption authority. The Fund may also use the mandatory redemption right in the context of a general liquidation of the Fund’s assets. See “The Trust Agreement—Mandatory Redemption.” | ||||

| Fiscal Year | The fiscal year of the Fund ends on December 31 of each year. | |||

| Investment Risks | An investment in the Shares is speculative and involves a high degree of risk. Prospective investors should be aware that: | |||

| • An investor could lose a substantial portion or all of its investment. | ||||

| • Commodity trading is highly speculative, and the Fund is likely to be volatile and could suffer from periods of prolonged decline in value. | ||||

| • The Fund has limited performance history to serve as a basis for investors to evaluate an investment in the Fund and such performance history may not be indicative of future results. | ||||

| • The structure and operation of the Fund may involve conflicts of interest. | ||||

| • The Fund is subject to the fees and expenses described herein (in addition to the amount of any commissions charged by the investor’s broker in connection with an investor’s purchase of Shares) and will be successful only if significant losses are avoided. | ||||

| • Investors will have no rights to participate in the management of the Fund and will have to rely on the duties and judgment of the Sponsor to manage the Fund. | ||||

| • Currently, although coal futures markets are only subject to position limits in the expiration month and position accountability limits in the other months, regulatory authorities may in the future apply position limits to all coal futures delivery months, which could limit the Fund’s investment objective. | ||||

| • Investors may choose to use the Fund as a means of indirectly investing in coal. There is a risk that the daily changes in the price of the Shares on the NYSE Arca, if so listed, will not closely track the daily changes in Coal Futures or spot coal prices due to a variety of reasons, which may limit an investor’s ability to use an investment in the Shares as a cost-effective way to invest indirectly in coal or as a hedge against the risk of loss in coal-related transactions. | ||||

| • Investors may choose to use the Fund as a means of investing indirectly in coal, and there are risks involved in such an investment. For example, the risks and hazards that are inherent in coal production or consumption may cause the price of coal, coal derivatives and the Shares to fluctuate significantly. | ||||

4

Table of Contents

| • Investors in the Fund will receive a Schedule K-1 which reports their allocable portion of tax items. Schedule K-1’s are complex and, especially for individual investors, usually require the engagement of tax advisers. The Fund uses certain conventions and makes certain assumptions when preparing the Schedule K-1’s which if not accepted by the IRS could result in income, gain, loss and deduction being adjusted or reallocated in a manner that adversely affects one or more Shareholders. | ||||

| • The Sponsor expects that the Sub-Adviser will manage the Fund’s positions in Coal Futures so that the Fund’s assets are not leveraged (i.e., the notional value of the Fund’s investments never exceeds 100% of its U.S. Treasuries, cash and/or cash equivalents held as margin or otherwise). There is no assurance that the Sub-Adviser will successfully implement this investment strategy. If the Fund becomes leveraged, an investor could lose all or substantially all of its investment if the Fund’s trading positions suddenly turn unprofitable. | ||||

| See “Risk Factors” for a description of certain additional risks that prospective investors should consider before investing in the Shares. | ||||

Breakeven Table

The following table shows the estimated amount of fees and expenses that are anticipated to be incurred by a new investor in the Shares during the first twelve (12) months of ownership. The total estimated fees and expenses are expressed as a percentage of $32.65 (the NAV per Share on March 31, 2016) or $816,250 (the NAV per Basket on March 31, 2016). Although the Sponsor has used actual numbers and good faith estimates in preparing this table, the actual expenses associated with an investment in the Shares may differ. See “Charges—Fees and Expenses” for a description of the estimated fees, commissions, expenses and other charges of the Fund.

| Income/Expense |

Per Share (1) | Per Basket (2) | ||||||||||||||

| NAV (as March 31, 2016) |

$ | 32.65 | 100 | % | $ | 816,250 | 100 | % | ||||||||

| Sponsor Fee (3) |

0.31 | 0.95 | 7,754 | 0.95 | ||||||||||||

| Brokerage Commissions and Fees (4)(5) |

0.10 | 0.30 | 2,449 | 0.30 | ||||||||||||

| Organizational and Offering Expenses (6) |

0.00 | 0.00 | 0 | 0.00 | ||||||||||||

| Routine Operational, Administrative and Other Ordinary Expenses (7)(8) |

0.00 | 0.00 | 0 | 0.00 | ||||||||||||

| Interest Income (9) |

0.00 | 0.00 | 0 | 0.00 | ||||||||||||

| Annual Breakeven (10) |

$ | 0.41 | 1.25 | % | $ | 10,203 | 1.25 | % | ||||||||

| (1) | Assumes that the Shares have a constant month-end NAV and is based on $32.65 as the NAV per Share. The actual NAV of the Fund will differ. |

| (2) | Assumes that the Baskets have a constant month-end NAV and is based on $816,250 as the NAV per Basket. The actual NAV of the Fund will differ. |

| (3) | The Fund is contractually obligated to pay the Sponsor a Sponsor Fee of 0.95% per annum on average NAV, payable monthly. From the Sponsor Fee, the Sponsor will be responsible for paying the fees and expenses of the Administrator, the Distributor and the Trustee, and the routine operational, administrative and other ordinary expenses of the Fund including the fee payable to the Sub-Adviser, in each case subject to reimbursement by the Fund (other than marketing-related expenses). See “Charges—Fees and Expenses.” |

| (4) | Investors may pay customary brokerage commissions to their brokers in connection with the purchases of Shares. Because brokerage commission rates will vary from investor to investor, brokerage commissions are not included in the Breakeven Table. Investors are encouraged to review the terms of their brokerage accounts for details on applicable charges. |

| (5) | The Fund is subject to brokerage commissions (not expected to be higher than 0.30% per annum of the Fund’s average daily NAV) including applicable exchange fees, NFA fees, give up fees, pit brokerage fees and other transaction related fees and expenses charged in connection with trading activities for the Fund’s investments in CFTC-regulated investments. The effects of trading spreads, financing costs associated with Coal Futures, and costs relating to the purchase of U.S. Treasuries or similar high credit quality, short-term, fixed-income or similar securities are not included in this analysis. See “—Accrual” below and “Charges—Fees and Expenses—Accrual.” |

| (6) | The Sponsor’s predecessor paid all of the costs and expenses incurred in connection with the Fund’s organization and the continuous offering of the Shares through December 31, 2015, which are estimated |

5

Table of Contents

| to be approximately $368,051. From January 1, 2016 forward, the Sponsor will continue to pay the costs and expenses incurred in connection with the continuous offering of the Shares, subject to reimbursement by the Fund in the future. See “—Accrual” below and “Charges—Fees and Expenses—Accrual.” |

| (7) | The Sponsor’s predecessor paid all of the Fund’s routine operational, administrative and other ordinary expenses through December 31, 2015, excluding brokerage commissions and other fees prohibited by the Trust Agreement, which are estimated to be approximately $209,969. From January 1, 2016 forward, the Sponsor will continue to pay the Fund’s routine operational, administrative and other ordinary expenses, subject to reimbursement by the Fund in the future. See “—Accrual” below and “Charges—Fees and Expenses—Accrual.” |

| (8) | In connection with orders to create and redeem Baskets, Authorized Participants pay a transaction fee in the amount of $200 per order. Because these transaction fees are de minimis in amount, are charged on a transaction by transaction basis (and not on a Basket by Basket basis), and are expected to be borne by the Authorized Participants, they have not been included in the Breakeven Table. |

| (9) | The Fund is not expected to earn more than a de minimis amount of interest income. As a result, the dollar amounts and percentages shown for interest income are zero. |

| (10) | The percentage of revenue required for the Fund to breakeven at the end of the first twelve (12) months of an investment, by definition, is expected to be 1.25% per annum the Fund’s average daily NAV. |

The Fund will be successful only if its annual return from trading, plus its annual interest income from U.S. Treasuries (if any), exceeds its fees and expenses per annum. The Fund is not expected to earn more than a de minimis amount of interest income. Consequently, based upon the difference between the expected interest income rate and the annual fees and expenses set forth above, the Fund is expected to require trading income equal to approximately 1.25% per annum to breakeven.

Accrual

The Fund’s (i) brokerage commissions and fees, (ii) organizational and offering fees and expenses, and (iii) ongoing operational, administrative, professional and other ordinary fees and expenses, including fees paid to the Sub-Adviser and certain other Fund advisers, are accrued at a rate of 0.30% per annum in the aggregate. Of the amounts so accrued, the Fund will first pay its brokerage commissions and fees, with the remainder, if any, to be applied towards the reimbursement of the Sponsor for first, the Fund’s ongoing operational, administrative, professional and other ordinary fees and expenses (other than any marketing-related fees and expenses) incurred from January 1, 2016 forward, and second, the Fund’s organizational and offering fees and expenses incurred from January 1, 2016 forward.

6

Table of Contents

Investors should consider carefully the risks described below and elsewhere in this prospectus before making an investment decision. Before investing in the Shares, Investors should also refer to the other information included in this prospectus, and the Fund’s financial statements and the related notes as reported in the Fund’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which is incorporated by reference herein.

Risks Associated with the Coal Industry

The Fund and its assets are subject to the risks inherent in the coal industry.

The Fund’s investment objective is to provide investors with exposure to the daily change in the price of Coal Futures, before Fund liabilities and expenses. Accordingly, the value of the Shares relates directly to the value of the Fund’s portfolio of Coal Futures, and the price of Coal Futures relates directly to coal commodity prices. In the past, the price of coal has been volatile, and the Sponsor expects this volatility to continue. The markets and prices for coal are affected by many factors, including:

| • | the location, availability, quality and price of competing fuels such as natural gas and oil, and alternative energy sources such as hydroelectric and nuclear power; |

| • | technological developments in the traditional and alternative energy industries; |

| • | global demand for electricity and steel; |

| • | energy, environmental, fiscal and other governmental programs and policies; |

| • | weather and other environmental conditions; |

| • | global or regional political, economic or financial events and conditions; |

| • | global coal inventories, production rates and production costs; |

| • | currency exchange rates; and |

| • | the general sentiment of market participants. |

The Sponsor anticipates that a decline in the price of coal will result in a decline in the NAV and the value of the Shares.

The coal industry is extensively regulated, and costs of compliance with existing and future regulations could adversely impact the price of coal.

Coal mining operations are subject to a variety of foreign, federal, state and local environmental, health and safety, transportation, labor and other laws and regulations. Examples include laws and regulations relating to employee health and safety, emissions to air and discharges to water, reclamation and restoration, and storage, treatment and disposal of waste. Industry participants incur substantial costs to comply with such laws and regulations. New laws and regulations, as well as future interpretations or different enforcement of existing laws and regulations, may require substantial increases in equipment and operating costs and delays, interruptions or a termination of operations, all of which may negatively impact the price of coal and an investment in the Shares.

Climate change initiatives could significantly reduce the demand for coal, increase coal production costs and adversely impact the price of coal.

Global climate change continues to attract considerable public and scientific attention with widespread concern about the impacts of human activity, especially the emissions of greenhouse gasses (“GHGs”) such as carbon dioxide and methane. Combustion of fossil fuels, such as coal, results in the creation of carbon dioxide that is currently emitted into the atmosphere by coal end users, such as coal-fired electric generation power plants. Considerable and increasing foreign, federal, state and local government attention is being paid to reducing GHG emissions. In addition, recent private initiatives, such as “green” standards developed by end users and service providers to suppliers and end users, have similarly focused on the reduction of GHG emissions. Changes in GHG emissions standards or other relevant climate change initiatives could adversely affect the price and demand for coal and an investment in the Shares.

7

Table of Contents

Risks Associated with the Fund’s Operations

The Fund may not always achieve its stated investment objective.

The Fund seeks to invest its assets to the fullest extent possible in Coal Futures to achieve its investment objective of providing investors exposure to the daily change in Coal Futures, before Fund liabilities and expenses. However, changes in the NAV may not replicate the performance of Coal Futures due to a variety of reasons, including but not limited to:

| • | the Fund may not be able to purchase or sell the exact amount of Coal Futures required to meet its investment objective; |

| • | coal market disruptions may prevent the Fund from purchasing Coal Futures at a particular price, or at all; |

| • | regulatory or other extraordinary circumstances may limit the Fund’s ability to create or redeem Baskets; |

| • | the Fund will pay certain of its fees and expenses, including brokerage fees and expenses, extraordinary expenses, and the Sponsor Fee, and a significant increase in the Fund’s liabilities and expenses could lead to underperformance of the Fund relative to daily percentage changes in the Coal Futures; |

| • | to avoid being leveraged, the Fund will always attempt to invest slightly under 100% of its assets in Coal Futures, which could lead to underperformance of the Fund relative to daily percentage changes in the Coal Futures; |

| • | an imperfect correlation between the performance of Coal Futures held by the Fund and the Fund’s NAV; |

| • | bid-ask spreads; |

| • | market illiquidity or disruption; |

| • | rounding of Share prices; |

| • | the amount of Coal Futures liquidated to satisfy redemption requests; |

| • | the need to conform the Fund’s portfolio holdings to comply with investment restrictions or policies, or regulatory or tax law requirements; and |

| • | early and unanticipated closings of the markets on which the holdings of the Fund trade, resulting in the inability of the Fund to execute intended portfolio transactions. |

Regulatory and exchange position limits, accountability limits and other rules may restrict the creation of Baskets and the Fund’s ability to achieve its investment objective.

Various commodity exchange rules impose speculative position and accountability limits on market participants trading in certain commodities. For example, Rotterdam Coal Futures Contracts listed on the CME Facilities currently have position limits only in the expiration month, with accountability limits applying to all other delivery months. Although accountability limits are not a firm limit, the CME may exercise greater scrutiny and control once an investor’s position has passed the accountability limit (which is 7,000 contracts for Rotterdam Coal futures contracts).

In addition to accountability and position limits, exchanges may also set daily price fluctuation limits on futures contracts. The daily price fluctuation limit establishes the maximum amount that the price of a futures contract may vary either up or down from the previous day’s settlement price. Once the daily price fluctuation limit has been reached with respect to a particular futures contract, no trades may be made at a price beyond that limit. The Fund intends to invest all of its assets to the greatest extent possible in Coal Futures. If the Fund encounters accountability levels, position limits or price fluctuation limits for these contracts, it may not be able to create the Baskets necessary to accomplish its stated investment objective.

Furthermore, certain market conditions may restrict the Fund’s ability to trade in Coal Futures, including extreme volatility or trading halts in the coal futures markets or the financial markets generally, operational issues causing dissemination of inaccurate market information, and force majeure events such as system failures, natural or man-made disasters, acts of God, armed conflict, acts of terrorism, riot or labor disruptions or any similar intervening circumstance. If the Fund encounters such extreme market conditions, it may not be able to create or redeem the Baskets necessary to accomplish its stated investment objective.

8

Table of Contents

The Fund’s NAV may not always correspond to the Fund’s market price and, as a result, investors may be adversely affected by the creation or redemption of Baskets at a value that differs from the market price of the Shares.

The NAV per Share will change as fluctuations occur in the market value of the Fund’s portfolio. Investors should be aware that the public trading price of a number of Shares otherwise amounting to a Basket may be different from the NAV of an actual Basket (i.e., 25,000 individual Shares may trade at a premium over, or a discount to, the NAV of a Basket), and similarly the public trading price per Share may be different from the NAV per Share. Consequently, an Authorized Participant may be able to create or redeem a Basket at a discount or a premium to the public trading price per Share. This price difference may be due, in large part, to the fact that supply and demand forces at work in the secondary trading market for Shares is closely related, but not identical, to the same forces influencing the price of the underlying commodity at any point in time. Investors also should note that the size of the Fund in terms of total assets held may change substantially over time and from time-to-time as Baskets are created and redeemed.

Authorized Participants or their clients or customers may have an opportunity to realize a riskless profit if they can purchase a Basket at a discount to the public trading price of the Shares or can redeem a Basket at a premium over the public trading price of the Shares. The Sponsor expects that the exploitation of such arbitrage opportunities by Authorized Participants and their clients and customers will tend to cause the public trading price to closely track the NAV per Share over time.

The value of a Share may be influenced by non-concurrent trading hours between the NYSE Arca (or any other exchange or market on which the Shares may be quoted or traded) and the exchange on which the Coal Futures are traded. While the Shares are expected to trade on the NYSE Arca from 9:30 a.m. to 4:00 p.m. New York City time, Coal Futures may be traded during different time frames. Consequently, liquidity in Coal Futures will be reduced after the close of trading at the applicable commodities exchange. As a result, during the time when the NYSE Arca is open and the applicable commodities exchange is closed, trading spreads and the resulting premium or discount on the Shares may widen and, therefore, increase the difference between the price of the Shares and the NAV.

The inability to register or otherwise obtain regulatory approval for the sale of additional Shares may result in the market price of the Shares to diverge from the NAV.

At any time, the price at which Shares trade on the NYSE Arca (or any other exchange or market on which the Shares may be quoted or traded) may not accurately reflect the NAV per Share. The Shares may trade at a premium to the NAV per Share due to a number of conditions, including, but not limited to, the Fund’s inability to obtain regulatory approval from the SEC, FINRA or other regulator for the registration or sale of additional Shares. Investors who purchase Shares that are trading at a premium risk losing returns on their investment if the market price per Share subsequently converges with the NAV per Share.

Changes in the NAV may not correlate with changes in the price of the Fund’s Coal Futures traded on the CME Facilities.

The Fund may make use of “mini” Coal Futures traded on the CME Globex (if they are available) as a way of investing a dollar amount in Coal Futures that may more closely match the dollar amount of net assets of the Fund. However, even the use of mini contracts does not completely eliminate the risk that the Fund will not be able to buy or sell the exact number of Coal Futures necessary. In addition, there is a risk that because of the size and relative liquidity of such contracts when compared to standard size Coal Futures contracts, the price of a smaller contract for a particular month may not equate to the standard size Coal Futures, which could cause the change in the Fund’s per Share price and NAV to vary from changes in the average price of the Coal Futures.

The NAV may be overstated or understated due to the valuation method employed when a settlement price for Coal Futures is not available on the date of NAV calculation.

The NAV will include, in part, any unrealized profits or losses on open Coal Futures. Under normal circumstances, the NAV will reflect the settlement price of open Coal Futures on the date when the NAV is being calculated. However, a Coal Futures contract trading on the CME Facilities may not be trading on a day when the Fund is accepting creation and redemption orders. As a result, the Fund may attempt to calculate the fair value of such Coal Futures. In such a situation, the Sponsor may use the settlement price on the most recent date on which the Coal Futures could have been traded as the basis for determining the market value of such contract for such day, or use an alternative fair value methodology. Accordingly, if the Sponsor implements fair value methodologies to calculate the value of Coal Futures for any reason, there is a risk that the calculation of the NAV on the applicable day will be overstated or understated, which may adversely effect an investment in the Shares.

An unanticipated number of redemption requests during a short period of time could have an adverse effect on the NAV.

If a substantial number of requests for the redemption of Baskets are received by the Fund during a relatively short period of time, the Fund may not be able to satisfy the requests solely from the Fund’s assets not committed to trading. As a consequence, it could be necessary to liquidate positions in the Fund’s trading positions before the time that the trading strategies would otherwise dictate liquidation, which could have an adverse effect on the NAV.

If the Sponsor causes or permits the Fund to become leveraged, the Fund could incur substantial losses if the Fund’s trading positions suddenly turn unprofitable.

Commodity pools’ trading positions in futures contracts or other commodity interests are typically required to be secured

9

Table of Contents

by the deposit of margin funds that represent only a small percentage of the market value of the underlying futures contracts or other commodity interests. This feature permits commodity pools to “leverage” their assets by purchasing futures contracts or other commodity interests with an aggregate value in excess of the commodity pool’s assets. While this leverage can increase a pool’s profits, relatively small adverse movements in the price of the pool’s futures contracts or other commodity interests can cause significant losses to the pool. While the Sponsor expects the Sub-Adviser to not leverage the assets of the Fund, the Fund is dependent upon the trading and management skills of the Sub-Adviser to maintain the proper position sizes. If the Fund becomes leveraged, it could realize losses or become unable to satisfy its current or potential margin and/or collateral obligations with respect to its investments.

The Sponsor and the Administrator have the authority to postpone, suspend or reject redemption orders.

The Sponsor may suspend the right of redemption or postpone the redemption settlement date for (1) any period during which the NYSE Arca or other exchange on which the Shares are listed is closed, other than customary holidays or weekends, or when trading is restricted or suspended, (2) any period during which an emergency exists as a result of which the redemption distribution is not reasonably practicable, or (3) in the event any price limits imposed by the CME or the CFTC are reached and the Sponsor believes that permitting redemptions under such circumstances may adversely impact investors. In addition, the Administrator will reject a redemption order if the order is not in proper form as described in the Participant Agreement or if the fulfillment of the order might be unlawful. Any such postponement, suspension or rejection could adversely affect a redeeming Authorized Participant. For example, the resulting delay may adversely affect the value of the Authorized Participant’s redemption proceeds if the NAV declines during the period of the delay. The parties disclaim any liability for any loss or damage that may result from any such suspension, postponement or rejection.

A Commodity Broker may become bankrupt or fail to segregate funds on the Fund’s behalf.

The Commodity Exchange Act requires a clearing broker to segregate all customer funds from the broker’s proprietary assets. If a Commodity Broker fails to comply, the assets of the Fund might not be fully protected in the event of the broker’s bankruptcy, and Shareholders could lose their investment or be limited to recovering only a pro rata share of all available funds segregated on behalf of the broker’s combined customer accounts. A Commodity Broker may, from time to time, be subject to certain regulatory and private causes of action. Current and material causes of action for the initial Commodity Brokers and Execution Broker are described under “The Brokers.”

In the event of a bankruptcy or insolvency of an exchange or clearing house, the Fund could also experience a loss of the funds deposited through a Commodity Broker as margin with the exchange or clearing house, a loss of any profits on its open positions on the exchange, and/or the loss of unrealized profits on its closed positions on the exchange.

Illiquidity in the coal futures markets could make it impossible for the Fund to realize profits or limit losses.

In illiquid markets, the Fund could be unable to close out positions or take new positions to fill subscription and redemption orders or to otherwise fulfill its investment objective. There are too many different factors that can contribute to market illiquidity to predict when or where illiquid markets may occur. Unexpected market illiquidity has caused major losses for some traders in recent years in market sectors such as emerging markets and mortgage-backed securities. There can be no assurance that the same will not happen in the markets traded by the Fund. In addition, the large size of the positions the Fund may take increases the risk of illiquidity by both making its positions more difficult to liquidate and increasing the losses incurred while trying to do so. U.S. commodity exchanges impose limits on the amount by which the price of some, but not all, futures contracts may change on a single day. Once a futures contract has reached its daily limit, it may be impossible for the Fund to liquidate a position in that contract until the limit is either raised by the exchange or the contract begins to trade away from the limit price. In addition, because Coal Futures contracts traded on CME Facilities can be thinly traded, it may be difficult for the Fund to enter or exit a Coal Futures position without significantly impacting the quoted price. This could result in increased trading costs. In some cases, the liquidation of a position in a Coal Futures contract on CME Facilities may not be possible within a reasonable period of time, which could also result in increased losses to the Fund and its Shareholders.

Regulatory changes or new legislation may alter the Fund’s operations.

The futures markets are subject to comprehensive statutes, regulations and margin requirements. In addition, the CFTC and the exchanges are authorized to take extraordinary actions in the event of a market emergency, including, for example, the retroactive implementation of speculative position limits or higher margin requirements, the establishment of daily price limits and the suspension of trading. The regulation of futures transactions in the United States is a rapidly changing area of law and is subject to modification by government and judicial action. For example, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) contains measures aimed at increasing the transparency and stability of the OTC derivative markets and preventing excessive speculation. Although the Dodd-Frank Act was enacted on July 21, 2010, the CFTC and the SEC, along with certain other regulators, must promulgate final rules and regulations to implement many of its provisions relating to OTC derivatives. While some of these rules have been finalized, many have not and, as a result, the final form and timing of the implementation of the new regulatory regime affecting commodity derivatives remains uncertain. In particular, on October 18, 2011, the CFTC adopted final rules under the Dodd-Frank Act establishing position limits for certain energy commodity futures and options contracts and economically equivalent swaps, futures and options. The CFTC’s rules on position limits have since

10

Table of Contents

been vacated on September 28, 2012 by the U.S. Circuit Court of the District of Columbia. In vacating and remanding the new position limits rules, the court nevertheless upheld the CFTC’s revisions to the legacy position limits that amended previously-enacted position limits rules and are already in place pursuant to CFTC rules. On November 5, 2013, the CFTC re-proposed for public comment new position limits and an aggregation rule both of which are currently pending and have not yet been adopted. In addition, the CFTC proposed regulations that would expand certain exemptions from aggregation of accounts of related parties. The CFTC directed staff to hold a public roundtable on June 19, 2014 to discuss certain position limit and aggregation issues. In order to provide interested parties an opportunity to comment on these issues, the CFTC reopened the public comment periods for these proposed regulations until January 22, 2015. It remains to be seen whether the CFTC will modify the proposed regulations in response to public comments. There can be no assurance that the timing, applicability and impact of final rules will not have a material adverse impact on the Fund by affecting the prices of or market for commodities relevant to the Fund’s operations and/or by reducing the availability of commodity derivatives.

The Fund and the Sponsor may be sued by outside parties which may cause the NAV or market value of the Fund to not track the value of the portfolio of the Fund and could cause the Fund to lose money.

If the Fund is sued by an outside party for any reason including unlicensed use of intellectual property, data fees, or settlement data, it could cause the NAV or market value of the Fund to not track the Fund’s underlying portfolio. Such a lawsuit could cause the Fund’s market value to deviate from the value of the Fund’s underlying portfolio and could result in losses to the Fund and its Shareholders.

The Fund may incur higher fees and expenses upon renewing existing or entering into new contractual relationships.

If the Fund enters into new contractual relationships or renews existing relationships with its service providers, it may incur higher fees and expenses and need to change the accruals of its Sponsor Fee, brokerage fees and expenses, or introduce new fees or expenses. Any such change in accruals or additional fees or expenses could make an investor’s investment in the Fund less profitable.

U.S. financial markets may experience periods of disruption.

U.S. financial market conditions have, from time to time, been characterized by reduced levels of corporate credit and liquidity, and have experienced periods of significant instability and volatility. Such market conditions have existed on several occasions, sometimes for extended periods, since 2008. Although U.S. financial markets have demonstrated some signs of recovery in recent periods, a return of unstable and volatile conditions could adversely affect the financial condition and results of operations of the Fund’s service providers and Authorized Participants, thereby negatively impacting the Fund’s NAV and the ability of the Fund to achieve its investment objective.

The U.S. Treasury could default on its obligations to make payments on U.S. Treasuries.

In August 2011, Standard & Poor’s downgraded the United States’ long-term credit rating from AAA to AA+. Any default by the U.S. Government on all or a material portion of the Fund’s investments in U.S. Treasuries would have a negative impact on the Fund.

The Fund will experience a loss if it is required to sell U.S. Treasuries at a price lower than the price at which they were acquired.

If the Fund is required to sell U.S. Treasuries at a price lower than the price at which they were acquired, the Fund will experience a loss. This loss may adversely impact the NAV and an investment in the Shares.

The Fund may not realize gains sufficient to compensate for its expenses and other liabilities.

The Fund will pay its accrued brokerage charges and other ordinary expenses of 0.30%, a Sponsor Fee at an annual rate of 0.95% of its average net assets, and all extraordinary expenses. See “Charges—Fees and Expenses.” These fees and expenses must be paid regardless of whether Fund activities are profitable. The Fund is expected to earn interest income at an annual rate of 0.26% per annum, based upon the yield on 90 day U.S. Treasury Bills as of December 31, 2015. Consequently, it is expected that interest income will not exceed the Fund’s fees and expenses, and therefore the Fund will need to experience positive price performance to break-even net of fees and expenses. Accordingly, the Fund must realize price gains sufficient to cover these fees and expenses before it can earn any profit. See “Charges—Breakeven Table.” A prolonged period of sustained Fund losses could negatively impact an investment in the Shares.

The Fund is not actively managed and will attempt to deliver investors exposure to daily changes in the price of Coal Futures during periods in which the prices of Coal Futures are flat or declining as well as when they are rising.

The Sponsor will seek to hold Coal Futures during periods in which daily changes in the price of Coal Futures are flat or declining as well as when they are rising, and will not actively manage the Fund based on any other discretionary criteria. For example, if the Fund’s positions in Coal Futures are declining in value, the Fund will not close out such positions, except during roll periods or for creation and redemption orders in accordance with its investment objective. Any decrease in value of the Fund’s Coal Futures positions will result in a decrease in the NAV and likely will result in a decrease in the market price of the Shares.

11

Table of Contents

The past performance of the members of the Sponsor’s management team may be an inadequate or unsuitable indicator of their ability to manage the Fund.

The past performance of the members of the Sponsor’s management team is no indication of their ability to manage the Fund. See “The Sponsor and the Sub-Adviser—Sponsor—Officers” for a description of the relevant experience of the Sponsor’s new management team that was put in place on January 4, 2016.

The liability of the Sponsor and the Trustee is limited.

Under the Trust Agreement, the Trustee and the Sponsor are not liable, and have the right to be indemnified, for any liability or expense incurred, except to the extent that such liability or expense results from the gross negligence or willful misconduct on the part of the Trustee or the Sponsor or breach by the Sponsor of the Trust Agreement, as the case may be. The Sponsor may require the Fund’s assets to be sold to cover losses or liability suffered by it or by the Trustee, resulting in a potential reduction of the NAV and value of the Shares.

The Fund and the Sponsor are subject to extensive regulatory reporting and compliance obligations.

The Shares are listed on the NYSE Arca. As a result, the Fund is subject to certain rules and regulations of federal and state authorities and relevant financial market exchange entities charged with the protection of investors and the oversight of companies whose securities are publicly traded. These entities, including the Public Company Accounting Oversight Board (“PCAOB”), SEC, CFTC, NFA, FINRA and the New York Stock Exchange (“NYSE”), have in recent years issued new requirements and regulations, most notably those resulting from the enactment of the Sarbanes-Oxley Act of 2002. From time to time, since the adoption of the Sarbanes-Oxley Act of 2002, these authorities have continued to develop additional regulations or interpretations of existing regulations. The Sponsor’s efforts to comply with these regulations and interpretations will result in increased general and administrative expenses and diversion of management time and attention from achieving the Fund’s investment objective.

In addition, the Sponsor is responsible for establishing and maintaining adequate systems of internal control over financial reporting of the Fund. The Fund’s internal control system is designed to provide reasonable assurance regarding the preparation and fair presentation of published financial statements. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to the Fund’s financial statement preparation and presentation.

The success of the Fund depends on the ability of the Sub-Adviser to accurately implement trading systems, and any failure to do so could subject the Fund to losses on such transactions.

The Sub-Adviser will use mathematical formulas to facilitate the purchase and sale of Coal Futures. The Sub-Adviser must make accurate calculations and execute the trades dictated by such calculations. In addition, the Fund relies on the Sub-Adviser to properly operate and maintain its computer and communications systems. Execution of the formulas and operation of the systems are subject to human error. Any failure, inaccuracy or delay in implementing any of the formulas or systems or executing the Fund’s transactions could impair the Fund’s ability to achieve its investment objective.

The Fund may experience substantial losses if the computer or communications systems of the Fund, the Sub-Adviser or various third parties fail.

The Fund will rely on the integrity and performance of its and the Sub-Adviser’s computer and communications systems to gather and analyze information, enter orders, process data, monitor risk levels and otherwise engage in trading activities. The Fund also depends on the proper and timely function of computer and communications systems maintained and operated by the futures exchanges, brokers and other data providers that the Fund uses to conduct trading activities. Extraordinary transaction volume, hardware or software failure, power or telecommunications failure, or a natural disaster or other catastrophe could cause such systems to operate at an unacceptably slow speed or even fail. Any significant degradation or failure of such systems may result in substantial Fund losses, liability to other parties, lost profit opportunities, increased operational expenses and diversion of technical resources.

Investors cannot be assured of the Sponsor’s or Sub-Adviser’s continued services, which if discontinued may be detrimental to the Fund.

Investors cannot be assured that the Sponsor or Sub-Adviser will be willing or able to continue to service the Fund for any length of time. If either party discontinues its activities on behalf of the Fund, the Fund may be adversely affected, as there may be no entity servicing the Fund for a period of time. If either party’s registrations or memberships in the NFA were revoked or suspended, such party would no longer be able to provide services to the Fund. As the Fund itself is not registered with the CFTC in any capacity, if either party were unable to provide services to the Fund, the Fund would be unable to pursue its investment objective unless and until such party’s ability to provide services to the Fund is reinstated or a replacement is appointed. Such an event could result in termination of the Fund.

12

Table of Contents

The Fund is subject to various actual and potential conflicts of interest.

The Sponsor, the Sub-Adviser and their principals are not required to devote substantially all of their time to the business of the Fund, which presents the potential for numerous conflicts of interest. In addition, the Fund’s service providers may have other conflicts of interest. See “Conflicts of Interest.” Accordingly, such parties have a financial incentive to act in a manner other than in the best interests of the Fund and the Shareholders. Investors will be dependent on the good faith of the respective parties subject to such conflicts to resolve them equitably. Although the Sponsor attempts to monitor these conflicts, it is extremely difficult, if not impossible, for the Sponsor to ensure that these conflicts do not, in fact, result in adverse consequences to the Fund or its Shareholders.

Risks Associated with an Investment in the Shares

Shareholders will not have the protections associated with ownership in an investment company registered under the Investment Company Act.

The Fund is not required to register, and is not registered, as an investment company under the Investment Company Act of 1940, as amended (the “Investment Company Act”). Consequently, Shareholders will not have the regulatory protections provided to investors in registered investment companies.

Futures-based investing is complex and risky and an investment in the Fund should be monitored consistently by investors.

Futures contracts have a high degree of price variability and are subject to occasional rapid and substantial changes. Consequently, an investor could lose all of their investment in the Fund. Investing in futures-based investment products can be complex and risky and as such an investment in the Fund should be monitored consistently by investors.

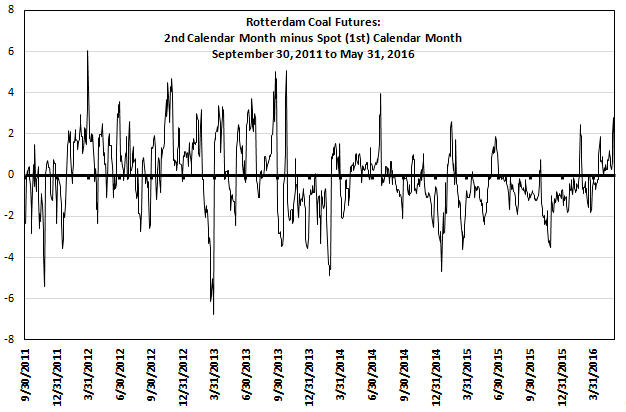

An absence of “backwardation” or the presence of “contango” in the prices of Coal Futures may decrease the value of the Shares.

As the Fund’s Coal Futures near expiration, they will be replaced by contracts that have a later expiration. For example, a contract purchased and held in January 2016 may specify a March 2016 expiration. As that contract nears expiration, it may be replaced by selling the January 2016 contract and purchasing the contract expiring in April 2016. This process is referred to as “rolling.” Backwardation exists when the price for commodity contracts with shorter-term expirations are higher than the price for contracts with longer-term expirations. In these circumstances, absent other factors, the sale of the January 2016 contract would be consummated at a price that is higher than the price at which the April 2016 contract is purchased. Once the Fund purchased the April 2016 contract and assuming no other changes to the prevailing spot coal price nor the price relationship between the spot coal price and futures contracts, hypothetically the value of the April 2016 contract would increase over time, thereby creating a gain for the Fund.

Conversely, contango exists when the price for commodity contracts with longer-term expirations are higher than the price for contracts with shorter-term expirations. In these circumstances, absent other factors, the sale of the January 2016 contract would be consummated at a price that is lower than the price at which the April 2016 contract is purchased. Once the Fund purchased the April 2016 contract and assuming no other changes to the prevailing spot coal price nor the price relationship between the spot coal price and the corresponding futures contracts, hypothetically the value of the April 2016 contract would increase over time, thereby creating a loss for the Fund.

Coal Futures have historically been in a state of contango. If such a state of contango continues to persist, an investor in the Fund may experience a decrease in their return relative to spot coal prices. In addition, contango may cause a decrease in the value of the Shares in the Fund over time.

Significant variations between the market value of Shares and the prices of Coal Futures may limit an investor’s ability to use the Shares as a means to indirectly invest in coal or for hedging purposes.

While it is expected that the trading prices of the Shares will fluctuate in accordance with changes in the NAV, the market price for the Shares may also be influenced by other factors, including the short-term supply and demand for coal derivatives and the Shares. There is no guarantee that the Shares will not trade at appreciable discounts from, and/or premiums to, the NAV. This could cause changes in the price of the Shares to substantially vary from changes in the price of Coal Futures, which could prevent investors from being able to effectively use an investment in the Fund as a way to indirectly invest in coal or hedge the risk of losses in coal-related transactions.

The price of coal can be volatile, which could result in large fluctuations in the price of Shares.

Movements in the price of coal will be outside of the Sponsor’s control and may not be anticipated by the Sponsor. As

13

Table of Contents

discussed in more detail above, price movements for coal are influenced by, among other things, weather conditions, transportation difficulties, governmental policies, changing demand and seasonal fluctuations in supply. Coal prices may also be influenced by economic and monetary events such as changes in interest rates, changes in balances of payments and trade, U.S. and international inflation rates, currency valuations and devaluations, and changes in the philosophies and emotions of market participants. Because the Fund is exposed primarily to interests in coal, it is not a diversified investment vehicle, and therefore may be subject to greater volatility than a diversified portfolio of stocks or bonds or a more diversified commodity pool.

The investment objective of the Fund is not intended to correlate exactly with the spot price of coal or any spot price coal indexes and this could cause the changes in the price of the Shares to substantially vary from the changes in the spot price of coal.

The investment objective of the Fund is to provide investors exposure to the daily change in the price of Coal Futures, not the current spot prices of coal or any coal spot price indexes. Weak correlation between the NAV or market price of the Fund and the coal spot prices may result from typical seasonal fluctuations in coal prices, among other factors. If there is a weak correlation between Coal Futures and the coal spot prices, then the market price of the Shares may not accurately track the coal spot prices and investors may not be able to effectively use the Fund as a way to hedge the risk of losses in coal-related transactions or as a way to indirectly invest in coal.

The lack of an active trading market for the Shares will affect the liquidity of the Shares.

Although the Shares are listed and traded on the NYSE Arca, there can be no guarantee that an active trading market for the Shares will develop or be maintained. If an active public market for the Shares does not exist or continue, the market prices and liquidity of the Shares may be adversely affected.

The NYSE Arca may halt trading in the Shares or delist the Shares.