Exhibit 2.1

AGREEMENT AND PLAN OF REORGANIZATION

This AGREEMENT AND PLAN OF REORGANIZATION (this “Agreement”), dated as of October 1, 2014, is by and among Fuse Science, Inc., a Nevada corporation (the “Parent”), Spiral Acquisition Sub, Inc., a wholly-owned subsidiary of Parent (“Merger Sub”) and Spiral Energy Tech, Inc., a Nevada corporation (the “Company”). Each of the parties to this Agreement is individually referred to herein as a “Party” and collectively as the “Parties.”

BACKGROUND AND RECITALS

The Company has 15,144,885 shares of common stock outstanding (the “Company Shares”) after giving effect to the Cancellation Agreement, as defined below. In connection with a recapitalization of Parent, and subject to the terms and conditions of this Agreement, including without limitation the execution and delivery of the Constituent Agreements (as defined below), the parties hereto have agreed to effect the merger of Merger Sub with and into the Company (the “Merger”) pursuant to the terms of this Agreement, with Company remaining as the Surviving Company (as defined herein).

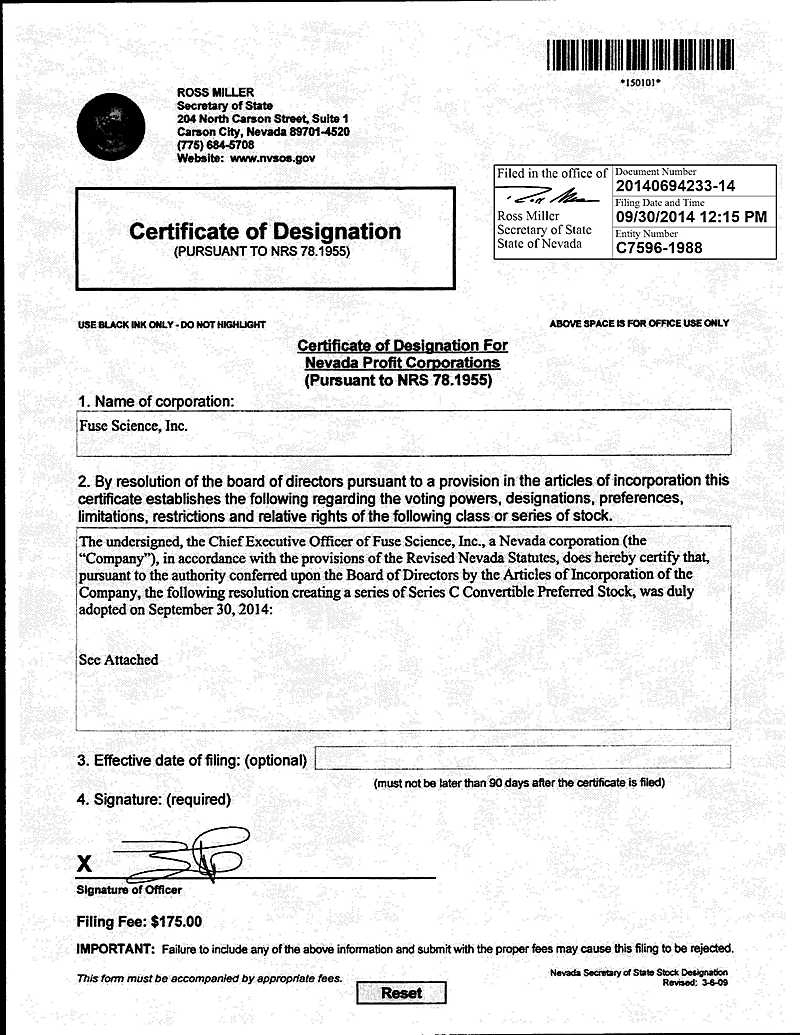

As a result of the Merger, among other effects, at the Effective Time of the Merger (as defined herein), (i) Fifty One Percent (51%) of the Company Shares issued and outstanding immediately prior to the Effective Time (calculated on a pro rata basis among the shareholders of the Company immediately prior to the Effective Time of the Merger) shall no longer be outstanding and shall automatically be cancelled and retired and shall cease to exist and certificates previously evidencing any such Company Shares shall thereafter represent the right to receive an aggregate of One Hundred and Fifty Million (150,000,000) newly issued shares of common stock, par value $0.001 per share, of the Parent, (the “Parent Common Stock”) or, at the election of any holder of the Company Shares who, as a result of receiving shares of Parent Common Stock in connection with the Merger would hold in excess of 5% of the issued and outstanding shares of Parent Common Stock, shares of Series C Convertible Preferred Stock, par value $0.001 per share, of the Parent, with such rights and limitations as set forth in the Certificate of Designations of Preferences, Rights and Limitations of Series C Convertible Preferred Stock, attached hereto as Exhibit A (the “Parent Preferred Stock”) (such shares of Parent Common Stock and Parent Preferred Stock issued in the Merger, if any, the “Parent Stock) (ii) Forty Nine (49%) of the Company Shares issued and outstanding immediately prior to the Effective Time (calculated on a pro rata basis among the shareholders of the Company immediately prior to the Effective Time of the Merger) shall remain outstanding and represent the right to receive shares of the Surviving Company equal to Forty Nine Percent (49%) of the issued and outstanding stock of the Surviving Company and (iii) each share of Merger Sub, par value $0.0001 per share, held by Parent immediately prior to the Effective Time of the Merger shall, by virtue of the Merger and without any action on the part of the Parent, be converted into the right to receive 7,723,892 shares of the Surviving Company, which shall represent Fifty One Percent (51%) of the Surviving Company’s issued and outstanding common stock.

The Merger is intended to constitute a reorganization within the meaning of the Internal Revenue Code of 1986, as amended (the “Code”), or such other tax free reorganization or restructuring provisions as may be available under the Code.

The Board of Directors of each of the Parent and the Company has determined that it is desirable to effect this plan of reorganization and Merger.

Concurrent with and as a condition to the Merger, (i) the Parent will enter into an employment agreement with Ezra Green (“Green”), in the form attached as Exhibit B to serve as Chief Executive Officer, Chief Financial Officer, Secretary and Treasurer of Parent (the “Employment Agreement”), (ii) Green and the Incoming Directors (as defined herein) shall execute lockup agreements, in the form attached hereto as Exhibit C (the “Incoming Lockup Agreements”); (iii) the Outgoing Officers and Directors (as defined herein) shall execute lockups agreements, in the form attached hereto as Exhibit D (the “Outgoing Lockup Agreements”); (iv) the Parent and Brian Tuffin (“Tuffin”), the Parent’s current Chief Executive Officer and interim Chief Financial Officer, shall enter into the Severance Agreement, in the form attached hereto as Exhibit E (the “Tuffin Severance Agreement”);(v) the Parent, and the recipients of the Former Management Shares (as defined herein) (collectively, the “Indemnifying Individuals”) shall enter into an escrow agreement, in the form attached hereto as Exhibit F (the “Escrow Agreement”) with a third party escrow

-1-

agent pursuant to which the Indemnifying Individuals shall deposit certain securities of the Parent and cash into an escrow account (vi) the Parent and Jeanne Hebert, the Parent’s Senior Vice President of Marketing and Clinical Research and Secretary shall enter into a severance agreement in the form attached hereto as Exhibit G (the “Hebert Severance Agreement”); and (vii) the President of the Company will enter into a Cancellation Agreement in the form attached hereto as Exhibit H (the “Cancellation Agreement”). The Employment Agreement, the Incoming Lockup Agreements, the Outgoing Lockup Agreements, the Tuffin Severance Agreement, the Escrow Agreement, the Hebert Severance Agreement and the Cancellation Agreement shall collectively be referred to herein as the “Constituent Agreements”.

The Parties intend for the Merger to occur at a concurrent closing upon execution and delivery of this Agreement and the Constituent Agreements.

AGREEMENT

NOW THEREFORE, based on the foregoing premises and for good and valuable consideration the receipt and sufficiency of which is hereby acknowledged, the Parties hereto intending to be legally bound hereby agree as follows:

ARTICLE I

Exchange of Shares

SECTION 1.01 The Merger. At the Closing (as defined in Section 1.05), subject to the terms and conditions of this Agreement, Merger Sub shall merge with and into the Company in accordance with applicable provisions of Nevada law, the separate existence of Merger Sub shall cease and the Company shall survive and continue to exist as a corporation under the Nevada Revised Statutes (the “NRS”) (the “Surviving Company”) under the name “Spiral Energy Tech, Inc.”. The Articles of Incorporation of the Company as on file with the Nevada Secretary of State and the Bylaws of Company, as in force and effect immediately prior to the Effective Time of the Merger, shall continue to be the Articles of Incorporation and Bylaws of the Surviving Company until duly amended in accordance with the provisions thereof and applicable law. The officers and directors of the Company shall be the officers and directors of the Surviving Company.

SECTION 1.02 Effect of the Merger. At the Effective Time of the Merger, the effect of the Merger shall be as provided in the NRS. Without limiting the generality of the foregoing, at the Effective Time of the Merger all the property, rights, privileges, powers and franchise of the Merger Sub shall vest in the Surviving Company, and all debts, liabilities and duties of the Merger Sub shall become the debts, liabilities and duties of the Surviving Company.

SECTION 1.03 Effective Time of the Merger. The parties shall cause Articles of Merger required by the NRS relating to the Merger in the form attached hereto as Exhibit I to be filed with the Secretary of State of the State of Nevada pursuant to the NRS on the Closing Date. The Merger provided for herein shall become effective upon such filings or on such date as may be specified therein (the “Effective Time of the Merger”).

-2-

SECTION 1.04 Conversion of Company Shares. At the Effective Time of the Merger, automatically by virtue of the Merger and without any action on the part of any Person: (i) Fifty One Percent (51%) of the Company Shares issued and outstanding immediately prior to the Effective Time of the Merger (calculated on a pro rata basis among the shareholders of the Company immediately prior to the Effective Time of the Merger after giving effect to the Cancellation Agreement), shall be cancelled and converted into the pro-rata portion of validly issued, fully paid, and non- assessable share of Parent Stock (150,000,000 shares) to be issued hereunder in connection with the Merger; (ii) Forty Nine (49%) of the Company Shares issued and outstanding immediately prior to the Effective Time of the Merger (calculated on a pro rata basis among the shareholders of the Company immediately prior to the Effective Time of the Merger) shall remain outstanding and represent the right to receive shares of the Surviving Company equal to Forty Nine Percent (49%) of the issued and outstanding stock of the Surviving Company and (iii) each share of Merger Sub, par value $0.0001 per share, held by Parent immediately prior to the Effective Time of the Merger shall, by virtue of the Merger and without any action on the part of the Parent, be converted into the right to receive 7,723,892 shares of the Surviving Company, which shall represent Fifty One Percent (51%) of the Surviving Company’s issued and outstanding common stock. Certificates representing the Parent Stock shall be delivered to the shareholders of the Surviving Company at the Effective Time of the Merger pursuant to the terms of this Agreement.

SECTION 1.05 Closing. The closing (the “Closing”) of the transactions contemplated by this Agreement (the “Transactions”) shall take place concurrently with the execution and delivery of this Agreement on such date, time and location as shall be mutually determined by the Company and Parent (the “Closing Date”).

ARTICLE II

Indemnification; Escrow

SECTION 2.01 Indemnification by Indemnifying Individuals. At the Effective Time of the Merger, in accordance with the terms of the Escrow Agreement, Parent shall deliver to Sichenzia Ross Friedman Ference LLP, as escrow agent (the “Escrow Agent”), (i) the Former Management Shares (as defined herein) (the “Escrow Shares”); and (ii) Seventy Five Thousand Dollars ($75,000) in cash from the total amount payable pursuant to the terms of the Tuffin Severance Agreement (the “Escrow Cash” and, collectively with the Escrow Shares, the “Escrow Items”). The Escrow Items shall be available to secure any claims that may arise with respect to (i) any breach of any representation or warranty of the Parent set forth in this Agreement; (ii) all Taxes to the extent resulting from or relating to the ownership, management or use of and the operation of the Parent prior to and including the Closing Date and (iii) any breach of any representation or warranty made to investors contained in those certain subscription agreements dated as of the date of this Agreement between the Parent and certain accredited investors and any transaction documents related thereto (the “Financing Documents”) entered into in connection herewith for the private placement of Parent’s securities, until the first (1st) anniversary of the Closing Date (“Escrow Period”). In no event shall the indemnification obligations of the Indemnifying Individuals under this Agreement exceed the Escrow Items other than in the case of fraud or intentional misrepresentation. The Escrow Shares shall not be available for sale, transfer or other disposition by the Indemnifying Individuals (as applicable) during the Escrow Period, without the consent of the parties to the Escrow Agreement and the Escrow Agent. All claims made against the Escrow Items shall be paid pursuant to the terms of the Escrow Agreement first using the Escrow Cash and then the Escrow Shares.

SECTION 2.02 Indemnification. Subject to the limitations set forth this Article II, the Indemnifying Individuals designated as such on the signature pages hereto (the “Management Indemnifying Parties”), agree to indemnify and hold harmless Parent, the Company, the Surviving Company and their respective directors, officers and affiliates and their successors and assigns (each an “Indemnified Party”) from and against any and all Losses of the Indemnified Parties, to the extent directly or indirectly resulting or arising from or based upon: (i) any breach of any representation or warranty of the Parent set forth in this Agreement; (ii) all Taxes to the extent resulting from or relating to the ownership, management or use of and the operation of the Parent prior to and including the Closing Date and (iii) any breach of any representation or warranty contained in any Financing Document. For purposes hereof, “Losses” shall be defined as “any action, cost, damage, disbursement, expense, liability, loss, deficiency, diminution in value, obligation, penalty or settlement of any kind or nature, whether foreseeable or unforeseeable, including but not limited to, interest or other carrying costs, penalties, legal, accounting and other professional fees and expenses incurred in the investigation, collection, prosecution and defense of claims and amounts paid in settlement, that may be imposed on or otherwise incurred or suffered by the specified person”.

-3-

SECTION 2.03 Limitations on Liability. The obligations of the Management Indemnifying Parties under this Article II shall be subject to the following limitations:

(i) Parent and Company waive, on behalf of itself and any Indemnified Party, any right to multiply actual damages or recover consequential, indirect, special, punitive or exemplary damages (including, without limitation, damages for lost profits or loss of business opportunity) arising in connection with or with respect to the indemnification provisions hereof or any right to recovery from any source other than the Escrow Items. For the avoidance of doubt, the Management Indemnifying Parties’ indemnification obligation is limited to the Escrow Items, other than in the case of fraud or intentional misrepresentation.

(iii) In no event shall the Management Indemnifying Parties’ aggregate liability to any Indemnified Party under Article II exceed the after tax amount of such Claim and all Claims shall be net of any insurance proceeds reasonably expected to be received in respect of Losses subject to such Claim. The Indemnified Parties shall use all reasonable efforts to collect any amounts available under applicable insurance policies with respect to Losses subject to a Claim.

SECTION 2.04 Procedure. An Indemnified Party shall give the Management Indemnifying Parties (each, an “Indemnifying Party”), as applicable, notice (a “Claim Notice”) of any matter which an Indemnified Party has determined has given or could reasonably give rise to a right of indemnification under this Agreement (a “Claim”), within forty-five (45) days of such determination; provided, however, that any failure of the Indemnified Party to provide such Claim Notice shall not release the Indemnifying Party from any of its obligations under this Article II except to the extent the Indemnifying Party is materially prejudiced by such failure and shall not relieve the Indemnifying Party from any other obligation or liability that it may have to any Indemnified Party otherwise than under this Article II except to the extent the Indemnifying Party is materially prejudiced by such failure. Upon receipt of the Claim Notice, the Indemnifying Party shall be entitled to assume and control the defense of such Claim at its expense if it gives notice of its intention to do so to the Indemnified Party within ten (10) business days of the receipt of such Claim Notice from the Indemnified Party; provided, however, that (i) Indemnified Party must approve of the selection of legal counsel by Indemnifying Party, which approval shall not be unreasonably withheld, delayed or conditioned and (ii) if there exists or is reasonably likely to exist a conflict of interest that would make it inappropriate in the judgment of the Indemnified Party, in its reasonable discretion, for the same counsel to represent both the Indemnified Party and the Indemnifying Party, then the Indemnified Party shall be entitled to retain its own counsel, in each jurisdiction for which the Indemnified Party determines counsel is required, at the expense of the Indemnifying Party. In the event the Indemnifying Party exercises the right to undertake any such defense against any such Claim as provided above, the Indemnified Party shall cooperate with the Indemnifying Party in such defense and make available to the Indemnifying Party, at the Indemnifying Party’s expense, all witnesses, pertinent records, materials and information in the Indemnified Party’s possession or under the Indemnified Party’s control relating thereto as is reasonably required by the Indemnifying Party. Similarly, in the event the Indemnified Party is, directly or indirectly, conducting the defense against any such Claim, the Indemnifying Party shall cooperate with the Indemnified Party in such defense and make available to the Indemnified Party, at the Indemnifying Party’s expense, all such witnesses, records, materials and information in the Indemnifying Party’s possession or under the Indemnifying Party’s control relating thereto as is reasonably required by the Indemnified Party. No such Claim may be settled by the Indemnifying Party without the prior written consent of the Indemnified Party, which consent shall not be unreasonably withheld, delayed or conditioned so long as (a) there is no payment or other consideration required of the Indemnified Party and (b) such settlement does not require or otherwise involve any restrictions on the conduct of the business of the Indemnified Party.

SECTION 2.05 Survival. The representations and warranties of the Parent contained in this Agreement, including the Exhibits and the Schedules to this Agreement, shall survive the Closing until the first (1st) anniversary of the Closing Date. An Indemnifying Party is not required to make any indemnification payment hereunder unless a Claim is delivered to the Indemnifying Party on or before 5:00 p.m. ET of the one year anniversary of the Closing Date, except with respect to Claims of fraud committed by the Indemnifying Party. Any matter as to which a Claim has been asserted by a Claim Notice to the other party that is pending or unresolved at the end of any applicable limitation period shall continue to be covered by this Article II notwithstanding any applicable statute of limitations (which the parties hereby waive) until such matter is finally terminated or otherwise resolved by the parties under this Agreement or by a final, nonappealable judgment of a court of competent jurisdiction and any amounts payable hereunder are finally determined and paid.

-4-

SECTION 2.06 Notice by Indemnifying Party. The Indemnifying Party agrees to notify the Indemnified Party of any liabilities, claims or misrepresentations, breaches or other matters covered by this Article II upon discovery or receipt of notice thereof (other than such claims from the Indemnified Party).

SECTION 2.07 Exclusive Remedy.

Other than rights to equitable relief, to the extent available under applicable law, each of the parties acknowledges and agrees that the sole and exclusive remedy for any Losses arising from Claims described in this Article II or any other Claims of every nature arising in any manner in connection with this Agreement, shall be indemnification in accordance with this Article II.

SECTION 2.08 Mitigation

. Prior to the resolution of any Claim for indemnification under this Agreement, the Indemnified Party shall utilize all commercially reasonable efforts, consistent with normal past practices and policies and good commercial practice, to mitigate such Losses.

SECTION 2.09 Consequential and Other Damages

. No party shall be liable for any lost profits or consequential, special, punitive, indirect or incidental Losses or damages in connection with this Agreement.

ARTICLE III

Representations and Warranties of the Company

The Company represents and warrants to the Parent as provided below, except as set forth in a schedule or the Registration Statement on Form S-1/A, as amended, filed with the Securities and Exchange Commission July 7, 2014 (collectively, the “Company Disclosure Schedule”) (it being understood and agreed that disclosure of any event, item or occurrence set forth in the Company Disclosure Schedule shall apply to, qualify or modify the Section or subsection to which it corresponds and each of the other Sections of this Agreement to the extent the relevance of such disclosure to such other Section or subsection is reasonably apparent from the text and nature of such disclosure). For purposes of this Agreement a “Company Material Adverse Effect” shall mean a sustained material adverse change or event in the business, results of operations, or financial condition of the Company or adversely affecting the ability of the Company to perform its obligations under this Agreement or on the ability of the Company to consummate the Transactions. For purposes of this clause, a “Company Material Adverse Effect” shall not include any effects, events, developments or changes arising out of or resulting from (A) changes or conditions in the U.S. or global economy or capital or financial markets generally, including changes in interest or exchange rates, (B) changes in the industries in which the Company operates, (C) changes in general legal, tax, regulatory, political or general economic conditions affecting the Company in each case, proposed, adopted or enacted after the date hereof, or the interpretation or enforcement thereof, with the exception of any law that would prevent the business of the Company to be concluded in the ordinary course and in accordance with past practice or that would prevent or substantially impair the consummation of the Transactions, (D) any action taken by Parent or its affiliates in bad faith or in violation of this Agreement, or (E) any matter fully, fairly, and specifically disclosed in the Company Disclosure Schedule.

SECTION 3.01 Organization, Standing and Power. The Company is duly organized, validly existing and in good standing under the laws of the State of Nevada and has the requisite organizational power and authority and possesses all governmental franchises, licenses, permits, authorizations and approvals necessary to enable it to own, lease or otherwise hold its properties and assets and to conduct its businesses as presently conducted, other than such franchises, licenses, permits, authorizations and approvals the lack of which, individually or in the aggregate, has not had and would not reasonably be expected to have a Company Material Adverse Effect . The Company is duly qualified to do business in each jurisdiction where the nature of its business or its ownership or leasing of its properties make such qualification necessary, except where the failure to so qualify would not reasonably be expected to have a Company Material Adverse Effect. The Company has delivered to the Parent true and complete copies of the articles of incorporation and bylaws of the Company, each as amended to the date of this Agreement (as so amended, the “Company Charter Documents”). The Company owns or controls, directly or indirectly, all of the capital stock or comparable equity interests of each subsidiary (each, a “Subsidiary”) listed in the Company Disclosure Schedule, free and clear of any lien, and all issued and outstanding shares of capital stock or comparable equity interest of each Subsidiary are validly issued and are fully paid, non-assessable and free of preemptive and similar rights.

-5-

SECTION 3.02 Capital Structure. The authorized capital structure of the Company consists of Two Hundred Million (200,000,000) shares of common stock of which after giving effect to the Cancellation Agreement 15,144,885 are issued and outstanding and Fifty Million (50,000,000) shares of preferred stock, none of which are outstanding. No other Company Shares are issued, reserved for issuance or outstanding. All outstanding Company Shares are duly authorized, validly issued, fully paid and non-assessable and not subject to or issued in violation of any purchase option, call option, right of first refusal, preemptive right, subscription right or any similar right under any provision of the applicable corporate laws of its state of incorporation, the Company Charter Documents or any Contract (as defined in Section 3.04) to which the Company is a party or otherwise bound. There are no bonds, debentures, notes or other indebtedness of the Company having the right to vote (or convertible into, or exchangeable for, securities having the right to vote) on any matters on which holders of Company Shares may vote (“Voting Company Debt”). Except as otherwise set forth herein, as of the date of this Agreement, there are no options, warrants, rights, convertible or exchangeable securities, “phantom” stock rights, stock appreciation rights, stock-based performance units, commitments, Contracts, arrangements or undertakings of any kind to which the Company is a party or by which the Company is bound (i) obligating the Company to issue, deliver or sell, or cause to be issued, delivered or sold, additional Company Shares or other equity interests in, or any security convertible or exercisable for or exchangeable into any Company Shares or other equity interest in, the Company or any Voting Company Debt, (ii) obligating the Company to issue, grant, extend or enter into any such option, warrant, call, right, security, commitment, Contract, arrangement or undertaking or (iii) that give any person the right to receive any economic benefit or right similar to or derived from the economic benefits and rights occurring to holders of Company Shares.

SECTION 3.03 Authority; Execution and Delivery; Enforceability. The Company has all requisite organizational power and authority to execute and deliver this Agreement and to perform its obligations hereunder. The execution and delivery by the Company of this Agreement and the performance of its obligations under this Agreement have been duly authorized and approved by the Board of Directors of the Company and no other proceedings on the part of the Company are necessary to authorize this Agreement and the Transactions. When executed and delivered, this Agreement will be enforceable against the Company in accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar Laws relating to or affecting the enforcement of creditors’ rights in general and by general principles of equity (regardless of whether enforcement is sought in equity or at law). No other consent, approval or agreement of any individual or entity is required to be obtained by the Company in connection with the execution and performance by the Company of this Agreement or the Constituent Agreements (as applicable) or the execution and performance by the Company of any agreements, instruments or other obligations entered into in connection with this Agreement.

SECTION 3.04 No Conflicts; Consents.

(a) The execution and delivery by the Company of this Agreement does not, and the consummation of the Transactions and compliance with the terms hereof and thereof will not, conflict with, or result in any violation of or default (with or without notice or lapse of time, or both) under, or give rise to a right of termination, cancellation or acceleration of any obligation or to loss of a material benefit under, or result in the creation of any Lien upon any of the properties or assets of the Company under any provision of (i) the Company Charter Documents, (ii) any material contract, lease, license, indenture, note, bond, agreement, permit, concession, franchise or other instrument (a “Contract”) to which the Company is a party or by which any of its respective properties or assets is bound or (iii) subject to the filings and other matters referred to in Section 3.04(b), any material judgment, order or decree (“Judgment”) or material Law applicable to the Company or its properties or assets, other than, in the case of clauses (ii) and (iii) above, any such items that, individually or in the aggregate, have not had and would not reasonably be expected to have a Company Material Adverse Effect.

(b) Except for filings required under NRS with respect to the Merger, required filings with the Securities and Exchange Commission (the “SEC”) and applicable “Blue Sky” or state securities commissions, no material consent, approval, license, permit, order or authorization (“Consent”) of, or registration, declaration or filing with, or permit from, any Governmental Entity is required to be obtained or made by or with respect to the Company in connection with the execution, delivery and performance of this Agreement or the performance by the Company of its obligations under this Agreement.

-6-

SECTION 3.05 Taxes.

(a) The Company has timely filed, or has caused to be timely filed on its behalf, all Tax Returns required to be filed by it, and all such Tax Returns were correct and complete in all material respects except to the extent any failure to file, any delinquency in filing or any inaccuracies in any filed Tax Returns, individually or in the aggregate, have not had and would not reasonably be expected to have a Company Material Adverse Effect. All Taxes shown to be due on such Tax Returns, or otherwise owed, have been timely paid, except to the extent that any failure to pay, individually or in the aggregate, has not had and would not reasonably be expected to have a Company Material Adverse Effect. There are no unpaid taxes in any material amount claimed to be due by the taxing authority of any jurisdiction, and the officers of the Company know of no basis for any such claim.

(b) If applicable, the Company has established an adequate reserve reflected on its financial statements for all Taxes payable by the Company (in addition to any reserve for deferred Taxes to reflect timing differences between book and Tax items) for all Taxable periods and portions thereof through the date of such financial statements. No deficiency with respect to any Taxes has been proposed, asserted or assessed against the Company, and no requests for waivers of the time to assess any such Taxes are pending, except to the extent any such deficiency or request for waiver, individually or in the aggregate, has not had and would not reasonably be expected to have a Company Material Adverse Effect.

(c) For purposes of this Agreement:

“Taxes” includes all forms of taxation, whenever created or imposed, and whether of the United States or elsewhere, and whether imposed by a local, municipal, governmental, state, foreign, federal or other Governmental Entity, or in connection with any agreement with respect to Taxes, including all interest, penalties and additions imposed with respect to such amounts.

“Tax Return” means all federal, state, local, provincial and foreign Tax returns, declarations, statements, reports, schedules, forms and information returns and any amended Tax return relating to Taxes.

SECTION 3.06 Benefit Plans. Except as set forth in the Company Disclosure Schedule, the Company does not have or maintain any collective bargaining agreement or any bonus, pension, profit sharing, deferred compensation, incentive compensation, share ownership, share purchase, share option, phantom stock, retirement, vacation, severance, disability, death benefit, hospitalization, medical or other plan, arrangement or understanding (whether or not legally binding) providing benefits to any current or former employee, officer or director of the Company (collectively, “Company Benefit Plans”). As of the date of this Agreement, except as set forth in the Company Disclosure Schedule, there are no employment, consulting, indemnification, severance or termination agreements or arrangements between the Company and any current or former employee, officer or director of the Company, nor does the Company have any general severance plan or policy.

SECTION 3.07 Litigation. Except as set forth on the Company Disclosure Schedule, to the knowledge of the Company, there is no action, suit, inquiry, notice of violation, proceeding (including any partial proceeding such as a deposition) or investigation pending or threatened in writing against or affecting the Company, or any of its properties before or by any court, arbitrator, governmental or administrative agency, regulatory authority (federal, state, county, local or foreign), stock market, stock exchange or trading facility, including an investigation pending before the Securities and Exchange Commission regarding various matters (“Action”). Neither the Company nor any director or officer thereof (in his or her capacity as such), is or has been the subject of any Action involving a claim or violation of or liability under federal or state securities laws or a claim of breach of fiduciary duty.

SECTION 3.08 Compliance with Applicable Laws. To the best of its knowledge, the Company is in material compliance with all applicable Laws, except for instances of noncompliance that, individually and in the aggregate, have not had and would not reasonably be expected to have a Company Material Adverse Effect. This Section 3.08 does not relate to matters with respect to Taxes, which are the subject of Section 3.05.

-7-

SECTION 3.09 Brokers; Schedule of Fees and Expenses. No broker, investment banker, financial advisor or other person is entitled to any broker’s, finder’s, financial advisor’s or other similar fee or commission for which Parent or the Company is obligated in connection with the Transactions based upon arrangements made by or on behalf of the Company.

SECTION 3.10 Contracts. Except as disclosed in the Company Disclosure Schedule, there are no Contracts that are material to the business, properties, assets, financial condition, results of operations or prospects of the Company and its Subsidiaries taken as a whole. To the knowledge of the Company, the Company is not in violation of or in default under (nor does there exist any condition which upon the passage of time or the giving of notice would cause such a violation of or default under) any Contract to which it is a party or by which it or any of its properties or assets is bound, except for violations or defaults that would not, individually or in the aggregate, reasonably be expected to result in a Company Material Adverse Effect. Except as disclosed in the Company Disclosure Schedule, the Company’s execution of this Agreement and the consummation of the Transactions contemplated herein would not violate any Contract to which the Company or any of its Subsidiaries is a party nor will the execution of this Agreement or the consummation of the Transactions consummated hereby violate or trigger any “change in control” provision or covenant in any Contract to which the Company or any Subsidiary is a party.

SECTION 3.11 Title to Properties. Except as set forth in the Company Disclosure Schedule, the Company does not own any real property. The Company has sufficient title to, or valid leasehold interests in, all of its properties and assets used in the conduct of its businesses. All such assets and properties, other than assets and properties in which the Company has leasehold interests, are free and clear of all Liens other than those Liens that, in the aggregate, do not and will not materially interfere with the ability of the Company to conduct business as currently conducted or result in or would reasonably be expected to result in a Company Material Adverse Effect.

SECTION 3.12 Intellectual Property. The Company owns, or, to the knowledge of the Company, is validly licensed or otherwise has the right to use, all Intellectual Property (the “Intellectual Property Rights”) which are material to the conduct of the business of the Company taken as a whole. The Company Disclosure Schedule sets forth a description of all Intellectual Property Rights which are material to the conduct of the business of the Company taken as a whole. To the knowledge of the Company, no claims are pending or, to the knowledge of the Company, threatened that the Company is infringing or otherwise adversely affecting the rights of any Person with regard to any Intellectual Property Right. To the knowledge of the Company, no Person is infringing the rights of the Company with respect to any Intellectual Property Right other than as to which the Company has the full right and power to bring action and to enforce such Intellectual Property Right, and receive the entirety of the proceeds thereof, by way of judgment settlement or otherwise, and no third-party has any such claims or rights.

SECTION 3.13 Insurance. Except as set forth on the Company Disclosure Schedule, the Company does not hold any insurance policy.

SECTION 3.14 Transactions With Affiliates and Employees. Except as set forth in the Company Disclosure Schedule, none of the officers or directors of the Company and, to the knowledge of the Company, none of the employees of the Company is presently a party to any transaction with the Company (other than for services as employees, officers and directors), including any contract, agreement or other arrangement providing for the furnishing of services to or by, providing for rental of real or personal property to or from, or otherwise requiring payments to or from any officer, director or such employee or, to the knowledge of the Company, any entity in which any officer, director, or any such employee has a substantial interest or is an officer, director, trustee or partner.

SECTION 3.15 Application of Takeover Protections. The Company is not subject to any control share acquisition, business combination, poison pill (including any distribution under a rights agreement) or other similar anti-takeover provision under the Company Charter Documents or the laws of its state of incorporation that is or could become applicable to Parent as a result of Parent and the Company fulfilling their obligations or exercising their rights under this Agreement, including, without limitation, the issuance of the Parent Stock.

-8-

SECTION 3.16 Labor Matters. Neither the Company nor any of its Subsidiaries is a party to any collective bargaining agreement or employs any member of a union. The Company believes that its and its Subsidiaries’ relations with their respective employees are good. The Company and its Subsidiaries are in compliance with all federal, state, local and foreign laws and regulations respecting labor, employment and employment practices and benefits, terms and conditions of employment and wages and hours, except where failure to be in compliance would not, either individually or in the aggregate, reasonably be expected to result in a Company Material Adverse Effect.

SECTION 3.17 ERISA Compliance; Excess Parachute Payments. Except as disclosed in the Company Disclosure Schedule, the Company does not, and since its inception never has, maintained, or contributed to any “employee pension benefit plans” (as defined in Section 3(2) of ERISA), “employee welfare benefit plans” (as defined in Section 3(1) of ERISA) or any other Company Benefit Plan for the benefit of any current or former employees, consultants, officers or directors of Company.

SECTION 3.18 Investment Company. The Company is not, and is not an affiliate of, and immediately following the Closing will not have become, an “investment company” within the meaning of the Investment Company Act of 1940, as amended.

SECTION 3.19 Disclosure. All disclosure provided to the Parent regarding the Company, its business and the Transactions, furnished by or on behalf of the Company (including the Company’s representations and warranties set forth in this Agreement and the Company Disclosure Schedule) are true and correct in all material respects and do not contain any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements made therein, in light of the circumstances under which they were made, not misleading.

SECTION 3.20 Absence of Certain Changes or Events. Except in connection with the Transactions and as disclosed in the Company Disclosure Schedule, since the date of the Company’s most recent audited financial statements, the Company has conducted its business only in the ordinary course, and there has not been:

(a) any change in the assets, liabilities, financial condition or operating results of the Company, except changes in the ordinary course of business that have not caused, in the aggregate, a Company Material Adverse Effect;

(b) any damage, destruction or loss, whether or not covered by insurance, that would have a Company Material Adverse Effect;

(c) any waiver or compromise by the Company of a valuable right or of a material debt owed to it;

(d) any satisfaction or discharge of any lien, claim, or encumbrance or payment of any obligation by the Company, except in the ordinary course of business and the satisfaction or discharge of which would not have a Company Material Adverse Effect;

(e) any material change to a material Contract by which the Company or any of its assets is bound or subject;

(f) any mortgage, pledge, transfer of a security interest in, or lien, created by the Company, with respect to any of its material properties or assets, except liens for taxes not yet due or payable and liens that arise in the ordinary course of business and does not materially impair the Company’s ownership or use of such property or assets;

(g) any loans or guarantees made by the Company to or for the benefit of its employees, officers or directors, or any members of their immediate families, other than travel advances and other advances made in the ordinary course of its business;

-9-

(h) any alteration of the Company’s method of accounting or the identity of its auditors;

(i) any declaration or payment of dividend or distribution of cash or other property to its shareholders or any purchase, redemption or agreements to purchase or redeem any Company Shares;

(j) any issuance of equity securities to any officer, director or affiliate; or

(k) any arrangement or commitment by the Company to do any of the things described in this Section.

SECTION 3.21 Foreign Corrupt Practices. Neither the Company, nor, to the Company’s knowledge, any director, officer, agent, employee or other person acting on behalf of the Company has, in the course of its actions for, or on behalf of, the Company (i) used any corporate funds for any unlawful contribution, gift, entertainment or other unlawful expenses relating to political activity; (ii) made any direct or indirect unlawful payment to any foreign or domestic government official or employee from corporate funds; (iii) violated or is in violation of any provision of the U.S. Foreign Corrupt Practices Act of 1977, as amended; or (iv) made any unlawful bribe, rebate, payoff, influence payment, kickback or other unlawful payment to any foreign or domestic government official or employee.

SECTION 3.22 Licenses and Permits. The Company has obtained and maintains all federal, state, local and foreign licenses, permits, consents, approvals, registrations, memberships, authorizations and qualifications required to be maintained in connection with the operations of the Company as presently conducted and as proposed to be conducted the absence of which has caused or is reasonably likely to cause a Company Material Adverse Effect. The Company is not in default under any of such licenses, permits, consents, approvals, registrations, memberships, authorizations and qualifications except for such defaults that have not caused or would not reasonably be likely to result in a Company Material Adverse Effect.

SECTION 3.23 Environmental Laws. The Company and each Subsidiary (i) is in compliance in all material respects with any and all Environmental Laws (as hereinafter defined), (ii) has received all permits, licenses or other approvals required of them under applicable Environmental Laws to conduct their respective businesses and (iii) is in compliance in all material respects with all terms and conditions of any such permit, license or approval where, in each of the foregoing clauses (i), (ii) and (iii), the failure to so comply would be reasonably expected to have, individually or in the aggregate, a Company Material Adverse Effect. The term “Environmental Laws” means all federal, state, local or foreign laws relating to pollution or protection of human health or the environment (including, without limitation, ambient air, surface water, groundwater, land surface or subsurface strata), including, without limitation, laws relating to emissions, discharges, releases or threatened releases of chemicals, pollutants, contaminants, or toxic or hazardous substances or wastes (collectively, “Hazardous Materials”) into the environment, or otherwise relating to the manufacture, processing, distribution, use, treatment, storage, disposal, transport or handling of Hazardous Materials, as well as all authorizations, codes, decrees, demands or demand letters, injunctions, judgments, licenses, notices or notice letters, orders, permits, plans or regulations issued, entered, promulgated or approved thereunder.

SECTION 3.24 Indebtedness. Except as disclosed in the Company Disclosure Schedule, neither the Company nor any Subsidiary (i) has any outstanding Indebtedness (as defined below), (ii) is in violation of any term of or is in default under any contract, agreement or instrument relating to any Indebtedness, except where such violations and defaults would not result, individually or in the aggregate, in a Company Material Adverse Effect, and (iii) is a party to any contract, agreement or instrument relating to any Indebtedness, the performance of which, in the judgment of the Company's officers, has or is expected to have a Company Material Adverse Effect. For purposes of this Agreement: (x) “Indebtedness” of any Person means, without duplication (A) all indebtedness for borrowed money, (B) all obligations issued, undertaken or assumed as the deferred purchase price of property or services (other than trade payables entered into in the ordinary course of business), (C) all reimbursement or payment obligations with respect to letters of credit, surety bonds and other similar instruments, (D) all obligations evidenced by notes, bonds, debentures or similar instruments, including obligations so evidenced incurred in connection with the acquisition of property, assets or businesses, (E) all indebtedness created or arising under any

-10-

conditional sale or other title retention agreement, or incurred as financing, in either case with respect to any property or assets acquired with the proceeds of such indebtedness (even though the rights and remedies of the seller or bank under such agreement in the event of default are limited to repossession or sale of such property), (F) all monetary obligations under any leasing or similar arrangement which, in connection with generally accepted accounting principles, consistently applied for the periods covered thereby, is classified as a capital lease, (G) all indebtedness referred to in clauses (A) through (F) above secured by (or for which the holder of such Indebtedness has an existing right, contingent or otherwise, to be secured by) any mortgage, lien, pledge, charge, security interest or other encumbrance upon or in any property or assets (including accounts and contract rights) owned by any Person, even though the Person which owns such assets or property has not assumed or become liable for the payment of such indebtedness, and (H) all Contingent Obligations in respect of indebtedness or obligations of others of the kinds referred to in clauses (A) through (G) above; (y) “Contingent Obligation” means, as to any Person, any direct or indirect liability, contingent or otherwise, of that Person with respect to any indebtedness, lease, dividend or other obligation of another Person if the primary purpose or intent of the Person incurring such liability, or the primary effect thereof, is to provide assurance to the obligee of such liability that such liability will be paid or discharged, or that any agreements relating thereto will be complied with, or that the holders of such liability will be protected (in whole or in part) against loss with respect thereto; and (z) “Person” means an individual, a limited liability company, a partnership, a joint venture, a corporation, a trust, an unincorporated organization, a government or any department or agency thereof and any other legal entity.

SECTION 3.25 Money Laundering. The Company and its Subsidiaries are in compliance with, and have not previously violated, the USA Patriot Act of 2001 and all other applicable U.S. and non-U.S. anti-money laundering laws and regulations, including, but not limited to, the laws, regulations and Executive Orders and sanctions programs administered by the U.S. Office of Foreign Assets Control, including, but not limited, to (i) Executive Order 13224 of September 23, 2001 entitled, “Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism” (66 Fed. Reg. 49079 (2001)); and (ii) any regulations contained in 31 CFR, Subtitle B, Chapter V.

SECTION 3.26 Management. During the past five year period, no current officer or director or, to the knowledge of the Company, no former officer or director or current ten percent (10%) or greater member of the Company or any of its Subsidiaries has been the subject of:

(a) a petition under bankruptcy laws or any other insolvency or moratorium law or the appointment by a court of a receiver, fiscal agent or similar officer for such Person, or any partnership in which such person was a general partner at or within two years before the filing of such petition or such appointment, or any corporation or business association of which such person was an executive officer at or within two years before the time of the filing of such petition or such appointment;

(b) a conviction in a criminal proceeding or a named subject of a pending criminal proceeding (excluding traffic violations that do not relate to driving while intoxicated or driving under the influence);

(c) any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining any such person from, or otherwise limiting, the following activities:

-11-

(i) Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the United States Commodity Futures Trading Commission or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity;

(ii) Engaging in any type of business practice; or

(iii) Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of securities laws or commodities laws;

(d) any order, judgment or decree, not subsequently reversed, suspended or vacated, of any authority barring, suspending or otherwise limiting for more than 60 days the right of any such person to engage in any activity described in the preceding sub paragraph, or to be associated with persons engaged in any such activity;

(e) a finding by a court of competent jurisdiction in a civil action or by the SEC or other authority to have violated any securities law, regulation or decree and the judgment in such civil action or finding by the SEC or any other authority has not been subsequently reversed, suspended or vacated; or

(f) a finding by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any federal commodities law, and the judgment in such civil action or finding has not been subsequently reversed, suspended or vacated.

SECTION 3.27 Public Utility Holding Act. None of the Company nor any of its Subsidiaries is a “holding company,” or an “affiliate” of a “holding company,” as such terms are defined in the Public Utility Holding Act of 2005.

SECTION 3.28 Federal Power Act. None of the Company nor any of its Subsidiaries is subject to regulation as a “public utility” under the Federal Power Act, as amended.

SECTION 3.29 No Undisclosed Events, Liabilities, Developments or Circumstances. To the best knowledge of the Company no event, liability, development or circumstance has occurred or exists, or is reasonably expected to exist or occur with respect to the Company, any of its Subsidiaries or any of their respective businesses, properties, liabilities, prospects, operations (including results thereof) or condition (financial or otherwise), that in the reasonable judgment of the Company (i) has not already been made known to the Parent; or (ii) could have a Company Material Adverse Effect. Except as set forth in the Company Disclosure Schedule, the Company has no liabilities or obligations of any nature (whether accrued, absolute, contingent or otherwise). The Company Disclosure Schedule sets forth all financial and contractual obligations and liabilities (including any obligations to issue Company Shares or other securities of the Company) due after the date hereof.

SECTION 3.30 No Other Representations or Warranties. Except for the representations and warranties contained in Article III of this Agreement, the Company has not made any representation or warranty, express or implied, concerning the Company, its financial condition, results of operations, assets, or prospects, and such representations and warranties supersede any prior statements made by any person regarding the Transactions.

-12-

ARTICLE IV

Representations and Warranties of the Parent

The Parent represents and warrants as follows to the Company, that, except as set forth in Parent SEC Documents (as defined in Section 4.06(a) herein or in a Disclosure Schedule delivered by the Parent to the Company (the “Parent Disclosure Schedule”) (it being understood and agreed that disclosure of any event, item or occurrence set forth in the Parent Disclosure Letter shall apply to, qualify or modify the Section or subsection to which it corresponds and each of the other Sections of this Agreement to the extent the relevance of such disclosure to such other Section or subsection is reasonably apparent from the text and nature of such disclosure). For purposes of this Agreement a “Parent Material Adverse Effect” shall mean a sustained material adverse change or event in the business, results of operations, or financial condition of the Parent or adversely affecting the ability of the Parent to perform its obligations under this Agreement or on the ability of the Parent to consummate the Transactions. For purposes of this clause, a “Parent Material Adverse Effect” shall not include any effects, events, developments or changes arising out of or resulting from (A) changes or conditions in the U.S. or global economy or capital or financial markets generally, including changes in interest or exchange rates, (B) changes in the industries in which the Parent operates, (C) changes in general legal, tax, regulatory, political or general economic conditions affecting the Parent in each case, proposed, adopted or enacted after the date hereof, or the interpretation or enforcement thereof, with the exception of any law that would prevent the business of the Parent to be concluded in the ordinary course and in accordance with past practice or that would prevent or substantially impair the consummation of the Transactions, (D) natural disasters, (E) the commencement, occurrence, continuation or intensification of any war, sabotage, armed hostilities or acts of terrorism, (F) any action taken by Company or its affiliates in bad faith or in violation of this Agreement, or (G) any matter fully, fairly, and specifically disclosed in the Parent Disclosure Schedule

SECTION 4.01 Organization, Standing and Power. The Parent is duly organized, validly existing and in good standing under the laws of the State of Nevada and has full corporate power and authority and possesses all governmental franchises, licenses, permits, authorizations and approvals necessary to enable it to own, lease or otherwise hold its properties and assets and to conduct its businesses as presently conducted, other than such franchises, licenses, permits, authorizations and approvals the lack of which, individually or in the aggregate, has not had and would not reasonably be expected to have a Parent Material Adverse Effect. The Parent is duly qualified to do business in each jurisdiction where the nature of its business or the ownership or leasing of its properties make such qualification necessary and where the failure to so qualify would reasonably be expected to have a Parent Material Adverse Effect. The Parent has delivered to the Company true and complete copies of the Amended and Restated Articles of Incorporation of the Parent, as amended to the date of this Agreement (as so amended, the “Parent Charter”), and the Bylaws of the Parent, as amended to the date of this Agreement (as so amended, the “Parent Bylaws”). Merger Sub is duly incorporated, validly existing and in good standing under the laws of the State of Nevada and has full organizational power and authority to enter into this Agreement. Merger Sub has not conducted any business. Merger Sub has no liabilities of whatever kind or nature or any obligations other than as provided for in this Agreement.

SECTION 4.02 Subsidiaries; Equity Interests. Other than Merger Sub, the Parent does not own, directly or indirectly, any capital stock, membership interest, partnership interest, joint venture interest or other equity interest in any person.

SECTION 4.03 Capital Structure. The authorized capital stock of the Parent consists of Eight Hundred Million (800,000,000) shares of Parent Common Stock, and Ten Million (10,000,000) shares of preferred stock, par value $0.001 per share, of which (i) 2,326,557 shares of Parent Common Stock are issued and outstanding (ii) One Million Five Hundred Thousand (1,500,000) shares of Preferred Stock are designated as Series A Convertible Preferred Stock, all of which are outstanding and which are convertible into an aggregate of One Hundred and Fifty Million (150,000,000) shares of Parent Common Stock and (iii) no shares of Parent Common Stock or preferred stock are held by the Parent in its treasury. Parent also has stock purchase warrants for the purchase of 989,449 shares of Parent Common Stock, 436,377 shares of Parent Common Stock reserved for issuance under existing stock incentive plans and stock options for the purchase of 237,554 shares of Parent Common Stock outstanding. No

-13-

other shares of capital stock or other voting securities of the Parent are issued, reserved for issuance or outstanding. All outstanding shares of the capital stock of the Parent, including the Parent Stock, are, and all such shares that may be issued prior to the date hereof will be when issued, duly authorized, validly issued, fully paid and non-assessable and not subject to or issued in violation of any purchase option, call option, right of first refusal, preemptive right, subscription right or any similar right under any provision of the NRS, the Parent Charter, the Parent Bylaws or any Contract to which the Parent is a party or otherwise bound. There are no bonds, debentures, notes or other indebtedness of the Parent having the right to vote (or convertible into, or exchangeable for, securities having the right to vote) on any matters on which holders of Parent Stock may vote (“Voting Parent Debt”). Except as set forth in the Parent SEC Documents or the Parent Disclosure Schedule, as of the date of this Agreement, there are no options, warrants, rights, convertible or exchangeable securities, “phantom” stock rights, stock appreciation rights, stock-based performance units, commitments, Contracts, arrangements or undertakings of any kind to which the Parent is a party or by which it is bound (i) obligating the Parent to issue, deliver or sell, or cause to be issued, delivered or sold, additional shares of capital stock or other equity interests in, or any security convertible or exercisable for or exchangeable into any capital stock of or other equity interest in, the Parent or any Voting Parent Debt, (ii) obligating the Parent to issue, grant, extend or enter into any such option, warrant, call, right, security, commitment, Contract, arrangement or undertaking or (iii) that give any person the right to receive any economic benefit or right similar to or derived from the economic benefits and rights occurring to holders of the capital stock of the Parent. Except as set forth in the Parent SEC Documents or the Parent Disclosure Schedule or as otherwise contemplated hereby, the Parent is not a party to any agreement granting any security holder of the Parent the right to cause the Parent to register shares of the capital stock or other securities of the Parent held by such security holder under the Securities Act.

SECTION 4.04 Authority; Execution and Delivery; Enforceability. The Parent has all the requisite organization power and authority to execute and deliver this Agreement and to perform its obligations hereunder. The execution and delivery by the Parent of this Agreement and the Constituent Agreements (as applicable) and the consummation by the Parent of the Merger have been duly authorized and approved by the Board of Directors of the Parent and no other corporate proceedings on the part of the Parent are necessary to authorize this Agreement, the Constituent Agreements and the Merger. Each of this Agreement and the Constituent Agreements (as applicable) constitutes a legal, valid and binding obligation of the Parent, enforceable against the Parent in accordance with the terms hereof.

SECTION 4.05 No Conflicts; Consents.

(a) The execution and delivery by the Parent of this Agreement and the Constituent Agreements (as applicable), do not, and the consummation of Merger and compliance with the terms hereof and thereof will not, conflict with, or result in any violation of or default (with or without notice or lapse of time, or both) under, or give rise to a right of termination, cancellation or acceleration of any obligation or to loss of a material benefit under, or to increased, additional, accelerated or guaranteed rights or entitlements of any person under, or result in the creation of any Lien upon any of the properties or assets of the Parent under, any provision of (i) the Parent Charter or Parent Bylaws, (ii) any material Contract to which the Parent is a party or by which any of its properties or assets is bound or (iii) subject to the filings and other matters referred to in Section 4.05(b), any material Judgment or material Law applicable to the Parent or its properties or assets, other than, in the case of clauses (ii) and (iii) above, any such items that, individually or in the aggregate, have not had and would not reasonably be expected to have a Parent Material Adverse Effect.

-14-

(b) No Consent of, or registration, declaration or filing with, or permit from, any Governmental Entity is required to be obtained or made by or with respect to the Parent in connection with the execution, delivery and performance of this Agreement or the Constituent Agreements (as applicable) or the consummation of the Merger other than the (A) filing with the SEC of reports under Sections 13 and 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and (B) filings under state “blue sky” laws, as each may be required in connection with this Agreement and the Transactions.

SECTION 4.06 SEC Documents; Undisclosed Liabilities.

(a) The Parent has filed or furnished (as applicable) all Parent SEC Documents for the prior two (2) fiscal years, pursuant to Sections 13 and 15 of the Exchange Act or Section 5 of the Securities Act, as applicable, and applicable regulations promulgated thereunder and together with all certifications required pursuant to the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) (such documents and any other documents filed by Parent with the SEC, together will all amendments thereto and including all exhibits and schedules thereto and documents incorporated by reference therein collectively the “Parent SEC Documents”.

(b) As of its respective filing date, or in the case of Parent SEC Documents that are registration statements filed pursuant to the Securities Act, as of their respective effective dates, each Parent SEC Document complied in all material respects with the requirements of the Exchange Act or the Securities Act, as applicable, and the rules and regulations of the SEC promulgated thereunder applicable to such Parent SEC Document, and did not contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading. Except to the extent that information contained in any Parent SEC Document has been revised or superseded by a later filed Parent SEC Document, none of the Parent SEC Documents contains any untrue statement of a material fact or omits to state any material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading. The financial statements of the Parent included in the Parent SEC Documents: (i) have been prepared from and in accordance with, and accurately reflect, the books and records of Parent and its Subsidiaries in all material respects; (ii) comply as to form in all material respects with applicable accounting requirements and the published rules and regulations of the SEC with respect thereto; (iii) have been prepared in accordance with the U.S. generally accepted accounting principles (“GAAP”) (except, in the case of unaudited statements, as may be indicated in the notes thereto or, for normal and recurring year-end adjustments as may be permitted by the SEC on Form 10-Q or Form 8-K or any successor or like form) applied on a consistent basis during the periods involved (except as may be indicated in the notes thereto), and (iv) fairly present the financial position of Parent and Subsidiaries as of the dates thereof and the results of its operations and cash flows for the periods shown (subject, in the case of unaudited statements, to normal year-end audit adjustments).

(c) Except as set forth in the Parent SEC Documents or the Parent Disclosure Schedule, the Parent has no liabilities or obligations of any nature (whether accrued, absolute, contingent or otherwise) required by GAAP to be set forth on a balance sheet of the Parent or in the notes thereto. The Parent SEC Documents set forth all financial and contractual obligations and liabilities (including any obligations to issue capital stock or other securities of the Parent) due after the date hereof.

(d) There are no “off balance sheet arrangements,” as defined in Item 303 of Regulation S-K under the Securities Act, to which Parent or any Subsidiary of the Company is a party.

(e) The Parent Disclosure Schedule describes all outstanding payables and the aging of such payables.

(f) Except for outstanding payables listed in the Parent Disclosure Schedule Parent has no Indebtedness as of the Closing.

-15-

SECTION 4.07 Absence of Certain Changes or Events. Except as disclosed in the Parent SEC Documents or in the Parent Disclosure Schedule, from the date of the most recent audited financial statements included in the Parent SEC Documents to the date of this Agreement, the Parent has conducted its business only in the ordinary course, and during such period there has not been:

(a) any change in the assets, liabilities, financial condition or operating results of the Parent from that reflected in the Parent SEC Documents, except changes in the ordinary course of business that have not caused, in the aggregate, a Parent Material Adverse Effect;

(b) any damage, destruction or loss, whether or not covered by insurance, that would have a Parent Material Adverse Effect;

(c) any waiver or compromise by the Parent of a valuable right or of a material debt owed to it;

(d) any satisfaction or discharge of any lien, claim, or encumbrance or payment of any obligation by the Parent, except in the ordinary course of business and the satisfaction or discharge of which would not have a Parent Material Adverse Effect;

(e) any material change to a material Contract by which the Parent or any of its assets is bound or subject;

(f) any material change in any compensation arrangement or agreement with any employee, officer, director or stockholder;

(g) any resignation or termination of employment of any officer of the Parent;

(h) any mortgage, pledge, transfer of a security interest in, or lien, created by the Parent, with respect to any of its material properties or assets, except liens for taxes not yet due or payable and liens that arise in the ordinary course of business and do not materially impair the Parent’s ownership or use of such property or assets;

(i) any loans or guarantees made by the Parent to or for the benefit of its employees, officers or directors, or any members of their immediate families, other than travel advances and other advances made in the ordinary course of its business;

(j) any declaration, setting aside or payment or other distribution in respect of any of the Parent’s capital stock, or any direct or indirect redemption, purchase, or other acquisition of any of such stock by the Parent;

(k) any alteration of the Parent’s method of accounting or the identity of its auditors;

(l) any issuance of equity securities to any officer, director or affiliate, except pursuant to existing option plans of the Parent; or

(m) any arrangement or commitment by the Parent to do any of the things described in this Section 4.07.

-16-

SECTION 4.08 Taxes.

(a) Except as disclosed on the Parent Disclosure Schedule, The Parent has timely filed, or has caused to be timely filed on its behalf, all Tax Returns required to be filed by it, and all such Tax Returns are true, complete and accurate, except to the extent any failure to file, any delinquency in filing or any inaccuracies in any filed Tax Returns, individually or in the aggregate, have not had and would not reasonably be expected to have a Parent Material Adverse Effect. All Taxes shown to be due on such Tax Returns, or otherwise owed, has been timely paid, except to the extent that any failure to pay, individually or in the aggregate, has not had and would not reasonably be expected to have a Parent Material Adverse Effect. There are no unpaid taxes in any material amount claimed to be due by the taxing authority of any jurisdiction.

(b) The most recent financial statements contained in the Parent SEC Documents reflect an adequate reserve for all Taxes payable by the Parent (in addition to any reserve for deferred Taxes to reflect timing differences between book and Tax items) for all Taxable periods and portions thereof through the date of such financial statements. No deficiency with respect to any Taxes have been proposed, asserted or assessed against the Parent, and no requests for waivers of the time to assess any such Taxes are pending, except to the extent any such deficiency or request for waiver, individually or in the aggregate, has not had and would not reasonably be expected to have a Parent Material Adverse Effect.

(c) There are no Liens for Taxes (other than for current Taxes not yet due and payable) on the assets of the Parent. The Parent is not bound by any agreement with respect to Taxes.

SECTION 4.09 Absence of Changes in Benefit Plans. From the date of the most recent audited financial statements included in the Parent SEC Documents to the date of this Agreement, except as set forth in the Parent SEC Documents or the Parent Disclosure Schedule, there has not been any adoption or amendment in any material respect by Parent of any collective bargaining agreement or any bonus, pension, profit sharing, deferred compensation, incentive compensation, stock ownership, stock purchase, stock option, phantom stock, retirement, vacation, severance, disability, death benefit, hospitalization, medical or other plan, arrangement or understanding (whether or not legally binding) providing benefits to any current or former employee, officer or director of Parent (collectively, “Parent Benefit Plans”). As of the date of this Agreement, except as disclosed in the Parent SEC Documents or the Parent Disclosure Schedule, there are not any employment, consulting, indemnification, severance or termination agreements or arrangements between the Parent and any current or former employee, officer or director of the Parent, nor does the Parent have any general severance plan or policy.

SECTION 4.10 ERISA Compliance; Excess Parachute Payments. Except as disclosed in the Parent Disclosure Schedule, the Parent does not, and since its inception never has, maintained, or contributed to any “employee pension benefit plans” (as defined in Section 3(2) of ERISA), “employee welfare benefit plans” (as defined in Section 3(1) of ERISA) or any other Parent Benefit Plan for the benefit of any current or former employees, consultants, officers or directors of Parent.

SECTION 4.11 Litigation. Except as disclosed in the Parent SEC Documents or the Parent Disclosure Schedule, there is no Action which (i) adversely affects or challenges the legality, validity or enforceability of any of this Agreement or the Parent Stock or (ii) could, if there were an unfavorable decision, individually or in the aggregate, have or reasonably be expected to result in a Parent Material Adverse Effect and neither the Parent nor any director or officer thereof (in his or her capacity as such), is or has been the subject of any Action involving a claim or violation of or liability under federal or state securities laws or a claim of breach of fiduciary duty.

SECTION 4.12 Compliance with Applicable Laws. Except as disclosed in the Parent SEC Documents or the Parent Disclosure Schedule, the Parent is in compliance with all applicable Laws, except for instances of noncompliance that, individually and in the aggregate, have not had and would not reasonably be expected to have a Parent Material Adverse Effect. Except as set forth in the Parent SEC Documents, the Parent has not received any written communication during the past two years from a Governmental Entity that alleges that the Parent is not in compliance in any material respect with any applicable Law. The Parent is in compliance with all effective requirements of the Sarbanes-Oxley Act of 2002, as amended, and the rules and regulations thereunder, that are applicable to it, except where such noncompliance could not have or reasonably be expected to result in a Parent Material Adverse Effect.

-17-

SECTION 4.13 Contracts. Except as disclosed in the Parent SEC Documents, there are no Contracts that are material to the business, properties, assets, condition (financial or otherwise), results of operations or prospects of the Parent taken as a whole. The Parent is not in violation of or in default under (nor does there exist any condition which upon the passage of time or the giving of notice would cause such a violation of or default under) any Contract to which it is a party or by which it or any of its properties or assets is bound, except for violations or defaults that would not, individually or in the aggregate, reasonably be expected to result in a Parent Material Adverse Effect.

SECTION 4.14 Title to Properties. The Parent has good title to, or valid leasehold interests in, all of its properties and assets used in the conduct of its businesses. All such assets and properties, other than assets and properties in which the Parent has leasehold interests, are free and clear of all Liens and except for Liens that, in the aggregate, do not and will not materially interfere with the ability of the Parent to conduct business as currently conducted or result in or would reasonably be expected to result in a Parent Material Adverse Effect. The Parent has complied in all material respects with the terms of all material leases to which it is a party and under which it is in occupancy, and all such leases are in full force and effect.

SECTION 4.15 Intellectual Property. The Parent owns, or is validly licensed or otherwise has the right to use, all Intellectual Property Rights which are material to the conduct of the business of the Parent taken as a whole. The Parent Disclosure Schedule sets forth a description of all Intellectual Property Rights which are material to the conduct of the business of the Parent taken as a whole. No claims are pending or, to the knowledge of the Parent, threatened that the Parent is infringing or otherwise adversely affecting the rights of any Person with regard to any Intellectual Property Right. To the knowledge of the Parent, no Person is infringing the rights of the Parent with respect to any Intellectual Property Right other than as to which the Parent has the full right and power to bring action and to enforce such Intellectual Property Right, and receive the entirety of the proceeds thereof, by way of judgment settlement or otherwise, and no third-party has any such claims or rights.

SECTION 4.16 Labor Matters. There are no collective bargaining or other labor union agreements to which the Parent is a party or by which it is bound. No material labor dispute exists or, to the knowledge of the Parent, is imminent with respect to any of the employees of the Parent.