UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the fiscal year ended December 31, 2022

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from ___________________ to __________________

Commission file number 001-35714

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

(Address of principal executive offices) (Zip code)

(419 ) 421-2414

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The aggregate market value of common units held by non-affiliates as of June 30, 2022 was approximately $10.6 billion. This amount is based on the closing price of the registrant’s common units on the New York Stock Exchange on June 30, 2022. Common units held by executive officers and directors of the registrant and its affiliates are not included in the computation. The registrant, solely for the purpose of this required presentation, has deemed its directors and executive officers and those of its affiliates to be affiliates.

MPLX LP had 1,001,043,931 common units outstanding at February 16, 2023.

Documents Incorporated By Reference: None

Table of Contents

| Page | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

Unless otherwise stated or the context otherwise indicates, all references in this report to “MPLX LP,” “MPLX,” “the Partnership,” “we,” “our,” “us,” or like terms refer to MPLX LP and its subsidiaries. References to our sponsor and customer, “MPC”, refer collectively to Marathon Petroleum Corporation and its subsidiaries, other than the Partnership. Additionally, throughout this Annual Report on Form 10-K, we have used terms in our discussion of the business and operating results that have been defined in our Glossary of Terms.

Glossary of Terms

The abbreviations, acronyms and industry terminology used in this report are defined as follows:

| ARO | Asset retirement obligation | ||||

| ASC | Accounting Standards Codification | ||||

| ASU | Accounting Standards Update | ||||

| Barrel (Bbl) | One stock tank barrel, or 42 United States gallons of liquid volume, used in reference to crude oil or other liquid hydrocarbons. | ||||

| Bcf/d | One billion cubic feet per day | ||||

| Btu | One British thermal unit, an energy measurement | ||||

| DCF (a non-GAAP financial measure) | Distributable Cash Flow | ||||

| DOT | United States Department of Transportation | ||||

| EBITDA (a non-GAAP financial measure) | Earnings Before Interest, Taxes, Depreciation and Amortization | ||||

| EPA | United States Environmental Protection Agency | ||||

| FASB | Financial Accounting Standards Board | ||||

| FCF (a non-GAAP financial measure) | Free Cash Flow | ||||

| FERC | Federal Energy Regulatory Commission | ||||

| GAAP | Accounting principles generally accepted in the United States of America | ||||

| G&P | Gathering and Processing segment | ||||

| IRS | Internal Revenue Service | ||||

| LIBOR | London Interbank Offered Rate | ||||

| L&S | Logistics and Storage segment | ||||

| mbbls | Thousands of barrels | ||||

| mbpd | Thousand barrels per day | ||||

| MMBtu | One million British thermal units, an energy measurement | ||||

| MMcf/d | One million cubic feet per day | ||||

| MRF | Marine repair facility | ||||

| NGL | Natural gas liquids, such as ethane, propane, butanes and natural gasoline | ||||

| NYSE | New York Stock Exchange | ||||

| PHMSA | Pipeline and Hazardous Materials Safety Administration | ||||

| SEC | United States Securities and Exchange Commission | ||||

| SOFR | Secured Overnight Financing Rate | ||||

| USCG | United States Coast Guard | ||||

| VIE | Variable interest entity | ||||

Disclosures Regarding Forward-Looking Statements

This Annual Report on Form 10-K, particularly Item 1. Business, Item 1A. Risk Factors, Item 3. Legal Proceedings, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 7A. Quantitative and Qualitative Disclosures about Market Risk, includes forward-looking statements that are subject to risks, contingencies or uncertainties. You can identify forward-looking statements by words such as “anticipate,” “believe,” “commitment,” “could,” “design,” “estimate,” “expect,” “forecast,” “goal,” “guidance,” “intend,” “may,” “objective,” “opportunity,” “outlook,” “plan,” “policy,” “position,” “potential,” “predict,” “priority,” “project,” “prospective,” “pursue,” “seek,” “should,” “strategy,” “target,” “will,” “would” or other similar expressions that convey the uncertainty of future events or outcomes.

Forward-looking statements include, among other things, statements regarding:

•future financial and operating results;

•environmental, social and governance (“ESG”) goals and targets, including those related to greenhouse gas (“GHG”) emissions, diversity and inclusion and ESG reporting;

•future levels of capital, environmental or maintenance expenditures, general and administrative and other expenses;

•our plans to achieve our ESG goals and targets and to monitor and report progress thereon;

•the success or timing of completion of ongoing or anticipated capital or maintenance projects;

•business strategies, growth opportunities and expected investments;

•the timing and amount of future distributions or unit repurchases; and

•the anticipated effects of actions of third parties such as competitors, activist investors, federal, foreign, state or local regulatory authorities, or plaintiffs in litigation.

Our forward-looking statements are not guarantees of future performance and you should not rely unduly on them, as they involve risks, uncertainties and assumptions. Material differences between actual results and any future performance suggested in our forward-looking statements could result from a variety of factors, including the following:

•general economic, political or regulatory developments, including inflation, changes in governmental policies relating to refined petroleum products, crude oil, natural gas, NGLs, or renewables, or taxation;

•the ability of MPC to achieve its strategic objectives and the effects of those strategic decisions on us;

•further impairments;

•negative capital market conditions, including an increase of the current yield on common units;

•the ability to achieve strategic and financial objectives, including with respect to distribution coverage, future distribution levels, proposed projects and completed transactions;

•the success of MPC’s portfolio optimization, including the ability to complete any divestitures on commercially reasonable terms and/or within the expected timeframe, and the effects of any such divestitures on our business, financial condition, results of operations and cash flows;

•the adequacy of capital resources and liquidity, including the availability of sufficient cash flow to pay distributions and access to debt on commercially reasonable terms, and the ability to successfully execute business plans, growth strategies and self-funding models;

•the timing and extent of changes in commodity prices and demand for crude oil, refined products, feedstocks, other hydrocarbon-based products, or renewables;

•volatility in or degradation of general economic, market, industry or business conditions as a result of the COVID-19 pandemic, other infectious disease outbreaks, natural hazards, extreme weather events, the military conflict between Russia and Ukraine, other conflicts, inflation, rising interest rates or otherwise;

•changes to the expected construction costs and timing of projects and planned investments, and the ability to obtain regulatory and other approvals with respect thereto;

•completion of midstream infrastructure by competitors;

•disruptions due to equipment interruption or failure, including electrical shortages and power grid failures;

•the suspension, reduction or termination of MPC’s obligations under MPLX’s commercial agreements;

•modifications to financial policies, capital budgets, and earnings and distributions;

•the ability to manage disruptions in credit markets or changes to credit ratings;

1

•compliance with federal and state environmental, economic, health and safety, energy and other policies and regulations or enforcement actions initiated thereunder;

•adverse results in litigation;

•the effect of restructuring or reorganization of business components;

•the potential effects of changes in tariff rates on our business, financial condition, results of operations and cash flows;

•foreign imports and exports of crude oil, refined products, natural gas and NGLs;

•changes in producer customers’ drilling plans or in volumes of throughput of crude oil, natural gas, NGLs, refined products, other hydrocarbon-based products, or renewables;

•changes in the cost or availability of third-party vessels, pipelines, railcars and other means of transportation for crude oil, natural gas, NGLs, feedstocks, refined products, and renewables;

•the price, availability and acceptance of alternative fuels and alternative-fuel vehicles and laws mandating such fuels or vehicles;

•actions taken by our competitors, including pricing adjustments and the expansion and retirement of pipeline capacity, processing, fractionation and treating facilities in response to market conditions;

•expectations regarding joint venture arrangements and other acquisitions or divestitures of assets;

•midstream and refining industry overcapacity or undercapacity;

•accidents or other unscheduled shutdowns affecting our machinery, pipelines, processing, fractionation and treating facilities or equipment, means of transportation, or those of our suppliers or customers;

•acts of war, terrorism or civil unrest that could impair our ability to gather, process, fractionate or transport crude oil, natural gas, NGLs, refined products, or renewables;

•political pressure and influence of environmental groups upon policies and decisions related to the production, gathering, refining, processing, fractionation, transportation and marketing of crude oil or other feedstocks, refined products, natural gas, NGLs, other hydrocarbon-based products, or renewables;

•our ability to successfully achieve our ESG goals and targets within the expected timeframe, if at all; and

•the other factors described in Item 1A. Risk Factors.

We undertake no obligation to update any forward-looking statements except to the extent required by applicable law.

2

Part I

Item 1. Business

OVERVIEW

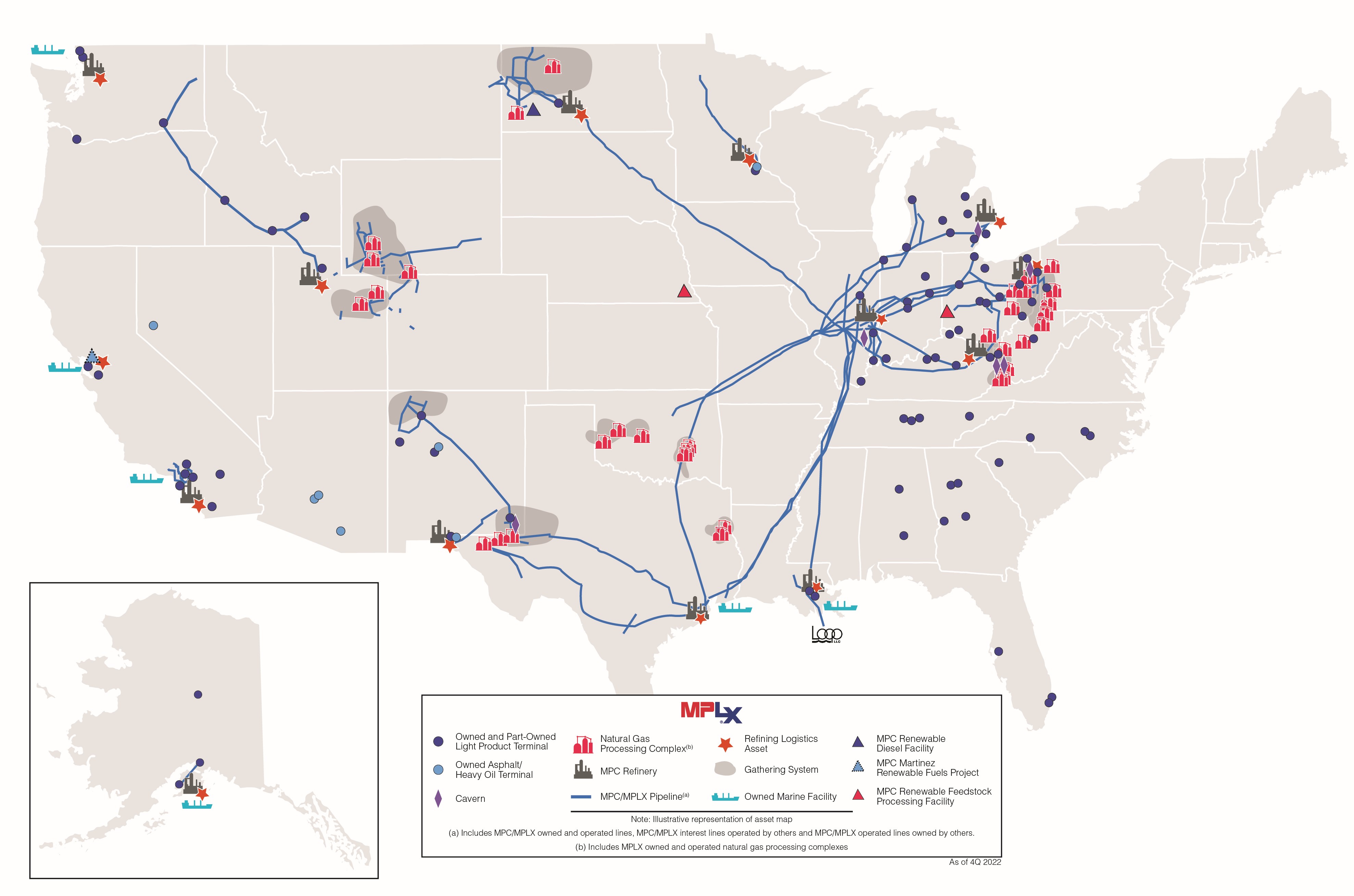

We are a diversified, large-cap master limited partnership formed by MPC in 2012 (as our sponsor) that owns and operates midstream energy infrastructure and logistics assets, and provides fuels distribution services. Our assets include a network of crude oil and refined product pipelines; an inland marine business; light-product, asphalt, heavy oil and marine terminals; storage caverns; refinery tanks, docks, loading racks, and associated piping; crude oil and natural gas gathering systems and pipelines; as well as natural gas and NGL processing and fractionation facilities. The business consists of two segments based on the nature of services it offers: Logistics and Storage (“L&S”) and Gathering and Processing (“G&P”). Our assets are positioned throughout the United States. The L&S segment primarily engages in the gathering, transportation, storage and distribution of crude oil, refined products, other hydrocarbon-based products, and renewables. The L&S segment also includes the operation of our refining logistics, fuels distribution and inland marine businesses, terminals, rail facilities and storage caverns. The G&P segment provides gathering, processing and transportation of natural gas as well as the transportation, fractionation, storage and marketing of NGLs. For more information on these segments, see Our Operating Segments discussion below. The map below and Item 2. Properties provide information about our assets as of December 31, 2022:

We continue to have a strategic relationship with MPC, which is a large source of our revenues. We have executed numerous long-term, fee-based agreements with minimum volume commitments with MPC which provide us with a stable and predictable revenue stream and source of cash flows. As of December 31, 2022, MPC owned our general partner and approximately 65 percent of our outstanding common units. In 2022, MPC accounted for 47 percent of our total revenues and other income, primarily within our L&S segment, and will continue to be an important source of our revenues and cash flows for the foreseeable future. We also have long-term relationships with a diverse set of producer customers in many crude oil and natural gas resource plays, including the Marcellus Shale, Permian Basin, Utica Shale, STACK Shale and Bakken Shale, among others.

MPLX remains guided by its strategic priorities of strict capital discipline, fostering a low-cost culture, and optimizing our asset portfolio. We continuously evaluate our portfolio to identify opportunities to develop, expand, debottleneck and participate in projects that complement our existing assets, assess strategic acquisitions, and ensure we are optimizing all assets in the portfolio. This includes positioning the MPLX portfolio and capabilities to be successful through the energy evolution.

3

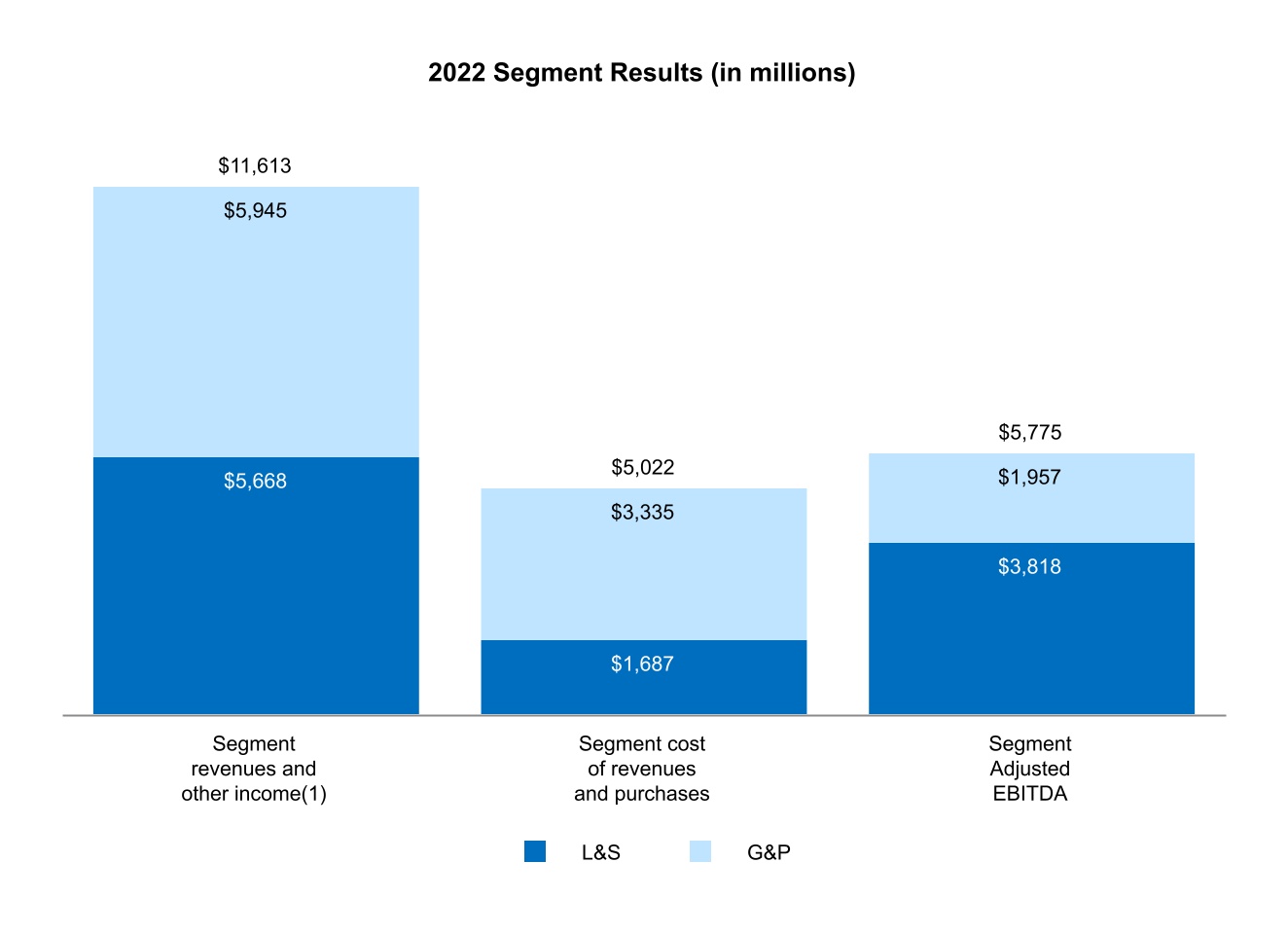

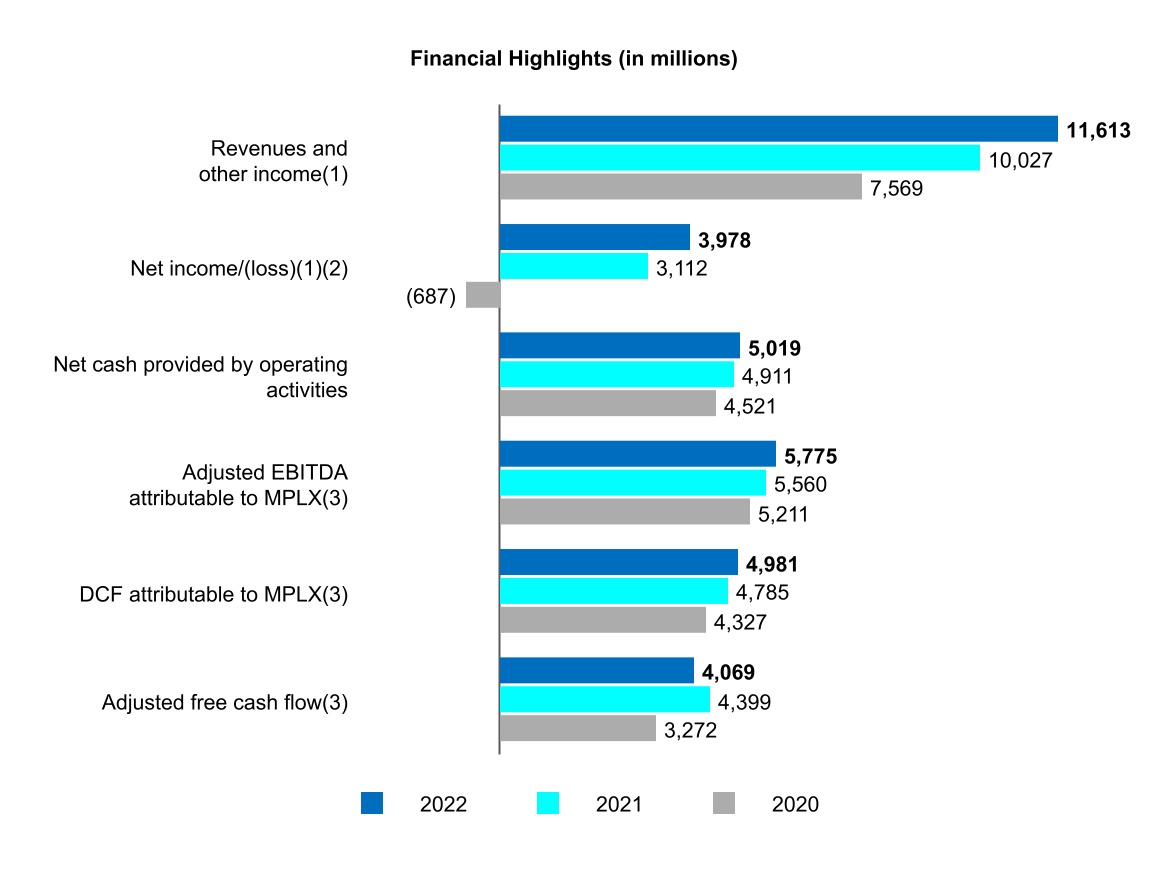

2022 RESULTS

The following table summarizes the operating performance for each segment for the year ended December 31, 2022. For further discussion of our segments and a reconciliation of Non-GAAP measures to our Consolidated Statements of Income, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations as well as Item 8. Financial Statements and Supplementary Data – Note 10.

(1) Includes non-cash gain on a lease reclassification of $509 million. See Item 8. Financial Statements and Supplementary Data - Note 20 in the consolidated financial statements for additional information.

RECENT DEVELOPMENTS

•On January 25, 2023, we announced the board of directors of our general partner declared a distribution of $0.7750 per common unit that was paid on February 14, 2023 to common unitholders of record on February 6, 2023.

•On February 9, 2023, we issued $1.1 billion aggregate principal amount of 5.00 percent senior notes due 2033 and $500 million aggregate principal amount of 5.65 percent senior notes due 2053 in an underwritten public offering.

•On February 15, 2023, we redeemed all of the 600,000 outstanding Series B preferred units at the redemption price of $1,000 per unit. The semi-annual distribution due to Series B unitholders on February 15, 2023, was also paid on that date, in the usual manner. We also provided notice to redeem all of MPLX’s and MarkWest’s $1.0 billion aggregate principal amount of 4.50 percent senior notes due July 2023.

BUSINESS STRATEGIES

Maintain Safe and Reliable Operations: We are committed to maintaining and improving the safety, reliability and efficiency of our operations and promoting high standards for safety and environmental stewardship. Providing safe, reliable and efficient services is also a key component in generating stable cash flows.

Grow Stable Cash Flows While Maintaining Strict Capital Discipline: We are focused on growing our feed-based services through long-term contracts, which provide through-cycle cash flow stability. We also challenge ourselves to be disciplined in our capital spending as we look to effectively deploy capital to grow our business and its cash flows.

4

Focus on Low-Cost Culture: We are committed to achieving operational excellence by reducing costs, improving efficiency, and driving operational improvements. This means lowering our costs in all aspects of our business and challenging ourselves to be disciplined in every dollar we spend across our organization.

Commitment to Return Capital to Unitholders: We are committed to generating cash flows in excess of both our capital spending and our distributions, while maintaining a strong balance sheet. With our commitment to strict-capital discipline and adoption of a low-cost culture, we expect to continue generating strong cash flow, enhancing our financial flexibility to invest in and grow the business, while also supporting the return of capital to MPLX unitholders.

Commitment to Sustainability: Our approach to sustainability spans the environmental, social and governance dimensions of our business. That means strengthening resiliency by lowering carbon intensity and conserving natural resources; innovating for the future by investing in renewables and emerging technologies; and embedding sustainability in decision-making and in how we engage our people and many stakeholders. We are progressing towards meeting our 2025 and 2030 methane intensity reduction goals, as well as our biodiversity target, by applying sustainable landscapes to our compatible right of ways.

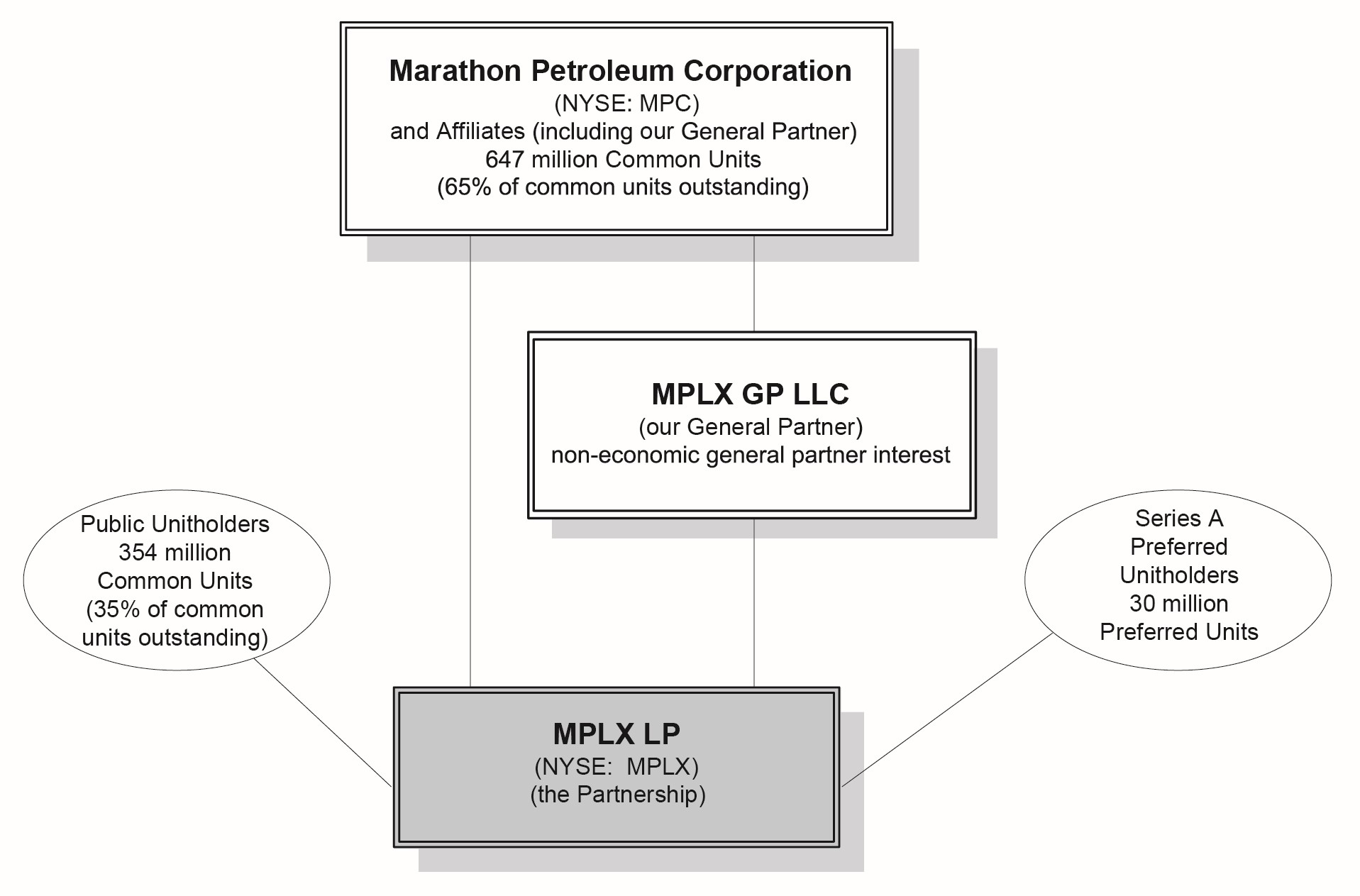

ORGANIZATIONAL STRUCTURE

The following diagram depicts our organizational structure and MPC’s ownership interest in us as of February 16, 2023.

We are an MLP with outstanding common units held by MPC and public unitholders as well as preferred units. Our common units are publicly traded on the NYSE under the symbol “MPLX.” Our Series A preferred units rank senior to all common units. The holders of the Series A preferred units are entitled to receive a quarterly distribution equal to the greater of $0.528125 per unit or the amount of distributions they would have received on an as converted basis. Our Series B preferred units were redeemed on February 15, 2023 and are no longer outstanding.

5

INDUSTRY OVERVIEW

As of December 31, 2022, our diversified services in the midstream sector broken down by our segments are as follows:

L&S:

The midstream sector plays a crucial role in the oil and gas industry by providing gathering, transportation, terminalling, storage and marketing services as depicted below.

Crude oil is the primary raw material for transportation fuels and the basis for many products, including plastics, petrochemicals and heating oil for homes. Pipelines bring advantaged North American crude oil from the upper Great Plains, Louisiana, Texas, Canada and West Coast to numerous refineries throughout the United States. Terminals provide for the receipt, storage, blending, additization, handling and redelivery of refined products via pipeline, rail, marine and over-the-road modes of transportation. This network of logistics infrastructure also allows for export opportunities by connecting supply to global demand markets. The hydrocarbon market is often volatile and the ability to take advantage of fast-moving market conditions is enhanced by the ability to store crude oil, refined products, other hydrocarbon-based products, and renewables at tank farms, caverns, and tanks at refineries and terminals. The ability to store various products provides flexibility and logistics optionality which allows participants within the industry to take advantage of changing market conditions.

G&P:

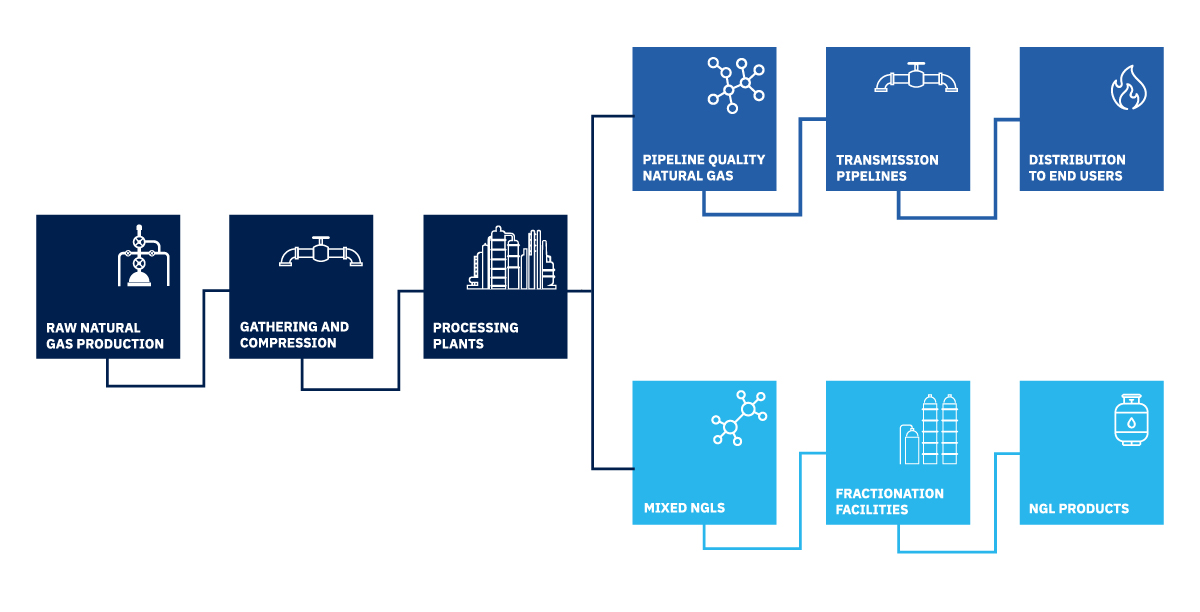

The midstream natural gas industry is the link between the exploration for, and production of, natural gas and the delivery of its hydrocarbon components to end-use markets, as graphically depicted and further described below:

•Gathering. The natural gas production process begins with the drilling of wells into gas-bearing rock formations. At the initial stages of the midstream value chain, our network of pipelines known as gathering systems directly connect to wellheads in the production area. Our gathering systems then transport raw, or untreated, natural gas to a central location for treating and processing.

6

•Processing. Natural gas has a widely varying composition depending on the field, formation reservoir or facility from which it is produced. Our natural gas processing complexes remove the heavier and more valuable hydrocarbon components, which are extracted as a mixed NGL stream that includes ethane, propane, butanes and natural gasoline (also referred to as “y-grade”). Processing aids in allowing the residue gas remaining after extraction of NGLs to meet the quality specifications for long-haul pipeline transportation and commercial use.

•Fractionation. Fractionation is the further separation of the mixture of extracted NGLs into individual components for end-use sale. Fractionation systems typically exist either as an integral part of a gas processing plant or as a central fractionator.

•Storage, transportation and marketing. Once the raw natural gas has been treated or processed and the raw NGL mix has been fractionated into individual NGL components, the natural gas is delivered to downstream transmission pipelines and NGL components are stored, transported and marketed to end-use markets.

Due to advances in well completion technology and horizontal drilling techniques, unconventional sources, such as shale and tight sand formations, have become a source of current and expected future natural gas production. The industry as a whole is characterized by regional competition, based on the proximity of gathering systems and processing/fractionation plants to producing natural gas wells, or to facilities that produce natural gas as a byproduct of refining crude oil. Due to the shift in the source of natural gas production, midstream providers with a significant presence in the shale plays will likely have a competitive advantage. Well-positioned operations allow access to all major NGL markets and provide for the development of export solutions for producers. This proximity is enhanced by infrastructure build-out and pipeline projects.

OUR OPERATING SEGMENTS

We conduct our operations in two reportable segments, which include L&S and G&P. Each of these segments is organized and managed based upon the nature of the products and services it offers.

L&S:

The L&S segment includes gathering, transportation, storage and distribution of crude oil, refined products, other hydrocarbon-based products and renewables. These assets consist of a network of 15,105 miles of wholly and jointly-owned common carrier pipelines and associated storage assets, refining logistics assets at 13 refineries, 89 terminals including one export terminal, storage caverns, tank farm assets including rail and truck racks, an inland marine business and a fuels distribution business. For information related to our L&S assets, please see Item 2. Properties - Logistics and Storage. Our L&S assets are integral to the success of MPC’s operations. We continue to evaluate projects and opportunities that will further enhance our existing operations and provide valuable services to MPC and third parties.

We generate revenue in the L&S segment primarily by charging tariffs for gathering and transporting crude oil, refined products, other hydrocarbon-based products and renewables through our pipelines and at our barge docks delivering to domestic and international destinations, and fees for storing crude oil, refined products and renewables at our storage facilities. Our marine business generates revenue under a fee-for-capacity contract with MPC. Our fuels distribution business provides services related to the scheduling and marketing of products on behalf of MPC, for which it generates revenue based on the volume of MPC’s products sold each month. We are also the operator of additional crude oil and refined product pipelines owned by MPC and third parties for which we are paid operating fees. For the year ended December 31, 2022, approximately 88 percent of L&S segment revenues and other income was generated from MPC.

G&P:

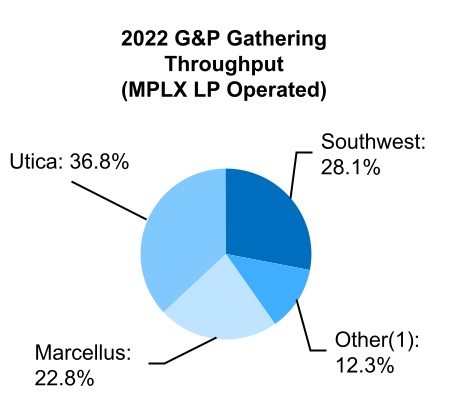

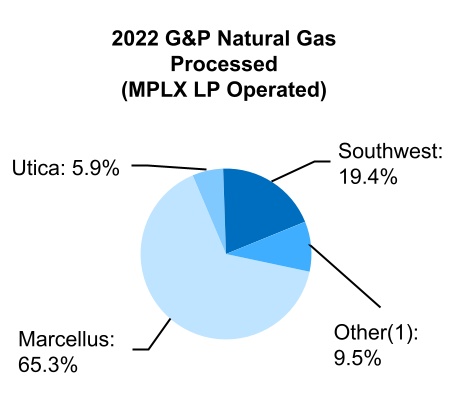

The G&P segment gathers, processes and transports natural gas; and transports, fractionates, stores and markets NGLs. As of December 31, 2022, gathering and processing assets available to MPLX included approximately 10.4 Bcf/d of gathering capacity, 12.0 Bcf/d of natural gas processing capacity and 829 mbpd of fractionation and de-ethanization capacity. For a summary of our gas processing facilities, fractionation facilities, natural gas gathering systems, NGL pipelines and natural gas pipelines see Item 2. Properties - Gathering and Processing. For the year ended December 31, 2022, revenues earned from two customers within the Marcellus region were significant to the segment. Neither of these customers was significant to MPLX consolidated revenues.

For further financial information regarding our segments, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8. Financial Statements and Supplementary Data included in this Annual Report on Form 10-K.

7

OUR RELATIONSHIP WITH MPC

One of our competitive strengths is our strategic relationship with MPC, which is the largest crude oil refiner in the United States in terms of refining capacity. MPC owns and operates 13 refineries in the Gulf Coast, Mid-Continent and West Coast regions of the United States and distributes refined products, including renewable diesel, through transportation, storage, distribution and marketing services provided by its midstream segment, which primarily consists of MPLX. MPLX, through its fuels distribution services, distributes refined products under the Marathon brand through an extensive network of retail locations owned or operated by independent entrepreneurs across the United States.

MPC retains a significant interest in us through its non-economic ownership of our general partner and holding approximately 65 percent of the outstanding common units of MPLX as of December 31, 2022. Given MPC’s significant interest in us, we believe MPC will promote and support the successful execution of our business strategies.

OUR L&S CONTRACTS WITH MPC AND THIRD PARTIES

Transportation Services Agreements, Storage Services Agreements, Terminal Services Agreements and Fuels Distribution Services Agreement with MPC

Our L&S assets are strategically located within, and integral to, MPC’s operations. We have entered into multiple transportation, terminal and storage services agreements with MPC. Under these long-term, fee-based agreements, we provide transportation, terminal and storage services to MPC and, other than under our marine transportation services agreement, most of these agreements include minimum committed volumes from MPC. MPC has also committed to pay a fixed fee for 100 percent of available capacity for boats, barges and third-party chartered equipment under the marine transportation services agreement. We also have a fuels distribution agreement with MPC under which we provide scheduling and other services of MPC’s products.

The following table sets forth additional information regarding our transportation, storage, terminal, and fuels distribution services agreements with MPC as expected to be in effect throughout 2023:

| Agreement | Initiation Date | Initial Term (years) | MPC minimum commitment | |||||||||||||||||

| Transportation Services (mbpd): | ||||||||||||||||||||

Crude pipelines(1) | Various | 4-10 | 2,023 | |||||||||||||||||

Refined product pipelines(2) | Various | 1-15 | 1,756 | |||||||||||||||||

Marine(3) | January 2015 | 6 | N/A | |||||||||||||||||

| Storage Services (mbbls): | ||||||||||||||||||||

Tank Farms(4) | Various | 2-12 | 131,791 | |||||||||||||||||

Caverns(5) | Various | 10-17 | 4,209 | |||||||||||||||||

Terminal Services(6) (mbpd) | Various | Various | 2,013 | |||||||||||||||||

Fuels Distribution Services(7) (millions of gallons per year) | February 2018 | 10 | 23,449 | |||||||||||||||||

(1) Commitments are adjusted for crude viscosity. Renewal terms include multiple two to five-year terms.

(2) Renewal terms include multiple one to five-year terms.

(3) MPC has committed to utilize 100 percent of our available capacity of boats and barges. Renewal terms include two additional five-year terms. The contract is currently within the first renewal period.

(4) Volume shown represents total shell capacity available for MPC’s use and includes refining logistics tanks. Renewal terms vary and range from year-to-year to multiple additional five-year terms.

(5) Renewal terms vary and range from zero to 10 years. Volume shown represents total shell capacity.

(6) Renewal terms vary and range from month-to-month to two additional five-year terms.

(7) Includes one additional five-year renewal term.

Under transportation services agreements containing minimum volume commitments, if MPC fails to transport its minimum throughput volumes during any period, then MPC will pay us a deficiency payment equal to the volume of the deficiency multiplied by the tariff rate then in effect. Under certain transportation services agreements, the amount of any deficiency payment paid by MPC may be applied as a credit for any volumes transported on the applicable pipeline in excess of MPC’s minimum volume commitment during a limited number of succeeding periods, after which time any unused credits will expire.

We have a trucking transportation services agreement with MPC. Under this trucking transportation services agreement, we receive a service fee per barrel for gathering barrels and providing trucking, dispatch, delivery and data services.

Under most of our terminal services agreements, if MPC fails to meet its minimum volume commitment during any period, then MPC will pay us a deficiency payment equal to the volume of the deficiency multiplied by the contractual fee then in effect. Some of our terminal services agreements contain minimum commitments for various additional services such as storage and blending.

8

We have a fuels distribution service agreement with MPC in which MPC pays MPLX a tiered monthly fee based on the volume of MPC’s products marketed by MPLX each month, subject to a maximum annual volume. MPLX has agreed to use commercially reasonable efforts to sell not less than a minimum quarterly volume of MPC’s products during each calendar quarter. If MPLX sells less than the minimum quarterly volume of MPC’s products during any calendar quarter despite its commercially reasonable efforts, MPC will pay MPLX a deficiency payment equal to the volume deficiency multiplied by the applicable tiered fee. The dollar amount of actual sales volume of MPC’s products that exceeds the minimum quarterly volume (an “Excess Sale”) for a particular quarter will be applied as a credit, on a first-in-first-out basis, against any future deficiency payment owed by MPC to MPLX during the four calendar quarters immediately following the calendar quarter in which the Excess Sale occurs.

Our agreements with MPC provide for annual escalations that are either fixed or based on a variety of factors including the FERC index and various other inflation-based indexes depending on the nature and geography of the services provided.

Pipeline Operating Agreements with MPC

We operate various pipelines owned by MPC under operating services agreements. Under these operating services agreements, we receive an operating fee for operating the assets, which include certain MPC wholly owned or partially owned crude oil, natural gas, and refined product pipelines, and for providing various operational services with respect to those assets. We are generally reimbursed for all direct and indirect costs associated with operating the assets and providing such operational services. These agreements vary in length and automatically renew with most agreements being indexed for inflation.

Pipeline Operating Agreements with Third Parties

We maintain and operate six pipelines in which either MPC or MPLX has a joint interest. We receive an operating fee for each of these pipelines, which is subject to adjustment for inflation. In addition, we are reimbursed for specific costs associated with operating each pipeline. The length and renewal terms for each agreement vary.

Transportation, Terminal and Storage Services Agreements with Third Parties

We have multiple transportation and terminal services agreements with third parties under which we provide use of pipelines and tank storage, and provide services, facilities and other infrastructure related to the receipt, storage, throughput, blending and delivery of commodities. Some of these agreements are subject to prepaid throughput volumes under which we agree to handle a certain amount of product throughput each month in exchange for a predetermined fixed fee, with any excess throughput or ancillary services subject to additional charges. Under the remaining agreements, we receive an agreed upon fee based on actual product throughput following the completion of services.

Marine Services Agreements with MPC

MPLX has an agreement with MPC under which it provides management services to assist MPC in the oversight and management of the marine business. MPLX receives fixed annual fees for providing the required services, which are subject to predetermined annual escalation rates. This agreement is subject to an initial term of five years and automatically renews for one additional five-year renewal period unless terminated by either party.

Other Agreements with MPC

We have omnibus agreements with MPC that address our payment of a fixed annual fee to MPC for the provision of executive management services by certain executive officers of our general partner and our reimbursement to MPC for the provision of certain services to us, as well as MPC’s indemnification of us for certain matters, including certain environmental, title and tax matters. In addition, we indemnify MPC for certain matters under these agreements.

We also have various employee services agreements and a secondment agreement under which we reimburse MPC for the provision of certain operational and management services to us. All of the employees that conduct our business are directly employed by affiliates of our general partner.

Additionally, we have certain indemnification agreements with MPC under which MPC retains responsibility for remediation of known environmental liabilities due to the use or operation of the assets prior to our ownership, and indemnifies us for any losses we incurred arising out of those remediation obligations. The indemnification for unknown pre-closing remediation liabilities is generally limited to five years.

OUR G&P CONTRACTS WITH MPC AND THIRD PARTIES

The majority of our revenues in the G&P segment are generated from natural gas gathering, transportation and processing; and NGL transportation, fractionation, exchange, marketing and storage. MPLX enters into a variety of contract types including fee-based, percent-of-proceeds, keep-whole and purchase arrangements in order to generate revenues. See Item 8. Financial Statements and Supplementary Data - Note 2 for a further description of these different types of arrangements.

9

In many cases, MPLX provides services under contracts that contain a combination of more than one of the arrangements described above. The terms of MPLX’s contracts vary based on gas quality conditions, the competitive environment when the contracts are signed and customer requirements. In addition, minimum volume commitments may create contract liabilities or deferred credits if current period payments can be used for future services. These are recognized into service revenue in instances where it is probable the customer will not use the credit in future periods.

MPLX’s contract mix and exposure to natural gas and NGL prices may change as a result of changes in producer preferences, MPLX expansion in regions where some types of contracts are more common and other market factors, including current market and financial conditions which have increased the risk of volatility in oil, natural gas and NGL prices. Any change in mix may influence our long-term financial results.

Keep-whole agreement with MPC

MPLX has a keep-whole commodity agreement related to our Rockies operations with MPC. Under the agreement, MPC pays us a processing fee for NGLs related to keep-whole agreements and delivers shrink gas to the producers on our behalf. We pay MPC a marketing fee in exchange for assuming the commodity risk. The pricing structure under this agreement provides for a base volume subject to a base rate and incremental volumes subject to variable rates, which are calculated with reference to certain of our costs incurred as processor of the volumes. The pricing for both the base and incremental volumes are subject to revision each year.

COMPETITION

Within our L&S segment, our competition primarily comes from independent terminal and pipeline companies, integrated petroleum companies, refining and marketing companies, distribution companies with marketing and trading arms and from other wholesale petroleum products distributors. Competition in any particular geographic area is affected significantly by the volume of products produced by refineries in the area, and in areas where no refinery is present, by the availability of products and the cost of transportation to the area from other locations. Competition for oil supplies is based primarily on the price and scope of services, location of the facility and connectivity to the best priced markets.

As a result of our contractual relationship with MPC under our transportation and storage services agreements, our terminal services agreement, our fuels distribution agreement and our physical asset connections to MPC’s refineries and terminals, we believe that MPC will continue to utilize our assets for transportation, storage, distribution and marketing services. If MPC’s customers reduced their purchases of refined products from MPC due to increased availability of less expensive refined product from other suppliers or for other reasons, MPC may only receive or deliver the minimum volumes through our terminals (or pay the shortfall payment if it does not deliver the minimum volumes), which could decrease our revenues.

In our G&P segment, we face competition for natural gas gathering and in obtaining natural gas supplies for our processing and related services; in obtaining unprocessed NGLs for transportation and fractionation; and in marketing our products and services. Competition for natural gas supplies is based primarily on the location of gas gathering systems and gas processing plants, operating efficiency and reliability, residue gas and NGL market connectivity, the ability to obtain a satisfactory price for products recovered and the fees charged for services supplied to the customer. Competitive factors affecting our fractionation services include availability of fractionation capacity, proximity to supply and industry marketing centers, the fees charged for fractionation services and operating efficiency and reliability of service. Competition for customers to purchase our natural gas and NGLs is based primarily on price, credit and market connectivity.

Our G&P competitors include:

•natural gas midstream providers, of varying financial resources and experience, that gather, transport, process, fractionate, store and market natural gas and NGLs;

•major integrated oil companies and refineries;

•independent exploration and production companies;

•interstate and intrastate pipelines; and

•other marine and land-based transporters of natural gas and NGLs.

Certain competitors, such as major oil and gas and pipeline companies, may have capital resources and contracted supplies of natural gas substantially greater than ours. Smaller local distributors may have a marketing advantage in their immediate service areas.

We believe that our customer focus, demonstrated by our ability to offer an integrated package of services and our flexibility in considering various types of contractual arrangements, allows us to compete more effectively. This includes having access to both NGL and natural gas markets to allow for flexibility in our gathering and processing in addition to having critical connections to a strong sponsor and key market outlets for NGLs and natural gas. Our strategic gathering and processing agreements with key producers enhances our competitive position to participate in the further development of our resource plays. The strategic

10

location of our assets, including those connected to MPC, and the long-term nature of many of our contracts also provide a significant competitive advantage.

INSURANCE

Our assets may experience physical damage as a result of an accident or natural disaster. These hazards can also cause personal injury and loss of life, severe damage to and destruction of property and equipment, pollution or environmental damage and business interruption. We are insured under MPC and other third-party insurance policies. The MPC policies are subject to shared deductibles.

SEASONALITY

The volume of crude oil and refined products transported and stored utilizing our assets is affected by the level of supply and demand for crude oil and refined products in the markets served directly or indirectly by our assets. The majority of effects of seasonality on the L&S segment’s revenues will be mitigated through the use of our fee-based transportation and storage services agreements with MPC that include minimum volume commitments.

In our G&P segment, we experience minimal impacts from seasonal fluctuations which impact the demand for natural gas and NGLs and the related commodity prices caused by various factors including variations in weather patterns from year to year. We are able to manage the seasonality impacts through the execution of our marketing strategy. Overall, our exposure to the seasonality fluctuations is limited due to the nature of our fee-based business.

REGULATORY MATTERS

Our operations are subject to numerous laws and regulations, including those relating to the protection of the environment. Such laws and regulations include, among others, the Interstate Commerce Act (“ICA”), the Natural Gas Act (“NGA”), the Clean Water Act (“CWA”) with respect to water discharges, the Clean Air Act (“CAA”) with respect to air emissions, the Resource Conservation and Recovery Act (“RCRA”) with respect to solid and hazardous waste treatment, storage and disposal, the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”) with respect to releases and remediation of hazardous substances and the Oil Pollution Act of 1990 (“OPA-90”) with respect to oil pollution and response. In addition, many states where we operate have similar laws. New laws are being enacted and regulations are being adopted on a continuing basis, and the costs of compliance with such new laws and regulations are very difficult to estimate until finalized.

For a discussion of environmental capital expenditures and costs of compliance, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Environmental Matters and Compliance Costs. For additional information regarding regulatory risks, see Item 1A. Risk Factors.

Pipeline Regulations

Liquids Pipelines

Some of our existing pipelines are considered interstate common carrier pipelines subject to regulation by the Federal Energy Regulatory Commission (“FERC”) under the ICA, Energy Policy Act of 1992 (“EPAct 1992”) and the rules and regulations promulgated under those laws. The ICA and FERC regulations require that tariff rates for oil pipelines, a category that includes crude oil and petroleum product pipelines, be just and reasonable and the terms and conditions of service must not be unduly discriminatory. The ICA permits interested persons to challenge newly proposed tariff rates or terms and conditions of service, or any change to tariff rates or terms and conditions of service, and authorizes FERC to suspend the effectiveness of such proposal or change for a period of time to investigate. If, upon completion of an investigation, FERC finds that the new or changed service or rate is unlawful, it is authorized to require the carrier to refund the revenues in excess of the prior tariff collected during the pendency of the investigation. An interested person may also challenge existing terms and conditions of service or rates and FERC may order a carrier to change its terms and conditions of service or rates prospectively. Upon an appropriate showing, a shipper may also obtain reparations, from a pipeline, for damages sustained as a result of rates or terms which FERC deemed were not just and reasonable. Such reparation damages may accrue from the complaint through the final order and during the two years prior to the filing of a complaint.

EPAct 1992 deemed certain interstate petroleum pipeline rates then in effect to be just and reasonable under the ICA. These rates are commonly referred to as “grandfathered rates.” Our rates for interstate transportation service in effect for the 365-day period ending on the date of the passage of EPAct 1992 were deemed just and reasonable and therefore are grandfathered. Subsequent changes to those rates are not grandfathered. New rates have since been established after EPAct 1992 for certain pipelines, and certain of our pipelines have subsequently been approved to charge market-based rates.

FERC permits regulated oil pipelines to change their rates within prescribed ceiling levels that are tied to an inflation index. A carrier must, as a general rule, utilize the indexing methodology to change its rates. Cost-of-service ratemaking, market-based rates and settlement rates are alternatives to the indexing approach and may be used in certain specified circumstances to change rates.

11

Intrastate services provided by certain of our liquids pipelines are subject to regulation by state regulatory authorities. Much of the state regulation is complaint-based, both as to rates and priority of access. Not all state regulatory bodies allow for changes based on an index method similar to that used by FERC. In those instances, rates are generally changed only through a rate case process. The state regulators could limit our ability to increase our rates or to set rates based on our costs or could order us to reduce our rates and could, if permitted under state law, require the payment of refunds to shippers.

FERC and state regulatory agencies generally have not investigated rates on their own initiative when those rates are not the subject of a protest or a complaint by a shipper. FERC or a state commission could investigate our rates on its own initiative or at the urging of a third party if the third party is either a current shipper or is able to show that it has a substantial economic interest in our tariff rate level.

Natural Gas Pipelines

Our natural gas pipeline operations are subject to federal, state and local regulatory authorities. Under the NGA, FERC has authority to regulate natural gas companies that provide natural gas pipeline transportation services in interstate commerce. FERC’s authority to regulate those services includes the rates charged for the services, terms and conditions of service, certification and construction of new facilities, the extension or abandonment of services and facilities, the maintenance of accounts and records, the acquisition and disposition of facilities, the initiation and discontinuation of services and various other matters. Natural gas companies may not charge rates that have been determined to be unjust and unreasonable, or unduly discriminatory by FERC. In addition, FERC prohibits FERC-regulated natural gas companies from unduly preferring, or unduly discriminating against, any person with respect to pipeline rates or terms and conditions of service or other matters. Pursuant to FERC’s jurisdiction, existing rates and/or other tariff provisions may be challenged (e.g., by complaint) and rate increases proposed by the pipeline or other tariff changes may be challenged (e.g., by protest). Any successful complaint or protest related to our services or facilities could have an adverse impact on our revenues.

Some of our intrastate gas pipeline facilities are subject to various state laws and regulations that affect the rates we charge and terms of service. Although state regulation is typically less onerous than FERC, state regulation typically requires pipelines to charge just and reasonable rates and to provide service on a non-discriminatory basis. The rates and service of an intrastate pipeline generally are subject to challenge by complaint. Additionally, FERC has adopted certain regulations and reporting requirements applicable to intrastate natural gas pipelines (and Hinshaw natural gas pipelines) that provide certain interstate services subject to FERC’s jurisdiction. We are subject to such regulations and reporting requirements to the extent that any of our intrastate pipelines provide, or are found to provide, such interstate services.

Natural Gas Gathering

Section 1(b) of the NGA exempts natural gas production and gathering from the jurisdiction of FERC. There is, however, no bright-line test for determining the jurisdictional status of pipeline facilities. We own a number of facilities that we believe qualify as production and gathering facilities not subject to FERC jurisdiction. The distinction between FERC-regulated transmission services and federally unregulated gathering services is the subject of litigation from time to time, so we cannot provide assurance that FERC will not at some point assert that these facilities are within its jurisdiction or that such an assertion would not adversely affect our results of operations and revenues. In such a case, we would possibly be required to file a tariff with FERC, potentially provide a cost justification for the transportation charge and obtain certificate(s) of public convenience and necessity for the FERC-regulated pipelines, and comply with additional FERC reporting requirements.

In the states in which we operate, regulation of gathering facilities and intrastate pipeline facilities generally includes various safety, environmental and, in some circumstances, open access, non-discriminatory take requirement and complaint-based rate regulation. For example, some of our natural gas gathering facilities are subject to state ratable take and common purchaser statutes and regulations. Ratable take statutes and regulations generally require gatherers to take, without undue discrimination, natural gas production that may be tendered to the gatherer for handling. Similarly, common purchaser statutes and regulations generally require gatherers to purchase gas without undue discrimination as to source of supply or producer. These statutes are designed to prohibit discrimination in favor of one producer over another producer or one source of supply over another source of supply. Although state regulation is typically less onerous than at FERC, these statutes and regulations have the effect of restricting our right as an owner of gathering facilities to decide with whom we contract to purchase or gather natural gas.

Our gathering operations could be adversely affected should they be subject in the future to the application of state or federal regulation of rates and services or regulated as a public utility. Our gathering operations also may be or become subject to safety and operational regulations and permitting requirements relating to the design, siting, installation, testing, construction, operation, replacement and management of gathering facilities. Additional rules and legislation pertaining to these matters are considered or adopted from time to time. We cannot predict what effect, if any, such changes might have on our operations, but the industry could be required to incur additional capital expenditures and increased costs depending on future legislative and regulatory changes.

12

Energy Policy Act of 2005

Under the Domenici-Barton Energy Policy Act of 2005 (“EPAct 2005”) and related regulations, it is unlawful for gas pipelines and storage companies that provide interstate services to: (i) directly or indirectly, use or employ any device, scheme or artifice to defraud in connection with the purchase or sale of natural gas subject to the jurisdiction of FERC, or the purchase or sale of transportation services subject to the jurisdiction of FERC; (ii) make any untrue statement of material fact or omit to make any such statement necessary to make the statements made not misleading; or (iii) engage in any act or practice that operates as a fraud or deceit upon any person. EPAct 2005 gives the FERC civil penalty authority to impose penalties for certain violations of up to approximately $1.3 million per day for each violation, subject to FERC’s annual inflation adjustment. FERC also has the authority to order disgorgement of profits from transactions deemed to violate the NGA and the EPAct 2005.

Standards of Conduct

FERC has adopted affiliate standards of conduct applicable to interstate natural gas pipelines and certain other regulated entities, defined as “Transmission Providers.” Under these rules, a Transmission Provider becomes subject to the standards of conduct if it provides service to affiliates that engage in marketing functions (as defined in the standards). If a Transmission Provider is subject to the standards of conduct, the Transmission Provider’s transmission function employees (including the transmission function employees of any of its affiliates) must function independently from the Transmission Provider’s marketing function employees (including the marketing function employees of any of its affiliates). The Transmission Provider must also comply with certain posting and other requirements.

PHMSA Regulation

We are subject to regulation by the DOT under the Hazardous Liquid Pipeline Safety Act of 1979 (“HLPSA”). The HLPSA delegated to the DOT the authority to develop, prescribe and enforce minimum federal safety standards for the transportation of hazardous liquids by pipeline. Congress also enacted the Pipeline Safety Act of 1992, also known as the PSA, which added the environment to the list of statutory factors that must be considered in establishing safety standards for hazardous liquid pipelines, required regulations be issued to define the term “gathering line” and establish safety standards for certain “regulated gathering lines,” and mandated that regulations be issued to establish criteria for operators to use in identifying and inspecting pipelines located in High Consequence Areas (“HCAs”), defined as those areas that are unusually sensitive to environmental damage, that cross a navigable waterway, or that have a high population density. In 1996, Congress enacted the Accountable Pipeline Safety and Partnership Act, which limited the operator identification requirement mandate to pipelines that cross a waterway where a substantial likelihood of commercial navigation exists, required that certain areas where a pipeline rupture would likely cause permanent or long-term environmental damage be considered in determining whether an area is unusually sensitive to environmental damage, and mandated that regulations be issued for the qualification and testing of certain pipeline personnel. In the Pipeline Inspection, Protection, Enforcement, and Safety Act of 2006, Congress required mandatory inspections for certain U.S. crude oil and natural gas transmission pipelines in HCAs and mandated that regulations be issued for low-stress hazardous liquid pipelines and pipeline control room management. We are also subject to the Pipeline Safety, Regulatory Certainty and Job Creation Act of 2011, which increased penalties for safety violations, established additional safety requirements for newly constructed pipelines and required studies of certain safety issues that could result in the adoption of new regulatory requirements for existing pipelines. Additionally, we are subject to the Protecting our Infrastructure of Pipelines and Enhancing Safety Act of 2016, which required PHMSA to develop underground gas storage standards within two years and provided PHMSA with significant new authority to issue industry-wide emergency orders if an unsafe condition or practices results in an imminent hazard.

The DOT has delegated its authority under these statutes to the PHMSA, which administers compliance with these statutes and has promulgated comprehensive safety standards and regulations for the transportation of natural gas by pipeline (49 C.F.R. Part 192), as well as hazardous liquids by pipeline (49 C.F.R. Part 195), including regulations for the design and construction of new pipelines or those that have been relocated, replaced or otherwise changed (Subparts C and D of 49 C.F.R., Part 195); pressure testing of new pipelines (Subpart E of 49 C.F.R. Part 195); operation and maintenance of pipelines, including inspecting and reburying pipelines in the Gulf of Mexico and its inlets, establishing programs for public awareness and damage prevention, managing the integrity of pipelines in HCAs and managing the operation of pipeline control rooms (Subpart F of 49 C.F.R. Part 195); protecting steel pipelines from the adverse effects of internal and external corrosion (Subpart H of 49 C.F.R. Part 195); and integrity management requirements for pipelines in HCAs (49 C.F.R. 195.452). PHMSA has undertaken a number of initiatives to reevaluate its pipeline safety regulations. We do not anticipate that we would be impacted by these regulatory initiatives to any greater degree than other similarly situated competitors.

Notwithstanding the foregoing, PHMSA and one or more state regulators have, in isolated circumstances in the past, sought to expand the scope of their regulatory inspections to include certain in-plant equipment and pipelines found within NGL fractionation facilities and associated storage facilities in order to assess compliance with hazardous liquids pipeline safety requirements. If any of these actions were made broadly enforceable as part of a rule-making process or codified into law, they could result in additional capital costs, possible operational delays and increased costs of operation.

13

Environmental and Other Regulations

General

Our processing and fractionation plants, storage facilities, pipelines and associated facilities are subject to multiple obligations and potential liabilities under a variety of federal, regional, state and local laws and regulations relating to environmental protection. Such environmental laws and regulations may affect many aspects of our present and future operations, including for example, requiring the acquisition of permits or other approvals to conduct regulated activities that may impose burdensome conditions or potentially cause delays, restricting the manner in which we handle or dispose of our wastes, limiting or prohibiting construction or other activities in environmentally sensitive areas such as wetlands or areas inhabited by threatened or endangered species, requiring us to incur capital costs to construct, maintain and/or upgrade processes, equipment and/or facilities, restricting the locations in which we may construct our compressor stations and other facilities and/or requiring the relocation of existing stations and facilities, and requiring remedial actions to mitigate any pollution that might be caused by our operations or attributable to former operations. Spills, releases or other incidents may occur in connection with our active operations or as a result of events outside of our reasonable control, which incidents may result in non-compliance with such laws and regulations. Any failure to comply with these legal requirements may expose us to the assessment of sanctions, including administrative, civil and criminal penalties, the imposition of remedial or corrective actions and the issuance of orders enjoining or limiting some or all of our operations.

We believe that our operations and facilities are in substantial compliance with applicable environmental laws and regulations and the cost of continued compliance with such laws and regulations will not have a material adverse effect on our results of operations or financial condition. Generally speaking, however, the trend in environmental law is to place more restrictions and limitations on activities that may be perceived to adversely affect the environment, which may cause significant delays in obtaining permitting approvals for our facilities, result in the denial of our permitting applications, or cause us to become involved in time consuming and costly litigation. Thus, there can be no assurance as to the amount or timing of future expenditures for compliance with environmental laws and regulations, permits and permitting requirements or remedial actions pursuant to such laws and regulations, and actual future expenditures may be different from the amounts we currently anticipate. Revised or additional environmental requirements may result in increased compliance and mitigation costs or additional operating restrictions, particularly if those costs are not fully recoverable from our customers, and could have a material adverse effect on our business, financial condition, results of operations and cash flow. We may not be able to recover some or any of these costs from insurance. Such revised or additional environmental requirements may also result in substantially increased costs and material delays in the construction of new facilities or expansion of our existing facilities, which may materially impact our ability to meet our construction obligations with our producer customers.

Remediation

A comprehensive framework of environmental laws and regulations governs our operations as they relate to the possible release of hazardous substances or non-hazardous or hazardous wastes into soils, groundwater and surface water and measures taken to mitigate pollution into the environment. CERCLA, also known as the “Superfund” law, as well as comparable state laws, impose liability without regard to fault or the legality of the original conduct on certain classes of persons who are considered to be responsible for the release of a hazardous substance into the environment. These persons include current and prior owners or operators of a site where a release occurred and companies that transported or disposed or arranged for the transport or disposal of the hazardous substances released from the site. Under CERCLA, these persons may be subject to strict joint and several liability for the costs of removing or remediating hazardous substances that have been released into the environment and for restoration costs and damages to natural resources. RCRA and similar state laws may also impose liability for removing or remediating releases of hazardous or non-hazardous wastes from impacted properties.

We currently own or lease, and have in the past owned or leased, properties that have been used over the years for natural gas gathering, processing and transportation, for NGL fractionation, for the storage, gathering and transportation of crude oil, or for the storage and transportation of refined products. During the normal course of operation, whether by us or prior owners or operators, releases of petroleum hydrocarbons or other non-hazardous or hazardous wastes have or may have occurred. We could be required to remove or remediate previously disposed wastes or property contamination, including groundwater contamination, or to perform remedial operations to prevent future contamination. We do not believe that we have any current material liability for cleanup costs under such laws or for third-party claims.

On September 6, 2022, EPA issued a notice of proposed rulemaking that would designate Perfluorooctanoic Acid (“PFOA”) and Perfluorooctane Sulfonate (“PFOS”) as hazardous substances under CERCLA Section 102(a). Additional per- and polyfluoroalkyl substances (“PFAS”) regulation could include the designation of PFAS as a RCRA hazardous waste. We cannot currently predict the impact of potential statutes or regulations related to PFAS on our remediation costs.

Hazardous and Solid Wastes

We may incur liability under RCRA, and comparable or more stringent state statutes, which impose requirements relating to the handling and disposal of non-hazardous and hazardous wastes. In the course of our operations, we generate some amount of ordinary industrial wastes, such as paint wastes, waste solvents and waste oils that may be regulated as hazardous wastes. It is

14

possible that some wastes generated by us that are currently classified as non-hazardous wastes may in the future be designated as hazardous wastes, resulting in the wastes being subject to more rigorous and costly transportation, storage, treatment and disposal requirements.

Water

We maintain numerous discharge permits as required under the National Pollutant Discharge Elimination System program of the CWA and have implemented systems to oversee our compliance with these permits. In addition, we are regulated under OPA-90, which, among other things, requires the owner or operator of a tank vessel or a facility to maintain an emergency plan to respond to releases of oil or hazardous substances. OPA-90 also requires the responsible company to pay resulting removal costs and damages and provides for civil penalties and criminal sanctions for violations of its provisions. We operate tank vessels and facilities from which spills of oil and hazardous substances could occur. We have implemented emergency oil response plans for all of our components and facilities covered by OPA-90 and we have established Spill Prevention, Control and Countermeasures plans for all facilities subject to such requirements. Some coastal states in which we operate have passed state laws similar to OPA-90, but with expanded liability provisions, that include provisions for cargo owner responsibility as well as ship owner and operator responsibility.

Construction or maintenance of our plants, compressor stations, pipelines, barge docks and storage facilities may impact wetlands or other surface water bodies, which are also regulated under the CWA by the EPA, the United States Army Corps of Engineers and state water quality agencies. Regulatory requirements governing wetlands and other surface water bodies (including associated mitigation projects) may result in the delay of our projects while we obtain necessary permits and may increase the cost of new projects and maintenance activities. We believe that we are in substantial compliance with the CWA and analogous state laws. However, there is no assurance that we will not incur material increases in our operating costs or delays in the construction or expansion of our facilities because of future developments, the implementation of new laws and regulations, the reinterpretation of existing laws and regulations, or otherwise, including, for example, increased construction activities, potential inadvertent releases arising from pursuing borings for pipelines, and earth slips due to heavy rain and/or other causes.

On October 22, 2019, EPA and the United States Army Corps of Engineers (“Army Corps”) published a final rule to repeal the 2015 “Clean Water Rule: Definition of Waters of the United States” (“2015 Rule”), which amended portions of the Code of Federal Regulations to restore the regulatory text that existed prior to the 2015 Rule, effective December 23, 2019. The rule repealing the 2015 Rule has been challenged in multiple federal courts. On April 21, 2020, EPA and the Army Corps promulgated the Navigable Waters Protection Rule (“2020 Rule”) to define “waters of the United States.” The 2020 Rule has been vacated by a federal court. On December 7, 2021, EPA and the Army Corps issued a notice of proposed rulemaking with the stated purpose of repealing the 2020 Rule defining “waters of the United States” and adopting a rule largely based upon the definition adopted in 1986 with some revisions based upon subsequent U.S. Supreme Court rulings, in particular Rapanos v. United States (2006) which produced two different tests for determining “waters of the United States”, the relatively permanent waters and significant nexus tests. A broader definition could result in increased cost of compliance or increased capital costs for construction of new facilities or expansion of existing facilities.

In April 2020, the U.S. District Court in Montana vacated Nationwide Permit 12 (“NWP 12”), which authorizes the placement of fill material in “waters of the United States” for utility line activities as long as certain best management practices are implemented. The decision was ultimately appealed to the United States Supreme Court, which partially reversed the district court’s decision, temporarily reinstating NWP 12 for all projects except the Keystone XL oil pipeline. The Army Corps subsequently reissued its nationwide permit authorizations on January 13, 2021, by dividing the NWP that authorizes utility line activities (NWP 12) into three separate NWPs that address the differences in how different utility line projects are constructed, the substances they convey, and the different standards and best management practices that help ensure those NWPs authorize only those activities that have no more than minimal adverse environmental effects. A challenge of the 2021 authorization is currently pending before the U.S. District Court for the District of Columbia (“D.D.C.”), after being transferred from the U.S. District Court for the District of Montana in August 2022 and the plaintiffs request the court vacate and remand the 2021 authorization. Also, a petition has been filed with the Army Corps asking it to revoke the 2021 authorization. The Biden Administration could repeal or replace the 2021 authorization in a subsequent rulemaking. Repeal, vacation, revocation or replacement of the 2021 authorization could impact pipeline construction and maintenance activities.

As part of our emergency response activities, we have used aqueous film forming foam (“AFFF”) containing PFAS chemicals as a vapor and fire suppressant. At this time, AFFFs containing PFAS are the only proven foams that can prevent and control a flammable petroleum-based liquid fire involving a large storage tank or tank containment area. In May 2016, the EPA issued lifetime health advisory levels (“HALs”) and health effects support documents for two PFAS substances - PFOA and PFOS. These HALs were updated in June 2022, when EPA also issued HALs for two additional PFAS substances. In February 2019, EPA issued a PFAS Action Plan identifying actions the EPA is planning to take to study and regulate various PFAS chemicals. The EPA identified that it would evaluate, among other actions, (1) proposing national drinking water standards for PFOA and PFOS, (2) develop cleanup recommendations for PFOA and PFOS, (3) evaluate listing PFOA and PFOS as hazardous substances under CERCLA, and (4) conduct toxicity assessments for other PFAS chemicals. In October 2021, EPA updated the 2019 PFAS Action Plan. On December 5, 2022, EPA issued to states and EPA regional offices a memorandum providing guidance for addressing PFAS discharges in wastewater and stormwater. Also, EPA has indicated it intends to issue a notice of proposed rulemaking in 2023 that will establish national drinking water standards for PFOS and PFOA. Congress may also take

15

further action to regulate PFAS. We cannot currently predict the impact of potential statutes or regulations on our operations. In addition, many states are actively proposing and adopting legislation and regulations relating to the use of AFFFs containing PFAS. Additionally, many states are using the EPA HALs for PFOS and PFOA and some states are adopting and proposing state-specific drinking water and cleanup standards for various PFAS, including PFOS and PFOA. We cannot currently predict the impact of these regulations on our liquidity, financial position, or results of operations.

Air Emissions

The Clean Air Act (“CAA”) and comparable state laws restrict the emission of air pollutants from many sources, including processing plants and compressor stations, and also impose various monitoring and reporting requirements. These laws and any implementing regulations may require us to obtain pre-approval for the construction or modification of certain projects or facilities expected to produce or significantly increase air emissions, obtain and strictly comply with stringent air permit requirements, utilize specific equipment or technologies to control emissions, or aggregate two or more of our facilities into one application for permitting purposes. We believe that our operations are in substantial compliance with applicable air permitting and control technology requirements. However, we may be required to incur capital expenditures in the future for installation of air pollution control equipment and encounter construction or operational delays while applying for, or awaiting the review, processing and issuance of new or amended permits, and we may be required to modify certain of our operations which could increase our operating costs.

In 2021, the EPA announced it is reconsidering the National Ambient Air Quality Standards (“NAAQS”) for ozone and fine particulate matter. In January 2023, EPA published its proposal to lower the primary fine particulate matter annual standard from its current level of 12.0 µg/m3 to within the range of 9.0 to 10.0 µg/m3. EPA has not yet announced its decision on reconsideration of the ozone NAAQS. Lowering of the NAAQS and subsequent designation as a nonattainment area could result in increased costs associated with, or result in cancellation or delay of, capital projects at our or our customers’ facilities, or could require emission reductions that could result in increased costs to us or our customers. We cannot predict the effects of the various state implementation plan requirements at this time.

In 2007, the California Air Resources Board (“CARB”) adopted the At-Berth Regulation to control airborne emissions from ocean-going vessels at berth but excluded tanker vessels due to safety and technological challenges for stack emission capture on vessels with hazardous cargo, which challenges still exist today. CARB amended the regulation in August 2020 to include maximum emission rates from auxiliary engines and boilers used to unload tanker vessels at berth. The obligation to meet the emission rates applies to both a vessel and the terminal where it is unloading. The emission rates apply to vessels unloading at terminals at the Port of Long Beach and the Port of Los Angeles beginning January 1, 2025, and at all other terminals beginning January 1, 2027. The amended regulation has been challenged in court and could impact the compliance timeline. Compliance with the regulation is expected to increase our costs at affected facilities.

Climate Change