mplx-202203312022Q10001552000--12-31falseP5YP5Yhttp://fasb.org/us-gaap/2021-01-31#ProductAndServiceOtherMemberhttp://fasb.org/us-gaap/2021-01-31#ProductAndServiceOtherMemberhttp://fasb.org/us-gaap/2021-01-31#ProductAndServiceOtherMemberhttp://fasb.org/us-gaap/2021-01-31#ProductAndServiceOtherMemberhttp://fasb.org/us-gaap/2021-01-31#ProductAndServiceOtherMemberhttp://fasb.org/us-gaap/2021-01-31#ProductAndServiceOtherMember9123400015520002022-01-012022-03-3100015520002022-04-29xbrli:shares0001552000us-gaap:ServiceMember2022-01-012022-03-31iso4217:USD0001552000us-gaap:ServiceMember2021-01-012021-03-310001552000us-gaap:ServiceMembersrt:AffiliatedEntityMember2022-01-012022-03-310001552000us-gaap:ServiceMembersrt:AffiliatedEntityMember2021-01-012021-03-310001552000us-gaap:ServiceOtherMember2022-01-012022-03-310001552000us-gaap:ServiceOtherMember2021-01-012021-03-310001552000mplx:ThirdPartyMember2022-01-012022-03-310001552000mplx:ThirdPartyMember2021-01-012021-03-310001552000srt:AffiliatedEntityMember2022-01-012022-03-310001552000srt:AffiliatedEntityMember2021-01-012021-03-310001552000us-gaap:ProductMember2022-01-012022-03-310001552000us-gaap:ProductMember2021-01-012021-03-310001552000srt:AffiliatedEntityMemberus-gaap:ProductMember2022-01-012022-03-310001552000srt:AffiliatedEntityMemberus-gaap:ProductMember2021-01-012021-03-3100015520002021-01-012021-03-310001552000us-gaap:OilAndGasRefiningAndMarketingMember2022-01-012022-03-310001552000us-gaap:OilAndGasRefiningAndMarketingMember2021-01-012021-03-310001552000us-gaap:NaturalGasMidstreamMember2022-01-012022-03-310001552000us-gaap:NaturalGasMidstreamMember2021-01-012021-03-310001552000mplx:RentalCostOfSalesMember2022-01-012022-03-310001552000mplx:RentalCostOfSalesMember2021-01-012021-03-310001552000mplx:RentalcostofsalesrelatedpartiesMembersrt:AffiliatedEntityMember2022-01-012022-03-310001552000mplx:RentalcostofsalesrelatedpartiesMembersrt:AffiliatedEntityMember2021-01-012021-03-310001552000mplx:RelatedPartyAndThirdPartyMember2022-01-012022-03-310001552000mplx:RelatedPartyAndThirdPartyMember2021-01-012021-03-310001552000us-gaap:PreferredPartnerMemberus-gaap:SeriesAPreferredStockMember2022-01-012022-03-310001552000us-gaap:PreferredPartnerMemberus-gaap:SeriesAPreferredStockMember2021-01-012021-03-310001552000us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredPartnerMember2022-01-012022-03-310001552000us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredPartnerMember2021-01-012021-03-310001552000mplx:LimitedPartnersCommonUnitsMember2022-01-012022-03-31iso4217:USDxbrli:shares0001552000mplx:LimitedPartnersCommonUnitsMember2021-01-012021-03-310001552000us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-03-310001552000us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-03-3100015520002022-03-3100015520002021-12-310001552000srt:AffiliatedEntityMember2022-03-310001552000srt:AffiliatedEntityMember2021-12-310001552000mplx:ThirdPartyMember2022-03-310001552000mplx:ThirdPartyMember2021-12-310001552000mplx:SeriesAConvertiblePreferredUnitsMember2022-03-310001552000mplx:SeriesAConvertiblePreferredUnitsMember2021-12-310001552000us-gaap:SeriesAPreferredStockMember2022-03-310001552000us-gaap:SeriesAPreferredStockMember2021-12-310001552000mplx:PublicMembermplx:LimitedPartnersCommonUnitsMember2022-03-310001552000mplx:PublicMembermplx:LimitedPartnersCommonUnitsMember2021-12-310001552000mplx:MarathonPetroleumCorporationMembermplx:LimitedPartnersCommonUnitsMember2022-03-310001552000mplx:MarathonPetroleumCorporationMembermplx:LimitedPartnersCommonUnitsMember2021-12-310001552000us-gaap:SeriesBPreferredStockMember2022-03-310001552000us-gaap:SeriesBPreferredStockMember2021-12-310001552000mplx:LoopLlcandExplorerPipelineMember2022-03-310001552000mplx:LoopLlcandExplorerPipelineMember2021-12-310001552000mplx:MPCInvestmentMembermplx:RelatedPartyRevolvingCreditAgreementMember2022-01-012022-03-310001552000mplx:MPCInvestmentMembermplx:RelatedPartyRevolvingCreditAgreementMember2021-01-012021-03-3100015520002020-12-3100015520002021-03-310001552000mplx:PublicMembermplx:LimitedPartnersCommonUnitsMember2020-12-310001552000mplx:MarathonPetroleumCorporationMembermplx:LimitedPartnersCommonUnitsMember2020-12-310001552000us-gaap:SeriesBPreferredStockMember2020-12-310001552000mplx:LoopLlcandExplorerPipelineMember2020-12-310001552000us-gaap:SeriesAPreferredStockMember2020-12-310001552000mplx:PublicMembermplx:LimitedPartnersCommonUnitsMember2021-01-012021-03-310001552000mplx:MarathonPetroleumCorporationMembermplx:LimitedPartnersCommonUnitsMember2021-01-012021-03-310001552000us-gaap:SeriesBPreferredStockMember2021-01-012021-03-310001552000us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001552000us-gaap:NoncontrollingInterestMember2021-01-012021-03-310001552000us-gaap:SeriesAPreferredStockMember2021-01-012021-03-310001552000mplx:PublicMembermplx:LimitedPartnersCommonUnitsMember2021-03-310001552000mplx:MarathonPetroleumCorporationMembermplx:LimitedPartnersCommonUnitsMember2021-03-310001552000us-gaap:SeriesBPreferredStockMember2021-03-310001552000mplx:LoopLlcandExplorerPipelineMember2021-03-310001552000us-gaap:SeriesAPreferredStockMember2021-03-310001552000mplx:PublicMembermplx:LimitedPartnersCommonUnitsMember2022-01-012022-03-310001552000mplx:MarathonPetroleumCorporationMembermplx:LimitedPartnersCommonUnitsMember2022-01-012022-03-310001552000us-gaap:SeriesBPreferredStockMember2022-01-012022-03-310001552000us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001552000us-gaap:NoncontrollingInterestMember2022-01-012022-03-310001552000us-gaap:SeriesAPreferredStockMember2022-01-012022-03-31xbrli:pure0001552000mplx:MarEnBakkenCompanyLLCMember2022-03-310001552000mplx:LogisticsandStorageMembermplx:MarEnBakkenCompanyLLCMember2022-03-310001552000mplx:LogisticsandStorageMembermplx:MarEnBakkenCompanyLLCMember2021-12-310001552000mplx:IllinoisExtensionPipelineCompanyLLCMember2022-03-310001552000mplx:LogisticsandStorageMembermplx:IllinoisExtensionPipelineCompanyLLCMember2022-03-310001552000mplx:LogisticsandStorageMembermplx:IllinoisExtensionPipelineCompanyLLCMember2021-12-310001552000mplx:LoopLlcMember2022-03-310001552000mplx:LogisticsandStorageMembermplx:LoopLlcMember2022-03-310001552000mplx:LogisticsandStorageMembermplx:LoopLlcMember2021-12-310001552000mplx:AndeavorLogisticsRioPipelineMember2022-03-310001552000mplx:LogisticsandStorageMembermplx:AndeavorLogisticsRioPipelineMember2022-03-310001552000mplx:LogisticsandStorageMembermplx:AndeavorLogisticsRioPipelineMember2021-12-310001552000mplx:MinnesotaPipeLineCompanyLLCMember2022-03-310001552000mplx:LogisticsandStorageMembermplx:MinnesotaPipeLineCompanyLLCMember2022-03-310001552000mplx:LogisticsandStorageMembermplx:MinnesotaPipeLineCompanyLLCMember2021-12-310001552000mplx:WhistlerPipelineLLCMember2022-03-310001552000mplx:LogisticsandStorageMembermplx:WhistlerPipelineLLCMember2022-03-310001552000mplx:LogisticsandStorageMembermplx:WhistlerPipelineLLCMember2021-12-310001552000mplx:ExplorerPipelineMember2022-03-310001552000mplx:LogisticsandStorageMembermplx:ExplorerPipelineMember2022-03-310001552000mplx:LogisticsandStorageMembermplx:ExplorerPipelineMember2021-12-310001552000mplx:W2WHoldingsLLCMember2022-03-310001552000mplx:W2WHoldingsLLCMembermplx:LogisticsandStorageMember2022-03-310001552000mplx:W2WHoldingsLLCMembermplx:LogisticsandStorageMember2021-12-310001552000mplx:OtherVIEsandNonVIEsMembermplx:LogisticsandStorageMember2022-03-310001552000mplx:OtherVIEsandNonVIEsMembermplx:LogisticsandStorageMember2021-12-310001552000mplx:LogisticsandStorageMemberus-gaap:OperatingSegmentsMember2022-03-310001552000mplx:LogisticsandStorageMemberus-gaap:OperatingSegmentsMember2021-12-310001552000mplx:MarkWestUticaEMGMember2022-03-310001552000mplx:GatheringandProcessingMembermplx:MarkWestUticaEMGMember2022-03-310001552000mplx:GatheringandProcessingMembermplx:MarkWestUticaEMGMember2021-12-310001552000mplx:SherwoodMidstreamLLCMember2022-03-310001552000mplx:GatheringandProcessingMembermplx:SherwoodMidstreamLLCMember2022-03-310001552000mplx:GatheringandProcessingMembermplx:SherwoodMidstreamLLCMember2021-12-310001552000mplx:MarkWestEMGJeffersonDryGasGatheringCompanyL.L.C.Member2022-03-310001552000mplx:GatheringandProcessingMembermplx:MarkWestEMGJeffersonDryGasGatheringCompanyL.L.C.Member2022-03-310001552000mplx:GatheringandProcessingMembermplx:MarkWestEMGJeffersonDryGasGatheringCompanyL.L.C.Member2021-12-310001552000mplx:MarkWestTornadoGPLLCMember2022-03-310001552000mplx:GatheringandProcessingMembermplx:MarkWestTornadoGPLLCMember2022-03-310001552000mplx:GatheringandProcessingMembermplx:MarkWestTornadoGPLLCMember2021-12-310001552000mplx:RendezvousGasServicesL.L.C.Member2022-03-310001552000mplx:GatheringandProcessingMembermplx:RendezvousGasServicesL.L.C.Member2022-03-310001552000mplx:GatheringandProcessingMembermplx:RendezvousGasServicesL.L.C.Member2021-12-310001552000mplx:SherwoodMidstreamHoldingsMembermplx:DirectOwnershipInterestMember2022-03-310001552000mplx:GatheringandProcessingMembermplx:SherwoodMidstreamHoldingsMember2022-03-310001552000mplx:GatheringandProcessingMembermplx:SherwoodMidstreamHoldingsMember2021-12-310001552000mplx:CentrahomaProcessingLLCMember2022-03-310001552000mplx:GatheringandProcessingMembermplx:CentrahomaProcessingLLCMember2022-03-310001552000mplx:GatheringandProcessingMembermplx:CentrahomaProcessingLLCMember2021-12-310001552000mplx:OtherVIEsandNonVIEsMembermplx:GatheringandProcessingMember2022-03-310001552000mplx:OtherVIEsandNonVIEsMembermplx:GatheringandProcessingMember2021-12-310001552000mplx:GatheringandProcessingMemberus-gaap:OperatingSegmentsMember2022-03-310001552000mplx:GatheringandProcessingMemberus-gaap:OperatingSegmentsMember2021-12-310001552000mplx:IndirectOwnershipInterestMembermplx:BakkenPipelineSystemMember2022-03-310001552000mplx:SherwoodMidstreamHoldingsMembermplx:IndirectOwnershipInterestMember2022-03-310001552000mplx:OtherVIEsMember2022-01-012022-03-310001552000mplx:NonVIEsMember2022-01-012022-03-310001552000mplx:OtherVIEsandNonVIEsMember2022-01-012022-03-310001552000mplx:OtherVIEsMember2021-01-012021-03-310001552000mplx:NonVIEsMember2021-01-012021-03-310001552000mplx:OtherVIEsandNonVIEsMember2021-01-012021-03-310001552000mplx:OtherVIEsMember2022-03-310001552000mplx:NonVIEsMember2022-03-310001552000mplx:OtherVIEsandNonVIEsMember2022-03-310001552000mplx:OtherVIEsMember2021-12-310001552000mplx:NonVIEsMember2021-12-310001552000mplx:OtherVIEsandNonVIEsMember2021-12-310001552000mplx:MPCInvestmentMembermplx:RelatedPartyRevolvingCreditAgreementMember2022-03-310001552000mplx:MPCInvestmentMembermplx:RelatedPartyRevolvingCreditAgreementMember2021-03-310001552000mplx:MarathonPetroleumCorporationMember2022-01-012022-03-310001552000mplx:MarathonPetroleumCorporationMember2021-01-012021-03-310001552000mplx:MarathonPetroleumCorporationMemberus-gaap:AssetUnderConstructionMember2022-01-012022-03-310001552000mplx:MarathonPetroleumCorporationMemberus-gaap:AssetUnderConstructionMember2021-01-012021-03-310001552000srt:AffiliatedEntityMembermplx:MinimumCommittedVolumeContractsMember2022-03-310001552000srt:AffiliatedEntityMembermplx:MinimumCommittedVolumeContractsMember2021-12-310001552000srt:AffiliatedEntityMembermplx:ReimbursableProjectsMember2022-03-310001552000srt:AffiliatedEntityMembermplx:ReimbursableProjectsMember2021-12-310001552000mplx:MPCInvestmentMembermplx:RelatedPartyRevolvingCreditAgreementMember2021-12-310001552000mplx:LimitedPartnersCommonUnitsMember2021-12-310001552000mplx:LimitedPartnersCommonUnitsMember2022-03-3100015520002020-11-020001552000us-gaap:SeriesBPreferredStockMember2022-03-310001552000us-gaap:SeriesBPreferredStockMember2022-01-012022-03-310001552000us-gaap:SeriesBPreferredStockMemberus-gaap:SubsequentEventMember2023-02-162023-12-310001552000us-gaap:SubsequentEventMember2022-04-262022-04-260001552000us-gaap:SubsequentEventMember2022-05-132022-05-130001552000us-gaap:SubsequentEventMember2022-05-062022-05-0600015520002021-04-272021-04-270001552000us-gaap:SeriesBPreferredStockMember2022-02-152022-02-150001552000mplx:LimitedPartnersCommonUnitsMemberus-gaap:CommonStockMember2022-01-012022-03-310001552000mplx:LimitedPartnersCommonUnitsMemberus-gaap:CommonStockMember2021-01-012021-03-310001552000us-gaap:ServiceMembermplx:LogisticsandStorageMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310001552000us-gaap:ServiceMembermplx:LogisticsandStorageMemberus-gaap:OperatingSegmentsMember2021-01-012021-03-310001552000mplx:LogisticsandStorageMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310001552000mplx:LogisticsandStorageMemberus-gaap:OperatingSegmentsMember2021-01-012021-03-310001552000mplx:LogisticsandStorageMemberus-gaap:ProductMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310001552000mplx:LogisticsandStorageMemberus-gaap:ProductMemberus-gaap:OperatingSegmentsMember2021-01-012021-03-310001552000mplx:LogisticsandStorageMembermplx:MarathonPetroleumCorporationMember2022-01-012022-03-310001552000mplx:LogisticsandStorageMembermplx:MarathonPetroleumCorporationMember2021-01-012021-03-310001552000mplx:LogisticsandStorageMember2022-01-012022-03-310001552000mplx:LogisticsandStorageMember2021-01-012021-03-310001552000us-gaap:ServiceMembermplx:GatheringandProcessingMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310001552000us-gaap:ServiceMembermplx:GatheringandProcessingMemberus-gaap:OperatingSegmentsMember2021-01-012021-03-310001552000mplx:GatheringandProcessingMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310001552000mplx:GatheringandProcessingMemberus-gaap:OperatingSegmentsMember2021-01-012021-03-310001552000mplx:GatheringandProcessingMemberus-gaap:ProductMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310001552000mplx:GatheringandProcessingMemberus-gaap:ProductMemberus-gaap:OperatingSegmentsMember2021-01-012021-03-310001552000mplx:GatheringandProcessingMember2022-01-012022-03-310001552000mplx:GatheringandProcessingMember2021-01-012021-03-310001552000mplx:LogisticsandStorageMembermplx:ThirdPartyMember2022-01-012022-03-310001552000mplx:LogisticsandStorageMembermplx:ThirdPartyMember2021-01-012021-03-310001552000mplx:GatheringandProcessingMembermplx:ThirdPartyMember2022-01-012022-03-310001552000mplx:GatheringandProcessingMembermplx:ThirdPartyMember2021-01-012021-03-310001552000us-gaap:OperatingSegmentsMember2022-01-012022-03-310001552000us-gaap:OperatingSegmentsMember2021-01-012021-03-310001552000us-gaap:MaterialReconcilingItemsMember2022-01-012022-03-310001552000us-gaap:MaterialReconcilingItemsMember2021-01-012021-03-310001552000mplx:LogisticsandStorageMember2022-03-310001552000mplx:LogisticsandStorageMember2021-12-310001552000mplx:GatheringandProcessingMember2022-03-310001552000mplx:GatheringandProcessingMember2021-12-310001552000us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMembersrt:MinimumMember2022-03-310001552000us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMembersrt:MaximumMember2022-03-31iso4217:USDutr:gal0001552000us-gaap:FairValueInputsLevel3Memberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2022-01-012022-03-310001552000mplx:NaturalGasMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2022-01-012022-03-310001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-12-310001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-12-310001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2022-01-012022-03-310001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-01-012021-03-310001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2022-03-310001552000us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-03-310001552000us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-03-310001552000us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-03-310001552000us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310001552000us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310001552000mplx:NaturalGasMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2022-03-310001552000us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2022-03-310001552000us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-12-310001552000us-gaap:OtherCurrentAssetsMemberus-gaap:NondesignatedMemberus-gaap:CommodityContractMember2022-03-310001552000us-gaap:NondesignatedMemberus-gaap:CommodityContractMemberus-gaap:OtherCurrentLiabilitiesMember2022-03-310001552000us-gaap:OtherCurrentAssetsMemberus-gaap:NondesignatedMemberus-gaap:CommodityContractMember2021-12-310001552000us-gaap:NondesignatedMemberus-gaap:CommodityContractMemberus-gaap:OtherCurrentLiabilitiesMember2021-12-310001552000us-gaap:OtherNoncurrentAssetsMemberus-gaap:NondesignatedMemberus-gaap:CommodityContractMember2022-03-310001552000us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:CommodityContractMember2022-03-310001552000us-gaap:OtherNoncurrentAssetsMemberus-gaap:NondesignatedMemberus-gaap:CommodityContractMember2021-12-310001552000us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:CommodityContractMember2021-12-310001552000us-gaap:NondesignatedMemberus-gaap:CommodityContractMember2022-03-310001552000us-gaap:NondesignatedMemberus-gaap:CommodityContractMember2021-12-310001552000mplx:PurchasedproductcostsMember2022-01-012022-03-310001552000mplx:PurchasedproductcostsMember2021-01-012021-03-310001552000us-gaap:NondesignatedMembermplx:PurchasedproductcostsMember2022-01-012022-03-310001552000us-gaap:NondesignatedMembermplx:PurchasedproductcostsMember2021-01-012021-03-310001552000mplx:MPLXRevolvingCreditFacilitydueJuly2024Member2022-03-310001552000mplx:MPLXRevolvingCreditFacilitydueJuly2024Member2021-12-310001552000mplx:FixedRateSeniorNotesMembermplx:MPLXLPMember2022-03-310001552000mplx:FixedRateSeniorNotesMembermplx:MPLXLPMember2021-12-310001552000mplx:FixedRateSeniorNotesMembermplx:MarkWestMember2022-03-310001552000mplx:FixedRateSeniorNotesMembermplx:MarkWestMember2021-12-310001552000mplx:FixedRateSeniorNotesMembermplx:ANDXLPMember2022-03-310001552000mplx:FixedRateSeniorNotesMembermplx:ANDXLPMember2021-12-310001552000mplx:MPLXLPMembermplx:FinanceLeaseMember2022-03-310001552000mplx:MPLXLPMembermplx:FinanceLeaseMember2021-12-310001552000mplx:MPLXRevolvingCreditFacilitydueJuly2024Membermplx:MPLXLPMember2022-01-012022-03-310001552000mplx:MPLXRevolvingCreditFacilitydueJuly2024Membermplx:MPLXLPMember2022-03-310001552000us-gaap:SeniorNotesMembersrt:MinimumMember2022-03-310001552000us-gaap:SeniorNotesMembersrt:MaximumMember2022-03-310001552000us-gaap:SeniorNotesMembermplx:SeniorNoteDueMarch2052Domain2022-03-142022-03-140001552000us-gaap:SeniorNotesMembermplx:SeniorNoteDueMarch2052Domain2022-03-310001552000us-gaap:ServiceMembermplx:LogisticsandStorageMember2022-01-012022-03-310001552000us-gaap:ServiceMembermplx:GatheringandProcessingMember2022-01-012022-03-310001552000mplx:LogisticsandStorageMemberus-gaap:ServiceOtherMember2022-01-012022-03-310001552000mplx:GatheringandProcessingMemberus-gaap:ServiceOtherMember2022-01-012022-03-310001552000mplx:LogisticsandStorageMemberus-gaap:ProductMember2022-01-012022-03-310001552000mplx:GatheringandProcessingMemberus-gaap:ProductMember2022-01-012022-03-310001552000us-gaap:ServiceMembermplx:LogisticsandStorageMember2021-01-012021-03-310001552000us-gaap:ServiceMembermplx:GatheringandProcessingMember2021-01-012021-03-310001552000mplx:LogisticsandStorageMemberus-gaap:ServiceOtherMember2021-01-012021-03-310001552000mplx:GatheringandProcessingMemberus-gaap:ServiceOtherMember2021-01-012021-03-310001552000mplx:LogisticsandStorageMemberus-gaap:ProductMember2021-01-012021-03-310001552000mplx:GatheringandProcessingMemberus-gaap:ProductMember2021-01-012021-03-310001552000us-gaap:AccountingStandardsUpdate201409Member2021-12-310001552000us-gaap:AccountingStandardsUpdate201409Member2022-01-012022-03-310001552000us-gaap:AccountingStandardsUpdate201409Member2022-03-310001552000us-gaap:AccountingStandardsUpdate201409Member2020-12-310001552000us-gaap:AccountingStandardsUpdate201409Member2021-01-012021-03-310001552000us-gaap:AccountingStandardsUpdate201409Member2021-03-3100015520002043-10-012022-03-3100015520002022-04-012022-03-3100015520002023-01-012022-03-3100015520002024-01-012022-03-3100015520002025-01-012022-03-3100015520002026-01-012022-03-310001552000us-gaap:GuaranteeTypeOtherMember2022-03-3100015520002021-04-012021-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

FORM 10-Q

____________________________________________

| | | | | |

| (Mark One) |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2022

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-35714

_____________________________________________

MPLX LP

(Exact name of registrant as specified in its charter)

_____________________________________________

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | | 27-0005456 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | | | | |

| 200 E. Hardin Street, | Findlay, | Ohio | | 45840 | |

| (Address of principal executive offices) | | (Zip code) | |

(419) 421-2414

(Registrant’s telephone number, including area code)

_____________________________________________

| | | | | | | | |

| Securities Registered pursuant to Section 12(b) of the Act |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Units Representing Limited Partnership Interests | MPLX | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.) Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ☐ No x

MPLX LP had 1,012,303,833 common units outstanding at April 29, 2022.

Table of Contents

Unless the context otherwise requires, references in this report to “MPLX LP,” “MPLX,” “the Partnership,” “we,” “our,” “us,” or like terms refer to MPLX LP and its subsidiaries. Additionally, throughout this Quarterly Report on Form 10-Q, we have used terms in our discussion of the business and operating results that have been defined in our Glossary of Terms.

Glossary of Terms

The abbreviations, acronyms and industry technology used in this report are defined as follows. | | | | | |

| |

| ASC | Accounting Standards Codification |

| ASU | Accounting Standards Update |

| |

| Barrel | One stock tank barrel, or 42 U.S. gallons of liquid volume, used in reference to crude oil or other liquid hydrocarbons |

| |

| |

| Btu | One British thermal unit, an energy measurement |

| |

| DCF (a non-GAAP financial measure) | Distributable Cash Flow |

| |

| EBITDA (a non-GAAP financial measure) | Earnings Before Interest, Taxes, Depreciation and Amortization |

| |

| |

| |

| GAAP | Accounting principles generally accepted in the United States of America |

| |

| |

| |

| |

| G&P | Gathering and Processing segment |

| LIBOR | London Interbank Offered Rate |

| L&S | Logistics and Storage segment |

| mbpd | Thousand barrels per day |

| |

| MMBtu | One million British thermal units, an energy measurement |

| MMcf/d | One million cubic feet of natural gas per day |

| NGL | Natural gas liquids, such as ethane, propane, butanes and natural gasoline |

| |

| |

| |

| |

| |

| SEC | U.S. Securities and Exchange Commission |

| |

| VIE | Variable interest entity |

| |

| |

Part I—Financial Information

Item 1. Financial Statements

MPLX LP

Consolidated Statements of Income (Unaudited) | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| (In millions, except per unit data) | 2022 | | 2021 | | | | |

| Revenues and other income: | | | | | | | |

| Service revenue | $ | 554 | | | $ | 589 | | | | | |

| Service revenue - related parties | 915 | | | 872 | | | | | |

| Service revenue - product related | 123 | | | 77 | | | | | |

| Rental income | 91 | | | 99 | | | | | |

| Rental income - related parties | 165 | | | 242 | | | | | |

| Product sales | 497 | | | 282 | | | | | |

| Product sales - related parties | 45 | | | 42 | | | | | |

| | | | | | | |

| Sales-type lease revenue - related parties | 111 | | | 37 | | | | | |

| Income from equity method investments | 99 | | | 70 | | | | | |

| Other income (loss) | (17) | | | 1 | | | | | |

| Other income - related parties | 27 | | | 28 | | | | | |

| Total revenues and other income | 2,610 | | | 2,339 | | | | | |

| Costs and expenses: | | | | | | | |

| Cost of revenues (excludes items below) | 287 | | | 273 | | | | | |

| Purchased product costs | 467 | | | 276 | | | | | |

| Rental cost of sales | 37 | | | 32 | | | | | |

| Rental cost of sales - related parties | 15 | | | 39 | | | | | |

| Purchases - related parties | 319 | | | 298 | | | | | |

| Depreciation and amortization | 313 | | | 329 | | | | | |

| | | | | | | |

| General and administrative expenses | 78 | | | 86 | | | | | |

| | | | | | | |

| Other taxes | 34 | | | 32 | | | | | |

| Total costs and expenses | 1,550 | | | 1,365 | | | | | |

| Income from operations | 1,060 | | | 974 | | | | | |

| Related party interest and other financial costs | 4 | | | — | | | | | |

Interest expense (net of amounts capitalized of $2 million, $5 million, respectively) | 198 | | | 198 | | | | | |

| Other financial costs | 20 | | | 27 | | | | | |

| Income before income taxes | 838 | | | 749 | | | | | |

| Provision for income taxes | 5 | | | 1 | | | | | |

| Net income | 833 | | | 748 | | | | | |

| Less: Net income attributable to noncontrolling interests | 8 | | | 9 | | | | | |

| | | | | | | |

| Net income attributable to MPLX LP | 825 | | | 739 | | | | | |

| Less: Series A preferred unitholders interest in net income | 21 | | | 20 | | | | | |

| Less: Series B preferred unitholders interest in net income | 11 | | | 11 | | | | | |

| | | | | | | |

| Limited partners’ interest in net income attributable to MPLX LP | $ | 793 | | | $ | 708 | | | | | |

| Per Unit Data (See Note 6) | | | | | | | |

| Net income attributable to MPLX LP per limited partner unit: | | | | | | | |

| Common - basic | $ | 0.78 | | | $ | 0.68 | | | | | |

| Common - diluted | $ | 0.78 | | | $ | 0.68 | | | | | |

| Weighted average limited partner units outstanding: | | | | | | | |

| Common - basic | 1,015 | | | 1,037 | | | | | |

| Common - diluted | 1,015 | | | 1,037 | | | | | |

| | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

MPLX LP

Consolidated Statements of Comprehensive Income (Unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | | | |

| (In millions) | 2022 | | 2021 | | | | | | |

| Net income | $ | 833 | | | $ | 748 | | | | | | | |

| Other comprehensive income, net of tax: | | | | | | | | | |

| Remeasurements of pension and other postretirement benefits related to equity method investments, net of tax | 9 | | | (2) | | | | | | | |

| Comprehensive income | 842 | | | 746 | | | | | | | |

| Less comprehensive income attributable to: | | | | | | | | | |

| Noncontrolling interests | 8 | | | 9 | | | | | | | |

| | | | | | | | | |

| Comprehensive income attributable to MPLX LP | $ | 834 | | | $ | 737 | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

MPLX LP

Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | |

| (In millions) | March 31, 2022 | | December 31, 2021 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 42 | | | $ | 13 | |

| | | |

| Receivables, net | 741 | | | 654 | |

| Current assets - related parties | 813 | | | 644 | |

| Inventories | 149 | | | 142 | |

| | | |

| Other current assets | 53 | | | 54 | |

| Total current assets | 1,798 | | | 1,507 | |

| Equity method investments | 4,079 | | | 3,981 | |

| Property, plant and equipment, net | 19,912 | | | 20,042 | |

| Intangibles, net | 800 | | | 831 | |

| Goodwill | 7,657 | | | 7,657 | |

| Right of use assets, net | 280 | | | 268 | |

| Noncurrent assets - related parties | 1,151 | | | 1,161 | |

| Other noncurrent assets | 50 | | | 60 | |

| Total assets | 35,727 | | | 35,507 | |

| Liabilities | | | |

| Current liabilities: | | | |

| Accounts payable | 214 | | | 172 | |

| Accrued liabilities | 396 | | | 363 | |

| | | |

| | | |

| | | |

| Current liabilities - related parties | 687 | | | 1,780 | |

| Accrued property, plant and equipment | 91 | | | 97 | |

| | | |

| Long-term debt due within one year | 999 | | | 499 | |

| Accrued interest payable | 192 | | | 202 | |

| Operating lease liabilities | 47 | | | 59 | |

| | | |

| Other current liabilities | 232 | | | 176 | |

| Total current liabilities | 2,858 | | | 3,348 | |

| Long-term deferred revenue | 405 | | | 383 | |

| Long-term liabilities - related parties | 305 | | | 302 | |

| Long-term debt | 18,757 | | | 18,072 | |

| Deferred income taxes | 14 | | | 10 | |

| Long-term operating lease liabilities | 228 | | | 205 | |

| Deferred credits and other liabilities | 159 | | | 170 | |

| Total liabilities | 22,726 | | | 22,490 | |

| Commitments and contingencies (see Note 14) | | | |

Series A preferred units (30 million and 30 million units issued and outstanding) | 965 | | | 965 | |

| Equity | | | |

Common unitholders - public (366 million and 369 million units issued and outstanding) | 8,505 | | | 8,579 | |

| | | |

Common unitholders - MPC (647 million and 647 million units issued and outstanding) | 2,698 | | | 2,638 | |

| | | |

| | | |

Series B preferred units (0.6 million and 0.6 million units issued and outstanding) | 601 | | | 611 | |

| | | |

| Accumulated other comprehensive loss | (8) | | | (17) | |

| Total MPLX LP partners’ capital | 11,796 | | | 11,811 | |

| Noncontrolling interests | 240 | | | 241 | |

| Total equity | 12,036 | | | 12,052 | |

| Total liabilities, preferred units and equity | $ | 35,727 | | | $ | 35,507 | |

The accompanying notes are an integral part of these consolidated financial statements.

MPLX LP

Consolidated Statements of Cash Flows (Unaudited) | | | | | | | | | | | |

| Three Months Ended March 31, |

| (In millions) | 2022 | | 2021 |

| Operating activities: | | | |

| Net income | $ | 833 | | | $ | 748 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Amortization of deferred financing costs | 18 | | | 17 | |

| Depreciation and amortization | 313 | | | 329 | |

| | | |

| Deferred income taxes | 4 | | | — | |

| | | |

| Loss on disposal of assets | 18 | | | — | |

| Income from equity method investments | (99) | | | (70) | |

| Distributions from unconsolidated affiliates | 120 | | | 119 | |

| Change in fair value of derivatives | (9) | | | 3 | |

| Changes in: | | | |

| Current receivables | (87) | | | (67) | |

| Inventories | (7) | | | (11) | |

| Current accounts payable and accrued liabilities | 73 | | | 26 | |

| Current assets/current liabilities - related parties | (112) | | | (8) | |

| | | |

| Right of use assets/operating lease liabilities | (1) | | | (1) | |

| Deferred revenue | 16 | | | 24 | |

| All other, net | 45 | | | 15 | |

| Net cash provided by operating activities | 1,125 | | | 1,124 | |

| Investing activities: | | | |

| Additions to property, plant and equipment | (169) | | | (126) | |

| | | |

| Disposal of assets | 3 | | | 70 | |

| | | |

| Investments in unconsolidated affiliates | (110) | | | (35) | |

| | | |

| | | |

| All other, net | — | | | 1 | |

| Net cash used in investing activities | (276) | | | (90) | |

| Financing activities: | | | |

| Long-term debt - borrowings | 2,385 | | | 1,910 | |

| - repayments | (1,201) | | | (2,020) | |

| Related party debt - borrowings | 1,849 | | | 2,241 | |

| - repayments | (2,976) | | | (2,241) | |

| Debt issuance costs | (16) | | | — | |

| | | |

| Unit repurchases | (100) | | | (155) | |

| | | |

| | | |

| | | |

| | | |

| Distributions to noncontrolling interests | (9) | | | (10) | |

| Distributions to Series A preferred unitholders | (21) | | | (20) | |

| Distributions to Series B preferred unitholders | (21) | | | (21) | |

| Distributions to unitholders and general partner | (716) | | | (713) | |

| | | |

| Contributions from MPC | 10 | | | 7 | |

| | | |

| All other, net | (4) | | | (3) | |

| Net cash used in financing activities | (820) | | | (1,025) | |

| Net increase in cash, cash equivalents and restricted cash | 29 | | | 9 | |

| Cash, cash equivalents and restricted cash at beginning of period | 13 | | | 15 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 42 | | | $ | 24 | |

The accompanying notes are an integral part of these consolidated financial statements.

MPLX LP

Consolidated Statements of Equity and Series A Preferred Units (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Partnership | | | | | | | | | | | |

| (In millions) | Common

Unit-holders

Public | | Common

Unit-holder

MPC | | Series B Preferred Unit-holders | | Accumulated Other Comprehensive Loss | | Non-controlling

Interests | | | | Total | | | Series A Preferred Unit-holders |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | |

| | | |

| Balance at December 31, 2020 | $ | 9,384 | | | $ | 2,792 | | | $ | 611 | | | $ | (15) | | | $ | 245 | | | | | $ | 13,017 | | | | $ | 968 | |

| Net income | 266 | | | 443 | | | 11 | | | — | | | 9 | | | | | 729 | | | | 20 | |

| Unit Repurchases | (155) | | | — | | | — | | | — | | | — | | | | | (155) | | | | — | |

| Distributions | (269) | | | (445) | | | (21) | | | — | | | (10) | | | | | (745) | | | | (20) | |

| Contributions | — | | | 7 | | | — | | | — | | | — | | | | | 7 | | | | — | |

| Other | — | | | (1) | | | — | | | (2) | | | — | | | | | (3) | | | | — | |

| Balance at March 31, 2021 | $ | 9,226 | | | $ | 2,796 | | | $ | 601 | | | $ | (17) | | | $ | 244 | | | | | $ | 12,850 | | | | $ | 968 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | |

| | | |

| | | | | | | | | | | | | | | | |

| Balance at December 31, 2021 | $ | 8,579 | | | $ | 2,638 | | | $ | 611 | | | $ | (17) | | | $ | 241 | | | | | $ | 12,052 | | | | $ | 965 | |

| | | | | | | | | | | | | | | | |

| Net income | 287 | | | 506 | | | 11 | | | — | | | 8 | | | | | 812 | | | | 21 | |

| Unit Repurchases | (100) | | | — | | | — | | | — | | | — | | | | | (100) | | | | — | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Distributions | (260) | | | (456) | | | (21) | | | — | | | (9) | | | | | (746) | | | | (21) | |

| Contributions | — | | | 10 | | | — | | | — | | | — | | | | | 10 | | | | — | |

| | | | | | | | | | | | | | | | |

| Other | (1) | | | — | | | — | | | 9 | | | — | | | | | 8 | | | | — | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Balance at March 31, 2022 | $ | 8,505 | | | $ | 2,698 | | | $ | 601 | | | $ | (8) | | | $ | 240 | | | | | $ | 12,036 | | | | $ | 965 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

Notes to Consolidated Financial Statements (Unaudited)

1. Description of the Business and Basis of Presentation

Description of the Business

MPLX LP is a diversified, large-cap master limited partnership formed by Marathon Petroleum Corporation that owns and operates midstream energy infrastructure and logistics assets, and provides fuels distribution services. References in this report to “MPLX LP,” “MPLX,” “the Partnership,” “we,” “ours,” “us,” or like terms refer to MPLX LP and its subsidiaries. References to “MPC” refer collectively to Marathon Petroleum Corporation as our sponsor and its subsidiaries, other than the Partnership. We are engaged in the gathering, transportation, storage and distribution of crude oil, refined products and other hydrocarbon-based products; the gathering, processing and transportation of natural gas; and the gathering, transportation, fractionation, storage and marketing of NGLs. MPLX’s principal executive office is located in Findlay, Ohio.

MPLX’s business consists of two segments based on the nature of services it offers: Logistics and Storage (“L&S”), which relates primarily to crude oil, refined products and other hydrocarbon-based products; and Gathering and Processing (“G&P”), which relates primarily to natural gas and NGLs. See Note 7 for additional information regarding the operations and results of these segments.

Basis of Presentation

The accompanying interim consolidated financial statements are unaudited; however, in the opinion of MPLX’s management, these statements reflect all adjustments necessary for a fair statement of the results for the periods reported. All such adjustments are of a normal, recurring nature unless otherwise disclosed. These interim consolidated financial statements, including the notes, have been prepared in accordance with the rules and regulations of the SEC applicable to interim period financial statements and do not include all of the information and disclosures required by GAAP for complete financial statements. Certain information derived from our audited annual financial statements, prepared in accordance with GAAP, has been condensed or omitted from these interim financial statements.

These interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2021. The results of operations for the three months ended March 31, 2022 are not necessarily indicative of the results to be expected for the full year.

MPLX’s consolidated financial statements include all majority-owned and controlled subsidiaries. For non-wholly owned consolidated subsidiaries, the interests owned by third parties have been recorded as “Noncontrolling interests” on the accompanying Consolidated Balance Sheets. Intercompany investments, accounts and transactions have been eliminated. MPLX’s investments in which MPLX exercises significant influence but does not control and does not have a controlling financial interest are accounted for using the equity method. MPLX’s investments in VIEs in which MPLX exercises significant influence but does not control and is not the primary beneficiary are also accounted for using the equity method.

Certain prior period financial statement amounts have been reclassified to conform to current period presentation.

2. Accounting Standards

Recently Adopted

ASU 2021-10, Government Assistance (Topic 832): Disclosures by Business Entities about Government Assistance

In November 2021, the FASB issued guidance requiring disclosures for certain types of government assistance that have been accounted for by analogy to grant or contribution models. Disclosures will include information about the type of transactions, accounting and the impact on financial statements. MPLX prospectively adopted this standard in the first quarter of 2022. The adoption of this standard did not have a material impact on our financial statements or disclosures.

3. Investments and Noncontrolling Interests

The following table presents MPLX’s equity method investments at the dates indicated:

| | | | | | | | | | | | | | | | | |

| Ownership as of | | Carrying value at |

| March 31, | | March 31, | | December 31, |

| (In millions, except ownership percentages) | 2022 | | 2022 | | 2021 |

| L&S | | | | | |

MarEn Bakken Company LLC(1) | 25% | | $ | 502 | | | $ | 449 | |

| Illinois Extension Pipeline Company, L.L.C. | 35% | | 249 | | | 243 | |

| LOOP LLC | 41% | | 274 | | | 265 | |

Andeavor Logistics Rio Pipeline LLC(2) | 67% | | 181 | | | 183 | |

| Minnesota Pipe Line Company, LLC | 17% | | 182 | | | 183 | |

Whistler Pipeline LLC(2) | 38% | | 166 | | | 155 | |

| Explorer Pipeline Company | 25% | | 65 | | | 66 | |

W2W Holdings LLC(2) | 50% | | 56 | | | 58 | |

| | | | | |

Other(2) | | | 125 | | | 116 | |

| Total L&S | | | 1,800 | | | 1,718 | |

| G&P | | | | | |

MarkWest Utica EMG, L.L.C.(2) | 57% | | 681 | | | 680 | |

Sherwood Midstream LLC(2) | 50% | | 539 | | | 544 | |

MarkWest EMG Jefferson Dry Gas Gathering Company, L.L.C.(2) | 67% | | 336 | | | 332 | |

MarkWest Torñado GP, L.L.C.(2) | 60% | | 266 | | | 246 | |

Rendezvous Gas Services, L.L.C.(2) | 78% | | 145 | | | 147 | |

Sherwood Midstream Holdings LLC(2) | 51% | | 133 | | | 136 | |

| | | | | |

| Centrahoma Processing LLC | 40% | | 133 | | | 133 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Other(2) | | | 46 | | | 45 | |

| Total G&P | | | 2,279 | | | 2,263 | |

| Total | | | $ | 4,079 | | | $ | 3,981 | |

(1) The investment in MarEn Bakken Company LLC includes our 9.19 percent indirect interest in a joint venture (“Dakota Access”) that owns and operates the Dakota Access Pipeline and Energy Transfer Crude Oil Pipeline projects, collectively referred to as the Bakken Pipeline system or DAPL.

(2) Investments deemed to be VIEs. Some investments included within “Other” have also been deemed to be VIEs.

For those entities that have been deemed to be VIEs, neither MPLX nor any of its subsidiaries have been deemed to be the primary beneficiary due to voting rights on significant matters. While we have the ability to exercise influence through participation in the management committees which make all significant decisions, we have equal influence over each committee as a joint interest partner and all significant decisions require the consent of the other investors without regard to economic interest; as such, we have determined that these entities should not be consolidated and apply the equity method of accounting with respect to our investments in each entity.

Sherwood Midstream LLC (“Sherwood Midstream”) has been deemed the primary beneficiary of Sherwood Midstream Holdings LLC (“Sherwood Midstream Holdings”) due to its controlling financial interest through its authority to manage the joint venture. As a result, Sherwood Midstream consolidates Sherwood Midstream Holdings. Therefore, MPLX also reports its portion of Sherwood Midstream Holdings’ net assets as a component of its investment in Sherwood Midstream. As of March 31, 2022, MPLX has a 24.55 percent indirect ownership interest in Sherwood Midstream Holdings through Sherwood Midstream.

MPLX’s maximum exposure to loss as a result of its involvement with equity method investments includes its equity investment, any additional capital contribution commitments and any operating expenses incurred by the subsidiary operator in excess of its compensation received for the performance of the operating services. MPLX did not provide any financial support to equity method investments that it was not contractually obligated to provide during the three months ended March 31, 2022.

Summarized financial information for MPLX’s equity method investments for the three months ended March 31, 2022 and 2021 is as follows:

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2022 |

| (In millions) | VIEs | | Non-VIEs | | Total |

| Revenues and other income | $ | 249 | | | $ | 308 | | | $ | 557 | |

| Costs and expenses | 137 | | | 129 | | | 266 | |

| Income from operations | 112 | | | 179 | | | 291 | |

| Net income | 103 | | | 166 | | | 269 | |

| Income from equity method investments | $ | 55 | | | $ | 44 | | | $ | 99 | |

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2021 |

| (In millions) | VIEs | | Non-VIEs | | Total |

| Revenues and other income | $ | 163 | | | $ | 284 | | | $ | 447 | |

| Costs and expenses | 107 | | | 131 | | | 238 | |

| Income from operations | 56 | | | 153 | | | 209 | |

| Net income | 64 | | | 140 | | | 204 | |

| Income from equity method investments | $ | 39 | | | $ | 31 | | | $ | 70 | |

Summarized balance sheet information for MPLX’s equity method investments as of March 31, 2022 and December 31, 2021 is as follows:

| | | | | | | | | | | | | | | | | |

| March 31, 2022 |

| (In millions) | VIEs | | Non-VIEs | | Total |

| Current assets | $ | 386 | | | $ | 370 | | | $ | 756 | |

| Noncurrent assets | 7,482 | | | 4,875 | | | 12,357 | |

| Current liabilities | 773 | | | 259 | | | 1,032 | |

| Noncurrent liabilities | $ | 1,929 | | | $ | 789 | | | $ | 2,718 | |

| | | | | | | | | | | | | | | | | |

| December 31, 2021 |

| (In millions) | VIEs | | Non-VIEs | | Total |

| Current assets | $ | 335 | | | $ | 411 | | | $ | 746 | |

| Noncurrent assets | 7,439 | | | 4,895 | | | 12,334 | |

| Current liabilities | 217 | | | 310 | | | 527 | |

| Noncurrent liabilities | $ | 2,461 | | | $ | 788 | | | $ | 3,249 | |

4. Related Party Agreements and Transactions

MPLX engages in transactions with both MPC and certain of its equity method investments as part of its normal business; however, transactions with MPC make up the majority of MPLX’s related party transactions. Transactions with related parties are further described below.

MPLX has various long-term, fee-based commercial agreements with MPC. Under these agreements, MPLX provides transportation, gathering, terminal, fuels distribution, marketing, storage, management, operational and other services to MPC. MPC has committed to provide MPLX with minimum quarterly throughput volumes on crude oil and refined products, other fees for storage capacity, operating and management fees, as well as reimbursements for certain direct and indirect costs. MPC has also committed to provide a fixed fee for 100 percent of available capacity for boats, barges and third-party chartered equipment under the marine transportation service agreement. MPLX also has a keep-whole commodity agreement with MPC under which MPC pays us a processing fee for NGLs related to keep-whole agreements and delivers shrink gas to the producers on our behalf. We pay MPC a marketing fee in exchange for assuming the commodity risk. Additionally, MPLX has obligations to MPC for services provided to MPLX by MPC under omnibus and employee services-type agreements as well as other agreements.

Related Party Loan

MPLX is party to a loan agreement with MPC Investment LLC (“MPC Investment”) (the “MPC Loan Agreement”). Under the terms of the agreement, MPC Investment extends loans to MPLX on a revolving basis as requested by MPLX and as agreed to by MPC Investment. The borrowing capacity of the MPC Loan Agreement is $1.5 billion aggregate principal amount of all loans outstanding at any one time. The loan agreement is scheduled to expire, and borrowings under the loan agreement are scheduled to mature and become due and payable, on July 31, 2024, provided that MPC Investment may demand payment of all or any portion of the outstanding principal amount of the loan, together with all accrued and unpaid interest and other amounts (if any), at any time prior to maturity. Borrowings under the MPC Loan Agreement bear interest at LIBOR plus 1.25 percent or such lower rate as would be applicable to such loans under the MPLX Credit Agreement as discussed in Note 11.

Activity on the MPC Loan Agreement was as follows:

| | | | | | | | | | | |

| Three Months Ended March 31, |

| (In millions) | 2022 | | 2021 |

| Borrowings | $ | 1,849 | | | $ | 2,241 | |

| Average interest rate of borrowings | 1.400 | % | | 1.371 | % |

| Repayments | $ | 2,976 | | | $ | 2,241 | |

| Outstanding balance at end of period | $ | 323 | | | $ | — | |

Related Party Revenue

Related party sales to MPC primarily consist of crude oil and refined products pipeline and trucking transportation services based on tariff or contracted rates; storage, terminal and fuels distribution services based on contracted rates; and marine transportation services. Related party sales to MPC also consist of revenue related to volume deficiency credits.

MPLX also has operating agreements with MPC under which it receives a fee for operating MPC’s retained pipeline assets and a fixed annual fee for providing oversight and management services required to run the marine business. MPLX also receives management fee revenue for engineering, construction and administrative services for operating certain of its equity method investments. These agreements are classified as “Other income - related parties” on the Consolidated Statements of Income.

Certain product sales to MPC net to zero within the consolidated financial statements as the transactions are recorded net due to the terms of the agreements under which such product was sold. For the three months ended March 31, 2022 and March 31, 2021, these sales totaled $293 million and $168 million, respectively.

Related Party Expenses

MPC charges MPLX for executive management services and certain general and administrative services to MPLX under the terms of our omnibus agreements (“Omnibus charges”). Omnibus charges included in “Rental cost of sales - related parties” primarily relate to services that support MPLX’s rental operations and maintenance of assets available for rent, as well as compensation expenses. Omnibus charges included in “Purchases - related parties” primarily relate to services that support MPLX’s operations and maintenance activities, as well as compensation expenses. Omnibus charges included in “General and administrative expenses” primarily relate to services that support MPLX’s executive management, accounting and human resources activities. MPLX also obtains employee services from MPC under employee services agreements (“ESA charges”). ESA charges for personnel directly involved in or supporting operations and maintenance activities related to rental services are classified as “Rental cost of sales - related parties.” ESA charges for personnel directly involved in or supporting operations and maintenance activities related to other services are classified as “Purchases - related parties.” ESA charges for personnel involved in executive management, accounting and human resources activities are classified as “General and administrative expenses.” In addition to these agreements, MPLX purchases products from MPC, makes payments to MPC in its capacity as general contractor to MPLX, and has certain lease agreements with MPC.

For the three months ended March 31, 2022 and March 31, 2021, “General and administrative expenses” incurred from MPC totaled $55 million and $57 million, respectively.

Some charges incurred under the omnibus and ESA agreements are related to engineering services and are associated with assets under construction. These charges are added to “Property, plant and equipment, net” on the Consolidated Balance Sheets. For the three months ended March 31, 2022 and March 31, 2021, these charges totaled $19 million and $12 million, respectively.

Related Party Assets and Liabilities

Assets and liabilities with related parties appearing on the Consolidated Balance Sheets are detailed in the table below. This table identifies the various components of related party assets and liabilities, including those associated with leases and deferred revenue on minimum volume commitments. If MPC fails to meet its minimum committed volumes, MPC will pay MPLX a deficiency payment based on the terms of the agreement. The deficiency amounts received under these agreements (excluding payments received under agreements classified as sales-type leases) are recorded as “Current liabilities - related parties.” In many cases, MPC may then apply the amount of any such deficiency payments as a credit for volumes in excess of its minimum volume commitment in future periods under the terms of the applicable agreements. MPLX recognizes related party revenues for the deficiency payments when credits are used for volumes in excess of minimum quarterly volume commitments, where it is probable the customer will not use the credit in future periods or upon the expiration of the credits. The use or expiration of the credits is a decrease in “Current liabilities - related parties.” Deficiency payments under agreements that have been classified as sales-type leases are recorded as a reduction against the corresponding lease receivable. In addition, capital projects MPLX undertakes at the request of MPC are reimbursed in cash and recognized as revenue over the remaining term of the applicable agreements or in some cases, as a contribution from MPC.

| | | | | | | | | | | |

| (In millions) | March 31, 2022 | | December 31, 2021 |

| Current assets - related parties | | | |

| Receivables | $ | 707 | | | $ | 555 | |

| Prepaid | 17 | | | 4 | |

| Other | 3 | | | 3 | |

| Lease receivables | 86 | | | 82 | |

| Total | 813 | | | 644 | |

| Noncurrent assets - related parties | | | |

| Long-term receivables | 30 | | | 31 | |

| Right of use assets | 229 | | | 229 | |

| Long-term lease receivables | 828 | | | 854 | |

| Unguaranteed residual asset | 64 | | | 47 | |

| Total | 1,151 | | | 1,161 | |

| Current liabilities - related parties | | | |

MPC loan agreement and other payables(1) | 606 | | | 1,702 | |

| Operating lease liabilities | 1 | | | 1 | |

| | | |

| Deferred revenue - Minimum volume deficiencies | 38 | | | 35 | |

| | | |

| | | |

| Deferred revenue - Project reimbursements | 42 | | | 42 | |

| Total | 687 | | | 1,780 | |

| Long-term liabilities - related parties | | | |

| Long-term operating lease liabilities | 228 | | | 228 | |

| | | |

| | | |

| | | |

| | | |

| Long-term deferred revenue - Project reimbursements | 77 | | | 74 | |

| Total | $ | 305 | | | $ | 302 | |

(1) Includes $323 million as of March 31, 2022 and $1,450 million as of December 31, 2021 related to outstanding borrowings on the intercompany loan with MPC, which are included in “Current liabilities - related parties” on the Consolidated Balance Sheets.

5. Equity

The changes in the number of common units during the three months ended March 31, 2022 are summarized below:

| | | | | | | | | | | |

| (In units) | Common | | | | | | |

| Balance at December 31, 2021 | 1,016,178,378 | | | | | | | |

| Unit-based compensation awards | 148,951 | | | | | | | |

| Units redeemed in unit repurchase program | (3,119,522) | | | | | | | |

| | | | | | | |

| Balance at March 31, 2022 | 1,013,207,807 | | | | | | | |

Unit Repurchase Program

On November 2, 2020, MPLX announced the board authorization of a unit repurchase program for the repurchase of up to $1 billion of MPLX’s outstanding common units held by the public. MPLX may utilize various methods to effect the repurchases, which could include open market repurchases, negotiated block transactions, tender offers, accelerated unit repurchases or open market solicitations for units, some of which may be effected through Rule 10b5-1 plans. The timing and amount of repurchases will depend upon several factors, including market and business conditions, and repurchases may be initiated, suspended or discontinued at any time. The repurchase authorization has no expiration date. During the three months ended March 31, 2022, we repurchased 3,119,522 common units at an average cost per unit of $32.06 per unit and paid $100 million of cash. As of March 31, 2022, we had $237 million remaining under our repurchase authorization.

Series B Preferred Units

MPLX has 600,000 outstanding units of 6.875 percent Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units representing limited partner interests of MPLX with a price to the public of $1,000 per unit (the “Series B preferred units”). The Series B preferred units are pari passu with the Series A preferred units with respect to distribution rights and rights upon liquidation. Series B preferred unitholders are entitled to receive a fixed distribution of $68.75 per unit, per annum, payable semi-annually in arrears on the 15th day, or the first business day thereafter, of February and August of each year up to and including February 15, 2023. After February 15, 2023, the holders of Series B preferred units are entitled to receive cumulative, quarterly distributions payable in arrears on the 15th day of February, May, August and November of each year, or the first business day thereafter, based on a floating annual rate equal to the three-month LIBOR plus 4.652 percent, in each case assuming a distribution is declared by the Board of Directors. MPLX has the right to redeem some or all of the Series B preferred units, at any time, on or after February 15, 2023 at the Series B preferred unit redemption price of $1,000 per unit, plus any accumulated and unpaid distributions up to the redemption date.

Cash distributions

On April 26, 2022, MPLX declared a cash distribution for the first quarter of 2022, totaling $713 million, or $0.7050 per common unit. This distribution will be paid on May 13, 2022 to common unitholders of record on May 6, 2022. This rate will also be received by Series A preferred unitholders.

Quarterly distributions for 2022 and 2021 are summarized below:

| | | | | | | | | | | |

| (Per common unit) | 2022 | | 2021 |

| March 31, | $ | 0.7050 | | | $ | 0.6875 | |

| | | |

| | | |

| | | |

In accordance with the distribution rights discussed above, MPLX made a cash distribution totaling $21 million to Series B unitholders on February 15, 2022.

The allocation of total quarterly cash distributions to limited and preferred unitholders is as follows for the three months ended March 31, 2022 and 2021. Distributions, although earned, are not accrued until declared. MPLX’s distributions are declared subsequent to quarter end; therefore, the following table represents total cash distributions applicable to the period in which the distributions were earned.

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| (In millions) | 2022 | | 2021 | | | | |

| Common and preferred unit distributions: | | | | | | | |

| Common unitholders, includes common units of general partner | $ | 713 | | | $ | 707 | | | | | |

| | | | | | | |

Series A preferred unit distributions | 21 | | | 20 | | | | | |

| Series B preferred unit distributions | 11 | | | 11 | | | | | |

| Total cash distributions declared | $ | 745 | | | $ | 738 | | | | | |

6. Net Income/(Loss) Per Limited Partner Unit

Net income/(loss) per unit applicable to common units is computed by dividing net income attributable to MPLX LP less income allocated to participating securities by the weighted average number of common units outstanding.

During the three months ended March 31, 2022 and 2021, MPLX had participating securities consisting of common units, certain equity-based compensation awards, Series A preferred units and Series B preferred units and had dilutive potential common units consisting of certain equity-based compensation awards. Potential common units omitted from the diluted earnings per unit calculation for the three months ended March 31, 2022 and 2021 were less than 1 million.

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| (In millions) | 2022 | | 2021 | | | | |

| Net income attributable to MPLX LP | $ | 825 | | | $ | 739 | | | | | |

| Less: Distributions declared on Series A preferred units | 21 | | | 20 | | | | | |

| | | | | | | |

| Distributions declared on Series B preferred units | 11 | | | 11 | | | | | |

| Limited partners’ distributions declared on MPLX common units (including common units of general partner) | 713 | | | 707 | | | | | |

| | | | | | | |

| Undistributed net gain attributable to MPLX LP | $ | 80 | | | $ | 1 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2022 |

| (In millions, except per unit data) | Limited Partners’

Common Units | | | | Series A Preferred Units | | Series B Preferred Units | | Total |

| Basic and diluted net income attributable to MPLX LP per unit | | | | | | | | | |

| Net income attributable to MPLX LP: | | | | | | | | | |

| Distributions declared | $ | 713 | | | | | $ | 21 | | | $ | 11 | | | $ | 745 | |

| Undistributed net gain attributable to MPLX LP | 78 | | | | | 2 | | | — | | | 80 | |

Net income attributable to MPLX LP(1) | $ | 791 | | | | | $ | 23 | | | $ | 11 | | | $ | 825 | |

| Weighted average units outstanding: | | | | | | | | | |

| Basic | 1,015 | | | | | | | | | |

| Diluted | 1,015 | | | | | | | | | |

| Net income attributable to MPLX LP per limited partner unit: | | | | | | | | | |

| Basic | $ | 0.78 | | | | | | | | | |

| Diluted | $ | 0.78 | | | | | | | | | |

(1) Allocation of net income attributable to MPLX LP assumes all earnings for the period had been distributed based on the distribution priorities applicable to the period.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2021 |

| (In millions, except per unit data) | Limited Partners’

Common Units | | Series A Preferred Units | | Series B Preferred Units | | Total |

| Basic and diluted net income attributable to MPLX LP per unit | | | | | | | |

| Net income attributable to MPLX LP: | | | | | | | |

| Distributions declared | $ | 707 | | | $ | 20 | | | $ | 11 | | | $ | 738 | |

| Undistributed net gain attributable to MPLX LP | 1 | | | — | | | — | | | 1 | |

Net income attributable to MPLX LP(1) | $ | 708 | | | $ | 20 | | | $ | 11 | | | $ | 739 | |

| Weighted average units outstanding: | | | | | | | |

| Basic | 1,037 | | | | | | | |

| Diluted | 1,037 | | | | | | | |

| Net income attributable to MPLX LP per limited partner unit: | | | | | | | |

| Basic | $ | 0.68 | | | | | | | |

| Diluted | $ | 0.68 | | | | | | | |

(1) Allocation of net income attributable to MPLX LP assumes all earnings for the period had been distributed based on the distribution priorities applicable to the period.

7. Segment Information

MPLX’s chief operating decision maker is the chief executive officer (“CEO”) of its general partner. The CEO reviews MPLX’s discrete financial information, makes operating decisions, assesses financial performance and allocates resources on a type of service basis. MPLX has two reportable segments: L&S and G&P. Each of these segments is organized and managed based upon the nature of the products and services it offers.

•L&S – transports, gathers, stores and distributes crude oil, refined products, and other hydrocarbon-based products. Also includes the operation of refining logistics, fuels distribution and inland marine businesses, terminals, rail facilities, and storage caverns.

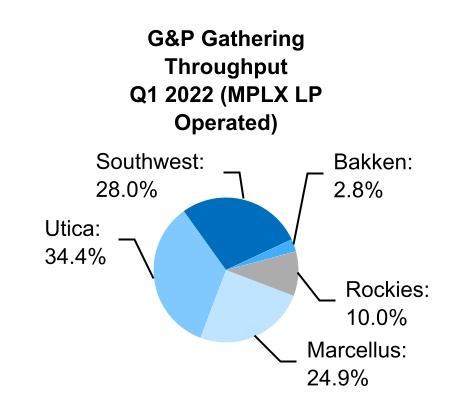

•G&P – gathers, processes and transports natural gas; and gathers, transports, fractionates, stores and markets NGLs.

Our CEO evaluates the performance of our segments using Segment Adjusted EBITDA. Amounts included in net income and excluded from Segment Adjusted EBITDA include: (i) depreciation and amortization; (ii) interest and other financial costs; (iii) impairment expense; (iv) income/(loss) from equity method investments; (v) distributions and adjustments related to equity method investments; (vi) noncontrolling interests; and (vii) other adjustments as deemed necessary. These items are either: (i) believed to be non-recurring in nature; (ii) not believed to be allocable or controlled by the segment; or (iii) are not tied to the operational performance of the segment.

The tables below present information about revenues and other income, Segment Adjusted EBITDA, restructuring expenses, capital expenditures and investments in unconsolidated affiliates for our reportable segments:

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| (In millions) | 2022 | | 2021 | | | | |

| L&S | | | | | | | |

| Service revenue | $ | 983 | | | $ | 953 | | | | | |

| Rental income | 175 | | | 249 | | | | | |

| Product related revenue | 4 | | | 4 | | | | | |

| Sales-type lease revenue | 111 | | | 37 | | | | | |

| Income from equity method investments | 52 | | | 36 | | | | | |

| Other income | 12 | | | 15 | | | | | |

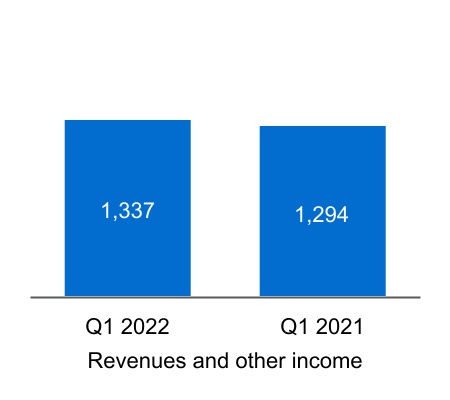

Total segment revenues and other income(1) | 1,337 | | | 1,294 | | | | | |

Segment Adjusted EBITDA(2) | 904 | | | 896 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Capital expenditures | 77 | | | 59 | | | | | |

| Investments in unconsolidated affiliates | 68 | | | 9 | | | | | |

| G&P | | | | | | | |

| Service revenue | 486 | | | 508 | | | | | |

| Rental income | 81 | | | 92 | | | | | |

| Product related revenue | 661 | | | 397 | | | | | |

| Income from equity method investments | 47 | | | 34 | | | | | |

| Other income/(loss) | (2) | | | 14 | | | | | |

Total segment revenues and other income(1) | 1,273 | | | 1,045 | | | | | |

Segment Adjusted EBITDA(2) | 489 | | | 456 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Capital expenditures | 95 | | | 30 | | | | | |

| Investments in unconsolidated affiliates | $ | 42 | | | $ | 26 | | | | | |

(1) Within the total segment revenues and other income amounts presented above, third party revenues for the L&S segment were $135 million and $129 million for the three months ended March 31, 2022 and March 31, 2021, respectively. Third party revenues for the G&P segment were $1,212 million and $989 million for the three months ended March 31, 2022 and March 31, 2021, respectively.

(2) See below for the reconciliation from Segment Adjusted EBITDA to “Net income.”

The table below provides a reconciliation between “Net income” and Segment Adjusted EBITDA.

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| (In millions) | 2022 | | 2021 | | | | |

| Reconciliation to Net income: | | | | | | | |

| L&S Segment Adjusted EBITDA | $ | 904 | | | $ | 896 | | | | | |

| G&P Segment Adjusted EBITDA | 489 | | | 456 | | | | | |

| Total reportable segments | 1,393 | | | 1,352 | | | | | |

Depreciation and amortization(1) | (313) | | | (329) | | | | | |

| | | | | | | |

| Interest and other financial costs | (222) | | | (225) | | | | | |

| Income from equity method investments | 99 | | | 70 | | | | | |

| Distributions/adjustments related to equity method investments | (132) | | | (121) | | | | | |

| | | | | | | |

| | | | | | | |

| Other | (1) | | | (9) | | | | | |

| Adjusted EBITDA attributable to noncontrolling interests | 9 | | | 10 | | | | | |

| | | | | | | |

| Net income | $ | 833 | | | $ | 748 | | | | | |

(1) Depreciation and amortization attributable to L&S was $130 million and $147 million for the three months ended March 31, 2022 and March 31, 2021, respectively. Depreciation and amortization attributable to G&P was $183 million and $182 million for the three months ended March 31, 2022 and March 31, 2021, respectively.

8. Property, Plant and Equipment

Property, plant and equipment with associated accumulated depreciation is shown below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | March 31, 2022 | | December 31, 2021 |

| (In millions) | | | Gross PP&E | | Accumulated Depreciation | | Net PP&E | | Gross PP&E | | Accumulated Depreciation | | Net PP&E |

| L&S | | | $ | 12,438 | | | $ | 3,347 | | | $ | 9,091 | | | $ | 12,371 | | | $ | 3,227 | | | $ | 9,144 | |

| G&P | | | 14,253 | | | 3,432 | | | 10,821 | | | 14,175 | | | 3,277 | | | 10,898 | |

| Total | | | $ | 26,691 | | | $ | 6,779 | | | $ | 19,912 | | | $ | 26,546 | | | $ | 6,504 | | | $ | 20,042 | |

9. Fair Value Measurements

Fair Values – Recurring

Fair value measurements and disclosures relate primarily to MPLX’s derivative positions as discussed in Note 10.

Level 3 instruments relate to an embedded derivative liability for a natural gas purchase commitment embedded in a keep-whole processing agreement. The fair value calculation for these Level 3 instruments used significant unobservable inputs including: (1) NGL prices interpolated and extrapolated due to inactive markets ranging from $0.73 to $2.38 per gallon with a weighted average of $0.97 per gallon and (2) the probability of renewal of 100 percent for the five-year renewal term of the gas purchase commitment and related keep-whole processing agreement. Increases or decreases in the fractionation spread result in an increase or decrease in the fair value of the embedded derivative liability, respectively. Beyond the embedded derivative discussed above, we had no outstanding commodity derivative contracts as of March 31, 2022 or December 31, 2021.

Changes in Level 3 Fair Value Measurements

The following table is a reconciliation of the net beginning and ending balances recorded for net assets and liabilities classified as Level 3 in the fair value hierarchy.

| | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended March 31, |

| | | | | 2022 | | | | | | 2021 |

| (In millions) | | | | | Embedded Derivatives in Commodity Contracts (net) | | | | | | Embedded Derivatives in Commodity Contracts (net) |

| Fair value at beginning of period | | | | | $ | (108) | | | | | | | $ | (63) | |

Total gain/(loss) (realized and unrealized) included in earnings(1) | | | | | 4 | | | | | | | (6) | |

| Settlements | | | | | 5 | | | | | | | 3 | |

| | | | | | | | | | | |

| Fair value at end of period | | | | | (99) | | | | | | | (66) | |

| The amount of total gain/(loss) for the period included in earnings attributable to the change in unrealized gain/(loss) relating to liabilities still held at end of period | | | | | $ | 5 | | | | | | | $ | (5) | |

(1) Gain/(loss) on derivatives embedded in commodity contracts are recorded in “Purchased product costs” on the Consolidated Statements of Income.

Fair Values – Reported

MPLX’s primary financial instruments are cash and cash equivalents, receivables, receivables from related parties, lease receivables from related parties, accounts payable, payables to related parties and debt. MPLX’s fair value assessment incorporates a variety of considerations, including (1) the duration of the instruments, (2) MPC’s investment-grade credit rating and (3) the historical incurrence of and expected future insignificance of bad debt expense, which includes an evaluation of counterparty credit risk. MPLX believes the carrying values of its current assets and liabilities approximate fair value. The recorded value of the amounts outstanding under the bank revolving credit facility, if any, approximates fair value due to the variable interest rate that approximate current market rates. Derivative instruments are recorded at fair value, based on available market information (see Note 10).

The fair value of MPLX’s debt is estimated based on recent market non-binding indicative quotes. The debt fair values are considered Level 3 measurements. The following table summarizes the fair value and carrying value of our third-party debt, excluding finance leases and unamortized debt issuance costs:

| | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2022 | | December 31, 2021 |

| (In millions) | Fair Value | | Carrying Value | | Fair Value | | Carrying Value |