UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

OUR |

To improve the quality of life and the environment through the use of power management technologies and services. |

|

LEADERSHIP ATTRIBUTES |

Our culture and what we value are represented in the attributes of all Eaton employees.

■ Ethical: We are ethical. We play by the rules and act with integrity.

■ Passionate: We are passionate. We care deeply about what we do. We set high expectations and we perform.

■ Accountable: We are accountable. We seek responsibility and take ownership. We do what we say.

■ Efficient: We are efficient. We value speed and simplicity.

■ Transparent: We are transparent. We say what we think. We make it okay to disagree.

■ Learner: We learn. We are curious, adaptable and willing to teach what we know.

|

MEETING AGENDA:

| 1. | Electing the 9 director nominees named in the Proxy Statement; |

| 2. | Approving the appointment of Ernst & Young as independent auditor for 2024 and authorizing the Audit Committee of the Board of Directors to set its remuneration; |

| 3. | Approving, on an advisory basis, the Company’s executive compensation; |

| 4. | Approving a proposal to grant the Board authority to issue shares under Irish law; |

| 5. | Approving a proposal to grant the Board authority to opt-out of pre-emption rights under Irish law; |

| 6. | Authorizing the Company and any subsidiary of the Company to make overseas market purchases of Company shares; |

| 7. | Transacting any other business that may properly come before the meeting. |

Proposals 1, 2, 3, 4, and 6 are ordinary resolutions requiring a simple majority of the votes cast at the meeting or by proxy. Proposal 5 is a special resolution requiring the affirmative vote of at least 75% of the votes cast at the meeting or by proxy. Each proposal is more fully described in the accompanying proxy statement.

Also during the meeting, management will present Eaton’s Irish Statutory Accounts for the fiscal year ended December 31, 2023 along with the related directors’ and auditor’s reports.

If you hold your shares through a broker, bank or other nominee in “street name” (instead of as a registered holder) and you wish to vote during the Annual General Meeting, you will need a legal proxy from your broker, bank or other nominee that you must follow for your shares to be voted.

By order of the Board of Directors,

Nigel Crawford

Vice President and Secretary

March 15, 2024

| Date: | April 24, 2024 |

| Time: | 9:00 a.m. local time |

| Eaton House | |

| Location | 30 Pembroke Road |

| Dublin 4, Ireland |

Record date: February 26, 2024

Online proxy delivery and voting: As permitted by the Securities and Exchange Commission (“SEC”), we are making this proxy statement, the Company’s annual report to shareholders and our Irish Statutory Accounts available to our shareholders electronically via the Internet. We believe electronic delivery expedites your receipt of materials, reduces the environmental impact of our Annual General Meeting and reduces costs significantly. The Notice Regarding Internet Availability of Proxy Materials (the “Notice”) contains instructions on how you can access the proxy materials and how to vote online. If you received the Notice by mail, you will not receive a printed copy of the proxy materials unless you request one in accordance with the instructions provided in the Notice. The Notice has been mailed to shareholders commencing on March 15, 2024.

| YOUR VOTE IS IMPORTANT. WE ENCOURAGE YOU TO VOTE. |

| If possible, please vote your shares using the Internet instructions found in the Notice. Alternatively, you may request a printed copy of the proxy materials and mark, sign, date and mail your proxy form in the postage-paid envelope that will be provided. Voting by any of these methods will not limit your right to vote in person at the Annual General Meeting. Under New York Stock Exchange rules, if you hold your shares in “street name” through a brokerage account, your broker will NOT be able to vote your shares on non-routine matters being considered at the Annual General Meeting unless you have given instructions to your broker prior to the meeting on how to vote your shares. Proposals 1 and 3 are considered non-routine matters under New York Stock Exchange rules. This means that you must give specific voting instructions to your broker on how to vote your shares so that your vote can be counted. |

Important Notice Regarding Internet Availability of Proxy Materials for the Annual General Meeting of Shareholders to be held on April 24, 2024: This proxy statement, the Company’s 2023 Annual Report to Shareholders and our Irish Statutory Accounts for the year ended December 31, 2023 are available at www.proxyvote.com.

| EATON 2024 Proxy Statement and Notice of Meeting |

This summary provides an overview of the items that you will find elsewhere in this proxy statement. We encourage you to read the entire proxy statement for more information about these topics before voting.

This proxy statement, Eaton’s annual report for the year ended December 31, 2023 and our Irish Statutory Accounts for the year ended December 31, 2023 will be made available or sent to shareholders commencing on or about March 15, 2024.

Throughout this proxy statement, all references to our Board of Directors for periods prior to November 30, 2012, are references to the Board of Directors of Eaton Corporation, our predecessor. Similarly, all references to the Company for such periods refer to Eaton Corporation.

This year there are six proposals on the agenda. Adoption of Proposals 1, 2, 3, 4, and 6 requires the affirmative vote of a majority of the votes cast in person or by proxy. Adoption of Proposal 5 requires the affirmative vote of at least 75% of the votes cast in person or by proxy.

| Proposals | Board Voting Recommendations |

Page | ||

| Proposal 1 To elect the 9 director nominees named in this Proxy Statement |

|

FOR each nominee | 6 | |

| Proposal

2 To appoint Ernst & Young as independent auditor for the 2024 fiscal year and to authorize the Audit Committee to set the auditor fees |

|

FOR | 23 | |

| Proposal

3 To approve, on an advisory (non-binding) basis, our named executive officers’ compensation as described in this Proxy Statement |

|

FOR | 25 | |

| Proposal 4 To grant the Board authority to issue shares under Irish law |

|

FOR | 70 | |

| Proposal 5 To grant the Board authority to opt-out of pre-emption rights under Irish law |

|

FOR | 71 | |

| Proposal 6 To authorize the Company and any subsidiaries of the Company to make overseas market purchases of Company shares |

|

FOR | 73 | |

| EATON 2024 Proxy Statement and Notice of Meeting | 1 |

Eaton’s Code of Ethics and Board of Directors Governance Guidelines help to ensure that we “do business right.” For more information about our governance programs and Board of Directors, see Proposal 1 beginning on page 6.

| Board and Governance Information | Board and Governance Information | |||

| Number of new Directors added in the last three years | 2 | Mandatory retirement Age | Yes | |

| Board Meetings Held in 2023 (average Director attendance 95.83%) | 4 | Proxy access rights for shareholders | Yes | |

| Diverse Board committee chairs | Yes | Holders of 10% of the outstanding stock may call a special meeting of shareholders | Yes | |

| Annual election of all Directors | Yes | Board orientation and Continuing Education Program | Yes | |

| Majority voting for Directors | Yes | Board-level oversight of Environmental, Social & Governance (ESG) matters | Yes | |

| Independent Lead Director | Yes | Code of Ethics for Directors, officers and employees | Yes | |

| Independent Directors meet without management present | Yes | Succession planning | Yes | |

| Director stock ownership guidelines | Yes | Sustainability reporting: SASB, TCFD and GRI | Yes |

| EATON 2024 Proxy Statement and Notice of Meeting | 2 |

Each director nominee is elected annually by a majority of votes cast. For more information about our nominees, see pages 6 through 10 of this proxy statement.

| Board Committee Memberships | Other Public Company Boards |

|||||||||||||||||||||||

| Name | Age(1) | Director Since |

Independent | Audit | Compensation & Organization |

Executive(2) | Finance | Governance | Innovation & Technology |

Gender(3) | Race / Ethnicity(4) | |||||||||||||

| Craig Arnold Chairman, Eaton Corporation plc and Chief Executive Officer, Eaton Corporation |

63 | 2015 |  |

1 | Male | Black / African American | ||||||||||||||||||

| Silvio Napoli Chief Executive Officer and Executive Chairman of the Board, Schindler Holding Ltd. |

58 | 2019 |  |

|

|

|

|

1 | Male | White / Caucasian | ||||||||||||||

| Gregory R. Page Retired Chairman and Chief Executive Officer, Cargill |

72 | 2003 |  |

|

|

|

3 | Male | White / Caucasian | |||||||||||||||

| Sandra Pianalto Retired President and Chief Executive Officer of the Federal Reserve Bank of Cleveland |

69 | 2014 |  |

|

|

|

|

1 | Female | White / Caucasian | ||||||||||||||

| Robert V. Pragada Chief Executive Officer, Jacobs Solutions Inc. |

55 | 2021 |  |

|

|

|

1 | Male | Indian / South Asian | |||||||||||||||

| Lori J. Ryerkerk Chairman, Chief Executive Officer and President, Celanese Corporation |

61 | 2020 |  |

|

|

|

|

1 | Female | White / Caucasian | ||||||||||||||

| Gerald B. Smith Chairman, Smith Graham & Co. |

73 | 2012 |  |

|

|

|

1 | Male | Black / African American | |||||||||||||||

| Dorothy C. Thompson Retired Chief Executive, Drax Group plc |

63 | 2016 |  |

|

|

|

1 | Female | White / Caucasian | |||||||||||||||

| Darryl L. Wilson Founder, Chairman and President of The Wilson Collective |

60 | 2021 |  |

|

|

2 | Male | Black / African American | ||||||||||||||||

| (1) | Average age of Director nominees (as

of Annual General Meeting) is 64.42.  Member Member  Chair Chair |

| (2) | Mr. Arnold was a member of the Executive Committee for all of 2023 and serves as Committee Chair. The Lead Director and the chairs of each Board Committee serve as members of the Executive Committee. It did not meet in 2023. |

| (3) | Director gender identification based on such Director’s self-identification from the following: Female, Male, Non-Binary |

| (4) | Director racial/ethnic identification based on such Director’s self-identification from the following: Asian, Black/ African American, Hispanic/ Latin American, Indian/ South Asian, Middle Eastern/ North African, Native American, Alaska Native, Native Hawaiian, or other Pacific Islander, or White/ Caucasian |

| EATON 2024 Proxy Statement and Notice of Meeting | 3 |

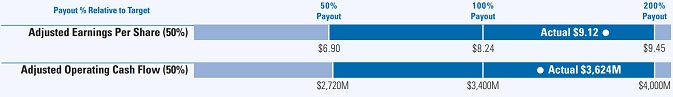

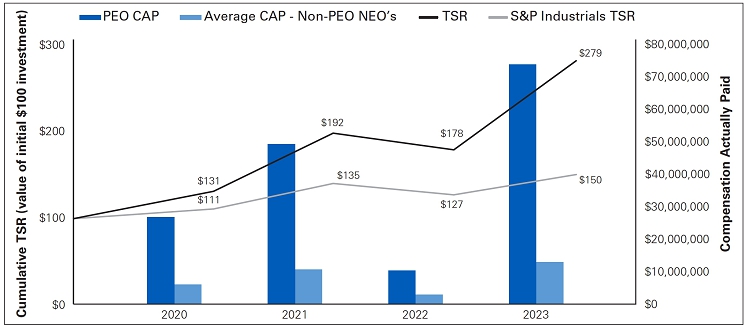

Our executive compensation programs reflect the belief that the amount earned by our executives must, to a significant extent, depend on achieving rigorous Company, business unit and individual performance objectives designed to enhance shareholder value. The chart below shows the payouts as a percentage of target under our performance-based short- and long-term incentive programs and total return to shareholders over Mr. Arnold’s tenure as CEO, illustrating the strong correlation between pay and the performance we are delivering to our shareholders.

TOTAL SHAREHOLDER RETURN (TSR) AND PERFORMANCE-BASED INCENTIVE PLAN PAYOUTS

| (1) | In 2015, we changed the length of our performance-based long-term award periods from four to three years. As a result, two long-term performance periods ended on December 31, 2017. Awards for each period were earned at 25% of target. |

| (2) | In 2016, we changed the long-term incentive plan performance criteria from Adjusted Earnings per Share growth and Cash Flow Return on Gross Capital (weighted equally) to relative TSR. The first TSR-based award period began on January 1, 2016 and ended on December 31, 2018. More information about our short- and long-term incentive programs begins on page 37. |

| (3) | In 2021, we replaced the Cash Flow Return on Gross Capital metric that had been used in our short-term incentive plan since 1993 with an Adjusted Operating Cash Flow metric. This metric and an Adjusted Earnings per Share metric serve as the financial performance measures in our short-term incentive plan. |

| EATON 2024 Proxy Statement and Notice of Meeting | 4 |

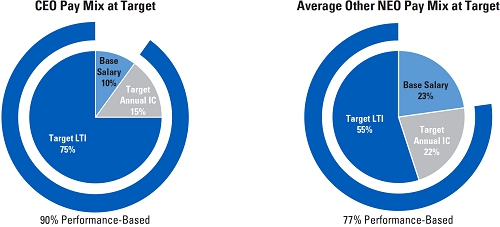

We design our executive compensation plans and programs to help us attract, motivate, reward, and retain highly qualified executives who are capable of creating and sustaining value for our shareholders over the long term. We endorse compensation actions that fairly reflect company performance as well as the responsibilities and personal performance of individual executives.

Our executive compensation programs are intended to align the interests of our executives with those of our stakeholders and are structured to reflect best practices. Some features of our programs are included in the following chart.

2023 EXECUTIVE COMPENSATION PRACTICES

| What We Do: | What We Don’t Do: | |||

|

Focus on long-term compensation to deliver rewards based on sustained performance over time |  |

No employment contracts with any salaried U.S. employees, including named executive officers | |

|

Stock ownership requirements for executives (6X base salary for CEO) |  |

No hedging or pledging of our shares | |

|

Caps in our short- and long-term incentive plans prevent unintended windfalls |  |

No dividend or dividend equivalent payments on unearned performance-based grants | |

|

Compensation recovery policy (clawbacks) |  |

No repricing of stock options and no discounted stock options | |

|

Use different metrics in short- and long-term incentive plans which focus on absolute and relative performance |  |

No tax gross ups | |

| Say On Pay 2023 Advisory Vote |

|

The Board of Directors is committed to understanding the views of our shareholders by providing an opportunity to endorse our executive compensation through an advisory, non-binding vote. In 2023, our shareholders approved our executives’ compensation by a vote of 92%.

The Committee will continue to review our compensation programs each year in light of the annual “say-on-pay” voting results and feedback we receive from our shareholders.

|

| EATON 2024 Proxy Statement and Notice of Meeting | 5 |

Our Board of Directors is currently comprised of 9 members. Each nominee is being nominated for election for a one-year term ending at the 2025 Annual General Meeting. All nominees are currently Eaton directors who were elected by shareholders at the 2023 Annual General Meeting.

If any of the nominees become unable or decline to serve, the individuals acting as proxies will have the authority to vote for any substitutes who may be nominated in accordance with our Articles of Association. However, we have no reason to believe that this will occur.

|

Craig Arnold Chairman, Eaton Corporation plc Craig Arnold is Chairman of the Company and Chief Executive Officer of Eaton Corporation. Mr. Arnold joined Eaton in 2000 as senior vice president and group executive of the Fluid Power Group. He was Vice Chairman and Chief Operating Officer of the Industrial Sector until August 2015 and President and Chief Operating Officer until June 2016. Mr. Arnold currently serves on the boards of Medtronic plc, The Business Roundtable and University Hospitals Health System. He serves as a director of The Greater Cleveland Partnership and United Way of Greater Cleveland. Mr. Arnold is also a member of The Business Council and the advisory board of The Salvation Army of Greater Cleveland.

Director Qualifications: Mr. Arnold’s years of senior management and executive leadership experience at Eaton provide important insight into the Company to the benefit of the Board of Directors. Mr. Arnold has gained detailed knowledge of Eaton’s businesses, customers, end markets, sales and marketing, technology innovation and new product development, supply chains, manufacturing operations, talent development, policies and internal functions through his service in a wide range of management roles within the Industrial Sector, and as President and Chief Operating Officer of the Company. Further, he possesses significant corporate governance knowledge developed by current and past service on the boards of other publicly traded companies, most notably for Medtronic plc, a publicly traded company domiciled in Ireland. |

Director

since 2015

|

| Director Skills and Experience per Company’s Director Skills Matrix: | ||||||||

| ■ | Operations and Manufacturing | ■ | Risk Management | ■ | Mergers and Acquisitions | |||

| ■ | Innovation and Technology | ■ | Human Capital Management | ■ | Global | |||

| ■ | Cybersecurity | ■ | Financial | ■ | Regulatory and Government | |||

| EATON 2024 Proxy Statement and Notice of Meeting | 6 |

|

Silvio Napoli Chief Executive Officer and Executive Chairman, Schindler Holding Ltd. Silvio Napoli is Chief Executive Officer and Executive Chairman of the Board of Directors of Schindler Holding Ltd., one of the world’s leading providers of elevators, escalators and related services. He joined the Schindler Group in 1994. During his time with Schindler, he served in a number of leadership roles including director of corporate development, president and chief executive officer of Schindler India, president of Asia-Pacific, and as the company’s chief executive officer. He previously worked for The Dow Chemical Company in Europe.

Director Skills and Qualifications: As the Chief Executive Officer and executive chairman of a large global industrial company, Mr. Napoli has extensive executive leadership experience and is very knowledgeable in the management of industrial products and services. In particular, he has considerable experience in the areas of talent development, financial management, manufacturing and product innovation, and risk management. Mr. Napoli also brings a dynamic international business perspective and global corporate strategy experience to the Board, which are of particular benefit in his role as Chair of the Innovation and Technology Committee. |

Director

since 2019

|

| Director Skills and Experience per Company’s Director Skills Matrix: | ||||||||

| ■ | Operations and Manufacturing | ■ | Risk Management | ■ | Mergers and Acquisitions | |||

| ■ | Innovation and Technology | ■ | Human Capital Management | ■ | Global | |||

| ■ | Cybersecurity | ■ | Financial | ■ | Regulatory and Government | |||

|

Gregory R. Page Retired Chairman and Chief Executive Officer, Cargill Gregory R. Page is the retired Chairman and Chief Executive Officer of Cargill, an international marketer, processor and distributor of agricultural, food, financial and industrial products and services. He was named Corporate Vice President & Sector President, Financial Markets and Red Meat Group of Cargill in 1998, Corporate Executive Vice President, Financial Markets and Red Meat Group in 1999, and President and Chief Operating Officer in 2000. He became Chairman and Chief Executive Officer in 2007 and was named Executive Chairman in 2013. Mr. Page served as Executive Director from 2015 to 2016, after which he retired from the Cargill Board. He is a director of 3M and Deere & Company and is non-executive chairman and a director of Corteva, Inc. Mr. Page is past Chairman and current board member of Big Brothers Big Sisters of America, past President and a board member of the Northern Star Council of the Boy Scouts of America, and a board member of Alight (fka the American Refugee Committee).

Director Skills and Qualifications: As the retired Chairman and former Chief Executive Officer of one of the largest global corporations, Mr. Page brings extensive leadership and global business experience, in-depth knowledge of commodity markets, and a thorough familiarity with the key operating processes of a major corporation, including financial systems and processes, global market dynamics, succession management, and sustainable practices. Mr. Page’s experience and expertise enable him to provide valuable insight on financial, operational and strategic matters. His senior leadership experience is of particular benefit to Eaton in his role as Lead Director. |

Lead Director Director since 2003

|

| Director Skills and Experience per Company’s Director Skills Matrix: | ||||||||

| ■ | Operations and Manufacturing | ■ | Risk Management | ■ | Mergers and Acquisitions | |||

| ■ | Innovation and Technology | ■ | Human Capital Management | ■ | Global | |||

| ■ | Financial | ■ | Regulatory and Government | |||||

| EATON 2024 Proxy Statement and Notice of Meeting | 7 |

|

Sandra Pianalto Retired President and Chief Executive Officer of the Federal Reserve Bank of Cleveland Sandra Pianalto served as President and Chief Executive Officer of the Federal Reserve Bank of Cleveland from February 2003 until her retirement in June 2014. She joined the Bank in 1983 as an economist in the research department and was appointed Assistant Vice President of public affairs in 1984, Vice President and Secretary to the board of directors in 1988, and Vice President and Chief Operating Officer in 1993. Before joining the Bank, Ms. Pianalto was an economist at the Federal Reserve Board of Governors and served on the staff of the Budget Committee of the U.S. House of Representatives. She is currently a director of Prudential Financial, Inc. Ms. Pianalto is an Executive in Residence at the University of Akron. She is a lifetime trustee and past chair of the board of University Hospitals Health System and life director and past chair of the board of United Way of Greater Cleveland.

Director Skills and Qualifications: Ms. Pianalto has extensive experience in monetary policy and financial services and brings to Eaton wide-ranging leadership and operating skills through her former roles with the Federal Reserve Bank of Cleveland. As Chief Executive Officer of the Bank, she developed expertise in economic research, management of financial institutions, and payment services to banks and the U.S. Treasury. Ms. Pianalto’s comprehensive experience qualifies her to provide substantial guidance and oversight to the Board in her role as Chair of the Finance Committee. |

Director

since 2014

|

| Director Skills and Experience per Company’s Director Skills Matrix: | ||||||||

| ■ | Operations and Manufacturing | ■ | Risk Management | ■ | Mergers and Acquisitions | |||

| ■ | Innovation and Technology | ■ | Human Capital Management | ■ | Global | |||

| ■ | Cybersecurity | ■ | Financial | ■ | Regulatory and Government | |||

|

Robert V. Pragada Chief Executive Officer, Jacobs Solutions Inc. Robert V. Pragada is the Chief Executive Officer and Director of Jacobs Solutions Inc., a professional and technical solutions company that provides consulting, technical, scientific and project delivery services for the government and private sector. Immediately prior to this role, Mr. Pragada served as the president and chief operating officer of Jacobs Solutions Inc., where he had executive oversight of the company’s global operations, which consist of the Aerospace, Technology, and Nuclear, and Buildings, Infrastructure and Advanced Facilities lines of business. Prior to joining Jacobs in 2016, Mr. Pragada served as president and chief executive officer of The Brock Group, Inc. from 2014-2016. He also served in various senior management roles for Jacobs from 2006-2014 and for Kinetic Systems, Inc. from 1998-2006. Mr. Pragada was a naval officer in the United States Navy from 1990-1998. He serves on the boards of Dallas Regional Chamber and the US Naval Academy Foundation.

Director Skills and Qualifications: As the Chief Executive Officer of a Fortune 500 company, Mr. Pragada has strong business, technology, and executive leadership skills. He also brings to Eaton extensive experience in mergers, acquisitions, and large-scale integrations. Mr. Pragada also has significant experience of importance to the Company, including excellent business and cultural transformation capabilities with proven results and deep expertise in organizational management and dynamics. |

Director

since 2021

|

| Director Skills and Experience per Company’s Director Skills Matrix: | ||||||||

| ■ | Operations and Manufacturing | ■ | Risk Management | ■ | Mergers and Acquisitions | |||

| ■ | Innovation and Technology | ■ | Human Capital Management | ■ | Global | |||

| ■ | Cybersecurity | ■ | Financial | ■ | Regulatory and Government | |||

| EATON 2024 Proxy Statement and Notice of Meeting | 8 |

|

Lori J. Ryerkerk Chairman, Chief Executive Officer and President, Celanese Corporation Lori J. Ryerkerk is the Chairman, Chief Executive Officer and President and a director of Celanese Corporation, a Fortune 500 global chemical and specialty materials company. Prior to joining Celanese in May 2019, she was the Executive Vice President of Global Manufacturing of Shell Downstream Inc. Ms. Ryerkerk joined Shell in May 2010 as Regional Vice President of Manufacturing in Europe and Africa. In October 2013, she was named Executive Vice President of Global Manufacturing. Before joining Shell, Ms. Ryerkerk was Senior Vice President, Refining, Supply and Terminals at Hess Corporation from 2008 through 2010. Prior to that, she spent 24 years with ExxonMobil and served in a variety of operational and senior leadership roles. Ms. Ryerkerk served on the board of Axalta Coating Systems Limited from 2015 through 2019.

Director Skills and Qualifications: As the Chief Executive Officer and a director of a company with global engineering and manufacturing operations, Ms. Ryerkerk has executive leadership experience in the area of industrial materials and products production. In particular, she has considerable experience in leading global operations and managing complex technologies, engineering and supply chain systems. Ms. Ryerkerk also brings an international business perspective, having previously spent time in roles in Europe and Africa. Her experience with industrial companies and in responding to changing market conditions are of particular benefit to Eaton. Her leadership experience also allows her to provide guidance and oversight in her role as Chair of the Compensation and Organization Committee. |

Director

since 2020

|

| Director Skills and Experience per Company’s Director Skills Matrix: | ||||||||

| ■ | Operations and Manufacturing | ■ | Risk Management | ■ | Mergers and Acquisitions | |||

| ■ | Innovation and Technology | ■ | Human Capital Management | ■ | Global | |||

| ■ | Cybersecurity | ■ | Financial | ■ | Regulatory and Government | |||

|

Gerald B. Smith Chairman, Smith Graham & Co. Gerald B. Smith was a director of Cooper Industries plc from 2000 until 2012 and served as lead independent director of Cooper Industries plc from 2007 to 2012. Mr. Smith joined the Board effective upon the close of the Cooper acquisition. He is Chairman and former Chief Executive Officer of Smith Graham & Co., an investment management firm that he founded in 1990. Prior to launching Smith Graham, he served as Senior Vice President and Director of Fixed Income for Underwood Neuhaus & Company. He was a member of the Board of Trustees and chair of the Investment Oversight Committee for The Charles Schwab Family of Funds from 1990 until 2020. Mr. Smith also serves as a director of ONEOK, Inc., a New York Stock Exchange listed natural gas diversified company, and a director and chair of the Investment Committee of the New York Life Insurance Company. He serves as Chairman of the Texas Southern University Foundation and a director of the Federal Reserve Bank of Dallas, and a member of the Board of Trustees of Rice University’s Baker Institute for Public Policy.

Director Skills and Qualifications: Mr. Smith has expertise in finance, portfolio management and marketing through executive positions in the financial services industry, including being founder, Chairman and Chief Executive Officer of Smith Graham & Co. His experience as a director of companies in the oil and gas and energy services businesses has provided him with valuable insight into markets in which Eaton also participates. Mr. Smith’s past experience as lead independent director of Cooper provides ongoing institutional knowledge of legacy Cooper businesses and has benefited the process of integrating Cooper into Eaton. His experience and expertise provide him valuable insight on financial, operational and strategic matters in his role as Chair of the Audit Committee. |

Director

since 2012

|

| Director Skills and Experience per Company’s Director Skills Matrix: | ||||||||

| ■ | Operations and Manufacturing | ■ | Risk Management | ■ | Mergers and Acquisitions | |||

| ■ | Innovation and Technology | ■ | Human Capital Management | ■ | Global | |||

| ■ | Cybersecurity | ■ | Financial | ■ | Regulatory and Government | |||

| EATON 2024 Proxy Statement and Notice of Meeting | 9 |

|

Dorothy C. Thompson Retired Chief Executive, Drax Group plc Dorothy C. Thompson CBE is the retired Chief Executive and director of Drax Group plc, an international renewable energy company, where she served from 2005 until her retirement in 2017. Before joining Drax, Ms. Thompson managed InterGen NV’s European power business, was assistant group treasurer at Powergen plc and worked at CDC Capital Partners, the private sector arm of the British Government’s aid program. Ms. Thompson serves as an independent non-executive chair of Rotork plc, a global flow control and instrumentation company. She also serves as non-executive chair of Statera Energy Limited, a renewable energy company. Ms. Thompson was a member of the Court of Directors of the Bank of England, where she also served as Chair of the Audit and Risk Committee and Senior Independent Director. She also served from 2018 through 2021 as the non-executive chair of Tullow Oil plc, the London Stock Exchange listed oil exploration and production company. She was also a director of Johnson Matthey Plc from 2007 through 2016.

Director Skills and Qualifications: As the Chief Executive of Drax, Ms. Thompson gained unique insight into the sourcing, generation and supply of sustainable and renewable energy, positioning her well to contribute invaluable expertise toward Eaton’s mission of accelerating the energy transition. She also brings to the Board vast experience in all aspects of finance as well as an international business perspective. Ms. Thompson’s prior work as Chair of the Audit and Risk Committee of the Bank of England and Chair of Tullow Oil plc provide her with valuable financial and governance insight and experience to the Board and Audit Committee of the Company. Her extensive experience is of particular benefit to Eaton in her role as Chair of the Governance Committee. |

Director

since 2016

|

| Director Skills and Experience per Company’s Director Skills Matrix: | ||||||||

| ■ | Operations and Manufacturing | ■ | Risk Management | ■ | Mergers and Acquisitions | |||

| ■ | Innovation and Technology | ■ | Human Capital Management | ■ | Global | |||

| ■ | Cybersecurity | ■ | Financial | ■ | Regulatory and Government | |||

|

Darryl L. Wilson Founder, Chairman and President, The Wilson Collective Darryl L. Wilson is the founder, chairman and president of The Wilson Collective, a business advisory and investment firm that invests in startup companies and provides resource and advisory services to a broad base of global clients. Prior to his retirement in 2018, Mr. Wilson spent more than 30 years in global leadership roles, with 25 years at General Electric and 5 years with British Petroleum NA. At General Electric he held a number of leadership positions including vice president of commercial, GE Power division, vice president and chief commercial officer of GE Distributed Power, vice president GE Energy Connections, president and chief executive officer of GE Aeroderivative Gas Turbines, president and chief executive officer, GE Consumer and Industrial Asia Pacific and India, president and chief executive officer, GE Consumer Products, Europe, Middle East and Africa and general manager GE Automotive Lighting. Mr. Wilson serves as an independent non-executive director of NextEra Energy, Inc., a New York Stock Exchange listed energy company. He serves as independent non-executive director of Primerica, Inc., a financial services company. He also is a director of Genserve, Inc. and formerly Chairman of the board of the Federal Reserve Bank of Dallas, Houston branch. He also serves on the boards of The Houston Endowment, Good Reason Houston and the Texas Children’s Hospital.

Director Skills and Qualifications: Mr. Wilson has extensive global leadership experience in operations, commercial management, global manufacturing, digitization and services. He brings product domain expertise in electrical power generation, power management, grid, aeroderivatives, motors, lighting and appliances. As a result of his international assignments, he also brings a global perspective to manufacturing, services and growth. Mr. Wilson brings extensive electrical industry experience to Eaton. He also has significant governance and committee experience and experiences of importance to the Company, including management of various global businesses in various industries. |

Director

since 2021

|

| Director Skills and Experience per Company’s Director Skills Matrix: | ||||||||

| ■ | Operations and Manufacturing | ■ | Risk Management | ■ | Mergers and Acquisitions | |||

| ■ | Innovation and Technology | ■ | Human Capital Management | ■ | Global | |||

| ■ | Cybersecurity | ■ | Financial | ■ | Regulatory and Government | |||

The Board of Directors recommends a vote FOR each of the director nominees. The Board of Directors recommends a vote FOR each of the director nominees. |

| EATON 2024 Proxy Statement and Notice of Meeting | 10 |

The Governance Committee of the Board, composed entirely of directors who meet the independence standards of the Board of Directors and the New York Stock Exchange, is responsible for overseeing the process of nominating individuals to stand for election as directors. The Governance Committee charter is available on our website at www.eaton.com/governance.

The Governance Committee will consider director candidates recommended by our shareholders, consistent with the process used for all candidates. To learn how to submit a shareholder recommendation, see below under “Shareholder Recommendations of Director Candidates.”

The Governance Committee Chair reviews all potential director candidates in consultation with the Chairman, typically with the assistance of a professional search firm retained by the Committee. The Committee decides whether to recommend one or more candidates to the Board of Directors for nomination. Candidates who are ultimately nominated by the Board stand for election by the shareholders at the Annual General Meeting. Between Annual General Meetings, nominees may also be elected by the Board itself.

The Board of Directors recognizes the value of nominating director candidates who bring diverse opinions, perspectives, skills, experiences, and backgrounds to Board deliberations. The Governance Committee uses a rigorous process for identifying and evaluating director nominees. In order to be recommended by the Committee, a candidate must have the following minimum qualifications, as described in the Board of Directors Governance Guidelines: personal ability, integrity, intelligence, relevant business background, independence, experience and expertise in areas of importance to our objectives, and a sensitivity to our corporate responsibilities. In addition, the Committee looks for individuals with specific qualifications so that the Board as a whole has diversity in experience, international perspective, background, expertise, skills, age, gender, and ethnicity. These specific qualifications may vary from year to year, depending upon the composition of the Board at that time. As a result of the Board’s focus on Board composition diversity, the Board is 77.78% gender and ethnically/racially diverse, 33.33% gender diverse and 44.44% racially/ethnically diverse.

The Governance Committee is responsible for ensuring that director qualifications are met and Board balance and diversity objectives are considered during its review of director candidates. The Committee annually evaluates the extent to which these goals are satisfied as part of its yearly assessment of the skills and experience of each of the current directors using a director skills matrix and a Board evaluation process.

The skills included in the director skills matrix are Cybersecurity, Financial, Global, Human Capital Management, Innovation & Technology, Mergers and Acquisitions, Operations and Manufacturing, Regulatory and Government, and Risk Management.

| Skills and experience in Company’s Director Skills Matrix |

Director Nominees | |||||

| Financial, Global, Human Capital Management, Innovation & Technology, M&A, Operations & Manufacturing, Regulatory / Government, and Risk Management | Craig Arnold Silvio Napoli Gregory R. Page | Sandra Pianalto Robert V. Pragada Lori J. Ryerkerk | Gerald B. Smith Dorothy C. Thompson Darryl L. Wilson | |||

| Cybersecurity | Craig Arnold Silvio Napoli Sandra Pianalto Robert V. Pragada |

Lori J. Ryerkerk Gerald B. Smith Dorothy C. Thompson Darryl L. Wilson | ||||

| EATON 2024 Proxy Statement and Notice of Meeting | 11 |

The Board evaluation process includes evaluation of the Board as a whole, the Committees and a self-evaluation by the independent directors. The process includes individual evaluation meetings between the Lead Director and each of the independent directors. Separately, the Chairs of each Committee lead an annual Committee evaluation at the October meetings. The Board evaluation process is designed to elicit each director’s thoughts about his or her contributions in light of the needs of the Board and the Company. The evaluation is focused on opportunities for further improvement in effectiveness, indication of preferences in future Board committee rotation, and identification of board matter priorities, including educational and orientation priorities and information. The Board evaluation process is typically conducted between the April and October meetings. At the conclusion of the evaluation process, the Board discusses the results of the evaluations at the October Board meeting and the Lead Director separately provides specific feedback to the individual directors relative to further performance improvement, educational opportunities, and other counsel.

Upon completion of the skills matrix and the evaluation process, the Governance Committee identifies areas of director knowledge and experience that may benefit the Board in the future and uses that information as part of the director search and nomination efforts, as well as further Board improvements.

The Board of Directors Governance Guidelines are available on our website at www.eaton.com/governance.

The Governance Committee will consider director candidates who are recommended to it in writing by any Eaton shareholder who submits a recommendation in accordance with our Articles of Association for nominating director candidates, including stating the reasons for the recommendation, the full name, age and address of each proposed nominee, a brief biographical history setting forth past and present directorships, past and present positions held, occupations and civic activities, and details of Company shares owned by each proposed nominee. Any shareholder wishing to recommend an individual as a nominee for election at the 2025 Annual General Meeting should send a signed letter of recommendation to the following address: Eaton Corporation plc, Attention: Company Secretary, Eaton House, 30 Pembroke Road, Dublin 4, Ireland D04 Y0C2. Recommendation letters must be received no earlier than November 15, 2024, and no later than December 15, 2024. The recommendation letter should be accompanied by a written statement from the proposed nominee consenting to be nominated and, if nominated and elected, to serve as a director.

Any shareholder wishing to recommend an individual as a nominee for election as a director must also describe in a detailed writing any financial agreement, arrangement or understanding between the nominee and any party other than the Company relating to such nominee’s potential service as a director, and details of any compensation or other payment received from any such third party relating to such nominee’s potential service as a director.

Any shareholder who intends to solicit proxies in support of director nominees other than the Company’s nominees by means of a universal proxy, must provide notice that sets forth the information required by SEC Rule 14a-19. Such notice must be postmarked or transmitted electronically no later than February 23, 2025.

The Board of Directors Governance Guidelines provide that all of our non-employee directors should be independent. The listing standards of the New York Stock Exchange state that no director can qualify as independent unless the Board of Directors affirmatively determines that he or she has no material relationship with the Company. Additional, and more stringent, standards of independence are required of Audit Committee members. Our annual proxy statement discloses the Board’s determination as to the independence of the Audit Committee members and of all non-employee directors. For our current non-employee directors and nominees, we describe these determinations here.

As permitted by the New York Stock Exchange listing standards, the Board of Directors has determined that certain categories of relationships between a non-employee director and the Company will be treated as immaterial for purposes of determining a director’s independence. These “categorical” standards are included in the Board of Directors’ independence criteria. The independence criteria for non-employee directors and members of the Audit Committee are available on our website at www.eaton.com/governance.

Because director independence may be influenced by the use of Company aircraft and other Company-paid transportation, the Board has adopted a policy on this subject.

| EATON 2024 Proxy Statement and Notice of Meeting | 12 |

In their review of director and nominee independence, the Board of Directors and its Governance Committee have considered the following circumstances:

| ■ | Former Director Olivier Leonetti and current Directors Silvio Napoli, Robert V. Pragada and Lori J. Ryerkerk serve, or have served during 2023, as executive officers of companies that had purchases and/or sales of property or services with Eaton during 2023. In each case, the amounts of the purchases and sales met the Board’s categorical standard for immateriality; that is, they were less than the greater of $1 million or 2% of the annual consolidated gross revenues of the director’s company. Mr. Leonetti was Executive Vice President and Chief Financial Officer of Johnson Controls International plc, which had purchases of approximately $840,000 from Eaton and sales of approximately $736,000 to Eaton during 2023. Mr. Napoli is the Chairman and Chief Executive Officer of Schindler Holding Ltd., which had purchases of approximately $802,000 from Eaton and sales of approximately $10,000 to Eaton during 2023. Mr. Pragada is the Chief Executive Officer of Jacobs Solutions Inc., which received a net amount of approximately $276,000 in credits/refunds for purchases from Eaton during 2023. Ms. Ryerkerk is the Chairman, Chief Executive Officer and President of Celanese Corporation, which had purchases of approximately $101,000 from Eaton and sales of approximately $2,810,000 to Eaton during 2023. |

| ■ | The use of our aircraft and other Company-paid transportation by all non-employee directors is consistent with Board policy. |

After reviewing the circumstances described above (which are the only relevant circumstances known to the Board of Directors), the Board has affirmatively determined that none of our non-employee directors has a material relationship with the Company other than in his or her capacity as a director, and that all of our non-employee directors qualify as independent under the Board’s independence criteria and the New York Stock Exchange standards. All members of the Audit, Compensation and Organization, Finance, Governance, and Innovation and Technology Committees qualify as independent under the standards described above.

The Board also has affirmatively determined that each member who served on the Audit Committee at any time during 2023, Olivier Leonetti, Sandra Pianalto, Gerald Smith, Dorothy Thompson and Darryl Wilson, met not only our Board’s independence criteria but the special independence standards required by the New York Stock Exchange and the Sarbanes-Oxley Act of 2002 and the related rules adopted by the Securities and Exchange Commission. Further, each member of the Audit Committee on the date of this Proxy Statement continues to meet such criteria and standards.

Our Board of Directors has adopted a written policy to identify and evaluate “related person transactions,” that is, transactions between the Company and any of our executive officers, directors, director nominees, 5%-plus security holders or members of their “immediate families,” or organizations where they or their family members serve as officers or employees. The Board policy calls for the disinterested members of the Board’s Governance Committee to conduct an annual review of all such transactions. At the Committee’s direction, a survey is conducted annually of all transactions involving related persons, and the Committee reviews the results in February of each year. The Committee is responsible for determining whether any “related person transaction” (i) poses a significant risk of impairing, or appearing to impair, the judgment or objectivity of the individuals involved; (ii) poses a significant risk of impairing, or appearing to impair, the independence of an outside director or director nominee; or (iii) has terms that are less favorable to us than those generally available in the marketplace. Depending upon the Committee’s assessment of these risks, the Committee will respond appropriately. In addition, as required by the rules of the Securities and Exchange Commission, any transactions that are material to a related person are disclosed in our proxy statement.

As disclosed above, the Governance Committee is charged with reviewing issues involving director independence and all related persons transactions. The Committee and the Board have determined that since the beginning of 2023, the only related person transactions were those described above under the heading “Director Independence” and that none of our executive officers engaged in any such transactions. The Committee also concluded that none of the related person transactions posed risks to the Company in any of the areas described above.

| EATON 2024 Proxy Statement and Notice of Meeting | 13 |

The Board of Directors has the following standing committees: Audit, Compensation and Organization, Executive, Finance, Innovation and Technology, and Governance.

| Audit Committee | Met 5 times in 2023 | ||

|

Gerald B. Smith Sandra Pianalto |

The functions of the Audit Committee include assisting the Board in overseeing:

■ the integrity of our consolidated financial statements and our systems of internal accounting and financial controls; ■ the independence, qualifications and performance of our independent auditor; ■ the performance of our internal auditors; ■ the cybersecurity program as part of the risk oversight function; and ■ our compliance with legal and regulatory requirements.

The Committee also has sole authority to appoint, compensate and terminate the independent auditor, and pre-approves all auditing services and permitted non-audit services that the audit firm may perform for the Company. The Committee is also responsible for negotiating the audit fees. In order to ensure continuing auditor independence, the Committee periodically considers whether there should be a rotation of the independent audit firm. In conjunction with the mandated rotation of the audit firm’s lead engagement partner, the Committee and its Chair are directly involved in the selection of the audit firm’s new lead engagement partner. Among its other responsibilities, the Committee meets regularly in separate Executive Sessions with our independent auditor and senior leaders of Eaton Corporation, including the Chief Financial Officer, Executive Vice President and Chief Legal Officer, Senior Vice President-Internal Audit, Executive Vice President and Chief Information Officer, and Senior Vice President-Global Ethics and Compliance; approves the Committee’s report to be included in our annual proxy statement; assures that performance evaluations of the Audit Committee are conducted annually; and establishes procedures for the proper handling of complaints concerning accounting or auditing matters.

Each Committee member meets the independence requirements, and all Committee members collectively meet the other requirements, of the New York Stock Exchange, the Sarbanes-Oxley Act of 2002 and the Securities and Exchange Commission. In addition, Committee members are prohibited from serving on more than two other public company audit committees. The Board of Directors has determined that each member of the Audit Committee is financially literate, that Mr. Smith and Mses. Pianalto and Thompson each qualify as an audit committee financial expert (as defined in Securities and Exchange Commission rules) and that all members of the Audit Committee have accounting or related financial management expertise. | ||

| EATON 2024 Proxy Statement and Notice of Meeting | 14 |

| Compensation and Organization Committee | Met 4 times in 2023 | ||

|

Lori J. Ryerkerk Silvio Napoli |

The functions of the Compensation and Organization Committee include:

■ reviewing proposed organization or responsibility changes at the senior officer level; ■ evaluating the performance of the Company’s Chairman and Eaton Corporation’s Chief Executive Officer with input from all non-employee directors; ■ reviewing the performance evaluations of the other senior officers; ■ reviewing succession planning; ■ reviewing our practices for recruiting and developing a diverse talent pool; ■ determining the annual salaries and short- and long-term incentive opportunities for our senior officers; ■ establishing performance objectives under our short-and long-term incentive compensation plans and assessing performance against these objectives; ■ annually determining the aggregate amount of awards to be made under our short-term incentive compensation plans and adjusting those amounts as it deems appropriate within the terms of those plans; ■ annually determining the individual awards to be made to our senior officers under our short- and long-term incentive compensation plans; ■ overseeing our stock plans; ■ reviewing compensation practices as they relate to key employees to confirm that those plans remain equitable and competitive; ■ reviewing significant new employee benefit plans or significant changes in such plans or changes with a disproportionate effect on our officers or primarily benefiting key employees; and ■ issuing an annual report for our proxy statement regarding executive compensation.

Additional information on the Committee’s processes and procedures is contained in the Compensation Discussion and Analysis portion of this proxy statement beginning on page 27. | ||

| Executive Committee | Did not meet in 2023 | ||

|

Craig Arnold Silvio Napoli |

The functions of the Executive Committee include:

■ acting on matters requiring Board action during the intervals between Board meetings; and ■ carrying out any function of the Board except for filling Board or Committee vacancies.

Mr. Arnold serves as Committee Chair. The Lead Director and the chairs of each Board Committee serve as members of the Executive Committee. | ||

| EATON 2024 Proxy Statement and Notice of Meeting | 15 |

| Finance Committee | Met 2 times in 2023 | ||

|

Sandra Pianalto Silvio Napoli |

The functions of the Finance Committee include:

■ the periodic review of our financial condition and the recommendation of financial policies to the Board; ■ analyzing Company policy regarding its debt-to-equity relationship; ■ reviewing and making recommendations to the Board regarding our dividend policy; ■ reviewing our cash flow, proposals for long-and short-term debt financing and the financial risk management program; ■ meeting with and reviewing the performance of the management Retirement & Investment Committee and any other fiduciaries appointed by the Board for pension and profit-sharing retirement plans; and ■ reviewing the key assumptions used to calculate annual pension expense.

| ||

| Governance Committee | Met 4 times in 2023 | ||

|

Dorothy C. Thompson Gregory R. Page |

The responsibilities of the Governance Committee include:

■ recommending to the Board improvements in our corporate governance processes and any changes in the Board Governance Guidelines; ■ advising the Board on changes in the size and composition of the Board; ■ annually submitting to the Board candidates for members and chairs of each standing Board committee; ■ in consultation with the Chief Executive Officer of Eaton Corporation, identifying and recommending to the Board candidates for Board membership; ■ reviewing and recommending to the Board the nomination of directors for re-election; ■ overseeing the orientation of new directors and the ongoing education of the Board; ■ recommending to the Board compensation of non-employee directors; ■ administering the Board’s policy on director retirements and resignations; and ■ establishing guidelines and procedures to be used by the directors to evaluate the Board’s performance.

Other responsibilities include providing oversight on significant public policy issues with respect to our relationships with shareholders, employees, customers, competitors, suppliers and the communities in which we operate, including such areas as ethics, compliance, environmental, health and safety issues, community relations, government relations, charitable contributions and shareholder relations. | ||

| Innovation & Technology Committee | Met 2 times in 2023 | ||

|

Silvio Napoli Sandra Pianalto |

The responsibilities of the Innovation & Technology Committee include:

■ reviewing technology trends that could have a material impact on the Company; ■ monitoring and reviewing the Company’s innovation and technology strategy; ■ reviewing the Company’s innovation related investments, engineering tools and organizational priorities; ■ evaluating and reviewing the Company’s capital allocation process relative to its capacity to carry out the work deemed necessary; ■ reviewing the Company’s engineering organizational structure and key members of the engineering leadership team; ■ reviewing significant potential acquisitions, partnerships or other corporate development opportunities intended to support the Company’s innovation and technology investment strategy; and ■ evaluating the Company’s competitiveness from a technology standpoint. | ||

| EATON 2024 Proxy Statement and Notice of Meeting | 16 |

The Board committee charters are available on our website at www.eaton.com/governance.

In addition to the Board of Directors Governance Guidelines, certain other policies relating to corporate governance matters are adopted from time to time by Board committees, or by the Board itself upon recommendation of the committees.

The Board of Directors held four meetings in 2023. Each of the directors attended at least 75% of the meetings of the Board and the committees on which he or she served. The average rate of attendance for all directors was 95.8%. Further, the Governance Committee conducts an annual review of director commitment levels in accordance with the Directors Governance Guidelines and affirms that all director candidates are compliant with such guidelines in relation to commitment levels at this time.

The policy of the Board of Directors is that all directors, absent exigent circumstances, should attend the Annual General Meetings. Nine out of ten of the directors on the Board at that time attended the 2023 Annual General Meeting.

The Board revised the Board of Directors Governance Guidelines most recently in October 2023, as recommended by the Governance Committee of the Board. The revised Governance Guidelines are available on our website at www.eaton.com/governance.

The Board’s policy is that the non-employee directors, all of whom qualify as “independent” under the criteria of the Board of Directors and the New York Stock Exchange, meet in Executive Session at each regular Board meeting, without the Chairman or other members of management present, to discuss topics they deem appropriate. As described more fully in “Leadership Structure” below, the Lead Director chairs these Executive Sessions.

At each meeting of the Audit, Compensation and Organization, Finance, Governance, and Innovation and Technology Committees, the Committee members (all of whom qualify as independent) hold an Executive Session, without any members of our management present, to discuss topics they deem appropriate.

Our governance structure follows a successful leadership model under which the Chief Executive Officer of Eaton Corporation also serves as Chairman of the Board of the Company. Recognizing that different leadership models may work well for other companies at different times depending upon individual circumstances, we believe that our Company has been well served by the combined Chief Executive Officer and Chairman leadership structure and that this approach has continued to be highly effective with the presence of an independent Lead Director. We believe we have benefited greatly from having a Chairman who sets the tone and direction for the Company while also having the primary responsibility as Chief Executive Officer for managing Eaton’s day-to-day operations, and allowing the Board to carry out its strategic, governance, oversight and decision-making responsibilities with the equal involvement of each Director.

Our Board is currently composed exclusively of independent directors, except for our Chairman, Mr. Arnold. Of our eight non-employee director nominees, five are currently serving or have served as a chief executive officer and/or chair of a publicly traded company. The Audit, Compensation and Organization, Finance, Governance, and Innovation and Technology Committees are chaired by independent directors. Our Chairman has benefited from the extensive leadership experience represented on our Board of Directors.

The Board evaluates the leadership structure annually, and it will continue to do so as circumstances change. In its most recent annual evaluation, the Board concluded that the current leadership structure — under which the Chief Executive Officer of Eaton Corporation serves as Chairman of the Board of the Company, our Board committees are chaired by independent directors, and a Lead Director assumes specific responsibilities on behalf of the independent directors — remains the optimal board leadership structure for our Company and our shareholders at the present time.

| EATON 2024 Proxy Statement and Notice of Meeting | 17 |

Gregory R. Page, who has served on Eaton’s Board since 2003, was elected Lead Director by our independent directors in 2022. His background is detailed on page 7. The Lead Director has specific responsibilities, including chairing meetings of the Board at which the Chairman is not present (including Executive Sessions of the Board), approving the agenda and schedule for Board meetings on behalf of the independent directors, approving information sent to the Board, serving as liaison between the Chairman and the independent directors, and being available for consultation and direct communications with shareholders and other Company stakeholders. The Lead Director has the authority to call meetings of the independent directors and to retain outside advisors who report directly to the Board of Directors. The Lead Director’s performance is assessed annually by the Board in a process led by the Chair of the Governance Committee, and the position of Lead Director is elected annually by our independent directors.

We regularly seek the perspectives of our shareholders on issues important to them, including to identify and address potential concerns related to our long-term financial viability. Additionally, we engage with many of our largest shareholders regarding ESG topics. We pursue ongoing engagement with our shareholders through:

| ■ | annual shareholders meetings; |

| ■ | annual and quarterly reporting; |

| ■ | analyst conferences and reports; |

| ■ | investor relations page on Eaton.com where shareholders can submit questions or retrieve financial information from Eaton archives; |

| ■ | meetings between investors, senior leadership and members of the Board; and |

| ■ | quarterly earnings calls |

| For additional information related to our stakeholder engagement, please visit our website at www.eaton.com. | |

Our Board of Directors, as a whole and through its committees, has responsibility for the oversight of risk management, while our management is responsible for the day-to-day management of the material risks facing the Company. The Board has chosen to retain overall responsibility for risk assessment and oversight at the Board level in light of the interrelated nature of the elements of risk, rather than delegating this responsibility to a Board committee.

The Board is also responsible for oversight of Eaton’s Enterprise Risk Management program (“ERM”), which identifies, assesses and mitigates our top risks. As part of our ERM program, we seek input from our businesses, regions and corporate functions and regularly update the Board on such risks.

| EATON 2024 Proxy Statement and Notice of Meeting | 18 |

| Board Responsibilities | ||||||||

| The Board is responsible for overseeing the strategic planning process and reviewing and monitoring management’s execution of the corporate and business plan. The Board receives updates from senior management and periodically from outside advisors regarding significant risks facing the Company. The Board and its committees exercise their risk oversight function by carefully evaluating the reports they receive from management and by making inquiries of management with respect to areas of particular interest to the Board. | ||||||||

| Audit Committee | Compensation & Organization Committee |

Governance Committee | Finance Committee | Innovation & Technology Committee | ||||

■ Reviews risks related to internal controls, disclosure, financial reporting and legal and compliance matters. ■ Reviews risks related to cybersecurity. ■ Meets regularly in closed-door sessions with our internal and external auditors and our senior leaders, including the senior members of the Finance function, the Executive Vice President and Chief Legal Officer, and the Senior Vice President-Global Ethics and Compliance. ■ Senior leadership regularly briefs the Audit Committee on cyber/information security risks. |

■ Reviews risks related to succession planning for the Company’s senior officers. ■ Reviews risks associated with the Company’s compensation programs to ensure that incentive compensation arrangements for senior executives do not encourage inappropriate risk taking, as discussed further below under “Relationship Between Compensation Plans and Risk” on page 46. ■ Reviews matters under the social pillar of ESG, which may include matters such as employee engagement, culture, training and development, inclusion and diversity and pay equity. |

■ Reviews risks related to corporate governance, such as director independence and related person transactions. ■ Reviews risks associated with the environment, health and safety. ■ Reviews other significant public policy issues, such as ethics and compliance, public and community affairs, shareholder relations, and matters related to the Company’s environmental and governance pillars of ESG. |

■ Reviews risks related to our financial condition and financial policies. ■ Reviews risks related to our policy with respect to our debt-to-equity relationship. |

■ Reviews risks related to emerging technologies and digital trends, and how these translate into new products and services developments of the Company. ■ Oversees the Company’s enterprise-wide technology and digital innovation strategy. | ||||

| Management Responsibilities | |

| ■ | Continually monitor the material risks facing the Company, including strategic risk, financial risk, operational risk, and legal and compliance risk. |

| ■ | Ensure that information with respect to any material risks is provided to the Board of Directors. |

| ■ | Implement appropriate risk management strategies. |

| ■ | Integrate risk management into our decision-making process. |

| ■ | Attend committee meetings and report on matters that may not be otherwise addressed. |

ESG is central to our business strategy. By capitalizing on the global growth trends of electrification and digitalization, we are helping to accelerate the planet’s transition to renewable energy, helping to solve the world’s most urgent power management challenges, and doing what’s best for our stakeholders and all of society. Our Board has ultimate oversight of ESG. The Board’s oversight of ESG includes review of environmental, community affairs, corporate governance, health and safety, diversity and inclusion, culture and human capital management matters. As noted above, the Governance Committee reviews matters related to the Company’s environmental and governance pillars of ESG and the Compensation and Organization Committee reviews matters related to the social pillar of ESG.

With the support and oversight of our Board of Directors, our Sustainability Executive Council, which is chaired by our Chairman and also includes our Chief Operating Officers, Chief Financial Officer, Chief Legal Officer, Chief Sustainability Officer and Chief Human Resources Officer, is responsible for developing and executing on our ESG strategy.

| EATON 2024 Proxy Statement and Notice of Meeting | 19 |

At Eaton, sustainability is at the core of not only our revenue growth strategy, but our mission – to improve the quality of life and protect the environment for people everywhere. We are guided by our commitment to do business right, to operate sustainably and to help our customers manage power – today and well into the future. Our ambitious 2030 sustainability goals outline our long-term strategy to ensure a healthy planet that supports all our stakeholders – including employees, customers, shareholders, suppliers, and our communities.

We have been transparent about our commitment to sustainability since our inaugural sustainability report in 2006 and have continued to report our progress annually. We align our Sustainability Report to the guidelines of the Sustainability Accounting Standards Board (SASB) and the Task Force for Climate-Related Financial Disclosures (TCFD) and in reference to the Global Reporting Initiative (GRI). In 2023, we released our third standalone TCFD report for governance, strategy, risk management, and metrics and targets related to our climate risks and opportunities.

| EATON 2024 Proxy Statement and Notice of Meeting | 20 |

Our efforts are aligned with the world’s leading sustainability experts, which is why we became a participant of the United Nations Global Compact, a move that conveys our commitment to doing business responsibly and advancing broader societal goals. We maintain our commitment to Business Ambition for 1.5°C, a United Nations backed campaign which aligns with our goal to reach science-based targets and carbon neutrality in our operations by 2030. This also makes us a member of the United Nations-backed Race to Zero campaign for climate action. We joined this initiative by setting science-based emissions reduction targets consistent with keeping global warming to 1.5°C above pre-industrial levels.

Further, we have reported energy and emissions data to the Carbon Disclosure Project (CDP), an international nonprofit environmental reporting organization, since 2006. In 2023, we again received an A- from CDP on our Climate Change Score, which ranks us among the leaders in our peer group.

Additionally, in relation to our human capital management efforts, and as part of our continued commitment to transparency about our progress in our inclusion and diversity efforts, in 2022, we published a Global Inclusion and Diversity Transparency Report, which includes our inclusion and diversity metrics. We have long believed an inclusive and diverse workplace is a better one. Today, we remain deeply committed to putting diverse perspectives to work and becoming a model of inclusion and diversity in our industry.

To learn more about our sustainability and ESG efforts, please visit our website at www.eaton.com, where our current Sustainability Report, TCFD Report, CDP responses, and Global Inclusion and Diversity Transparency Report can be found. Please note that the information on or accessible through our website is not part of, nor incorporated by reference into, this proxy statement.

We have a Code of Ethics that was approved by the Board of Directors. We provide training globally for all employees on our Code of Ethics. We require that all directors, officers and employees of the Company, and our subsidiaries and affiliates abide by our Code of Ethics, which is available on our website at www.eaton.com/governance. In addition, we will disclose on our website any waiver of or amendment to our Code of Ethics requiring disclosure under applicable rules.

The Board of Directors provides a process for shareholders and other interested parties to send communications to the Board, individual directors or the non-employee directors as a group. Shareholders and other interested parties may send such communications by mail or courier delivery addressed as follows:

Company Secretary

Eaton Corporation plc

Eaton House

30 Pembroke Road

Dublin 4, Ireland

D04 Y0C2

Email messages to the directors may be sent to Board@eaton.com.

Generally, the Company Secretary forwards all such communications to the Lead Director. The Lead Director determines whether the communications should be forwarded to other members of the Board and forwards them accordingly. For communications addressed to a particular member of the Board, the Chair of a particular Board committee or the non-employee directors as a group, the Company Secretary forwards those communications directly to those individuals.

| EATON 2024 Proxy Statement and Notice of Meeting | 21 |

Alternatively, correspondence may be sent to:

Lead Director

Eaton Corporation plc

Eaton House

30 Pembroke Road

Dublin 4, Ireland

D04 Y0C2

The Company Secretary maintains a log of all correspondence addressed to the Board and, except as noted below, forwards all communications to the interested directors. For example, correspondence on a financial topic would be sent to the Chair of the Finance or Audit Committees, and correspondence on governance topics to the Lead Director or Chair of the Governance Committee.

The Company Secretary makes periodic reports to the Governance Committee regarding correspondence from shareholders and other interested parties.

Derivative shareholder communications and demands for inspection of company records should be sent to the Company Secretary who will promptly disseminate such communications to the entire Board. The Board will consult with the Chief Legal Officer or his designee to determine appropriate action.

The Directors have requested that communications that do not directly relate to their duties and responsibilities as our directors be excluded from distribution and deleted from email that they access directly. Such excluded items include “spam,” advertisements, mass mailings, form letters and email campaigns that involve unduly large numbers of similar communications, solicitations for goods, services, employment or contributions, surveys and individual product inquiries or complaints. Additionally, communications that appear to be unduly hostile, intimidating, threatening, illegal or similarly inappropriate will be screened for omission. Any omitted or deleted communications will be made available to any Director upon request.

| EATON 2024 Proxy Statement and Notice of Meeting | 22 |

Shareholders are being asked to approve the appointment of our independent auditor and to authorize the Audit Committee of our Board of Directors to set the auditor’s remuneration. Appointment of the independent auditor and authorization of the Audit Committee to set its remuneration require the affirmative vote of a majority of the votes cast by the holders of ordinary shares represented at the Annual General Meeting in person or by proxy. The Audit Committee and the Board recommend that shareholders reappoint Ernst & Young as our independent auditor to audit our accounts for the fiscal year ending December 31, 2024 and authorize the Audit Committee of the Board to set the auditor’s remuneration.

A representative of Ernst & Young will be present at the Annual General Meeting to answer any questions concerning the independent auditor’s areas of responsibility and will have an opportunity to make a statement if he or she desires to do so.

The Audit Committee of the Board of Directors is responsible for assisting the Board in overseeing: (1) the integrity of the Company’s consolidated financial statements and its systems of internal accounting and financial controls, (2) the independence, qualifications and performance of the Company’s independent auditor, (3) the performance of the Company’s internal auditors, and (4) the Company’s compliance with legal and regulatory requirements. The Committee’s specific responsibilities, as described in its charter, include the sole authority to appoint, terminate and compensate the Company’s independent auditor, and to pre-approve all audit services and other permitted non-audit services to be provided to the Company by the independent auditor. The Committee is currently comprised of four directors, all of whom are independent under the Sarbanes-Oxley Act of 2002, the rules of the Securities and Exchange Commission and the Board of Directors’ own independence criteria.

The Board of Directors amended the Committee’s charter most recently on October 27, 2021. A copy of the charter is available on the Company’s website at www.eaton.com/governance.

The Audit Committee has retained Ernst & Young as Eaton’s independent auditor for 2024. Ernst & Young has been the independent auditor for the Company or its predecessor since 1923. The members of the Audit Committee and the Board believe that due to Ernst & Young’s deep knowledge of the Company and of the industries in which we operate, it is in the best interests of the Company and its shareholders to continue retention of Ernst & Young to serve as Eaton’s independent auditor.

In carrying out its responsibilities, the Audit Committee has reviewed, and has discussed with the Company’s management and independent auditor, the Company’s 2023 audited consolidated financial statements and the assessment of the Company’s internal control over financial reporting.

The Committee has also discussed with Ernst & Young the matters required to be discussed by applicable auditing standards.

The Committee has received the written disclosures from Ernst & Young regarding their independence from the Company that are required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditor’s communications with the Audit Committee concerning independence, has discussed with Ernst & Young their independence and has considered whether their provision of non-audit services to the Company is compatible with their independence.

| EATON 2024 Proxy Statement and Notice of Meeting | 23 |

For 2023 and 2022, Ernst & Young’s fees to the Company and certain of its subsidiaries were as follows:

| 2023 | 2022 | |||

| Audit Fees | $21.3 million | $20.5 million | ||

| Includes Sarbanes-Oxley Section 404 attest services | ||||