Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

or

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-35628

PERFORMANT FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 20-0484934 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

333 North Canyons Parkway, Livermore, CA | 94551 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (925) 960-4800

Securities registered pursuant to Section 12(b) of the Act:

|

| |

Title of each class: | Name of each exchange on which registered: |

Common Stock, par value $.0001 per share | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.0001 per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer | ¨ | Accelerated filer | ¨ |

| | | |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x |

| | | |

| | Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2018 (the last business day of the registrant’s most recently completed second quarter), the aggregate market value of the common stock held by non-affiliates of the registrant was $55,076,384. Shares of common stock beneficially held by each officer and director and by each person who owns 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 29, 2019, 53,146,350 shares of the registrant’s common stock were outstanding.

Documents Incorporated By Reference

All or a portion of Items 10 through 14 in Part III of this Form 10-K are incorporated by reference to the Registrant’s definitive proxy statement on Schedule 14A, which will be filed within 120 days after the close of the fiscal year covered by this report on Form 10-K, or if the Registrant’s Schedule 14A is not filed within such period, will be included in an amendment to this Report on Form 10-K which will be filed within such 120 day period.

TABLE OF CONTENTS

PART I

Cautionary Statement Regarding Forward-Looking Information

This Annual Report on Form 10-K contains, in addition to historical information, certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this Annual Report on Form 10-K, including statements regarding our future results of operations and financial position, strategy and plans, and our expectations for future operations, are forward-looking statements. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “design,” “intend,” “expect” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, strategy, short-term and long-term business operations and objectives, and financial needs. Forward-looking statements include, but are not limited to, statements about:

| |

• | our opportunities and expectations for growth in the student lending, healthcare and other markets; |

| |

• | anticipated trends and challenges in our business and competition in the markets in which we operate; |

| |

• | our client relationships and future growth opportunities; |

| |

• | the adaptability of our technology platform to new markets and processes; |

| |

• | our ability to invest in and utilize our data and analytics capabilities to expand our capabilities; |

| |

• | our growth strategy of expanding in our existing markets and considering strategic alliances or acquisitions; |

| |

• | our ability to meet our liquidity and working capital needs; |

| |

• | maintaining, protecting and enhancing our intellectual property; |

| |

• | our expectations regarding future expenses; |

| |

• | expected future financial performance; and |

| |

• | our ability to comply with and adapt to industry regulations and compliance demands. |

These statements reflect current views with respect to future events and are based on assumptions and subject to risks and uncertainties. There are a variety of factors could cause actual results to differ materially from the anticipated results or expectations expressed in our forward-looking statements. These risks and uncertainties include, but are not limited to, those risks discussed in Item 1A of this report. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Forward-looking statements contained in this report present management’s views only as of the date of this report. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any further disclosures we make on related subjects in our quarterly reports on Form 10-Q and current reports on Form 8-K filed with the Securities and Exchange Commission.

ITEM 1. Business

Overview

We provide technology-enabled audit, recovery, outsource customer services, and related analytics services in the United States. Our services help identify improper payments, and in some markets, restructure and recover delinquent or defaulted assets and improper payments for both government and private clients in a broad range of markets. Our clients typically operate in complex and regulated environments and outsource their audit and recovery needs in order to reduce losses on billions of dollars of defaulted student loans, improper healthcare payments and delinquent state tax and federal treasury and other receivables. We also provide complex outsource customer services for clients across our various markets. We generally provide our services on an outsourced basis, where we handle many or all aspects of our clients’ audit and recovery processes.

We believe we have a leading position in our markets based on our technology-enabled services platform, long-standing client relationships and the large volume of claims or funds we have audited and recovered for our clients. In the student loan recovery market, we have relationships with a large number of the active Guaranty Agencies (GAs), which are state or non-profit agencies that administer and rehabilitate student loans issued under the former federally-governed student loan program. In the healthcare market, we have been a Medicare Recovery Audit Contractor (RAC), in the United States for the Centers for Medicare and Medicaid Services (CMS), for over ten years, and are currently servicing two RAC contracts and

an additional Medicare Secondary Payer Commercial Repayment Center (CRC) contract. We have also expanded our client base to include multiple insurance providers in the private healthcare market.

We believe that our business platform is easily adaptable to new markets and processes. Over the past several years, we have successfully extended our platform into additional markets with significant recovery opportunities. For example, we utilized the same basic platform previously used primarily for student loan recovery activities to enter the state tax, federal treasury receivables and healthcare recovery markets. We continue to enhance our platform through investment in new data and analytics capabilities, which we believe will enable us to provide additional services such as services relating to the detection of fraud, waste and abuse. We endeavor to automate and optimize what traditionally have been manually intensive processes in order to drive higher workforce productivity. In 2018, we generated in excess of $100,000 of revenue per employee, based on the average number of employees during the year.

Our revenue model is generally success-based as we earn fees based on a percentage of the aggregate correct audits, and/or amount of funds that we enable our clients to recover. Our services do not require any significant upfront investments by our clients, and we offer our clients the opportunity to recover significant funds otherwise lost. Because our model is based upon the success of our efforts, our business objectives are aligned with those of our clients and we are generally not reliant on their spending budgets. Furthermore, our business model does not require significant capital as we do not purchase loans or obligations.

For the year ended December 31, 2018, we generated approximately $155.7 million in revenues, $8.0 million in net loss, $(5.2) million in adjusted EBITDA and $14.3 million in adjusted net loss. See “Management's Discussion and Analysis of Financial Condition and Results of Operations - Adjusted EBITDA and Adjusted Net Income” in Item 7 below for a definition of adjusted EBITDA and adjusted net income and reconciliations of adjusted EBITDA and adjusted net income to net income determined in accordance with generally accepted accounting principles.

Our Markets

We operate in markets characterized by strong growth, a complex regulatory environment and a significant amount of delinquent, defaulted or improperly paid assets.

Student Lending

Government-supported student loans are authorized under Title IV of the Higher Education Act of 1965. Historically, there have been two distribution channels for student loans: (i) the Federal Direct Student Loan Program, or FDSLP, which represents loans made and managed directly by the Department of Education; and (ii) the Federal Family Education Loan Program, or FFELP, which represents loans made by private institutions and currently backed by any of the 25 GAs.

In July 2010, the government-supported student loan sector underwent a structural change with the passage of the Student Aid and Fiscal Responsibility Act, or SAFRA. This legislation transitioned all new government-supported student loan originations to the FDSLP, and away from originations made by private institutions within the FFELP that had previously utilized the GAs to guarantee, manage and service loans. The GAs are non-profit 501(c)(3) public benefit corporations operating under contract with the U.S. Secretary of Education, pursuant to the Higher Education Act of 1965, as amended, solely for the purpose of guaranteeing and managing student loans originated by lenders participating in the FFELP. Consequently, the original distribution channels for student loans have been consolidated solely into the Department of Education. Despite this transition of all new loan originations to the FDSLP, GAs continue to manage a significant amount of defaulted student loans due to their outstanding portfolios of loans originated prior to July 2010. The outstanding portfolios of defaulted FFELP loans managed by the GAs will, therefore, require recovery for the foreseeable future, although at progressively lower volumes.

The Department of Education estimates that the balance of defaulted loans was approximately $101.4 billion in the FDSLP and approximately $38.9 billion in the FFELP as of September 30, 2018. The total amount of federally managed loans in default is $140.3 billion. The collective amount of defaulted loans serviced by the GAs as of September 30, 2018 was $26.1 billion. Given the operational and logistical complexity involved in managing the recovery of defaulted student loans, the GAs and the Department of Education have historically chosen to outsource these services to third parties.

Healthcare

The healthcare industry represents a significant portion of the U.S. Gross Domestic Product (GDP). According to CMS, U.S. healthcare spending grew 3.9 percent in 2017, reaching $3.5 trillion or $10,739 per person. As a share of the nation's GDP, health spending accounted for 17.9 percent. Currently, national health spending is projected to grow at an average

rate of 5.5 percent per year for 2018-27 and to reach nearly $6.0 trillion by 2027. Federal government-related spending grew 4.2% to $705.9 billion in 2017 for Medicare, which provides a range of healthcare coverage primarily to elderly and disabled Americans and grew 2.9% to $581.9 billion in 2017 for Medicaid, which provides federal matching funds for states to finance healthcare for individuals at or below the public assistance level.

Medicare was initially established as part of the Social Security Act of 1965 and consists of four parts: Part A covers hospital and other inpatient stays; Part B covers hospital outpatient, physician and other services; Part C is known as Medicare Advantage, under which beneficiaries receive benefits through private health plans; and Part D is the Medicare outpatient prescription drug benefit.

The Department of Health and Human Services estimated that for Medicare Part A and Part B spending in 2018, approximately $31.6 billion, or approximately 8.1%, was improper. Medicare improper payments generally involve incorrect coding, procedures performed which were not medically necessary, and incomplete documentation or claims submitted based on outdated fee schedules, among other issues.

In accordance with the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, a demonstration program was conducted from March 2005 to March 2008 in six states to determine if recovery audit contractors could be effectively used to identify improper payments for claims paid under Medicare Part A and Part B. Due to the success of this demonstration, under The Tax Relief and Health Care Act of 2006, the U.S. Congress authorized the expansion of the recovery audit program nationwide. CMS relies on third-party contractors to execute the recovery audit program to analyze millions of Medicare claims annually for improper payments to healthcare providers. The program was implemented by designating one prime contractor in each of the four major regions in the United States: West, Midwest, South, and Northeast. Contracts with recovery audit contractors, or RACs, were initially awarded in 2009. These contracts effectively expired in 2016 and new contracts were awarded in October 2016.

In addition to government-related healthcare spending, significant growth in spending is expected in the private healthcare market. According to CMS’ National Health Expenditures Projections (NHE), the private healthcare market accounted for approximately $1.2 trillion in spending in 2017, and private expenditures are projected to grow by 5.1% per year on average between 2020 and 2027.

Other Markets

State Tax Market

As state governments struggle with revenue generation and face significant budget deficits, many states have focused on recovery of delinquent state taxes. According to the Center on Budget and Policy Priorities, an independent think tank, 31 U.S. states faced projected budget shortfalls totaling $46.1 billion in 2017 and 2018. The economic recession beginning in 2008 led to lower income and sales taxes from both individuals and corporations, reducing overall tax revenues and leading to large budget deficits at the state government level. Although there has been some improvement (from $55 billion in 2013 to $46.1 billion in 2017 and 2018), the budget deficits continue to be a challenge for these states. While many states have received federal aid, most have cut services and increased taxes to help close the budget shortfall and have evaluated outsourcing at least some aspect of delinquent tax recovery.

Federal Agency Market

The federal agency market consists of government debt subrogated to the Department of the Treasury by numerous different federal agencies, comprising a mix of commercial and individual obligations and a diverse range of receivables. These debts are managed by the Bureau of the Fiscal Service (formerly the Department of Financial Management Service), or FS, a bureau of the Department of the Treasury.

Federal Tax Market

In September 2016 the Internal Revenue Service(IRS) announced its plans to begin private collection of certain federal tax debts starting in the spring of 2017 and named Performant as one of four companies to perform these recovery services. The new program, authorized under a federal law, calls for the use of private companies to recover, on the government’s behalf, outstanding inactive tax receivables. In Fiscal 2018, this program returned over $82 million, before costs to the U.S. Treasury.

Our Competitive Strengths

We believe that our business is difficult to replicate, as it incorporates a combination of several important and differentiated elements, including:

| |

• | Scalable and flexible technology-enabled services platform. We have a technology platform that is highly flexible, intuitive and easy to use for our audit, recovery and claims specialists. Our platform is easily configurable and deployable across multiple markets and processes. For example, we have successfully extended our platform from the student loan market to the state and federal tax, federal treasury receivables and the healthcare recovery markets, each having its own industry complexities and specific regulations. |

| |

• | Advanced, technology-enabled workflow processes. Our technology-enabled workflow processes, developed over many years of operational experience in recovery services, disaggregate otherwise complex recovery processes into a series of simple, efficient and consistent steps that are easily configurable and applicable to different types of recovery-related applications. We believe our workflow software is highly intuitive and helps our audit, recovery and claims specialists manage each step of the recovery process, while automating a series of otherwise manually-intensive and document-intensive steps in the recovery process. We believe our streamlined workflow technology drives higher efficiencies in our operations, as illustrated by our ability to generate in excess of $100,000 of revenues per employee during 2018, based on the average number of employees during the year. We believe our streamlined workflow technology also improves recovery results relative to more labor-intensive outsourcing models. |

| |

• | Strong data and analytics capabilities. Our data and analytics capabilities allow us to achieve strong audit results and recovery rates for our clients. We have a proprietary data management and analysis platform which we use throughout our business. In some of our businesses, we have collected recovery-related data for over two decades, which we combine with large volumes of client and third-party data to effectively analyze our clients’ delinquent or defaulted assets and improper payments. We have also developed a number of analytical models for claims auditing, and analytics tools that we use to score our clients’ recovery inventory, determine the optimal recovery process and allocation of resources, and achieve higher levels of recovery results for our clients. In addition, we utilize analytics tools to continuously measure and test our recovery workflow processes to drive refinements and further enhance the quality and effectiveness of our capabilities. |

| |

• | Long-standing client relationships. We believe our long-standing focus on achieving superior recovery performance for our clients and the significant value our clients derive from this focus have helped us achieve long-tenured client relationships, strong contract retention and better access to new clients and future growth opportunities. We have business relationships with 14 GAs either as clients or through our contracts with ECMC and Navient and these relationships average more than eight years in length. In the healthcare market, we have a relationship with CMS that exceeds ten years. In October 2016 we were awarded two contracts out of the second recovery audit program procurement process, including for a region consisting of 11 states in the Northeast and Midwest and the national DMEPOS and home health contract. In October 2017, we were awarded a national exclusive (MSP CRC) contract by CMS. |

| |

• | Extensive domain expertise in complex and regulated markets. We have extensive experience and domain expertise in providing recovery services for government and private institutions that generally operate in complex and regulated markets. We have demonstrated our ability to develop domain expertise in new markets such as healthcare and state tax and federal Treasury receivables. We believe we have the necessary organizational experience to understand and adapt to evolving public policy and how it shapes the regulatory environment and objectives of our clients. We believe this helps us identify and anticipate growth opportunities. For example, we successfully identified government healthcare as a potential growth opportunity that has thus far led to the award of five contracts to us by CMS. Together with our flexible technology platform, we have the ability to adapt our business strategy, to allocate resources and to respond to changes in our regulatory environment to capitalize on new growth opportunities. |

| |

• | Proven and experienced management team. Our management team has significant industry experience and has demonstrated strong execution capabilities. Our senior management team, led by Lisa Im, has been with us for an average of approximately 18 years. This team has successfully grown our revenue base and service offerings beyond the original student loan market into healthcare and delinquent state and federal tax and private financial institutions receivables. Our management team’s industry experience, combined with deep and specialized understanding of complex and highly regulated industries, has enabled us to maintain long-standing client relationships and strong financial results. |

Our Growth Strategy

Key elements of our growth strategy include the following:

| |

• | Expand our recovery services in the healthcare market. According to CMS, Medicare spending totaled approximately $705.9 billion in 2017 and is expected to grow by 7.6% per year on average between 2020 and 2027. In the private healthcare market, spending totaled $1.2 trillion in 2017 and expenditures are projected to grow by 5.1% per year on average between 2020 and 2027, according to CMS’ NHE Projections. As these large markets continue to grow, we expect the need for audit and recovery services to increase in the public and private healthcare markets. In October 2016, we were awarded new RAC contracts for Region 1 which consists of 11 states in the Northeast and Midwest, and Region 5, which covers claims for durable medical equipment, prosthetics and orthotics and home health and hospice payment claims across the U.S. In October 2017, we were awarded the national exclusive MSP CRC contract by CMS. We have also entered into numerous private insurance payer contracts and are pursuing additional opportunities to provide audit, recovery and analytics services in the private healthcare market. In addition, we intend to pursue opportunities to find and eliminate losses prior to payment for healthcare services, including the detection of fraud, waste and abuse in the public and private healthcare markets. |

| |

• | Maintain our position in the student loan market. The balance of defaulted government-supported student loans was approximately $140 billion as of September 30, 2018. We have long-standing relationships with some of the largest participants in the government-supported student loan market. Although the Department of Education announced in January 2018 that we were selected as one of two recovery contractors under its award for new student loan recovery contracts, we were notified on May 3, 2018 that the Department of Education has decided to cancel the current procurement in its entirety, and as a result terminated our contract award. Protests have been filed by certain of the unsuccessful bidders of the procurement of the new contracts from the Department of Education, and at this time, we cannot speculate on the outcome of any such protest or when work will begin under our new contract award. |

| |

• | Expand outsource services, and recovery services in other markets. We intend to expand our outsource services, and recovery services in other markets, including the private healthcare recovery market, state and federal tax and federal treasury receivables. We intend to capitalize on our extensive experience and domain expertise and our highly-flexible technology platform to seek opportunities in these additional markets. |

| |

• | Pursue strategic alliances and acquisitions. We intend to selectively consider opportunities to grow through strategic alliances or acquisitions that are complementary to our business. These opportunities may enhance our existing capabilities, enable us to enter new markets, expand our product offerings and allow us to diversify our revenues. |

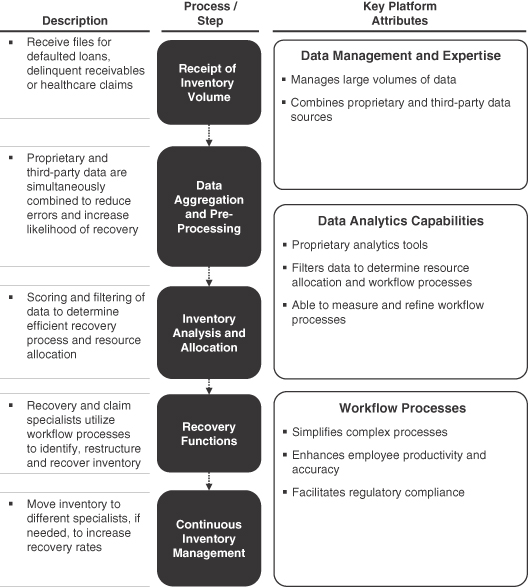

Our Platform

Our data management, analytics, and technology-enabled services platform is proprietary and based on over two decades of experience in auditing and recovering large amounts of funds on behalf of our clients across several markets. The components of our platform include our data management expertise, analytics capabilities and technology-based workflow processes. Our platform integrates these components to allow us to achieve optimized outcomes for our clients in the form of increased efficiency and productivity and high recovery rates. Our platform and workflow processes are also intuitive and easy to use for our recovery and claims specialists and allow us to increase our employee retention and productivity.

The components of our platform include the following:

Data Management Expertise

Our platform manages and stores large amounts of data throughout the workflow process. This includes both proprietary data we have compiled over two decades, as well as third-party data which we can integrate efficiently and in real-time to reduce errors, reduce cycle time processing and, ultimately, improve audit finding and recovery rates. The strength of our data management expertise augments our analytics capabilities and provides our recovery and claims specialists with powerful workflow processes.

Data Analytics Capabilities

Our data analytics capabilities efficiently screen and allocate massive volumes of inventory. For example, in our student loan business, we utilize our proprietary algorithms to assist us in determining the most efficient recovery process and the optimal allocation of recovery specialist resources for each loan. In the healthcare market, we analyze millions of healthcare

claims to find potential correlations between claims data and improper payments, which enhance our finding rates. Across all of our current markets, we utilize our proprietary analytics tools to continuously and rigorously test our workflow processes in real-time to drive greater process efficiency and improvement in recovery rates.

Furthermore, we believe our analytics capabilities will extend our potential markets, permitting us to pursue significant new business opportunities. For example, we have expanded the use of our data analytics capabilities in the healthcare sector to offer a variety of services from post- and pre-payment audit of healthcare claims in both the public and private healthcare sector, to detection of fraud, waste and abuse of healthcare claims, to coordination of benefits and pharmacy fraud detection.

Workflow Processes

Over many years, we have developed and refined our workflow processes, which we believe drive higher efficiency and productivity and reduce our reliance on labor-intensive methods relative to more traditional outsourcing models. Our patented technology that supports our proprietary workflows to disaggregate otherwise complex processes into a series of simple, efficient and consistent steps that are easily configurable and applicable to different types of applications. Our workflow processes integrate a broad range of functions that encompass each stage of a workflow process.

The following recovery diagram illustrates how the various components of our platform work together to solve a typical recovery client workflow:

Our Services

We use our technology-enabled services platform to provide recovery and analytics services in a broad range of markets for the identification and recovery of student loans, improper healthcare payments and delinquent state and federal tax and federal treasury receivables. The table below summarizes our recovery services and related analytics capabilities and the markets we serve.

|

| | | | | | |

Recovery Services | | Analytics Capabilities |

Student Loans | | Healthcare | | Other Markets | |

• Provide recovery services to clients in Federal guaranteed student loan program and private institutions • Identify and track defaulted borrowers across our clients’ portfolios of student loans • Utilize our proprietary technology, our history of borrower data and our analytics capabilities to rehabilitate and recover past due student loans • Earn contingent, success-based fees calculated as a percentage of funds that we enable our clients to recover | | • Provide audit and recovery services to identify improper healthcare payments for public and private healthcare clients • Identify improper payments typically resulting from incorrect coding, procedures that were not medically necessary, incomplete documentation or claims submitted based on outdated fee schedules • Earn contingent, success-based fees based on a percentage of claim amounts recovered | | • Provide tax recovery services to state and municipal agencies and the IRS • Recover government debt for numerous different federal agencies under a contract with the Treasury • Enable financial institutions to proactively manage loan portfolios and reduce the incidence of defaulted loan assets • Earn contingent, success-based fees calculated as a percentage of the amounts recovered, fees based on dedicated headcount and hosted technology licensing fees | | • We use our enhanced data analytics capabilities, which we refer to as Performant Insight, to offer a variety of services from post- and pre-payment audit of healthcare claims to detection of fraud, waste and abuse of healthcare claims, to coordination of benefits and pharmacy fraud detection |

Recovery Services

Student Loans

We provide recovery services primarily to the government-supported student loan industry, and our current clients include several of the largest GAs, as well as private financial institutions. We use our proprietary technology to identify, track and communicate with defaulted borrowers on behalf of our clients to implement suitable recovery programs for the repayment of outstanding student loan balances.

Our clients contract with us to provide recovery services for large pools of student loans generally representing a portion of the total outstanding defaulted balances they manage, which they provide to us as “placements” on a periodic basis. Generally, the volume of placements that we receive from our clients is influenced by our performance under our contracts and our ability to recover funds from defaulted student loans, as measured against the performance of competitors who may service a similar pool of defaulted loans for the same client. To the extent we perform well under our existing contracts and differentiate our services from those of our competitors, we may receive a relatively greater number of student loan placements under these contracts and may improve our ability to obtain future contracts from these clients and other potential clients.

We use algorithms derived from over two decades of experience with defaulted student loans to make reasonably accurate estimates of the recovery outcomes likely to be derived from a placement of defaulted student loans.

We also restructure and recover student loans issued directly by banks to students outside of federal lending programs. These types of loans typically supplement government-supported student loans to meet any shortfall in supply of student loan needs that cannot be met by grants or federal loans. Unlike government-supported student loans, private student loans do not have capped interest rates and, accordingly, involve higher instances of default relative to federally-backed student loans. Additionally, with the burgeoning personal loan industry we believe there is more opportunity for us to expand services into this private sector.

Healthcare

We provide audit and recovery services related to improper payments in the healthcare market. In October 2016 we were awarded two new RAC contracts by CMS. One new award covers Parts A and B Medicare payments in a region consisting of 11 states in the Northeast and Midwest. The second award involves post-payment review of DMEPOS and home health and hospice claims across the U.S. In addition, in October 2017 we were awarded the national exclusive MSP CRC contract by CMS. In addition, we have entered into numerous private insurance payer contracts and are pursuing additional opportunities to provide audit, recovery and analytic services in the private healthcare market.

Under our RAC contracts with CMS, we utilize our technology-enabled services platform to screen Medicare claims against several criteria, including coding procedures and medical necessity standards, to determine whether a claim should be further investigated for recoupment or adjustment by CMS. We conduct automated and, where appropriate, detailed medical necessity reviews. If we determine that the likelihood of finding a potential improper payment warrants further investigation, we request and review healthcare provider medical records related to the claim, utilizing experts in Medicare coding and registered nurses. We interact and communicate with healthcare providers and other administrative entities, and ultimately submit the claim to CMS for correction.

In the private healthcare market, we utilize our technology-enabled services platform to provide audit, recovery and analytical services for private healthcare payers. Our experience from our RAC contracts has helped establish our presence in the private healthcare market by providing us the opportunity to provide audit and recovery services for several national commercial health plans. Our audit and analytics capabilities have allowed us not only to expand our services with these initial private healthcare clients, but also gain entry into other related private healthcare opportunities. Additionally, following our acquisition of Premiere Credit of North America in August of 2018, we now also help hospitals and other medical providers recover payments directly from patients.

Other Markets

We also provide recovery services to several federal, state and municipal tax authorities, the Department of the Treasury and a number of financial institutions.

In September 2016 the Internal Revenue Service, or IRS, announced its plans to begin private collection of certain federal tax debts starting in the spring of 2017 and named us as one of four companies to perform these recovery services. The new program, authorized under a federal law, calls for the use of private companies to recover, on the government’s behalf, outstanding inactive tax receivables. Although the initial placement volumes were low when we commenced work under this contract in April 2017 reflecting the IRS’s objective of a methodical contract start, by the end of 2018, the number of placements of federal tax receivables we received from the IRS more than doubled from what we had processed in 2017. In the 2018 fiscal year, this new recovery program returned an aggregate of over $82 million, before costs, to the U.S. Department of the Treasury.

For state and municipal tax authorities, we analyze a portfolio of delinquent tax and other receivables placed with us, develop a recovery plan and execute a recovery process designed to maximize the recovery of funds. In some instances, we have also run state tax amnesty programs, which provide one-time relief for delinquent tax obligations, and other debtor management services for our clients. We currently have relationships with numerous state and municipal governments. Delinquent obligations are placed with us by our clients and we utilize a process that is similar to the student loan recovery process for recovering these obligations.

For the Department of the Treasury, we recover government debt subrogated to it by numerous different federal agencies. The placements we are provided represent a mix of commercial and individual obligations. We are one of four contractors for the most recent Treasury contract.

We also provide risk management advisory services that enable these clients to proactively manage loan portfolios and reduce the incidence of defaulted loan assets over time. Our experience suggests that proactive default prevention practices produce significant net yield and earnings gains for our clients. We deliver these services in two forms. First, we contact and consult with borrowers to implement a repayment program, including payment through automatic debit arrangements, prior to the beginning of the repayment period in order to increase the likelihood that payments begin on time. Second, we offer a service that involves contacting delinquent borrowers in an effort to cure the delinquency prior to the loan entering default.

Analytics Capabilities

For several years, we have leveraged our data analytics tools to help filter, identify audit claims and recover delinquent and defaulted assets and improper payments as part of our core services platform. Through our data analytics capabilities, which we refer to as Performant Insight, we are able to review, aggregate, and synthesize very large volumes of structured and unstructured data, at high speeds, from the initial intake of disparate data sources, to the warehousing of the data, to the analysis and reporting of the data. We believe we have built a differentiated, next-generation “end-to-end” data processing solution that will maximize value for current and future customers.

Performant Insight provides numerous benefits for our audit and recovery services platform. Performant Insight has not only enhanced our existing recovery services under our RAC contracts and other private healthcare contracts by analyzing significantly higher volumes of healthcare claims at faster rates and reducing our cycle time to review and assess healthcare claims, but has also enabled us to develop improved and more sophisticated business intelligence rules that can be applied to our audit processes. We believe our analytics capabilities will extend our potential markets, permitting us to pursue significant new business opportunities. We have expanded the use of our data analytics capabilities in the healthcare sector to offer a variety of services from post and pre-payment audit of healthcare claims in both the public and private healthcare sector, to detection of fraud, waste and abuse of healthcare claims, to coordination of benefits and pharmacy fraud detection.

Our Clients

We provide our services across a broad range of government and private clients in several markets.

Guaranty Agencies

We restructure and recover defaulted student loans issued by private lenders and backed by GAs under the FFELP. As a result of the transition from FFELP to FDSLP that commenced in 2010, the volume of defaulted student loans managed by the GAs has begun to decline over the last few years and is expected to continue to decline. When a borrower stops making regular payments on a FFELP loan, the GA is obligated to reimburse the lender approximately 97% of the loan’s principal and accrued interest. GAs then seek to recover and restructure these obligations. The GAs with which we contract generally structure one to three-year initial term contracts with multiple renewal periods.

We have a relationship with 14 GAs in the U.S. either as clients or through our contracts with ECMC and Navient; these relationships average more than eight years in length. On June 15, 2017, we received a termination notice from one of our significant GA clients, Great Lakes Higher Education Guaranty Corporation (Great Lakes). The termination of this contract was based on Great Lakes' decision to bundle its student loan servicing work, a service that we currently do not provide, along with its student loan recovery work to a single third-party vendor. In September 2017, we entered into a contract with Navient, who is now servicing the Great Lakes portfolio, to act as a recovery subcontractor on the Great Lakes' portfolio. This contract has no set term, and Navient has the right to terminate the contract at will.

CMS

Our relationship with CMS extends beyond ten years in duration. Under our first RAC contract with CMS, which was awarded in 2009 and expired in 2016, we were responsible for identifying and facilitating the recovery of improper Part A and Part B Medicare payments in the Northeast region of the United States. On January 31, 2018, CMS issued to us their final Letter of Demand which reconciled all outstanding payables to CMS for the old Region A contract. Accordingly, we released an aggregate of approximately $27.8 million and $0.6 million of the estimated liability for appeals and the Net payable to client balances, during the first quarter and third quarter of 2018, respectively. This increased first quarter 2018 revenue by $27.8 million and third quarter revenue by $0.6 million. In conjunction with the release, we also derecognized approximately $9.0 million of prepaid expenses and other current assets, with a charge to other operating expenses, reflecting accrued receivables associated with amounts due to us from our subcontractors for decided and yet-to-be decided appeals. In October 2016, we were awarded two new RAC contracts. We received the contract to audit improper payments for claims made under Medicare Parts A and B in Region 1, which consists of Connecticut, Michigan, Indiana, Maine, Massachusetts, New Hampshire, New York, Ohio, Kentucky, Rhode Island and Vermont, and the contract for Region 5, which involves post-payment review of claims related to DMEPOS and home health and hospice across the U.S. The fees that we receive for identifying improper payments from CMS under these contracts are entirely contingency-based, and the contingency-fee percentage depends on the methods of recovery, and, in some cases, the type of improper payment that we identify. Our audit activity on the new RAC contracts is limited at this time to approximately 0.5% of claims; however, CMS has indicated that there may be an opportunity to increase the audit activity percentage based on provider error rates. Additionally, in October 2017 we were awarded the national exclusive MSP CRC contract by CMS. Under this MSP CRC contract, we are responsible for identifying and recovering payments in situations where Medicare should not be the primary payer of healthcare claims because a beneficiary

has other forms of insurance coverage, such as through an employer group health plan or certain other payers. In February of 2018 we commenced operations on the MSP CRC contract with activity increasing during the year.

Department of Education

We have provided student loan recovery services to the Department of Education for approximately 25 years; the Department of Education had historically been our largest or one of our largest clients, accounting for 15.5%, 23.8%, and 27.2% of our revenues in 2016, 2015 and 2014, respectively. However, following the expiration of our most recent contract in April 2015, and the subsequent decline of student loan placement volumes, revenues from the Department of Education fell to 4% of our 2017 revenues. Although the Department of Education announced in January 2018 that we were selected as one of two recovery contractors under its award for new student loan recovery contracts, no work was completed under that contract and we were subsequently notified on May 3, 2018 that the Department of Education had decided to cancel the current procurement in its entirety, and as a result terminated our contract award.

Private Healthcare

In the private healthcare market, we utilize our technology-enabled services platform to provide audit, recovery and analytical services for private healthcare payers. Our experience from our RAC contracts has helped establish our presence in the private healthcare market by providing us the opportunity to provide audit and recovery services for several national commercial health plans. Our audit and analytics capabilities have allowed us not only to expand our services with these initial private healthcare clients, but also gain entry into other related private healthcare opportunities.

U.S. Department of the Treasury

We have assisted the Department of the Treasury for over 20 years in the recovery of delinquent receivables owed to a number of different federal agencies. The debt obligations we help to recover on behalf of the Department of the Treasury include commercial and individual debt obligations. We are one of the six firms servicing the current Department of the Treasury contract. Similar to our other recovery contracts, our fees under this contract are contingency-based. We view this as an important strategic relationship, as it provides us valuable insight into other business opportunities within the federal government.

State Tax Agencies

We provide recovery services for individuals’ delinquent state tax obligations on a hosted model. We currently have relationships with a number of state governments.

Private Lenders

We provide recovery services for private student loans, which supplement federally guaranteed loans, and home mortgages to private lenders. Additionally, with the burgeoning personal loan industry we believe there is more opportunity for us to expand services into this private sector.

Internal Revenue Service

In September 2016 the Internal Revenue Service, or IRS, announced it plans to begin private collection of certain federal tax debts starting in 2017 and awarded us a contract to perform these recovery services. The new program, authorized under a federal law enacted by Congress, enables us, along with three other contractors to collect, on the government’s behalf, outstanding inactive tax receivables. Our ability to recover these receivables will be limited to accounts where taxpayers owe money, but the IRS is no longer actively working their accounts. Although the initial placement volumes were low when we commenced work under this contract in April 2017 reflecting the IRS’s objective of a methodical contract start, by the end of 2018, the number of placements of federal tax receivables we received from the IRS more than doubled from what we had processed in 2017.

Sales and Marketing

Our new business opportunities have historically been driven largely by referrals and natural extensions of our existing client relationships, as well as a targeted outreach by our sales team and senior management. Our sales cycles are often lengthy, and demand high levels of attention from our senior management. At any point in time, we are typically focused on a limited number of potentially significant new business opportunities. As a result, to date, we have operated with a small staff of experienced individuals with responsibility for developing new sales, relying heavily upon our executive staff, including an appropriate sales and marketing team covering various markets.

Technology Operations

Our technology center is based in Livermore, California, with a redundant capacity in our Grants Pass, Oregon office. Additionally, Performant Insight, our data analytics business, is supported by staff in Sunrise, Florida. We have designed our infrastructure for scalability and redundancy, which allows us to continue to operate in the event of an outage at either datacenter. We maintain an information systems environment with advanced network security intrusion detection and prevention with 24x7 monitoring and security incident response capabilities. We utilize encryption technologies to protect sensitive data on our systems, all data during transmission and all data on redundancy or backup media. We also maintain a comprehensive enterprise wide information security program based on industry standards such as NIST 800-53 and PCI/DSS.

Competition

We face significant competition in all aspects of our business. In recovery services for delinquent and defaulted assets, we face competition from a number of companies. Holders of these delinquent and defaulted assets typically engage several firms simultaneously to provide recovery services on different portions of their portfolios. The number of recovery firms engaged varies by client. Initially, we compete to be one of the retained firms in a competitive bidding process and, if we are successful, we then face continuing competition from the client’s other retained firms based on the client’s benchmarking of the recovery performance of its several vendors. Some clients will allocate additional placements to those recovery vendors producing the highest recovery rates. We believe that we primarily compete on the basis of recovery rate performance, as well as maintenance of high standards of recovery practices and data security capabilities. We believe that we compete favorably with respect to these factors as evidenced by our long-standing relationships with our clients in these markets. Pricing is not usually a major competitive factor as all recovery services vendors in these markets typically receive the same contingency-based fee rate.

In the audit and recovery of improper healthcare payments, we face competition in the bidding process for commercial healthcare contracts, and the RAC contracts awarded by CMS. However, based on our structured, highly professional and effective recovery process within the healthcare market, we believe these are contracts for which we are uniquely qualified. This qualification allows us to compete more effectively for contracts such as the MSP CRC contract, which we were awarded in October 2017. In the most recent RAC bidding process, the identified competitive factors were demonstrated experience in effective recovery services in the healthcare market, sufficient capacity to address claims volumes, maintenance of high standards of recovery practices, financial capability to perform under the RAC contract and recovery fee rates. In the commercial healthcare space, those same factors are generally applicable. Our competition in the private healthcare arena includes the other RAC service providers, Health Management Systems, Inc. and Cotiviti, LLC, and a variety of healthcare consulting and healthcare information services companies. Many of these companies have greater financial, technological and other resources than we do.

Government Regulation

The nature of our business requires that we adhere to a complex array of federal and state laws and regulations. These include the Health Insurance Portability and Accountability Act, or HIPAA, the Fair Debt Collection Practices Act, or FDCPA, the Fair Credit Reporting Act, or FCRA, the rules and regulations established by the Consumer Financial Protection Bureau, or CFPB, and related state laws. We are also governed by a variety of state laws that regulate the collection, use, disclosure and protection of personal information. We have implemented and maintain physical, technical and administrative safeguards intended to protect all personal data and we have processes in place to assist us in complying with applicable laws and regulations regarding the protection of this data. Our compliance efforts include training of personnel and monitoring our systems and personnel.

HIPAA and Related State Laws

Our Medicare recovery business subjects us to compliance with HIPAA and various related state laws that contain substantial restrictions and requirements with respect to the use and disclosure of an individual’s protected health information. HIPAA prohibits us from using or disclosing an individual’s protected health information unless the use or disclosure is authorized by the individual or is specifically required or permitted under HIPAA. Under HIPAA, we must establish administrative, physical and technical safeguards to protect the confidentiality, integrity and availability of electronic protected health information maintained or transmitted by us or by others on our behalf. We are required to notify affected individuals and government authorities of data security breaches involving unsecured protected health information. The Department of Health and Human Services Office of Civil Rights enforces HIPAA privacy violations; CMS enforces HIPAA security violations and the Department of Justice enforces criminal violations of HIPAA. We are subject to statutory penalties for violations of HIPAA.

Most states have enacted patient confidentiality laws that protect against the unauthorized disclosure of confidential medical information, and many states have adopted or are considering further legislation in this area, including privacy safeguards, security standards and data security breach notification requirements. These state laws, if more stringent than HIPAA requirements, are not preempted by the federal requirements, and we must comply with them even though they may be subject to different interpretations by various courts and other governmental authorities. In addition, numerous other state laws govern the collection, dissemination, use, access to and confidentiality of individually identifiable health and healthcare provider information.

Our compliance efforts include the encryption of protected health information that we hold and the development of procedures to detect, investigate and provide appropriate notification if protected health information is compromised. Our employees and contractors receive initial and periodic supplemental training and are tested to ensure compliance. As part of our certification and accreditation process, we must undergo audits by federal agencies as noted below. CMS regularly audits us for, among other items, compliance with their security standards.

Privacy Act of 1974

The Privacy Act of 1974 governs the collection, use, storage, destruction and disclosure of personal information about individuals by a government agency and extends to government contractors who have access to agency records performing services for government agencies. The Privacy Act requires maintenance of a code of conduct for employees with access to the agency records addressing the obligations under the Privacy Act, training of employees and discipline procedures for noncompliance. The Privacy Act also requires adopting and maintaining appropriate administrative, technical and physical safeguards to insure the security and confidentiality of records and to protect against any anticipated threats or hazards to their security or integrity.

As a contractor to federal government agencies we are required to comply with the Privacy Act of 1974. Our compliance effort includes initial and ongoing training of employees and contractors in their obligations under the Privacy Act. In addition, we have implemented and maintain physical, technical and administrative safeguards and processes intended to protect all personal data consistent with or exceeding our obligations under the Privacy Act.

Certification, Accreditation and Security

Business services that collect, store, transmit or process information for United States government agencies and organizations are required to undergo a rigorous certification and accreditation process to ensure that they operate at an acceptable level of security risk. As a government contractor, we currently have Authority to Operate, or ATO, licenses from both the Department of Education and CMS.

We maintain a comprehensive enterprise-wide information security program based on industry standards such as NIST 800-53 and PCI/DSS. In addition, we hold SSAE – SOC 1 Type II certification, which provides assurance to auditors of third parties that we maintain the necessary controls and procedures to effectively manage third party data. We undergo an independent audit by our government agency clients on the award of the contract and periodically thereafter. We also conduct periodic self-assessments.

Our regulatory compliance group is charged with the responsibility of ensuring our regulatory compliance and security. All our facilities have security perimeter controls with segregated access by security clearance level. The information systems environment maintains advanced network security intrusion detection and prevention with 24x7 monitoring and security incident response capabilities. We utilize encryption technologies to protect sensitive data on our systems, all data during transmission and all data on redundancy or backup media. Employees undergo background and security checks appropriate to their position. This can include security clearances by the Federal Bureau of Investigation. We also maintain compliant disaster recovery and business continuity plans, annually conduct two table top disaster exercises, conduct routine security risk assessments and maintain a continuous improvement process as part of our security risk mitigation and management activity.

FDCPA and Related State Laws

The FDCPA regulates persons who regularly collect or attempt to collect, directly or indirectly, consumer debts owed or asserted to be owed to another person. Certain of our debt recovery and loan restructuring activities may be subject to the FDCPA. The FDCPA establishes specific guidelines and procedures that debt recovery firms must follow in communicating with consumer debtors, including the time, place and manner of such communications. Further, it prohibits harassment or abuse by debt recovery firms, including the threat of violence or criminal prosecution, obscene language or repeated telephone calls made with the intent to abuse or harass. The FDCPA also places restrictions on communications with individuals other than

consumer debtors in connection with the collection of any consumer debt and sets forth specific procedures to be followed when communicating with such third parties for purposes of obtaining location information about the consumer. In addition, the FDCPA contains various notice and disclosure requirements and prohibits unfair or misleading representations by debt recovery firms. Finally, the FDCPA imposes certain limitations on lawsuits to collect debts against consumers.

Prior to the adoption of amendments to the FDCPA as part of the Dodd-Frank Act, no federal agency had the authority to issue interpretative regulations for the FDCPA. As a result, judicial determinations and non-binding interpretative positions issued by the Federal Trade Commission under the FDCPA created compliance difficulties for the consumer debt collections industry. With the adoption of the amendments to the FDCPA as part of the Dodd-Frank Act in 2011, however, as well as specific statutory authority to issue implementing regulations for the FDCPA, primary jurisdiction for the FDCPA was transferred to the Consumer Financial Protection Bureau, or CFPB. Subsequently, the CFPB has indicated that it may issue proposed regulations under the FDCPA.

Debt recovery activities are also regulated at the state level. Most states have laws regulating debt recovery activities in ways that are similar to, and in some cases more stringent than, the FDCPA. In addition, some states require debt recovery firms to be licensed.

Our compliance efforts include written procedures for compliance with the FDCPA and related state laws, employee training and monitoring, auditing client calls, periodic review, testing and retraining of employees, and procedures for responding to client complaints. In all states where we operate, we believe that we currently hold all required state licenses or are exempt from licensing. Violations of the FDCPA may be enforced by the U.S. Federal Trade Commission, or FTC, or by a private action by an individual or class. Violations of the FDCPA are deemed to be an unfair or deceptive act under the Federal Trade Commission Act, which can be punished by fines for each violation. Class action damages can total up to one percent of the net worth of the entity violating the statute. Attorney fees and costs are also recoverable. In the ordinary course of business, we are sued for alleged violations of the FDCPA and comparable state laws, although the amounts involved in the disposition or settlement of any such claims have not been significant.

TCPA

The Telephone Consumer Protection Act, or TCPA, regulates the initiation of calls (which includes text messages) to residential or cellular telephones, including the use of automatic telephone dialing systems as well as artificial or prerecorded voices. The TCPA requires callers to obtain prior express consent or, in some cases, prior express written consent from individuals before placing restricted calls. Our compliance efforts include confirming a consumer has provided prior express consent consistent with the requirements of the law. Violations of the TCPA may be enforced by the U.S. Federal Communications Commission, or FCC, or by a private action by an individual or class. Violations of the TCPA can be punished by recovery of damages or penalties up to $1,500 per violation for willful violations. Attorney fees and costs are also recoverable. In the ordinary course of business, we are sued for alleged violations of the TCPA and comparable state laws, although the amounts involved in the disposition or settlement of any such claims have not been significant.

FCRA

We are also subject to the Fair Credit Reporting Act, or FCRA, which regulates consumer credit reporting and which may impose liability on us to the extent that the adverse credit information reported on a consumer to a credit bureau is false or inaccurate. State law, to the extent it is not preempted by the FCRA, may also impose restrictions or liability on us with respect to reporting adverse credit information. Our compliance efforts include initial and ongoing training of employees working with consumer credit reports and the monitoring of usage. Violations of FCRA, which are deemed to be unfair or deceptive acts under the Federal Trade Commission Act, are enforced by the FTC or by a private action by an individual or class. Civil actions by consumers may seek damages per violation, with punitive damages, attorney's fees and costs also recoverable. Under the Federal Trade Commission Act, penalties for engaging in unfair or deceptive acts can be punished by fines for each violation.

CFPB

The CFPB was created as part of the Dodd-Frank Act in 2011, with primary implementing and interpretative authority for many federal consumer protection laws, for example the FDCPA, transferred to the CFPB. Among other things, the CFPB was given the authority to issue interpretive regulations for the FDCPA.

In addition to its authority in regard to federal consumer protection laws, the CFPB was also provided direct jurisdiction over certain consumer financial service providers. In October of 2012, the CFPB issued a rule asserting direct jurisdiction over large consumer debt collectors, which includes debt collectors with annual assets of more than $10 million. In accordance with the calculations included in this rule, we are subject to direct jurisdiction of the CFPB and in the future may be

directly examined and supervised by the CFPB. In that regard, the CFPB has also released examination guidance that its examiners will use when reviewing compliance by debt collectors subject to its direct supervision.

The CFPB focuses on service providers involved in collecting debt related to any consumer financial product from committing unfair, deceptive, or abusive acts or practices, or UDAAPs, in violation of the Dodd-Frank Act. UDAAPs include actions that are unfair and likely to cause substantial injury to consumers, deceptive actions that mislead or likely to mislead a consumer and abusive acts that interfere with the ability of a consumer to understand a term or condition of a consumer financial product or takes unreasonable advantage of a consumer’s lack of understanding of a consumer financial product. Although abusive acts or practices may also be unfair or deceptive, each of these prohibitions are separate and distinct, and are governed by separate legal standards. Original creditors and other covered persons and service providers involved in collecting debt related to any consumer financial product or service are subject to the prohibition against UDAAPs. The CFPB has indicated that it will continue to review closely the practices of those engaged in the collection of consumer debts for potential UDAAPs in violation of the Dodd-Frank Act.

State Law Compliance and Security Breach Response

Many states impose an obligation on any entity that holds personally identifiable information or health information to adopt appropriate security to protect such data against unauthorized access, misuse, destruction, or modification. All fifty states and the District of Columbia have enacted laws requiring holders of personal information to take certain actions in response to data breach incidents, such as providing prompt notification of the breach to affected individuals and government authorities, and in some cases offering credit monitoring services. In many cases, these laws are limited to electronic data, but states are increasingly enacting or considering stricter and broader requirements. Massachusetts has enacted a regulation that requires any entity that holds, transmits or collects certain personal information about its residents to adopt a written data security plan meeting the requirements set forth in the statute. We have implemented and maintained physical, technical and administrative safeguards intended to protect all personal data and have processes in place to assist us in complying with applicable laws and regulations regarding the protection of this data and properly responding to any security incidents. We have adopted a system security plan and security breach incident response plans to address our compliance with these laws.

Intellectual Property

Our intellectual property is a significant component of our business, including, most notably, the intellectual property underlying our proprietary technology-enabled services platform through which we provide our defaulted asset recovery and other services. To protect our intellectual property, we rely on a combination of intellectual property rights, including patents, trade secrets, trademarks and copyrights. We also utilize customary confidentiality and other contractual protections, including employee and third-party confidentiality and invention assignment agreements.

As of December 31, 2018, we had two U.S. patents, both covering aspects of the workflow management systems and methods incorporated into our technology-enabled services platform. These patents will expire in September 2024. We routinely assess appropriate occasions for seeking additional patent protection for those aspects of our platform and other technologies that we believe may provide competitive advantages to our business. We also rely on certain unpatented proprietary expertise and other know-how, licensed and acquired third-party technologies, and continuous improvements and other developments of our various technologies, all intended to maintain our leadership position in the industry.

As of December 31, 2018, we had six trademarks registered with the U.S. Patent and Trademark office: DCS, Performant Recovery, Performant Technologies, Discovery Analytics, Performant Insight, and Premiere Credit.

We have registered copyrights covering various copyrighted material relevant to our business. We also have unregistered copyrights in many components of our software systems. We may not be able to use these unregistered copyrights to prevent misappropriation of such content by unauthorized parties in the future; however, we rely on our extensive information technology security measures and contractual arrangements with employees and third-party contractors to minimize the opportunities for any such misuse of this content.

We are not subject to any material intellectual property claims alleging that we infringe, misappropriate or otherwise violate the intellectual property rights of any third party, nor have we asserted any material intellectual property infringement claim against any third party.

Employees

As of December 31, 2018, we had approximately 1,892 full-time employees. None of our employees is a member of a labor union and we consider our employee relations to be good.

Available Information

The SEC maintains an Internet site at http://www.sec.gov that contains our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, if any, or other filings filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, proxy and information statements.

ITEM 1A. Risk Factors

Our business, financial condition, results of operations and liquidity are subject to various risks and uncertainties, including those described below, and as a result, the trading price of our common stock could decline.

Risks Related to Our Business

Revenues generated from our three largest clients represented 61% of our revenues in 2018 and 63% of our revenues in 2017. Our relationships with one of these clients, Great Lakes Higher Education Guaranty Corporation, was terminated in 2017. Any termination of or deterioration in our relationship with any of our other significant clients would result in a further decline in our revenues.

We have derived a substantial majority of our revenues from a limited number of clients. Revenues from our three largest clients represented 61% of our revenues for the year ended December 31, 2018 and 63% of our revenues for the year ended December 31, 2017. We have had relationships with numerous GAs in the U.S. including Pennsylvania Higher Education Assistance Authority and Great Lakes, which were responsible for 17% and 17%, respectively, of our revenues for the year ended December 31, 2018. On June 15, 2017, we received a 30-day termination notice with respect to our contract with Great Lakes, based on Great Lakes’ decision to bundle with a single third-party vendor its student loan servicing work, a service that we currently do not provide, along with its student loan recovery work. While we subsequently obtained a subcontract for student loan recovery work from Navient, the new provider of servicing and defaulted portfolio management to Great Lakes, this contract has no set term or volume, and Navient has the right to terminate the contract at will. Because the Department of Education terminated our January 2018 contract and the current procurement in its entirety, we now will become even more dependent on our business relationships with our remaining GA clients for our student loan revenues. In that regard, we believe that the portfolios of our GA clients will continue to decrease over time due to (i) the effect of federal legislation in 2010 that requires all student loan originations to come from the Department of Education (which means that there will be no further growth in student loans held by GAs), and (ii) because we are seeing a larger amount of defaulted student loans in our GA client portfolios that have been previously rehabilitated and by regulation are not subject to rehabilitation for a second time. All of our contracts with our significant clients are subject to periodic renewal and re-bidding processes and if we lose one of these clients or if the terms of our relationships with any of these clients become less favorable to us, our revenues would decline, which would harm our business, financial condition and results of operations.

Many of our contracts with our clients for the recovery of student loans and other receivables are not exclusive and do not commit our clients to provide specified volumes of business. In addition, the terms of these contracts may be changed unilaterally and on short notice by our clients. As a consequence, there is no assurance that we will be able to maintain our revenues and operating results.

Substantially all of our existing contracts for the recovery of student loans and other receivables, which represented approximately 64% of our revenues for the year ended December 31, 2018 and 92% of our revenues in the year ended December 31, 2017, enable our clients to unilaterally terminate their contractual relationship with us at any time without penalty, potentially leading to loss of business or renegotiation of terms. Further, most of our contracts in these markets allow our clients to unilaterally change the volume of loans and other receivables that are placed with us or the payment terms at any given time. In addition, most of our contracts are not exclusive, with our clients retaining multiple service providers with whom we must compete for placements of loans or other obligations. Therefore, despite our contractual relationships with our clients, our contracts do not provide assurance that we will generate a minimum amount of revenues or that we will receive a specific volume of placements. Our revenues and operating results would be negatively affected if our student loan and receivables clients reduce the volume of student loan placements provided to us, modify the terms of service, including the success fees we are able to earn upon recovery of defaulted student loans, or any of these clients establish more favorable relationships with our competitors.

We typically face a long period to implement a new contract which may cause us to incur expenses before we receive revenues from new client relationships.

If we are successful in obtaining an engagement with a new client or a new contract with an existing client, we typically have a subsequent long implementation period in which the services are planned in detail and we integrate our technology, processes and resources with the client’s operations. If we enter into a contract with a new client, we typically will not receive revenues until implementation is completed and work under the contract actually begins. Our clients may also experience delays in obtaining approvals or managing protests from unsuccessful bidders, or delays associated with technology or system implementations, such as the delays experienced with the implementation of our first RAC contract with CMS. Because we generally begin to hire new employees to provide services to a new client once a contract is signed, we may incur

significant expenses associated with these additional hires before we receive corresponding revenues under any such new contract. If we are not successful in maintaining contractual commitments after the expenses we incur during our typically long implementation cycle, our cash flows and results of operations could be adversely affected.

We may not have sufficient cash flows from operations and availability of funds under our credit agreement to fund our ongoing operations and our other liquidity needs, which could adversely affect our business and financial condition.