As filed with the Securities and Exchange

Commission on March 29, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Malvern Bancorp, Inc.

(Exact Name of Registrant as Specified in

Its Charter)

| Pennsylvania |

6035 |

45-5307782 |

| (State or Other Jurisdiction |

(Primary Standard Industrial |

(IRS Employer |

| of Incorporation or Organization) |

Classification Code Number) |

Identification Number) |

42 E. Lancaster Avenue

Paoli, Pennsylvania 19301

(610) 644-9400

(Address, Including Zip Code, and Telephone

Number,

Including Area Code, of Registrant’s Principal Executive

Offices)

Anthony C. Weagley

President and Chief Executive Officer

Malvern Bancorp, Inc.

42 E. Lancaster Ave.

Paoli, Pennsylvania 19301

(610) 644-9400

(Name, Address, Including Zip Code, and

Telephone

Number, Including Area Code, of

Agent for Service)

Copies to:

Peter H. Ehrenberg, Esq.

Laura R. Kuntz, Esq.

Lowenstein Sandler LLP

65 Livingston Avenue

Roseland, New Jersey 07068

(973) 597-2500

Approximate date of commencement of proposed

sale to the public: As soon as practicable after this registration statement becomes effective.

If the securities being registered on this Form

are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check

the following box. ¨

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act.

| Large accelerated filer |

¨ |

|

Accelerated filer |

x |

| Non-accelerated filer |

¨ |

(Do not check if a smaller reporting company) |

Smaller reporting company |

¨ |

If applicable, place an X in the box to designate the

appropriate rule provision relied upon in conducting this transaction:

| Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

¨ |

| Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

¨ |

CALCULATION OF REGISTRATION FEE

Title of each class of

securities to be registered | |

Amount

to be

registered(1) | | |

Proposed

maximum

offering price

per unit(1) | | |

Proposed

maximum

aggregate

offering price(1) | | |

Amount of

registration fee | |

6.125% Fixed-to-Floating Rate Subordinated

Notes Due 2027 | |

$ | 25,000,000 | | |

| 100 | % | |

$ | 25,000,000 | | |

$ | 2,898 | |

| (1) | The registration fee has

been calculated pursuant to Rule 457(f) under the Securities Act of 1933, as amended. The proposed maximum offering price is estimated

solely for the purpose of calculating the registration fee. |

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment

which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities

and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete

and may be changed. We may not complete the exchange offer and issue these securities until the registration statement filed with

the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting

an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

MARCH 29, 2017

PROSPECTUS

Malvern Bancorp, Inc.

Offer to Exchange

$25,000,000 aggregate principal amount of

6.125% Fixed-to-Floating Rate Subordinated

Notes due 2027

that have been registered under the Securities

Act of 1933

for any and all outstanding unregistered

6.125% Fixed-to-Floating Rate Subordinated

Notes due 2027

The exchange offer will expire at 11:59

p.m., New York City time, on , 2017, unless extended.

We are offering to exchange 6.125% Fixed-to-Floating

Rate Subordinated Notes due 2027 that have been registered under the Securities Act of 1933, as amended (“Securities Act”),

which we refer to in this prospectus as the “New Notes,” for any and all of our outstanding unregistered 6.125% Fixed-to-Floating

Rate Subordinated Notes due 2027 that we issued in a private placement on February 7, 2017, which we refer to in this prospectus

as the “Old Notes.” We are making this offer to exchange the New Notes for the Old Notes to satisfy our obligations

under a registration rights agreement that we entered into with the purchasers of the Old Notes in connection with our issuance

of the Old Notes to those purchasers.

We will not receive any cash proceeds from this

exchange offer. The issuance of the New Notes in exchange for the Old Notes will not result in any increase in our outstanding

indebtedness. Old Notes that are not exchanged for New Notes in this exchange offer will remain outstanding. The exchange offer

is not subject to any minimum tender condition, but is subject to certain customary conditions.

Upon expiration of the exchange offer, all Old

Notes that have been validly tendered and not withdrawn will be exchanged for an equal principal amount of New Notes. The terms

of the New Notes are identical in all material respects to the terms of the Old Notes, except that the New Notes are registered

under the Securities Act and are generally not subject to transfer restrictions, are not entitled to registration rights under

the registration rights agreement that we entered into with the initial purchasers of the Old Notes and do not have the right to

additional interest under the circumstances described in that registration rights agreement relating to our fulfillment of our

registration obligations. The New Notes evidence the same debt as the Old Notes and are governed by the same indenture under which

the Old Notes were issued.

There is no existing public market for the Old

Notes or the New Notes and we do not expect any public market to develop in the future for either the Old Notes or the New Notes.

The Old Notes are not listed on any national securities exchange or quotation system and we do not intend to list the New Notes

on any national securities exchange or quotation system.

You may withdraw your tender of Old Notes at

any time prior to the expiration of the exchange offer. We will exchange all of the outstanding Old Notes that are validly tendered

and not validly withdrawn prior to the expiration of the exchange offer for an equal principal amount of New Notes.

Each broker-dealer that receives New Notes for

its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus meeting the requirements of the

Securities Act in connection with any resale of such New Notes. A broker-dealer that acquired Old Notes because of market-making

or other trading activities may use this prospectus, as supplemented or amended from time to time, in connection with resales of

the New Notes for a period of 180 days after the completion of the exchange offer. See “Plan of Distribution.”

Investing in our securities involves certain

risks. See “Risk Factors” beginning on page 7, as well as the risk factors contained in our Annual Report on

Form 10-K for the fiscal year ended September 30, 2016, and in the other reports filed by us with the Securities and Exchange Commission

and incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful

or complete. Any representation to the contrary is a criminal offense.

These securities are not savings or deposit

accounts or other obligations of any bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any

other governmental agency.

The date of this prospectus is

, 2017.

TABLE OF CONTENTS

This prospectus is a part of a registration

statement that we have filed with the Securities and Exchange Commission (the “SEC”) under the Securities Act. This

prospectus does not contain all the information set forth in the registration statement, certain parts of which are omitted in

accordance with the rules and regulations of the SEC. For further information with respect to us, the exchange offer and the securities

offered by this prospectus, reference is made to the registration statement, including the exhibits to the registration statement

and the documents incorporated by reference.

We are providing this prospectus to holders

of Old Notes in connection with our offer to exchange Old Notes for New Notes. We are not making this exchange offer in any jurisdiction

where the exchange offer is not permitted.

You should rely only on the information contained

or incorporated by reference in this prospectus and in the accompanying exchange offer transmittal documents filed by us with the

SEC. We have not authorized any other person to provide you with any other information. If anyone provides you with different or

inconsistent information, you should not rely on it. You should not assume that the information contained or incorporated by reference

in this prospectus is accurate as of any date other than the date of the applicable document that contains that information. Our

business, financial condition, results of operations and prospects may have changed since that date.

You should not consider any information in this

prospectus to be investment, legal or tax advice. You should consult your own counsel, accountant and other advisors for legal,

tax, business, financial and related advice regarding the exchange offer and ownership of these securities.

Each broker-dealer that receives New Notes for

its own account in exchange for Old Notes acquired by the broker-dealer as a result of market-making or other trading activities

must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale

of such New Notes. This prospectus, as it may be amended or supplemented from time to time, may be used by a participating broker-dealer

in connection with resales of New Notes received in exchange for Old Notes. We have agreed in the letter of transmittal to make

this prospectus, as amended or supplemented, available to any such broker-dealer that requests copies of this prospectus for use

in connection with any such resale. See “Plan of Distribution.”

References in this prospectus to the “Corporation,”

the “Company,” “we,” “us,” “our,” or similar references refer to Malvern Bancorp,

Inc., a Pennsylvania corporation, and its subsidiaries on a consolidated basis, except where the context otherwise requires or

as otherwise indicated. References in this prospectus to the “Bank” refer to Malvern Federal Savings Bank, a federally-chartered

savings bank.

This prospectus incorporates important business

and financial information about us that is not included in or delivered with this prospectus. Such information is available without

charge to holders of Old Notes upon written or oral request made to:

Malvern Bancorp, Inc.

Attention: Joseph Gangemi, Senior Vice President

and Chief Financial Officer

42 E. Lancaster Avenue

Paoli, Pennsylvania 19301

Telephone: (610) 644-9400

E-mail: jgangemi@malvernfederal.com

To ensure timely delivery of any requested information,

holders of Old Notes must make any request no later than , 2017, which is five business

days before the expiration date of the exchange offer, or, if we decide to extend the expiration date of the exchange offer, no

later than five business days before such extended expiration date.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. You may also read and copy any document we file with the SEC at its public

reference facilities at 100 F Street, N.E., Washington, D.C. 20549. You also may obtain copies of the documents at prescribed rates

by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330

for further information on the operation of the public reference facilities. The SEC also maintains an Internet site that contains

reports, proxy statements and other information about issuers, like us, that file electronically with the SEC. The address of that

site is http://www.sec.gov. Our SEC filings are also available on our website, http://www.malvernfederal.com. The information on

our website is not a part of (and is not incorporated by reference into) this prospectus.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference”

information into this prospectus. This means that we can disclose important information to you by referring you to another document

filed separately with the SEC. The information incorporated by reference is considered to be a part of this prospectus. These documents

may include periodic reports, such as our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form

8-K, as well as definitive Proxy Statements. Any documents that we subsequently file with the SEC will automatically update and

replace the information previously filed with the SEC. Therefore, in the case of a conflict or inconsistency between information

set forth in this prospectus and information incorporated by reference into this prospectus, you should rely on the information

contained in the document that was filed later.

This prospectus incorporates by reference the

documents listed below that we have previously filed with the SEC, except to the extent that any information in such filings is

deemed “furnished” but not “filed” in accordance with SEC rules.

| |

• |

Our Annual Report on Form 10-K for the fiscal year ended September 30, 2016, filed with the SEC on December 14, 2016; |

| |

• |

Our Quarterly Report on Form 10-Q for the quarter ended December 31, 2016, filed with the SEC on February 9, 2017; |

| |

• |

Our Current Reports on Form 8-K filed with the SEC on each of October 28, 2016, February 8, 2017 and February 17, 2017 (in each case, except to the extent any portion of any such Current Report on Form 8-K is furnished but not filed); and |

| |

• |

Our Definitive Proxy Statement on Schedule 14A filed with the SEC on January 12, 2017. |

We are also incorporating by reference all other

documents that we subsequently file with the SEC pursuant to Section 13(a), 13(c), 14 or 15 (d) of the Securities Exchange Act

of 1934, as amended (“Exchange Act”), after the date of the initial registration statement of which this prospectus

is a part but prior to the effectiveness of the registration statement and between the date of this prospectus and the later of

(i) the termination or completion of the exchange offer and (ii) the termination of the period of time described under “Plan

of Distribution” during which we have agreed to make available this prospectus to broker-dealers in connection with certain

resales of the New Notes.

You may obtain a copy of any or all of the documents

incorporated by reference in this prospectus (other than an exhibit to a document unless that exhibit is specifically incorporated

by reference into that document) from the SEC through the SEC’s Internet site at http://www.sec.gov. You also may obtain

these documents from us without charge by visiting our website at http://www.malvernfederal.com or by requesting them in

writing, by e-mail or by telephone from us at the following address:

Malvern Bancorp, Inc.

Attention: Joseph Gangemi, Senior Vice President

and Chief Financial Officer

42 E. Lancaster Avenue

Paoli, Pennsylvania 19301

Telephone: (610) 644-9400

E-mail: jgangemi@malvernfederal.com

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain of the statements contained in this

report and the documents incorporated by reference herein may constitute forward-looking statements for the purposes of the Securities

Act of 1933, as amended and the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of

1995, as amended, and may involve known and unknown risks, uncertainties and other factors which may cause our actual results,

performance or achievements to be materially different from future results, performance or achievements expressed or implied by

such forward-looking statements. These forward-looking statements include statements with respect to our financial goals, business

plans, business prospects, credit quality, credit risk, reserve adequacy, liquidity, origination and sale of residential mortgage

loans, mortgage servicing rights, the effect of changes in accounting standards, and market and pricing trends. The words “may”,

“would”, “could”, “will”, “likely”, “expect,” “anticipate,”

“intend”, “estimate”, “plan”, “forecast”, “project” and “believe”

and similar expressions are intended to identify such forward-looking statements. Our actual results may differ materially from

the results anticipated by the forward-looking statements due to a variety of factors, including without limitation the risks and

uncertainties discussed in this prospectus and in the documents incorporated by reference herein, including without limitation:

| • | competitive pressures among

depository institutions may increase significantly; |

| |

• |

changes in the interest rate environment may reduce interest margins; |

| |

• |

prepayment speeds, loan origination and sale volumes, charge-offs and loan loss provisions may vary substantially from period to period; |

| |

• |

general economic conditions may be less favorable than expected; |

| |

• |

political developments, wars or other hostilities may disrupt or increase volatility in securities markets or other economic conditions; |

| |

• |

legislative or regulatory changes or actions may adversely affect the businesses in which Malvern Bancorp, Inc. is engaged; |

| |

• |

changes and trends in the securities markets may adversely impact Malvern Bancorp, Inc.; |

| |

• |

a delayed or incomplete resolution of regulatory issues could adversely impact our planning; |

| |

• |

difficulties in integrating any businesses that we may acquire, which may increase our expenses and delay the achievement of any benefits that we may expect from such acquisitions; |

| |

• |

the impact of reputation risk created by the developments discussed above on such matters as business generation and retention, funding and liquidity could be significant; |

| |

• |

the outcome of regulatory and legal investigations and proceedings may not be anticipated; and |

| |

• |

our success in managing the risks involved in the foregoing. |

Additional factors that could cause our results

to differ materially from those described in the forward-looking statements can be found in our Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC. See “Where You Can Find More Information”

for a description of where you can find this information.

Forward-looking statements speak only as of

the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events

or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events. In light

of these risks, uncertainties and assumptions, the forward-looking statements discussed in this prospectus or the incorporated

documents might not occur and you should not put undue reliance on any forward-looking statements.

SUMMARY

This summary highlights information contained

elsewhere in this prospectus and in the documents we incorporate by reference into this prospectus. This summary does not contain

all of the information that you should consider before deciding to exchange your Old Notes for New Notes. You should read this

prospectus carefully, including the “Risk Factors” sections contained in this prospectus and in our Annual Report on

Form 10-K for the fiscal year ended September 30, 2016, which is incorporated by reference herein, as updated by our subsequently

filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, our financial statements and the related notes and the other

documents incorporated by reference herein, which are described under the heading “Information Incorporated by Reference”

in this prospectus before making a decision about whether to exchange your Old Notes for New Notes.

Malvern Bancorp, Inc.

We are a bank holding

company incorporated under Pennsylvania law in 2012. We are the holding company for Malvern Federal Savings Bank (the “Bank”),

a federally-chartered, FDIC-insured savings bank that was originally organized in 1887 and now serves as one of the oldest banks

headquartered on the Philadelphia Mainline. For more than a century, the Bank has been committed to helping people build prosperous

communities as a trusted financial partner, forging lasting relationships through teamwork, respect and integrity. The Bank conducts

business from its headquarters in Paoli, Pennsylvania, a suburb of Philadelphia, as well as eight other financial centers located

throughout Chester and Delaware Counties, Pennsylvania, and a Private Banking Loan Production headquarters office in Morristown,

New Jersey. Its primary market niche is providing personalized service to its client base.

The Bank, through its

Private Banking division and strategic partnership with Bell Rock Capital, Rehoboth Delaware, provides personalized wealth management

and advisory services to high net worth individuals and families. Our services include banking, liquidity management, investment

services, 401(k) accounts and planning, custody, tailored lending, wealth planning, trust and fiduciary services, insurance, family

wealth advisory services and philanthropic advisory services.

Our common stock is quoted on the NASDAQ

Global Select Market under the symbol “MLVF.” Our principal executive offices are located at 42 E. Lancaster

Avenue, Paoli, Pennsylvania 19301 and our telephone number is (610) 644-9400. Our website address is

http://www.malvernfederal.com. Information on our website does not constitute a part of this prospectus and is not

incorporated by reference herein. Except where the context requires otherwise or as otherwise indicated, references to the

“Company,” “we,” “us,” “ours” or similar references as used herein refer to

Malvern Bancorp, Inc. and its consolidated subsidiaries.

Summary of the Exchange Offer

The following provides a summary of certain

terms of the exchange offer. Please refer to the section “The Exchange Offer” appearing elsewhere in this prospectus

for a more complete description of the exchange offer and the section “Description of the Notes” for a more complete

description of the terms of the Old Notes and New Notes.

| Old Notes |

|

$25,000,000 in aggregate principal amount of 6.125% Fixed-to-Floating Rate Subordinated Notes due 2027. |

| |

|

|

| New Notes |

|

Up to $25,000,000 in aggregate principal amount of 6.125% Fixed-to-Floating Rate Subordinated Notes due 2027 which have terms that are identical in all material respects to the terms of the Old Notes, except that the New Notes are registered under the Securities Act and are generally not subject to transfer restrictions, are not entitled to registration rights under the registration rights agreement and do not have the right to additional interest under the circumstances described in the registration rights agreement relating to our fulfillment of our registration obligations. |

| |

|

|

| Exchange Offer |

|

We are offering to exchange the New Notes for a like principal amount of Old Notes. Subject to the terms of this exchange offer, promptly following the termination of the exchange offer, we will exchange New Notes for all Old Notes that have been validly tendered and not validly withdrawn prior to the expiration of the exchange offer. |

| |

|

|

| Expiration Date |

|

The exchange offer will expire at 11:59 p.m., New York City time, on , 2017, unless extended. |

| |

|

|

| Withdrawal Rights |

|

You may withdraw the tender of your Old Notes at any time before the expiration date. |

| |

|

|

| Conditions to Exchange Offer |

|

This exchange offer is subject to customary conditions, which we may waive. See “The Exchange Offer—Conditions.” |

| |

|

|

| Procedures for Tendering Old Notes |

|

In order to participate in the exchange offer and exchange your

Old Notes for New Notes, if your Old Notes are registered in your name, you must complete, sign and date the accompanying letter

of transmittal, or a facsimile of the letter of transmittal, according to the instructions contained in this prospectus and the

letter of transmittal. You must also mail or otherwise deliver the letter of transmittal, or a facsimile of the letter of transmittal,

together with the Old Notes and any other required documents, to the exchange agent at the address set forth on the cover page

of the letter of transmittal that accompanies this prospectus. Do not send the letter of transmittal, any Old Notes or any other

required document to us or to anyone other than the exchange agent.

In order to participate in the exchange offer and exchange your

Old Notes for New Notes, if your Old Notes are held by a custodial entity, such as a bank, broker, dealer, trust company or other

nominee, you must instruct this custodial entity to tender your Old Notes on your behalf under the procedures of the custodial

entity.

Please note that by signing, or agreeing to be bound by, the letter

of transmittal, you will be making a number of important representations to us. See “The Exchange Offer—Eligibility;

Transferability.” |

|

Certain United States Federal Income

Tax Considerations |

|

The exchange of Old Notes for New Notes in the exchange offer generally should not constitute a taxable event for U.S. federal income tax purposes. See “Certain United States Federal Income Tax Considerations.” You should consult your own tax advisor as to the tax consequences of exchanging your Old Notes for New Notes. |

| Registration Rights |

|

Under the terms of the registration rights agreement that we entered into with the initial purchasers of the Old Notes at the time we issued the Old Notes, we agreed to register the New Notes and undertake this exchange offer. This exchange offer is intended to satisfy the rights of holders of Old Notes under that registration rights agreement. After the exchange offer is completed, we will have no further obligations, except under certain limited circumstances, to provide for any exchange or undertake any further registration with respect to the Old Notes. |

| |

|

|

| Transferability |

|

Based upon existing interpretations of the Securities Act by the staff of the SEC contained in several no-action letters issued to third parties, we believe that the New Notes may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act, provided that: |

| |

|

|

| |

|

• |

|

you are acquiring the New Notes in the ordinary course of your business; |

| |

|

|

|

|

| |

|

• |

|

you are not participating or engaged in, do not intend to participate or engage in, and have no arrangement or understanding with any person to participate in, the distribution of the New Notes issued to you; |

| |

|

|

|

|

| |

|

• |

|

you are not an “affiliate” of ours within the meaning of Rule 405 under the Securities Act; and |

| |

|

|

|

|

| |

|

• |

|

you are not acting on behalf of any person who could not truthfully make these statements. |

| |

|

Our belief that transfers of New Notes would be permitted without

registration or prospectus delivery under the conditions described above is based on interpretations by the staff of the SEC given

to other, unrelated issuers in similar exchange offers. The staff of the SEC has not considered this exchange offer in the context

of a no-action letter, and we cannot assure you that the staff of the SEC would make a similar interpretation with respect to our

exchange offer.

If our belief is not accurate and you transfer a New Note

without delivering a prospectus meeting the requirements of the Securities Act or without an exemption from such requirements,

you may incur liability under the Securities Act. We do not and will not assume, or indemnify you against, such liability. |

| |

|

Each broker-dealer that receives New Notes for its own account under the exchange offer in exchange for Old Notes that were acquired by the broker-dealer as a result of market-making or other trading activity must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the New Notes.

See “The Exchange Offer—Eligibility; Transferability”

and “Plan of Distribution.” |

| |

|

|

|

Consequences of Failing to Exchange

Old Notes |

|

Any Old Notes that are not exchanged in the exchange offer will continue to be governed by the indenture relating to the Old Notes and the terms of the Old Notes. Old Notes that are not exchanged will remain subject to the restrictions on transfer described in the Old Notes, and you will not be able to offer or sell the Old Notes except under an exemption from the requirements of the Securities Act or unless the Old Notes are registered under the Securities Act. Upon the completion of the exchange offer, we will have no further obligations, except under limited circumstances, to provide for registration of the Old Notes under the U.S. federal securities laws. If you do not participate in the exchange offer, the liquidity of your Old Notes could be adversely affected. See “The Exchange Offer—Consequences of Failure to Exchange.” |

| |

|

|

| Use of Proceeds |

|

We will not receive any cash proceeds from the exchange of Old Notes for New Notes as a result of the exchange offer. |

| |

|

|

| Cancellation of Exchanged Old Notes |

|

Old Notes that are surrendered in exchange for New Notes will be retired and cancelled by us upon receipt and will not be reissued. Accordingly, the issuance of the New Notes under this exchange offer will not result in any increase in our outstanding indebtedness. |

| |

|

|

| Exchange Agent |

|

U.S. Bank National Association is serving as the exchange agent for this exchange offer. See “The Exchange Offer—Exchange Agent” for the address and telephone number of the exchange agent. |

Summary of the New Notes

The following provides a summary of certain

terms of the New Notes. The New Notes have terms that are identical in all material respects to the terms of the Old Notes, except

that the New Notes are registered under the Securities Act and are generally not subject to transfer restrictions, are not entitled

to registration rights under the registration rights agreement and do not have the right to additional interest under the circumstances

described in the registration rights agreement relating to our fulfillment of our registration obligations. The New Notes will

evidence the same debt as the Old Notes and will be governed by the same indenture under which the Old Notes were issued. Please

refer to the section “Description of the Notes” for a more complete description of the terms of the New Notes. References

in this prospectus to the “notes” include both the Old Notes and the New Notes unless otherwise specified or the context

otherwise requires.

| Issuer |

|

Malvern Bancorp, Inc. |

| |

|

|

| Securities Offered |

|

6.125% Fixed-to-Floating Rate Subordinated Notes due February 15, 2027. |

| |

|

|

| Aggregate Principal Amount |

|

Up to $25,000,000. |

| Maturity Date |

|

February 15, 2027, unless previously redeemed. |

| |

|

|

| Form and Denomination |

|

The New Notes will be issued only in fully registered form without interest coupons, in minimum denominations of $1,000 and any integral multiple of $1,000 in excess thereof. Unless otherwise required for institutional accredited investors, the New Notes will be evidenced by a global note deposited with the trustee for the New Notes, as custodian for The Depository Trust Company, or DTC, and transfers of beneficial interests will be facilitated only through records maintained by DTC and its participants. |

| |

|

|

| Interest Rate and Interest Rate Payment Dates During Fixed-Rate Period |

|

From and including February 7, 2017 to but excluding February 15, 2022 or any earlier redemption date, the New Notes will bear interest at a fixed rate equal to 6.125% per year, payable semi-annually in arrears on February 15 and August 15 of each year, beginning on August 15, 2017. |

| Interest Rate and Interest Rate Payment Dates During Floating-Rate Period |

|

From and including February 15, 2022 to but excluding the maturity

date or earlier redemption date, the New Notes will bear interest at an annual floating rate, reset quarterly, equal to LIBOR determined

for the applicable interest period plus a spread of 414.5 basis points (4.145%), payable quarterly in arrears on February

15, May 15, August 15 and November 15 of each year commencing on May 15, 2022.

For any interest period, “LIBOR” means the 3-month U.S.

dollar LIBOR, which will be the offered rate for 3-month deposits in U.S. dollars, as that rate appears on the Reuters Screen LIBOR01

Page (or any successor page thereto) as of 11:00 a.m., London time, as observed two London banking days prior to the first day

of the applicable floating rate interest period. If the 3-month U.S. dollar LIBOR is not displayed as of such time with respect

to any applicable floating rate interest period, then LIBOR will be LIBOR in effect for the floating rate interest period preceding

the floating rate interest period for which LIBOR is to be determined, or, with respect to the first floating rate interest period,

the most recent possible prior date. |

| Day Count Convention |

|

30-day month/360-day year to but excluding February 15, 2022, and thereafter, a 360-day year and the number of days actually elapsed. |

| |

|

|

| Record Dates |

|

Each interest payment will be made to the holders of record who held the New Notes at the close of business on the fifteenth calendar day prior to the applicable interest payment date. |

| |

|

|

| Subordination; Ranking |

|

The New Notes will be our general unsecured, subordinated obligations and: |

| |

|

|

| |

|

• |

|

will rank junior in right of payment to all of our existing and future senior indebtedness (as defined herein); |

| |

|

|

|

|

| |

|

• |

|

will rank equally in right of payment with all of our existing and future unsecured subordinated indebtedness; and |

| |

|

|

|

|

| |

|

• |

|

will be effectively subordinated to all of the existing and future indebtedness, liabilities and other obligations of the Bank and our other current and future subsidiaries, including without limitation the Bank’s deposit liabilities and claims of other creditors of the Bank. |

| Optional Redemption |

|

We may, at our option, redeem the New Notes (i) in whole or in part,

beginning with the interest payment date of February 15, 2022 and on any interest payment date thereafter and (ii) in whole but

not in part, at any time upon the occurrence of a Tier 2 Capital Event, Tax Event or an Investment Company Event (each as described

in “Description of the Notes—Redemption”).

Any redemption of the New Notes will be subject to prior approval

of the Federal Reserve, to the extent such approval is then required. Any redemption of the New Notes will be at a redemption price

equal to 100% of the principal amount of the New Notes being redeemed plus accrued and unpaid interest to, but excluding, the date

of redemption.

The New Notes are not subject to repayment at the option of the

holders and there is no sinking fund for the New Notes. |

| |

|

|

| No Limitations On Indebtedness |

|

The terms of the New Notes do not limit the amount of additional indebtedness the Company, the Bank or any of our respective subsidiaries may incur or the amount of other obligations ranking senior or equal to the New Notes that we may incur. |

| Limited Indenture Covenants |

|

The indenture governing the New Notes contains no financial covenants

requiring us to achieve or maintain any minimum financial results relating to our financial position or results of operations or

meet or exceed any financial ratios as a general matter or in order to incur additional indebtedness or obligations or to maintain

any reserves.

Moreover, neither the indenture nor the New Notes contain any covenants

prohibiting us from, or limiting our right to, grant liens on our assets to secure our indebtedness or other obligations that are

senior in right of payment to the New Notes, to repurchase our stock or other securities, including any of the New Notes, or to

pay dividends or make other distributions to our shareholders (except, in the case of dividends or other distributions on junior

securities, upon our failure to timely pay the principal of or interest on the New Notes, when the same becomes due and payable). |

| |

|

|

| Listing; No Public Market |

|

The New Notes are a new issue of securities with no established trading market and we do not expect any public market to develop in the future for the New Notes. We do not intend to list the New Notes on any national securities exchange or quotation system. |

| |

|

|

| Risk Factors |

|

See “Risk Factors” beginning on page 7 of this prospectus, as well as in our reports filed with the SEC, and other information included or incorporated by reference in this prospectus for a discussion of factors you should consider carefully before deciding to participate in the exchange offer. |

| |

|

|

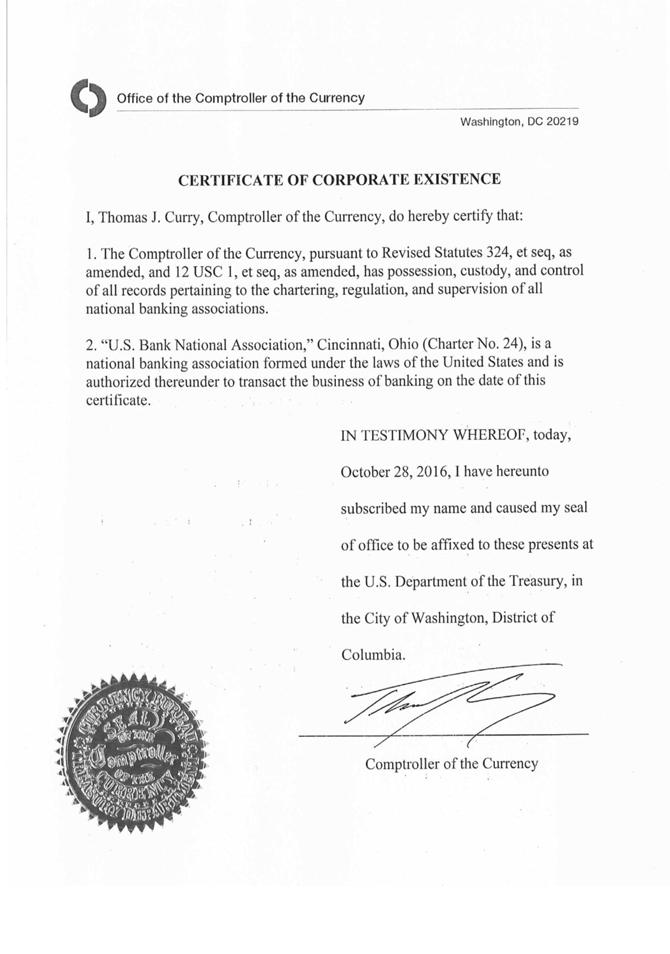

| Trustee |

|

U.S. Bank National Association. |

| |

|

|

| Governing Law |

|

The New Notes and the indenture will be governed by and construed in accordance with the laws of the State of New York. |

RISK FACTORS

In consultation with your own advisors, you

should carefully consider, among other matters, the factors set forth below as well as the other information included or incorporated

by reference in this prospectus before deciding whether to participate in the exchange offer. In particular, you should carefully

consider, among other things, the factors described under the caption “Risk Factors” in our Annual Report on Form 10-K

for the fiscal year ended September 30, 2016, which is incorporated herein by reference, as updated by our subsequently filed Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K. If any of the risks contained in or incorporated by reference into this prospectus

develop into actual events, our business, financial condition, liquidity, results of operations and prospects could be materially

and adversely affected, the value of the New Notes could decline, our ability to repay the New Notes may be impaired, and you may

lose all or part of your investment. Some statements in this prospectus, including statements in the following risk factors, constitute

forward-looking statements. See the “Special Note Regarding Forward-Looking Statements” section in this prospectus.

Risks Related to Our Business

For a discussion of certain risks applicable

to our business and operations, please refer to the section entitled “Risk Factors” in Part I, Item 1A of our Annual

Report on Form 10-K for the fiscal year ended September 30, 2016.

Risks Related to the Exchange Offer

If you do not properly tender your Old Notes, you will continue

to hold unregistered Old Notes and your ability to transfer Old Notes will be adversely affected.

We will only issue New Notes in exchange for

Old Notes that you timely and properly tender. Therefore, you should allow sufficient time to ensure timely delivery of the Old

Notes and you should carefully follow the instructions on how to tender your Old Notes. Neither we nor the exchange agent are required

to tell you of any defects or irregularities with respect to your tender of Old Notes. See “The Exchange Offer—Procedures

for Tendering Old Notes.”

If you do not exchange your Old Notes for New

Notes in the exchange offer, you will continue to be subject to the restrictions on transfer of your Old Notes described in the

legend on the certificates for your Old Notes. In general, you may only offer or sell the Old Notes if they are registered under

the Securities Act and applicable state securities laws, or you offer and sell under an exemption from these requirements. We do

not plan to register any sale of the Old Notes under the Securities Act.

The tender of Old Notes under the exchange offer

will reduce the principal amount of the Old Notes outstanding, which may have an adverse effect upon, and increase the volatility

of, the market price of the Old Notes due to reduction in liquidity.

You may not receive New Notes in the exchange offer if you do

not properly follow the exchange offer procedures.

We will issue New Notes in exchange for your

Old Notes only if you properly tender the Old Notes before expiration of the exchange offer. Neither we nor the exchange agent

are required to tell you of any defects or irregularities with respect to your tender of Old Notes. If you are the beneficial holder

of Old Notes that are held through your broker, dealer, commercial bank, trust company or other nominee, and you wish to tender

such Old Notes in the exchange offer, you should promptly contact the person through whom your Old Notes are held and instruct

that person to tender on your behalf in accordance with the procedures described in this prospectus and the accompanying transmittal

letter.

Some holders who exchange their Old Notes may be deemed to be

underwriters.

Based on interpretations of the staff of the

SEC contained in certain no action letters addressed to other parties, we believe that you may offer for resale, resell or otherwise

transfer the New Notes without compliance with the registration and prospectus delivery requirements of the Securities Act. However,

in some instances described in this prospectus under “Plan of Distribution,” certain holders of New Notes will remain

obligated to comply with the registration and prospectus delivery requirements of the Securities Act to transfer the New Notes.

If such a holder transfers any New Notes without delivering a prospectus meeting the requirements of the Securities Act or without

an applicable exemption from registration under the Securities Act, such a holder may incur liability under the Securities Act.

We do not and will not assume, or indemnify such a holder against, such liability.

Risks Related to the Notes

The notes are unsecured and subordinated to our existing and

future senior indebtedness.

Although the New Notes will rank on par with

the Old Notes, the notes will be unsecured, subordinated obligations of Malvern Bancorp, Inc. and, consequently, will rank junior

in right of payment to all of our secured and unsecured “senior indebtedness” now existing or that we incur in the

future, as described under “Description of the Notes—Subordination.” As a result, upon any payment or distribution

of assets to creditors in the case of liquidation, dissolution, winding up, reorganization, assignment for the benefit of creditors

or any bankruptcy, insolvency or similar proceeding, the holders of the senior indebtedness will be entitled to have the senior

indebtedness paid in full prior to the holders of the notes receiving any payment of principal of, or interest on, the notes.

As of December 31, 2016, the Company and our

subsidiaries had outstanding indebtedness, total deposits and other liabilities of $783.3 million, excluding intercompany liabilities,

all of which would rank structurally senior to the notes. As of December 31, 2016, the Bank had $786.6 million in aggregate principal

amount of senior indebtedness outstanding on a consolidated basis, which consisted entirely of the outstanding indebtedness, total

deposits and other liabilities of our subsidiaries. The notes do not limit the amount of additional indebtedness or senior indebtedness

that we or any of our subsidiaries, including the Bank, may incur. Accordingly, in the future, we and our subsidiaries may incur

other indebtedness, which may be substantial in amount, including senior indebtedness, indebtedness ranking equally with the notes

and indebtedness ranking effectively senior to the notes, as applicable. Any additional indebtedness and liabilities that we and

our subsidiaries incur may adversely affect our ability to pay our obligations on the notes.

As a consequence of the subordination of the

notes to our existing and future senior indebtedness, an investor in the notes may lose all or some of its investment upon our

liquidation, dissolution, winding up, reorganization, assignment for the benefit of creditors or any bankruptcy, insolvency or

similar proceeding. In such an event, our assets would be available to pay the principal of, and any accrued and unpaid interest

on, the notes only after all of our senior indebtedness had been paid in full. In such an event, any of our other general, unsecured

obligations that do not constitute senior indebtedness, depending upon their respective preferences, will share pro rata in our

remaining assets after we have paid all of our senior indebtedness in full.

The notes are obligations only of Malvern Bancorp, Inc. and not

obligations of the Bank or any of our other subsidiaries and will be effectively subordinated to the existing and future indebtedness,

deposits of the Bank, and other liabilities of the Bank and our other subsidiaries.

The notes are obligations solely of Malvern

Bancorp, Inc. and are not obligations of the Bank or any of our other subsidiaries. The Bank and our other subsidiaries are separate

and distinct legal entities from Malvern Bancorp, Inc. The rights of Malvern Bancorp, Inc. and the rights of its creditors, including

the holders of the notes, to participate in any distribution of the assets of the Bank or any other subsidiary (either as a shareholder

or as a creditor) upon an insolvency, bankruptcy, liquidation, dissolution, winding up or similar proceeding of the Bank or such

other subsidiary (and the consequent right of the holders of the notes to participate in those assets after repayment of our existing

or future senior indebtedness), will be subject to the claims of the creditors of the Bank, including depositors of the Bank, or

such other subsidiary. Accordingly, the notes are effectively subordinated to all of the existing and future indebtedness, deposits

and other liabilities and preferred equity of the Bank and our other subsidiaries, to the extent that those liabilities, including

deposit liabilities, equal or exceed their respective assets.

As of December 31, 2016, the Company and our

subsidiaries had outstanding indebtedness, total deposits and other liabilities of $783.3 million, excluding intercompany liabilities,

all of which would rank structurally senior to the notes. The notes do not limit the amount of indebtedness or other liabilities

that the Bank or any of our other subsidiaries may incur, all of which would rank structurally senior to the notes. Any additional

indebtedness and liabilities that our subsidiaries incur may adversely affect our ability to pay our obligations on the notes.

We are a holding company and depend on our subsidiaries for dividends,

distributions and other payments.

Malvern Bancorp, Inc. is a holding company and

reports financial information on a consolidated basis with its subsidiaries. Substantially all of our consolidated assets are held

by our subsidiaries, and, in particular, the Bank. Our principal source of cash flow, including cash flow to pay dividends to our

shareholders and to pay principal of and interest on our outstanding debt, is dividends from the Bank. The Bank and our other subsidiaries

have no obligation to pay any amounts to Malvern Bancorp, Inc., including any dividends, to make any other distributions to us

or to provide us with funds to meet any of our obligations, including the notes. In addition, various federal and state statutes,

regulations and rules limit, directly or indirectly, the amount of dividends that the Bank and our other subsidiaries may pay to

us without regulatory approval. In particular, dividend and other distributions from the Bank to us would require notice to or

approval of the applicable regulatory authority. There can be no assurances that we would receive such approval.

In addition, the Federal Reserve, the OCC

and the FDIC have the authority to prohibit or to limit the payment of dividends by a banking organization under its

jurisdiction if, in the regulator’s opinion, the organization is engaged in or is about to engage in an unsafe or

unsound practice. Depending on the financial condition of the Bank, we may be deemed to be engaged in an unsafe or unsound

practice if the Bank were to pay dividends. Federal Reserve policy generally requires insured banks only to pay dividends out

of current operating earnings. Payment of dividends could also be subject to regulatory limitations if the Bank became

“under-capitalized” for purposes of the “prompt corrective action” regulations of the federal bank

regulatory agencies.

As a result, no assurance can be given that

the Bank will, in any circumstances, pay dividends to us. If the Bank cannot pay dividends to us for any period as a result of

any regulatory limitation or prohibition or cannot, for any reason, pay dividends in an amount sufficient for us to pay the principal

of, or any accrued and unpaid interest on, the notes, we may be unable to pay the principal of, or interest on, the notes in a

timely manner, or at all, unless we are able to borrow funds from other sources or sell additional securities to obtain funds necessary

to make such payments.

To service our debt, we will require a significant amount of

cash. Our ability to generate cash depends on many factors.

Our ability to make payments on or to

refinance our indebtedness, including our ability to meet our obligations under the notes, and to fund our operations depends

on our ability to generate cash and our access to the capital markets in the future. These will depend on our financial and

operating performance, which, to a certain extent, are subject to general economic, financial, competitive, legislative,

regulatory and capital market conditions and other factors that are beyond our control. If our cash flows and capital resources

are insufficient to fund our debt service obligations, we may be unable to obtain new financing or to fund our obligations to

our customers and business partners, implement our business plans, sell assets, seek additional capital or restructure or

refinance our indebtedness, including the notes. As a result, we may be unable to meet our obligations under the notes. In

the absence of sufficient capital resources, we could face substantial liquidity problems and might be required to dispose of

material assets or operations to meet debt service and other obligations. We may not be able to consummate those dispositions

of assets or to obtain the proceeds that could be realized from them and these proceeds may not be adequate to meet any debt

service obligations then due, including obligations under the notes.

The notes include limited covenants and do not restrict our ability

to incur additional debt.

The notes do not contain any financial covenants

that would require us to achieve or maintain any minimum financial results relating to our financial condition, liquidity or results

of operations or meet or exceed certain financial ratios as a general matter or to incur additional indebtedness or obligations

or to maintain any reserves. Moreover, the notes do not contain any covenants prohibiting us or our subsidiaries from, or limiting

our or our subsidiaries’ right to, grant liens on assets to secure indebtedness or other obligations, to repurchase our stock

or other securities, including any of the notes, or to pay dividends or make other distributions to our shareholders. The notes

do not contain any provision that would provide protection to the holders of the notes against a material decline in our credit

quality.

In addition, the notes do not limit the

amount of additional indebtedness Malvern Bancorp, Inc., the Bank or any of our other subsidiaries may incur or the amount of

other obligations that Malvern Bancorp, Inc. or the Bank may incur ranking senior or equal to the indebtedness evidenced by

the notes. The issuance or guarantee of any such securities or the incurrence of any such other liabilities may reduce the

amount, if any, recoverable by holders of the notes in the event of our insolvency, bankruptcy, liquidation, dissolution,

winding up or similar proceeding, and may limit our ability to meet our obligations under the notes.

The notes are subject to limited rights of acceleration.

Payment of principal of the notes may be accelerated

only in the case of certain bankruptcy-related events with respect to us. As a result, you have no right to accelerate the payment

of principal of the notes if we fail to pay principal of or interest on the notes or if we fail in the performance of any of our

other obligations under the notes.

The amount of interest payable on the notes will vary beginning

February 15, 2022, and interest after that date may be less than the initial fixed annual rate of 6.125% in effect until February

15, 2022.

Because three-month LIBOR is a floating rate,

the interest rate on the notes will vary beginning February 15, 2022 at an annual floating rate equal to three-month LIBOR, as

determined quarterly on the determination date for the applicable interest period, plus 414.5 basis points. The interest rate that

is determined on the relevant determination date will apply to the entire interest period following such determination date, even

if three-month LIBOR increases during that interest period. The floating rate may be volatile over time and could be substantially

less than the fixed rate. This could result in holders of the notes experiencing a decline in their receipt of interest and also

could cause a decline in the market price of the notes. We have no control over a number of factors that may affect market interest

rates, including geopolitical conditions and economic, financial, political, regulatory, judicial or other events that affect the

markets generally and that are important in determining the existence, magnitude and longevity of market rate risk.

In the past, the level of three-month LIBOR

has experienced significant fluctuations. Historical levels, fluctuations and trends of three-month LIBOR are not necessarily indicative

of future levels. Any historical upward or downward trend in three-month LIBOR is not an indication that three-month LIBOR is more

or less likely to increase or decrease at any time during the floating rate period, and you should not take the historical levels

of three-month LIBOR as an indication of its future performance.

Beginning on February 15, 2022, or at any time in the case of

a regulatory capital treatment event, the notes may be redeemed at our option, which limits the ability of holders of the notes

to accrue interest over the full stated term of the notes.

We may, at our option, redeem the notes (i)

in whole or in part, beginning with the interest payment date of February 15, 2022 and on any interest payment date thereafter

and (ii) in whole but not in part, at any time upon the occurrence of a Tier 2 Capital Event, Tax Event or an Investment Company

Event, in each case at a redemption price equal to 100% of the principal amount of the notes to be redeemed plus accrued and unpaid

interest to, but not including, the date of redemption. Any redemption of the notes will be subject to prior approval of the Federal

Reserve, to the extent such approval is then required. There can be no assurance that the Federal Reserve will approve any redemption

of the notes that we may propose. Furthermore, you should not expect us to redeem any notes when they first become redeemable or

on any particular date thereafter. If we redeem the notes for any reason, you will not have the opportunity to continue to accrue

and be paid interest to the stated maturity date and you may not be able to reinvest the redemption proceeds you receive in a similar

security or in securities bearing similar interest rates or yields.

There may be no active trading market for the notes.

The notes are a new issue of securities with

no established trading market. We are not obligated to and do not intend to apply for listing of the notes on any national securities

exchange or quotation system. A liquid or active trading market for the notes may not develop. If an active trading market for

the notes does not develop, the market price and liquidity of the notes may be adversely affected. If the notes are traded, they

may trade at a discount from their initial offering price, depending on prevailing interest rates, the market for similar securities,

our performance and other factors. Accordingly, we cannot assure you that you will be able to sell any notes or the prices, if any, at which holders may be able to sell their notes.

Our indebtedness could adversely affect our financial results

and prevent us from fulfilling our obligations under the notes.

In addition to our currently outstanding indebtedness,

we may be able to borrow substantial additional indebtedness in the future. If new indebtedness is incurred in addition to our

current debt levels, the related risks that we now face could increase. Our indebtedness, including the indebtedness we may incur

in the future, could have important consequences for the holders of the notes, including:

| • | limiting our ability to satisfy

our obligations with respect to the notes; |

| |

• |

increasing our vulnerability to general adverse economic industry conditions; |

| |

• |

limiting our ability to obtain additional financing to fund future working capital, capital expenditures and other general corporate requirements; |

| |

• |

requiring a substantial portion of our cash flow from operations for the payment of principal of and interest on our indebtedness and thereby reducing our ability to use our cash flow to fund working capital, capital expenditures and general corporate requirements; |

| |

• |

limiting our flexibility in planning for, or reacting to, changes in our business and the industry; and |

| |

• |

putting us at a disadvantage compared to competitors with less indebtedness. |

Our credit ratings may not reflect all risks of an investment

in the notes, and changes in our credit rating could adversely affect the market price or liquidity of the notes.

Our credit ratings are an assessment of

our ability to pay our obligations as they become due. Accordingly, real or anticipated changes in our credit ratings or

their outlook will generally affect the market price of the notes. Our credit ratings, however, may not reflect the potential

risks related to the market or other factors impacting the market price of the notes. Furthermore, because your return on the

notes depends upon factors in addition to our ability to pay our obligations, an improvement in our credit ratings will not

reduce the other investment risks related to the notes. A credit rating is not a recommendation to buy, sell or hold

securities and may be revised or withdrawn by the rating agency at any time.

Credit rating agencies continually revise their

ratings for the companies that they follow, including us. Such ratings are based on a number of factors, including financial strength,

as well as factors not entirely within our control, such as conditions affecting the financial services industry generally. In

addition, credit ratings agencies have themselves been subject to scrutiny arising from the financial crisis that began in 2008

and there is no assurance that credit rating agencies will not make or be required to make substantial changes to their ratings

policies or practices or that such changes would not affect ratings of our securities, including the Old Notes and the New Notes.

A negative change in our ratings could have an adverse effect on the price of the notes that may remain outstanding. More generally,

a negative change in our ratings could increase our borrowing costs and limit our access to the capital markets.

An investment in the notes is not an FDIC insured deposit.

The notes are not savings accounts, deposits

or other obligations of any of our bank or non-bank subsidiaries and are not insured or guaranteed by the FDIC or any other governmental

agency or instrumentality. Your investment will be subject to investment risk and you may experience loss with respect to your

investment.

USE OF PROCEEDS

We will not receive any cash proceeds from

the exchange offer. In consideration for issuing the New Notes as contemplated by this prospectus, we will receive in

exchange Old Notes in like principal amount. We intend to cancel all Old Notes received in exchange for New Notes in the

exchange offer.

RATIO OF EARNINGS TO FIXED CHARGES

The following unaudited table presents our consolidated

ratio of earnings to fixed charges as defined in Item 503(d) of Regulation S-K for the periods presented. This information

should be read in conjunction with our consolidated financial statements and the accompanying notes incorporated by reference in

this prospectus and Exhibit 12.1 filed with the registration statement of which this prospectus is a part.

| | |

Three

Months

Ended

December

31, | |

Three

Months

Ended

December

31, | |

Year Ended September 30, |

| | |

2016 | |

2015 | |

2016 | |

2015 | |

2014 | |

2013 | |

2012 |

| Ratio of Earnings to Fixed Charges: | |

| |

| |

| |

| |

| |

| |

|

| Excluding interest on deposits | |

3.7X | |

3.6X | |

3.7X | |

3.0X | |

1.3X | |

-6.7X | |

2.5X |

| Including interest on deposits | |

1.8X | |

1.9X | |

1.9X | |

1.7X | |

1.1X | |

-0.8X | |

1.3X |

The ratio of earnings to fixed charges is

calculated in accordance with SEC requirements and computed by dividing earnings by fixed charges. For purposes of computing

the ratio of earnings to fixed charges, earnings represent earnings before income taxes plus fixed charges. Fixed charges,

excluding interest on deposits, include interest expense. Fixed charges, including interest on deposits, include interest

expense plus interest on deposits.

THE EXCHANGE OFFER

General

In connection with the issuance of the Old Notes

on February 7, 2017, we entered into a registration rights agreement with the initial purchasers of the Old Notes, which provides

for the exchange offer we are making pursuant to this prospectus. The exchange offer will permit eligible holders of Old Notes

to exchange their Old Notes for New Notes that are identical in all material respects with the Old Notes, except that:

| • | the New Notes have been registered

with the SEC under the Securities Act and, as a result, will not bear any legend restricting their transfer; |

| |

• |

the New Notes bear different CUSIP numbers from the Old Notes; |

| |

• |

the New Notes generally will not be subject to transfer restrictions; |

| |

• |

the New Notes will not be entitled to registration rights under the registration rights agreement or otherwise; and |

| |

• |

because the New Notes will not be entitled to registration rights, holders of the New Notes will not have the right to additional interest under the circumstances described in the registration rights agreement relating to our fulfillment of our registration obligations. |

The New Notes will evidence the same debt as

the Old Notes. Holders of the New Notes will be entitled to the benefits of the indenture. Accordingly, the New Notes and the Old

Notes will be treated as a single series of subordinated debt securities under the indenture. Old Notes that are not tendered for

exchange in the exchange offer will remain outstanding and interest on those Old Notes will continue to accrue at the applicable

interest rate and be subject to the terms of the indenture.

The exchange offer does not depend on any minimum

aggregate principal amount of Old Notes being tendered for exchange.

We intend to conduct the exchange offer in accordance

with the provisions of the registration rights agreement and the applicable requirements of the Exchange Act, and the related rules

and regulations of the SEC applicable to transactions of this type.

We will be deemed to have accepted validly tendered

Old Notes when and if we have given oral or written notice to the exchange agent of our acceptance of such Old Notes. Subject to

the terms and conditions of this exchange offer, delivery of New Notes will be made by the exchange agent promptly after receipt

of our notice of acceptance. The exchange agent will act as agent for the holders of Old Notes tendering their Old Notes for the

purpose of receiving New Notes from us in exchange for such tendered and accepted Old Notes. If any tendered Old Notes are not

accepted for exchange because of an invalid tender, the occurrence of other events described in this prospectus or otherwise, we

will return or cause to be returned the certificates for any unaccepted Old Notes, at our expense, to the tendering holder promptly

after the expiration of the exchange offer.

If a holder of Old Notes validly tenders Old

Notes in the exchange offer, the tendering holder will not be required to pay us brokerage commissions or fees. In addition, subject

to the instructions in the letter of transmittal and certain limited exceptions described in this prospectus, the tendering holder

will not have to pay transfer taxes for the exchange of Old Notes. Subject to certain exceptions described in this prospectus,

we will pay all of the expenses in connection with the exchange offer, other than certain applicable taxes. See “—Fees

and Expenses.”

Holders of outstanding Old Notes do not have

any appraisal, dissenters’ or similar rights in connection with the exchange offer. Outstanding Old Notes which are not tendered,

or are tendered but not accepted, in connection with the exchange offer will remain outstanding. See “Risk Factors—Risks

Related to the Exchange Offer—If you do not properly tender your Old Notes, you will continue to hold unregistered Old Notes

and your ability to transfer Old Notes will be adversely affected.”

WE ARE NOT MAKING ANY RECOMMENDATION TO THE HOLDERS OF THE OUTSTANDING

OLD NOTES AS TO WHETHER TO TENDER OR REFRAIN FROM TENDERING ALL OR ANY PORTION OF THEIR OUTSTANDING OLD NOTES IN THE EXCHANGE OFFER.

IN ADDITION, WE HAVE NOT AUTHORIZED ANYONE TO MAKE ANY SUCH RECOMMENDATION. HOLDERS OF THE OUTSTANDING OLD NOTES MUST MAKE THEIR

OWN DECISION WHETHER TO TENDER PURSUANT TO THE EXCHANGE OFFER, AND, IF SO, THE AGGREGATE PRINCIPAL AMOUNT OF OUTSTANDING OLD NOTES

TO TENDER AFTER READING THIS PROSPECTUS AND THE LETTER OF TRANSMITTAL AND CONSULTING WITH THEIR ADVISERS, IF ANY, BASED ON THEIR

FINANCIAL POSITION AND INDIVIDUAL REQUIREMENTS.

Registration Rights Agreement

The following provides a summary of certain

terms of the registration rights agreement. This summary is qualified in its entirety by reference to the complete version of the

registration rights agreement, which is incorporated by reference as an exhibit to the registration statement of which this prospectus

is a part.

Under the terms of the registration rights agreement

that we entered into with the purchasers of the Old Notes at the time we issued the Old Notes, we agreed to register the New Notes

and undertake this exchange offer. This exchange offer is intended to satisfy the rights of holders of Old Notes under that registration

rights agreement. After the exchange offer is completed, we will have no further obligations, except under the limited circumstances

described below, to provide for any exchange or undertake any further registration with respect to the Old Notes.

Under the terms of the registration rights agreement,

we agreed, among other things, to:

| |

• |

file a registration statement with the SEC under the Securities Act with respect to a registered offer to exchange the Old Notes for substantially identical notes that do not contain transfer restrictions and will be registered under the Securities Act; and |

| |

• |

use our commercially reasonable efforts to cause that registration statement to become effective no later than 120 days after February 7, 2017. |

The registration rights agreement also requires

us to commence the exchange offer promptly after the effectiveness of the registration statement and to keep the exchange offer

open for not less than 20 business days, or longer if required by applicable law, after the date on which notice of the exchange

offer is mailed to the holders of the Old Notes.

We also agreed to issue and exchange New Notes

for all Old Notes validly tendered and not validly withdrawn before the expiration of the exchange offer. We are sending this prospectus,

together with a letter of transmittal, to all the holders of the Old Notes known to us. For each Old Note validly tendered to us

in the exchange offer and not validly withdrawn, the holder will receive a New Note having a principal amount equal to the principal

amount of the tendered Old Note. Old Notes may be exchanged, and New Notes will be issued, only in minimum denominations of $1,000

and integral multiples of $1,000 in excess thereof.

We further agreed that under certain circumstances

we would either file a shelf registration statement with the SEC or designate an existing effective shelf registration statement

of ours that would allow resales by certain holders of the Old Notes in lieu of such holders participating in the exchange offer.

Eligibility; Transferability

We are making this exchange offer in reliance

on interpretations of the staff of the SEC set forth in several no-action letters provided to other parties. We have not sought

our own no-action letter from the staff of the SEC with respect to this particular exchange offer. However, based on these existing

SEC staff interpretations, we believe that you, or any other person receiving New Notes, may offer for resale, resell or otherwise

transfer the New Notes without complying with the registration and prospectus delivery requirements of the U.S. federal securities

laws, if:

|

|

• |

you are, or the person receiving the New Notes is, acquiring the New Notes in the ordinary course of business; |

| |

• |

you do not, nor does any such person, have an arrangement or understanding with any person to participate in any distribution (within the meaning of the Securities Act) of the New Notes; |

| |

• |

you are not, nor is any such person, our affiliate as such term is defined under Rule 405 under the Securities Act; |

| |

• |

you are not, or any such person is not, a broker-dealer registered under the Exchange Act,

and you are not engaged in or such person is not engaged in, and do not intend to engage in, any distribution (within the

meaning of the Securities Act) of the New Notes; and |

| |

• |

you are not acting on behalf of any person who could not truthfully make these statements. |

To participate in the exchange offer, you must

represent as a holder of Old Notes that each of these statements is true.

In addition, in order for broker-dealers registered

under the Exchange Act to participate in the exchange offer, each such broker-dealer must also (i) represent that it is participating

in the exchange offer for its own account and is exchanging Old Notes acquired as a result of market-making activities or other

trading activities; (ii) confirm that it has not entered into any arrangement or understanding with us or any of our affiliates

to distribute the New Notes; and (iii) acknowledge that it will deliver a prospectus meeting the requirements of the Securities

Act in connection with any resale of the New Notes. The letter of transmittal to be delivered in connection with a tender of the

Old Notes states that by acknowledging that it will deliver, and by delivering, a prospectus, a broker-dealer will not be deemed

to admit that it is an underwriter within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented

from time to time, may be used by a broker-dealer in connection with resale of the New Notes received in exchange for the Old Notes

where such Old Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We

have agreed that, for a period of 180 days following the expiration date, we will amend or supplement this prospectus to expedite