UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D. C. 20549

FORM 10-K

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the year ended December 31, 2016

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

Commission File Number 000-55432

TriLinc Global Impact Fund, LLC

(Exact name of registrant as specified in its charter)

|

Delaware |

|

36-4732802 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

1230 Rosecrans Avenue, Suite 605,

Manhattan Beach, CA 90266

(Address of principal executive offices)

(310) 997-0580

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Units of Limited Liability Company Interest

Indicate by check mark whether the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☑ |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act) Yes ☐ No ☑

There is no established trading market for the registrant’s units, and therefore the aggregate market value of the registrant’s units held by non-affiliates cannot be determined.

As of March 24, 2017, the Company had outstanding 16,890,678 Class A units, 7,724,769 Class C units, and 8,633,674 Class I units.

FOR THE YEAR ENDED DECEMBER 31, 2015

INDEX

|

|

|

|

|

Page |

|

|

|

|||

|

Item 1 |

|

|

4 |

|

|

Item 1A |

|

|

14 |

|

|

Item 1B |

|

|

30 |

|

|

Item 2 |

|

|

30 |

|

|

Item 3 |

|

|

30 |

|

|

Item 4 |

|

|

30 |

|

|

|

|

|||

|

Item 5 |

|

|

31 |

|

|

Item 6 |

|

|

35 |

|

|

Item 7 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

35 |

|

Item 7A |

|

|

48 |

|

|

Item 8 |

|

|

50 |

|

|

Item 9 |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

50 |

|

Item 9A |

|

|

50 |

|

|

Item 9B |

|

|

50 |

|

|

|

|

|||

|

Item 10 |

|

|

51 |

|

|

Item 11 |

|

|

56 |

|

|

Item 12 |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

58 |

|

Item 13 |

|

Certain Relationships and Related Transactions, and Director Independence |

|

58 |

|

Item 14 |

|

|

61 |

|

|

|

|

|||

|

Item 15 |

|

|

62 |

|

|

|

|

|

|

|

2

This Annual Report on Form 10-K contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue,” “future” or other similar words or expressions. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Such statements include, but are not limited to, those relating to our ability to successfully complete our public offering, our ability to pay distributions to our unitholders, our reliance on TriLinc Advisors, LLC, or the Advisor, and TriLinc Global, LLC, or the Sponsor, strategies and investment activities and our ability to effectively deploy capital. Our ability to predict results or the actual effect of plans or strategies is inherently uncertain. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements and you should not unduly rely on these statements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from those forward-looking statements. These factors include, but are not limited to:

|

|

• |

our future operating results; |

|

|

• |

our ability to raise capital in our offerings; |

|

|

• |

our ability to purchase or make investments; |

|

|

• |

our business prospects and the prospects of our borrowers; |

|

|

• |

the economic, social and/or environmental impact of the investments that we expect to make; |

|

|

• |

our contractual arrangements and relationships with third parties; |

|

|

• |

our ability to make distributions to our unitholders; |

|

|

• |

the dependence of our future success on the general economy and its impact on the companies in which we invest; |

|

|

• |

the availability of cash flow from operating activities for distributions and payment of operating expenses; |

|

|

• |

the performance of our Advisor, our sub-advisors and our Sponsor; |

|

|

• |

our dependence on our Advisor and our dependence on and the availability of the financial resources of our Sponsor; |

|

|

• |

the ability of our borrowers to make required payments; |

|

|

• |

our Advisor’s ability to attract and retain sufficient personnel to support our growth and operations; |

|

|

• |

the lack of a public trading market for our units; |

|

|

• |

our limited operating history; |

|

|

• |

our ability to obtain financing; |

|

|

• |

the adequacy of our cash resources and working capital; |

|

|

• |

performance of our investments relative to our expectations and the impact on our actual return on invested equity, as well as the cash provided by these investments; |

|

|

• |

any failure in our Advisor’s or sub-advisors’ due diligence to identify all relevant facts in our underwriting process or otherwise; |

|

|

• |

the ability of our sub-advisors and borrowers to achieve their objectives; |

|

|

• |

the effectiveness of our portfolio management techniques and strategies; |

|

|

• |

failure to maintain effective internal controls; and |

|

|

• |

the loss of our exemption from the definition of an “investment company” under the Investment Company Act of 1940, as amended. |

The foregoing list of factors is not exhaustive. All forward-looking statements included in this Annual Report on Form 10-K are based on information available to us on the date hereof and we are under no duty to update any of the forward-looking statements after the date of this report to conform these statements to actual results.

Factors that could have a material adverse effect on our operations and future prospects are set forth in our filings with the United States Securities and Exchange Commission, or the SEC, including the “Risk Factors” in this Annual Report on Form 10-K beginning on page 14. The risk factors set forth in our filings with the SEC could cause our actual results to differ significantly from those contained in any forward-looking statement contained in this report.

3

TriLinc Global Impact Fund, LLC is a Delaware limited liability company formed on April 30, 2012. Unless otherwise noted, the terms “we,” “us,” “our,” “the Company” and “our Company” refer to TriLinc Global Impact Fund, LLC; the term our “Advisor” and “TriLinc Advisors” refers to TriLinc Advisors, LLC, our external advisor; the term “SC Distributors” and our “dealer manager” refers to SC Distributors, LLC, our dealer manager; and the term our “Sponsor” refers to TriLinc Global, LLC, our sponsor.

Overview

The Company makes impact investments in Small and Medium Enterprises, or SMEs, which we define as those businesses having less than 500 employees, primarily in developing economies that provide the opportunity to achieve both competitive financial returns and positive measurable impact. To a lesser extent, we may also make impact investments in companies that may not meet our technical definition of SMEs due to a larger number of employees but that also provide the opportunity to achieve both competitive financial returns and positive measurable impact. We generally expect that such investments will have similar investment characteristics as SMEs as defined by us. We were organized as a Delaware limited liability company on April 30, 2012. We believe that we operate and intend to operate our business in a manner that permits us to maintain our exemption from registration under the Investment Company Act of 1940. We invest in SMEs through local market sub-advisors and our objective is to build a diversified portfolio of financial assets, including direct loans, loan participations, convertible debt instruments, trade finance, structured credit and preferred and common equity investments. We anticipate that a substantial portion of our assets will continue to consist of collateralized private debt instruments, which we believe offer opportunities for competitive risk-adjusted returns through income generation. We are externally managed and advised by TriLinc Advisors.

To assist the Company in achieving its investment objective, the Company makes investments via wholly owned subsidiaries. As of December 31, 2016, the Company has nine subsidiaries, all of which are Cayman Islands exempted companies. To assist the Advisor in managing the Company and its subsidiaries, the Advisor may provide services via TriLinc Advisors International, Ltd. (“TAI”), a Cayman Islands exempted company that is wholly owned by TriLinc Advisors, LLC.

Our business strategy is to generate competitive financial returns and positive economic, social and/or environmental impact by providing financing to SMEs, primarily in developing economies, defined as countries with national income classified by the World Bank as upper-middle income and below. Our style of investment is referred to as impact investing, which J.P. Morgan Global Research and Rockefeller Foundation in a 2010 report called “an emerging alternative asset class” and defined as investing with the intent to create positive impact beyond financial return. We believe it is possible to generate competitive financial returns while creating positive, measurable impact. Through our investments in SMEs, we intend to enable job creation and stimulate economic growth.

Our investment objectives are to provide our unitholders current income, capital preservation and modest capital appreciation. These objectives are achieved primarily through SME trade finance and term loan financing, while employing rigorous risk mitigation and due diligence practices, and transparently measuring and reporting the economic, social and environmental impacts of our investments. The majority of our investments are senior secured trade finance, senior secured loans, and other collateralized loans or loan participations to SMEs with established, profitable businesses in developing economies. With our sub-advisors, we expect to provide growth capital financing generally ranging in size from $5-15 million per transaction for direct SME loans and $500,000 to $10 million for trade finance transactions. We seek to protect and grow investor capital by: (1) targeting countries with favorable economic growth and investor protections; (2) partnering with sub-advisors with significant experience in local markets; (3) focusing on creditworthy lending targets which have at least 3-year operating histories and demonstrated cash flows enabling loan repayment; (4) making primarily debt investments, backed by collateral and borrower guarantees; (5) employing best practices in our due diligence and risk mitigation processes; and (6) monitoring our portfolio on an ongoing basis.

Our goal is to create a diversified portfolio of primarily private debt instruments, including trade finance and term loans, whose counterparties are small and medium-size businesses in developing economies. Private debt facilities generate current income and in some cases offer the potential for modest capital appreciation, while maintaining a higher place in a company’s capital structure than the equity held by the owners and other investors. As small and growing businesses, our borrowers have used and we expect them to continue to use capital to expand operations, improve the financial standing of their operations, or finance the trade of their goods. According to the most recent IFC SME Banking Guide, SMEs have been shown to improve job creation and GDP growth throughout the world, and we expect the portfolio of our investments to have a positive, measurable impact in their communities, in addition to offering a competitive financial return to the investor.

4

On February 25, 2013, our registration statement on Form S-1 was declared effective by the SEC. Pursuant to the registration statement, we are offering on a continuous basis up to $1.5 billion in units of our limited liability company interest, consisting of up to $1.25 billion of units in our primary offering, consisting of Class A units and Class C units at the initial offering prices of $10.00 per unit and $9.576 per unit, respectively, and Class I units at $9.025 per unit, which we refer to as the Primary Offering, and up to $250 million of units pursuant to our distribution reinvestment plan, which we refer to as the Distribution Reinvestment Plan, and which we collectively refer to as the Offering. The Primary Offering is due to terminate on March 31, 2017.

In May 2012, the Advisor purchased 22,161 Class A units for aggregate gross proceeds of $200,000. In June 2013, we satisfied our minimum offering requirement of $2,000,000 when the Sponsor purchased 321,330 Class A units for aggregate gross proceeds of $2,900,000 and we commenced operations. In February 2015, our board of managers elected to extend the Offering for up to an additional one year period, expiring on February 25, 2016. On November 18, 2015, our board of managers elected to extend the Offering for up to an additional six month period, expiring August 25, 2016. In February 2016, our board elected to extend the Offering to December 31, 2016. On September 20, 2016, the Company elected to further extend its current offering to March 31, 2017. Our board has the right to terminate the Offering at any time. As of December 31, 2016, we had received subscriptions for and issued 30,781,900 of our units, including 1,200,164 units issued under our Distribution Reinvestment Plan, for gross proceeds of approximately $296,248,000 including approximately $10,832,000 reinvested under our Distribution Reinvestment Plan (before dealer-manager fees of approximately $4,137,000 and selling commissions of $14,341,000, for net proceeds of $277,770,000).

On November 20, 2015, we filed a registration statement on Form S-1 with the SEC in connection with the proposed offering of up to $1.15 billion in units of our limited liability company interest, including $150.0 million in units to be issued pursuant to our distribution reinvestment plan (the “Follow-On Offering”). As of the date of this Annual Report on Form 10-K, the registration statement for the Follow-On Offering has not been declared effective by the SEC. If the Follow-On Offering is launched, it will only commence after the termination of the Primary Offering. Unless and until a follow-on offering is launched, we will file a Form S-3 registration statement to continue to sell units pursuant to our Distribution Reinvestment Plan. As of December 31, 2016, $1.20 billion in units remained available for sales pursuant to the Offering, including approximately $239.2 million in units available pursuant to our Distribution Reinvestment Plan.

Our Dealer Manager

SC Distributors, LLC, or SC Distributors, a Delaware limited liability company formed in March 2009, serves as our dealer manager for the Offering. Strategic Capital Advisory Services, LLC, or Strategic Capital, is an affiliate of our dealer manager and has an equity interest in our Advisor. Our dealer manager is a member firm of the Financial Industry Regulatory Authority, or FINRA. Our dealer manager receives dealer manager fees, selling commissions, distribution fees with respect to Class C units, and certain reimbursements for services relating to our Offering.

Our Advisor

TriLinc Advisors manages our investments. TriLinc Advisors is a private investment advisory firm focusing on impact investments in SMEs around the world. TriLinc Advisors is a registered investment adviser with the SEC. Led by its Chief Executive Officer and President, Gloria Nelund, its Chief Operating Officer and Chief Financial Officer, Brent VanNorman, and its Chief Investment Officer, Paul Sanford, TriLinc Advisors’ management team has a long track record and broad experience in the management of regulated, multi-billion dollar fund complexes and global macro portfolio management. TriLinc Advisors and our sub-advisors have an extensive network of relationships with emerging market private equity and debt managers, bilateral and multilateral Development Financial Institutions, or DFIs, and international consultancies and service providers that we believe benefit our portfolio of investments. We benefit from both the top-down, global macro investing approach of TriLinc Advisors and the bottom-up deal sourcing and structuring of our sub-advisors. Pursuant to the joint venture agreement and its ownership in TriLinc Advisors, Strategic Capital is entitled to receive distributions equal to 15% of the gross cash proceeds received by TriLinc Advisors from the management and incentive fees payable by us to TriLinc Advisors under the Amended and Restated Advisory Agreement, dated as of February 25, 2014, by and between the Company and the Advisor, as renewed through February 25, 2018 (the “Advisory Agreement”). See “Investment Advisory Agreements and Fees” section below.

We seek to capitalize on the significant investment experience of our Advisor’s management team, which has over 100 years of collective experience in financial services and investment. Our CEO and President, Gloria Nelund, founded our Sponsor in 2008 after a thirty year career in the international asset management industry.

To date, we have engaged, through our Advisor, ten investment managers in a sub-advisory capacity to source, evaluate, and monitor investments. Our local market sub-advisors have significant experience and established networks in our targeted asset classes, regions and countries, and adhere to the investment parameters as directed by the Advisor’s investment team and our board of managers. Primary sub-advisors, who will source the majority of our investments, must have a minimum five year investment track record and have invested at least $250 million in their target region. Secondary sub-advisors, who focus on a specific region or asset

5

class, must have a minimum three year investment track record and have invested at least $100 million in their target region. All sub-advisors must have continuity in their investment team, including senior management, and an investment strategy that can responsibly deploy appropriate levels of capital. Sub-advisors must have strong, independent risk controls and must screen for and track impact and the Environmental, Social and Governance (ESG) practices of the borrowers.

TriLinc Advisors has selected the following managers to act as sub-advisors:

|

|

• |

The International Investment Group L.L.C. (IIG): an SEC Registered Investment Advisor founded in 1994 focusing primarily on developing and managing alternative investment vehicles involved in global trade finance. Through various affiliates, the company has deployed over $9.0 billion in commodity and trade finance transactions to small and medium enterprises, primarily in developing economies. With approximately $720 million in total assets, IIG currently manages and/or services over $530 million in trade finance transactions. IIG is headquartered in New York with additional representatives in Brazil, Chile, Colombia, Ecuador and Malta. IIG’s management team has well over 100 years of cumulative experience in commodity and trade finance investments as well as in developing economies. Selective in transaction sourcing and execution, and typically working in conjunction with a large network of legal advisors, banks, merchants, brokers, professional organizations, investors and local representatives, the firm has successfully pursued the international trade finance strategy despite volatile markets for almost 20 years. IIG serves as a primary sub-advisor. |

|

|

• |

Asia Impact Capital Ltd. (AIC): an investment firm advised by the founding principals of TAEL Partners Ltd. (“TAEL”) and established to provide investment management services to us. TAEL is a leading Southeast Asian investment firm founded in 2007 by seasoned industry veterans with long term track records and diverse investment capabilities across Southeast Asia. TAEL’s investment professionals have deep roots in Southeast Asia and extensive experience working for leading financial institutions on both international and local levels. The company has a hands-on approach and can adapt and tailor its investment structures to the nuances of the Southeast Asian markets while partnering with established, growing businesses. Leveraging its wide and established network of business relationships in the region, TAEL generally enjoys an absence of competitive bidding, and is often able to undertake investments at attractive pricing levels. TAEL’s founding principals have over 70 years of collective Asian market investment experience and have closed over $30 billion worth of transactions across a diverse range of industries. AIC serves as a primary sub-advisor. |

|

|

• |

GMG Investment Advisors, LLC (GMG): based in New York, GMG is a specialized asset management firm focused on private credit investments in global emerging markets. The firm was co-founded in 2010 by Greg Gentile, former Head of Latin America Credit at both Lehman Brothers and Barclays Capital. He was joined by two additional senior partners who also held previous trading roles at Lehman Brothers. GMG invests primarily in the debt of SMEs, as well as securitizations and other asset backed transactions, which are structured in-house. The firm also co-manages a fund and a specialty lending company focused on microfinance lending and socially responsible debt. GMG serves as a secondary sub-advisor. |

|

|

• |

Barak Fund Management Ltd. (Barak): is an African based asset management company founded in 2008 that is focused on providing trade finance to small and middle market companies in the agriculture and commodities sectors. Barak specializes in sourcing and originating mainly soft commodity and food-related transactions with strong collateral characteristics. With affiliate offices in Mauritius and South Africa, the Barak team is able to source and take advantage of the numerous opportunities that arise in some of the world’s fastest growing economies. Barak has completed close to $1 billion in transactions across Sub-Saharan Africa since its inception. Barak’s two founding principals have more than 35 years of combined experience in trading, international banking and private equity investment in Africa. Both possess specialist expertise and proven track records in the agricultural and commodities sectors, developed at a variety of world class institutions such as Standard Bank, Absa, Barclays and Rand Merchant Bank. Barak serves as a secondary sub-advisor. |

|

|

• |

Helios Investment Partners, LLP (Helios): is an Africa-focused private investment firm managing funds totaling over $3 billion. Established in 2004, led and managed by a predominantly African team and based in London, Nigeria, and Kenya, Helios has completed investments in countries across the African continent. Helios’ portfolio companies operate in more than 35 countries in all regions of the continent, and the firm’s diverse investor base comprises a broad range of the world’s leading investors, including sovereign wealth funds, corporate and public pension funds, endowments and foundations, funds of funds, family offices and development finance institutions across the US, Europe, Asia and Africa. The Helios credit team’s senior members collectively have more than 55 years of investment experience in institutional lending, debt structuring, trading and risk management with previous tenures at leading financial institutions including Standard Chartered PLC, Bank of America N.A., Citibank N.A. and Renaissance Financial Holdings Limited and have completed over $4.2 billion in debt transactions across Africa. These investment professionals lead the Helios credit team’s disciplined loan structuring and diligent risk management processes and procedures to create attractive investment and impact opportunities for the Company’s term loan strategy throughout Sub-Saharan Africa. As one of the leading investment firms in the region, Helios’ regional networks will support the credit team’s mandate to provide financing to companies not well-served by banks or equity investors. Helios serves as a secondary sub-advisor. |

6

|

|

equity, private credit, hedge funds, fixed income, infrastructure and real estate. TRG is headquartered in New York, with offices around the globe including Brazil, Mexico, Peru, Uruguay, Argentina, India, Singapore, Hong Kong and London. TRG’s Latin American Credit Team (“LACT”) is comprised of four senior members, the majority of whom have been with the firm since 2004. Collectively, the four members have over 70 years of investment experience in institutional lending, debt structuring, sales and trading, and high-yield distressed debt transactions with previous tenures at leading financial institutions including J.P. Morgan, Citibank, Merrill Lynch, BBVA and the World Bank. With a deep network of relationships throughout Latin America, LACT has deployed over $490 million, since 2004, in credit transactions in some of the region’s most predominant sectors, including the utility, telecommunications, retail, and energy industries. TRG’s disciplined investment process, diligent investment administration and operations infrastructure, and strong emerging market investment track record support LACT and its strategy to create substantial value for its investors and SMEs that are currently underserved by traditional banks and financial intermediaries operating in the region. TRG serves as a secondary sub-advisor. |

|

|

• |

Alsis Funds, S.C. (“Alsis”): is a Latin America-focused asset management firm with offices in Mexico City and Miami that has deployed over $250 million, including $114 million asset-based lending, since its inception in 2007. Alsis is managed by a team of locals with significant experience, market knowledge, and extensive in-country networks. While Alsis’ investment activity is primarily in Mexico, the firm has proven to be a critical provider of capital to the growing SME segment and real estate industry across the region, with an attractive track record of deployed capital and realized returns in key growth industries. Alsis executes its SME strategy through a direct private lending approach that focuses on transactions that can be collateralized by purchase contracts with strong off-takers and also targets companies seeking financing backed by financial assets or real estate assets. Alsis’ executive management team possesses over 100 years of combined experience in transaction sourcing, underwriting, credit analysis, and asset management, at firms such as J.P. Morgan Chase, Deutsche Bank, Bear Stearns, and BBVA Bancomer. Alsis serves as a secondary sub-advisor. |

|

|

• |

Scipion Capital, Ltd. (“Scipion”): is a Sub-Saharan Africa-focused investment management firm that has deployed approximately $451 million in trade finance transactions since its inception in 2007. Headquartered in London, with an office in Geneva and investment team member presence in Botswana and South Africa, the firm focuses its investment strategy on managing a diversified portfolio of trade finance assets across multiple industries, geographies, and financing structures. More specifically, Scipion’s emphasis on short duration and self-liquidating transactions is a cornerstone of its investment strategy and has translated into an attractive track record of risk-adjusted returns and a reputation as one of the leading trade finance managers in the region. Scipion accomplishes its value proposition through the provision of short-term liquidity, usually with facility tenors of 120 days or less, to SMEs engaged in export and import-related transactions that would otherwise not have time-efficient access to finance from local financial institutions. Furthermore, Scipion’s investments pursue strong collateral coverage profiles consisting of inventory and accounts receivables. Scipion’s senior investment team executes the firm’s strategy through over 125 years of combined experience in banking and emerging markets, including over 50 years of combined experience specifically with trade finance in Africa, at firms such as Credit Suisse, Citicorp Investment Bank, Standard Chartered Bank, Barclays, and Chase. Scipion serves as a secondary sub-advisor. |

|

|

• |

EuroFin Investments Pte Ltd. and EFA RET Management Pte Ltd. (the “EFA Group”): is a Southeast Asia-headquartered asset manager that specializes in term loan and trade finance strategies, respectively, through its affiliated firms. Since inception in 2003, EFA Group has deployed over $5.4 billion in trade finance and term loan transactions globally, including over $107 million in term loan transactions in the Company’s target geographies of Vietnam, Malaysia, Indonesia, and Philippines. Headquartered in Singapore with offices in London, Geneva, Istanbul, and Dubai, EFA Group is a signatory to the United Nations-support Principles for Responsible Investment and is managed by an experienced team of investment professionals with in-depth market knowledge and extensive in-country networks. |

EFA Group’s term loan strategy leverages robust track records, credit histories, and relationships with borrowers from its trade finance portfolio. The synergy between the affiliated firms capitalizes on proprietary information and market intelligence, enabling EFA Group to execute structured senior secured mid-term loans to middle-market enterprises operating along the region’s real economy value chains.

Through its complementary lending strategies, EFA Group structures term loan products with strong collateral packages that include hard assets as well as service contracts, inventory, and share pledges.

The execution of EFA Group’s term loan strategy is led by the firm’s principals who have over 50 years of combined experience in lending strategies throughout the region, including past tenures at Rabobank Singapore, Noble Trade Finance Limited, FINCO Asia, PwC, and Calyon CIB. EFA Group’s investment activities are supported by a global network of more than 50 employees who provide strategic deal origination, credit underwriting, asset management, operations, and financial administration expertise. EFA Group’s experienced team and extensive track record of facilitating timely and flexible financing to growth-stage enterprises in the region is deepened by a diverse investor base, including top-tier pension funds, insurance companies, fund of funds, and family offices.

7

|

|

companies, agricultural producers, and manufacturers, who sell directly to overseas buyers. Since its inception, TransAsia has deployed approximately $350 million in over 850 Asian trade finance transactions with no default losses. TransAsia’s extensive in-country network allows the firm to leverage its reputation in the region to strengthen historical relationships and develop new relations with prospective clients. TransAsia’s competitive advantage is supported by its sophisticated institutional investor base. |

TransAsia has recognized that over the past five years, the demand for Asian trade finance, particularly for longer-dated transactions, has outpaced supply due to changes in regulatory capital requirements. TransAsia aims to reduce the widening gap in the lending market, created in large part by banks that have reallocated credit lines to larger borrowers. TriLinc’s partnership with TransAsia will provide longer dated trade finance and term loans to borrowers in Indonesia, Malaysia, Philippines, Cambodia, Thailand, Singapore, and Hong Kong, matching the demand of target borrower companies in the region, and helping them achieve sustainable growth through more flexible financing options.

TransAsia’s three managing partners are well-versed in Asian debt asset management with 90 years of combined experience in banking, private equity, and private debt. Each partner has robust experience in Asian markets developed at leading global financial institutions such as Lloyds, Chase Bank, Income Partners Asset Management, MeesPierson/Fortis Bank, and HypoVereinsbank. TransAsia’s strong credit analysis and structuring expertise is further supported by an in-house credit scoring system that is used for risk structuring, management, and monitoring.

TriLinc Advisors is a joint venture between our Sponsor and Strategic Capital. The purpose of the joint venture is to permit our Advisor to capitalize upon the expertise of our Sponsor’s management team as well as the experience of the executives of Strategic Capital in providing advisory services in connection with the formation, organization, registration and operation of entities similar to us. Strategic Capital provides certain services to, and on behalf of, our Advisor, including but not limited to formation and advisory services related to our formation and the structure of our public offering, financial and strategic planning advice and analysis, overseeing the development of marketing materials, selecting and negotiating with third party vendors and other administrative and operational services.

Investment Strategy

The Company seeks to generate competitive financial returns and positive economic, social and environmental impact by providing financing to SMEs. Our investment objectives are to provide our unitholders current income, capital preservation, and modest capital appreciation. We intend to meet our investment objectives through:

|

|

• |

Investing primarily in SME trade finance and term loans |

|

|

• |

A rigorous multi-level risk mitigation strategy at the portfolio level through “extreme” diversification, the sub-advisor level through rigorous due diligence and oversight, and the investment level through local market knowledge and credit expertise of our sub-advisors |

|

|

• |

Equity warrants and discounted trade receivables |

The majority of our investments have been and will continue to be senior secured trade finance, senior secured loans and other collateralized loans or loan participations to SMEs with established, profitable businesses in developing economies. With our sub-advisors, we provide growth capital financing generally ranging in size from $5-15 million per transaction for direct SME loans and $500,000 to $10 million for trade finance transactions. We seek to protect and grow investor capital by: (1) targeting countries with favorable economic growth and investor protections; (2) partnering with sub-advisors with significant experience in local markets; (3) focusing on creditworthy lending targets who have at least 3-year operating histories and demonstrated cash flows enabling loan repayment; (4) making primarily debt investments, backed by collateral and borrower guarantees; (5) employing sound due diligence and risk mitigation processes; and (6) monitoring our portfolio on an ongoing basis.

Investments have been and will continue to be primarily credit facilities to developing economy SMEs, including trade finance and SME term loans, through TriLinc Advisors’ team of professional sub-advisors with a local presence in the markets where they invest. We typically provide financing that is collateralized, has a short to medium-term maturity and is self-liquidating through the repayment of principal. By providing additional liquidity to growing small businesses, we believe we will support both economic growth and the expansion of the global middle class.

Investment Portfolio

The Company invests in various industries. The Company separately evaluates the performance of each of its investment relationships. However, because each of these investment relationships has similar business and economic characteristics, they have been aggregated into a single investment segment.

8

During the year ended December 31, 2016, we invested, either through direct loans or loans participation, approximately $252.2 million across 33 portfolio companies. Our investments consisted of senior secured trade finance participations, senior secured term loan participations, and senior secured term loans. Additionally, we received proceeds from repayments of investment principal of approximately $150.2 million. During the year ended December 31, 2015, we had invested approximately $138.1 million across 31 portfolio companies and received repayments of $90.5 million.

At December 31, 2016, our portfolio included 32 companies and was comprised of $28,673,487 or 14.1% in senior secured term loans, $58,450,761 or 28.7% in senior secured term loans participations, and $116,671,565 or 57.2% in senior secured trade finance participations. At December 31, 2015, our portfolio included 25 companies and was comprised of $5,474,534 or 5.4% in senior secured term loans, $18,484,242 or 18.3% in senior secured term loans participations, and $77,069,328 or 76.3% in senior secured trade finance participations.

The industrial and geographic composition of our portfolio at fair value as of December 31, 2016 and 2015 were as follows:

|

|

|

As of December 31, 2016 |

|

|

As of December 31, 2015 |

|

||||||||||

|

|

|

Fair |

|

|

Percentage |

|

|

Fair |

|

|

Percentage |

|

||||

|

Industry |

|

Value |

|

|

of Total |

|

|

Value |

|

|

of Total |

|

||||

|

Agricultural Products |

|

$ |

22,851,296 |

|

|

|

11.2 |

% |

|

$ |

27,452,577 |

|

|

|

27.2 |

% |

|

Bulk Fuel Stations and Terminals |

|

|

15,437,474 |

|

|

|

7.6 |

% |

|

|

— |

|

|

|

— |

|

|

Cash Grains |

|

|

— |

|

|

|

— |

|

|

|

4,275,182 |

|

|

|

4.2 |

% |

|

Coal and Other Minerals and Ores |

|

|

6,574,351 |

|

|

|

3.2 |

% |

|

|

— |

|

|

|

— |

|

|

Commercial Fishing |

|

|

1,058,273 |

|

|

|

0.5 |

% |

|

|

1,756,243 |

|

|

|

1.7 |

% |

|

Communications Equipment |

|

|

6,111,941 |

|

|

|

3.0 |

% |

|

|

5,918,086 |

|

|

|

5.9 |

% |

|

Construction Materials |

|

|

— |

|

|

|

— |

|

|

|

181,943 |

|

|

|

0.2 |

% |

|

Consumer Products |

|

|

9,900,000 |

|

|

|

4.9 |

% |

|

|

8,940,000 |

|

|

|

8.8 |

% |

|

Electric Services |

|

|

19,500,000 |

|

|

|

9.6 |

% |

|

|

— |

|

|

|

— |

|

|

Farm Products |

|

|

3,142,480 |

|

|

|

1.5 |

% |

|

|

2,900,000 |

|

|

|

2.9 |

% |

|

Fats and Oils |

|

|

6,000,000 |

|

|

|

2.9 |

% |

|

|

3,100,000 |

|

|

|

3.1 |

% |

|

Fertilizer & Agricultural Chemicals |

|

|

5,078,526 |

|

|

|

2.5 |

% |

|

|

5,750,000 |

|

|

|

5.7 |

% |

|

Fresh or Frozen Packaged Fish |

|

|

5,037,134 |

|

|

|

2.5 |

% |

|

|

— |

|

|

|

— |

|

|

Food Products |

|

|

740,690 |

|

|

|

0.4 |

% |

|

|

667,838 |

|

|

|

0.7 |

% |

|

Groceries and Related Products |

|

|

11,195,862 |

|

|

|

5.5 |

% |

|

|

— |

|

|

|

— |

|

|

Hotels and Motels |

|

|

17,000,000 |

|

|

|

8.3 |

% |

|

|

— |

|

|

|

— |

|

|

Machinery, Equipment, and Supplies |

|

|

11,483 |

|

|

|

0.0 |

% |

|

|

— |

|

|

|

— |

|

|

Meat, Poultry & Fish |

|

|

9,675,717 |

|

|

|

4.7 |

% |

|

|

11,524,816 |

|

|

|

11.4 |

% |

|

Metals & Mining |

|

|

2,234,145 |

|

|

|

1.1 |

% |

|

|

2,500,000 |

|

|

|

2.5 |

% |

|

Miscellaneous Plastics Products |

|

|

161,018 |

|

|

|

0.1 |

% |

|

|

— |

|

|

|

|

|

|

Packaged Foods & Meats |

|

|

500,000 |

|

|

|

0.2 |

% |

|

|

1,000,000 |

|

|

|

1.0 |

% |

|

Primary Nonferrous Metals |

|

|

3,000,000 |

|

|

|

1.5 |

% |

|

|

— |

|

|

|

— |

|

|

Primary Metal Industries |

|

|

6,000,000 |

|

|

|

2.9 |

% |

|

|

6,000,000 |

|

|

|

5.9 |

% |

|

Programming and Data Processing |

|

|

10,236,013 |

|

|

|

5.0 |

% |

|

|

5,474,534 |

|

|

|

5.4 |

% |

|

Rental of Railroad Cars |

|

|

4,411,650 |

|

|

|

2.2 |

% |

|

|

— |

|

|

|

— |

|

|

Secondary Nonferrous Metals |

|

|

7,649,945 |

|

|

|

3.8 |

% |

|

|

— |

|

|

|

— |

|

|

Soap, Detergents, and Cleaning |

|

|

2,000,000 |

|

|

|

1.0 |

% |

|

|

— |

|

|

|

— |

|

|

Street Construction |

|

|

14,927,195 |

|

|

|

7.3 |

% |

|

|

— |

|

|

|

— |

|

|

Textiles, Apparel & Luxury Goods |

|

|

— |

|

|

|

— |

|

|

|

724,219 |

|

|

|

0.7 |

% |

|

Water Transportation |

|

|

13,360,620 |

|

|

|

6.6 |

% |

|

|

12,862,666 |

|

|

|

12.7 |

% |

|

Total |

|

$ |

203,795,813 |

|

|

|

100.0 |

% |

|

$ |

101,028,104 |

|

|

|

100.0 |

% |

9

|

|

|

As of December 31, 2016 |

|

|

As of December 31, 2015 |

|

||||||||||

|

|

|

Fair |

|

|

Percentage |

|

|

Fair |

|

|

Percentage |

|

||||

|

Country |

|

Value |

|

|

of Total |

|

|

Value |

|

|

of Total |

|

||||

|

Argentina |

|

$ |

31,000,000 |

|

|

|

15.3 |

% |

|

$ |

27,800,000 |

|

|

|

27.5 |

% |

|

Brazil |

|

|

13,087,309 |

|

|

|

6.4 |

% |

|

|

8,156,110 |

|

|

|

8.1 |

% |

|

Cabo Verde |

|

|

17,000,000 |

|

|

|

8.3 |

% |

|

|

— |

|

|

|

— |

|

|

Chile |

|

|

2,234,915 |

|

|

|

1.1 |

% |

|

|

1,900,000 |

|

|

|

1.9 |

% |

|

Ecuador |

|

|

6,095,407 |

|

|

|

3.0 |

% |

|

|

1,756,243 |

|

|

|

1.7 |

% |

|

Ghana |

|

|

19,500,000 |

|

|

|

9.6 |

% |

|

|

— |

|

|

|

— |

|

|

Guatemala |

|

|

907,565 |

|

|

|

0.4 |

% |

|

|

1,000,000 |

|

|

|

1.0 |

% |

|

Indonesia |

|

|

17,927,195 |

|

|

|

8.8 |

% |

|

|

— |

|

|

|

— |

|

|

Kenya |

|

|

161,018 |

|

|

|

— |

|

|

|

375,182 |

|

|

|

0.4 |

% |

|

Mauritius |

|

|

11,195,862 |

|

|

|

5.5 |

% |

|

|

— |

|

|

|

— |

|

|

Morocco |

|

|

7,649,945 |

|

|

|

3.8 |

% |

|

|

— |

|

|

|

— |

|

|

Namibia |

|

|

500,000 |

|

|

|

0.2 |

% |

|

|

1,000,000 |

|

|

|

1.0 |

% |

|

Nigeria |

|

|

13,360,620 |

|

|

|

6.6 |

% |

|

|

12,862,666 |

|

|

|

12.7 |

% |

|

Peru |

|

|

19,337,474 |

|

|

|

9.5 |

% |

|

|

2,940,000 |

|

|

|

2.9 |

% |

|

Singapore |

|

|

10,000,000 |

|

|

|

4.9 |

% |

|

|

10,000,000 |

|

|

|

9.9 |

% |

|

South Africa |

|

|

14,174,143 |

|

|

|

7.0 |

% |

|

|

18,837,903 |

|

|

|

18.6 |

% |

|

Tanzania |

|

|

— |

|

|

|

— |

|

|

|

3,900,000 |

|

|

|

3.9 |

% |

|

United Kingdom |

|

|

6,585,834 |

|

|

|

3.2 |

% |

|

|

— |

|

|

|

— |

|

|

Zambia |

|

|

13,078,526 |

|

|

|

6.4 |

% |

|

|

10,500,000 |

|

|

|

10.4 |

% |

|

Total |

|

$ |

203,795,813 |

|

|

|

100.0 |

% |

|

$ |

101,028,104 |

|

|

|

100.0 |

% |

As of December 31, 2016, our largest investment represented approximately 7.8% of our net assets or 9.6% of our total portfolio.

As of December 31, 2015, our largest investment represented approximately 9.3% of our net assets or 12.7% of our total portfolio.

Measuring Impact

We measure and expect to regularly provide accounting of economic, social and/or environmental impact achieved through our investments. The Company’s impact measurement system is utilized with investments to evaluate the progress of borrower companies toward their impact objectives during the life of the investment. The system leverages technology that has been specifically developed for tracking and analyzing impact and includes full integration of the Global Impact Investing Network’s Impact Reporting and Investment Standards (“IRIS”) metrics. Impact measurement is accomplished through the establishment of initial baseline measurements for both the Company core economic development metrics, as well as metrics associated with borrower companies’ stated impact objectives. These baseline measurements will be compared against future measurements in order to track incremental progress. In addition to furthering the Company’s economic development impact objectives, we anticipate that our investments will have a positive effect on borrower companies’ ability to make progress toward their stated impact objectives(s).

On an annual basis, an updating assessment is completed. This includes collection of our core impact metrics and borrower company impact objective-specific metrics. Annual external assurance of impact metrics data will be completed by an independent, third party provider. In February 2015, we engaged Moss Adams LLP, with the approval of our Audit Committee, to perform an independent review of certain impact data which will be reported once the Company reaches a statistically significant sample of borrower companies that have been in our portfolio for at least one year. In January 2017, the Company issued its first Sustainability and Impact Report as of June 30, 2016.

Financing Strategy

We may opt to supplement our equity capital and increase potential returns to our unitholders through the use of prudent levels of borrowings from either commercial financial institutions or DFIs. We may use debt when the available terms and conditions are favorable to long-term investing and well-aligned with our investment strategy and portfolio composition. In determining whether to borrow money, we will seek to optimize maturity, covenant packages and rate structures. Most importantly, the risks of borrowing within the context of our investment outlook and the impact on our investment portfolio will be extensively analyzed in making this determination. As of December 31, 2016 and 2015, we had borrowings, through note offerings, amounting to $1,635,000 and $0, respectively. If we are not able to obtain additional financings, our returns are expected to be lower than originally anticipated.

10

Most of our investments are anticipated to continue to be denominated in U.S. dollars, but when exposed to foreign currencies, we will seek to hedge the exposure when prudent and cost-effective. These hedging activities may include the use of derivatives, swaps, or other financial products to hedge our interest rate or currency risk. At December 31, 2016 and 2015, all our investments were denominated in U.S. Dollars and, accordingly, we had not entered into any hedging transactions.

Operating Expense Responsibility Agreement

On March 25, 2017, the Company, Advisor and the Sponsor entered into an Amended and Restated Operating Expense Responsibility Agreement (“Responsibility Agreement”) originally effective as of June 11, 2013 and covering expenses through December 31, 2016. Since the inception of the Company through December 31, 2016, pursuant to the terms of the Responsibility Agreement, the Sponsor has paid approximately $9,496,400 of operating expenses, management fees, and incentive fees on behalf of the Company and will pay or reimburse to the Company an additional $3,333,600 of expenses, which have been accrued by the Sponsor as of December 31, 2016. Such expenses may not be reimbursable to the Sponsor until the Company has raised $200 million of gross proceeds in the Primary Offering and such reimbursement does not cause the Company’s net asset value per unit to fall below the prior quarter’s net asset value per unit (the “NAV Hurdle”). To the extent the Company does not meet the NAV Hurdle in any quarter, no amount will be payable by the Company for reimbursement to the Sponsor. While the Company has raised over $200 million of gross proceeds in the Primary Offering as of December 31, 2016, the Company has not met the NAV Hurdle for the quarter ended December 31, 2016 because any reimbursement would have caused the Company’s net asset value per unit to fall below the prior quarter. Therefore, expenses of the Company covered by the Responsibility Agreement have not been recorded as expenses of the Company as of December 31, 2016. In accordance with ASC 450, Contingencies, such expenses will be accrued and payable by the Company in the period that they become both probable and estimable. Following the end of the Primary Offering, the Sponsor could demand the reimbursement of operating expenses covered by the Responsibility Agreement if it does not cause a drop in the net asset value per unit. The Company cannot predict if or when this may occur.

Investment Advisory Agreements and Fees

We pay TriLinc Advisors an asset management fee and an incentive fee for its services under the Advisory Agreement. For the years ended December 31, 2016 and 2015, the Company incurred $4,172,643 and $2,006,532, respectively in management fees and $3,319,149 and $1,576,895, respectively in incentive fees to our Advisor. During the years ended December 31, 2016 and 2015, our Sponsor made expense support payments to the Company under the Amended and Restated Operating Expense Responsibility Agreement amounting to $842,468 and $559,734, respectively, for management fees and $2,970,292 and $1,576,895, respectively, for incentive fees.

Asset Management Fee

The asset management fee is calculated at an annual rate of 2.00% of our gross assets payable quarterly in arrears. For purposes of calculating the asset management fee, the term “gross assets” means the total net fair value of the Company’s assets at the end of the quarter, other than intangibles and after the deduction of associated allowance and reserves, as determined by the Advisor in its sole discretion.

Incentive Fee

The incentive fee is comprised of two parts: (i) a subordinated incentive fee on income and (ii) an incentive fee on capital gains. Each part of the incentive fee is outlined below.

The subordinated incentive fee on income is earned on pre-incentive fee net investment income and is determined and payable in arrears as of the end of each calendar quarter during which the Advisory Agreement is in effect. If the Advisory Agreement is terminated, the fee will also become payable as of the effective date of the termination.

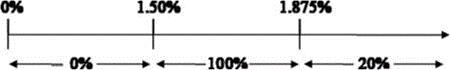

The subordinated incentive fee on income is subject to a quarterly preferred return to investors, expressed as a rate of return on net assets at the beginning of the most recently completed calendar quarter, of 1.50% (6.0% annualized), subject to a “catch up” feature. The subordinated incentive fee on income for each quarter is calculated as follows:

No incentive fee is earned by the Advisor in any calendar quarter in which our pre-incentive fee net investment income does not exceed the preferred return rate of 1.50%, or the preferred return.

100% of our pre-incentive fee net investment income, if any, that exceeds the quarterly preferred return, but is less than or equal to 1.875% (7.5% annualized) on our net assets at the end of the immediately preceding fiscal quarter, in any quarter, is payable to the

11

Advisor. We refer to this portion of our subordinated incentive fee on income as the catch up. It is intended to provide an incentive fee of 20% on all of our pre-incentive fee net investment income when our pre-incentive fee net investment income exceeds 1.875% on our net assets at the end of the immediately preceding fiscal quarter in any quarter.

For any quarter in which our pre-incentive fee net investment income exceeds 1.875% on our net assets at the end of the immediately preceding fiscal quarter, the subordinated incentive fee on income equals 20% of the amount of our pre-incentive fee net investment income, because the preferred return and catch up will have been achieved.

Pre-incentive fee net investment income is defined as interest income, dividend income and any other income accrued during the calendar quarter, minus our operating expenses for the quarter, including the asset management fee and operating expenses reimbursed to the Advisor. Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation.

The following is a graphical representation of the calculation of the quarterly subordinated incentive fee on income:

Quarterly Subordinated Incentive Fee on Income

Pre-incentive fee net investment income

(expressed as a percentage of net assets)

Percentage of pre-incentive fee net investment income

allocated to quarterly incentive fee

The incentive fee on capital gains is earned on investments sold or matured and shall be determined and payable in arrears as of the end of each calendar year during which the Advisory Agreement is in effect. In the case the Advisory Agreement is terminated, the fee will also become payable as of the effective date of such termination. The fee will equal 20% of our realized capital gains, less the aggregate amount of any previously paid incentive fee on capital gains. Incentive fee on capital gains is equal to our realized capital gains on a cumulative basis from inception, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis.

Because of the structure of the subordinated incentive fee on income and the incentive fee on capital gains, it is possible that we may pay such fees in a quarter where we incur a net loss. For example, if we receive pre-incentive fee net investment income in excess of the 1.75% on our net assets at the end of the immediately preceding fiscal quarter for a quarter, we will pay the applicable incentive fee even if we have incurred a net loss in the quarter due to a realized or unrealized capital loss. Our Advisor will not be under any obligation to reimburse us for any part of the incentive fee it receives that is based on prior period accrued income that we never receive as a result of a subsequent decline in the value of our portfolio.

The fees that are payable under the Advisory Agreement for any partial period are appropriately prorated. The fees are calculated using a detailed policy and procedure approved by our Advisor and our board of managers, including a majority of the independent managers, and such policy and procedure is consistent with the description of the calculation of the fees set forth above.

Our Advisor may elect to defer or waive all or a portion of the fees that would otherwise be paid to it in its sole discretion. Any portion of a fee not taken as to any month, quarter or year will be deferred without interest and may be taken in any such other month prior to the occurrence of a liquidity event as our Advisor may determine in its sole discretion.

Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act. For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. Although these exemptions will be available to us, they will not have a material impact on our public reporting and disclosure. We are deemed a “smaller reporting company” under the Securities Exchange Act of 1934, or the Exchange Act, and as a smaller reporting company,

12

we are permanently exempt from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act. In addition, because we have no employees, we do not have any executive compensation or golden parachute payments to report in our periodic reports and proxy statements.

We could be an emerging growth company for up to five years, although circumstances could cause us to lose that status earlier. We will remain an “emerging growth company” until the earliest to occur of (i) the last day of the fiscal year during which our total annual revenues equal or exceed $1 billion (subject to adjustment for inflation), (ii) the last day of the fiscal year following the fifth anniversary of our initial public offering, (iii) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt, or (iv) the date on which we are deemed a “large accelerated filer” under the Exchange Act.

Under the JOBS Act, emerging growth companies can also delay the adoption of new or revised accounting standards until such time as those standards apply to private companies. We are choosing to take advantage of the extended transition period for complying with new or revised accounting standards. As a result, our financial statements may not be comparable to those of companies that comply with public company effective dates.

Investment Company Act Considerations

We have conducted and intend to continue to conduct our operations so that we and our subsidiaries will qualify for an exemption under, or otherwise will not be required to register as an investment company under, the Investment Company Act of 1940, as amended, which we refer to as the Investment Company Act.

Section 3(a)(1)(A) of the Investment Company Act defines an investment company as any issuer that is or holds itself out as being engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities. Section 3(a)(1)(C) of the Investment Company Act defines an investment company as any issuer that is engaged or proposes to engage in the business of investing, reinvesting, owning, holding or trading in securities and owns or proposes to acquire investment securities having a value exceeding 40% of the value of the issuer’s total assets (exclusive of U.S. Government securities and cash items) on an unconsolidated basis, which we refer to as the 40% test. Excluded from the term “investment securities,” among other things, are U.S. Government securities and securities issued by majority-owned subsidiaries that are not themselves investment companies and are not relying on the exception from the definition of investment company set forth in Section 3(c)(1) or Section 3(c)(7) of the Investment Company Act.

We conduct our business primarily through our direct and indirect wholly- and majority-owned subsidiaries, including foreign subsidiaries, which were established to carry out specific activities. Although we reserve the right to modify our business methods at any time, the focus of our business involves providing loans and other financing of the nature described in this Form 10-K. We conduct our operations so that they comply with the limit imposed by the 40% test and we do not hold ourselves out as being engaged primarily, or actually engaged, in the business of investing in securities. Therefore, we expect that we will not be subject to registration or regulation as an investment company of any kind (including, without limitation, a face-amount certificate company, unit investment trust, open-end or closed-end company or a management company electing to be treated as a business development company) under the Investment Company Act. The securities issued to us by our wholly-owned or majority-owned subsidiaries, which subsidiaries will be neither investment companies nor companies exempt under Section 3(c)(1) or 3(c)(7) of the Investment Company Act, will not be investment securities for the purpose of this 40% test.

One or more of our subsidiaries may seek to qualify for an exception or exemption from registration as an investment company under the Investment Company Act pursuant to other provisions of the Investment Company Act, such as Sections 3(c)(5)(A) which is available for entities “primarily engaged in the business of purchasing or otherwise acquiring notes, drafts, acceptances, open accounts receivable, and other obligations representing part or all of the sales price of merchandise, insurance and services” and Section 3(c)(5)(B) which is available for entities “primarily engaged in the business of making loans to manufacturers, wholesalers, and retailers of, and to prospective purchasers of, specified merchandise, insurance and services.” Each of these exemptions generally requires that at least 55% of such subsidiary’s assets be invested in eligible loans and receivables. To qualify for either of the foregoing exemptions, the subsidiary would be required to comply with interpretations issued by the staff of the SEC that govern the respective activities.

We monitor our holdings and those of our subsidiaries to ensure continuing and ongoing compliance with these and/or other applicable tests, and we are responsible for making the determinations and calculations required to confirm our compliance with tests. If the SEC does not agree with our determinations, we may be required to adjust our activities and/or those of our subsidiaries.

Qualification for these or other exceptions or exemptions could affect our ability to originate, participate in or hold fixed-income assets, or could require us to dispose of investments that we might prefer to retain in order to remain qualified for such exemptions. Changes in current policies by the SEC and its staff could also require that we alter our business activities for this purpose. For a discussion of certain risks associated with the Investment Company Act, please see “Risk Factors.”

13

We compete with a large number of commercial banks, non-bank financial institutions, private equity funds, leveraged buyout and venture capital funds, investment banks and other equity and non-equity based investment funds. Many of our potential competitors are substantially larger and have considerably greater financial, technical and marketing resources than we do. For example, some competitors may have a lower cost of funds and access to funding sources that are not available to us. In addition, certain of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments and establish more relationships and build their market shares.

Concentration of credit risk

At December 31, 2016, our portfolio of $203,795,813 (at fair value) included 32 companies and was comprised of $28,673,487 or 14.1% in senior secured term loans, $58,450,761 or 28.7% in senior secured term loans participations, and $116,671,565 or 57.2% in senior secured trade finance participations. Our largest loan by value was $19,500,000 or 9.6% of our total portfolio. Our 5 largest loans by value comprised 39.4% of our portfolio at December 31, 2016. Participation in loans represented 85.9% of our portfolio at December 31, 2016.

Employees

We have no employees. Pursuant to the terms of the Advisory Agreement, the Advisor assumes principal responsibility for managing our affairs and we compensate the Advisor for these services.

Additional Information

Our internet address is www.trilincglobalimpactfund.com. Through a link on our website, we make available, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and prospectus, along with any amendments to those filings, as soon as reasonably practicable after we file or furnish them to the SEC.

Our privacy policy and Code of Ethics are also available on our website. Within the time period and as required by the rules of the SEC, we will post on our website any amendment to our Code of Ethics.

You should carefully read and consider the risks described below together with all other information in this Annual Report, including our consolidated financial statements and the related notes thereto, before making a decision to purchase our units. If certain of the following risks actually occur, our results of operations and ability to pay distributions would likely suffer materially, or could be eliminated entirely. As a result, the value of our units may decline, and our unitholders could lose all or part of the money they paid to buy our units.

Risks Relating to our Business and Structure: General

We have limited operating history and may be unable to successfully implement our investment strategy.

We were formed on April 30, 2012, and are subject to all of the business risks and uncertainties associated with any new business, including the risk that we will not achieve our investment objectives and that the value of units could decline substantially. Our financial condition and results of operations will depend on many factors including the availability of investment opportunities, general economic and market conditions and the performance of our Advisor and sub-advisors.

The lack of liquidity of our privately held investments may adversely affect our business.

Most of our investments consist and will continue to consist of loans and other fixed income instruments either originated in private transactions directly from borrowers or via participating agreements with direct lenders and the borrower. Investments may be subject to restrictions on resale, including, in some instances, legal restrictions, or will otherwise be less liquid than publicly traded securities. The illiquidity of our investments may make it difficult for us to quickly obtain cash equal to the value at which we record our investments if the need arises. This could cause us to miss important business opportunities. In addition, if we are required to quickly liquidate all or a portion of our portfolio, we may realize significantly less than the value at which we have previously recorded our investments. In addition, we may face other restrictions on our ability to liquidate an investment in a public company to the extent that the Company, its Advisor, or respective officers, employees or affiliates have material non-public information regarding such company.

14

We may not raise sufficient capital to sustain our operations or the operations of our Sponsor and Advisor

Pursuant to the terms of the Amended and Restated Operating Expense Responsibility Agreement, our Sponsor has absorbed and deferred reimbursement for a substantial portion of our operating expenses since we began our operations. As of December 31, 2016, the Sponsor has agreed to pay a cumulative total of approximately $12.8 million of operating expenses. If we fail to raise sufficient capital, our Sponsor and Advisor may not attain profitability and may not have sufficient liquidity to continue to support our operations. The lack of financial support from the Sponsor and Advisor could force us to significantly reduce our planned operations.

When we are a debt or minority equity investor in a portfolio company, which we expect will generally be the case, we may not be in a position to control the entity, and its management may make decisions that could decrease the value of our investment.

Most of our investments are and, we anticipate will continue to be in the future, either debt or minority equity investments in our portfolio companies. Therefore, we will be subject to risk that a portfolio company may make business decisions with which we disagree, and the management of such company may take risks or otherwise act in ways that do not serve our best interests. As a result, a portfolio company may make decisions that could decrease the value of our portfolio holdings. In addition, we will generally not be in a position to control any portfolio company by investing in its debt securities.

We operate in a highly competitive market for investment opportunities.

A large number of entities compete with us and make the types of investments that we seek to make in small and medium-sized privately owned businesses. We compete with a large number of commercial banks, non-bank financial institutions, private equity funds, leveraged buyout and venture capital funds, investment banks and other equity and non-equity based investment funds. Many of our competitors are substantially larger and have considerably greater financial, technical and marketing resources than we do. For example, some competitors may have a lower cost of funds and access to funding sources that are not available to us. In addition, certain of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments and establish more relationships and build their market shares. The competitive pressures we face may have a material adverse effect on our business, financial condition and results of operations. Also, as a result of this competition, we may not be able to take advantage of attractive investment opportunities from time to time, or to identify and make investments that satisfy our investment objectives or that we will be able to fully invest our available capital.

An investment strategy focused primarily on privately held companies presents certain challenges, including the lack of available information about these companies, a dependence on the talents and efforts of only a few key borrower personnel and a greater vulnerability to economic downturns.