Filed Pursuant to Rule 424(b)(3)

Registration No. 333-185676

TRILINC GLOBAL IMPACT FUND, LLC

SUPPLEMENT NO. 9 DATED OCTOBER 31, 2014

TO THE PROSPECTUS DATED APRIL 15, 2014

This prospectus supplement (“Supplement”) is part of and should be read in conjunction with the prospectus of TriLinc Global Impact Fund, LLC (the “Company”), dated April 15, 2014, as supplemented by Prospectus Supplement No. 1, dated May 19, 2014, Prospectus Supplement No. 2, dated June 30, 2014, Prospectus Supplement No. 3, dated July 7, 2014, Prospectus Supplement No. 4, dated July 23, 2014, Prospectus Supplement No. 5, dated July 28, 2014, Prospectus Supplement No. 6, dated August 18, 2014, Prospectus Supplement No. 7, dated August 29, 2014, and Prospectus Supplement No. 8, dated September 24, 2014 (the “Prospectus”).

The purposes of this Supplement are as follows:

| A. | To provide information regarding our public offering; and |

| B. | To update the section of the Prospectus titled “Business.” |

| A. | Status of Our Public Offering |

As of October 29, 2014, we had raised gross proceeds of approximately $56.2 million from the sale of approximately 6.0 million units of our limited liability company interest, including units issued pursuant to our distribution reinvestment plan.

| B. | Update to the Section Titled “Business” |

| 1. | The following information updates and supplements the “Business – Investments – Overview” section of the Prospectus to provide information regarding the Company’s investment portfolio as of September 30, 2014: |

Investments

Since the Company commenced operations and through September 30, 2014, the Company has funded in excess of $54.4 million in term loans and trade finance facilities. Given the Company’s weighted average portfolio duration of less than a year, a significant portion of the secured borrower debt has paid off and been reinvested in new transactions.

As of September 30, 2014 the Company had the following investments:

| Description | Sector | Country | Investment Type |

Maturity1 | Interest Rate2 |

Total Loan Commitment3 |

Total Amount Outstanding4 |

Primary Impact | ||||||||||||||

| Agriculture Distributor |

Agricultural Products |

Argentina | Trade Finance | 7/28/2015 | 9.00 | % | $ | 5,000,000 | $ | 5,000,000 | Job Creation | |||||||||||

| Beef Exporter |

Meat, Poultry & Fish |

Argentina | Trade Finance | 6/4/2015 | 11.98 | % | $ | 5,000,000 | $ | 4,000,000 | Job Creation | |||||||||||

| Candle Distributor |

Household Products |

South Africa | Trade Finance | 11/27/2014 | 12.75 | % | $ | 1,400,000 | $ | 1,400,000 | Job Creation | |||||||||||

| Cement Distributor |

Construction Materials |

Kenya | Trade Finance | 3/17/2015 | 14.75 | % | $ | 5,000,000 | $ | 5,000,000 | Job Creation | |||||||||||

| Consumer Goods Distributor |

Packaged Foods & Meats |

Namibia | Trade Finance | 11/15/2014 | 12.50 | % | $ | 2,000,000 | $ | 2,000,000 | Job Creation | |||||||||||

| Dairy Co-Operative |

Consumer Products |

Argentina | Trade Finance | 2/25/2015 | 10.33 | % | $ | 5,000,000 | $ | 3,500,000 | Job Creation | |||||||||||

| Diaper Mfg.5 |

Personal Products |

Peru | Term Loan | 06/15/2017 | 14.85 | % | $ | 2,750,000 | $ | 2,750,000 | Job Creation | |||||||||||

| Farm Supplies Distributor |

Fertilizers & Agricultural Chemicals |

Zambia | Trade Finance | 10/22/2014 | 12.50 | % | $ | 3,000,000 | $ | 3,000,000 | Job Creation | |||||||||||

| Fertilizer Distributor |

Fertilizers & Agricultural Chemicals |

Zambia | Trade Finance | 10/6/2014 | 12.00 | % | $ | 3,000,000 | $ | 1,808,823 | Job Creation | |||||||||||

| Description | Sector | Country | Investment Type |

Maturity1 | Interest Rate2 |

Total Loan Commitment3 |

Total Amount Outstanding4 |

Primary Impact | ||||||||||||||

| Food Processor |

Food Products |

Peru | Term Loan | 11/29/2014 | 13.00 | % | $ | 352,000 | $ | 352,000 | Job Creation | |||||||||||

| Fruit & Nut Distributor |

Food Products |

South Africa | Trade Finance | 10/2/2014 | 17.50 | % | $ | 1,250,000 | $ | 1,250,000 | Job Creation | |||||||||||

| Insulated Wire Manufacturer |

Electrical Equipment |

Peru | Trade Finance | 10/25/2014 | 8.00 | % | $ | 3,000,000 | $ | 1,991,000 | Job Creation | |||||||||||

| Meat Processor |

Meat, Poultry & Fish |

South Africa | Trade Finance | 11/1/2014 | 12.50 | % | $ | 1,000,000 | $ | 1,000,000 | Job Creation | |||||||||||

| Rice & Bean Importer |

Food Products |

South Africa | Trade Finance | 10/30/2014 | 12.50 | % | $ | 1,000,000 | $ | 1,000,000 | Job Creation | |||||||||||

| Sugar Producer |

Agricultural Products |

Brazil | Term Loan | 12/15/2016 | 12.43 | % | $ | 3,000,000 | $ | 3,000,000 | Capacity-Building | |||||||||||

| Textile Distributor |

Textiles, Apparel & Luxury Goods |

South Africa | Trade Finance | 12/5/2014 | 15.00 | % | $ | 1,500,000 | $ | 1,041,801 | Job Creation | |||||||||||

| Timber Exporter |

Forest Products |

Chile | Trade Finance | 6/28/2014 | 9.85 | % | $ | 500,000 | $ | 0,000 | Job Creation | |||||||||||

| Portfolio Totals |

$ | 43,752,000 | $ | 38,093,624 | ||||||||||||||||||

| 1 | Given the nature of trade finance contracts, trade finance borrowers typically have a 30 day grace period relative to the maturity date. |

| 2 | Interest rates are as of September 30, 2014. Interest rates include contractual rates and accrued fees where applicable. |

| 3 | The total loan commitment represents the maximum amount that can be borrowed under the agreement. The actual amount drawn on the loan by the borrower may change over time. Loan commitments are subject to availability of funds and do not represent a contractual obligation to provide funds to a borrower. |

| 4 | The total amount outstanding represents the actual amount borrowed under the loan as of September 30, 2014. In some instances where there is a $0 balance, the borrower may have paid back the original amount borrowed under a trade finance facility and under an agreement, may borrow again. |

| 5 | The interest rate includes 1.75% of deferred interest. |

In addition to the investments included in the above chart, on October 9 and October 10, 2014, the Company funded $176,633 and $167,607, respectively, as part of a trade finance transaction of up to $550,000 at a fixed interest rate of 12.75% to a South African construction materials supplier engaged in importing and distributing plastic piping and fittings for commercial and residential infrastructure purposes. The transaction, set to mature on April 9, 2015, is supported by specific piping and fitting inventory. The borrower anticipates that the financing will enable it to increase job creation.

Additionally, on October 23, 2014, the Company funded a $2,500,000 trade finance transaction at a rate of 17.5% to a South African mine remediation company engaged in the remediation of a recently shuttered zinc mine. The borrower’s activities include the creation of a rehabilitation fund, dismantling and disposal of mining equipment, removal and sale of tailings, and monitoring of ground water. The transaction, set to mature on October 1, 2015, is supported by inventory and receivables. In addition to recovering commercial-use materials from the soil, the remediation activities mitigate the environmental effects of the former mine. The borrower anticipates that the financing will enable it to generate employment opportunities.

Certain Portfolio Characteristics

| Total Assets (est.) |

44,742,000 | |||

| Current Loan Commitments |

43,752,000 | |||

| Leverage |

0 | % | ||

| Weighted Average Portfolio Loan Size |

3,173,239 | |||

| Weighted Average Portfolio Duration1 |

0.64 years | |||

| Weighted Average Position Yield |

12.24 | % | ||

| USD Denominated |

100 | % | ||

| Countries2 |

8 |

S-2

| 1 | Duration is calculated through the average turn of trade finance transactions and the contracted amortization of term loans. |

| 2 | The figure represents all countries where the Company has a loan commitment as of September 30, 2014. Due to the revolving debt nature of trade finance facilities and the timing of funding, it is possible that certain commitments currently have a zero outstanding balance and would therefore not be represented in the Developing Economies chart below, which represents invested capital. |

Top Five Investments by Percentage

| Agriculture Distributor |

Argentina | 11.2 | % | |||

| Cement Distributor |

Kenya | 11.2 | % | |||

| Beef Exporter |

Argentina | 8.9 | % | |||

| Dairy Co-Operative |

Argentina | 7.8 | % | |||

| Sugar Producer |

Brazil | 6.7 | % |

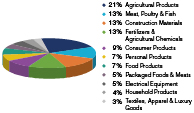

| Investment Type |

Developing Economies | Sector Diversification | ||

|

|

|

| ||

| 2. | The following information updates and supplements the “Business – Investments – Overview – Impact Overview” section of the Prospectus to provide an impact overview of the Company’s investment portfolio as of September 30, 2014: |

Impact Overview as of September 30, 2014

The Company’s borrower companies currently employ a total of 9,615 employees.

| Percentage of the Borrowers that: |

||||

| Comply with local environmental, labor, health, safety and business laws, standards and regulations |

100 | % | ||

| Demonstrate their positive impact on the community through community service and/or community donations |

65 | % | ||

| Commit to working towards implementing international environmental and health and safety best practices |

100 | % | ||

| Implement environmentally sustainable practices including energy savings, waste reduction and/or water conservation |

76 | % | ||

| Top Borrower Impact Objectives (total over 100% as borrowers can choose multiple) |

||||

| Job Creation |

94 | % | ||

| Agricultural Productivity & Food Security |

18 | % | ||

| Wage Increase |

18 | % | ||

| Capacity-Building |

12 | % | ||

| Health Improvement |

6 | % | ||

| Additional Borrower Impact Highlights |

||||

| Percentage of employees receiving training or technical assistance |

32 | % | ||

| Percentage of female employees |

15 | % | ||

S-3

| 3. | A. The following information updates and supplements the “Business – Investments – Investment Spotlight” section of the Prospectus to provide highlights from selected borrowers that have received financing from the Company September 30, 2014: |

Meat Processor

Investment Overview

| Investment Type | Trade Finance | |

| Structure |

Purchase & Repurchase Loan Facility | |

| Facility Amount1 |

1,000,000 | |

| Approximate Repayment Period2 |

1-365 days | |

| Interest Rate |

12.5% | |

| Sector |

Meat, Poultry & Fish | |

| Collateral Coverage Ratio3 |

1.17 | |

| Environmental, Social, and Governance Screens |

Compliant | |

| Primary Impact Objective |

Job Creation |

| 1 | The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time. |

| 2 | Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but will never exceed 365 days. |

| 3 | The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility. |

Borrower Background

According to the World Bank, South Africa is the second largest economy in Sub-Saharan Africa and has benefited from an estimated $32 billion of foreign direct investment in 2013. However, as noted by the World Bank, improvements in South Africa’s post-apartheid living standards and income inequality have not occurred as quickly as anticipated, as evidenced by the country’s nationwide unemployment rate of 25%. According to Statistics South Africa, these social and economic discrepancies are particularly apparent in the country’s rural areas, where unemployment rates range from 15.9% to 35%.

In July 2014, the Company extended a $1,000,000 trade finance facility to a vertically-integrated meat processing company operating in the rural provinces of Northern Cape and North West. Established in 1986, the borrower supplies meat to large, well-established wholesalers, retailers, and restaurants throughout the country. The borrower’s meat processing facility is one of only three in South Africa that have been certified by the South African Bureau of Standards as Hazard Analysis Critical Control Point (HACCP) compliant.

The Company’s financing is expected to support the borrower’s continued growth through the expansion of its distribution network and the addition of more retail outlets in the country’s underserved low- to middle-income consumer market. As a part of this growth, the borrower anticipates that it will expand its employee base. The borrower is one of the largest employers in the region and co-sponsors a school offering accredited on-site primary and secondary education and agricultural training to local children. Additionally, the borrower provides on-site housing for its employees, day care services for employees’ children, funds a soup kitchen, and makes additional food donations to local charitable organizations.

S-4

Consumer Goods Distributor

Investment Overview

| Investment Type | Senior Secured Trade Finance | |

| Structure | Purchase & Repurchase Loan Facility | |

| Facility Amount1 | 2,000,000 | |

| Approximate Repayment Period2 | 1-365 days | |

| Interest Rate | 12.5% | |

| Sector | Packaged Foods & Meats | |

| Collateral Coverage Ratio3 | 1.17 | |

| Environmental, Social, and Governance Screens | Compliant | |

| Primary Impact Objective | Job Creation |

| 1 | The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time. |

| 2 | Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but will never exceed 365 days. |

| 3 | The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility |

Borrower Background

The Company has provided financing to a consumer goods importer and distributor located in Namibia. Incorporated in 2006, the borrower distributes imported proprietary brand products to small, medium, and large-scale retailers throughout Namibia and other markets in Sub-Saharan Africa. The borrower’s product lines, which include sugar, rice, washing powder, UHT milk, and canned sardines, are sourced from international suppliers in Brazil and India, among others. It is anticipated that the Company’s financing will enable the borrower to increase its number of distribution channels, expand its regional footprint, increase sales, and continue to grow its employee base in a country historically noted for its high unemployment rate. The transaction is part of a purchase and repurchase trade finance facility that is secured by sugar and rice inventory as well as receivables. Additionally, the borrower:

| • | Targets job creation as the primary impact objective of its business activities. |

| • | Seeks to promote equality and empowerment in Namibia by targeting Namibia’s minority and/or previously excluded communities in its hiring efforts. |

| • | Strengthens food security in Sub-Saharan Africa by providing affordable and accessible consumer staple products to both Namibian and regional markets. |

| • | Is managed by professionals with over 21 years of industry experience, the borrower enhances affordability and accessibility in the region’s consumer goods market |

Fertilizer Distributor

Investment Overview

| Investment Type | Senior Secured Trade Finance | |

| Structure | Receivable Financing | |

| Facility Amount1 | 3,000,000 | |

| Approximate Repayment Period2 | 1-365 days | |

| Interest Rate | 12.00% | |

| Sector | Fertilizers and Agricultural Chemicals | |

| Collateral Coverage Ratio3 | 1.25 | |

| Environmental, Social, and Governance Screens | Compliant | |

| Primary Impact Objective | Job Creation |

S-5

| 1 | The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time. |

| 2 | Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but will never exceed 365 days. |

| 3 | The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility |

Borrower Background

The Company has provided financing to a fertilizer distributor in Zambia. Incorporated in 2004, the borrower is one of the largest crop enhancement blenders and distributors in Zambia and is known to be the only company that offers mixed inorganic and organic fertilizer varieties in the country. Although the U.S. Central Intelligence Agency reports that Zambia’s agricultural sector represents approximately 85% of its labor force and 19.8% of its annual GDP, growth in this sector is limited by inefficient natural resource management techniques, soil degredation, and low levels of productivity. As a fertilizer distributor, the borrower plays a crucial role in promoting agricultural productivity and food security throughout Zambia. The borrower provides blends for specific crop types and also distributes its product in various sizes, thereby serving the needs of subsistence farmers as well as commercial growers. The Company’s financing provides short-term liquidity to the borrower to secure future purchases of additional fertilizer product from its international supplier network. Historically, such liquidity has allowed the borrower to strengthen its position in the Zambian fertilizer market as a reliable and consistent supplier in the country’s agricultural value chain. Additionally, the borrower:

| • | Provides agronomic training to small-scale farmers and their employees so as to promote increased crop yields, efficiency, productivity, and land management techniques. |

| • | Provides three distinct fertilizer products for distribution to small-scale farmers and farmer associations throughout Zambia through the Government of Zambia’s Farmer Input Support Program. |

| • | Offers crop-specific fertilizer blends for enchanced yields and distributes its product in both industry standard packaging for commerical customers and price-acesssible packaging for subsistence end-users. |

| • | Has management practices that include waste reduction and energy savings programs, subsidized meals for employees, and fair hiring, with a preference for employees from local communities. |

Fruit and Nut Distributor

Investment Overview

| Investment Type |

Senior Secured Trade Finance | |

| Structure |

Purchase and Repurchase Loan Facility | |

| Facility Amount1 |

1,250,000 | |

| Approximate Repayment Period2 |

1-365 days | |

| Interest Rate |

17.50% | |

| Sector |

Food Products | |

| Collateral Coverage Ratio3 |

1.17 | |

| Environmental, Social, and Governance Screens |

Compliant | |

| Primary Impact Objective |

Job Creation |

| 1 | The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time. |

| 2 | Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but will never exceed 365 days. |

S-6

| 3 | The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility. |

Borrower Background

The Company has provided financing to a nut, dried fruit and seed processor and distributor located in South Africa. Incorporated in 2011, the borrower company’s two key principals have nearly 40 years of combined experience in the sector. Through the financing and logistical expertise provided by the Company’s sub-advisor, the borrower has been able to grow its sourcing network around the globe. It is anticipated that the Company’s financing will allow the borrower to continue to improve its capacity to support sales growth. The borrower has established a consistent repayment track record with the sub-advisor. According to the borrower, all production is overseen by a food technologist and monitored by a quality control team following the guidelines of Good Manufacturing Practices (GMP). The borrower prides itself on bringing the nutritional and health benefits of nuts, seeds and dried fruits to consumers. Additionally, the borrower:

| • | Targets job creation, equal opportunity employment through South Africa’s Broad-Based Black Economic Empowerment program, and health improvement as major objectives of its business. |

| • | Complies with GMP as regulated by the South African Medicines Control Council (MCC), which ensures consistent, high quality products for consumers. |

| • | Borrower maintains a modern manufacturing facility that offers a safe work environment for its employees. |

Rice and Bean Importer

Investment Overview

| Investment Type |

Senior Secured Trade Finance | |

| Structure |

Purchase and Repurchase Loan Facility | |

| Facility Amount1 |

1,000,000 | |

| Approximate Repayment Period2 |

1-365 days | |

| Interest Rate |

12.50% | |

| Sector |

Food Products | |

| Collateral Coverage Ratio3 |

1.17 | |

| Environmental, Social, and Governance Screens |

Compliant | |

| Primary Impact Objective |

Job Creation |

| 1 | The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time. |

| 2 | Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but will never exceed 365 days. |

| 3 | The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility. |

Borrower Background

The Company has provided financing to a rice and bean importer located in South Africa. Incorporated in 2001, the borrower began its operations as a small-scale distributor of rice and bean imports from India. Over the past five years, the borrower has expanded its business significantly and is now a supplier to large discount supermarkets throughout South Africa and the greater Sub-Saharan Africa region. These supermarkets sell substantial volumes of rice product to small-size traders and independent stores that serve both the rural and low-income consumer segments. For example, the borrower is the largest supplier of store brand rice to Massmart, a subsidiary of Walmart with over 376 locations (346 in South Africa) and 431 buying group

S-7

members throughout the region. It is anticipated that the Company’s financing will allow the borrower to strengthen its operations, continue providing a consistent supply of product, and increase its number of employees. According to the sub-advisor, the borrower has established a consistent repayment track record. The transaction is part of a purchase and repurchase agreement secured by rice inventory. Additionally, the borrower:

| • | Provides professional training programs such as computer literacy, junior management and supervisor development, and occupational health and safety to its employees, approximately half of whom are classified as either semi-skilled or unskilled laborers. |

| • | Is committed to product safety, quality, and freshness and utilizes an independent auditor to ensure compliance with Hazard Analysis Critical Control Point (HACCP) principles, ISO/TS 22002 Prerequisite Programmes on Food Safety and the Global Food Safety Initiative’s (GFSI) Food Safety Management System requirements, amongst other national and international certification standards and regulations. |

| • | Targets job creation and equal opportunity employment through implementing South Africa’s Broad-Based Black Economic Empowerment program. |

Textile Distributor

Investment Overview

| Investment Type |

Senior Secured Trade Finance | |

| Structure |

Purchase and Repurchase Loan Facility | |

| Facility Amount1 |

1,500,000 | |

| Approximate Repayment Period2 |

1-365 days | |

| Interest Rate |

15.00% | |

| Sector |

Textile, Apparel, and Luxury Goods | |

| Collateral Coverage Ratio3 |

1.17 | |

| Environmental, Social, and Governance Screens |

Compliant | |

| Primary Impact Objective |

Job Creation |

| 1 | The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time. |

| 2 | Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but will never exceed 365 days. |

| 3 | The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility. |

Borrower Background

The Company has provided financing to a textile and clothing distributor located in South Africa. Incorporated in 1999, the borrower has expanded its business operations to include an Australian offshore clothing wholesaler and a Hong Kong-based sourcing warehouse. In South Africa, the borrower provides a range of services to its retail business customers, including trend forecasting, product design and development, production sourcing and planning, inbound and outbound logistics, and management of replenishment stock and order packaging. It is anticipated that the Company financing will enable the borrower to continue to increase its number of employees and expand its market presence in South Africa. The transaction is part of a revolving trade finance facility that is secured by inventory and receivables. The borrower prides itself on servicing the growing South African retail market through catalyzing the supply of clothing and textiles to a variety of market segments, including the low-income, budget-conscious, mid-priced, and high quality categories. Additionally, the borrower:

| • | Targets job creation as the primary impact objective of its business activities. |

S-8

| • | Is responsible corporate citizen that provides both in-kind and monetary donations to employee-selected local charities on an annual basis. For example, the borrower has historically focused on empowerment through education as a cornerstone of its corporate citizenship policy by providing used computers to local schools. |

| • | Is conscious of its environmental impact as it implements energy efficient lighting and recycling programs at its facilities. |

B. The following information supplements the disclosure in section titled “Business – Investments – Investment Spotlight- Sustainable Timber Exporter-Borrower Background” on page 76 of the Prospectus:

The borrower is engaged in the acquisition and processing of timber into wood chips and wood blocks for export to a large Tokyo-based Japanese conglomerate. In operation since 1991, the borrower expects that the Company’s financing will support continued sales growth and enable the company to create more jobs. The facility is backed by a letter of credit issued by a major Japanese bank, as well as inventory.

S-9