Table of Contents

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange On Which Registered | ||

(one American depositary share representing two Class A ordinary shares, par value US$0.00002 per share) |

(The Nasdaq Global Select Market) | |||

The Stock Exchange of Hong Kong Limited | ||||

| ☒ | Accelerated filer | ☐ | ||||||

Non-accelerated filer |

☐ | Emerging growth company | ||||||

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ |

Other ☐ |

Table of Contents

TABLE OF CONTENT

i

Table of Contents

INTRODUCTION

Unless otherwise indicated or the context otherwise requires, references in this annual report to:

| • | “ADSs” are to our American depositary shares, each of which represents two Class A ordinary shares; |

| • | “annual active customer accounts” are to customer accounts that made at least one purchase during the twelve months ended on the respective dates, including both online retail and online marketplace; |

| • | “CCASS” are to the Central Clearing and Settlement System established and operated by Hong Kong Securities Clearing Company Limited, a wholly-owned subsidiary of Hong Kong Exchange and Clearing Limited; |

| • | “China” or the “PRC” are to the People’s Republic of China; |

| • | “Companies (WUMP) Ordinance” are to the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Chapter 32 of the Laws of Hong Kong), as amended or supplemented from time to time; |

| • | “CSRC” are to the China Securities Regulatory Commission; |

| • | “HFCAA” are to the Holding Foreign Companies Accountable Act; |

| • | “HK$” or “Hong Kong dollars” or “HK dollars” are to Hong Kong dollars, the lawful currency of Hong Kong; |

| • | “Hong Kong” or “HK” or “Hong Kong S.A.R.” are to the Hong Kong Special Administrative Region of the PRC; |

| • | “Hong Kong Listing Rules” are to the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited, as amended or supplemented from time to time; |

| • | “Hong Kong Share Registrar” are to Computershare Hong Kong Investor Services Limited; |

| • | “Hong Kong Stock Exchange” are to The Stock Exchange of Hong Kong Limited; |

| • | “JD Health” are to JD Health International Inc., a consolidated subsidiary of our company and the shares of which are listed on the Main Board of the Hong Kong Stock Exchange (Stock Code: 6618), and, except where the context otherwise requires, its subsidiaries and its consolidated variable interest entities and their subsidiaries; |

| • | “JD Industrials” are to JINGDONG Industrials, Inc. (formerly known as JD Industrial Technology Inc. and renamed as in March 2023), a consolidated subsidiary of our company and, except where the context otherwise requires, its subsidiaries and its consolidated variable interest entities and their subsidiaries; |

| • | “JD Logistics” are to JD Logistics, Inc., a consolidated subsidiary of our company and the shares of which are listed on the Main Board of the Hong Kong Stock Exchange (Stock Code: 2618), and, except where the context otherwise requires, its subsidiaries and its consolidated variable interest entities and their subsidiaries; |

| • | “JD Property” are to JINGDONG Property, Inc. (formerly known as JD Property Group Corporation and renamed as in March 2023), a consolidated subsidiary of our company and, except where the context otherwise requires, its subsidiaries and its consolidated variable interest entities and their subsidiaries; |

| • | “Main Board” are to the stock market (excluding the option market) operated by the Hong Kong Stock Exchange which is independent from and operated in parallel with the Growth Enterprise Market, or GEM, of the Hong Kong Stock Exchange; |

| • | “ordinary shares” are to our Class A and Class B ordinary shares, par value US$0.00002 per share; |

| • | “PCAOB” are to the Public Company Accounting Oversight Board of the United States; |

| • | “SEC” are to the United States Securities and Exchange Commission; |

| • | “SFC” are to the Securities and Futures Commission of Hong Kong; |

1

Table of Contents

| • | “SFO” are to the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong), as amended or supplemented from time to time; and |

| • | “we,” “us,” “our company” or “our” are to JD.com, Inc., its subsidiaries, and, in the context of describing our operations and consolidated financial information, the consolidated variable interest entities and their subsidiaries. The consolidated variable interest entities include, among others, Beijing Jingdong 360 Degree E-Commerce Co., Ltd., Jiangsu Yuanzhou E-Commerce Co., Ltd., Xi’an Jingdong Xincheng Information Technology Co., Ltd., Jiangsu Jingdong Bangneng Investment Management Co., Ltd., and Suqian Juhe Digital Enterprise Management Co., Ltd. References to the consolidated variable interest entities may include their subsidiaries, depending on the context as appropriate. The consolidated variable interest entities are PRC companies conducting operations in the Chinese mainland, and their financial results have been consolidated into our consolidated financial statements under U.S. GAAP for accounting purposes. JD.com, Inc. is a holding company with no operations of its own. We do not have any equity ownership in the consolidated variable interest entities. |

Summary of Risk Factors

An investment in our ADSs or Class A ordinary shares involves significant risks. Below is a summary of material risks we face, organized under relevant headings. The operational risks associated with being based in and having operations in the Chinese mainland also apply to operations in Hong Kong and Macau. While entities and businesses in Hong Kong and Macau operate under different sets of laws from the Chinese mainland, the legal risks associated with being based in and having operations in the Chinese mainland could apply to our operations in Hong Kong and Macau, if the laws applicable to the Chinese mainland become applicable to entities and businesses in Hong Kong and Macau in the future. These risks are discussed more fully in “Item 3.D. Key Information—Risk Factors.”

Risks Related to Our Business

Risks and uncertainties relating to our business include, but are not limited to, the following:

| • | If we are unable to manage our growth or execute our strategies effectively, our business and prospects may be materially and adversely affected. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Business—If we are unable to manage our growth or execute our strategies effectively, our business and prospects may be materially and adversely affected” on page 22 for details; |

| • | We incurred net losses in the past and we may not be able to maintain profitability in the future. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Business—We incurred net losses in the past and we may not be able to maintain profitability in the future” on page 22 for details; |

| • | If we are unable to provide superior customer experience, our business and reputation may be materially and adversely affected. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Business—If we are unable to provide superior customer experience, our business and reputation may be materially and adversely affected” on page 22 for details; |

| • | Uncertainties relating to the growth and profitability of the retail industry in China in general, and the online retail industry in particular, could adversely affect our revenues and business prospects. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Business—Uncertainties relating to the growth and profitability of the retail industry in China in general, and the online retail industry in particular, could adversely affect our business, prospects and results of operations” on page 23 for details; |

| • | Any harm to our JD brand or reputation may materially and adversely affect our business and results of operations. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Business—Any harm to our JD brand or reputation may materially and adversely affect our business and results of operations” on page 23 for details; |

| • | If we are unable to offer products that attract purchases from new and existing customers, our business, financial condition and results of operations may be materially and adversely affected. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Business—If we are unable to offer products that attract purchases from new and existing customers, our business, financial condition and results of operations may be materially and adversely affected” on page 24 for details; |

| • | If we are unable to manage our nationwide fulfillment infrastructure efficiently and effectively, our business prospects and results of operations may be materially and adversely affected. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Business—If we are unable to manage our nationwide fulfillment infrastructure efficiently and effectively, our business prospects and results of operations may be materially and adversely affected” on page 24 for details; |

2

Table of Contents

| • | We face intense competition. We may not be able to maintain or may lose market share and customers if we fail to compete effectively. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Business—We face intense competition. We may not be able to maintain or may lose market share and customers if we fail to compete effectively” on page 25 for details; |

| • | Our expansion into new product categories and substantial increase in the number of products may expose us to new challenges and more risks. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Business—Our expansion into new product categories and substantial increase in the number of products may expose us to new challenges and more risks” on page 26 for details; |

| • | If we fail to manage our inventory effectively, our results of operations, financial condition and liquidity may be materially and adversely affected. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Business—If we fail to manage our inventory effectively, our results of operations, financial condition and liquidity may be materially and adversely affected” on page 26 for details; |

| • | Our business is subject to complex and evolving Chinese and international laws and regulations regarding data privacy and cybersecurity. Failure to protect confidential information of our customers and network against security breaches could damage our reputation and brand and substantially harm our business and results of operations. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Business—Our business is subject to complex and evolving Chinese and international laws and regulations regarding data privacy and cybersecurity. Failure to protect confidential information of our customers and network against security breaches could damage our reputation and brand and substantially harm our business and results of operations” on page 35 for details; |

| • | The approval of the CSRC or other PRC government authorities may be required in connection with our offshore offerings under PRC law, and, if required, we cannot predict whether or for how long we will be able to obtain such approval. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Business—The approval of and/or filing with the CSRC or other PRC government authorities may be required in connection with our offshore offerings under PRC law, and, if required, we cannot predict whether or for how long we will be able to obtain such approval or complete such filing” on page 49 for details; |

| • | The PCAOB had historically been unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections of our auditor in the past has deprived our investors with the benefits of such inspections. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Business—The PCAOB had historically been unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections of our auditor in the past has deprived our investors with the benefits of such inspections” on page 50 for details; and |

| • | Our ADSs may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in China. The delisting of the ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Business—Our ADSs may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in China. The delisting of the ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment” on page 50 for details. |

Risks Related to Our Corporate Structure

Risks and uncertainties relating to our corporate structure include, but are not limited to, the following:

| • | We are a Cayman Islands holding company with no equity ownership in the consolidated variable interest entities and we conduct certain of our operations through the consolidated variable interest entities, with which we have maintained contractual arrangements. Investors in our ADSs or Class A ordinary shares thus are not purchasing equity interest in the consolidated variable interest entities in China but instead are purchasing equity interest in a Cayman Islands holding company. If the PRC government determines that the contractual agreements that constituting part of the consolidated variable interest entities the structure do not comply with PRC laws and regulations, or if these laws and regulations change or are interpreted differently in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. Our holding company, the consolidated variable interest entities and investors of our company face uncertainty about potential future actions by the PRC government that could affect the enforceability of the contractual arrangements with the consolidated variable interest entities and, consequently, significantly affect the financial performance of the consolidated variable interest entities and our company as a whole. The PRC regulatory authorities could disallow the variable interest entities structure, which would likely result in a material adverse change in our operations, and our ADSs or Class A ordinary shares may decline significantly in value. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Corporate Structure—If the PRC government determines that the contractual arrangements constituting part of the consolidated variable interest entities structure do not comply with PRC laws and regulations, or if these laws and regulations change or are interpreted differently in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations” on page 52 for details |

3

Table of Contents

| • | Any failure by the consolidated variable interest entities or their shareholders to perform their obligations under the contractual arrangements with them would have a material and adverse effect on our business. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Corporate Structure—Any failure by the consolidated variable interest entities or their shareholders to perform their obligations under our contractual arrangements with them would have a material and adverse effect on our business” on page 54 for details; and |

| • | The shareholders of the consolidated variable interest entities may have potential conflicts of interest with us, which may materially and adversely affect our business and financial condition. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Corporate Structure—The shareholders of the consolidate variable interest entities may have potential conflicts of interest with us, which may materially and adversely affect our business and financial condition” on page 55 for details. |

Risks Related to Doing Business in China

We are also subject to risks and uncertainties relating to doing business in China in general, including, but are not limited to, the following:

| • | PRC government has significant authority in regulating our operations and may influence our operations. It may exert more oversight and control over offerings conducted overseas by, and/or foreign investment in, China-based issuers, which could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. Implementation of industry-wide regulations in this nature may cause the value of such securities to significantly decline. See “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—The PRC government’s significant oversight over our business operation could result in a material adverse change in our operations and the value of our ADSs and Class A ordinary shares” on page 61 for details; |

| • | Changes in China’s or global economic, political or social conditions or government policies could have a material and adverse effect on our business and operations. See “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—Changes in China’s or global economic, political or social conditions or government policies could have a material and adverse effect on our business and operations” on page 57 for details; |

| • | Uncertainties with respect to the legal system in the Chinese mainland could adversely affect us. Certain laws and regulations in the Chinese mainland can evolve quickly, which bring risks and uncertainties to their interpretation and enforcement. Administrative and court proceedings in the Chinese mainland may be protracted. Some government policies and internal rules may not be published on a timely manner. These risks and uncertainties may make it difficult for us to meet or comply with requirements under the applicable laws and regulations. See “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—Uncertainties with respect to the legal system in the Chinese mainland could adversely affect us” on page 58 for details; |

| • | We are subject to consumer protection laws that could require us to modify our current business practices and incur increased costs. See “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—We are subject to consumer protection laws that could require us to modify our current business practices and incur increased costs” on page 58 for details; |

| • | We may be adversely affected by the complexity, uncertainties and changes in PRC regulation of internet-related business and companies. See “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—We may be adversely affected by the complexity, uncertainties and changes in PRC regulation of internet-related business and companies such as e-commerce business and internet platforms” on page 59 for details; and |

| • | The funds in our PRC subsidiaries or the consolidated variable interest entities in the Chinese mainland may not be available to fund operations or for other use outside of the Chinese mainland due to interventions in or the imposition of restrictions and limitations on the ability of our holding company, our subsidiaries, or the consolidated variable interest entities by the PRC government on cash transfers. Although currently there are not equivalent or similar restrictions or limitations in Hong Kong on cash transfers in, or out of, our Hong Kong entities, if certain restrictions or limitations in the Chinese mainland were to become applicable to cash transfers in and out of Hong Kong entities in the future, the funds in our Hong Kong entities, likewise, may not be available to fund operations or for other use outside of Hong Kong. See “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business” on page 55 and “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—Governmental control of currency conversion may limit our ability to utilize our revenues effectively and affect the value of your investment” on page 63 for details. |

4

Table of Contents

Risks Related to Our ADSs and Class A Ordinary Shares

In addition to the risks described above, we are subject to general risks relating to our ADSs and Class A ordinary shares, including, but not limited to, the following:

| • | The trading price of our ADSs and Class A ordinary shares have been and are likely to continue to be volatile, which could result in substantial losses to holders of our Class A ordinary shares and/or ADSs. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our ADSs and Class A Ordinary Shares—The trading price of our ADSs and Class A ordinary shares have been and are likely to continue to be volatile, which could result in substantial losses to holders of our Class A ordinary shares and/or ADSs” on page 67 for details; |

| • | We adopt different practices as to certain matters as compared with many other companies listed on the Hong Kong Stock Exchange. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our ADSs and Class A Ordinary Shares—We adopt different practices as to certain matters as compared with many other companies listed on the Hong Kong Stock Exchange” on page 68 for details; |

| • | We cannot guarantee that any share repurchase program will be fully consummated or that any share repurchase program will enhance long-term shareholder value, and share repurchases could increase the volatility of the price of our Class A ordinary shares and/or ADSs and could diminish our cash reserves. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our ADSs and Class A Ordinary Shares—We cannot guarantee that any share repurchase program will be fully consummated or that any share repurchase program will enhance long-term shareholder value, and share repurchases could increase the volatility of the price of our Class A ordinary shares and/or ADSs and could diminish our cash reserves” on page 68 for details; and |

| • | If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, the market price for our Class A ordinary shares and/or ADSs and trading volume could decline. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our ADSs and Class A Ordinary Shares—If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, the market price for our Class A ordinary shares and/or ADSs and trading volume could decline” on page 68 for details. |

5

Table of Contents

FORWARD-LOOKING INFORMATION

This annual report on Form 20-F contains forward-looking statements that reflect our current expectations and views of future events. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by terminology such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “future,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include statements relating to, among other things:

| • | our goals and strategies; |

| • | our future business development, financial conditions and results of operations; |

| • | the expected growth of the retail and online retail markets in China; |

| • | our expectations regarding demand for and market acceptance of our products and services; |

| • | our expectations regarding our relationships with customers, suppliers and third-party merchants; |

| • | our plans to invest in our fulfillment infrastructure and technology platform as well as new business initiatives; |

| • | competition in our industry; and |

| • | relevant government policies and regulations relating to our industry. |

We would like to caution you not to place undue reliance on these forward-looking statements and you should read these statements in conjunction with the risk factors disclosed in “Item 3.D. Key Information—Risk Factors.” Those risks are not exhaustive. We operate in a rapidly evolving environment. New risks emerge from time to time and it is impossible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ from those contained in any forward-looking statement. We do not undertake any obligation to update or revise the forward-looking statements except as required under applicable law. You should read this annual report and the documents that we reference in this annual report completely and with the understanding that our actual future results may be materially different from what we expect.

Our reporting currency is the Renminbi, or RMB. This annual report contains translations of RMB and Hong Kong dollar amounts into U.S. dollars at specific rates solely for the convenience of the reader. Unless otherwise stated, all translations of RMB and Hong Kong dollars into U.S. dollars and from U.S. dollars into RMB in this annual report were made at a rate of RMB6.8972 to US$1.00 and HK$7.8015 to US$1.00, the respective exchange rates on December 30, 2022 set forth in the H.10 statistical release of the Federal Reserve Board. We make no representation that any RMB, Hong Kong dollar or U.S. dollar amounts referred to in this annual report could have been, or could be, converted into U.S. dollars, RMB or Hong Kong dollars, as the case may be, at any particular rate or at all.

6

Table of Contents

PART I

| Item 1. | Identity of Directors, Senior Management and Advisers |

Not applicable.

| Item 2. | Offer Statistics and Expected Timetable |

Not applicable.

| Item 3. | Key Information |

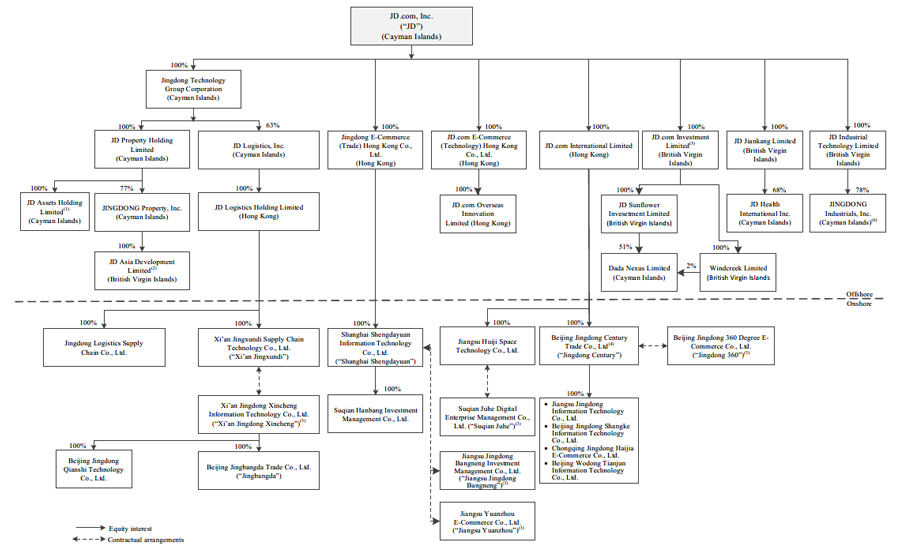

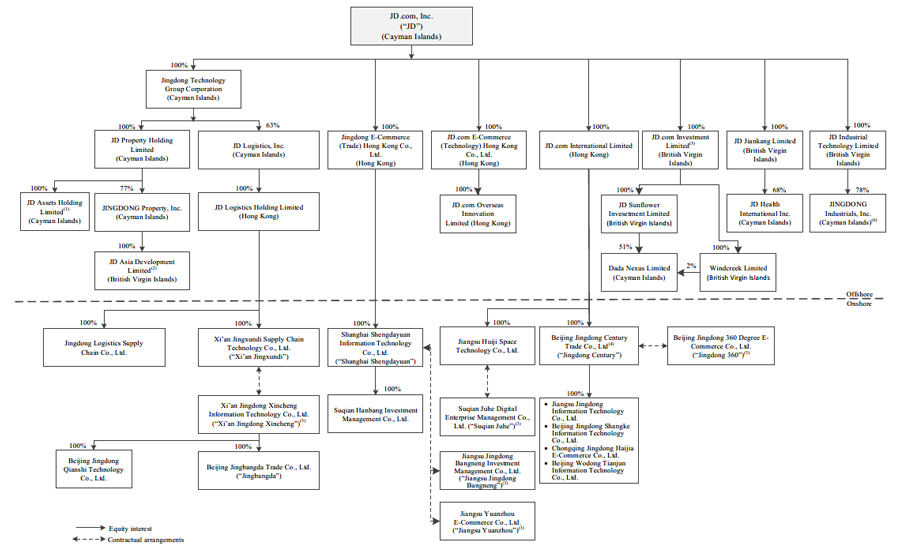

Our Organizational Structure

The following diagram illustrates our corporate structure, including our principal subsidiaries and the consolidated variable interest entities as of February 28, 2023:

Notes:

| (1) | JD Assets Holding Limited has 59 subsidiaries holding, directly or indirectly, non-logistics properties. |

| (2) | JD Asia Development Limited has 418 subsidiaries holding, directly or indirectly, logistics properties. |

| (3) | Jingdong 360, Jiangsu Yuanzhou, Xi’an Jingdong Xincheng, Jiangsu Jingdong Bangneng and Suqian Juhe are the significant consolidated variable interest entities which we have contractual arrangements with. Suqian Juhe is 45% owned by Mr. Richard Qiangdong Liu, 30% owned by Ms. Yayun Li and 25% owned by Ms. Pang Zhang. Each of Jingdong 360, Jiangsu Yuanzhou, Xi’an Jingdong Xincheng and Jiangsu Jingdong Bangneng is 45% owned by Mr. Qin Miao, 30% owned by Ms. Yayun Li and 25% owned by Ms. Pang Zhang. Mr. Richard Qiangdong Liu is our chairman of board of directors, Mr. Qin Miao is a vice president of our company, Ms. Yayun Li is chief executive officer of JD Technology (formerly known as Jingdong Digits Technology Holding Co., Ltd. and renamed as Jingdong Technology Holding Co., Ltd. in May 2021), a significant investee of our company, and Ms. Pang Zhang is our chief human resources officer. |

7

Table of Contents

| (4) | Jingdong Century has 259 subsidiaries that engage in retail business. |

| (5) | JD.com Investment Limited has 75 subsidiaries that hold, directly or indirectly, the companies invested by us. |

| (6) | JINGDONG Industrials, Inc. completed its Series B Preference Shares financing in March 2023, upon which we held approximately 78% of the issued and outstanding shares of JINGDONG Industrials, Inc. |

| * | The diagram above omits our equity investees that are insignificant individually and in the aggregate. |

Our Holding Company Structure and Contractual Arrangements with the Consolidated Variable Interest Entities

JD.com, Inc. is not an operating company but a Cayman Islands holding company with no equity ownership in the consolidated variable interest entities, but maintains contractual arrangements with the consolidated variable interest entities and is considered the primary beneficiary of these entities, whose financial results are consolidated in JD.com, Inc.’s consolidated financial statements under the U.S. GAAP for accounting purposes. The contractual arrangements may not be as effective as direct equity ownership in the consolidated variable interest entities, and the relevant government authorities may challenge the enforceability of these contractual arrangements. We conduct our operations in the Chinese mainland through (i) our PRC subsidiaries and (ii) the consolidated variable interest entities with which we have maintained contractual arrangements. The laws and regulations in the Chinese mainland restrict and impose conditions on foreign investment in certain value-added telecommunication services and certain other restricted services related to our businesses, such as domestic document delivery services. Accordingly, we operate these businesses in the Chinese mainland through the consolidated variable interest entities, and such structure is used to provide investors with exposure to foreign investment in China-based companies where laws and regulations in the Chinese mainland prohibit or restrict direct foreign investment in certain operating companies, and rely on contractual arrangements among our PRC subsidiaries, the consolidated variable interest entities and their shareholders to control the business operations of the consolidated variable interest entities. The external revenues contributed by the consolidated variable interest entities accounted for 5.0%, 6.2% and 6.9% of our total revenues for the years of 2020, 2021 and 2022, respectively. As used in this annual report, “we,” “us,” “our company” and “our” refers to JD.com, Inc., its subsidiaries, and, in the context of describing our operations and consolidated financial information, the consolidated variable interest entities in China, including but not limited to Beijing Jingdong 360 Degree E-Commerce Co., Ltd., or Jingdong 360, which was established in April 2007 and holds our ICP license as an internet information provider and operates our www.jd.com website; Jiangsu Yuanzhou E-Commerce Co., Ltd., or Jiangsu Yuanzhou, which was established in September 2010 and primarily engages in the business of selling books, audio and video products; Xi’an Jingdong Xincheng Information Technology Co., Ltd., or Xi’an Jingdong Xincheng, which was established in June 2017 and primarily provides technology and consulting services relating to logistics services; Jiangsu Jingdong Bangneng Investment Management Co., Ltd., or Jiangsu Jingdong Bangneng, which was established in August 2015 and primarily engages in business of investment management; and Suqian Juhe Digital Enterprise Management Co., Ltd., or Suqian Juhe, which was established in June 2020 and primarily provides enterprise management services. The consolidated variable interest entities are PRC companies conducting operations in the Chinese mainland, and their financial results have been consolidated into our consolidated financial statements under U.S. GAAP for accounting purposes. JD.com, Inc. is a holding company with no operations of its own. We do not have any equity ownership in the consolidated variable interest entities. Investors in our ADSs or Class A ordinary shares are not purchasing equity interest in the consolidated variable interest entities in the Chinese mainland but instead are purchasing equity interest in a holding company incorporated in the Cayman Islands, and may never directly hold equity interests in the consolidated variable interest entities in the Chinese mainland.

A series of contractual agreements, including loan agreements, exclusive purchase option agreements, exclusive technology consulting and services agreements or exclusive business cooperation agreements, as applicable, intellectual property rights license agreement, equity pledge agreements, powers of attorney, business cooperation agreement and business operations agreements, have been entered into by and among our subsidiaries, the consolidated variable interest entities and their respective shareholders. Terms contained in each set of contractual arrangements with the consolidated variable interest entities and their respective shareholders are substantially similar. As a result of the contractual arrangements, we are considered the primary beneficiary of these companies and have consolidated the financial results of these companies in our consolidated financial statements under the U.S. GAAP for accounting purposes. Neither JD.com, Inc. nor its investors has an equity ownership in, direct foreign investment in, or control through such ownership or investment of, the consolidated variable interest entities, and the contractual arrangements are not equivalent to an equity ownership in the business of the consolidated variable interest entities. For more details of these contractual arrangements, see “Item 4.C. Information on the Company—Organizational Structure—The Consolidated Variable Interest Entities.”

8

Table of Contents

However, the contractual arrangements may not be as effective as direct ownership in providing us with control over the consolidated variable interest entities and we may incur substantial costs to enforce the terms of the arrangements. In addition, these agreements have not been tested in courts of the Chinese mainland. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Corporate Structure—We rely on contractual arrangements with the consolidated variable interest entities and their owners for a portion of our business operations, which may not be as effective as direct ownership in providing operational control” and “Item 3.D. Key Information—Risk Factors—Risks Related to Our Corporate Structure—The shareholders of the consolidated variable interest entities may have potential conflicts of interest with us, which may materially and adversely affect our business and financial condition.”

Our corporate structure is subject to risks associated with the contractual arrangements with the consolidated variable interest entities. If the PRC government determines that the contractual arrangements constituting part of the consolidated variable interest entities structure do not comply with PRC laws and regulations, or if these laws and regulations change or are interpreted differently in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. The PRC regulatory authorities could disallow the variable interest entities structure, which would likely result in a material adverse change in our operations, and our ADSs or Class A ordinary shares may decline significantly in value or become worthless. Our holding company, our PRC subsidiaries and the consolidated variable interest entities, and investors of our company face uncertainty about potential future actions by the PRC government that could affect the enforceability of the contractual arrangements with the consolidated variable interest entities and, consequently, significantly affect the financial performance of the consolidated variable interest entities and our company as a whole. For a detailed description of the risks associated with our corporate structure, please refer to risks disclosed under “Item 3.D. Key Information—Risk Factors—Risks Related to Our Corporate Structure.” Specifically, there are also substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations and rules regarding the status of the rights of our Cayman Islands holding company with respect to its contractual arrangements with the consolidated variable interest entities and their shareholders. It is uncertain whether any new PRC laws or regulations relating to variable interest entity structures will be adopted or if adopted, what they would provide. If we or any of the consolidated variable interest entities is found to be in violation of any existing or future PRC laws or regulations, or fail to obtain or maintain any of the required permits or approvals, the relevant PRC regulatory authorities would have broad discretion to take action in dealing with such violations or failures. See “Item 3.D. Key Information—Risk Factors—Risks Related to Our Corporate Structure—If the PRC government determines that the contractual arrangements constituting part of the consolidated variable interest entities structure do not comply with PRC laws and regulations, or if these laws and regulations change or are interpreted differently in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations” and “—Our current corporate structure and business operations may be affected by the PRC Foreign Investment Law.”

Risks and Uncertainties Relating to Doing Business in China

We face various risks and uncertainties related to doing business in the Chinese mainland. Our business operations are primarily conducted in the Chinese mainland, and we are subject to complex and evolving laws and regulations in the Chinese mainland. For example, we face risks associated with regulatory approvals on offshore offerings, antimonopoly regulatory actions, and oversight on cybersecurity and data privacy, as well as the lack of inspection by the PCAOB, on our auditor, which may impact our ability to conduct certain businesses, accept foreign investments, or list on a United States stock exchange. These risks could result in a material adverse change in our operations and the value of our ADSs and Class A ordinary shares, significantly limit or completely hinder our ability to continue to offer securities to investors, or cause the value of such securities to significantly decline. As of the date of this annual report, regulatory actions related to data security or anti-monopoly concerns in Hong Kong do not have a material impact on our ability to conduct business, accept foreign investment in the future, continue to list on a United States stock exchange or maintain our listing status on the Hong Kong Stock Exchange. However, new regulatory actions related to data security or anti-monopoly concerns in Hong Kong may be taken in the future, and such regulatory actions may have a material impact on our ability to conduct business, accept foreign investment, continue to list on a United States stock exchange or maintain our listing status on the Hong Kong Stock Exchange. For a detailed description of risks related to doing business in China, please refer to risks disclosed under “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China.”

PRC government has significant authority in regulating our operations and may influence our operations. It may exert more oversight and control over offerings conducted overseas by, and/or foreign investment in, China-based issuers, which could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. Implementation of industry-wide regulations in this nature may cause the value of such securities to significantly decline. For more details, see “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—The PRC government’s significant oversight over our business operation could result in a material adverse change in our operations and the value of our ADSs and Class A ordinary shares.”

Risks and uncertainties arising from the PRC legal system, including risks and uncertainties regarding the enforcement of laws and quickly evolving rules and regulations in the Chinese mainland, could result in a material adverse change in our operations and the value of our ADSs and Class A ordinary shares. For more details, see “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—Uncertainties with respect to the legal system in the Chinese mainland could adversely affect us” and “—We may be adversely affected by the complexity, uncertainties and changes in PRC regulation of internet-related business and companies such as e-commerce business and internet platforms.”

9

Table of Contents

The Holding Foreign Companies Accountable Act

Pursuant to the HFCAA, if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspections by the PCAOB for two consecutive years, the SEC will prohibit our shares or ADSs from being traded on a national securities exchange or in the over-the-counter trading market in the United States. On December 16, 2021, the PCAOB issued a report to notify the SEC of its determination that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in the Chinese mainland and Hong Kong, including our auditor. In May 2022, the SEC conclusively listed us as a Commission-Identified Issuer under the HFCAA following the filing of the annual report on Form 20-F for the fiscal year ended December 31, 2021. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed the Chinese mainland and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. For this reason, we do not expect to be identified as a Commission-Identified Issuer under the HFCAA after we file this annual report on Form 20-F. Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in the Chinese mainland and Hong Kong, among other jurisdictions. If PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in the Chinese mainland and Hong Kong and we continue to use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed with the Securities and Exchange Commission, we would be identified as a Commission-Identified Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not be identified as a Commission-Identified Issuer for any future fiscal year, and if we were so identified for two consecutive years, we would become subject to the prohibition on trading under the HFCAA. For more details, see “Item 3.D. Key Information—Risk Factors—Risks Related to Our Business—The PCAOB had historically been unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections of our auditor in the past has deprived our investors with the benefits of such inspections” and “Item 3.D. Key Information—Risk Factors—Risks Related to Our Business—Our ADSs may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in China. The delisting of the ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

Permissions Required from the PRC Authorities for Our Operations

We conduct our business primarily through our PRC subsidiaries and the consolidated variable interest entities in China. Our operations in China are governed by PRC laws and regulations. As of the date of this annual report, our PRC subsidiaries and the consolidated variable interest entities have obtained the necessary licenses and permits from the PRC government authorities, including, among others, ICP licenses, Courier Service Operation Permits and Practicing License for Medical Institutions, except as disclosed in “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—We may be adversely affected by the complexity, uncertainties and changes in PRC regulation of internet-related business and companies such as e-commerce business and internet platforms.” Given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by relevant government authorities, we may be required to obtain additional licenses, permits, filings or approvals for our business and operations in the future.

Furthermore, in connection with our previous issuance of securities to foreign investors, under current PRC laws, regulations and regulatory rules, as of the date of this annual report, we, our PRC subsidiaries and the consolidated variable interest entities, (i) are not required to obtain permissions from the China Securities Regulatory Commission, or the CSRC, (ii) are not required to file an application for cybersecurity review by the Cyberspace Administration of China, or the CAC, as advised by Shihui Partners, our PRC legal counsel, and (iii) have not been asked to obtain or were denied such permissions by any PRC authority.

If (i) we do not receive or maintain any permissions or approvals, (ii) we inadvertently concluded that certain permissions or approvals have been acquired or are not required, or (iii) applicable laws, regulations or interpretations thereof change and we become subject to the requirement of additional permissions or approvals in the future, we cannot assure you that we will be able to obtain such permissions or approvals in a timely manner, or at all, and such approvals may be rescinded even if obtained. Any such circumstance could subject us to penalties, including fines, suspension of business and revocation of required licenses, which could materially and adversely affect our business, financial condition and results of operations.

10

Table of Contents

However, the PRC government has promulgated certain regulations and rules to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers. On February 17, 2023, the CSRC released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies and five supporting guidelines, or, collectively, the Trial Measures, which came into effect on March 31, 2023. According to the Trial Measures, domestic companies in the Chinese mainland that directly or indirectly offer or list their securities in an overseas market are required to file with the CSRC. In addition, an overseas-listed company must also submit the filing with respect to its follow-on offerings, issuance of convertible corporate bonds and exchangeable bonds, and other equivalent offering activities, within a specific time frame requested under the Trial Measures. Therefore, we will be required to file with the CSRC for our overseas offering of equity and equity linked securities in the future within the applicable scope of the Trial Measures. For more detailed information, see “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—The approval of and/or filing with the CSRC or other PRC government authorities may be required in connection with our offshore offerings under PRC law, and, if required, we cannot predict whether or for how long we will be able to obtain such approval or complete such filing.”

Cash and Asset Flows through Our Organization

JD.com, Inc. is a holding company with no operations of its own. We conduct our operations in the Chinese mainland primarily through our subsidiaries and the consolidated variable interest entities in the Chinese mainland. As a result, although other means are available for us to obtain financing at the holding company level, JD.com, Inc.’s ability to pay dividends to the shareholders and investors of the ADSs and to service any debt it may incur may depend upon dividends paid by our PRC subsidiaries and license and service fees paid by the consolidated variable interest entities. If any of our subsidiaries incurs debt on its own behalf in the future, the instruments governing such debt may restrict its ability to pay dividends to JD.com, Inc. In addition, our PRC subsidiaries are permitted to pay dividends to JD.com, Inc. only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Further, our PRC subsidiaries and the consolidated variable interest entities are required to make appropriations to certain statutory reserve funds or may make appropriations to certain discretionary funds, which are not distributable as cash dividends except in the event of a solvent liquidation of the companies. For more details, see “Item 5.B. Operating and Financial Review and Prospects—Liquidity and Capital Resources—Holding Company Structure.”

Our board of directors has complete discretion on whether to distribute dividends subject to our current memorandum and articles of association and certain restrictions under Cayman Islands law. In addition, our shareholders may, by ordinary resolution, declare dividends, but no dividend shall exceed the amount recommended by our board of directors. Under Cayman Islands law, a Cayman Islands company may pay a dividend out of either profit or share premium account, provided that in no circumstances may a dividend be paid if this would result in the company being unable to pay its debts as they fall due in the ordinary course of business. See “Item 8.A. Financial Information—Consolidated Statements and Other Financial Information—Dividend Policy” for details.

As a Cayman Islands exempted company and offshore holding company, we are permitted under PRC laws and regulations to provide funding to our wholly foreign-owned subsidiaries in the Chinese mainland only through loans or capital contributions, subject to the approval of government authorities and limits on the amount of capital contributions and loans. In addition, our wholly foreign-owned subsidiaries in the Chinese mainland may provide RMB funding to their respective subsidiaries only through capital contributions and entrusted loans, and to the consolidated variable interest entities only through entrusted loans. See “Introduction—Summary of Risk Factors—Risks Related to Our Corporate Structure,” “Item 5.B. Operating and Financial Review—Liquidity and Capital Resources” and “Item 3.D. Key Information—Risk Factors—Risks Related to Our Corporate Structure—PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from making loans to our PRC subsidiaries and the consolidated variable interest entities or making additional capital contributions to our wholly foreign-owned subsidiaries in the Chinese mainland, which could materially and adversely affect our liquidity and our ability to fund and expand our business.”

Under PRC laws and regulations, our PRC subsidiaries and the consolidated variable interest entities are subject to certain restrictions with respect to paying dividends or otherwise transferring any of their net assets to us. Remittance of dividends by a wholly foreign-owned enterprise out of the Chinese mainland is also subject to examination by the banks designated by State Administration of Foreign Exchange, or SAFE. The amounts restricted include the paid-in capital and the statutory reserve funds of our PRC subsidiaries and the net assets of the consolidated variable interest entities in which we have no legal ownership, totaling RMB28.9 billion, RMB46.4 billion and RMB58.2 billion (US$8.4 billion) as of December 31, 2020, 2021 and 2022, respectively. Furthermore, cash transfers from our PRC subsidiaries and the consolidated variable interest entities to entities outside of the Chinese mainland are subject to PRC governmental control on currency conversion. As a result, the funds in our PRC subsidiaries or the consolidated variable interest entities in the Chinese mainland may not be available to fund operations or for other use outside of the Chinese mainland due to interventions in, or the imposition of restrictions and limitations on, the ability of our holding company, our subsidiaries, or the consolidated variable interest entities by the PRC government on such currency conversion. As of the date of this annual report, there are not equivalent or similar restrictions or limitations in Hong Kong on cash transfers in, or out of, our Hong Kong entities. However, if certain restrictions or limitations were to become applicable to cash transfers in and out of Hong Kong entities in the future, the funds in our Hong Kong entities may not be available to fund operations or for other use outside of Hong Kong. For risks relating to the fund flows of our operations in China, see “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business.” and “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—Governmental control of currency conversion may limit our ability to utilize our revenues effectively and affect the value of your investment.”

11

Table of Contents

Under PRC law, JD.com, Inc. may provide funding to our PRC subsidiaries only through capital contributions or loans, and to the PRC consolidated variable interest entities only through loans, subject to satisfaction of applicable government registration that we are not able to make direct capital contribution.

Our company has established a centralized cash management policy to direct how funds are transferred between JD.com, Inc., our subsidiaries and the consolidated variable interest entities and their subsidiaries to improve the efficiency and ensure the security of cash management. Our management has established a series of manuals and policies on funds management, bank accounts management, financing activities and safe handling of cash and assets, which apply to all of our subsidiaries and the consolidated variable interest entities and their subsidiaries. We and our consolidated subsidiaries that are listed on the Hong Kong Stock Exchange have also established respective centralized cash management accounts within certain entities, under which funds are transferred and dispatched to each subsidiary or consolidated variable interest entity under central command. The major offshore entities outside of the Chinese mainland with the function of centralized cash management are JD.com, Inc. (our holding company), JD.com International Limited (our intermediate holding company), JD Logistics, Inc., and JD Health International Inc. (both of which are our subsidiaries). In addition, the major entities within the Chinese mainland with similar functions are Beijing Jingdong Century Trade Co., Ltd. (a primary beneficiary of the consolidated variable interest entities), Beijing Jingbangda Trade Co., Ltd. (a consolidated variable interest entity), and Beijing Jingdong Jiankang Co., Ltd. (a primary beneficiary of the consolidated variable interest entities). The centralized cash management function in these entities lead to high-volume and high-frequency cash transferred and dispatched to the remaining consolidated subsidiaries and consolidated variable interest entities. We have complied with the applicable laws and regulations for the operation of such cash centralized management accounts and completed necessary registration and approval procedures with relevant governmental authorities. Every fund transfer within our group goes through an appropriate review and approval process depending on the nature and amount of the transfer under our cash management policy.

For the years ended December 31, 2020, 2021 and 2022, JD.com, Inc. provided loans of RMB13.4 billion and RMB20.9 billion to, and received repayment of RMB7.4 billion (US$1.1 billion) from, our intermediate holding companies through our day-to-day centralized cash management activities. Please refer to the line item “Loans (provided to)/settled by internal companies” in the “Parent” column of the tables titled “Financial Information Related to the Consolidated Variable Interest Entities—Selected Condensed Consolidated Cash Flows Information” for the years ended December 31, 2020, 2021 and 2022 on pages 19–21 for the detail figures.

Our day-to-day centralized cash management activities also cover the cash flow of the consolidated variable interest entities. For the years ended December 31, 2020 and 2021, the consolidated variable interest entities received funding by (i) loans from our intermediate holding companies and (ii) capital contribution in the form of loans from our intermediate holding companies to nominee shareholders, totaling RMB3.4 billion and RMB11.7 billion, respectively. For the year ended December 31, 2022, the consolidated variable interest entities repaid RMB3.2 billion (US$0.5 billion) to our intermediate holding companies. Please refer to the sum of line item “Capital injection from controlling shareholders” and line item “Net proceeds from/(repayment to) internal companies” in the “Consolidated Variable Interest Entities” column of the tables titled “Financial Information Related to the Consolidated Variable Interest Entities—Selected Condensed Consolidated Cash Flows Information” for the years ended December 31, 2020, 2021 and 2022 on pages 19–21 for the detail figures. The consolidated variable interest entities received repayment of loans of RMB0.3 billion, RMB1.1 billion from, and provided funding of RMB11.3 billion (US$1.6 billion) to, our intermediate holding companies for the years ended December 31, 2020, 2021 and 2022, respectively.] Please refer to the line item “Loans (provided to)/settled by internal companies” in the “Consolidated Variable Interest Entities” column of the tables titled “Financial Information Related to the Consolidated Variable Interest Entities—Selected Condensed Consolidated Cash Flows Information” for the years ended December 31, 2020, 2021 and 2022 on pages 19–21 for the detail figures.

In May 2022, our board of directors approved a special cash dividend of US$0.63 per ordinary share, or US$1.26 per ADS, to holders of ordinary shares and holders of ADSs, respectively. The aggregate amount of the special dividend was approximately US$2.0 billion. In March 2023, our board of directors approved a cash dividend of US$0.31 per ordinary share, or US$0.62 per ADS, to holders of ordinary shares and holders of ADSs. The aggregate amount of the cash dividend was approximately US$1.0 billion. In addition, we plan to adopt an annual dividend policy, under which we may choose to declare and distribute a cash dividend each year, at an amount determined in relation to our financial performance in the previous fiscal year, among other factors. The determination to make dividend distributions in any particular year will be made at the discretion of our board of directors based upon factors such as our results of operations, cash flow, financial condition, capital requirements and other considerations that the board deems relevant. See “Item 8.A. Financial Information—Consolidated Statements and Other Financial Information—Dividend Policy.” For PRC and United States federal income tax considerations of an investment in our ADSs, see “Item 10.E. Additional Information—Taxation.”

12

Table of Contents

A. Selected Financial Data

The following table presents the selected consolidated financial information of our company. The selected consolidated statements of operations data for the years ended December 31, 2020, 2021 and 2022, selected consolidated balance sheets data as of December 31, 2021 and 2022, selected consolidated cash flow data for the years ended December 31, 2020, 2021 and 2022 have been derived from our audited consolidated financial statements, which are included in this annual report.

The selected consolidated statements of operations data for the years ended December 31, 2018 and 2019, selected consolidated balance sheets data as of December 31, 2018, 2019 and 2020 and selected consolidated cash flow data for the years ended December 31, 2018 and 2019 have been derived from our audited consolidated financial statements not included in this annual report. Our historical results do not necessarily indicate results expected for any future periods. The selected consolidated financial data should be read in conjunction with, and are qualified in their entirety by reference to, our audited consolidated financial statements and related notes and “Operating and Financial Review and Prospects” below. Our consolidated financial statements are prepared and presented in accordance with U.S. GAAP.

| For the Year Ended December 31, | ||||||||||||||||||||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | ||||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | US$ | |||||||||||||||||||

| (in millions, except for share, per share and per ADS data) | ||||||||||||||||||||||||

| Selected Consolidated Statements of Operations Data: |

||||||||||||||||||||||||

| Net Revenues(1): |

||||||||||||||||||||||||

| Net product revenues |

416,109 | 510,734 | 651,879 | 815,655 | 865,062 | 125,422 | ||||||||||||||||||

| Net service revenues |

45,911 | 66,154 | 93,923 | 135,937 | 181,174 | 26,268 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total net revenues |

462,020 | 576,888 | 745,802 | 951,592 | 1,046,236 | 151,690 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Cost of revenues |

(396,066 | ) | (492,467 | ) | (636,694 | ) | (822,526 | ) | (899,163 | ) | (130,366 | ) | ||||||||||||

| Fulfillment |

(32,010 | ) | (36,968 | ) | (48,700 | ) | (59,055 | ) | (63,011 | ) | (9,136 | ) | ||||||||||||

| Marketing |

(19,237 | ) | (22,234 | ) | (27,156 | ) | (38,743 | ) | (37,772 | ) | (5,476 | ) | ||||||||||||

| Research and development |

(12,144 | ) | (14,619 | ) | (16,149 | ) | (16,332 | ) | (16,893 | ) | (2,449 | ) | ||||||||||||

| General and administrative |

(5,160 | ) | (5,490 | ) | (6,409 | ) | (11,562 | ) | (11,053 | ) | (1,603 | ) | ||||||||||||

| Impairment of goodwill and intangible assets |

(22 | ) | — | — | — | — | — | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Gain on sale of development properties |

— | 3,885 | 1,649 | 767 | 1,379 | 200 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income/(loss) from operations(2)(3) |

(2,619 | ) | 8,995 | 12,343 | 4,141 | 19,723 | 2,860 | |||||||||||||||||

| Other income/(expense): |

||||||||||||||||||||||||

| Share of results of equity investees |

(1,113 | ) | (1,738 | ) | 4,291 | (4,918 | ) | (2,195 | ) | (318 | ) | |||||||||||||

| Interest expense |

(855 | ) | (725 | ) | (1,125 | ) | (1,213 | ) | (2,106 | ) | (305 | ) | ||||||||||||

| Others, net(4) |

2,213 | 7,161 | 35,310 | (590 | ) | (1,555 | ) | (225 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income/(loss) before tax |

(2,374 | ) | 13,693 | 50,819 | (2,580 | ) | 13,867 | 2,012 | ||||||||||||||||

| Income tax expenses |

(427 | ) | (1,803 | ) | (1,482 | ) | (1,887 | ) | (4,176 | ) | (605 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income/(loss) |

(2,801 | ) | 11,890 | 49,337 | (4,467 | ) | 9,691 | 1,407 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss attributable to non-controlling interests shareholders |

(311 | ) | (297 | ) | (75 | ) | (923 | ) | (697 | ) | (101 | ) | ||||||||||||

| Net income attributable to mezzanine equity classified as non-controlling interests shareholders |

2 | 3 | 7 | 16 | 8 | 1 | ||||||||||||||||||

| Net income/(loss) attributable to ordinary shareholders |

(2,492 | ) | 12,184 | 49,405 | (3,560 | ) | 10,380 | 1,507 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income/(loss) per share Basic |

||||||||||||||||||||||||

| Net income/(loss) per share |

(0.87 | ) | 4.18 | 16.35 | (1.15 | ) | 3.32 | 0.48 | ||||||||||||||||

| Diluted |

||||||||||||||||||||||||

| Net income/(loss) per share |

(0.87 | ) | 4.11 | 15.84 | (1.15 | ) | 3.21 | 0.47 | ||||||||||||||||

| Net income/(loss) per ADS(5) |

||||||||||||||||||||||||

| Basic |

||||||||||||||||||||||||

| Net income/(loss) per ADS |

(1.73 | ) | 8.37 | 32.70 | (2.29 | ) | 6.64 | 0.96 | ||||||||||||||||

| Diluted |

||||||||||||||||||||||||

| Net income/(loss) per ADS |

(1.73 | ) | 8.21 | 31.68 | (2.29 | ) | 6.42 | 0.93 | ||||||||||||||||

| Weighted average number of shares: |

||||||||||||||||||||||||

| Basic |

2,877,902,678 | 2,912,637,241 | 3,021,808,985 | 3,107,436,665 | 3,125,571,110 | 3,125,571,110 | ||||||||||||||||||

| Diluted |

2,877,902,678 | 2,967,321,803 | 3,109,024,030 | 3,107,436,665 | 3,180,886,136 | 3,180,886,136 | ||||||||||||||||||

13

Table of Contents

| (1) | Our net revenues include net product revenues and net service revenues. Product sales is further divided into sales of electronics and home appliances products and sales of general merchandise products. Net revenues from electronics and home appliances products include revenues from sales of computer, communication and consumer electronics products as well as home appliances. Net revenues from general merchandise products mainly include revenues from sales of food, beverage and fresh produce, baby and maternity products, furniture and household goods, cosmetics and other personal care items, pharmaceutical and healthcare products, industrial products, books, automobile accessories, apparel and footwear, bags and jewelry. Net service revenues are further divided into revenues from online marketplace and marketing and revenues from logistics and other services. The following table breaks down our total net revenues by these categories, by amounts and as percentages of total net revenues: |

| For the Year Ended December 31, | ||||||||||||||||||||||||||||||||||||||||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | ||||||||||||||||||||||||||||||||||||||||

| RMB | % | RMB | % | RMB | % | RMB | % | RMB | US$ | % | ||||||||||||||||||||||||||||||||||

| (in millions, except for percentages) | ||||||||||||||||||||||||||||||||||||||||||||

| Electronics and home appliances revenues |

280,059 | 60.6 | 328,703 | 57.0 | 400,927 | 53.8 | 492,592 | 51.8 | 515,945 | 74,805 | 49.3 | |||||||||||||||||||||||||||||||||

| General merchandise revenues |

136,050 | 29.5 | 182,031 | 31.5 | 250,952 | 33.6 | 323,063 | 33.9 | 349,117 | 50,617 | 33.4 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Net product revenues |

416,109 | 90.1 | 510,734 | 88.5 | 651,879 | 87.4 | 815,655 | 85.7 | 865,062 | 125,422 | 82.7 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Marketplace and marketing revenues |

33,532 | 7.2 | 42,680 | 7.4 | 53,473 | 7.2 | 72,118 | 7.6 | 81,970 | 11,885 | 7.8 | |||||||||||||||||||||||||||||||||

| Logistics and other service revenues |

12,379 | 2.7 | 23,474 | 4.1 | 40,450 | 5.4 | 63,819 | 6.7 | 99,204 | 14,383 | 9.5 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Net service revenues |

45,911 | 9.9 | 66,154 | 11.5 | 93,923 | 12.6 | 135,937 | 14.3 | 181,174 | 26,268 | 17.3 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Total net revenues |

462,020 | 100.0 | 576,888 | 100.0 | 745,802 | 100.0 | 951,592 | 100.0 | 1,046,236 | 151,690 | 100.0 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| (2) | Includes share-based compensation expenses as follows: |

| For the Year Ended December 31, | ||||||||||||||||||||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | ||||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | US$ | |||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||

| Cost of revenues |

(72 | ) | (82 | ) | (98 | ) | (102 | ) | (143 | ) | (21 | ) | ||||||||||||

| Fulfillment |

(419 | ) | (440 | ) | (646 | ) | (882 | ) | (930 | ) | (135 | ) | ||||||||||||

| Marketing |

(190 | ) | (259 | ) | (347 | ) | (586 | ) | (631 | ) | (91 | ) | ||||||||||||

| Research and development |

(1,163 | ) | (1,340 | ) | (1,400 | ) | (1,781 | ) | (1,557 | ) | (226 | ) | ||||||||||||

| General and administrative |

(1,816 | ) | (1,574 | ) | (1,665 | ) | (5,783 | ) | (4,287 | ) | (622 | ) | ||||||||||||

| (3) | Includes amortization of business cooperation arrangement and intangible assets resulting from assets and business acquisitions as follows: |

14

Table of Contents

| For the Year Ended December 31, | ||||||||||||||||||||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | ||||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | US$ | |||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||

| Fulfillment |

(168 | ) | (165 | ) | (193 | ) | (220 | ) | (392 | ) | (57 | ) | ||||||||||||

| Marketing |

(1,232 | ) | (637 | ) | (692 | ) | (854 | ) | (868 | ) | (126 | ) | ||||||||||||

| Research and development |

(98 | ) | (99 | ) | (99 | ) | (104 | ) | (271 | ) | (39 | ) | ||||||||||||

| General and administrative |

(308 | ) | (308 | ) | (309 | ) | (309 | ) | (161 | ) | (22 | ) | ||||||||||||

| (4) | Interest income was included in Others, net since 2021, and the presentation of prior years was also updated to conform to current presentation. |

| (5) | Each ADS represents two Class A ordinary shares. |

| For the Year Ended December 31, | ||||||||||||||||||||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | ||||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | US$ | |||||||||||||||||||

| (in millions, except for share data) | ||||||||||||||||||||||||

| Selected Consolidated Balance Sheets Data: |

||||||||||||||||||||||||

| Cash and cash equivalents |

34,262 | 36,971 | 86,085 | 70,767 | 78,861 | 11,434 | ||||||||||||||||||

| Restricted cash |

3,240 | 2,941 | 4,434 | 5,926 | 6,254 | 907 | ||||||||||||||||||

| Short-term investments |

2,036 | 24,603 | 60,577 | 114,564 | 141,095 | 20,457 | ||||||||||||||||||

| Accounts receivable, net |

11,110 | 6,191 | 7,112 | 11,900 | 20,576 | 2,983 | ||||||||||||||||||

| Inventories, net |

44,030 | 57,932 | 58,933 | 75,601 | 77,949 | 11,302 | ||||||||||||||||||

| Property, equipment and software, net |

21,083 | 20,654 | 22,597 | 32,944 | 55,080 | 7,986 | ||||||||||||||||||

| Land use rights, net |

10,476 | 10,892 | 11,125 | 14,328 | 33,848 | 4,907 | ||||||||||||||||||

| Operating lease right-of-use assets |

— | 8,644 | 15,484 | 19,987 | 22,267 | 3,228 | ||||||||||||||||||

| Investment in equity investees |

31,357 | 35,576 | 58,501 | 63,222 | 57,641 | 8,357 | ||||||||||||||||||

| Investment securities |

15,902 | 21,417 | 39,085 | 19,088 | 11,611 | 1,683 | ||||||||||||||||||

| Other non-current assets |

5,284 | 6,806 | 13,316 | 21,804 | 18,770 | 2,722 | ||||||||||||||||||

| Total assets |

209,165 | 259,724 | 422,288 | 496,507 | 595,250 | 86,303 | ||||||||||||||||||

| Short-term debts |

147 | — | — | 4,368 | 12,146 | 1,761 | ||||||||||||||||||

| Accounts payable |

79,985 | 90,428 | 106,818 | 140,484 | 160,607 | 23,286 | ||||||||||||||||||

| Accrued expenses and other current liabilities |

20,293 | 24,656 | 30,035 | 34,468 | 42,570 | 6,172 | ||||||||||||||||||

| Non-recourse securitization debt |

4,398 | — | — | — | — | — | ||||||||||||||||||

| Unsecured senior notes |

6,786 | 6,912 | 12,854 | 9,386 | 10,224 | 1,482 | ||||||||||||||||||

| Long-term borrowings |

3,088 | 3,139 | 2,936 | — | 20,009 | 2,901 | ||||||||||||||||||

| Operating lease liabilities |

— | 8,717 | 15,763 | 20,386 | 22,666 | 3,287 | ||||||||||||||||||

| Total liabilities |

132,337 | 159,099 | 200,669 | 249,723 | 321,127 | 46,558 | ||||||||||||||||||

| Total mezzanine equity |

15,961 | 15,964 | 17,133 | 1,212 | 590 | 86 | ||||||||||||||||||

| Total JD.com, Inc. shareholders’ equity |

59,771 | 81,856 | 187,543 | 208,911 | 213,366 | 30,936 | ||||||||||||||||||

| Number of outstanding ordinary shares |

2,894,296,355 | 2,924,315,263 | 3,103,499,039 | 3,110,791,649 | 3,135,679,247 | 3,135,679,247 | ||||||||||||||||||

15

Table of Contents

| For the Year Ended December 31, | ||||||||||||||||||||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | ||||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | US$ | |||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||

| Selected Consolidated Cash Flows Data: |

||||||||||||||||||||||||

| Net cash provided by operating activities |

20,881 | 24,781 | 42,544 | 42,301 | 57,819 | 8,383 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net cash used in investing activities |

(26,079 | ) | (25,349 | ) | (57,811 | ) | (74,248 | ) | (54,026 | ) | (7,833 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net cash provided by financing activities |

11,220 | 2,572 | 71,072 | 19,503 | 1,180 | 171 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

1,682 | 406 | (5,082 | ) | (1,498 | ) | 3,490 | 506 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase/(decrease) in cash, cash equivalents and restricted cash |

7,704 | 2,410 | 50,723 | (13,942 | ) | 8,463 | 1,227 | |||||||||||||||||

| Cash, cash equivalents, and restricted cash at beginning of year, including cash and cash equivalents classified within assets held for sale |

29,798 | 37,502 | 39,912 | 90,635 | 76,693 | 11,119 | ||||||||||||||||||

| Less: cash, cash equivalents, and restricted cash classified within assets held for sale at beginning of year |

— | — | — | 116 | — | — | ||||||||||||||||||

| Cash, cash equivalents, and restricted cash at beginning of year |

29,798 | 37,502 | 39,912 | 90,519 | 76,693 | 11,119 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Cash, cash equivalents and restricted cash at end of year, including cash and cash equivalents classified within assets held for sale |

37,502 | 39,912 | 90,635 | 76,693 | 85,156 | 12,346 | ||||||||||||||||||

| Less: cash, cash equivalents, and restricted cash classified within assets held for sale at end of year |

— | — | 116 | — | 41 | 5 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||