UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________________________________________________________________________

FORM 10-K

(Mark One)

For the fiscal year ended December 31 , 2021

or

For the transition period from ___ to ___

Commission File Number: 001-35669

__________________________________________________________________________________________________________________________________

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

______________________________________________________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2021, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of its voting and non-voting common stock held by non-affiliates was $2,303,919,923 , based on the last reported sale price of the registrant’s common stock on that date.

On February 4, 2022, 36,357,198 shares of the registrant’s common stock were outstanding.

____________________________________________________________________________

DOCUMENTS INCORPORATED BY REFERENCE

Form 10-K

For the Fiscal Year Ended December 31, 2021

TABLE OF CONTENTS

| Page | ||||||||

F-1 | ||||||||

2

PART I

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, particularly in the discussions under the captions “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All statements other than statements of historical fact, are forward-looking. Examples of forward-looking statements include, but are not limited to, statements regarding guidance, industry prospects, future business, future results of operations or financial condition, future dividends, future stock performance, our ability to consummate acquisitions and integrate the businesses we have acquired or may acquire into our existing operations, new or planned features, products or services, management strategies, our competitive position and the COVID-19 pandemic. You can identify many forward-looking statements by words such as “may,” “will,” “would,” “should,” “could,” “expects,” “aim,” “anticipates,” “believes,” “estimates,” “intends,” “plan,” “predict,” “project,” “seek,” “potential,” “opportunities” and other similar expressions and the negatives of such expressions. However, not all forward-looking statements contain these words. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from those expressed or implied in the forward-looking statements. Such risks and uncertainties include, among others, those discussed under the caption “Risk Factors” of this Annual Report on Form 10-K, as well as in our consolidated financial statements, related notes, and the other information appearing elsewhere in this report and our other filings with the Securities and Exchange Commission, or the SEC. Given these risks and uncertainties, you should not place undue reliance on any forward-looking statements. The forward-looking statements contained in this Annual Report on Form 10-K are made only as of the date hereof, and we do not intend, and, except as required by law, we undertake no obligation, to update any of our forward-looking statements contained herein after the date of this report to reflect actual results or future events or circumstances.

Unless the context otherwise indicates, references in this Annual Report on Form 10-K to the terms “Shutterstock,” “the Company,” “we,” “our” and “us” refer to Shutterstock, Inc. and its subsidiaries. “Shutterstock,” “Shutterstock Editorial,” “Asset Assurance,” “Offset,” “Bigstock,” “Rex Features,” “PremiumBeat,” “TurboSquid,” “PicMonkey,” “Pattern89,” “Shotzr,” “Shutterstock Studios” and “Shutterstock Editor” and their logos are registered trademarks and are the property of Shutterstock, Inc. or one of our subsidiaries. All other trademarks, service marks and trade names appearing in this Annual Report on Form 10-K are the property of their respective owners.

3

Item 1. Business.

Overview

Shutterstock, Inc. (referred to herein as the “Company,” “we,” “our,” and “us”) is a leading global creative platform offering full-service solutions, high-quality content, and creative workflow solutions for brands, businesses and media companies. Our platform brings together content creators and contributors by providing readily-searchable content that our customers pay to license and by compensating contributors as their content is licensed.

Our key offerings include:

•Images - consisting of photographs, vectors and illustrations. Images are typically used in visual communications, such as websites, digital and print marketing materials, corporate communications, books, publications and other similar uses.

•Footage - consisting of video clips, premium footage filmed by industry experts and cinema grade video effects, available in HD and 4K formats. Footage is often integrated into websites, social media, marketing campaigns and cinematic productions.

•Music - consisting of high-quality music tracks and sound effects, which are often used to complement images and footage.

•3 Dimensional (“3D”) Models - consisting of 3D models, used in a variety of industries such as advertising, media and video production, gaming, retail, education, design and architecture, following our acquisition of TurboSquid, Inc. (“TurboSquid”) on February 1, 2021.

•Creative Design Software - consisting of our online graphic design and image editing platform. On September 3, 2021, we completed the acquisition of substantially all of the assets and assumption of certain liabilities from PicMonkey, LLC (“PicMonkey”).

In addition, in July of 2021, through our newly formed entity Shutterstock.AI, Inc. (“Shutterstock.AI”), we acquired Pattern89, Inc., Datasine Limited, and assets from Shotzr, Inc., three artificial intelligence (“AI”) entities that provide data driven insights and predictions about creative content’s propensity to perform through their AI platforms. Shutterstock.AI will commercialize the underlying metadata of our existing content library. In addition, with AI tools obtained from these acquisitions, we plan to develop predictive performance capabilities to help customers make more data-informed content decisions.

We believe that we benefit from scale and network effects between customers and contributors. We have managed to build a world class library of images, footage clips, music and 3D models, sourced from our vast network of contributors. Our extensive content library and contributor network enables us to attract a global and diverse customer base representing businesses of all sizes and from all major industries. Our robust content and rich database continue to attract more customers and draw more contributors, which enhances our network effects and global reach. We believe the success of this network effect is facilitated by the trust that users place in Shutterstock to maintain the quality and integrity of our branded marketplace, and our commitment to seamless integration into users’ creative workflows.

We believe that our licensing model and creative platform drive a high volume of download activity that in turn provides a high volume of search, download and other customer behavioral data that enables us to continuously improve the quality and accuracy of our proprietary search algorithms, including keyword, search localization and similar image identification, and encourages the creation and contribution of new content to meet our customers’ needs. We enable users to search and discover content to meet their unique needs by searching our collection and previewing our content alongside its propensity to perform and global utilization, at no cost prior to licensing. We also leverage, to the greatest extent possible, the global nature of our user interfaces and marketing efforts, including local languages, currencies and payment methods, and our effective use of current and emerging technology and marketing channels to attract and retain customers and contributors. We typically offer a royalty-free, non-exclusive license, and the processes we maintain to properly license content and the indemnification protections we provide allow individuals and businesses of all sizes, including media agencies, publishers, production companies and creative service providers, to confidently utilize such content for their unique commercial or editorial needs.

Our high-quality content is distributed to customers under the following brands: Shutterstock — our flagship brand, Bigstock, Offset, PremiumBeat and TurboSquid. Our Shutterstock brand includes various content types and offerings such as image, footage, editorial, music and studios. Bigstock maintains a separate content library tailored for creators seeking to incorporate cost-effective imagery into their projects. Our Offset brand provides authentic and exceptional content for high-impact use cases that require extraordinary images, featuring work from top assignment photographers and illustrators from around the world. PremiumBeat’s library of exclusive high-quality music tracks provides producers, filmmakers and marketers

4

the ability to search handpicked production music from the world’s leading composers. TurboSquid operates a marketplace that offers more than one million 3D models and a 2 dimensional (“2D”) marketplace derived from 3D objects.

For customers seeking specialized solutions, Shutterstock Studios extends our offerings by providing custom, high-quality content matched with production tools and services at scale. Shutterstock Studios delivers end-to-end custom creative services providing data-driven content strategy and full-scale production for our customers. Shutterstock Editorial provides imagery and video content for the latest news, sports and entertainment, and Shutterstock Editorial also offers the Newsroom, for global breaking news, exclusives and archival content.

In addition to our content-driven solutions, we are committed to investing in applications and technology targeted at enhancing our customers’ workflow management needs and to enable efficient search capabilities. During 2021, we launched Catalog and Plan applications, which form the beginnings of Shutterstock’s Creative Flow, a suite of applications powered by creative insights designed to enhance creativity and encourage collaboration.

In addition to workflow applications, Shutterstock continues to invest in making it easier for customers to find the content they need, faster. Our efficient search capabilities include:

•Our Music Match Tool - an AI-powered search feature that allows customers to find the perfect song based on a song they already know. Enterprise customers searching for music for film and media projects can now access our Music Match Tool, enabling them to streamline their process for finding the right music for every project.

•Our robust search engine, with highly sophisticated search capabilities, leverages our AI based search algorithms to enhance the speed and curation of images, footage and audio files. We obtain a high volume of data generated from these user searches and content downloads, which enables us to continuously improve our search algorithms. Our behavioral and keyword data, along with our investments in technology and our experience in developing AI-based search algorithms, enable us to deliver a rich user experience by increasing the chances that our users can efficiently find the content they require.

Subsequent to our acquisition of PicMonkey in September 2021, we also offer our customers access to a leading online graphic design and image editing platform. This application enables creators of any skill level to design high-quality visual assets – from presentations, advertisements and logos, to business cards and banners – for an array of use cases, including digital marketing, advertising and social media posts. While some professional design applications require formal training, the integration of PicMonkey into Shutterstock will further empower our customers, regardless of their skill level or expertise, to create beautiful, best-in-class content with efficiency and ease in just a few clicks.

Also, our Application Programming Interface (API) driven infrastructure further enhances and streamlines our customers’ workflow and project management needs by allowing businesses to gain access to our content without leaving their platform. Through our API, content can be integrated into the platforms of our Enterprise sales channel customers and can also be distributed to end users through our partnerships with several social media, software and marketing technology platforms including Microsoft Audience Network, Facebook Ads, Hubspot, Google Ads and Wix. In addition, we have developed plug-ins that our customers can use to seamlessly access our content directly from Apple’s Final Cut Pro® X video editing application, several Microsoft applications, Adobe Creative Cloud® desktop applications and Google SlidesTM.

Sales and Distribution Channels

Our online platform provides a freely searchable collection of content that our users can license, download and incorporate into their work. We encourage all our customers to take advantage of our creative platform’s comprehensive search capabilities, our credit card-based payment options and the immediate digital delivery of licensed content. We strive to offer simple, transparent purchase options designed to cater to customers’ specific needs. We believe the ability to search for, select, license, download and customize content on our creative platform offers our users a streamlined workflow, convenience and speed, and enables us to achieve greater economies of scale. We also have contractual arrangements with third-party resellers and affiliates to license content to customers in markets where we may not have a significant sales and marketing presence. Certain third-party resellers and affiliates sell our products directly to end-users and remit amounts to us based on the type of product sold.

Customer sales are diversified across the following channels:

•E-commerce: The majority of our customers license content directly through our self-service web properties. Customers in our e-commerce sales channel have the flexibility to purchase a subscription-based plan that is paid on either a monthly or annual basis or to license content on a transactional basis. These customers generally license content under our standard or enhanced licenses, with additional licensing options available to meet customers’ individual needs.

5

•Enterprise: We also have a base of customers with unique content, licensing and workflow needs. These customers benefit from communication with our dedicated sales, service and research teams which provide a number of tailored enhancements to their creative workflows including non-standard licensing rights, multi-seat access, ability to pay on credit terms, multi-brand licensing packages, increased indemnification protection and content licensed for use-cases outside of those available on our e-commerce platform. Customers in our enterprise sales channel may also benefit from our API platform as well as access to Shutterstock Editorial, which includes our library of editorial images and videos and Shutterstock Studios, our offering which provides custom, high-quality content matched with production tools and services at scale. Our range of solutions, including the depth of our API integration, appeals to a broad and diverse customer base and enables us to adapt and evolve with the needs of our more high touch clients to deliver capabilities that embed deep within their workflows.

Revenues generated from each of the sales channels are as follows (in thousands):

| Year Ended December 31, | ||||||||||||||||||||

| 2021 | 2020 | 2019 | ||||||||||||||||||

| E-commerce | $ | 490,212 | $ | 412,521 | $ | 392,241 | ||||||||||||||

| Enterprise | 283,203 | 254,165 | 258,282 | |||||||||||||||||

| Total Revenue | $ | 773,415 | $ | 666,686 | $ | 650,523 | ||||||||||||||

An important driver of our growth is customer acquisition, which we achieve primarily through online marketing efforts and directly through our sales force. Online marketing includes paid search, online display advertising, print advertising, trade shows, email marketing, direct mail, affiliate marketing, public relations, social media and partnerships. Over the past several years, our investments in marketing have represented a significant percentage of revenue. This spend considers, among other things, the blended average customer lifetime value across our various purchase options so we can manage customer acquisition costs and aim to achieve targeted returns.

We believe that another important driver of growth is the quality of the user experience we provide on our websites, especially the efficiency and speed with which our search interfaces and algorithms help customers find and download the content that they need, the degree to which our websites have been localized for our global user base, the degree to which we make use of the large quantity of data we collect about image, footage and music and search patterns, and the security of user information on our platform. To this end, we have invested aggressively in product development and cloud-based hosting infrastructure, and we intend to continue to invest in these areas, to the extent that we can improve the customer experience and increase the efficiency with which we deploy new products and features.

Our Customers

We serve a diverse array of customers across a variety of industries, organizational sizes and geographies. For the year ended December 31, 2021, over 2.0 million customers in more than 150 countries licensed revenue-generating content, with approximately 37%, 33% and 30% of revenue coming from customers in North America, Europe and the rest of the world, respectively. Our top 25 customers in the aggregate accounted for less than 7% of our revenue in 2021. Our customers are typically classified among three categories, as follows:

•Corporate Professionals and Organizations. Marketing and communications professionals incorporate licensed content in the work they produce for their organizational or clients’ business communications. Whether providing graphic design, web design, interactive design, advertising, public relations, communications or marketing materials, these professional users and teams support organizations of various sizes including the largest global agencies, large not-for-profit organizations and Fortune 500 companies.

•Media and Broadcast Companies. Media organizations and professionals incorporate licensed content into their work, which includes digital publications, newspapers, books, magazines, television and film, as well as to market their products effectively. Our media and broadcast users range from independent bloggers to multi-national publishing, broadcast and production organizations.

•Small and Medium-Sized Businesses and Individual Creators. Organizations of all sizes utilize creative content for a wide range of internal- and external-use communications such as websites, print and digital advertisements, merchandise, brochures, employee communications, newsletters, social media, email marketing campaigns and other presentations. These organizations and users vary in size and type of organization and include casual creatives ranging from sole proprietors to social media influencers.

6

As the use cases for our creative solutions expand, we believe our customers are seeking alternative means to consume our offerings. As a result, we have seen strong growth in customers purchasing monthly subscription products, including our suite of multi-asset subscriptions, launched in 2021. These multi-asset products are credit-based and enable customers to license images, footage and music in a single subscription. Our subscriptions provide for either a fixed number of content licenses or credits that may be used to download content during the month. Our subscription-based pricing model makes the creative process easier because customers can download content in our collection for use in their creative process without incremental costs, which provides greater creative freedom and helps improve work product. In addition, customers may also purchase licenses through other contractual plans where the customer commits to buy a predetermined quantity of content licenses that may be downloaded over a period of time, generally between one month to one year. For users who need less content, individual content licenses may also be purchased on a transactional basis, paid for at the time of download.

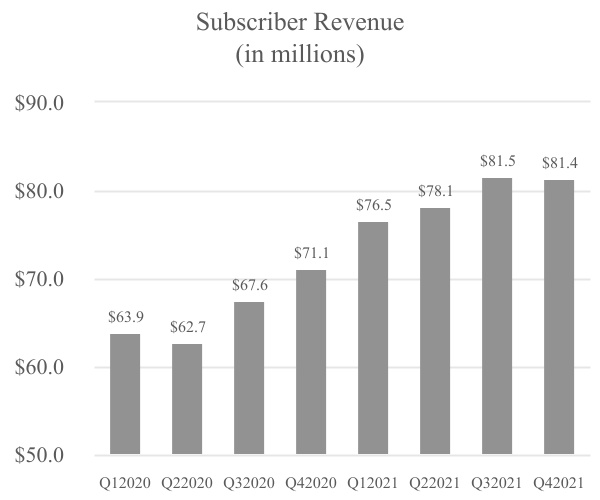

Customers that purchase one of our monthly recurring products for a continuous period of at least three months are considered subscribers. Our number of subscribers and our subscriber revenue have grown by 22% and 14%, respectively, as of and for the three months ended December 31, 2021 compared to December 31, 2020 (excluding PicMonkey and TurboSquid). Subscriber growth has outpaced subscriber revenue growth due to the popularity and expansion of our smaller subscription plans, but we expect this relationship to evolve as changes in product mix occur. Our quarterly number of subscribers and subscriber revenue are as follows:

Content Contributors and Content Review Process

Our collection of content is provided by a community of contributors from around the world and is vetted through our proprietary technology and by a specialized team of reviewers to ensure that it meets our standards of quality and licensability. Whether photographers, videographers, illustrators, designers or musicians, our community of more than 2.0 million approved contributors as of December 31, 2021 ranges from part-time enthusiasts to full-time professionals. The content contributed by our five highest-earning contributors was together responsible for less than 6% of downloads in 2021, demonstrating the depth and diversity of our contributor population.

The breadth and quality of our content offerings are critical to our success, and we have created an easy-to-use online and mobile account creation process, where we enable contributors to create an account, become verified, submit content, and once approved for submission, upload content onto our platform for licensing. Our contributor website and mobile application operate in 21 languages and contributors can register and upload content directly within the mobile application.

We use proprietary computer vision technology along with a trained team of reviewers to complete a comprehensive evaluation of all content submissions. Our content review process is highly efficient, and our content review team generally evaluates and processes images and footage within 24 hours of submission to make them available for license on our sites, while working to continually improve our process to reduce review time.

Contributors are required to add a descriptive title and up to 50 keywords to each image and footage submission. We guide our contributors to provide terms that not only describe literally the objects in the image or clip, but also what is conveyed conceptually and thematically. We provide technical keywording assistance to contributors through our suggested keyword tools, which include a tool that leverages our proprietary computer vision technology to automatically suggest keywords based on visually similar images. We have compiled a vast amount of data relating to the content in our collection,

7

including keywords and aggregated customer behavioral data, which combined with our proprietary computer vision and artificial intelligence technology, drives discovery of content through our search algorithms and search engine optimization (SEO), therefore empowering customers to discover the content best suited for their needs.

We evaluate submissions based on certain technical and legal criteria to ensure we maintain the quality and integrity of our content library, including whether applicable releases have been obtained, whether third-party intellectual property is excluded, and seeking to minimize other technical concerns such as excess noise or focus issues. As of December 31, 2021, over 625 million images and footage clips have been submitted from verified contributor accounts. For each content submission that is not approved during the review process, we notify the contributor by email with an explanation why the image was not published, including guidance on our standards and insight into customers’ expectations. We believe that this feedback is valuable to contributors and enhances the quality of future content submissions as well as our customers’ experience.

Content accepted into our collection is added to our web properties where it is available for search, selection, license and download. Contributors of content typically earn a royalty each time their work is licensed. Contributors earn royalties based on our published earnings schedule that is based on annual licensing volume, which determines the contributor’s earnings tier and the purchase option under which the content was licensed. Contributors may choose to remove their content from our collection, subject to the terms of service that govern our contributor relationships.

We provide valuable tools and insights to our contributors. Our contributors can monitor download activity by content type and geography, as well as by self-defined imagery themes. We also provide data on search trends, allowing content creators to see which images and subjects are popular on our site, and to plan new content themes accordingly.

In addition to content sourced through direct submission to our e-commerce platform, we also obtain all types of content through exclusive distribution agreements with strategic partners or through the direct acquisition of content, content libraries or archives. In certain cases, we enter into arrangements with contributors or strategic partners whereby we guarantee a minimum royalty, in exchange for exclusive rights to distribute content when we believe such exclusivity provides us with a distinct competitive advantage. When we license content that has been obtained through direct acquisition, we pay no royalties. We continuously enhance our collection through the direct acquisition of content and by entering into other strategic agreements and partnerships and we continue to seek opportunities for direct acquisition and strategic partnerships to enhance our collection and provide customers with relevant and high-quality content.

Technology and Infrastructure

Our technology is critical to our business and we have developed proprietary technology to power our products and services. We believe that delivering intuitive, fast and effective user experiences, supported by scalable technology platforms, is critical to our success. We employ technology to support both our public-facing web properties and our back-office systems. In developing, improving and enhancing these sites and systems, we focus our internal development efforts on creating and enhancing specialized proprietary software that is unique to our business and we leverage commercially available and open source technologies for our more generalized needs.

Our customer-facing software enables users to search the millions of images, vectors, illustrations, footage, music tracks and 3D models available in our collection or request custom branded content and then select, organize, pay for, license and download the content that suits their individual needs. Our search platform evolves automatically based on our own 1st party behavioral data, with each search and download that a user performs on our platform providing our search engine with additional information to improve search results in subsequent queries. We consider the data that we have collected and the search technology that it powers to be an important proprietary asset and competitive advantage that allows us to provide exceptional service to our customers and enable our business. We continuously invest in the localization of our creative platform across many countries and regions, allowing customers to search and make purchases in a variety of languages and currencies. We also maintain an API driven infrastructure, enabling integration of our content platform with various other software tools and services, which enables businesses, and their customers, to gain access to our content without leaving their platform.

Further, we have continued to build and launch innovations to the customer experience. Through Shutterstock.AI, we acquired Pattern89, Inc., Datasine Limited, and assets from Shotzr, Inc., three artificial intelligence entities that provide data driven insights through their artificial intelligence platforms. With these three acquisitions, Shutterstock.AI plans to develop its own predictive performance capabilities to help creatives and customers accomplish their goals by making more data-informed content decisions. Shutterstock is helping solve our customers' problems by expertly navigating the availability of content. By developing predictive creative AI models and leveraging cutting edge technology, Shuttertstock.AI plans to help customers make more informed content choices and provide more confidence about the performance of what they produce.

In addition to our predictive performance capabilities, Shutterstock continues to invest in making it easier for customers to find the right music they need, faster. Our Music Match Tool, also launched in 2021, is an AI-powered search feature that

8

allows customers to find the perfect song based on a song they already know. Enterprise customers searching for music for film and media projects can now access our Music Match Tool, enabling them to streamline their process for finding the right music for every project.

We are also committed to investing in applications and technology targeted at enhancing our customers’ project management needs and to enable efficient search capabilities. During 2021, we launched Catalog and Plan applications, which form the beginnings of Shutterstock’s Creative Flow, a suite of applications powered by creative insights designed to enhance creativity and encourage collaboration. These workflow solutions include:

•Our Catalog application allows Enterprise customers to centralize access to content anytime, and anywhere. With Catalog, customers can tag, organize, comment on and approve content together, as well as share content across departments, companies, and time zones.

•Our Plan application is a single content plan and calendar for teams and clients to access, fostering real-time collaboration. Plan enables quick access to collections of content, and keeps teams organized, on the same page, and confident in what they are creating.

We also develop and continuously invest in contributor-facing web properties, which operate in 21 languages and enable individuals and creative professionals to become contributors, upload and tag content, receive feedback on their submissions from our review team, see reports on earnings and payouts, and participate in online discussion forums with other contributors, among other activities. We have also developed proprietary tools to enable our contributors to improve their success on our web properties, including our keyword trends tool that allows contributors to see what terms customers are searching for and how those search terms are trending over time, which, in turn, allows contributors to anticipate demand and generate content that customers may want to license. Our contributor-facing web properties are powered by proprietary technology which supports a content review system that allows our review team to efficiently and effectively review content submissions. Our combination of proprietary technology and large-scale datasets allows us to deliver value to our users and enhances their experience on our platform, which drives growth on our marketplace.

We use a combination of internally-developed software and third-party applications that enable customer and contributor support, intellectual property rights and license tracking, centralized invoicing and sales order processing, customer database management, language translation and global contributor payouts, in addition to supporting the compliance, finance and accounting functions. We continually improve upon these internal tools to enable business growth and drive efficiency.

Our systems infrastructure is hosted primarily by third-party cloud hosting providers that we believe offer scalable, reliable and secure global infrastructure. We also continue to invest in our infrastructure to improve the resiliency of our sites and systems.

By using cloud services providers, we believe we are able to dedicate an increasing proportion of our technology resources to scaling our business, better serving our rapidly growing collection of content and meeting global customer demand. We believe continued use of third-party cloud hosting, along with improvements to our platform, allow us to further diversify our product offerings, reach new customers and contributors around the world and enable our developers to rapidly deploy new products, features and functionality.

We have expanded our use of content delivery network solutions to help enable our customers around the world to have sustained and reliable high-speed access to our platform. As we continue to grow our business, our technological needs continue to expand and therefore, we continually invest in our technology to enhance existing products and services and develop new products and services. We view our investments in technology as integral to our long-term success and we intend to continue to investigate, develop and make capital investments in technology and operational systems that support our current business and new areas of potential business expansion.

Marketing

An important driver of our growth is customer acquisition, which we achieve primarily through online marketing efforts, TV campaigns and directly through our sales force. Online marketing includes paid search, online display advertising, print advertising, trade shows, email marketing, direct mail, affiliate marketing, public relations, social media and partnerships. Over the past several years, our investments in marketing have represented a significant percentage of revenue. This spend considers, among other things, the blended average customer lifetime value across our various purchase options so we can manage customer acquisition costs and aim to achieve targeted returns.

9

We also use customer relationship management (CRM) marketing to grow the lifetime value of our existing customers. Our marketing activities aim to raise awareness of our brands and attract paying customers to our websites and our direct sales organization by promoting the key value propositions of our offerings: diverse and high-quality content, intuitive and efficient interfaces and economical content options.

As our marketing efforts attract additional paying customers and generate more revenue for us, our contributors are also able to receive increased earnings from us. Increasing contributor earnings helps attract more content submissions, which in turn helps Shutterstock convert and retain even more paying customers. We believe the high degree of satisfaction that customers have with our product drives word-of-mouth recommendations, which helps our marketing efforts attract an even broader and more diverse audience than we reach directly. Therefore, we believe our marketing efforts have a self-reinforcing network effect, which powers the growth and success of our marketplace.

Customer Support

In addition to outbound sales and marketing activities, our customer service teams assist users worldwide via email, chat and phone in over 20 languages and 150 countries. We have customer service teams in a variety of locations including Singapore, Berlin and New York.

Product Rights and Intellectual Property

Product Rights and Indemnification

All of the content that we make available to customers on our websites is offered under perpetual, royalty-free licenses, with the exception of certain custom, editorial, music, and other content with specific licensing requirements. Royalty-free means that once a customer has licensed content from us, that customer may use the associated content in accordance with the license terms in perpetuity without having to pay any ongoing royalties to us. Typically, content from our library is licensed on a non-exclusive basis, meaning that multiple customers can license the same image, footage clip or music track under the applicable Shutterstock license agreement. Custom content is one-of-a-kind branded content and is licensed on an exclusive basis to our customers to fulfill their specific use-cases. We do not typically require that contributors of content to our library provide their content to us on an exclusive basis, with the exception of custom content and certain editorial, music and other content to which we have exclusive distribution rights. However, once a contributor’s content is licensed through our platform, such content is perpetually subject to the customer’s license even if the contributor removes the image from our marketplace, except in periodic circumstances where content is removed due to concerns about third-party intellectual property rights.

Under our various license agreements, we expressly represent and warrant that unaltered content downloaded and used in compliance with our license agreements and applicable law will not infringe any copyright, trademark or other intellectual property right, violate any third-party’s rights of privacy or publicity, violate any U.S. law, be defamatory or libelous, or be pornographic or obscene. Provided that a customer has not breached the license agreement or any other agreement with us, we will defend, indemnify, and hold a customer harmless from direct damages attributable to breaches of the express representations and warranties provided in our license agreements. From time to time, we agree to customize our license agreements with non-standard indemnification terms. Regardless of customization, indemnification only applies to claims for damages attributable to our breach of the express representations and warranties provided in our license agreement and is generally conditioned on our timely receipt of an indemnification claim and our right to assume the defense of such claim. Our license agreements generally cap our indemnification obligations at amounts ranging from $10,000 to $250,000, with exceptions for certain products for which our indemnification obligations may be uncapped. We maintain commercially reasonable insurance intended to protect against the costs of intellectual property litigation and our indemnification obligations under our license agreements.

Intellectual Property

We protect our intellectual property through a combination of patent, trademark, copyright and domain name registrations, as well as trade secret protections.

We own a portfolio of trademarks, including “Shutterstock,” “Shutterstock Editorial,” “Asset Assurance,” “Offset,” “Bigstock,” “Rex Features,” “PremiumBeat,” “TurboSquid,” “PicMonkey,” “Pattern89,” “Shotzr,” “Shutterstock Studios,” “Shutterstock Editor” and associated logos. We will pursue additional trademark registrations to the extent that we create any additional material and registrable trademarks or logos. We are the registered owner of a variety of the shutterstock.com, bigstock.com, offset.com, premiumbeat.com, rexfeatures.com, turbosquid.com and picmonkey.com internet domain names and various other related domain names. We have successfully recovered infringing domain names in the past and intend to continue to enforce our rights in the future. We also own copyrights, including certain content on our web properties, publications and designs, as well as patents, including with respect to our display systems and search capabilities. These intellectual property rights are important to our business and marketing efforts. The duration of the protection afforded to our

10

intellectual property depends on the type of property in question, the laws and regulations of the relevant jurisdiction and the terms of our license agreements with others. With respect to our trademarks, trade names and patents, laws and rights are generally territorial in scope and limited to those countries where a mark has been registered or protected. While trademark registrations may generally be maintained in effect for as long as the mark is in use in the respective jurisdictions, there may be occasions where a mark or title is not registrable or protectable or cannot be used in a particular country. In addition, a trademark registration may be canceled or invalidated if challenged by others based on certain use requirements or other limited grounds. We believe the duration of our patents is adequate, relative to the expected lives of our products.

We protect our intellectual property rights by relying on federal, state, and common law rights, including registration, in the United States and applicable foreign jurisdictions, as well as contractual restrictions. We enforce and protect our intellectual property rights through litigation from time to time, and by controlling access to our intellectual property and proprietary technology, in part, by entering into confidentiality and proprietary rights agreements with our employees, consultants, contractors, and vendors. In this way, we have historically chosen to protect our software and other technological intellectual property as trade secrets. We further control the use of our proprietary technology and intellectual property through provisions in our websites’ terms of use and license agreements.

Government Regulation

We are subject to a number of U.S. federal and state and foreign laws and regulations that affect companies conducting business on the internet as well as companies that provide access to content. Many of these laws and regulations are still evolving and are being tested in courts, and the manner in which existing laws and regulations will be applied to the internet and online content in general, and how the foregoing will relate to our business in particular, is still unclear in many cases. These laws and regulations may involve privacy, data management and protection (including with respect to personal information), cybersecurity, content regulation, intellectual property ownership and infringement, defamation, publicity rights, advertising, marketing, employment, taxation, e-commerce, subscription-based billing, quality of products and services, internet neutrality, antitrust, outsourcing, securities law compliance, and online payment services. Additionally, because we operate internationally, we need to comply with various laws associated with doing business outside of the United States, including data privacy and security, anti-money laundering, sanctions, anti-corruption and export control laws. A number of U.S. federal and state and foreign laws that could have an impact on our business practices and e-commerce generally have already been adopted, including, for example:

•The Digital Millennium Copyright Act (the “DMCA”), which regulates digital material and created updated copyright laws to address the unique challenges of regulating the use of digital content.

•The Directive on Copyright in the Digital Single Market, which governs a marketplace for copyright in the European Union.

•The Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003 and similar laws adopted by a number of states, which regulate the format, functionality and distribution of commercial solicitation e-mails, create criminal penalties for unmarked sexually-oriented material, and control other online marketing practices.

•The Children’s Online Privacy Protection Act and the Prosecutorial Remedies and Other Tools to End Exploitation of Children Today Act of 2003, which regulate the collection or use of information, and restrict the distribution of certain materials, as related to certain protected age groups. In addition, the Protection of Children From Sexual Predators Act of 1998 provides for reporting and other obligations by online service providers in the area of child pornography.

•The Federal Trade Commission Act and numerous state “mini-FTC” acts, which bar “deceptive” and “unfair” trade practices, including in the contexts of online advertising and representations made in privacy policies and other online representations.

•The European Union General Data Protection Regulation (“GDPR”), which governs how we can collect and process the personal data of, primarily, European Union residents.

•The California Consumer Privacy Act of 2018 (“CCPA”), which governs how we can collect and process the personal data of California residents.

11

In particular, we are subject to U.S. federal and state, and foreign laws regarding privacy and data protection as well as foreign, federal and state regulation. Foreign data protection, privacy, content regulation, consumer protection, and other laws and regulations can be more restrictive than those in the United States and often have extraterritorial application, and the interpretation and application of these laws are continuously evolving, still uncertain and remain in flux. For example, the GDPR, which took effect on May 25, 2018, includes more stringent operational requirements for entities using, processing, and transferring personal information and significant penalties for non-compliance. Several other foreign jurisdictions, such as Brazil and India, have adopted, are considering adopting, or have updated comprehensive privacy legislation to offer additional data privacy protections for individuals. In the U.S., data protection legislation is also becoming increasingly common at both the federal and state level. There are a number of legislative proposals pending before the U.S. Congress and various state legislative bodies concerning privacy, security, content regulation, data protection and other consumer issues that could affect us. For example, the State of California has enacted the CCPA, which became effective in January 2020. The CCPA, among other things, requires companies that collect personal information about California residents to make disclosures to those residents about data collection, use and sharing practices, allows residents to opt out of certain data sharing with third parties and provides a new cause of action for data breaches. Moreover, a new privacy law passed in California, the California Privacy Rights Act (“CPRA”), which is scheduled to take effect on January 1, 2023 (with a lookback to January 1, 2022), will significantly modify the CCPA, and will impose additional data protection obligations on companies such as ours doing business in California.

In addition, from a taxation perspective, there are applicable and potential government regulatory matters that may impact us. In particular, certain provisions of the Tax Cuts and Jobs Act of 2017 (the “TCJA”) have had and will continue to have a significant impact on our financial position and results of operations. The TCJA continues to be subject to further regulatory interpretation and technical corrections by the U.S. Treasury Department and the I.R.S. and therefore, the full impact of the TCJA on our tax provision may continue to evolve. Further, we continue to remain subject to uncertainty related to foreign jurisdictions’ potential reactions to the TCJA, as well as evolving regulatory views and legislation regarding taxation of e-commerce businesses such as the Organization for Economic Cooperation and Development (“OECD”) Base Erosion and Profit Shifting (“BEPS”) proposals and other country specific digital tax initiatives. As these and other tax laws and related regulations continue to evolve, our financial results could prospectively be materially impacted.

The application, interpretation, and enforcement of these U.S. and foreign laws and regulations are often uncertain, particularly in the rapidly evolving industry in which we operate, and may be interpreted and applied inconsistently from country to country and inconsistently with our current policies and practices. Any existing or new legislation applicable to our operations could expose us to substantial liability, including significant expenses necessary to comply with such laws and regulations, to respond to regulatory inquiries or investigations, and to defend individual or class litigation. These events could dampen growth in the use of the internet in general, and cause Shutterstock to divert significant resources and funds to addressing these issues, and possibly require us to change our business practices.

Competition

We seek to be an integral component of the creative process for our customers based on a number of factors including the quality, relevance and breadth of content; ability to source new content; accessibility of content; distribution capabilities; ease and speed of search and fulfillment; content pricing models and practices; content licensing options and the degree to which users are protected from legal risk; brand recognition and reputation; the effective use of current and emerging technology; the global nature of our interfaces and marketing efforts, including the degree of localization; and customer service. We also compete for contributors on the basis of several similar factors including ease and speed of the upload and content review process; the volume of customers who license their submitted content; contributor commission models and practices; the degree to which contributors are protected from legal risk; brand recognition and reputation; the effective use of technology; the global nature of our interfaces; and customer service.

The industry in which we operate is extremely competitive and rapidly evolving, with low barriers to entry. Some of our currently and potentially significant competitors include:

•other online platforms that feature marketplaces for stock content or creative workflow tools such as Getty Images and its iStockphoto offering, AdobeStock, VimeoStock, Canva and Pond5;

•specialized visual content companies that are established in local, content or product-specific market segments, such as Visual China Group;

•providers of commercially licensable music such as Universal Music Publishing Group, Sony/ATV Music Publishing and Warner/Chappell Music;

•websites focused on image search and discovery such as Google Images;

•websites for image hosting, art and related products such as Flickr;

12

•providers of free images, photography, music, footage and related tools;

•social networking and social media services; and

•commissioned photographers and photography agencies.

In addition, we compete with the alternative of creating one’s own content or choosing not to consume licensed content due to price considerations or because the user is not aware of how to access licensed content.

Human Capital

The Company and its consolidated subsidiaries have 1,148 full-time employees as of December 31, 2021, as compared to 967 as of December 31, 2020. Approximately 68% of our global workforce is located in North America and 27% are located in Europe with the remainder located in the rest of the world. None of our employees in the United States are covered by collective bargaining arrangements. In several foreign jurisdictions, including Italy, Canada, France and Brazil, our employees may be subject to national collective bargaining agreements that set minimum salaries, benefits, working conditions and / or termination requirements. We consider our employee relations to be satisfactory. Competition for qualified personnel in our industry is intense, particularly for software engineers, computer scientists and other technical staff.

Our people are critical to our success. We have implemented certain strategies with respect to our employees, to provide a safe, rewarding and respectful workplace. We adhere to our Code of Business Conduct and Ethics, which sets forth a commitment to our stakeholders, including our employees, to operate with integrity and mutual respect. We also incorporate safety principles into every aspect of our business. We have well-developed health and safety programs, which are reinforced through policies, education and engagement of our employees.

We strive to create an outstanding employee experience by creating a culture aligned with our principles by providing our employees access to the programs and initiatives that promote their career growth and development, recognize and reward their performance and support their overall well-being. Our Total Rewards program focuses on developing and implementing policies and programs that support our business goals, maintain competitiveness, promote shared fiscal responsibility among the Company and our employees, strategically align talent within our organization and reward performance, while also managing the costs of such policies and programs. Through our Total Rewards program, we provide our employees with competitive fixed and/or variable pay, and for eligible employees we currently provide access to medical, dental and life insurance benefits, disability coverage, a 401(k) plan, equity-based compensation and employee assistance programs, among other benefits. We encourage employee engagement through regular employee events, productive communication, our global recognition program and by creating a culture of belonging.

Our Diversity, Equity, and Inclusion (“DEI”) goal is to build a workforce, contributor network and content library that is representative of the diverse global community we serve. We have a long-term commitment to creating an inclusive culture, embedding DEI throughout our recruiting and retention efforts and promoting representation and inclusion throughout our platform. In 2021, we focused on building leaders' and managers' cultural competency and inclusive leadership skills, as well as increasing our access to a diverse pipeline of talent. In addition, we focused on increasing the number of historically excluded contributors in our network through our Create Fund program. In addition, we have eight employee resource groups that partner with our DEI team to help raise awareness about inclusion and advocate for various historically excluded groups.

During the COVID-19 pandemic, our commitment to our employees has been put into action. One of the principles that has guided and continues to guide our decision-making during the COVID-19 pandemic is to safeguard the health of our employees. We are following all local and national government guidance in implementing mandatory work-from-home policies and in March 2020, our global workforce effectively transitioned to working remotely. While we re-opened certain office spaces by the end of 2020, in order to ensure the safety of our employees, our voluntary work-from-home program has been extended through March 2022. For those employees who voluntarily elect to work from the office (where local law and public health authorities permit offices to operate), we have taken steps to ensure their safety, including providing training, deep cleaning our facilities on a regular basis, installing hand sanitizer stations, providing face masks, installing plexi-glass where appropriate, encouraging hygiene practices advised by health authorities, implementing social distancing policies and restricting business travel and site visitors. We continue to enhance our practices to remain aligned with federal, state, local and international regulations and guidelines.

13

Seasonality

Our operating results may fluctuate from quarter to quarter as a result of a variety of factors. Our quarterly and annual results may reflect the effects of intra-period trends in customer behavior. For example, we expect that certain customers’ usage may decrease at times during the third quarter of each calendar year due to the summer vacation season and may increase at times during the fourth quarter of each calendar year as demand is generally higher to support marketing campaigns in advance of the fourth quarter holiday season. While we believe seasonal trends have affected and will continue to affect our quarterly results, our growth trajectory may have overshadowed these effects to date. Additionally, because a significant portion of our revenue is derived from repeat customers who have purchased subscription plans, our revenues have historically been less volatile than if we had no subscription-based customers.

In addition, expenditures on content by customers tend to be discretionary in nature, reflecting overall economic conditions, the economic prospects of specific industries, budgeting constraints, buying patterns and a variety of other factors, many of which are outside our control, including any impacts from COVID-19. As a result of these and other factors, the results of any prior quarterly or annual periods should not be relied upon as indicators of our future operating performance.

Corporate and Available Information

We launched our platform in 2003, and on October 5, 2012, we reorganized as Shutterstock, Inc., a Delaware corporation, from Shutterstock Images LLC, a New York limited liability company. We completed our initial public offering, in October 2012, and completed a follow-on offering in September 2013. Our common stock is listed on the New York Stock Exchange under the symbol “SSTK”.

Our corporate headquarters and principal executive offices are located at 350 Fifth Avenue, 21st Floor, New York, NY 10118, and our telephone number is (646) 710-3417. We maintain a website at investor.shutterstock.com, where our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports are available without charge, as soon as reasonably practicable following the time they are electronically filed with or furnished to the SEC. The information on or accessible through our websites is not incorporated by reference into this Annual Report on Form 10-K. In addition, the SEC maintains a website, www.sec.gov, that includes filings of and information about issuers that file electronically with the SEC.

14

Item 1A. Risk Factors.

You should carefully consider the risks and uncertainties described below, together with the financial and other information contained in this Annual Report on Form 10-K. Our business may also be adversely affected by risks and uncertainties not presently known to us or that we currently believe to be immaterial. If any of the following risks, such other risks or the risks described elsewhere in this Annual Report on Form 10-K, including in the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, actually occur, our business, financial condition, operating results, cash flow and prospects could be materially adversely affected. This could cause the trading price of our common stock to decline.

Risk Factors Summary

Risks Related to the Coronavirus (COVID-19) Pandemic

•The effect of the COVID-19 pandemic on our operations, and the operations of our customers, partners and suppliers, has had and could have a material adverse effect on our business, financial condition, cash flows and results of operations, and the extent to which the pandemic will have a continued impact remains uncertain.

Risks Related to Industry Dynamics and Competition

•The success of our business depends on our ability to continue to attract and retain customers of, and contributors to, our creative platform. If customers reduce or cease their spending with us, or if content contributors reduce or end their participation on our platform, our business will be harmed.

•The industry in which we operate is highly competitive with low barriers to entry and if we do not compete effectively, our operating results could suffer.

•Our marketing efforts to acquire new, and retain existing customers may not be effective or cost-efficient, and may be affected by external factors beyond our control.

•If we cannot continue to innovate technologically or develop, market and offer new products and services, or enhance existing technology and products and services to meet customer requirements, our ability to grow our revenue could be impaired.

•Unless we increase market awareness of our brand and our existing and new products and services, our revenue may not continue to grow.

•In order to continue to attract large corporate customers, we may encounter greater pricing pressure, and increased service, indemnification and working capital requirements, each of which could increase our costs and harm our business and operating results.

•Expansion of our operations into new products, services and technologies, including content categories, is inherently risky and may subject us to additional business, legal, financial and competitive risks.

•The impact of worldwide economic, political and social conditions, including effects on advertising and marketing budgets, may adversely affect our business and operating results.

Risks Related to Operating our Business

•We may not continue to grow our revenues at historical rates.

•If we do not effectively expand, train, manage changes to, and retain our sales force, we may be unable to add new customers or increase sales to our existing customers, and our revenue growth and business could be adversely affected.

•We have continued to grow in recent periods and if we fail to effectively manage our growth, our business and operating results may suffer.

•If we do not successfully make, integrate and maintain acquisitions and investments, our business could be adversely impacted.

•We rely on highly skilled personnel and if we are unable to retain and motivate key personnel, attract qualified personnel, integrate new members of our management team or maintain our corporate culture, we may not be able to grow effectively.

•We may be exposed to risks related to our use of independent contractors.

•The non-payment or late payments of amounts due to us from certain customers may negatively impact our financial condition.

•We are subject to payment-related risks that may result in higher operating costs or the inability to process payments, either of which could harm our financial condition and results of operations.

•If our goodwill or intangible assets become impaired, we may be required to record a significant charge to earnings.

•We may need to raise additional capital in the future and may be unable to do so on acceptable terms or at all.

Risks Related to our Intellectual Property and Security Vulnerabilities

•We rely on information technologies and systems to operate our business and maintain our competitiveness, and any failures in our technology infrastructure could harm our reputation and brand and adversely affect our business.

•Technological interruptions that impair access to our web properties or the efficiency of our marketplace could harm our reputation and brand and adversely affect our business and results of operations.

15

•We face risks resulting from the content in our collection such as unforeseen costs related to infringement claims, potential liability arising from indemnification claims, changes to intellectual property content regulations and laws and the inability to prevent or monitor misuse.

•Assertions by third parties of infringement of intellectual property rights related to our technology could result in significant costs and substantially harm our business and operating results.

•We collect, store, process, transmit and use personally identifiable information and other data, which subjects us to governmental regulation and other legal obligations related to privacy, information security and data protection in many jurisdictions. Any cybersecurity breaches or our actual or perceived failure to comply with such legal obligations by us, or by our third-party service providers or partners, could harm our business.

•Cybersecurity breaches and improper access to or disclosure of data or confidential information we maintain, or hacking or phishing attacks on our systems, could expose us to liability, protracted and costly litigation and damage our reputation.

•Failure to protect our intellectual property could substantially harm our business and operating results.

•Much of the software and technologies used to provide our services incorporate, or have been developed with, “open source” software, which may restrict how we use or distribute our services or require that we publicly release certain portions of our source code.

•Catastrophic events or other interruptions or failures of our information technology systems could hurt our ability to effectively provide our products and services, which could harm our reputation and brand and adversely affect our business and operating results.

Risks Related to our International Operations

•Our international operations and our continued expansion internationally expose us to many risks.

•The uncertainty caused by the U.K.’s exit from the European Union (Brexit) on January 31, 2020 may negatively impact our operations.

•We are subject to foreign exchange risk.

Risks Related to Regulatory and Tax Challenges

•Government regulation of the internet, both in the United States and abroad, is evolving and unfavorable changes could have a negative impact on our business.

•Action by governments to restrict access to, or operation of, our services or the content we distribute in their countries could substantially harm our reputation, business and financial results.

•Income tax laws or regulations could be enacted or changed and existing income tax laws or regulations could be applied to us in a manner that could increase the costs of our products and services, which could harm our financial condition and results of operations.

•Our operations may expose us to greater than anticipated withholding, sales and transaction tax liabilities, including VAT, which could harm our financial condition and results of operations.

Risks Related to Ownership of Our Common Stock

•Our operating results may fluctuate, which could cause our results to fall short of expectations and our stock price to decline.

•Our stock price has been and will likely continue to be volatile.

•Jonathan Oringer, our founder and Executive Chairman of the Board, owns and controls approximately 33.1% of our outstanding shares of common stock, and his ownership percentage may increase, including as a result of any share repurchases pursuant to our share repurchase program. This concentration of ownership may have an effect on matters requiring the approval of our stockholders, including elections to our board of directors and transactions that are otherwise favorable to our stockholders.

•Purchases of shares of our common stock pursuant to our share repurchase program may affect the value of our common stock, and there can be no assurance that our share repurchase program will enhance stockholder value.

•If securities or industry analysts do not publish or cease publishing research or reports about us, our business or our market, or if they change their recommendations regarding our stock adversely, our stock price and trading volume could decline.

•Future sales of our common stock in the public market could cause our share price to decline.

•Anti-takeover provisions in our charter documents and Delaware law could discourage, delay or prevent a change in control of our Company and may affect the trading price of our common stock.

•There can be no assurance that we will declare dividends in the future.

•We have incurred and expect to continue to incur increased costs and our management will continue to face increased demands as a result of continuously improving our operations as a public company.

•If we fail to maintain an effective system of internal control over financial reporting, we may not be able to report our financial results accurately or in a timely fashion, and we may not be able to prevent fraud; in such case, our stockholders

16

could lose confidence in our financial reporting, which would harm our business and could negatively impact the price of our stock.

Risks Related to the Coronavirus (COVID-19) Pandemic

The effect of the COVID-19 pandemic on our operations, and the operations of our customers, partners and suppliers, has had and could have a material adverse effect on our business, financial condition, cash flows and results of operations, and the extent to which the pandemic will have a continued impact remains uncertain.

In December 2019, a novel coronavirus disease (“COVID-19”) was initially reported and on March 11, 2020, the World Health Organization characterized COVID-19 as a pandemic. COVID-19 has had a widespread and detrimental effect on the global economy as a result of the continued fluctuation in the number of cases and affected countries and actions by public health and governmental authorities, businesses, other organizations and individuals to address the outbreak, including travel bans and restrictions, quarantines, shelter in place, stay at home or total lock-down orders and business limitations and shutdowns. Despite recent developments of vaccines, the duration and severity of COVID-19 and possible mutations and the degree of its impact on our business is uncertain and difficult to predict. The continued spread of the outbreak could result in one or more of the following conditions that could have a material adverse impact on our business operations and financial condition: decreased business spending by our customers and prospective customers, reduced demand for our products, lower renewal rates by our customers; increased customer losses/churn and turnover of talent; increased challenges in or cost of acquiring new customers and talent; reduction in the amount of content uploaded by our contributors and/or reduction in the number of contributors on our site because of reduced royalties earned by our contributors; inability of our Custom contributors and editorial photographers to complete assignments because of travel and in-person event restrictions; increased competition; increased risk in collectability of accounts receivable; reduced productivity due to remote work arrangements; lost productivity due to illness and/or illness of family members; inability to hire key roles; adverse effects on our strategic partners’ businesses; impairment charges; extreme currency exchange-rate fluctuations; inability to recover costs from insurance carriers; business continuity concerns for us and our third-party vendors; inability of counterparties to perform under their agreements with us; increased risk of vulnerability to cybersecurity attacks or breaches resulting from a greater number of our employees working remotely for extended periods of time; and challenges with Internet infrastructure due to high loads. If we are not able to respond to and manage the potential impact of such events effectively, our business could be harmed.

As we generally recognize revenue from our customers as content is downloaded, the impact to our reported revenue resulting from recent and near-term changes in our sales activity due to COVID-19 may not be fully apparent until future periods. Our efforts to help mitigate the negative impact of the outbreak on our business may not be effective, and we may be affected by a protracted economic downturn. Furthermore, while many governmental authorities around the world have and continue to enact legislation to address the impact of COVID-19, including measures intended to mitigate some of the more severe anticipated economic effects of the virus, we may not benefit from such legislation or such legislation may prove to be ineffective in addressing COVID-19’s impact on our and our customer’s businesses and operations. Even after the COVID-19 outbreak has subsided, we may continue to experience impacts to our business as a result of the coronavirus’ global economic impact and any recession that has occurred or may occur in the future. Further, as the COVID-19 situation is unprecedented and continuously evolving, COVID-19 may also affect our operating and financial results in a manner that is not presently known to us or in a manner that we currently do not consider to present significant risks to our operations.

In addition, the overall uncertainty regarding the economic impact of the COVID-19 pandemic and the impact on our revenue growth, could impact our cash flows from operations and liquidity. To the extent the COVID-19 pandemic adversely affects our business and financial results, it may also have the effect of heightening many of the other risks described in this “Risk Factors” section. Material changes to our cash flows, liquidity and the volatility of the stock market and our stock price could impact our capital allocation strategy, including our quarterly dividend program and our outstanding authorization under our stock repurchase program.

Risks Related to Industry Dynamics and Competition

The success of our business depends on our ability to continue to attract and retain customers of, and contributors to, our creative platform. If customers reduce or cease their spending with us, or if content contributors reduce or end their participation on our platform, our business will be harmed.

The continued use of our creative platform by customers and contributors is critical to our success. Our future performance largely depends on our ability to attract new, and retain existing, paying customers and contributors. We do not know whether we will be able to achieve user growth rates in the future similar to our previous results. The majority of our revenue is derived from customers who have purchased from us in the past, but customers have several options to find content.

17

If we lose existing customers, or new customers are not as active as our existing customers, our financial performance and growth could be harmed.

Our ability to attract new customers and contributors, and to incentivize our customers to continue purchasing our products and our contributors to add new content to our platform depends on several factors, including:

•the scope of content available for licensing;

•the effectiveness of our marketing efforts;

•the features and functionality of our platform;

•competitive pricing of our products;

•our current products and services and ability to expand our offerings;

•our customers’ and contributors’ experience in using our platform; and

•the quality and accuracy of our search algorithms.